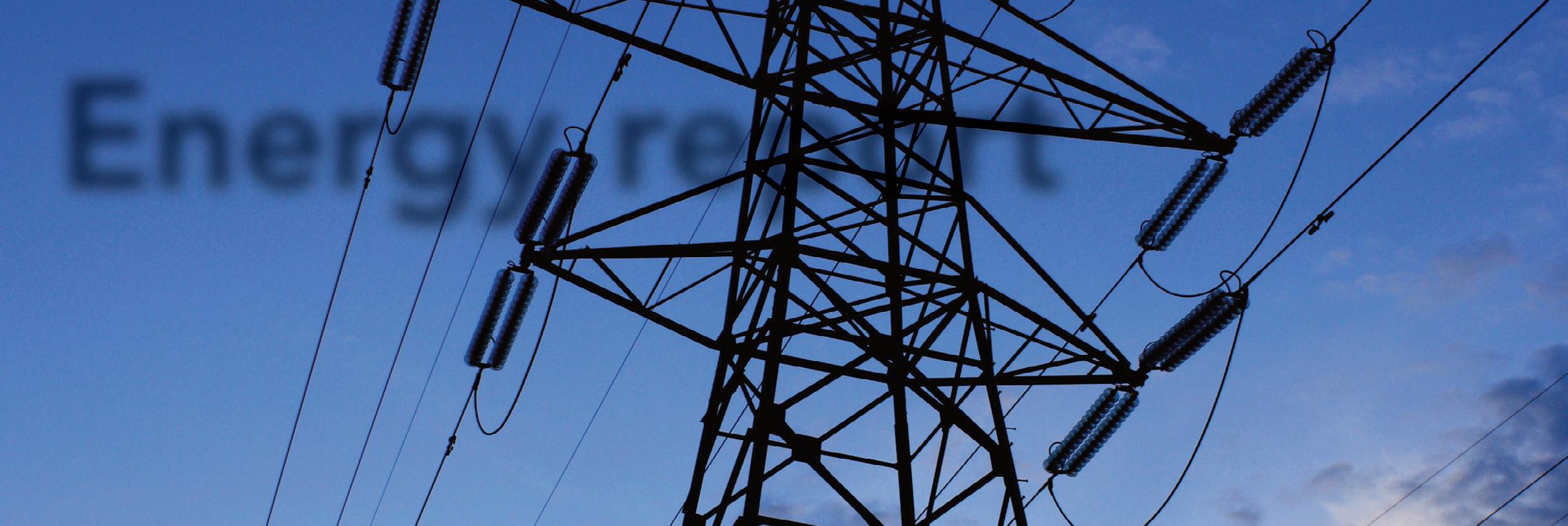

As NIE Networks prepares to invest up to £4 billion upgrading Northern Ireland’s electricity network over the next decade, newly appointed Finance Director, Ted Browne, outlines the organisation’s role in delivering a reliable and sustainable energy system for all.

Browne brings over 25 years’ finance and utility experience to NIE Networks at a time when the organisation is embarking on one of the largest public sector investments in the history of Northern Ireland.

Having previously worked for the Republic’s electricity network owner, ESB, Browne has extensive experience in finance strategy and business

transformation, including responsibility for ESB’s international debt investors who lent £5 billion to ESB.

Recognising the transformational power of strategic investment, he believes that the opportunity presented by the journey to net zero for NIE Networks and Northern Ireland as a whole is one that must be fully grasped.

“As we approach a net zero future, the role of the electricity network will undergo fundamental reform involving the investment of billions of pounds into the local economy. We are at a critical point in time in the company’s history and we are working with a great number of stakeholders to ensure we get it right,” Browne explains.

The company collaborated with the Department for the Economy (DfE) and other stakeholders on developing Northern Ireland’s Path to Net Zero Energy strategy, which was published in December 2021. The strategy sets ambitious targets for net zero carbon energy, while seeking to maintain affordability, and key elements of the strategy are enshrined in the Climate Change Act (Northern Ireland) 2022.

NIE Networks is the owner of the electricity transmission and distribution networks in Northern Ireland, transporting electricity from generators to over 910,000 customers. Its employees maintain and extend the electricity infrastructure across Northern Ireland, connect end user and generation customers to the network and ensure that equipment is safe and reliable. It also provides electricity meters and metering data to suppliers and market operators and develops and reconfigures the electricity network to facilitate the connection of further renewable generation.

However, much of that is due to change according to Browne: “Our future network will need to not only deliver electricity to homes, farms, and businesses but also receive significant amounts of renewable generation from multiple sources across Northern Ireland. It is a large body of

work, one that will require a significant private sector investment in Northern Ireland and will see NIE Networks evolve to be a fully active Distribution System Operator (DSO).”

Browne outlines how net zero is also an area of significant interest to investors:

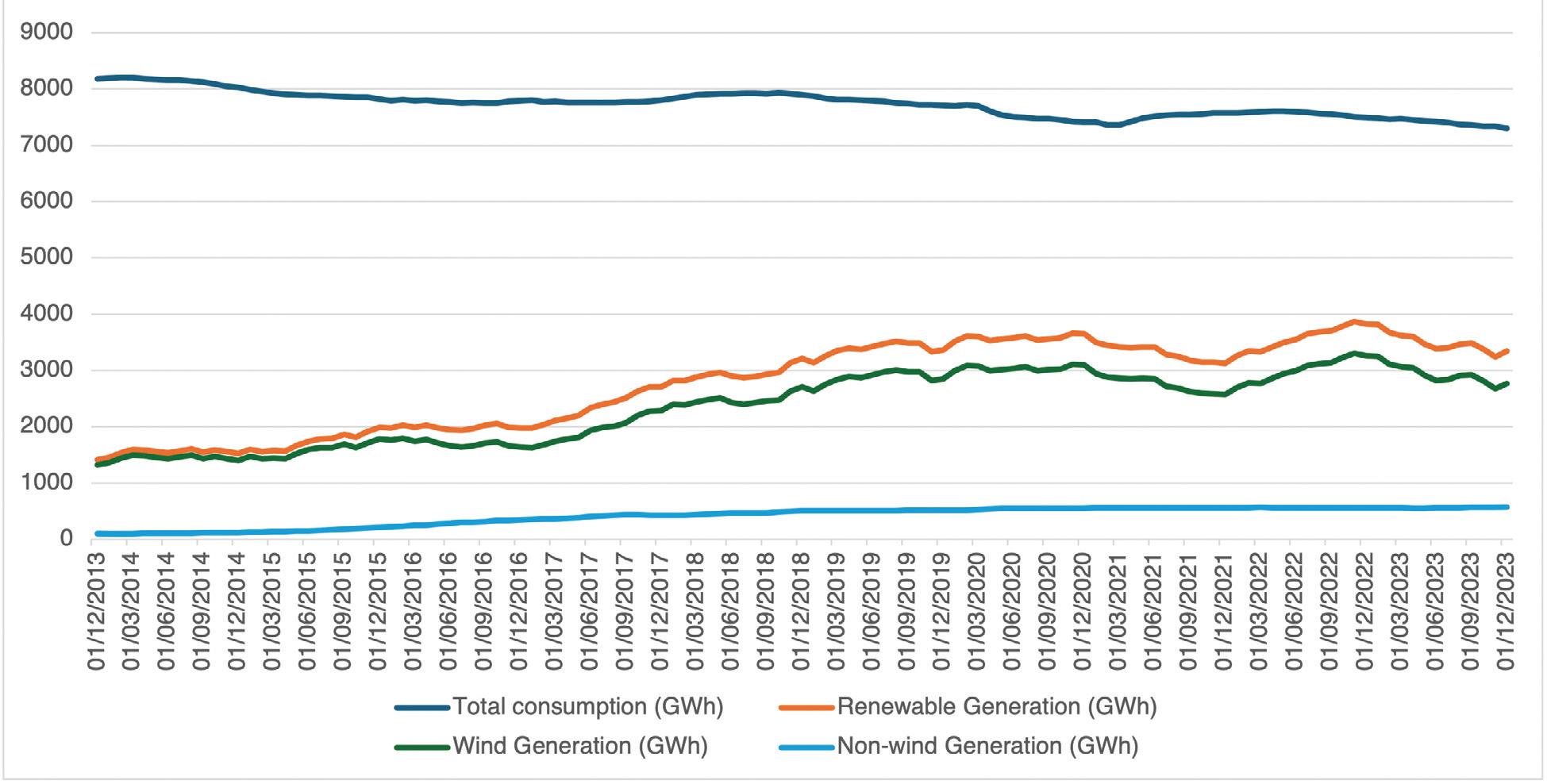

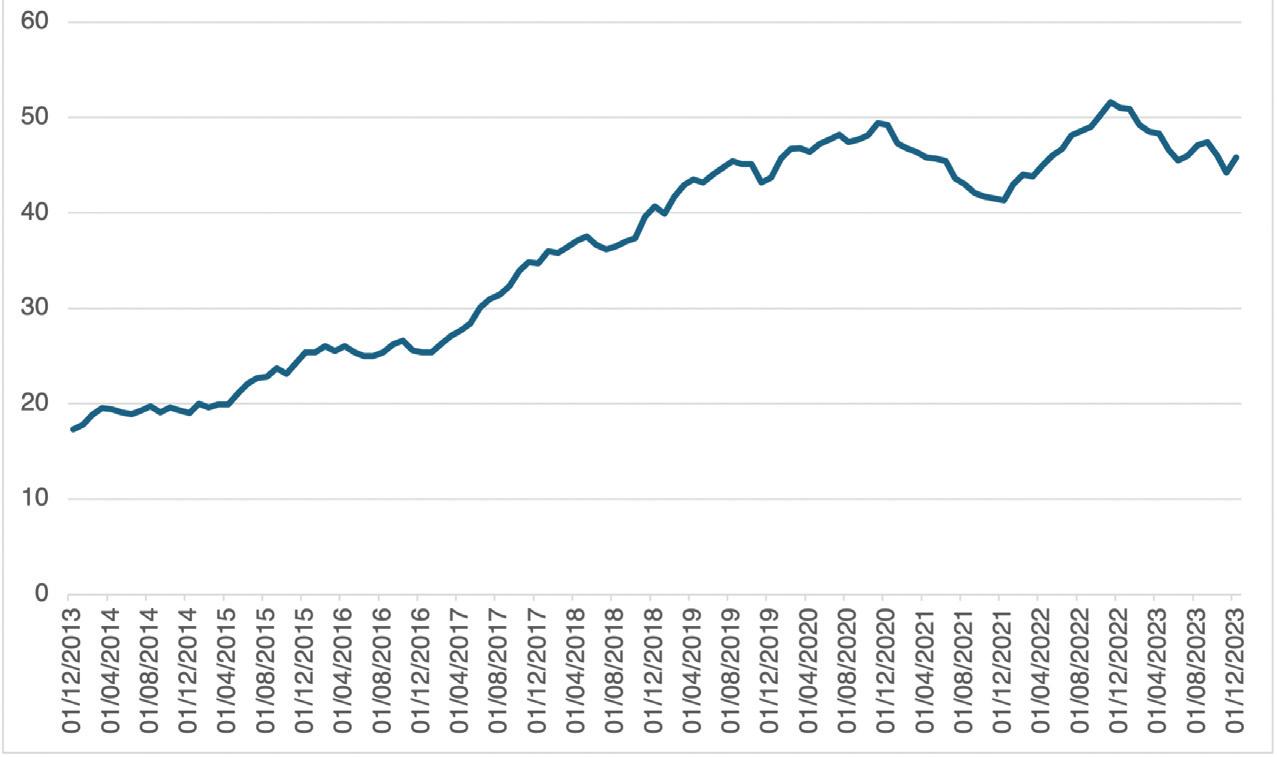

“The production of green energy is a growing market and Northern Ireland is already of interest to those wishing to invest in this area. Wind farm investors, for example, are eager to avail of our ever-prevailing Atlantic winds. To date, NIE Networks has successfully connected around 26,400 renewable generators, significantly increasing the available capacity and resulting in approximately 1.8GW of renewable electricity connected to the network which supplied 47 per cent of Northern Ireland’s annual electricity consumption in 2023.”

The net zero target is to have 80 per cent of annual electricity consumption from renewable consumption by 2030 and 100 per cent by 2050.

“Helpfully, there continues to be interest from generators to connect potential further renewable capacity to the network. However, investors need to be assured that they will be able to connect

that generation to the network before they proceed. In order to provide the required assurances, we must ensure that the capacity to connect low carbon technologies is increased and that we can enable a net zero future.

“At the same time, NIE Networks needs to map the priority areas using data from the market and digital technology to efficiently plan network upgrades in such a way as to maximise the investment and renewable outputs possible,” Browne explains.

Many elements of NIE Networks’ own Networks for Net Zero report are mirrored in the DfE’s Path to Net Zero

Energy. There is strong alignment between the two strategies and NIE Networks’ draft Business Plan for the next seven years (RP7).

NIE Networks’ RP7 Business plan submission is currently with the Utility Regulator which requested an investment of approximately £2.6 billion over the next seven years. The plan outlines the investment required to facilitate the decarbonisation of society, maintain a safe and reliable network and ensure customers continue to receive excellent customer service. The Regulator’s final determination is due in October 2024.

Net zero will transform how the people of Northern Ireland live and work as the electrification of heat and transport will play a fundamental role in meeting the 2050 target.

Browne explains: “The challenge for NIE Networks is to make sure that customers are supported in their own efforts to cut emissions and live a more sustainable life. So, whether you wish to install an electric vehicle charger in Belfast or a heat pump in the Sperrins, NIE Networks needs to enable that to happen. That will be a significant challenge for us as society evolves to become overwhelmingly focused on renewable living.

“In years to come it is possible that we will begin to see communities introducing their own generation and, in addition to homes having electric vehicle chargers and heat pumps, it will become typical for a property to have battery storage facilities. Indeed, we are already seeing an increase in interest from customers connecting integrated micro generation and battery storage.

“Consumers will become more involved in managing their own electricity consumption. To support this, NIE Networks needs to increase digital visualisation on the network, particularly the distribution network, which did not previously require this level of monitoring. In turn, the people of Northern Ireland will be able to trust that the electricity network will continue to be reliable as they use electricity to replace fossil fuels in their homes, businesses, and transport.”

The company will evolve from a Network Operator to a Distribution System Operator (DSO) managing the two-way flow of electricity, supply of data, and digital mechanisms to facilitate consumers to manage their electricity consumption in a similar manner to their heating system.

In 2023, the board approved changes in the leadership team structure in readiness for RP7 and in recognition of the organisation’s transition to a Distribution System Operator (DSO). A Future Networks Director and business function was established along with the recruitment of a Chief Information Officer to give focus to the part that technology and data will play in the future.

The delivery of the increased level of investment will require a considerable increase in our workforce, contractors, and the development of new capabilities.

NIE Networks has already begun to recruit and enhance capabilities estimating an increase of 35 per cent in their current workforce to bring the total number of people employed to around 2,000 by 2030.

A recruitment drive for both newly qualified and experienced engineers closed on 6 May 2023. Browne explains that it is not solely related to electrical roles: “In addition to electrical skills, there is a considerable increase in the

supporting functions; surveyors, procurement, finance, IT and data specialists. To support our own efforts in sustainability, and ensure we have optimum reporting mechanisms for investors, there are also opportunities in sustainability and ESG roles.”

It is a major area of focus for anyone involved in the energy transition so the market is competitive – not just in Northern Ireland but across the world.

Vital talent pipelines for the company are their student opportunities; traineeships, apprentice academy, higher level apprenticeships and scholarships for undergraduates. NIE Networks has an employee retention rate of 98 per cent and considerable development opportunities for career progression. Several of the Directors started out their career as apprentices in the company and it is not unusual to meet employees with more than 30 years’ experience.

NIE Networks has plans to develop and expand these talent pipelines, alongside the learning and development function, over the coming years.

One key challenge for the green energy sector as a whole is the societal culture, as Browne explains: “The majority of young people are persuaded to follow a university route without considering alternative options that may be more appropriate for them. While highly skilled graduates will always be required, the industry will undoubtedly rely on young people coming through the traditional skills route. The challenge

lies in persuading future talent – and their influencers – to realise the potential in the vocational route and take up traineeships and apprenticeship.

“Skills are a fundamental enabler for the net zero target. If we do not have enough people with the right skills it will not happen. The Green Energy Sector has a hugely exciting future ahead but we need the best skilled talent to ensure the sector and the wider economy in Northern Ireland reaches its full potential. It is important that all employers within the sector, Government and the education sector collaborate effectively and take ownership of developing the correct talent pipelines.

“It is the right thing to do for our people and for the planet.”

As a gateway for net zero the company is investing significantly in the electricity network to increase its capacity and resilience for the benefit of customers. Underlying capital expenditure was £219 million in 2023, up £32 million or 17 per cent on 2022. Supporting this investment, and future projected investment of up to £4 billion over the next decade, will require careful financial management to deliver and fund this investment cost effectively for the benefit of customers.

Browne is keen to emphasise the benefit to Northern Ireland: “Over £190 million was contributed to the Northern Ireland economy in 2023 and this will only increase as the years progress. NIE Networks will ensure that, through the right planning and investment, costs for customers are minimised and they are supported in their own efforts to cut emissions and live a more sustainable life.

“It is dependent on good partnership and collaboration with industry participants, customers, and other stakeholders.”

Browne concludes: “It is a once in a generation opportunity and we have a responsibility to get it right for the people of Northern Ireland and future generations. I am personally enjoying working with the capable and committed people in NIE Networks and key stakeholders to enable the delivery of a sustainable energy system for the benefit of Northern Ireland and its economy.”

“Over £190 million was contributed to the Northern Ireland economy in 2023 and this will only increase as the years progress.”

Ted Browne

Ted Browne was appointed Financial Director of NIE Networks in September 2023, having previously served in a variety of senior roles for ESB, including as Financial Controller of ESB’s Engineering and Major Projects division, and as Chief Financial Officer for ESB Networks. He began his career as a senior auditor for KPMG Ireland in 1988 and is a fellow of the Institute of Chartered Accountants.

Outside of work Browne is enjoying getting to know Northern Ireland and its people. He enjoys travelling, almost all sports, and spending time with his wife Deirdre and their four children, who he explains keep them busy in a good way.

joined by Chair of the newly appointed independent board, Peter McNaney, to discuss the importance of plan-led acceleration of a net zero electricity system.

In 2021, Northern Ireland reached a major milestone by becoming among the first power systems in the world to enable up to three-quarters of the electricity on the grid at any one time to come from variable renewable sources.

Credit for the engineering feat, which has served as an exemplar for neighbouring and global power systems, lies with the

System Operator Northern Ireland (SONI), and should be viewed in the context of major challenges posed to the safe, secure, and constant flow of electricity in the region.

SONI is responsible for balancing consumer demand with generation to ensure a constant supply of power in Northern Ireland, but also takes the lead

on planning for Northern Ireland’s future energy needs by developing projects to upgrade and enhance the high-voltage electricity grid.

As SONI’s Chief Executive Alan Campbell explains, there is no room for SONI to rest on its laurels, with less than six years left to meet the ambitious target set by the Climate Change (Northern Ireland) Act

2022 of 80 per cent of electricity consumption coming from renewables by 2030.

“If Northern Ireland is to meet ambitious targets of the integration and use of significantly more renewable energy, the electricity grid, and how the system is operated, has to be upgraded in an unprecedented manner,” he states.

Recently, SONI published an update to Shaping Our Electricity Future, its longterm roadmap to balance increasing power demand with ambitious climate change policies.

Explaining the fundamental vision for the roadmap, Campbell says: “To achieve these targets by 2030, more energy from renewable sources needs to be connected to the power system. This means that the electricity grid will need to carry more power from energy sources that vary depending on the weather. This power will also need to be carried over longer distances. As a result, we need to make the grid stronger and more flexible.”

The appointment of a new independent board to SONI towards the end of 2023 marked a significant change in the governance and operations of the Transmission System Operator (TSO).

The operation and governance changes come at a critical time for the TSO, as it seeks to be an enabler of a net zero electricity grid in Northern Ireland.

The establishment of the board is one of a suite of changes being driven by the Utility Regulator’s license modifications to SONI, which has mandated greater managerial and operational independence from its parent company, EirGrid plc.

As well as transitioning from Managing Director of SONI to its new Chief Executive, Campbell also sits on the new board chaired by McNaney along with four other independent members, all of whom are geared towards meeting the challenges and harvesting the opportunities that exist in the creation of a fully integrated and decarbonised power system.

Discussing the implementation of the board, Campbell says: “At this crucial time in the energy transition, our team

“SONI’s direct cost to the consumer is on average only around 2 per cent of their electricity bill, however, our influence on the whole cost to electricity consumers is much more significant.”

SONI’s Chief Executive Alan Campbell

looks forward to working with the new board members, who each bring considerable expertise and experience, to drive forward our mission to deliver a cleaner energy future for everyone in Northern Ireland.”

Describing his attraction to take up the position as SONI Chair, the experienced Peter McNaney, a former chief executive of Belfast City Council and chair of the Belfast Health and Social Care Trust, explains that SONI has the foresight, opportunity, and talent to make a lasting change to the region.

“In the coming years, delivering the challenging ambitions set by the Northern Ireland energy strategy and Climate Change Act is going to require a step change in the intensity of ideas, collaboration, and delivery within the energy industry and beyond.

“Along with the other new members of the board, I look forward to working with the team in SONI to deliver its vision for the future and ensuring it can thrive as a successful TSO for the benefit of local communities, businesses, and farms across Northern Ireland.”

Campbell echoes McNaney’s sentiments that the largest upgrade to the electricity system since electrification itself is a defining topic of our age and welcomes the “fresh perspective and challenge”.

“While Northern Ireland’s 2030 renewable energy targets are very ambitious and challenging, the social, economic, and environmental opportunities afforded by this once-in-ageneration transition are huge,” he adds.

SONI and its board retain a close collaboration with their parent company EirGrid, however, the change has

enabled a restructuring of SONI’s leadership in Belfast, including plans to recruit four new directors. Additionally, the board has set about an engagement process with key stakeholders in the electricity system, not least the Utility Regulator and the Northern Ireland Executive.

SONI’s future vision for the electricity grid is being delivered in the context of challenging short-term delivery conditions. The Winter Outlook, published at the end of 2023, showed that SONI was cautiously optimistic that there would be sufficient electricity generation to meet expected demand in normal operating conditions.

However, the complexity of balancing supply and demand on a daily basis was evident in a warning that risk of supply had increased due to the “tightening of electricity buffer margins”. A similar theme was evident in SONI’s Ten-Year Generation Capacity Statement 20232032, an annual all-island study that sets out the likely balance between electricity supply and anticipated demand over the next 10 years, which pointed to challenges ahead.

The analysis was a clear signal to the electricity market that investment in new generation and the subsequent timely delivery of secured contracts will be required to ensure a stable and secure supply of electricity for consumers in both Northern Ireland and the Republic of Ireland. As the System Operator, SONI relies on the market to deliver the required generation to plan the system to meet Northern Ireland’s energy needs.

Campbell is quick to point out that the short-term challenges associated with maintaining supply while also undergoing 4

a significant modernisation process is not unique to Northern Ireland, but adds that SONI and all relevant stakeholders must work together to manage the reliable supply of electricity,

Acknowledging the scale of the challenge, McNaney says that evidence to date indicates that SONI is well-placed to meet the needs of the region.

“SONI’s Shaping our Electricity Future Roadmap, in its original form, predated the release of the energy strategy and the Climate Change Act and it is telling that the ambition already existed to reach those high 70 to 80 per cent renewable electricity targets.

“SONI is well placed to support the energy transition because the foresight enabled by their research and evidencebase means that the organisations are already turned in that direction. Their direction of travel is clear, concise, and well-documented, something that was very appealing to me when I applied for the post of chair.”

SONI’s Tomorrow’s Energy Scenarios research programme explores a number of likely scenarios to understand how much electricity we might need and how it can be provided, beyond 2030, up to 2050.

As Campbell explains, SONI’s scenario planning and forecasting is a critical part

of its role as an independent and trusted advisor to government energy policy, ensuring that decision-makers are best informed on the potential long-term implications of policy decisions.

This collaboration with decision-makers and key energy market stakeholders is something that must be fostered if Northern Ireland is to maximise the opportunities of a transition to a net zero future. Outlining that currently SONI must approach connections to the grid and plans to increase grid capacity reactively, in response to demand for developers, Campbell believes this approach to be inefficient and contributory to increased costs and timescales.

Instead, he has called for a shift to a more plan-led approach in collaboration with industry, government, and regulatory partners.

“SONI can increase grid capacity in a more strategic, proactive, and timely manner through more anticipatory investment while reducing costs and timescales for grid connections,” he explains.

Such collaboration is a crucial part of SONI’s forthcoming Transmission Development Plan for Northern Ireland (TDPNI), a 10-year roadmap for the strategic development of the electricity transmission network, for which consultation closed at the end of 2023.

McNaney explains that the Transmission Development Plan will also be critical to the delivery of SONI’s next price control submission out to 2030, work on which is already being undertaken.

However, SONI’s Chief Executive is insistent that transformational plans for the future grid must also acknowledge the short-term challenges of managing a power system in transition, highlighting that SONI’s priority must be to maintain security of supply of electricity for consumers. To this end, he welcomes the forthcoming delivery of a new renewable energy support scheme to increase renewable generation but stresses the importance of the appropriate market incentive mechanisms to ensure the “right generation is delivered in the right place at the right time”.

“SONI’s direct cost to the consumer is on average only around 2 per cent of their electricity bill, however, our influence on the whole cost to electricity consumers is much more significant. That is why it is so important that we strike the correct balance between increasing the levels of renewable electricity on the grid to meet demand but doing it in the most costeffective way which does not threaten security of supply.”

McNaney highlights that in recognition of the role SONI has in providing this balance, the grid operator launched a

fundamental review of its engagement strategy in February 2024, with the aim of improving how it engages with local communities, businesses, landowners, and the energy industry, as it seeks to make fundamental changes to the electricity grid.

Greater levels of renewables on the system also means greater levels of intermittence, and a geographic realignment of where generation must be transported from, if Northern Ireland is to transition away from on fossil fuel power plants. Campbell describes it as “vitally important” that the second North South Interconnector is built, to provide greater stability through the Single Electricity Market (SEM).

He indicates Northern Ireland’s planning system as a potential barrier regarding the need to double the amount of renewable generation connected to the grid by 2030 and questions the deliverability of a total overhaul of the planning system given the pressing timescales.

“Ultimately, the planning system needs to be appropriately resourced to meet the level of demand being placed on it, and the increased demand set to come forward. If planning authorities are going to deliver on tight timelines, then they must have the adequate resources to do so. I believe having that overarching plan-led approach to renewable development and grid expansion will be beneficial to allowing those authorities to prioritise.”

Alongside greater levels of interconnection, SONI is also engaged in several programmes of service development, integrating technologies that will help maintain stable supply. Four large battery sites in Northern Ireland have already been connected to the grid, and in October 2023, SONI published a call for evidence on the market procurement options for long duration energy storage.

McNaney illustrates that as well as managing and deploying those on-grid services, SONI also has a role in helping to shape behavioural change in relation to energy use and how consumers engage with the electricity grid.

“As we look to electrification as the primary driver of decarbonisation, there is a widespread recognition that keeping the same societal behaviours will result in higher and frankly unsustainable demand for renewable electricity. We need a smarter approach to our electricity use, so that we can minimise the amount of additional infrastructure required and the technology that will need to be deployed.

“The Department for the Economy is set to develop a plan for the implementation of electricity smart meters and systems, and this is a welcome step to encourage and incentivise households to engage with and help manage the electricity grid.”

He continues: “As a board, we are very mindful of the need to ensure the energy transition is affordable to the consumer but we are also keen to ensure that the actions being taken to reach the ambitious decarbonisation targets are being done with consumers, and not to consumers.

“SONI’s track record of community engagement to date is well

documented and has been successful, but as we move faster and further it is important that we build on those relationships and bring people along on the journey.

Concluding, Campbell says: “While Northern Ireland’s 2030 renewable energy targets are very ambitious and challenging, we know collectively what we need to do and we have a plan. The key challenge is time, and now is the moment to rise to that challenge.

“As an organisation, SONI is geared to help maximise those opportunities and our people are driven by potential to make lasting change to through world-leading engineering solutions and to benefit the consumer.

“The substantive policy direction and the required measures to deliver Northern Ireland’s renewable energy targets are largely in place. The key focus now needs to be on removing the barriers which risk falling short and proactively identifying opportunities to accelerate delivery. As Northern Ireland's Transmission System Operator, SONI is committed to working collaboratively to meet this challenge."

McNaney adds: “There is nothing I have seen in the past six months that causes me any concern about the ability of this organisation to rise and meet the challenges ahead, driven by the right values. As we stand at a historical point in time, SONI is well placed to ensure Northern Ireland, through its expertise in technology and engineering, can realise the opportunities and potential of this energy transition.”

Alan Campbell was appointed Chief Executive in October 2023, having been the Managing Director of SONI since July 2020. He joined SONI in July 2017, as Head of Grid Infrastructure Projects and Connections moving from ESB, where he managed the Coolkeeragh Power Station. He is a mechanical engineering graduate from Queen’s University Belfast.

Peter McNaney practised as a corporate lawyer for 20 years before serving as Chief Executive of Belfast City Council between 2001 to 2014. As a non-executive, he was chair of the governing body of Belfast Metropolitan College and served as a member of the board of Invest NI. He was also the senior independent director and chair of the audit committee of Northern Ireland Water and recently stood down as chair of the Belfast Health and Social Care Trust after nine years.

2030 target to be met by two

An

ambitious target of 80 per cent renewable electricity consumption by 2030 will need to be met by just two project auctions under the forthcoming renewable electricity support scheme (RESS).

Although not finalised, design considerations by the Department for the Economy for the RESS scheme suggest that only projects procured in the scheme’s first two auctions will be operational by 2030.

Currently, around 45 per cent of Northern Ireland’s electricity consumption comes from renewable sources, mostly onshore wind, and a significant gap exists in reaching the 80 per cent target mandated by the Climate Change Act in less than six years.

An estimated 3.5 TWh of generation are expected to require support if Northern Ireland is to meet the 80 per cent renewable electricity target and the Department’s proposed auction roadmap sees 1,000 GWh (~500MW), procured in 2025/26 for delivery in 2027. This means that auction one of the new support scheme is expected to

deliver around 30 per cent of the supported energy volumes required to meet the 2030 target, with the vast majority being from onshore wind and solar projects.

Auction two, therefore, which is set to be held in 2027 for project delivery in 2029 will need to procure around 70 per cent of supported energy needed, a volume of some 2,500 GWh (~1250 (MW).

The Department says that this second auction will be used to increase the procurement volume of other technologies beyond onshore wind and solar, but it is not expected to support offshore wind projects.

Interestingly, no timeline has been offered for offshore wind support, despite recognition of the critical role it is intended to play in Northern Ireland’s transition to net zero. The Energy Strategy Action Plan 2022 commits the

Department to a target of 1GW of offshore wind capacity from 2030 and the Department says that while it continues to “refine the timeline for offshore wind delivery, at this stage in development, it is not possible to confirm the scale and timing of offshore renewable generation deployment in Northern Ireland”.

The Department for the Economy first held a consultation on design considerations for a renewable electricity support scheme in February 2023 and in early April 2024, the Department issued its Proposed High Level Design on the RESS.

Calls for a renewable electricity support scheme had been longstanding with recognition that market conditions provided little incentive for developers to build further generation. The Northern Ireland Renewables Obligation (NIRO) was Northern Ireland’s last

• Procure projects at advanced stages of development.

• Procure ~30% of the suppor ted energ y volumes required to meet 2030 target, mainly through Pot 1

• Procure remaining ~70% of suppor ted energ y volumes required to meet 2030 target.

• Increase procurement volume of Pot 2 to diversif y the supply mix 2

Source: Department for the Economy

support scheme for encouraging increased renewable electricity generation in Northern Ireland and successfully catapulted the region to a world leader in renewable electricity.

However, the scheme closed in 2016/17, with the substantial delivery of new clean energy development in the region largely ending with it.

Outlining the primary aim of the scheme as “to encourage investment in local renewable electricity projects whilst also protecting consumers from global price shocks”, the Department stresses that the high level design paper is a “preliminary proposition only” and that the detailed design will be developed throughout the remainder of 2024.

The Department’s high level design paper was informed by analysis carried out by Aurora Energy Research on its behalf, which included a range of preliminary recommendations.

The design proposes a contract for difference (CfD) scheme, based on successful deployment internationally, for a variety of eligible technologies ranging from onshore wind and solar through to tidal energy and storage infrastructure.

Importantly, the scheme is likely to be voluntary, recognising that a mandatory migration to a CfD scheme for legacy projects would significantly alter the financial business model. Additionally, potential delays caused by legal objections to inclusion in a mandatory scheme should be avoided. Finally, feedback suggests that a mandatory scheme could pose a barrier to

alternative routes to market, such as corporate power purchase agreements (CPPAs).

Subject to change is the proposal that the scheme proposes a minimum capacity for eligibility of 5MW, however, this is likely to be reduced following industry feedback. The Department notes no “broad consensus” for a dedicated support scheme for microgeneration, however, there is recognition that microgeneration could continue to make an important contribution to reaching targets, leaving open the possibility of delivery of a future scheme.

Also likely to be included in the final scheme is a community benefit fund, with the Department recognising widespread agreement that communities hosting renewable projects should benefit from the wider advantages gained by consumers in Northern Ireland.

The majority of feedback agrees that the optimal frequency for access to the scheme would be between one and two years, with a proposed contract length of 15 years. However, technologyspecific contract lengths are an option.

“A clear roadmap for upcoming auctions was also widely identified as critical to providing enough predictability for developers to manage risk,” the Department states.

On price, pay-as-clear stands out as the most suitable price clearing process, on the basis that auctions need sufficient competition for this approach to be effective. As expected,

strike prices are likely to be indexed to inflation, minimising revenue uncertainty over the lifetime of the contract for generators.

Finally, there is wide agreement that Planning Permission and a Grid Connection Offer should be required for projects to be eligible. It is also noted by respondents that these requirements are essential to protect customers from non-delivery or overly speculative bids. However, it has been warned that a balance must be found, and that additional requirements beyond planning permission and a grid connection offer may deter achievable projects, resulting in reduced competition in the auction process.

This eligibility poses a challenge. The Department estimates that the 30 per cent contribution from auction one will be from projects already in the planning pipeline. The planning system in its current format has been criticised as slow and cumbersome, particularly when it comes to major infrastructure projects.

With only projects procured in the first two auction round of a new renewable electricity support scheme likely to be operational by 2030, meeting the ambitious 80 per cent electricity consumption from renewable sources target by that timeframe will require a substantial shortening in determination times for planning applications.

Calor is pioneering sustainable solutions for Northern Ireland's rural communities, writes Mary Coughlin, Calor’s Regional Sales Manager.

Calor has been a reliable supplier of energy solutions for over eight decades, particularly catering to rural consumers off the natural gas grid here in Northern Ireland.

Our product range caters to a wide array of sectors, spanning agriculture, hospitality, industrial settings needing high-temperature heat, and residential

properties. Deeply attuned to consumers’ and businesses’ unique needs, our journey to net zero is well underway and is committed to offering a variety of options to fulfil current and future energy requirements.

This commitment extends to our role in guiding them through the transition to more sustainable energy solutions. Still,

with this move, there’s a necessity for robust governmental support and a collaborative approach to marketing efforts to ensure that customers are adequately informed about the available options, empowering them to make wellinformed decisions regarding their energy choices.

For the past 80 years, Calor has been synonymous with LPG (liquefied petroleum gas) supply, and in 2018, we introduced our first renewable fuel, BioLPG. This marked a significant milestone in achieving our aspiration of offering 100 per cent renewable and sustainably sourced energy, in line with our ethos of caring for future generations.

Our BioLPG is a significant part of this journey and delivers up to 80 per cent certified carbon savings compared to fossil fuels*, offering an environmentally conscious choice as a drop-in fuel compatible with existing infrastructure, simplifying the transition for users.

BioLPG can also blend seamlessly with LPG. This flexibility empowers users to dictate their own green trajectory while balancing the associated financial costs because they can blend from 10 per cent to 100 per cent BioLPG — the option is theirs.

BioLPG, while a massive part of our net zero efforts, will be one of many innovative products. As part of SHV Energy, a global leader in LPG, Calor draws on vast insight and experience, and we are proud that Northern Ireland is leading the way in our parent company’s broader adoption of BioLPG.

Since we introduced BioLPG in 2018,

Northern Ireland has been among the earliest global adopters, driven by local businesses embracing our products. Additionally, with our parent company, we are actively pioneering alternative fuels like renewable dimethyl ether (rDME) — a clean-burning fuel produced from renewable sources such as organic waste or biomass. Through the joint venture Dimeta, SHV aims to expedite rDME production, offering another clean fuel option while supporting local waste management.

At Calor, we believe partnerships play a crucial role in achieving our and society’s net zero goals. Our partnerships with leading universities, including Queen’s University Belfast, enable us to undertake groundbreaking research and development projects to meet the evolving needs of our customers and the environment.

Calor also adopts a mixed technology approach, which we know will be a valuable asset in the transition to more sustainable energy solutions. This combines traditional LPG and BioLPG with renewable energy technologies such as solar panels and heat pumps. It enables us to offer a range of economically viable solutions for off-grid homes and businesses, ensuring reliable warmth while cutting carbon emissions. Our ongoing exploration of hybrid solutions is another part of our commitment to meeting evolving customer needs and advancing towards a more sustainable energy future.

However, this energy transition comes with challenges, particularly in rural areas. Limited public knowledge and the upfront costs of transitioning remain significant barriers. Research carried out by Calor in March 2024 cited cost as the primary barrier in the shift towards lower carbon or renewable energy, followed by 38 per cent indicating a lack of access to infrastructure.

Educating consumers and providing financial support for equipment upgrades are essential steps in overcoming these challenges. Government policies that promote mixed technology solutions and support energy efficiency improvements can further facilitate this transition.

The survey showed that more than half (54 per cent) of respondents said the Government is not giving enough support in facilitating the transition to lower carbon or renewable energy sources. This highlights the need for government

leadership through policy to address this gap.

Four key challenges for the adoption of renewable liquid gases require collective action; firstly, the need for clear policy direction is crucial. The Northern Ireland energy strategy and subsequent yearly action plans by the Department for the Economy (DfE) is a promising step.

Secondly, as part of the broader LPG sector, collaboration with Liquid Gas UK is vital to address these challenges.

Decarbonising heat is another pressing issue to achieve net zero by 2050. It is essential to offer consumers a mixed offering rather than relying solely on one solution such as electricity. We can learn from neighbouring countries, where policies favouring one solution over others have proven ineffective, emphasising the importance of providing choice.

Lastly, time is of the essence, and adopting a multi-technology approach is paramount. We view LPG as the initial

step, followed by renewable gases, to tackle these challenges effectively.

As a business, Calor is committed to leading the transition to greener energy in Northern Ireland – particularly in rural areas. Through innovative products like BioLPG, ongoing research into renewable fuels like rDME and eventually Hydrogen, alongside our strategic partnerships we are helping shape a more sustainable future for generations to come.

Right now, Calor will continue to communicate and support people to join in using lower carbon LPG and BioLPG. We are aiming to invest, and we’ve taken this step and journey before there was a policy there and we will continue to work towards that to enable our customers to make lower carbon choices.

Mary Coughlin

E: Mary.coughlin@calorgas.ie

W: www.calorgas.ie

Hydrogen use will become “an important lever” in the transport sector after projected advances in technology, production, and storage capacity, and will be particularly prominent in the decarbonisation of aviation, the International Energy Agency’s (IEA) Shane McDonagh claims.

Shane McDonagh, an IEA research analyst and former researcher at UCC’s MaREI, has outlined that by 2050, hydrogen will be in widespread use throughout the heavy-duty transport sector both directly and in the form of hydrogen-based fuels, and that the most significant scope for development is in the aviation industry, although there are wider roles to be played in maritime and to a lesser extent road transport.

McDonagh acknowledges that these are long-term aspirations as hydrogen production is “likely to be limited” prior to significant demand emerging in these sectors and before the introduction of

Source: IEA

Over 45% of hydrogen demand in 2050 in the NZE goes to support transport, either directly or in the form of hydrogen-based fuels

adequate storage and distribution capacity, which is not anticipated to happen prior to 2030. Furthermore, he indicates that as electricity becomes the dominant source of energy for road transport, the use of biofuels will shift to shipping and particularly aviation.

McDonagh says that the key lesson being drawn from IEA research thus far is that there is a need to “use electricity directly where possible”, suggesting where practical, direct electrification generally provides the lowest costs and carbon emissions of the competing solutions.

Given the current limitations of batteries, this still leaves significant room for hydrogen and in the IEA’s net zero emissions by 2050 scenario “electricity demand for hydrogen-based fuels production will increase total transport electricity demand by 6,000 TWh to reach a total of almost 17,000 TWh,” he explains.

Hydrogen is touted by McDonagh as having a “prominent” role to play in the reduction of emissions. However, in concluding, the analyst is mindful that hydrogen will play a role which is

“complementary” to wider electricity and bioenergy use in all transport sectors.

“In shipping, biofuels are increasingly used, reaching about 20 per cent of fuel demand, but due to limits on sustainable biomass availability and competition with the aviation industry, we could see green ammonia emerge as the most dominate zero emission fuel in 2050, meeting about 50 per cent of fuel demand.

“Hydrogen, which is not as well suited as ammonia and biofuels for long, transoceanic journeys, is used for shorter range coastal vessels. Hydrogen could account for 15 per cent of shipping fuel demand in 2050; and the other 15 per cent of fuel will still come from oil.”

He concludes, rationalising: “One of the reasons for the slow transition of maritime shipping to zero carbon fuels is that for ammonia and hydrogen especially, new ship designs and standards will be needed.” Even once these ships are built, turnover will be low as “shipping vessels have lifetimes of 20 to 30 years”.

Patricia McGrath, Head of Project Development at renewable energy developer ABO Energy discusses Northern Ireland’s renewable electricity target and the opportunities presented by the need to decarbonise.

Whilst Northern Ireland has shown in the past that it has the expertise and ambition to meet and exceed renewable energy goals; a number of factors have slowed the delivery of new projects in recent years. However, a renewable electricity consumption target of at least

80 per cent by 2030 and recent announcements from the Department for the Economy mean the sector is focused and ready to deliver once again.

“There is no doubt the last six or seven

years have been frustrating when it comes to delivering new projects in Northern Ireland,” says McGrath. “Being the only region in the UK and Ireland without a government support mechanism meant we were effectively operating with our hands tied behind our back. Most of the financial investment went to other areas that were simply more attractive to investors.”

During those difficult years, most large renewable energy companies scaled back their involvement in Northern Ireland, with many leaving the region completely. However, ABO Energy continued to invest in its team and in new opportunities, which means it is now perfectly positioned to support the drive to 80 per cent by 2030.

“Our confidence in and commitment to Northern Ireland never wavered. Even when there was little cause for optimism, we focused on identifying opportunities, securing new sites and further developing our own expertise and experience. We are very proud of our fantastic team,” explains McGrath.

This approach has paid off. With a team of almost 20 full-time professionals in its Lisburn office, ABO Energy has expanded its interests here from its original involvement in onshore wind, to a portfolio of projects that now also includes battery energy storage, green hydrogen, and solar PV.

The company’s growing expertise in a wide range of technologies prompted a recent name change, having previously been known as ‘ABO Wind’.

“We had many successful years under our previous name, but ABO Energy much better reflects the breadth of skills and expertise we now have. A fundamental part of our approach is developing trusted partnerships with landowners and we want them to know from the start that we can work with them on much more than just wind energy projects.” says McGrath.

“Our new branding has been so well received but we are also very keen to emphasise that we are still the same

company with no change in ownership. Our ethos remains unchanged and everyone who deals with ABO Energy will see the same ambition, professionalism and respect they are used to from our team.”

The ambition McGrath refers to has made ABO Energy one of the most active developers in Northern Ireland, with a pipeline of developments that will make a substantial contribution to the 2030 renewable electricity target.

“As things stand we have achieved planning approval for over 375MW of projects in Northern Ireland. That includes wind farms, a green hydrogen facility and one of the largest battery energy storage projects consented on the island of Ireland,” says McGrath.

“We also have live planning applications for further projects totalling over 300MW and we expect this to grow further in the coming months. When built-out, our consented and currently proposed developments will involve an investment of £450 million.”

McGrath believes there are very few, if any, other industries that offer such significant promise across Northern Ireland: “As a sector, we are proposing generational levels of private investment here. It is Northern Ireland’s single biggest economic opportunity.”

Born and raised outside Dungannon, County Tyrone, McGrath studied at Queen’s University Belfast and now

lives with her husband and three young children close to where she grew up. “I particularly like the fact our investments create benefits across the region –mostly in rural areas that otherwise really struggle to attract funding and economic growth. That is important to me personally, as well as the investment needed to build and operate our projects, our community benefit funds will support local groups and organisations long into the future.”

ABO Energy has an extensive educational programme in Northern Ireland, where an experienced teacher, Mrs Pauline Davison works with local primary schools on renewable energy and sustainability classes. “We see such enthusiasm from the children who are not only very conscious of the need to look after our planet, but also enjoy learning about renewables as an industry that they might one day work in,” says McGrath.

Slow and inconsistent planning decisions remain a barrier to new developments, but it is hoped recent announcements about a new support mechanism will boost activity in the renewables sector further.

“The planning issues are well rehearsed and go beyond the renewables sector, but we need to see urgent progress in that regard,” explains McGrath. “On a more positive note, we very much welcome the Department for the Economy’s announcement that a

renewable energy support scheme is to be put in place, with the first auction –where projects can bid for contracts – to be held in early 2026.

“Although we feel the auction should be held sooner given the 80 per cent target date of 2030 is fast approaching, I do expect to see more interest across the sector in Northern Ireland now that we know the support scheme is on its way. It will help make new projects viable.

“That is good news for everyone, as ultimately the more locally produced green energy we can generate the less reliance we have on polluting and expensive fossil fuels.”

Concluding on whether she ever considers moving to ply her trade in another sector, McGrath, who holds an undergraduate degree in geography and a Master’s in environmental planning, responds: “No. I love the challenging nature of working on renewable energy projects, even after 12 years; and most importantly I believe we are doing the right thing.”

T: + 44 28 9099 6445

W: www.aboenergy.co.uk

E: info@aboenergy.co.uk

With the 2030 energy deadline fast approaching, several challenges, such as regulatory hurdles, energy price rises, and consumer affordability, are significantly stalling progress, MPs have been told.

These challenges are the focus of the Northern Ireland Affairs Committee (NIAC), aiming to evaluate Northern Ireland's strategy for meeting its 2030 and 2050 energy targets.

To help the UK Government fulfil its 2050 net zero commitment, Northern Ireland’s Executive set a target for 80 per cent of its electricity to come from renewable sources by 2030. Yet, latest statistics reveal that progress towards this ambition is regressing, prompting the committee to launch an inquiry into the issue in the absence of Stormont.

Ian Snowden, Permanent Secretary of the Department for the Economy, highlights: “There is a fantastic opportunity in Northern Ireland to

achieve energy self-sufficiency, possibly for the first time in history of the region... It will be extremely challenging to push all of that through in the timescale, but it is possible.”

However, Richard Rodgers, Director of Energy for the Department for the Economy, underscores the tight timeline, stating: “What we have done in 23 years now has to be done in six.” This urgency was echoed by Steven Agnew, Director of RenewableNI, who cited a report, based on the latest research from SONI in Tomorrow’s Energy Scenarios, indicating that Northern Ireland might not achieve zero carbon electricity until 2040 at the earliest.

Derek Scully, Head of Corporate Affairs in Energia Group points out that Northern Ireland has made “exceptional” achievements, with up to 50 per cent of its electricity coming from renewables, primarily onshore wind.

“Some 40 per cent to 50 per cent of electricity in Northern Ireland is from renewables. We can look anywhere else in the world, and you will find higher renewable numbers, but you will not find it where it has been almost exclusively onshore wind.” However, Scully acknowledged that “the 80 per cent target by 2030... is going to be a real challenge”.

Other experts, like Professor David Rooney, who specialises at the Research Centre in Sustainable Energy at Queen’s University Belfast emphasises the need to speed up processes and planning, with James Richardson, Chief Economist of the UK Climate Change Committee, adding that several factors have been detrimental to progress, stating: “planning has been an issue, regulations have been an issue, connection charges have been an issue.”

To increase renewable energy generation, the committee acknowledges that expanding grid capacity and improving infrastructure are crucial. Agnew warns: “Business as usual will mean that we do not just miss our 2030 target, but miss it by a mile.”

Mark Fitch, Corporate Development Director at Transmission Investment, calls for stable policies and regulations to encourage investment. Furthermore, Fitch suggests that Northern Ireland could benefit from adopting practices that are already proven elsewhere, such as the UK and Republic of Ireland. This, in turn, would help speed up the planning process and therefore accelerate growth in relation to renewable energy within Northern Ireland.

Affordability and consumer perception are significant barriers to achieving renewable energy targets. Peter McClenaghan, Director of the Consumer Council for Northern Ireland, notes that “97 per cent of people... are significantly worried about energy prices”.

Addressing these concerns requires clear data collection and a shift in energy pricing. Snowden explains that data collection is “key” in terms of “either a surcharge on those using fossil fuels or a discount on those using renewable energies”.

Investor confidence is essential for driving renewable energy projects forward.

Paddy Larkin, CEO of Mutual Energy, states:

“We do not have a support scheme for renewable generation, so there is not any being built.” The absence of consistent support schemes has driven investment to other regions, such as the south of Ireland.

In February 2023, the Department for the Economy issued a consultation to gather insights for the development of a renewable electricity support scheme (RESS) in Northern Ireland, and subsequently a ‘Proposed High Level Design’ was issued in April 2024.

Fitch reinforces the need for stability during this time, suggesting that adopting established support systems would attract investors.

Agnew firmly believes that the status-quo in achieving 2030 targets will not achieve the renewable energy needed, stating: “You will not be connected (via grid connections) until 2030, no matter how quickly you can build it.”

James Richardson, Chief Economist at the UK Climate Change Committee believes that limited grid capacity is a key challenge in Northern Ireland: “It is mostly going to require upgrading the grid. There are certainly things that you can do, which mean that you do not have to upgrade the grid by as much as you are upgrading the use of electricity, by putting more flexibility into the system and shifting demand out of the peaks, because you have to build these grids for the peak. It is typically in the evening when you can shift demand for things like electric vehicle charging. Heat pumps are pretty flexible about when you can put them on.”

Rooney emphasises this point, stating, “I would agree. Large-scale investment in the main energy carriers in the future, which is electricity, needs to happen and needs to happen as soon as possible.”

Fitch suggests: “I would say, “Let us look at our close neighbours and what they are doing and seek to copy the mature things that are going on there to bring more people in to deliver it more quickly, cheaper, and better.”

David Blevings, Ireland Manager of OFTEC suggests a “fast, streamlined process for energy policy”, emphasising the need for government intervention to accelerate planning.

Northern Ireland’s journey toward net zero and renewable energy is filled with challenges, from infrastructure to investor confidence and consumer affordability. The NIAC discussions highlight the need for a cohesive strategy, robust support schemes, and expedited planning processes. Without these changes, achieving the 2030 target could be an uphill battle.

Ltd, David Surplus, outlines the opportunities of using the maritime e-methanol market to fast-track deployment of large-scale offshore wind.

It is important to mention that B9 Energy always supports direct electrification whenever possible because it is the most efficient route to decarbonisation. However, when industry sectors, such as marine transport need liquid fuel alternatives, then Power-to-X and e-fuel synthesis become a priority.

Decarbonising the Northern Ireland economy by 2050 will require the deployment of large-scale offshore wind farms. These will be additional to the existing onshore capacity and have both geographical and hourly correlation to the electrical loads being supplied.

The existing electrical grid network is not

capable, in the time and budgets available, of transporting such large amounts of power on its own but assistance can be provided by Powerto-X systems to allow crossover of hydrogen into gas networks.

The infrastructure map (figure 1) shows offshore wind, Power-to-X (P2X) electrolyser stations, dedicated sub-sea cables and pure hydrogen pipelines. It also shows the location of the proposed 500 million m3 salt cavern storage facility at Ballylumford, Islandmagee, which can store green hydrogen. The total system shown is 3.45GWe capacity, requires €9 billion CAPEX from private investors and is called ‘Ulster Hydrogen Valley’ 1

Routes to market for H2 gas include blending into natural gas pipelines and delivery to existing power stations to provide future security of supply during periods of low wind. Unfortunately, slow policy development in these areas means there is insufficient legislation or regulations to support the ambitious project development needed to solve the climate emergency.

A faster and larger route to market for green hydrogen is offered through the development of an e-methanol economy, particularly as it relates to the fastgrowing maritime fuel sector. Note that methanol is a chemical fusion of hydrogen and CO2

B9 Energy Storage together with partners: DFDS Seaways, DFDS Logistics, Larne Harbour, JG Maritime Consultants, Mutual Energy and the Net Zero Industry Innovation Centre at Teesside University are being funded by Innovate UK and Department of Transport through the Clean Maritime Demonstration Competition round 4 (CMDC4) to carry out feasibility studies and pre-deployment trials in respect of a

‘NI/GB Green Shipping Corridor’ between Larne in Northern Ireland and the north west of England (preferably Liverpool) using a ro-ro freight ferry design optimised for the carriage of unaccompanied trailers and powered by hydrogen reformed onboard from green methanol delivered in road mobile ISO tank containers.

The green methanol would be synthesised at Larne Harbour from green H2 and CO2 as an extension of the Ballylumford Power-to-X Project. The main innovation in the project is to capture CO2 from the onboard reformer and return it to the methanol synthesis plant in the same (now empty) tank containers that delivered the methanol, thereby setting up a circular CO2 economy that avoids the inevitable future supply constraint of green CO2

The port based flexible green methanol plant will use otherwise curtailed wind power to drive a PEM and/or Alkaline electrolyser that feeds green hydrogen to a catalytic reactor. The Domestic Green Shipping Corridor would have ‘true-zero’ emissions, would not be reliant upon limited supplies of bio derived CO2 or direct air captured CO2 and would not need any carbon offsetting to meet net zero objectives.

The system diagram of Figure 2 relates to the recirculation of CO2 to enable scale-up of e-methanol as a marine fuel. It also shows the ‘linear’ application of

1. https://h2v.eu/hydrogen-valleys/ulster-hydrogen-valley

captured green CO2 from biogenic sources (anaerobic digestion) and direct air capture (DAC) from the atmosphere to serve the linear end uses of emethanol, such as blending into E10 specification petrol, selling as pure methanol (M100) for spark ignition engine powered vehicles and for subsequent synthesis into Dimethyl Ether (DME), which is a substitute for LPG, and e-kerosene, which is a sustainable aircraft fuel. These linear CO2 applications end up with CO2 being vented to atmosphere and so they can deliver carbon neutral performance.

B9 Energy storage is hosting a DESNZ funded DAC demonstration project at its HQ office in Larne. The unit has been designed by CO2CirculAir for intermittent operation using wind power without the need for energy storage or forced draft fans. Deployment of DAC machines driven by off-grid single wind turbines, ranging in size from 250kW to 1MW, can usefully be carried out at up to circa 1,000 different farm locations in Northern Ireland.

Wind can be augmented with low-cost ground mounted solar PV arrays. In many cases these sites already have planning permission for wind turbines but no cost-effective grid connection

offer. Collection of the liquid CO2 would use similar logistics operations to bulk milk collections and animal feed deliveries. The DAC sourced CO2 is pure enough to be used in the food and drink sector.

There are several turnkey suppliers of methanol plants that have specifically designed for variable inputs of green hydrogen from renewable energy driven electrolyser installations. An example is ‘FlexMethanol’ from BSE Engineering which claims flexible operation in the range 10 per cent to 120 per cent in less than 15 seconds. Use of such a flexible system would remove the need for large scale hydrogen compression and storage, which are expensive operations.

David Surplus Managing Director

B9 Energy Storage Ltd

E: d.surplus@b9energy.co.uk

W: www.b9energystorage.co.uk

2. https://www.shippax.com/en/news/green-methanol-on-track-to-become-a-scalable-zero-emission-fuel-in-the-maritime-sector.aspx

The role of long-duration storage in a net zero future

Mutual Energy hosted a roundtable discussion with experts from across the industry to discuss the role of energy storage can play in decarbonisaing Northern Ireland's energy system.

How does long-duration storage have a role in delivering an integrated, decarbonised energy system for Northern Ireland?

Eimear Watson

Long-duration energy storage is a fundamental part of decarbonising the power system and has various benefits. One obvious benefit is the potential for SONI, as Transmission System Operator, to reduce the dispatch down of

renewable generation in times of high supply, while also minimising the use of fossil-fuelled peaking plants in times of low supply, particularly over prolonged periods, which will reduce costs and help with delivering a net zero carbon energy system. Another potential benefit is assisting with grid congestion and the challenges that come with the east-west imbalance of supply and demand that we have on the power system. Ultimately, if long-duration energy storage can be deployed quicker than grid investment, then it could enable the

Round table discussion hosted by

use of more renewable generation sooner and defer or potentially remove the need for some grid investment.

Paddy Larkin

Wind and solar are the leading technologies for decarbonising our electricity network but the supply given by these technologies is not only intermittent, but also unpredictable. Ultimately, this leads to a mismatch between supply and demand. Modelling suggests that over the course of a year, with same levels of generation, and the same levels of demand, the mismatch is around 40 per cent. This is where the need for storage comes in. The benefits of increased wind generation are starting to be diminished because of the marginal cost of curtailment across the board. Developers are no longer going to absorb the risk factors of dispatch down and curtailment, so society and

government will be required to take on that risk to enable the build out of the renewables needed.

David Surplus

Long-duration storage enables the management of intermittent renewables by providing instantaneous balancing of electrical load. A typical curtailment episode in Northern Ireland could last for 10 hours, which exceeds the capacity of conventional batteries being operated today.

Sean Kelly

For the past 25 years flexibility in the electricity grid has been afforded by generation from natural gas stations. Now, the reality is that climate change and low carbon targets mean that we need a new approach. The island of Ireland, as an islanded electricity network, albeit with some interconnection, is at the cutting edge of incorporating high levels of renewables and the means to tackle that lie in having flexible options including a mix of shortterm, medium-term, and long-term storage options.

Tony Roulstone

The future electricity system is going to be driven by supply rather than demand because of the level of variation on a grid fuelled by solar and wind generation. Our modelling for Great Britain indicated that in such a system, if you built renewable supply on a nominal basis, you would have a shortfall some 20 per cent of the time. If 20 per cent of your energy is mistimed or mismatched then you have a security of supply issue, and that is where energy storage comes in. Our research highlighted the requirement and importance of energy storage for different time periods. To move energy through time, the question is: How long does it need to be stored? We found most of the energy needed to be stored for days rather than hours, with 12 per cent only a few hours and balance for months or longer.

Peter Russell

I think it is important to note that the overarching aim is to decarbonise across power, heat, and transport – not just to decarbonise the energy sector. Northern Ireland has a lot of advantages, because of its size and agility while also already moving at pace across many different sectors to meet ambitious decarbonisation targets. We can get the right people in a room to discuss these challenges more easily that other jurisdictions. Long-duration storage is key to addressing the intermittent and

Sean Kelly is the transmission grid manager for the SSE Renewables 1500MW Coire Glas Hydro Pump Storage Project. He has been involved in this project since its inception in 2010 and led the project consenting phase achieving planning consent from the Scottish Government in 2020. Kelly is chartered engineer and IET Fellow.

Paddy Larkin joined Mutual Energy (then Northern Ireland Energy Holdings) in 2007 as an Executive Director and Managing Director of Moyle Interconnector Ltd and, in 2010, took over as Chief Executive of the Group. Previously, Larkin was the Chief Executive of Premier Power, a subsidiary of the BG Group and owner of Ballylumford Power Station. He is an engineering graduate from Queen’s University Belfast, a fellow of the Irish Academy of Engineering and serves as a non-executive director of Northern Ireland Water.

Tony Roulstone worked for Rolls-Royce for 20 years culminating in running a group of power businesses. He was a key contributor to the Royal Society’s 2023 study of long duration energy storage. Also, he established the nuclear energy master’s programme in the department of engineering at the University of Cambridge. He is also involved with the design of national energy systems for net-zero in 2050 and the industrialisation and the economics of fusion. He is a Fellow of the Institution of Mechanical Engineers and a Fellow of the Nuclear Institute.

Peter Russell

Peter Russell has been the Utility Regulator’s Executive Director of price controls, networks and energy futures group since January 2024. Prior to joining the Utility Regulator, he was Director for electricity and security of supply in the Department for the Economy. Russell is an economist and has a master’s degree from the University of Glasgow and an MBA from the University of Strathclyde.

David Surplus

David Surplus is a chartered marine engineer and former Lloyd’s register surveyor who moved from offshore oil and gas into renewables 32 years ago to form the B9 Energy group of companies. B9 has developed wind farm, AD, landfill gas, solar PV, and power-to-X projects and is now focused on GW scale emethanol synthesis for the roll-on/roll-off freight ferry sector.

Eimear Watson

Eimear Watson is Head of Networks at SONI and is responsible for transmission system and connections planning, transmission infrastructure delivery and connections contract management. Watson holds a Master’s in Electrical and Electronic Engineering from Queen’s University Belfast.

“A good mix of short and long-term energy storage options offers the greatest potential to maximise the renewable generation we have coming onto the system.” Eimear Watson

predictability challenges of renewable supply, while providing other system benefits, but it ultimately needs to delivered at a fair price for consumers and the technology options used need to be right for Northern Ireland.

Outline the long-duration storage options available that could suitably be deployed in Northern Ireland

David Surplus

The conclusion we came to with the Ballylumford Power-to-X project is that you can use the natural gas pipe network as a store. Gas infrastructure possesses five times the energy carrying capacity that the electricity grid has. Additionally, our research indicates the salt caverns at Islandmagee will be suitable for hydrogen gas storage. That would give us an almost infinite ability to put electrolyser load on to the grid and balance both wind and solar variation. Only around one-quarter of the fossil fuels consumed in Northern Ireland are for the electricity sector, as the majority are used to fuel both heat and transport. It must be recognised that as we increase renewable electricity generation, predominantly through offshore wind, not all of it will be used in the electricity

sector. Consequently, there is a real opportunity to address heat and transport emissions through various eFuels.

Sean Kelly

Northern Ireland’s electricity system is heavily dependent on fossil fuels for periods of low renewables. Therefore,

“It must be recognised that as we increase renewable electricity generation, predominantly through offshore wind, not all of it will be used in the electricity sector.”

David Surplus

storage considerations must prioritise decarbonisation. There are several options and technologies available but hydro pumped storage has been around longest and represents the most mature option, at the greatest scale to date. Hydrogen also presents great potential to ‘load shift’ renewable power. Looking beyond security of supply, energy storage presents a huge economic opportunity. The industrial revolution was built on the availability of cheap fuel. Ireland has the best renewables resource in western Europe and therefore the opportunity to capitalise on the growing demand for clean energy, not just through export, but through building the manufacturing and processes aligned with clean energy storage.

Tony Roulstone

The options available can be categorised into three types of solution. The first is short-term, for a few hours – battery systems. The second are physical-based systems which are useful in the short-tomedium term up to a week and include the likes of pumped hydro, compressed air and liquid air energy storage. Finally, chemical-based systems such as hydrogen, ammonia and synthetic fuels cover longer storage timeframes beyond a week. Cost is important. Battery systems are cheap in terms of power capacity, but expensive when you consider energy volumes. Physicalsystems are between two and three times more expensive in terms of power but could be 10 times cheaper in terms of volume. Chemical systems are even more expensive when compared to batteries for providing power but can be vastly cheaper in terms of storing volume of energy. Governments need to support the demonstration of both physical and chemical storage systems, bringing them to the stage where they become replicable with supply chains that will bring down costs. While the initial cost estimates are high, replication can have a big effect as it has with wind turbines.

Paddy Larkin

I believe all the options will be needed when you consider the scale of the storage requirement, which is around one month of energy. A completely decarbonised electrical network is likely to need some 600 GWh of storage. For context, Turlough Hill Power Station, the only pumped storage in Ireland, offers around 3 GWh, giving a sense of the scale needed. We need short-, mediumand long-term options and these options have three drivers: cost; turnaround

“An evident flightpath for energy storage volume for the near, medium and long-term is key to energising progress in this area.” Paddy Larkin

efficiency; and scale. The reality is that no option will provide all three and that is why it is important that there is a holistic approach. If we are focused on 2030 targets then batteries, with a 15-to-20year lifespan, are the best option for quick and fast deployment but if we are decarbonising our future, then we need to be thinking longer-term about what options will pay back over 100 years, rather than 20. In making those decisions, we need to have consideration for what works best in

Northern Ireland’s geology and geography, and what delivers the right value for customers.

Eimear Watson

As a Transmission System Operator we would like to see a diversity of energy storage options connected to the power system. A good mix of short and longterm energy storage options offers the greatest potential to maximise the renewable generation we have coming on to the system.

“Energy storage must be available to meet gaps in supply when needed, not run to maximise revenue.”

Tony Roulstone

Would Northern Ireland’s energy system benefit from selecting and supporting a single long-duration storage technology?

Peter Russell

Fundamentally, the technology requirements of long-duration energy storage in Northern Ireland will be defined by the parameters of what we, as a region, are trying to achieve. All options are on the table, but 2030 is not that far away and we need to consider what is best for the long-term, as well as realising the economic opportunity that exists. It is important to define what we need from the technology, and then let the market bring forward solutions.

Tony Roulstone

If the focus is on the short-term 2030 targets, then the solution will be driven by what is available and doable today, which will be battery systems plus carbon emitting gas turbines. Northern Ireland potentially will need between 200 to 300 GWh each year to balance supply and demand, while meeting its 2030 renewables target. Capital cost of batteries is estimated to be £10 billion per 100 GWh. This £20 to £30 billion is not feasible and it will not deliver net zero because of the continuing use of fossil fuel. The UK, as a whole, needs a

strategy for energy storage beyond nearterm targets and for the demonstration of longer term physical and chemical systems.

David Surplus

The deployment of windfarms in Northern Ireland effectively stopped in 2018 with the end of Renewable

Obligation Certificates and the rise of curtailment and constraint. That undermined investor confidence to build and that is a problem when you consider the targets for 2030 and beyond. Having that long-duration controllable electrical load, in whatever form that takes, is important as a basis for increasing generation.

Paddy Larkin

The scale of the storage required is so large that there needs to be a multitude of technological solutions coming forward, and it will require most of them. However, it is worth noting that longterm storage projects in Northern Ireland would be transformational in scale. With projects that size, comes an element of risk.

What are the existing barriers to the delivery of long-duration energy storage options?

Tony Roulstone

Market-based approaches that depend on subsidies needs to be rethought because the risks to security of supply are much too high. Long-duration storage needs are strategic. Energy storage must be available to meet gaps in supply when needed, not run to maximise revenue. With market base methods, either stores could be empty when needed, or for the longest durations they will never be built.

“The biggest barrier is the lack of investment signals for long-duration energy storage.” Sean Kelly

Sean Kelly

The biggest barrier is the lack of investment signals for long duration energy storage. Currently, the drivers to develop storage are not great enough and whilst there is a recognition that while more operational storage on the grid will drive down peak costs for the consumer, the arbitrage for the developer will be lower. The question is how do we finance it in the longer term if there is no incentive for developers and manufacturers?

Eimear Watson

I agree, the main barrier to the delivery of long-duration energy storage is the missing money gap that comes from the existing market mechanisms. There is a renewables support scheme being developed by the Department for the Economy, should there equally be an energy storage support scheme developed to support these renewables connecting to the electricity system? Existing market mechanisms should be reviewed and new market mechanisms explored as well. SONI and EirGrid published a Call for Evidence on Long Duration Energy Storage in 2023 and are currently finalising our response.

Paddy Larkin

In current market mechanisms, security of supply provision through storage is not rewarded. Not only is the arbitrage ability very low, but there is no certainty around what the grid will require. If you consider these projects being long-life, what is the incentive for a developer to assume risk on what is going to happen in 40 or 50 years’ time? The introduction of interconnectors in Great Britain is a good exemplar of how other mechanisms were deployed in recognition that the market would not function if such high risk remained. The underpinning of risk by things like a cap and floor regime should be explored.