November 2023

Following the publication of the Energy Action Plan 2023, Head of Energy for the Department for the Economy, Deputy Secretary Richard Rodgers, discusses the need for acceleration towards a totally decarbonised energy system.

In 2016, the closure of the Northern Ireland Renewables Obligation (NIRO), a support scheme designed to boost the generation of renewable energy, coincided with the region’s soaring reputation for renewable generation across the globe.

Far from coincidental, the scheme had served its purpose in incentivising investment in, for the most part, onshore wind turbines. Onshore wind aided Northern Ireland to far exceed targets set for renewable electricity generation in 2020 and is largely responsible for renewable electricity levels reaching over and above 50 per cent by the end of 2022.

However, since 2016, Northern Ireland has shifted from leading to lagging in renewable generation, a fact articulated by the Department for Economy’s Head of Energy Richard Rodgers.

On why the shift has been so dramatic, Rodgers contends that Northern Ireland, as a region, failed to grasp the economic opportunity that presented itself in the form of renewable incentivisation. However, the Deputy Secretary is adamant that the opportunity still exists, so long as the region moves at speed.

In the wake of the NIRO scheme, as the rest of Great Britain and the Republic of Ireland delivered fresh supports, work on revised renewable supports for Northern Ireland were put into stasis as a public inquiry dealt with the fallout out of the failed Renewable Heat Incentive (RHI) scheme.

“RHI stopped a lot of things in their tracks, which is much of the reason as to why we have gone from being a leader in this area to being behind all of our neighbours. Looking forward though, the drive to a totally

decarbonised energy system for this region is now much more focused.”

In March 2023, the Department for the Economy published its second iteration of the annual energy action plans, necessitated by the overarching Path to Net Zero strategy published in December 2021. Included in the 2023 action plan is a pledge to publish the final design of renewable electricity support, along with a pathway and timeline for the support being in place, within the year.

Describing the support scheme as “critical” to putting energy policy to effective use, creating the conditions for investment, and delivering consumer protections, which are lacking today, Rodgers says: “This is so important because everyone can see that the current market is delivering high energy prices, that we, as consumers, are forced to pay.”

The final design of the support scheme, along with a timeline for the support being in place, is expected by the end of 2023. It is understood the support will target offshore wind generation, but Rodgers explains that the Department’s vision is for all future renewable generation technologies to potentially fall under the scheme’s remit.

“The launch of the design is going to be a critical path to getting offshore wind by 2030, but it has implications for all other energy, such as geothermal and biomethane. It is a design for electricity, but essentially the same principles apply to all the energy we produce.”

Asked about the potential shape of the scheme, Rodgers says that the principles are similar to that of the Contracts for Difference (CfD) scheme used in the UK, or the RESS scheme in the Republic of Ireland, whereby the aim is to competitively establish a strike price that will be payable over the lifetime of the asset.

Although it was originally touted that Northern

“A huge positive is that the Executive approved the overarching energy strategy, which means we have an agreed and accepted vision for where we want to get to: self-sufficiency in affordable and renewable energy. The prize, which is crucially important in today’s global energy market, is that we can become our own price maker, and not a price taker.

“That vision, which underpins the economic opportunity in self-sufficiency, provides us with the opportunity to tackle fuel poverty and boost economic growth. It is a very exciting prospect.”

Importantly, underpinning the Department and wider Government’s vision is legislation in the form of the Climate Change Act (Northern Ireland) 2022 and the draft Northern Ireland carbon budgets and recommended annual emissions for each sector, produced by the Climate Change Committee.

Asked about the pace of decarbonisation, in comparison to neighbouring countries, Rodgers

“We must move fast because we want to be part of enabling supply chains, not waiting at the back of the queue. That is why our action plans are so important, they are setting out what we are aiming to deliver now.”

Ireland may be part of the UK’s CfD scheme for offshore, the unique circumstances of the region meant that the decision was not taken forward. Use of CfDs has been trending across Europe because of recognition that they prove costeffective for consumers, while offering long-term price stability that investors require to cover upfront costs.

Rodgers believes that learnings from both the UK’s and the Republic of Ireland’s scheme mean that Northern Ireland has the opportunity to do better for consumers and investors, in the scheme’s design. For example, the absence of indexation in the Republic of Ireland’s RESS has pushed prices up. Similarly, shorter contract lengths in other countries have been recognised as an obstacle, while auction frequency and eligibility criteria are also critical.

The action plan sets out progress made by its predecessor, the 2022 action plan, but also flags a number of 2022 actions which were not achieved, and so have been rolled over.

While many may point to the absence of a functioning government in Northern Ireland, as well as the recently published ‘restrictive’ budget for public services, as cause for delay, Rodgers is quick to point out that the Department’s work is progressing on a solid foundation.

states: “We must move fast because we want to be part of enabling supply chains, not waiting at the back of the queue. That is why our action plans are so important, they are setting out what we are aiming to deliver now.”

Rodgers accepts that the absence of a Northern Ireland Executive and Assembly could be a barrier to future progress, highlighting the need in the near future for legislation in areas such as offshore wind, or hydrogen, he adds: “That is not stopping us from getting on to be ready for those technologies right now.”

In January 2023, the Department and the Crown Estate issued a statement of intent on a commitment to establishing offshore wind leasing for Northern Ireland. The statement signalled progress on the Energy Strategy’s ambition to generate 1GW of offshore by 2030. Around the same time as the statement, the Department published its draft Offshore Renewable Energy Action Plan.

Rodgers describes the statement as a “sign of real intent”, outlining the focus on what can be done in the absence of political leadership, building on the elements approved by the previous Executive. Interestingly, Rodgers says that the 1GW is an ambition which could soon be enhanced, stressing that it is the enabling

components of creating an offshore wind market, which are most valuable.

“What we need is a route to market for an abundance of offshore wind, which is not just about meeting our own current needs, but also attracting new manufacturing opportunities and producing the sustainable maritime and aviation fuels of the future.”

On progress made to date under the annual action plans, Rodgers lists the approval of permitted development rights for heat pumps, as early stages of aligning Northern Ireland with the rest of Great Britain and the Republic of Ireland in enabling heat pumps to be in every home in Northern Ireland, if policy assesses this as the most cost effective route to domestic heat decarbonisation.

The Head of Energy explains that the potential benefits expand beyond environmental benefits alone and could be a huge economic opportunity. Highlighting a number of indigenous businesses which are already serving as disruptors in the Great Britain market, Rodgers says: “The benefit of this is not just the expansion of the footprint of a single business, but the 50 or so local companies which are in the supply chain. That is the 10X economy in action.”

Another big advantage of market creation, Rodgers explains, is the enablement of a pathway for skills development. An energy skills audit, proposed in the 2022 action plan, has been delayed. The 2023 action plan says it will commence implementation of a plan, based in the findings of the

“That vision, which underpins the economic opportunity in self-sufficiency, provides us with the opportunity to tackle fuel poverty and boost economic growth. It is a very exciting prospect.”

audit, from June 2023. Rodgers says that the audit is complete, but not yet published, and outlines that the Department hosted a multi-stakeholder workshop in April to inform a future plan.

The Deputy Secretary believes that a real opportunity exists for tertiary education and indigenous companies to create an eco-system of skills development for a net zero future, much like the software clusters which exist now, and building on Northern Ireland’s historic reputation for quality engineering.

“The real question is: how do we enable these innovative companies?” Rodgers asks. “I think a point which is really worth stressing is that unlike the past, where Belfast was a central hub for manufacturing and engineering, the innovative companies which exist currently are spread across the region. By fostering more organisations like this, we have a real opportunity to drive economic growth on a regional basis.

“We can bring back the manufacturing we lost when we have an abundance of renewable energy, but we cannot have that abundance of renewable energy unless we have a route to market for the investment. That is where technologies like offshore wind, heat pumps and hydrogen provide that pathway. However, in order to make that happen, we need to be giving signals to industry that there is a longterm and sustainable future for these technologies in Northern Ireland.”

In a time of serious budget constraint, Rodgers believes that the finite resources in public services must be focused in the right areas in order to offer those signals to industry. To this end, he believes a truly joined-up approach across government, with a multi-year commitment is the solution to driving forward on missed targets under the 2022 action plan, such as the launch of domestic and business energy efficiency schemes.

Rodgers says that he is keen that investment in these schemes is a priority for a new Executive, to leverage private investment and create a multiplier effect for local communities, skills development, and the local economy.

“I am confident that if we create the conditions for the innovators in this region, it will not take much to succeed in moving the dial on our decarbonisation journey,” he states.

He concludes: “Going back to our 10X economic vision, we want to be one of the elite small economies in the world. That means increasing GVA, so not just creating jobs, but creating high-value jobs, much like the software cluster has done.

“That work can inform and enable the energy revolution. Our solution must be to focus on our strengths and create the right atmosphere to foster innovation, investment and ultimately, economic growth.”

The future of the power grid has arrived. Smart Grid Ireland’s industry and utility network members are responding to the challenges of the energy transition and network modernization. Grid-technology innovations are redefining how the system operates.

Smart Grid Ireland has a track record of working constructuvely to infuluence energy policy and regulation in both jurisdictions on the island of Ireland.

We provide our members with opportunities for networking and thought leadership in new network related technologies to deliver world-class energy solutions and address climate issues. With offices at the Technology Centre, Queen’s University Belfast and Dublin City West, Smart Grid Ireland partners with both Queen’s and Ulster University, and the Energy Institute, University College Dublin.

For more information contact www.smartgridireland.org info@smartgridireland.org

Bob Barbour CEO & Secretariat for Smart Grid Ireland bob.barbour@smartgridireland.org

Bob Barbour CEO & Secretariat for Smart Grid Ireland bob.barbour@smartgridireland.org

As the Department for the Economy seeks to deliver on its 2023 energy action plan pledge to have a renewable energy support scheme in place by the end of 2023, a recently closed consultation phase sought to set out how that scheme should take shape.

While the idea of simply transposing the renewable energy support scheme in Britain onto Northern Ireland was deemed not viable by the Department for the Economy, a scoping exercise performed by Cornwall Insight on behalf of the Department prior to the publication of the consultation terms found that “a highly competitive auction process similar to those seen in the Great Britain and Republic of Ireland markets is likely to be the best approach” for larger investors and economies of scale.

However, the report into the scoping round also notes that microgenerators “would require a very different subsidy, with more certainty and less complexity”, meaning that it is incumbent upon DfE to structure a scheme that will “meet the needs of all parties, or [find out] if alternative approaches (such as separate pots or even separate subsidies) are required”.

Central to the consultation and the eventual shape that the scheme will take will be the principles it follows, which form the first

question of the consultation document. Respondents were asked if they agree with the three core principles as outlined by DfE:

1. Incentivise sufficient renewable electricity generation to ensure that at least 80 per cent of electricity consumption is from renewable sources by 2030.

2. Ensure that consumers pay a fair price for electricity produced locally and that prices are more stable.

3. Encourage a wide range of renewable sources to diversify the technology mix to support security of supply.

The second question put to respondents concerned whether a Contracts for Difference (CfD) scheme should be the preferred approach to supporting renewable electricity generation in Northern Ireland, providing the clearest hint as to the approach most likely to be taken. The main advantage of such an approach, DfE states, is that “depending on

“A consultation on the performance of the CfD scheme in Britain published in July 2021 found that the many projects would not have been viable without the CfD support mechanisms, meaning that the scheme has supported the faster rollout of renewable electricity projects while delivering lower costs for consumers.”

current energy market prices, funds can move bidirectionally to support either renewable electricity generators or consumers”, meaning that funds move from suppliers to generators when wholesale prices are below the strike price and vice versa when the wholesale prices are above the strike price.

The Department states that CfD schemes have “contributed to dramatically reducing the cost per unit of energy”, citing the example of the UK, which has utilised a CfD scheme in its renewable energy supports. The cost of electricity generated by UK offshore wind farms has “reduced from over £100/MWh in the initial auction rounds to around £40/MWh in the latest rounds” under CfD mechanisms. A consultation on the performance of the CfD scheme in Britain published in July 2021 found that the many projects would not have been viable without the CfD support mechanisms, meaning that the scheme has supported the faster rollout of renewable electricity projects while delivering lower costs for consumers. The use of the CfD model allowed the UK Government to unveil its biggest ever round of renewable energy auctions with £285 million per annum in funding for low-carbon technologies, including £200 million for offshore wind per year, in December 2021.

CfD mechanisms can provide protection against market volatility, a concern for investors given that prices in the Single Electricity Market fell to €23/MWh in May 2020, rose to €143/MWh in July 2021, and reached €402/MWh in September 2021 during a period of low wind which coincided with a number of gas plants being offline. CfD structures provide certainty, and benefit consumers in the right market conditions, by locking in a price per unit of energy generated over the course of the contract agreed. Since September 2021, market prices have risen above strike prices and CfD generators in Britain have been paying back to suppliers, reducing the green levy applied to British household electricity bills. Low

Carbon Contracts Company research shows that £275 million was paid back to suppliers from CfD generators over quarter four 2021 and quarter one 2022.

The Department also points to the fact of both Britain and the Republic of Ireland having already established support schemes using broadly similar CfD mechanisms and states that “should a similarly designed auction-based support scheme be launched in Northern Ireland, such familiarity and confidence in the effectiveness of CfD schemes would be expected to encourage investment and draw developers’ interest to the Northern Irish market”. However, Cornwall Insight’s scoping report notes differences between the British and Irish markets, with the Irish Government considering the extension of the lifespan of the subsidy to encourage investor participation, while British consultations have considered shortening the lifespan to benefit consumers. The DfE, the report says, will “need to carefully balance these types of considerations”.

The third question put to respondents in the consultation regarded the fairness of participation in the renewable energy support scheme being made mandatory for all generators. Such an approach would “allow more protection to consumers, as the costs of the schemes would be established when the support is awarded and changes in market prices would less directly impact the costs to consumers” and the more assets deployed under the structure, the more guaranteed protection for consumers. While the British market is currently voluntary for generators, the UK Government “has recently considered moving existing merchant and Renewable Obligation subsidised assets onto CfDs in a response to high market prices and supernormal profits”, with similar approaches seen in both Italy and Germany.

“Small and micro generation has played a ‘crucial role’ in reaching 40 per cent renewable share by 2020, but DfE notes that the 80 per cent target ‘naturally favours the introduction of a scheme that focuses on encouraging the deployment of large-scale assets over small and micro generators’.”

Respondents were also asked what the minimum capacity for new sites should be for a project to be eligible for the renewable energy support scheme, and if that minimum capacity should be technology specific. As Northern Ireland aims at an 80 per cent share of electricity generation for renewables by 2030, renewable output will be required to effectively double by then. Small and micro generation has played a “crucial role” in reaching 40 per cent renewable share by 2020, but DfE notes that the 80 per cent target “naturally favours the introduction of a scheme that focuses on encouraging the deployment of large-scale assets over small and micro generators”. The Republic’s RESS requires a minimum capacity of 0.5MW, while Britain’s CfD scheme requires a minimum of 5MW for solar, onshore wind, and remote island wind to be eligible.

The Cornwall Insight report states that small-scale assets contributed to roughly 40 per cent of total solar PV capacity deployed in Britain in 2021, but DfE points to that fact that wind sites accounted for almost 85 per cent of all renewable electricity generation in Northern Ireland in September 2022, indicating that “even when microgeneration composed a substantial portion of total solar PV capacity, it only very marginally contributed to

meeting wider renewable electricity targets”. Indeed, the Department’s attitude towards small-scale and microgeneration can perhaps be best seen in the phrasing of its question on the topic: “Do you agree that incentivising small-scale and microgeneration would not make a substantial contribution to reaching the Energy Strategy targets?”

One of the core differences between the models in Britain and the Republic of Ireland is that the Republic’s RESS scheme requires a project to deliver support to its local community at a set level, while the British scheme contains no such provisions. Such supports can take the form of community grants or discounts on electricity network charges that taper off with increasing distance from the supported wind farm. The Danish policy of requiring developers to offer the local community the opportunity to invest in the project is also mentioned by DfE as a successful example.

With the consultation period having closed in April 2023, and contract and payment structures also to be factored in, DfE will now seek to finalise its design of how a support scheme will look in Northern Ireland and reach its target of publication before year-end 2023.

As Northern Ireland reflects on the result of the recent council elections, we continue without a sitting Assembly. RenewableNI, the voice of Northern Ireland’s renewable electricity industry, has been continuing to engage with policy makers and developers in the Assembly’s absence, achieving change in difficult circumstances.

RenewableNI’s series of sold-out events has allowed people to hear expert speakers from government departments and those in the industry. The key message coming from these is that while we are finally moving in the right direction, the planning system means we are doing so at a snail’s pace.

Steven Agnew, Director of RenewableNI, says: “We have been working very closely with the Department for the Economy (DfE) as they roll out the actions for the Energy Strategy. We have fed into their consultations on the Offshore Renewable Energy Action Plan (OREAP) and Design Considerations for a Renewable Energy Support Scheme.

“DfE have provided speakers for our last few seminars and taken questions from the audience. This engagement has been vital to help drive the industry forward, despite the absence of ministers.

“We welcome recent increased engagement with the Department for Infrastructure (DfI) but it is still very much the first steps. In mid-May 2023, DfI facilitated an engagement session

with the renewables industry and those with the planning system. This was an excellent opportunity to better understand the issues from both sides, but more importantly to see how we can better work together to overcome them.”

Northern Ireland has some of the best wind in the world, but the uncertainty of planning timescales is driving away the potential investment. Solar development here has stalled at a time when there has been a boom in Republic of Ireland.

The Climate Act set a target of 80 per cent renewable electricity by 2030. This will require more than doubling our current capacity of 1.8GW to meet the electrification of heat and transport.

Achieving this target will bring over £5 billion GVA to the local economy, create 2,000 jobs and reduce the cost to consumers. We would also reduce carbon emissions from the electricity sector by 75 per cent from where they are today.

Agnew concludes: “Developers are facing a backlog at every stage of the planning system. Amongst our members, 85MW of renewable electricity, enough to power up to 85,000 homes, has been held up for more than three years and counting.

“At a time when we should be accelerating towards a cleaner energy future, it very much feels like the handbrake is on. Without major changes we have no chance of getting close to 80 per cent this decade. There is a climate emergency. Now we need to see an emergency style response from the relevant departments, business as usual is not an option.”

RenewableNI

W: www.RenewableNI.com

Twitter: @RenewableNI

In the first of a three-part series, Consumer Council Chief Executive, Noyona Chundur, explains how the organisation’s research programme captures consumers’ needs, attitudes, and experiences of the energy transition to inform industry and policymakers and aid the delivery of a sustainable energy future that works for everyone in Northern Ireland.

is

Governments across the world, including our own, are moving forward with commitments to meet ambitious net zero targets by 2050 to avert a climate emergency. The impact of these challenging targets on society and consumers are yet to be fully understood but it is clear the transition to net zero will significantly impact consumers in the coming decades.

The Northern Ireland Executive’s Energy Strategy provides a strong grounding to address this challenge as it places consumer needs at the heart of the energy transition; without understanding consumer needs and addressing them we will not meet Northern Ireland’s carbon reduction ambition.

The Consumer Council is Northern Ireland’s statutory consumer body, working to promote and protect the interests of consumers.The Consumer Council’s contribution to ensuring we meet our goal is to provide detailed evidence that enables policymakers and the energy sector to establish appropriate energy transition pathways while meeting the energy needs of the population sustainably and costeffectively.

The energy transition has the potential to disrupt the lives of every citizen and its outcome will define life prospects locally and globally.

Therefore, we will travel this journey with consumers, undertaking annual research to ensure we can provide a contemporaneous picture of their experiences.

In doing so, we will be equipped to provide policymakers and the energy and transport sectors with the insights they need as they act to facilitate the

Noyona Chundur, Consumer Council Chief Executive.energy transition. Deep understanding of consumers’ needs will be essential to the success of the energy transition because, as our research highlights, significant barriers to individuals’ energy transition remain.

As experts in the field of consumer research, regularly carrying out research and face to face engagement with consumers, the Consumer Council is perfectly placed to undertake this work.

In our first annual ‘Attitudes to the Energy Transition’ research study, we represent consumers on one of the most important issues that they will experience in their lifetime. Energy transition will mean significant changes to how people live, eat, travel, and heat their homes, and it is crucial that the consumer insights we capture inform decision making.

Our critique of transition planning to date is that emersion in technical plans to tackle the climate challenge has left little space to consider the holistic needs of the consumers who will be asked to implement many of the actions sectoral strategies seek to address.

In that regard, more work is required to aid consumer understanding of the challenge ahead. For example, three in 10 consumers report having no understanding of what the term ‘net zero’ means. Meanwhile, not much more than half of consumers (54 per cent) are aware that the Northern Ireland government is aiming to reduce greenhouse gas emissions to net zero by 2050 and three in 10 people are unaware of the planned phase out of combustion engine cars by 2035.

Closing this knowledge gap between the energy and transport sectors and the consumer is key to bringing consumers along on the energy transition journey.

More positively, our research finds eight out of 10 consumers support the use of renewable energy to provide electricity, heat and transport, four in 10 are already driving less, and seven out of 10 consumers have started saving energy at home. Consumers understand the importance of energy transition and show a willingness to make change.

Consumers report fears over the cost of the energy transition. Our research indicates over half of the population is likely to update or improve the energy

“Deep understanding of consumers’ needs will be essential to the success of the energy transition.”

efficiency of their home, through measures such as insulation, draughtproofing, or new windows.

However, of those who said they are unlikely to do this, cost was the main reason. 52 per cent of people said they would like to make improvements to their homes, but simply could not afford to do so. Incentives and grants will play a crucial role in addressing these costrelated concerns and enabling our citizens to make necessary household and lifestyle alterations.

Consumers tell us that simple solutions will be the successful solutions and behavioural change should not be demanded without first providing appropriate support, incentives and a safety net.

Over half of consumers support the building of new infrastructure in their local areas to facilitate greater use of renewable energy. However, the research showed that methods such as placing higher taxes on petrol and diesel cars, or bans on burning fossil fuels, would be less welcome.

It is essential that we achieve a just and fair transition by ensuring affordability, security of energy supply and protection for all consumers, particularly our vulnerable citizens and as such, net zero must come about through the development of a sustainable energy future that works for us all.

We believe that achieving net zero emissions from energy is essential for long-term consumer protection. We will continue to play our part, working with partners to support consumers and bring about positive change. We support the Northern Ireland Executive’s Energy Strategy and climate change ambitions for a carbon neutral economy and are committed to working in partnership to deliver it, and the consumer education, support and empowerment needed to help our citizens with this transition.

To read the ‘Attitudes to the Energy Transition’ report visit: www.consumercouncil.org.uk

Anouk Honoré, Senior Research Fellow at The Oxford Institute for Energy Studies says that while the European gas market is in a much better position than a year ago, tightness in the market means there is little room for complacency in the time ahead.

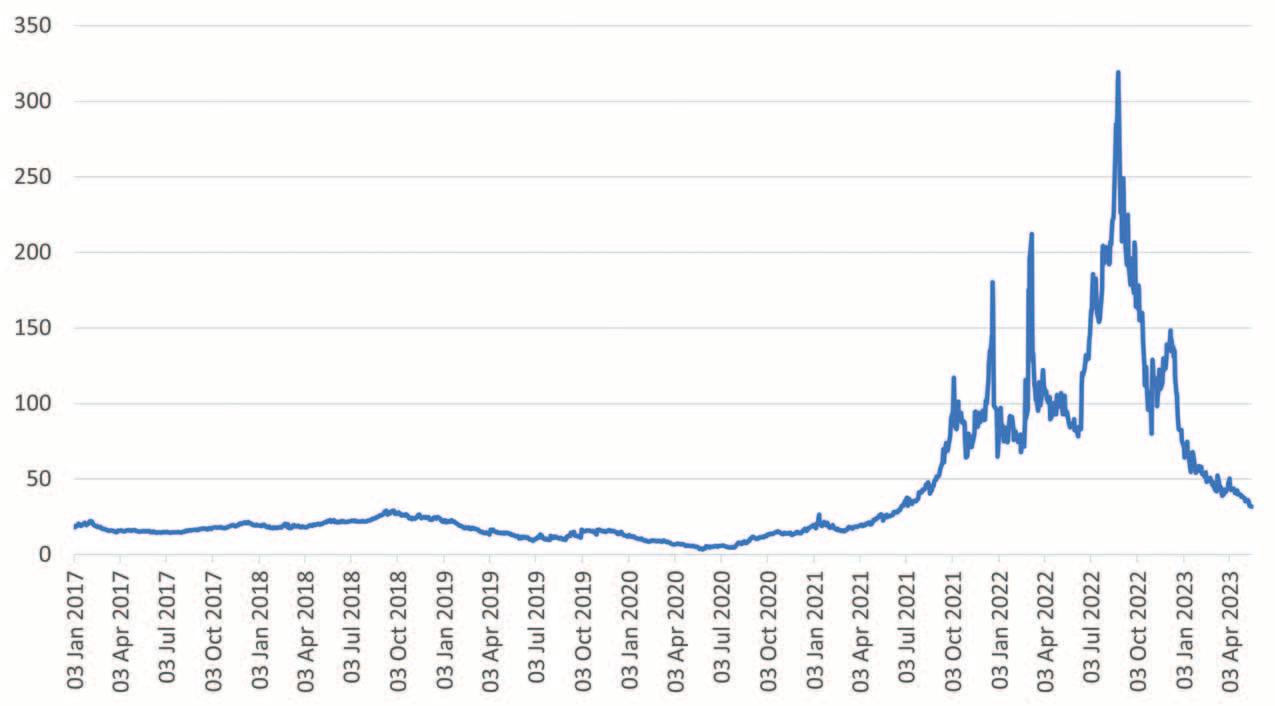

European gas (and energy) prices have been on a roller-coaster since 2021. They climbed from very low levels in 2020 to record highs in 2021 and 2022, before declining again from December 2022. In May 2023, they reached their lowest point in almost two years at about €30/MWh (TTF Front-Month on 19 May). Despite this relative lull, the supply and demand balance remains very tight.

For the next 12 to 18 months, indigenous production and pipeline imports are unlikely to be higher than at present. Russian gas flows via Belarus, the Baltics and Finland, and Nord Stream have stopped in 2022; and the only flows left are via Ukraine and Turkish Stream. Other sources of pipeline gas (Norway, north Africa, Azerbaijan) have been relatively stable, but there is limited additional gas to be expected.

TTF Front-Month gas prices from January 2017 to April 2023 (midpoint, Euro/MWh)

LNG imports have ramped up rapidly last year to make up for the loss of Russian pipeline gas. It is now the single largest source of supply to the region, with some upside potential thanks to new regasification capacity (over 40 bcm expected in northern Europe by end 2023 plus additional capacities around the region in the coming years). The downside is that Europe is now far more exposed to global LNG trends than ever before, although for now, the return of freeport liquefaction capacity (USA) and relatively low Asian demand mean that cargoes are arriving in Europe, in time to help with storage replenishment.

Europe finished the winter with relatively high storage levels, and stocks were already at 63 bcm by the end of April 2023. This was over 28 bcm higher year-on-year. As a result, Europe is unlikely to need to repeat the large net injection made in the calendar year 2022. Meeting the target of 90 per cent of the stocks filled by November should not be problematic despite the region receiving far less Russian pipeline gas in Q2 2023 than in Q2 2022, although the speed of stock build remains uncertain. There could be some potential nervousness (and therefore likely higher prices) around September if storage levels are still low by then.

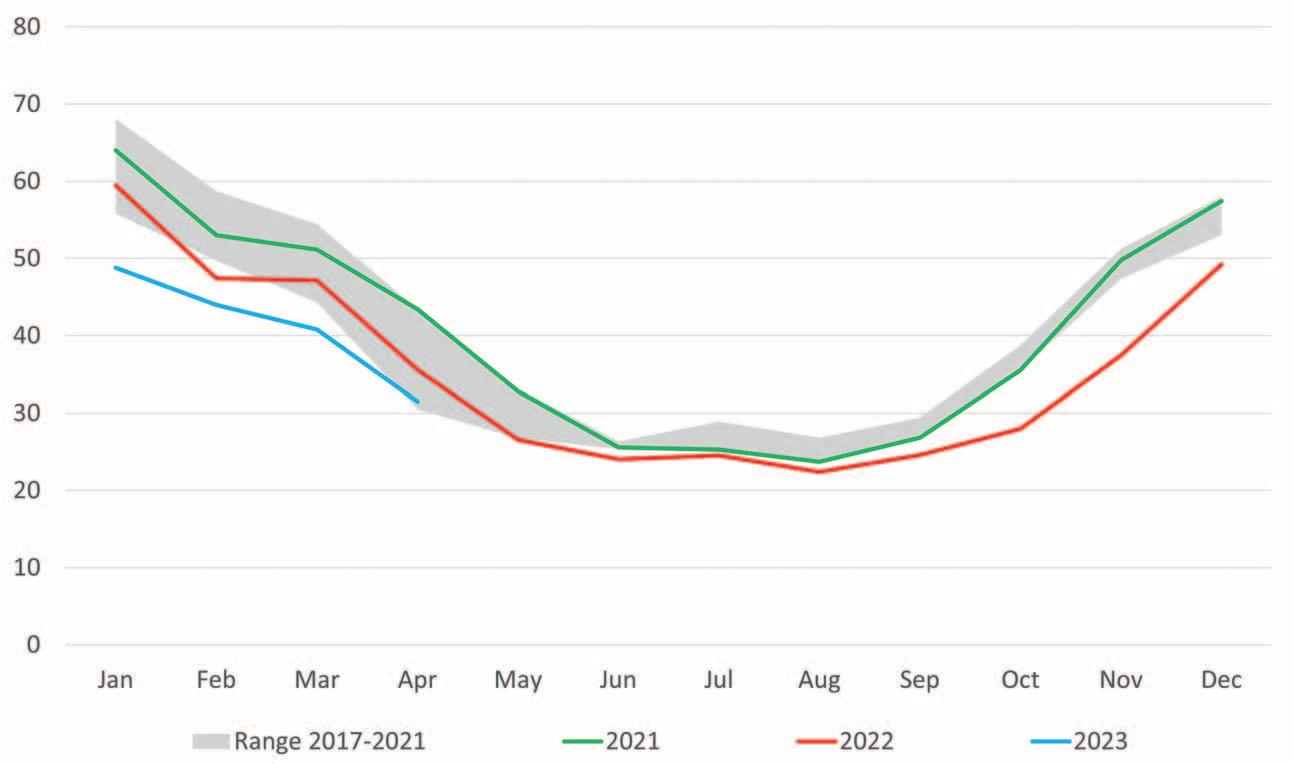

The biggest uncertainty might be on the demand side. Gas consumption in Europe (EU27 + UK) collapsed in 2022 (-13 per cent) on the back of mild temperatures, high gas prices and changes in consumer behaviour. Trends in 2023 remain subdued (-14 per cent in the first four months) helped by unseasonably mild weather across most of Europe and higher availability of renewables (hydro, wind, and solar) in power generation, but the fundamentals in the three main sectors seem to point toward a potential recovery of gas demand in the coming months.

Many industrial sectors were able to reduce their gas demand without reducing their production over the past 18 months, by switching to alternative fuels (especially oil products) and improving operational efficiency (although the chemical sector, the pulp and paper sector and the iron and steel sector were clear exceptions). Since the beginning of 2023, there seems to be a

Monthly gas demand in the EU27 + UK, bcm

Source: charts by Anouke Honoré (OIES) with data from IEA, Eurostat, ENTSOG, Entsoe, GRTgaz, Terega, NCG, Gaspool, THE, SNAM, Enagas, NationalGrid, Gridwatch, Honoré’s assumptions and calculations.

“Europe is in a much better position than a year ago, but it still cannot be complacent.”

slow recovery of gas demand in most sectors, and a continuation of relative low gas prices in 2023 (and continued governmental support), as well as a limited economic downturn, could contribute to higher industrial gas use in the coming months compared to 2022.

In the residential and commercial sectors, mild weather limited the use of gas for heating in 2022 and early 2023. Coupled with high gas prices, warm temperatures also seem to have facilitated an important demand response from small consumers, a usually rather inelastic sector. Continued participation of consumers in demand saving measures will be essential in the coming months, though consumers’ willingness to reduce their energy for heating may erode if cold temperatures hit Europe at the end of 2023.

The biggest unknown is in the electricity generation sector. Lower electricity demand, strong renewables and the progressive return of French nuclear fleet limited the need for gas at the end of 2022, but gas demand could remain high this year due to uncertainties regarding the level of French nuclear generation in 2023 (stress corrosion tests, new cracks, drought in the summer), coal to gas switching, low hydro availability in the summer and a possible electricity demand’ recovery.

The European gas market is a complex puzzle with many moving pieces, and despite lower gas prices since the beginning of 2023, the market is still tight. Even small changes on the supply or on the demand side could trigger a sharp increase in gas prices. Europe is in a much better position than a year ago, but it still cannot be complacent.

Northern Ireland needs a focus on a holistic and inclusive transformative change process, not just the de-fossiling of the present, if it is to reap the economic benefits, says Martin Doherty, centre manager of the Centre for Advanced Sustainable Energy (CASE).

The fact that change must happen when it comes to how we produce, store, and use energy is absolutely undeniable, not only for us here in Northern Ireland but right across the globe. We need to remove fossil fuels from our energy mix, and it needs to be done both rapidly, and thoughtfully.

The future of energy is utterly intrinsic to people’s quality of life, and the massive rises in energy costs have brought the issue to the fore in people’s minds in a way that it has seldom been seen before.

That is why the Centre for Advanced Sustainable Energy (CASE) is hosting

the first Northern Ireland Energy Summit where we will present our policy document, Pathway to a Renewable Future. This document, which is being produced after a comprehensive stakeholder outreach process will showcase what we believe is a holistic and inclusive transformative change process that equips us for the economy of 2050 rather than simply de-fossilising the present.

After an encouraging start, Northern Ireland seems to have rested on its laurels and is allowing others to steal a march on progress to a net zero future.

The absence of the Assembly

undoubtably adds to the complexity of making change happen but should not prevent it happening. The ascent of the Climate Change Act 2022 demonstrated that there is a political willingness to see a transformation in how we power our economy and lifestyles.

The ability to make decisions in a bold, ambitious and pragmatic manner is possible, as demonstrated by the actions of the Assembly during the recent pandemic. This whole systems approach to managing a national crisis is again required to overcome the fragmentation that energy developers and communities see when attempting to effect change.

The Climate Change Act mandates that government departments to act in a connected manner and act as enablers. Energy and decarbonisation cuts across economy, agriculture, environment, and infrastructure impacts everyone. Creating policy in isolation can result in missed opportunities to holistically address a larger scale problem. Joined up policy and departmental cooperation works better. For example, using agricultural waste streams to generate energy allows for rebalancing our economy whilst turning erstwhile

pollutants into the building blocks of a biobased industry.

The ambition of the 10X strategy for the economy is not supported by our current energy plans. In fact, the goals for wind generation in Great Britain and Ireland, potentially in excess of 100 and 70GW respectively, over the coming decades dwarfs current Northern Ireland policy considerations. We must match our neighbours’ ambitious goals to amplify and leverage our own potential.

In short, our economy will struggle to compete as global markets demand zero-carbon supply chains, and to sustain carbon taxes as they ramp up by the end of the decade; unless we transform our energy supply and decarbonise. How do we achieve the investment required now, when Northern Ireland lacks the billions of pounds needed to invest annually from the public purse? Attracting capital investment is vital. Large, direct subsidies are mostly unaffordable, but strategically creating opportunities for low-risk with good returns, can stimulate investment. The CASE white paper will explore options for novel financing and experimental governance models that will stimulate the necessary debate about what changes we need to take to unlock our potential.

Recent CASE published research opened a new thinking on how we could heat our homes and power businesses with the clever utilisation of our biogenic resources (farm wastes for those outside agriculture).

The potential for biomethane is clear but represents only a small fraction of what can be achieved. Converting the CO2 content of biogas to e-methane with the addition of green hydrogen could give as much as 10 TWh of energy (biomethane + e-methane), more than enough to meet current gas demands.

Storing this green gas in gas caverns during the summer, when demand is low, gives energy resilience for winter months. A further circular economic and clustering approach would see the heat generated from these processes deployed as district heating for homes thus displacing even more of fossil fuel dependency.

Opportunities for such system-based approaches with clusters of businesses have been shown to be common across Northern Ireland and offer routes for local energy supply and decarbonisation as well as new products and services. Additionally, the social value in this

“Our economy will struggle to compete as global markets demand zero carbon supply chains, and to sustain carbon taxes as they ramp up by the end of the decade; unless we transform our energy supply and decarbonise.”

approach is very high with the ability to provide locally generated low-cost heat to homes, schools and hospitals combined secure skilled employment.

A critical component of underpinning the necessary societal change will be increasing the carbon literacy of all. This will empower decision-makers and communities to ensure that energy transformation is equitable and a force for the better. There will be impacts in terms of infrastructure development, but we can ensure that they are weighted by greater community wealth and opportunity with the potential to eradicate fuel poverty.

We can learn from our past. Generations ago, seeding opportunity from renewable energy provided a platform for Northern Ireland to become a global, industrial powerhouse starting with linen production. We can do the

same again. Northern Ireland has the wind, water, solar and biogenic resources to displace fossil fuels.

Achieving carbon neutrality alleviates and reduces the harm on health from fossil fuel pollution and the perilous dependency on uncertain foreign supply of oil and gas. We can once again harness the pioneering innovation and research that lead to our world leading role in textiles to become renewable technology haberdashers to a global marketplace.

This opportunity cannot be wasted, let us ensure we move forward together, with benefits for all.

Contact E: Martin.Doherty@qub.ac.uk W: www.nienergysummit.com

A consultation is ongoing for a proposal by the Department for Infrastructure (DfI) aiming to secure the “orderly and consistent development of land in Northern Ireland under the reformed two-tier planning system”.

The draft review on strategic planning policy on renewable and low carbon energy will be open for consultations until 30 June 2023.

The review aims to ensure that regional strategic planning policy on renewable and low carbon energy remains fit for purpose and up-to-date to inform decision-making in relation to development proposals for this subject area.

It is also intended to inform the local development plan (LDP) process and enable decision-makers to bring forward appropriate local policies to meet Northern Ireland’s energy needs, under the Northern Ireland Energy Strategy, whilst meeting its obligations under the Climate Change Act (Northern Ireland) 2022.

The Department for the Economy acknowledges the “need to improve the process for plan-making and the determination of planning applications, including for renewable and low carbon energy development”.

The draft report contextualises that, since reforms of the planning system and the transfer of planning powers to local government on 1 April 2015 to the end of September 2022, 837 renewable energy planning applications were approved, including:

• 32 wind farms;

• 583 single wind turbines;

• 32 hydroelectric plants;

• 93 applications for solar panels;

• 76 biomass/anaerobic digesters; and

• 21 other (includes landfill gases, waste incineration and heat pumps).

The Northern Ireland Energy Strategy established a renewable electricity consumption target of 70 per cent by 2030, a target which has subsequently increased to 80 per cent by 2030 under the auspices of the Climate Change (Northern Ireland) Act 2022.

The Climate Change Act places a duty on Executive departments to ensure that the greenhouse emissions in 2050 is at least 100 per cent lower than the baseline figures from 1990, and to ensure that the net emissions account for carbon dioxide for the year 2050 is at least 100 per cent lower than the baseline for carbon dioxide.

The report has been published shortly after a memorandum of understanding between the Department for the Economy and the Crown Estate which is expected to lead to bidding for offshore renewable energy development, a procedure which has been hampered by several stumbling blocks, including delays to new market and incentive arrangements in 2014, and a statement by the Department for the Economy in 2019 saying that Northern Ireland’s coastline was not suitable for offshore wind development due to likely objections to the visual landscape which would emerge from the expansion of offshore wind infrastructure.

The report states that the Department for the Economy recognises “that there are landscapes across Northern Ireland where their intrinsic value should be protected against inappropriate renewable and low carbon energy development”.

It continues: “A cautious approach for renewable and low carbon energy development proposals will apply within designated landscapes which are of significant value, such as areas of outstanding natural beauty, World 7 Heritage Sites and their wider settings, including the Giant’s Causeway and Causeway Coast World Heritage Site.”

The report also calls on visually dominant development proposals to be avoided in such sensitive landscapes as it may be difficult to accommodate developments and their associated infrastructure, without detriment to the region’s cultural and natural heritage assets.

It further states how, for wind farm development, a separation distance of 10 times rotor diameter to occupied property, with a minimum distance not less than 500 metres, will generally apply. This will also apply to any wind turbine development with a rotor diameter of 50 metres or greater.

Noteworthy is that the ETSU-R-97 system remains the UK standard methodology for the assessment of noise from wind energy development. “It, along with A Good Practice Guide to the Application of ETSU-R-97 for the Assessment and Rating of Wind Turbine Noise, prepared by the Institute of Acoustics, should be taken into account by decisionmakers, including any future update to this standard,” the report states.

“Potential noise impacts, including amplitude modulation, from wind turbines on surrounding properties must be carefully considered. Applicants should seek to minimise and mitigate against any potential impacts from wind energy proposals which are likely to result in shadow flicker on nearby properties.”

The review on strategic planning policy on renewable and low carbon energy is currently open for submissions, with the consultations process to run until 30 June 2023. However, implementation of any future policy deriving from the review will not be possible until the reformation of a Northern Ireland Executive.

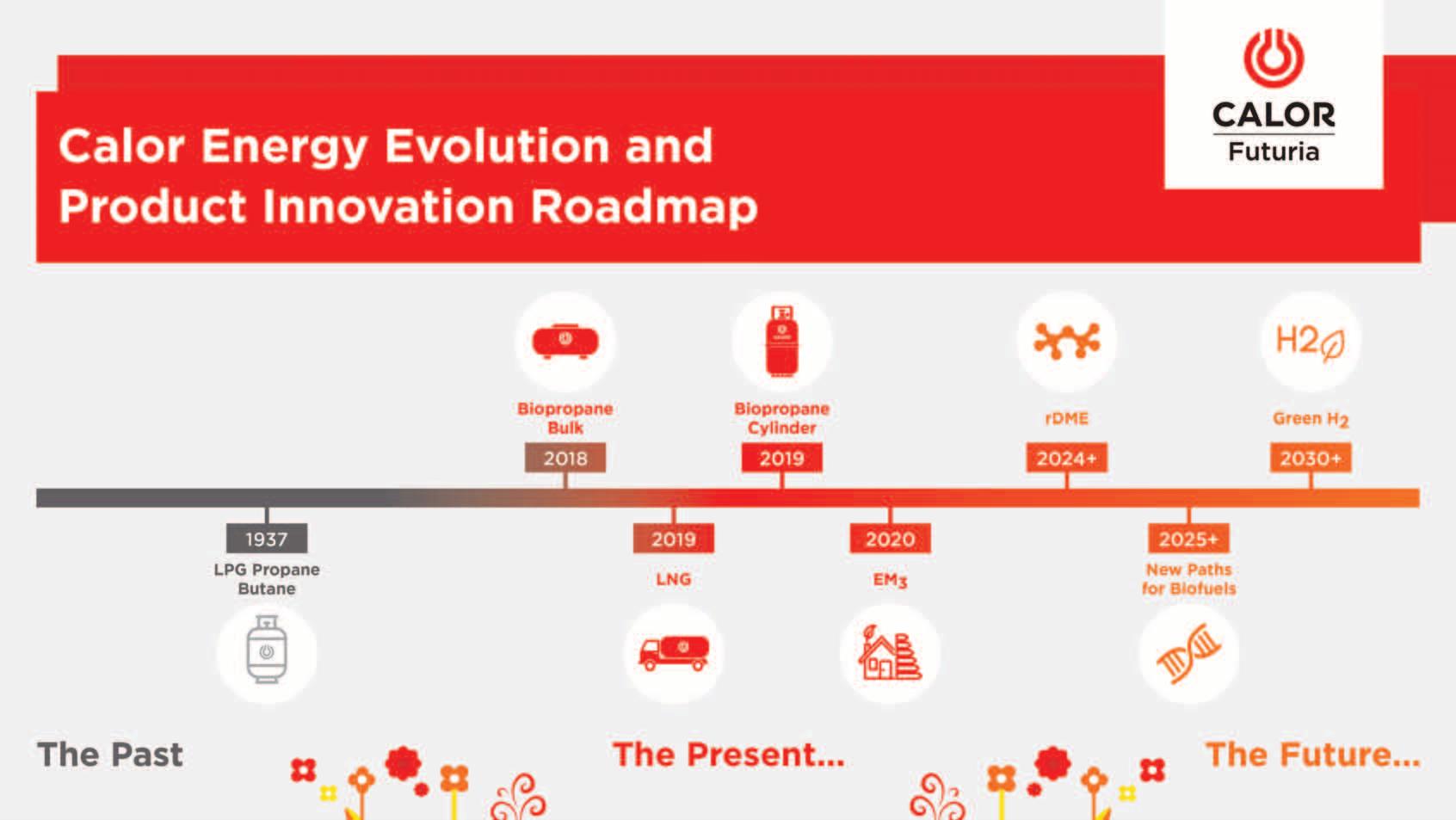

Calor has a bold ambition. It is to offer its rurally-based customers 100 per cent renewably and sustainably sourced energy by 2037, its centenary year.

Calor recognises that to realise this goal, innovation, and collaboration are essential and is working closely with employees, customers, suppliers, and partners to continuously identify new solutions and make them available.

Energy security and affordability are at the forefront of people’s minds. There is a growing focus on how to heat homes and businesses, potential renewable solutions and the costs associated with a warm and comfortable environment.

Decarbonising heat is key to achieving net zero. However, it is imperative that consumers have a choice of home energy solutions to meet every budget, infrastructural challenge, and environmental goal.

SHV Energy, Calor’s parent company, has a long history of innovation and commitment to lowering the carbon footprint of the fuel range offered across the organisation’s business units. Over the years, as the environmental impact of carbon and air pollutants has become clearer, they have moved away from coal and oil to offer Liquefied Petroleum Gas

(LPG) and Liquefied Natural Gas (LNG.)

Working with rural consumers located off the natural gas grid, Calor has been providing LPG to homes and businesses for over 80 years, offering significant advantages to many business sectors due to its lower carbon credentials compared to oil and other higher carbon producing fossil fuels. With more and more companies placing sustainability in their long-term strategies, Calor has introduced Futuria, a new and growing portfolio of sustainable energy solutions, and a commitment to grow and develop the pathways to make these available in the future. In tandem with its parent company SHV Energy, Calor is making strides in developing, investing in, and growing the Futuria range.

Since 2018, Calor Ireland has been at the forefront of enabling off grid consumers to make more environmentally friendly choices by delivering access to the first commercially available, certified renewable gas in Ireland, BioLPG. Produced from renewable feedstocks,

such as plant and vegetable waste, BioLPG reduces CO2 emissions by up to 90 per cent*, and is identical in use and performance to conventional LPG meaning that the transition is simple and cost effective with no requirement to change equipment if using LPG powered appliances currently.

Richard Alexander, Sustainable Fuels

Lead, Calor says: “Calor and SHV Energy understand that we will need to do more to meet climate targets. SHV Energy is partnering with leading, innovative players to help make sustainable fuel advances possible through its Futuria Sustainability Strategy. Calor Ireland has been to the forefront of enabling off grid consumers to make more environmentally friendly choices by delivering access to our certified renewable gas since 2018. Calor has the experience and the expertise to play a leading role in Northern Ireland’s green energy evolution, with its ambition that all its energy products will be from renewable sources by its centenary year 2037.”

SHV Energy has partnered with leading, innovative players to help make these sustainable fuel advances possible. it has a strong global portfolio of R&D projects and partners, working to develop dedicated pathways to purposely produce BioLPG and other sustainable fuels with high yields and from a wide range of feedstock. These active collaboration with leading universities, such as Queen’s University Belfast, the University of Amsterdam, and Aston University.

There is a clear need for alternative renewable energy solutions in off-grid areas, whether for homes and businesses in rural areas, hard to electrify HGVs or industrial processes. To address this the LPG Industry across the globe are transitioning to ‘drop-in’ renewable liquid gases, one of which is dimethyl ether (rDME), a renewable gas produced from municipal waste. rDME is an affordable drop-in fuel that can be safely blended into LPG and BioLPG with no change to existing infrastructure. It is envisioned that the sustainable fuel

“Calor Ireland has been at the forefront of enabling off grid consumers to make more environmentally friendly choices by delivering access to our certified renewable gas since 2018.”

will then be used by the LPG Industry in a variety of applications, benefiting homes and businesses in rural areas in the future.

Recently, SHV Energy announced their commitment to accelerating the development of rDME with a joint investment venture with UGI International, into a company called Dimeta, which will produce the rDME and accelerate its adoption. This, alongside other renewable liquid gases can reduce carbon emissions, improve air quality in an affordable way. Renewable and recycled carbon DME (rDME) is a safe, clean-burning, sustainable fuel that can support decarbonisation of the off-grid energy sector including domestic and commercial heating and cooking, industry and transport.

Dimeta plans to produce 50,000 tonnes per year of rDME in the first UK plant. The production facility is located in Teesside, one of the UK’s leading decarbonising industrial clusters and shall be in operation in 2025.

Calor has the experience and the expertise to play a leading role in Northern Ireland’s energy transition and in collaboration with its stakeholders, contributing towards cleaner air and a safe and stable climate for generations to come.

For more information visit: www.calorgas.ie

Phil McNally, talks about the lessons to be learnt from the rollout of offshore wind in the UK.

McNally opens by describing the UK as having been a “trailblazer” in the development of offshore wind technology, adding that “although the UK’s share of global offshore wind capacity has fallen, that can be seen as a positive development”.

“Between 2011 and 2020, the UK share of global offshore wind energy production was over 50 per cent for the first three years and it has been declining as a proportion ever since. That is not because the UK has been slowing down but rather that the rest of the world has been increasing and speeding up its production.”

A further development relevant to ensuring the success of renewables, McNally explains, is increasing energy efficiency. “Total UK electricity generation has declined over the last 15 years because we have seen energy efficiency gains across the UK economy.”

McNally also points to the scale of technological advancement as having played a strong contributing

factor in the UK’s relative success in offshore wind production. “In 1990, we produced a 35m-high offshore turbine, which had 0.2MW of production capacity. Now, we are installing turbines exceeding 200m in height which can power 15MW.”

These developments, McNally says, have led to “a dramatic fall in emissions from the UK power sector,” adding that “emissions in the electricity sector have been reduced by 74 per cent in the UK since 1990”.

McNally outlines the scale of technology deployment required over the coming years to meet the UK’s targets for net zero by 2030.

“In 2019, we had installed 30,000 heat pumps but by 2030, we need to be installing one million heat pumps per year. There was 10GW of offshore wind installed between 2004-2019, the target for the UK Government by 2030 is now 50GW.

“We somehow have to deploy 38GW of offshore wind in the next eight years. At the same time, we also have to be developing hydrogen from an emerging technology to a fully functioning sector.”

McNally identifies eight broad lessons to be learned from the UK’s rollout of offshore wind:

Long-term political commitment is crucial to drive low-cost deployment and domestic benefits: “Offshore wind has benefitted from consistent political support, which has fostered confidence across industry to invest in Ireland in related research and development, supply chains, and skills. Certainty is crucial to a realistic deployment pathway for other low-carbon technologies.”

Tackling the cost of capital should be a central objective of policy: “The cost of capital is a critical development of the overall project cost. By reducing investor risk, and therefore the cost of capital, a Contract for Difference (CfD) – the British Government’s main mechanism to support largescale renewable projects – can deliver a reduction of between 10 and 21 per cent on overall project costs. This focus on cost of capital has been hugely successful with offshore wind and there is evidence that it has had a strong influence on global deployment. A similar approach should be followed with other early-stage technologies to ensure an affordable transition for consumers both in the UK and globally.”

The need to adapt support to the maturity of the technology: “Offshore wind has benefitted from the right support at the right time, whether that was early-stage development funding, supply-chain investment, or the CfD. If technologies are eligible for a CfD but consistently fail to win a contract, as has happened with wave and geothermal power, government should consider whether this is the right type of support, or whether the technology should be pursued at all.”

Design markets around long-term outcomes: “To date, government has followed an approach of increasingly complex market intervention in an attempt to shoehorn low-carbon technologies into a market designed around fossil-fuel technologies. Now that there is clarity on the type of technology required, government must initiate a comprehensive market reform process to ensure that incentives across the system are aligned to deliver a flexible, net zero, cost effective reform by 2035.”

A healthy pipeline is key for competition and supply-chain development: “By offering a reliable revenue stream and a stable timeline of auctions,

the CfD has created sustained investor interest in the UK renewables market. This has manifested as a strong pipeline of offshore wind projects bidding into each auction, creating intense competition between developers on cost. A strong pipeline also delivers line of sight, making it crucial to the development of a sustainable supply chain, meaning jobs and economic benefits for the UK.”

Partnership between industry and government can deliver sustained development: “Offshore wind has profited from a close relationship between industry and government through partnerships such as the Offshore Wind Industry Council and the Offshore Wind Sector Deal. Such partnerships are crucial in forming dialogue between industry and government, allowing the articulation of a joint vision and a means of tackling barriers to deployment.”

Strategic systems thinking is required for an efficient transition: “To date, each new wind farm in the North Sea has received a point-to-point connection with the onshore electricity grid, disrupting local communities on the British east coast. The British Government is now considering an offshore transmission system to reduce costs and limit the need for onshore infrastructure. The Government must think strategically to ensure an efficient and political feasible transition to net zero.”

A clear strategy is needed for securing domestic benefits: “The Government has failed to capitalise on the domestic economic opportunities of being an early mover. If UK electricity consumers are expected to pay a premium to commercialise nascent technologies, then they should also expect the Government to secure long-term social and economic benefits for the UK. The failure to capitalise on that opportunity with offshore wind is now being rectified through the Offshore Wind Sector Deal and CfD contract terms, but the Government must take care to analyse and capitalise on domestic opportunities from other net zero technologies.”

Phil McNally is a research fellow at University College London focusing on electricity markets. He previously led low-carbon power policy at Energy UK and net-zero research at the Tony Blair Institute. He has sat on several expert government advisory groups, and specialises on the policy and economic reform required to accelerate the transition to as low-carbon energy system.

Eighty per cent of heating in Northern Ireland can be done using heat pumps, with geothermal a key source and store of energy, writes Managing Director of Causeway Energies, Simon Todd.

Northern Ireland has big ambitions for its contribution to meeting the climate change challenge. With respect to the final use of energy, it is heat that is the largest component of energy use (Figure 1) and it is this sector that so far is proving hardest to decarbonise. With no fossil energy supplies in Northern Ireland, decarbonisation has now become an imperative for energy security and energy poverty, as well as sustainability.

Northern Ireland’s last volcanoes were active 55 million years ago, so we do not have hot geothermal resources from which we can generate clean electricity. Instead we have a very useful, and currently very underutilised, resource of heat in subsurface from 10m to 2km depth that can be economically and sustainably harnessed.

These rocks and contained brines are relatively low temperature compared to classic geothermal provinces like Iceland, but combined with electric heat pumps, this emission-free heat can be gathered and amplified to serve heating demands up to 150ºC and up to 10+ MWth scale.

What is more, while Northern Ireland is currently way behind in using geothermal and heat pumps, we can learn from the decades of experience elsewhere in places like Sweden, the Netherlands and the northern United States.

The public sector, including schools, hospitals, government and council buildings is the smallest sector in total, but is arguably the most important sector to decarbonise to provide “pioneer” leadership to others.

Of the public facilities in Northern Ireland, it is hospitals and schools that are the largest energy users. All these buildings, of whatever size, are serviceable by heat pumps to replace the current gas and oil fuel use. Hospitals sometimes have higher temperature demands for laundry and sterilisation of equipment, but this smaller load can now be dealt with high temperature industrial heat pumps that are coming on the market.

Causeway Energies completed a geothermal assessment of one of Northern Ireland’s largest hospitals last year. We found that at all the site’s ~8 MWth of heating could be provided by around four pairs or doublets of ‘open loop’ geothermal abstraction and reinjection boreholes. There are plans afoot for the hospital to start this year on its geothermal journey.

Schools are also ripe for geothermal heat pump solutions, from small primary schools in rural settings to large secondary schools in urban settings. Educational buildings also provide a wonderful opportunity to demonstrate to the pupils and their parents the potential and the benefits of low/zero carbon energy solutions including geothermal which even when deployed is often not known about because of its negligible surface footprint.

Simon Todd, Managing Director, Causeway Energies.It is natural for the owners of fossil gas and oil networks and supply chain to seek opportunities to decarbonise their molecules. But if we consider our problem as an affordable and immediate decarbonisation of heat rather than gas, then electrification of heat using heat pumps becomes the obvious solution. This is even more pertinent for the majority of homes in Northern Ireland that have no connection to the gas grid but are of course connected to electrical power.

Air source heat pumps are often a good solution for homes, but because of the significantly greater efficiencies of their geothermal (or ‘ground source’) sisters, we believe that government and electricity networks should be promoting community heat networks and geothermal, aquathermal (rivers, lakes) and solar thermal sources. The lure of lower capital costs of air source systems compared to geothermal must be balanced with considerations of gross and peak demands of electricity from the regional grid which is already forecasted to be declining in resilience over the next few years.

Industry and commerce are the biggest users of heat (and cooling) in Northern Ireland. Although we do not have granular data by manufacturing sector in Northern Ireland, comparison with Ireland where there is such data, indicates more than 40 per cent of thermal energy demand is less than 150ºC. Hence at least 40 per cent of heat use in commerce and industry is within the scope of heat pumps.

Causeway Energies is focused on applying heat pump technology applications on these demands, as well as the other sectors discussed above. As we engage with clients in assessments, we are finding that we can directly substitute for fossil fuels using heat pumps. These solutions are cost competitive with gas and are financially superior if the avoided emissions can be monetised. We are also identifying major opportunities for efficiency and energy demand reduction. For example, we have proposed a design concept to several clients in which surplus heat (particularly in the summer) can be stored underground in the geothermal resource for recovery and use in the winter.

Source: DfE

Providing a low/zero carbon energy system, electrical (power) and thermal (heat and cold) to our economy will be critical to attracting foreign investment in Northern Ireland’s economy. While we

have strong suits in the development of future tech in Northern Ireland which we must continue to support, there is so much we can do now, with proven or nearly commercial technology.

“Providing a low/zero carbon energy system, electrical (power) and thermal (heat and cold) to our economy will be critical to attracting foreign investment in Northern Ireland’s economy.”

Our mission at Causeway Energies is focused on the decarbonisation of larger demand heating (and cooling) in the sectors described in this article. We are building a portfolio of clients in the commercial, industrial, public and heat network sectors in the UK, Ireland and elsewhere. We are also developing leading edge technologies to improve the bandwidth, efficiency and cost effectiveness of geothermal + heat pump applications.

E:contact@causewaygt.com • W: www.causewaygt.com

NIE Networks hosted a round table discussion with key stakeholders across various sectors to discuss the role of environmental, social, and governance (ESG) in reaching net zero.

What are the benefits and opportunities of an organisation-wide focus on environmental, social and governance outcomes?

Gillian McKeeA major benefit is employee attraction and retention. Surveys show that around two-thirds of Gen Z employees consider company sustainability when choosing an employer. When building a workforce for the future, it is an important consideration. Companies that move quickly will have a competitive edge in the recruitment market. In the longer term, there are cost efficiencies for organisations that reduce their dependency on fossil fuels, particularly if emission reductions are passed along the supply chain. And a key benefit has to be building stakeholder trust by being transparent about your impacts on people and planet.

Gareth Walls

The attraction and retention of the best talent are exceptionally important drivers because all of our industries and businesses are founded upon our people. If you can get the cultural understanding correct through recruitment and retention, then you can make 'good ESG' not just a cultural norm for the business, but a cultural necessity. However, there is also a more defensive aspect, which manifests as legal compliance. This is not just an esoteric concern; compliance with legislation and regulations requires a comprehensive approach to protect the corporation and the individual.

Geoff Nuttall

There are potentially great cost efficiencies complementing the environmental benefits of moving to net zero, however, limited resources mean that not every business or organisation is

Round table discussion hosted by

practically able to consider all the ESG ramifications of their business operations. A lack of cost-effective and free support for smaller and less-resourced organisations to make that journey is a barrier to achieving those benefits and opportunities.

Mark Palmer

One major benefit is the creation of shared values. An organisation-wide focus on ESG will require conversations around what an organisation’s values are, mandating engagement with a diverse range of stakeholders and voices. This is a boundary-spanning opportunity, and we know that greater diversity enhances performance for teams.

Robert Clements

The evidence shows there are long-term benefits to having a sustainable business model. Take decarbonised heat for example, there are clear economic benefits to investing in an indigenous, sustainable fuel source, but there are also wider benefits, including better health outcomes for householders. From a governance point of view, compliance is essential, but fundamentally, it is the right thing to do. There are clear benefits of an ESG focus in attracting investment, in recruiting talent, and in lowering

operating costs, but fundamentally, the major benefit is a plan of action for our people, the planet, and delivering prosperity.

Derek Hynes

ESG is a fundamental tool to understanding and promoting the purpose and mission of an organisation. The challenge for organisations, and NIE Networks is no different, is to truly embed those values in your operations. There are specific tangible benefits, for example, when we go to debt markets, unless your ESG reporting shows you are doing the right things as an organisation, you either do not get money, or you pay a lot more for it. There is also a compliance element, ultimately, you have to know that the fabric of an organisation will deliver on your ESG responsibilities, but it must come from the heart of an organisation in terms of its purpose. This cannot be just another tick box exercise.

Can the creation of comprehensive and supportive governance, risk, and control (GRC) frameworks better prepare organisations for a net zero future?

Robert Clements

I believe they can, especially in relation to risk. A lot of discussions on net zero centres on climate mitigation but not enough on climate adaptation. Currently, there are 45,000 houses in Northern Ireland deemed at risk of flooding, and the cost of adaptation will be in the tens of millions. The reality is that it is often the most socially vulnerable that live in these areas. If we are striving for a just transition, we need to think about adaptation and businesses need to understand their level of resilience to the future climate. Doing this properly can improve a business’s credibility with the public, and with potential investors.

Gillian McKee

Yes, to a degree. Frameworks are important to ensure that organisations are managing future risk and putting an environmental lens on their decision-making. However, I do not think public trust centres on frameworks, but on tangible action. ESG reporting is still largely being driven by investor requirements when it really needs to be focused on humanity’s requirements. To achieve that, organisations must be committed to sustainability and have that commitment built into their operations.

Geoff Nuttall

Good frameworks, rigour and credibility are very important, but it is worth highlighting that there are a lot of different frameworks and accreditation systems out there, some more credible than others. It can be very resource intensive to keep up with different systems and I think the challenge is how do we encourage organisations to take up GRC frameworks without making it overly burdensome? Taking the community and voluntary sector as an example, time and resources are scarce, and what they are doing might well be delivering on those decarbonisation themes, but how do they systemise that in a way that recognises their capacity?

Robert Clements

Robert Clements is the interim Head of Sustainable Development for the Housing Executive and leads on the Sustainable Development Strategy. He also manages the Home Energy Conservation Authority statutory functions for Northern Ireland. Robert has worked in social housing for over 20 years and has extensive experience in residential refurbishment and development with his previous roles in the private and housing association sector. He is currently a board member for Sustainable NI.

Derek Hynes

Derek Hynes was appointed Managing Director of NIE Networks on 1 September 2022. He is a director of Energy Networks Association Ltd, Centre for Competitiveness, and Smart Grid Ireland. He joined ESB in 2000, where he held several senior management positions. He is a chartered engineer with post-graduate qualifications in operations management and corporate governance and he has completed the Advanced Management Programme at Harvard University.

Gillian McKee

Gillian McKee runs sustainability and ESG consultancy GIRAFFE Associates, working with companies across the manufacturing, construction, agri-food, and other sectors to develop ESG strategies and deliver training to staff. Having spent 22 years with Business in the Community, she is now an external assessor for the CORE Standard and the independent auditor for Diversity Mark’s Gold Standard. She is also trained to support companies who wish to become certified as B Corporations.

Geoff Nuttall

Geoff Nuttall is Head of Policy and Public Affairs for NICVA. He has over 20 years’ experience in the voluntary and community sector, including five years as Head of NICVA’s European Unit and over 15 years in environmental policy advocacy and project development, as Head of WWF NI, Head of Policy and Campaigns for the National Trust, and Development Manager for the Woodland Trust.

Mark Palmer

Mark Palmer is Professor of Marketing and Strategy at Queen’s University Belfast. Previously he has held faculty appointments at the University of Birmingham and Aston University. His research approaches the grand challenge of net zero from a neo-institutional perspective.

Gareth Walls

Gareth Walls is partner and Head of the A&L Goodbody's Employment and Incentives group in Belfast. Gareth is an experienced commercial litigator with particular emphasis on injunctive relief in the employment context, modern slavery, as well as being a sought-after speaker on employment issues in Northern Ireland.

“The idea that we can be sustainable businesses whilst using less is the ultimate answer to all of this.” Derek Hynes

Gareth Walls

ESG is not a new concept and therefore, an awful lot of the structures for getting it right already exist. In recent times the terminology of ESG has broadened, and rightly so, to become an umbrella term for the 'right thing to do' in many aspects of society, law, and the environment. Corporate governance frameworks are unattractive, but they are an absolute necessity. Where the link between these frameworks and environmental goals fails is when organisations use such frameworks to communicate ESG credentials to the market, which they simply do not have. The worst instances are often described as greenwashing or virtue signalling. While the law is often slow to deal with this, the court of public opinion is not and such claims can be fundamentally destructive to a business, an organisation, and its people.

Derek Hynes

Governance is most valuable when you can move away from reporting what has happened in the past and utilising it to help predict the future. Organisations of any size are constantly balancing the competing demands for people, finance, and capability, but if you do not do the

governance, risk reporting, and compliance correctly, you are stabbing in the dark when deciding where to invest scarce resources. In relation to net zero, governance has a role in the sense that as we look at reducing Scope 1 and Scope 2 emissions, we are also engaging in supply chains that are doing the same. Governance has its part in that selffulfilling circular of moving towards net zero.

Mark PalmerI would suggest that organisations need to take a step back and find perspective. The energy transition is a complex problem and puzzle. Having oversight of the multiple parts and how they fit together will be important. Portfolio driven approaches can help but I would caution on the one-size-fits-all approach with GRC.

What does a strong social impact strategy comprise of, and who are the beneficiaries?

Derek HynesWe are a large organisation with a premium carbon footprint. We have an impact on nature and have had for 100 years. The most important thing is for our staff to see us accept that history and accept the responsibility we have to do things differently in the future. The consequence of not doing this is that people will not buy into the employment prospect with NIE Networks. There is also an issue of public trust. If NIE

Networks wants to have access to farmland and precious environment, to build and maintain our infrastructure, then the communities need to know that we are being open and honest, and that we are doing the right thing.

Geoff Nuttall

Issues like climate change are pansocietal, and mitigating climate change benefits society as a whole, but a strong social impact strategy targets areas of greatest social need and social impact. A social impact strategy gets strength through credible action. There is a role for a measuring system, but a strategy needs to detail what is being done differently because of climate change, and what are the outcomes.

Mark Palmer

It comprises of tangible actions. I would caution against just using one framework, because that could lead to a situation where organisations are effectively hitting the same problems with the same tool, repeatedly. It will require a diversity of tools as indicators. For example, we often see a new building being opened and the environmental impact or habitat credentials are boasted, but often the social and behavioural impact falls off. It is important to understand how infrastructure developments impact people’s lives and broader civic society. Our universities can play a key role in understanding this with research.

Gillian McKee

Historically, when corporate social responsibility was the buzz word, a social impact strategy related to a charitable donation, fundraising, and engaging with the local community. It is much broader now. For me, a strong social impact strategy is one where the company looks at its social impact at every stage of its value chain. It is not just about your own local communities; it must go far beyond that. To quote a former colleague: “Social responsibility is not about how you spend your profits, it is about how you make them in the first place.”

Gareth WallsThere are two elements to a strong social impact strategy. Firstly, it starts with boardroom responsibility, and should not be delegated down to a lower level of the management chain. It should also be flexible, recognising that if an organisation makes a start, there is space to learn from mistakes and adapt. Secondly, societal impact starts with the immediate internal consequence for our

“When instituting change in the system, we must be mindful of the impact on people and their values over the long run.” Mark Palmer