Delivering a balanced, sustainable, productive and prosperous economy

Delivering a balanced, sustainable, productive and prosperous economy

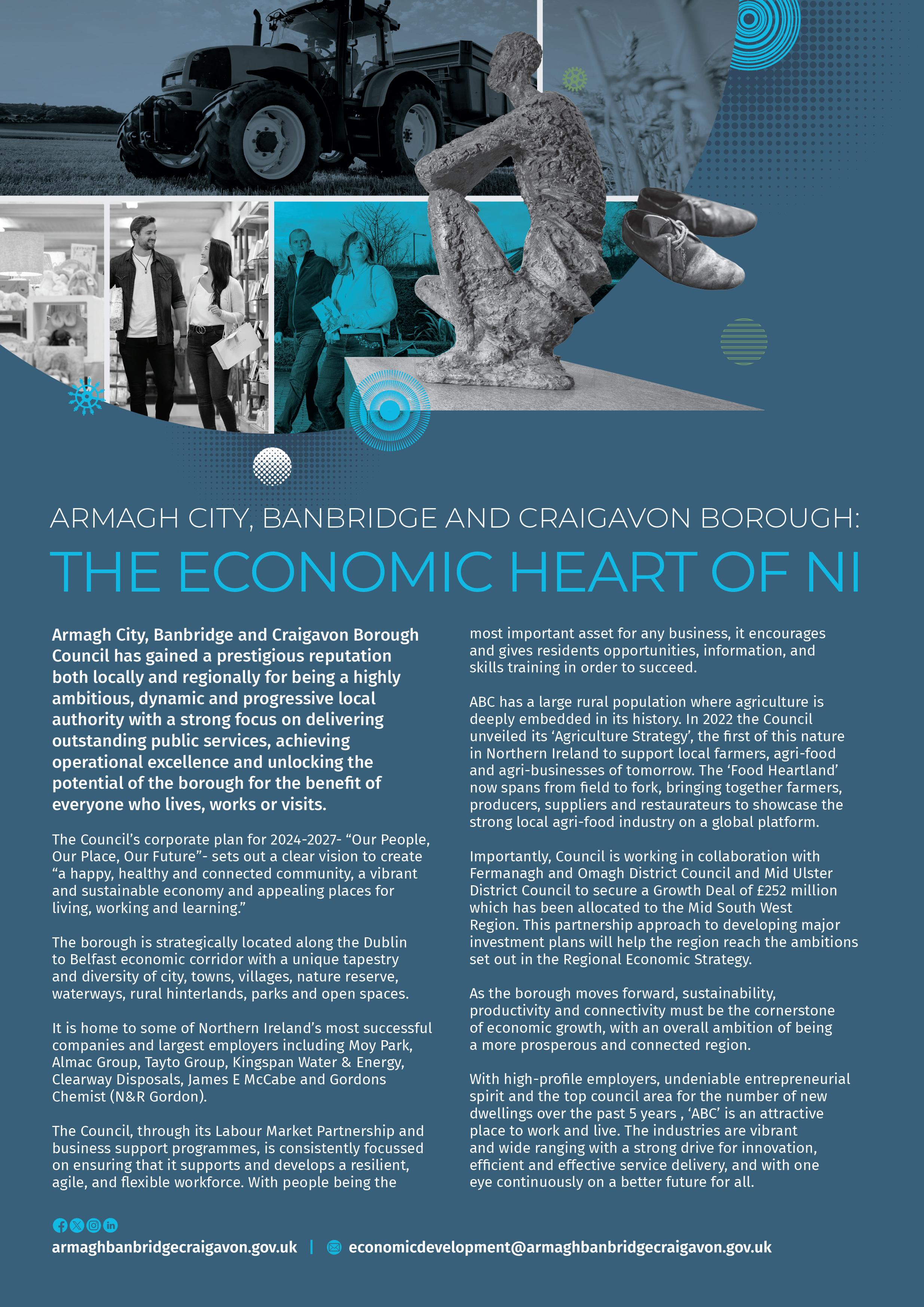

Fresh from setting out his four key priorities as part of a new economic mission and the publication of action plans to grow seven priority sectors, Economy Minister Conor Murphy MLA talks to David Whelan about his ambitions in a shortened mandate.

Mid-morning in late July and Minister for the Economy has just returned from launching a £46 million agri-food investment initiative with Invest NI, having already visited a local business in Lurgan, County Armagh. It is just one of a flurry of initiatives launched by the Minister six months since taking up office, which correlates with his stated desire to “hit the ground running”.

An interview with agendaNi is just one of several back-to-back meetings on

what is said to be a typical day for the Minister who is early in his tenure and cognisant that less than three years of the mandate remain.

Asked about the short lead-in time to his new economic mission, which was launched just a fortnight after the Executive returned in February 2024, Murphy indicates that his party’s much anticipated selection of the economy portfolio as its first choice in a reformed Executive necessitated much

preparatory work to be carried out in advance.

“We [Sinn Féin] had a sense of the timeframe involved and know what we want to achieve,” he explains. “Having signalled our intention to take the economy portfolio as a party, we had done a lot of engagement on our policy priorities to ensure that we hit the ground running from day one.”

Also defined by the timeframe, seemingly, is the Minister’s approach

Delivering a balanced,

to delivering his economic policies. A February 2024 address to the Northern Ireland Assembly outlined four objectives of the Minister’s economic vision, namely:

1. to create good jobs;

2. to promote regional balance;

3. to raise productivity; and

4. to reduce carbon emissions.

The Department for the Economy has appointed independent experts to each of these objectives, whom the Minister says will act as “critical friends” in advising how, at a strategic level, these objectives should be pursued, and to help monitor progress.

While these objectives may form part of a future economic strategy, at present the Minister signals his intention not to publish a new economic strategy, but instead to bring forward a business plan in autumn 2024, which will cover the remainder of the mandate.

“In the autumn, we will be bringing forward a sub-regional economic action plan, in the context of an overarching business plan, which reflects our approach for the years ahead,” he explains. “This department had a variety of strategies, some of which have had many objectives, and some of which have had none. Given the shortness of the mandate, we took the approach that to revisit and then consult on those many strategies would leave little to no time for delivering improved outcomes.”

Murphy indicates that a call for a better strategic focus from the Department and its arm’s length bodies – as per the critical independent review of Invest NI in 2023 – as well as engagement with key stakeholders, was central to his decision to navigate towards a four-pillared economic vision.

At the end of June 2024, the Minister published seven sectoral action plans, covering areas such as fintech, software, and screen industries, which he believes are designed to “enhance growth across seven of the North’s most innovative, productive, and export-orientated economic sectors”.

In May 2024, unemployment in Northern Ireland reached a record low of 2 per cent. However, the headline figure masks an undercurrent of longstanding challenges, not least that the region has the joint highest proportion of low-paid jobs across the UK. In addition, some 27.4 per cent of the population was deemed economically inactive – and therefore outside the labour market – in March/May 2024, well above the 22.1 per cent UK average.

As a result of these challenges and more, productivity in Northern Ireland is deemed to be 11 per cent per cent lower than the UK average,

and almost 20 per cent lower than in the Republic.

Whereas previous economic policies tended to focus on job creation figures, Murphy has indicated a desire to ensure that better and more productive jobs are part of Northern Ireland’s economic future.

“We were [historically] selling ourselves as a low wage economy,” he suggests. “That means attracting jobs that are not stable, well paid, or necessarily highly skilled. That is in contrast to sectors of our economy that are doing well, and which depend on having a highly skilled workforce.”

In July 2024, the Economy Minister announced a consultation on good jobs and improving workers’ rights, identifying the modernising of the employment law framework as one of his key priorities.

In addition, the Minister is clear that improving the skillset of the Northern Ireland labour market is a key element of increasing foreign direct investment and ensuring good job creation. However, he is also aware of the benefits to both existing and new indigenous businesses.

Outlining his belief that productivity is a fundamental driver of overall living standards, he says: “We want to support people who have innovative ideas to start building those businesses of the future. Equally, we want to equip those existing businesses with the tools to upskill their workforce, so that they can improve their productivity, enter export markets, and take advantage of the dual market access the North now has.”

On whether the current budget settlement was enough to deliver the step changes needed for both improved productivity and the growth of good jobs, Murphy describes the financial situation as “challenging”.

“Primarily, funding for work in these areas was sourced from European funding, which was stopped, and not replaced in full, as first pledged, by the then-Tory government. That has left a significant gap, and one we are attempting to bridge as much as possible, as evidenced by the £12 million ring fenced Skills Fund which I announced at the start of July.

“The Executive has set itself the task of getting our fiscal framework correct, which we would hope would yield more support. However, that will not happen today or tomorrow, and that is why we are seeking to plug those gaps.”

Emphasising that economic growth is an Executive-wide priority, albeit led by his department, he points to wider investment plans, which can have a positive impact on the productivity challenge.

“If, for example, we invest in childcare, as has been set out, then there is an economic benefit

to allowing more people with caring responsibilities to re-enter the workforce. Work by the collective Executive departments can all play a role in the ambitions of our economic vision. We have to try and stretch and make best use of the resources which are currently available, while ensuring we get the best outcomes.”

While no clear commitment has been given, Murphy describes party colleague and Finance Minister Caoimhe Archibald MLA’s initial conversations with the Treasury under the new Labour government as “positive” and expresses his hope for an “improved picture” in relation to funding.

“We will continue to argue the case. There is a recognition from London that we are underfunded according to our need. We need to correct that and rebalance it,” he states.

Another criticism levelled at Northern Ireland’s economic development agency, Invest NI, contained within the independent review, was the finding that “the regional offices of Invest NI are underutilised with staff and decision-

making largely centralised in Belfast”.

While Northern Ireland’s economy often sits as a laggard in many metrics when compared to other regions of the UK and the Republic, the local economy itself also displays a lot of disparity. The employment and economic inactivity rate gap between the highest-performing regions and the lowest-performing regions has been recorded as high as 10 per cent in some instances.

Acknowledging the criticism of Invest NI and identifying a pre-existing “Belfastcentric” approach to economic development, Murphy says that his ambition to improve regional balance is centred on amplifying local voices.

“We want to empower local areas to have an input into their own economic development, but also to ensure that their voices are heard in policy development across government,” he explains.

“I do not believe good policy is sculpted in a central building and then delivered down. We want to encourage that twoway exchange and genuinely empower local voiced to contribute to the discussion for the benefit of their own area.”

Murphy believes that such an approach will also help with the Department’s efficient use of finances. “Recognising the financial challenges in delivering the levels of support needed, a focus of resources in areas where it will have the most impact, and the greatest chance of fostering further investment, will give us the best outcomes,” he states.

The Minister is cognisant of the potential of his fourth economic priority –reducing carbon emissions – to act as a vehicle to deliver the other three pillars. More than that, net zero by 2050 is a legal requirement following passage of the Climate Change Act and Murphy believes the focus on the transition could be a lever of success.

“We live on an island at the edge of the Atlantic Ocean meaning that we have significant renewable energy resources at our disposal. Our all-island electricity market, coupled with strong linkages and shared ambitions with the Dublin Government means that we have a broad ambition to deliver a sustainable energy system on the island, which is not subject to the variations and outside influences associated with imported fossil fuels.

“We have to try and stretch and make best use of the resources which are currently available, while ensuring we get the best outcomes.”

Economy Minister Conor Murphy MLA Delivering

“By establishing a goal of delivering a sustainable and secure supply of renewable energy, we can create a lot of opportunities within various sectors of our economy. For example, we have a manufacturing sector with world-leading skills and that sector is closely linked with our academic sector, which offers great opportunities for innovation in the sectors that we are exploring, not only wind, but also for geothermal, biomethane, and hydrogen. There is a significant opportunity for us to become world leaders in those areas,” he states.

In the recent past, Northern Ireland was viewed as a world leader in the generation and system penetration of renewables via onshore wind. However, inertia, not least because of the stopstart nature of the Stormont institutions, has seen the region lag behind neighbouring countries. In 2022, over half the electricity used in Northern Ireland was from renewable sources, but by March 2023, that figure dropped by over 5 per cent, while Britain and the Republic achieved new records of renewable generation.

Asked whether there is a risk that Northern Ireland is not moving fast enough to fully capitalise on the opportunities that exist, the Minister acknowledges the need to move quicker, pointing to an appetite to do so within the Department for the Economy and among its various stakeholders.

“I think we are well placed in that we are relatively small,” he explains, pointing to work already underway to harness the connectivity between some of Northern Ireland’s most important economic sectors.

In March 2024, the UK Government published plans to support the creation of a £150 million enhanced investment zone (EIZ). The Economy Minister has indicated a preference that the initiative is used to “pump prime” green technologies and skills for a green economy.

“Done right, the transition to a greener and more sustainable economy can be a just transition that also generates prosperity for all. This sector will help drive forward my economic priorities of improved regional balance and productivity, good jobs, and decarbonisation,” he says.

“Of course, we have to move quicker than has been the case if we are to meet the targets, but significant opportunities exist and there is an appetite among industry, academia, and government to try to come together to make sure we avail of those opportunities in a timely manner.”

Asked to outline what success over the next year might look like, Murphy says that he aims to deliver progress in each of the four economic priorities.

“We want to move closer to our net zero targets and we want to strengthen regional voices with the overall aim of improving the regional balance of our economic growth. Low productivity has been a long-standing issue and not something we will solve overnight but certainly we believe we have the right focus and are setting the right direction to improving that productivity and the creation of good jobs.

“In the year ahead, we are looking for the direction of travel to become very obvious and very sustainable. Undoubtedly, particularly within the private sector, I have encountered a mood of optimism upon taking up the role, despite the challenging public financing situation. Businesses are keen to invest in their skills, their workforce, and their plant and infrastructure.

“People are very keen to be on this journey with us and there is an optimism there that gives me hope for progress over the next number of years,” he concludes.

New Invest Northern Ireland’s Chief Executive Kieran Donoghue discusses his initial impressions and strategic vision for the agency.

Northern Ireland is a region characterised by resilience, innovation, a strong entrepreneurial spirit, and deep attachment to places and community. These qualities have been evident in every interaction that I have had since starting the position of Chief Executive at Invest Northern Ireland, whether with family-owned businesses like agri-food company Davison Canners near Armagh, which has successfully navigated the challenges of the Covid19 pandemic and energy crises, or with multinational firms such as Seagate in Derry~Londonderry, a global leader in its industry.

The spirit of entrepreneurship and the drive to succeed are clearly evident across the business landscape, making it an exciting time to be at the helm of Invest NI.

Locally, a significant highlight and focus of my first six months has been my engagements with our clients, local business organisations, councils, chambers, enterprise agencies, and other key stakeholders across the region. These engagements have been

crucial for understanding the diverse needs and aspirations of the communities we serve.

Every meeting, visit, or event has been a real learning opportunity.

By listening to the challenges faced by businesses and the strategic goals of partner organisations, I am confident that Invest NI can tailor its support, build partnerships, and work together to deliver a stronger, more resilient economy that benefits all.

Undoubtedly, one of the highlights of my past six months at Invest NI, was the recent programme for the St Patrick’s Day events in the United States, where the opportunity to spend time with the First and deputy First Ministers, Economy Minister Conor Murphy MLA, and their advisors was invaluable.

This visit was about showcasing Northern Ireland as a prime destination for investment and innovation. The positive reception Northern Ireland received highlights the strong interest in our economic potential.

Similarly, I recently had the opportunity to attend the Farnborough Airshow, a premier global aerospace and defence event. Northern Ireland has a strong aviation heritage, and our companies continue to demonstrate their commitment to innovation, continuous improvement and product and service quality. Invest NI supported 11 companies to attend the trade exhibition and showcase Northern Ireland’s commitment to engineering excellence on an international stage and to help them access new markets. The deputy First Minister led our delegation at Farnborough, and this highlighted the strategic importance of the sector to our region’s economy.

Invest NI is an organisation with a proud record of achievement and plays a vital role in economic development across Northern Ireland. This success is underpinned by the dedication and

expertise of our team, who work to support businesses to expand their operations, access new markets, and drive innovation.

The team at Invest NI has consistently delivered impactful results, positioning Northern Ireland as a trusted business partner and as a competitive and attractive location for investment by both indigenous companies and multinational enterprises. Our recent End of Year results underscore this commitment.

In 2023/24, Invest NI offered £93 million of support to locally owned businesses with 76 per cent of the companies supported located outside Belfast. This demonstrates our ongoing commitment to promoting regional economic balance.

Investing in research and development (R&D) and innovation is a necessity to achieve sustained growth and competitiveness and in 2023/24 we helped 520 businesses to invest £111 million in R&D and innovation across the region.

Additionally, our Ambition to Grow programme, launched in late 2022, is specifically designed with regionally based micro and small business in mind. In 2023/24 we had over 270 applications to the programme. This support will help these companies create new jobs, explore new markets, and develop new products, processes, and skills.

We also launched a new £5 million programme called FounderLabs. Targeted at tech start-ups, it aims to provide support to 40 high growth innovation driven enterprises. Technology-based companies are crucial to our economy as they grow our R&D base and have high-growth potential which can lead to above average salaries and enhanced living standards for all.

Our 2023 key performance indicators (KPIs) also show a strong increase across sales, external sales, and exports among the businesses we supported, with agri-food and advanced engineering and manufacturing recording the largest increase in sales.

As a result of our trade support this year we have helped companies generate over £240 million of new external sales. Since 2021 the monetary value of the outcomes of our trade support has reached over £0.5 billion – a phenomenal figure which is testament to the work of our international teams.

“The spirit of entrepreneurship and the drive to succeed are clearly evident across the business landscape, making it an exciting time to be at the helm of Invest NI.”

In short, there is a tremendously strong platform for us to build upon into the future.

We are currently in the process of finalising our new three-year business strategy which we are aligning strongly to the Minister for the Economy’s four policy priorities: raising productivity, creating good jobs, achieving stronger regional balance, and driving the transition to net zero. These policy priorities are the guiding principles that will shape our efforts and initiatives over the coming years.

Productivity is a fundamental economic driver, and this will be at the core of our new business strategy through investment in plant and equipment, automation, innovation, digitisation, skills development and increased exports. Our interventions will be structured and aligned with recognised productivity drivers which have been designed to reflect the UK’s productivity drivers and the drivers of those identified in the Northern Ireland productivity dashboard.

In this context, our recently launched £46 million Agri-Food Investment Initiative will support local agri-food and drink processors to help improve the overall competitiveness and productivity of the sector in Northern Ireland. We will introduce other similar productivity enhancing interventions to address specific sectoral and regional needs across Northern Ireland.

Our strategy will also focus on the green economy. Northern Ireland is already leveraging its recognised expertise in engineering, technology, and construction to win market share in low carbon and net zero markets.

Significantly, 60 per cent of our manufacturing companies are already selling into the green economy and generating £1.5 billion in turnover and £230 million in exports.

To support our green economy and low carbon ambitions, we recently launched a £20 million Energy Support Fund to help businesses to reduce their carbon emissions and improve their competitiveness through investment in energy and resource efficiency. This support will ensure that Northern Ireland is an ideal partner for international

investors to capitalise on global net zero opportunities and to drive impactful economic growth.

Our commitment to regional balance will be another area of focus in our strategy. We are currently finalising a new Regional Property Programme to ensure that Invest NI can offer existing clients and new investors the real estate necessary to establish a new business or to expand existing operations. This programme will be a key enabler of our regional development strategy and help drive economic growth in all parts of Northern Ireland.

We are also working with our partners to ignite regional economic growth through the ambitious City and Growth Deal projects, which offer a transformational opportunity to deliver more and better jobs and a more balanced distribution of economic activity across the region.

Our new strategy will emphasise that, to deliver these desired policy outcomes, Invest NI will need to work even more closely with client companies, new investors, and key stakeholders to incentivise and enable more investment and innovation. This will involve codesigning and delivering a range of initiatives encompassing capital investment, R&D, and innovation, training and upskilling, product, and process improvements and sustainability initiatives.

Collaboration and partnerships will be key to achieving our goals. We are working closely with universities, colleges, councils, and other stakeholders to ensure that our efforts are coordinated and effective.

The ongoing transformation within Invest NI is not just about new strategies and initiatives; it is also about addressing the findings of the Independent Review and associated Action Plan. Several significant actions will be completed this year.

The Review provided the organisation with valuable insights into areas where we can improve, particularly in terms of our operational efficiency and the effectiveness of our engagement with client companies.

One of the key areas identified for improvement was our operating model and internal processes. The review highlighted the fact that some of our procedures were overly bureaucratic, making it difficult for businesses to navigate our support systems. In response, we are undertaking a comprehensive review of our policies, procedures, and processes to make them more user-friendly and efficient. This includes digitising our processes, investing in a new client portal, and pioneering a new, faster, and more

flexible approach to internal innovation. Our goal is to ensure that we can support our clients effectively while meeting our governance, risk management, and compliance (GRC) requirements as custodians of public funds.

Another significant area of focus is our organisational structure. The new strategy will serve as the basis for a restructuring of Invest NI to ensure that we are configured appropriately to execute our strategic objectives.

The Independent Review also underscored the importance of Invest NI leading by example. If we are going to ask our clients to invest and innovate, we must be willing to do the same. This commitment to innovation is reflected in our internal transformation efforts, where we are actively seeking to identify and address inefficiencies and opportunities for improvement.

The global economic environment is increasingly volatile, with new industrial policies and geopolitical risks reshaping the investment landscape. As we develop our strategy, we are mindful of these challenges and the need to position Northern Ireland favourably within this context.

Delivering

The volatile, uncertain, complex, and ambiguous (VUCA) model developed by professors Warren Bennis and Burt Nanus serves as a useful framework for understanding the current international environment.

We are seeing a significant increase in more interventionist industrial policies, such as the United States’ new manufacturing and innovation strategy and the European Union’s Chips Act and Green Deal. The US, for example, is proposing to invest more than $3.5 trillion over the next decade. If sustained, this strategy will crowd-in private investment into clean energy and technological innovation in strategic industries and transport infrastructure.

The combined effect of the policies being adopted by these large markets is to reshape the structure and geography of investment through the provision of bigger incentives, increasing capital intensity of production, the localisation/regionalisation of supplychains and the channelling of investment into preferred sectors such as semiconductors, life sciences, and renewable energy. Northern Ireland will have to adapt to these realities from both a trade and FDI perspective to remain competitive and attractive for further investment.

One of the most significant changes we are observing is the shift in language around trade and investment. Terms like “de-globalisation”, “friend-shoring”, “resilience”, and “strategic autonomy” are becoming more prevalent, reflecting the increasing importance of geopolitical and security considerations in investment decision-making. This shift presents both challenges and opportunities for Northern Ireland. For example, our aerospace, defence, and security sectors could potentially benefit from these developments.

Similarly, the local operating environment in Northern Ireland presents its own set of challenges and opportunities. With limited fiscal space, full employment, low population growth, skill shortages in certain areas, and capacity issues in education, we must find ways to grow our economy despite these constraints. This will require a focus on improving productivity, increasing the efficient use of existing resources, and exploiting opportunities such as the unique dual market access that we provide companies through the Windsor Framework.

“The transformation we are undertaking is not just about meeting immediate goals but is also about changing our mindset and about positioning Northern Ireland for longterm success.”

The more I see the more optimistic I am about the direction in which Invest NI is heading. The substantial progress that we have made over the past six months is just the beginning. We are establishing the foundation for a more focused, efficient, and effective organisation that is better equipped to support Northern Ireland's businesses and drive economic growth.

The transformation we are undertaking is not just about meeting immediate goals but is also about changing our mindset and about positioning Northern Ireland for long-term success. This includes capitalising on our strengths in the green economy, improving regional balance, and ensuring that we are ready to navigate the complexities of the global economic landscape.

At Invest NI, we are committed to working closely with our clients, stakeholders, and partners to harness the momentum we have built and to

continue driving forward. Certainly, from what I have seen, heard, and experienced in my early months, I am confident that by working together we can achieve our shared vision of a regionally balanced, sustainable, productive and prosperous economy that benefits all.

W: www.investni.com

T: 0800 181 4422

NIE Networks hosted key stakeholders from across Northern Ireland’s economy to discuss how the transition to decarbonised use of the electricity network can underpin the region’s economic growth

What role does the electricity network play in improving socioeconomic outcomes for Northern Ireland?

Derek Hynes

The electricity network is a tool for connectivity. A total of 929,000 homes and businesses are connected to the network through wires and cables, making the electricity network a unique offering. We need to upgrade the network if we are going to offer those

homes and businesses the opportunity to move away from using fossil fuels. Ultimately, we will invest in the network, but the decisions informing that investment will determine the socioeconomic opportunities that flow from it. Job creation, apprenticeships for our young people, and a better environment are just some of the opportunities that exist for a more modern and prosperous region, if we can maximise those connected opportunities.

Rachel Sankannawar

The electricity network is a critical

Round table discussion hosted by

infrastructure that underpins economic growth, social development, and environmental sustainability. It is akin to a nervous system in that it joins up the regions and presents opportunities for balanced economic development. From a green economy perspective, a reliable and expansive network is not only critical to reaching net zero for the region, but a key agent in attracting new green investments in technologies and fostering the innovation we need to improve social and economic outcomes.

David Rooney

The electricity network is a tool, which may be employed, with great success, to improve socioeconomic outcomes. When we talk about the business connectivity potential, we must give equal consideration to the value of community wealth-building projects that may stem from the upgrade investments.

Equally, the electricity network is an innovation platform. Previously, we led the way in renewable penetration, utilising our unique offering – such as our extensive wire network – across a very wide geographical area. There are opportunities that we can maximise for our own economy, while accumulating knowledge that can be exported to the rest of the world, to enable other transitions to net zero.

Noyona Chundur

There is no doubt the electricity network will be a key lever in decarbonising our energy system, but behavioural considerations are hugely important as we progress the transition. Consumers still need the same fundamentals – a secure and reliable supply, at an affordable cost, with minimal environmental impact – however, they are being asked to participate in the transition at pace and at a time when they face significant affordability challenges. There is no realistic pathway for electrification – or any realistic pathway to net zero – that does not require our communities and society to change behaviours at scale, therefore, we must mobilise the opportunities of this change. Getting our communities and citizens participating in and supporting the transition is critical and a key driver is the investment that stimulates and advances economic growth, which consumers will benefit from.

Economy Minister Conor Murphy MLA’s recently announced vision is clear on the opportunities to build a green economy through collaborative strategic investment in areas such as the Single Electricity Market and an integrated, balanced, decarbonised energy system. The Department for the Economy is assessing the policy levers that will be required to deploy smart systems and flexibility. A good example is our plan to finalise the high-level design for smart meters later in 2024. In addition, we are working with the Utility Regulator and other stakeholders to research how interconnectors and storage options will impact on all of this. We are also reviewing the electricity grid connection charging policy, recognising that it currently acts as a barrier for consumers and businesses, and ensuring Northern Ireland is a favourable destination for renewable investment.

Noyona Chundur is Chief Executive of the Consumer Council for Northern Ireland. She is a Chartered Director and a Fellow of the Institute of Directors. Chundur is a council member for the Northern Ireland Chamber of Commerce and Industry and chair of the Cathedral Quarter Arts Festival. Prior to becoming Chief Executive, she was a Consumer Council board member and chair of the Audit and Risk Assurance Committee.

Derek Hynes was appointed Managing Director of NIE Networks on 1 September 2022. He is a director of Energy Networks Association Ltd, Centre for Competitiveness, and Smart Grid Ireland. He joined ESB in 2000, where he held several senior management positions. He is a chartered engineer with post-graduate qualifications in operations management and corporate governance, and he has completed the advanced management programme at Harvard University.

Anne-Maire McConn is the Department for the Economy’s Director of Energy Strategy, Energy Group. Previously, she worked in the Department of Finance and DAERA, with local and Great Britain ministers and the EU, developing policy, legislation, and schemes for animal disease control, food policy and leading communications and people issues.

David Rooney is the Dean of Internationalisation and Reputation within the Faculty of Engineering and Physical Sciences at Queen’s University Belfast. He is a professor of Chemical Engineering at Queen’s and Director of the Centre for Advanced Sustainable Energy. He has a H-Index of 57, over 10,000 citations, and a grant portfolio of over £10 million.

Rachel Sankannawar is Invest NI’s Head of Green Economy Development and focuses on empowering Northern Ireland businesses to fully optimise the opportunities emerging in the green economy, and to support business decarbonisation in the drive towards net zero. She has over 10 years’ experience across private and public sector, and advises on strategic direction for the development of solutions, capability and technologies needed to tackle climate change and advance a green economy in Northern Ireland.

“Perfection has become the enemy of progress when there are lots of low-regret actions that can be taken now.” Derek Hynes

How can the transition to net zero underpin the Economy Minister’s four strategic policy ambitions?

Anne-Maire McConn

Decarbonisation is one of the four policy ambitions, but it is also a recognised driver of the other three, namely, creating good jobs, increased productivity, and improving regional balance. The DfE’s Energy Strategy predated the Climate Change Act, but it placed the consumer at the heart of the transition and in doing so, recognised the potential for innovative businesses in Northern Ireland, with unique access to EU and UK markets, to not only help protect the environment but to create good jobs, boost productivity, and improve regional balance. By way of example, to maximise the employment opportunity presented by the net zero transition, we are working with industry to publish a skills action plan in September 2024. Similarly, and in relation to regional balance, DfE is coordinating the development of a sub-regional economic action plan in collaboration with local councils and recently launched the lowcarbon/net zero sectoral action plan as part of a suite of sector-specific actions.

Rachel Sankannawar

Invest NI recognises the green economy and decarbonisation as a key driver of growth and prosperity. Our role is twofold. Firstly, we help businesses to decarbonise with the view to making them more competitive and productive.

Secondly, we look for business opportunities that arise from the global drive to net zero. Oxford Economics estimates that new green activities are projected to create $10.3 trillion in global GDP by 2050. For the UK, this market is projected to deliver up to £170 billion in exports alone by 2030. Northern Ireland needs a slice of this pie and to do so, we must anchor green industrial development within the region to deliver long-term economic benefit.

There are multiple growth pathways that align with the Minister’s four economic priorities ranging from our potential to create and export green technologies and expertise, to ‘crafting clean’ and recognising that a decarbonisation plan is becoming a passport for doing business. As we seek to revolutionise production with renewables and clean energy, organisations like NIE Networks play a critical role in enabling businesses to become more productive and competitive in those global markets.

Derek Hynes

On the surface, NIE Network’s role in reaching net zero is fairly straightforward in that we have to manage the network in a way that enables households and businesses access to clean electricity. That means expanding and improving the network to meet future demand. We are enabled by a mechanism that allows us to fund this through a small proportion of a consumers bill but also importantly, to be able to raise debt. The real challenge lies in the decision-making

“Now is the time to mobilise and anchor value offered by the green economy.” Rachel Sankannawar

around how and where we spend that money to ensure we get the best outcomes for Northern Ireland. For example, if we are choosing a location for significant investment, do we opt for somewhere that has historically suffered from a lack of investment, or do we opt for an area that will generate greater capacity for industry to develop? You can see how our connected ecosystem links in with those ministerial missions and the role all our organisations have, not just in decarbonisation, but maximising the economic and societal opportunities of the transition.

David Rooney

The transition can underpin the economic priorities in two ways. Firstly, by supporting the region’s existing business base and drawing up a roadmap for the direction of travel as we move towards what is effectively a rebalancing with nature. That must include more decentralised production of energy, among other things, and requires greater circularity, being able to use more place-based resources, and activities which are embedded in communities. Secondly, new opportunities will stem from the transition as we maximise the utility of this tool. Every sector in Northern Ireland must decarbonise. On that journey, we have the opportunity to utilise the skills and expertise of our flagship growth sectors to create new business and to boost economic opportunities across the region.

Noyona Chundur

How the consumer interacts with markets and the opportunities being created is important for ensuring they buy into and experience the benefits of decarbonisation, a policy ambition. Also, as a micro-business economy, many businesses interact with the energy market in the same way as individual consumers, meaning they share common traits of low awareness and understanding and uncertainty around decision-making, even if they have the best intentions. To support consumers –and some businesses – we need to offer simple, connected pathways through a one-stop shop where trusted and accessible advice, incentive, support and signposting sits together to lift and guide ambition and action, and crucially, offers them a voice in codesigning interventions.

“By boosting productivity and delivering better paid jobs, the improved discretionary spending power should enable consumers to make greener choices and investment decisions.” David Rooney

What are the most significant challenges in delivering net zero and enabling the wider

Noyona Chundur

From a consumer perspective, there are two main challenges. The first is ensuring consumer centricity. We talk about putting the consumer at the heart of the transition, but we need to embed it into our business as usual if we are going to achieve the behavioural change required. The second challenge is how we embed consumer insights into the decision-making process, moving away from primarily gathering consumer views when we need to inform policy development. Good consumer engagement is good practice and that means not just gathering the data but ensuring an ongoing conversation, and monitoring lived experiences and how these change over time. Inclusive design principles from the outset will also breed the confidence and assurance people need to participate in the transition.

Rachel Sankannawar

Our biggest challenges are also our

biggest opportunities. If we can prioritise and solve them, then they give us a competitive advantage. On a high level, we have planning challenges, alongside challenges around skills development and workforce availability. We need to be an attractive proposition to secure private investment, and that requires consensus and clear pathways. However, we have proven in the past our ability to be world-leading in renewables when we focus our efforts. Now is the time to mobilise and anchor value offered by the green economy.

David Rooney

Uncertainty around what the net zero agenda means and what impact it will have on consumers and businesses is the greatest challenge. We have had transitions in the past – such as the move to smokeless coal or unleaded fuel – that were successful because the benefits were evident. To date, for the transition to net zero, that has not been the case because we have yet to fully articulate the changes and benefits.

Anne-Maire McConn

De-fossilisation remains the biggest overarching challenge because it requires the restructuring of entire

“Good consumer engagement is good practice and that means not just gathering the data but ensuring an ongoing conversation, and monitoring lived experiences and how these change over time.”

Noyona Chundur

industries. What we are doing in DfE is trying to create the policies, regulations, and legislation that will facilitate that restructure. Decarbonisation is not the job of government alone, but we are cognisant of the need for policy certainty and direction. Our Energy Strategy gives that direction and as we approach the fifth year, plans are in place to carry out a mid-term review of the strategy alongside our stakeholders in 2025.

Derek Hynes

Often the pursuit of perfection is the greatest challenge. To some extent, perfection has become the enemy of progress when there are lots of lowregret actions that can be taken now. There is no point in us reaching net zero by 2050 if we continue to heavily emit carbon up until 2049 because the accumulated damage will be done. Ironically, one of Northern Ireland’s current advantages is that it has lagged behind the energy transition decisions taken in neighbouring countries in recent decades, so there are working technologies that we can copy in a lowregret manner. Smart meters are a good example of where the strive for perfection and certainty is somewhat unnecessary.

Anne-Maire McConn

On the flip side of that, there are consumer acceptance issues stemming from when things have been done wrongly in the past. We must ensure that we are fully communicating how we are doing things better and correctly to ensure we can mitigate those fears and biases.

Noyona Chundur

Net zero is a recognised opportunity to drive economic growth, increase job creation, and deliver the public health benefits from increasing our carbon savings. However, to achieve this the consumer needs to understand what is being asked of them and be able to access the appropriate support, tailored to their circumstances. Remember, it is the consumer who pays for the energy transition, both directly and indirectly, so they deserve to be engaged in the process as early and as often as possible. What we must guard against is the creation of a two-tiered system whereby those who can afford it enjoy the benefits of a decarbonised economy, and those who cannot are left behind.

Derek Hynes

Articulating the benefits of our investment work in the present –delivering a better service in the future –can be difficult. Covid-19 provided a lot of learnings around the importance of grid resilience and the impact any outages had on people’s lives and livelihoods. However, it has not changed a general reluctance to increased bills or additional maintenance work in an area, even if that means greater resilience in the future. It is difficult to have a national conversation about net zero electricity in a rational way because the topic is so

abstract that we do not adequately link household choices to the net zero agenda. To this end, we need better communication. As such, we must listen and be prepared to do something different.

Anne-Maire McConn

Demonstrating societal benefits is key to gaining public support for change. On 18 June 2024, the Minister for the Economy announced plans to establish a working group to identify what community benefits can be delivered through industrial decarbonisation. That will act as a pathfinder for us to demonstrate how these projects will bring long-term benefit to communities and change the public perception around near-term actions for long-term gain, in relation to renewables.

Noyona Chundur

Achieving public buy-in requires coordination to avoid confusion. We need greater cohesion and an agreed common toolkit and priorities. We also need to ensure we are highlighting localised benefits because the macro benefits are confusing for people, and they struggle to apply them to their dayto-day lives. Organisations need to go out regularly and frequently, and communicate with trust, confidence, and transparency.

David Rooney

We are trying to deliver the equivalent of the industrial revolution, in a fraction of the timescale, with a recognition that the immediate benefits are not always obvious to the consumer. It is important that we talk about affordability rather than cost, because they are very different metrics. If we enhance wider economic prosperity, then these measures become more affordable for society. If decarbonisation allows us to grow the economy and increase prosperity by boosting productivity and delivering better paid jobs, the improved discretionary spending power should enable consumers to make greener choices and investment decisions.

How can Northern Ireland maximise its socioeconomic opportunities for the future?

Noyona Chundur

Through a just transition. The two main pillars of this are security of supply –

“Decarbonisation is not the job of government alone, but we are cognisant of the need for policy certainty and direction.” Anne-Maire McConn

which means safeguarding what consumers need and want – and affordability – which means making the right decisions for consumers as they move through this journey. A just and fair transition embracing all citizens will bring the social and economic benefits that we are seeking to achieve.

David Rooney

We need to embrace risk and the best means to do so is by creating a regional investment fund to support investment decisions, enable action and return investment back into Northern Ireland and into the grid. The electricity network, and other key green energy infrastructures, are being constrained because we are slow to accept risk. Meanwhile, other regions are taking risks and reaping the rewards.

Derek Hynes

I agree with David about risk. We tend to treat the electricity grid like the ‘good sitting room’ at home, where no one is allowed in and there is to be no mess, in the name of security of supply. However, the electricity network is quite a robust system and the feedback we are getting is that while Northern Ireland leads on its grid and renewable penetration levels, it has some of the highest constraints in the world. That risk aversion stems from policy and the idea that there is no room for mistakes. The reality is that we need to take short-term actions while planning for the long-term. The strive for

perfection causes a continual churn for perfection of policy and certainty, which distracts people away from doing the things that are achievable now.

Rachel Sankannawar

We need to take the assets and capabilities we have in Northern Ireland and go after the market opportunities. We are uniquely positioned for those opportunities in the green economy, and we need to take some risk to ensure that we are benefiting from those green transactions taking place across the globe. Derek talks about letting people be innovative with our electricity network and the same principle applies to our businesses. We need to be agile enough to tailor and support our vibrant and growing ecosystem of indigenous businesses to the needs of the local and global markets.

Anne-Maire McConn

As a small and flexible region, with limited resources, the opportunities lie in collaboration. If we are to maximise the resources available, we must avoid overlapping on key areas and that is why we are working with partners such as Invest NI to deliver initiatives including the Energy Efficiency Capital Grant. This collaboration must also stretch into our communication strategy around the benefits of the transition to net zero.

With annual growth of some 1.1 per cent now putting Northern Ireland’s economy 7.6 per cent above pandemic level, signs of improvement are evident. However, short-term growth measurements fail to fully reflect the impact of longstanding structural challenges which have meant little improvement in almost two decades.

Headline figures suggest that Northern Ireland is on a growth trajectory far greater than that of the UK. An annual increase of 1.1 per cent for Northern Ireland compares to 0.2 per cent for the UK. Similarly, the 7.6 per cent increase from pre-pandemic levels in Northern Ireland compares to a 1.7 per cent GDP improvement for the UK in the same timeframe.

However, what these figures fail to reflect is a larger picture whereby Northern Ireland’s starting point for growth is much lower, thereby exacerbating the scale of percentage point growth. Quarter 2 in 2023 was the first time Northern Ireland’s economy returned to levels last observed at the end of 2007, immediately prior to the financial crash.

Despite itself being a poor performing economy by global comparison (the UK’s real GDP percentage growth from pre-pandemic

levels is 2.3 per cent, compared to the 4 per cent eurozone average), the UK economy has recorded GDP growth in 32 of the last 40 quarters of the past decade, compared to the Northern Ireland Composite Economic Index (NICEI) comparison of growth in just 23 of the last 40 quarters.

UK GDP is now estimated to be 16.4 per cent higher compared to its pre-economic downturn peak at the beginning of 2008, compared to Northern Ireland which is now just 2 per cent higher than its 2007 high.

Similarly, comparing the Republic of Ireland’s 5.9 per cent annual decline in economic output to Northern Ireland’s 1.1 per cent increase fails to reflect that the Republic’s GDP is now 21.4 per cent above prepandemic levels.

NICEI, comparison with selected GDP measures, Q1 2006 to Q1 2024

Source: NISRA NI Composite Economic Index.

Services make up the majority (52 per cent) of Northern Ireland’s GVA, and a 1.5 per cent annual growth in the sector is a large factor in overall growth across the year. Smaller contributions to growth from the construction (0.4 per cent) and the public sector (0.2 per cent), have offset a decrease in the production sector (-0.6 per cent).

Northern Ireland’s unique market access, including alignment with the EU single market rules for goods, growth in the public sector, which makes up about one-quarter of employment in the region, and the return of an Executive and Assembly in February 2024 are all attributed to recent improved performance.

A prime example of how headline figures for Northern Ireland’s economy often mask longlasting challenges in the labour market, and in particular, productivity.

In August 2024, Northern Ireland’s unemployment rate dropped to a record low of less than 2 per cent. This figure does not reflect the some 320,000 people classified as economically inactive, meaning they are neither in employment nor classified as unemployed.

Evidence suggests that Northern Ireland’s employment growth in the past decade has been dominated by growth in low productivity areas.

NICEI growth compared with selected GDP measures: Pre-pandemic change

Source: NISRA

Source: UUEPC, OBR.

The UUEPC estimates that 73 per cent of employment expansion between 2013 and 2023 was in sectors with ‘below-average wages’.

“The greater employment increase in below average productivity sectors has resulted in low overall average wage growth,” it states.

Importantly, while Northern Ireland continues to record a steady annual increase in the total number of hours worked since the pandemic, the overall figure remains 0.6 per cent below the prepandemic position recorded in OctoberDecember 2019.

The UUEPC’s Summer Outlook points to a 5.9 per cent average nominal wage increase for all employees in 2023, building upon similar rises in the two previous years. Despite this, Northern Ireland has the second lowest annual growth rates across all 12 UK regions. When inflation is factored in, average real wages actually declined in 2022 and 2023, meaning that real wages have only increased by 0.6 per cent in the decade to 2023.

Productivity is a key driver of higher wages and better living standards, however, recent data suggests that Northern Ireland is 11 per cent below the UK productivity average, which itself is 8 per cent below the productivity rate recorded for the Republic of Ireland.

Looking deeper, productivity challenges are complex. Existing and future reliance on migration for labour supply are limited by existing and potential future immigration rules. Added to this is existing disparity in the labour market, employment rates in the most deprived areas of Northern Ireland are significantly lower in the least deprived

areas. It is estimated that if the employment rate in Northern Ireland’s most deprived areas was increased to match the Northern Ireland average, there would be almost 29,000 more people in employment –equivalent to more than 3 per cent of Northern Ireland’s GDP.

Northern Ireland’s education system has also been linked to historic levels of low productivity. The continued use of academic selection in some schools in Northern Ireland has been linked to poor educational outcomes, and the disparity in outcomes depending on socioeconomic background.

In 2022/23, just 56.5 per cent of those entitled to free school meals – a measure of socioeconomic background – achieved at least five GCSEs at grades A*-C or equivalent, including GCSE English and maths, compared to an almost 90 per cent average for the wider school leaver population.

Northern Ireland has the highest proportion of individuals with no or low (NVQ1) skills of any UK region, at almost 20 per cent. While the proportion of those with a tertiary education (NVQ4+) has increased significantly in recent years, Northern Ireland suffers from a documented ‘brain drain’.

A tight labour market, an ageing working population, and a long-standing inability to address structural problems means that even small projected growth in the short term is not necessarily sustainable in the medium to long term. Renewed focus on economic growth driven by the return of the Executive in February 2024 offers a potential change to the economic outlook.

Anne-Marie Murphy, Director of Strategy and Emerging Markets at the Consumer Council for Northern Ireland explains the current consumer experience in Northern Ireland and offers key insights that could help to shape economic growth in the region.

Whilst some positive economic indicators have emerged, disparity in wealth and opportunity is evident in Northern Ireland and many citizens are struggling to make ends meet and cope with financial pressures.

The Consumer Council is the statutory consumer body for Northern Ireland, responsible for representing, protecting, and empowering consumers here. Over the last three years, it has provided advice to and investigated complaints for 30,000 consumers through its helpline and engaged with over 36,000 consumers through outreach.

Through its research and insight programme, the Consumer Council monitors current and emerging issues and their impact on consumers, vital insights that can help to shape policy development and implementation.

64 per cent of Northern Ireland’s economic output is driven by consumer spending and this spending is vital for rebuilding and rebalancing our economy.

In the past two years, consumers have experienced instability such as the energy price crisis, rising food costs, disruption to supply chains, and the rising cost of borrowing. Increasing inflation has eroded purchasing power, making it less likely that consumers have surplus income to spend after covering basic expenses.

The Consumer Council, through its rich consumer insight portfolio, can quantify the impact of these factors on consumer behaviours, their spending activities, and what changes people are making to cope.

For economic prosperity to continue in Northern Ireland, and for the quality of life for our citizens to improve, consumers need realistic and timely interventions, designed with their needs and experiences at the core.

The Consumer Council launched its Northern Ireland Household Expenditure Tracker in 2022 which monitors the income and expenditure of all citizens across four income quartiles.

Between January and March 2022, the lowest earning households in Northern Ireland had only £29 left per week after paying for bills and essentials. One year later in January-March 2023, this figure dropped to a stark low of £19, and in the same period of 2024, it rose to £41. This marginal increase provides little relief for consumers in the lowest income quartile. Northern Ireland exhibits vast disparity in experiences and whilst the lowest earners had £41 per week left after bills and expenses, the highest earners had £678 left.

Economic instability has implications right across the consumer landscape. As purchasing power reduces so does consumer confidence and resilience, which has a detrimental impact on mental health and wellbeing, as our direct consumer engagement can attest to.

Our research published in August 2024 reported that 96 per cent of consumers

were concerned about food prices, 95 per cent were concerned about energy costs, 85 per cent were concerned about petrol and diesel prices, and 66 per cent were concerned about product availability and selection in shops. When we asked consumers through focus groups about the impact that rising costs is having on them; they expressed disbelief at how quickly food prices have increased in recent years, and that it has had a negative effect on their mental health including feelings of social isolation.

Consumer behaviour has changed, and continues to change, in response to these conditions.

Just under half the population are dipping into their savings to meet rising costs, nine in 10 consumers have shopped around or switched service providers, and 66 per cent have cut back on eating out. A quarter of consumers said they have had to skip meals or eat fewer times in the day. Our recent deep-dive into the use of ‘buynow-pay-later’ products in Northern Ireland showed that it is the second most used form of credit in the region, with half of those who used it saying they are using it more because of the increase in the cost of living.

The financial pressures that consumers have faced, and continue to face, cannot be overlooked. Whilst some positive

“The financial pressures that consumers have faced, and continue to face, cannot be overlooked. Whilst some positive economic indicators suggest signs of recovery, the lived experience demonstrated through our research shows that many consumers continue to face hardship that must be addressed.”

economic indicators suggest signs of recovery, the lived experience demonstrated through our research shows that many consumers continue to face hardship that must be addressed.

Confident consumers drive competitive markets and economic prosperity. Together, we must ensure that consumers have the support, access to markets, choice, necessary consumer protection and the opportunity to avail of the products and services that they need and want and to experience a good quality of life.

Whilst the challenges that lie ahead for Northern Ireland’s decision makers are momentous in improving the lived experience of consumers, positive pathways continue to emerge. We welcome the return of the Executive and look forward to working together and sharing our insight. The Department for the Economy’s economic mission published in February 2024 sets out four pillars for growth: good jobs; regional balance; productivity; and net zero – all themes that the Consumer Council supports and contributes to.

As we have always done, the Consumer Council will travel this uncharted journey with consumers, representing their needs and views through our direct consumer engagement and representative research, and using this to advocate on their behalf, and help them directly through our services in complaints investigations and empowerment.

We will continue to work with governments and policy makers, locally and further afield, making sure that consumer journeys and experiences frame policy, legislation, regulation and interventions.

T: 0800 121 6022

E: info@consumercouncil.org.uk

W: www.consumercouncil.org.uk

Although unemployment has fallen in the first half of 2024, Northern Ireland’s level of economic inactivity remains significantly higher than the UK average.

The most recent Labour Market Report, published in August 2024, shows that the economic inactivity rate, i.e. the proportion of people aged 16 to 64 who were not working and not seeking or available to work, increased over the quarter and decreased over the year to 27.1 per cent.

The UK economic inactivity rate for April to June 2024 was estimated at 22.2 per cent, broadly similar to the rate of 22. 6per cent in the Republic.

Over the last 15 years, economic inactivity in Northern Ireland has been consistently higher than the UK average, with more variability in economic inactivity in Northern Ireland than the UK. Economic inactivity in Northern Ireland peaked in 2009 at over 31 per cent, compared to the UK rate of almost 24 per cent at the beginning of 2010.

While unemployment is low, the number of people who are in low-paid work –sometimes termed ‘underemployed’ –outnumbers that in Britain. Speaking in January 2023, Nevin Economic Research Institute economist Lisa Wilson stated: “While Great Britain may be experiencing a pandemic-induced increase in economic inactivity, it does not appear that the pandemic has been the principal driver of that trend in Northern Ireland. The movements in Northern Ireland would appear to be more connected with structural causes of economic inactivity which have been a feature of Northern Ireland’s labour market for many years.”

The most recent hourly pay report shows that the average hourly rate for

all workers in Northern Ireland is £13.39. Disparities exist in the subdata, for example, the hourly median rate for full-time workers (£14.79) is significantly higher than for part-time workers (£10.68) and, overall, males (£13.99) tend to earn more per hour than females (£12.82).

The distribution of earnings in Northern Ireland also tells a story. The lowest paid 10 per cent of workers in Northern Ireland earn an average of £9.51 per hour, compared to the best paid 10 per cent, who earn around £27 per hour. Both figures are significantly lower relative to the UK as a whole, or the Republic of Ireland.

Between 2009 and 2019, the trend for both the UK and Northern Ireland economic inactivity rates was generally downward. From the onset of the Covid

pandemic, the report asserts that both UK and Northern Ireland economic inactivity rates increased. Since early-2021 however, the trends have varied, with the Northern Ireland rate trending downwards whilst the UK rate is trending upwards. Over the last year, the economic inactivity rate in Northern Ireland has seen a decrease of 0.1 per cent whilst the UK rate has seen an increase of 0.8 per cent.

The most recent economic inactivity rates for Northern Ireland (27.0 per cent) and the UK (22.3 per cent) were 1.1 per cent and 1.6 per cent higher than their pre-pandemic equivalents in November-January 2020.

UK economic inactivity is driven by older people leaving the labour market earlier. However, in Northern Ireland, this phenomenon is observed across the board, which suggest a larger structural problem driving economic inactivity. In Northern Ireland, this differentiation is characterised by a higher rate of people who are long-term sick which is potentially linked to the underinvestment in public services and the health crisis showing out in the labour market.

The Northern Ireland economic inactivity rate (aged 16 to 64) for March to May 2024 (the most recent quarter for which statistics are available at the time of print) was estimated at 27.1 per cent, which was a decrease of 0.7 per cent over the year.

The number of economically inactive people (age 16 and over) in Northern Ireland was estimated at 618,000, which was:

• up 6,000 from previous quarter (December 2023 to February 2024); and

• down 3,000 from the same period last year. Annual changes by sex (for those aged 16 to 64) showed:

• a decrease of 0.2 per cent over the year in the male economic inactivity rate to 22.7 per cent; and

• a decrease of 1.5 per cent over the year in the female economic inactivity rate to 30.3 per cent.

UK regional comparison:

• The Northern Ireland economic inactivity rate (aged 16 to 64) of 27.1 per cent was 4.9 per cent above the most recent UK rate of 22. per cent.

• Northern Ireland is the third highest of the twelve UK regions.

While employee jobs have also increased to a new series high. Unemployment and economic inactivity rates have both decreased and the employment rate has increased.

HMRC payroll data shows that payrolled employee numbers increased by 0.1 percent over the month and increased by 2.3 per cent over the year. Payrolled earnings decreased by 3.5 per cent over the month and were 7.9 per cent higher than July 2023.

Households reported, via the Labour Force Survey (LFS), over the year to April to June 2024, a 1.2 per cent increase in the employment rate (to 71.6 per cent), a 0.7 per cent decrease in the economic inactivity rate (to 27.1 per cent), and a 0.7 per cent decrease in the unemployment rate (to 1.9 per cent).

The total number of hours worked in April to June 2024 increased by 2.7 per cent over the year. This is 0.6 per cent below the pre-pandemic position recorded in November-January 2020.

The most recent Quarterly Employment Survey shows that employee jobs in Northern Ireland increased over the second quarter of 2024 and the year to reach a new series high, 824,300 jobs, in March 2024. Quarterly increases in employee jobs were recorded within the construction, services, and other industry sectors. Employee jobs decreased over the quarter within the manufacturing sector. Over the year from Q2 2023 to Q2 2024, employee jobs increased across all four sectors.

In July 2024, the Department for the Economy was notified of 40 confirmed redundancies, bringing the rolling twelve-month total of confirmed redundancies to 2,550. There were 2,820 redundancies proposed in the 12 months to July 2024.

• The Northern Ireland unemployment rate for April to June 2024 decreased over both the quarter and the year to 1.9 per cent, and

• the most recent UK unemployment rate for April to June 2024 was estimated at 4.2 per cent.

Over the last 15 years, the UK unemployment rate peaked at 8.4 per cent in late-2011, while the Northern Ireland unemployment rate peaked at 8.3 per cent in early-2013. Following these peaks, both unemployment rates showed a downward trend until the end of 2019. After rises during the early part of the pandemic, both rates have since decreased. Over the most recent year to April to June 2024 the Northern Ireland unemployment rate decreased by 0.7 per cent to 1.9 per cent, the lowest rate in this time period, while the UK unemployment rate decreased by 0.1 per cent to 4.2 per cent.

The Northern Ireland unemployment rate (age 16 and over) for the period April to June 2024 was estimated at 1.9 per cent. This was:

• a decrease of 0.2 per cent over the quarter; and

• a decrease of 0.7 per cent over the year.

The number of unemployed people (age 16 and over) in Northern Ireland was estimated at 17,000, which was:

• down 2,000 over the quarter; and

• down 6,000 from the same period last year.

UK regional comparison:

• The Northern Ireland unemployment rate (age 16 and over) of 1.9 per cent was 2.2 per cent below the most recent UK rate of 4.2 per cent, and

• Northern Ireland is the lowest of the twelve UK regions.

• The Northern Ireland employment rate for April to June 2024 decreased over both the quarter and year to 71.6 per cent, and

• the most recent UK employment rate for April to June 2024 was estimated at 74.5 per cent.

Over the last 15 years, the Northern Ireland employment rate has been consistently below the UK rate. Although showing a similar trend, the fall in the employment rate in Northern Ireland between 2019 and 2021 was steeper than the fall in the UK rate. The most recent Northern Ireland employment rate (71.6 per cent) was the highest rate since the pre-pandemic rate of 72.3 per cent recorded in NovemberJanuary 2020.

The most recent Northern Ireland employment rate (aged 16 to 64) for the period April to June 2024 was estimated at 71.6 per cent. This was:

• A decrease of 0.3 per cent over the quarter; and

• an increase of 1.2 per cent over the year (not statistically significant).

The number of employed people (age 16 and over) in Northern Ireland was estimated at 878,000, which was:

• down 1,000 from last quarter; and

• up 20,000 from the same period in 2023.

Annual changes by sex (for those aged 16 to 64) showed that:

• the male employment rate (74.4 per cent) increased by 0.5 per cent over the year; and

• the female employment rate (68.9 per cent) increased by 1.4 per cent over the year.

UK regional comparison:

• The Northern Ireland employment rate (aged 16 to 64) of 71.6 per cent was 3.0 per cent below the most recent UK rate of 74.5 per cent, and

• Northern Ireland is the third lowest of the twelve UK regions.

Self-employment:

• In April to June 2024, there were 115,000 self-employed, an increase of 21,000 (+22.0 per cent) on a year ago, and 19,000 lower (-13.9 per cent) than the pre-pandemic figure in October to December 2019, and

• the proportion of self-employed people (13.2 per cent) remains below the prepandemic proportion (15.5 per cent recorded in October to December 2019).

Employment by age:

• In March to May 2024, those aged 35 to 49 had the highest employment rate (83.6 per cent), whilst those aged 16 to 24 had the lowest (49.4 per cent), and

• compared to the pre-pandemic rates in October to December 2019, the employment rate for those aged 50 to 64 saw the largest, and only, increase (by 0.7 per cent, from 64.2 per cent to 65.0 per cent), whilst the rate for those aged 16 to 24 saw the largest decrease (by -6.3 per cent, from 55.7 per cent to 49.4 per cent).

The borough of Antrim and Newtownabbey has fast become an ‘investment magnet’, attracting an influx of major companies which have chosen the area as the perfect location to establish or expand their business.

The strategic planning team and planning committee is at the heart of this success delivering a robust performance which has earned the Council an enviable reputation as a leading planning authority in Northern Ireland, consistently exceeding statutory targets.

This has been reinforced by the latest statistics issued by the Department for Infrastructure (DfI) which illustrate that Antrim and Newtownabbey was one of only three councils to meet the processing target for major applications of 30 weeks, with an average processing time of an impressive 21 weeks.

This outstanding performance combined with the innovation and commitment of the Council’s award-winning economic development team has secured a multimillion-pound investment pipeline for the borough, creating significant job opportunities, and delivering an economic boost for the borough.

Two prime examples of this collaborative work are evidenced by the results achieved at Global Point Newtownabbey and Nutts Corner, once undeveloped areas of land they are rapidly transforming into best-in-class hubs for advanced manufacturing, health and life sciences and logistics.

In June 2024, work commenced on the plans for the Advanced Manufacturing Innovation Centre (AMIC), a £100 million investment led by Queen’s University Belfast with plans approved by the Council in just 25 weeks. This significant investment also includes £10 million investment by the Council, underpinning its support for economic growth and job creation for the borough and beyond. This Factory of the Future, at Global Point, is part of the Belfast Region City Deal and will reinvigorate Northern Ireland’s industrial potential.

More recently, the Council has given the

green light to plans for a landmark £150 million investment by the Errigal Group, one of the largest industrial developments in Northern Ireland’s history. The 165,323m2 development will transform the landscape of the area, restoring the original Enkalon site, creating 690 new jobs once operational, with 200 construction jobs over a six-year period.

Planning approvals for major housing developments at Ballyclare, Antrim, Doagh and Mallusk will complement these economic investments, with over 1,200 new homes attracting new residents to the borough for employment increasing footfall and boosting the local economy.

The Council is also currently constructing two 16,000 sq. ft state-of-the-art flexible workspaces in Antrim and Glengormley which will foster business start-up and entrepreneurship, fuelling commercial development, and laying the groundwork for sustainable economic prosperity. The workspace hubs, alongside wider regeneration programmes will be key drivers to support the future success of the borough’s town centres. The impressive Antrim facility will be opening in September 2024 with construction in Glengormley underway and due for completion in 2026.

Mayor of Antrim and Newtownabbey Councillor Neil Kelly adds: “I commend the work of the officers and members who drive this economic progress, through our planning and economic development functions.

“The Council remains fully committed to supporting a vibrant and prosperous economy that promotes positive sustainable development and growth.”

For more information on our workspace hubs please visit investment@antrimandnewtownabbey.gov.uk

Since opening its doors 25 years ago InterTradeIreland has assisted tens of thousands of businesses on both sides of the border.

The all-island economic development agency helps firms across the island to trade cross-border, connect, innovate, collaborate, and attract investment. Its unique role is to identify opportunities for north/south collaboration that accelerate economic growth and to date it has generated £1.6 billion in business development value.

agendaNi sits down with InterTradeIreland’s Director of Strategy, Martin Robinson, who observes that the economic importance of all-island trade has never been more apparent.

Official figures from the Northern Ireland Statistics and Research Agency (NISRA) for 2022 show that cross-border trade reached an all-time high of £10 billion. These figures are not yet available for 2023. However, according to the Central Statistics Office in Ireland (CSO), goods trade alone in 2023 was valued at €10 billion, suggesting that the figure, including services, will be even higher.

“We know that there are significant benefits available through increased trade and co-operation across the island. We have an important piece of research underway that will help us and our partners to deliver more enterprise growth and drive productivity through collaboration. We look forward to sharing the findings with businesses, industry groups and policymakers,” Martin says.

“One of our great strengths is our agility, which allows us to respond to changing business needs. A great example of this is our All-Island Business Monitor, the

largest survey of its type on the island. We speak to over 750 businesses every quarter and this enables us to stay on the pulse of business sentiment. We really listen to what businesses are telling us, and that helps to inform the strategic direction of our initiatives and programmes, as well as provide insight to policymakers.”

InterTradeIreland’s programmes include a suite of services to enable businesses at all stages of their export journey to take advantage of all-island trade opportunities.

“For any business that wants to grow, the cross-border market is an obvious place to start. Our trade export pathway offers free specialist support to develop cross-border sales, while our Trade Hub contains all the latest information and advice for businesses engaged, or planning to engage, in trade between the Republic of Ireland, Northern Ireland and Great Britain.

“For example, new requirements from September 2024 will impact some businesses in Northern Ireland that receive parcels from Great Britain. Our Trade Hub explains this in detail and also includes access to advice, tailored support and a fully funded trade health check for businesses.”

InterTradeIreland also supports businesses across the island to take advantage of all-island innovation, clustering, and funding opportunities.

“Our Innovation Boost and Business Explorer programmes partner SMEs and academics across the island, delivering industry-led knowledge transfer that results in new and improved products and services. As partners of the allisland Halo Business Angel Network (HBAN), we also support the flow of equity investment to ambitious entrepreneurs across the island,” says Robinson.