QUARTER I 2024 | ISSUE 045 | THE PREMIER SELF-MANAGED SUPER MAGAZINE

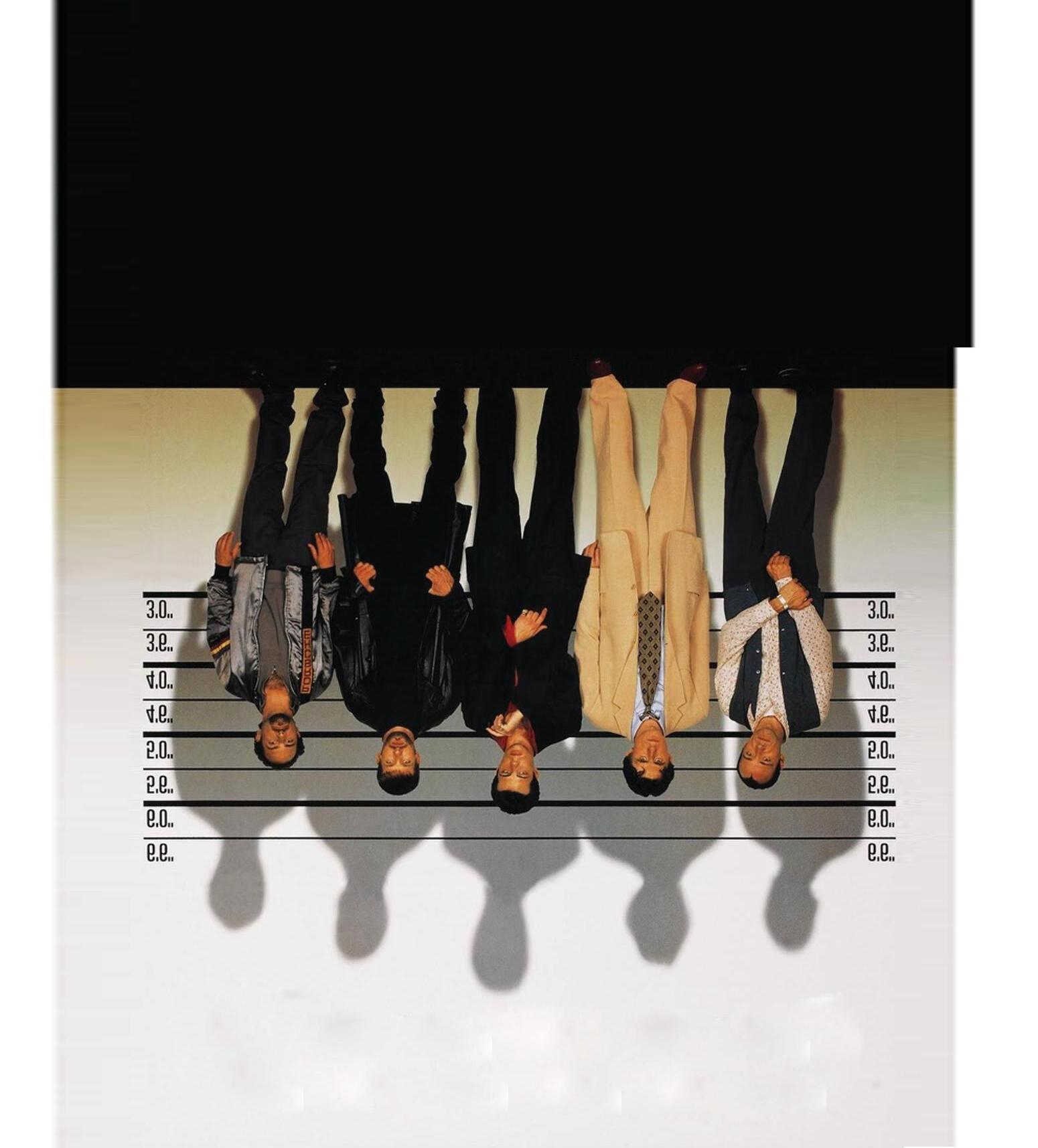

FEATURE Trustee disqualifications Driving factors

STRATEGY Div 296 tax Impact modelling

COMPLIANCE In-house assets Compliance requirements

STRATEGY Super alternatives Optimal HNW outcomes

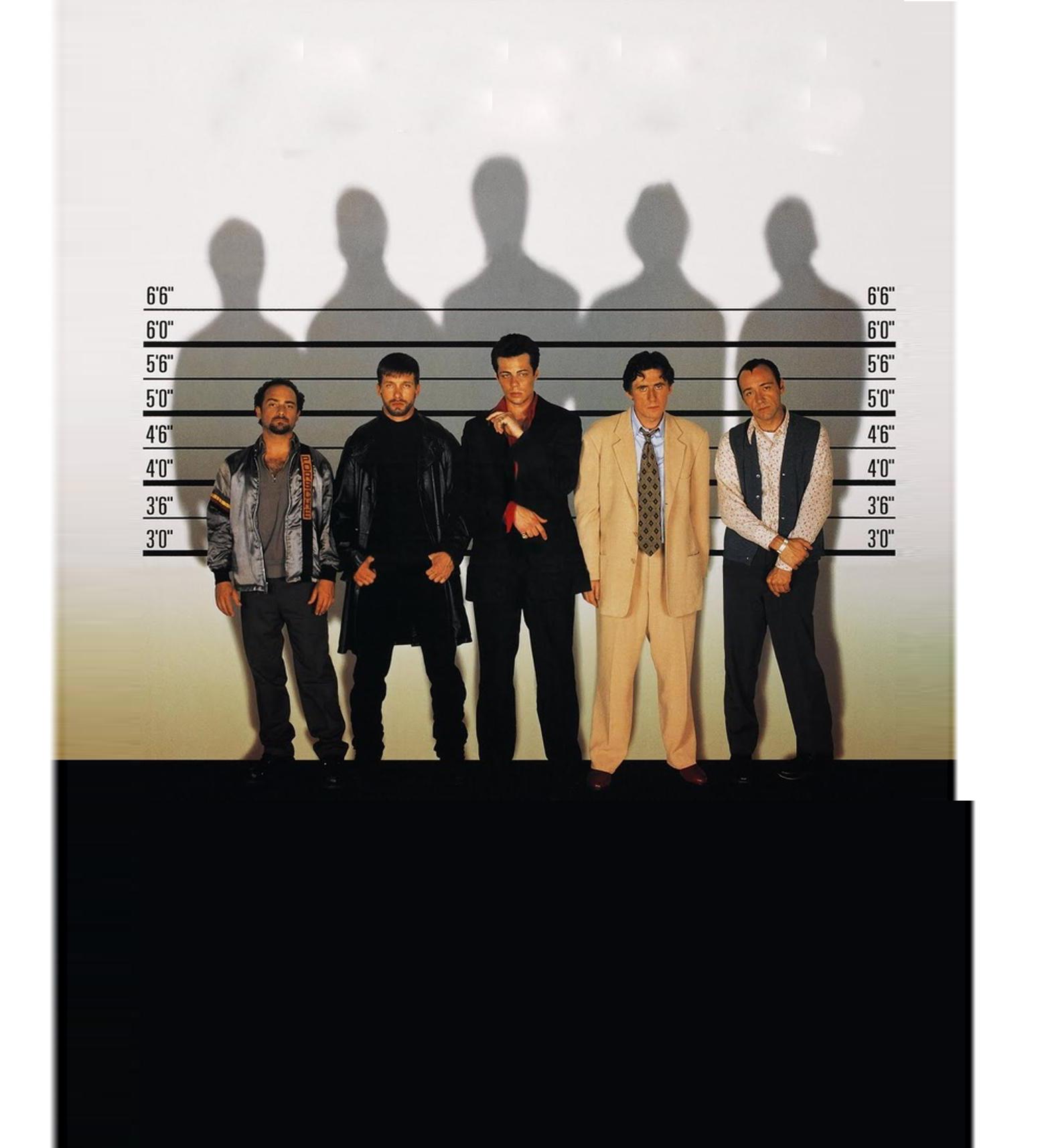

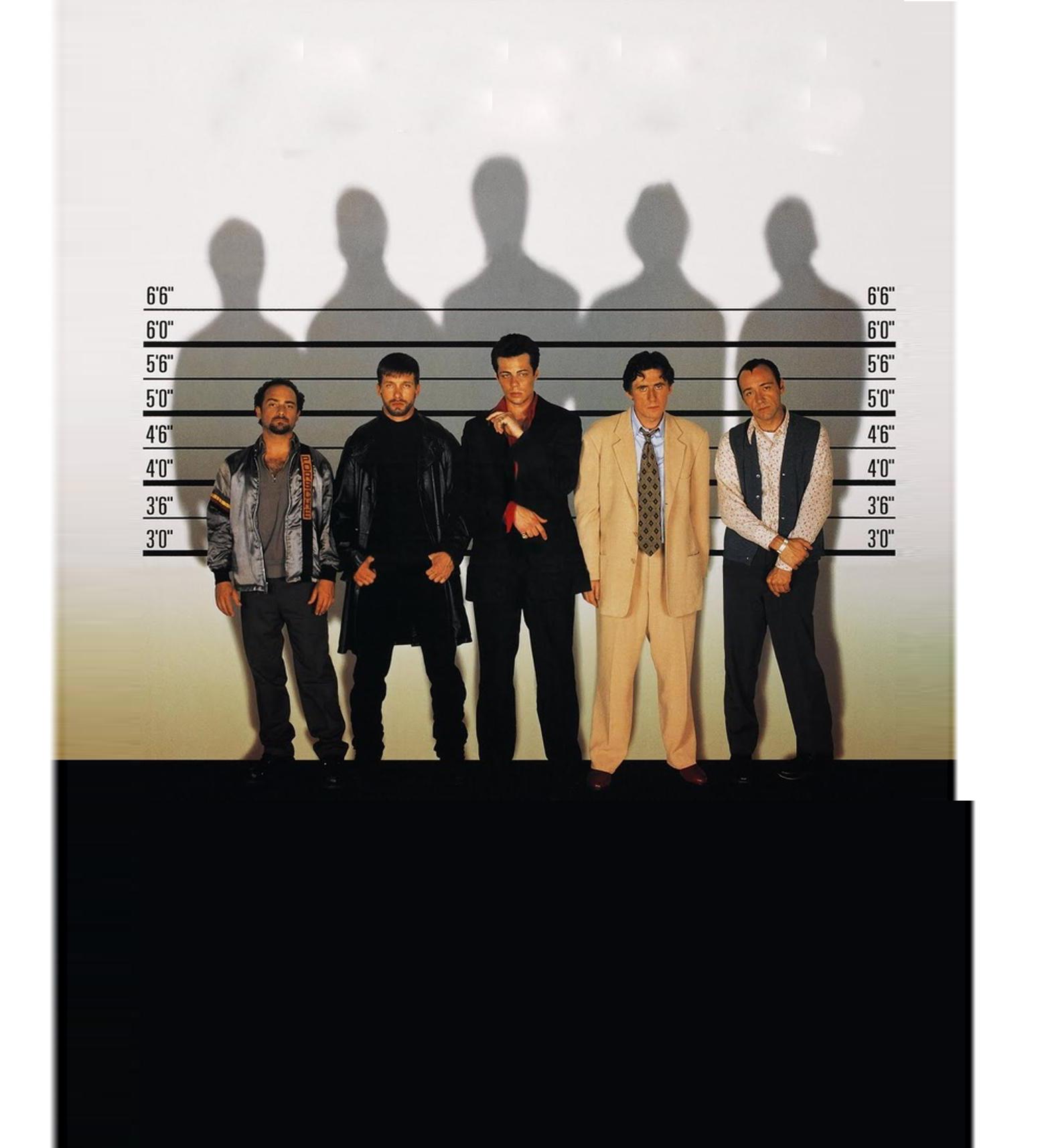

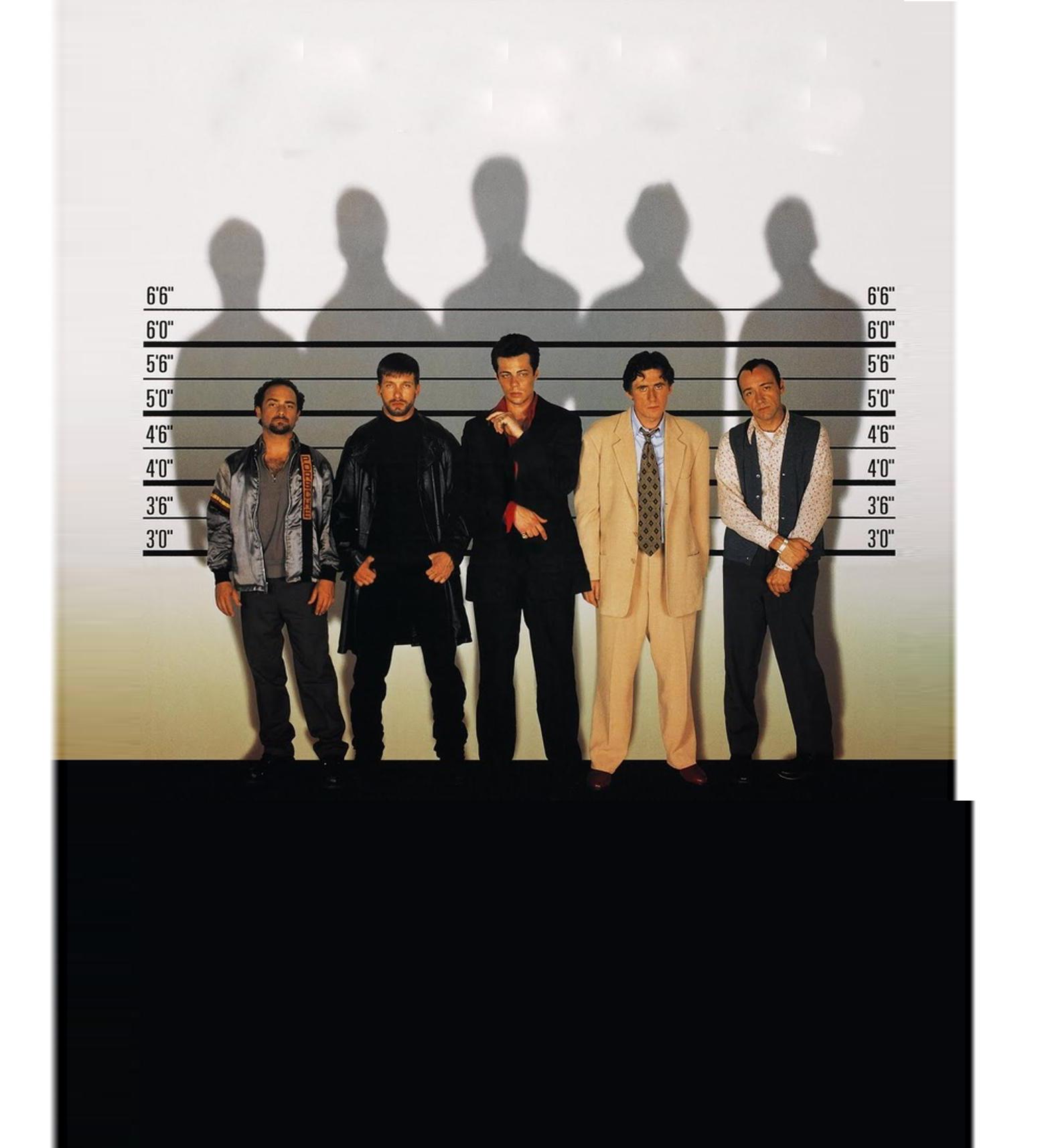

Speakers

Brought to you by SMSF PROFESSIONALS DAY 2024 21 MAY | MELBOURNE 23 MAY | SYDNEY 28 MAY | BRISBANE

Mark Ellem Head of Education (SMSF) Accurium Melanie Dunn Principal Accurium Lee-Ann Hayes Head of Education (Tax) Accurium Anthony Cullen Senior SMSF Educator Accurium Matthew Richardson SMSF Manager Accurium Event MC Darin Tyson-Chan Founder and Publisher selfmanagedsuper Sponsorship opportunities now available https://smsmagazine.com.au/events Register now

COLUMNS

Investing | 20

The best emerging market economies.

Investing | 24

Merger and acquisition activity set to increase.

Strategy | 26

Modelling the impact of the Division 296 tax.

Compliance | 30

The rules regarding in-house assets.

Strategy | 34

How to make contributions deliver optimal outcomes.

Compliance | 38

How to calculate the Division 296 tax liability.

Strategy | 42

Assessing the options for high net worth clients.

Compliance | 46

Contributions cap indexation.

Strategy | 50

Managing super splitting.

Compliance | 54

Temporary incapacity cover inside an SMSF.

Compliance | 58

Holding a farm as a fund asset.

Strategy | 62

Tax benefit maximisation.

Compliance | 66

The merit of staff discount policies.

REGULARS

What’s on | 3

News | 4

News in brief | 5

SMSFA | 6

CPA | 7

The role of superannuation in retirement | 16 Changes recommended.

IFPA | 8

CAANZ | 9

IPA | 10

Regulation round-up | 11

Super Events | 68

Last word | 70

FEATURE

QUARTER I 2024 1

FROM THE EDITOR DARIN TYSON-CHAN

INAUGURAL SMSF ASSOCIATION TRADE MEDIA JOURNALIST OF THE YEAR

Couldn’t care less

The SMSF Association National Conference has not been a happy stomping ground for Assistant Treasurer and Minister for Financial Services Stephen Jones and it would appear he may have completely given up on the experience.

It began when he presented as shadow minister for financial services before the last election. At the time, I had never heard of Jones, but I noted he committed several fundamental errors when he spoke. Firstly, he rattled off a series of sector statistics – a pointless exercise seeing all of the delegates would already have been across that information, but secondly, some of the data he quoted was actually wrong. Surely if you are going to do something like this, at least check your numbers are correct.

Next came last year’s train wreck when he incorporated the beehive conference theme into his speech. Not entirely his fault, but it was perceived the government regards superannuation as a honey pot it just can’t wait to get its hands on.

So this year he decided not to attend the event and instead recorded a short video for delegates. Predictably the message was not groundbreaking or noteworthy in any way, shape or form. And the delegates certainly sent a message to Canberra that unfortunately he didn’t get to see. Just as the video began, attendees started heading for the exits immediately, much like when a football team is consigned to a defeat and supporters want to get a jump on the traffic out of the ground. It is something I have never witnessed before in the 17 consecutive years I have been attending the conference.

Worse still, he now has the dubious honour of being one of the few superannuation ministers, if the not the only one, to have not attended the conference in person. A bad look indicating in many people’s eyes he just couldn’t care less about SMSFs.

The signs of indifference to the sector, and probably the industry as a whole, have been emphasised also with the error, which the legislation for the proposed Division 296 tax. The bill contains an anomaly I have reported on whereby a person who dies on 30 June is caught by the measure while someone who dies on any other day of the year is exempt.

This is clearly a drafting error, which the SMSF Association pointed out in its first submission regarding this policy, and it has made more than one. However, the bill still has not been amended to correct this quirk. It led association chief executive Peter Burgess to question whether any of the politicians actually read any of the industry feedback they receive.

Getting back to the conference, in contrast shadow treasurer Angus Taylor did show up and presented in person and this made a difference just in terms of that perceived care factor. Don’t get me wrong, he didn’t say anything we didn’t expect, but at least he was there.

And none of us are swallowing his criticism of the government without question as the coalition is not averse to poor policy either, dare I mention the transfer balance cap.

But Taylor’s presence exacerbated the perception Jones is not really prepared to even engage with the SMSF space, let alone seriously listen to it, and that spells trouble for all of us.

Editor

Darin Tyson-Chan darin.tyson-chan@bmarkmedia.com.au

Senior journalist

Jason Spits

Journalist

Todd Wills

Sub-editor

Taras Misko

Sales and marketing sales@bmarkmedia.com.au

Publisher

Benchmark Media info@bmarkmedia.com.au

Design and production

AJRM Design Services

2 selfmanagedsuper

WHAT’S ON

SMSF Professionals Day 2024

Inquiries:

Vicky Zhao (02) 8973 3315 or email events@bmarkmedia.com.au

VIC

21 May 2024

Rendezvous Hotel Melbourne

328 Flinders Street, Melbourne

NSW

23 May 2024

Rydges Sydney Central

28 Albion Street, Surry Hills

QLD

28 May 2024

Hotel Grand Chancellor Brisbane

23 Leichhardt Street, Spring Hill

Accurium

Inquiries:

1800 203 123 or email enquiries@accurium.com.au

Mastering SMSF property taxation

3 April 2024

Webinar

2.00pm-3.00pm AEST

ECPI war stories

4 April 2024

Webinar

2.00pm-3.00pm AEST

Critical audit issues for SMSF property investments

10 April 2024

Webinar

2.00pm-3.00pm AEST

Steering clear of legal issues for SMSF real estate

17 April 2024

Webinar

2.00pm-3.00pm AEST

SMSF hot topics

4 June 2024

Webinar

2.00pm-3.00pm AEST

To have an upcoming event featured on the What’s On page, please contact darin.tyson-chan@bmarkmedia.com.au.

SMSF live Q&A – June

6 June 2024

Webinar

2.00pm-3.00pm AEST

The Auditors Institute

Inquiries: (02) 8315 7796

Auditing the release of benefit payments

9 April 2024

Webinar

1.00pm-2.00pm AEST

Homing in on downsizer contributions

23 April 2024

Webinar

1.00pm-2.00pm AEST

Payment of death and disability benefits

7 May 2024

Webinar

1.00pm-2.00pm AEST

When the ATO audits an SMSF auditor

21 May 2024

Webinar

1.00pm-2.00pm AEST

Regulatory changes in SMSF auditing

4 June 2024

Webinar

1.00pm-2.00pm AEST

DBA Lawyers

Inquiries: dba@dbanetwork.com.au

SMSF Online Updates

12 April 2024

12.00pm-1.30pm AEST

10 May 2024

12.00pm-1.30pm AEST

7 June 2024

12.00pm-1.30pm AEST

Heffron

Inquiries: 1300 Heffron

SMSF Clinic

23 April 2024

Webinar 1.30pm-2.30pm AEST

2024 Post Budget Webinar

15 May 2024

Webinar 3.00pm-4.00pm AEST

Quarterly Technical Webinar

30 May 2024

Webinar Accountants 11:00am-12:30pm AEST

Advisers 1:30pm-3:00pm AEST

Windups – Tips and Traps

6 June 2024

Webinar 11:30am-1:00pm AEST

Institute of Financial Professionals Australia

Inquiries: 1800 203 123 or email info@ifpa.com.au

2024 Super Quarterly Update

6 June 2024

Webinar 12:30pm-1:30pm AEST

QUARTER I 2024 3

Opposition recognises super belongs to Australians

By Darin Tyson-Chan

The federal opposition has revealed the approach it will take to future superannuation policy and regulation, emphasising one critical element all governments need to recognise.

“As we develop further policy, the first principle we will apply throughout is that superannuation is Australians’ money. Not the government’s money, not the Prime Minister’s money, not the Treasurer’s money, it is Australians’ money,” shadow treasurer Angus Taylor confirmed while presenting to attendees at this year’s SMSF

Association National Conference in Brisbane.

“And as research has pointed out [recently] when it comes to super, Australians trust themselves first, the funds second and the government last. That is a message that needs to be heeded by the government.

“Australians make long-term decisions about their super [and] Australian governments should be extremely cautious about raising taxes on Australian super, watering down consumer protections on APRA (Australian Prudential Regulation Authority)-regulated funds and trying to direct retiring savings to meet political goals, not the goals of the individual

investor.”

He stressed superannuation policy needs to be conservative, measured and responsive to the actual gaps in the system rather than the “whims and objectives” of the government of the day.

“It’s essential that we don’t just preserve Australians’ retirement incomes, but that we maintain the confidence in superannuation as an institution,” he said.

He acknowledged retirement is an individual experience and as such a one-size-fits-all solution is not practical and highlighted the importance of the SMSF sector in this context and the opposition’s commitment to it.

“We need policy that delivers

Div 296 TSB calculation, preparations confirmed

By Darin Tyson-Chan

The ATO has confirmed how the redefinition of an individual’s total super balance (TSB) for the purposes of the proposed new Division 296 tax will be applied.

“An individual’s total super balance will be calculated from the sum of the total super balance values of each of their superannuation interests and that total super balance value will be determined using a method or value prescribed in the regulations for the withdrawal benefit,” ATO superannuation and employer obligations assistant commissioner Peta Lonergan told attendees of the Institute of Financial Professionals Australia 2024 Annual Conference held in Melbourne.

Lonergan also revealed additional detail on the calculation, representing a

modification to the current framework.

“Now the TSB changes will remove the link to the transfer balance cap and it will apply to working out an individual’s TSB from 30 June 2025 onwards,” she said.

According to Lonergan, the regulator is currently working to make the implementation of the new measure as easy as possible for superannuants.

“To minimise the impact on funds and members, we are looking at the most costeffective way to ensure we have the necessary data to administer this calculation. So that [will mean] leveraging existing reporting requirements where possible,” she revealed.

“The ATO is considering the administrative options for the measure at the moment and we will be consulting with key external stakeholders once the policy parameters are finalised.”

During her presentation, she took the opportunity to also inform practitioners as to

choice, informed options and the advice and adviser network to deliver the best outcomes in retirement. Self-managed super funds are an integral part of that choice,” he said.

“Self-managed super was a key component of the original [retirement savings] act that was legislated in 1993 and it will remain critical under a future coalition government.

“And just as [the Howard and Costello] government supported the sector, so too will a future coalition government act to support choice, individual flexibility and simplicity of regulation for Australians who choose to utilise it.”

the current status of the current non-arm’slength expenditure (NALE) rules.

“I did want to give you a quick update about the draft Taxation Determination 2023/1, [which] outlines our view about how NALE and CGT (capital gains tax) interact,” she said.

“We did receive a fair number of responses during the consultation period and we’re still working through that feedback. We do expect to issue a final tax determination soon so keep an eye out for that.”

NEWS

4 selfmanagedsuper

Peta Lonergan

Illegal access link quantified

The ATO has revealed the magnitude to which SMSF establishment is contributing to its most concerning area of compliance failure, being the illegal early access of super benefits.

ATO superannuation and employer obligations assistant commissioner Peta Lonergan noted: “Did you know about two-thirds of illegal early access behaviour we’re concerned about relates to individuals entering the system with no genuine interest to run a self-managed super fund?

“Unfortunately, this is often facilitated by promoters who are charging a large fee.”

With regard to combatting this behaviour, Lonergan recommended SMSF practitioners and their clients use the regulator’s existing resources, such as the fact sheet on its website, and confirmed the ATO is continuing to take action to address the issue.

“We have a very strong compliance program. So we do contact a lot of new entrants and make sure that they understand what their obligations are,” she said.

She also acknowledged the extent of the role practitioners were already playing in the sector’s efforts to eliminate the problem.

“We are pleased to say we have seen an increase in professionals reaching out to let us know about arrangements they are concerned about,” she said.

More auditors sanctioned

The Australian Securities and Investments Commission (ASIC) has taken action against 15 SMSF auditors, resulting in conditions being imposed on the registrations of 13 auditors and the voluntary cancellation of two over concerns they were performing in-house audits.

The corporate watchdog stated it sanctioned the auditors after receiving referrals from the ATO following a review of audit firms that undertook both accounting and auditing work for SMSF clients.

The enforcement measures are related to concerns financial statements for SMSF clients were prepared by the same firm that also conducted the audit, in breach of the auditor’s independence requirements.

The conditions emphasise the restriction on performing in-house audits, require an independence review of all SMSF audit clients and notification of the measures to their professional association.

One auditor has applied to the Administrative Appeals Tribunal for a review of ASIC’s decision to impose conditions on their registration.

“Independence is fundamental to auditors to protect the integrity of the SMSF industry. SMSF auditors should carefully consider their structure and any services provided to audit clients to identify and evaluate independence. ASIC will take action where appropriate to reinforce the independence requirements,” ASIC deputy chair Sarah Court stated.

Fund aged care with super

A government-appointed taskforce has released a report recommending older Australians with higher levels of superannuation help fund aged-care services.

The Aged Care Financing Taskforce, chaired by Aged Care Minister Anika Wells, recommended that: “It is appropriate older people make a fair co contribution to the cost of their aged care based on their means.”

In making the statement, the taskforce explicitly referenced super, noting: “Generally, older people are expected to be wealthier than their predecessors, largely due to the maturing superannuation system.”

The report added the proportion of people over 65 who would access

the age pension would fall by around 15 percentage points by 2062/63 and of those receiving a pension, fewer would receive it at the full rate due to the increased accumulation of income and assets.

“These superannuation trends, combined with high asset wealth through the family home and other investments, mean increasingly people still have accumulated wealth and income streams when they need to access aged-care services,” it stated.

“As a result, there is more scope for older people to contribute to their agedcare costs by using their accumulated wealth than in previous generations.”

New level of IFPA membership

The Institute of Financial Professionals Australia (IFPA) has announced it is providing a new platinum membership that will build upon its existing offerings.

“This premium tier of membership is designed to go beyond the extensive benefits of our professional membership,” IFPA chief executive Pippa McKee told delegates during her welcoming speech at the industry body’s 2024 conference held in Melbourne recently.

“Platinum offers you more than just your membership. It’s a way to fully immerse yourself in everything that IFPA has to offer.”

McKee pointed out some of the benefits of the highest level of membership include unlimited access to the webinars IFPA hosts, access to all tax and superannuation groups where individuals can participate either in person or online, complimentary admittance to the body’s annual conference and access to the CPD (continuing professional development) Pro package.

This last feature will provide members with over 40 hours of CPD content to assist them in satisfying their continual education obligations.

NEWS IN BRIEF

QUARTER I 2024 5

We all gained from levelling up

PETER BURGESS is chief executive of the SMSF Association.

There was a welcome first for the SMSF Association at this year’s National Conference. At the Thought Leadership Breakfast on the opening morning, seated alongside the usual suspects, such as Heffron managing director Meg Heffron, was Brighter Super chief executive Kate Farrar. It marked an unprecedented situation as an Australian Prudential Regulation Authority (APRA)-regulated fund executive had never graced our premier event in a speaking role before and it was with a little trepidation that the invitation was extended.

However, we need not have worried. I suspect no one left the breakfast thinking it would be all sweetness and light between our super sector and the APRA funds in the future – as Farrar bluntly said, we are competitors – but it did demonstrate we could occupy a podium together and intelligently discuss issues of mutual concern.

What I think we all realised is there is more that unites us than divides us and both super sectors can learn from each other. I suspect the fact APRA funds are in a far more competitive environment, as well as having to address how they handle members’ accounts in retirement, is making them more amenable to speaking to our sector where retirement income strategies are our bread and butter. At the very least, if this forum helps start a process where civil discussions, even on policy issues where we strongly disagree, are the norm and not the exception, then it will be an initiative from which all superannuation sectors will benefit.

This year’s breakfast forum was, in my opinion, one of the more enlightening discussions we have had over the years since this event started in 2015. The topic, “Holding up the mirror – what the SMSF sector does well and where it needs to level up”, was just what we needed to get the conference off to a flying start, with our moderator, Class chief executive Tim Steel, ensuring the considered views of all four panellists were fully aired.

It dovetailed neatly into the overarching theme of this year’s conference – how we can level up and grow together. The concept of growing together is a unique feature of our conference (and our super sector) as we bring together many different professionals who work cooperatively for the benefit of the client. Whether they

be accountants, auditors, lawyers, financial advisers, stockbrokers, actuaries or SMSF administrators, achieving the best outcome for the client is their common goal.

These professionals become advocates for each other and a potential referral source for new business, with this collaboration clearly on display at the conference. It’s what makes this event so valuable for delegates, an assertion not only backed by the anecdotal evidence I received during and after the conference, but by the empirical fact this year’s event was one of our largest ever.

From my perspective, my biggest disappointment, again, is that I simply couldn’t get to enough of the sessions. All the feedback I have received is the speakers went the extra mile to ensure their sessions were stimulating, educational and topical. The conference committee puts a lot of effort into getting informed speakers addressing topics relevant to SMSF advisers and by all accounts they succeeded in spades.

Sessions such as Hopgood Ganim Lawyers partner Brian Herd’s on enduring powers of attorney, RSM Australia SMSF services director Katie Timms’ covering the holding of farm assets within a fund and Bluestone Home Loans head of specialised distribution Richard Chesworth’s discussing lending and financing were examples of topics that attracted keen delegate interest.

But learning is not limited to plenary and concurrent sessions or workshops as it was evident conversations with peers outside the sessions were also invaluable, be they about client issues requiring a fresh insight or using artificial intelligence.

Also worthy of mention was announcing the winner of the 2024 SMSF Association Chair Award, Aaron Dunn, and our first-ever joint winners of the SMSF Association CEO Award – Naomi Kewley and Marjon Muizer – the co-authors of the association’s SMSF Specialist Auditor accreditation modules. It was fitting recognition for their outstanding contribution, not only to the association, but also the broader SMSF sector.

Next year we are back to Melbourne with a fresh theme, agenda, speakers and, no doubt, challenges. I hope to see all our 2024 delegates sign up again and for those who chose not to travel to Brisbane to put Melbourne in their diaries for 2025. It will be worthwhile.

6 selfmanagedsuper SMSFA

A broader retirement approach worth consideration

The $3.5 trillion superannuation sector, often hailed as the cornerstone of Australia’s retirement income system, finds itself highly visible in various opportunistic policy debates, with housing affordability emerging as a particular concern in recent years. As legislators grapple with defining the purpose of super, there is an attraction in extending the system’s role beyond mere financial preparation for retirement and applying it as a solution to broader societal and economic issues.

At the heart of legislation currently before parliament lies the intent to provide clarity and coherence to the superannuation landscape. By enshrining the core objective of super in law, policymakers aim to ensure savings are earmarked for members’ retirement years, rather than whatever occupies policymakers’ attention in the short term. This move towards legislative certainty seeks to offer better predictability and stability, with the hope it will benefit Australians across all walks of life who are diligently planning for their retirement. However, this is not a shield of invulnerability. The practical implementation of such a legislative measure poses significant challenges. Despite the establishment of mechanisms to flag non-compliant bills or regulations, there remains a gap between intent and execution. The reality is that even if a red flag goes up on a bill, it can still receive royal assent, potentially undermining the intended purpose of the objective. The objective itself could still be amended or repealed by a future government. This susceptibility underscores its fragility as a legislative safeguard, leaving the system vulnerable to shifting political winds, as well as substantial legislative risk for Australia’s superannuation fund members.

Complicating matters further is the intertwined nature of other policy areas with retirement planning, most notably housing. For many Australians, homeownership is not just a personal aspiration, but a fundamental aspect of retirement security. The family home has long been linked with Australia’s retirement income system, explicitly forming part of the non-super savings pillar of Australia’s three-pillar retirement income model. Consequently the prevailing assumption is retirees will enter their post-working years with a property already secured.

Yet, as housing affordability continues to deteriorate and homeownership becomes increasingly out of reach for younger generations, the viability of this assumption is called into question. Recognising this societal shift is imperative as projections indicate long-term decline in homeownership rates among future retirees. Failure

to address this trend risks exacerbating inequality in retirement outcomes, with non-homeowners disproportionately disadvantaged.

Recalibrating the retirement income system to better accommodate the needs of non-homeowners is therefore an increasingly important priority. While concessions for non-homeowners exist within the system, their adequacy remains a subject of debate. The findings of the 2009 Harmer review highlighted deficiencies in this regard, yet subsequent reforms to address these have failed to fully materialise. Enhancing concessions for non-homeowners within the retirement income framework could mitigate some of the challenges associated with housing unaffordability, thereby improving retirement outcomes for this growing segment of the population.

However, future potential strain on the superannuation system extends beyond housing. The recent discontinued policy proposal to enable domestic violence victims to access their own super underscores the system’s broader societal implications. The proposal’s requirement for victims to have the ability to use existing superannuation holdings raised equity concerns, particularly for those from financially disadvantaged backgrounds. Moreover, the notion of using one’s own retirement savings to address immediate emergencies highlights systemic flaws in Australia’s social safety net.

Women’s superannuation balances, in particular, serve as a poignant indicator of broader societal inequities. While factors such as parenthood, caring responsibilities and workplace discrimination, both age and gender based, contribute to the gender super gap, these are causes that originate outside the superannuation system itself. Policies aimed at addressing these discrepancies, such as the recent announcement on extending super to government parental leave payments, represent positive steps forward. However, they only scratch the surface of more profound systemic issues, since the gender superannuation gap is caused by the wage gap between men and women, along with other matters.

We welcome efforts to clarify the role of superannuation, but these efforts must be accompanied by broader reforms addressing systemic challenges. The necessary commingling of retirement planning with broader societal and economic issues necessitates a broader approach to retirement policymaking. By acknowledging and addressing these interconnections, policymakers can pave the way for a more equitable and sustainable retirement system that benefits all Australians.

QUARTER I 2024 7

RICHARD WEBB is superannuation leader at CPA Australia.

CPA

The rise and fall of caps and thresholds

The latest average weekly ordinary time earnings (AWOTE) data for the December quarter 2023 has confirmed the contribution caps will increase on 1 July 2024, which is great news. However, not all caps and thresholds will go up.

The general transfer balance cap (TBC) will remain at $1.9 million for 2024/25 as the relevant Consumer Price Index figures were not enough to trigger a $100,000 increase to $2 million. This is because the contribution caps are linked to wage growth, reflected by AWOTE, whereas the general TBC is linked to inflation. The inconsistency in how the contribution caps and other thresholds are indexed highlights the nuances of our superannuation system, which can lead to such unexpected outcomes where not all caps and thresholds increase at the same time.

We now also know the non-concessional contribution (NCC) cap will be increasing as it is a four-times multiple of the concessional contributions cap. However, the fact the TBC will remain unchanged will result in flow-on effects for other measures such as the bring-forward requirements relating to NCCs. In short, the total superannuation balance (TSB) thresholds that determine eligibility to use the bring-forward rules will decrease on 1 July 2024 as these limits are determined by subtracting a multiple of the NCC cap from the general TBC.

The last time the contributions caps increased was on 1 July 2021, but back then both the contribution caps and the general TBC rose at the same time, which meant all the TSB thresholds went up as well.

The lowered TSB thresholds may affect certain individuals’ eligibility to use the bring-forward rules if they already are close to a current TSB threshold. Further, advisers will double check a client’s TSB at 30 June 2024 before recommending the use of the NCC bring-forward provisions in 2024/25 to ensure they do not inadvertently exceed their NCC cap due to the reduced thresholds. It can be

a simple mistake to assume the TSB thresholds will remain the same when in fact they will reduce.

The inconsistency in the superannuation system in how various thresholds are indexed causes such complexity and I haven’t even touched on the complications of proportional indexation when it comes to an individual’s personal TBC. Many industry stakeholders, including the Institute of Financial Professionals Australia (IFPA), have argued it would be better to have these thresholds indexed under the same formula, such as AWOTE, to ensure consistency across the system, but I suspect this won’t happen anytime soon given the government’s jam-packed agenda.

Before the 1 July 2017 changes to superannuation occurred, it was much simpler as individuals under age 65 were able to make NCCs of $180,000 a year or $540,000 every three years regardless of their TSB. Since the amendments on 1 July 2017, individuals have no longer been eligible to make NCCs if their TSB is over the general TBC of $1.9 million (originally $1.6 million). We also saw the TSB eligibility thresholds to determine whether a superannuant can use the bring-forward rules come into effect at this time. Despite the fact the age eligibility criteria to make contributions back then was more stringent, the simplicity of being able to make an NCC, including under a bringforward arrangement, was more straightforward.

Another IFPA wish list item is to streamline certain thresholds, such as removing the three-tier TSB thresholds in order to use the bring-forward rule as it will reduce the complexity involved, particularly if an individual is close to the relevant TSB threshold. It may be worth having one single threshold that is aligned with the general TBC, where individuals with a TSB below the general TBC will be allowed to use the three-year bringforward rule. This streamlined process will simplify the retirement planning process for many Australians. Again, this ask is most likely a long shot, but as the saying goes, if you don’t ask, you’ll never know.

IFPA

8 selfmanagedsuper

NATASHA PANAGIS is head of superannuation and financial services at the Institute of Financial Professionals Australia.

Accountants a critical advice component

The last few months have been incredibly busy with various submission deadlines and other government consultations.

Recently, Chartered Accountants Australia and New Zealand has been working closely with a range of other professional associations to share ideas and where possible make joint submissions. We regularly work with CPA Australia, the Financial Advice Association of Australia, Institute of Public Accountants and SMSF Association.

For financial advice matters we work with all the above associations, as well as eight other organisations. Collectively this group of 13 associations is known as the Joint Associations Working Group or JAWG.

Some might argue accountants don’t belong in the financial advice space. Everyone is entitled to their view, but I disagree. It makes perfect sense for the accounting professional associations to have a say in the financial advice space for the following reasons – we have members who are full-time financial advisers; we also have members who together with other advisory services, such as tax and audit, provide part-time financial advice services. Further, many of our members have clients whose financial affairs are impacted by the financial advice provided by a related or unrelated advice business and lastly we have members who are clients of financial advisers.

We also have many members in public practice who do not have any involvement with a financial services licensee and struggle with the unreasonable restrictions current policy settings place on their working lives.

The current government has made it clear it wants to expand the provision of financial advice. This is a worthy aim and the new class of adviser, currently officially known as a ‘qualified adviser’, may go some way to plugging the very large unmet consumer advice needs. The existing cohort of financial advisers, and the newer less-qualified advisers, will not solve the market’s supply and demand problems. This is especially the case for SMSFs where research over the years has consistently shown there is a large unmet advice need.

We think accountants in public practice also have a role to play and for some time we have been encouraging successive governments to be bold in

amending the law.

Government regulation makes the Australian retirement landscape incredibly complicated –superannuation, taxation, age pension, aged care, estate planning and so on do not easily relate to each other. On many occasions they are often diametrically opposed to each other. Constant changes to policy settings add another layer of complexity. It is impossible for any consumer to work their way successfully through these rules and get everything right or even mostly right. All this complexity has been created because government laws have been developed in silos and without much consideration for the impact on other policy areas.

I often think most consumers end up being Frodo entering Shelob’s lair in The Lord of the Rings, but without the light of Eärendil or his sword Sting.

Only the government can untangle this mess. Maybe this is seen as an impossible and thankless task. In our view if we don’t have some serious simplification of the retirement policy settings, then Australia may not adequately cope with the ageing population we will face in the next three or four decades.

In our pre-budget submission we again reiterated our opposition to the government’s additional tax applying to total super balances of at least $3 million. One aspect of this policy we do not like is the taxation of unrealised capital gains with losses being carried forward to future years.

Seventy per cent of our members have told us they do not like this aspect of this policy.

There are many associations that support additional tax on higher superannuation balances. If this must be put in place, then our preferred solution is that withdrawn lump sum benefits for individuals with at least $3 million in superannuation should be taxed at a higher rate. This additional tax should not apply to death benefits paid to non-dependants as they already face additional tax.

We think our solution is the simplest and least disruptive policy and removes the problem of taxing unrealised capital gains.

And obviously the $3 million threshold should be indexed every 1 July. We think it should be indexed by movements in average weekly ordinary time earnings like many other superannuation thresholds.

CAANZ QUARTER I 2024 9

TONY NEGLINE is superannuation and financial services leader at Chartered Accountants Australia and New Zealand.

The wider implications of pay day super

TONY GRECO is technical policy general manager at the Institute of Public Accountants.

TONY GRECO is technical policy general manager at the Institute of Public Accountants.

The Securing Australians’ Superannuation package unveiled in the 2023/24 federal budget promises to revolutionise the landscape of super contributions in Australia.

However, transitioning to this new regime requires careful consideration and a willingness to address existing inefficiencies.

Starting in July 2026, pay day super (PDS) will aim to synchronise superannuation contributions with employers’ payroll cycles, marking a significant departure from the existing system.

While the initiative holds the potential for enhancing superannuation compliance that will benefit employees, crucial consideration should be given to the reforms needed to ensure its effectiveness.

Under the current system, more than 60 per cent of employers pay their superannuation guarantee (SG) contributions quarterly, leading to delays and potential underpayments. PDS will aim to rectify these issues by integrating super payments into regular payroll processes.

One of the primary concerns lies in the readiness of existing systems to support real-time superannuation payments. Process efficiencies must be improved and known issues must be addressed before implementing PDS.

The Institute of Public Accountants’ (IPA) pre-budget submission highlights the need to thoroughly examine existing processes, such as SuperStream, clearing houses and remittance processes, to ensure seamless integration with the new regime.

Failure to address these issues risks introducing unnecessary complexity and hindering the success of PDS.

Transitioning to more frequent SG contributions may burden employers, particularly small and medium-sized businesses, financially. Higher processing costs and cash-flow implications must be carefully managed to prevent adverse effects on businesses, especially during the transitional period.

A staggered implementation timetable, similar to the single-touch payroll process, could alleviate some of these concerns by providing businesses with adequate time to adapt to the new requirements.

The current penalty regime for late or underpayment of SG also needs a major revision.

The SG charge model is deemed overly complex and punitive, discouraging employers from rectifying the problem themselves. A fairer and proportionate penalty system must be introduced under PDS to incentivise compliance while differentiating between accidental errors and deliberate non-compliance.

In light of these considerations, the IPA made several recommendations in its pre-budget submissions that can help ensure the successful implementation of PDS:

1. Process efficiencies: Prioritise the resolution of existing inefficiencies in superannuation payment systems before transitioning to PDS. The joint bodies’ submission provides valuable insights into areas requiring improvement and streamlining.

2. Penalties: Revise the penalty regime for late SG payments to make it simpler and more proportionate. The new regime should encourage voluntary reporting and rectification of errors while deterring deliberate non-compliance.

3. Compliance and cash flow: Consider a staggered implementation timetable for PDS, especially for small and medium-sized businesses. This approach would allow businesses adequate time to adapt to the new requirements and mitigate cash-flow impacts. Additionally, the ATO should be able to exempt certain employers from compliance on a case-by-case basis, particularly those facing exceptional circumstances.

By implementing these recommendations, the government can ensure a smooth transition to PDS while maximising its potential benefits for both employers and employees.

Addressing existing challenges and designing a system that promotes compliance, efficiency and fairness in superannuation contributions is imperative.

Ultimately, the success of PDS hinges on comprehensive reforms and careful consideration of its implications across all sectors of the economy.

IPA

10 selfmanagedsuper

REGULATION ROUND-UP

Deductibility of advice fees ATO Taxation Determination 2023/D4

Louise Biti Director, Aged Care Steps

Louise Biti Director, Aged Care Steps

Aged Care Steps (AFSL 486723) specialises in the development of advice strategies to support financial planners, accountants and other service providers in relation to aged care and estate planning. For further information refer to www.agedcaresteps.com.au

When finalised, draft Taxation Determination (TD) 2023/D4 will replace TD 95/60 to outline the ATO view on the deductibility of financial advice fees.

The ATO has stated the TD does not represent a change in the tax commissioner’s view, but is merely an update to reflect legislative changes since the original TD was released in 1995.

A tax deduction for advice fees can still only be claimed under section 8-1 of the Income Tax Assessment Act 1997 (incurred in gaining or producing assessable income) or section 25-5 (cost of managing tax affairs).

The TD does, however, provide some clarification on apportioning fees.

Proposed increase for penalty units

2023/24 Mid-Year Economic and Fiscal Outlook

Under the Superannuation Industry (Supervision) Act, monetary penalties may be applied to trustees for errors and breaches.

The monetary value of a penalty unit is currently set at $313, with indexation applied every three years.

Last December’s Mid-Year Economic and Fiscal Outlook statement included a proposal to increase the amount to $330 per unit (indexed). This increase is still pending legislation.

Loose diamonds not a collectable or personal use asset

ATO QC73738

An article published on the ATO website confirms natural diamonds held in loose form (not mounted or used in any way as adornment) are not considered to be a collectable nor a personal use asset.

Therefore the storage and insurance requirements for those asset types do not apply. However, standard investment rules regarding appropriateness of the investments and sole purpose test continue to apply.

Superannuation in Retirement review

The federal government is continuing to consider the challenges around superannuation and how it can support Australians throughout retirement.

A discussion paper, titled “Superannuation in Retirement”, was released in December (with consultation closed on 9 February) to seek views on how to support:

• members to navigate the retirement income system,

• funds to deliver better retirement income stream products, and

• greater access to lifetime income products.

The Senate Economics Reference Committee has referred an inquiry into improvements for the retirement system – Improving consumer experience, choice and outcomes in Australia’s retirement system. This inquiry is due to report by 30 June 2024. The terms of reference

for the inquiry include:

• impediments (both regulatory and tax) to the innovation and purchase of insurance products in retirement,

• the interaction of health insurance, life insurance, general insurance and social security supports to retirement outcomes,

• the role of fintech platforms and technology,

• policy options to support greater choice and quality of life in the retirement income system, and

• progressing the Retirement Income Covenant.

The chair of the committee highlighted the focus on insurance in super and aged care with an interest in the merits of an aged-care insurance product to help make aged care financially viable.

Digital execution of declarations

The Statutory Declarations Amendment Bill 2023

The passing of the Statutory Declarations Amendment Bill 2023 at the end of 2023 gives clients two digital options to authorise statutory declarations, in addition to the standard paper option.

This is a federal government bill and only covers commonwealth matters (for example, taxation and social security). State-based declarations still need to be authorised under the relevant state rules.

Clients wishing to use the electronic options can either:

• create and download a digital commonwealth statutory declaration through myGov using their myGovID, or

• complete a commonwealth statutory declaration for digital execution on the Attorney-General’s website. This option needs to be witnessed in person or via video link on the website.

Further information is available on the myGov website.

Thresholds indexing 1 July

November AWOTE figures

Contribution caps will increase from 1 July 2024 with the concessional contributions cap increasing to $30,000 following the release of the November average weekly ordinary time earnings figures.

Superannuation objective

Superannuation (Objective) Bill 2023

The Superannuation (Objective) Bill 2023 is currently before parliament and aims to create some stability for super.

It will define the objective of superannuation as “to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”.

Members of parliament who introduce new bills or regulators who create new regulations that relate to changes to the superannuation system will be required to issue a statement of compatibility.

QUARTER I 2024 11

There is an irrefutable trend involving an increasing number of people being disqualified from performing the role of an SMSF trustee. Todd Wills explores this phenomenon and the factors driving it.

12 selfmanagedsuper FEATURE

With establishment rates not abating year-on-year, SMSFs continue to enjoy a significant level of popularity as a retirement savings vehicle. However, a troubling trend has emerged recently, being a rising number of trustee disqualifications by the ATO for noncomplying behaviour.

By the end of 2023, no less than 751 SMSF trustees found themselves on the Disqualified Trustees Register, marking a 33 per cent surge from the previous year. Clearly, the intentions, conduct and behaviour of individuals choosing to establish SMSFs are increasingly coming under the regulatory microscope.

The size and scale of this trend has not gone unnoticed. SMSF Association chief executive Peter Burgess used his address at the industry body’s 2024 national conference to highlight the rising number of disqualifications as a development with significant ramifications for the integrity and reputation of the sector and issued a call to action for stakeholders to tackle the underlying causes.

“We have seen a significant increase in the number of individuals being disqualified as trustees [and] we are on track to break another record this year in terms of disqualifications. I think what these numbers are telling us is we need to do more as an industry to try to weed out these individuals to make sure they don’t end up with a self-managed super fund,” Burgess said at the conference in Brisbane in February.

Causes for concern

One observation seemingly shared within the industry is that more individuals are viewing SMSFs as a means to tap into their superannuation monies earlier than legally entitled.

ATO data released at the SMSF Association National Conference 2024 illustrated the extent of this issue, indicating a total of $637 million in superannuation savings had exited the

system prematurely and illegally through SMSFs during the 2020 and 2021 financial years. Moreover, two-thirds of the total super monies that were at risk were attributed to newly established funds.

According to ATO SMSF regulatory branch assistant commissioner Justin Micale, having access to this data has shaped the regulator’s approach to addressing trustees who have illegally accessed their entitlements.

“We know from our data that the majority of SMSFs do the right thing, but we also know for those that aren’t, it does have a significant impact on the system. The growth in disqualifications does reflect the fact that we’ve scaled up our compliance actions in direct response to our concerns about increasing levels of illegal early access occurring across the sector,” Micale says.

“We see illegal early access play out in three main ways. Firstly, we see people entering the system with the sole intent of raiding their retirement savings. There’s never really any intention to actually run an SMSF.

“We also see existing trustees who stop lodging an SMSF annual return because they’ve illegally accessed some or all of their retirement savings. And the third group we see is existing trustees that lodge, but have illegally or inappropriately accessed some of their super. That is often reported to us as loans.”

However, as SMSF Association head of technical Mary Simmons points out, the desire to unlock access to super may not be the sole driver contributing to trustee disqualifications and the problem might be more widespread.

“You might have someone who’s gone bankrupt or they’ve been convicted of dishonest conduct and under the law they are a disqualified person and they can’t be a member or trustee of an SMSF. Those individuals are not part of this register that is maintained by the ATO,” Simmons notes.

“And then there’s another pocket which contributes to the spike: tax agents or

FEATURE A WORRYING TREND

“The growth in disqualifications does reflect the fact that we’ve scaled up our compliance actions in direct response to our concerns about increasing levels of illegal early access occurring across the sector.”

– Justin Micale, ATO

auditors who have their own personal SMSF lodgement obligations outstanding, because the ATO believes that as professionals, they need to be held to a higher standard when it comes to meeting tax and regulatory obligations.”

The view from the coalface

For experienced practitioners working in the sector, the key drivers and

Continued on next page

QUARTER I 2024 13

FEATURE A WORRYING TREND

Continued from previous page

indicators of non-complying trustee behaviour, which may possibly eventuate in a disqualification, are often varied and complex. There is a sense a combination of factors, including inexperience, a lack of technical expertise and understanding of the rules, is contributing to trustees either deliberately or unknowingly flaunting their obligations under the Superannuation Industry (Supervision) (SIS) Act .

This manifests itself in a number of ways, including a reluctance to engage with both regulators and professionals, as Heffron managing director Meg Heffron highlights.

“The biggest red flag for me is when trustees become non-responsive. Part of our job is we’ll set the fund up, we’ll set up data feeds, so we’re getting data coming into our systems on what’s going on in the bank account,” Heffron reveals.

“And because we know we’re going to be doing the accounting work at the end of the year, if we see money coming in or going out, we’ll get in touch with the client at the time to ask what the transaction is so we can get a head start on doing the work at the end of the year.

“And as soon as you ask the question and the trustee becomes non-responsive, that’s almost a dead giveaway they’ve taken the money out illegally. I think more and more, we probably should accept it’s an indicator that something’s gone wrong and to get the ATO involved straightaway

“As soon as you ask the question and then the trustee becomes non-responsive, that’s almost a dead giveaway that they’ve taken the money out illegally. I think more and more, we probably should accept that’s an indicator that something’s gone wrong and get the ATO involved straightaway, rather than waiting until the lodgement deadlines.”

– Meg Heffron, Heffron

rather than waiting until the lodgement deadlines.”

This has also been the experience of Sonas Wealth managing director Liam Shorte, who notes a lack of sound investment knowledge can often lead to the breakdown of a fund.

“I tend to pick up trustees after they’ve made a mistake and have gone into an investment such as cryptocurrency, property development or international shares and they’re trying to pick a winner and the investment has fallen apart,” Shorte explains.

“What we’re finding is trustees put their head in the sand and they don’t do their annual financials. Then the ATO, after 18 or 24 months, is just deregistering the SMSF and disqualifying them as trustees.

“In my experience, many trustees think they’re going to get in trouble for losing their money. The ATO doesn’t care that they’ve lost their money. The ATO just wants them to do their financials and show that the super fund has lost funds.

“That’s the nature of investing. But they seem to put their head in the sand and are afraid to admit it, and then they get one, two or three years behind and suddenly they get themselves in trouble.”

Another common theme that has emerged is of trustees who feel they are capable of managing the affairs of their SMSF independently and without consulting professional advice or support.

ASF Audits head of education Shelley Banton cautions against this approach

as the increasingly rapid changes within the regulatory environment of the sector in addition to the technical knowledge demands could see trustees left behind.

“It’s not compulsory to have an SMSF. There are other retirement vehicle choices out there, but if you are going to have one, you have to obviously swim within the flags of compliance, because as the ATO says: ‘It is your money, but just not yet,’” Banton says.

“There’s a segment of trustees who may be getting into SMSFs for the right reasons, but then find themselves in difficult economic and financial circumstances. They begin looking at their SMSFs and they believe they can dip their hands into that SMSF cookie jar, which is non-complying behaviour.

“Once you start the fund, if there are things you want to do and you’re not too sure those actions are allowable under the SIS Act , that’s where having the experience of a trusted adviser, auditor or a professional team is going to help you the most.

“Because once that horse is bolted, it’s really hard to try and put it back into the corral. You’ve really got to be able to work within the SIS rules, which often have long tentacles in terms of how they interact.

“All the rules interact with each other, which means that you’re not just breaching one aspect of the SIS Act , you’re usually breaching several areas. If you’re not experienced, you’ve got

Continued on next page

14 selfmanagedsuper

Continued from previous page

to then try and get your fund back to complying status and even those actions can often result in breaches.”

It’s also evident SMSFs, as a relatively sophisticated retirement savings vehicle, carry with them a substantial administrative, regulatory and technical burden, which may be too much to bear for some individuals entering the system.

For SMSF Alliance principal David Busoli, the surge in disqualified trustees could also stem from a deficiency in knowledge or competency on the part of the trustee, particularly in cases where individuals are entering the sector from an unadvised environment or failing to seek appropriate support.

“I imagine many disqualifications are related to illegal early access, but not all. I’ve dealt with trustees before where they’ve just been quite hopeless in running their own fund, in particular where there are related unit trusts and companies involved and they’ve mixed them up so much that in the end it’s just become too difficult to distinguish what’s an SMSF property and what’s not. And very simply, their funds end up becoming non-complying and those trustees are disqualified,” Busoli says.

What’s next for the industry?

As some trustees face disqualification and continue to disregard their obligations, it’s natural to wonder about the future regulatory landscape for this sector. Over the past decade, the environment in which

SMSFs operate has undergone significant changes, largely due to compliance challenges.

“When we’re talking about additional measures in the future, what I would say is that our programs never really stand still. We’re always looking for ways to continually evolve them, whether that’s our strategies or the risk detection mechanisms we have in place. Those programs have been ramped up and are definitely becoming more sophisticated, and they will continuously evolve,” Micale states.

“Professionals in the SMSF sector do have a key role to play in helping us address this issue. Whether that involves helping to bust myths about when you can and can’t take your money out, educating their clients about the consequences of doing the wrong thing or warning people about the dangers of scheme promoters, they play a very important role.”

According to Banton, all options to address consistently illegal behaviour by trustees will be on the regulator’s table.

“Anything’s possible. I think we’ve seen a lot of change to SMSFs over the last 12 to 24 months and if this sort of trend does continue, anything could be possible. I would imagine the ATO will be looking at anything and everything to try and reduce the amount of money that’s been illegally accessed through super down to zero,” she notes.

“Certainly they’ve got an education program that they’re about to roll out. For new trustees looking to establish a fund, will that become compulsory education?

“There’s no education directions that are being given out at the moment. There’s only rectification directions. So we don’t know how that education program is going to be pieced together and placed within their compliance basket.”

While she stresses the need for targeted action to address compliance issues in order to maintain the integrity and strength of the sector, Heffron cautions against a blanket approach, as an ill-thought-out resolution is likely to impact the large majority of participating trustees who seem to have no problems maintaining the compliance of their funds.

“The trouble with anything designed to stamp out an undesirable practice, like increased prevention measures from the regulator or increased legislation, is you can’t just target the bad guys,” she says.

“Anything of that nature affects everybody, so we run the risk if we don’t get on board and be part of a solution, that the natural behaviour of the regulator will be to put more and more barriers to people setting SMSFs up. And that hurts all the people who are doing the right thing.

“If we’re not part of the solution, we’ll end up getting what we deserve.”

It’s clearly evident the industry needs to address the behaviour of a problematic minority of trustees within the system. However, as long as the misconceived perception exists that SMSFs are the key to accessing the super treasure chest in any circumstance, finding a solution to the matter may still take some considerable time.

“There’s a segment of trustees who may be getting into SMSFs for the right reasons, but then find themselves in difficult economic and financial circumstances. They begin looking at their SMSFs and they believe they can dip their hands into that SMSF cookie jar, which is non-complying behaviour.”

- Shelly Banton, ASF Audits

FEATURE

QUARTER I 2024 15

With the growing number of retirees in the Australian population, the role of superannuation in retirement is under question and, as Jason Spits writes, the proposed answers seem very familiar to many.

FEATURE 16 selfmanagedsuper

For many in the SMSF sector, government plans to address an issue can often feel like a solution looking for a problem, with the lengthy discussions around non-arm’s-length income and expenditure, and the more recent dialogue regarding the Division 296 tax, adding some credence to the perception.

Having spent much of 2023 working through those two issues by way of a series of short-run consultations (see Issue 44: “People hearing without listening”), the superannuation sector went into Christmas last year considering another Treasury discussion paper, titled “Retirement phase of superannuation”.

It considered the take-up of retirement income products under the Retirement Income Covenant (RIC) and how it could be accelerated by supporting super fund members to navigate the retirement income system, supporting super funds to deliver better retirement income products and services, and making lifetime income products more accessible. (See “Another consultation paper” below.)

While these aims are laudable, there were a few key issues that may raise some red flags for the SMSF space, including a call to look beyond account-based pensions (ABP), heavily used by the sector, to annuities to address longevity needs, and to include SMSFs under the obligations of the RIC.

Why fix it?

This latter suggestion came out the blue with the paper noting SMSF trustees faced the same complex decisions as members of Australian Prudential Regulation Authority (APRA)regulated funds when deciding on how to structure their retirement income, but without “the same entitlement to support that members of APRA-regulated funds receive under the RIC”.

As such, it questioned the approaches SMSF trustees take to manage risk and maximise income, what barriers there are to achieving these outcomes and how the government can assist in improving them.

Unsurprisingly, there is little support for the suggestion SMSFs should be covered by the RIC. This is not new and harks back to the arguments made in 2021, when SMSFs were originally excluded from the RIC, that APRAregulated funds and SMSFs operate in very different ways.

SMSF Association head of policy and advocacy Tracey Scotchbrook says it was natural to ask the question given the wider discussion on retirement income that is taking place, but there is no expectation potential changes are in the pipeline.

“We looked hard at this question again and the RIC policy drivers do not fit the SMSF environment. APRA-regulated funds tend to be more disconnected from their members in comparison to SMSFs where the trustees are the members of the fund as well,” Scotchbrook notes.

“Some SMSFs will need some support and the sector can work with government and regulators to promote education and advice, but SMSF trustees are required to make declarations when setting up their fund about their obligations to the fund and its members.

“The annual compliance checks that have come to the sector via the ATO means every fund has ongoing engagement with its trustees.”

Financial Advice Association Australia general manager of policy and advocacy Phil Anderson also sees the differences between APRA-regulated funds and SMSFs making the latter unsuitable to sit under a regime designed predominantly for the former.

Anderson points out APRA-regulated funds have limited knowledge of their members’ needs and that segments of the superannuation system treat people as part of an aged-based cohort.

“This is very different from the SMSF members, who often have an adviser and their own obligations and there is no reason why the government should apply a default model from one part of the system to another part which acts very specifically,” he explains.

“If people are not ideally suited to being in an SMSF, that is a different issue, but what can be done with an SMSF can’t be done at the APRA-regulated fund level.”

Actuaries Institute superannuation and investments practice committee chair Tim Jenkins also sees little will be gained by extending the RIC to cover SMSFs, but feels there is value in considering some of the guidance measures that are being discussed. These include regular contact with fund members, providing guidance and education that could be timed as ‘nudges’ to action when a member approaches or reaches a key date or

“We should be cautious about repeating the mistakes of the past and provide exit strategies for fund members who take on any form of retirement income product and this applies to members of APRA-regulated funds as much as it does to SMSFs.”

– Natasha Panagis, IFPA

event in their life.

“We see a role for government and SMSF service providers to give guidance along the way and to promote the idea that superannuation is a pot of money for retirement living and not a nest-egg to be maintained well into the future,” Jenkins adds.

“The superannuation guarantee model over the past 30 years has encouraged saving and building member balances, but people in any type of fund need reminding superannuation was designed for spending in retirement.”

Where’s the problem?

Jenkins’ comments touch upon an issue raised in the paper, being to encouraging more

Continued on next page

FEATURE IF IT AIN’T BROKE

QUARTER I 2024 17

FEATURE IF IT AIN’T BROKE

Continued from previous page

people to take up retirement income stream products and shift their thinking away from the view superannuation should be held for as long as possible, often with the intention of passing it on to the next generation.

The paper notes while 84 per cent of retirement savings are in ABPs, these products do not manage the risk of outliving those savings and research has found many people are drawing down only the minimum required, depriving themselves of a better standard of living and subsequently dying with large balances still in hand.

Conversely, only 3.5 per cent of retirement income streams are held in annuities, raising the question of whether this binary, one-sided split in product selection is a problem.

Jenkins says the research cited in the paper about people sitting on pension income is not universally accepted and some run them down before death, adding the uptake of pensions is a good outcome for many and people treating their superannuation as a nest-egg is a separate issue.

“Pensions are a great product because they work for many people, but it is still horses for courses and they may not be suited to every situation,” he suggests.

“The consultation paper said the lack of annuity products was due to a limited supply from product providers, but we would argue it is a lack of demand.”

Institute of Financial Professionals Australia head of superannuation and financial services Natasha Panagis says pensions have achieved widespread use due to their flexibility, while annuities are often complex to understand without advice or guidance.

“Capital is locked away in an annuity and super fund members have to weigh up the flexibility of a pension against the longevity risk offset that comes from an annuity, and this is where advice can consider the pros and cons of each type of product,” Panagis points out.

“This is particularly important when it may be hard to find product providers causing people to view annuities as an alternative option.”

Anderson notes the issue with choice between a pension and an annuity is “the decision people are invited to make is to lock their money away for a length of time for a lower return to address longevity risk and they probably won’t do that unless they understand

the benefits”.

“This comes back to the low levels of financial literacy many people have, which is why we still see people withdraw their super at age 65 and bank it just for the certainty of knowing what it’s doing,” he says.

Avoiding the past

Given the lack of awareness around retirement income products existing among the millions of people heading into or already in retirement, the consultation paper put forward the idea of a ‘suggested product’ that could be offered to fund members, as well as industry standardisation around the development of any new products.

This also appears to have little support and Financial Services Council (FSC) chief executive Blake Briggs acknowledges the body’s consumer polling shows many people don’t want to be constrained either by government policy or products.

“FSC research shows that 73 per cent of people wanted to tailor their retirement arrangements to suit their needs and that high-quality affordable advice is central to supporting consumers as they prepare for their retirement,” Briggs says.

“A one-size-fits-all approach is not suitable for retirement and would be rejected by consumers, and the government and superannuation funds need to be careful not to be imposing solutions on their members.”

Scotchbrook and Panagis indicate the SMSF sector is also wary of a top-down imposition of retirement income products and is keen to avoid the formation of legacy products like market-linked pensions that have become very difficult to exit after superannuation rules changed.

“We should be cautious about repeating the mistakes of the past and provide exit strategies for fund members who take on any form of retirement income product and this applies to members of APRA-regulated funds as much as it does to SMSFs,” Panagis warns.

To this point Scotchbrook adds: “Product innovation is useful, but it is at low levels because there is no demand at present for more, but more advice can shift that dial.”

“There is already a shift underway with APRA-regulated funds under the RIC and the proposed changes from the Quality of Advice Review will continue to increase consumer knowledge and confidence.

“We looked hard at this question again and the RIC policy drivers do not fit the SMSF environment. APRA-regulated funds tend to be more disconnected from their members in comparison to SMSFs where the trustees are the members of the fund as well.”

– Tracey Scotchbrook, SMSFA

“Keep in mind, the RIC has not been in operation for that long, but the timing of this paper and the discussions around expanding advice to super funds shows there is an alignment in discussions and the need for better outcomes for many people who cannot access advice.

Sizing up the future

These better outcomes are a central theme of the discussion paper and while it puts forward ways to hasten results, it also recognises the scale of the task at hand. It states at present there are 1.6 million people aged 65 and over receiving income from a superannuation product and in the next 10 years a further estimated 2.5 million Australians will

Continued on next page

18 selfmanagedsuper

move from the accumulation into the retirement phase of their super and information and education will be central to a smooth transition.

These figures underplay the significant change that will be taking place in the retirement income system, as well as in the lives of the individuals concerned.

“There was never going to be an easy process to move this many people from accumulation to pension phase,” Anderson says, adding many will need to have a greater level of financial literacy to make the move.

“They will also need access to advice at a critical time when they are changing financial structures and their life situation and to have confidence in their future plans before they

decide on which product they will choose.”

For Jenkins, the discussion paper raises the prospect of dealing with the current wave of retirees, but also laying the framework for those still to move through the system.

“The real focus of this paper is providing help and guidance and starting it early and carrying that through to retirement. The current environment is not easy for super funds to provide that support and under the rules at present they can’t do so unless the members ask for it,” he says.

Whether this will change remains to be seen, with the period for comment on the paper having closed in early February and a government response still pending, however, Scotchbrook suggests the government can look to the SMSF sector as an example of the

outcomes it is seeking.

“SMSFs are a case study of what happens when members are engaged, advised and calling the shots on what happens as they head into retirement, which APRA-regulated funds could adopt using the nudges suggested in the paper,” she says.

“These would work with their model and we would like to see them applied to SMSFs as well, but there is no single solution. Defaults and mandates are not the right outcomes, but the RIC and the provision of advice are the two levers in the wider system and many funds are still finding their feet on advice.

“Good outcomes will not happen overnight and organic results can’t be forced and we would be concerned if policy was the driver behind member outcomes.”

“A one-size-fits-all approach is not suitable for retirement and would be rejected by consumers, and the government and superannuation funds need to be careful not to be imposing solutions on their members.”

– Blake Briggs, FSC

The “Retirement phase of superannuation” discussion paper, released on 4 December 2023, around 18 months after the commencement of the Retirement Income Covenant (RIC), took its starting point from a joint review by the Australian Prudential Regulation Authority (APRA) and Australian Securities and Investments Commission (ASIC) of superannuation funds’ efforts to meet the RIC objectives.

Those objectives were to maximise retirement income, manage risks to the sustainability and stability of that income and maintain flexible access to capital, and

they were only binding on APRA-regulated funds after SMSFs were excluded by the previous government.

The review found most APRA-regulated fund trustees had not conducted any close analysis of their members’ income needs in retirement and lacked any metrics to assess the retirement outcomes provided to members, leading to the paper’s conclusion that the take-up of lifetime income products was low and the market was underdeveloped.

While the absence of SMSFs from the RIC and the use of pensions were put forward as key areas for consultation, the paper notes retirees are required to decide how they will draw down their superannuation savings during their retirement to cover expected and unexpected living costs.

At the same time, the paper

acknowledges there is a need to transition people from the nest-egg mindset, developed during the accumulation phase, to thinking about superannuation in retirement as capital that should be drawn down and spent.

To this end it stated “minimum drawdown rates are generic settings which are not designed for, and do not lead to, an optimal retirement income for all retirees” and guidance, education and communication, including ‘nudges’ to spur retirees to action, should be part of the retirement income landscape.

In conjunction with this, the paper called for more and better retirement income products and the creation of a standardised framework so these products can be compared across the metrics of cost, risk, expected income and access to capital while offsetting longevity risks.

FEATURE

Continued from previous page

QUARTER I 2024 19

A shift in emerging markets

Emerging market discussions were once dominated by considerations involving Brazil, Russia, India and China, but John Moorhead writes there is now a changing of the guard.

Experienced investors will remember the popularity of the BRIC (Brazil, Russia, India and China) economies in the early 2000s, when they were growing strongly and many saw attractive investment opportunities. The global financial crisis changed a number of dynamics for these countries and with the passage of time and economic evolution today, we coin a new emerging markets acronym for investors to focus on: the BITs, namely Brazil, Indonesia and Turkey. Each of these fascinating and unique economies offers up idiosyncratic investment opportunities driven out of sometimes rapid and unexpected change.

Positive change in Turkey

While Turkish President Recep Tayyip Erdoğan’s macroeconomic handbook has been very unconventional and much criticised, recent changes suggest a return to a more stable economic approach,

which could yield attractive investment results for investors prepared to do their research on the country. Turkey has undergone substantial and surprisingly positive change in the past 18 months. We started to assess Turkey more closely in September 2022 when yearly consumer price inflation hit 81 per cent and Erdogan was losing popularity. But we recognised there was potential for economic change. Few things remain constant, especially in emerging markets, and being able to recognise critical turning points is crucial.

From late 2022, we could see the potential for change coming out of the 2023 Turkish presidential election. Before that, consumer sentiment had plummeted, and the opposition political party had maintained a lead in the polls for over 12 months. To

Continued on next page

INVESTING

JOHN MOORHEAD is head of global emerging markets at Maple-Brown Abbott.

20 selfmanagedsuper

Graph 1: Turkey central bank repo rate – dots represent a change in central bank governor

Source: FactSet, Wikipedia, 4 March 2024

the market’s surprise, Erdogan managed to turn this result in his direction after a tight first round of voting and won power.

The second surprise, however, was far more important: in June last year, Erdogan made a series of relatively wiser appointments to senior economic positions. The first was appointing Mehmet Simsek as Finance Minister, who was previously in the position from 2009 to 2015 and Deputy Prime Minister from 2015 to 2018 – both periods of conventional and market-friendly policies. The second was appointing Dr Hafize Gaye Erkan, a former co-chief executive and president of First Republic Bank and Goldman Sachs alumni, as the governor of the central bank.

Following that, interest rates were increased for the first time since 2021, when