HOW THREE PEOPLE ARE REVOLUTIONIZING THE MARKET FOR HIGH-END HOLIDAY LETS

Creating a Business Ecosystem

P.20 P.10

Ben & Jack have built an ecosystem of property businesses, giving them full control over their development projects and allowing their primary suppliers to be companies they own. In this article, they share tips on how you can build your own ecosystem to maximise profitability.

P.6

From Watching Homes Under the Hammer to Appearing on It: Why Hard Work is the Secret to Living the Life of Your Dreams

A few short years ago, Andrew decided to leave his low-paying job and pursue his passion for property development. His story contains inspiration, a healthy case study and some practical advice on how anyone can go from full-time employment to full-time in property.

P.36

Growing a Profitable Property Business: The Mindset Changes Needed to Take You from Investor to Business Owner

Sky TV’s very own Hayley Andrews shares her advice on switching your mindset away from that of an investor to one of a business owner.

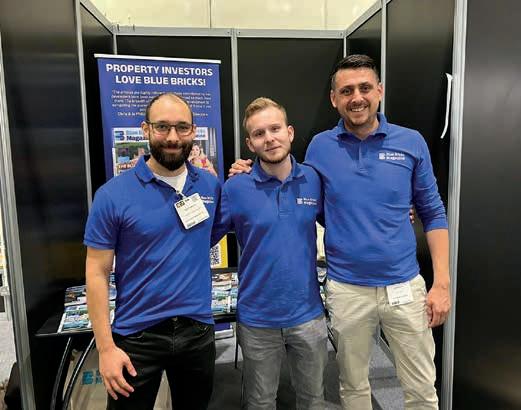

The Swish Story: How Three People are Revolutionizing the Market for High-End Holiday Lets

Our interview with Tom & Charlotte delves into the creation of Swish and how and why they are on a mission to take the serviced accommodation strategy to new heights.

P.5

The Market Pulse

Stay ahead with the latest market updates and industry news.

P.8

The Power of Knowing Demand Data

John shares his data-centric approach to how you can check demand data in your investment area.

P.17

Securing a Solid Exit Strategy: Essential Advice for Property

Developers Seeking a Successful Exit

Mike shares the core things that developers need to consider if they want a profitable and stress-free exit on their development deals.

A Guide to Short Lease Extensions: How to Add Up to 25% to the Value of Your Next Property Deal

Jason is an expert on the lease extension strategy. In this article, he breaks down how this strategy works and how you can use it to add up to 25% to a property’s value.

P.30

One Sourcing Agent Fined £23,000 –Could You Be Next?

Tina shares some of the eye-watering fines that are being issued to non-compliant property sourcers, what sourcers need to do to avoid them, and how this is relevant to property investors.

P.33

From Figure Skating to 7-Figure Property Portfolio:

Wendy shares the mindset lessons she learned from figure skating and how she implemented them as a property investor to build a seven-figure property portfolio.

P.39

From Adversity to Achievement: How to Overcome Personal Battles While Building Your Property Portfolio

Michelle has faced many hardships in both her business and personal life. In this article, Michelle shares how you can build a resilient mindset and deal with personal issues in a way that does not hinder your property business.

P.42

Refurb Red Flags: What You Need to Look Out for On Your Next Property Project (and How to Save Costs at The Same Time)

Karel uses his experience from a lifetime in construction to explain how you can save money on your refurbishments and what red flags you need to look out for on property viewings.

P.44

Life Less Ordinary: A Soldier’s Guide to Growing Wealth Through Property Investment

Nick has lived an interesting life, working his way up through the ranks of the military before leaving and scaling a group of property-related companies. In this article, Nick shares his philosophy of wealth creation and the importance of living a life of purpose.

Sam Cooke Editor of Blue Bricks Magazine

It’s a strange time to be a property investor. With the newly imposed Renters’ Rights Bill and concerns that short-term lets may soon face restrictions similar to Houses in Multiple Occupation (HMOs) under Article 4, many are anxious about what the future holds.

The problem is that there’s a lot of potential legislation hanging in the air, with no clear guidelines on what exactly will be included, when it will come into effect, and what landlords can do to prepare.

This uncertainty has led many landlords to leave the market. Rightmove data highlights this trend, showing that 18% of properties now for sale were previously listed for rent.

But this isn’t a message of doom and gloom. The property industry is always changing. All we can do is keep an eye on what’s happening in the economy (which we cover in our weekly email newsletter) and prepare accordingly.

As landlords exit the market, more potential investment properties are likely to become available. Every cloud...

Now more than ever, it’s important to be part of communities with other property investors, to share advice and support each other through these uncertain times. That’s why we’ve relaunched our monthly online meetups, bringing members of Blue Bricks Magazine together from all over the UK. For more information on this or our weekly newsletter, email hi@bluebricksmagazine.com

With the economic update out of the way, let’s move on to the good stuff: what’s in this issue of Blue Bricks Magazine?

This is a varied issue, with a mix of case studies, in-depth interviews, and advice columns on everything from building a resilient mindset to running and scaling a property business.

There’s great content here—content that will help you make more money from your portfolio and move closer to your goals, regardless of your current experience level.

One article I’m particularly excited about is from our main features: Tom Sumer and Charlotte Boxall from Swish. Swish is taking serviced accommodation to new heights, with luxury themed properties that will take your breath away.

Wendy Brumwell has drawn a perfect comparison between a sports mindset and the mindset needed to succeed in property with her article: From Figure Skating to a 7-Figure Property Portfolio.

Savoys has contributed a fantastic case study on how they combined strategies in a development to maximise profitability.

For the more business-minded, Hayley Andrews, Nick Thorpe, and Jack & Ben from XP Properties have written brilliant articles covering topics like growing an ecosystem, maintaining a pipeline of opportunities, and investing with intent.

No matter what you’re looking for, you’ll find it within these pages, with insights from some of the industry’s best on how to be a savvy property investor.

I hope you enjoy the read. As always, if we can help you with anything at all, just contact the team at hi@bluebricksmagazine.com

Over the past decades, Nick has founded, grown and sold multiple companies. His businesses help people passively replace their income with property or other investment services. Nick’s main focus is coaching business owners, helping them fast-track their progress.

Swish is taking high-end serviced accommodation to new levels with luxury apartments in Blackpool that are attracting the attention of celebrities and influencers alike. Alongside growing their business, the team is passionate about helping local charities and giving back to the community.

Hayley is an experienced property investor having participated in almost every kind of investment strategy. She is also the co-founder of Your Freedom Empire, an award-winning property training company, and a host on Property Elevator, a series on Sky TV

Michelle Walker Smith

Michelle is a letting agent and property investor based in the North East. She is passionate about helping others and regularly uses her networking event, PINE to raise money for charity.

Karel has spent most of his life on construction sites, working on multi-million-pound projects for some of the biggest companies in the UK. Over the past eight years, he’s run his own construction firm, Carl Construction Ltd, working with residential clients, investors and developers.

Founders of XP Property, Jack & Ben have been in business together for the past seven years. Over this time, they have built an ‘ecosystem’ of companies, including a measured surveying company, a property development company, and a management business.

Andrew is a self-taught property investor and landlord. Starting five years ago with no experience or money, he leared to identify great deals by spotting potential others missed. He has since acquired a large portfolio covering different strategies and takes pride in bringing neglected properties back to life.

Tina Walsh

Tina developed a passion for law during her time as a police officer. So, when she moved into property sourcing, she was surprised at how unregulated the sector was. Tina has since made it her mission to raise standards for property sourcers and protect property investors from rogue agents.

Malkit Purewal and Sanjay Kumar are multi-awardwinning developers from Savoys Properties who have been in the industry for 20 years. They specialise in HMOs/conversions and have won awards in three categories at the Property Investor Awards 2020 and 2021.

Jason Patterson

Jason has been investing in property for over two decades. He focuses on the short-lease strategy, buying properties with short leases and extending the lease to add value to the building.

John is a property insights expert, renowned for his forecasts and use of data to assist the industry in better understanding future market trends. He has co-created the property technology and data portal, Ultimate Property Dashboard, and supports businesses directly through Flex Property Education

Wendy is a property developer who loves turning empty, unloved buildings into beautiful homes. Loving the life that property affords her, she became a property coach and mentor to help others escape their 9-5 and achieve financial freedom.

As a Development Acquisitions Manager at CityRise, Mike has spent the last few years helping clients build successful property portfolios. CityRise is a company dedicated to delivering high-volume, off-plan sales for developers.

Cheaper mortgage rates following the Bank of England’s Base Rate cut in August have led to a surge in house prices towards the end of the summer months here in the UK.

Unsurprisingly, that’s also led to more mortgages being approved and a rise in the number of advertised properties coming onto the market for sale. Although slightly dampened, the rental market is still seeing demand outstrip supply.

House prices rise year-on-year

House prices continue to rise annually (if not monthly). The latest Nationwide House Price Index puts the value of the average house at £265,375. This August figure represents a 2.4% rise compared to a year ago, but is 0.2% down on July’s figure. It’s still 3% lower than the house price record, which was set in August 2022. However, at that point, mortgage interest rates were extremely low compared to today.

More mortgages are approved

The number of mortgages approved over the summer increased by 1,400 between June and July, bringing the total number of new approvals to 62,000, according to new figures from the Bank of England. Net mortgage lending in July reached £2.8bn – the highest figure since the post-pandemic surge in autumn 2022.

‘Mortgage deals’ follow Base Rate cut

The cut in the Bank of England Base Rate at the start of August from 5.25% to 5% has boosted mortgage applications and encouraged lenders to lower interest rates. Lloyds Bank announced it would lend first-time buyers up to five times their annual household income.

This summer’s Base Rate cut was the first in more than four years, but it’s not expected to be the last. That’s because inflation has now fallen to 2% – the Bank’s intended target rate. Ashley Webb, UK economist at consultancy Capital Economics, said he believes mortgage rates will fall further this year, resulting in a faster rise in house prices.

More

Online estate agency Zoopla reported a seven-year high in the number of properties listed on its portal. It’s a 14% increase compared to the same period last year, indicating that the market is starting to pick up again.

When it comes to the rental market, there’s not much change. The average UK private rent increased by 8.6% between July 2023 and 2024, according to figures from the Office for National Statistics. This brought national averages to £1,310 in England, £743 in Wales, and £959 in Scotland. Rental inflation has slowed considerably, however, and is expected to remain at a more stable pace in the near future with an increase of around 6% for the entire year.

This is because, according to the latest rental market survey by RICS, tenant demand appears to have levelled out.

But property market forecasters JLL paint a different picture. They say landlords should be more optimistic about rental income over the coming years, with the company predicting private rents will increase by 18.8% between 2024 and 2028.

THE NUMBER OF MORTGAGES APPROVED OVER THE SUMMER INCREASED BY 1,400 BETWEEN JUNE AND JULY, BRINGING THE TOTAL NUMBER OF NEW APPROVALS TO 62,000

The Royal Institution of Chartered Surveyors (RICS) also reports an increase in new buyer activity – a jump of 8% from the previous month. Agents say it’s also coinciding with the more popular autumnal buying season.

Labour is planning to reform planning laws to make it easier to build more homes, specifically on ‘green belt’ land, and figures show it’s desperately needed. According to government data, there were 13% fewer homes built in the 12 months from March 2024. This brought the number of new homes built to 183,610 – similar to the amount built during the 2021 lockdown period. To make up for the shortfall, Labour has already pledged to build 1.5m new homes in England alone over its new term in government. Whether they can do enough to tempt big developers to get involved remains to be seen.

The date was the 15th of April 2021, and it was yet another day in the job I hated, sitting at a desk in one of the thousands of generic call centres that litter the UK. I was five months away from my 40th birthday and trading my time for money.

An envelope was placed on my desk; I opened it and found a one-page letter informing me that my annual wage was to increase by 6.1% from £19,136. I deemed this little remuneration for a job I hated, with shift patterns that covered from 8 am to 10 pm seven days a week. Nevertheless, this was the wake-up call I needed; I knew I had to formulate my ‘out.’

I have never considered myself that smart; indeed, I felt some of my colleagues to be my intellectual superiors, and I seldom give myself praise to the point of many accurately labelling me a self-deprecator.

Even now, I find it difficult to type the established fact that—in a very short period of time—I was able to leave my livingwage job to embark on a new career as a successful property developer and landlord.

My aim in writing this article is simply to inspire you to take your first or next step in your journey.

The Fuse Is Lit

During my lunch break, I kept tight hold of the letter while I watched Homes Under the

Hammer on BBC 1, as I so often did. I always found the programme inspiring as I watched developers with envy. It wasn’t about the money they made as much as the freedom that property gave them.

I looked at the letter several times that day as I was extremely grateful to have received it (not the £1,227 wage rise, but the physical letter itself). It was my affirmation and a catalyst to make the move into property development.

No more procrastination. A switch was flipped inside me, and my low wage, lack of savings, and practical knowledge were not going to stop me; of this fact, I was sure.

This is my favourite Arnold Schwarzenegger quote, and it also became my plan: I was going to live frugally, work every hour of overtime available, work two additional jobs driving and labouring (I hated both), and educate myself about all things property.

The plan was crude, but I have always had a strong work ethic and, more importantly, I knew where I wanted to be and was determined to get there.

Often, people ask me, “What is the most important component of your success?” I refer to the above quote, and they roll their eyes. But it’s true. Unfortunately, there is no magic pill that makes your dreams a reality.

Andrew West Property Investor and Landlord

My first investment was a one-bedroom terraced house that sold just 18 months earlier for £54,000 (following a comprehensive refurbishment). The owner was struggling to sell for the asking price of £50,000, and consequently, the price was slashed to £39,950.

I understood why; the door had been kicked, and the tenants had left an unsanitary mess, the details of which I will spare you. Most around me, including my Dad (a former estate agent), tried strongly to discourage me from property in general, but in particular this one.

At this point, I had to be brave; you have to be in our industry. I knew the street well and felt the property would be a great buy once the cosmetic issues had been addressed and some minor layout changes had taken place. After some time, it became apparent that the vendor would accept the price of £35,000 for a quick cash sale, a £15,000 reduction on the original asking price.

Through a combination of savings, a small personal loan from my brother, and primarily, a credit card cash advance, I was able to obtain the sum of £28,500. To my amazement, the offer was accepted; it’s amazing how much easier negotiation is when you can’t bid any higher! If I had more funds available to me, I would never have made such an audacious offer.

It’s definitely not a strategy for everyone—or even something I recommend—but I was officially ‘all in’ on a compact but charming house in my hometown of South Shields.

It’s Not

I had acquired a solid property, yet despite my excitement, it had previously occurred to me that I neither had the skills nor finances to refurbish it. One evening, I highlighted my predicament in a local pub to friends, a place where many of the best ideas and conversations start.

Some of the best contacts I have made have been from talking about what I do in social situations; the power of social media is amazing, but I always advise people not to use it in isolation. One of the lads pulled me aside; he was an out-of-work builder who had recently returned to the area but had nowhere to live. The synergy was beyond apparent. A frank discussion ensued and a ‘rent for work’ agreement was reached within one pint.

We immediately became symbionts and later very good friends. I agreed to assist him with the refurbishment and provide the required materials; the latter would be done via an interest-free credit card. I had been astute enough to protect my credit score and take time to tell people what I do, and I was about to reap the rewards of these actions.

I smile looking back at the acquisition, and why not? There is a strong argument that it is right up there with my best deals. On this scale, any investor would be happy with the below figures:

Purchase price, including legals: £29,500

Refurb costs (excluding three months free rent): £2,500

‘Done up value’: £65,000

75% refinance at 2.1% for five years

Monthly rental income: £565 pcm

Gross monthly profit (after mortgage and insurance): £480

Purchase Price: £29,500

Legal Fees

VAT thereon

Electron Transfer

Land reg search

Stamp duty (na)

Land reg fee

Survey (didn’t get)

Total:

EPC

CP12 (no issues detected)

EICR renewal + minor work

£450

£90

£36

£4

£0

£20

£0

£600

Living room – before and after

£35

£45

£180 (new earth connection to gas meter and replace x 2 RCDS

2 x fire alarms

Carbon monoxide detector

Insurance

Total:

15 x spot lights, bulbs

£30

£20

£135

£445

£85 and wiring

Paint and applicators

Laminate flooring

£360

£435 and underlay

Carpet (reclaimed)

£90 and underlay

Addition of new WC

Total:

Total:

My time (priceless)

Builder/future tenant

£490

£1,460

£32,005

£0

£4,000 time deducted from prospective rent)

I embraced my frugal existence, spending weekends immersing myself in propertyrelated content while my friends enjoyed their social lives.

Attracting investment (sales) has never been my strong point, and to this day, I’ve avoided investor finance or joint ventures. Instead, I made a shrewd decision to purchase properties near the South Shields coastline and refurbish them to a high standard.

My strategy was to run them as holiday lets, capitalising on the Times 2022 Beach of the Year award and the surge in staycations.

This strategy proved more popular than I could ever have anticipated. Demand

was high, yet so were my prices, as at times I struggled to cope with demand. Nevertheless, the cash flow I was generating, along with refinancing my own house and low operational overheads (due to doing most things myself), facilitated a rapid expansion of the business.

By mid-2022, less than a year and a half after my journey began, I left my nine-to-five job, living off the income my holiday lets generated. By early 2023, I achieved my next goal of owning a double-digit portfolio featuring a diverse mix of standard rentals, serviced accommodation, student lets, and houses of multiple occupancy.

I recently received a call from Lion TV. They told me they were aware of my recent auction purchase. I knew who they were and waited with bated breath for them to ask, “Will you consider filming an episode of Homes Under the Hammer?” Without hesitation, I responded that I would. This had been a dream of mine and was the biggest milestone I have achieved in my journey to date.

To be completely honest, it was only at this point that I realised how far I had come in such a short time. Things had gone full circle; now someone would be looking up at me on their TV screen the same way I did to others a mere three years ago.

There have, of course, been many challenges along the way and costly lessons have been learnt. Property is far from easy, and I would advise you to give a wide berth to anyone who tells you otherwise. I’m still at the start of my journey for what I want to achieve, and I really can’t wait for the next three years of it.

I hope my story has given you some inspiration to get to where you want to be. Keep an eye out for me on Homes Under the Hammer later this year.

Connect with me on Facebook, or email me at info@newdayproperties.co.uk

Have you ever wondered what demand is like right now for a property strategy in a postcode or street? If you have, did you know that there is a brilliant but little-known way to do this anywhere in the UK, and in near real-time?

The property industry has, since time immemorial, used movements in prices and numbers of transactions to give itself an insight into the state of the market. This method is fine in retrospect, but near to useless for getting a steer on how the market is right now.

Then, to get an idea of how things are, we ask estate agents if they think demand is high. And when they say it isn’t, we accept that demand is low.

We also use mortgage approvals, getting data on the volume of approvals to see if the market is up or down.

A good investor has to let go of prejudices and traditions relating to market insights. Sadly, much of the noise, commentary, and opinion is grounded in these measures.

This all sounds robust but-and this is an important but-this data does not indicate demand; it indicates volume. The confusion of volume and demand is why our industry always seems to fail in predictions and forecasts.

We have to think about these measures more carefully, especially as property investors.

First is price movements. Price movements are after an event and often are at least 6 to 12 months behind where the market is because:

The time from offer to exchange is normally at least 3 months, and

The time taken for data to be published via the Land Registry can be up to a year.

So, we look to agents. Agents tell us it’s busy when they have lots of sales and quiet when there aren’t many sales. But what about listings? When we had the Liz Truss mini-budget and rates rose quickly, agents said demand had dropped massively. It hadn’t; it actually increased.

The major shock wasn’t sales (which did fall), but listings fell dramatically and quickly. So agents had less to sell, but a higher percentage of the stock was actually selling. Wonder why the market didn’t collapse? This is why.

Ah yes, but aren’t mortgage approvals a great measure – it’s what the banks use? Well, actually no. Approvals tell us the transaction volume again. When transactions are down, approvals are down. This doesn’t mean property demand is low. Furthermore, events like rate changes and even the weather can impact this. So we cannot use this for demand.

Since 2012, I have worked to improve the data and metrics we have to measure the industry. Time and time again I am reminded of the importance of knowing demand. Buying in a good-demand area and high-demand property types ensures I:

Protect myself from pricing falls

Am in a rising market, making finance or refinance after work easier

Can rent or sell on properties without issues

In my own property businesses, I only acquire properties that are at the top end of growth projections, which in plain English means I only buy in the highest-demand streets and property types in an area. You’d be astonished, as I often am, at the differences focusing on one of these postcodes makes, and by how quickly they can change from good to bad, or bad to good.

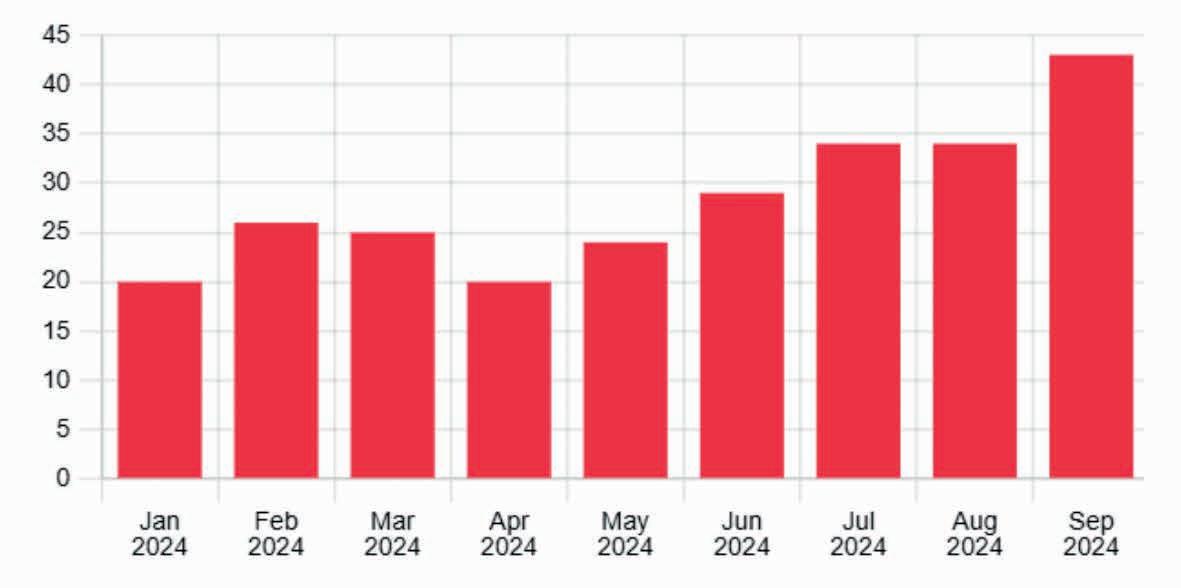

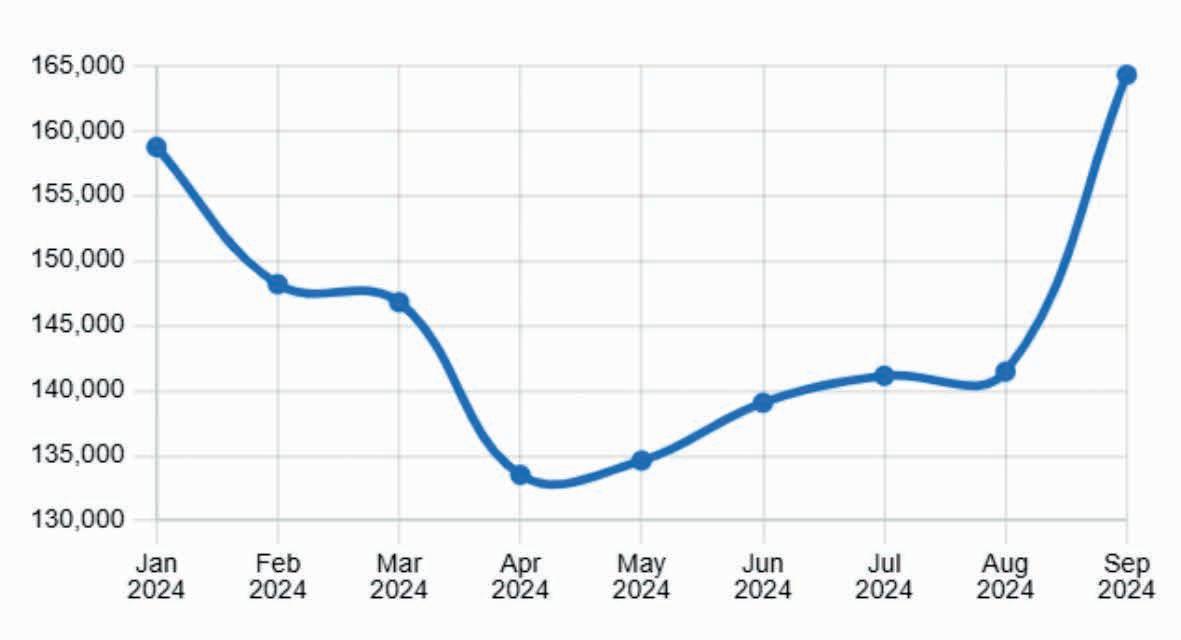

Here’s an example of demand and house price change for a location in South Wales:

Asking price changes

Following demand, I would have started investing in this area far sooner, as I could see demand climbing from February, at a time

You can do this using UPD Insight. Every UK postcode has demand data, updated every month. Demand can be overlaid on a map, and you can use it to find high-demand property leads as seen below.

There is a two-week free trial available to our platform. If you’re interested in learning more, then get in touch using any of the details below.

ultimatepropertydashboard.com

John Penquet upd.ai

Our team have over two decades of experience in fire safety, helping to keep our clients compliant and on the right side of the law. Alongside protecting your tenant’s lives, we protect your greatest assets, ensuring that they are safe from fire hazards. Our services include:

• Fire risk assessments (commercial and residential)

• Fire door inspection

• Fire safety compliance

• Cover the whole of the UK

Discover more about our service and keep your assets safe by going to www.soteriafireportection.co.uk

IT IS IMPERATIVE THAT AT ALL TIMES WE USE GOOD DEMAND DATA TO HELP US UNDERSTAND HOW OUR INVESTMENTS ARE GOING TO DO. AND KNOWING WHICH DATA TO LOOK AT FIRST IS CRITICAL Contact our team for a free fire safety consultation by emailing

Ben Richards & Jack Jiggens Founders of XP Properties

In seven years of being in business, it feels like we’ve gathered 20 years of experience. That’s partly due to the ups, downs, complications, and challenges that everyone faces in our industry, and partly because we’ve worked so hard building and scaling multiple businesses.

Fast forward seven years from when we started, and we now have a group of five propertyrelated companies, each one playing a vital role in helping us grow our portfolio through our development business, XP Property.

This is how we created an ecosystem of businesses that act as our suppliers and customers, and how you can use this same strategy to have more control over your investments.

Seven years ago, myself (Ben Richards) and my business partner, Jack Jiggens, were both mentored by the same person, and both our evening hobbies consisted of networking events.

Since we were both trying to achieve the same thing in the same area, our mutual mentor recommended that we meet for a coffee. It was a good recommendation because it sparked a business partnership that is still strong seven years later!

Before we met, Jack was completing his own flips, putting in sweat equity as a builder and using a dusty car bonnet as a deal calculator (I’m not joking). I was designing and delivering my own new-build, two-bed

property alongside my full-time job as a Technical Manager for Berkeley Group.

Jack and I work well together because we both have different skill sets that complement each other. Jack is much better at sales and negotiating, while I’m better at design, delivery, and project management.

The other reason we work well together is that we didn’t set out to be friends. Most business partnerships are formed by two people who have been friends for most of their lives, so they assume that means they’ll work well together in business.

Our sole goal was to build a commercial enterprise. Friendship wasn’t the priority, results were. Thankfully, over the past seven years, a solid friendship has been built, but our focus has always been on our goals.

With our history out of the way, let’s dive into the main topic: building your business ecosystem.

A business ecosystem is when you own businesses that are your suppliers. For example, if you owned a construction company that you used on your own refurbishments. In essence, it means you become your own customer, paying yourself rather than someone else.

We have five businesses that sit within our group: XP Surveys, Aura Architecture & Interiors, XP Property, Central Suites, and Oparo Social.

To give you an idea of where each business is at:

XP Property is delivering £40m+ in development sites, producing over 65 award-winning flats and houses.

XP Surveys is providing a fast, accurate, and reliable service for over 20 clients per month, and growing.

Central Suites is an award-winning co-living portfolio with over 120 units.

Oparo Social has over 140 social housing studios built from repurposing dwellings.

When we take on a development project, the process might look something like this: XP Property finds a site and passes it to XP Surveys, who will draw up the maps and deal with the front end.

The project is then passed to Aura Architecture, who act as our architects on the deal and design the site. The project is built and delivered by XP Property, and any units we retain are passed to Central Suites—our property management business—or to Oparo Social, a business that deals directly with social housing providers.

We could write an entire article on this subject alone, so instead, we’ll give you a brief overview of the main benefits:

Increased control over the speed and efficiency of a service.

When you pay a supplier, you pay one of your own businesses.

Better control over quality.

Control over the price you pay for products or services.

Ensuring the best interests of your company are always the sole focus.

For example, on the last point, if you owned a letting agency, you could ensure they push for the best room rates for your houses in multiple occupations (HMOs).

The problem with developments is that the income you receive is lumpy. You’re receiving big pots of cash at the end of a development, but up until completion, cash flow is tight. This desire for consistent cash flow is what inspired me to start Aura Architecture XP Surveys was built out of sheer frustration at the service (or lack of it) measured survey companies were giving us.

The point is, every business has a purpose. We don’t start businesses just because we like the idea of them. Each one must fit into the ecosystem in its own way.

As entrepreneurs, we have a hundred ideas a day. The trick is to pick the ones that will bring you closer to your goals, either by reducing costs or giving you more control over your portfolio.

Our golden rule is that we only set up a new business when we have a team to manage our existing one. Realistically, you want to give it two years from the launch of one business before you open another.

Finally, think about how much time you’ll need to run your new business, double it, and if you can spare that time, then go for it. It’s better to do one or two things with excellence (or run one business well) than to do ten things averagely.

How do you pick between a shiny penny and a good idea? There are some indicators that will tell you whether setting up a business is a benefit over a distraction.

For example, in Aura Architecture, we were paying so much money to measured surveying companies—for a bad service, no less—that it was the equivalent of someone’s wage.

We figured that we might as well hire someone for the same cost, and at least that way, we could control the process. We had so much work coming through Aura that we were instantly able to pass ten measured surveys a month to the new business. Even if we had no new clients, we could sustain ourselves.

If you’re spending a lot of money on one product or service, or increased control of that product/service would improve your business, then that’s a positive indicator.

Any business you start must be one that you’re passionate about. You can have the best work ethic and all the knowledge under the sun, but if you’re not interested in what you do, you’re going to hit a roadblock.

Passion kicks in when times get hard. If you don’t have passion, then you’ll crumble at the first hurdle.

Finally, don’t start a business without doing a low-cost analysis of the market. You don’t want to spend thousands of pounds launching a business just to discover there’s no demand for it.

Before starting a business, you need a clear growth plan. For example, XP Surveys made a profit in year one, but in years two and three, we lost money.

Without a plan, that would have been disheartening. But because we knew we wanted to grow, we expected this to happen.

As you scale, costs rise. You must pay for more staff, newer systems, and sometimes, bigger office space. They call this phase ‘going through Death Valley’.

Create a plan and account for growth, then things like this won’t come as a nasty shock!

One of our main pieces of advice is from James Sinclair: E+M=S. That stands for Entrepreneurship plus Management equals Success!

If you want to grow, then the only way to do that is by having the right people in the right places. Build a team that can manage your property business so you can focus on growing it.

You can be a limitation or an asset to your business. If you can find someone better at a task than you, like sales, then step out of the way and let them take the reins.

Finally, be resilient. To be in business or property, you need a resilient mindset. This is a difficult industry, and problems get thrown at you every day.

It’s like the analogy of the swan: you need to remain smooth and composed on the surface, but underneath, your legs will be paddling like crazy.

If you’d like to learn more about what we do, then follow us on the social media channels below, or tune into our podcast, Property XPerts.

@xpproperty XP Property Property XPerts

Accounts preparation

Annual

CGT return preparation

Tax planning / advisory

Tax Investigations

Voluntary Disclosures

Malkit Purewal & Sanjay Kumar are multi-awardwinning developers from Savoys Properties who have been in the property industry for 23 years, specialising in the house in multiple occupation (HMO) strategy for 13 years. The duo has been featured in The Times newspaper, appeared on BBC Radio 4, and won three awards at the Property Investor Awards.

Often, when people look at a potential deal, they’ll consider it with only one strategy in mind. For example, when looking at a commercial unit, they might think of transforming it straight into residential housing, without considering the potential for an HMO or mixed-use.

However, combining two strategies when doing a development can be highly profitable, which is something we demonstrated when working with one of our clients. Here is a case study of the project, and how we maximised the development site’s potential.

In early 2024, we helped our client purchase a defunct commercial building in Reading, Berkshire. They became our client as we worked together to purchase the property in their name, and they paid us to build out the project.

The commercial property was arranged as a retail unit on the ground floor, with an outbuilding with ancillary use, and a large two-bedroom flat on the first floor.

Our client wanted to get the maximum value for the property and the maximum rent per annum. The solution was combining the commercial-toresidential strategy with the HMO strategy. However, this would involve permitted development, prior approval, and a full planning application.

HMOs benefit from permitted development rights, which is the right to develop residential houses without planning permission.

Case law (Gravesham Borough Council v SoS and Michael W O’Brien 1982)

has established that the distinctive characteristic of a “dwelling house” is its ability to afford those who use it the facilities required for day-to-day private domestic existence. Whether a building is or is not a dwelling house is a question of fact.

Therefore, as the uppers of the residential property were already a Use Class C3, it would be permitted development to change the uppers under permitted development to HMO Use Class C4. However, as the property is a flat, we would need to apply for full planning to add roof dormers to incorporate the loft into the HMO.

It is permitted development to convert commercial buildings from Use Class E to Residential Use Class C3, but you need to submit a prior approval application to the local council. Prior approval is a formal submission to your local planning authority, and the purpose of it is to seek confirmation that specified parts of a development are acceptable before work can commence.

There are different types of prior approval, which require various levels of detail before a council will assess a proposal. Depending on what you are seeking prior approval for, you could be required to submit information on a wide variety of aspects of the proposal, including:

Design and external appearance

The transport impacts of the development Flooding information

Full planning permission is for a variety of proposals—primarily works to flats and non-residential sites (such as a shop), as well as the creation of new residential units and changes of use. So, basically, if the property doesn’t benefit from permitted development or prior approval rights, you will need to submit a full planning application.

We ended up using permitted development, prior approval, and gaining full planning permission to create:

1 x Retail unit

1 x Studio flat at the rear of the retail unit

1 x Studio flat in the detached outbuilding

1 x 5-bed en-suite HMO

This is how we used the various planning consents:

Prior approval was used to create 2 x residential studio flats.

Permitted development was used to create a 5-bed en-suite HMO on the first and second floors.

Full planning was used to create two dormers to the rear roof elevations.

Now, here is what everyone wants to know:

Purchase price: £320,000

Refurbishment and fees: £275,000

Total investment: £595,000

Gross development value (GDV): £930,000

Monthly rental income: £7,158

Monthly mortgage payment: £4,965

Monthly costs: £700

Monthly net cashflow: £1,793

Think outside the box. The best and most profitable strategy might not always be the most obvious one. The more strategies you know, the more creative you can be in combining them.

Combining investment strategies can be far more profitable than just focusing on one.

Always look out for opportunities that others might miss. The more knowledge you have, the more opportunities you’ll be able to spot.

Connect with the Savoys team on the following handles:

www.savoysproperties.co.uk www.savoyseducation.co.uk savoysproperties savoys properties

Specialist property portfolio and contractual arrangement advice.

At Ison Harrison, our Corporate Lawyers have considerable experience in assisting businesses and investors negotiate terms of Joint Venture and Collaboration Agreements. Our Lawyers' expertise in this field spans across a variety of sectors, structuring Joint Venture Agreements for sharing risk, resources, IP and profits.

Business ventures such as these can be extremely successful and lucrative, but it is imperative to have comprehensive agreements in place at the first instance to define parameters and protect your interests.

We are leading Commercial Property Lawyers who can assist you with a full range of matters on a fixed-fee basis.

Tel: 0113 284 5000 corporate@isonharrison.co.uk

ESSENTIAL

Mike Myerscough Development Acquisitions Manager at CityRise

Navigating the property development landscape can be complex. In today’s competitive market, developers must focus on more than just construction and design; they also need to prioritise a wellconsidered exit strategy.

A profitable and timely exit is vital for recouping investments, freeing up capital for future projects, and maintaining a strong reputation in the industry.

While estate agents have traditionally played a key role in selling properties, the dynamics of the market have evolved. Developers now often find that traditional agents, with their focus on completed properties, may not fully grasp the intricacies of selling off-plan developments. This is where specialised property agencies, which focus on investment properties and off-plan sales, offer a significant advantage.

In this article, we will explore key considerations for property developers when planning their exit strategy. We will cover why a tailored approach is essential, the importance of early planning, and how working with specialists can provide a competitive edge.

The Importance of an Early Exit Strategy

Careful market analysis and early planning are crucial for the success of any property

development project. Yet, many developers make the mistake of considering their exit strategy as an afterthought, focusing solely on the construction phase. However, a wellplanned exit strategy is not just about selling properties; it is about market positioning, understanding the target buyer, and timing the sale appropriately.

What are the benefits of an early exit strategy?

Accurate gross development values (GDV) estimates – Market analysis allows developers to gain a clearer understanding of the Gross Development Value (GDV), which impacts profitability. Maintaining cash flow – Early planning ensures profitability and helps maintain

PRS/BTR Fund

Block Sale (institutional investor/family office/, housing associations)

Retain & Refinance

Selling on Completion (usually owner-occupiers

Off-plan Sales

a steady cash flow, which is essential for ongoing projects and future developments.

Minimising risk – Developers can reduce the likelihood of being left with unsold units, providing better financial security and profit.

Better alignment with market conditions – By planning early, developers can align project timelines with the most favourable market conditions, increasing the likelihood of success.

While this article will focus on fractional offplan sales, it’s important to be aware of the various exit strategies available. Below are the pros and cons of the main types:

• Can get forward funding for the build (construction drawdown) OR

• Can get forward commit (% down in escrow, rest on completion)

• One transaction More focused on numbers rather than aesthetics of the building (good for buildings with F&B or certain office conversions)

• Generate monthly cash flow

• Capital appreciation on the asset

• Can borrow money against these assets

• Typically needed for higher-value houses

• Could achieve higher GDV if the market improves during the build

• Early exchanges give security of sales

• Potential to use buyer deposits for cash flow and paying off finance

• Need to have an extensive track record

• Typically offered a lower GDV

• Involvement of credit committee (it takes a long time to get the deal done and goalposts can change a lot)

• Can often be complicated with prolonged legal process.

• High fall-through rate (sometimes at the 11th hour)

• Buyers typically want to achieve a higher yield than a fractional investor, which reduces GDV

• A highly leveraged position has default risks if not managed properly

• High interest rates

reduce profitability

• Less liquidity for developing larger sites

May not get values on completion

• Can be left with unsold units

• Could get down valuations

• Could reduce GDV if the market goes down during the build

• Higher agency fees

• Could become investor-led if not managed correctly (wrong agent or multiple agents)

Inexperienced developers may buy land and start building without any thought given to the following questions:

Can they achieve the GDV required for a block sale?

Is this the right location for the type of development they plan to build? Has this area experienced positive capital growth?

Is there strong rental demand in this area?

In 2022, CityRise was approached to sell a development fractionally with the following qualities:

18 completed apartments

High-end specification

Located in a small village in South Yorkshire

Expected GDV of £2.9m

We declined at the time because after our initial assessment of the area and meetings with the developer, we knew that:

The anticipated GDV was too high for a block sale, which is why they were now looking at fractional sales.

There had been no rentals in the village for two years.

The developers had already attempted to partner with three alternative sales agents but hired and fired them quickly, meaning the project had already been widely marketed, reducing its desirability.

We have since been approached again two and a half years after completion to aid in selling the units, meaning this developer still has money tied up in a project that simply could not give them the returns they wanted or needed.

The property market operates in cycles, and understanding where a development fits into current market conditions is essential. Comprehensive market analysis should be one of the first steps in planning any project. This includes assessing demand for the type of property being developed, economic factors affecting buyer confidence, and competition in the area.

Timing is equally critical. Launching a development at the wrong time can result in extended sales periods, discounted prices, or even unsold units. By planning ahead, developers can better align their timeline with favourable market conditions, maximising the potential for a successful and profitable exit.

Knowing your target audience is a foundational element in shaping an effective exit strategy. Whether you are targeting first-time buyers, seasoned investors, or

downsizers, each group has unique priorities. For example, investors often prioritise rental yield and long-term appreciation, while firsttime buyers might be more concerned with affordability and location.

Identifying your audience early enables developers to tailor their marketing, pricing, and sales strategies accordingly— significantly improving the chances of a swift and successful exit.

Traditional estate agents are effective at selling completed homes but often struggle when it comes to marketing off-plan developments or projects with multiple units. Their primary focus on completed properties limits their ability to sell based on floor plans or renderings—a key aspect of off-plan sales.

Additionally, many estate agents target owner-occupiers rather than investors, restricting their reach to a broader audience. Their localised marketing efforts further limit access to global investors, who are crucial for selling off-plan properties.

When starting your development project, it’s essential that you’ve thoroughly researched rental appraisals, capital appreciation, and demand for your type of project. If you don’t have the means to do so, then approach a specialised agency.

Specialised property agencies offer several advantages for developers, particularly in selling off-plan properties. These agencies focus on investment properties and understand the nuances of off-plan sales, often boasting extensive networks of investors and tailored marketing strategies.

By tapping into these investor networks and employing bespoke marketing tactics, specialised agencies can secure bulk sales and boost early interest, providing a quicker and more secure exit for developers.

A secure exit requires more than just finding buyers; developers must ensure that reservations turn into firm commitments and manage the mortgage process efficiently for smooth completions.

Securing early exchanges within 28 days of the reservation is key to locking in buyer commitments, reducing the risk of sales falling through, and providing financial security. Close collaboration with specialised agencies can streamline this, offering buyers all necessary information upfront and possible incentives for early commitment.

The mortgage process for off-plan purchases can cause delays, so developers should work with agencies experienced in off-plan mortgage approvals and collaborate with brokers familiar with these challenges. Keeping buyers informed throughout helps prevent delays and ensures timely completions.

Other strategic considerations include setting a competitive pricing strategy, releasing units in phases to create demand, offering early buyer incentives, and staying flexible to adjust pricing or marketing based on market conditions.

For property developers, a well-executed exit strategy is crucial to the success of any project. Early planning, careful market analysis, and partnering with specialised agencies can provide the edge needed to secure a timely and profitable exit.

By following these guidelines, developers can minimise risk and maximise the potential for future success.

Want to discuss your exit strategy? Feel free to contact me below.

mike@cityrise.co.uk

+44 7875 650 164

www.cityrise.co.uk

As you’ll see from the rest of this magazine, articles are written in the first person, coming from the perspective of the author. But this feature is so different, that we decided to take a different approach.

Tom Sumner is the Director of Swish Holiday Apartments, with his business partners, Charlotte and Dave Boxall. Blue Bricks met with Tom to speak about his business, and we decided that it needed to be a main feature in the magazine.

So, this is a two-parter. Part one, which is this article, will focus on Swish as a business, whereas part two will focus on Tom himself, covering his story of going from the military to working as a bodyguard and finally building his wealth through property.

Swish is taking serviced accommodation to new heights. I hope this article inspires you and gives you some ideas to use in your own portfolio—whatever your

investment strategy. More importantly, I hope it helps you to stand out from the competition, boost your revenue, and, if it’s something you’re keen on, build a strong property brand.

I’ve seen high-end holiday lets before. To be entirely honest, I think the words ‘luxury’ or ‘high-end’ are often overused! But when it comes to Swish, if anything, these words aren’t descriptive enough.

Before we dive into this article, let me set the scene. The Swish Apartments comprise two buildings. They’re on a quiet road a stone’s throw from Blackpool Centre. You smell the sea breeze and hear the seagulls squawk as you park on the driveway and prepare to enter.

There is a third hotel underway, but that is currently under construction, so we won’t focus on that in this article.

The first building contains four apartments, and the one to the right of it contains five. Each apartment has a different theme. One of them even has its own indoor cinema with recliner seats! A separate one, The Rockstar, which Tom was kind enough to let my Marketing Manager, Zac, and me stay in, had a beautiful colour scheme of black and gold with showers so big you could get lost in them.

Every apartment feels less like a place you visit and more like an experience. It’s like you want to stay in every one just to feel what it’s like.

I hope that the pictures and the wording in this article do the apartments justice, and give a flavour of what they’re really like.

The Rockstar apartment is where this interview took place, with Tom and Charlotte on one sofa, myself on the other and Zac working the video camera.

Below is a summary of the questions I asked, and the replies that Tom and Charlotte gave.

Sam: “Firstly, thank you for having us. This is a beautiful place, and something special. I want to start the article by telling our readers a little more about you. I know you two met three years ago. Give me a brief background on how you met, and what you were doing before Swish”.

Charlotte: “Before I got into property I had shares in a family business. I’d been in that business most of my life, and I was ready to do something different. Property stood out to me, and I knew that’s what I wanted to pursue.

My shares were worth a good amount of money when I sold them, and I knew that I needed to get educated before investing. So, with the pot of cash I had, I started on a property training course, and that’s where I met Tom”.

Tom: “I was born and bred in Blackpool. I’m a former military man who went into bodyguarding as a medic and slowly got into property by investing the money I was making from my bodyguarding job. I was abroad most of the time and well looked after by clients (and well paid). That left me with a good amount of residual income to invest.

That job was intensive, and as a medic, I saw all kinds of awful things happen. After a while, that takes a toll on you, and I was getting to an age where I wanted to move on.

Leaving my job and coming back to England, I slowly go into property, working on the tools and doing a few refurbishments. It wasn’t until Covid hit that I invested in my education, doing training courses on different strategies, which is where I met Charlotte.

Our relationship built organically. We had tonnes of conversations over a matter of months. We talked about everything from our values, to what we wanted to achieve. It wasn’t a rushed partnership”.

Sam: What made you want to work together?

Charlotte: “Tom knew so much on the course. Whenever he spoke, he was just so full of knowledge. I went home to my husband after meeting Tom and I told him that there was someone really smart on the course who I wanted him to meet.

I knew I wanted to work with Tom as soon as I met him. He knew more than the trainer, so I knew he’d be able to help me invest the money I had from selling my shares. He’s like family to us now”.

Sam: Tom, how did you know so much about property?

Tom: “I just learnt from doing. Everything is risk-based. You can analyse risk as much as you want. That’s what I was doing as a bodyguard in the villages, just analysing risk and quantifying everything and whatnot.

Tom & Charlotte Founders of Swish Holiday Apartments

It’s the same with property. I was buying buyto-lets but always analysing risk to see how I could invest faster or more efficiently. It’s a military thing, go in and ask questions after.

It’s risky, and I’ve had money sat in big projects, mainly because of COVID. I just wanted to learn everything and absorb information, which is why I went on these courses to network. I wanted to be around like-minded people, which was the main reason for going on them.

With masterminds or mentors, you’re paying to learn how to avoid other people’s mistakes. You can lose a lot of money very quickly in property, and if you learn from others, you can avoid doing that”.

Sam: How did Swish come about? You have your normal SAs with the blue sofas and yellow cushions. What made you do things differently? There isn’t much out there like this.

Tom: “I work at a certain level, and everything must be at a certain level, or I won’t do it. I’m always looking for ways to make things better and improve.

It was quite organic. We weren’t doing this initially. I was doing a commercial conversion and splitting the titles at the time this came up through an agent. Since me and Charlotte had recently done a serviced accommodation course, we thought we’d give it a go.

We did all the design between us. It was a lot of late nights and time spent planning. We’re willing to go all out in everything we do, and we both have high standards”.

Sam: “I understand that, and I share the mindset around doing things to a high standard. But Blackpool does not have the best reputation. What made you decide to go high-end here and take things to the next level?”

Charlotte: “It’s a bit of a risk, and I like to take a risk with things. We genuinely

didn’t know if people would spend a lot of money to stay somewhere high-end like this.

Me and Tom were financing the deal, so that allowed us to take the leap.

Everyone’s shocked when I say I’m coming here for business meetings. I love proving people wrong because this project is exceeding our expectations.

I trust Tom, so when he told me there’s a lot of investment going into this area, I followed him. There’s a lot coming to this area that people don’t know about, which makes it an ideal hotspot for us”.

Tom: “We have gone out of our way to network with business owners who are doing good things in the area. We know what’s coming up, and we can see that in the figures.

We have a lot of commercial clients and people involved in the construction game. We wouldn’t have known we’d get those types of clients if we didn’t go out networking and put ourselves out there”.

Charlotte: “The way that people travel has changed. Guests want to stay somewhere that isn’t like their own home. We want to give them an experience, and we know that people will pay for that experience”.

Sam: With this being so different to anything in the area, how did you check comparables? There’s no real ‘like for like’ to go against.

Tom: “In business, you are either better than the competition or cheaper.

We found that everyone talks about occupancy rates all the time. We’re not bothered about occupancy rates, because we are charging £500-£600 a night on some apartments.

We want clients who are coming here to enjoy themselves and spend a few days in

Blackpool. With our rates, 50% occupancy is still more than all our competitors make at 80%.

I always work on the worst case. When we analysed this deal, we did it on 45% occupancy. Banks take a pessimistic look too, so we needed a worst-case scenario in case we refinance under a commercial mortgage. We’ve been at 100% occupancy through parts of the summer.

We knew we’d do well, but we had no idea we’d do this well”.

Sam: That’s great. What does one apartment bring in on average?

Charlotte: “It depends. The Grandstand is about £410 per night. The High Roller is around £280. The Rockstar is £360, and the one beds are on for £175. It’s a bit higher on Booking.com, as we have to pay for those fees.

We did £5,000 last week, and we did £12,000 in two weeks in August. We’ve just opened this building, so those figures are just from five of the apartments”.

Tom: “When next door is fully ready we’ll be doing around £229,000 per year at 60% occupancy”.

Sam: What was the purchase price for each block?

Tom: “So, the purchase price was £220,000 for next door. This one was £300,000, and we bought it off-market. The first one was through an agent, we got this one by knocking on the door and speaking with the vendor.

We’ve just bought a third one across the road, which is under construction, and that was through an agent as well”.

Sam: Those aren’t bad prices for two big buildings. What state were they in when you bought them?

Tom: “Next door was derelict. It was a hotel, and then someone rented it from the owner. What the person who rented it decided to do was to cut it up into lots of individual units, so about 20 people were living there.

This building that we’re currently in was really nice and was a fully functioning hotel.

The problem was that they were both old properties, so we had to do a lot of rebuilding. All the bays on the other block are brand new, and we had to rebuild the fronts of both buildings, taking off the roofs and putting new steels in. They looked great aesthetically, but when you peeled them back, they were ruined”.

Sam: Did you face any issues on the build?

Tom: “There were some structural issues next door. The previous owners decided to take part of the spine wall out, so the floors were all dropped down. We had to jack the floors back up and put steels throughout the building…which was quite an interesting job to do, and required full planning”.

Sam: One thing I love about these apartments is that you decided to put a full cinema inside one of them! What made you decide to do that?

Tom: “So many people say they have a cinema room. They’re not proper ones, they just have a big TV. We wondered what would happen if you put a proper one in, with tiered seating, speakers in the ceiling, subs under the floor and shadow lighting.

As a unique selling point, it works. I know people who build cinemas, and they have come in and said it’s the best they’ve ever seen. The TV on the wall is 100 inches. We’ve even soundproofed the room so that people in the other apartments can’t hear it”.

Sam: Let’s talk about Swish. You obviously go for luxury, but what motivated you to do this?

Tom: “Do it properly. Look at the market. People are just throwing a few cushions on a sofa and saying ‘Look at my serviced accommodation’. I looked at high-end hotels and thought, actually, serviced apartments could be like that.

If you look at some of our rooms, with a group booking, it’s only £60 a night each, and it gives people the opportunity to be in a £50,000-£60,000 bathroom.

Some of the rooms are so relaxing that you can come here to get away. We have had show directors come from London saying they’ve paid four times more for a hotel room down there than that’s just‘standard’ than they have paid us for a whole luxury apartment.

We’ve had influencers and celebrities here, like Dapper Laughs, people from Coronation Street, Big Brother, and Emmerdale. We’ve even got some A-list celebrities lined up to stay next year”.

Sam: Do you think your military background helps?

Tom: “100%. You never get out of that. I joined when I was 16. I was so young that I’ll never get out of that mindset.

Bringing the military thing across to property works perfectly. It’s all about being efficient and timely, but that being said, I couldn’t do it without my team.

We have our own construction company under Swish. I am direct, and the lads on the tools don’t take that personally. They understand that’s how I am. They’re so good at what they do now because the way we do everything is systematic, and we push the boundaries.

Charlotte is direct too, which is why we get along so well. We work a project ahead, and we all have our own roles. So, while I’m managing the lads on site, Charlotte and Dave are getting the pictures, furniture, frames and everything else ready for the project the lads have just finished on.

Everyone sees the building site and what it looks like after. Few people understand what goes on behind the scenes”.

Sam: Every apartment you enter, it’s like “wow”. And that doesn’t stop as you go around. It can’t have been cheap to do that. What were your build costs like?

Tom: “…Astronomical. Thankfully, it’s us doing it all with our own in-house team. If we tried an external contractor, they wouldn’t take this job on. Everything is so bespoke. No one room is the same. It’s impossible to cost. It cost us a few million to do both buildings. That includes the furnishing. You can’t do something of this quality without the finance to do it. It’s hard to obtain financing because there are no comparables for lenders to look at”.

Sam: Have you had a rough valuation on the building yet?

Charlotte: “If it’s valued commercially, then it’ll be multi-millions over the business”.

Sam: How long did the whole project take?

Charlotte: “Around 16 months. We had a lot to deal with in terms of planning. We also use a lot of tech, which took time to integrate. All the doors can be locked or unlocked from our phones, from anywhere in the world.

We also needed a guest portal to send the codes to the locks out, and we had to invest in a property management system. Three years ago, I didn’t know any of this stuff, and we had to learn quickly and throw ourselves in the deep end!

Codes can be sent to guest’s phones via an app, and they can access the main door and their apartments using those.

On the app, guests can even see restaurants and bars we recommend, and we have affiliate schemes with them where our guests get a discount.”

Tom: “We do that to help local businesses. It’s great for us because we get to try them all out to see where’s good”.

Charlotte: “The cocktail bar is very popular…”

Sam: “I know you don’t shout about this, but it’s important to me that we talk about it. I know you are doing a lot with local charities. Before we started this interview, I saw a family’s reaction when you let them stay in the apartment with the cinema room for free for two nights, and piled it with gifts, balloons and sweets for their little girl’s birthday, who suffers from a severe illness. It’s one of the best things I’ve ever seen”.

Charlotte: “With the fortunate position we’re in, it’s important to give back. With the girl in the Grandstand, she had a wish list where she wanted to come to the seaside, ride a donkey, and go to the cinema. We saw this and decided to give her an experience she wouldn’t forget.

There’s another person we are working with who has a vision for Blackpool where every child is within 20 minutes from a local youth club. He’s also setting up an apprenticeship scheme to train kids to be youth workers. His cause means a lot to us”.

Sam: I hope this article inspires people. It’s inspired me just walking around this place. If people want to do something like this, what’s your advice?

Charlotte: “Throw yourself in the deep end”.

Tom: “CALCULATEDLY throw yourself in the deep end!

There is no substitute for working hard. You have to know what you want to do, and you need a vision to get there”.

Charlotte: “You need to know your WHY”.

Tom: “You can do all these big things in property or business, but if all the money disappears tomorrow, you need to know how to earn it back. You need to have that drive, but it’s not just about that. You have to sustain what you’re doing.

You have to have a bit of mindset there first, and then get the skillset. Try and self-educate yourself in different areas, and then get a good mentor. Someone with good values who can give you feedback. Selfpraise is no praise.

Be consistently consistent and persistently persistent.

Know your end game. Are you building a portfolio for yourself, or to pass it to your family, or something else? For me, I want to pass everything I have, and everything I’ve learnt, onto my son”.

Sam: What advice do you both have about building that mindset?

Tom: “You need structure and discipline. You need a routine. Work on three or four things a day and achieve those things. That will prevent overwhelm.

Make sure the goals you set are achievable, but with your long-term goals, push the boundary.

If you don’t believe in yourself, who will? If you believe in yourself, then people will see that and join you.

Write down your goals, and that will bring you forward”.

Charlotte: “My mindset is different from Tom’s because he’s ex-military. My mindset comes from the things I’ve achieved or overcome, and I don’t have much self-doubt anymore.

The best thing I have learnt to do is block out negative energy and people who don’t believe in me.

I read inspirational books from people who have overcome adversity, and I soak it up. You almost have to walk through life a bit

to develop a strong mindset. There is no easy path”.

Sam: What Does the future hold for Swish? What’s the end goal?

Tom: “We have another hotel on the go, and we’re looking at a few HMOs. Then we have our buy-to-lets on the side, which is our bread and butter.

We want to set up a charity which will be a part of Swish. What we’re also doing every quarter is supporting a different local charity and doing some fundraising alongside other local businesses.

We want to give back massively and give respite to families who need it. Especially families who are caring for children with lifelong or terminal illnesses.

Our mission is to keep this standard. We’re building a brand, and we’re even working on an underground cinema in the next hotel. Another thing we are doing is catering for dogs and installing dog showers!

Swish as a brand is always developing and improving. We want customers to come in, and go ‘you know what? That is the best place I’ve ever stayed’”.

Charlotte: “We have had summer and Christmas bookings for 2025. It gives us confidence that what we’re doing is working”.

Sam: Tom, Charlotte, thank you so much for everything. I can’t wait to publish this. If people want to contact you, what’s the best way to do that?

Tom: “Facebook or Instagram Instagram is Swish_apartments. Facebook is Swish Holiday Apartments. Or connect with me on LinkedIn, which is under my name, Tom Sumner. If you want to stay with us, then booking direct is much cheaper”.

Closing Thoughts – Sam Cooke

I love learning about the mindset of different people. Alongside that, I love to learn from people who do things differently from ‘the norm’.

Tom, Charlotte and Dave-who I unfortunately didn’t get to meet – are definitely doing that.

Even if you’re not interested in taking over the world, or working on a project of this complexity, I hope that this article inspires you, or gives you a few tips that either strengthen your mindset or allow you to maximise the results you’re getting from your property portfolio.

Stay tuned for our next issue, where we take a deep dive into Tom’s life, explore his journey and dig deeper into that military mindset.

Connect with the Swish team

Swish_apartments

Swish Holiday Apartments swishholidayapartments.co.uk

Most people see the word ‘leasehold’ and run a mile. I think that’s partly because not everyone understands what a leasehold is, and partly from fear of what leaseholds sometimes bring, like high ground rent or service charges.

However, if you understand leasehold properties and know how to navigate ones with a short lease, they can go from a source of fear to a source of opportunity—a source of opportunity that can add significant value to your next property deal.

This is the short lease extension strategy, how it works, and how you can use it to add up to 25% to a property’s value.

My property career started in 2001 while I worked a full-time job stacking bread at the local supermarket. I became something of a bread expert, and as I worked my way up the ranks, I occasionally got promoted to the freezer aisle (not fun if you didn’t bring a jacket).

The problem was, I didn’t see a future at my job. My managers weren’t getting paid much more than me, and I saw the way that area managers talked down to them. After deciding to take control of my future, I began stacking money alongside the bread and soon had enough to buy a vanilla buy-to-let.

I did this for years, working part-time as a college maths lecturer for extra money, and working every bit of overtime I could. I bought 1-3 properties a year from my savings, soon building a portfolio that allowed me to leave my job.

But it wasn’t the day I left the supermarket behind that changed my life. It was in 2003 when I invested in my second property: a leasehold flat.

In 2001, property was a side thing to me, so I wasn’t an expert. That’s why, when I bought my first leasehold flat, I wasn’t aware of what marriage value was.

Marriage value definition: Marriage value refers to the increase in value of a leasehold property after its lease is extended beyond 80 years.

My property was just about to drop below an 80-year lease, and it was my friend who pointed out to me that, when this happens, the property begins to lose value. I contacted the freeholder and got an extension from an 82-year lease to a 125-year one, and it only cost me £1,000 (I think he felt sorry for me as I was young and naive). For just £1,000, I’d increased the value of my second property substantially. From there, I fell in love with leasehold opportunities.

You find a property with a lease that is close to or less than 80 years. Because it has a short lease, it is typically worth less (so you can buy it for a discount).

You then negotiate with the freeholder to extend or buy the lease. Either option immediately adds 20-25% to the value of the property. It’s like a paper version of the buy, refurbish, refinance (BRR) strategy!

Before we dive into the nitty-gritty of this strategy and the things you need to look out for, let’s clear up some definitions.

FREEHOLD: Freehold means that you own the land that your property or unit resides on. There are no limits on ownership, and you are free to change the property in any way, providing you have the correct planning permission.

LEASEHOLD: Leasehold is when you own a property or unit, but you don’t own the land it’s on. You mainly see this with flats and apartments. A leasehold means you’re leasing the land for a certain number of years. In these instances, you usually have to pay ground rent to the landowner. Sometimes you will pay a service charge to a block management company. This payment goes towards the upkeep of communal areas, including things like clearing bins and landscaping the gardens.

The best opportunities are properties with a short lease that need refurbishment work and can be reconfigured to add an extra bedroom or create more space. I call these opportunities the triple threat because you’re adding value in three separate ways.

Jason Patterson Property Investor & Short-lease Expert

To make sure we are on the same page, this is a quick summary of how short lease extensions work:

With lease extensions alone, I was making £30,000-£50,000 per flat. It’s a good strategy if you get it right. I don’t always extend the lease immediately. Sometimes I’ll hold the property for a couple of years, benefit from the rental income, and then extend it. This allows me to save money or invest it in another deal rather than paying for the lease extension straight away.

You might be wondering why this strategy isn’t used by everyone. It almost sounds too good to be true. The reason some people avoid leaseholds is because the ground rent and service charges put them off.

On top of that, the cost of extending a lease isn’t always cheap. Sometimes, it can cost in excess of £20,000. But if you think about it, that’s the cost of a refurbishment.

The biggest barrier to entry is that many lenders don’t like lending on properties that have a short lease. This means that you often have to buy the property with cash or bridging finance. I’ll cover this in more detail further down the article.

Is There a Risk That You Won’t Get Your Lease Extended?

Under Section 42, so long as you have owned the leasehold property for at least two years, the freeholder is legally obliged to extend your lease. Michael Gove changed this law from 24 May 2024. Now, you can extend your lease from day one rather than waiting for two years of ownership. I’m not sure how this will change now Labour are in power. This law should be implemented within two years.

Mortgages are available depending on the length of the lease

There is the informal route, which is to approach the freeholder on your own and negotiate an extension. I prefer this route, as it doesn’t create any animosity. It also gives me the option to buy the freehold, providing the owner is open to it, and then extend my own lease.

I do this because, if you want to reconfigure a property (by moving the kitchen or adding a bedroom, for example), you need the freeholder’s permission. This is known as a Consent to Alter.

The easiest places to look are online property portals. Look for any listings that say ‘cash buyers only’ or ‘low lease’.

I have also found a few deals at auction. I do pre or post-auction because you can find unsold opportunities this way. It’s like rooting through a rubbish tip for gold! You tend to find unsold leaseholds here because people don’t understand what they are or know what they’re doing when it comes to extending them.

As soon as the lease drops below 70 years, lenders start to drop off. At this point, you’re looking at buying with either cash or bridging

finance mainly. Although mortgages are available depending on the length of the lease and the type of property.