INHERITANCE TAX insurance

Inheritance Tax insurance is a type of life insurance policy that can be set up to provide liquidity to fund Inheritance Tax liabilities that may arise on death. Such policies can be set up to fund Inheritance Tax liabilities that may arise on an individual’s estate, on a lifetime gift, or both.

Policies can be set up for an individual or a married couple, with the policy length set to last for a specific term or whole of life. The cover amount can be fixed, in which case, the premium can be guaranteed whilst the policy remains in place. Alternatively, it may be possible for the cover amount to be set up to increase annually, to help mitigate against a future growth in asset values. In this scenario, the premium will also increase.

CASE STUDY ONE

Most importantly, if an individual’s circumstances or Inheritance Tax legislation changes, the policy can be adjusted. For example, the cover amount under the policy can be reduced, and the premium will also reduce. Alternatively, the policy can be cancelled at any time, and there will be no further premiums due following cancellation.

Once set up, it may also be necessary for policies to be settled in a trust, to ensure that the sum paid out following death can be accessed quickly, and to ensure that no tax arises on the sum when it is paid out. This is a straightforward process to undertake, and insurance companies will provide their own trust deeds which can be used without charge. Alternatively, individuals may opt for their lawyer to draft a trust deed.

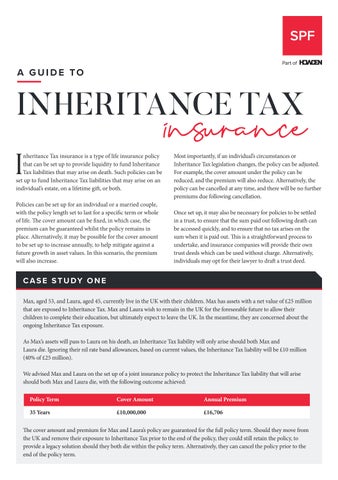

Max, aged 53, and Laura, aged 45, currently live in the UK with their children. Max has assets with a net value of £25 million that are exposed to Inheritance Tax. Max and Laura wish to remain in the UK for the foreseeable future to allow their children to complete their education, but ultimately expect to leave the UK. In the meantime, they are concerned about the ongoing Inheritance Tax exposure.

As Max’s assets will pass to Laura on his death, an Inheritance Tax liability will only arise should both Max and Laura die. Ignoring their nil rate band allowances, based on current values, the Inheritance Tax liability will be £10 million (40% of £25 million).

We advised Max and Laura on the set up of a joint insurance policy to protect the Inheritance Tax liability that will arise should both Max and Laura die, with the following outcome achieved:

The cover amount and premium for Max and Laura’s policy are guaranteed for the full policy term. Should they move from the UK and remove their exposure to Inheritance Tax prior to the end of the policy, they could still retain the policy, to provide a legacy solution should they both die within the policy term. Alternatively, they can cancel the policy prior to the end of the policy term.

CASE STUDY TWO

Costas, aged 75, and Marie, aged 69, currently live in Switzerland. They own a UK residential property that they are jointly gifting to their daughter.

The value of the property at the time of gifting is £9.75 million. As such, Costas and Marie will each be deemed to have made a gift of £4.875 million. As the gift amount by each of them will exceed their nil rate band allowance, an Inheritance Tax liability will arise should either of them die within seven years of the gift. The exposure for each of them is £1.82 million for the first three years following the gift and will reduce in line with taper relief each year thereafter.

We advised Costas and Marie on the set-up of two separate insurance policies to protect the Inheritance Tax liability that will arise should either of their deaths arise within 7 years of the gift to their daughter, with the following outcome achieved:

£1,456,000

Premiums Payable

£1,820,000

£1,456,000

£1,092,000

£728,000

£364,000

Premiums Payable £1,820,000 £1,820,000

£11,849

£11,849

£11,849

£9,601

£7,353

£5,105

£2,654

£60,260

As the Inheritance Tax exposure on the gifts from Costas and Marie will reduce over the 7 years, in line with taper relief, the cover amount of £1.82 million for each policy was set-up to reduce over the policy term to match the reducing tax exposure, and the annual premium will also reduce accordingly.

CASE STUDY THREE

Cedric, aged 44, currently lives in the UK with his wife, Tatiana, and their children. Cedric is deemed UK domiciled and has assets with a net value of £50 million that are exposed to Inheritance Tax. Cedric and Tatiana wish to remain in the UK for the foreseeable future, but ultimately expect to leave the UK. In the meantime, they are concerned about the ongoing Inheritance Tax exposure.

Although Cedric’s assets will pass to Tatiana on his death, Tatiana is non-UK domiciled which means an Inheritance Tax liability could arise on Cedric’s sole death. Ignoring Cedric’s nil rate band allowance, based on current values, the Inheritance Tax liability will be £20 million (40% of £50 million).

We advised Cedric on the set-up of an insurance policy to protect the Inheritance Tax liability that will arise should he die, with the following outcome achieved:

The cover amount and premium for Cedric’s policy are guaranteed for the full policy term. Should he and Tatiana move from the UK, and the exposure to Inheritance Tax be removed prior to the end of the policy, Cedric could still retain the policy, to provide a legacy solution should he die within the policy term. Alternatively, he can cancel the policy prior to the end of the policy term.

CONTACT US

To find out more about Inheritance Tax insurance, please contact:

Rob May TEP

Director - Private Office

+44 (0)20 7330 8586 rmay@spf.co.uk

Henry Wood APFS

Associate - Private Office

+44 (0)20 7330 8519 hwood@spf.co.uk

The case studies included in this guide reflect completed business but names have been changed to maintain client anonymity.

Advice must always be taken before implementing a life insurance solution. Clients should not take or refrain from any action based on the contents of this guide. Tax benefits depend on circumstances and tax rules can change. If in doubt, please seek specialist tax advice.

SPF Private Clients Limited is authorised and regulated by the Financial Conduct Authority (FCA).

The FCA does not regulate taxation advice. www.spf.co.uk