GAS: Korea, Vietnam and Cold War

his time in the U.S. Air Force he was lucky to always have fying jobs.

“I got in because I didn’t want to be sent to Korea,” said Meppen. He wanted a choice, or as much as a person could have in the military. However, not long after the confict in Korea subsided, he was sent to Vietnam.

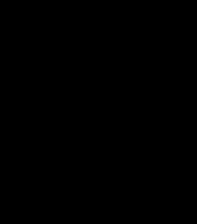

He was stationed at U-Tapao Royal Thai Navy Airfeld for much of his time in Southeast Asia. While he was there, one of the things he did was fy sorties with the F-105 Thunderchiefs, over Thailand and Laos, to the border with North Vietnam. He would wait in the air as they went in to make their bombing runs.

Those F-105s were bomber-fghters, and had a reputation for confdent and seasoned pilots. According to Meppen, the pilots were also a partying bunch, but he always revered those guys. He said he felt bad for them, because they had one of the most dangerous jobs in the air over Vietnam. According to Valiant Air Command, a museum that chiefy features war planes, out of 833 Thunderchiefs that were produced, 382 were lost in Vietnam. Meppen’s job was to refuel these fghters right before they would fy in to do their strikes, and he would rendezvous with them as they headed back out of Vietnam to refuel again and head home.

Meppen spoke of the typhoons that would come through during the monsoon season, where it could become so dark a person couldn’t see out the windows. During one of these, two B-52 bombers, fully loaded with ordnance, collided mid-air of his right wing. He saw the blast and felt the concussion wave, but never was able to see them impact due to the poor visibility.

Later in his career, he spent a lot of his time in air bases during the Cuban Missile Crisis and the Cold War. Working for SAC, he was part of the response, in case the Soviet Union decided to retaliate. He remembers, during the crisis, an alarm blaze, sending them to load into their planes, ready to take of, waiting for an order that thankfully nev er came. If it had, he would have fown out to refuel planes as they started fying over to fght World War III, and poten tially the nuclear destruction of Earth.

For the length of the Cold War, Mep pen said there always had to be B-52s in the air, and those crews would often fy for 24 hours straight, and they needed to refuel in-air. On missions, he could often fnd himself in the air for around 16 hours at a time. “We like to say we

Eventually, the Cold War dropped further in temperature, and later, SAC was disestablished in 1992. Meppen retired before that. He sold real estate in Priest Lake, Idaho, for around 17 years, and after that, spent four years with his wife in Guam. She taught school while they were there, and he said he was a “house husband,” playing bridge and golf. In fact, now at Sapphire Lutheran Homes, in Hamilton, Meppen says the golf is what he misses most. He and his wife liked Charleston, South Carolina, and they ended up moving there for 25 years. For him, it was about the year-round golf. While in South Carolina, he spent 13 years with National Car Rentals driving rental cars around,

His family was stationed in northern Maine while he was in Spain for a time. While he was there enjoying the good weather, he said he felt bad that his wife was at home, shoveling snow. “Enough isn’t said for the wives and families,” Meppen said. Armed Forces families often need to be just as emotionally tough as their service members, often not knowing where they will be sent and unsure if their person will make it home every time they

A KC-135 refuling F-105 Thunderchiefs during the Vietnam War. U.S. Air Force photo, courtesy National Museum of the Unites States Air Force.

DITCH COSTLY

HEATING BILLS with an EPA certifed Central Boiler Classic Edge Titanium HDX OUTDOOR WOOD FURNACE. Call today for efcient warmth!

Axmen 7655 US Hwy 10 W Missoula MT 406-7287020 www.axmenmt.com steve@axmen.com

SWITCH AND SAVE

UP TO $250/YEAR ON YOUR TALK, TEXT AND DATA. No contract and no hidden fees. Unlimited talk and text with fexible data plans. Premium nationwide coverage. 100% U.S. based customer service. Limited time ofer - get $50 of on any new account. Use code GIFT50. For more information, call 1-877324-0193.

Get DISH Satellite TV + Internet! Free Install, Free HD-DVR Upgrade, 80,000 On- Demand Movies, Plus Limited Time Up To $600 In Gift Cards. Call Today! 1-855- 995-3572

CONNECT TO THE BEST WIRELESS HOME INTERNET WITH EARTHLINK. Enjoy speeds from 5Gand 4G LTE networks, no contracts, easy installation, and data plans up to 300

GB. Call 855-419-7978.

GET YOUR DEDUCTION AHEAD OF THE YEAR-END! Donate your car, truck, or SUV to assist the blind and visually impaired. Arrange a swift, no-cost vehicle pickup and secure a generous year-end tax credit. Call Heritage for the Blind Today at 1-855- 901-2620 today!

IF YOU HAD KNEE OR HIP REPLACEMENT SURGERY and sufered an infection due to use of a Bair Hugger (Blue Blanket), between 2020 and the present time, you may be entitled to compensation. Call attorney Charles H. Johnson 800/535-5727

PORTABLE OXYGEN CONCENTRATOR May Be Covered by Medicare! Reclaim independence and mobility with the compact design and long-lasting battery of Inogen One. Free information kit! Call 855-7621508

SAFE STEP. NORTH AMERICA’S #1 WALK-IN TUB. Comprehensive lifetime warranty.Top-of-theline installation and service. Now featuring our FREE shower package and $1600 Of for a limited time! Call today! Financing available. Call Safe Step 1-855-6012865.

THE CATERED TABLE NEEDS A CHEF ASSISTANT, Full Time, MUST have experience, will train you on our menu. Send or drop of resume at: Catered Table, 205 Main St. Stevensville, Call (406) 777-7090 or email at www.cateredtable.com for appointment. Salary based on experience.

INDEPENDENT LIV-

ING SPECIALIST – Hamilton: Full-time, starting wage $19/hr. Position provides individual advocacy and resource development; information and referral; skills training; facilitation of workshops; consumer service coordination, nursing home and youth transition; and other community integration services. Position conducts advocacy, outreach, and public education activities designed to improve service systems; increase public understanding of disability issues, improve community resources; and advance civil rights of people with disabilities. Job description and application at https:// www.summitilc.org/about/ employment. Contact: Alan Fugleberg, Deputy Director, 406-363-5424, Ext. 1.

SALON BOOTH RENTAL AVAILABLE, TRENDZ SALON, $350 a month in Hamilton, for more info call

(406) 381-8379 or (831) 905-5016.

FRESH EGGS from Howell’s Happy Hens are back! $5.00/doz. Pick up at Bitterroot Star ofce, 115 W. 3rd, Suite 108, Stevensville.

LOOKING FOR GOOD READING MATERIAL? Try local author, Jane Lambert’s nationally acclaimed books “Charlie Russell the Cowboy Years” or “Makin’ Tracks with my Horses and Mules.” Both received medals from the Will Rogers Medallion Awards, and both are available at Valley Drug, Stevensville, and at Chapter One, in Hamilton.

Looking for the Bitterroot Star? It’s FREE on more than 100

Montana 21st Judicial District Court, Ravalli County

In the Matter of the Name Change of Leslie Porter, Leslie Porter, Petitioner.

Cause No.: DV-25-142

Dept. 1

NOTICE OF HEARING ON NAME CHANGE

This is notice that Petitioner has asked the District Court for a name change from Leslie Walter Porter to Leslie Walter Jessop.

The hearing will be on June 4, 2025 at 1:30 p.m. The hearing will be at the courthouse in Ravalli County.

DATED this 21st day of April, 2025.

/s/ Paige Trautwein Clerk of District Court /s/ Sarah Sargent

Deputy Clerk of Court

BS 4-30, 5-7, 5-14, 5-21-25.

MNAXLP

PUBLIC NOTICE

The Darby Study Commission will hold a Public Hearing to receive comments oral or written of the Tentative Report of the proposed changes to the form of government for the town of Darby. A copy of the tentative report can found online at www.darbymt.net The Public Hearing will be held May 15, 2025, 5:30 pm at the Darby Clubhouse, 106 N Main Street, Darby, Montana. BS 4-30, 5-14-25.

MNAXLP

William J. Nelson, Esq. Nelson Law Ofce PLLC 217 North 3rd Street, Suite J Hamilton, MT 59840

Telephone: (406) 3633181

Attorney for Personal Representative

MONTANA TWENTY

FIRST JUDICIAL DISTRICT COURT, RAVALLI COUNTY IN RE THE ESTATE OF: FREDA JO BRAWLEY, Deceased.

Cause No. DP-2024-68

Dept. 2 NOTICE TO CREDITORS NOTICE IS HEREBY

GIVEN that the undersigned has been appointed Personal Representative of the abovenamed estate. All persons having claims against the decedent are required to present their claims within four months after the date of the frst publication of this notice or said claims will be forever barred.

Claims must either be mailed to the Personal Representative, ANITA BRAWLEY, return receipt requested, c/o Nelson Law Ofce PLLC , 217 North Third Street, Suite J, Hamilton, MT 59840, or fled with the Clerk of the above Court.

DATED this 28th day of April 2025.

/s/ William J. Nelson

Attorney for Personal Representative /s/ Anita Brawley

Personal Representative

BS 4-30, 5-7, 5-14-25. MNAXLP

MONTANA TWENTY-FIRST JUDICIAL DISTRICT COURT, RAVALLI COUNTY IN THE MATTER OF THE ESTATE OF AUGUSTA JOY CLARKE, AKA JOY BROWN CLARKE, Deceased.

Probate No.: DP-2025-45

Dept. No.: 2 NOTICE TO CREDITORS NOTICE IS HEREBY

GIVEN that Edward Clarke has been appointed Personal Representative of the abovenamed estate. All persons having claims against the said Decedent are required to present their claims within four (4) months after the date of the frst publication of this notice or said claims will be forever barred. Claims must either be mailed to Edward Clarke, the Personal Representative, return receipt requested, at c/o Montana Legacy Law, PLLC, 178 South 2nd St., Hamilton, MT 59840, or fled with the Clerk of the above Court.

NOTICE THAT A TAX DEED MAY BE ISSUED IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

1139 Hamilton Heights Rd.

Corvallis, MT 59828

Philip A. DiJoseph Jr. 1139 Hamilton Heights Rd. Corvallis, MT 59828

Philip A. DiJoseph Jr. PO Box 638

Darby, MT 59829

Philip A. DiJoseph Jr. PO Box 638

Darby, MT 59829-0638

Philip A. DiJoseph Jr. 405 Pennsylvania Ave. Hamilton, MT 59840

Philip A. DiJoseph Jr. 70 Less Traveled Rd. Darby, MT 59829

Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000091 and Tax Code Parcel No. 179511 as follows:

Lot 1, Skysong Farm, Ravalli County, Montana, according to the ofcial recorded plat thereof.

Street address: 1139 Hamilton Heights Rd., Corvallis, MT 59828. The property taxes became delinquent on May 31, 2022.

The property tax lien was attached on August 1, 2022.

The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $6,629.83

PENALTY: $96.64

INTEREST: $1,375.37

COST: $281.57

TOTAL: $8,383.41

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed auction will be held within 60 days of the tax deed application date.

Any surplus funds resulting from the auction will be distributed to the legal titleholder of record.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton, MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed auction.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

BS 5-7, 5-14-25.

MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED

IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Philip A. DiJoseph Jr.

405 Pennsylvania Ave. Hamilton, MT 59840

Philip A. DiJoseph Jr.

PO Box 638

Darby, MT 59829

Philip A. DiJoseph Jr.

PO Box 638

Darby, MT 59829-0638

Philip A. DiJoseph Jr. 1139 Hamilton Heights Rd.

Corvallis, MT 59828

Philip A. DiJoseph Jr.

70 Less Traveled Rd.

Darby, MT 59829

Ravalli County Treasurer

215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000218 and Tax Code

Parcel No. 499510 as follows: Lot 3B, Amended Subdivision Plat No. 574229, being a portion of Lot 3, Block 37, Riverview, Ravalli County Montana, according to the ofcial recorded plat thereof.

Street address: 405 Pennsylvania Ave., Hamilton, MT 59840.

The property taxes became delinquent on May 31, 2022.

The property tax lien was attached on August 1, 2022.

The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $7,416.51

PENALTY: $116.63

INTEREST: $1,722.97

COST: $281.57

TOTAL: $9,537.68

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed may be issued to the assignee or county that is the possessor of the tax lien on the day following the date that the redemption period expires.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed issuance.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten

Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

BS 5-7, 5-14-25. MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED

IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

213 Luby Ln.

Florence, MT 59833

Robin D. Pearson

213 Luby Ln. Florence, MT 59833

Robin D. Pearson

Robin D. Pearson PO Box 145

Florence, MT 59833

Collection Bureau Services Inc. PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

c/o Michael J. Moore PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

c/o Erica T. deVries PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

212 E. Spruce St Missoula, MT 598024502

Collection Bureau Services Inc.

c/o Jennifer Whipple, Registered Agent

212 E. Spruce St

Missoula, MT 59802

Ravalli County Treasurer

215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Ofce under Tax Lien Certifcate 2021000594 and Tax Code Parcel No. 1465100 as follows:

A tract of land located in the SE¼ of Section 26 and the NE¼ Section 35, Township 10 North, Range 20 West, P.M.M., Ravalli County, Montana, and being more particularly described as follows: Commencing at the South ¼ corner of Sections 26, Township 10 North, Range 20 West, P.M.M: thence N.17°48’38” East 697.24 feet to the point of beginning and a point on a non-tangent curve with radius being N.26°thence counterclockwise along said curve an arc distance of 100.00 feet; thence N.47°05’37” East, 225.61 feet; thence S.43°55’34” East, 1115.13 feet to a point in the thread of a side channel from the Bitterroot River; thence S.29°39’31” West, 246.00 feet along said thread; thence S.07°39’30” West, 162.00 feet along said thread; thence S.40°39’37” West, 47.49 feet along said thread; thence N.40°09’31” West, 1312.66 feet to the true point of beginning.

Recording Reference Book 216 of Deeds, page 496

Also shown of record as:

A tract of land located in the SE¼ of Section 26 and the NE¼ Section 35, Township 10 North, Range 20 West, P.M.M., Ravalli County, Montana, and being more particularly described as follows:

Commencing at the South ¼ corner of Sections 26, Township 10 North, Range 20 West, P.M.M: thence N.17°48’38” East 697.24 feet to the point of beginning and a point on a non-tangent curve with radius being N.26°thence counterclockwise along said curve an arc distance of 100.00 feet; thence N.47°05’37” East, 225.61 feet; thence S.43°55’34” West, 1115.13 feet to a point in the thread of a side channel from the Bitterroot River; thence S.29°39’31” West, 246.00 feet along said thread; thence S.07°39’30” West, 162.00 feet along said thread; thence S.40°39’37” West, 47.49 feet along said thread; thence N.40°09’31” West, 1312.66 feet to the true point of beginning.

Recording Reference Book 155 of Deeds, page 419 Street address: 213 Luby Ln, Florence, MT 59833.

The property taxes became delinquent on May 31, 2022.

PENALTY: $67.72

INTEREST: $1,005.21

COST: $281.57

TOTAL: $5,625.73

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed may be issued to the assignee or county that is the possessor of the tax lien on the day following the date that the redemption period expires.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed issuance.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY BS 5-7, 5-14-25. MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

894 Doty Lane

Corvallis, MT 59828 Jason Wilcox

894 Doty Lane

Corvallis, MT 59828

Jason S. Wilcox

894 Doty Ln

Corvallis, MT 59828 Jason Wilcox 321 Coyote Butte Rd. Hamilton, MT 598409136

State of Montana Department of Revenue PO Box 6169

Helena, MT 59604-6169

State of Montana Department of Revenue PO Box 1712

Helena, MT 59624-1712

Ofce of the Attorney General Justice Building, Third Floor 215 Sanders Helena, MT 59620-1401

Ofce of the Attorney General PO Box 201401

Helena, MT 59620-1401

Collection Bureau Services Inc. 212 E. Spruce St Missoula, MT 598024502

Collection Bureau Services Inc. PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

c/o Jennifer Whipple, Registered Agent 212 E. Spruce St Missoula, MT 59802

Collection Bureau Services Inc.

Attn: Michael J. Moore PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

Attn: Erica T. deVries PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

Montana Code Annotated, NOTICE IS HEREBY GIVEN: As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest: Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000030 and Tax Code Parcel No. 45970

be paid by August 1, 2025, which is the date that the redemption period expires or expired. If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed auction will be held within 60 days of the tax deed application date. Any surplus funds resulting from the auction will be distributed to the legal titleholder of record. The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton, MT 59840, (406) 375-6600. FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN The address of the interested party is unknown. The published notice meets the legal requirements for notice of a pending tax deed auction. The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025. By: Eli J. Patten Crowley Fleck PLLP PO Box 2529 Billings,

BS 5-7, 5-14, 5-21-25.

MNAXLP

Occupant

405 Pennsylvania Ave. Hamilton, MT 59840

213 Luby Ln. Florence, MT 59833-6812

Robin D. Pearson

259 Luby Lane Florence, MT 59833

The property tax lien was attached on August 1, 2022. The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is: TAXES: $4,271.23

Attn: Ramon E. Mercado PO Box 7339 Missoula, MT 59807 Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840 Pursuant to 15-18-219,

Lot 5, Amended Subdivision Plat No. 485694, being a portion of Misty Vale Subdivision, Amended Lot A, Ravalli County, Montana, according to the ofcial recorded plat thereof.

Street Address: 473 Misty Vale Loop, Corvallis, MT 59828

The property taxes became delinquent on May 31, 2022. The property tax lien was attached on August 1, 2022.

The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $9,777.64

PENALTY: $160.55

INTEREST: $2,385.87

COST: $281.57

TOTAL: $12,605.63

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed auction will be held within 60 days of the tax deed application date.

Any surplus funds resulting from the auction will be distributed to the legal titleholder of record.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton, MT 59840, (406) 375-6600. FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed auction.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten

Crowley Fleck PLLP

PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN

TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

BS 5-7, 5-14-25. MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED

IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

194 China Silk Way Hamilton MT 59840

Michael L. Freie 194 China Silk Way Hamilton, MT 598409292

Michael L. Freie

13180 Pleasant Vista Lane Auburn, CA 95603

Joette E. Costa 194 China Silk Way Hamilton, MT 598409292

Joette E. Costa

13180 Pleasant Vista Lane Auburn, CA 95603

Joette E. Costa 12326 Pepperwood Cir. Auburn, CA 95603-2903

Ravalli County Treasurer 215 S 4th Street, Suite H Hamilton, MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest: Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000256 and Tax Code Parcel No. 610019 as follows: Lot 18, Daly Estates, Ravalli County, Montana, according to the ofcial plat recorded September 22, 2006 as Instrument No. 577738. Street Address: 194 China Silk Way, Hamilton, MT 59840 The property taxes became delinquent on May 31, 2022. The property tax lien was

attached on August 1, 2022. The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022. As of the date of this notice, the amount of tax due is:

TAXES: $1,332.98

PENALTY: $26.67

INTEREST: $424.18

COST: $281.57

TOTAL: $2,065.40

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired. If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed auction will be held within 60 days of the tax deed application date. Any surplus funds resulting from the auction will be distributed to the legal titleholder of record.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton, MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown. The published notice meets the legal requirements for notice of a pending tax deed auction.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY BS 5-7, 5-14-25. MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

540 Queens Way Hamilton, MT 59840

Ryan Hunter Lewis 540 Queens Way Hamilton, MT 59840

Ryan Hunter Lewis 314 S. 5th Street Hamilton, MT 59840 Ryan Hunter Lewis 492 Honeyhouse Ct. Corvallis, MT 59828-9391 Ravalli County Treasurer 215 S 4th Street, Suite H Hamilton, MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000093 and Tax Code Parcel No. 180800 as follows:

A tract of land located in and being a portion of the NE¼NE¼ Section 34, Township 7 North, Range 21 West, P.M.M., Ravalli County, Montana, more particularly described as Parcel A-1, Certifcate of Survey No. 3431. Street Address: 540 Queens Way, Hamilton, MT 59840

The property taxes became delinquent on May 31, 2022.

The property tax lien was attached on August 1, 2022. The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $6,440.83

PENALTY: $106.65

INTEREST: $1,567.92

COST: $281.57

TOTAL: $8,396.97

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not

paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed auction will be held within 60 days of the tax deed application date.

Any surplus funds resulting from the auction will be distributed to the legal titleholder of record.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton, MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED

ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed auction.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten

Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

BS 5-7, 5-14-25.

MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED

IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

No Occupant

Robin D. Pearson

213 Luby Ln. Florence, MT 59833

Robin D. Pearson

213 Luby Ln. Florence, MT 59833-6812

Robin D. Pearson

259 Luby Lane Florence, MT 59833

Robin D. Pearson PO Box 145 Florence, MT 59833

Collection Bureau Services Inc. PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

c/o Michael J. Moore PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

c/o Erica T. deVries PO Box 7339

Missoula, MT 59807

Collection Bureau Services Inc.

212 E. Spruce St

Missoula, MT 598024502

Collection Bureau Services Inc.

c/o Jennifer Whipple, Registered Agent

212 E. Spruce St Missoula, MT 59802

Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Ofce under Tax Lien

Certifcate 2021000590 and Tax Code Parcel No. 1449600 as follows:

A tract of land in the S½ of Section 26 and the N½ of Section 35, all in Township 10 North. Range 20 West, P.M.M., Ravalli County, Montana and being more particularly described as follows: Commencing at the ¼ corner common to Sections 26 and 35, Township 10 North, Range 20 West, Principal Meridian, Montana: thence N.07°04’27” W., 508.76 feet to the true point of beginning; thence S.37°14’07”E., 1470.85 feet thence S.03°20’30”E., 44.15 feet to a point on a non-tangent curve with center being S.11°01’00”W., 849.00 feet radial distance; thence counter-clockwise along said curve an arc distance of 387.14 feet; thence S.74°53’24”W., 49.29 feet; thence N.34°19’19”W„ 1234.48 feet; thence N.46°34’03”E., 323.08 feet to the true point of beginning.

Recording Reference: Book 172 of Deeds, p. 280. Street address: NHN Luby Lane, Florence, MT 59833.

The property taxes became delinquent on May 31, 2022.

The property tax lien was attached on August 1, 2022.

The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $4,291.56

PENALTY: $67.95

INTEREST: $1,008.71

COST: $281.57

TOTAL: $5,649.79

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed may be issued to the assignee or county that is the possessor of the tax lien on the day following the date that the redemption period expires.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed issuance.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten

Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

BS 5-7, 5-14-25.

MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

749 W Main St. Hamilton, MT 59840

Heirs of Patricia Carole Sabo

749 W Main St. Hamilton, MT 59840

Heirs of Patricia Carole Sabo PO Box 215 Darby, Montana 59829

Heirs of Patricia Carole Sabo PO Box 215 Darby, Montana 598290215

David G. Niles

Personal Representative of the Estate of Patricia Carole Sabo PO Box 215 Darby, MT 59829

David G. Niles

Personal Representative of the Estate of Patricia Carole Sabo PO Box 215

Darby, MT 59829-0215

David G. Niles

Personal Representative of the Estate of Patricia Carole Sabo

749 W Main St. Hamilton, MT 59840

William J. Nelson

Nelson Law Ofce PLLC 217 North Third Street, Suite J Hamilton, MT 59840

Kyle J. Workman Workman Law, PLLC PO Box 1167 Hamilton, MT 59840

Barbara J. McNey 618 10th Street Hamilton, MT 59840

Linda Oglesby 16650 N. Stadium Way #206 Surprise, AZ 85374

Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000216 and Tax Code Parcel No. 488200 as follows: Lots 1 and 2, Block 35, Original Townsite of Hamilton, Ravalli County, Montana according to the ofcial recorded plat thereof.

Street address: 749 W Main St., Hamilton, MT 59840.

The property taxes became delinquent on May 31, 2022.

The property tax lien was attached on August 1, 2022.

The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $5,417.39

PENALTY: $80.10

INTEREST: $1,104.67

COST: $281.57

TOTAL: $6,883.73

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed may be issued to the assignee or county that is the possessor of the tax lien on the day following the date that the redemption period expires.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton MT 59840, (406) 375-6600. FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed issuance.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten

Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY BS 5-7, 5-14-25.

MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant 105 Belmont Ave. Hamilton, MT 59840

MEI-709, LLC 105 Belmont Ave. Hamilton, MT 59840

MEI-709, LLC PO Box 638 Darby, MT 59829

MEI-709, LLC

320 W Broadway Missoula, MT 59802

MEI-709, LLC 107 Belmont Ave. Hamilton, MT 59840

MEI-709, LLC

c/o Naomi Alm, Registered Agent 320 W Broadway Missoula, MT 59802 Montana Exchange Inc.

Attn: Brandie Clark PO Box 8262 Missoula, MT 59807 Montana Exchange Inc.

c/o Clayton T. Christian, Registered Agent 3800 Lincoln Rd. Missoula, MT 598023039 Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN: As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Offce under Tax Lien Certifcate 2021000211 and Tax Code Parcel No. 458220 as follows: Lot 2, Amended Subdivision Plat No. 626725, being a portion of Lot 1, Block 38, Riverview, Ravalli County, Montana

lien was

The lien

MT

on October 12, 2022. As of the date of this notice, the amount of tax due is: TAXES: $6,914.82

PENALTY: $ 114.60 INTEREST: $1,702.56 COST: $281.57

TOTAL: $9,013.55 For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired. If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed may be issued to the assignee or county that is the possessor of the tax lien on the day following the date that the redemption period expires. The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton MT 59840, (406) 375-6600. FURTHER NOTICE FOR THOSE PERSONS LISTED ABOVE WHOSE ADDRESSES ARE UNKNOWN The address of the interested party is unknown. The published notice meets the legal requirements for notice of a pending tax deed issuance. The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025. By: Eli J. Patten Crowley Fleck PLLP PO Box 2529 Billings, MT 59103 Attorney for: GUARDIAN TAX MT, LLC IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY BS 5-7, 5-14-25. MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY Occupant

107 Belmont Ave. Hamilton, MT 59840 MEI-709, LLC 107 Belmont Ave. Hamilton, MT 59840 MEI-709, LLC PO Box 638 Darby, MT 59829 MEI-709, LLC 320 W Broadway Missoula, MT 59802 MEI-709, LLC c/o Naomi Alm, Registered Agent 320 W Broadway Missoula, MT 59802 MEI-709, LLC 105 Belmont Ave. Hamilton, MT 59840 Montana Exchange Inc. Attn: Brandie Clark PO Box 8262 Missoula, MT 59807 Montana Exchange Inc. c/o Clayton T. Christian, Registered Agent 3800 Lincoln Rd. Missoula, MT 598023039 Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840 Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN: As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest: Property described in

Lot 1, Amended Subdivision Plat No. 626725, being a portion of Lot 1, Block 38, Riverview, Ravalli County Montana according to the ofcial recorded plat thereof.

Street address: 107 Belmont Ave., Hamilton, MT 59840.

The property taxes became delinquent on May 31, 2022. The property tax lien was attached on August 1, 2022. The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $6,799.65

PENALTY: $112.30

INTEREST: $1,667.67

COST: $281.57

TOTAL: $8,861.19

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1, 2025, which is the date the redemption period expires, a tax deed may be issued to the assignee or county that is the possessor of the tax lien on the day following the date that the redemption period expires.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED

ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed issuance.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC

IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY BS 5-7, 5-14-25. MNAXLP

NOTICE THAT A TAX DEED MAY BE ISSUED

IF YOU DO NOT RESPOND TO THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

Occupant

5629 Cottonwood Dr. N Florence, MT 59833

Dana S. Cather

5629 Cottonwood Dr. N Florence, MT 59833

Dana S. Cather

5629 Cottonwood Dr. N Florence, MT 59833 –6614

Holly L. Cather

5629 Cottonwood Dr. N Florence, MT 59833

Holly L. Cather

5629 Cottonwood Dr. N Florence, MT 598336614 Horlacher Foundation,

Inc.

8538 E. Turney Ave. Scottsdale, AZ 85251

Horlacher Foundation, Inc.

3885 US Hwy 93 N., Suite D

Stevensville, MT 59870

Horlacher Foundation, Inc.

c/o W A S Inc., Registered Agent 9141 E. Hidden Spur Trail Scottsdale, AZ 85255

First Montana Title Company

250 W Main St. Hamilton, MT 59840

Ravalli County Treasurer 215 South 4th Street, Suite H Hamilton MT 59840

Pursuant to 15-18-219, Montana Code Annotated, NOTICE IS HEREBY GIVEN:

As a result of a property tax delinquency, a property tax lien exists on the following described real property in which you may have an interest:

Property described in the Ravalli County Treasurer’s Ofce under Tax Lien Certifcate 2021000573 and Tax Code Parcel No. 1387410 as follows:

Lot 5B, Block 2, Amended Subdivision Plat No. 344, being a portion of Lot 5, Block 2, Riverview Orchards, Ravalli County, Montana, according to the ofcial recorded plat thereof.

Street Address: 5629 Cottonwood Dr. N Florence MT 59833

The property taxes became delinquent on May 31, 2022.

The property tax lien was attached on August 1, 2022.

The lien was subsequently assigned to Guardian Tax MT LLC on October 12, 2022.

As of the date of this notice, the amount of tax due is:

TAXES: $5,038.35

PENALTY: $73.36

INTEREST: $1,155.74

COST: $ 281.57

TOTAL: $6,549.02

For the property tax lien to be liquidated, the total amount listed in paragraph 5, plus additional interest and costs, must be paid by August 1, 2025, which is the date that the redemption period expires or expired.

If all taxes, penalties, interest, and costs are not paid to the county treasurer on or prior to August 1,

2025, which is the date the redemption period expires, a tax deed auction will be held within 60 days of the tax deed application date.

Any surplus funds resulting from the auction will be distributed to the legal titleholder of record.

The business address and telephone number of the county treasurer who is responsible for issuing the tax deed is: Ravalli County Treasurer, 215 South 4th Street, Suite H, Hamilton, MT 59840, (406) 375-6600.

FURTHER NOTICE FOR THOSE PERSONS LISTED

ABOVE WHOSE ADDRESSES ARE UNKNOWN

The address of the interested party is unknown.

The published notice meets the legal requirements for notice of a pending tax deed auction.

The interested party’s rights in the property may be in jeopardy.

DATED at Billings, Montana this 7th day of May 2025.

By: Eli J. Patten

Crowley Fleck PLLP PO Box 2529

Billings, MT 59103

Attorney for: GUARDIAN TAX MT, LLC IF YOU DO NOT RESPOND THIS NOTICE, YOU WILL LOSE YOUR PROPERTY

BS 5-7, 5-14-25.

MNAXLP

NOTICE

The 2 nd half of the 2024 Real Estate Taxes are due payable before 5 PM, June 2, 2025.

We have a Night Drop located at North end of Administration Building in drive thru. Mailed payments, must be postmarked by June 2, 2025 or the payment will be returned for penalty and interest. Please make checks payable to the Ravalli County Treasurer. Master Card, Visa, Discover and American Express cards are accepted. Also accepting online payments at www.Ravalli.us/196/ Property-Tax. Paying with Credit/Debit card will include a 2.15% convenience fee and $1.25 Transaction Fee.

Ravalli County Treasurer Dan Whitesitt 215 S 4 th St Ste H

Hamilton MT 59840 406-375-6600 BS 5-7, 5-14, 5-21, 5-28-25.

Kyle J. Workman State Bar No. 65442127 WORKMAN LAW, PLLC P.O. Box 1167

Hamilton, MT 59840 T: (406) 802-2198 kyle@workmanlawmt.com courts@workmanlawmt. com Attorney for Personal Representative MONTANA TWENTY-FIRST JUDICIAL DISTRICT COURT, RAVALLI COUNTY IN THE MATTER OF THE ESTATE OF: SCOTT TEEL HACKETT, Deceased. Probate No. DP-41-20250000048-II Dept. No. 1 NOTICE TO CREDITORS NOTICE IS HEREBY GIVEN that the undersigned has been appointed as Personal Representative of the above-named estate. All persons having claims against the decedent are required to present their claims within four (4) months after the date of the frst publication of this notice, or said claims will be forever barred. Claims must either be mailed to DIANE BESSLER-HACKETT, the Personal Representative, in care of WORKMAN LAW, PLLC, P.O. Box 1167, Hamilton, Montana 59840, or fled with the Clerk of the above Court. I declare under penalty of perjury under the laws of the State of Montana the foregoing is true and correct.

Dated this 30th day of April, 2025.

/s/ Diane Bessler-Hackett Workman Law, PLLC

Kyle J. Workman

By:

Attorney for Personal Representative BS 5-7, 5-14, 5-21-25.

MNAXLP

LEGAL NOTICE

The Board of County Commissioners (BCC) will conduct a public hearing for two Ravalli County Open Lands Bond projects on Thursday, June 5th, 2025 at 1:30 P.M. and at 2:30 P.M. in the Commissioners’ Meeting Room (Third Floor) of the

County Administrative Building located at 215 South 4th Street, Hamilton, MT 59840. The frst project is called Rory R Ranch Victor Conservation Easement (193.2 acres). The project is located 1.5 miles NW of Victor of of Bugle Ridge Lane. Tax ID # (948400). The second project is called Lippert Conservation Easement (69.61 acres). The project is located west of downtown Victor, on Sweathouse Creek Road. Tax ID # (927600).

Bitter Root Land Trust is the applicant. Information describing the proposals are available for inspection at the Planning Department, located at the County Administrative Building, 215 S. 4th Street, Suite F, Hamilton, MT 59840. Written comments are encouraged to be submitted to the Planning Department prior to the public hearing and will be forwarded to the BCC for consideration at the public hearing. The public may comment verbally or in writing at the hearings. Comments and information submitted at the public hearing will be considered in the decision. Submit email comments to: planning@rc.mt.gov, and questions can be asked by phone at 406-375-6530.

BS 5-14, 5-21-25.

MNAXLP

TAX APPEAL BOARD

NOTICE

The Ravalli County Tax Appeal Board will be in session from July 1, through December 31, 2025, for the business of hearing appeals. Any taxpayer who disagrees with the appraised value of his or her property may fle an appeal with the Ravalli County Tax Appeal Board within 30 days of the receipt of the Notice of Classifcation and Appraisal, or Notice of Change Valuation (assessment notice) established by the Montana Department of Revenue. Appeal forms are available from www.mtab. mt.gov. Appeals must be fled with the County Clerk and Recorder who will notify the County Tax Appeal Board to schedule a hearing. For further information, contact:

Regina Plettenberg

406-375-6555 recorder@rc.mt.gov BS 5-14-25.

MNAXLP

Legal Notice High Post Subdivision Ravalli County has received an application for a 5-lot minor subdivision, located on Tract A of CS #509504-F, existing Tax ID: 1376313 on 24.5 acres. Florence is approximately 5.5 miles southwest of the subject property.The subdivision property is located within the Florence School and Rural Fire Districts. The proposed lots will be served by private wells and septic systems. The applicant is Michael Maine of IMEG Corp., representing JWT LLP. The subdivision is referred to as High Post Subdivision. A copy of the Preliminary Plat is posted on our Website at https://ravalli. us/178/Subdivisions-Exemptions and is enclosed with this letter. Information describing the proposal is available for inspection at the Planning Department, in the County Administrative Center, 215 S. 4th St., Suite F, Hamilton, MT 59840. Written comments are encouraged to be submitted to the Planning Department prior to the below meeting, and will be forwarded to the Board of County Commissioners (BCC). The BCC will hold a Public Hearing on the proposal on June 9th, 2025, at 1:30 p.m., in the County Administrative Center (BCC Conference Room, 3rd Floor). The BCC will also accept verbal or written comments from the public. At the conclusion of the public hearing, the BCC may make a fnal decision on the subdivision proposal. The public may comment verbally, or in writing, at the meeting. Comments and information submitted at the public meeting/hearing will be considered in the decision on the subdivision. However, please note that only under select circumstances will new information be allowed into the record after the public hearing. BS 5-14, 5-21-25. MNAXLP