Experience newfound clarity with the Nexera XS inert UHPLC. Offering reliable, robust performance, the Nexera XS inert represents a new peak in the analysis of biopolymers. It features a metal-free sample flow path prepared from corrosion-resistant materials, so that results will be clear and unaffected by sample adsorption or surface corrosion. Together with a new range of consumables, Shimadzu now offers the complete solution for bioanalysis.

Unconstrained recovery and sensitivity

Bioinert flow path prevents sample loss due to adsorption.

Clear resolution without restrictions UHPLC performance for high efficiency bioanalysis.

Assured reliability and reproducibility

Corrosion-resistant material ensures long-term stability and reliable data acquisition.

Ultra High Performance

Liquid Chromatograph

Nexera XS inert

Learn more!

ADRIEN SAMSON is Healthcare Policy Senior Manager at EuropaBio, the European Biotech Industry Association. He leads the association’s policy work on health biotech issues. He has expertise on EU pharmaceutical and industrial policies and works with a diverse range of stakeholders, including policymakers, regulators, industry representatives, patient groups, and research organisations, to promote the benefits and potential of biotech for health and society.

The 2023 State of the Union speech saw biotechnology rise as a priority for the European Union. It has been designated as a critical technology for Europe’s economic security. In March 2024, the European Commission presented its biotechnology and biomanufacturing strategy with a clear leadership ambition for Europe’s biotech industries. The Letta Report on the future of the Single Market, published April 2024, proposed a fifth freedom on research and innovation which would directly benefit biotech.

In a sign of how quickly policy priorities change in Brussels, six months before the European Commission published its much-anticipated revision of the EU General Pharmaceutical Legislation (GPL). The proposals make no reference to biotech and the impact on the biotech ecosystem was not specifically assessed. The revision proposed several welcomed improvements, including reducing the assessment periods and the creation of sandboxes for cutting edge products, but also proposed a lower baseline incentives and unpredictable modulation for novel medicines, including for rare diseases that will negatively impact the biotech ecosystem.

Within healthcare, biotech is increasingly the primary source of new therapies, bringing previously untreatable diseases within reach and transitioning from ‘manage’ to ‘cure’ with improvements to quality of life, freeing patients, families, and healthcare systems. Higher risk and long development timelines characterise the translation of biotech into therapies, with smaller companies being the primary vehicle for translation of Europe’s research into development pipelines. The pathway to patients is a highly collaborative ecosystem between companies of all sizes. Innovators, especially emerging and small companies, are highly reliant on a strong and predictable incentives framework to secure early investment for long term programmes.

The GPL is a force for growth in EU biotech innovation and patient benefit. The Commission’s proposals will negatively impact Europe’s biotech ecosystem, with small innovators are at greatest risk and with them the EU’s engine for novel medicines. Biotech companies are strongly inter-dependent for successful development of medicines. Proposed changes negatively impact partnerships and Europe’s healthcare autonomy. Reducing incentives and certainty for early programmes is a barrier to the delivery of innovative medicines through biotech.

Despite the European Parliament having adopted its position on the proposals in record time, it must not be forgotten that GPL is legislation for future innovation and will only become law at the end of the decade. There is still time and opportunity for the Member States in the Council to ensure the GPL is aligned with Europe’s priorities on competitiveness and open strategic autonomy, and delivers a more ambitious vision for the future of biotech innovation.

The Three R (Replacement, Reduction and Refinement) principles developed over 60 years ago provide a framework for more humane lab animal testing and, more importantly, less of it. A range of in-vitro model systems that might one day replace animal-based programmes is now out there, but only recently has the use of multi-organ chips gained serious momentum. High-tech developments are increasingly allowing the replication of human tissues and organs for testing purposes.

6 European Commission raises hopes for biotech boost in next term

12 Parliament approves highly criticised EU pharma package with minor improvements; European Court of Auditors presents flawed mobility report; EuropaBio criticises rules for joint clinical assessments

13 Clinical trials: deregulation to bring Germany back to the forefront of the European Union

14 ECCP 2024 – doomed to innovation

16 Interview: Montse Daban, President, Council of European Bioregions (CEBR)

24 Interview: Alexander Schueller, CEO cellvie AG, Zurich

27 Analyst commentary

28 European Biotech Stocks

31 Swiss Biotech Day(s): vibrant ecosystem showcase

34 Carbios starts biorecycling of PET waste

36 Update on clinical trials

40 Interview: Prof. Dr. Salah-Eddin Al-Batran Frankfurt Institute for Clinical Cancer Research IKF GmbH

60 Northern Europe: Sweden, Denmark, Norway and Finland

62 Western Europe: France, Belgium, The Netherlands and the UK

64 Central Europe: Germany, Switzerland and Austria

66 Southern Europe: Italy, Spain, Greece, Slovenia and Portugal

68 Eastern Europe: Poland, Hungary, Lithuania, and the Czech Republic

SCIENCE & TECHNOLOGY

69 Next-gen dry AMD drug

70 Cure for Hurler sydrome

71 Fish flesh goes production

72 RNA replacing pesticides

73 Microbial plastic-eaters

74 Smart paths to cultured coffee

75 mRNA versus metabolic disease

44 Biopeople

76 News from Biotech Associations

80 Company index/ New product

81 Events

82 Encore

IMPRINT European Biotechnology (ISSN 2364-2351) is published quarterly by: BIOCOM Interrelations GmbH, Jacobsenweg 61, D-13509 Berlin, Germany, Tel.: +49-30-264921-0, Fax: +49-30-264921-11, Email: service@european-biotechnology.com, Internet: www.european-biotechnology.com; Publisher: Andreas Mietzsch; Editorial Team: Thomas Gabrielczyk (Editor in Chief), Derrick Williams (Co-editor), Dr. Georg Kääb, Uta Mommert, Maren Kühr; Advertising: Oliver Schnell, +49-30-264921-45, Christian Böhm, +49-30-264921-49, Andreas Macht, +49-30-264921-54; Distribution: Ianuaria Cipolletta, +49-30-264921-72; Graphic Design: Michaela Reblin; Production: Martina Willnow; Printed at: Königsdruck, Berlin; European Biotechnology Life Sciences & Industry Magazine is only regularly available through subscription with a BIOCOM CARD. Annual subscription BIOCOM CARD Europe: €80 for private individuals (students €40) incl. VAT, €120 plus VAT for corporates. Prices includes postage & packaging. Ordered subscriptions can be cancelled within two weeks directly at BIOCOM AG. The subscription is initially valid for one calendar year and is automatically renewed every year after. The subscription can be cancelled at any time and is valid until the end of that calendar month. Failures of delivery, which BIOCOM AG is not responsible for, do not entitle the subscriber to delivery or reimbursement of pre-paid fees. Seat of court is Berlin, Germany. As regards contents: individually named articles are published within the sole responsibility of their respective authors. All material published is protected by copyright. No article or part thereof may be reproduced in any way or processed, copied, and proliferated by electronic means without the prior written consent of the publisher. Bound-in inserts: Life Science Factory, Göttingen; Cover Photo: © William - stock.adobe.com; ® BIOCOM is a registered trademark of BIOCOM AG, Berlin, Germany.

With the presentation of a biotech and biomanufacturing initiative shortly before its putative re-election, the EU Commission has raised hopes in the biotech sector for good framework conditions in Europe. However, in addition to the vague promise to draft by an EU Biotech Act, the non-binding paper contains many ifs and buts.

Within a single year, new treatments for obesity – incretin agonists – have propelled Novo Nordisk and Eli Lilly to first and second place in the global ranks of top-selling pharma companies. In a global race, developers are now targeting hunger control with combination therapies that boost the effect.

47 New event season

48 CPHI Milan 2024, Milan, Italy

50 Global Bioeconomy Summit, Nairobi, Kenya

52 Bio-Europe 2024, Stockholm, Sweden

With a grand gesture, the European Court of Auditors (ECA) issued its first statement on the future of the internal combustion engine in the EU with a ‘report’ – and cast a clear vote against synthetic and biofuels and in favour of electric mobility in passenger transport. That would be all well and good, if only the statement of opinion disguised as an analysis were not riddled with outdated facts and errors that also politically obstruct the future of a sustainable solution to the fuel problem in heavy goods transport. The auditors are apparently unaware that, in addition to bio-based fuels, there are also fuels that can be produced directly from sunlight and a few minerals without any sourcing problems. Several European and US companies are also working on diesel from nonGM algae that are 70% oils that can be easily converted into certified diesel fuel.

The auditors also failed to realise that these and other biofuels are not overpriced, but can be produced at a price of €1.50/litre even before upscaling. There are just two problems. First, it will cost money to build the ponds for algae cultivation, and second, these would have to be located in places that get a lot of sunlight, such as Africa. Hopefully postpandemic Europe has learnt from its mistakes in the past, as well as a thing or two about cooperation.

Thomas Gabrielczyk Editor-in-Chief

Thomas Gabrielczyk Editor-in-Chief

EU Europe is good when it comes to visions. The EU pioneered a bioeconomy strategy, it was first globally to authorise a biosimilar and establish rules for ATMPs. The only thing the Eurocrats are not so good at is implementation. However, in the power vacuum before the elections of the new EU Commission, the old one has raised hopes for an Biotech Act that might unveil the potential of biotech in Europe.

At the end of March, Danish EU VicePresident Margrethe Vestager took to the lectern and announced – unusually clearly for the EU Commission, which is never at a loss for words – eight measures to realise the potential of biotechnology in Europe through a EU Biotech and Biomanufacturing Initiative.

“Everywhere across Europe, we are faced with the same challenges: climate change affects us all. Resource scarcity affects us all,” said Vestager. “Biotechnology can contribute to solving these challenges. Biotech also largely supports Europe’s economy and contributes to our competitiveness, with high growth potential and labour productivity. And by reducing Europe’s dependency on fos -

sil-based input and other sources of raw materials biotech also increases circularity and strengthens our path towards independence of fossil fuels,” the Commissioner for the Digital Age stressed. “With today’s proposal we want to create the right environment for this sector to grow and deliver global solutions to societal and environmental problems,” Vestager closed applauded by EU industry federations Cefic, EuropaBio, Bio-based Industries and others.

Nobody in the life sciences sector had seriously believed yet in the non-legislative EU Biotech and Biomanufacturing

Initiative, which Commission President Ursula von der Leyen had promised in her State of the Union address in September 2023. This was because von der Leyen failed to make some promises of her legendary speech come true. The most important was to prioritise the underfunded EU biotech sector with an investment boost of up to €160bn through a new vehicle termed STEP (the Strategic Technologies for Europe Platform). In the end, the budget earmarked for STEP’s priority areas, namely biotech, cleantech and IT/deeptech, failed to be approved due to the resistance of EU member states, whose representatives did not want to give any extra cent even as innovation support, and particularly not the €10bn of seed capital for setting up STEP. With the financial cut, STEP, which was the EU’s central driver to catch up internationally now appears like a toothless tiger. The instrument that was formally adopted by the EU Council and Parliament at the end of February, does have some money available through the redistribution of existing EU money from 11 EU financial instruments. However, the starting capital for STEP has been shrinked to €1.5bn. Zero extra investment is now expected to finally unleash the huge potential of bio technologies for setting up a fossilfree industrial production in Europe. As no extra money is available for the EU’s new biotech priority, the Commission is focussed on making the EU regulatory framework and its implementation smoother. The sector‘s industry inter-

Profit from

est group EuropaBio stressed the importance of rapidly addressing regulatory challenges in a statement. “If Europe is to succeed, this initiative has to rapidly transform ‘rhetoric’ into policy and legislative action for competitiveness, enabling innovators to thrive and grow, and creating long-term investment into infrastructures, employment and skills in Europe,” the association stressed.

“What we hear from industry is that there are indeed huge differences, in what time it takes to have a product that is finalised and tested from the side of the business to being able to market it,” Vestager explained presenting the proposal. “The claim is that in the US you can do that in two to three years, but within the European Union, it will take you six to eight years,” she added.

So what exactly can we expect from the eight actions (see below) published along with the legally non-binding communication about the biotechnology and biomanufacturing initiative? Biotech entrepreneurs can be pleased that EU policy is increasingly recognising the importance of biotechnology, albeit the initiative includes many ifs and buts

and still relies on safeguarding through lengthy studies instead of immediate implementation. In it, the EU Biotech Act is also described vaguely as an option instead of taking bold and swift action following the prioritisation of biotechnology. Measured against the claim to establish Europe as a leading biotech region, the Commission is publicly denying important facts.

According to EuropaBio Director Claire Skentelbery “we actually have everything we need for a good location: excellently trained staff, good research and expertise. We have also seen during the pandemic that much is possible if the political will is there.” European biotech, medtech and CDMO CEOs, however, recently complained at a panel moderated by the Brit that they always face exactly the same problem: a lack of harmonised rules and extremely slow processing times due to downstream EU bureaucracy.

Vestager’s initiative picks up on this and promises improvement but ignores that actually, Europe is lagging behind in biotechnology. The US market share of biotech sales is around 60%, that of the EU 12%, followed by China with 11%, which is growing much faster due to massive strategic state subsidies. The US

administration has already recognised the geopolitical importance of its leading role in biotech and protect it against the emerging Middle Kingdom, which has already left it behind in terms of the number of clinical gene therapy studies, by classifying biotech as important for the national security. Europe does not protect its sector. Figures from the Commission’s scientific service, the JRC, show that the USA has six times as many jobs in biotechnology in relation to the population as Europe. The EU is also increasingly losing ground in terms of biotech patent applications (as of Patstat 2023) compared to emerging China, and even more so compared to the USA (see graph). The fact that the EU’s current biotech strategy is 22 years old, while the USA has only recently set itself ambitious goals in pharmaceutical, industrial and plant biotechnology, shows the real pressure on Europe and a certain verbal whitewashing of EU policy. Instead of concentrating on financial support, it is focussing on improving the political framework without, however, clearly naming and eliminating past mistakes. EuropE an Biot Echnology has learnt from Commission circles that it is important to publicly name future priorities even before the new EU Commission is elected and that the new bioeconomy strategy planned for the end of 2025 will have ‘surprising’ things in store.

Although the German Christian Democrats support the re-nomination of current EU Commission President von der Leyen, who only received around 52% of votes in favour in the last EU Parliament confirmatory vote, the parent party is calling for the Green Deal, which many Christian Democrats see as a bureaucratic monster that is stifling any growth in Europe, to be de-prioritised. Instead, more emphasis should be placed on competitiveness and growth. How this fits in with the half-hearted commitment of the biotech and biomanufacturing initiative remains to be seen. What is clear, however, is that von der Leyen’s EPP can

The US and China are the top performers in more investment performance metrics than Europe, exhibiting stronger growth trends

count on a clear majority in the European elections and that a second term in office is therefore likely.

But now to the actions associated with biotech/biomanufacturing initiative, presented by Vestager, and the associated EU thinking. According to the EU paper, the EU biotechnology and biomanufacturing sector is facing several challenges: research and technology transfer to the market, regulatory complexity, access to finance, skills, value chain obstacles, intellectual property, public acceptance and economic security. The EU biotech and biomanufacturing initiative aims to map current challenges and barriers for biotechnologies and biomanufacturing and proposes eight actions “to address these challenges in a timely manner”. Most of them will require lengthy studies instead implementing action:

› Leveraging research and boosting innovation: To help to identify drivers and bottlenecks of innovation and of technology adoption, the Commis -

sion has commissioned another study to investigate again the EU’s position compared to other global leaders in emerging biotechnology generation and transfer to the biomanufacturing industry. On top, the Commission seeks to explore ways to accelerate the development and use of the Industrial Biotechnology Innovation and Synthetic Biology Accelerator (EU IBISBA) as a digital repository and service network for the sector.

› Stimulating market demand: To succeed on the market, bio-based products need to prove their lower environmental impact when compared, for instance, to petrochemical products. The Commission will review the assessment of fossil-based and bio-based products to ensure equivalence of treatment and incorporate methods for carbon storage in construction materials. To accelerate the substitution of fossil feedstock and to stimulate the demand and market uptake of bio-manufactured products, the Commission will conduct an in-depth impact assessment of the feasibility of bio-based content requirements in specific product categories and in public

procurement instead eliminating subsidies making the fossil-based industry more cost-effective. Furthermore, the Commission said it will explore how bio-manufactured non-food products could profile themselves better through labelling.

› Streamlining regulatory pathways : The old Commission promises to assess how EU legislation and its implementation could be streamlined and shorten the time to market for biotech innovations. Another study is set to lay the foundations for a ”possible EU Biotech Act“. The Commission plans also to establishing an EU Biotech Hub that helps biotechs to navigate through the regulatory framework and identify support to scale up, by the end of this year. In addition it is planned to establish so-called regulatory sandboxes that allow to test novel solutions in a controlled environment for a limited amount of time under the supervision of regulators, as a way of bringing more of them quickly to the market.

› Fostering public and private investments: The EU names a lot of exist-

ing financing instruments to support biotechnology and biomanufacturing such as Horizon Europe; the Innovation Fund; and STEP. To develop and scale up innovations with the potential to create new markets, a policy goal is to support specific challenges on biotech and biomanufacturing in the European Innovation Council (EIC) accelerator Work Programme 2025. Furthermore, the Commission will launch a study by the end of 2024 to identify barriers and ways to support the consolidation of investment funds, stock exchanges and post-trading infrastructure in order to enable the development of the necessary scale, enhance the knowledge base, create deeper pools of liquidity and help lower the cost of financing for highgrowth companies.

› Strengthening biotech-related skills: According to the paper, large-scale and regional skills partnerships might play

an important role in providing upskilling and reskilling opportunities on biotech and biomanufacturing. A specific large-scale partnership for biotech and biomanufacturing players will be explored, which can be co-financed through the Blueprint Alliances activity of the Erasmus+ programme.

› Updating standards: The Commission said it will encourage the elaboration and updating of European standards for biotech and biomanufacturing to facilitate market access.

› Supporting collaboration: The Commission will encourage the deployment of technologies related to biotech processes across EU regions through so called Regional Innovation Valleys.

› Fostering international cooperation. The Commission will explore the possibility of launching international biotech and biomanufacturing partnerships with international partners to collaborate on research and tech-transfer, in strategic

cooperations on regulatory and market access-related topics.

› Using AI and generative AI: the Commission wants to accelerate the uptake of AI, and generative AI in biotech and biomanufacturing in the context of GenAI4EU.

› Reviewing the bioeconomy strategy: Finally, the Commission will review its EU Bioeconomy Strategy by the end of 2025.

According to Skentelbery, “a global technology and market race is underway within biotechnology and biomanufacturing. Successful regions will lead global trade and supply chains for sectors that Europe considers vital and grow next generation economies based on biotech innovation. It is vital that the proposed Initiative recognises the need for tangible industrial impact during the next Commission mandate and is bold in its ambition”. L

t.gabrielczyk@biocom.eu

BioSpring is your trusted partner for manufacturing and analysis of therapeutic siRNA, ASOs, guide RNA and many more. With more than 27 years of experience, we know what’s needed to help you succeed with your therapeutic program.

EU PARLIAMENT In mid-April, just one year after the European Commission proposed a pharmaceutical package to revise the EU’s pharmaceutical legislation, MEPs adopted their proposals to revamp EU pharmaceutical legislation (495 votes in favour, 57 against and 45 abstentions) and regulation (488 votes in favour, 67 against and 34 abstentions). MEPs want to introduce a minimum regulatory data protection period of seven and a half years, in addition to two years of market protection during which generic, hybrid or biosimilar products cannot be sold, following a marketing authorisation. One year will be added if the product addresses an unmet medical need, if the product adds benefit in another indication plus six months, if comparative clinical trials are being conducted on the product. Orphan drugs would benefit from up to 11 years of market exclusivity if they address a high unmet medical need.

To incentivise R&D of novel antimicrobials, MEPs want to introduce market entry rewards and milestone payment reward schemes. These would be complemented by a subscription model scheme through voluntary joint procurement agreements, to encourage investment in antimicrobials.

The MEPs also support the introduction of a transferable data exclusivity voucher for priority antimicrobials, providing for a maximum of 12 additional months of data protection for an authorised product. The voucher could not be used for a product that has already benefited from maximum regulatory data protection and would be transferable only once to another marketing authorisation holder. “The revision of the EU pharmaceutical legislation is vital for patients, industry and society,” said Pernille Weiss, the Danish Rapporteur for the Directive. “We hope Council takes note of our ambition and commitment to create a robust legislative framework, setting the scene for effective negotiations.”

Tiemo Wölken, Rapporteur for the regulation added: “This revision paves the way to addressing challenges such as medicines shortages and AMR. Measures improving access to medicines, whilst incentivising areas of unmet medical needs, are crucial parts of this reform.” The file will be followed up by the new Parliament after the 6 - 9 June European elections.

The EU pharma industry federation EFPIA and national pharma associations criticised the Parliament. “An opportunity has been missed for the pharmaceutical industry,” stressed German pharma lobbyist Han Steutel, President of the vfa. “Europe‘s profile as a centre of innovation has not been raised, nor has patient care been improved. In particular, the planned weakening of document protection is hostile to innovation,” said Steutel. “Although the reports by MEPs in Parliament are moving in the right direction compared to the EU Commission‘s previous proposals, they still fall short in many respects,” added Dr Kai Joachimsen, Managing Director of German BPI. “It is now up to the EU member states to sharpen up and set the course for futureproof legislation.”

ECA In an analysis of the ban on vehicles with combustion engines registered after 2035, the European Court of Auditors (ECA) described the future of HVO100, e- or synfuels and biofuels as “uncertain”. Vehicle emissions were still as high as they were eleven years ago, said Court of Auditors member Nikolaos Milionis. As 1st generation biofuels – i.e. biogenic fuels not produced from residual materials or by photosynthetic microorganism – were “more expensive than fossil fuels”, it would be “cheaper to purchase emission certificates than to reduce CO2 emissions with the help of biofuels, which are not always favoured by the taxation policies of EU countries”, the auditors stated. Both the competition for biogenic raw materials and their limited quantity make combustion engines appear to auditors as no alternative to battery-powered electric vehicles, which the ECA members – similar to many EU decision-makers – presented as the only viable alternative. The report does not consider carbon negative fuels produced from photosynthetic micro- and macroalgae that cost €1.50/l. Contrary to the auditors’ statement, these primary producers growing in brackish, fresh and seawater do not require a sugary nutrient medium, but use CO2 as a source of carbon and sunlight as a source of energy.

HTA JCA EU Biotech federation EuropaBio has warned that the draft Joint Clinical Assessment Implementing Act (HTA JCA) could limit patient access to innovative biotech meds due to double work, delays, and resource waste On top, lack of early involvement of developers could hinder biotech innovator abilities to deliver on the aims of the Regulation. According to Claire Skentelbery, Director of EuropaBio “it is essential to give health technology innovators the predictability and time required to successfully complete the JCA.” L

CLINICAL TRIALS With a new law, the German government wants to increase the number of clinical trials conducted in Germany and make the country number one in the EU again. The draft Medical Research Act presented by German Health Minister Karl Lauterbach in Berlin before Easter is the centrepiece of Germany’s pharma strategy, which aims at making Germany an attractive location for biopharma production and R&D. The Medical Research Act is designed to help remove bureaucratic and legal obstacles that currently prevent the rapid start of industry-sponsored and investigator-initiatied clinical trials in Germany.

As Germany had fallen from 2nd to 6th place worldwide in terms of the number of clinical trials between 2016 and 2021, policy makers saw a need for action following strong pressure from the pharmaceutical industry, CRO and medical associations. To this end, the authorisation procedures for clinical trials at the German regulatory authority BFArM, which is subordinate to the Federal Ministry of Health, will be shortened to 26 days and a central ethics committee subordinate to the ministry will take over the role of the previous state ethics committees. In addition, the Ministry of Health recommends using model contract clauses drawn up by industry and medical associations in a legally non-binding manner in order to speed up negotiations between study clinics and study sponsors, which are particularly lengthy in Germany.

Pharmaceutical, biotech, CRO and medical associations had recommended that the model contract clauses they developed and publicly presented at the end of 2023 should be made legally binding by ordinance, as a quick conclusion of contracts between study sponsors and clinics is considered essential for a quick start to studies. While it usually takes 4-6 months to conclude such a contract in Germany, it takes much less time in neighbouring countries such as France (76 days), Spain (111 days) and the

UK (134 days), as binding standard contractual clauses have been in place there for years.

When presenting the draft bill, German Health Minister Karl Lauterbach, who is known to be resistant to consultation, was highly optimistic that the yearslong backlog would be made up: “We will see significantly more pharmaceutical and academic studies in Germany in the coming years,” he said. However, as essential wishes of the industry – such as legally binding model contract clauses or the authority of the well-established state ethics commissions to issue directives –were ignored and sacrificed to the ministry’s claim to leadership, the draft law was met with disappointment in the in dustry.

“It is regrettable that the current ver sion of the Medical Research Act misses the opportunity to achieve a significant breakthrough that could automatical ly bring us closer to the international forefront of clinical trials,“ said Martin Krauss, head of the VDMA, which repre sents the interests of Germany’s contract research organisations (CROs) that carry out 60% of clinical trials. The planned establishment of a central ethics commit tee calls into question the independence of the ethical evaluation of study pro jects, criticised the German Medical As sociation BÄK. The state ethics commit tees organised in AKEK also do not find the draft law expedient: “The Medical Research Act does not solve any prob lems regarding the regulation of clinical studies. Instead, it creates new problems by creating a parallel bureaucracy,” said Georg Schmidt, Chairman of the AKEK.

From the point of view of lawyers who were significantly involved in the drafting of the model contract clauses, the draft law does not advance Germany one centimetre as a study location. “The regulations related to standard contractual clauses for the conduct of clinical trials leaves much room for improvement,” stressed Dr Ute Kilger, Partner at Boehmert & Boehmert in Berlin. L

The better way to DNA!

Customized High Quality Grade DNA for GMP production of viral vectors, RNA and CAR-T cells QC including CGE service pDG/pDP plasmids for AAV production

High Quality Grade Plasmid & Minicircle DNA ask for

2 plasmid system

Serotypes including AAV8 & AAV9 GFP transfer plasmids

ITRRESCUE® In Stock service

now!

EU Compared to the US and China, EU biotech clusters appear to be dwarfed by the lack of industry-specific support in terms of access to funding, resources and scaling up (bio-)production. At the beginning of May, more than 900 experts from clusters and the EU Commission discussed at the sold-out 9 th European Cluster Conference what cluster policy is needed to make Europe a world leading place for the Green and Digital Transition.

Although Europe is highly innovative in biotech research it does not translate this into marketable solutions as effectively as its global competitors (see p.8), albeit modellings of the EU bio-industry (https://datam.jrc.ec.europa.eu/datam/mashup/BIOECONOMICS/) paint another picture. From the perspective of the European Federation of Pharmaceutical Industries and Associations (EFPIA), the solution lies in concentrating resources in a few large clusters in order to keep pace with global biopharma hubs such as Boston, San Francisco or Maryland. In view of the high number of innovative SMEs in Europe, however, the networking of expertise flanked by appropriate funding and sector-specific political and regulatory support could also help Europe to achieve sustainable growth. At the beginning of May, more than 900 experts from clusters and the EU Commission discussed at the sold-out 9th European Cluster Conference (ECCP.2024, Brussels) what cluster policy is needed to make Europe a world leader in the technology fields that have already been prioritised by the EU Commission, namely the green and digital transition and biotechnology. The major topic: how to attract investors.

In 2022, experts from Charles River Associates made seven recommendations on behalf of EFPIA to improve the factors that attract pharmaceutical investments in the EU. Greenfield projects outside of clusters favoured by EU Horizon funding were sharply criticised. Instead, the pharmaceutical experts want to see the EU concentrating scientific, clinical and transla-

Full house: 900 cluster professionals and policy makers in Brussels at the 9th European Cluster Conference

tional expertise in a few hubs, along the lines of the global pharma cluster Basel, the hubs around Oxford and Cambridge or the world‘s third largest gene therapy centre Catapult in the UK, where biotech value creation can be measured by deal volumes. Cluster experts from various sectors expressed a completely different view at ECCP.2024. Montse Daban, President of the Council of European Bioregions, CEBR, spoke out in favour of more networking and mapping of existing expertise in topic-specific metaclusters.

At the opening of the conference, Thierry Breton, European Commissioner for the Internal Market, addressed the topic of cluster networking with reference to the Euroclusters project. “We must overcome cross-border barriers to the internal market”, he said in a video message. That this is not always easy was not difficult to understand from conversations on the fringes

of the conference. „There are two worlds in EU cluster policy,” according to stakesholders from a Slovenian cluster, „a wellfunded one and one with fewer resources that is concerned with survival.”

How the claim “it is important to grow small clusters to innovation networks” formulated by Antonio Novo, President of the European Clusters Alliance, could look in reality, however, was not specifically addressed. In discussions, the cluster managers conveyed that although the EU Commission is endeavouring to create the conditions for growth and an appropriate regulatory environment, the clusters, with their very different and specific expertise, feel that their sector-specific needs are not being heard or understood. Whether the USA and emerging Asian countries are better able at providing the relevant expertise in the responsible bodies – keyword: mindset – was also not thematised

at the conference. Hard facts on innovation scores and the corresponding global ranking in key technologies were presented at the conference by Jan-Philippe Kramer, Team Leader, Data and Policy, European Cluster Collaboration Platform, at Prognos.

According to Prognos analyses, China has already caught up with the EU in terms of innovation through massive investment and sector-specific policies and is on its way – with a steep growth curve – to catching up with the vice-innovation champion USA (and – not shown –world champion Switzerland). According to Prognos, 17% of the mapped EU cluster organisations are in the healthcare and agrifood sectors, respectively, and 18% in the energy sector. Kramer emphasised the great importance of clusters in the innovation process, citing that the densely clustered Spanish province of Catalonia alone accounts for around a third of Spanish patents. Kramer noted that the most innovative clusters are those that are well-positioned in the green and digital transition and highlighted that the achievement of innovation policy goals depends crucially on cooperation with clusters, but that the success of clusters is also highly dependent on long-term, coherent and practical political support through stable political framework conditions. To date, 14 EU member states are active in cluster policy.

Cleantech and biotech solutions play a strategically important role when it comes to the competitive reorganisation of existing value chains and the creation of new ones that are climate-friendly and low in fossil fuels. Montse Daban, President of CEBR, which represents 50 European Bioregions, emphasised: “We have to map the technological competencies that are available in clusters.” Due to the increasing fusion and simultaneous use of technology fields such as AI/data sciences, biotech and med-tech/diagnostics, it is crucial for success to develop solutions cross-sectorally and to network competences, such as in the EU Fab Initiative from the pandemic year 2022. It is about networking many

smaller contract manufacturers in order to be able to produce a wide variety of vaccines in sufficient quantities if needed. In Europe, with its numerous SMEs, this is a prime example of how expertise can be bundled thematically without geographical clustering. Like many visitors to the conference, Daban called for more stability and predictability in political priorities: “Investors need only two things: stability and critical mass, that is how we can attract money”, she said (see p. 16). This probably meant a long-term commitment and rapid implementation, as recently demonstrated by the UK government with its 10-year biomanufacturing plan and the US with its modern bioeconomy strategy. According to current plans, the new EU Commission will not take up this important topic until mid-2015 and adapt it to the current global state of development.

The discussion then turned to the priorities of the eagerly awaited new (old) Commission. It is clear that the desired green and digital transformation will require a lot of investment while fresh money is not available due to the mid-term financial plannings of the EU. However, how the money is to be distributed across the fields of SME funding, scaling and product roll-out will not be decided until mid-2025.

During an interactive brainstorming session initiated by the Commission on

cluster needs in various fields of technology, it became clear that not much can be created in the clusters without funding. However, Christian Ketels from Innovation Fund Denmark previously had summarised well what the many cluster managers gathered in Brussels are actually concerned about. Much has changed as a result of the current geopolitical crises, he said: “The current challenges must be tackled in co-operation. No single company can do that any more. That‘s why we need new forms of co-operation and that is expressed in the clusters and in its cooperation. It is a real challenge, because only a few recognise the problem-solving expertise of clusters.” Their actual task is not to offer services for companies, but to offer industry the strategic solutions it needs. “We need to talk to politicians with one voice, because we hold the means of implementation in our hands. It is important that EU policy does not see clusters as recipients of funding, but as partners in solving problems.” With regard to the maximum funding period of ten years, Marc Andres from Flanders innovation & entrepreneurship added “making clusters self-sufficient is not a good idea, because it drives them into dependency from industry.”

Verónique Willems, Secretary-General of SMEunited, made it clear in Brussels that the pandemic had driven a lot of SMEs into bankruptcy, but that state subsidies did not necessarily lead to a loss of

competitiveness. “You can‘t buy them,” she explained. Companies would tend to avoid the funding offer simply because of the time-consuming application process, but would love clusters with a thematic focus, as these help take away investors fear of risk and offer infrastructure and network value.

In addition to the biotech incubators‘ permanent hunger for funds, the 70 exhibitors in Brussels – despite major support from EU funding – are also struggling with a completely different problem: regulatory issues. While the US has a single authority responsible for the approval of therapeutics and their accompanying diagnostics, particularly in personalised medicine, there is a lack of notified bodies for diagnostics subject to EU medical device regulation, it was said on the fringes of the conference. Coordinated authorisation of early and companion diagnostics for novel medicinal products is hardly possible, according to various stakeholders. It is therefore no wonder that companies such as Adrenomed AG are seeking FDA accelerated approval procedure for the first effective sepsis medicine in a patient population previously stratified with two biomarkers. Furthermore, the early cancer diagnostics company Harbinger Health Inc., founded by German researchers in the USA and seeded with US$80m in capital, is validating its approval-relevant methylation pattern liquid biopsy tests, which cover the Big Five cancer indications in Stage I and II, on 10,000 US citizens.

It remains to be seen whether, as suggested in the Green Transition session moderated by Kirstin Dunlop, CEO of the EIT Climate KIC, the clusters can only be helped by a “green dictatorship” that implements industry-friendly rules as quickly as Singapore, China and the USA. The newly elected European Commission and the decision criteria extracted from the dialogue with the experts will be in the focus of attention and discussion. L

t.gabrielczyk@biocom.eu

CEBR Biotech clusters and ecosystems are seen as the cradle of innovation. At the European Cluster Conference 2024, Europ E an Biot Echnology spoke with Montse Daban, President of the Council of European Bioregions, about Europe’s position and outlooks.

EuroBiotech_Europe’s biotech sector and clusters lag far behind the USA and now also behind Asian countries such as China and South Korea in terms of value creation and financing. What are the reasons and possible solutions?

Daban_If we look at Europe as a whole, according to a recent EuropaBio report,

DR MONTSE DABAN holds master’s degrees in science communication with a focus on medicine, biology, and diplomacy and foreign relations. She also holds a doctorate in molecular biology. She has over 35 years of experience as a life sciences and scientific communication researcher, having worked in Cleveland, Barcelona, Lille, France, and Ohio. In addition to her work as a scientific publisher at Editorial Rubes, she has advised the Department of Research and Universities of the Generalitat of Catalonia on R&I policies and international relations. Dr Daban has worked at Biocat, the BioRegion of Catalonia since 2006, currently as Director fo Strategic Foresight and International Relations. She serves as President of the Council of European BioRegions (CEBR) and as member of the Board of Directors of the European Clusters Alliance (ECA).

the industry has a production turnover of €425bn and there are around 9,51 million people employed in healthcare in the EU, and another 840,000 in the life sciences industry. Europe is a biotech hub. It’s true that biotech companies in the US receive more financing than the companies in Europe but along with the United States and China, the EU is a major hub for biotechnology. Compared to these regions, Europe is a more complex market. Thousands of EU companies are developing new therapies, new diagnostic equipment, vaccines, and advanced medicinal products, but Europe’s rules for innovation and financing are complex and there are differences among Member States that complicate the landscape while offering an attractive diversity and huge possibilities. At the same time, there’s a huge effort in life sciences funding in the EU from public EU funds and investment instruments and Member States to leverage private funding. The pharma package is seen as an opportunity to increase access and affordability, improve resilience and foster innovation, even if some players have expressed fears that it could attract or slow investment and reduce or not close the gap with US and China.

EuroBiotech _How can clusters help to improve the situation?

Daban_We are at the European Clusters Conference. The main take-home message is: it is unlikely that companies attracting investment are not in a cluster, connected synergistically with other key players and profiles in the ecosystem. Clusters, understood as ecosystems and not just industrial associations, are more than connectors. Provide stability and critical mass, the two main drivers to attract investment. Talent, funding, policy making, connection, dem-

onstration spaces, critical mass to drive change – this happens in a cluster. Cluster organisations are multipliers of value.

EuroBiotech _Why don’t we simply copy the approach of large clusters from the US? What makes sense in Europe and promises success?

Daban_It does not work the same way in Europe as it works in the US. Even if there are large hubs in Europe, every country has its policies, regulations, legislation. The European model for innovation is about not leaving anyone behind. We cannot concentrate and leave others behind. The policies in Europe tend to reduce the gaps not increase them. The model is different and my belief is that Europe can only be competitive if all the territories are competitive. And clusters, with metaclusters like the Council of European BioRegions and the European Clusters Alliance, contribute to this connection across Europe

EuroBiotech _Which political flanking measures do biotech SMEs in the EU clusters need in order to bring the high level of innovation in research to the market?

Daban_There are several measures but I would like to highlight three enablers: skilled talent across the value chains, reduction of regulatory burdens and increased innovation procurement.

Global biotech ranking map. Since 2009, Thinkbiotech gives updates on parameters determining the global competitivity of biotech in a nation regarding productivity, intensity, enterprise support, education & workforce, foundations, as well as policy and stability. In contrast to scores that focus on pharma biotech, the map ranges from advanced medicines to and improvements in agriculture to feedstocks and biofuels, and further to exotic industrial materials and processes and is a a distillation of the Scientific American WorldView Scorecard which was developed by Dr. Yali Friedman in 2009.

EuroBiotech_How can the networking of small clusters and open innovation contribute to creating success stories similar to the large clusters in Boston or San Francisco?

Daban_European Clusters do have success stories. Existing metaclusters connecting these not-so-small clusters across member states, collaborating to reduce the gap and increasing impact

on European population, connecting sectors, growing business that put the patient not at the center but at the origin is a success story. These clusters reduced disruptions in value chains during the pandemics through daily collaboration (calls, exchanges, connections) for months. That is a clusters’ success story too. L

t.gabrielczyk@biocom.eu

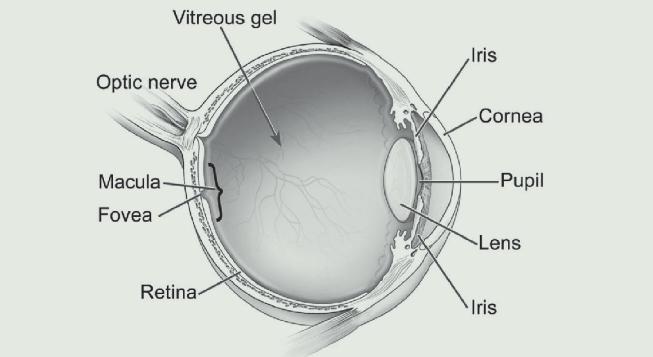

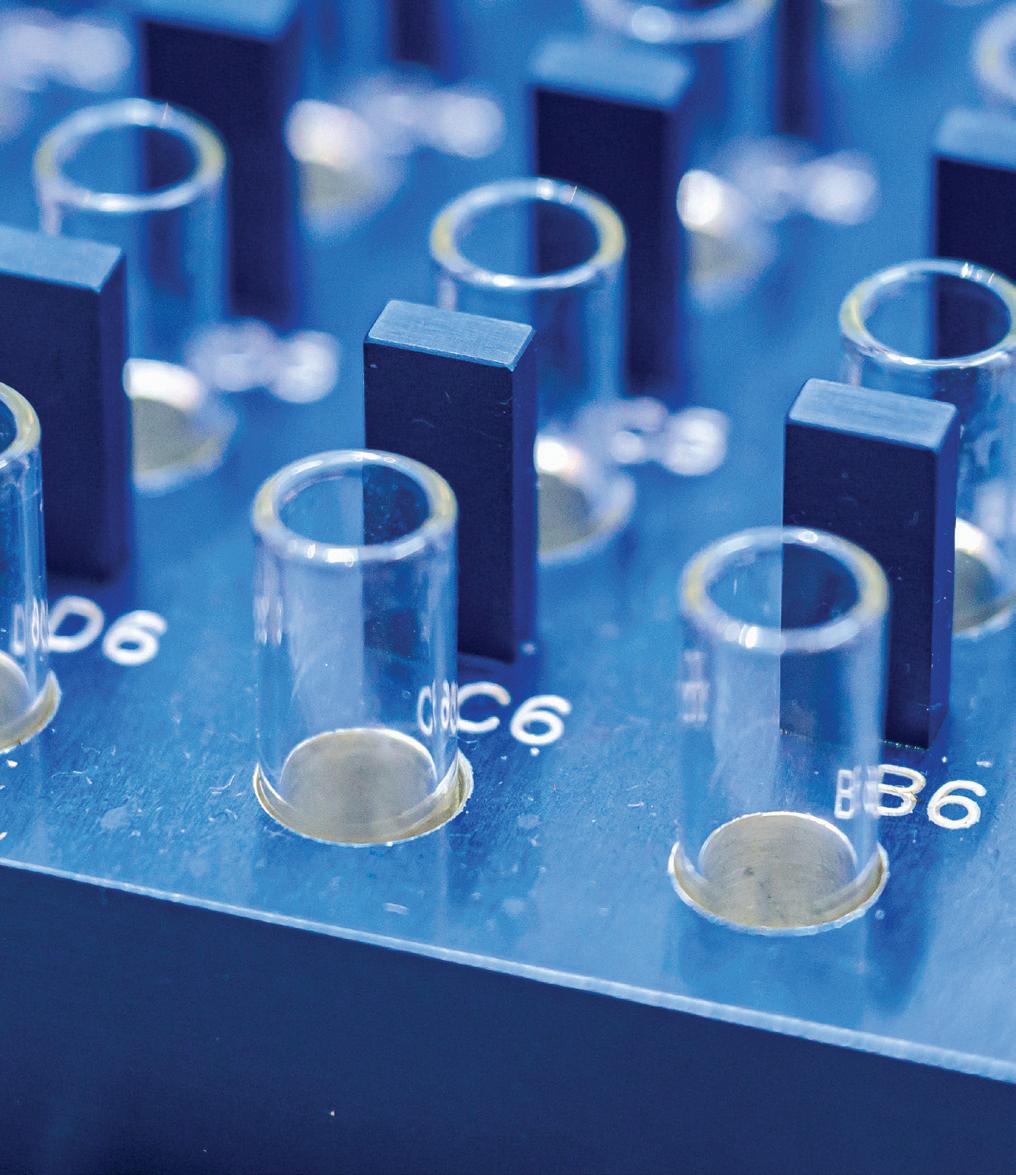

MODELLING The Three R (Replacement, Reduction and Refinement) principles developed over 60 years ago provide a framework for more humane animal testing and, more importantly, less of it. A number of in-vitro model systems are now out there, but only recently has the use of multi-organ chips gained serious momentum. 3D printing technologies loaded with stem cells are increasingly allowing the replication of human tissues and organs for testing purposes.

The Three Rs were first defined in 1957 by Russell and Burch in their book The Principles of Humane Experimental Technique. Since then, the guidelines have been incorporated into national and international laws and regulations governing the use of animals in scientific procedures, as well as into the policies of organisations that fund or conduct animal experiments. But despite some headway, animal testing in the life sciences continues to decline slowly, if at all.

For many years, the EU’s statistical database ALURES (AnimaL Use REporting System) on the use of animals for scientific purposes in accordance with Directive 2010/63/EU has attempted to provide a numerical basis for animal testing in research and product approvals. However, the data framework changed in 2019 due to Brexit and new inclusion for Norway, leaving room for misinterpretation. In spite of those complicating factors, indications imply that the number of animal experiments in the EU has fallen. There were around 8.1 million lab animals in the bloc in 2019, and just 7.3 million in 2020. That’s the first time the number of animals has dropped below 8 million since the introduction of Di -

rective 2010/63/EU. There’s an ongoing debate as to whether this fall might only be a result of pandemic-driven lockdowns. Viewed positively, however, it’s hard to see why the number of animals involved in clinical testing might have actually dropped despite massive efforts to get vaccines and therapeutics against COVID -19 over the approval line.

One way or the other, there is major interest in finding alternatives to animal testing, as animal data are not just costly, time-consuming and ethically questionable, but also often fail to predict results in human trials. A lack of humanrelevant preclinical models – and the resulting high failure rates for therapeutics in the clinic – have led to unsustainable rises in healthcare costs and fewer effective medicines reaching patients. Pressure from societies and governments to find alternatives to animal testing is also growing harder to ignore, as evidenced by the US Food and Drug Administration (FDA) Modernisation Act of 2021 and the Humane Research and Testing Act (HR 1744) passed by the US Congress. This new law disperses with the requirement that drugs in development have to be tested on animals before being given to participants in human trials. Signed by

US President Joe Biden in December as part of a larger spending package, however, the new legislation doesn’t ban testing new drugs on animals completely. Instead, it simply removes the former hard requirement that pharma companies use animals to test new drugs before testing them on humans. Companies are still allowed to test drugs on animals if they wish. Even so, the act is a sign of how strongly the FDA is promoting the development of alternative testing methods.

The stage is thus set for other methods pharma companies can use to evaluate new treatments, such as computer modelling and “organs-on-a-chip” (OOCs) –microfluidic devices that can mimic how organ function is affected by drugs. And companies that provide technology or equipment for organoids and OOC models have indeed seen increased demand since the new FDA law was passed, according to Reyk Horland of Berlin-based TissUse GmbH.

Currently, however, genetically modified mice and other animal models continue to dominate both basic research and drug development. Aware of this fact, the FDA has not mandated an immediate end to the most widely used research methods. Avoiding animal testing is hence still

There are many different options when it comes to organ-on-a-chip systems

a recommendation rather than a requirement. Most industry experts say the transition will take time, because almost every benchmark animal model will have to be replaced by an alternative system on a case-by-case basis, and each replacement will have to prove its efficacy. So these are uncertain times for companies that choose to use alternative test methods to replace animal testing. And as always, uncertain times harbour both risks and opportunities. New technologies could very well be able detect potential toxicities and safely capture all the conceivable types of toxicity that have been observed in the past. But it’s also important to be aware of their limitations.

The pharmaceutical and biotechnology industries spend billions every year to take compounds from discovery in the lab to approval by healthcare authorities. In many parts of the world today, regulatory approval continues to require animal testing for safety and efficacy – even though many studies have shown that results from animal testing often don’t accurately predict results in humans. Over and over again, that approach has led to drugs and vaccines that successfully pass through the preclinical development pipeline – including studies in small animals or even non-human primates –but then either fail to show efficacy (e.g. tuberculosis MV85a, HIV-1 DNA/rAd5,

hepatitis C vaccines) or cause potentially life-threatening toxicities. That was the case for instance with monoclonal antibody Hu5c8 (CD40L), which showed unexpected thrombotic complications. Like many other discontinued candidates, it led to human trials that resulted in serious side effects (e.g. TGN1412/ Tegenero). Some have even caused deaths. Equally worrisome is that there are probably drug candidates that would have proven safe and effective in humans, but never reached clinical trials in our species because they were dropped from development pipelines due to erroneous results in animals.

The poor predictive power of preclinical models is particularly troublesome given their heavy reliance on animals – especially genetically modified mice – in basic research, which is where potential drug targets are often first identified. When researchers have directly compared the predictive value of mouse models for a number of human diseases (among them Alzheimer’s, sepsis and acute respiratory distress syndrome) the results have proven dismal. Even when animal models of disease are phenotypically similar to humans, underlying molecular and cellular mechanisms are often different, and potential therapeutic targets identified in these models may therefore lack clinical relevance.

The greatest attrition in development pipelines still happens when making the jump to the clinic, with failure rates of 45% in Phase I and another 50% in Phase II. And those numbers are also often related to poor comparability of animal and human data. One attempt to circumvent this uncomfortable fact has been to implant more and more humanlike tissues and cell structures into experimental animals. But although there are now ‘human’ immune systems in GM mice or ‘human’ organs in large animals like pigs, comparability remains limited.

The call for relevant models

The development of therapeutics has been additionally transformed in recent decades by the creation of biological therapies like monoclonal antibodies, adeno-associated viral gene vectors, small interfering RNAs and CRISPR-RNA therapies. What all these approaches have in common is that some of these compounds may be so specific to human target sequences or conformations that they should either have no effects in non-human models or initiate completely different activities. With biological therapies approaching personalised medicine levels in almost half of all drugs in development, preclinical models that are relevant to individual humans have become a critical need.

Other challenges also require human modelling. For example, one recent paradigm shift in medicine has been the recognition of the central role that the microbiome plays in human health and disease. However, the complex communities of microorganisms that make up the microbiome differ in humans between different individuals, and even in the same person at different times or places. This challenge is compounded by the fact that it still isn’t possible to culture complex microbial communities in direct contact with human cells, as the process often leads to contamination and rapid cell-death.

The need for personalised preclinical models has grown even more important as the healthcare industry shifts focus to precision medicine. For example,

findings of a high variability in response to therapies between different genetic or ethnic populations, which is seen in some clinical trials, raises the question of whether it still makes sense to model human genetic diseases using inbred animal lines. Iconic geneticist Craig Venter has often said in plenary discussions that the mouse and human genomes are simply too different to be compared at all. There are ways to address these new challenges. Among them are preclinical human in-vitro models that use organspecific cells isolated from surgical specimens, as well as organoids containing adult stem cells or induced pluripotent stem cells (iPS cells) from individual patients.

Organ-on-a-chip (OOC) micro fluidic culture devices represent one recent success in the quest for in-vitro microphysiological systems (MPS) that can recapitulate organ-level realities and even organ-level functions. To avoid linguistic confusion between spheroids, organoids, organs-on-chips and many other terms, the lowest common denominator of all these approaches is termed the “microphysiological system”. On a chip, the microfluidic form of a microphysiological system can be of different sizes and shapes, but all contain hollow channels lined with living cells and tissues cultured under dynamic fluid flow. Some devices replicate organ-level structures (e.g., tissue-tissue interfaces) and provide the relevant mechanical cues (such as respiration and peristaltic-like motions) needed to faithfully model organ physiology and disease states. By fluidically coupling two or more organ chips, human “body-on-chips” can be created. These multi-organ systems mimic whole-body physiology, along with drug distribution and disposition. Advances in stem-cell technology, like those involving iPS cells and organoids, have enabled the cultivation of personalised stem cells that can now be integrated and differentiated into OOCs to create patient-specific preclinical models.

To date, developers of microfluidic devices have focused on design and construction, along with an experimental demonstration of their ability to replicate relevant tissue and organ functions. Over the years, a range of different companies have built up high levels of expertise in chip design, the use of suitable materials, miniature pumps and the application of microphysical forces to move fluids, as well as in the detailed analysis of the components in these systems. They involve tiny volumes, but also extremely fast interactions. And it all takes place in a small space, a situation that has to be resolved using various spectroscopic and microscopic methods.

The challenge now is to take things to the next level by demonstrating equivalence or even superiority to animal models. If human OOCs prove to be better, they can be used not only to reduce animal testing, but also truly used to develop or select therapeutics that have been personalised for individual patients, specific genetic subpopulations or even subgroups with specific disease comorbidities. The field has the potential to revolutionise clinical trial design.

The first microfluidic culture device recapitulated structures and functions at the organ level (i.e. multiple tissues) of a major functional unit of a human organ – the pulmonary alveolus. It was created using a soft lithography-based manufacturing approach borrowed from the microchip industry.

The Lung Alveolar Chip is a device around the size of a flash drive made from an optically clear, elastomeric polydimethylsiloxane (PDMS) material that contains two parallel hollow channels separated by a porous membrane. It’s coated with extracellular cell matrices (ECM) lined with human lung alveolar epithelial cells on one side and human vascular endothelium on the other, mimicking the alveolar-capillary interface. A culture medium is perfused through the endothelium-lined channel to mimic vascular perfusion, and air is introduced into the epithelial channel to mimic the airliquid interface of the lung. This is critical for lung differentiation and function, and instigates cyclic aspiration on the hollow side-chambers. That in turn allows cyclic tissue deformation to occur at the flexible tissue-tissue interface, mimicking respiratory movements.

This dual-channel chip design has since been modified to permit open access to one channel, allowing the formation of a thicker tissue construct while still applying cyclic mechanical stresses (e.g. for a skin chip). It has been used by several groups to create microfluidic models of various organ types with fluids flowing through both channels. Other single device and multiplexed versions have been fabricated using a range of methods (among them soft lithography, physical removal of sacrificial cylindrical mandrels, injection moulding) or by replacing the porous membrane with an ECM gel to support tissue ECM formation, tissue-tissue interface formation,

or cellular ingrowth to study dynamic 3D morpho genetic processes (e.g. tumour angiogenesis and lymphangiogenesis).

“An extremely large number of new methods have emerged,” says Reyk Horland from TissUse. “In a chip, you try to reproduce not only the cell architecture but also the physiological conditions in a way that is as close as possible to the human situation. This is commonly not the case with cells or tissue cultured in a standard cell culture plate,” he remarks, clarifying the differences between OOC developers and the organoid community. The presence of dynamic fluid flow and organ-specific mechanical cues has been repeatedly shown to promote higher levels of tissue-specific differentiation and improve organ-level functions – even beyond those seen in static 3D organoid cultures, when organoid-derived cells are used to line the chips. As these chips are actively perfused, immune cells can be channeled through the vascular endothelium-lined channel, like in circulating blood. Resident immune cells can also be placed on-chip in 3D ECM gels

to mimic lymphatic and haematopoietic microenvironments, thereby reconstituting specialised lymphoid follicular and bone marrow structures and functions in vitro.

As OOCs are typically fabricated using microengineering approaches, it is also possible to incorporate various types of in-line sensors to monitor tissue viability and function, including real-time monitoring of oxygen levels, changes in tissue barrier integrity (e.g. use of integrated electrodes to measure transepithelial and/or transendothelial electrical resistance or impedance spectro scopy) and cellular electrical activity (e.g. use of multi-electrode arrays).

As interest in the field skyrockets, all of these approaches are entering the limelight at once, and it isn’t easy to select the best system to answer a particular question. For example, growing numbers of special-tissue organoids modelling brain or hearts (like those from

ahead.bio or Heartbeat.Bio in Vienna) are growing in importance in early drug testing. They also have a lot to teach us about the minimal necessary interplay of cell types and tissue architecture when it comes to transferring such systems to chip platforms and a high-throughput testing environment.

But observing how tissue develops in an organ culture can also bring new insights. Sasha Mendjan from the Institute of Molecular Biotechnology (IMBA) and co-founder of Heartbeat.Bio recently published a study in the journal cEll (autumn 2023) on the first heart organoid to have multi-chamber architecture. These cardioids are licensed to Heartbeat.Bio and allow researchers to analyse chamberspecific defects. As a proof-of-principle, the Mendjan team has established a defect screening platform in which they are investigating how known teratogens and mutations affect hundreds of cardiac organoids simultaneously.

Thalidomide is known to cause severe heart defects in foetuses. The same is true of retinoid derivatives used to treat leukaemia, psoriasis and acne. Both teratogens induced similar severe ventricular defects in cardiac organoids. Similarly, mutations in three cardiac transcription factor genes led to ventricle-specific defects like those observed sometimes in human development. “Our tests show that multi-chamber cardiac organoids can recapitulate embryonic heart development and reveal perturbing effects on the whole heart with high specificity. We do this with a holistic approach by looking at multiple measurements simultaneously,” Mendjan explains.

OOCs developed in the last decade now model a wide range of human disorders in virtually all organ systems, providing new insights into the molecular and cellular basis of various physiological and pathophysiological processes. They’ve also been used to simulate different types of drug delivery approaches, and to recapitulate clinical responses to therapeutics in human patients.

Human OOCs have been produced using primary cells from human donors or established cell lines and patient-derived organoids or iPS cells. Hamburg-based Evotec SE is very confident in its iPS stem-cell platform, which makes it possible to generate different cell types and use them in a high-throughput process for screening in the early analysis of active substances. Its multi-billion research collaboration with Bristol Myers Squibb shows how much interest this approach to organ-like cellular test systems is attracting.

Based on recent advances with iPS cells in the field, it is now possible to envisage a future where single OOCs – or multiorgan chip systems made with organotypic cells from the same patient – could be used as personalised living avatars (organ-twins) to repurpose or select more effective and less toxic therapeutics, optimise routes of administration and develop dosing regimens for a specific patient, opening up new avenues in precision medicine. Such an approach will be costly, so one early step might be to produce chips loaded with primary or stem cells from patients who represent unique genetic subpopulations, and use these chips to develop or select new drugs for specific groups, and only then conducting clinical trials with these patients. That could reduce both time and cost factors and increase the likelihood of success in the drug development process.

The community is taking it step by step, according to Horland: “Many experts believe that eleven organs are probably enough to represent a mini-organism of the human. Preferably with a female and a male version to meet the growing demand for gender-specific analysis methods. But we are not there yet.”

Although OOC technology has a lot of potential, there are still technical, social and economic hurdles left to overcome before significant numbers and types of animals can be replaced. For some areas of testing, like behaviour or cognition studies, or ones looking emotions or anxiety, chip formats won’t work. But in places like ADME (toxicity testing of Absorption, Distribution, Metabolism and Excretion) studies could be adequately performed on a device.

Sourcing high-quality human cells has also always presented major challenges, but with iPS cells and organoids growing more available, this is less of an issue today. Most OOCs are also low-throughput but high-content. So they generate a lot of data. And that can be valuable in later stages of the drug development pipeline (e.g. when lead compounds need to be selected for further drug development), although not in the earlier discovery phase. Also, artifical intelligence is being integrated in simulation procedures.

Higher-throughput systems are necessary to enable statistically significant studies with a lot of replication, which is essential for pharmaceutical validation. The recent development of higher-throughput OOCs (i.e. single devices with many parallel culture chambers) is addressing this issue. If they can retain many of the key features required for drugs testing, this route should also be pursued. Another aspect that needs improving is automation. There new players from very different industry sectors have been entering the OOC space, among them assembly line experts from the Festo Group, who collaborated on an automated chip environ ment with robot-assisted chip handling process in the incubator.

Perhaps the biggest challenge facing organoid/organ-on-a-chip technologies, however, is a conceptual one. Many pharmaceutical, regulatory and academic researchers have invested heavily in the way they currently conduct research, and may be reluctant to change their methods. They will demand convincing data demonstrating the advantages of human OOCs over animal models before accepting the new technology in their labs. However, the new rules from the FDA should help accelerate acceptance of devices as a replacement for animal models. It feels as though we have reached a turning point in the field, with a real reduction in the use of animals on the horizon, along with applications that will help make more effective approaches to drug development and personalised medicine a reality.

The European Commission, on the other hand, has been slow to move in this direction, stating last year that it “does not share the view that a legislative proposal is necessary to achieve the objective of phasing out the use of animals in research, education and training.” However, it continued uninspired, the EU would “begin to explore the possibility of coordinating the activities of member states and national authorities in this area.” L g.kaeaeb@biocom.eu

There is a growing body of evidence showing that mitochondria are not only the powerhouses of a cell, but that their transfer may also function in rescue of cells in distress. Still early times, start-ups are already working to bring mitochondria therapy to the patient. EBM spoke to Alexander Schueller, CEO of Switzerland-based cellvie, about a long and winding road.

EuroBiotech _Mitochondria are not part of the standard repertoire of research, let alone clinical practice. Are the systems for dealing with these cell organelles sufficiently developed?

Alexander Schueller_Mitochondria remain somewhat elusive, given that most laboratory technologies available today were designed for research on cells –which are often more than 1000-fold larger than your average mitochondrion. This presents a challenge to the field as it limits our ability to characterise and trace mitochondria for example.

EuroBiotech _Would you say that regulation is more refined at this point, where does mitochondrial transplantation stand?

Schueller_The regulation for mitochondria transplantation is still evolving, but we expect that the therapy will be regulated as a biologic in the USA. Now, while there is little explicit precedent to go on, we can take cues from the regulation on cell and gene therapies or exosomes. So, I would say we roughly know what to expect, but the details remain to be determined. On the upside, as the ones pioneering the field, we will have the chance to work closely with the FDA or EMA to help shape the regulation.

EuroBiotech _What exactly is cellvie’s therapy and how to use it?

Schueller_We take mitochondria from cells and purify them. Most importantly, we developed processes and excipients to be able to freeze these mitochondria

ALEXANDER SCHUELLER CEO of cellvie AG, located in Zurich, Switzerland and Houston, Texas (USA). The company with founders from Harvard Medical School was seedfinanced by Kizoo of Michael Greve.

without compromising their therapeutic potential. This is essential to enable centralised manufacturing, allowing for the mandated process controls and documentation, as well as the production at scale and thus reasonable costs. So, the product are frozen mitochondria in a vial, provided with a delivery buffer, ready to use within minutes, allowing seamless integration into the clinical workflow. In terms of applications, we view mitochondria as a platform technology. We are pursuing kidney transplantation first, as a steppingstone to the large

cardiac markets of ischemia-reperfusion injury. By rescuing cells that are damaged in conjunction with organ extraction, transport and transplantation, we expect to improve organ viability, longevity as well as availability. Importantly, this is not a day dream. The efficacy of our stored human mitochondria has been shown in corresponding large animal experiments. In addition to our lead-asset for ischemia-reperfusion injury, we have been developing a promising pipeline in cell and gene therapy, for example the use of mitochondria as non-viral vectors for gene therapy delivery to solid organs other than the liver.

EuroBiotech _What is known and understood to date about the therapeutic potential of mitochondria to ameliorate the ischemia-reperfusion injury, for example during an organ transplantation? Schueller_There are still unknowns, given the relatively early stage of the field. But researchers in academia and industry have been converging on a key mechanism by which mitochondria transplantation likely rescues cells or improves their performance. Specifically, we and others have observed mitochondria transplantation to trigger mitophagy and mitogenesis and thereby reinvigorate the cell energy metabolism, which has been disturbed due to ischemia – i.e., the lack of blood flow. A finding, which was confirmed very recently in a Nature publication, one of the most rigorous and hence impactful scientific journals. Whilst a consensus seems to be building in that mitophagy and mitogenesis are key mechanisms of

action, they may not be the only ones. The exact function and effect of the transplanted mitochondria are hence still being debated, particularly across different applications. But their complex nature and multi-dimensional effects are precisely why, in my opinion, they may offer a completely new starting point for thus far intractable human conditions such as ischemia-reperfusion injury.

EuroBiotech _What therapeutic applications do you foresee for mitochondria transplantation?

Schueller_We believe in mitochondria as a platform technology. However, one has to be careful to not overstate the expected use-cases. Mitochondria are not pixiedust. But there are already a range of medical conditions wherein mitochondria transplantation has shown promise. Most notably and repeatedly, in ischemia-reperfusion injury, which was the application wherein my co-founder, Dr.

McCully, pioneered the field. Ischemiareperfusion injury arises whenever the flow of blood is interrupted and subsequently re-introduced. Medical conditions include heart attacks, organ transplantations, strokes, or long surgical procedures. There are hence millions of patients that stand to benefit each year. Recently, a group in the US, in collaboration with Dr. McCully, also showed that the performance of the aging muscle may be improved by mitochondria transplantation. Another interesting area, which we are also working in, is the amplification of cell therapies by ex-vivo transplantation of mitochondria. There may be more, and, with the zeroing in on mitophagy and mitogenesis as a key mechanism of action, I believe a roadmap may be emerging to find them.

EuroBiotech _But do investors react favourably to such early, high-risk projects in the current climate?

Schueller_I have prior experience in founding a company, but in medical devices. We developed a surgical adhesive. There the story was more simple. You could see the glue, you could put it on your skin to showcase its characteristics or perform acute animal workshops for that same purpose. There was also a clear understanding of the regulations and the path to follow for approval. Now with mitochondria it’s completely different. Something this new does not commonly trigger enthusiasm among investors, but uncertainty. I frankly underestimated the extent to which ambiguity may overshadow upside potential.So, no, I would not say that investors generally view such early stage projects favorably, and even less so in the current climate.

EuroBiotech_And your experience didn’t play so much of a role in convincing investors?

Schueller_It helped, but it was insufficient. Even with our Harvard origin, a strong founding team, and first clinical proof of concept data, mitochondria transplantation was seen as too risky, or fringy by most people we spoke to. We were fundraising for nearly two years until Michael Greve with his venture capital firm Kizoo gave us the first major capital to start addressing the uncertainties that kept more traditional VC funds at bay. We are very grateful for that. Without his impact-driven investment philosophy, we would not have been able to bring Taiho Ventures on board, who led our funding round last year. Generally speaking, the average investor, especially in Europe, does not have the fund size or mandate to fund the emergence of a new field of medicine.

EuroBiotech _Buzzwords such as longevity are not enough to open the check books?