Partnering to produce high quality, life-changing biotechnological treatments for patients

State-of-the-art mammalian cell culture manufacturing facilities in Europe and Asia for clinical and commercial material, ranging from 150 to 13,000 liters.

Customized solutions and efficient handling for your microbial-based products, with upstream and downstream capabilities ranging from 150 to 40,000 liters.

High-quality plasmid DNA and RNA manufacturing for various types of RNA drugs (including siRNA), mRNA vaccines and innovative gene and cell therapies, up to a scale of 3,000 liters.

Rely on a leading Cell & Gene therapy manufacturer with an excellent team and high-tech facilities.

Producing viral vectors for vaccines or cell and gene therapy in a state-of-the-art facility.

A fully integrated set of services and solutions for aseptic fill and finish of medicinal products. Available packaging systems and volumes include:

• Vials (liquid, lyophilized)

• Pre-filled syringes

• Low-level siliconized syringes

• Droptainers

• Ampules

• Tubes

Manufacturing master cell and working cell banks to enable high-quality clinical and commercial production.

We follow a comprehensive Novartis quality assurance system, with all our facilities operating in compliance with cGMP regulations.

To find out how we can help, get in touch at biotech.cooperations@novartis.com www.novartis.com/globalbiotechcooperations

In a world where biotechnology has been enabling products and processes for decades, it’s time to step out from behind the technology and claim the resulting products and their value in our everyday life. It needs higher visibility and recognition of impact, moving beyond its ‘enabling’ brand which forever makes it sound like the benefits are just around the corner, rather than the existing significant economic and industrial impact.

CLAIRE SKENTELBERY, PH.D., a biochemist by training, has worked in the development of scientific associations for 20 years. She started her career within the UK Cambridge biotech cluster and was a co-founder of the Council of European BioRegions. In Brussels from 2009, she was also Secretary General for the European Biotechnology Network, working across sectors, organisations and countries as part of the mission to facilitate partnerships. Claire became Director General of the globally-focused Nanotechnology Industries Association until November 2020 when she joined EuropaBio as Director General.

Step up ‘Biomanufacturing’. It has relevance across sectors and the language is accessible and tangible. When we speak of biomanufacturing, we speak of employment, skills, products, trade and economic growth. It perfectly fits the evolving narrative landscape for biotech. Within EuropaBio, we see biomanufacturing delivering advanced healthcare, resilient food supply chains, sustainable manufacturing across sectors…the list is a long one and it’s time to speak with a single voice. This comes at a time of critical industrial transition. Industrial processes are responding to climate change, stretched and fractured supply chains, technologies able to deliver ever more complex products and biotechnology is right in the centre.

Europe is one player amongst many in this critical industrial transition. The White House Executive Order on Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe, and Secure American Bioeconomy kind of says it all really. Published in September 2022, the US aims to wire up its own complex landscape so that biomanufacturing can flourish. And the US is far from alone. China also has an innovative bioeconomy strategy and can move at a scale and speed beyond both Europe and the US.

What Europe needs, is its own joint plan for biomanufacturing. In the melee of General Pharma Legislation, Net Zero Industry Act, Novel Genomic Techniques, Taxonomy Regulation, Recovery and Resilience plans plus the 27 countries through whom these are delivered, biomanufacturing needs a focus and a strategy across sectors. We know from experience that policy can pull advanced technologies apart rather than give them the critical mass needed to bring investment for impactful outcomes. To that end, EuropaBio has launched a Bio manufacturing Platform, as an expansion of the 26-year-old association, that reflects the changing position and recognition of biotechnology through the lens of biomanufacture. It projects the activities and priorities of our members to deliver the investment and critical mass so crucial to the delivery of biomanufacturing. By the time of publication, we will have hosted our first Biomanufacturing Policy Summit, which will build visibility for biomanufacturing within European industrial and sector strategies. It marks the recognition of an important journey for Europe, one that it has already begun but needs to go faster and further, with a smooth road, clear signposts and the right destination.

Pre-clinical through commercial

Protein biologics | Advanced therapies

Choose a CDMO with experience at all stages of the pharmaceutical journey. AGC Biologics provides development, analytical services, and manufacturing capabilities customized to fit your project.

100+

150+

cell culture-based products

8 EFSA: Insect protein is only the beginning

12 Statement: BioNTech leaves; what does Germany do?

14 Interview: José Maria Fernández Sousa-Faro, Chairman of the Board at PharmaMar SA

18 EU stakeholder platform set to speed up clinical trials; Petroleum giants and the greenhouse-gas lie ECONOMY

Nearly thirty years ago, Bill Gates commented that “DNA is like a computer program, but far more advanced than any software ever created.”

That recognition, however, was only the first step on a long road. Reconfiguring cellular or viral DNA to create something entirely new remained stubbornly expensive for decades. Now programmable biology is maturing, and finally looks set to drive revolutions in medicine, chemistry and consumer markets.

80

64 Northern Europe: Sweden, Denmark, Norway and Finland

66 Western Europe: France, Belgium, The Netherlands and the UK

68 Central Europe: Germany, Switzerland and Austria

70 S outhern Europe: Italy, Spain, Slovenia and Portugal

72 Eastern Europe: Estonia, Hungary and t he Czech Rebublic

74 SOS from adipose cells; Modelling fatty liver disease; Gut microbiome affects onset of multiple sclerosis

76 The price of eating ultra-processed food

PICK & MIX

81 News from Biotech Austria; the European Circular Bioeconomy Fund, Young European Biotech Network, Swiss Biotech Association, German Association of Synthetic Biology and the European Biotechnology Network

88 Company index/New product 89 Events

IMPRINT European Biotechnology (ISSN 2364-2351) is published quarterly by: BIOCOM AG, Jacobsenweg 61, D-13509 Berlin, Germany, Tel.: +49-30-264921-0, Fax: +49-30-264921-11, Email: service@ european-biotechnology.com, Internet: www.european-biotechnology.com; Publisher: Andreas Mietzsch; Editorial Team: Thomas Gabrielczyk (Editor-in-chief), Derrick Williams (Co-editor), Dr Georg Kääb, Uta Mommert, Gwendolyn Dorow, Margarita Milidakis, Maren Kühr, Arno Fricke; Advertising: Oliver Schnell, +49-30-264921-45, Christian Böhm, +49-30-264921-49, Andreas Macht, +49-30264921-54; Distribution: Lukas Bannert, +49-30-264921-72; Graphic Design: Michaela Reblin; Production: Martina Willnow; Printed at: Königsdruck, Berlin; European Biotechnology Life Sciences & Industry Magazine is only regularly available through subscription with a BIOCOM CARD. Annual subscription BIOCOM CARD Europe: €80 for private individuals (students €40) incl. VAT, €120 plus VAT for corporates. Prices includes postage & packaging. Ordered subscriptions can be cancelled within two weeks directly at BIOCOM AG. The subscription is initially valid for one calendar year and is automatically renewed every year after. The subscription can be cancelled at any time and is valid until the end of that calendar month. Failures of delivery, which BIOCOM AG is not responsible for, do not entitle the subscriber to delivery or reimbursement of pre-paid fees. Seat of court is Berlin, Germany. As regards contents: individually named articles are published within the sole responsibility of their respective authors. All material published is protected by copyright. No article or part thereof may be reproduced in any way or processed, copied, and proliferated by electronic means without the prior written consent of the publisher. Cover Photo: © Alexander Limbach - stock.adobe.com; ® BIOCOM is a registered trademark of BIOCOM AG, Berlin, Germany.

BIOSIMILARS

Europe has been very proactive in the early adoption of biosimilars, with over 70 authorised in the bloc. But distribution on the continent is uneven. Some countries use them far more than others. Market opportunities abroad are also beckoning, but only a few companies have organised strategies to expand into the Middle East or Africa. If they miss the boat, India and South Korea could slip ahead.

Pressure to focus on sustainability issues are rising for companies in every industry, and pharmaceuticals is no exception. Some firms are trying to meet requirements for environmentally-friendly packaging alternatives. They were in the limelight at this year’s Pharmapack Europe.

As recently as the 1950s, petroleum was seen as a futuristic source of progress and prosperity: Cars became a symbol of freedom, plastics an earmark of progress. Just 70 years later, fossil resources stand for environmental pollution and global warming. The EU Commission is set to ban non-reusable and non-recyclable plastic packaging by 2030, and is aiming to prohibit combustion engines by 2035. In a range of sectors, the potential consequences of the EU Plastics Strategy are already evident. At this year’s Pharmapack event in Paris, sustainability was in the front row (see p. 46). The situation is similar for CDMOs that rely on single-use bags. As Big Pharma demands ESGcompliant services, working on your green footprint has become a matter of survival for companies in the sector (see p. 41). The cosmetics, food and chemical industries have to follow suit. Many biotech firms stand to profit from the Green Deal. Driven by the belief that GDP as a parameter for prosperity can be completely decoupled from resource consumption through efficiency increases and a circular economy, the focus is now shifting to bioengineering and synbio (see p. 20), protein substitutes from the fermenter, along with biomaterials and enzymes that enable degradable plastic substitutes. But regardless of whether the green dream of growth without sacrifice comes true, a new era in biosynthesis has already begun.

Thomas Gabrielczyk Editor-in-Chief

FOOD While the EU market for organic products for the first time stagnated in 2022 by 5%, the market for sustainable imitation meat and fish is booming. By 2030, global revenues for plant, insect, microbial and cell culture-based food is expected to grow from US $4.2bn to US $118bn. In January, the EU authority EFSA approved insect protein as a Novel Food.

At the end of January, the European Food Safety Authority (EFSA) classified consumption of house crickets ( Acheta domesticus) and larvae of the grain mould beetle ( Alphitobius diaperinus) as safe, adding two further insects to the list of insect protein-based foodstuffs. The new alternative sources of protein to meat or fish may be added to bread, pasta, crisps or meat preparations and are expected to have a better eco-footprint than animal meat production that occupies 71% of the global agricultural area for feedstuff production, while food production just occupies 18%.

The European Circular Economy Fund (ECBF) welcomed the decision, pointing to the high market potential of sustainably produced alternative proteins: “The world faces the dual challenge of increasing protein production to feed an ever-growing population while reducing carbon emissions,” stressed Stephané Roussel, partner at the ECBF, that last year co-invested €50m into the Dutch Black Soldier Fly producer Protix BV, along with BNP Paribas, the Prince Albert II Foundation, The Good Investors and existing investors. “While great efforts are being made to reduce losses in food production, there is still a need to develop additional sources of protein,” he added. “Insect breeding is fast becoming one of the most promising ways to meet this demand in the most environmentally friendly way,” according to Roussel.

Insects that can be fed with low-value materials or waste and its mass cultivation require only limited space. This might reduce greenhouse gas emissions according to model comparisons to animal-based protein production, making insects, including the four approved EU products, a potentially sustainable, circular source of protein: Mealybugs and migratory locusts have already been approved in 2021 under the EU Novel Food Regulation (EC 2015/2283). Contract producers for the flour beetle are SAS EAP Group (France), for the migratory locust and the house cricket Fair Insects BV, for the larvae of the grain mould beetle Ynsect NL BV (both: The Netherlands), and for the partially defatted powder of the house Cricket One Co Ltd (UK). However, applications of insects are not limited to the food sector. According to Spanish Tebrio Srl, which will finish construction

of Europe’s biggest mealworm farm, applications of Tebrio molitor go far beyond protein production for the food and feed sectors: insect ingredients such as chitosan for example can be used in water purification, as an additive in the food industry, as a fungicide and fertilizer in agriculture, as a compound to reduce cholesterol in the medical field, as well as an immobilising agent for enzymes. Others can be used to manufacture biodegradable plastics that dissolve in water, production of creams or cosmetics etc.

More than a dozen of insect breeding companies in Europe are recently scaling up production. However, insects are not the only field of bio-based protein production that competes with the already established €5.2bn world market (2021) of plant-based protein alternatives, which is led by the EU with €2.3bn and the US (€1.9bn). According to the brandnew survey “New Food Frontiers” conducted by Danish Lindberg International commissioned by plant manufacturer GEA Group AG among 1,000 chefs, at least 25% of all foods by 2040 will be manufactured using new proteins such as vegan eggs, meat, fish, and dairy products. About 90% of the chefs already perceive growing customer interest for alternative proteins. In the next decade, they see particular high consumer demand for plant based (95%) products, and microbially or cell-culture-produced proteins (45%), but only minor interest (36%) for insect-based protein alternatives. Con -

Sino Biological provides the most cost-effective solution for the rapid production of a large number of antibodies. In response to the rapidly increasing therapeutic needs, Sino Biological combines its expertise in gene synthesis, vector design and transient antibody expression technology to produce highly efficient antibodies in HEK293 and CHO cells in as fast as 2 weeks.

•

sequently, the market is booming, with €2.2bn in capital raised by European protein makers.

Several biotech protein producers such as Finnish Solar Foods (vegan meat), which already gained Novel Food approval in Asia, or German cheese maker Formo Bio GmbH (milk protein), who

raised €50m in a Series A financing, have just begun to scale up production, a field in which GEA also sees growth potential. But this is just the tip of an iceberg that is driven by consumer demand in animalfree protein for ecological (79%), ethical (50%) and health reasons, according to the survey. More than two thirds of the chefs surveyed think that quality improvements – particularly in taste or texture – will be essential for further mar-

A new study named “Politics of protein” published by the Belgian think tank Ipes-Food recommends shift the focus from a protein transition to a sustainable food system transition and sustainable food policies. The expert panel stresses that impacts on biodiversity, resource efficiency, circularity, resilience, sustainable livelihoods, local nutrient availability and food security, territorial cohesion, and food cultures must be taken

into account, alongside GHG emissions, in order to comprehensively assess the sustainability of livestock and fishery systems. To prevent consumer resistance – such as in the debate on genetic engineered crops – due to false claims, they recommend to define a clear set of parameters to assess technologies and realign innovation pathways with the public good. www.ipes-food.org/pages/ politicsofprotein L

ket success. Companies such as Belgian Paleo BV, which produce species-specific myoglobins that mediate meat taste and colour, are building a B2B business. In January, German start-up Project Eaden expanded its seed financing to €10.1m. The company produces edible protein fibres that mimic the texture and appearance of animal flesh ultra-realistically – the machine of the Berlin-based company spins 0.2 millimetre-threads from a stock of vegetable proteins, bundles 250 fibres, like muscle strands, and combines them with vegetable fats. The red and white marbled imitation meat that is almost indistinguishable in appearance and texture from the animal original.

EU discounters such as ALDI or LIDL have now entered the debate about use of insect proteins in their products because in contrast to Asian consumers, EU consumers reject insect-based food admixtures as strange. This shows that European protein producers and policy makers are well-advised not to disappoint EU consumer expectations concerning sustainability and health impact of products because most consumers are highly sceptical concerning processed vs. naturally appearing foods.

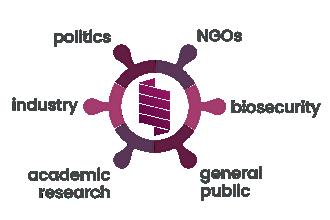

Sustainable foods made by means of biotech and fermentation will be in the focus of INDUSTRIA BIOTEC (21-22 September 2023) in Berlin. At the second edition of the European meeting of biotech innovators, politicians and NGOs, stakeholders will discuss how (bio)technology can contribute to mitigate global warming within a broader plan to make food and production systems inherently sustainable and compatible with nature’s circles. On the one hand, companies will stress what kind of regulatory framework might help to sustainably improve Europe’s ranking in protein alternatives, decarbonisation of industrial production, resource conservation and circularisation in different sectors. On the other hand, policy makers discuss how to achieve a sustainable system. L

t.gabrielczyk@biocom.de

STATEMENT In soccer, such a transfer would raise tempers: A superstar leaves his team because he no longer trusts it to succeed. A warning sign, a headline event, fodder for weeks of debate in the media. Something similar has just happened to the biotech industry, but things remain strangely quiet in the fan block of Germany’s top research – whispers at best, just whispers, but no outcry anywhere.

BioNTech, which has become the superstar of mRNA research with its corona vaccines, wants to cause a sensation in the UK and develop personalised mRNA cancer immunotherapies and new vaccines there. In addition to 70 highly qualified scientists moving to the island, a regional headquarters will be established in London – with such central departments as Regulatory Affairs, Medical Affairs, Intellectual Property and Legal.

It all sounds like systematic planning for the next big thing. Except, of course, that it will be British. And what happens here? A bit of whistling in the woods that BioNTech is by no means turning its back on Germany. According to experts, the Mainz-based company is moving to Great Britain because of the prohibitive and increasing bureaucracy, lack of skilled workers and slow processes in Germany (see p. 18).

Otherwise: isolated complaints about dwindling competitiveness that usual appeals to politicians. This is nothing new, and much has already been done. Is not Rhineland-Palatinate a prime example of good biotech support? For an innovation climate in which science and industry, university research, startups and pharmaceutical companies cooperate for the benefit of all? And yet, Mainz’s flagship company chose the British. Someone must have put even

Dr Ute Kilger and Elmar Jehn

better cards on the table or made the appropriate framework conditions possible. As Bio NTech co-founder Prof. Dr Özlem Türeci said diplomatically, “BioNTech relies on the strengths of the respective countries for research and development.”

Touchez! But what exactly are the German and European non-strengths or weaknesses? Clinical research and development for cell and gene therapies are now almost exclusively in the USA and Asia. Are other areas now migrating? The lament about more difficult data situations, regulatory freedoms, and risk averse investors in Germany is as

understandable as it is well known. Of course, all of this needs to be analysed, addressed, and directed into the proper channels with the necessary pressure.

And preferably at Germany’s pace, i.e. subito, as Chancellor Olaf Scholz just demanded during a BioNTech visit. What is possible for LNG terminals must also apply to research, he said. “We must make faster approval procedures possible for factories, new medicines, research projects and the use of research data,” he said. He added that the German government “now wants to help the medical industry and healthcare industry make progress in a very short time with many very concrete legislative projects.”

So far, so hopeful. But all this threatens to come to nothing if something fundamental is lacking: The industry’s self-confidence, the broad chest that can only be shown by those who fundamentally believe in themselves and the opportunities for Germany as a business location.

Ugur Sahin and Özlem Türeci have been elevated to exceptional researchers, celebrated, admired and highly respected for their success in the historic situation of the COVID -19 pandemic. Self-starters, so to speak. But are there not many Sahins and Türecis in laboratories in this country? World-class scientists, passionate doers, highly idealistic physicians? We hear too little about them; instead, it seems the industry is

labouring under a strange kind of despondency. Pharmaceuticals do not have a good reputation; distrust rustles through every package insert.

So it is better to keep a low profile and not appear too wide-eyed? The crux of the matter is that anyone who behaves this way finds it challenging to generate the economic and political support they so urgently need. Politicians, in particular, are prone to opportunistic reflexes. Why go out on a limb for a cause that cannot win a pot of gold in the public eye?

The ball is already in the court of the industry itself. It must find itself, become louder, more offensive. It must make clear to the public what an immense contribution it can make to the well-being of people – if only it is allowed to. If the industry doesn’t like political developments that lead to anti-innovative conditions, it must engage in public discussion and amend public perception.

This is another lesson from the COVID-19 pandemic: research and science must face the challenges the media poses. They must explain, they must advertise, and they must speak the language of the people. And they must not shy away from addressing their doubts, uncertainties and conflicts. This is the only way they can prove their relevance and credibility. On the other hand, what is not possible is to keep one’s feet still. No, when one superstar leaves, the others must run all the more.

CLINICAL STUDIES At the beginning of January, BioNTech SE announced a strategic partnership with the UK Government to provide up to 10,000 patients with personalised mRNA cancer immunotherapies by 2030, either in clinical trials or as authorised treatments. To achieve this, the parties plan to utilise the UK’s clinical trial network, genomics and health data assets. The next steps of the collaboration will be the selection of candidates, trial sites and the set-up of a development plan with the aim of being ready to enrol the first cancer patient in the second half of 2023. “The fact that BioNTech is now going to the UK is a signal that German politicians cannot approve of,”. commented Martin Krauss, the Chairman of the Board of BVMA e.V., which represents the interests of Contract Research Organizations (CROs) operating in Germany. BioNTech told EuropEan BiotEchnology that “the UK is an excellent partner for collaboration for a number of reasons: the country has succeeded in rapidly approving COVID-19 vaccines and rolling out the vaccination campaign; the country is an international leader in genomic analysis of cancer patients and is very experienced in conducting clinical trials in both oncology and infectious diseases.”

SigmaPlot® is an easy-to-use scientific graphing & statistical data analysis software package for researchers, scientists and engineers who need to create precise, publication-quality graphs that best communicates their research results for presentations, technical publications, and the web. Along with advanced curve fitting, a vector-based programming language, macro capability and over 50 frequently used statistical tests, SigmaPlot also provides more than 100 different 2D & 3D graph types from which one can choose a full range of graphing options such as technical axis scales, multiple axes, multiple intersecting 3-D graphs and much more. SigmaPlot now has SigmaStat included with it which is a perfect tool to visualize and understand basic and advanced statistics.

SigmaPlot offers:

•Complete Advisory Statistical Analysis

•Award-Winning Technical Graphing Capability

•Powerful and Easy-to-use Data Analysis

•Ability to Customize every Element of Graph

•Precise Publication-Quality Graphs

•Ability to Publish your Work Anywhere

Latest updates:

•Includes a New Heat Map Macro

•Removes all dependencies on old redistributable by removing Lead Tools and uses Windows Graphics Device Interface + (GDI+) for graph export

•Uses the latest Sentinel License Manager which is compatible with the latest Microsoft Server 2022

•Uses a hosted licensing service for smooth license activation and validation

•Has a new and refreshed ribbon manager that enhances the already commendable user experience in SigmaPlot

North America & South America

Inpixon USA

2479 E. Bayshore Rd, Suite 195. Palo Alto, CA 94303, United States saves.sales@inpixon.com

Germany, Austria, & Eastern Europe

Inpixon GmBH

Königsallee 92a, 40212 Düsseldorf, Germany saveskontakt@inpixon.com

UK & Western Europe

Inpixon UK Ltd

268 Bath Road, Slough, SLI 4DX, UK saves.sales@inpixon.com

©2022 by SYSTAT Software, Inc. SYSTAT, SigmaPlot, SigmaStat, TableCurve2D, TableCurve3D and PeakFit are trademakes of SYSTAT Software, Inc. All other product or brand names are trademarks or registered trademarks of their respective holders.

PHARMAMAR VS. EMA In 2016, PharmaMar filed a European marketing authorisation application for Aplidin as a treatment for patients with multiple myeloma. After the European Medicines Agency rejected the MAA twice, which was accepted in Australia with the same data, PharmaMar sued the EC. EuropE an BiotEchnology spoke with PharmaMar’s Chairman José María Fernández Sousa-Faro.

EuroBiotech _The cancer drug Aplidin (plitidepsin) is approved in Australia as a 4th-line treatment for patients with relapsed and refractory multiple myeloma, but not in Europe. How did the regulatory authorities justify this on the basis of the clinical data submitted?

Sousa-Faro_The data submitted to both agencies were the same. EMA’s rapporteur and co-rapporteur recommended the approval of plitidepsin with no outstanding issues. Then inexplicably, the Committee for Medicinal Products for Human Uses (CHMP) summoned an oral explanation in a short period of time making use of a deliberately predated document.

The Chairman conducted an incredible oral hearing in which the Swedish and Danish CHMP´s members attacked the recommendation of rapporteur and corapporteur leading to a negative vote of the majority with no need to justify it. Besides, it was contrary to the recommendation of rapporteurs. As far as we know, there is no precedent. In Australia, the authorities with the same Phase III study that we presented to the EMA concluded that the drug was safe and there was a positive benefit for the patients, where some stages of the disease had not many treatment options.

EuroBiotech_How did development continue in Europe after orphan drug status was granted in 2003?

Sousa-Faro_The development continued because we had the basis to believe that it could be a drug for multiple myeloma, so our objective was the registration for marketing authorisation. We conducted a Phase I and II and a Phase III study. The results were positive and that was precisely what encouraged us to register Aplidin in

SOUSA-FARO holds the position of Chairman of the Board of Directors of Pharma Mar SA and Chairman of Fundación Bankinter para la Innovación. He has been a member of the Board of the following companies: Antibióticos SA, ICI-Farma SA, Transportes Ferroviarios Especiales SA; Pescanova SA; Cooper Zeltia SA; Biolys SA; ICIZeltia SA; Penibérica SA; Banco Guipuzcoano SA and Zeltia SA. SousaFaro has a degree in Chemistry (1967) and a PhD in Biochemistry (1971) from Universidad Complutense, Madrid. Between 1971 and 1979, he was tenured professor and subsequently held the Chair of Biochemistry at the University of Santiago de Compostela. MBA from IESE (Universidad de Navarra), Madrid (1986-1987). He has over 100 academic publications and patents in the fields of biochemistry, molecular biology, and anti-infective and anti-tumour drugs.

the EMA and to other regulatory agencies. At that time, due to the good tolerance of plitidepsin, that allowed its addition to other three drugs, we invested in a quadruple combination with bortezomib, lenalidomide, dexamethasone and plitidepsin for multiple myeloma. This study was abandoned after the EMA’s refusal.

EuroBiotech _What reasons did the EMA give for refusing marketing authorisation in 2017 and in the appeal procedure in 2018?

Sousa-Faro_There were no real differences between the examination and the reexamination, the speech at the CHMP was always the same, despite the fact that a total of three of four rapporteurs and co-rapporteurs were positively recommending the approval. As usual, they stated that the benefit/risk ratio was negative. Other previously approved drugs in multiple myeloma had a similar profile.

EuroBiotech_How did PharmaMar assess this and why did PharmaMar initiate proceedings before the ECJ?

Sousa-Faro_During the evaluation procedure, we witnessed things that we thought were out of the usual procedure. As I said, they recommended us a method that later they did not accept, additionally there were errors of form. However, the most surprising was that the CHMP bypassed the rapporteur and co-rapporteur’s positive opinion, which is unusual and unique. We asked for a reexamination. Here, it is worth recalling the Swedish nationalities and Karolinska Institute´s training of the four members, who were key to the EMA’s negative opinion on plitidepsin. Tomas Salmonson, chair of the EMA’s CHMP, the rapporteur of the appeal, Filip Josephson,

the chair of the Scientific Advisory Group (SAG) assessment, Jonas Bergh, and SAG’s multiple myeloma expert, Hareth Nahi, who between 2015 and 2021 served as Senior Medical Advisor to the Swedish company XNK Therapeutics AB; a very high endogamy. I would like to highlight that the EMA does not have a compliance department as the FDA does, that verifies the declarations of the members regarding their independence.

Sousa-Faro_In 2020, the Court ruled in favour of PharmaMar, annulling the decision and ordering the European Commission (EC), the EMA depends on EC, to pay costs. The Court concluded that there was no guarantee that members of the EMA were free from a conflict of interest with the pharmaceutical industry. The EC did not appeal, so they accepted the sentence but Estonia and Germany did it in 2021, joined later by the Netherlands and the EMA itself as well. The question still unresolved here is: Why did Estonia and Germany appeal in opposition to the criterion of the only European institution concerned, the EC? Even more so when the Estonian CHMP abstained from voting in the Aplidin process. Last January, the Advocate General of the EU published his opinion about the case. His opinion was based on the fact that there was no conflict of interest because the Karolinska Institute is not a company; we all know that and this is not the point. The point is the SAG member that was working at that time for a company; XNK Therapeutics was linked to the Karolinska Institute. The Advocate General argues also, that there are multiple drugs for the treatment of multiple myeloma, which in his view should have led the judgment under appeal to declare the “rival products” rules on conflicts of interest inapplicable. However, he ignores that with respect to a drug there are first, second, third, fourth and fifth lines of treatment, so that competition per line is very limited, normally one or two, contrary to what the Advocate General says. Therefore, he inexplicably argues that since there are many treatments for multiple myeloma there is no competition from any product.

EuroBiotech _What is PharmaMar’s view on this and why and what did the EMA say in the proceedings?

Sousa-Faro_For us it is very clear. Our claim to the Court of Luxembourg had five allegations. The first one was conflict of interest and for which the Court ruled saying “the procedure that led to the adoption of the contested decision did not provide sufficient guarantees to exclude any legitimate doubt as to possible bias”.

It was also very clear for the Court because they did not examine the rest of the claim that referred to: breach of the principle of good administration, the principle of equal treatment, infringement of the requirement to provide a statement of reasons and infringement of the right of defence.

EuroBiotech _What is the explanation for the differences in the approval of Aplidin in Australia versus Europe?

Sousa-Faro_The Australian authorities can grant the independence of the members and therefore of the process versus EMA who has a sentence of the General Court of the EU for conflict of interest, an institution with the lack of a compliance department. This could be resolved with clear, transparent rules and if the decisions made by each member state belonging to the EMA were public and of course the motivation of the vote as happens in the oral hearings of the FDA that are of free public access.

EuroBiotech _What is the next step from PharmaMar’s point of view?

Sousa-Faro_We will fight until the end. Meanwhile, we are waiting for the Court of Justice of the EU to rule, from there we will take the decisions we have to take. If the Court again gives us the reason, the EMA has to re-evaluate the drug as it was left in 2017. In the event that the Court follows the opinion of the Advocate General, he recommended to cancel the previous sentence and to send the case back to the General Court, which will have to examine the other four points of the lawsuit that we filed against the EMA. L

t.gabrielczyk@biocom.eu

GLOBAL WARMING About a year and a half ago, a US Congressional Subcommittee questioned executives from ExxonMobil, BP, Chevron, Shell and US American Petroleum Institute about industry efforts to downplay the role of fossil fuels in climate change. Darren Wood, a member of Exxon’s board of directors, testified before MPs that the company’s public statements “have always been and continue to be truthful” and that the corporation “does not spread misinformation regarding climate change”. Internal company documents from the past 60 years indicate otherwise. A new study adds weight to ongoing legal investigations against ExxonMobil and partners for deliberate climate malfeasance.

For decades, the members of the oil industry tried to convince the public that a causative link between fossil fuel use and climate warming could not be made because the models used to project warming were too uncertain. As early as 1977, climate scenarios of ExxonMobil predicted global warming as a result of burning fossil fuels with an accuracy of 63% to 83%. This is confirmed by a German-US-American team’s analysis of the company's internal forecasts, that became public in 2015 (SciEncE, doi: 10.1126/science.abk0063).

According to study co-author Stefan Rahmstorf of the Potsdam Institute for Climate Impact Research, Exxon’s projections predicted global warming of 0.20 ± 0.04 degrees Celsius per decade as early as 1977. According to the study, the internal analyses accurately predicted when human-induced global warming would first be detected in measured data, and even realistically estimated the carbon budget for limiting warming to below 2°C.” Currently, Big Oil is greening its image with biotech partnerships. Exxon’s internal research from 1979 found that if the industry abandoned fossil fuel use and focused instead on renewable energy, this could reduce fossil fuel pollution in the 1990s and avoid a major climate crisis.

CTIS A new platform is set to facilitate the exchange of information on the optimisation of the electronic reporting system on clinical trials CTIS next year.

Following strong criticism ahead of the mandatory launch of the CTIS electronic clinical trial reporting portal by the European Medicines Agency (EMA), the EU SME Office has now launched a public consultation on the development of a multi-stakeholder platform to foster collaboration on improving clinical trials in the EU, as envisaged in Priority Action 3 of Accelerating Clinical Trials in the EU.

In particular, an alliance of German biopharma, physician and CRO associations as well as the ethics committees had complained before Christmas 2022 about technical errors making the portal “partially unusable” during the one-year transition phase. If these were not eliminated by the start of the portal on 1 February 2023, the goal of shortening the time to approval of a clinical trial would be missed and Europe would fall further behind the USA, Asia and the UK as a trial location, the Working Group of Medical Ethics Committees in the Federal Republic of Germany (AKEK), German University Medicine, the Network of Coordination Centres for Clinical Trials as well as

the German pharmaceutical associations BAH, BPI and vfa, the German CRO Association BVMA, the Association of Medical Faculties, the Association of University Clinics and the German Medical Association had complained. After the launch of CTIS, the EU pharma federation EFPIA, which was fierce behind the scenes, had thanked the EMA for its efforts in fixing the technical bugs and system errors.

The new platform will now host the previously public dialogue among stakeholders on clinical trials and facilitate the development of the clinical trial environment, according to a statement. It will help communicate advances in clinical trial methods, technology and science and serve as a neutral space to discuss “challenges” and “develop practical solutions”. There will be several development phases leading up to the final design of the platform, which have been summarised in a concept paper. The aim of the consultation, which runs until March 3rd, is to gauge interest in the platform, get feedback on priority discussion topics and gather comments on the proposal. The kick-off meeting of the multi-stakeholder platform will take place in Q2/2023.

In mid-January, the Good Clinical Trials Collaborative (GCTC) called for less bureaucracy and modernisation of clinical trials. The World Heart Federation, the two US-American heart associations AHA and ACG as well as the European and three German Cardiovacular Societies (DGTHG, DGK, DGPK) call for less bureaucracy in the planning and conduct of clinical trials as well as the possibility of using national electronic health records for the selection of subjects and validation of randomised clinical trials (RCTs). The ICH regulations have made these too complex, costly and lengthy, leading to frequent trial cancellations.

Innovative technology is the key to shifting from a fossil-based to a bio-based circular economy, crucial for achieving the European climate targets.

As a venture capital fund, our primary goal is to invest in scale-up companies with high potential for excellence on a pan-European or global scaledelivering both impact and financial returns at the highest level.

Our entire experience in venture capital and our investment scope spanning the circular economy and bioeconomy is focused on this purpose.

Supported by:

Investors:

BIOTECH Way back in 1995, Bill Gates commented that “DNA is like a computer program, but far more advanced than any software ever created.” That recognition was just the first step on a long road. For many years, reconfiguring cellular or viral DNA to create something entirely new was simply too expensive. Finally – two decades after its inception – programmable biology is set to drive revolutions in medicine, chemistry and consumption.

Although many people view genetic engineering and its advanced cousin – synthetic biology – as unnatural, a bio(tech) wave is just beginning to crest. Synbio products are rapidly permeating societies and by 2030, it’s very likely that you’ll have eaten, worn, used or been treated with at least one. Two decades after the human genome was comprehensively deciphered, DNA engineering looks set to become the dominant 21st-century technology. Products that involve reading, writing and editing DNA to redesign existing systems found in nature are already well advanced, or about to enter the market. They include synthetically produced viruses (among them polio, flu or SARSCoV-2), AI sequence-optimised mRNA vaccines, genetically engineered CAR-T cells, living therapeutics released to restore the gut microbiome after disease biomarkers have been detected, gene-scissored crops, programmed production strains for chemical manufacture of chemicals, microplastics-free fibres and biofuels. The field is already changing medicine, agriculture and – to some extent – petroleumbased chemistry.

“Since the publication of the first papers in natur E in 2000, synthetic biology has diversified so much,” says Martin Fussenegger from the ETH Zurich/University of Basel. Five years ago, he healed

mice of both gout and diabetes by means of encapsulated gene circuits. By 2021, scientists had created the first self-replicating xenobot – a programmable syn-

!We have some catching up to do, especially in the transfer from academic research – where Europe plays a serious role in many areas –to commercial application. Incentives are needed for researchers, venture capitalists and critical infrastructure managers to exchange more. Policymakers also seem to be still divided, despite success stories like Impossible Foods or BioNTech.

thetic organism derived from frog cells and designed by artificial intelligence (doi: 10.1073/pnas.2112672118). According to Fussenegger, “synbio has evolved to become the engineering science of biology, similar to chemical engineering for chemistry.” Depending on how and where they are applied, human-designed DNA technologies have the potential to stop the destruction of the environment and the climate catastrophe through new production methods, to offer healthy alternatives to factory farming, and to restore natural cycles that have been thrown out of balance by toxic fossil chemistry and the endless quest for profit. For instance, continuing to produce polyethylene, a material that persists for hundreds of years in the environment before breaking down into toxic microplastics, is not a good idea, even if it is made from waste or industrial emissions. It’s now time to move away from the old ‘jobs and growth’ mentality of the petroleum age, because permanent growth is neither natural nor sustainable. Economists like Maja Goepel, who has advised the German government, believe that the current economic paradigm must change in ways that allow companies to make profits without destroying frameworks.

According to Galya Laskar’s Equity Research team at Barclay’s Investment Bank, “consumer goods are the next big thing”

in synthetic biology, with animal-free meat, fish and dairy products at the forefront (see EuropE an BiotEchnology 2/22). Analysts at Vantage Market Research valued the synthetic biology market at more than US$10bn in revenue in 2021. As the commercialisation rate of academic synbio inventions is significantly higher than in any other product segment, they predict the market will triple to US$32.7bn by 2028. Among the most rapidly developing fields of innovation: medicines and diagnostics, sustainable plastics and petrochemical substitutes, and microbial or cell-culture-based foods. The US, China and the UK are leading the pack, followed by the Netherlands, Denmark, Switzerland, Germany and France. A recent McKinsey report predicts synbio applications will hit US$4tn annually by 2040, providing treatments for 45% of the world’s current disease burden and 60% of the world’s physical input.

Progress using synbio tools in combination with AI happened first in drug discovery and rational drug design. During the COVID-19 pandemic, mRNA vaccines were developed by BioNTech and Moderna that were genetically optimised

to improve intracellular stability and antigen expression, while reducing mRNA toxicity.

“The time has come for synthetic biologists to develop more real-world applications. The field has had its hype phase. Now it needs to deliver.”

Following the complete synthesis of polio and flu viruses by bioengineers, an attenuated codon-deoptimised SARS-CoV-2 virus (carrying all virus antigens, and thus mutation-insensitive) is currently being tested within the WHO’s Phase III Solidarity trial by Merck, Sharp & Dohme and Codagenix Inc. One drawback of codon deoptimisation compared to genetically optimised DNA or mRNA (i.e. cancer) vaccines may be that there is a trade-off in production between the degree of attenuation and viral recovery. The optimal mutational load may also need to be empirically determined for each virus. Another downside of new technology: it could also be used against humanity. Although researchers headed by David Evans were criticised for publishing a work-

flow in 2018 on how to resurrect the eradicated horsepox virus from synthesised DNA, their work demonstrated that viral bioweapons could theoretically be reconstructed via reverse genetics.

On the diagnostics side, paper-based toehold-switch RNA-sensor diagnostics have been able to detect femto molar amounts of viral nucleic acid, i.e. gut micro biome bacteria (including C. difficile) at a cost of just 0.1-1US$ per test. Switch RNA sensors in their off state have a stem-loop structure that prevents reporter gene translation. Target RNA binding to this toehold allows downstream translation. These gene circuits are freeze-dried on paper, stable for 12 months at room temperature, and can be administered anywhere – even sites with no hospital infrastructure.

Two FDA-approved CRISPR-based diagnostics for detecting SARS-CoV-2 RNA sequences through cleavage at specific sites and subsequent colour reaction with an attomolar sensitivity were marketed by Sherlock Biosciences and Mammoth Bio sciences during the pandemic. And yet another success using synbio has been engineering CAR-T cell therapies, which made US$2bn in revenues as 2nd and 3rd -line blood cancer treatments in 2022. They are expected to grow to

High-profile seed investors in synthetic biology include Bill Gates (Microsoft), Eric Schmidt (Google), Vinod Khosla (Sun Microsystems), Jerry Yang (Yahoo), Bryan Johnson (Venmo/Kernel), Peter Thiel and Max Levchin (PayPal).

strain engineering for industrial production, medicine, fashion / machine-learning genome mining for chemical-producing GMOs

Number of publications on synthetic biology (blue: 2000-2017, red: 2017-2022)

produce annual turnover of US$10bn by 2030. Traditionally, CAR-Ts link a singlechain variable fragment (scFv) to a CD8 transmembrane domain, an intracellular CD3 domain from the T cell receptor, and a co-stimulatory domain. When a target antigen is bound by the scFv, activation of both stimulatory and co-stimulatory domains is required to promote T cell proliferation and target-cell killing. As cytokine storms are common, biologically engineered control systems such as logic gates and split safety switches – like those developed by Bellicum Pharmaceuticals or Cogent Bio – are under development to balance safety and efficacy.

Another field of medical innovation through synbio is gut dysbiosis and its associated pathologies, which include inflammatory bowel disease, multiple sclerosis, ADHD, hypertension and other conditions. Living therapeutics such as rationally designed microbes and synthetic microbial communities also offer a platform for treating inherited disorders such as phenylketonuria and cancer, as well as communicable diseases such as chronic C. difficile infection (Seres Therapeutics).

Many companies have begun to combine synthetic biology and AI. “Whether in protein design, drug discovery or the optimisation of production strains that produce chemicals or animal-free protein from residues or CO2, AI and synthetic biology play together everywhere,” says Hendrick Cooper from the German Association for Synthetic Biology (GSAB). Together with the European Synthetic Biology Society (EUSynBioS), the GSAB is fighting for more acceptance and bet-

ter conditions for the research in Europe. “Scientists from Europe have been playing an important role in progressing the field, as their contributions rival the amount of literature produced in the US and other parts of the world, with the UK and Germany having the highest publishing output,“ stresses EUSynBioS head Stefano Donati from the The Novo Nordisk Foundation Center for Biosustainability. In contrast, the US has been the dominant driver in establishing industrial solutions, filing more than 50% of global patents and investing ten times more than Europe. But Europe could still catch up, provided policy makers support SMEs to scale up production of sustainable plastics, chemicals and protein alternatives – the next big market opportunities – and provide fast-track market approval like Singapore does. Many European food and feed innovators intend to target Asian markets first with their sustainable products.

According to Donati, the European Investment Bank (EIB) has launched ESCALAR, a €300m pilot programme focusing on providing finance for the scale-up companies. It was complemented in 2022 by an EIB committment of €500m for the European Tech Champions Initiative (ETCI), a multi-investor fund structure aimed at fostering growth in innovative European tech companies. Additionally, the Circular Bioeconomy Joint Undertaking (CBE JU) contributed €215.5m last year to finance projects. The eureKARE – a €60m fund – has invested in multi-

High Quality Grade Plasmid & Minicircle DNA

Customized High Quality Grade DNA for GMP production of viral vectors, RNA and CAR-T cells QC including CGE service

pDG/pDP plasmids for AAV production

2 plasmid system

Serotypes including AAV8 & AAV9 GFP transfer plasmids

ITRRESCUETM In Stock service

The better way to DNA! Coming soon

› European Biotechnology Magazine Subscription

› European Biotechnology Guide 2023

› Guide to German Biotech Companies 2023

› conveniently accessible ePapers

› Discount for BIOCOM events for 1 person

› additional partner offers

Price: 80 Euro p.a. (incl. VAT)

Students 50% discount (subject to proof of enrolment)

› European Biotechnology Magazine Subscription

› European Biotechnology Guide 2023

› Guide to German Biotech Companies 2023

› conveniently accessible ePapers

› Discount for BIOCOM events for 2 persons

› additional partner offers

Price: 120 Euro p.a. (plus VAT)

ple AI/synbio/microbiome-driven companies since 2021, among them biomanufacturing SPAC eureKing, French DNA synthesis company DNA Script, gene therapy delivery specialist Coave Therapeutics, Fecal Micro biota Transplant expert MaaT Pharma, live biotherapeutic product developer NovoBiome, food specialist Gynov and DNA data-storage expert Biomemory. Additionally, it supports cell-free manufacturing specialist EonBio and German Dirac Bio sciences at its Belgian biopharma suite. The latter develops gene circuits that release cancer drugs upon detection of specific cancer biomarkers.

Big players like Novozymes, Cargill, BASF, L’Oréal (see p. 46) and others are currently greening their product portfolio with partners like BRAIN Biotech, which use genetic engineering to mine metagenomes, finding and optimising new enzymes or production strains. There’s a wide range of such cell factories.

With help from engineered Clostridia chassis, companies like Lanzatech can already commercially produce ethylene and ethanol from industrial emissions or gasified organic waste. Using engineered bacterial enzymes, French Carbios SAS can recycle polyethylene terephthalate (PET) bottles and textiles down to the original mono mers at commercial scale. And German microbial nanocellulose maker Bioweg and US synbio contract reseach organisation Ginkgo Bioworks partnered in February to reduce microplastic waste. Their approach is to optimise bacteria that produce cellu lose to replace naphtha-based polyethylene, acrylates and polystyrol, which remain not accessible to enzymatic recycling (see p. 42). Most recently AMsilk, which produces natural high-performance biomaterials from recombinant silk protein, entered into a protein optimisation partnership with BRAIN Biotech, which has a wide range of such projects over different industries, including microbial lithium recycling.

The Next Big Thing is vegan protein alternatives, such as casein produced in optimised bacteria by vegan cheesemakers Formo Bio or Standing Ovation SA, the winner of last year’s INDUSTRIA BIOTEC start-up pitch, the sector’s annual meeting in Berlin (see EuropE an BiotEchnology 4/22, p. 59). Finnish Solar Foods has already received a Novel Food authorisation in Singapore for its protein alternative Solein, which is made from CO2 and regenerative energy. US Company Impossible Foods and Belgian Paleo BV have engineered microorganisms to produce leghemoglobin or species-specific myoglobins, respectively, which when added to vegan meat improve meaty flavours, colour and aromas. The B2C approach sold to vegan protein-makers is set to revolutionise the market for CO2-neutral, animal-free meat alternatives made with food additives copied from nature rather than unhealthy chemical supplements that may cause negative health effects in ultra-processed foods (see p. 76). Business approaches with ingredients or materials designed by nature, but produced sustainably and circularly with the help of synthetic biology, offer a way to unite the hitherto opposing interests of eco- and biotechnology stakeholders. If vegan products can be established worldwide in a CO2-neutral fashion, following nature’s example, part of the +70% of agricultural land currently used for concentrated feed production can be freed up for organic cultivation.

Mandatory designation of the seeds used could protect organic farming from unwanted contamination by GM and geneedited plants obtained through targeted biological mutagenesis. Only that kind of regulation will allow coexistence for the two types of farming on equal terms.

The technology has delivered. Now it’s time for politicians to step up and create a sensible framework that does not serve capital interests alone. In funding science, Europe can continue to focus just on the interests of chemical giants or seed- and crop-protection companies, or it can finally deliver a real Green Deal that reconciles business and nature. L

t.gabrielczyk@biocom.de

New product launch: The Bioprocess Autosampler

Delegate bioprocess sampling

Regular measurement of bioprocess parameters is the basis for process optimization.

The Bioprocess Autosampler from Eppendorf facilitates sampling 24/7 in short and regular intervals and like this gaining complete datasets.

> E ciency: Enables regular sampling 24/7

> Space-saving: No sterile hood is necessary for operation

> Flexibility: Compatible with di erently sized glass and single-use bioreactors operated with a DASbox ® Mini Bioreactor System or a DASGIP ® Parallel Bioreactor System

DR MARCUS WIEPRECHT, STIFEL EUROPE BANK AG From its all-time high in August 2021 the largest and most important index for the biotech industry also in Europe (NBI) lost around 25%. After a period of excessive capital inflows, money is much harder to come by these days. The answer can only be more creativity in structuring deals.

There are many reasons behind this quite hard and persistant landing. For sure, too many early-stage companies went public and find themselves today with limited cash runways combined with limited options to access fresh capital, resulting in a near record high number of c.200 listed biotech companies globally (out of a total of c.850) trading below their cash levels (i.e. a negative enterprise value).

However, Biotech stocks trade on longterm expectations for future cash flows and therefore trade inversely to interest rates, which have seen a record-breaking rise in the last months. As it turns out, inflation may not disappear quickly and higher interest rates may stay for longer. Have the fundamentals of the biotech industry changed after all? Probably not as there is a stronger than ever innovation power and leading-edge technology out there. But markets probably overshot on the upside, and now we are living the consequences.

Money is certainly available. However, going forward, greater scrutiny from public, private and venture capital investors can be expected on how capital is deployed. Successful biotechs will ensure a clear connection between capital allocation and value creation in R&D. Against this backdrop, transaction activity and average deal values continue to decline from 2021 highs through the beginning of 2023. As inflation remains elevated, Central Banks likely maintain their hawkish stance and current market conditions, if they persist much longer, will force issuers in need of capital to make tough decisions.

In summary, a prolonged buyers’ market means the opportunities to support issuers will require increasingly investor-friendly terms. Strong companies with recurring revenues, profitability, and compelling uses of proceeds can find success in accessing the record amounts of investors’ dry powder even in this challenging market.

Hookipa Pharma Inc. Vienna-based company (NASDAQ: HOOK) has received a US$10m milestone under its 2022 agreement with Roche to develop an arenaviral immunotherapy for KRAS-mutated cancers. The non-dilutive milestone payment was due for

the start of the manufacturing process to support a Phase I clinical trial of HB700, a novel arenaviral immunotherapy for KRAS-mutated cancers. Hookipa plans to submit an IND to the US Food and Drug Administration in the first half of 2024. In October 2022, Hookipa and

Also, large pharma companies collectively are sitting on historically high cash piles to fund M&A and strategic partnerships, while facing significant product exclusivity losses in the coming years themselves. However, large pharma M&A may or may not pick up any time soon and in case it does, it will for sure not rescue all biotech companies running out of cash.

Despite this tough funding environment, a few follow-ons were successfully placed in the market recently, including in Europe. Some biotechs have secured funding from existing investors, often through private investments in public equity, but these options are unattractive or unobtainable for many smaller companies given current valuations.

How can hundreds of public biotechs gain financing through the downturn? The answer can only be more creativity in structuring deals including alternative funding options such as royalty deals, structured financing for clinical trials, an expanded role for private equity, convertible bonds and even non-traditional venture debt financing. L

Roche announced this strategic collaboration agreement under which the company from Austria is eligible for research, development and commercialisation milestone-based payments up to approximately US$930m in two programs, plus royalties. L

The unique and most complete list of share price developments of biotech companies listed in Europe – exclusively in European Biotechnology Magazine.

How

do I find a new job or a new employee? Now, there is an easy solution: eurobiotechjobs.net, the Europe-wide job market for biotechnology and the life sciences. Presented by the European Biotechnology Network.

VENTURE CAPITAL Jeito Capital is a young global investment company, founded 2018 in France. Initially unveiled with €200m in January 2020, backed by Sanofi and others, Jeito I has raised €534m in September 2021 with the aim of financing between 12 and 15 European biopharmas. Europ E an Biot Echnology spoke to the US-Partner of Jeito Capital, Rachel Mears.

EuroBiotech _Before we talk about some special characteristics with the people at Jeito Capital, can you describe the investment focus in your strategy?

Rachel Maers_Jeito is therapeutics focused, modality agnostic from biologics to gene therapy or small molecules, anything, with a focus on immuno-oncology in our portfolio lately, we believe in datadriven innovation where the application of new tools like AI is a new opportunity, defining the right patient at the right time for example.

EuroBiotech _Our last issue of Europ E anB iot E chnology n E ws was titled ‘Crisiswhat crisis?’ Do you see any negative trends in your area of investment in these challenging times?

Rachel Maers_The fundamentals of investing in the health care sector are not affected by any crises. Human health is a major driver and enduring unmet medical need is economically non-cyclical. On the other side there is an enduring need for innovation by pharma, since patents are running out. These enduring needs from both sides are perhaps not crisis-proof, but in the personal meetings at partnering conferences you can sense the excitement to act in our times.

EuroBiotech _With your experience from many years in the US and your perspective from the other side of the Atlantic: What – if at all – makes investing in Europe attractive?

Rachel Maers_We see more traditional investors coming to European rounds, also from the US. We at Jeito Capital think, that key for innovation is to have strong syndicates, the European ecosystem holds a multitude of opportunities.

RACHEL MAERS Partner with Jeito Capital, residing in New York City. She adds the US-perspective to European investments but is also looking for investment opportunities in the USA.

Strong science is the basis, but strong talent is key too. The serial drug developer is essential, with talent, strong science and capital you have it right in the making.

EuroBiotech _Can you describe the process of validating an investment target at Jeito? Is there a ‘Jeito way’ of decision making?

Rachel Maers_First we come in on validated science, we focus on the path to the patient, what is the need? Which data set will deliver on the unmet medical need? Who will treat this patient, what is the path to the patient for the therapy? With this picture in mind, we look at companies who address this issue.

EuroBiotech _Why is this? These opportunities have been there in Europe for a long time. What has changed in the awareness in the US?

Rachel Maers_The biotech innovation profits from the ecosystem around. Such ecosystems have to become robust to challenges from outside the sector and Europe is on a good way.

EuroBiotech _So to say, there is more experience in starting and running a company available in Europe?

Rachel Maers_Yes, that´s right. Jeito believes that there are tremendous opportunities in EU, and saying this means that there are also the people to leverage.

EuroBiotech _Jeito once started as an “all women” company, founded by Rafaèle Tordjman, who was tasked by the French government with boosting the biotech ecosystem in the country. Meanwhile, at least some male investment experts are working at Jeito. Is gender an issue in venture capital?

Rachel Maers_Yes. It is difficult to describe, and gender is not the bottom line, there are more and divers factors.

EuroBiotech _Can you elaborate on this point a little more?

Rachel Maers_We focus on an approach called ‘collective intelligence’, so not the gender, the function or the level of a person is important as we collect everything that delivers on the whole picture for an intelligence driven investment that fits into our strategy for patient driven benefit.

EuroBiotech _If gender is not key on the investors side, what about the patient

side, where Jeito is claiming to ‘go faster’ to the bedside?

Rachel Maers_We see that the patient population is very important to look at, to understand disease and differences in treatment and outcomes.

EuroBiotech _But is it about gender?

Rachel Maers _It is about not leaving groups outside the research. Not only gender, but from a holistic perspective having representative diversity in place.

EuroBiotech _Let´s come back to the dependence of innovation on the fitting ecosystem. You said, Europe has kind of evolved with more experienced people. Is this possible everywhere?

Rachel Maers_Years ago I would have said, innovation is location driven. Today, I and we at Jeito as a team see, that the way investors are acting in the (local) ecosystem is important. They are at best on a mission, focused to find the best approach on a global scale.

EuroBiotech _So the investor is shaping the local ecosystem?

Rachel Maers_The investor’s behaviour can transform an ecosystem. The growing talent pool of experienced managers and investors in Europe is an asset today.

EuroBiotech _How is Jeito Capital transforming the European ecosystem in health innovation?

Rachel Maers_.Jeito’s strategy is focused on supporting and empowering ambitious entrepreneurs to bring groundbreaking treatments to market quickly, benefiting patients worldwide. CDR Life, SparingVision, and CatalYm [see box] are excellent examples of companies that fit this strategy due to their focus on developing treatments for areas of high unmet medical need. These companies’ dedication to innovation aligns with Jeito’s approach, and we’re committed to supporting them as they work to bring new treatments to patients in need. By working together, we believe that we can make a meaningful difference in the lives of patients and their families.

g.kaeaeb@biocom.eu

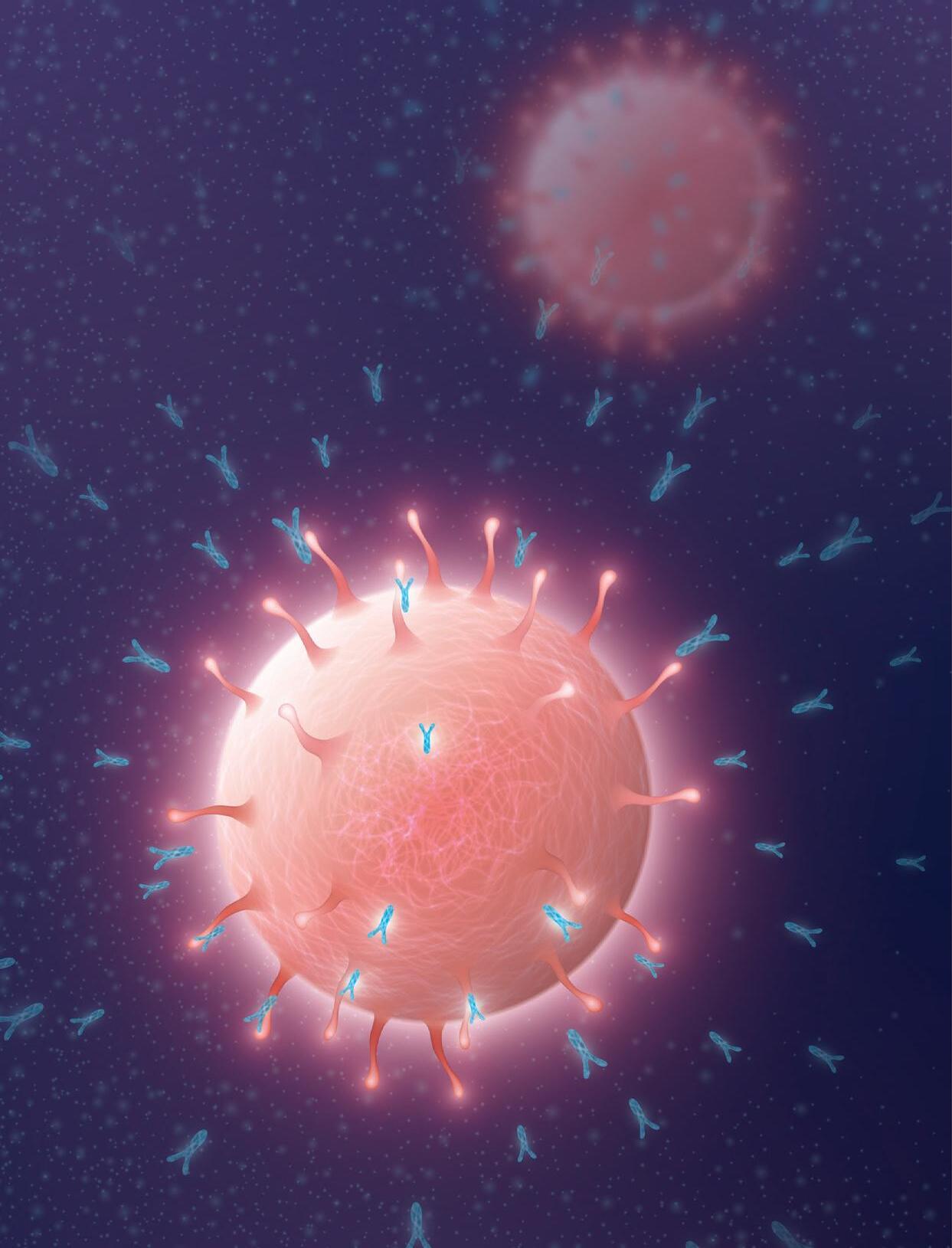

JEITO CAPITAL Jeito selects companies according to its investment strategy to support the development of the most promising European Biopharma with growth and acceleration potential. In November 2022 Jeito co-led a €50m Series C financing round in CatalYm GmbH, a clinical-stage biopharmaceutical company developing novel immunotherapies to fight cancer. CatalYm was founded in 2016 as a spin-off from Würzburg University and is based in Munich (Germany). The lead candidate, visugromab is a humanized monoclonal antibody engineered to neutralise the tumour-produced Growth Differentiation Factor-15 (GDF-15). GDF-15 acts as a key regulator of immune cell activation and as an inhibitor of immune cell infiltration into the tumour tissue and is currently in Phase II clinical studies in patients with solid tumours that are relapsed/refractory to prior anti-PD1/-PD-L1 treatment. Dr. Andreas Wallnoefer, Partner at Jeito Capital, has joined CatalYm’s Board of Directors.

S paringVision In September 2022 Jeito co-led a €75m Series B financing round in SparingVision, a privately held French biotech company. As a spinoff of the Paris Vision Institute and the result of more than 20 years of scientific research, SparingVision develops genetic innovative therapies in ophthalmology for the treatment of blinding inherited retinal diseases. Proceeds from the financing will be primarily used to advance the development of SparingVision’s breakthrough lead treatments, SPVN06 and SPVN20, for a unique mutation-agnostic approach leading to new treatments in retinitis pigmentosa, one of the leading inherited causes of blindness. Most notably, the funding will support SparingVision’s first-in-human studies, bringing lead assets to clinical validation. Proceeds will also accelerate the development of other innovative genomic medicines products of the pipeline. SparingVision was Jeito’s first French investment following Jeito’s Fund I launch in January 2020.

CDR Life Already in April 2022 Jeito had co-led a $76m Series A financing round in CDR-Life, a Swiss privately-held biotech company developing a new generation of immuno-oncology therapies. Dr Rafaèle Tordjman, founder and CEO of Jeito Capital joined the company’s board of directors. Founded in 2017, CDR-Life leverages the exceptional expertise and track record of its founders, Christian Leisner, Dominik Escher, Konstantin von Schulthess, Leonardo Borras and Rouven Bingel-Erlenmeyer, who together have developed new antibody drugs, notably FDA approved Beovu ®, and closed major biotech deals, such as ESBATech, in the field of ophthalmology. CDR-Life is currently advancing its lead program, CDR404, the first dual MAGE-A4 T-cell engager that targets solid tumours across multiple indications, based on the company’s unique M-gager ® technology. The Series A funding will advance CDR404 through potential clinical proof-of-concept readout as well as expansion of the pipeline leveraging the Company’s M-gager ® technology for targeting intracellular antigens positioned to deliver unparalleled specificity and affinity in solid tumours.

Noema Pharma WIth Noema Pharma as the latest addition to the portfolio on March 7th this year, Jeito Capital co-lead a €104m financing of the Swiss clinical-stage company targeting debilitating central nervous system disorders. L

Pharming Group

NV enrolled the first of 15 children aged 4 to 11 with heritable activated phosphoinositide 3-kinase delta syndrome in a global Phase III clinical trial (NCT05438407) evaluating leniolisib in mid-February. According to Phase II/III results, the oral, selective phosphoinositide 3-kinase delta (PI3Kd) blocker reached the primary efficacy endpoints of reduction in index lymph node size and an increased proportion of naïve B cells out of total B cells from baseline at 12 weeks. Secondary endpoints of the pivotal Phase III trial additionally include a patient-reported assessment of the ability of leniolisib to modify health-related quality of life. FDA will decide on an accelerated US approval on 29 March, the EMA’s decision is expected in Q2/2023. PI3Kd is expressed predominately in heamatopoietic cells and is essential to normal immune system function through conversion of phosphatidylinositol-4-5-trisphosphate (PIP2) to phosphatidylinositol-3-4-5-trisphosphate (PIP3).

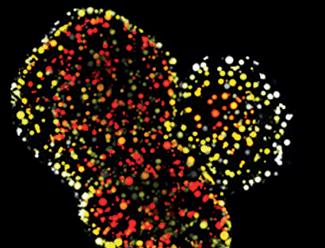

In February, Neogap Therapeutics AB has got the green light to start a monocentric Phase I/IIa trial of pTTL, its personalised cell therapy against colorectal cancer in H1/2023. Using its machine learning software PIOR, Neogap identifies a patient’s most prominent tumour neoantigens and uses its EpiTCer platform to proliferate T cells attacking these targets. The ultimate goal of the trial is to treat solid tumours by training the immune system to recognise neoantigens and thereby attack the cancer.

Swiss Hoffmann-La Roche AG’s faricimab has met the primary endpoints of noninferior visual acuity gains at 24 weeks compared to treatment with Bayer AG/ Regeneron Pharmaceuticals’ vacular endothelian growth factor (VEGF) blocker aflibercept in two global Phase III studies (BALATON and COMINO) in patients with macular oedema due to branch and central retinal vein occlusion. Roche’s bispecific antibody, which will be evaluated for further 48 weeks, targets and inhibits angiopoietin-2 (Ang-2) and VEGFA. For the first 20 weeks, patients were randomised 1:1 to receive six monthly injections of either faricimab (6 mg) or aflibercept (2 mg). From weeks 24-72, all patients (will) receive faricimab (6 mg) up to every four months – according to a personalised treatment interval dosing regimen. While In BALATON, one third of patients (34%) treated with faricimab had an absence of leakage compared to one fifth (21%) of aflibercept patients. In COMINO, the rates were 44% for faricimab patients vs. 30% for aflibercept patients. However, the average vision gains from baseline were comparable between the two treatments (faricimab: +16.9 letter vs. aflibercept: +17.5/17.3 letters) in both studies.

However, as the patent of Bayer/Regeneron’s aflibercept will expire in 2026, biosimilars are already on the horizon. In February, German Formycon AG published positive preliminary efficacy and safety data from MAGELLAN-AMD Phase III clinical trial for FYB203, its biosimilar candidate to the €9bn blockbuster aflibercept. According to an FDA-specific interim analysis of the randomised, doubleblind, multi-centre Phase III study, FYB203 met the primary efficacy endpoint, demonstrating comparable efficacy between FYB203 and aflibercept in patients with neovascular age-related macular degeneration (nAMD). Most recently, Klinge Biopharma GmbH, licensee and exclusive holder of the worldwide commercialisation rights of FYB203, had entered into

a binding term sheet for its exclusive commercialisation in the US with Coherus BioSciences Inc

In February, Abionyx Pharma SA has announced positive data from Phase IIa testing of iCER-001, a recombinant apoA-I, as a treatment for septic patients at high risk of developing Acute Kidney Injury (AKI). According to a Phase IIa pilot study enrolling 20 patients with bacterially induced sepsis at high risk for developing AKI, Abionyx Pharma SA’s recombinant apoA-I iCER-001 was able to scavenge endotoxins, to modulate the cytokine storm, and to prevent endothelial disruption. So far, the latter was only achieved up by adrecizumab, an antibody drug developed by German Adrenomed AG, that has entered a pivotal Phase III clinical trial in December 2022.

Tübingen-based CureVac NV and its partner GlaxoSmithKline plc reported positive data from two ongoing Phase I trials at the beginning of January. After evaluation of five dose levels of the mRNACOVID-19 vaccine candidate CV0501 between 12.5µg and 100µg, an eightfold increase in the titre of the antibody directed against the BA-1 region of the Omicron variant was observed in young patients. A 3.3-fold increase in antibody titre against seasonal influenza virus haemagglutinin antigens was observed following administration of three dose levels of FluSV mRNA in young patients. After evaluating data from the dose levels given to older patients, the companies plan to start two Phase II trials later this year. Both vaccines have a backbone of modified mRNA, unlike previous vaccine candidates. With the British partner, CureVac, which has relied exclusively on almost unmodified mRNA vaccines since 2000, is thus making a major turnaround. CureVac is the first company publicly comparing whether modified mRNA (CV0501) actually shows advantages in safety and efficacy over unmodified

mRNA (CV2CoV). Although other developers have been able to achieve great successes with modified mRNA vaccines, full data transparency does not yet exist. The scientific journal naturE speaks of a historic head-to-head study.

The Swiss subsidiary of Italian immuno-oncology specialist Nouscom Srl is collaborating with global pharma player Merck Sharp & Dohme (Merck & Co., Inc.). Under the terms of the collaboration, announced in early January, the companies are conducting a Phase II combination trial comparing the safety and efficacy of Nouscom’s lead candidate NOUS-209 together with MSD’s anti-PD-1 cancer immunotherapy pembrolizumab versus pembrolizumab monotherapy. Patients with metastatic colorectal cancer (CRC) with the biomarker Mismatch Repair/Microsatellite Instable High (dMMR/MSI-H) will be recruited. NOUS-209 is an immunotherapy that targets 209 cancer neoantigens found in unresectable or metastatic dMMR/MSI-H tumours of the stomach, colorectum and gastroesophageal tract. The Phase II study (NCT04041310) includes two cohorts: a randomised patient group eligible for firstline treatment randomised in a 2:1 ratio to NOUS-209 plus pembrolizumab versus monotherapy, and a single-arm cohort without control group, enrolling pa-

tients who have failed to respond to prior anti-PD1 treatment.

In mid-February, Scancell Holdings plc announced the completion of an openlabel single-arm dose finding study of its Phase I/II ModiFY basket trial of its cancer vaccine Modi-1. Modi-1 combines three citrullinated peptides: two vimentins, which are commonly found after epithelial mesenchymal transition of endometrial, renal, sarcomas, lymphomas and lung cancers, and an alpha-enolase involved in the tumours metabolic switch to glycolytic lactic acid production. Modi-1 peptides have each been conjugated to a tolllike receptor (TLR) 1/2 agonist, which acts as an adjuvant and was licenced from Dutch ISA Pharmaceuticals. Data from patients with advanced head and neck, ovarian, triple-negative breast and renal carcinomas receiving the Modi-1 cancer vaccine as a monotherapy demonstrated that it was safe and well tolerated. Furthermore, Scancell reported hints to early efficacy in a head and neck cancer patient and in high grade serous ovarian carcinoma (HGSOC) and triple negative breast cancer (TNBC). Modi-1 is the first candidate from Scancell’s Moditope ® platform. Up to 138 cancer patients will be recruited into either the monotherapy groups of the trial, or treated in combination with Merck Sharp & Dohme’s checkpoint inhibitor pembrolizumab.