UFCW LOCAL 555 EMPLOYERS HEALTH TRUST

2023 OPEN ENROLLMENT

Newly Organized Fred Meyer store in Fisher’s Landing Grocery Department

Newly Organized Fred Meyer store in Fisher’s Landing Grocery Department

Administered by Zenith American Solutions

12205 SW Tualatin Road, Suite 200 Tualatin, OR 97062

(503)486-2102 or (866) 796-7623 Fax: (971) 239-0672

May 2, 2023

RE: Enrollment for Fred Meyer Fisher’s Landing Grocery Department Employees

Effective June 1, 2023 newly organized employees of Fred Meyer in Fisher’s Landing Grocery Department will begin receiving health and welfare benefits through the UFCW Local 555-Employers Health Trust and pension benefits through the Oregon Retail Employees Pension Trust per a collective bargaining agreement between Fred Meyer and the UFCW Local 555. This will replace your current benefit coverage through the Fred Meyer Company Plan. The attached packet provides information about the transition, the benefits you will receive, and other important information.

In this packet you will find:

• An Enrollment Form

• A Summary of Benefits and Coverage for your Medical and Prescription Drug benefits

• Information about your Dental benefits

• Information about your Vision benefits

• Information about Weekly Disability benefits

• Information about your Life and AD&D benefits

• A Contact Sheet for your new Trust Office and benefit providers.

To receive coverage effective June 1, 2023, under the UFCW Local 555 –Employers Health Trust, you must return the enrollment form in this packet no later than May 23, 2023.

If you have questions, please contact the UFCW Local 555-Employers Health Trust Office at 1-866-796-7623.

c/o Zenith American Solutions 12205 SW Tualatin Rd, Suite 200, Tualatin, OR 97062

Phone: (503) 486-2102 * (866) 796-7623 * Fax: (971) 239-0672

Please complete the enclosed application along with all requested documents that apply to you. These documents are necessary to process your application.

Please return your form by May 23, 2023 to ensure coverage begins June 1, 2023.

Document Checklist:

All pages of the Enrollment Form

Copy of Birth Certificates for Newborns

Copy of Birth Certificates for children with a different last name than member

Copy of Birth Certificate and Marriage Certificate for adding a Step-Child to the plan

Copy of Marriage Certificate for new marriages

Copy of Marriage Certificate for spouses with a different last name than member

Proof of your name change, if applicable

Your signature on Information about you

Sincerely,

Trust OfficeUFCW LOCAL 555-EMPLOYERS

Enrollment Form—N

Level 3 Coverage—Weekly Employee Share Required

You are being provided this Enrollment Form because Trust records indicate you are eligible for Level 3 coverage from the Trust and your bargaining agreement requires payment of an employee weekly share for coverage.

If you do nothing, you will be "opted out" of coverage and only be eligible for Time Loss and Life and AD&D benefits. You will not be able to make any changes to dependent coverage or change your medical or dental coverage until the next annual Open Enrollment. Your completed form must be returned to the Trust Office by May 23, 2023.

Employees may elect changes to coverage outside of the annual enrollment provision only if one of the events that give rise to Special Enrollment rights occurs. Please refer questions directly to the Trust Office.

1. Your Level 3 Benefits

Medical, prescription drug, dental and vision coverage for Employee and Covered Dependents; and time loss, life and AD&D coverage for employee only.

2. Coverage Options

a. Medical and Prescription Drug

The Trust offers employees a choice between its self-funded medical and prescription drug plan and Kaiser. Kaiser is an option for those participants who live in the Kaiser service area. In general, the Kaiser service area is the Portland metropolitan area, Vancouver, Longview, Salem, and Eugene/Springfield. Kaiser is an HMO which means you must receive all your care through a Kaiser-affiliated hospital or provider. For more details, review the Kaiser Summary of Benefits and Coverage that is enclosed. To determine if you reside in the Kaiser service area, please go to my.kp.org/ufcw555 or call 1-888-491-1124.

Please select which medical option you elect:

Check one box only

Trust Indemnity Medical and Prescription Drug

Kaiser Medical and Prescription Drug

The Trust offers two dental options. The benefits available under each option can be reviewed in your Plan Booklet. Please select one of the options below:

Check one box only

Trust Dental

Willamette Dental

If no election is made, you will stay with your current option. If you have not previously had dental coverage and no selection is made, you will be placed in the Trust Dental.

Weekly Employee Options Share Required

Check one box only

Opt Out* $0 (If you select this please review Section 4)

Employee Only $10 per week

Employee & Dependent Children $15 per week

Employee & Spouse/ Same-Sex Domestic Partner $20 per week

Employee & Family $25 per week

If you are covering a Spouse/Registered Same-Sex Domestic Partner and/or Dependent Children, please list their names, Social Security Numbers, gender and birth dates here. If you are adding a newborn or a child with a different last name than yours, you will need to provide proof of birth. If adding a new spouse or a spouse with a different last name, you will need to provide a marriage certificate.

You have the option to opt out of coverage from the Trust. You can opt out for any reason. If you opt out you will pay no weekly employee share but you also will not be eligible for any benefit from the Health Trust other than life and AD&D and time loss benefits for the employee only. That means you and any dependents will not receive any medical, prescription drug, dental or vision benefits from the Trust for the period covered by your selection. If you opt out, you will not be able to change your selection until the annual Open Enrollment period, or if one of the events giving rise to special enrollment rights (described below) occurs.

If you opt out and decline coverage for yourself (or any of your Dependents) because of coverage under another group health plan or other health insurance, you may select coverage under this Trust for yourself and your dependents if you or your dependents exhaust COBRA continuation coverage, lose eligibility for the other coverage or the employer ceases contributing toward the cost of the other coverage. You must notify the Trust within 30 days of the other coverage (or the employer’s contribution for it) ending. You will be required to provide proof that you, or your Dependents, had the coverage at the time your selection to opt out was effective. You may also add a new dependent acquired through marriage, domestic partnership registration, birth, adoption or placement for adoption if you notify the Trust within 30 days of acquiring the new dependent.

You may add eligible dependents if you have not covered them because they have other insurance. Special enrollment rights exist if your dependents lose coverage under this other insurance, exhaust COBRA continuation coverage or an employer ceases contributing towards the coverage. You may also add a new dependent acquired through marriage, domestic partner registration, birth, adoption or placement for adoption. To utilize special enrollment rights, you must notify the Trust within 30 days of the above events occurring.

If you or any dependents have other health insurance, please complete.

Person(s) who has other insurance: Is it through employment? Yes No

Name of Other Carrier:

If you enroll in the Trust Dependent Spouse or Same-Sex Domestic Partner is eligible for other coverage and declines it, the Trust will charge the Employee $100 a month to cover his or her Spouse or Same-Sex Domestic Partner. If the amount is not paid, the Spouse or SameSex Domestic Partner will not be covered under the Trust.

Has your Spouse or Same-Sex Domestic Partner declined other insurance coverage?

Yes No

Please note that the Trust will be doing an audit to confirm that all children, Spouses and Same-Sex Domestic Partners meet Plan eligibility requirements. If you have questions about what the Plan’s eligibility rules provide, please check your Plan Booklet or contact the Trust Office.

(Intentionally Left Blank)

Effective January 1, 2023

Effective January 1, 2023, the Trust will be changing its Pharmacy Benefit Manager (PBM) from MagellanRx to OptumRx.

Prior to January 1, 2023, you and your covered dependents (if applicable) will receive new member ID cards that includes information for OptumRx. Please be sure to replace your current ID cards with the new ID cards for prescription drug coverage on or after January 1, 2023.

The Trustees look forward to developing a long-standing relationship with OptumRx, and thank you in advance for your patience during the transition process.

The following benefits apply to outpatient dialysis services received on or after January 1, 2023.

The Trust covers all outpatient dialysis (including hemodialysis, peritoneal dialysis and home filtration services and supplies). Outpatient dialysis benefits are subject to the deductible and co-insurance requirements applicable to your level of benefits. As with other Trust benefits the co-insurance requirement is 10% less if a Preferred or Participating Provider is used.

For Preferred or Participating Providers whose contract specifies its terms supersede any Plan provisions, the amount paid will be determined pursuant to the Provider’s agreement with Regence. For Non-Participating Providers or for Participating Providers where contract does not specify that its terms supersedes the Trust’s benefit provisions, the Trust’s benefit for outpatient dialysis shall be 150% of the Medicare Allowed Amount. For purposes of the benefit Medicare Allowed Amount is the amount that a Medicare-Contracted Provider agrees to accept for a Covered Service.

The Trust will pay primary to Medicare when required to do so by applicable federal law. In all other situations, the Trust will pay secondary. If the Trust is secondary to Medicare, it will not pay any part of a Covered Service to the extent it is actually paid under Medicare or would have been paid by Medicare if the Participant or Beneficiary had properly applied for or maintained Medicare Part A and B coverage. When paying secondary to Medicare, the maximum amount the Trust will pay for outpatient dialysis claims is the Medicare Allowed Amount.

If you are receiving outpatient dialysis, your diagnosis may make you eligible for Medicare. If you are eligible for Medicare and enrolled in Medicare Part B and receive dialysis from a Medicare-Contracted Provider, you may not be responsible for any additional out-of-pocket costs for outpatient dialysis beyond any deductible and co-insurance responsibilities and what is paid by the Trust.

If you are receiving outpatient dialysis services while the Trust is primary and are eligible for Medicare, you are eligible to have your Medicare Part A and B premiums reimbursed by the Trust. To receive reimbursement you will need to submit proof of payment to the Trust’s Claims Administrative Agent.

Coverage Period: 01/01/202 3 –12/31/202

Coverage for: Individual + Family | Plan Type: PPO

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services

NOTE: Information about the cost of this plan (called the premium ) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete term s of coverage, contact Zenith at (503) 4862102 . For general definitions of common terms, such as allowed amount , balance billing , coinsurance , copayment , deductible , provider , or other underlined terms see the Glossary. You can view the Glossary at www.dol.gov/ebsa/healthreform or call (503) 4862102 .

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the plan , each family member mu st meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible .

This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost sharing and before you meet your deductible . See a list of covered preventive services at https://www.healthcare.gov/coverage/preventivecarebenefits/

You don’t have to meet deductibles for specific services.

The outofpocket limit is the most you could pay in a year for covered services. If you have other family members in this plan , they have to meet their own outofpocket limits until the overall family outofpocket limit has been met.

1

Answers

Important Questions

Participating , Preferred and NonParticipating providers combined: $3 00/Individual; $ 6 00/Family

Why This Matters: What is the overall deductible ?

Yes. For Preferred and Participating Providers: Preventive care , diabetic education services, second opinions, the special accident benefit, birthing center facility services, outpatient dialysis treatment after 120 days, and both InNetwork and OutofNetwork outpatient prescription drugs are covered before you meet your deductible .

Are there services covered before you meet your deductible ?

No

Are there other deductibles for specific services?

Medical: Preferred Providers and Participating Providers : $ 3, 3 00 / Individual, $6,6 00 / Family . Outpatient prescription drugs : $5, 40 0 /Individual, $ 10 ,9 00/Family

What is the outofpocket limit for this plan ?

Medical: All expenses for services from NonParticipating providers , premiums , balancebilling charges, penalties for failure to obtain preauthorization , outpatient prescription drug expenses, and health care this plan doesn’t cover.

Premiums, balancebilling charges, a ll expenses for services from NonNetwork pharmacies, amounts you pay above the standard copay for a NonPreferred drug, penalties for failure to obtain preauthorization , medical expenses , and health care this plan doesn’t cover.

Outpatient prescription drugs :

What is not included in the outofpocket limit ?

12

You can see the specialist you choose without a referral . All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

, Exceptions

Common Medical Event Services You May Need W hat You Will Pay

Information Preferred Provider (You will pay the least) Participating Provider (You will pay more) NonParticipating Provider (You will pay the most) If you visit a health care provider’s office or clinic Primary care visit to treat an injury or illness $10 copayment /visit , then 15% coinsurance

copayment /visit , then 25% coinsurance $10 copayment /visit , then 25% coinsurance plus balance b illing None. Specialist visit

• Deductible does not apply. Except as noted below, your cost sharing at network pharmacies applies to the prescription drug outofpocket limit Copayments are charged per prescription based on the greater of 100 units or 34day supply.

• No charge for FDAapproved generic contraceptives (or brand name contraceptives if a generic is medically inappropriate).

• Certain OvertheCounter (OTC) drugs are covered wit hout copayment if a prescription is received .

• A Market Priced Drug (MPD) program applies to certain prescription drug classes to encourage utilization of lower cost FDAapproved alternatives. Higher costs may apply if recommended alternatives are not utilized, and any extra cost sharing will not be included in the prescription drug outofpocket limit .

You must pay 100% at time of purchas e and submit a claim to Optum Rx. You will be responsible for 20% of the Allowed Amount after the applicable copayment .

• You pay the lesser of the copayment or the drug cost.

• Weight loss drugs and Cialis require preauthorization by Optum Rx to be covered.

• Deductible does not apply.

• Specialty drugs require preauthorization by Optum Rx to be covered .

• Your cost sharing at network pharmacies counts toward the prescription drug outofpocket limit .

Same as generic, Preferred or Nonpreferred copayments

Specialty

• Professional/physician charges may be billed separately.

• Copayment waived if admitted.

• If you do not have an emergency medical condition , b enefits may be reduced if services could have been provided in a less costly setting.

• The first $300 for treatment of an accident is paid at 100%, deductible is waived.

• Professional/physician charges may be billed separately.

• Copayment applies to care in an urgent care office/facility (but not to urgent care services in an outpatient hospital setting).

If you have a hospital stay

services: 25% coinsurance plus balance

plus

visit: $10 copayment /visit , then 25% coinsurance plus balance billing. Other balance billing

Office visit: $10 copayment /visit , then 25% coinsurance. Other outpatient services: 25% coinsurance 25% coinsurance

Office visit: $10 copayment /visit , then 15% coinsurance. Other outpatient service: 15% coinsurance 25% coinsurance

15

• Cost sharing does not apply for preventive

• Depending on the type of services, a copayment , coinsurance , or deductible may apply.

• Maternity care may include tests and services described somewhere else in the SBC (i.e., ultrasound).

• Preauthorization is required if hospital stay is more than 48 hours for a vaginal delivery or 96 hours for a Csection to be covered

• Delivery expenses of pregnant children are not covered.

• Deductible does not apply to a delivery in a birthing center facility.

Covered services include physical, occupational or speech therapy necessary to restore or improve lost function caused by an illness or injury.

W hat You Will Pay

Limitations , Exceptions , & Other Important Information

Preferred Provider (You will pay the least)

Services You May Need

Common Medical Event

covered Not covered

• Routine eye care (Adult and Child) (through a separate vision plan )

• Routine foot care

Children’s eye exam

Children’s glasses

NonParticipating Provider (You will pay the most) If your child needs dental or eye care Not

E xcluded Services & Other Covered Services: Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any othe r excluded services .)

• Infertility treatment

• Longterm care

• Cosmetic surgery

• Dental care ( through a separate dental plan )

• Weight loss programs (except as required by the health reform law) Other Covered Services ( Limitations may apply to these services. This isn’t a complete list. Please see your plan document. )

Nonemergency care when traveling outside the U.S.

• Privateduty nursing

Chiropractic care

Hearing aids

• Acupuncture

• Bariatric surgery ( preauthorization required to be covered )

Y our Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is the Department of Labor’s Employee Benefits Security Administration at 1866444EBSA (3272) or www.dol.g ov/ebsa/healthreform . Other coverage options may be available to you too, including buying individual insurance coverage through the Health Insurance Marketplace . For more information about the Marketplace , visit www.HealthCare.gov or call 18003182596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim . This complaint is called a grievance or appeal . For more information about your rights, look at the explanation of benefits you will receive for that medical claim . Your plan documents also provide complete information on how to submit a claim , appeal , or a grievance for any reason to your plan . For more information about your rights, this notice, or assistance, contact the Trust Office at (503) 4862102 . You may also contact the Department of Labor’s Employee Benefits Security Administration at 1866444EBSA (3272) or www.dol.gov/ebsa/healthreform .

17

oes this plan meet the Minimum Value Standards? Yes

If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace .

Languag e Access Services:

Spanish (Español): Para obtener asistencia en Español, llame al ( 503 ) 4862102 .

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa ( 503 ) 4862102 .

Chinese ( 中文 ): 如果需要中文的帮助, 请拨 打 这 个号 码 ( 503 ) 4862102 .

Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' (503) 4862102 .

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

these Coverage Examples: This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical

Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharing amounts ( deductibles , copayments and coinsurance ) and excluded se rvices under the plan . Use this information to compare the portion of costs you might pay under different health plans . Please note these coverage examples are based on selfonly coverage.

covered services.

The pl an would be responsible for the other costs of these

The UFCW Local 555-Employers Health Trust complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex. The UFCW Local 555-Employers Health Trust does not exclude people or treat them differently because of race, color, national origin, age, disability, or sex.

UFCW Local 555-Employers Health Trust:

Provides free aids and services to people with disabilities to communicate effectively with us, such as:

- Qualified sign language interpreters

- Written information in other formats (large print, audio, accessible electronic formats, other formats)

• Provides free language services to people whose primary language is not English, such as:

- Qualified interpreters

- Information written in other languages

If you need these services, contact Pati Piro at Zenith Administrators.

If you believe that the UFCW Local 555-Employers Health Trust has failed to provide these services or discriminated in another way on the basis of race, color, national origin, age, disability, or sex, you can file a grievance with:

Pati PiroZenith

Administrators12205 S.W. Tualatin Road, Suite 200 Tualatin, OR 97062

Phone: 503-486-2045

Fax: 503-612-0855

ppirobosley@zenith-american.com

You can file a grievance in person or by mail, fax, or email. If you need help filing a grievance, Pati Piro, Civil Rights Coordinator, is available to help you. You can also file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights electronically through the Office for Civil Rights Complaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at: U.S. Department of Health and Human Services, 200 Independence Avenue SW., Room 509F, HHH Building, Washington, DC 20201, 1-800-868-1019, 800-537-7697 (TDD).

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

Regence Customer Service can help with translation services. Call 888-977-2583 for assistance in all languages.

ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 1-503-4862102 (TTY: 1-503-486-2102).

CHÚ Ý: Nếu bạn nói Tiếng Việt, có các dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Gọi số 1-503-486-2102 (TTY: 1-503-486-2102).

注意:如果您使用繁體中文,您可以免費獲得語言援助服務。請致電 1-503-486-2102(TTY:1-503-486-2102

)。

ВНИМАНИЕ: Если вы говорите на русском языке, то вам доступны бесплатные услуги перевода. Звоните 1503-486-2102 (телетайп: 1-503-486-2102).

주의: 한국어를 사용하시는 경우, 언어 지원 서비스를 무료로 이용하실 수 있습니다 1-503-486-2102 (TTY: 1-503-486-2102)번으로 전화해 주십시오

УВАГА! Якщо ви розмовляєте українською мовою, ви можете звернутися до безкоштовної служби мовної підтримки. Телефонуйте за номером 1-503-486-2102 (телетайп: 1-503-486-2102).

注意事項:日本 語を話される場合、無料の言語支援をご利用いただけます。 1-503-486-2102( TTY:1-503486-2102)まで、お電話にてご連絡ください。

ATENȚIE: Dacă vorbiți limba română, vă stau la dispoziție servicii de asistență lingvistică, gratuit. Sunați la 1-503486-2102 (TTY: 1-503-486-2102).

XIYYEEFFANNAA: Afaan dubbattu Oroomiffa, tajaajila gargaarsa afaanii, kanfaltiidhaan ala, ni argama. Bilbilaa 1503-486-2102 (TTY: 1-503-486-2102).

ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Rufnummer: 1-503-486-2102 (TTY: 1-503-486-2102).

ATTENTION : Si vous parlez français, des services d'aide linguistique vous sont proposés gratuitement. Appelez le 1503-486-2102 (ATS : 1-503-486-2102).

Coverage Period: 01/01/2023 -

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services : UFCW Local 555-Empl HLTH Trust –AC23 –Level 3 All plans offered and underwritten by Kaiser Foundation Health Plan of the Northwest

Coverage for: Individual / Family | Plan Type: EPO The Summary of Benefits and Coverage (SBC) document will help you choose a health plan . The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium ) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage see www.kp.org/plandocuments or call 1-800-813-2000 (TTY: 711). For definitions of common terms, such as allowed amount , balance billing , coinsurance , copayment , deductible , provider , or other underlined terms see the Glossary. You can view the Glossary at http://www.healthcare.gov/sbc-glossary or call 1-800-813-2000 (TTY: 711) to request a copy.

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the plan , each family member must meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible .

This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost-sharing and before you meet your deductible See a list of covered preventive services at https://www.healthcare.gov/coverage/preventivecarebenefits/ .

You don’t have to meet deductibles for specific services.

The out-of-pocket limit is the most you could pay in a year for covered services. If you have other family members in this plan , they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met.

Even though you pay these expenses, they don’t count toward the out–of–pocket limit .

This plan uses a provider network . You will pay less if you use a provider in the plan’s network . You will pay the most if you use an out-of-network provider , and you might receive a bill from a provider for the difference between the provider’s charge and what your plan pays ( balance billing ).Be aware your network provider might use an out-ofnetwork provider for some services (such as lab work). Check with your provider before you get services.

Answers

$300 Individual / $600 Family

Yes. Preventive care and services indicated in chart starting on page 2.

Important Questions

Why This Matters: What is the overall deductible ?

Are there services covered before you meet your deductible ?

Are there other deductibles for specific services? No.

$3,000 Individual / $6,000 Family

What is the out-of-pocket limit for this plan ?

Premiums , health care this plan doesn’t cover, and services indicated in chart starting on page 2.

What is not included in the out-of-pocket limit ?

Will you pay less if you use a network provider ?

This plan will pay some or all of the costs to see a specialist for covered services but only if you have a referral before you see the specialist . All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

You may have to pay for services that aren’t preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

Up to a 30-day supply (retail); up to a 90-day supply (mail order). Subject to formulary guidelines.

Yes, but you may self-refer to certain specialists .

Do you need a referral to see a specialist ?

If you visit a health care provider’s office or clinic

X-ray: $10 / visit, deductible does not apply. Lab tests: $10 / visit, deductible does not apply.

Diagnostic test (x-ray, blood work)

If you have a test

If you need drugs to treat your illness or condition

Applicable Generic or Preferred brand drug cost shares

apply.

Generic or Preferred brand drug cost shares apply.

23

If you have outpatient surgery

If you need immediate medical attention

If you have a hospital stay

If you need mental health, behavioral health, or substance abuse services

If you need help recovering or have other special needs

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is shown in the chart below. Other coverage options may be available to you, too, including buying individual insurance coverage through the Health Insurance Marketplace . For more information about the Marketplace , visit www.HealthCare.gov or call 1-800-318-2596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim . This complaint is called a grievance or appeal . For more information about your rights, look at the explanation of benefits you will receive for that medical claim . Your plan documents also provide complete information on how to submit a claim , appeal , or a grievance for any reason to your plan . For more information about your rights, this notice, or assistance, contact the agencies in the chart below.

1-800-813-2000 (TTY: 711) or www.kp.org/memberservices

1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform

1-877-267-2323 x61565 or www.cciio.cms.gov

1-888-877-4894 or www.dfr.oregon.gov

1-800 562 6900 or www.insurance.wa.gov

Kaiser Permanente Member Services

Department of Labor’s Employee Benefits Security Administration

Department of Health & Human Services, Center for Consumer Information & Insurance Oversight

Oregon Division of Financial Regulation

Washington Department of Insurance

Contact Information for Your Rights to Continue Coverage & Your Grievance and Appeals Rights:

Does this plan provide Minimum Essential Coverage? Yes

Minimum Essential Coverage generally includes plans , health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage you may not be eligible for the premium tax credit .

Does this plan meet the Minimum Value Standards? Yes If your plan doesn’t meet the Minimum Value Standards , you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace

Language Access Services:

Spanish (Español): Para obtener asistencia en Español, llame al 1-800-813-2000 (TTY: 711).

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-813-2000 (TTY: 711).

码 1-800-813-2000 (TTY: 711).

Chinese (

Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-800-813-2000 (TTY: 711).

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

actual costs

shown are just examples of how this plan might

About these Coverage Examples: This is not a cost estimator.

be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus

might pay under different health plans . Please note these coverage examples are based on self-only

costs

covered services.]

[The plan would be responsible for the other costs of these

service area. If different treatments are available, Necessary Dental Care includes the concept that the Trust will only cover the least costly alternative treatment that can be safely provided.

The Plan will determine the amount payable for any Covered Services not listed in the Schedule of Allowances based on the amount payable for an equivalent procedure that is listed. The Plan covers the following BasicServices:

• Oral Examination-Exam of the mouth andteeth;

• Prophylaxis-Cleaning, scaling and polishing of theteeth;

• Topical Fluoride Application-Applying fluoride to the exposed teethsurfaces;

• Periapical and Bitewing X-Rays-Dental x-rays of the inside of the mouth. Periapical x-rays reveal the entire tooth and surrounding bone and gum tissue. Bitewing x-rays reveal some of the upper and lower teeth in the samefilm;

• Extractions -The removal or pulling ofteeth;

• Fillings-The Plan will cover fillings of silver amalgam, silicate or plastic restorative material. If the Participant elects to have another restorative material such as gold foil, the Plan will cover up to the cost of a silver amalgamfilling;

• PalliativeEmergencyTreatment-Emergencytreatmentprimarilyforrelief,ratherthancure;

• Space Maintainers -An appliance to preserve the space between the teeth caused by premature loss of a primary tooth. The primary teeth are the first set of teeth, sometimes known as baby teeth. The Plan does not cover space maintainers used to create a space between teeth and used in orthodontics, except as provided under "Orthodontic Benefits." Space maintaine r benefits are limited to childrenonly;

• Repair of Dentures and Bridges -Repair of artificialteeth;

• Oral Surgery-Surgery pertaining to the gums, teeth ortooth structure for dental purposes and treatment of fractures anddislocations;

• Apicoectomy-Surgical removal of the tip of the toothroot;

• Endodontics-The prevention, diagnosis, and treatment of diseases and injuries of the tooth pulp, root and surrounding tissue. This includes pulpotomy, pulp capping and root canal treatment;and

• Periodontic Services -Services of the connective tissue around and supporting the teeth. The Plan covers surgical periodontic exams, gingival curettage, gingivectomy, osseous surgery including flap entry and closure, mucogingivoplastic surgery, and management of acute infection and oral lesions related to the toothstructure.

Prosthetic services are services relating to an artificial device that replaces a missing dental part. The Plan will pay 100% of the amount listed in the Schedule of Allowances. The Plan will determine the amount payable for any Covered Services not listed in the Schedule based on the amount payable for an equivalent procedure that is listed. Covered prosthetic services are:

• Inlays,onlays;

• Crowns consisting of a castingprocedure;

• Bridges, fixed and removable;and

ThePlanwillprovide benefitsfordental implants andrelatedprocedures,uptothedenturebenefit, for dental implants which are deemed by the Plan to be necessary and appropriate. This allowance includes the crowns necessary for theimplants.

The following four prosthetic services are not covered:

• Replacement, within five years, of a prosthetic appliance or fixed bridge {furnished under the Plan) by either a prosthetic appliance or fixed bridge, more often than once in fiveyears;

• Duplication Qump case) of an existing denture more often than once in fiveyears;

• Replacement ofa prostheticappliancewhich isorcan be made satisfactory; or

• Procedures started prior to becomingcovered.

Benefits are limited to the charge for the standard procedure for the replacement of missing teeth with a full or partial denture. Personalized restoration and special techniques are not covered.

Orthodontic services are services for the installation of orthodontic appliances (not including space maintainers for primary teeth) and treatment to reduce or eliminate malocclusion. Benefits are payable only whenatreatment planhasbeensubmitted.

Once an individual is accepted for care under the orthodontic program, foll benefits will be paid, even though coverage may terminate. A 60-day extension period is also allowed for final placement after coverage is terminated.

For Orthodontic Services, the Plan will pay 70% of Usual and Customary Charges for necessary orthodontic treatment up to a maximum of $825 per individual Usual and Customary Charges are charges the Plan determines fall within a range of those most frequently made for services and supplies in our service area by those who supply them. After an individual reaches the $825 maximum, the Plan will not provide further orthodontic benefits until a period of five years has elapsed from the date of the .first orthodontic payment under the Scheduled DentalPlan.

For more Information on your Dental Benefits, call:

UFCW Local 555-Employers Health Trust c/o Zenith American Solutions 12205 SW Tualatin Rd, Suite 200 Tualatin, OR 97062

Phone (503) 486-2102 * Fax: (971) 239-0671 www.zenith-american.com

Instead of the Scheduled Dental Plan, an Employee may choose to enroll in the Willamette Dental Plan. The Employee may change from one Dental Plan option to the other only during the Annual Open Enrollment period or within 30 days of adding a new Dependent.

Willamette Dental is a group practice Dental Plan which provides all dental services through contracted Dentists practicing at specified offices. The Willamette Dental Plan option is offered through Regence BlueCross BlueShield of Oregon. In addition to the Willamette Dental contact information, Regence Customer Service is available to provide information on benefits and Willamette Dental locations.

Except for a small visit charge and copayments for certain procedures, Willamette Dental provides all necessary dental services without charge to Participants.

• Willamette Dental services are provided only at Willamette Dental offices. The available locations are shown in the Willamette Dental Provider list available from the Trust Office or by contacting Willamette Dental's Patient Relations Department(800-460-7644).

• Most dental offices are open from 7:00 a.m. until 6:00 p.m., Monday through Saturday. Evening appointments areavailable for all locations. To make an appointment, call the Appointment Center at 503-952-2100 or1-800-461-8994.

• Regence BlueCross BlueShield of Oregon Customer Service is also available from 6:00 a.m. to 6:00 p.m. to assist with benefit questions and to provide assistance in finding a Willamette Dentallocation.RegenceCustomerServicecanbereached at1-888-977-2583,formembersonly press 2. If you are a Provider, you have to call1-866-227-0913.

• When an Employee first enrolls in the Willamette Dental Plan, the Employee should make a dental appointment for himself or herself (and any eligible Dependents) whether or not the individual is then in need of dental care. The purpose of this early visit is to acquaint the individual with the Dentist and help determine the individual's dental care needs. Appointments canbemadebycallingthefollowingtelephonenumber:1-800-461-8994.

• At the first visit, most or all of the following can be expected, depending on the individual's particularneeds: a review of the Participant's medical and dental history; an oral examination; any necessary x-rays; emergency treatment, if required; teeth cleaning or a scheduled appointment for teeth cleaning; and a personal dental hygiene program with instruction in homecare.

• If a Participant does not make a reasonable effort to follow the treatment program recommended by his or her dentist, the management of the Willamette Dental Plan has the option of asking the Participant to transfer to the Scheduled Dental Plan (or to seek another source of dental care) at the end of a Planyear.

Each patient pays a $15 charge for each dental appointment. Certain procedures also require a copayment. Visit charges and copayments are listed below. There are no other charges. Under the Willamette Dental Plan preventative dental services are covered at 100% and require no copayment. These services include: dental examinations; x-rays, cleaning; fluoride treatments; sealants; oral hygiene instruction; periodontal charting; periodontal evaluation; fillings; and simple extractions.

Note: If you need to cancel an appointment, you must notify the dental office 24 hours in advanceora$10missedappointmentchargewillapply.

LifeMapAssuranceCompanyGroupManagedCareDentalPlanprovidesemployeesandtheirfamilymemberstheopportunity to receive dental services through Willamette Dental Groupproviders.

& Resin anterior, posterior primary, &resin based crowns

-2 to 4 surfaces, posterior permanent

Coverage is available to you and, if you choose, eligible family members including a spouse and children under age 26. All premiums will be paid through payroll deduction.

Participating Providers include Willamette Dental Group, P.C., and the providers who are employed by or are under contract with Willamette Dental Group, P.C., or any of its affiliates. To receive the excellent benefits of this plan, you must receive care from a Willamette Dental Group provider Willamette Dental Group has over 50 office locations throughout Oregon, Washington, and Idaho. You are free to select your Willamette Dental Group provider and whichever location is best for you.

This summary is provided for your convenience only and is not intended to be inclusive of all policy provisions. Please see your certificate for complete details. If there is any discrepancy between this document and the master policy, the master policy provisions will prevail.

Exclusions:

No Benefits will be provided for any of the following conditions, treatments, services, supplies, or accommodations, including any direct complications or consequences that arise from them, unless otherwise specified.

Aesthetic Dental Procedures and complications arising out of such services Including services and supplies provided in connection with dental procedures that are primarily aesthetic, including bleaching of teeth and labial veneers. Benefits not stated meaning services and supplies that are not identified as Benefits under the Policy. Charges by any person other than a Participating Provider except for those instances indicated in the Benefits section of this Policy.

Cosmetic/Reconstructive Services and Supplies, except in the treatment of the following:

1. to treat a congenital anomaly for Members up to age 18;or

2. to restore a physical bodily function lost as result of injury orillness.

Cosmetic means services or supplies that are applied to normal structures of the body primarily to improve or change appearance and that do not primarily restore an impaired function of the body.

Reconstructive means:

1. services,procedures,andsurgeryperformedonabnormalstructuresofth ebodythatwerecausedbycongenitaldefects; or

2. developmental abnormalities, trauma, infection, tumors, ordisease.

Reconstructive services are generally performed to restore function, but also may be done to approximate a normal appearance.

For the purposes of this exclusion, psychological factors (for example, poor self-image, difficult social or peer relations) are not relevant and are not considered a physical bodily function.

Coverage that is available under any federal, state, or other governmental program if application is duly made therefore, except where required by law, such as for cases of emergency or for coverage provided by Medicaid.

Dental implants supported prosthetics or abutment-supported prosthetics (crowns, bridges, and dentures)

Dental implants, an implant surgically placed prior to the member’s effective date of coverage that has not received final restoration or dental implant for treatment of a primary or transitional definition.

Dental services which are not Necessary Dental Services as defined by this Policy.

Diagnostic Casts or Study Models

Endodontics, implants, bridges, crowns, or other service or prosthetic devices requiring multiple treatment dates or fittings if treatment was started or ordered prior to the Member’s Effective Date under this Policy or if the item was installed or delivered more than 60 days after the Member’s coverage under this Policy has terminated. Root canal treatment will be covered if the tooth canal was opened prior to termination and treatment is completed within 60 days after termination.

Excision of a tumor; biopsy of soft or hard tissue; removal of a cyst, nonodontogenic or exostosis.

Experimental/Investigational treatments, procedures and services, supplies, and accommodations provided in connection with Experimental/Investigational treatments or procedures.

Extraction of permanent teeth for tooth guidance procedures; procedures for tooth movement, regardless of purpose; correction of malocclusion; preventive orthodontic procedures; craniomandibular orthopedic treatment; and other orthodontic treatment, unless specified in the Schedule of Covered Services and Copays.

Full-mouth reconstruction.

General Anesthesia, including conscious sedation and intravenous sedation, unless specified in the Schedule of Covered Services and Copays.

Habit-breaking or stress-breaking appliances

Hospitalization for dentistry.

Maxillofacial prosthetic services.

Medication and Supply Charges including take home drugs, pre-medications, therapeutic drug injections, and supplies. Military Service-Related Conditions which includes services and supplies for treatment of an illness or injury caused by or incurred during service in the armed forces of any state or country.

Exclusions:

Motor Vehicle Coverage and Other Insurance Liability means any expenses for services and supplies that are payable under any:

1. automobilemedical,personalinjuryprotection(“PIP”),automobileno-fault,underinsuredoruninsuredmotoristcoverage;

2. homeowner’scoverage;

3. commercial premises coverage; or

4. similar policy orinsurance.

This applies when the policy or insurance is either issued to, or makes benefits available to a Member, whether or not the Member makes a claim under such coverage. Further, the Member is responsible for any cost-sharing required by the motor vehiclecoverage,unlessapplicablestatelawrequiresotherwise.Oncebenefitsundersuchpolicyorinsuranceareexhausted or deemed to no longer be injury-related under the no-fault provisions of the Policy, We will provide Benefits according to the Policy.

Non-Direct Patient Care and services that are not direct patient care, including:

1. charges for appointments scheduled and not kept ("missedappointments");

2. charges for preparing medical reports, itemized bills or claim forms (even at Our request);or

3. visitsor consultations that are not in person (including telephone consultations and e-mailexchanges) whether initiated by the Member or the Member’sprovider.

Occlusal Treatment and supplies provided in connection with dental occlusion, including the following:

1. complete occlusal adjustments;and

2. occlusalguards.

Personalized restorations, precision attachments, and special techniques. Repair or Replacement Services and supplies provided in connection with the repair or replacement of any dental appliance (including but not limited to dentures and retainers), whether lost, stolen, or broken. Replacement of sound restorations.

Riot, Rebellion, War and Illegal Acts including services and supplies for treatment of:

1. anillnessorinjurycausedbyaMember’sunlawfulinstigationand/oractiveparticipationinariotorwar,whetherdeclared or undeclared; armed invasion or aggression, insurrection, or rebellion; or

2. servicesandsuppliesfortreatmentofanillnessorinjurysustainedbyaMemberwhileintheactofcommittinganillegal act.

Services for accidental injury to natural teeth that are provided more than 12 months after the date of the accident. Services or supplies and related exams or consultations that are not within the prescribed treatment plan and/or are not recommended and approved a Participating Provider.

Services or supplies where there is no evidence of pathology, dysfunction, or disease other than covered preventive services.

Temporomandibular Joint (TMJ) Dysfunction Treatment. Services and supplies provided in connection with Temporomandibular Joint (TMJ) dysfunction.

Transseptal fiberotomy.

Treatment started prior to the Member’s Effective Date under this Policy or completed after this Policy terminates, unless otherwise stated.

Work-Related Injuries and expenses for services and supplies incurred as a result of any work-related injury, including any claims that are resolved pursuant to a disputed claim settlement for which a Member has or had a right to compensation. We may require the Member to file a claim for workers’ compensation benefits prior to providing any Benefits under the Policy. Services and supplies received for work-related injuries are not covered even if the service or supply is not a covered workers’ compensation benefit. The only exception is if a Member is exempt from state or federal workers’ compensation law.

This summary is provided for your convenience only and is not intended to be inclusive of all policy provisions. Please see your certificate for complete details. If there is any discrepancy between this document and the master policy, the master policy provisions will prevail. RLH

OR EE Page 3 of 3

SEE HEALTHY AND LIVE HAPPY WITH HELP FROM UFCW LOCAL 555 EMPLOYERS HEALTH TRUST AND VSP.

As a VSP® member, you get personalized care from a VSP network doctor at low out-of-pocket costs.

VALUE AND SAVINGS YOU LOVE.

Save on eyewear and eye care when you see a VSP network doctor. Plus, take advantage of Exclusive Member Extras for additional savings.

PROVIDER CHOICES YOU WANT.

With an average of five VSP network doctors within six miles of you, it’s easy to find a nearby in-network doctor. Plus, maximize your coverage with bonus offers and additional savings that are exclusive to Premier Program locations.

Like shopping online? Go to eyeconic.com and use your vision benefits to shop over 50 brands of contacts, eyeglasses, and sunglasses.

QUALITY VISION CARE YOU NEED.

USING YOUR BENEFIT IS EASY!

Create an account on vsp.com to view your in-network coverage, find the VSP network doctor who’s right for you, and discover savings with exclusive member extras. At your appointment, just tell them you have VSP.

GET YOUR PERFECT PAIR

You’ll get great care from a VSP network doctor, including a WellVision Exam® a comprehensive exam designed to detect eye and health conditions. +

EXTRA $20 TO SPEND ON FEATURED FRAME BRANDS*

UFCW LOCAL 555 EMPLOYERS HEALTH TRUST and VSP provide you with an affordable vision plan.

PROVIDER NETWORK:

VSP Signature

EFFECTIVE DATE: 01/01/2022

WELLVISION EXAM

PRESCRIPTION GLASSES

FRAME

LENSES

LENS ENHANCEMENTS

CONTACTS (INSTEAD OF GLASSES)

ESSENTIAL MEDICAL EYE CARE

YOUR COVERAGE WITH A VSP PROVIDER

Focuses on your eyes and overall wellness

$170 featured frame brands allowance

$150 frame allowance

20% savings on the amount over your allowance

Single vision, lined bifocal, and lined trifocal lenses

Impact-resistant lenses for dependent children

Standard progressive lenses

Premium progressive lenses

Custom progressive lenses

Average savings of 40% on other lens enhancements

$130 allowance for contacts; copay does not apply

Contact lens exam (fitting and evaluation)

Retinal screening for members with diabetes

Additional exams and services for members with diabetes, glaucoma, or age-related macular degeneration.

Treatment and diagnoses of eye conditions, including pink eye, vision loss, and cataracts available for all members

Limitations and coordination with your medical coverage may apply. Ask your VSP doctor for details

Glasses and Sunglasses

Every 12 months $0

Every 24 months $0

Every 12 months $0

$0

$80 - $90

$120 - $160

Up to $60

$0

$20 per exam

Every 12 months

Every 12 months

As needed

Extra $20 to spend on featured frame brands. Go to vsp.com/offers for details.

30% savings on additional glasses and sunglasses, including lens enhancements, from the same VSP provider on the same day as your WellVision Exam. Or get 20% from any VSP provider within 12 months of your last WellVision Exam.

EXTRA SAVINGS

Routine Retinal Screening

No more than a $39 copay on routine retinal screening as an enhancement to a WellVision Exam

Laser Vision Correction

Average 15% off the regular price or 5% off the promotional price; discounts only available from contracted facilities

After surgery, use your frame allowance (if eligible) for sunglasses from any VSP doctor

YOUR COVERAGE WITH OUT-OF-NETWORK PROVIDERS

Get the most out of your benefits and greater savings with a VSP network doctor. Call Member Services for out-of-network plan details. Coverage with a retail chain may be different or not apply. Log in to vsp.com to check your benefits for eligibility and to confirm in-network locations based on your plan type. VSP guarantees coverage from VSP network providers only. Coverage information is subject to change. In the event of a conflict between this information and your organization s contract with VSP, the terms of the contract will prevail. Based on applicable laws, benefits may vary by location. In the state of Washington, VSP Vision Care, Inc., is the legal name of the corporation through which VSP does business.

*Only available to VSP members with applicable plan benefits. Frame brands and promotions are subject to change. Savings based on doctor s retail price and vary by plan and purchase selection; average savings determined after benefits are applied. Ask your VSP network doctor for more details.

Classification: Restricted

©2021 Vision Service Plan. All rights reserved.

VSP, VSP Vision Care for life, Eyeconic, and WellVision Exam are registered trademarks, VSP Diabetic Eyecare Plus Program is servicemark of Vision Service Plan. Flexon is a registered trademark of Marchon Eyewear, Inc. All other brands or marks are the property of their respective owners.

U.A. UNION LOCAL NO. 290 PLUMBER, STEAMFITTER AND SHIPFITTER INDUSTRY PENSION TRUST

12205 SW Tualatin Road, Suite 200

Tualatin, OR 97062

ELIGIBILITY QUESTIONS:

- Eligibility for Coverage

- Enrollment for Coverage

- Demographic Changes (Names/Addresses etc.)

- Obtaining ID Cards

- Medical/Dental/Claims Appeals that were initially denied by Carrier.

- Proof of Insurance & Medicare D Notice.

- COBRA Information and Premium Payments

- Accident and Disability Weekly Benefits and Claims

- Death and AD&D Benefits and Claims

- Retirement Information & Premium Payments

BENEFIT AND CLAIMS QUESTIONS:

FOR TRUST INDEMNITY PLAN:

- Medical Benefits

- Medical Claims Submission

- Medical Claims Appeal

- ID Cards

KAISER HMO PLAN

- Kaiser Benefits & Claims

- Kaiser Claims Appeals

- ID Cards

DENTAL BENEFITS:

-Dental Benefits

-Dental Claims Submission

-Initial Dental Claims Appeals

-ID Cards

*Note, Dental Benefits are only available once you attain Level 2 coverage and above

---------------------------------------------------------

-Benefit Office Locations and Appointments

-ID Cards

Zenith American Solutions, Inc.

Contributions Accounting Department 12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

Fax: 971-239-0672

www.zenith-american.com

Zenith American Solutions, Inc.

Benefits & Claims Department

12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

Fax: 971-239-0671

www.zenith-american.com

Kaiser Permanente Member Services

500 NE Multnomah St Suite 100

Portland, OR 97232

503-813-2000 or 800-813-2000

www.kp.org

Trust Self-Funded Dental Plan 12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

Fax: 971-239-0671

www.zenith-american.com

Willamette Dental

Phone: (855) 433-6825

www.willamettedental.com

CLAIMS ADMINISTRATOR FOR PRESCRIPTION DRUGS :

TRUST INDEMNITY PLAN

-Information on Benefits

-Participating Pharmacies

-Claims Submissions for Prescriptions

-ID Cards

-Mail Order Pharmacy

-Market Place RX Program

-Specialty Drug Benefits (Precert. and Ordering)

VISION BENEFITS:

-Benefits/Vision Network Providers

-Claims Submission

-Claims Appeal for Vision Benefits

*Note: Vision Benefits are only available once you attain Level 3 coverage

PENSION BENEFITS:

-Information regarding Pension Eligibility

-Information Regarding Current Pension

-Applications and Forms

-Change in Personal Information

-Death Benefits for pre-and post-retirement

-Check and/or direct deposit status

WEEKLY DISABILITY INCOME:

-Apply for Weekly Disability Benefits

-Check Status of Disability Payment

If you are unsuccessful appealing your claim, Level 2 Claim Appeals for Medical, Prescription Drug, Dental, Vision, Death, Accidental Death and Dismemberment (AD&D) and Weekly Disability Benefit can be heard by the Board of Trustees.

MEDICARE

-Contact Medicare with questions regarding Medicare Part A, B, and/or D coverage.

HIPAA PRIVACY & SECURITY OFFICERS

-HIPAA Notice of Privacy Practice

Optum RX PO Box 650334 Dallas, TX 85034-0334

www.optumrx.com

(866)328-2005

Vision Service Plan (VSP) PO Box 385018 Birmingham, AL 35238-5018

www.vsp.com

(800)877-7195

Zenith American Solutions, Inc. Pension Department 12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

Fax: 971-239-5566

www.zenith-american.com

Zenith American Solutions, Inc. 12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

Fax: 971-239-0671

www.zenith-american.com

The Board of Trustees

UFCW Local 555 Trust Funds 12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

Medicare 1-800-633-4227

www.medicare.gov

Zenith American Solutions, Inc. 12205 SW Tualatin Rd. Suite 200

Tualatin, OR 97062

Phone: 503-486-2102

Toll Free: 866-796-7623

www.zenith-american.com

UFCW LOCAL 555 - EMPLOYERS HEALTH TRUST

12205 SW Tualatin Rd, Suite 200

Tualatin, OR 97062

Phone: (503) 486-2102 * 1-866-796-7623 Fax: (971) 239-0672

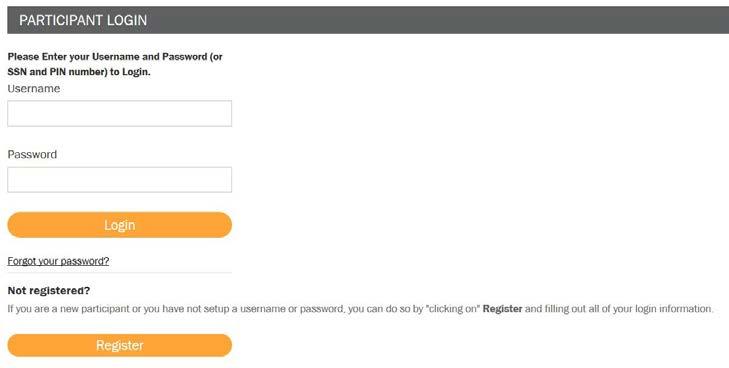

Welcome to UFCW 555 Member Online Access, sponsored by Zenith American Solutions (ZAS).

UFCW-ZAS is your one-stop shop for:

• Eligibility Information

• Covered Family Members and Dependents

• Work History

• Benefits Summary

• Claims and Short-term Disability Claim Status

• Pension

• Important Plan Documents

To access UFCW-ZAS, please follow the directions below:

1. Go to: http://www.zenith-american.com/

2. Click on “Login to your Account”

3. This takes you to the Account drop down menu. Select “Participant Edge (ZAS/ABPA)”.

Note: This will take you to the secure website URL: https://edge.zenith-american.com/page.php?p=members/index.php&ac=login

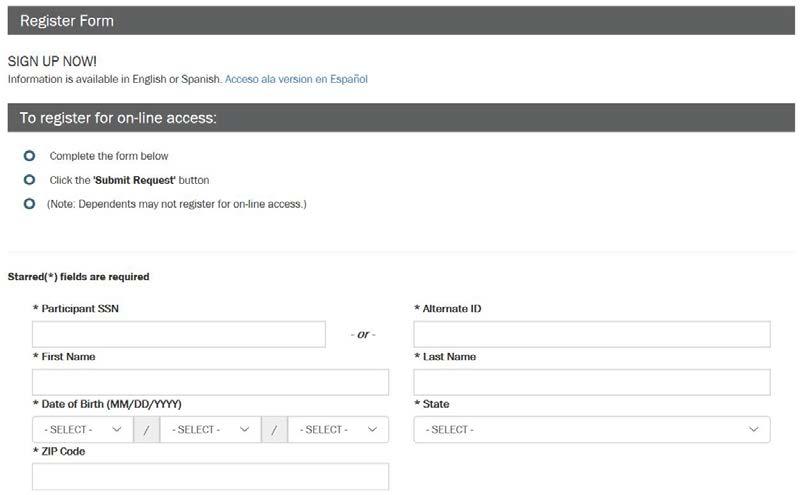

4. The first time that you visit the website, you will need to “Register” by selecting the “Register Form” link.

5. Complete the Website Registration Form

To complete the online registration, you will need the following information:

• Full Name

• SSN (or Alternate ID)

• Date of Birth

• State

• Zip Code

Note: Your Registration Information must match the Participant Information that the Trust has on record. Please contact the Trust if you need to change your address.

6. Next you will create your unique Username and Password, and also select a Security question and answer (to use in case you ever forget your password).

7. After you have registered successfully, you will now have access to the Secure UFCW Member website.

You can “Log In” using in your new username and password.

The Secure UFCW Member website can be used to check your Work History, Eligibility, Claims and Pension information online, in addition to accessing important Trust Documents and Links.