Industry puzzles over historic gap between mining valuations and commodity prices

PRECIOUS METALS SUMMIT | Gold expected to play key role in financial ‘reset’

BY HENRY LAZENBY

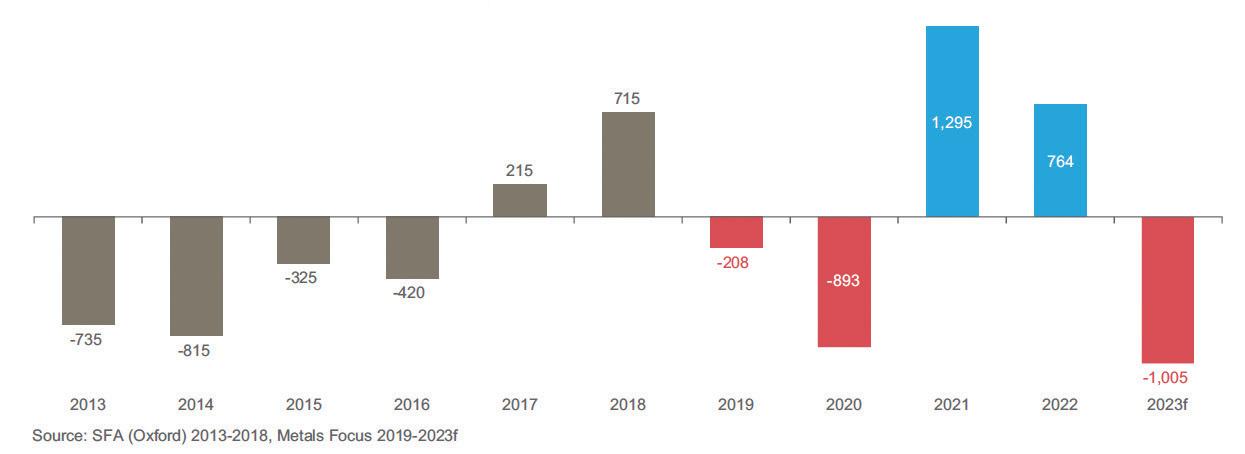

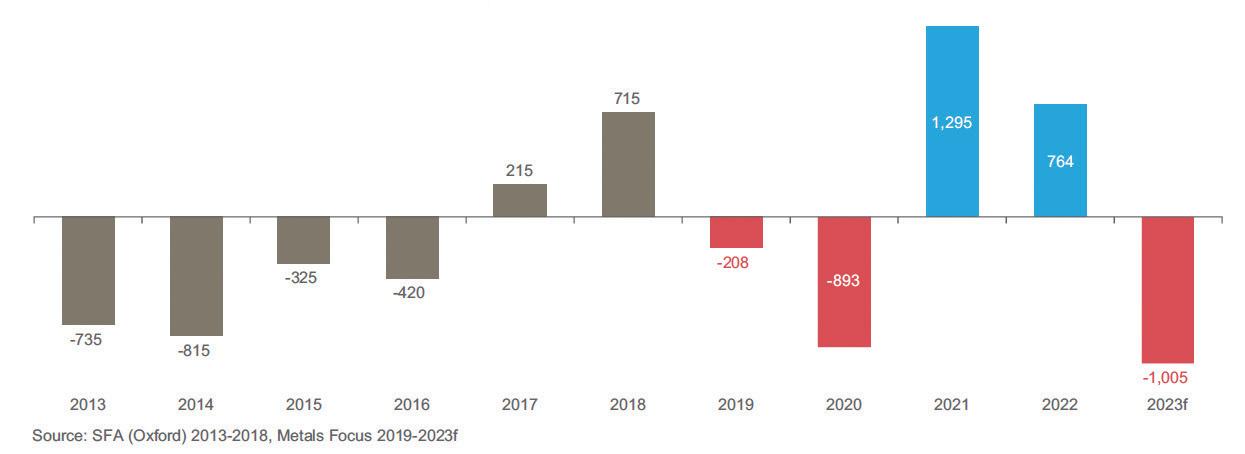

The mining sector, a longstanding pillar of the global economy and even more important now with rising attention to critical metals and secure supply in Western nations, is facing emerging challenges on multiple fronts — including access to finance. This means that despite the hype surrounding the industry, it has not translated into tangible investments or capital inflows, the Precious Metals Summit heard in September.

During the first day of the industry conference (Sept. 12-15) in Beaver Creek, Colo., industry

logical innovations, and substantial capital investments to bridge the existing disconnect and allow the sector to fulfill its important role.

One of the perplexing trends experts pointed out is a surprising regression in industry valuations.

“A lot of the companies we own today, in terms of valuations, are back to levels prior to discovery holes,” said Otavio ‘Tavi’ Costa, a partner and portfolio manager at Crescat Capital. This necessitates a reassessment of their investment strategies and a stronger focus on innovation, Costa said.

Diving deeper into the economics of the mining sector, another panelist at the summit, Haytham

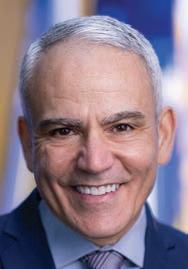

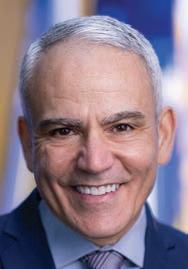

Ana Cabral is The Northern Miner’s Person of the Year for 2022

AWARDS | Sigma Lithium CEO brings tech mindset to mining

WPM; NYSE: WPM), highlighted the glaring disparity between mining company valuations and commodity prices. “This is probably the worst disconnect I’ve seen in over 20 years,” Hodaly noted.

Analysis by San Francisco-based Merk Investments, manager of the ASA Gold and Precious Metals (NYSE: ASA) fund, showed gold equities have been underperforming bullion for more than a decade and in April were near the all-time lows of 2015. Toronto-based Sprott in July listed company share dilution, misallocation of funds, jurisdictional risk, low margins and longer permitting times as reasons for the discrepancy.

BY ALISHA HIYATE

igma Lithium

’s

S(TSXV: SGML; NASDAQ:

SGML) advance from IPO in 2018 to first production at its Grota do Cirilo mine in Brazil this year has been impressive — as reflected in the tripling of its share price since January 2022, as well as takeover rumours earlier this year (involving Tesla, no less).

The now $5.3-billion market cap company expects to churn out 130,000 tonnes spodumene concentrate this year for a hungry lithium market, and near-term expansion plans to triple production. But to get here, it’s had to consistently deliver on its promises, not an easy thing to do in a nascent and volatile market.

That’s why Sigma Lithium CEO and co-founder Ana Cabral is The Northern Miner’s Mining Person of the Year for 2022.

Cabral, a Brazilian with a background in banking, including as a managing director and head of Latin American Capital Markets at Goldman Sachs, has been central to Sigma’s success, shepherding the company to its newfound status as one of the biggest hard rock producers in the Americas.

When the US$130-million initial mine in Minas Gerais state reaches full production this year, an annualized 270,000 tonnes spodumene concentrate at 5.5% lithium oxide (Li), it will be the largest hard rock spodumene producer outside of Australia. And, if it goes ahead with planned phase 2 and 3 expansions — an announcement was expected at press time in late September — Grota do Cirilo

would become a top five producer as soon as 2025, scaling up to 104,000 tonnes lithium carbonate equivalent (LCE) annually over a 13-year mine life from 37,000 tonnes LCE this year.

‘Obsession with discipline’

Influenced by her time in banking, Cabral has sought to run Sigma

GLOBAL MINING NEWS THE NORTHERN MINER | OC TOBER 2023 1 WHAT ARGENTINA’S OCTOBER ELECTIONS COULD MEAN FOR ITS MINING SECTOR / 8 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com OCTOBER 2023 / VOL. 109 ISSUE 19 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM

PM40069240 See CABRAL / 10

NEW FEATURE MINING, MARKETS AND METALS GOLD FUND AND ETF DATA, DRILL RESULTS AND MORE / 23–31 CANADIAN MINING HALL OF FAME NAMES

Tımes change. Has your mine plan? .com Ore Waste 2020 Now See COMMODITIES / 10

Ana Cabral, CEO and cofounder of Sigma Lithium. SIGMA LITHIUM

n Copper, aluminum to rise

Global copper and aluminum supply deficits may cause prices to soar within a few years while steel may drop, according to a new report on metals.

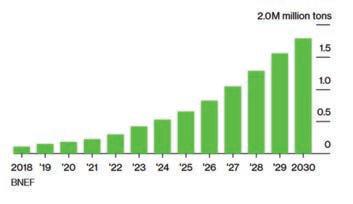

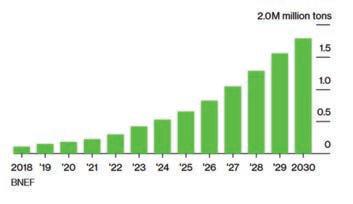

A 5.4-million-ton (4.9-million-tonne) copper supply shortfall by 2027 may push prices up by 20% to US$9,800 per ton from around US$8,200 per ton this year, Bloomberg New Energy Finance, a unit of the newswire company, says in its Industrial Metals Outlook 2H 2023: Heading into the storm.

Global annual demand for copper is forecast to rise by 2.6% from last year’s levels to 29.8 million tonnes by 2027 as the green energy transition to more electricity in transport and industry bites into supplies, the report published in September shows. Copper supplies are expected to increase by 10% over the period to 24.4 million tons.

Likewise, it projects a 30.7-million-ton aluminum shortfall despite a 10% production increase over the same period. That could see prices hit US$3,000 per ton in 2027 from US$2,200 per ton this year – a 36% hike, according to the report. It projected that pressure on energy costs and emissions could boost aluminum recycling efforts to feed 82% of supply by 2028.

In 2027, aluminum demand is projected to hit 108.2 million tonnes, as lightweight aluminum replaces heavier steel in vehicles and in electricity grid infrastructure.

By Northern Miner Staff

n Kodal unfazed by Mali law

Kodal Minerals said in September it is moving its Bougouni lithium project in Mali into the next development phase as it won’t be affected by new

legislation that entitles the state to a greater share of its resources.

Mali’s interim President Assimi Goita signed a new law in late August that doubles the stake the government can acquire to 20% within the first two years of commercial production. It also sets aside an additional 5% stake for local investors, taking state and private Malian interests in new projects to 35%.

Authorities had said the updated law wouldn’t apply to current gold operations, including Barrick Gold’s Loulo-Gounkoto and B2Gold’s Fekola assets. But until now, it was unclear what would happen to mines and projects in other mining sectors.

Kodal Minerals said Mali’s National Directorate of Geology and Mines has confirmed its licence to mine at Bougouni. The Phase 1 DMS development plan provides a fast-track pathway to lithium concentrate production at an expected construction timeline of around 12 months, Kodal said.

Phase 2 will see the construction and commissioning of the down-stream flotation plant.

By Mining.com Staff

n First Quantum founder dies

First Quantum Minerals has announced its chairman and co-founder Philip Pascall has died at age 75. The company says Pascall passed peacefully at his home in Perth, Western Australia, on Sept. 19.

Pascall began his career in 1973, holding various general management positions in South Africa before moving to Australia. He became the project manager of the Argyle diamond project in Western Australia, and then executive chairman and partowner of Nedpac Engineering between 1982-1990.

After selling his shares in Nedpac, he spent a few years as consultant in the mining industry, includ-

2 OCTOBER 2023 | THE NORTHERN MINER ww w.northernminer.com Night shift at SSR Mining’s Marigold gold mine in Nevada.

PHOTO OF THE MONTH in

CREDIT: JAMES HODGINS/ PENDA PRODUCTIONS

brief

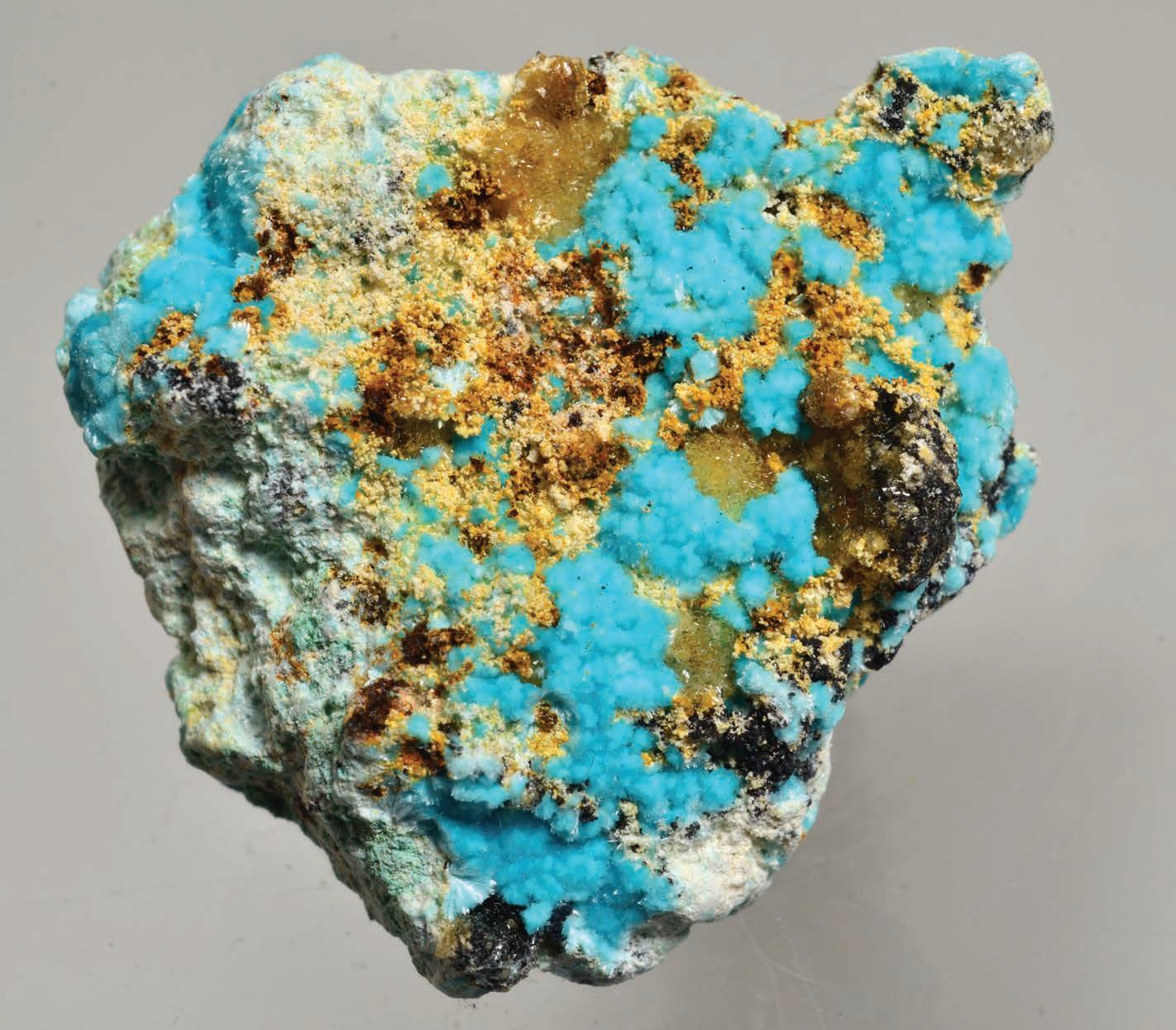

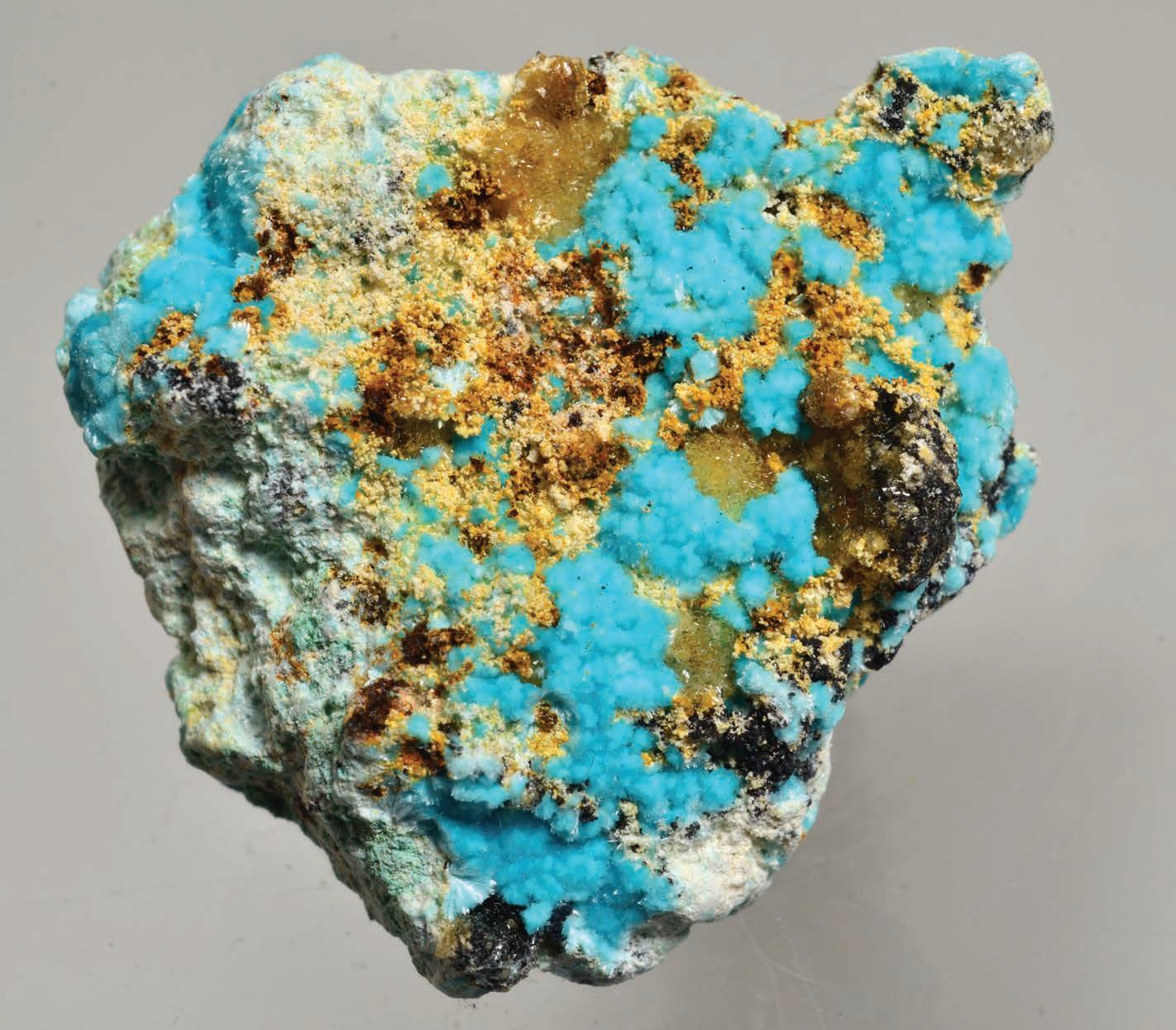

DEPARTMENTS 2 In Brief 4 Op-Ed 8 In-Depth 11 Done Deals 12 People 16 Project Updates 23 Mining, Metals & Markets continued on P6 > SELEX RESOURCES LTD • Private Ontario Parent-US Subsidiary • Klondike Porphyry Copper Prospect-SW Nevada • Undrilled porphyry copper-gold-lead-zinc- silver • 77 lode claims SW of Tonopah. • Mostly open surrounding ground. BLM Land KLONDIKE HIGHLIGHTS • South of vein polymetallic producing district. Massive sulfides assay up to 4.3% Cu, 13.3% Pb, 7.7% Zn, 3500 ppm Ag, 2.4 g/t Au • Turquoise deposit and copper oxide occurrences • Altered and mineralized quartz feldspar porphyry plugs and dikes • Propylitic to phyllic/potassic alteration of argillaceous, carbonate sediments and porphyries • Large regional magnetic/gravity anomaly complex 8km x 6km size • Geochemical sampling of altered felsic porphyry intrusives points to zoning patterns similar to large porphyry deposits. Eg Ni,Co,V outboard of Cu, Mo TTAYLOR@SELEXLTD.COM 775 843 5838 To submit your entry for Photo of the Month, please email bmcbride@northernminer.com. 42 Tech & Innovation 46 Executive Q&A 46 Company Index SPECIAL SECTIONS » Silver & PGMs 17 » Mining in Quebec 32 » Mining in the Prairies 38

Dundee’s novel processing techs address cyanide and arsenic risks

BY NORTHERN MINER STAFF

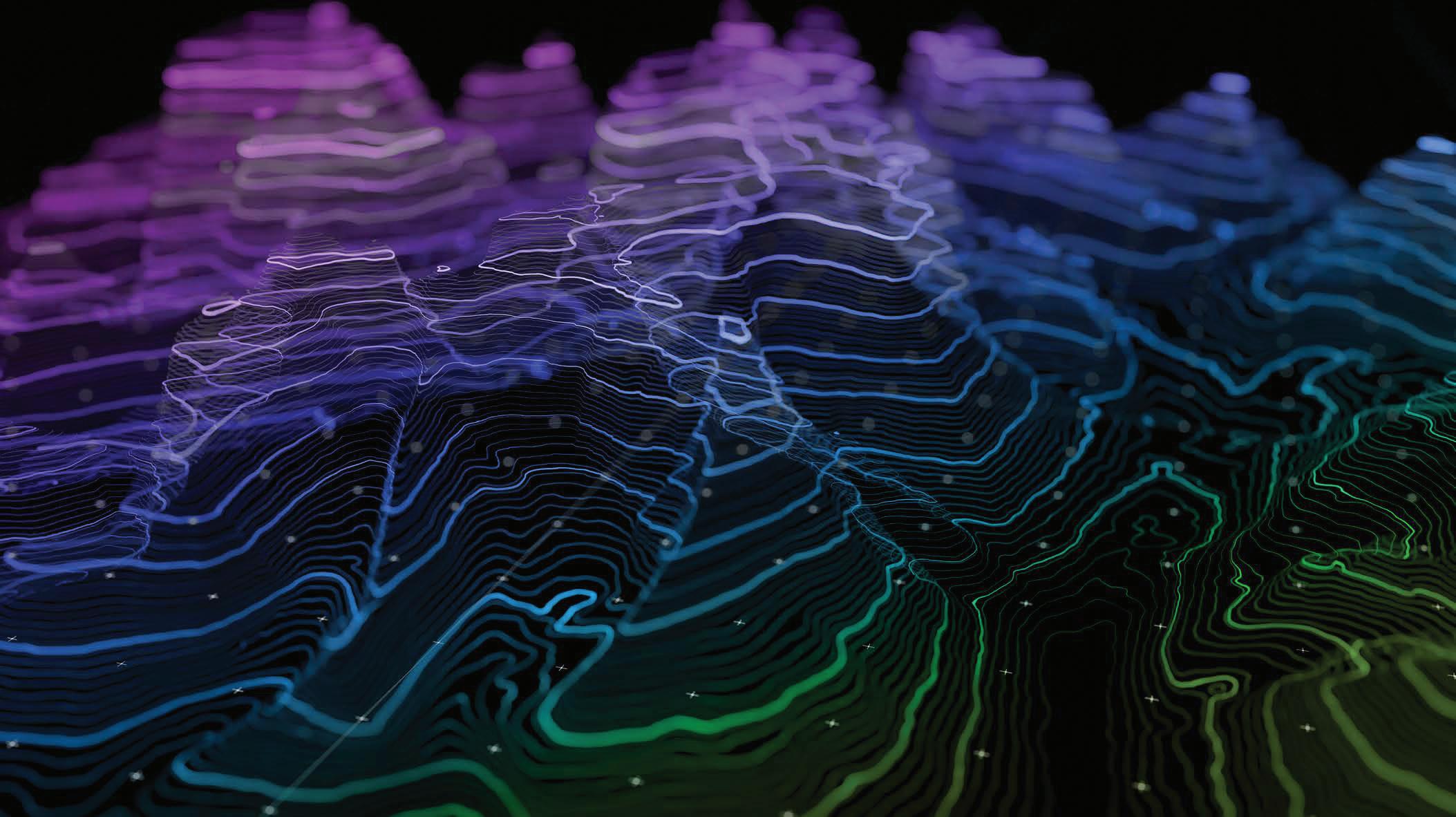

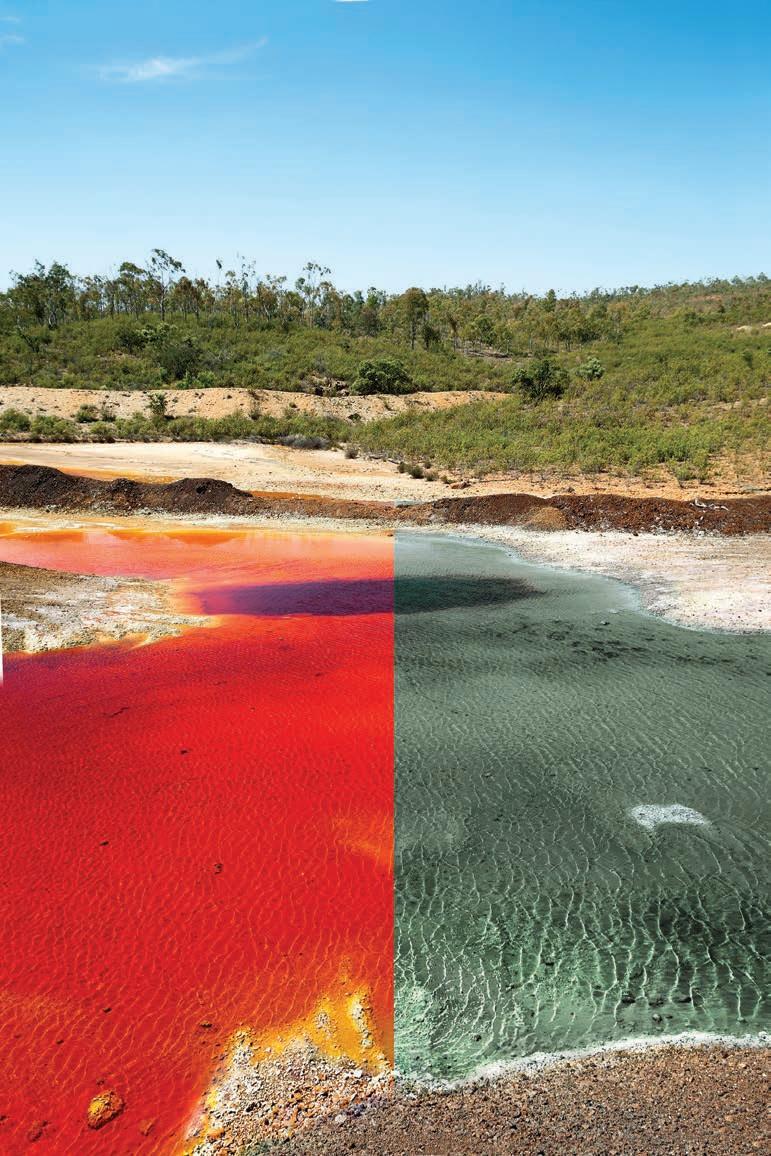

Two innovative metallurgical processes designed to alleviate environmental risks are beginning to attract the attention of mining companies eager to improve their ESG credentials. Dundee Sustainable Technologies’ CLEVR process is a cleaner, efficient and cost-effective alternative to cyanide for the extraction of gold, while its GLASSLOCK process removes and stabilizes arsenic associated with precious and base metal deposits.

A Canadian-based subsidiary of Dundee Corporation, DST has offices, a technical center, and an industrial demonstration facility in Thetford Mines, Que., 105 km south of Quebec City where its industrial size circuits can process up to 15 tonnes of concentrate per day.

The company began working on its CLEVR gold extraction process in 2008. A series of successful development programs then led to the construction and operation of its industrial demonstration facility in 2015 and, in 2020 it sold its first licence for CLEVR to a major gold company.

DST has also successfully demonstrated its GLASSLOCK arsenic stabilization process at an operating copper smelter in Namibia and is now finalizing the detailed engineering for a GLASSLOCK circuit to stabilize legacy arsenic trioxide at an operating gold mine in Ghana.

“Cyanide has been widely used to extract gold for decades and it works well,” said DST president and CEO Jean-Philippe Mai. “However, there’s growing opposition to the use of cyanide. Some jurisdictions have banned or restricted its use, so the industry is in need of an alternative process.

“Our objective,” he added, “is to provide an innovative, alternative process that not only does away with the use of cyanide but also improves gold extraction, shortens contact time and reduces infrastructure footprint.”

The CLEVR process, said Mai, is an ideal solution for developing gold projects in jurisdictions that are sensitive to the use of cyanide and for projects faced with complex ore bodies where cyanide is inefficient due to the presence of accessory base metals or the refractory nature of the ore.

Instead of cyanide, the process uses sodium hypochlorite with a catalytic amount of sodium hypobromite in acidic conditions at ambient temperature and pressure.

“The process allows us to rapidly put the gold into solution as a gold chloride compound,” explained Mai. “The gold is deposited into silica and recovered as a gold doré, then the depleted brine is fully recycled using an electrolysis cell, which allows us to operate in a fully closed loop.”

Typically, the process requires one or two hours of contact time, compared with 36 to 48 hours with the use of cyanide. “That’s a huge benefit in terms of process efficiency,” said Mai.

“CLEVR also provides additional chemical grinding of the ore’s host matrix which translates into higher gold yields than cyanide on most tested samples.”

The process also operates in a closed loop with the recovery and recycling of all reagents, so there’s no liquid effluent. Additionally, the tailings that are generated are sulphide depleted and non-

acid generating because if there’s significant sulphide content in the ore, such as in flotation concentrates, it would first go through an oxidation pre-treatment step. Any residual sulphide would be oxidized to sulphate as the CLEVR process operates in an oxidizing environment.

“This allows us to have inert and barren solid tailings for disposal, so there’s no need for a tailings pond,” Mai said. “The generation of barren solid tailings can benefit the mine site layout and footprint because when you have inert solid tails, you have options. You can co-mingle it with waste rock or stack it with reduced containment measures.”

The CLEVR process isn’t the only alternative to cyanide, Mai acknowledges. “However, it’s really advanced in terms of maturity. We’ve been developing it for close to 15 years. We’ve gone through numerous piloting stages. We’ve gone through industrial demonstration campaigns. We have industrial size facilities and operation data to support its efficiency and capacity, so as an alternative, CLEVR is definitely one of the few mature alternatives which can be considered by developers and miners for their recovery circuits.”

The process has received ISO 14034:2016 certification through the Canadian Environmental

Technology Verification Program, providing independent certification of its performance as a cyanidefree gold extraction process.

Under the program, 170 tonnes of gold bearing refractory pyrite concentrate were processed at DST’s demonstration plant with all solid residues meeting or exceeding environmental performance norms. The CLEVR circuit delivered gold recoveries which were up to 10 percentage points higher on average than cyanide yields on the same samples.

Cyanide isn’t the only toxic material that’s a cause of concern in the mining industry, so following its work on the CLEVR process, DST turned its attention to arsenic removal and stabilization.

“We weren’t satisfied with what the industry was doing in terms of long-term arsenic sequestration. That motivated us to develop the GLASSLOCK process,” said Mai.

“There’s a growing association of arsenic minerals with precious and base metal ores. Because more clean oxide metal deposits are depleting, there’s an increase in the arsenic sulphide content and the number of complex metal deposits being developed.”

The disposal of arsenic depends on its concentrations, but if it’s going through a flotation circuit, it ends up being smelted and recovered as arsenic trioxide,

calcium arsenate or ferric arsenate, all of which are either highly hazardous or semi-stable products in terms of long-term stability.

“The issue with arsenic is that it volatilizes at low temperatures, so it has been difficult historically to use a pyrometallurgical approach to process or stabilize it,” explained Mai. “So, with GLASSLOCK, we produce an intermediate compound that’s stable at the melting temperature of glass. That allows us to incorporate high amounts of arsenic within a vitrified silica mixture. We produce a glass product that is 15 to 20% arsenic. The glass is a single-phase amorphous structure that is very stable over time.”

The process complies with standard environmental leaching protocols (EPA & EN) and can work with a variety of arsenic feed sources, including arsenic trioxide, ferric arsenate, calcium arsenate, sodium arsenate, or arsenic in solution.

“It offers a permanent sequestration solution for arsenic, removing and reducing the need for long-term hazardous waste disposal facilities and site liabilities. It’s also very cost efficient in terms of the dollar per tonne of arsenic stabilized,” said Mai. “If you’re producing arsenic, we can bolt on a GLASSLOCK circuit to an existing plant.”

The disposal of the glass product is project specific, but it can be used as an aggregate in cement or concrete. It could also be used as an aggregate for a mine’s backfill paste plant.

A Clean Mineral Processing Technology Survey conducted earlier this year by the Northern Miner Group demonstrated some of the challenges and opportunities associated with the introduction of new metallurgical processes. For example, 76% of respondents said they spend either no time or less than they should assessing new process technologies. However, on the plus side, 98% said they would be interested in further investigating a metallurgical process that could eliminate the use of toxic chemicals and 85% said they would either consider the GLASSLOCK process or be interested in learning more about it. Mai advises mining companies to consider their processing options at resource development and PEA stages when the increased gold extraction, the generation of dry stack tailings, smaller footprint and the proper handling of arsenic offered by the CLEVR and GLASSLOCK processes can be reflected in the overall mine plan and project cost. “If they’re already at the feasibility stage, so much effort and money has already been invested in a particular design that it’s very difficult to go back and start making changes.

“We want to be viewed as a means for miners to improve operational efficiency and their ESG credentials,” concluded Mai. “We’ve done the heavy lifting. We’ve invested more than $40 million in the development of CLEVR and GLASSLOCK. We’ve demonstrated them at industrial scale. Now it’s up to mining companies and their technical groups to work with us in assessing the impact of our processes on their operations and on the environment.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Dundee Sustainable Technologies

with The Northern Miner. Visit: www.dundeetechnologies.com for more information.

GLOBAL MINING NEWS THE NORTHERN MINER | OC TOBER 2023 3 JOINT VENTURE ARTICLE

and produced in co-operation

Jean-Philippe Mai, president and CEO, Dundee Sustainable Technologies. DUNDEE SUSTAINABLE TECHNOLOGIES

Members of the Dundee Sustainable Technologies team responsible for the development of the CLEVR and GLASSLOCK processes. DUNDEE SUSTAINABLE TECHNOLOGIES

Above: The Dundee Sustainable Technologies industrial demonstration plant in Thetford Mines, Que., has a nominal capacity of 15 tonnes of gold concentrate per day. Left: The GLASSLOCK amorphous glass product sample pictured here contains 18% arsenic. DUNDEE SUSTAINABLE TECHNOLOGIES

GLOBAL MINING

Presenting a refreshed version of TNM Classic

Welcome to our first issue as a monthly publication.

We have several new sections and features that I’d like to draw your attention to.

THE VIEW FROM ENGLAND: COLUMN | Last word on a misguided industry

BY DR CHRIS HINDE Special to The Northern Miner

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate, BA (Poli Sci, Hist) ahiyate@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

SENIOR STAFF WRITER: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli, MA (Engl) apocobelli@northernminer.com

ADVERTISING:

Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/

APPOINTMENT NOTICES/

CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER:

Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 moliveira@northernminer.com

ADDRESS: Toronto Head Office 225 Duncan Mill Road, Suite 320 Toronto, ON, M3B 3K9 (416) 510-6789 tnm@northernminer.com SUBSCRIPTION

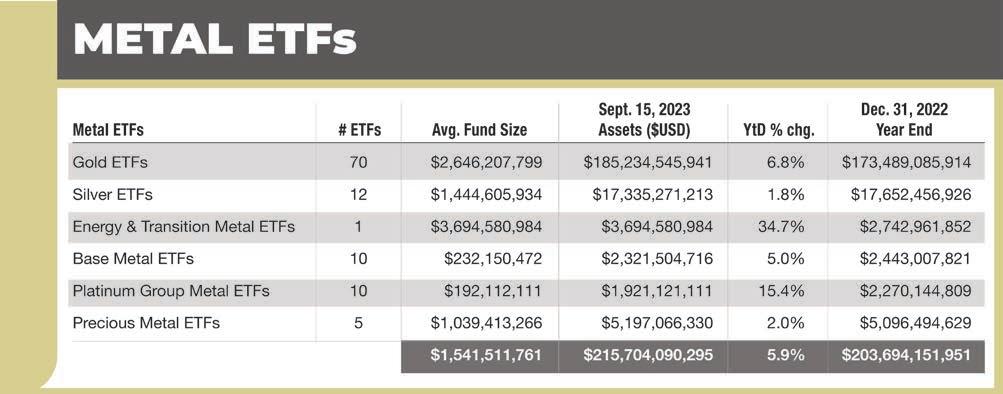

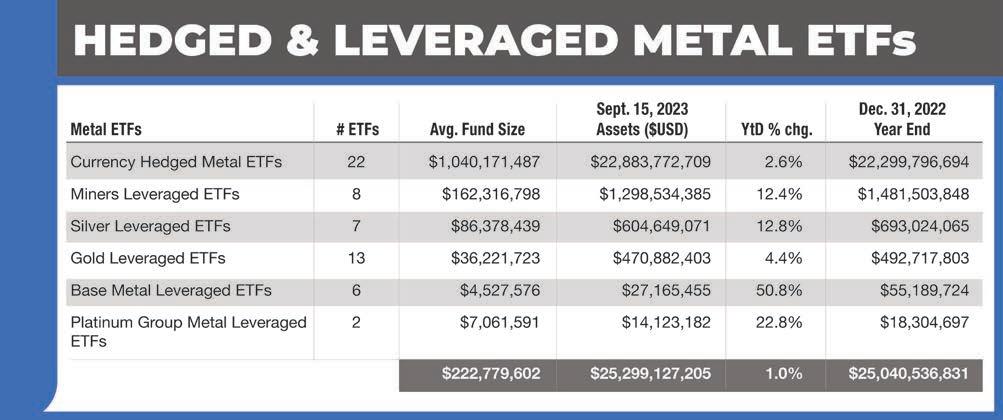

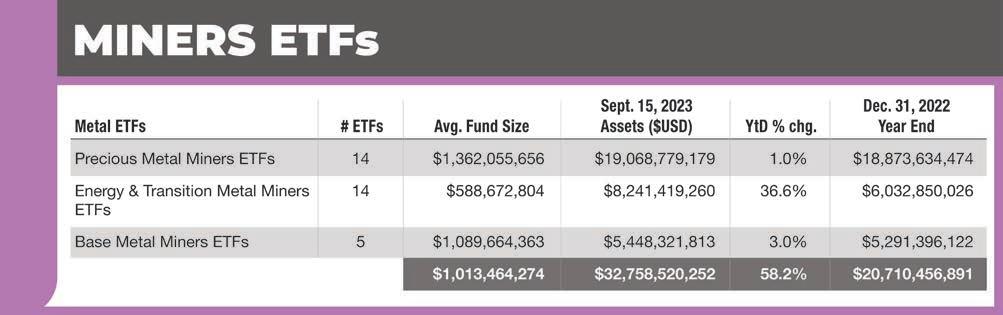

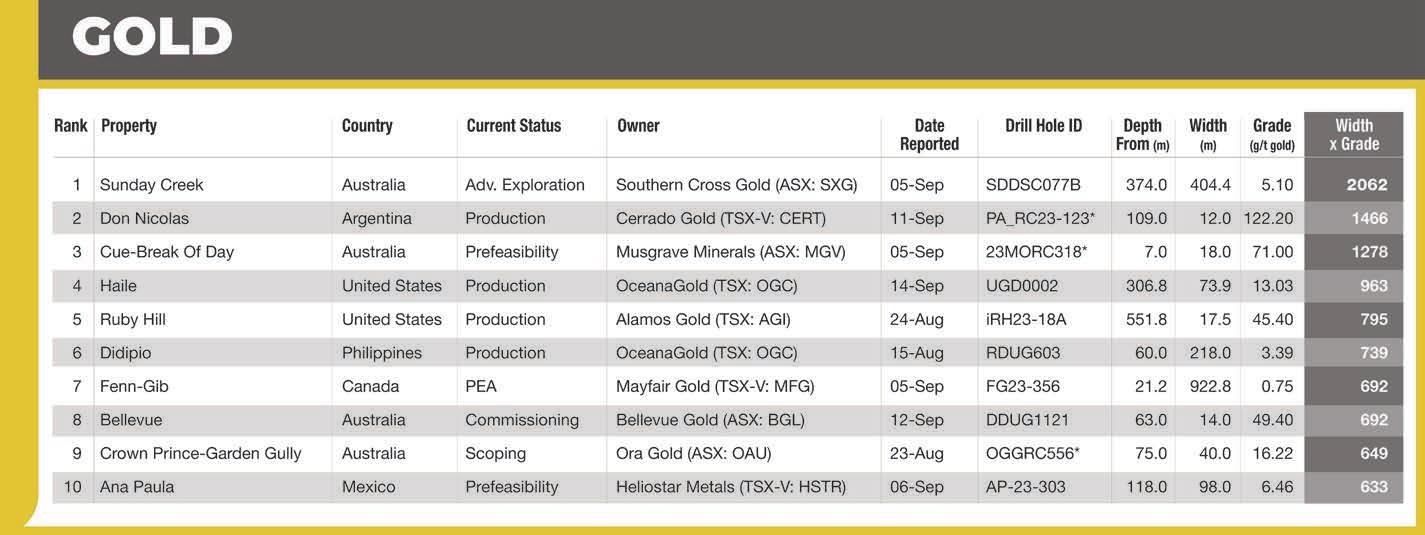

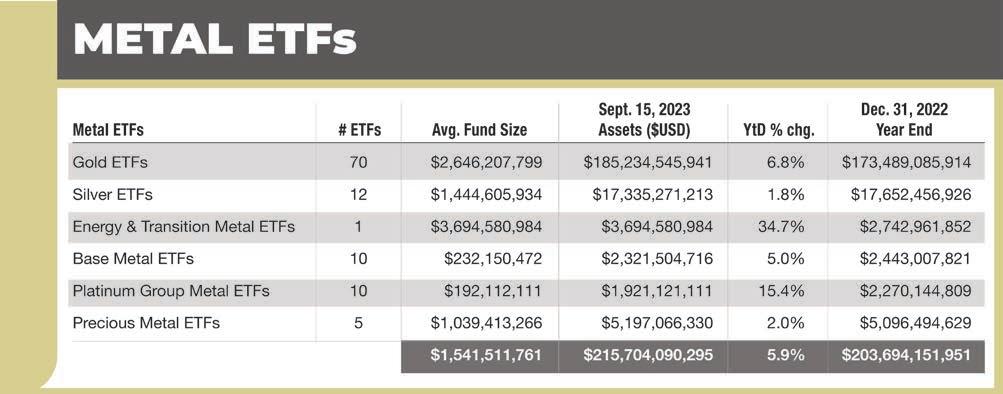

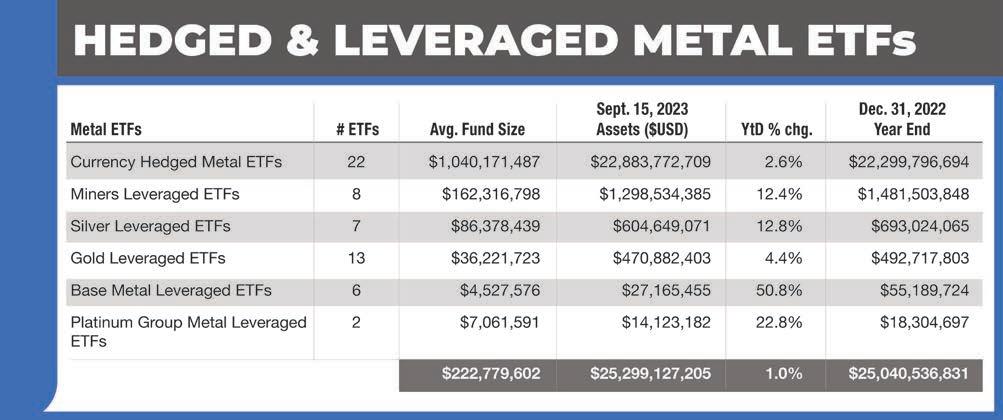

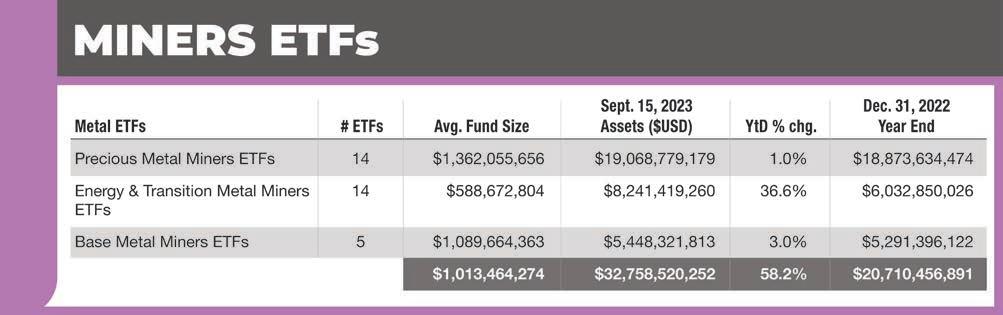

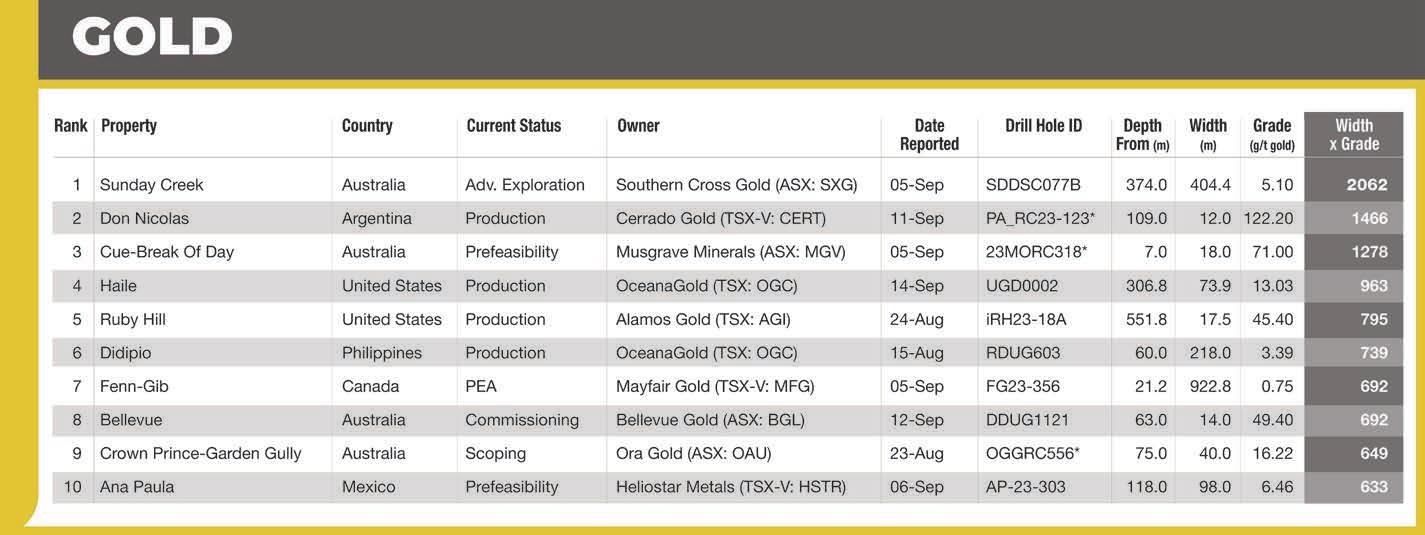

First, our new mining, markets and metals section is the pride and joy of the redesigned Northern Miner In a massive upgrade from our long-running stock tables, we’ve pulled together information from several excellent data sources, including two new ones. The Northern Miner Group’s own Costmine Intelligence (of which Mining Intelligence is a part) provides data for our capital raisings and TNM Drill Down pages highlighting the top assay results for the past month for gold, copper and lithium. MineralFunds.com, meanwhile, provides data for our gold funds and ETF assets pages. We’ve also aimed to package this information in visually appealing ways that we hope you’ll find insightful and useful. And where simple tables are the best way to convey the data, you’ll find that the text is larger and easier to read. We’ve also added more complete commodity pricing and warrants information, and a new Mining Events page to keep you up to date on what’s happening around the world.

BY ALISHA HIYATE

’Gwnewch y pethau bychain mewn bywyd’ is an ancient and historically important phrase but not one that is widely recognized. ‘Do the little things in life’ was the message of guidance to the Welsh from their patron saint, David, some 1,500 years ago, and it remains a well-known maxim in the country.

denied speaking slots at conferences and advertising space in our magazines, and access to finance and professional services should be made extremely difficult. We need to win back the trust of the public, and we are not going to do that while we fail to police our own industry. Even the largest companies should be named and shamed, and their directors barred (and we can all think of recent examples).

Special thanks to all the people who worked tirelessly to bring this section to life: Adam Berezuk, James Alafriz, Nicholas LePan, and our art director Barb Burrows!

Outside of this data-rich section, which is the centrepiece of the paper, we’ve introduced several new editorial sections that allow for more creativity and flexibility in how we keep you updated on our industry. These include:

> In Brief: News briefs for quick updates, plus a featured infographic of the month and photo of the month. We invite you to submit your entries for Photo of the Month. They can be current or historical — as long as there’s a story behind the image, it’s mining-related, and it’s high-resolution for print.

> In Depth: The traditional features we’re known for that dissect trends and issues, such as our coverage of Argentina’s election this month and what it could mean for the nation’s copper and lithium riches (page 8).

> People: You’ll find profiles, interviews and awards news in this section.

> Done Deals: Recent financings, mergers, and other agreements of note.

> Project Updates: Covers significant recent movement on key projects — whether permitting, resource updates, or new economic studies.

> Technology & Innovation: We report on developments that could improve discovery rates, recovery rates, or otherwise make mining better (more efficient)

> Executive Q&A: A fun new spotlight on our industry’s personalities, where we get to know what makes the sector’s leaders tick, what they do in their off time, their pet peeves, and more.

As always, you’ll find our themed sections, as outlined in our online media kit at https://mediakit.northernminer.com.

We’re eager to hear your feedback about our new direction. Please email me at ahiyate@northernminer.com with compliments, critiques, or ideas for what you’d like to see in future issues.

Mining Person of the Year

Also in this issue, we’ve announced our Mining Person of the Year for 2022 — Sigma Lithium CEO Ana Cabral. We are a bit late this year with our announcement, which has been timed to coincide with our first monthly issue, and our first two-day Canadian Mining Symposium in London, U.K. on Oct. 12-13.

Cabral isn’t like many of our past Mining People of the Year, an award TNM first started presenting in 1977. She’s not a geologist or mining engineer, but rather has a banking background in natural resources and in the health sector. She’s also Brazilian — a first for this award. (Incidentally, she’s the fourth woman to earn the accolade — the third since it was renamed in 2005 from Mining “Man” of the Year previously.) But we’ve been impressed by the Sigma story, and Cabral’s drive to build a different kind of company, one that scores high on environmental factors, which are obviously increasingly important to end users in the EV space and their customers. Cabral’s also excelled in bringing the right team together, and in keeping the company on track from IPO in 2018 to plant commissioning in late 2022 and first production this year.

Languishing gold stocks, uranium on the rise

And at press time in late September, following the two major gold focused September events — the Precious Metals Summit in Beaver Creek Colo. (see page 1), and the Denver Gold Forum a week later, the ongoing disconnect between gold prices and gold equity valuations has been on everyone’s minds. In the junior segment of the market, which is our bread and butter, this has seen investors selling companies that deliver good news and depressing any potential share price rallies.

A Sept. 21 report on junior exploration by Haywood Securities summed up the issue nicely: “With gold prices exceeding US$2,000 per oz. three times since March 2021, we still expect gold to move higher over time, although it becomes more difficult to attract new investors into the mining space with T-Bills returning >4% with no risk. New discoveries are few and far between in the mining space, and the explorers still have a role to play in delivering new discoveries for the industry.”

The excitement right now is in uranium, which has risen to over US$65 per lb. U3O8 in September from under US$50 at the beginning of the year, and from 2016 lows of around US$18 per lb. Analysts are predicting this runup has legs — with New York-based natural resources investing firm Goehring & Rozencwajg predicting prices could triple or quadruple over the next few years, which could see them matching or exceeding their 2007 all-time highs of US$140 per pound.

“For the first time in history, uranium has slipped into a persistent and widening deficit. We believe the results will be dramatic,” company analysts wrote in a Sept. 14 report. TNM

The phrase comes to mind as we recently celebrated the 900th anniversary of David’s canonization by Pope Callixtus II (1065-1124), who decreed in 1123 that two pilgrimages to St. David’s tomb in Pembrokeshire was the equivalent of one to Rome, with three trips to this corner of west Wales counting as one to Jerusalem.

David (Dewidd in Welsh) was born between 462 and 512, and is believed to have been the grandson of King Ceredig ap Cunedda (420-453). Renowned as a preacher, David founded 12 monasteries, including Glastonbury and Mynyw. His teaching was centred upon the latter monastery (called Minevia in Latin), which is now St. David’s cathedral in what is the U.K.’s smallest city.

Second, we should acknowledge that there is a fundamental difference in the added-value characteristics of precious metal (and gem) mining and the extraction of ‘useful’ metals and minerals. Unlike the major metals and energy minerals, the majority of gold mining activity has proven unable to anchor socioeconomic development and social sustainability.

More than half of the mining industry’s total exploration effort (and financing) is devoted to the search for a metal that the world doesn’t need (we are only adding 2% per year to the existing gold stockpile of some 190,000 tonnes).

It is obviously going to be difficult, but let’s at least try to focus on what is required for the energy transition and global economic growth.

Third (and not unrelated to the above), let’s also recognize that mining ‘smaller for longer’ has societal benefits over size. We need to change the paradigm to give more advantage to long-life operations so that stakeholders have a chance to develop secondary industries. Changing fiscal structures to facilitate communities (not individuals) gain equity in local mining operations will also help cement socioeconomic relationships.

David prescribed that his monks had to plough the land by hand, drink only water and eat only bread (albeit flavoured with salt and herbs). No personal possessions were allowed in his monasteries, and the evenings were spent reading, writing and praying. He died on Mar. 1, 589, which has been celebrated as the National Day of Wales since the 12th century.

St. David’s strictures are rather ignored nowadays (not least amongst passionate Welsh rugby supporters) but his ‘do the little things’ maxim continues to be widely observed amongst a kind and caring nation.

Unfortunately, I don’t think St. David’s message works properly at the corporate level, where doing ‘big things’ should be the guiding principle. It will be unpopular, but I believe that a fundamental reset is required for the mining industry. This should stem from recognizing three things.

First, our institutions and organizations have failed us. They are too weak, and need to go on the offensive, and with teeth. Our trade bodies and professional associations need to identify and weed out those companies and individuals that transgress the agreed standards. In addition to throwing them out, they must be

Correction

The ever-better implementation of rising safety and ESG (environmental, social and governance) standards is a given. In addition, we need to be thinking of mining’s utility (i.e. what metals and minerals does society actually need from us) and our relationship with local stakeholders (incorporating a ‘social’ element into a project’s net present value calculations would be a start).

I feel able to pontificate on these contentious issues because after three years as a regular columnist for Northern Miner, and 35 years since writing my first column (in 1988 as the editor of Mining Journal), I am laying down my quill.

Soberingly, I’ve reached 70, which, according to the Bible (Psalm 90:10), is the usual ‘length of our days’ (the King James ‘Authorized’ version of 1611 referred to this as a lifespan of ‘three-score and ten’). However, I intend to target the Hindu celebration of living to see 1,000 moons. To save your calculations, that is two months shy of 81 (marked in India by the Sahasra Purna Chandrodayam ceremony). Just 134 full moons to go; wish me luck!

Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm. He previously worked for S&P Global Market Intelligence’s Metals and Mining division. This is his last column for The Northern Miner.

An incorrect photo caption appeared on page 12 of our July 24, 2023 issue with the story “Volt eyes lithium big-league with breakthrough extraction technology.” The caption should have read: Exterior view of water treatment plant operations constructed by Volt’s equipment manufacturer.

4 OCTOBER 2023 | THE NORTHERN MINER ww w.northernminer.com

NEWS • SINCE

1915 www.northernminer.com

Canada: C$130.00

year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration

CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 225 Duncan Mill Road, Suite 320 Toronto, ON M3B 3K9 Publication Mail Agreement #40069240 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. office of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118 THE NORTHERN MINER is published biweekly by Glacier Resource Innovation Group, a division of Glacier Media Inc., a leading Canadian media company with interests in business-to-business information services. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-502-3456; Fax: (416) 447-7658; Mail to: Privacy Officer, The Northern Miner, 225 Duncan Mill Road, Suite 320, Toronto, ON M3B 3K9.

RATES:

one

# 809744071RT001 (ISSN 0029-3164)

EDITORIAL

More than half of the mining industry’s total exploration effort (and financing) is devoted to the search for a metal that the world doesn’t need.

GLOBAL MINING NEWS THE NORTHERN MINER | OC TOBER 2023 5 JOHANNESBURG|TORONTO|PERTH| NEW YORK | LONDON | LIMA | VIENNA INFO@AURAMET.COM WWW.AURAMET.COM 300 Frank W Burr Blvd Teaneck, NJ 07666 (201) 905-5000 Serving the Global Metals Industries since 2004 Physical Precious Metal Offtake Metals Financing Including Equity, Debt and Royalties / Streams Project Finance Advisory Supply and Risk Management

INFOGRAPHIC OF THE MONTH

Mine Build Tracker: QUEBEC LITHIUM

Charting the province’s most advanced projects

Mine Build Tracker — Quebec Lithium Charting the province's most advanced projects

Project - Company

Whabouchi – Livent/Nemaska Lithium

Rose – Critical Elements Lithium

North American LithiumSayona/Piedmont Lithium

James Bay - Allkem

Authier – Sayona/Piedmont Lithium

Source: Company Filings

ing a period with Rio Tinto’s Hamersley Iron, and with various projects in Zimbabwe and Zambia. In 1996, Pascall co-founded First Quantum, serving as chairman since its inception and CEO until 2022.

Under his leadership, the company grew from a 10,000tonne tailings re-processor with the Bwana Mkubwa project in Zambia to one of the world’s largest copper producers with operations spanning five continents and employing more than 20,000 people globally.

By Mining.com Staff

n ICMM emissions guidelines

Mining’s top industry group with BHP and Rio Tinto among its members has published a framework for companies to determine their emissions, including how to unravel pollution by suppliers and customers.

The guidelines issued in early September by the London-based International Council on Mining and Metals (ICMM) aim to improve transparency and collaboration with third parties to reduce emissions in the Scope 3 category.

Council members are vowing to report by the end of the year on their Scope 3 emissions, which are those produced in other parts of the value chain that aren’t under company control, can account for between 75% and 95% of a mining company’s overall emissions.

The effort is based on the most widely used standard for accounting and reporting corporate greenhouse gas (GHG) emissions globally, the council said. Its membership of the

world’s top miners, equipment manufacturers and associations account for a third of the global metals market.

The council in 2021 imposed a deadline in on its members to achieve net zero Scope 1 and 2 GHG emissions by 2050.

By Mining.com Staff

n Vale under scrutiny

Brazil’s comptroller general (CGU) has alleged in a report that Vale corrupted the “integrity” of the federal inspection system in the Brumadinho case.

The collapse of the dam at Vale’s Corrego do Feijao in mine in Brumadinho in 2019 left 270 dead and ravaged nearby forests, rivers and communities.

The report, signed on Mar. 18, was used by CGU in August to fine the mining company R$86.3 million (US$17.7 million). Four years after the disaster, the criminal case remains pending in the Minas Gerais court.

The CGU says that Vale reportedly falsified documents to “altering or preventing” government supervision in the case.

“Corrupting the integrity, logic and robustness of a federal inspection system, as the illicit acts of the legal entity Vale S.A did,” stated the CGU, as reported by Metropoles.

“Corruption is not just the practice of bribery and kickbacks, on the contrary, it is much broader. Lato sensu [in a broad sense], includes any fraudulent way or ethical deviation to achieve something in an illegal or immoral way, ” said the agency.

“It is clear that Vale’s attitudes, in omitting and failing to insert information in a real way in the documents presented to the ANM (National Mining Agency), are characterized as

6 CORE DRILLS FOR SALE

5 HELI-PORTABLE OR SKID MODE, 1 TRACKED RIG, NQ AND/OR BTW

5 used Duralite equivalent fly core drill rigs for drilling to 500m BTW (3 rigs) and 300m NQ (2 rigs). Two steel skids and sloops for skid mode rigs included. Drills are in Goose Bay, Labrador, NL, Canada., Also 14’x16’ Weatherhaven style tents (20) and camp equipment. Tracked Duralite rig and tracked mule are in NB. Owner retiring.

CONTACT

Jelle Terpstra, +1-709-896-7492 or jelle@cartwrightdrilling.ca

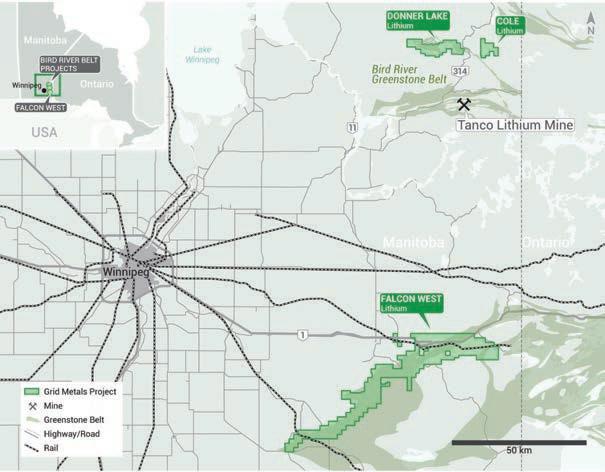

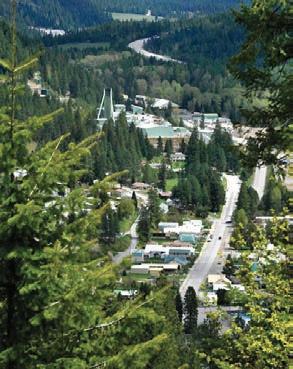

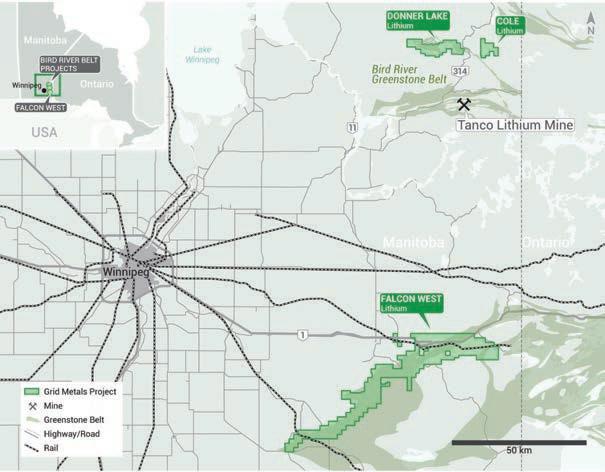

Canada’s lithium epicentre

Quebec hosts almost half the country’s 409 active lithium projects and most of its advanced projects, including Sayona Mining and Piedmont Lithium’s North American Lithium operation, which began production in March. Using information from data provider Mining Intelligence and from company documents, The Northern Miner built an infographic comparing the progress of five top lithium projects in La Belle Province. Allkem, owner of the James Bay project, hasn’t yet committed to a timeline for production. In February, the company said it would wait until construction permits are secured before announcing a timeline.

fraud,” the report reads.

Vale said it disagrees with the decision and will present a request for reconsideration.

By Mining.com Staff

n Taliban banks on metals

Afghanistan’s Taliban has signed seven mining contracts that would bring roughly US$6.5 billion in investments to the ruling government, the Associated Press reported on Aug. 31. This figure, AP says, represents the biggest round of deals made by the Taliban since they toppled the government of former president Ashraf Ghani and the United States withdrew its military forces in 2021.

According to AP, the contracts are with local companies, many of which have foreign partners in countries including China, Iran, and Turkey. The contracts include mining and processing of iron ore, lead, zinc, gold and copper in Herat, Ghor, Logar and Takhar provinces.

A separate report by Voice of America showed that a televised signing ceremony took place the same day, featuring Taliban’s minister of mines and petroleum Shahabuddin Dilawar and certain Chinese investors.

In an official statement, Dilawar said that the agreement with a Chinese company for gold extraction in Takhar would bring the Taliban government a 65% share of the earnings over five years.

By Mining.com Staff

n Abandoned Minto for sale

The idled Minto mine in central Yukon, which began operations in 2007 and produced about 500 million lb. of copper since, is officially up for sale.

PricewaterhouseCoopers, acting as the court-appointed receiver of mine owner Minto Metals Corp., confirmed on its website in late August that it’s soliciting offers for the entire property or parts of it. The initial bidding period will end on Oct. 6, 2023, the auditing firm said.

The sales process was launched about four months after the May 2023 suspension of the copper-gold-silver mine, which had been operated by the now-delisted Minto Metals. The subsidiary of U.K.-based Pembridge Resources bought the project from Capstone Mining in 2019.

Prior to the suspension, the territorial government had warned that the mine’s tailings storage pits were running out of room, thus increasing the risk of untreated water spilling into the nearby Minto Creek, and from there into the Yukon River.

Mining.com Staff

By

6 OCTOBER 2023 | THE NORTHERN MINER ww w.northernminer.com

inbrief [CONTINUED FROM P2]

2028 2027 2026 2025 2024 2023 2022 2021 2020 2019 2018 Year

Phase Start FEASIBILITY PERMITTING CONSTRUCTION PRODUCTION

Find full news articles at www.northernminer.com

INFOGRAPHIC BY BLAIR MCBRIDE AND NICHOLAS LEPAN

Sandvik’s Remote Monitoring Service predicts and prevents failures

BY NORTHERN MINER STAFF

For more than a year, remote monitoring specialists at Sandvik Mining & Rock Solutions have been identifying the efficiencies of loaders and trucks operating underground at privately held Magris Performance Materials’ Niobec mine in Quebec.

The mine is one of only three producers of niobium in the world and is the first mining operation in Canada to adopt Sandvik’s Remote Monitoring Service (RMS). The service oversees the safety and performance of the mine’s equipment, identifies competence development opportunities for operators, and enables more streamlined maintenance processes. In May, Magris renewed its RMS contract for another year.

“We started because we didn’t have people here in-house to do all the evaluation of the equipment and look at the telemetry data in near real-time,” says PierreLuc Lajoie, Niobec’s underground operation and maintenance director. “The Remote Monitoring specialists from Sandvik are constantly evaluating the data from the machines and letting us know immediately if they see any abnormalities. Sometimes problems arise related to mechanical issues, but most often they are related to bad habits or mistakes by the operators.”

By regularly monitoring the data, Sandvik’s remote monitoring specialists identify instances of machines exceeding control and temperature limits, low scores for transmission and engine health, and poor operator techniques. Alerts on speeding, brake violations, and freewheeling in neutral not only improve operator safety and efficiency but also increase the equipment’s lifespan.

The feedback is instantly relayed to Niobec, and in regularly scheduled weekly meetings, Sandvik visualizes issues that must be addressed by Niobec’s mechanics, or pinpoints areas like improper gear selection (excessive gear-hunting or pendulum shifting), which can damage power train components. RMS can pinpoint incorrect gear selection when driving uphill and downhill by using algorithms tailored to the specific mine site.

One of the keys to success, according to Lajoie, is proper change management. This was done by engaging Niobec’s operators early in the process to gain their buy-in. The operators, who regularly attend the RMS review meetings, help everyone understand how the equipment is being used, and, along with Sandvik, the best way to address various alarms.

“We used to do about 900 wrong gear shifts on our ramps over the course of a week, which would have made a big difference on how many hours the equipment’s transmission would have lasted,” Lajoie explains. “When Sandvik identified the issue, we figured out that a new operator was causing the problem by not knowing how to shift properly. With the help of the Remote Monitoring Service, we now have a view on how our people operate the machines so we can fix things that they probably didn’t catch when they were trained.”

The smart alarms sent to Niobec can also identify problems

like braking violations—where the operator is driving with their foot on the throttle and brake at the same time, which is going to result in additional wear and tear on the equipment. “Why would an operator do that?” asks Brad Atkins, Sandvik’s digital services manager. “Well, they have their muckers on, and they might be accidentally pushing on the brakes without even realizing it.”

Kevin Montambeault, an RMS specialist working with Niobec, cites one example where the company was able to fix a mechanical issue early to prevent failure. “Our alarm let us know that the turbo on one of their loaders was losing power,” he says.

“We were also able to tell them specifically how much pressure had been lost. They sent the loader to the shop and had the maintenance done.”

At one of the mine sites Sandvik works with, an operator had been driving with a high coolant temperature alarm. “Maybe they missed the alarm,” says Atkins. “In that case, there were six alerts about it over one weekend and then the equipment overheated and stopped working. From a change management perspective, RMS is a bit of an eye from the sky. We are an assisted service— paying attention and monitoring your equipment both from a maintenance and a productivity perspective.”

The key, says Atkins, is getting the mine’s equipment connected to Sandvik’s fleet telematics solution. Once that is done, the equipment collects all the signals, alarms and data and relays it to Sandvik’s RMS specialists. In addition to the local RMS specialists in Canada — and across other countries where Sandvik operates — the Remote Monitoring Service consists of a team of data scientists who

analyze data, and based on global feedback, create new algorithms to help identify declining health and misuse of equipment. Sandvik also has its OEM network of service technicians and design engineers from factories who collaborate with the company’s local specialists and customers. Currently Sandvik has over 70 mines using the Remote Monitoring Service globally.

“Think of it like a black box on an airplane that is constantly recording data and then the data is sent to Sandvik over the Internet,” Atkins says. “We pretty much haven’t met a piece of equipment or remote site we have been unable to connect, allowing us to analyze the data for reliability and productivity improvements.”

RMS also doesn’t require big investments in resources and IT infrastructure.

Sandvik’s leadership in technology, along with access to its enormous global pool of reference data, analytical skills, and in-depth OEM knowledge,

makes the service unique, Atkins says. The monitoring and status data acquired from underground mining equipment is translated into actionable recommendations, which increase efficiencies and help avert equipment failure.

It is also beneficial for the environment, Sandvik says, noting that the data gives insights into fuel consumption and excessive idling times that can reduce underground emissions. In addition, optimized component life can reduce operating costs.

Atkins notes that Sandvik is also learning from the data obtained with RMS to improve equipment design and engineering. “The competitive advantage of RMS is smart alarms, artificial intelligence, machine learning — that’s what these smart alarms are,” he says. “We take related signals, follow, and analyze them over time, and it tells us a story. It allows us to prevent equipment failures.”

“A lot of companies try to do it on their own, they hire people, but

they don’t have time to look at the data,” Atkins says. “Sandvik data scientists continuously monitor and analyze the data points acquired from the production equipment. They identify root causes for abnormalities and develop predictive solutions to increase the mean time between failures in a customer’s fleet.

The advantage is the intrinsic knowledge and experience the original equipment manufacturer (OEM) can have of its equipment.”

Barrick Gold (TSX: ABX; NYSE: GOLD) was an early adopter in a technology development partnership with Sandvik and has been using the service for the last five years at its LouloGounkoto underground mine in Mali. In March, the miner expanded the RMS to its entire global underground fleet of more than 200 connected Sandvik trucks, loaders, and drills. The rollout so far has included Barrick sites in Canada, Central and Western Africa and the United States.

“Barrick’s commitment to using RMS is a landmark in the widespread use of telemetry data to improve performance in the mining industry,” says Esa Mattila, Sandvik’s Global Digital Services Portfolio Manager.

“The ability to prevent failure and downtime, give real time recommendations during shifts to help operators improve performance and make maintenance practices more streamlined and effective will deliver unrealized value to our mining customers.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Sandvik Mining & Rock Solutions and produced in co-operation with The Northern Miner. Visit www. rocktechnology.sandvik for more information.

GLOBAL MINING NEWS THE NORTHERN MINER | OC TOBER 2023 7 JOINT VENTURE ARTICLE

Remote Monitoring Service is an assisted service in which Sandvik monitors and analyzes telemetry data acquired from the mine vehicle fleet and identifies root causes for abnormalities. SANDVIK MINING AND ROCK SOLUTIONS

Remote Monitoring Service can help achieve larger tonnage output with less emissions while increasing the life of the equipment and its components. SANDVIK MINING AND ROCK SOLUTIONS

depth

Will October election in near-bankrupt Argentina unlock its huge mineral potential?

SOUTH AMERICA | Libertarian populist candidate continues to poll well amid cost-of-living crisis

BY TOM AZZOPARDI Special to The Northern Miner

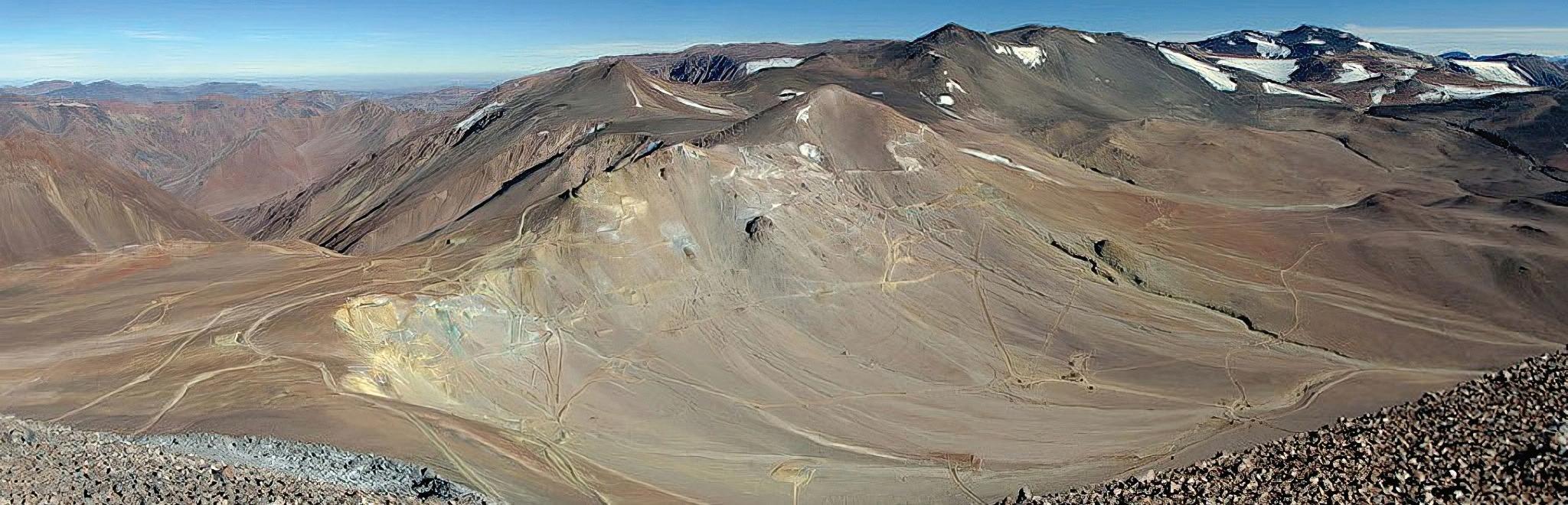

Food, energy and now minerals.

In a world where competition for raw materials is only increasing, Argentina is blessed with an abundance of natural resources. But the country’s nationalist politics and macroeconomic troubles have so far prevented it from realizing its potential, especially in copper — despite its prospective geology along the Andes Mountains.

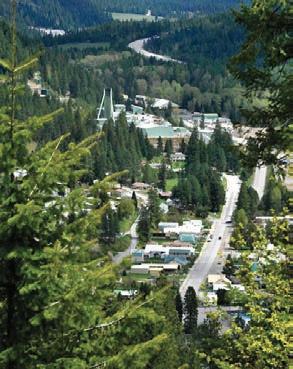

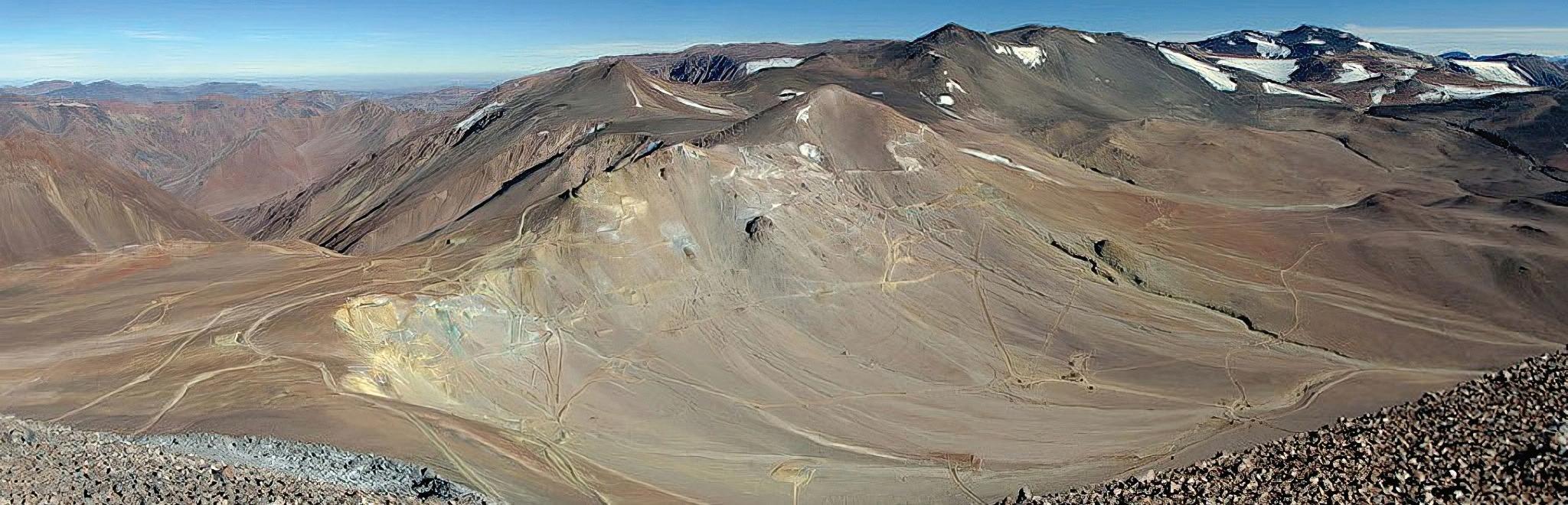

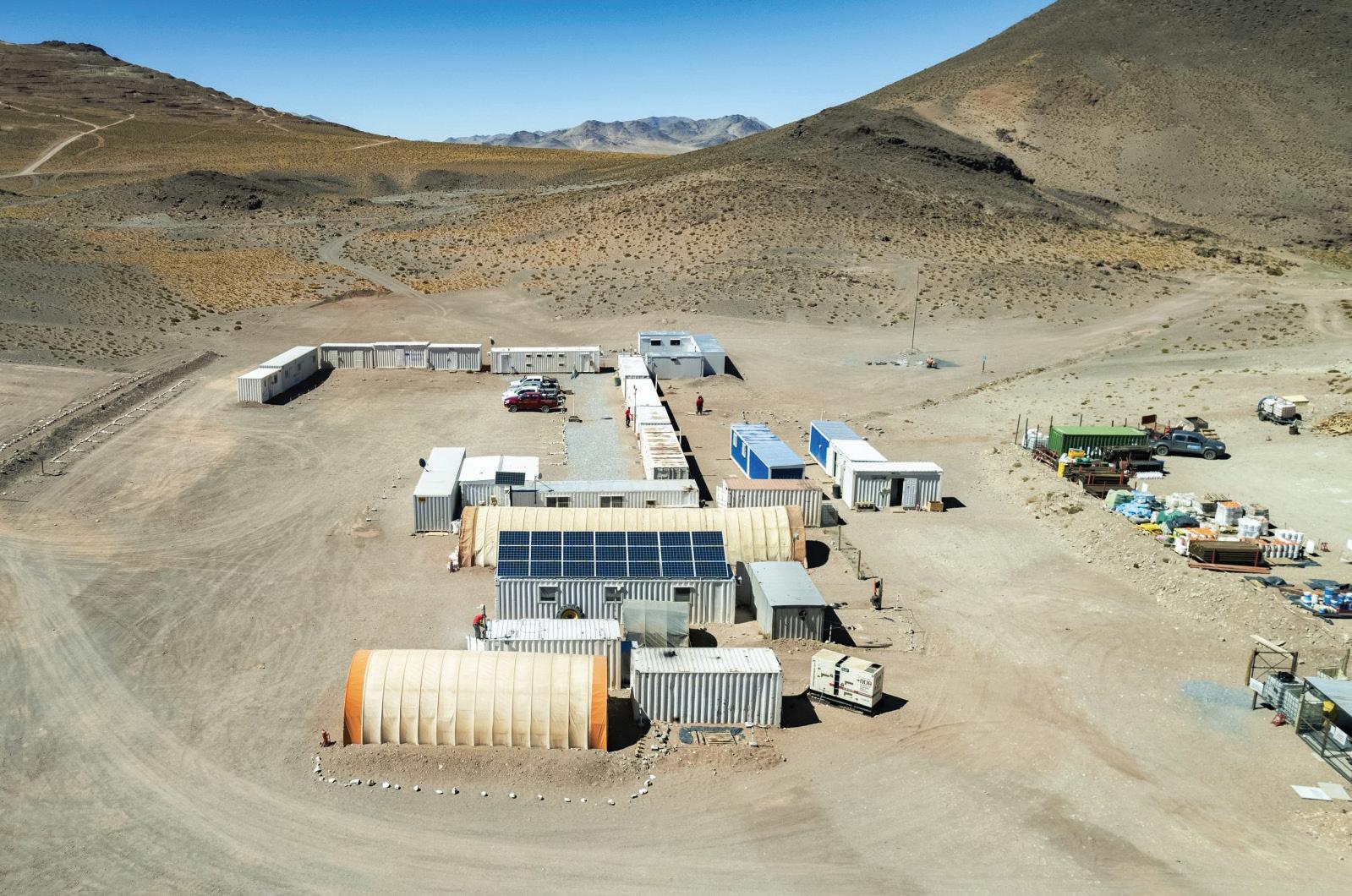

There is no doubt that the resources exist. Decades of mineral exploration have identified perhaps the largest collection of undeveloped copper projects, from First Quantum Minerals’ (TSX: FM) Taca Taca, Glencore’s (LSE: GLEN) Pachon and Aldebaran Resources’ (TSXV: ALDE) Altar. Not surprising given it shares the same geology as neighbouring Chile — the world’s top producer of the metal.

But so far only one major mine has made it into production — Glencore’s Bajo de la Alumbrera, where operations are now winding down.

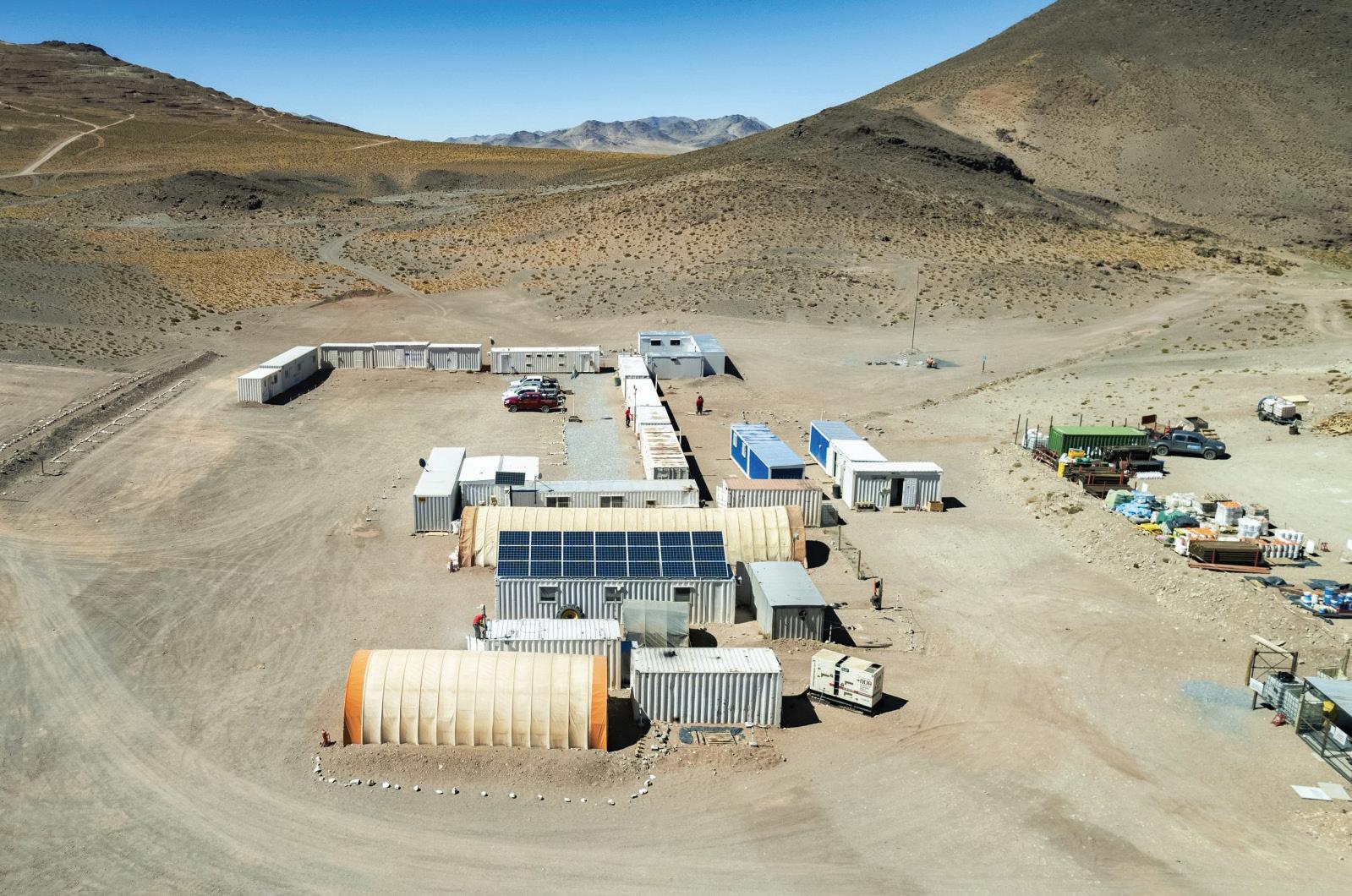

Others are approaching construction decisions. Lundin Mining (TSX: LUN) has already begun early works at its Josemaria project while it seeks a partner. McEwen Mining (TSX: MUX; NYSE: MUX) could list its Los Azules project in a new company to raise funds for development.

But major investments have been delayed as mining companies wait for the tangle of capital controls, import bans and export taxes imposed by successive governments to be lifted.

“Politicians here have always talked about the mineral resources, but not about the tools needed to develop them,” notes Miguel Martin, an industry consultant.

Mining can work in Argentina. Investment is booming in the northwest provinces of Catamarca, Jujuy and Salta as companies from around the world race to extract lithium from the region’s high-altitude salt-flats.

While development in Bolivia and Chile — which have larger resources — has been hindered by policies designed to increase state participation, Argentina’s more laissez-faire

approach should see production rise tenfold to almost 300,000 tonnes per year of lithium carbonate equivalent by the end of the decade.

In June, Lithium Americas’ (TSX: LAC; NYSE: LAC) 44.8%owned US$1-billion CaucharíOlaroz project (a joint venture with China’s Ganfeng Lithium and JEMSE) became Argentina’s third lithium facility to enter production. Eramet’s US$735-million Centenario project (24,000 tonnes lithium carbonate per year) is set to enter production by mid-2024, while in August, Australia’s Galan Lithium (ASX: GLN) started building its Hombre Muerto West project (5,400 tonnes lithium carbonate equivalent per year) expected to begin producing lithium chloride concentrate by mid-2025.

According to analysts at commodities research and consultancy firm CRU, Argentina is on track to become the world’s third largest lithium player by 2027, rising from its current No. 4 spot. With 38 projects under development, and 18 that could begin production in the next four years, production of lithium carbonate equivalent (LCE) could jump from the current 34,000 tonnes a year to 260,000 tonnes annually by 2027, CRU consultant Marcelo Bolton told a lithium forum held in Chile in September.

But what works for relatively small-scale brine operations does

not necessarily work for large-scale copper projects, says Martin. While lithium prices have retreated from record highs in late 2022, they’re still at profitable levels. And with investment costs of less than US$1 billion, lithium projects can live with tight capital controls, multiple exchange rates and tariff barriers that make Argentina one of the world’s most closed economies — all while retaining fat margins.

For copper projects with price tags of US$5 billion plus, mining companies need authorities to adopt a radically different approach to macroeconomic policy.

Upcoming election

Such change could be coming soon.

Cut off from international markets after defaulting on its IMF loans and loath to cut spending, Argentina’s government is financing itself by printing money at an unprecedented rate.

With annual inflation running at more than 100%, the peso plummeting against the U.S. dollar and international reserves exhausted, something’s got to give.

“The Central Bank today has negative net international reserves of US$10 billion, something we thought was impossible,” former Economy Minister Nicolas Dujovne said in a recent seminar. At this rate of spending, inflation could reach 200% by the end of the

year, a level that risks triggering hyperinflation.

That makes this year’s presidential elections on Oct. 22 potentially the most important in a generation. They are also the most uncertain, with voters getting ready to choose between the governing left-wing coalition, the traditional centre-right opposition and a new right-wing movement which hardly existed a year ago.

The official primaries on Aug. 13 made clear how wide open the presidential elections are. In a shock result, libertarian populist Javier Milei attracted more than 7.1 million votes or 30% of the total — more than were cast for either of the two main coalitions. His beyondthe-pale prescription includes not just cutting regulation and slashing the bloated public sector, but scrapping the Central Bank and dollarizing the economy.

His success reflects the desperation of Argentineans, especially the young, not just with the country’s current predicament but also a palpable feeling of decline. More than 40% of Argentineans now live below the poverty line while fewer young people are going to university than either Chile or Peru.

A month out from the first round Milei continued to poll ahead of his two rivals. As a result, whoever wins later this year will have to propose significant changes

FILO

to help the economy recover. There are reasons to be hopeful.

A drought which has blighted agriculture is ending, boosting grain exports from next year. Production from the giant Vaca Muerta shale field is rising rapidly, reducing Argentina’s reliance on costly LNG imports and turning it into a major oil exporter by the end of the decade.

Mining investment

Attracting mining investment is also likely to play a key role.

“The good thing is that all the candidates now see mining as an opportunity. That was not the case in the past,” says Ignacio Celorrio, president, Latin America at Lithium Americas.

As expectations grow that investment conditions will improve, mining companies have begun to move their chips.

Last year, BHP (NYSE: BHP; LSE: BHP; ASX: BHP) agreed to finance $100 million worth of exploration at Filo Corp.’s (TSX: FIL) Filo del Sol, while SibanyeStillwater (JSE: SSW) and South32 (LSE: S32; ASX: S32) have acquired more than a quarter of the shares in Aldebaran Resources, which owns the Altar project containing 1.2 billion measured and indicated tonnes at 0.43% copper and 0.09 gram gold per tonne.

Meanwhile, Glencore has become the sole owner of the Mara project (formerly known as Agua Rica) in Catamarca province after buying out stakes owned by Pan American Silver’s (TSX: PAAS; NYSE: PAAS) and Newmont (TSX: NGT; NYSE: NEM). Lying adjacent to the Alumbrera mine, Mara could be developed relatively quickly.

The question will be how quickly the necessary changes can be made and if they will be sustainable.

“This could be a unique opportunity if the candidates can keep their word,” Martin says. TNM

Tom Azzopardi is a freelance journalist based in Santiago. With a report from Cecilia Jamasmie.

8 OCTOBER 2023 | THE NORTHERN MINER ww w.northernminer.com

in

Above: Filo Mining’s Filo del Sol project on the Chile-Argentina border.

MINING

Left: Galan Lithium’s Hombre Muerto project in Argentina. GALAN LITHIUM

Presidential candidate Javier Milei. VOX ESPAÑA CREATIVE COMMONS

Ex-Yamana CEO Marrone leads Allied Gold in Africa in search of investor ‘torque’

PRECIOUS METALS | Newly listed gold miner targets higher grades, quicker turnarounds

BY COLIN MCCLELLAND

PPeter Marrone, who led Yamana Gold to a US$4.8 billion sale this year from being a small producer two decades ago, is seeking faster returns in conflict-plagued Mali and Ethiopia as well as Ivory Coast, which has its own democratic challenges.

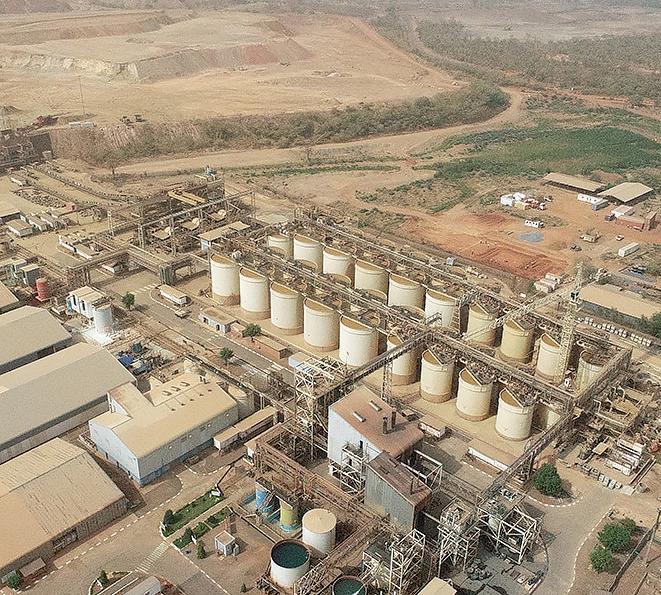

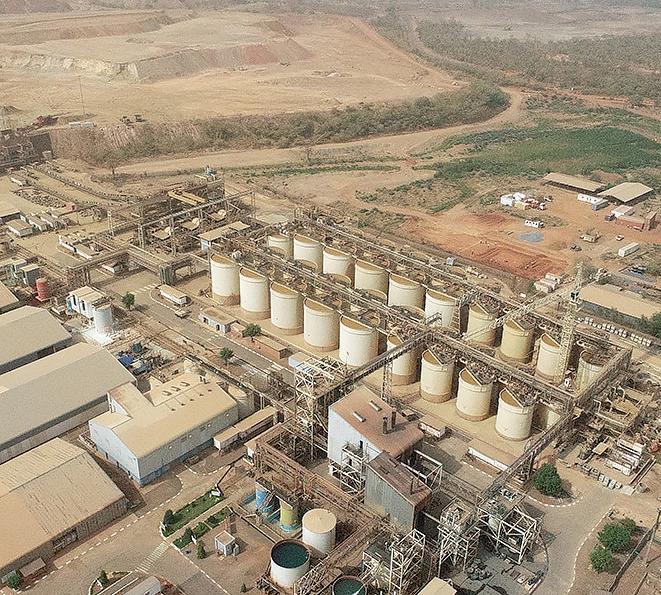

The CEO and four colleagues from Yamana now lead Allied Gold (TSX: AAUC) and its three producing mines after a reverse takeover this year. It operated as a private company for a decade. The new management plans to invest around US$950 million to more than double output to 800,000 oz. per year by 2029.The company started trading on the Toronto Stock Exchange on Sept. 11.

Allied says it’s attracted to Africa because of higher grades that can be mined with less expensive open-pit operations vs. underground mining, the relatively unexplored geology when compared with Canada or Australia, and permit times that can take a project from inception to production in four years. That’s half the time of the developed world but with the same environmental standards, Marrone said in a phone interview in mid-September in Toronto.

“I take the security and geopolitical side into account in the sense that it’s a factor that goes into the returns but not the exclusive factor to be looking at,” he said. “Emerging markets have a lot of the juice that investors are looking for, that’s where the torque is.”

Toronto-based Allied, which raised US$267 million this year, including US$40 million from management, operates Sadiola in Mali, and Bonikro and Agbaou in Ivory Coast. Total annual output is 375,000 ounces. The company has already passed a billion-dollar valuation, with its shares trading at $5 each at press time.

The CEO wants to cut all-in sustaining costs (AISC) by as much as US$200 an oz. to around US$1,100 an ounce. He’s targeting a doubling or tripling of last year’s US$160 million in earnings before interest, tax, depreciation and amortization when the company was still private.

Veteran team

Carey MacRury, a mining analyst with Canaccord Genuity, rates the company a buy and says the experienced management team can make formerly overlooked assets highly profitable.

“Geopolitical risk in West Africa is likely a concern for many investors,” MacRury wrote in a note on Sept. 15. “However, West Africa is the fastest-growing gold-producing region globally, is relatively underexplored and has higher grade potential than more established mining jurisdictions such as Canada or Australia.”

The company intends to spend US$500 million in two phases to expand its main development project, Kurmuk in Ethiopia. It’s located 500 km west of the capital, Addis Ababa, near the border with Sudan. Allied plans annual output at 240,000 oz. over a 15-year mine

life. First gold is planned for second-quarter 2026 at an AISC of less than US$950 per ounce.

Marrone is optimistic about Ethiopia even as a new conflict, with the Amhara ethnic group, is threatening to replace the previous civil war. That fighting with Tigrayans in the north killed about half a million people before a peace deal last November.

“Here’s a government that is publicly saying one of the five pillars for growth in our country is mining. And why? Because every part of the developed world has looked at extractive industries so why wouldn’t they?” Marrone said. “Among the Amharans and Tigrayans and others there’s strong support across the country for the development of the economy with those five pillars including mining.”

Sadiola in Mali

In Mali, Allied is spending US$61.6 million to increase Sadiola’s annual output by 25,000 oz. to 200,000 oz. by 2028. St. Louis-based analyst Stifel Investments estimates a second phase would cost US$378 million to build although Allied hasn’t released its own estimateyet. It would double production starting in 2029 before easing to 300,000 oz. a year after 2033 during the mine’s 19-year life, the miner says.

Near Sadiola, it’s spending US$12 million over this year and next to develop the newly acquired Diba project that will feed into the Sadiola plant. It plans to issue a reserve estimate for Diba by June 30 next year.

Mali, under military control and United Nations sanctions after two coups in 2020-21, is nonetheless the continent’s fourth-largest producer with Barrick Gold (TSX: ABX; NYSE: GOLD), B2Gold (TSX:BTO; NYSE: BTG) and

Resolute Mining (ASX: RSG; LSE: RSG) among the operators there. The junta has kicked out troops from colonial ruler France as well as the UN, and brought in Russian mercenary group Wagner in its battle against jihadist insurgents

Investing in the Canadian Resource Sector at Reduced Cost of Captial

PearTree is a Canadian Securities Dealer and Investment Fund Manager advancing over (CAD) $500 million annually for resource exploration and mine development in a uniquely Canadian structure which results in as much as $2.00 of capital deployed for every $1.00 invested by global institutions and family offices.

Averaging $500M deployed through PearTree in 2021 and 2022 for the mineral exploration & development sector

Watch our video in English, Français, Deutsch and Español on our website

GLOBAL MINING NEWS THE NORTHERN MINER | OC TOBER 2023 9

the universe of exploration capital.

peartreecanada.com Expanding

indepth

Left: Allied Gold’s Sadiola mine in Mali. ALLIED GOLD

Right: The Kurmuk project in western Ethiopia. ALLIED GOLD

Allied Gold CEO Peter Marrone. ALLIED GOLD

in depth continued on P10 >

CABRAL from 1 ling its spodumene concentrate

with the collaborative spirit — and generous employee stock option plans — of a tech company.

The ownership mentality that comes along with that has been key to the company’s quick progress, she says. It’s also helped the team maintain an unrelenting focus on execution that has allowed Sigma to navigate some choppy waters.

For instance, after Sigma went public in 2018, a downdraft in lithium prices pulled them down to lows of around US$5,000 per tonne in 2020. (At press time prices were hovering below US$27,000 after soaring above US$70,000 per tonne last year.)

Sigma succeeded over that period — which Cabral calls “the worst bear market in lithium,” by simply doing what it said it would do.

“We brought this obsession with discipline, which we saw sometimes lacked in the sector,” she said. “We didn’t have the luxury that Australian and Canadian companies do, we were a Brazilian company and so we never thought of the capital markets being open as a given. The given was there won’t be open capital markets — so we need to rely on our own private ability to fund this, and on achieving the next milestone to actually go back for more funding.”

Those milestones included starting up a pilot plant and filing an initial resource in 2018; tripling the resource, delivering a feasibility study for first phase production and getting environmental permits in 2019; and raising US$10 million in equity and announcing a US$60 million debt offering in 2020.

That set the stage for a listing on the NASDAQ in 2021, two more equity offerings of $178.7 million (the second upsized three times), and at the end of the year, the start of construction. The company completed a US$100-million financing in 2022 and completed a phase 2/3 production expansion study that pegged capex at US$155 million to boost production to 104,200 tonnes LCE annually.

The company shipped its first concentrate in July this year.

Cabral has also embedded ESG as a core part of Sigma’s identity. Far from green hushing — where companies avoid drawing attention to their sustainability initiatives and accomplishments for fear of blowback — Sigma puts its green credentials up front, label-

“green lithium” for achieving net zero carbon, 100% recycling of water and no tailings pond (the company produces dry stack tailings with a portion sold as a 1.3% lithium oxide byproduct). It also opted for processing via dense media separation (DMS) alone, avoiding the increased capex, complexity and use of sulphuric acid that would have come with a flotation plant, while still achieving recoveries of over 60%.

2012 purchase

Cabral, a math whiz from a young age whose father was a metallurgical engineer in Brazil’s navy and whose mother was a microbiologist with Johnston & Johnston, studied economics before earning her MBA from Columbia Business School and a masters in finance degree from London Business School.

Her experience with the natural resources sector began when as an associate in New York she volunteered to work on the privatization of Vale (NYSE: VALE) in the 1990s — at the time a Brazil state-owned company. She later also worked on Vale’s acquisition of Inco in 2006, in addition to an estimated 150 other transactions.

Sigma’s story began just over a decade ago, when Cabral purchased a majority interest in the asset that’s now known as Grota do Cirilo from the Brazilian family that held it in 2012.

It was actually Sigma’s former co-CEO and co-founder, Calvyn Gardner that originally flagged the project, and Cabral who purchased a majority interest with her own funds from a Brazilian family that held it in 2012.

Until earlier this year, Cabral (formerly Cabral-Gardner) shared co-CEO duties with Gardner, a former Anglo American executive and cofounder of mining-focused private equity firm Hardac Investments. Formerly a couple, the two split in 2020, but kept running the company together.

“He was there on site doing technical work and early development and then I was running just about everything else — from institutional relations to finance to law to environmental, social, the whole lot — and keeping a close eye on timetables and schedule.”

In return for running the exploration program from 2012 to 2016, Gardner earned a minority stake in the original Sigma as a See CABRAL / 44

DIAMOND DRILLS FOR SALE

Gone are the days where you would work 12/16 hr days for 3, 4 months straight, no trips to town,no days off then go straight home to harvest working 18 hr days.

Longyear 38 skid drill in shack, hyd wireline, boyles chuck, jd 4239 engine. Many, many spare parts, spare tower, spare transmissions, longyear trans, clutches,feed cylinders, shafts, bearings, swivel rings Good running condition.... 2010 Multi-Power d2 hyd fly drill, perkins engine. 2021 zinex A5.JD 6068 turbo,12HH chuck,P foot clamp, levelwind winch fly drill. Excellent condition, low hrs, comes with many spares and nq wireline spares, 420, 435 pumps. Fly boxes ,tool racks, rod rack,fuel tanks.

Ready to go.

May possibly be willing to run the machine to get you started for first year or two to give you a good start.

Corewest@live.ca

indepth [CONTINUED FROM P9]

Mexico or some parts of Brazil.”

Ivory Coast has one of Africa’s stronger economies with 6.7% gross domestic product growth last year, according to the World Bank. Still, it’s had two civil wars since 2002 and President Alassane Ouattara has remained in power since 2011 by amending the constitution.

and northern secessionists.

“They are looking at ensuring that their country does not become a jihadist focal point,” Marrone said. “That’s not different from what a lot of other places in the world are trying to do. There is a less developed geopolitics, less developed democratic process. But interestingly, even that military government in Mali has indicated that it’s looking to re-establish civilian rule as early as next year.”

Coup surge

The unrest in Mali marked the start of a series of recent coups in the Sahel region, with Burkina Faso, Chad, Guinea, Sudan, and the latest, Niger, in July.

Even so, Iamgold (TSX: IMG;

COMMODITIES from 1 enced more than 100% inflation a year, gold has gone up tenfold in the last three years in peso terms,” he noted.

McEwen, founder of McEwen Mining (TSX: MUX; NYSE: MUX), shared his concerns about royalty and streaming firms, which he perceives as having taken advantage of mining companies, eroding their profit margins and stunting growth opportunities. He likened their influence to sirens drawing sailors to their doom on the rocks, insinuating a cautionary tale for those in the mining industry.

“There are a lot of mining companies that have made Faustian bargains, and the devils have been that smiling royalty or streaming company with the dollars in hand, and you can see the damage they’ve done to our market.”

Critical metals shine

Despite concerns from some observers about the mining industry’s apparent inconsistency in providing value to generalist investors, it is currently experiencing growth, especially in the uranium and battery materials sectors.

As discussions veered towards the global energy transition, panelists underlined the mounting demands for power grid expansions on a global scale, coupled with the unprecedented rally expected in the demand for copper.

Industry expert John Feneck, president of Feneck Consulting, asserted, “Copper is set up for one of the biggest rallies in history.” He encouraged investors to keenly observe the ‘CPER’ and ‘COPX’ indexes for insights concerning the red metal.

Despite copper’s vital role in the energy transition, its price has been down recently, which the speakers interpret as a buying opportunity. They also anticipate a growing interest in investments in physical copper holdings, similar to the uranium, gold, and silver sectors.

Adding to this, Michael Konnert,

NYSE: IAG), Kinross Gold (TSX: K, NYSE: KGC) and Endeavour Mining (TSX: EDV; LSE: EDV) are some of the 44 Canadian miners that held $15.6 billion in assets in West Africa in 2021, according to Natural Resources Canada. However, Endeavour sold its Burkina Faso mines in June.

Marrone, who experienced some difficult places with Yamana such as Nicaragua, led by authoritarian President Daniel Ortega since 2007, says Allied follows conventional security arrangements and consultants similar to how Barrick and Endeavour operate.

“It’s very conventional and very, very normal for us. There is security, but I would venture to say that it’s not different from some parts of

Allied is combining its Bonikro and Agbaou mines there into one complex with 190,000 oz. of annual production. Across the operations including Sadiola, the company is applying other efficiency measures such as digitization, fuel conservation and better contractor management. The company is also reducing financial risk by redeploying some equipment to lower capital costs.

Marrone turned from steadfastness amid African insecurity to similarly assessing the uncertainty of financial markets. Prices for gold equities and bullion are near record divergence even though economies are wavering amid high government debt and inflation while strong job reports knock recession forecasts. Perhaps predictably, he said gold stocks must surge soon.

“The gold price will do well, but the gold equities will outperform the metal because they’re going to be playing a lot of catch up. That will take into account how they performed relatively poorly to the metal over the course of the last several years.” TNM

co-founder and managing partner of Inventa Capital, held a bullish outlook on nickel, predicting a growth path that could possibly parallel the surge witnessed in the lithium market over the previous decade.

Near-term challenges to nickel supply include an upcoming election next year in Indonesia, a significant global producer. He believes more nickel juniors could see significant investment from larger companies in the sector following on Glencore’s (LSE: GLEN) recent purchase of equity positions in Stillwater Critical Metals (TSXV: PGE; US-OTC: PGEZF) and Palladium One Mining (TSXV: PDM; US-OTC: NKORF).

Konnert is also bullish on silver, pointing to the critical role the metal plays in the energy transition, especially its use in solar panels and electric vehicles, and highlighted the growing deficit in silver supply. In recent times, the price of silver has experienced significant fluctuations due to decreasing supply. “Mining in prominent areas like South America is becoming more challenging and costly as mines deepen,” he says. “Even a minor disruption can significantly increase the prices of such commodities. We are nearing a point where we might witness a sharp increase in prices, again, similar to trends observed in the lithium market.” TNM

10 OCTOBER 2023 | THE NORTHERN MINER ww w.northernminer.com

From left: John Feneck, president of Feneck Consulting, Michael Konnert, co-founder and managing partner of Inventa Capital, and David Talbot, Red Cloud director of research, at the Precious Metals Summit in Beaver Creek, Colo. HENRY LAZENBY

Rob McEwen and Frank Giustra speak with Northern Miner Group president Anthony Vaccaro at the Precious Metals Summit in Colorado. HENRY LAZENBY

Allied Gold’s Bonikro and Agbaou projects that comprise the Côte d’Ivoire Complex in the namesake country. ALLIED GOLD

donedeals

B2Gold grabs AngloGold’s stake in Colombian project

M&A | Transaction comes after JV partners failed to find a buyer for Gramalote

NexGen raises US$110M for Rook I uranium project

FINANCING | $1.3B project is advancing through permitting

BY CANADIAN MINING JOURNAL STAFF

GNexGen Energy (TSX: NXE; NYSE: NXE; ASX: NXG) has closed a US$110 million unsecured convertible debenture financing to support development of its Rook I uranium project in northwestern Saskatchewan. The financing, with Queen’s Road Capital Investment and Washington H Soul Pattinson and Co., closed on Sept. 22. The company has $330 million in cash reserves.

In late August, when the agreement was announced, Leigh Curyer said the financing from two “highly respected investors,” including long standing investor QRC, positioned NexGen to deliver on its stated objectives in the development of Rook I project.

BY CECILIA JAMASMIE

B2Gold (TSX: BTO; NYSE: BTO) will

become the sole owner of the Gramalote gold project in Colombia after acquiring the 50% stake held by South Africa’s AngloGold Ashanti (NYSE: AU; ASX: AGG), its partner in the venture, for US$60 million.

The gold project, located 124 km northeast of Medellin, was put on hold in August last year, as preliminary results from an optimized feasibility study suggested that Gramalote did not meet the JV’s investment thresholds for mine development.

A few months later, the partners decided that selling Gramalote was the best option for both companies, but failed to find a third party to take over the project.

B2Gold said the consolidation of Gramalote under one owner would make it possible to analyze lower capital intensity, higher-return development opportunities for the project. It noted that so far, Gramalote was seen as a larger scale project to provide meaningful production growth to both companies.

The Vancouver-based gold producer will now asses smaller-scale development options to identify cost savings. It will also start a new study in the fourth quarter, with the goal of completing an initial assessment by the end of the second quarter of 2024.

The acquisition of Gramalote will add 2.1 million gold oz. of indicated mineral resources and 740,000 gold oz. of inferred mineral resources to B2Gold’s resource base. For AngloGold, the sale will help increase its focus on operating assets and projects it

intends to develop, the company said in a separate statement.

“AngloGold Ashanti remains a committed, long-term investor in Colombia with our exciting Quebradona copper and gold project and we look forward to playing a key role in developing a modern, responsible mining sector in the country,” CEO Alberto Calderon said.

B2Gold also said it was on track for first production at its Goose gold mine in Nunavut in early 2025. It acquired Sabina Gold & Silver for the asset this year. The mine is expected to produce 223,000 oz. of gold per year over a 15-year mine life. B2Gold pegged capital costs for the development at $800 million.

Gramalote details

AngloGold will receive the US$60 million from B2Gold in stages, with US$20 million due on closing of the transaction and the remainder in tranches, depending on the achievement of certain milestones. If commercial production does not begin within five years of the transaction closing date, no payment will be made, B2Gold said.

Gramalote was B2Gold’s first project when it started out as an exploration company. In 2015, it received the first environmental licence awarded in Colombia in 35 years.

The permit gave it three years to work through social aspects related to the open pit project, including relocating artisanal miners and some nearby residents.

During that time, Gramalote became the centre of a mining rights dispute with Canada’s Zonte Metals (TSXV: ZON), which remains active. TNM

First Quantum earns majority stake in La Granja

JV | Feasibility study under way for Peru project

BY CECILIA JAMASMIE

BY CECILIA JAMASMIE

Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) and First Quantum Minerals (TSX: FM) have formed a joint venture to advance the La Granja copper project in Peru to development, a deal that was originally announced in March. The new partners describe the project as one of the world’s largest undeveloped deposits of the metal.