De Beers plans return to marketing roots as split from Anglo American looms

BY BLAIR MCBRIDE

DeBeers, which created the global market for diamond engagement rings through its "A Diamond is Forever" campaign, is shi ing back to its marketing roots as its parent company Anglo American (LSE: AAL) moves to sell it o . Its new ‘Origins’ strategy is part of a wider pivot back towards natural diamonds, announced on May 31. e move makes sense because marketing has always set the diamond sector apart from other segments of mining, and it can’t a ord to ignore the demand creation side, New York City-based diamond analyst Paul Zimnisky told e Northern Miner

“Marketing is what moves the needle,” he said. “You can throw money at the problem, you can create demand if the products are marketed properly. You have to look at it as a luxury product, not as a commodity.”

In announcing the divestiture of De Beers on May 14, Anglo American said the move would give both companies “a new level

“There’s little interest in the diamond sector from an equity perspective. I don’t see how in a potential IPO there’s enough interest in a new diamond story.”

RAJ RAY, BMO CAPITAL MARKETS MINING ANALYST

of strategic exibility to maximize value” for Anglo and Botswana, which holda 15% stake, in the diamond company. Since then, Botswana’s government has indicated that it wants to increase that stake. High capital needs and declining diamond supply present further challenges in the diamond sector, analysts say.

DST is engaged in the development and commercialization of environment-friendly technologies for the treatment of materials in the mining industry. Through the development of patented, proprietary processes, the CLEVR and GlassLock processes, DST extracts precious and base metals from mineralized material, concentrates and tailings, while stabilizing contaminants such as arsenic, which could not otherwise be extracted or stabilized with conventional processes because of metallurgical issues or environmental considerations.

Anglo’s announcement of its De Beers plans, as well as plans to sell o its South Africa-based Anglo American Platinum (JSE: AMS) and its steelmaking coal assets was triggered by BHP’s (ASX: BHP) unsuccessful, multi-billion-dollar acquisition bid in mid-May.

‘Growing desire’

De Beers is also suspending its Element Six lab-grown diamonds (LGD) subsidiary for jewelry to focus instead on synthetic diamond technology for industrial applications, it said in late May. Production for the Lightbox LGD brand will stop in a few months, De Beers CEO Al Cook said in a June 13 interview with diamond news site Rapaport.

Cook explained to Rapaport the need to tell better diamond stories is greater now that “there are more diamonds above the surface of the Earth than below the surface. Every year, diamond mines are closing.”

In a separate news release, Cook said the outlook for natural diamonds is “compelling,”, adding that the company’s new approach will involve “growing desire for natural diamonds through the reinvigoration of category marketing, embracing new approaches that maximize reach and impact.”

De Beers rst entered the synthetic diamond jewelry market in 2018. To di erentiate mined from lab-grown diamonds in consumers’ minds and position mined

gems as the premium product, the company initially o ered Lightbox jewelry for up to 80% less than its competitors’ prices.

Slowing sales, production e stronger emphasis on marketing also comes as De Beers grapples with lower sales, with its most recent rough diamond sale reported on May 23, bringing in US$380 million — down by 20% from last year’s US$479 million for the same two-week period. Cook said the sales were due to the seasonally slower second quarter and less trading in India during the elections.

Production declined 8% to 31.9 million carats in 2023, from 34.6 million carats in 2022. First quarter output this year, at 6.8 million carats, was down 23% from the year-earlier gure of 8.9 million carats.

Above: Haul trucks at the Jwaneng diamond mine, held by a 50-50 joint venture of De Beers and the government of Botswana. ANGLO AMERICAN Left: A rough diamond. DE BEERS GROUP

Leopard™ DI650i Time for a new leader

NewLeopardTM DI650i down-the-holesur facedrillrig offers long-termproductivityand superiorstabilit y withrobustand reliablemain components – seamlessly integrated withstate-of -the-art technicalsolutions.Scalable automation, easy maintenance andoutstandingmovabilityarethefeatures that make LeopardTM DI650i apremiumproduct,which isan honortoown.

Leaveyour pawprintand enjoy thesmooth, efficientride.

A bust of Benny Hollinger by Sudbury, Ont., artist Tyler Fauvelle, unveiled in June. Hollinger discovered gold in 1909 at what is now Newmont’s Porcupine complex in Ontario. CREDIT:

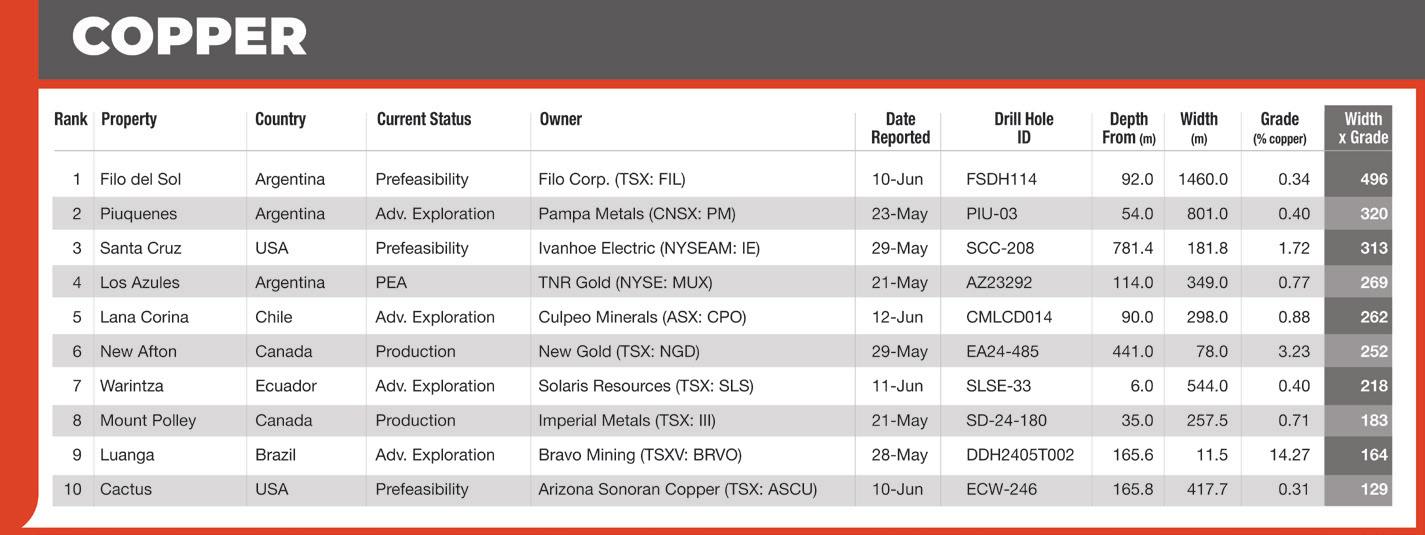

n Copper price slides

e price of copper has slid from its record high a er China’s real estate turmoil increased storage of the wiring and plumbing metal.

A pound of copper was at US$4.44 at press time in June, down 13% from US$5.08 on May 20. Stocks of the metal in Shanghai Futures Exchange warehouses reached the highest level in four years at 330,000 tonnes in June, according to Bloomberg gures.

High prices also weakened manufacturing demand and may see China switch out copper for aluminum.

e China Nonferrous Metals Industry Association has said substitution could somewhat lower the country’s dependence on copper imports and improve its resource security. China buys the vast majority of its copper, including more than 3 million tonnes a year of cathode, BMO said. Meantime, the country exports about 6 million tonnes a year of semi- nished aluminum. However, it still imports most of the bauxite used to make aluminum.

With high prices, manufacturers use their stockpiles before buying new metal, especially when demand for copper products has fallen. China’s property market has tumbled over the past few years as companies over-borrowed and went bust.

e country’s copper inventories usually accumulate early in the year, then decline as plants ramp up a er the Chinese Lunar New Year holiday which falls in the period of Jan. 21 to Feb. 20.

With the copper glut in China, imports of cathodes from the London Metals Exchange were selling at a US$14 per tonne discount during the third week of June, BMO reported, a rare situation.

Still, copper supplies outside of China remain low. Inventories for e Commodity Exchange (COMEX) in New York are surprisingly low even a er the price surge in May required traders to close positions where they bet the price to

fall, called a short squeeze. e market shows backwardation, when spot prices are higher than forecast trades, BMO said. “ is points to the challenges in obtaining copper suitable to deliver to COMEX warehouses, with much of the volume available globally either of Chinese or Russian origin,” BMO Capital Markets director of commodities research Colin Hamilton said in a note. “We still see signs of fundamental weakness, but if legacy short positions remain the potential for another squeeze is high, which is the key risk in play for further copper downside at the present time.”

BY NORTHERN MINER STAFF

n Japan, Chile boost lithium ties

Japan and Chile have agreed to strengthen cooperation on lithium mining and supply, including deals for Japanese rms’ acquisition of long-term preferential access to the battery metal, in exchange for adding value to the raw material extracted in Chile and transferring skills.

Japanese Trade Minister Saito Ken and Chile Mining Minister Aurora Williams said the two countries will focus on ensuring stable supply of the battery metal and the use of mining methods that protect the environment, Chilean news site Emol reported in mid-June.

Under the improved agreement, Japan and Chile will cooperate on developing lithium supply in environmentally friendly ways and hold an annual public-private joint conference on the mining sector to improve collaboration. is event will bring together Japanese companies operating in Chile and Chilean government o cials.

Since launching its national lithium strategy last year, which gives a majority stake in any projector to state-owned companies, Chile has been working to attract companies that can help

it develop processing and manufacturing capabilities.

In April last year, Chile granted Chinese EV maker BYD access to preferential prices for lithium carbonate produced by SQM, the world’s second-largest lithium producer. e output will be used in a cathode factory in the country’s north, which was set to open by the end of 2025. e plan is currently in standby due to “uncertainty,” the Chinese carmaker said, without elaborating.

Japan’s Sumitomo Corp., Mitsui & Co. and Sojitz Corp., are some of the companies involved in the battery and EV supply chain that have already tapped into the Chilean lithium market in the past year.

e South American nation has also sought to boost cooperation with other Asian players, including South Korea. Korean companies processing lithium in Chile may be eligible for incentives from the U.S. to diversify their clean energy supply chains. e nation, which has a free trade agreement with the U.S., has been in discussions with the Biden administration to determine if value-added products would meet the requirements for these incentives.

BY MINING.COM STAFF

PHOTO

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate ahiyate@northernminer.com

MANAGING EDITOR: Colin McClelland cmcclelland@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head O ce

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

C$130.00 one year; 5% G.S.T. to CDN orders.

7% P.S.T. to BC orders

13% H.S.T. to ON, NL orders

14% H.S.T. to PEI orders

15% H.S.T. to NB, NS orders

U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164) CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 69 Yonge

opinion

EDITORIAL

Get ready for more disputes about what’s ‘mine’ and theirs

BY ALISHA HIYATE

Eleven years ago, e Northern Miner ran a story titled “How Mexico reclaimed its mantle as a top mining nation.” e piece recounted how the nation opened up investment and in 2012, became the No. 1 jurisdiction in Latin America for spending on mineral exploration.

Last year, Mexico was the top jurisdiction in another category: the target of most new requests for arbitrations at the International Centre for the Settlement of Investment Disputes (ICSID). e 10 new claims registered against it in 2023 edged out El Salvador’s nine.

ey aren’t all mining-related claims as outgoing President Andrés Manuel López Obrador, elected in 2018, put in place protectionist policies a ecting its entire economy.

López Obrador’s term is up in November, when his protégé and president elect Claudia Sheinbaum following a June vote, will take over.

But the damage has been done as López Obrador nationalized Mexico’s lithium resources, blocked new mineral concessions for the past six years and proposed a ban on open pit mining. Several miners, including GoldGroup Resources, Silver Bull Resources, Almaden Minerals and China’s Ganfeng Lithium have all registered new claims against the country with the ICSID over the past year and a half.

International tribunals offer an impartial venue, but there are risks: decisions are meant to be binding and final. On average, mining arbitration take about five years to reach a judgment, according to a study released last year by Toronto-based law firm Charles River Associates. Gabriel Resources’ US$4.4-billion claim against Romania, which the company recently lost, was an outlier at nearly 10 years.

Resource nationalism spreading

As states tighten their grip on critical minerals, we can expect cases to shi from precious metals project disputes to those involving strategic minerals.

“It’s a universal phenomenon with legal claims that law follows business,” Hugh Meighen, a Toronto-based partner at Canadian law rm BLG said. “Where there is an active sector that is driving investment, that is driving commerce, those transactions, those investments over time, spin out disputes.”

Natural resources projects — oil and gas and mining —represent one quarter of all cases heard by ICSID panels since the World Bank body started hearing cases in 1972 — more than any other industry. Electric power and energy cases stand at 17%.

e biggest mining award given by the ICSID was for a copper project — Reko Diq in Pakistan. e case entered arbitration in 2011 and in 2019, Australia’s Tethyan Copper was awarded damages of US$5.9 billion. Barrick Gold, which owns Tethyan, agreed to waive the award a er the parties came to a new agreement in 2022. It restructured the project with 50% owned by Barrick and the rest split equally between Pakistan and Balochistan province.

More copper cases are in the works. First Quantum Minerals is preparing to ght Panama in arbitration for shutting down its Cobre Panama copper mine last year.

Why arbitration

Companies turn to international arbitration as a last resort when negotiations with the host government or court actions in the country fail to resolve the dispute.

GoldGroup, for example, alleges its San Jose de Gracia gold project was essentially expropriated by proceedings in domestic courts that have been stalled for a decade, and by another that it says was “plagued with incomprehensible procedural defects.”

International tribunals o er an impartial venue, but there are risks: decisions are meant to be binding and nal. On average, mining arbitration take about ve years to reach a judgment, according to a study released last year by Toronto-based law rm Charles River Associates. Gabriel Resources’ US$4.4-billion claim against Romania, which the company recently lost, was an outlier at nearly 10 years.

Awards, when given, can also be disappointing. Charles River’s study showed that 47% of mining awards for which information was available were for less than 10% of the amount claimed.

Indigenous Rights questions Investors should also be aware that environmental, social and governance factors are a growing cause of investor-state disputes, especially Indige-

COMMENTARY

Investors should

heed growing supply after uranium’s recent runup

BY JAMES COOPER

Uranium prices surged from just over US$50 per lb. in April 2023 to more than US$100 per lb. by January 2024. Since then, there has been a moderate pull-back; uranium is now consolidating just above US$90 per pound.

So is it too late to join the uranium bandwagon as an investor?

Well, that depends. Last year’s terri c run was driven by strong demand outlooks.

Uranium, the fuel for nuclear reactors, has bene tted from renewed interest in building global nuclear capacity. at’s partly due to the push to go green.

Here, nuclear energy o ers baseload power that’s carbon-free and reliable. Whether night or day, cloudy or windless, nuclear provides uninterrupted power.

But there’s another important side to the nuclear story: costs are rising.

Despite central bankers’ claims to the contrary, in ationary pressures continue to loom.

Rising tari s and trade tensions between the world’s two largest economies, China and the United States, threaten to bifurcate global trade. is is highly in ationary and occurs just as the U.S. ramps up broad trade embargoes against Russia, one of the world’s most resource-rich countries.

Meanwhile, con ict could erupt at any time in the Middle East. A regional spillover could have huge implications for global oil supply.

Echoes of 1970s ere are similarities between today’s in ationary environment and the 1970s’.

Back then, the war in Vietnam helped drive copper prices to extreme levels, above US$15,000 per tonne. Meanwhile, OPEC oil embargoes in the early ’70s caused the price of oil to quadruple in the U.S.

As in ation rocketed higher, households sweated under a costof-living crisis.

However, these economic conditions laid the foundation for rapid nuclear energy expansion throughout the decade.

As a source of relatively cheap baseload power, nuclear power o ered a proven long-term solution to the global energy problem. Nuclear was viewed as a long-term strategy to tackle the cost-of-living crisis.

e U.S. had fewer than 20 nuclear power facilities at the beginning of the 1970s. But by the decade’s end, the country had around 75 reactors in operation. Not surprisingly, the commodity fuelling these reactors went skyward.

Adjusted for in ation, the price of uranium shot past US$200 per lb. by the late 1970s. A record that stands today.

According to a report by the OECD, the tripling of the uranium price between 1973 and 1975 was

brought about by concerns over uranium supply shortfalls related to growing reactor orders and ongoing military requirements. Today, uranium trades at less than half that price. So, could there be another record high at some point in the 2020s?

If the 1970s o ered a blueprint for today’s economy, it’s certainly possible.

In ationary pressures loom large against the backdrop of war, tari s, embargoes and threats to energy security. e political will to push nuclear will only increase because of these stresses.

The supply story

As the Canadian mining magnate Robert Friedland once said, the set-up for higher commodity prices consists of one-third demand and two-thirds supply. So, how does the uranium supply story stack up? e outlook here is slightly less rosy.

Kazatomprom, the world’s largest uranium miner, is set to resume full production next year, a er it cut production during uranium’s long bear market following the Fukushima nuclear disaster. Meanwhile, the world’s second-largest miner, Cameco is looking to ramp up its McArthur River operation in Canada. is will add a further 6,900 tonnes of uranium to the global feedstock. According to GlobalData, worldwide uranium production is expected to grow with a compound annual growth rate of 4.1% from 2024 to 2030, with output reaching 76,800 tonnes by 2030.

So, what does that mean? Rising output could defuse uranium’s long-term bullish outlook. at’s set to be dampened further as several new sources of supply hit the market.

Paladin Energy’s restart of its Langer Heinrich uranium mine in Namibia is under way. Its expected to deliver 6 million lb. annually at full production, enough to supply more than ten 1,000-megawatt nuclear power plants for a year. en there’s South Australia’s Honeymoon operation. In 2015, Boss Energy acquired the project and recommissioned the mine, with production resuming earlier this year.

New owner Lotus Resources also plans a restart of its Kayelekera uranium project in Malawi. So why is this a potential threat to the uranium market?

Fully permitted mines with infrastructure already in place means several operations could come online simultaneously, easing any potential supply squeeze driven by demand. For now, investors remain laser-focused on the demand outlook. at means there’s still plenty of room to ride momentum in the uranium market.

In the long term, though, demand must overcome higher production threats.

A cost-of-living crisis could be the high-demand scenario that brings more reactors online and fuels demand for uranium. TNM

James Cooper runs the commodities investment service Diggers and Drillers. Follow him on X @JCooperGeo.

people

Beaty optimistic on Mexico ahead of cross-Canada bike trip to Greenstone opening

FUNDRAISING | Entrepreneur weighs in on Canada’s restrictions on Chinese investment

BY HENRY LAZENBY

Mexico’s new leader is an improvement while Canada should be careful in blocking Chinese investment, according to Ross Beaty, the Canadian Mining Hall of Famer who founded Pan American Silver (TSX: PAAS; NYSE: PAAS) and Equinox Gold (TSX: EQX; NYSE-AM: EQX).

Voters elected Claudia Sheinbaum, a climate scientist, as Mexican president on June 2 to replace the outgoing Andres Manuel López Obrador. She’s expected to continue his policies that have de-facto banned open-pit mining. But she may have a less rigid approach, said Beaty of the country where Pan American operates two mines.

“Sheinbaum is much more pragmatic, understands nature perhaps more, and understands climate and perhaps won’t be as radical,” Beaty said by phone June 20 in Vancouver. “ e former president was a kind of an older generation person. He didn’t believe in climate change, he didn’t want renewable energy, he didn’t want private sector development and he had a dislike for certain Mexican companies in the mining industry.”

Beaty spoke as he was preparing for a cross-Canada fundraising bicycle relay from Vancouver to Equinox’s Greenstone gold project at Geraldton in northern Ontario. Riders should nish the epic 3,634km journey in time to open the mine in August.

Hospital funding

e pedal-powered trip will bene t the Geraldton District Hospital, just ve minutes from the mine. More than $1 million has already raised or pledged. e hospital serves 2,767 km sq. of Northern Ontario, including ve Indigenous communities and the mine’s workforce.

“We’ve got a lot of keen cyclists in the company, and there’s a lot of keen cyclists in the mining industry and the brokerage industry here in Vancouver,” said Beaty, an avid cyclist planning to participate. “ is ride celebrates good health

Beaty spoke as he was preparing for a cross-Canada fundraising bicycle relay to benefit Geraldton District Hospital in northern Ontario.

and teamwork, and it may even catch some Canadians’ attention.”

Cyclists from Equinox Gold’s sites in California, Mexico and Brazil will join the relay and organize local events to raise money for charities in their regions. So far, the company has attracted sponsorships and aims to gather more support from vendors, contractors and industry leaders.

Other industry players, such as Barrick Gold (TSX: ABX; NYSE: GOLD) CEO Mark Bristow in his former Randgold Resources days, regularly undertook multi-week motorbike adventures visiting mines and sites across Africa, all in aid of local charities.

e cyclists are to start their journey on Aug. 5 from the company’s head o ce in Vancouver. Daily progress updates will be available on Equinox’s social media channels and the Ride to Greenstone website.

e Greenstone mine, which poured its rst gold on May 22 and hosted Ontario Premier Doug Ford and First Nations during an event at the mine ursday, is set to become the company’s agship asset. It aims to produce about 400,000 oz. gold per year for the rst ve years and average 360,000 oz. annually over its 14-year life. Equinox, which has eight gold mines in the America, recently bought out its former 40% partner at Greenstone, Orion Mine Finance.

Government overreach

On the Canadian front, Beaty backs the government’s e orts concerning the domestic energy transi-

tion and approves of its support for increased critical minerals processing in Canada. He discussed the government’s e orts to restrict

Chinese investment in the exploration sector, which he sees as excessive.

is week, the Canadian government arranged a $3-million sale of stockpiled rare earths from Vital Metals’ (ASX: VML) Nechalacho project in the Northwest Territories to the Saskatchewan Research Council. e move replaced China’s Shenghe Resources as the buyer. Two years ago, Ottawa ordered China to divest from three Canadian critical mineral companies even though their projects were abroad.

“I’m a little nervous about the Canadian government’s desire to restrict Chinese investment in the exploration industry where it’s carried out away from Canada,” Beaty said. “ at seems to me a bit of an overreach.” TNM

Far left: Equinox Gold’s Greenstone mine in Ontario. EQUINOX GOLD

Left: Ross Beaty speaks at AME Roundup 2024. NORTHERN MINER

Below left: Ross Beaty and Barrick Gold president and CEO Mark Bristow at the Canadian Mining Hall of Fame ceremony in Toronto in 2022. CANADIAN MINING HALL OF FAME

BREAKING DOWN GLOBAL NICKEL SUPPLY

BY BLAIR MCBRIDE

Nickel is an essential component in electric vehicle (EV) batteries, solar panels and alloys for the aerospace industry. Nickel demand for EVs is projected to grow about 40 times by 2040, according to the International Energy Agency. However, those uses represent a small proportion of the total nickel produced globally.

Battery-grade nickel has a purity level of 99.99%. Class 2, with 1.5% to 55% nickel purity, is mostly used for stainless steel and largely produced by Indonesia, whose China-backed projects have increased input at lower costs than competitors.

Top 10 producers of Class 1 nickel by 000 tonnes in 2023

Nickel demand from EVs is expected to grow by 40 times between 2020 and 2040 Source:

Top 10 producers of Class 2 nickel by 000 tonnes in 2023

commentary &analysis

More than minerals: Mid-stream capacity is key to Canada’s industrial future

COMMENTARY | Task demands approach inclusive of government, industry

BY IAN M. LONDON

Canada boasts of its rich history and continued success in mining, metallurgical and chemical processing, advanced manufacturing, strong trade relations north-south and east-west, access to clean energy and its commitment to sustainability.

While these strengths lay the foundation for Canada to succeed in a rapidly changing economy driven by the global energy transition, they’re not enough. e looming challenge is how can industry, governments, communities and investors lever and translate these capabilities and aspirations to ful ll Canada’s promise?

e energy transition depends on advancing technologies, many of which require critical material supply chains that have the con dence of consumers, investors, and society.

Emerging technologies are enabled by hardware and infrastructure, with end users purchasing cost competitive and sustainably produced assemblies, components, metals, alloys, powders and chemicals. Seldom do they purchase raw minerals. As such, Canada must establish much-needed value-adding mid-stream processing capacity to translate minerals production to meet these new industrial production demands.

Processing capacity

Building midstream materials processing capacity will enable Canada to capture value-adding energy transition applications in transportation, clean energy production and utilization, and digital and medical technologies when materials producers partner closely with their customers.

To get there, operators will need to build investor and customer condence by scaling up material processing and component production capacities from bench through to pilot and demonstration plants to full-scale operations.

Consistent production of midstream materials and components, supported by domestic raw mineral and recycled material supply, can help meet Canada’s requirements. at will also contribute to the world’s demand for critical materials.

Canada has identi ed 34 elements critical to its economic future. e available supply of each of these critical minerals are at different stages of maturity. Each faces unique challenges. Several of these material streams are championed by well-established companies, others by much smaller and medium-sized enterprises. Some are traditional, large volume commoditized elements such as iron, copper and aluminum. Most critical materials required for next generation technologies are smaller volume and non-commoditized (e.g., neodymium, dysprosium, gallium, graphite) sold on individual customer demand via speci ed o -take agreements. ese agreements include technical speci cations (quality), pricing, volumes and increasingly, environmental and social performance criteria.

Value-added manufacturing is demand for value added advanced manufacturing supported by Canadian critical processed material supply will ultimately contribute to Canada’s re-industrialization through augmenting the attractiveness of (re)shoring manufacturing in Canada and through export.

So how do we get to advanced domestic industrialization from promising resources still in the ground? Canada knows how to mine (fully respecting the challenges of permitting, nancing, and bringing economic and sustainable pro-

duction into service).

Achieving our mid- to longer-term goals will however, require a concerted, whole-of-government, industry, investor and academia approach to producing critical materials. Here are a few things we could do.

n Champion commercialization hubs. e economics of standalone facility overheads, scaling-up and sta ng don’t work for many start-ups or SMEs. e development of commercialization hubs would lower pre-production costs for emerging producing ventures through shared space, equipment,

overhead and ready access to technical expertise. ese would allow start-ups to produce material for sale without signi cant downtime between pilot and plant while allowing continued work on process optimization. Shared facilities could house several SMEs, who pool technical, operational and administrative resources. Government support could help to leverage capital to build the infrastructure hubs.

n Greater attention on the D, less on the R in R&D. De-risking, scale-up and commercialization of promising research are imperatives to the future economic security of

Canada and its partners. A focus on development would best align and deploy government, commercial labs and industry expertise and facilities needed to accelerate the mid-stream capabilities and capacity. Prudent yet practical technical readiness assessments balanced by commercialization/market readiness are key to setting priorities and allocating resources.

n Develop human resource capacity. We need people with the right training and expertise to build and deliver tomorrow’s critical mate-

Automated production of solar panels. Emerging and clean energy technologies require not raw critical minerals but the materials created from them. ADOBE/IM

commentary&analysis

Ring of Fire road must start ASAP

OPINION | First Nations stand to benefit from project rich in green tech metals

BY STAN SUDOL

The Ring of Fire camp is the most important mining discovery in Canadian history for its strategic minerals including nickel, copper, platinum group metals, chromite and titanium. It even exceeds the legendary Sudbury Basin.

Discovered in 2007, the region is located about 450 km northeast of under Bay in the isolated and vast peatlands of the Hudson Bay lowlands, an area roughly the size of Norway but with only about 10,000 people. Contrary to activists’ claims, sustainable exploration and mineral development will have minimal impact on the environment and provide critical minerals to mitigate global warming.

Australian miner Wyloo owns the Eagle’s Nest nickel-copper project and various chromite deposits in the Ring of Fire area.

e discovery has helped Ontario attract roughly $43 billion, and counting, of new electric vehicle (EV) investment. A Canadian junior explorer, Juno, holds claims on more than half of the camp. Marten Falls and Webequie First Nations also support the development and the promise of providing multi-generational jobs and economic opportunities across northwestern Ontario.

e West needs to bolster defence spending due to new wars and global instability, strip China of its critical mineral dominance, develop its own sources to power the green energy transition and help local First Nations faced with the shortest ice road season in memory. ese all converge at one point: the road to the Ring of Fire needs to start construction this summer.

Russia/Ukraine war

e Russian invasion of Ukraine in February 2022 has changed everything. If cobalt from the Congo, mined by poor African children was a problem for Western consumers, it’s safe to assume no one wants to buy an EV manufactured with “blood nickel” or any other commodity from Russia. e war was partly funded through global military spending that reached about $2.4 trillion last year, the most in 15 years, according to the Stockholm International Peace Research Institute.

Many European analysts fear the war in Ukraine, combined with the Gaza/Israel con ict and a possible Chinese invasion of Taiwan will spark a third World War. Ivanhoe Mines’ (TSX: IVN) Robert Friedland likes to cite how the war in Ukraine red 50,000 tonnes of copper shells into oblivion in its rst year. War puts pressure on mineral supplies.

During the 1950s, the United States government gave Falconbridge a $40-million subsidy, that would be worth $455 million today, to help develop a mine in Sudbury, Ont. at was to ensure diversity of supply from the predominant producer of that time, the Inco subsidiary International Nickel.

Today, the American military is again concerned about security of supply for essential commodities and, under the Defence Production Act, recently funded two Canadian junior mining projects: Fortune Minerals’ (TSX: FT) NICO cobalt-gold-bismuth-copper project in the Northwest Territories and Lomiko Metals’ (TSXV: LMR) graphite project in Quebec. Many more funding announcements are sure to follow.

Roughly 3.6 million tonnes of nickel were mined last year and Glencore (LSE: GLEN) has predicted global demand could grow to 9.2 million tonnes by 2050, mostly due to the EV battery market.

If all the proposed Western EV manufacturing operations are built, today’s North American nickel production, largely from Sudbury, ompson, Man., Voisey’s Bay, N.L. and Raglan in Quebec won’t be enough. New production needs to come on stream. And as in most sulphide nickel camps around the world, many mines are o en found. e same will eventually happen in the Ring of Fire.

Defence spendingIn 2023, if countries with extensive social programs such as Finland, the Netherlands, France and Britain can meet or come very close to the benchmark 2% of GDP military spending goals, there is no excuse for Canada, at only 1.4%, to keep freeloading on American coattails.

It’s a national embarrassment for the country and for our military who remember the outsized contributions this country provided in two world wars and the Korean con ict. America is in an economic war with its main rival, China. eir competition over the critical minerals needed to build the products essential for decarbonization is cut-throat and erce.

e Chinese seem to be ooding the world with cheap supplies of “dirty” Indonesian nickel. at economically undercuts production in Australia and potentially Canada, threatening Western supplies that are largely sustainable and green in comparison to Chinese practices. In 2023, China severely restricted access to gallium and germanium, essential minerals for semi-conductors and various

military applications, and has cut graphite exports.

Canada has a part to play, in defence spending and critical minerals supply.

Melting winter roads

Global warming is here. We’ve just ended one of the shortest winter ice road seasons on record. e roads are vital to ensure the delivery of bulk products like fresh vegetables that would cost much more if they were own in. Isolated First Nations communities depend on them.

Ironically, non-governmental organizations have been vehemently opposed to the proposed permanent roads and Ring of Fire mine development to produce the critical minerals needed to slow global warming.

Wyloo is working to sustainably build its Eagle’s Nest nickel mine with low environmental impacts. Tailings will be stored underground and all processed water will be recycled.

e actual mine disturbance is less than one square km – that includes airstrip, supply storage and other surface buildings aside from the minesha – which will release about 0.046 tonne of carbon per year, according to the company. Wyloo estimates the mine will generate $100 million a year for the local economy of First Nations businesses and the life of the mine will be at least 20 years, though it could last much longer since the deposit is open at depth. Raised eskers — sands and gravels le behind by glaciers that contain no carbon absorbing peat — will hold 80% of the proposed roads. e remaining 20% are to be built over peatlands and use modern oating geo-textile and

geo-grid materials that rest on top of the muskeg allowing it to continue to store carbon. is technology has been successfully implemented in the oilsands region of Alberta, northern Manitoba and in Scotland, all areas with extensive peatlands.

Webequie and Marten Falls First Nations, on whose traditional territories the majority of mineral deposits have been found, support sustainable mineral development. e leadership of some other First Nations, most of whose communities are located hundreds of kilometers away from the proposed mine, don’t support the project. An agreement seems possible between the province and Aroland First Nation, where the road into the isolated region would start, Ontario Premier Doug Ford said recently. e rst 100 km along an existing forestry road might not even need an environmental assessment. Canada is the second largest geologically-rich land mass on Earth and our mining practices are sustainable and green. e development of the Ring of Fire would be an enormous economic boost to marginalized First Nations throughout the region. And not developing the mineral abundance of the Ring of Fire would be a massive insult to our Western allies.

We need to start the road to the Ring of Fire now.

TNM

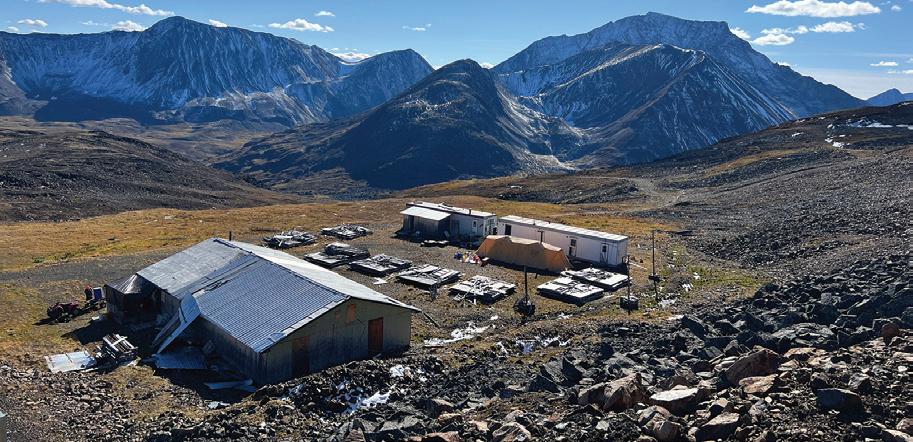

Wyloo’s Esker camp in Ontario’s Ring of Fire. Its Eagle’s Nest nickel-copper-platinum group metals project is the most advanced in the region, but requires road access to be developed. WYLOO

commentary&analysis

Palladium not written off the road yet, miners say

FORECAST | Electric cars not denting demand that much

BY COLIN MCCLELLAND

The price of palladium may gain in the short-to-medium term if constraints on recycling tighten and car buyers remain wary of electric vehicles (EVs) because of high interest rates, the World Platinum Investment Council says.

e supply of the metal, which is used in catalytic converters for pollution control on internal combustion engine (ICE) autos, is expected to be in a de cit of 1.3 million oz. this year, said the council, which represents miners of platinum group metals.

Palladium’s shortfall may ease to about 200,000 oz. next year before swinging into a surplus in 2026 that could build to as much as 700,000 oz. by 2028, the London-based council said in a May 29 report.

However, the forecast surplus is based on growth in recycling and depends on resolving several challenges, it said. ese include ICE vehicles being used for longer due to higher interest rates, consumer

The

skepticism

“Any

could slow the pace of the growth in recycling supply, resulting in deeper and more persistent decits and further postpone the surplus,” the council said. “ is would in turn feed into value expectations

Most energy and mining projects 20% in the red: study

BY CECILIA JAMASMIE

Miners and energy companies are facing average budget overruns of 15% to 20%, which puts nearly US$1.5 billion of capital invested in energy transition-related projects at risk each year through 2030, research from Bain & Co. shows.

Companies need to rethink traditional capital delivery models to avoid cost and timeline blowouts, the Boston-based management consultant says.

Examples abound, with one of the more recent being Horizonte Minerals’ (LSE: HZM; TSX: HZM) Araguaia nickel project in Brazil’s Amazon region. e company was put into administration in May a er it failed to secure nancing to nish building the US$1-billion project. Costs had almost doubled from the earlier estimate of US$537 million.

Another case in point is Teck Resources’ (TSX: TECK.A; TECK.B; NYSE: TECK) Quebrada Blanca copper project in Chile. e Vancouver-based miner, which spent much of last year ghting o a hostile takeover bid from Glencore (LSE: GLEN), last said its Quebrada Blanca 2 project would cost between US$8.6 billion and US$8.8 billion, compared with an original US$5.3 billion price tag.

To avoid cost surprises, Bain suggests companies need to adopt systematic portfolio thinking.

“Leading companies are begin-

ning to view their projects as part of an aggregated system rather than in isolation,” Bain says in its report. at way they can capture synergies and build resilience across their entire portfolio.

Companies should also realign their operating models, the consultant said. is would ensure that critical decisions are made with a broader perspective, addressing the blind spots that o en occur in siloed organizational structures.

Tech efficiency e adoption of digital solutions, automation, and AI tools is proving to be a game-changer for capital projects. In its research, Bain & Co.

and provide upward support for the palladium price.”

Platinum deficit

Platinum is also expected to remain in a de cit as motorists keep ICE cars for longer. However, platinum bene ts from a more diversi ed demand base and signi cant growth potential from an emerging hydrogen economy, the authors said. ey forecast the platinum market to remain in de cit for the foreseeable future.

e price of palladium has fallen 19% this year to US$885 per oz. near press time, according to Mining.com. Platinum has eased 2.8% over the same period to US$962.08 an ounce.

Contrary to a common perception, palladium surpluses won’t be the result of a rapid decline in ICE demand, says the council. It represents Anglo American (LSE: AAL), Northam Platinum, Impala Platinum Holdings (JSE: IMP), Sedibelo Platinum Mines, and arisa (JSE: THA).

Indeed, automotive demand for palladium may decline by just 1%

compounded annually to 2028, the council said. Palladium is being substituted for platinum while sales of more hybrid vehicles are osetting lower pure ICE demand, it said.

Revised outlook e report updates a September forecast by lengthening the time the palladium market remains in de cit to 2026 instead of a year earlier, because of the recycling challenges.

Palladium may also bene t from demand in developing countries adopting fossil fuel autos o setting some EV gains, but recycling is the main driver, according to the report.

“Secondary supply will be the major contributing variable in shi ing palladium markets into a structural surplus,” the council said.

“As such, the timing and extent of the recovery of scrap supply chains is key. With this uncertainty in mind there is scope for medium-term palladium market strength and short covering.” TNM

found that these technologies help eliminate waste and reduce friction by delivering immediate e ciencies and streamlining project management.

By thinking systematically across portfolios, realigning operating models, and embracing digital technology, mining and energy companies can mitigate risks and ensure more reliable project outcomes, the experts said.

Bain & Co. sees the sector's future of project management in integrated, technology-driven strategies that enhance e ciency and resilience, ensuring sustainable growth in an increasingly competitive landscape.

ADOBESTOCK/CORLAFFRA

Trial mining at Horizonte Minerals’ Araguaia nickel project in Brazil.

HORIZONTE MINERALS

politics&policy

New technocrat Mexican leader unlikely to be pro-mining

ELECTIONS | Climate scientist replaces ‘whim and bombast’

BY COLIN MCCLELLAND

Claudia Sheinbaum, a climate scientist, won Mexico’s election to become the country’s rst female leader and is expected to continue the anti-mining policies of outgoing President Andres Manuel López Obrador.

Sheinbaum secured the most ballots on June 2 in the nation’s 200year democratic history, about 60% of the vote, according to the country’s electoral authority. e tally also showed her coalition of parties secured more than two-thirds of the lower house of Congress, but fell just short of that mark in the Senate. e threshold is required to change the constitution without the opposition’s consent.

“ e country’s security situation and rising scal de cit, coupled with the strengthening of the Mexican peso, will represent critical challenges for her presidency,”

Colin Hamilton, BMO Capital Markets director of commodities research, wrote in a note on June 3.

“From a mining sector perspective it is unclear whether this will mean any li ing of restrictions, such as the de facto ban on

Feds

new open pit mines, though we would see this as only a possibility rather than a probability in the near term.”

Sheinbaum, a former mayor of Mexico City who has cited López Obrador as her mentor, campaigned on a platform of a ordability and promises to tackle corruption. e election saw the murders of around 37 candidates as drug cartels seek to control political outcomes.

To her bene t, the president-elect with a doctorate in environmental engineering, exercised a technocratic approach to crime as mayor and enlisted the business community. But she faces challenges such as low investment from foreign companies new to Mexico, gangs smuggling drugs and migrants into the United States and the erosion of democratic institutions that may target judges next, according to e Economist magazine.

“Sheinbaum’s to-do list is clear: tackle disorder, boost trade and investment and strengthen democracy,” the London-based publication wrote on June 2. “Yet is she really up to the task? One fear is that despite her technocratic credentials and style she is a captive of Mr López Obrador’s agenda.” e campaign saw Sheinbaum speak more about policy continuity and protecting López Obrador’s legacy than about her own propos-

als, the magazine noted. Her predecessor governed by whim and bombast, it said.

Peso falls

Mexico’s peso fell against the dollar a er the election as investors raised concerns about the ruling Morena party’s potential to be unchecked in Congress if it could attract a few more seats in the Senate to its policies.

e currency dropped 4.4% against the Canadian dollar to trade at the weakest level since November. One dollar bought 12.88 pesos just before the vote compared with 13.45 pesos near press time.

An opinion piece in e Wall St. Journal on June 2 warned Sheinbaum’s government may seek to directly elect Supreme Court justices, end proportional representation for congressional seats, and eliminate the Federal Economic Competition Commission and the National Institute for Transparency, Access to Information, and Protection of Personal Information. “ e reforms would be bad for Mexico, although in the short run things might not change much,” Mary Anastasia O’Grady wrote. “ e frog would boil slowly.” TNM

divert $3M rare earths sale from Chinese firm in ‘case of elevated interest for Canada’

CRITICAL

BY BLAIR MCBRIDE

The Canadian government has brokered the sale of stockpiled rare earths mined in the Northwest Territories by Vital Metals (ASX: VML), the company said on June 17, as Canada moves to keep its critical minerals out of Chinese hands.

Natural Resources Canada organized the $3 million sale of the rare earths, mined at Vital’s Nechalacho project, to the Saskatchewan Research Council (SRC), a Treasury Board Crown corporation overseen by the provincial government. It replaces a A$2.6-million ($2.3 million) sale announced in December to Chinese rm Shenghe Resources. Shenghe earned a 9.9% stake last October in the Australian company for A$5.9 million.

“We were presented with a case of elevated interest for Canada,” Vital managing director Geordie Mark told e Northern Miner by phone on June 17, though he declined to discuss details of government involvement in the sale.

“ is agreement highlights the strategic value and importance of the Nechalacho rare earths project, and the prioritization of a rare earths value chain in Canada,” Mark said in a news release. “ is sale is also bene cial in deriving value from our work at Nechalacho as we continue to advance the Tardi rare

“This agreement highlights the strategic value and importance of the Nechalacho rare earths project, and the prioritization of a rare earths value chain in Canada.”

GEORDIE MARK, MANAGING DIRECTOR, VITAL METALS

earths deposit as a long-life, largescale project with a scoping study to examine potential size and scalability of Tardi on track for delivery by the end of 2024.”

Grip on investment

e stockpile sale last December raised eyebrows, with some saying it

highlights the lack of investment by Canada in critical mineral projects.

But the stockpile had never le Saskatoon, Sask. and Vital hadn't bought back the rare earths from Shenghe because money in the deal had not yet exchanged hands, Mark said.

“Normally with overseas sales,

you get paid once it's on the ship,” he said, adding the new transaction doesn't change Shenghe's 9.9% stake in Vital.

Federal intervention in the Vital deal follows similar e orts since October 2022, when the government announced tougher foreign investment rules. A month later, it ordered three Chinese investors to divest their stakes in Canada-based battery metals companies. is year, two Canadian companies halted Chinese investment due to regulatory reviews. In May, Solaris Resources (TSX: SLS; NYSE: SLSR) cancelled a $130-million investment by China’s Zijin Mining for a 15% stake to aid the Warintza copper project in Ecuador. In March, Montreal-

based SRG Mining (TSXV: SRG) broke o a $16.9-million deal with China’s Carbon ONE New Energy Group to take 19.4% of the graphite miner.

Resource update

Vital updated the Tardi zone resource at Nechalacho in April by 79% to 31.1 measured and indicated tonnes grading 1.15% total rare earth oxides (TREO) for 358,000 contained TREO. at compared with the February 2023 resource. It also holds 181.6 million inferred tonnes at 1.17% TREO for 2.1 million contained tonnes.

Last September, Vital’s processing subsidiary Vital Metals Canada went bankrupt, following an operations review that found the half-completed, $55-million facility in Saskatoon wasn’t economical. e plant was to process rare earths mined at Nechalacho, located 110 km southeast of Yellowknife, which was brie y Canada’s only demonstration-scale rare earths production project. at plant is separate from the SRC’s adjacent rare earths processing facility of which began construction in 2021. e SRC says it expects the plant to be operational by the end of this year.

Vital shares traded for A0.3¢ apiece before press time, valuing the company at A$8.8 million. Its shares traded in a 52-week range of A0.2¢ and A1¢. TNM

Left and right: Vital Metals’ Nechalacho rare earths project in the Northwest Territories. VITAL METALS

Zocalo Square and Mexico City Cathedral. Claudia Sheinbaum is North America's first federally elected female leader. ADOBE/DIEGOGRANDI

indepth

How to attract Silicon Valley and Gen Zs to mining

TECHNOLOGY

| They’ll use AI, big data to improve the industry

BY COLIN MCCLELLAND

Silicon Valley could help the mining industry solve problems from funding to smelting but tech wizards shouldn’t necessarily run a mine, panellists told a conference on nancing trends in New York.

Tyler Hall, a 2023 Stanford graduate with a PhD in geology, co-founded ExploreTech to use data science and machine learning for drill planning and cloud computing. He says the San Francisco technology and venture capital hub is waiting for the industry to give it direction. He has also formed a WhatsApp group of 40 students across the world called the New Industrialists.

“It’s really an interesting trend that’s starting, but they don’t necessarily know where to look, or who to talk to, or where to go,” Hall told a May 21 session at the event run by the Society for Mining, Metallurgy & Exploration. “ ey really cannot wait to meet you because they want a deeper insight from people operating in the industry.”

Hugo Schumann, CEO of the silver unit at Hindustan Zinc, the world’s third-biggest silver producer, sees automation, digitalization, electric vehicles and drones being used in mines. Research is needed to conserve water and upgrade processing methods that

are decades old, he said.

Atusa Sadeghi, vice-president for North America at Denver-based private equity rm Resource Capital Funds (RCF), with about US$2.5 billion under management, says any company using new technology to improve its output or emissions deserves investor attention.

Millennials Hall, who’s worked in mining since 2013, and Sadeghi disputed Schumann’s premise that base metals such as nickel, zinc and iron ore are boring to Millennials and Gen Zs. ey are interested, Sadeghi said, but it’s more about the “ecosystem” that contains mining.

“What can you do to make the lives of those who are working outside in those environments easier, irrespective of what they’re min-

ing for?” she asked. “And when you talk through technologies that you’re seeing today, every day — AI, Gen AI, big data, analysis of synthesizing data — that’s really what people want to be excited for and contribute to.”

Taking mining to Millennials and Gen Zs shouldn’t be about appealing to those using sports betting apps and Reddit stock analysis, Kai Ho mann, CEO of Vancouver-based Soar Financial, said. Instead, try explaining projects on YouTube.

“Mining is very technical. You cannot dumb it down. You can simplify it, but you can’t get rid of it,” Ho mann said. “Be approachable, use those tools, use a decent camera, get a decent microphone and get in front of that audience.”

Chad Williams, founder of

Toronto-based Red Cloud Securities, said he’s concerned that as baby-boomers age and become more risk-averse, the Millennials and Gen Zs aren’t replacing them as investors. But every time the industry cycle performs well, it attracts naïve new investors who should use professional funds, he added.

“It scares me that some ultrahigh net worth individuals will be taken advantage of,” Williams said. “ ey are clearly out of their lane, out of their league, in terms of investing.”

Bio-mining

New technology could improve company decision-making by better linking all sta : mine operators, design engineers and C-suite capital allocators, Sadeghi said. One concept gaining interest among start-ups, she said, is bio-mining – using microbes to harvest metals such as copper, gold, uranium and nickel. RCF is among funders helping them acquire land to prove their concepts, she said.

Schumann focused on water.

Technologies to conserve it are becoming more important, especially as the world’s largest copper mines are in deserts such as the Atacama in Chile and the Sonoran in Arizona, but new mines face battles for water permits.

“It’s just a fascinating area that people maybe aren’t focused on yet enough,” Schumann said. “Water is

going to be a critical thing over the next couple of decades in mining.”

Ho mann said the industry needs innovation in processing so that high-arsenic copper can be smelted locally instead of being shipped to China. Schumann demurred.

“It is incredibly hard to compete with a country that’s going to use thermal coal blindly to generate power,” he said. “Smelters are incredibly energy intensive, and China and India are way ahead in the smelting game.”

Running a mine

Should a group of venture capitalists buy an existing mine?

“A terrible idea,” said Schumann, noting most Silicon Valley experience is limited to so ware and perhaps some decarbonization and energy-related technologies. “Owning a mine is a whole di erent skill set and they have no idea what they’re doing.”

But then KoBold Metals, backed by Bill Gates and Je Bezos, is “a bunch of Harvard PhDs” trying to build a mining company with its main Mingomba copper project in Zambia, Schumann said.

“ ey may succeed,” he said. “ ey’re really bright guys, but it’s just going to be really hard. Where Silicon Valley is playing in the mining industry is on the technology side, data science companies, where they understand more than owning and operating mines.”

Green bonds grow as financing option

BY COLIN MCCLELLAND

Green bonds are a rising source of funding as project developers widen their search for nancing beyond stock markets, according to a panel at a New York mining conference.

ere are more green bond products — debt designed to fund environmentally friendly projects — in more countries than there used to be, according to Erin Boeke-Burke, director and lead analyst for Americas sustainable nance at S&P Global Ratings. She put the amount at about 14% of the total bond market, or nearly US$1 trillion by the end of this year.

“It’s still not old enough to drive yet,” Boeke-Burke told a May 21 session at the event run by the Society for Mining, Metallurgy & Exploration. “ at said, it has grown up a lot over the last decade.”

A combination of fewer banks and funds supporting mining as in ation raises capital costs is requiring developers to tap multiple types of nancing besides traditional equity markets. ese include royalty companies, streamers, export credit agencies, traders and private equity and credit funds besides banks. Green bonds and sustainability-linked loans are a more recent development that help developers try to nance projects while improving mining’s environmental credibility. Canadian mining specialist funds

from a group of lenders including RBC, Mackenzie Investments and 1832 Asset Management fell to $2.8 billion in 2022 from $16 billion in 2010, according to Bloomberg gures presented at the annual conference on mine nancing trends.

Target-linked loans

Neil Pereira, principal investment o cer for metals and mining at the International Finance Corp. (IFC), the World Bank lender to the private sector, recounted nancing for an Allkem (TSX: AKE; ASX: AKE) green eld lithium project in Argentina last December. It comprised a green bond and sustainability-linked nancings with three key performance indicators: women in the workforce, reduced emissions and renewable energy.

In 2022, the IFC completed

nancing for Anglo American (LSE: AAL) in South Africa that nanced its local economic development program for schools, Pereira said.

“We coordinate very closely with host governments,” he said. “When you add it to the capex, you know, putting in renewable power for a community is almost negligible in the scope of the larger mining project.”

e bank is considering two projects. One is in an undisclosed but di cult jurisdiction where it lent money at lower than the market rate to attract investors and used a special purpose vehicle to pool investors’ funds. e nancing is tied to targets in gender, water use and renewable energy, he said.

e second is a mine where the operator wants nature-based solutions to meet global commitments on greenhouse gas reduction. e

“Even for critical mineral projects, it’s been difficult to be able to label them ‘green.’ For a battery project,

it’s a lot easier even though one needs the other.”

CHLOÉ TACCONI, DIRECTOR OF MINING, METALS AND INDUSTRIES FINANCE, SOCIÉTÉ GÉNÉRALE.

IFC is rehabilitating national forests and coastal wetlands in and around the operation, he said.

Greenwashing Chloé Tacconi, director of min-

ing, metals and industries nance at Société Générale, France’s third-largest bank by assets, said its most popular green products

By Order of C. Hardy, Vice Chair, Ontario Land Tribunal, dated May 27, 2024, Reynolds Sifferath Kosloskey, Charles Rudolph Kosloskey, Viola Marie Kosloskey or their executors, heirs, successors or assigns, and the Estate of James Ralph Kosloskey are ordered to pay $88.41 (Cdn.) to the Applicant, Gordon Roy John Harten and Laura Grace Harten, being the mining lands taxes for all surface and mining rights in, upon or under Parcel 1613, bearing PIN No. 31139-0027 (LT), situate in the Township of Abotossaway, District of Algoma. Payment may be made to Mr. G. Roy Harten, 20 Hiltz Road, Aweres Twp., Ontario, P6A 0E4. Failure to make payment or to request a hearing may result in an Order vesting all surface and mining rights in, upon or under the aforementioned Mining Lands in Gordon Roy John Harten and Laura Grace Harten pursuant to section 196 of the Mining Act, R.S.O. c. M. 14.

Tyler Hall and Alex Miltenberger, co-founders of start-up ExploreTech. EXPLORETECH

Anglo American used sustainabilitylinked financing for schools in South Africa. ANGLO AMERICAN

indepth

Considering M&A? Here’s what to ask

BUYOUTS | Partnerships, price, costs, management all figure

BY COLIN MCCLELLAND

Alarge copper miner in Chile only found it had been overpaying a royalty by a signicant amount a er three ownership deals and 20 years of operation, lawyer Greg McNab told a mining conference in New York.

“ ey took it in under the umbrella of an M&A exercise and they just assumed that ‘we’ll just keep doing it the way the company had been operating,’” the partner at Dentons in Toronto said. “So, you actually should just read that stu .”

It was just one of the due diligence tips to emerge from a panel at the event run by the Society for Mining, Metallurgy & Exploration. Others were about partnerships, price and closure costs. e May 21 discussion also mentioned mine plans, management and the environment.

ree experts from SRK Consulting, which has 45 o ces globally and has operated in more than 150 countries, lled out the panel.

It’s important to talk early and o en to partners such as companies, communities, Indigenous groups or governments and research them on social media, Je Parshley, an SRK consultant on the environment, mine closure and reclamation, told the panel. It can improve insight about them when time is short in a potential deal’s data room, he said.

“ at can give you some idea of whether you have supportive partners or not,” Parshley said. “And what the current buzz is on the project.”

Partnerships

Joint ventures, streaming and royalty agreements can harm projects if companies aren’t aligned in experience and expectations, said Matthew Sullivan, principal mineral economist at SRK.

“It can get very, very complicated very quickly and the project essentially stalls out,” he said. “Depending on where that streamer or royalty sits in the security structure, they may not care but it may make the project undevelopable.”

Streaming or royalties that are too high may restrict enough free cash ow to pay for debt or to sat-

> De Beers from P1

e wider industry also faces the challenge of lower demand, especially in the United States and China. De Beers cut the price of 0.75-carat stones by 4% to 6% at this year’s fourth trading session, according to a May 7 report from Rapaport. In the rst sale of the year, the company cut prices by about 10%.

e issue of declining production could be expensive for De Beers to deal with, BMO Capital Markets mining analyst Raj Ray implied.

“From the mining business point of view, not having a parent company like Anglo American backing De Beers could have some serious implications for diamond supply going forward,” he said.

Rough diamond supply has dropped to around 120 million carats from 150 million carats in 20172018, Ray said. It’s expected to drop even more in the next four to ve years.

Amid the supply constraints,

isfy an equity investor, Sullivan said. More potential di culties arise in joint ventures with minority holders competing for a slice when they hold rights of rst refusal, he said.

Determining a suitable price for a project depends on its development stage, the value of the commodity, and the company’s expertise, Sullivan said. Have they seen this before? he asked. Do they know what this price environment is capable of?

“Explorers really don’t know how to build a mine; mine builders really don’t know how to operate a mine and operators de nitely don’t know how to explore for new mines,” he said. “So, it’s really critical to understand what your management team actually is and how appropriate the stage in the project is for them.”

Discipline

Potential buyers should evaluate operators for discipline in a highpriced metal market, he said. ey shouldn’t cut corners to deplete a mine’s best ore to maximize pro t, leaving the buyer to contend with higher access costs later in a lowprice market.

“The cash flow model is almost always wrong.”

MATTHEW SULLIVAN, PRINCIPAL MINERAL ECONOMIST AT SRK

“ e cash ow model is almost always wrong,” Sullivan said. “If there’s a bunch of errors in it, hopefully they aren’t too impactful, but they are there.” e ease of a mine’s scalability should also be considered, Sullivan said. Is it a complex underground mine with expensive infrastructure, or an open-pit operation with a low stripping ratio that can be expanded easily? Can the property make money in a low-price metal market? Even if it’s not expandable, a mid-tier cash cost operation could be successful, he said.

“You have something that you can kind of bounce along the bottom and keep it running, keep everything in shape and people employed,” he said. “When the

De Beers has invested US$1 billion to extend the life of its agship Jwaneng mine in Botswana, and US$2.3 billion to move underground at the Venetia mine in South Africa.

“ e next 12 to 24 months don’t look great for the rough diamond industry,” Ray said. “Anyone looking at De Beers will have to acknowledge (that). ere's huge

capital investments that are needed over the next few years across mines to be able to maintain supply, forget about growing supply.”

But despite that hurdle, Ray and Zimnisky both see De Beers maintaining its 30% share of the global diamond market.

“ ey’ll continue to be the pre-eminent producer in the world,” Ray said. “Anyone who will buy (De

ment requirements, but not how a miner would actually rehabilitate a site, Parshley said. ey may even turn a mine’s net present value negative. Plus, industry guidelines for seismic and storm stability are getting stricter.

Potential buyers also should beware of some jurisdictions that don’t require assessments of longterm post-closure costs, and those could need perpetual water management.

“You’re now signing up for the long term,” he said. “We’re talking millions of dollars a year.”

ESG

SRK usually applies international standards for environmental, social and governance (ESG) issues because many methods, such as the Equator Principles, are vague, Parshley said. e rm must educate clients a fair bit, he said.

O en, ESG is considered a last-minute checklist to avoid “landmines,” McNab said. Companies should instead integrate the target company’s ESG process with their own.

Battery metals

e industry’s new emphasis on battery metals brings new legal concerns over the di erent levels of funding and pledges, sometimes from other countries like the United States supporting projects in Canada, McNab said.

“It can get quite complicated about where the money to fund the project is actually going to come from,” he said. “You have to spend a lot of time looking for things such as actual de nitive commitments because they’re sometimes buried in kind of owery commitments that can change when governments do.”

O ake deals are becoming more common as automakers and original equipment manufacturers (OEMs) secure battery materials. But they carry risks.

“If something happens and that OEM doesn’t want the material that comes out of that operation, the operation fails,” he said. “ eir major o -taker is gone.”

Nearly all mine closure cost estimates in data rooms are too low because they’re based on govern-

Beers) will continue to fund its projects. I don’t see any signi cant drop in production from the De Beers portfolio.”

Going solo?

Once De Beers formally leaves Anglo as part of the company’s restructuring, which CEO Duncan Wanblad has said could take 18 to 24 months to complete, the diamond miner will face the prospect of being purchased or going alone.

Zimnisky said either option has its own di culties.

“ is is something Anglo has wanted for a while,” he said. “ ey wanted Anglo to become more of a pure play copper producer, or a green infrastructure buildout commodity producer hoping it would lead to a higher valuation for the company. at said, De Beers is a complicated business and not easy to sell. It has (the) Debswana joint venture, which is the crown jewel of the company.”

Debswana is a 50-50 JV with Botswana that operates De Beers’

“ e only way you can do that is to nd out exactly what they’ve been doing,” he said. “ at is such a broad bucket that people don’t normally want to break it down.”

Companies should trust but verify when assessing a deal, said Parshley, citing a Russian proverb that Ronald Reagan applied to Cold War arms talks. e consultant recounted one company’s pledge that it had Indigenous OK for a tailings site when investigation found only 10% was approved. at meant delaying the project for about a year.

e panellists said more funding deals and ESG requirements make a data room’s organization important. Recalling a small heap leach miner in the Sierra Madre mountains, Parshley said some clues are in how tidy a company is.

“You could have eaten o the oor. I had never seen anything quite like it and when we started digging in, we found out that these guys ran a very, very tight operation,” he said. “You look in the corner and there’s a mess, that usually sends up a bit of a red ag.”TNM

diamond mines there.

Ray agrees that few potential buyers would have interest in a company like De Beers whose business requires massive capital investments. An IPO is also unlikely, he said.

“ ere’s little interest in the diamond sector from an equity perspective. I don’t see how in a potential IPO there’s enough interest in a new diamond story,” Ray said. “ is has to be a private sale or consortium that needs to come in and take a longer-term view of the diamond sector. ere could be growth expected in the retail segment. at’s where I think anyone taking a look at De Beers would see the value.”

Neither analyst sees the De Beers sale having much impact on the ailing diamond juniors.

“In order to stimulate exploration across the industry you would have to see a notable diamond price recovery,” Zimnisky said. “Prices have been at for almost a decade now.” TNM

Debswana mining machinery in Botswana. DEBSWANA

ADOBE /BAS 121

price spikes, you can actually take advantage of that price change.”

indepth

US lithium clay projects secure backing despite extraction hurdles

BATTERY METALS | Federal funding key to unlock huge clay-hosted deposits

BY HENRY LAZENBY

The United States’ great hope for domestic lithium supply could lie in the massive-scale, long-life sediment-hosted deposits in its southwestern region. And even with tricky metallurgy to overcome and higher price tags than brine or hard rock deposits, experts say that with federal backing, these operations could become the continent’s energy transition backbone.

Most of the country’s sediment-hosted lithium projects are in Nevada. Projects like Lithium Americas’ (TSX: LAC; NYSE: LAC) acker Pass, Ioneer’s (NASDAQ: IONR; ASX: INR) Rhyolite Ridge, and Century Lithium’s (TSXV: LCE) Clayton Valley have big potential that’s drawing strategic investment.

Lithium clay projects are particularly important for North America as a domestic source of the mineral, which is critical for the energy transition and the growing demand for electric vehicles (EVs), according to Allan Pedersen, principal analyst for lithium with Wood Mackenzie.

“ e metallurgy of extracting lithium from clay (sediments) is more complex and less proven than from brine or hard rock sources,” Pedersen said in an interview.

“Despite their complexity and high capex, these projects are crucial for ensuring a stable, secure supply of lithium, reducing dependency on foreign sources, and supporting the broader goals of national security and economic growth.”

Lithium prices have dropped by two-thirds since last summer to US$13,800 per tonne lithium carbonate in mid-June, according to Trading Economics.

Even so, lithium exploration and development in the U.S. have been boosted by growing demand for EV production, new extraction technologies and supportive government policies.

U.S. President Joe Biden’s 2022 In ation Reduction Act and other measures have focused on bolstering domestic supply and processing to establish a fully integrated North American lithium-ion battery supply chain.

National security concerns

Currently, about 65% of lithium worldwide is processed in China. However, U.S. lithium production is projected to increase 13-fold thanks to tax credits and other subsidies in the In ation Reduction Act.

e International Energy Agency reports that demand for lithium in batteries last year was around 140,000 tonnes, an increase of over 30% compared to 2022, with batteries representing 85% of total demand. Benchmark Mineral Intelligence estimating a de cit of over 3 million tonnes of lithium by 2040, equivalent to 50 acker Pass projects.

“ e United States will consume about a million tonnes of lithium carbonate equivalent by early next decade,” Ioneer managing director Bernard Rowe said in an interview. “Ensuring a secure and stable domestic supply is not just about bringing more lithium into the market; it’s about national security and maintaining a competitive edge in the global EV market.”

“The main challenge for sedimenthosted lithium deposits lies in the extraction process — which hasn’t been done yet on a commercial scale. ”

Cost comparison

Lithium clay projects under development are expected to have moderate to high operating costs due to complex chemical processing, positioning them between lower-cost brines and higher-cost hard rock mining. While brine projects bene t from cost-e cient solar evaporation, and hard rock projects face high energy and processing expenses, lithium clay projects could be competitive if scaled eciently, Pedersen said.

Lithium Americas, whose US$2.9-billion acker Pass is the most advanced sediment-hosted project in the U.S., announced backing from the U.S. Department of Energy (DOE) in March. e miner has a conditional commitment for a loan of US$2.2 billion — the largest-ever loan to a mining company from the DOE’s Loan Programs O ce. e loan is to help nance the construction of processing facilities at its project, which has the potential to become North America’s largest source of lithium for EVs. e plant is projected to produce an initial 40,000 tonnes of battery-grade lithium carbonate per year.

It also has the support of automaker General Motors, which invested US$650 million in Lithium Americas for an exclusive o ake deal for the rst 15 years of production, slated to start in 2027.

Metallurgically challenged e U.S. does have one producing lithium mine — Albemarle’s (NYSE: ALB) Silver Peak in Nevada — but it’s a small-scale

brine operation.

e main challenge for sediment-hosted lithium deposits lies in the extraction process — which hasn’t been done yet on a commercial scale. Unlike brine or spodumene projects, extracting lithium from clays requires handling ne particulate matter and achieving e ective solid-liquid separation to recover economically.

Creating a commercially viable ow sheet is crucial, Pedersen said. While proponents say their respective bench-scale testing has been successful, he warns that scaling up to commercial production introduces new investment risks.

Because of their scale, sedimentary deposits usually require fully integrated mine-to-downstream market operations, which means much higher pre-production capital costs than brine or hard rock developments, Pedersen said. Re ning material to higher-value downstream products such as lithium carbonate or hydroxide fetches higher market prices and consolidates the supply chain from a national security standpoint.

“Building vertically integrated operations, including mining, extraction, and processing facilities, results in high upfront costs, while navigating federal, state, and local permitting processes can cause delays,” he said. “Environmental concerns, such as impacts on local water supplies and ecosystems, add layers of uncertainty.”

Unique flow sheets

Lithium Americas has developed a unique extraction process tailored to acker Pass, which involves leaching lithium from clay using sulphuric acid. Its process has undergone extensive bench-scale testing and pilot plant operations, Lithium Americas’ vice-president of government and external a airs, Tim Crowley, said in an interview. e company had invested hundreds of millions of dollars to de-risk and re ne the ow sheet in the laboratory.

“We've done extensive drilling, engineering, and piloting work, and we are pleased with the results,” he said in an interview. “ is condence is re ected in our successful partnership with General Motors and the conditional loan commitment from the DOE.”

In southwestern Nevada, Century Lithium has been testing the