EXCLUSIVE:

Barrick CEO Bristow drives another U-turn in a remote land

Hands-on leader has penchant for tackling troubled assets

BY COLIN MCCLELLAND

Barrick Gold (TSX: ABX; NYSE: GOLD), the second-biggest gold miner by market value, has poured its rst gold in Papua New Guinea in nearly four years as CEO Mark Bristow marks another turnaround in a career coupling value investing with local partnerships.

e Porgera mine in the hills of the Paci c island country was under care and maintenance from April 2020 to December 2023 while Barrick and partner Zijin Mining renegotiated terms with the government. Hiring is going better than envisioned and the mine will ramp up this year, Bristow said in an exclusive interview with e Northern Miner on March 5.

“Last Friday we poured our rst bar of gold under the new company – we don’t make too much fuss about it,” Bristow said with a laugh in the Barrick headquarters in Toronto before turning more serious. “We’ve got some work to do re-erecting the power towers a er people blew them up.”

“Mining rights are binary. You either have a mine or you don’t. You can’t sort of say ‘I’m in a tough jurisdiction, so I’m going to discount it by 20%.’ I mean, there’s no such thing.”

MARK BRISTOW, BARRICK GOLD CEO

Tribal con icts and protests have downed power lines several times since Porgera started production in 1990 under Canada’s Placer Dome, which Barrick acquired in 2006. Such unrest might continue even with the new agreement, as assaults on illegal miners and toxic waste claims have dogged the operation, like at the Acacia mine in Tanzania.

risky is about building partnerships because without permissions, the mines shut, Bristow says.

But Bristow, who’s led the company since it merged in 2019 with the South African company he built, Randgold Resources, transformed Acacia a er what he called “a great deal for a crippled organization.”

Barrick held 72% of Acacia but no management control when authorities shut it down, forcing the company to take it private and renegotiate operations over several years. At the giant Reko Diq copper project in Pakistan, it took a decade to resolve arbitration in Barrick’s favour, and four years to sort out Papua New Guinea’s nationalization of Porgera.

Reko Diq

Now, Porgera has an ownership structure where locals control more than half the company and its pro t, similar to how Barrick is developing Reko Diq with half split evenly between the central government and the province of Baluchistan, leaving Barrick with half. Operating in locations deemed

“It’s all about licence to operate,” he said. “Mining rights are binary. You either have a mine or you don’t. You can’t sort of say ‘I’m in a tough jurisdiction, so I’m going to discount it by 20%.’ I mean, there’s no such thing.”

All gold miners have beneted from the metal achieving record prices — US$2,182.72 per oz. on March 11 — which Bristow ascribed to global risks such as slackening economic growth and rising geopolitical tensions.

“ e Chinese Communist Party came out with a 5% growth forecast, which is not good for anyone, and a messaging that that they’re pivoting away from a construction-driven economy,” he said, then turned to wars. “ ere’s this de-globalization, so we see it because of costs, particularly in the logistics supply chain.”

Barrick’s gold and copper production fell slightly in 2023. e

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 1 PDAC finance panel dissects decline of Canada’s once-mighty junior sector / 11 905 841 5004 | geotech.ca VTEM™ | ZTEM™ | Gravity | Magnetics Geotech_Earlug_2016_Alt2.pdf 1 2016-06-24 4:27:20 PM WWW.SGS.COM/MINING MINERALS@SGS.COM DELIVERING QUALITY EXPERTISE GLOBALLY ACROSS THE ENTIRE MINING LIFE CYCLE expert advice from exploration to closure .com APRIL 2024 / VOL. 110 ISSUE 4 / GLOBAL MINING NEWS • SINCE 1915 / $5.25 / WWW.NORTHERNMINER.COM PM44082538

PDAC |

ESG metals premiums? / 10 Barrick Gold P10 > specialfocus LATIN AMERICA Miners dig Ecuador’s new president; plus the hunt for precious and critical minerals. / 31–35 DST is engaged in the development and commercialization of environment-friendly technologies for the treatment of materials in the mining industry. Through the development of patented, proprietary processes, the CLEVR and GlassLock processes, DST extracts precious and base metals from mineralized material, concentrates and tailings, while stabilizing contaminants such as arsenic, which could not otherwise be extracted or stabilized with conventional processes because of metallurgical issues or environmental considerations. http://dundeetechnologies.com/home info@dundeetechnologies.com

Barrick Gold CEO Mark Bristow. COLIN MCCLELLAND

Taseko Mines’ Gibraltar copper mine in British Columbia, in October 2023.

CREDIT: HENRY LAZENBY

inbrief

DEPARTMENTS

SPECIAL SECTIONS » Latin America 31

n Glencore’s emissions jump

Mining and commodities trader Glencore has reported an 8.8% in its carbon emissions for 2023, reversing the downward trend of recent years. Expand coal production and the restart of an oil re nery in South Africa that was closed by an explosion were behind the jump.

e Swiss company reported a total of 432.8 million tonnes of carbon dioxide equivalent for the year.

In its 2024-2026 Climate Action Transition Plan, Glencore noted it was still “on track” to meet its 15% reduction of carbon dioxide equivalent emissions for its industrial assets from 2019 levels by the end of 2026, and of 50% by the end of 2035. e rest of Glencore’s revised climate plan is much like a previous plan it released — but this time includes the interim 2030 target.

Glencore published its rst climate action plans in 2020. One of the top global thermal coal exporters, it has faced backlash for being one of the few top miners still involved in the extraction of the fossil fuel. It has committed to run down its coal mines by the mid2040s, closing at least 12 by 2035.

BY MINING.COM STAFF

n AME critiques BC

British Columbia’s mining sector is being sidelined in the province’s push to overhaul regulations around mineral claims, the Association for Mineral Exploration (AME) said in March.

In the court-mandated overhaul of the Mineral Tenure Act (MTA), which must be completed by early 2025, the industry has been reduced to listenonly status, AME president and CEO Keerit Jutla says. e industry was caught by surprise when B.C. issued interim orders to protect Gitxaala Nation and Ehattesaht Nation’s mineral interests on March 7, and also outlined a process for cooperation and consultation for modernizing the act.

“Industry and stakeholders are not being engaged

in the manner and weight and importance that we should be,” Jutla said. “We’re getting brought in on these issues at the very last minute. And when we are, we’re being asked to sign NDAs and to kind of listen to feedback. But that’s all it is, feedback; it’s not input into a decision being made.”

B.C.’s Energy, Mines and Low Carbon Innovation ministry said the interim measures were implemented following an agreement with Gitxaała and Ehattesaht nations.

e measures respond to a September B.C. Supreme Court decision requiring consultation with First Nations before mineral title registration and mandating B.C. to revise the MTA within 18 months to incorporate those requirements. Following the new measures, First Nations temporarily halted some appeals, impacting mining activities and new permits in Gitxaała and Ehattesaht territories.

BY NORTHERN MINER STAFF

n Net-zero within reach?

Solar energy will dominate the mining industry by 2040, or it will take an additional 20 years, according to two new executive surveys from di erent sides of the globe.

Mining leaders from companies such as Rio Tinto, BHP and South32 predict solar will be their main energy source in 15 years, the Australian industry group State of Play says.

In San Francisco, management consultant Bain & Co. says 62% of industry leaders in oil and gas, utilities, chemicals, agribusiness as well as mining told it the world will take at least until 2060 to reach net-zero carbon emissions. at’s up from 54% last year as companies encounter more customers who don’t want to pay for the transition, Bain said.

Down Under, mining leaders predict oil and diesel will only contribute around 20% of the industry’s future energy, with 79% indicating solar will be the main power source over the next decade and a half.

BY NORTHERN MINER STAFF

2 APRIL 2024 | THE NORTHERN MINER www.northernminer.com

2 In Brief 4 Op-Ed 5 Commentary & Analysis 10 In Depth 17 Done Deals 18 Project Updates 20 Eye on Australia 21 Mining, Metals & Markets 38 Executive Q&A 38 Company Index

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 3 2024 PLATINUM SPONSORS MINING COUNTRY SPONSORS PATRON SPONSORS ® PREMIER SPONSORS GOLD SPONSORS DIAMOND SPONSOR THANK YOU TO OUR VALUED SPONSORS SAVE THE DATE: MARCH 2–5, 2025 | pdac.ca/convention

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Alisha Hiyate ahiyate@northernminer.com

MANAGING EDITOR: Colin McClelland cmcclelland@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING:

Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

opinion

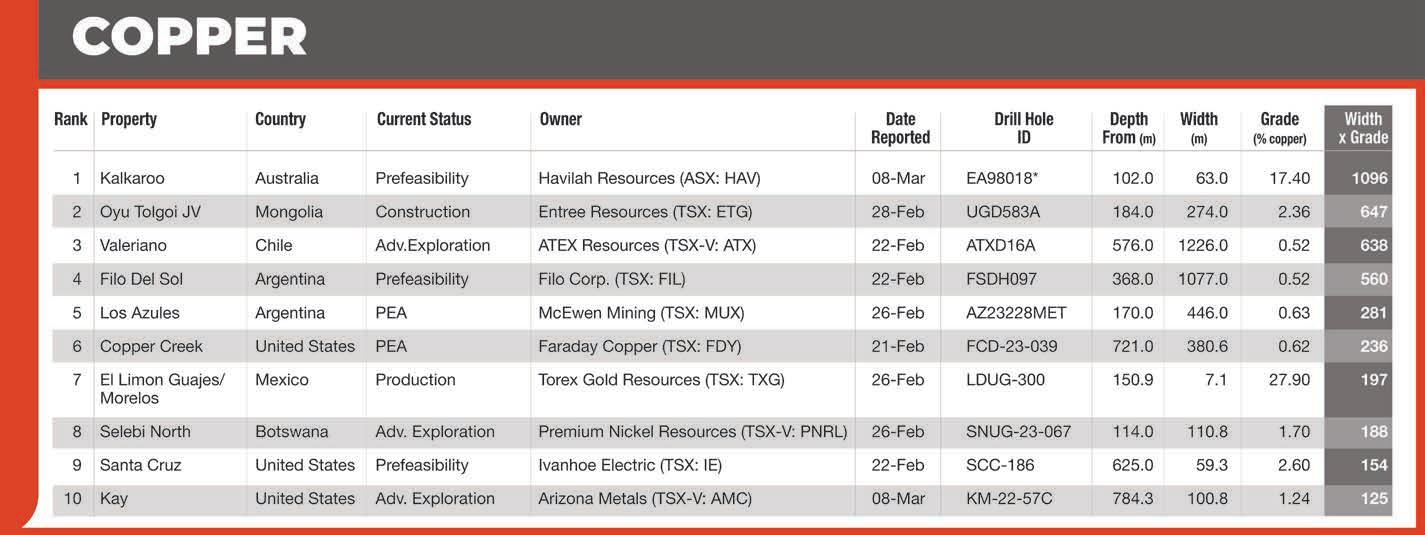

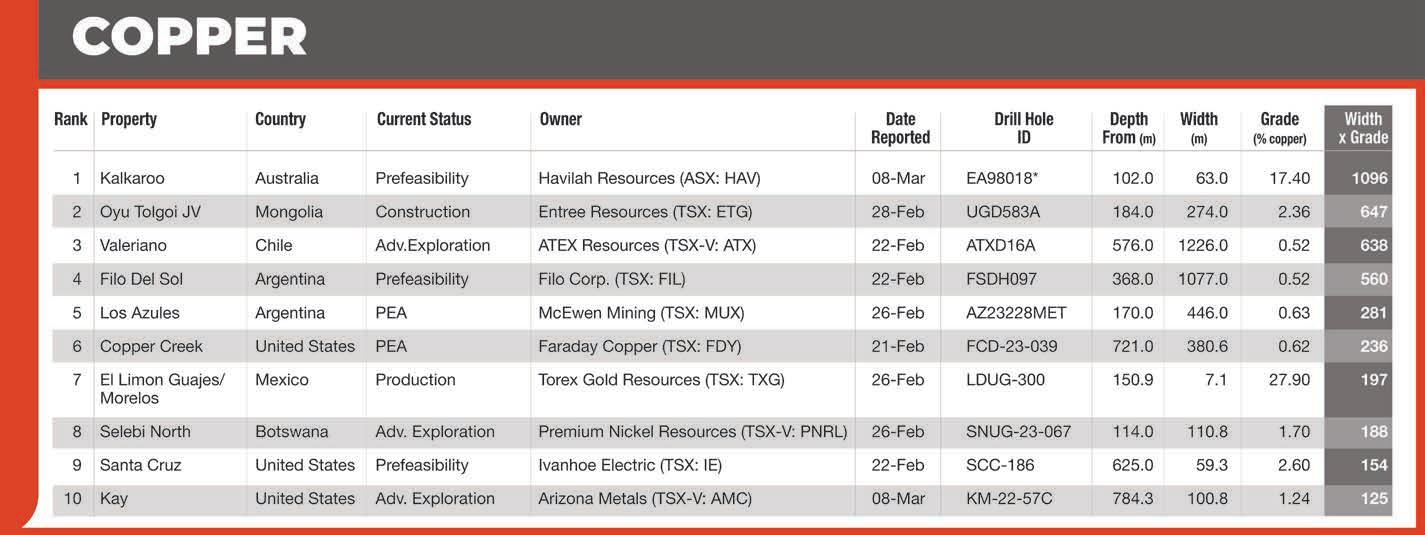

Explaining the copper conundrum

BY ALISHA HIYATE

BY ALISHA HIYATE

Arguably, no one is more aware of the coming copper shortage than copper miners themselves.

Glencore CEO Gary Nagle warned in late 2022

— just months before it made a play for Teck Resources, whose Quebrada Blanca 2 mine in Chile is one of few recent new copper builds — of a coming “huge copper de cit.”

e world’s largest miner, BHP, estimates the industry might need to spend US$250 billion by 2030 to bring 10 million tonnes of new copper production online, the amount needed in a “plausible upside demand scenario.”

In comparison, it said that last year, only 340,000 tonnes of new production had been formally sanctioned. at’s only 3.4% of the total that may be needed.

So why, then, are copper producers not building more new mines?

e simple fact is that capital costs have increased but copper prices aren’t high enough to compensate. at’s made M&A the smarter path, as evidenced by BHP’s takeover of Oz Minerals, Rio Tinto’s purchase of Turquoise Hill Resources, and here at home, Hudbay Minerals’ acquisition of Copper Mountain Mining.

Hudbay’s last build, its Constancia copper mine in Peru completed in 2014, illustrates the scale of cost increases over the past decade.

“ e capital intensity of Constancia is about half of the capital intensity of new projects that have been recently completed or on the verge of being completed,” Candace Brule, the company’s vice-president of investor relations, said at a recent critical minerals panel in Toronto organized by Marsh, a big player in mining insurance.

“We look at that metric and we determined that it was actually cheaper to go out and buy existing production than it was to take those risks to sanction a new project.”

Long-term thinking

Rising costs and commodity prices that aren’t high enough to justify new production are only part of the problem.

Miners naturally think long-term. e biggest, like BHP, evaluate projects over 50 and 100-year time frames.

Investors, on the other hand, are less patient.

At the Prospectors and Developers Association of Canada convention in March, mining luminary Pierre Lassonde quipped that while portfolio managers expect quick returns, “in our business, instant grati cation is like 10 years.”

Recalling a recent conversation with a BHP executive, Lassonde noted that while the company’s bar to invest in projects is a relatively modest 12-15% rate of return, over a 50-year period that climbs to 28%.

“ ese are the large copper mines that essentially catch two or three cycles in the metal and each time there’s a cycle, they can deliver a huge rate of return,” Lassonde said.

If there’s hope to get more parties outside of miners to think long-term on metals, it lies in the energy transition, which has governments rediscovering the importance of mining and entire supply chains to their future economies.

Unfortunately, incentive schemes like the United States’ 2022 In ation Reduction Act (IRA) stimulate investment in the wrong end of the value chain, Paul Mitchell, EY’s global mining & metals leader, said during the Marsh panel.

“ e IRA is incentivizing production of hydrogen and manufacturing of batteries. Neither of those things can happen without minerals,” Mitchell said. “ e government policies need to either reduce the cost of production or reduce the capital intensity of building a mine.”

We haven’t seen policies that address that yet.

e good news is that banks seem to be warming up to mining.

“In the last three or four years, there’s been a massive change,” Enrique Rico, global head of structured trade at Spanish bank Santander, told the Marsh panel. Only three or four years ago, the bank’s risk committee would dismiss mining transactions as “crazy,” he noted.

Contrast that with the bank’s risk committee approving nancing in February for a lithium mine in the Americas, which was celebrated with clapping.

“ ere’s an absolute huge di erence in the appetite of the bank,” he said.

More clapping could be on the way, if the coming copper crunch is as bad as the miners themselves expect.

TNM news is month, we’ve also got some TNM speci c news to announce.

First, in this issue, you’ll notice a brand new section, Eye on Australia. Canada and Australia have always been mining rivals, but the Aussie market of late has shown much more strength – for reasons we’ve discussed before in these pages. Canada has also bene ted from Aussie expertise as a ood of talent and Oz-headed companies have moved north in recent years. Keep watching this section, spearheaded by our Western Editor Henry Lazenby, as we expect to see it grow under his watch.

And our big congrats to Colin McClelland, previously a senior sta writer, who has been promoted to managing editor of e Northern Miner is is a new position in recognition of the rst-rate work Colin has done since he joined us in September 2022. His insightful features o en grace our front page, and his work consistently tops the most-read stories on our website. He’s also a master of the site visit video and was an essential contributor to the redesign of the paper last fall and on digital strategy.

As always, please feel free to reach out to any member of our team with questions, feedback, or story ideas. TNM

Contrarian opportunity or portfolio suicide?

BY JAMES COOPER

BY JAMES COOPER

Today, I’m taking a deep dive into the ill-fated nickel market.

If you’re a close follower of commodity markets, you probably know the problems a icting this sector. Surging output from Indonesia’s nickel laterite mines has ooded the market with new supply.

And if you’ve been listening to the commentary on nickel’s woes, you’ll probably consider this an uninvestable sector. Supply gluts are set to exceed last year’s numbers, according to some analysts.

In response, Australia’s nickel mines are shutting up shop. Andrew Forrest’s Wyloo Metals put its nickel operations in Kambalda, Western Australia, recently acquired through a takeover of Mincor Resources, on care and maintenance.

Meanwhile, BHP’s (NYSE: BHP; LSE: BHP; ASX: BHP) Nickel West operations have also been put on notice. e global response to oversupply has been predictable and unanimous. Operations are shiing into care and maintenance. Over time, that will take supply o the table.

While it will take time, Indonesia’s dominance could create structural problems for the global nickel market.Concentrating supply into a single region will make the sector less responsive to rising demand.

It also exposes the nickel market to sudden production cuts.As mines close abroad, the country has free rein to reduce supply and in uence prices. Indonesia is truly becoming the OPEC of nickel!

But there’s more than meets the eye regarding this important industrial metal. So, let’s tap into the nitty gritty before unpacking possible opportunities.

Nickel geology

Nickel deposits come in two forms: hard rock sulphide deposits, which consist of nickel-bearing minerals known as pentlandite and nickel laterite deposits.

Sulphide deposits are scattered worldwide, from northern Europe, South Africa, Canada and Western Australia.

We then have the laterites, which typically form in high-rainfall equatorial regions.As rain dissolves and removes minerals and elements from the soil it leaves behind immobile elements like nickel, iron and aluminum. at leads to a natural concentration of nickel in these regions. ere are outliers. Shi s in the global climate over geological history have enabled places like arid inland Australia to form laterite deposits. is region was once bathed in tropical rainfall and lush jungle.

But of the two sources of nickel, sulphides are far easier to process and re ne into high-purity products, the ideal choice when it comes to EV battery material. For this reason, sulphide miners have

“Sulphides are far easier to process and refine into high-purity products, the ideal choice when it comes to EV battery material.”

retained a competitive edge.

However, that started to shi in 2018 when the world’s largest nickel producer, China’s Tsingshan Holding Group, announced a US$700-million plan to produce battery-grade nickel from nickel laterites.Processing laterite ore into high-purity nickel uses a system known as high-pressure acid leaching (HPAL). e innovation unlocked a swathe of new supply and Indonesia’s nickel output exploded a er integrating HPAL technology in 2018.

Cloudy data in nickel outlook

In early March, the Macquarie Group’s nickel expert, Jim Lennon, claimed supply gluts could be overblown.

at assessment was based on a recent visit to China which led Lennon to conclude that the demand for stainless steel and other nickel alloys is far higher than the o cial numbers report. According to Lennon, nickel inventories are also far lower than the stated gures.In other words, he believes the consensus forecast of a nickel oversupply is wrong. It’s an interesting perspective. Chinese o cials are known for under or over-reporting gures to suit political motives.

But are Lennon’s observations, alone, enough for investors to move into this beleaguered market? Perhaps.

Resource stocks coming o a low base can result in large ‘recovery gains’ as sentiment creeps back into the market. It’s also worth noting that U.S. o cials recently excluded Indonesian nickel from lucrative tax credits as part of its In ation Reduction Act (IRA). at’s thanks to a tight interlink between Indonesian operators and Chinese investors.

So, where does that leave investors?

Everything is not what it seems in the nickel market and that’s where contrarian opportunities are born. Given that China plays a major role in supply and demand, this suggests there could be a lot more to this story. e data remains cloudy, meaning there could be more surprises in the months ahead.

A prime value opportunity may emerge with several nickel producers and explorers trading at multiyear lows, a theme I’ll explore over the coming months.

TNM

James Cooper runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

4 APRIL 2024 | THE NORTHERN MINER www.northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com ADDRESS: Toronto Head O ce 69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com SUBSCRIPTION RATES: Canada: C$130.00 one year; 5% G.S.T. to CDN orders. 7% P.S.T. to BC orders 13% H.S.T. to ON, NL orders 14% H.S.T. to PEI orders 15% H.S.T. to NB, NS orders U.S.A.: C$172.00 one year Foreign: C$222.00 one year GST Registration # 809744071RT001 (ISSN 0029-3164) CANADA POST: Return undeliverable Canadian addresses to Circulation Dept. c/o The Northern Miner 69 Yonge St., Suite 200 Toronto, ON M5E 1K3 Publication Mail Agreement # 44082538 Periodicals Postage Rates paid at Niagara Falls, NY, 14304. U.S. o ce of publication 2424 Niagara Falls Blvd, Niagara Falls, N.Y. 14304. U.S. POSTMASTER: send address corrections to: Northern Miner Box 1118 Niagara Falls, N.Y. 14304.-7118 THE NORTHERN MINER is published monthly by The Northern Miner Group, a division of EarthLabs Media Inc., a leading media and technology company serving the mining industry. From time to time we make our subscription list available to select companies and organizations whose products or services may interest you. If you do not wish your contact information to be made available, please contact us by one of the following methods: Phone: 1-888-5023456; Fax: (416) 447-7658; Mail to: Privacy O cer, The Northern Miner, 69 Yonge St., Suite 200, Toronto, ON M5E 1K3

COMMENTARY

EDITORIAL

commentary&analysis

Analysts expect rebound in lithium prices, equities

TRENDS | Mine closures, project deferrals ‘signal bottom of cycle’

BY BLAIR MCBRIDE

Prices for lithium and the stocks of companies trying to mine it are poised to rebound by July although they’re unlikely to resume the boom times of two years ago, Canaccord Genuity analysts say.

e investment bank forecasts lithium to reach US$16,000 per tonne for chemicals and US$1,200 per tonne for spodumene concentrate in the year’s rst six months compared to prices on March 8 of US$15,009 a tonne for lithium carbonate and US$1,105 per tonne for spodumene.

e removal of high-cost supply from the market, which limited production and deferred projects, plus robust growth in demand from electric vehicle production are factors backing the assessment, the analysts wrote on March 8.

e report comes as lithium carbonate, a precursor to lithium hydroxide used in batteries, was down from about 170,000 yuan (US$23,658) per tonne in September and 80% lower than in 2022, according to Trading Economics. e price drop has led some miners to cut production and costs. Core Lithium’s (ASX: CXO) Finniss mine in Australia halted operations in January and signicantly wrote down the value of its assets. Its CEO and a board member resigned in March a er the company reported a $167.6-million half-year loss. In January, Sayona Mining (ASX: SYA; US-OTC:

“We see reasons to be more optimistic towards lithium equities as pricing bottoms, with preferred exposures focused on incumbent producers and low-capex, near-term development plays.”

SYAXF) launched a cost review of its 75%-owned North American Lithium operation in Quebec and laid o 14 sta .

“Mine closures and project deferrals (are) a classic bottom of the cycle signal,” Canaccord said.

‘Goldilocks zone’

Prices for the sector will enter a more sustainable “Goldilocks zone” denoting prices that aren’t too hot as to spur high-cost supply and not too cold as to cause supply disrup-

tion, such as less than US$1,000 per tonne of spodumene concentrate, Canaccord said. Current prices are well below levels enticing enough to support new projects. ey must rise by at least 6% for the metal and 18% for lithium carbonate if projects are to be economical, the company said.

Prices from the end of last year and into this year were too low, which caused disruptions across

Australian spodumene, African direct ore shipping and Chinese lepidolite operations, typically the most expensive lithium mines.

Canaccord wrote that it’s reasonable for spodumene to trade as high as US$1,800 per tonne, and for lithium chemicals such as carbonate to trade as high as US$25,000 per tonne before supply is turned back on.

“If lithium markets and supply chains are to mature, we believe pricing within a sustainable ‘Goldilocks zone’ would represent the best outcome for EV adoption and development of the supply chain,” the analysts wrote

Canaccord estimates the market

was in a minor surplus last year and now expects the same into 2025. It also sees the potential for surpluses to switch to de cits, leading to risks of higher prices. Material de cits are forecast to emerge in 2027.

Equity rally

Some optimism has returned to equities in February and early March as reports of mine closures and project delays put uncertainty over current and future supply, the investment bank said.

“We see reasons to be more optimistic towards lithium equities as pricing bottoms, with preferred exposures focused on incumbent producers and low-capex, nearterm development plays,” it said. “Equities appear to be leading the rally; however, spot chemical/ spodumene prices are trading relatively at and appear to be lagging.”

Canaccord says it’s more condent in its current view that lithium has bottomed than it was last May due to production prices for lithium carbonate equivalent recently falling across several producers.

ose prices have made production from higher cost integrated Chinese lepidolite marginal.

Chinese spot prices for lithium carbonate, hydroxide and concentrate have risen by 14%, 17% and 7%, respectively, since late January 2024, Canaccord said. Lithium carbonate has already risen higher than its late February level, when it sat at 96,843 yuan (US$13,469) per tonne, its lowest level since the summer of 2021. TNM

Central bank buying, financial risk pushes gold to record, Smallwood, Bristow say

MCCLELLAND

BY COLIN

The price of gold hit new records in March as central banks increased bullion buying and concerns mounted about slowing global growth even as stock markets reached new heights.

Gold brie y traded above US$2,200 per oz. on March 21 before easing to US$2,176.70 per oz. closer to press time, still up 6% this year. China raised its imports of non-monetary gold by 53% to 372.2 tonnes during the year’s rst two months compared to a year ago, its customs data show. at aligns with record turnover on the Shanghai Gold Exchange, BMO Capital Markets said in a note on March 20.

“We see China’s gold demand as an underappreciated factor in helping drive prices to record nominal highs in early 2024,” BMO commodities analyst Colin Hamilton said.

Wheaton Precious Metals (TSX: WPM, NYSE: WPM; LSE: WPM) CEO Randy Smallwood said the central banks of Singapore, Turkey and Poland increased their gold buying in addition to China.

“A lot of those sovereign banks have pretty healthy U.S. dollar

reserves in there and I really look at it as they’re swapping out U.S. dollars for gold and that’s what’s pushing gold prices up,” Smallwood said on CNBC on March 19. “It’s just a shi towards that safety, that security.”

Financial risk and slowing growth are also part of gold’s price rise, according to Barrick Gold (TSX: ABX; NYSE: GOLD) CEO Mark Bristow.

“ ere are multiple things but one of them is global risks, and I’m talking about nancial risks,” Bristow said in an exclusive interview with e Northern Miner on March 5. “ e Chinese Communist Party came out with a 5% growth forecast, which is not good for anyone, and a messaging that that they’re pivoting away from a construction-driven economy.”

China concerns

Chinese leaders called their forecast “ambitious” when past years surpassed 7%. e country is contending with a property sector bubble that has rattled domestic investment and a shrinking population unable to ll its workforce.

In Europe, o cials cut their economic outlook to 0.9% growth this year from 1.3% predicted

in November because last year’s post-pandemic rebound stagnated.

In most developed economies, lower interest rates for nearly a decade and a half a er the 2007-8 nancial crisis allowed borrowers to substantially increase debt, also endangering mid-size lenders, Bristow said during the chat at Barrick’s Toronto headquarters.

“ e Western world, particularly the North American Western world, gets very quickly used to things and they got very used to free money,” he said. “And they built businesses that are not sustainable when you have to make something to pay back or service your interest.”

Geopolitics

Wars in Ukraine, Israel, and hot spots around the Middle East such as Iran, Yemen and the Red Sea, increasing trade protectionism and resource nationalism are all exacerbating damages to global supply chains started by the pandemic, the CEO says.

“You analyze the reaction, particularly the political reaction, and it doesn’t t because the world has become so reliant on each other,” Bristow said. “But there’s this de-globalization, so we see it

because of costs, particularly in the logistics supply chain, right. And Barrick has operations in all continents.”

Still, most economies dodged a major recession that had been predicted a er interest rates rose to contain 40-year high in ation spawned by massive government spending during the Covid-19 pandemic.

e S&P 500 closed at a record 5,241.53 points on March 21, the same day the TSX/S&P Composite Index broke its two-year-old record high by 0.04 of a point to set an all-time high of 22,087.26. Typically, gold doesn’t rise at the same time as stock markets because it usually bene ts from investors seeking safety by moving value from stocks to the metal. TNM

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 5

SAYONA

Left:

Core Lithium’s

CORE LITHIUM

Above: Sayona Mining’s North American Lithium mine in Quebec.

MINING

A spodumene shipment from

Finniss mine.

GEOPOLITICS | Cutting US dollar caches, concern over Chinese growth, cited by CEOs

KTDESIGN/ADOBESTOCK

commentary&analysis

Miners can reverse the trust deficit, but it won’t be easy

BY KEVIN PCJ D’SOUZA

The mining industry has a trust problem. Broad-based trust in our industry seems at an alltime low. e impact is wide-ranging: fracturing of public attitudes, community resentment and opposition, regulatory delays, and cancelled permits, government expropriation, an inability to attract and retain new talent, spreading of misinformation, being shunned by investors, and frustrating undervaluations. e di cult fact is that no amount of public relations spin, reputational management, or “awareness raising” will reduce the current degree of suspicion and mistrust. We may need mining, but the reality is no one wants it.

Why is there a trust deficit?

e International Council on Mining and Metals (ICMM) recently engaged GlobeScan to assess public trust in the industry. Its work showed that when it comes to ful lling responsibilities to society, mining ranks at the bottom, scoring the lowest since GlobeScan began collecting data in 2001. is is dicult for many of us to acknowledge: we are undeniably unloved, even as many governments recognize that mining is essential to meeting the world’s decarbonization challenges.

Right now, our industry needs to demonstrate it is responsible, to gain as much goodwill and trust as it can garner.

For the last few decades, like hamsters on wheels, we’ve made little tangible progress in e ective

“Trust is essential for a free, democratic, and functioning society. It is the true currency of life and business — the basis for almost everything we do.”

communication. We believe we simply need more ESG scores, sustainability reports festooned with buzzwords, and metal demand infographics — pushing “facts” to coax people into appreciating mining’s importance. We also

take umbrage when people are not as evangelical about our beloved industry as we are. So perhaps we should ask ourselves whether our current product-centric self-promotion of critical minerals for the energy transition will build trust.

As an industry, we have traditionally defaulted to engaging with civil society to be understood, rather than understand. We prefer to direct our messaging through friendly and predictable channels to a largely passive audience. We avoid those who are vocally critical of us. We defensibly feel the need to “correct” misperceptions by talking up mining’s great bene ts: local jobs, contracts, government tax revenues, and local socio-economic bene ts when today, these are considered the bare minimum. We don’t put enough e ort into understanding our real-world impacts,

fear being transparent about our mistakes and struggle to recover from them.

e answer lies in the idea that trust is a “contact sport” requiring regular, meaningful, and transparent e ort. is concept, espoused by Steve Martin, Faculty Director of Behavioural Science, Columbia Business School, at ICMM’s Responsible Mining Leadership Forum last year, means empathy, authenticity and trust cannot be assembled remotely in a corporate o ce or delegated to a third-party communications guru. Miners and their investors need to roll up their sleeves and put in the e ort. If we don’t, we will cede control of our industry to regulators and other stakeholders, spending disproportionate amounts of time and money responding to increased levels of scrutiny and compliance, rather than growth and shareholder returns.

‘Say-do’ gap

Meanwhile, the biggest media stories that shape the narrative around mining today are mostly negative: environmental pollution, fatalities, bribery, corruption, human rights abuses, tailings dam failures, workplace harassment, sexism and racism, artisanal mining, con ict minerals, and the destruction of cultural heritage. In this interconnected and image-dominated era, these controversies stay fresh in the minds of the public and investors who look to our recent past to gain con dence about the future. Some of these controversies have also shown that legal obligations are no longer a reliable proxy for ethical ones. Culture and leadership matter. We have made tremendous strides in so many ESG areas, but we still have a long way to go. It is not just a matter of telling our story better. We must acknowledge that there is mounting globalized anti-mining sentiment (coupled with increased resource nationalism) and we need to become more reliable and dependable; better match our words and actions; and actively address historical legacies rather than exacerbate them.

What is trust?

Sociologists have de ned trust variously. Trust is a prospective judgment (though in uenced by past experiences) about how much individuals can rely on others to act according to rules and norms. Some view trust as an expectation — one trusts because one has a reasonable set of expectations regarding the actions of another based on experience and norms. Others de ne trust as the willingness to be vulnerable or connect it to how con dent we feel about predicting another’s future actions.

Trust is a vital ingredient for gaining community acceptance and securing a social licence to operate. However, virtually every mine locality is characterized by varying levels of inequalities (income or status), institutional voids, community capacity and power imbalances which all interrelate to either promote or more o en, erode trust. Miners perhaps need to learn from social psychology that trust has both cognitive and emotional dimensions, which require di erent approaches. So, what does it take then for local communities to put their trust in an unknown foreign mining company?

My experiences in mining have taught me that trust is o en hard to de ne and learning how to build it is not always intuitive, but we know with certainty when it is lost. ere is no predictable formula — and once lost it is di cult to regain.

As with a lot of ESG issues, the devil lurks in “how.” It is especially complicated across geographical borders and cultural barriers, but the foundation is integrity, competency, and intent. Trust is earned when actions meet words but regrettably, there is o en a disconnect between miners’ ESG rhetoric and their on-the-ground reputation and performance: some call this the “say-do” gap. Companies o en have wonderfully scripted corporate ESG policies that are not properly, or consistently, executed on their mine sites. Miners need to help garner broad industry-wide trust whilst nurturing trustworthiness for their own company and their individual assets, as trust is very localized.

Some miners lose track of their social obligations and commitments and break their promises. is causes disillusionment, outrage, loss of trust and ultimately con ict. Trust requires miners to be predictable and have the integrity and competency to match actions to commitments while they authentically engage about their true intent and impacts.

Trustworthiness requires miners to be more vulnerable and transparent about their real agendas, which is o en out of the comfort zone for boards and executives. It also requires self-awareness that

6 APRIL 2024 | THE NORTHERN MINER www.northernminer.com

Due diligence .com How focused are your reviews?

COMMENTARY | Deposits, demand

Trust P16 >

STOCK

and dollars alone are not enough

LICHTMEISTER/ADOBE

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 7 JOHANNESBURG|TORONTO|PERTH | NEW YORK | LONDON | LIMA | VIENNA INFO@AURAMET.COM WWW.AURAMET.COM 300 Frank W Burr Blvd Teaneck, NJ 07666 (201)905-5000 Serving the Global Metals Industries since 2004 Physical Precious Metal O take Metals Financing Including Debt, Equity and Royalties / Streams Project Finance Advisory Supply and Risk Management

commentary&analysis

Poor forecasting triggers big writedowns for miners while some get lucky

STUDY | Companies blame metal price falls for majority of impairments

BY COLIN MCCLELLAND

Mining companies must improve their metal price forecasting to reduce mine failures and increase long-term returns for investors, according to a new study.

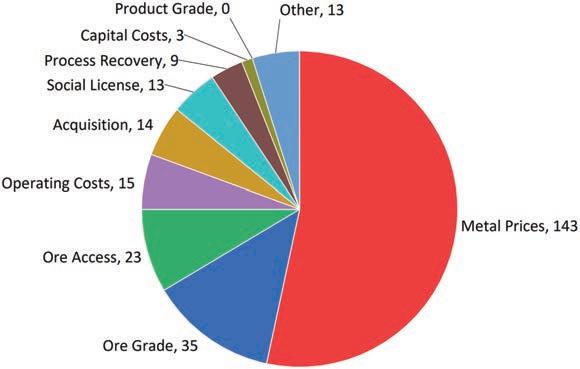

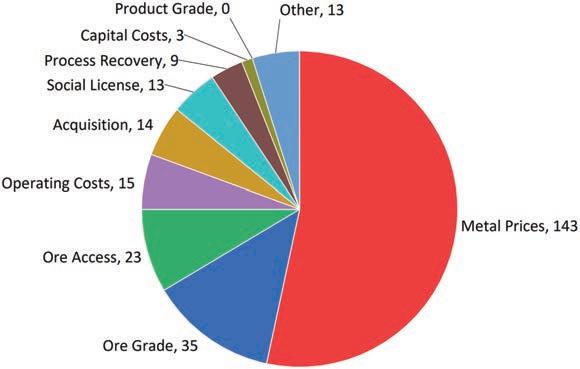

Tumbling metal prices account for more than half of all impairment charges, declared when xed assets fall below market values, the study of 105 TSX-listed mining companies found. ey incurred $68 billion in charges from 2002 to 2015. Using unfamiliar technology and locating in developing countries also contributed, data show.

Metal price drops accounted for 143 of 268 cases and $25.2 billion in impairment charges, according to the February publication of Resources Policy, an international journal on mineral rules and economics with editors in the United States, Australia and China. e research appears pertinent at a time when nickel and lithium prices have crashed from 2022 highs as gold has set new records.

“While impairments have been shown to be a common occurrence across mining companies, they also are a major contributor to the industry’s low average returns,” said the authors led by Andrew Gillis of Edmonton-based Aurora Hydrogen.

“ e degree of impairments is higher at mines in develop-

A breakdown in reasons of impairments according to amounts in thousands of Canadian dollars. RESOURCES POLICY

ing countries and at mines where the geographic location and mining processes are new to the company operating the mine,” said the authors, who included John Steen and W. Scott Dunbar of the Department of Mining Engineering at the University of British Columbia in Vancouver, and Andrew von Norden ycht of the Beedie School of Business at Simon Fraser University in Burnaby, B.C.

Get lucky Forecasting by its nature is uncertain. But some rms get lucky and only face a few impairments,

while others get unlucky and suffer many or large impairments, the authors said. eir targeted years of research coincided with the rise of the commodity super-cycle 20 years ago, followed by the nancial crisis and then declining metals prices from 2012.

e group recommended mining companies should improve their forecasting of mineral reserves, capital costs, production costs and commodity prices, which all impact future cash ows. It noted how C-suites might blame falling metal prices for impairments because other slips in capital

or operating costs could be directly attributed to their own forecasting. e ip side is that rising metal prices can hide some other forecasting errors.

More difficult And forecasting in foreign lands is simply more di cult, the authors said.

“ e sources of uncertainty are just greater, making forecasts harder and forecast errors easier, even for experienced forecasters,” they noted. In the end, the researchers recommended more studies on forecasting. ey could pinpoint the

root causes of forecasting errors through personal interviews with project participants, detailed comparisons of feasibility studies and actual outcomes, and assess their error prevention methods.

“Asset impairments have been identi ed as a primary determinant of long-term shareholder returns across Canadian mining rms,” the authors said.

“Our ndings suggest looking more closely into price forecasting procedures at mining companies to see if certain techniques or circumstances lead to more or fewer pricedriven impairments.” TNM

China’s clean-tech surge shakes markets and tests Western green resolve

BY HENRY LAZENBY

Against China’s production boom, Western countries are trying to gure out how to build their clean-tech industries without being undercut by cheaper Chinese products. ey’re stuck between wanting to secure production at home and the harsh reality of China’s ability to produce items at cost, leading to lower prices, says Antoine Vagneur-Jones, head of trade and supply chains at BloombergNEF (BNEF).

“Historically, we’ve never really been at a stage where we’ve had this much overcapacity,” VagneurJones told e Northern Miner in a March 15 interview. “Western governments need to carefully evaluate their priorities and make tough decisions regarding which sectors they want to support domestically.”

China’s trillion-dollar pivot from real estate to clean-tech manufacturing is seeing it produce more than it can sell and forcing the West to play catch-up. is growth has disrupted global markets by ooding them with lower-cost products, which has, in turn, challenged the economic viability of clean energy projects and manufacturing in other countries.

In a March 7 report titled ‘China’s

clean-tech overcapacity threatens onshoring dreams,’ Vagneur-Jones shows that Chinese EV exports have increased by more than 1,500% over three years. From January to October 2023 alone, the EU purchased US$12 billion or 42% of all Chinese EV exports, highlighting the impact of China’s excessive production rate on foreign markets. e annual value of China’s solar, battery, and EV exports increased by 117% from 2021 to 2023.

Nickel bellwether

“If you don’t stay at the cutting edge, your entire production fleet is reduced to being obsolete.”

ANTOINE VAGNEUR-JONES BLOOMBERGNEF, HEAD OF TRADE AND SUPPLY CHAINS

Vagneur-Jones says that while the record-defying production is good news for some, the clean-tech glut spells trouble elsewhere, with the mining and metals sectors, particularly nickel, nding themselves on the losing side.

Chinese investments, especially in Indonesia, have created a global nickel oversupply, cratering prices that have made Western mines uneconomic due to their higher production costs. is is forcing a global re-evaluation of mining strategies, emphasizing the need for diversi cation and innovation to adapt to changing industrial policies from China, which dominates demand.

Challenging Western grit e nickel market is just a smallscale example of China’s over-investment in production.

In less than four years, Chinese

banks have transitioned from allocating over US$1 trillion yearly to the domestic property sector to experiencing a net decline in outstanding debt for the rst time since 2005, Vagneur-Jones notes in the report. ese banks have facilitated about US$700 billion in new loans, o en at below-market interest rates, to support the growing manufacturing sectors for clean technologies like EVs and batteries.

Vagneur-Jones points out that the jaw-dropping scale of the overcapacity can be gauged with the photovoltaic panel market. Where China accounted for 36% of global demand four years ago, it now commands 75% of global production. is shi resulted from rapid industrial policy adjustments and local government subsidies, Vagneur-Jones says, which dramatically expanded China’s manufacturing capacity and slashed the global market share held by Western companies.

Change or die

All of this raises big questions about the global future of clean energy production and whether Western goals for local manufacturing can realistically be met. Vagneur-Jones says Western nations are facing a critical challenge: adapt their domestic manufacturing and sup-

ply chain strategies to this new landscape or lose out.

He suggests the West should consider alternative strategies, such as stockpiling critical materials when metals prices are low due to oversupply — or fostering manufacturing in regions outside of China to diversify supply chains and reduce reliance on Chinese products.

China controls 80% of the global supply chains for photovoltaic products and automotive batteries, and over 60% of electric cars worldwide are manufactured in China. is level of market dominance has raised concerns among other countries and led to various trade barriers and protective measures.

e Asian giant currently accounts for about US$469 billion of planned clean-tech manufacturing capacity, exceeding net-zero aligned demand over 2024-2027, according to Vagneur-Jones’ data.

ese numbers feed into an eightfold planned increase in annual clean-tech factory investment outside China from 2023 to 2025.

“It’s a game of chicken, where if you don’t stay at the cutting edge, your entire production eet is reduced to being obsolete. We’re in an era where Chinese overcapacity isn’t just reshaping global markets; it’s rede ning them,” VagneurJones said. TNM

8 APRIL 2024 | THE NORTHERN MINER www.northernminer.com

Reasons behind 268 impairment charges that mining companies faced during the 2002-2015 period. RESOURCES POLICY

SUPPLY CHAINS

Refined nickel. GLENCORE

| Western projects at risk as Chinese product prices plummet

STEP INTO THE FUTURE OF MINING.

Only MINExpo INTERNATIONAL 2024® connects you with the innovations that will transform the way your work gets done. With a focus on mining (and only mining), you’ll find the products, solutions and connections to future-proof your business at the world’s largest global mining event.

Register Now at MINExpo.com

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 9

indepth

Push for ESG price premiums may reshape global critical minerals markets

NICKEL | Experts say the challenge is defining what ‘ESG-compliant’ means

BY HENRY LAZENBY

As low nickel prices force Australian miners to scale back output, some have called for an ESG premium on low-carbon production that would help Western producers compete with cheaper, but more polluting Indonesian metal.

But are customers willing to pay more for low-carbon nickel? Some analysts say yes — under certain conditions.

“If the market sees a bene t in paying a premium for certain supplies then it will,” Jim Lennon, managing director of commodities at Macquarie Group, told e Northern Miner in an interview. “A buyer would be willing to pay a premium if they can see an economic bene t in using that product, such as receiving a government subsidy or securing a sale of a ‘greener’ electric vehicle.”

e price of nickel has been on a downtrend since late 2022 when it was US$33,575 per tonne (US$15.23 per pound). e price on March 19 was US$17,678 per tonne (US$8.02 per lb.) and in February dipped as low as US$15,850 per tonne (US$7.19 per pound).

e price doldrums have prompted Wyloo Metals and BHP (ASX: BHP) to suspend operations in Australia, with BHP announcing it would take a US$2.5 billion impairment on its assets.

Given the devastation to its nickel sector, Australia has been the most vocal in creating new variable price brackets for low-carbon emissions nickel.

e idea for premium ESG pricing isn’t new. In fact, some experts

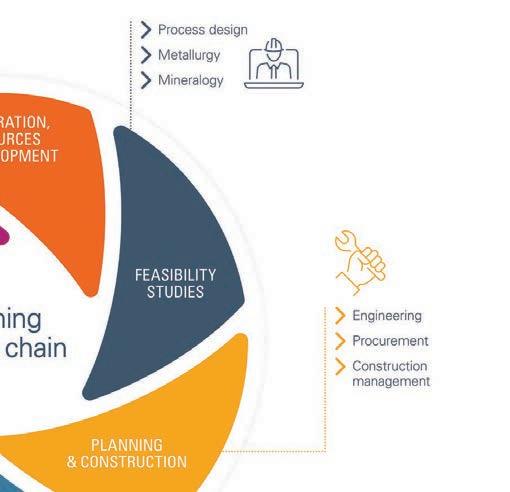

> Barrick Gold from P1 company has had to contend with an 18-month delay to permits at the Goldrush project, part of its Nevada Gold Mines partnership with Newmont (NYSE: NEM; TSX: NGT), and a slow start to commissioning at the Pueblo Viejo mine expansion in the Dominican Republic.

Reported talks to acquire the shut Cobre Panama copper mine in Central America from First Quantum Minerals (TSX: FM), which Bristow again denied, saw no deal even though it would have suited the CEO’s penchant for expanding more into the energy transition metal and turning around troubled assets. Especially ones marred by poor relations with governments.

Site visits Bristow, a hands-on CEO, visits each of the company’s roughly 20 sites at least three times a year, with the fourth round reserved for those that need attention or new initiatives.

“I don’t believe in o ces,” the South African native said. “For mining to be successful and agile, the mine management should own their businesses. at calls for a better quality general man-

argue that there’s already a premium.

Canada Nickel (TSX: CNC; US-OTC: CNIKF) CEO Mark Selby says people might be surprised to learn that price premia have already been paid for various North American products perceived as cleaner on Asian markets.

Selby notes that domestic premiums for certain materials have been sustained over several years.

ese premiums might not be directly attributable to lower carbon footprints or ESG factors

ager on the mines and we look to more CEO-style people.”

Bristow has long stated his aversion to paying a premium for projects. Between China increasing its reach in the world economy more aggressively from about 2005, through a 2011 gold price peak and fall until it started rising again in 2019, the CEO gures the industry had to write o almost US$80 billion in value because of deals o en sweetened with cash on top of premiums.

“ ere are moments when you will pay a premium, it depends how the market values the asset,” he said. “When you pay premiums on premiums, you’ve got to rely on the gold price to get yourself into the money. I’ve never done that.”

Bristow’s Randgold Resources brought African assets into the merger with Barrick, including the Loulo and Gounkoto mines in western Mali, Tongon in Ivory Coast and Kibali in the Democratic Republic of Congo (DRC) where it doubled the gold reserve within two years to 10 million ounces. Kibali, Africa’s largest gold mine, still has 10 million oz. in reserves more than a decade a er starting production.

Greenfields expansion is year, Barrick is focused on

alone but could be in uenced by a combination of causes, including local supply.

But this type of premium isn’t helping Australian nickel miners. And deliberately imposing an ESG premium would be a di erent story.

“ e main challenge is de ning what ‘ESG-compliant’ actually means,” Macquarie’s Lennon said.

It’s an obstacle the London Metal Exchange (LME) is facing as it investigates and prepares for the potential emergence of premium

Nevada, where the company is increasing green elds exploration spending to replicate discoveries like Fourmile and Goldrush with a 20-million-oz. nd that could boost Barrick’s gold production. It was 4.1 million oz. last year.

At Goldrush underground, where permits at last arrived in December, crews are preparing to install ventilation ducts allowing annual output to increase to 400,000 oz. by 2028 from 130,000 oz. this year, the CEO said. Permit delays had a ected cash ow, he said.

While mining in the U.S. might be considered less risky than say, the remote northeast DRC home of Kibali, America has its own hazards, such as litigation by anti-mining groups and lengthy permitting processes. During the pandemic, when many states suffered from lack of revenue for services, Barrick and Newmont stepped up to pay their taxes in Nevada ahead of time.

“No matter how you own it, a mine is actually a national asset,” he said. “When you invest in it to develop it, you should be investing in its people and its businesses, and people should bene t out of it and the economic bene ts should be split. It should be shared.” TNM

“If the market sees a benefit in paying a premium for certain supplies then it will.”

JIM LENNON, MACQUARIE GROUP, MANAGING DIRECTOR OF COMMODITIES

pricing for low-carbon products on separate trading contracts.

Georgina Hallett, LME’s chief sustainability o cer, says that there’s increasing interest from producers, consumers, and investors in establishing a price premium for metals produced with lower carbon footprints. However, de ning what constitutes ‘low carbon’ or ‘green’ metals isn’t easy due to the lack of a standardized, universally accepted framework for measuring and verifying the environmental impact of metal production processes.

“ e aim is to build a robust framework that supports the gradual introduction of sustainability-linked pricing mechanisms while ensuring broad market participation and avoiding undue disruption,”

Hallett told e Northern Miner

“By taking a step-by-step approach, the LME hopes to align the interests of various stakeholders and drive meaningful progress toward the integration of sustainability into the global metals market.”

Free market forces

Lennon suggests that establishing a special low-carbon contract for metals on the LME is unnecessary. is is because the prices for different products are already determined by normal market activities, such as supply and demand. Just like prices for di erent metal shapes

and origins adjust based on market conditions, the prices for products with various ESG qualities would naturally adjust in the same way.

“Exchanges don’t need necessarily to get involved since they can focus on ‘objective criteria’ for delivery (shapes, metal purity, etcetera) and leave the market to decide on ‘subjective’ factors such as value-inuse of di erent products/shapes and ESG,” Lennon said.

For exchanges like the LME, there is also a risk of damaging liquidity if they were to introduce multiple contracts. Compared with large commodity derivative markets, nickel is not particularly liquid and dividing this liquidity could reduce the usability of the market for some participants.

Lennon says markets will ultimately determine the outcome. Currently, nickel prices vary signicantly between products depending on supply and demand.

Today’s primary nickel products that are LME deliverable include metal rounds, pellets, cut cathode, and full plate cathode. When delivered to LME warehouses, each product is assigned an associated warrant. When buyers want to take delivery from the LME, they are o en willing to pay LME brokers a premium for warrants of a particular material shape or origin.

Similarly, other non-LME deliverable products, including intermediates (concentrates, mattes, mixed hydroxide or sulphide precipitates) or nished products (ferronickel, nickel pig iron, nickel sulphates and nickel chlorides) also sell at varying discounts or premiums to LME base prices. Lennon said these premiums/discounts can shi dramatically due to changes in supply and demand.

For example, nickel pig iron was selling at a premium to the LME price at the start of 2022 and then had fallen to a discount of 40% to the LME by the rst half of last year.

“Product type, ESG, and country of origin are all important properties and presumably were factors that led major automakers to agree to term supply contracts with BHP and Vale in recent years. ESG was no doubt a factor in these negotiations,” Lennon said.

Canada Nickel’s Selby emphasized the importance of provenance tracing rather than setting up a formal two-tiered pricing system.

He points out that imposing a pricing mechanism before the market is ready can lead to ine ciencies, such as a benchmark that does not accurately re ect market conditions. He suggests letting the market sort it out.

“We will continue to observe the distinction between Westernsupplied, clean, green nickel and the high-carbon, less ESG-compliant nickel from China and Indonesia,” he said. “As for the necessity of a formal pricing mechanism, it’s typically better if such mechanisms emerge naturally in the marketplace before establishing a formal platform for trading them.”

Aussie nickel rout

An increase in supply from Indonesia has cratered nickel

10 APRIL 2024 | THE NORTHERN MINER www.northernminer.com

Nickel mining in Indonesia. ANDYKA/ADOBESTOCK

Premiums P36 >

Some junior miners must die so others may live, finance panel concludes

PDAC | Companies urged to diversify funding sources outside of retail

BY ALISHA HIYATE

Canada’s once-mighty junior mining sector crumbled a er governments squeezed the middle class and let multinationals buy the country’s big miners, a panel of nance experts told mining’s biggest conference in March.

Large Canadian miners such as Falconbridge, Inco and Noranda (all gone by 2007) would use much as $200 million each a year to shepherd perhaps 100 junior level companies because they made half of the discoveries, Franco-Nevada (TSX: FNV; NYSE: FNV) co-founder Pierre Lassonde said on a panel at the Prospectors and Developers of Association of Canada convention in Toronto on March 5.

e industry’s poor performance and high interest rates that have made it easier for investors to make money with little risk are just parts of the equation, delegates heard. Retail investors, traditionally the biggest source of funding for juniors, have also disappeared. Lassonde tied the state of retail investing to high taxes.

“Back in the ’80s, the disposable income that the middle class had, it was far better than it is today with

“You have to have scale and you have to have grade. And you have to prove that you have something that your peers don’t.”

ADAM LUNDIN, CHAIR OF LUNDIN MINING

54% maximum tax rate here in Ontario,” he said.

“ ey would say, ‘I’ll take $1,000 or $2,000 and instead of going to Vegas, I’m just going to bet on a junior — it’s more fun and if there’s a discovery, I’m part of it.’ at group of people have been completely washed out by our government.”

Jacqueline Murray, a partner at Denver-based private equity rm Resource Capital Funds (RCF), said there are now far too many juniors competing for cash, com-

paring the task of si ing through them to nding something good to watch on TV.

“I think sometimes for investors they just see so much crap that they miss the good opportunities and it just looks a little too hard,” she said. “In the true junior and explorer space, sadly I think some just need to die so the good ones can survive and attract the funding.”

Lassonde advised the same for “lifestyle” companies in the sector that exist just to pay management salaries.

“Shut it down. Go work for someone else. Put yourself out of your own misery,” he said. “ at company is not going to create return for its shareholders. You’ve gotta always think how do you create a return, because at the end of the day it’s the only thing that matters.”

Retail role

Some 80% of the money for juniors comes from just 12,000 investors subscribing to ow-through shares on the TSX Venture exchange, according to Toronto-based Pear-

Tree Financial. But two thirds of those people are over the age of 80.

“Given these terrible demographics, is retail over?” an audience member asked.

Not entirely, according to Adam Lundin, whose grandfather Adolf Lundin founded the Lundin Group of companies. Most of the group was listed in Sweden because retail investors there were such a big source of capital.

“Retail is always going to play

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 11

A panel of financial experts discuss the mining investment climate at the Prospectors and Developers Association of Canada convention in Toronto. PROSPECTORS AND DEVELOPERS ASSOCIATION OF CANADA

in

Ontario’s Critical Minerals Powering the Electric Vehicle Revolution Ontario session held at the Energy Transition Metals Summit WASHINGTON D.C. Monday, April 29, 2024 10:10 a.m. – 10:55 a.m. ai17109617269_Final_CriticalMineralsAd_NortherMiner_5x8_20240320.pdf 1 03/20/2024 3:08:47 PM

Juniors P15 >

depth

M LONDON, P.ENG, MBA EXECUTIVE DIRECTOR CANADIAN CRITICAL MINERALS & MATERIALS ALLIANCE (C2M2A)

DR. GRANT S. BROMHAL SENIOR SCIENCE ADVISOR US DEPARTMENT OF ENERGY

ABIGAIL HUNTER DIRECTOR AMB. ALFRED J. HOFFMAN CENTER FOR CRITICAL MINERALS STRATEGY

JOHN FENECK PRESIDENT FENECK CONSULTING, LLC

RYAN CASTILLOUX MANAGING DIRECTOR ADAMAS INTELLIGENCE

ALEX JACQUEZ

SPECIAL ASSISTANT TO THE PRESIDENT FOR ECONOMIC DEVELOPMENT AND INDUSTRIAL STRATEGY WHITE HOUSE NATIONAL ECONOMIC COUNCIL

MELBYE EXECUTIVE VICE PRESIDENT URANIUM ENERGY CORP.

SPONSORS

MARTIN TURENNE PRESIDENT AND CEO FPX NICKEL

12 APRIL 2024 | THE NORTHERN MINER www.northernminer.com

TIM GITZEL PRESIDENT AND CEO CAMECO CORPORATION

ROB MCEWEN CHAIRMAN AND CHIEF OWNER MCEWEN MINING

ABBY WULF EXECUTIVE CHAIR DEPARTMENT OF ENERGY

GEORGE PIRIE MINISTER OF MINES ONTARIO MINISTRY OF MINES

ROBERT QUARTERMAIN CO-CHAIRMAN DAKOTA GOLD DANIEL CHIEF

DR. OTHON MONTEIRO MARKET ADVISOR US DEPARTMENT OF ENERGY

JOE SOPCISAK TECHNICAL INTEGRATION OFFICER DEPARTMENT OF DEFENSE

ANGELINA MEHTA GENERAL MANAGER RIO TINTO ALUMINIUM

TINA JEFFRESS GROUP MANAGER PANASONIC

IAN

BRENT GILCHRIST PRESIDENT, JDS RESOURCES INC. JDS GROUP OF COMPANIES

WILLIAM SHERRIFF EXECUTIVE CHAIRMAN ENCORE ENERGY CORP.

SCOTT

ALEX FITZSIMMONS HEAD OF GOVERNMENT AFFAIRS SILA

MARK SELBY

ADRIAN O’BRIEN DIRECTOR OF MARKETING AND COMMUNICATIONS MIDNIGHT SUN MINING

ANGELA JOHNSON VP CORPORATE DEVELOPMENT & SUSTAINABILITY FARADAY COPPER

JOCELYN DOUHÉRET DIRECTOR, MINING POLICIES MINISTRY OF NATURAL RESOURCES AND FORESTS

TREVOR WALKER PRESIDENT & CEO FRONTIER LITHIUM

KILLIAN CHARLES PRESIDENT AND CEO BRUNSWICK EXPLORATION

SCAN FOR

HTTPS://EVENTS.NORTHERNMINER.COM/ ENERGY-TRANSITION-METALS-SUMMIT-2024/

GLOBAL MINING NEWS THE NORTHERN MINER | APRIL 2024 13

ADAM HAWKINS PRESIDENT GLOBAL EXTERNAL

DANIEL ENDERTON CHIEF STRATEGY OFFICER KOBOLD METALS

JOHN CASH CHAIRMAN OF THE BOARD OF DIRECTORS AND CEO UR-ENERGY INC.

TERRY LYNCH CEO POWER NICKEL INC.

ANDY LEYLAND MANAGING DIRECTOR SUPPLY CHAIN INSIGHTS

SYLVAIN LÉPINE GENERAL DIRECTOR NQ MINING INVESTMENT

ZACK VALDEZ CHIEF OF STAFF U.S. DEPARTMENT OF ENERGY (DOE)

JUDY BROWN HEAD OF EXTERNAL AFFAIRS SOUTH32

CEO & DIRECTOR CANADA NICKEL COMPANY INC.

NADIA MYKYTCZUK CEO AND PRESIDENT MIRARCO

FITZSIMMONS SPONSORS

AGENDA

Junior miners see short-selling ‘epidemic’

BY ALISHA HIYATE

Junior miners say recently proposed new rules about short-selling could help stem the bleeding in their stocks, which are especially vulnerable to the practice.

e January proposal by a Canadian regulator would apply to “hard-to-borrow” stocks like junior miners. Before shorting such securities, traders would be required to con rm there is stock available to borrow or the short sale would be prohibited.

“ ey’re basically going to hold the brokerage rms accountable,” Kerry Knoll, chairman of Generation Mining (TSX: GENM) said of the proposed amendments by Canadian Investment Regulatory Organization (CIRO).

“People can’t just call up and short and then go looking for the stock,” he said on March 4 at the Prospectors and Developers Association of Canada (PDAC) convention in Toronto.

“With juniors, you frequently can’t nd the stock to borrow. I have never shorted one, but I’ve tried many times. And when I have tried, I call around and see if anybody can borrow the stock and it’s always ‘no.’”

Shorting is when traders borrow a security to sell into the market, hoping to buy it back at a lower price and pocket the pro t before returning the stock to its owner. It’s basically a bet that a stock’s price will go down. Junior mining stocks have been targeted by short-sellers because the market as a whole has been trending downward. However, because of low trading volumes in the sector, shorting can easily dev-

astate a junior’s stock price, leading to calls for di erent treatment of low-liquidity equities.

Knoll says Generation’s stock price was cut in half over a period of weeks by shorting activity during a time of low trading activity in shares. e company holds the development stage in Ontario.

“Suddenly every day with one second to go, somebody sold some amount of stock, maybe 300 shares, 500 shares and closed it down a penny or two,” he said. “ is went on for weeks and weeks.”

Short-sellers want to trade the stock down at the end of the day so they’ll be under less pressure to buy back the stock and cover their position, he said.

Chuck Fipke, who discovered Canada’s rst diamond mine Ekati

with Stu Blusson, says he’s also noticed unusual trading in his current venture, Cantex Mineral Development (TSXV: CD), and late-day low-ball bids meant to drive down the company’s share price.

Cantex’s Rackla North project in the Yukon hosts North America’s highest-grade silver-lead-zinc deposit. e company discovered early last year it also hosts very high grades of critical mineral germanium, used in solar panels, chips, and military applications, and production of which is dominated by China.

e stock rose, Fipke says, before “short-sellers knocked it down.”

But he admits he can’t prove what he describes as an “epidemic of short-selling” that’s plaguing juniors.

“I’m a geologist, hey, my job is I look for mineral deposits,” he said by phone ahead of PDAC, adding it’s up to the regulators to investigate the issue.

“I can’t do everything,” he said, adding he manages drilling of every hole at the project, which has seen 60,000 metres drilled since 2016. “It’s easy to drill, but it’s hard to drill in the right place.”

Junior market investors say the problem has emerged since Canadian regulators removed the uptick rule in 2012 that prohibited short sales at a lower price than the previous trade.

Knoll says the outsized e ects legal short-selling has on juniors could easily be remedied by bringing back the tick test. (He also says it’s one main reason Australia, which does have an uptick rule, has a stronger junior mining market than Canada’s.) But that would be counter to the interests of banks, which make money o every trade — including short sales — on their platforms and have more freedom to trade as they please without it.

CIRO proposal

Amended rules proposed by CIRO would require traders to determine if the stock they want to short is hard to borrow. If it is, they’d have to show that there’s stock available to borrow, or go as far as “pre-borrowing” the stock. If there is no “reasonable expectation” they will be able to settle the trade by the settlement date (within two days — on May 27 this changes to within one day), they can’t short the stock. As part of this requirement, CIRO sees dealers compiling lists of “easy to borrow” securities. e proposal is open for comment until April 12. In addition,

CIRO and CSA have established a working group looking at concerns raised by commenters through a previous consultation, a CIRO spokesperson told e Northern Miner by email.

However, the junior mining sector’s most outspoken advocate against illegal short-selling, Terry Lynch, called the proposals “woeful,” saying they will have no impact.

“ e reason why is that CIRO allows banks like CIBC and TD and others to rent (trading) pipe to o - and onshore hedge funds,” the founder of Save Canadian Mining wrote in a comment on e Northern Miner’s website.

“ ese hedge funds automatically can trade ‘short exempt,’ meaning they can short stocks without ( rst) borrowing.”

Lynch, the CEO of Power Nickel (TSXV: PNPN; US-OTC: PNPNF), started Save Canadian Mining in 2019 to uncover proof of illegal or uncovered short-selling in junior mining.

He says that only 40% of trading in Power Nickel stock is on the TSX Venture, with 60% taking place on less transparent “dark exchanges” on which institutional investors can trade out of the public eye.

Elsewhere at PDAC, tra c in the Investors Exchange at the mineral exploration-focused show, which opened on March 3 had been brisk — even at nickel and lithium juniors’ booths. Both metals sharply declined last year — lithium in the neighbourhood of 80% and nickel 40%.

One nickel junior attributed the steady stream of booth visitors to “bargain hunting,” while a lithium junior expressed hope that the lithium price, which has been rising recently, has bottomed. TNM

Copper tops banker panel’s picks for 2024

BY BLAIR MCBRIDE

BY BLAIR MCBRIDE

Copper is a good bet to outperform other major metals over the next year, senior Canadian bankers told delegates at the world’s largest mining industry gathering in March.

“ e fundamentals for copper in the near and long term are fantastic,” Ilan Bahar, managing director and co-head of Global Metals & Mining at BMO Capital Markets, said on March 4 at the Prospectors and

Developers Association of Canada (PDAC) convention in Toronto.

“I think we’ve seen extraordinary demand for copper equities. It’s a good time to buy copper equities and see them rise (though) there are some supply constraints with some mines.”

Bahar was one of four nance gurus on an investment banker panel that kicked o the “Mineral nancing and the banking ecosystem” talk at PDAC with an online audience poll on which metal will outperform over the next year.

Copper, which before press time sat at US$4.02 per lb., also topped the audience’s picks, followed by gold, uranium, lithium and nickel. Ryan Latinovich, global head of mining & metals at RBC Capital Markets, said the copper thematic has a broad and deep following, with a history of underinvestment.

“We’ve got a structural de cit that will require investment of about $2 billion over the next few years, and there’s (copper’s importance to)

14 APRIL 2024 | THE NORTHERN MINER www.northernminer.com MYRA FALLS MINE LTD. SALE AND INVESTMENT SOLICITATION PROCESS On December 18, 2023, Myra Falls Mine Ltd. (“MFM”) sought and obtained an initial order (the “Initial Order”) from the Supreme Court of British Columbia (the “Court”) under the Companies’ Creditors Arrangement Act, R.S.C. 1985, c. C-36, as amended, granting a stay of proceedings in favour of MFM and appointing FTI Consulting Canada Inc. as monitor (in such capacity, the “Monitor”). Pursuant to an order granted by the Court on February 27, 2024 (the “SISP Order”), MFM, with the assistance of FTI Capital Advisors – Canada ULC (the “Financial Advisor”), and under the supervision of the Monitor, has initiated a sale and investment solicitation process (“SISP”) to solicit interest in, and opportunities for, a sale of all or substantially all of the property or the business of MFM, or an investment in MFM or the business of MFM, or a combination thereof. The SISP is a two-phased process. Qualified interested parties who wish to submit a bid in the SISP must deliver a nonbinding letter of intent to MFM, the Financial Advisor, and the Monitor by no later than 12:00 p.m. PDT on April 12, 2024. Binding offers must be submitted by no later than 12:00 p.m. PDT on May 24, 2024 in accordance with the SISP Order. Copies of the Initial Order, the SISP Order and all related materials can be obtained from the website of the Monitor at: http://cfcanada.fticonsulting.com/myrafalls/. Those interested in participating in the SISP should contact the Financial Advisor to receive additional information at: FTI Capital Advisors – Canada ULC 79 Wellington Street West Suite 2010, P.O. Box 104 Toronto, ON M5K 1G8 Attention: Richard Kim Email: Richard.Kim@fticonsulting.com Copper P36 > indepth

PDAC | CIRO proposal floats ‘pre-borrowing’ bid for some low-volume shares

PDAC | Carbon, risk factors could spur China-West markets split

At the Prospectors and Developers Association of Canada convention in Toronto. ALISHA HIYATE

The bankers panel discusses the potential performance of various metals over the next year. URVISH MORE

indepth

Show the public that minerals, tech are solutions for net zero, says Seequent panel

PDAC 2024 | Industry ‘talks of old times’ as youth focus on work-life balance

BY BLAIR MCBRIDE

Instead of reminiscing about the old times of hunting for minerals in the bush, miners need to talk up tech opportunities to attract young people to mining, industry panelists told an event in downtown Toronto on March 4.

Organized on the sidelines of the Prospectors and Developers Association of Canada convention by mining so ware company Seequent, a ve-person panel discussed the challenge of achieving net zero mining, leveraging new technology, including arti cial intelligence, and attracting new talent. Seequent develops earth modelling, geo-data management and team collaboration so ware for the mining, energy and engineering sectors.

Sally Goodman, vice-president of generative exploration with Newmont (TSX: NGT; NYSE: NEM) recalled attending a recent panel where geologists acknowledged the declining interest in geology programs, but then recounted the “good old days” of prospecting in the bush for weeks on end.

“ e industry isn’t listening,” she said. “Young people are turned o of those old stories. It doesn’t have to be done that way anymore at remote sites. If we can reduce the amount of time people are away from their families, that would help bring people back in.”

Poll data of young Canadians published in an October 2023 report by the Mining Industry Human Resources Council found the industry ranks lowest in a list of impressions across job sectors. Among 1,501 Canadians polled,

> Juniors from P11

an important role, but it’s not the source to rely on when you’re raising capital,” the chair of Lundin Mining (TSX: LUN) said. “But especially when you’re getting up and going, they can really help your liquidity.”

Diverse funding

Murray, who said RCF’s 10-year funds invest in projects for about four to ve years, suggested that companies need to diversify their funding sources and educate themselves on other options outside of retail.

“ ere are other sources of capital across the full capital stack. We’ve named quite a few of the di erent sources — the issue would be that the junior companies are not aware of that, not connected into that. at is the next step — to not rely on the public markets.”

Companies that have been able to raise money have tapped other sources, including family o ces, private equity, streaming and royalty deals, o ake agreements and in the battery metals space, automakers and battery manufacturers. However, most of these sources aren’t suited to or available for earlystage exploration.

Outliers

Even in this environment, some companies are getting funding. Generally, they’re those that are led

19% held a “positive” view of mining, 36% “neutral” and 20% “negative.” Although 65% believe mining jobs pay well, only 26% think the work is safe.

“We have to start listening to them,” panel moderator and Northern Miner Group president Anthony Vaccaro said.

Goodman also explained that the industry should try to promote remote technology applications because young people are already used to gaming with people around the world.

“We need to start making mining companies feel like tech companies,” said Shelby Yee, co-founder and CEO of mining technology rm Rockmass. “How can we combine those two worlds?”

Promise and peril of AI Clever and e cient use of technology was a near-constant topic among the panelists, and Vaccaro

by teams with past successes under their belts, and have truly good deposits in workable jurisdictions.

“You have to have scale and you have to have grade,” Lundin told panel moderator David Halkyard, head of credit strategy at RCF. “And you have to prove that you have something that your peers don’t have. It’s tough to do.”

Lundin, previously CEO of Lundin Group companies Josemaria Resources and Filo Corp. (TSX: FIL), acknowledged that he’s been fortunate in raising money with the support of family investment and his father Lukas usually providing the lead order in nancings.

e group’s track record of adding value and ability to keep share dilution at a minimum is also key, he said.

Capstone Copper (TSX: CS; ASX: CSC) CEO John MacKenzie said the company, which operates mines in the United States, Mexico and Chile, started o in the private markets where there was more patience to stick with the company through permitting and invest during a down cycle.

“ e public markets weren’t really open. ey’d just been through the period of 12-15 years ago, when the industry heavily over-invested and had massive writedowns,” MacKenzie said.

“A lot of mining companies lost their licence to reinvest. To me, that was unfortunate, because that is the right time to be starting the

asked them how arti cial intelligence (AI) can be used for future exploration.

Goodman said that AI needs to be deployed to do the “grunt work” as it applies the concepts in the minds of geologists.

But AI’s possibilities also bring signi cant risk, such as with data security, said Marcelo Godoy, chief technology o cer with AngloGold Ashanti (NYSE: AU).