CONNECT & EDUCATE SYMPOSIUM! Thank you for attending our OREGON AGENT Q2 2023 IN THIS ISSUE: Welcome Christine Muduryan Surviving an Insurance Hard Market event recap on pages 8-9

Big I Oregon

PO Box 68366 Portland, OR 97268

Phone: 503-274-4000

Fax: 503-274-0062 Toll Free: 866-774-4226

Big I Oregon Staff

Tyra Dressel | Executive Director tyra@bigioregon.com

Christine Muduryan | Member Engagement Director christine@bigioregon.com

Melissa Reed | Director of Agency E&O oregoneoteam@bigioregon.com

Lyra Roberts | Agency E&O Senior Account Executive oregoneoteam@bigioregon.com

April Pitz | RLI Administrator April.Pitz@iiaba.net

Roger Beyer | Big I Oregon Lobbyist roger@rwbeyer.com

Jill Tieu | Bookkeeper jillt@bigioregon.com

CONTENTS

This year’s Connect & Educate Symposium was a success! We had fantastic education taught by IIABA’s Chris Boggs and a whole lot of fun.

- PAGES 8-9

PRESIDENT’S MESSAGE......................................5

Key Items That Warrant a Deep Dive This Spring

THE DIRECTOR’S CORNER...............................7

Welcoming Our Newest Team Member, Christine

COMMERCIAL LINES...........................................12-13

Insurers Increasingly Imposing Warranties and Safeguards on Commercial Property Policies

NEXTGEN........................................................................16

How to Survive an Insurance Hard Market

PERSONAL LINES...................................................18-19

An Agent Call to Action: Underinsurance

AGENCY OPERATIONS......................................22-23

The Hybrid Advantage

LEGISLATIVE UPDATE........................................26-27

Educating the Public on the Insurance Industry

E&O.....................................................................................30-31

Emailing Insurance Documents to Clients?

Read This!

contact Kaylyn Staudt at kaylyn@iiaw.com.

THANK YOU FOR ATTENDING OUR CE SYMPOSIUM Rothert Insurance......................................27 rothertinsurance.com UFG................................................................3 ufginsurance.com Western National......................................15 wnins.com

ADVERTISER INDEX Applied Underwriters................................32 auw.com/us Berkshire Hathaway GUARD....................31 guard.com IPFS................................................................13 ipfs.com For

on advertising,

The Oregon Agent is a publication of the Independent Insurance Agents and Brokers of Oregon and is published quarterly by Independent Insurance Agents of Wisconsin. Big I Oregon reserves the right in its sole discretion to reject advertising that does not meet Big I Oregon qualifications or which may detract from its business, professional or ethical standards. Big I Oregon and IIAW do not necessarily endorse any of the companies advertising in the publication or the views of its writers. The publisher cannot assume responsibility for claims made by advertisers, context provided by the editor, or for the opinions expressed by contributing authors.

more information

THINK UFG for simple insurance solutions

Simple solutions for complex times® is more than just our tagline at UFG Insurance.

We’ve made it our mission to create simple solutions for doing business with us, which begins with providing trusted insurance protection and service that exceeds expectations.

For a carrier committed to making insurance simple, think UFG. After all, insurance can be complicated and we all deserve simple solutions in these complex times.

Simple solutions for complex times INSURANCE

ufginsurance.com/services

© 2022 United Fire & Casualty Company. All rights reserved.

4 | Q2 2023 | We’re in this together. From care packages to pallets – or anything in between – count on UPS for convenient, dependable services and tools that make sending and receiving packages easy. Members can now take advantage of flat discounts of up to 50% on UPS® small package shipping services that include enhanced protection through UPS Capital Insurance Agency, Inc. To learn more and start saving: Visit: savewithups.com/iiaba Call: 1-800-MEMBERS (636-2377) © 2022 United Parcel Service of America, Inc. UPS, the UPS logo and the color brown are trademarks of the United Parcel Service of America, Inc. All rights reserved. 1008956603

KEY ITEMS THAT WARRANT A DEEP DIVE THIS SPRING

Are you making time to work “on” your business versus “in” your business?

If you want to create local and enthusiastic applicants for entry-level positions at your agencies, perhaps this is just what you need to create excitement? Share your feedback!

By: Russ Schweikert Big I Oregon President Ashland Insurance, Inc.

Now that we have concluded our annual Connect & Educate Symposium at the Oregon Coast, I am reminded of some of the highest quality and most important items around independent agencies today.

Steve Smelley, of Goldfinch Consulting, LLC, our National Director / Big I state representative briefed us on his recent trip to the national convention. Our dues and financial support matter! Key items that warrant a deep dive for many agents include:

• Starting an agency from scratch has never had so much support! Oregon is one of four pilot states for a program of support to help new agents launch and do business, circumventing so many pitfalls that many experience. From contract review, assistance with hiring, marketing, obtaining E&O coverage, etc. This live support model helps manage the process efficiently and inexpensively. Contact Tyra Dressel, tyra@iiaw. com, for more information and how to apply.

• Let’s meet our next generation of industry professionals where they are! The link to the best initiative I’ve seen is at: bit.ly/3FOz0y2. Please take a few minutes and skim around the Invest site. This program provides FREE course materials for delivering Insurance 101 topics to high schools and even college-level students. This meets most state requirements for CTE – previously known as vocational training. Notice there are chapters entitled “Introduction to Insurance”, “Marketing and Selling Insurance”, and “A Career in Insurance”! Scholarships are available to students and (this is what is meeting them where they are) the texts are e-books, the materials include online gaming examples, and all of this is free.

• Roger Beyer, who represents our association as lobbyist, has shared much with us recently. His top 11 items to watch are provided in your member portal, which can now be accessed via our normal Big I Oregon website www.bigioregon.com and then click on “Access Your Account, Member Info HUB”. Do yourself a favor and follow the link to determine how you can help yourself by following Mr. Beyers’ recommendations.

Roger has provided a specific “action alert” to each of us asking for action to our legislators. He does so much monitoring and analysis on our behalf, let’s take advantage of these efficiencies!

• Networking in person is more valuable than ever. Moving throughout the event at Lincoln City I heard agents helping agents place tough accounts, prepare each other for challenging E & O situations, planning to combine forces to gain access new markets, creating new revenue streams, and even sharing pictures of dogs, fishing boats, and grandchildren. Here’s to hoping that you can join us at INSURECON2023 in Sunriver, Oregon which is to be held August 20-22 this year.

• Committees are up and running! Organizational committees announced last year and launched in January this year are up and producing with the two existing committees that have been working behind the scenes consistently. If you want to be involved on a light basis but aren’t necessarily ready to step into leadership contact me or Tyra Dressel to obtain a list of those committees that are still open to new participants.

Happy serving, be well, and take care of your teams.

| Q2 2023 | 5

PRESIDENT’S MESSAGE

o

B i g I O r

April 2 0

April

August 2 02 2

This event benefits Make-A-Wish World Wide Wish Day, hosted by Big I Oregon's NextGen. This event is open to all! See event details on page 17.

TopGolfHillsboro, OR

Drives for Dreams National Legislative Conference

Every spring, more than a thousand agents visit Capitol Hill offices to lobby members of the House, Senate and their staffs on issues that directly impact independent agents and customers.

Renaissance Downtown HotelWashington D.C.

Big I Oregon's yearly in-person event that attracts agents from all over the state of Oregon. Enjoy a beautiful resort location combined with workshops, golf, an exhibit hall, entertainment and networking.

6 | Q2 2023 |

E v e n t s C h e c k O u t O u r E v e n t

i s t f o

L

r 2 0 2 3

F o r d e t a i l e d i n f o r m a t i o n : bigioregon.com

InsurCon2023

e g

Sunriver Resort - Sunriver, OR n

2 62 8

By: Tyra Dressel Executive Director of Big I Oregon

WELCOMING OUR NEWEST TEAM MEMBER, CHRISTINE

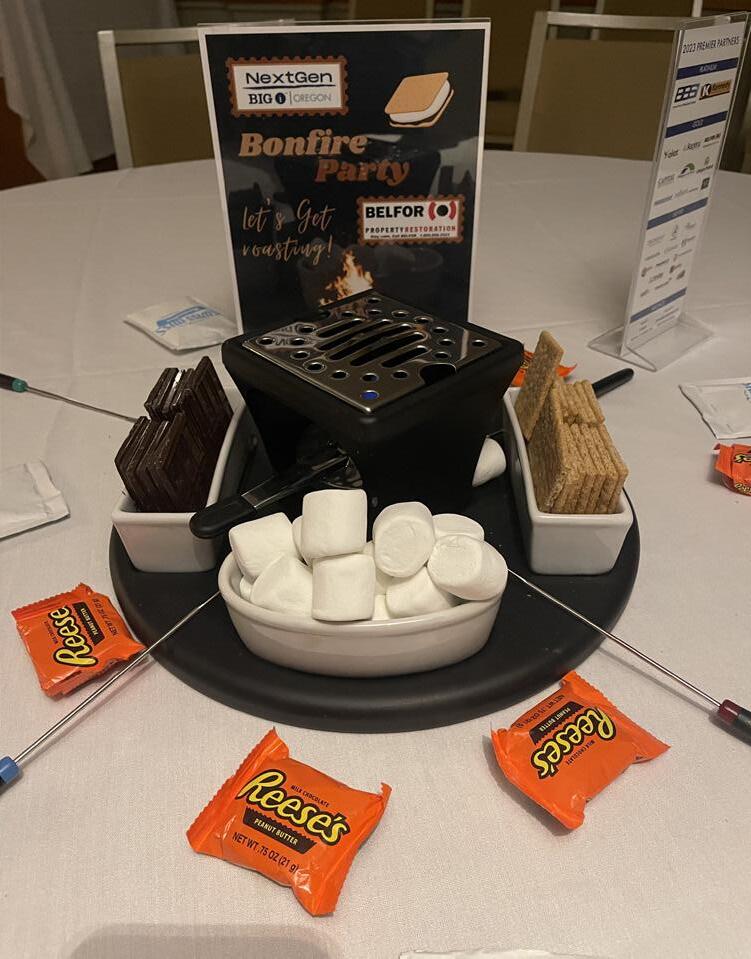

The first full week of March, over 70 members and Premier Partners of Big I Oregon gathered at the beautiful Inn at Spanish Head in Lincoln City for 2023 Connect and Educate Symposium. Everyone enjoyed the opportunity to network and obtain best in class continuing education from Chris Boggs, Vice President Agency Development, Research & Education, IIABA. While Mother Nature didn’t allow for the bonfire on the beach, BELFOR Property Restoration supported the NextGen by sponsoring their fun and festive party with cocktails and indoor s’mores! Those that weren’t there for the CE were able to attend the alternate activity of learning how to make Vietnamese Salad Rolls, Bún and Bánh mì and then enjoy eating them. Our own Jill Tieu lead the activity and she created culinary delights.

Preceding the CE Symposium, we held our Executive Committee Meeting and Board Meeting. Wow, do we have an engaged group of women and men looking out for each of you! We now have eleven active committees and each one is chaired by a Board Member. Our most recently formed committee is our Diversity, Equity and Inclusion Committee. All committee meetings are held via Zoom so you can be located anywhere in the state and still participate. I encourage you to consider joining a committee, it’s a great way to get involved in your association, make more connections and give back.

During our Board Meeting I introduced our newest employee, Christine Muduryan our Member Engagement Director. Christine’s first day was loading up my 4-Runner and riding with me to Lincoln City. Talk about jumping in! Christine possesses a unique blend of industry knowledge having worked for a national carrier (The Hartford),

two Big I associations, and most recently a large independent agency. Christine has been working for Symphony Risk Solutions (FKA MOC Insurance Services) out of California, for the past 16 years. From 2005-2007 she worked for our association, as Director of Education, until she moved to California. With her most recent employer she was an Executive Assistant/Client Services for the President/CEO and Executive Vice President/CFO from 2007-2014, Commercial Assistant Account Manager 20142022 and Associate – Workers’ Compensation 2022 to present. Christine moved back to Oregon July 2020 and Symphony Risk Solutions thought so highly of her they allowed her to continue her job from Oregon.

Over the course of her work experience Christine has been responsible for all aspects of event planning, provided support to platinum clients, producers and account executives managing large commercial book of business totaling $800K in revenue, cross selling and facilitated agency visibility including trade shows, sponsorships and community service. These are just some from a long list of the responsibilities she’s had. Christine is professional, always looks at her job with an eye toward improvement, gets along well with everyone and is a great team player. We are so fortunate to have her on our team! Send her an email, christine@bigioregon.com, and introduce yourself - she’s looking forward to getting to know you.

| Q2 2023 | 7

THE DIRECTOR’S CORNER

Christine Muduryan & Lyndsay Kooistra, our Immediate Past President, at our CE Symposium.

Thank you for attending our

CONNECT & EDUCATE SYMPOSIUM

THOSE NOT NEEDING CE LEARNED HOW TO MAKE VIETNAMESE SALAD ROLLS, BÚN AND

MÌ AND THEN ENJOYED EATING THEM!

8 | Q2 2023 |

JILL TIEU & MARIA HABERLOCK

CHRIS BOGGS AND A BEAUTIFUL VIEW OF THE PACIFIC OCEAN, A WINNING COMBINATION!

A WARM WELCOME FROM THE INN AT SPANISH HEAD!

BÁNH

COLE POWELL, JOHN POWELL, RACHEL POWELL, MARIA HABERLOCK, TARYN BRASETH, MAX MCCUDDY & JOSHUA KEENE

STEPHEN SMELLEY, BRAD FOLAND & DELLAS WALDO

MARK MINTEN, JOEY SPETEN, LIAM STAGEMEYER & CASSIE SMITH

NICK MALONE, BELFOR

ANGELA WILLIAMS, LYNDSAY KOOISTRA & MICHELLE GALLARDO

| Q2 2023 | 9

KAITY BLACKSHER, ANGELA WILLIAMS & TJ SULLIVAN

WHEN THE WEATHER DOESN’T COOPERATE, INDOOR S’MORES IT IS!

ELODEE CHAPMAN, DALLAS ROSS, KAITY BLACKSHER & ANGELA WILLIAMS

DENISE MOORE, ED DAVIS, LYNDSAY KOOISTRA, LEEANN SMELLEY, MICHELLE GALLARDO, STEPHEN SMELLEY, ANGELA WILLIAMS, ELODEE CHAPMAN, KAITY BLACKSHER & DALLAS ROSS

THOMAS WIRTH, KATRINA WIRTH, CHRIS BOGGS, DARREN EVERSOLE, KRISTEN HORLACHER, KRISTINA SCHWEIKERT, RUSS SCHWEIKERT, BRAD FOLAND

TYRA DRESSEL, PATTY BRANDT WALDO, DELLAS WALDO ATTENDEES NIGHTLY VIEW!

BRETT SLATER, DON WATERS, YANA CONNORS, HEATHER WATERS, TYRA DRESSEL, NICK MALONE, JUSTIN CONNORS & CHRISTINE MUDURYAN

DALLAS ROSS & MICHELLE GALLARDO

ELODEE CHAPMAN & TYSEN BODEWIG

10 | Q2 2023 |

YOU TO OUR PREMIER PARTNERS FOR THEIR CONTINUED SUPPORT! DIAMOND

DIAMOND

2023Premier Partners THANK

PLUS

| Q2 2023 | 11 Acuity Insurance CHUBB Mutual of Enumclaw Sublimity Superior Underwriters Western National GOLD SILVER BRONZE PLATINUM

INSURERS INCREASINGLY IMPOSING WARRANTIES AND SAFEGUARDS ON COMMERCIAL PROPERTY POLICIES

By: Nancy Germond

An interesting post on LinkedIn by risk management consultant Jack Schwartz, managing director at Davis + Gilbert Risk Management, caught my attention. The issue, according to Schwartz is that insurers are increasing the number of warranties placed on property policies, whether these are location-specific policies or smaller scheduled locations.

What are Representations Versus Warranties?

A representation is a statement made at the time of the application, either written or oral. For example, the insured may state no losses have occurred in the past five years. It is harder to void a policy or deny a claim based on a misrepresentation.

Warranties, on the other hand, are statements that could render the policy void even if they are not material to the loss. For example, a frequent warranty found in property policies is that no aluminum wiring is present in the building. If a burglary occurs, that warranty may not be relevant to the loss, but could still void coverage. According to the CPCU 530 text, “The law presumes warranties to be material, and their breach makes the contract voidable…. Warranties require strict compliance.”

According to Schwartz, “Insured should scrutinize quotes with greater detail since coverage restrictions and limitations are increasingly being added, particularly on location-specific policies…” Each quote may contain different warranties on each individual property, Schwartz warns. Additionally, underwriting scrutiny on renewals and new business is increasing. While agents often urge their clients to read the forms, agents open themselves to an errors & omissions claim if they fail to warn their clients of these warranties. Schwartz recommends both written and verbal warnings regarding warranties since so few insureds take the time to read their policies.

“Most policyholders lack the time, patience, or interest to actually review [their policies],” Schwarz added.

Replies to Schwartz’ Post

Some of the comments by agents to this LinkedIn post include the following.

• “I just received a renewal today with a list of ten different warranties, yes, ten! I did … discuss with the insured before binding coverage. Buyer beware!”

• “You know where they’ll get coverage? The E&O policy!”

What are Typical Warranties?

There are a variety of warranties, sometimes

12 | Q2 2023 |

COMMERCIAL LINES

Executive Director, Risk Management and Big I Education

referred to as “safeguards.”

Ansul systems or automatic fire suppression systems in restaurants

• Fending or onsite security on new construction or builders’ risk policies

• Burglar alarms

Sprinkler systems for fire suppression

• Video systems with recording Security services including on-site guards

• Electrical warranties

• Post-work fire watch protocols

• A warranty that any subcontractor will furnish a certificate of insurance to the contractor

When landlords are responsible for warranties in their tenants’ locations, problems can arise. Read an IA Magazine article outlining some of the challenges and possible solutions at bit. ly/3SxKTxz.

Where are Warranties Found in the Coverage?

Insurers often locate warranties in the exclusions of the policy, or by endorsement.

Some Cautionary Words to Agents

Schwartz has a few suggestions for agents offering property coverage. “Do your due diligence and explain and document to your clients any warranties.”

Schwartz warns agents that failing to disclose a warranty “In pursuit of the sale” will create an E&O exposure should a loss impacted by a warranty occur.

The commercial property market is as challenging today as many longterm agents have ever encountered.

The definition of catastrophes has expanded – hurricane, wildfires, freezes, civil unrest

have caused billions in losses the past few years. Ohio and Indiana now have wind and hail deductibles according to one broker. This hard market outpaces post-Katrina, and we are in a challenging market.

In the words of Bill Wilson, “If you can avoid a protective safeguards endorsement without sacrificing a premium discount, that may save your insured an unexpected and inexplicable loss.”

While insurers used to offer warranties to reduce premiums, today they are more frequently “must haves” to bind coverage, according to Schwartz.

Today, most insurance consumers try to cut costs. Sacrificing protection for a reduced premium has its pros and cons. That is one of the biggest challenges for today’s agent –getting the time you need with clients and potential clients to sell on value, not price.

| Q2 2023 | 13

DARREN EVERSOLE | 503.957.5460 | darren.eversole@ipfs.com Copyright © 2021 IPFS Corporation. All rights reserved.

This article was originally published on independentagent.com in August.

MAKE THE RIGHT FIRST DIGITAL IMPRESSION

Your Online Presence is Now More Important Than Ever

up for a FREE Trusted Choice Digital Review to have your website and social media channels analyzed and reviewed. You will receive an actionable report that gives you detailed feedback and insights on how you can improve your online presence and reach more customers. Visit trustedchoice.independentagent.com to learn more.

Sign

nice makes you smile.

At Western National Insurance, nice is what’s guided us for over 100 years. And we’re just getting started.

Western National Insurance. The power of nice.

www.wnins.com

By: Angela Williams

NextGen Chair

Huggins Insurance

HOW TO SURVIVE AN INSURANCE HARD MARKET

Insurance agents across the United States are feeling the same thing, and we are all asking ourselves the same question, “How will we survive this hard market?” Newly licensed account managers and producers are wondering why they decided to get into the insurance industry. Perhaps some agency owners are thinking this might be a good time to consider selling their business. Before you make any big decisions regarding your insurance career, do me a favor please. Let’s breathe…let’s think positive thoughts and say with me this too shall pass. Again, this too shall pass.

What exactly is a hard market? “A hard market is the upswing in a market cycle, when premiums increase and capacity for most types of insurance decreases. This can be caused by a number of factors, including falling investment returns for insurers, increases in frequency or severity of losses, and regulatory intervention deemed to be against the interests of insurers.” Yep. Sounds right. When I first began my career in the insurance industry, I was working for a personal lines captive insurance agent with a National Insurance Company. The office was a scratch agency, and the insurance company was only allowing agents to submit new business that was squeaky clean. The entire household could not have any sort of blemishes on their driving record which included claims within the past 3 years. The home could not have any sort of home claim within the past 5 years. It was tough, but we survived that crazy time.

Survival Tip #1-Be proactive. Try to get out in front of policy renewals before clients call your office. If possible, call all clients even if the rate increase was

small. Clients don’t know what we know about the insurance industry. Communicate positively with your client and they will be assured that you are the best insurance agent.

Survival Tip #2-Use videos to communicate with your clients. When a client sees you and knows who you are, it is harder to be upset about a rate increase. A wise insurance expert recently said, “How can a client be upset with you if you are smiling and holding your cat in a video?” Good point.

Survival Tip #3-Post on agency social media. Let clients know what community activities the agency is involved in. Post agency employees enjoying their hobbies, or organizations the agency is sponsoring. Make it personal and client retention will increase. If a client shares the same passions as agency employees, the client-agent bond grows stronger.

Survival Tip #4-Don’t forget to thank agency employees. Everyone is working hard. No one likes to feel neglected. Say thank you to your team with coffee cards, thank you cards, pizza Fridays or simply letting someone leave 1 hour early. These are small gestures that will go a long way with your team. “A single act of kindness throws out roots in all directions, and the roots spring up and make new trees.”-Amelia

Earhart.

16 | Q2 2023 |

NEXTGEN

My cat, Dutton, and I

Drives for Dreams

Benefiting Make-A-Wish World Wide Wish Day APRIL 20,

Registration

Registration includes food and two beverage tickets per person:

• $95 per person

OR BUY A BAY ($750):

• admission & golf for 6 people

• food & 2 drink tickets per person

• 1 complimentary InsurCon2023 registration for a NextGen attendee

• includes $150 donation to Make-a-Wish

There will also be an online auction with items ranging from experiences to wine!

SCHEDULE: 4:30 P.M.

P.M. SOCIAL

TO 5

5 P.M. TO 7 P.M. GOLF

2023 Top Golf

NE

Register today at bigioregon.com/events

5505

Huffman St. Hillsboro, OR 97214

| Q2 2023 | 17

AN AGENT CALL TO ACTION: UNDERINSURANCE

By: John E. Putnam

In the aftermath of the Marshall Wildfire in Boulder County, Colorado, the Denver press has continuously explored these questions from the insured survivor’s perspective, but there has been little discussion from the insurance industry perspective regarding this issue. The purpose of this blog is to start a discussion on the continuing perceptions of underinsurance especially after natural disasters to determine if there are changes needed to better estimate the replacement costs on both personal and commercial policies that agents sell to our customers.

Insurance to Value (ITV) is a basic concept which many insurance personnel are trained at the onset of their careers. Although counselled that we are not appraisers, adjusters, agents, and underwriters were provided with training and valuation tools aka costimators which seem to work very well over the years. Based upon conversations with many front-line agent/brokers assisting with their customer’s valuations, these tools do not change in their basic structure and do not regularly leave their customers underinsured. In retrospect, were they just lucky because they did not face many total losses or did their continual efforts to monitor and adjust the replacement cost values (RCV) help achieve those excellent valuation outcomes?

Bottom line, this methodology and training has worked quite well over the past fifty years to assist customers with valuing RCVs. Many agents have experienced occasionally competitor agents / companies using similar tools to undervalue required limits which permitted them to underbid higher, more correct valuations. While this behavior still exists, it does not occur as frequently as it once did and, in the new insurance marketplace used to occasional natural catastrophes, it presents another opportunity for the agent to advocate protection over lower prices.

Why does this subject matter to the author? When he was embarking into semi-retirement, he was asked to serve as a volunteer insurance consultant to the Waldo Canyon wildfire recovery team, Colorado Springs

Together (CST) because he was not directly contracted with any of the insurers who faced 347 total losses and some additional damaged properties. Starting that volunteer effort, he was initially concerned about the potential for underinsurance based upon other insurance catastrophes, local rumblings in the local press, and chattering in social media. This recovery process was a huge learning experience in many different aspects of how insurance policies deliver in a major natural disaster, but happily the issue of underinsurance did not prevent one of the most complete major wildfire recoveries experienced by a large urban fire. His early fears of underinsurance became unfounded as the Waldo survivors, their builders, and their companies navigated through the many different coverage “buckets” ie debris removal, law and ordinance, extended replacement, inflation guard, and landscape allowances which helped to close most rebuild gaps. In fact, the most extreme Coverage A dwelling underinsurance situation that he encountered (approximately 40%), the policy holder was able to close the gap with the above additional coverages and their company’s endorsement which doubled the extended replacement and law & ordinance limits when it resulted from a declared natural disaster.

• What were the lessons learned from his CST experience? There are too many stories to recount in this short piece, but the following were most significant:

• A community-based recovery team that allows for many segments of the local community to participate in the recovery goal is an important attribute to a quick and complete recovery.

• The recovery team needs a strong leader to keep the team focused on the main task – rebuilding the

18 | Q2 2023 | PERSONAL LINES

Insurance Consultant/Broker/Teacher

neighborhood.

• A community and team focused on minimizing politics, controversy, and adversarial relationships among any of the stakeholders is a critical component of a solid recovery.

• The encouragement of the survivors to better understand their policies and limits as well as the insurance claims process facilitates quicker resolution of any outstanding issues.

• Local economic conditions can be a positive driver of the recovery. The Waldo Recovery occurred during the end of the 2008 recession, so labor and supplies were more readily available to the recovery.

The recovery team had a self-imposed one-year recovery time limit because virtually all the pieces for the Mountain Shadows Neighborhood recovery were in place by the end of the year. Survivors, neighbors, the city, and team members were pleasantly surprised that, despite the early alleged obstacles, an amazing outcome was collectively achieved.

After such a positive recovery experience, he followed many other wildfire recoveries both in Colorado and other areas in the United States. Interestingly, he is not aware of another public-private recovery team approach as done here in Colorado Springs. In most cases, it appears that recoveries are driven by the local governments which tend to be slower due to the more bureaucratic approach that government must take to conduct all its business. Why does this matter in a discussion of underinsurance? Slow recoveries exacerbate the effects of underinsurance.

• As Boulder County faces its recovery from the Marshall Fire, the topic of underinsurance seems to dominate its early recovery preparations. Certainly, the recovery challenge is more than three times greater than the Waldo Recovery which will certainly further slow the recovery based solely on the scale of recovery. Without being imbedded in the Marshall recovery team, it is difficult to fully access the extent of the underinsurance at this time although there are some early warning signs of potential concern:

• The limited supply of builders needed to rebuild all the destroyed residences may be a driver of higher replacement/reconstruction costs;

• The unprecedented increases in the local building costs over the past two years that may not have yet been incorporated into the costimator valuation processes;

• Initial indications of added building code requirements needed to rebuild are very concerning and would not have been included in any costimators;

• Debris removal delays which will slow the actual reconstruction;

• Unusual supply chain challenges;

• Popular insurance advertising that promotes price

competition v coverage adequacy;

• Other natural catastrophe competition for resources ie Kentucky wildfires, California wildfires, Louisiana hurricanes, etc;

• Less streamlined rebuild permitting processes; and

• The continual reminder of underinsurance which creates more negativity among the survivors that their recovery will be impossible.

Going forward, it is critical for the insurance industry to take the lead in starting to diagnose any shortcomings in the procedures and systems for both valuing properties, as well as best practices to streamline recoveries. As we know, insurance coverages/limits may differ among the homeowners policies that different insurance companies write. Perhaps, it is also time to realize that there may be different valuation needs for natural disasters. Of course, the biggest hurdle is to overcome the average consumer’s belief “it can’t happen to me” paradigm.

What can front line agents do to start or aid this discussion? Here are some initial first steps: Identify either personal or commercial accounts where you think whatever costimator being used that may either under or over insure.

1. Identify any differences within your agency on how real property valuations are done and re-train as necessary so there are consistent processes.

2. Check with local claim departments and construction businesses to determine what the going rate is to build in your community/region.

3. Double check a sampling of real property valuations periodically to make sure they are responsive to local building costs and national inflation and supply line conditions.

4. Refer any valuations which are either over or under valued to the insurer and ask them to check to make sure that they agree with your valuation and have continuous conversations regarding insurance to value.

5. Start tracking any variations in valuation so valuation adjustments can be made as necessary.

6. Share any variations in values with your local agency associations so the magnitude of any underinsurance can be assessed. This is especially important in locations more frequently visited by natural catastrophes.

As a long-time independent agent, John knows agents can make great differences for both their customers and the industry. In the meantime, if you have examples of under- or over-insurance using the various costimators provided by your companies, please share them with me at jeputnam@aol.com.

This article first appeared on Bill Wilson’s Insurance Commentary blog.

| Q2 2023 | 19

2023 EXECUTIVE COMMITTEE

21 Years

RUSS SCHWEIKERT President Agency/Company Relations Chair Ashland Insurance, Inc. Ashland, OR 29 Years

LYNDSAY KOOISTRA Immediate Past President

Membership Chair LaPorte Insurance Portland, OR

DEBORAH MOHR Vice President Deborah Mohr Consulting Forest Grove, OR 27 Years

JENNIE WEILAND President-Elect Events Advisory Chair HUB International Northwest Portland, OR 22 Years

TIM CUNDARI Finance Chair Education Chair Cundari Insurance Portland, OR 28 Years

STEPHEN SMELLEY National Director

Product & Services Chair Goldfinch Consulting Beaverton, OR 36 Years

TYRA DRESSEL Executive Director Big I Oregon Portland, OR 30 Years

RUSS SCHWEIKERT President Agency/Company Relations Chair Ashland Insurance, Inc. Ashland, OR 29 Years

LYNDSAY KOOISTRA Immediate Past President

Membership Chair LaPorte Insurance Portland, OR

DEBORAH MOHR Vice President Deborah Mohr Consulting Forest Grove, OR 27 Years

JENNIE WEILAND President-Elect Events Advisory Chair HUB International Northwest Portland, OR 22 Years

TIM CUNDARI Finance Chair Education Chair Cundari Insurance Portland, OR 28 Years

STEPHEN SMELLEY National Director

Product & Services Chair Goldfinch Consulting Beaverton, OR 36 Years

TYRA DRESSEL Executive Director Big I Oregon Portland, OR 30 Years

bigioregon.com

2023 BOARD OF DIRECTORS

KAITY BLACKSHER

NextGen Immediate Past Chair Atkinson Insurance Group Portland, OR 18 Years

KRISTON CORRELL

JUUL Insurance Agency North Bend, OR 25 Years

MICHELLE GALLARDO

The Partner’s Group Tigard, OR 19 Years

CHRIS HUWALDT PayneWest Insurance McMinnville, OR 28 Years

TJ SULLIVAN

Hagan Hamilton Insurance Solutions Sheridan, OR 26 Years

DELLAS WALDO

ANGELA WILLIAMS

ED DAVIS

NextGen Chair

Legislative & Government Affairs Chair

Huggins Insurance Salem, OR

Maps Insurance Services Salem, OR 58 Years

STEVE LACESA

Oak Tree Insurance Lake Oswego, OR 39 Years

DALLAS ROSS Procurement Chair Timmco Insurance - Cornell Portland, OR 10 Years

Field-Waldo Insurance, Inc. Ontario, OR 6 Years

ANGELA WILLIAMS

NextGen Chair

Huggins Insurance Salem, OR 20 Years

| Q2 2023 | 21

THE HYBRID ADVANTAGE

By: WAHVE

It started in January 2023 as a slow trickle. However, the movement to get workers back in the offices and phase out hybrid schedules is gaining momentum despite the statistics that point to why the hybrid work culture is a boon for business.

Organizations ranging from Starbucks to Disney are now requiring more inperson workdays or pushing a full return to office life. Amid a tight, demanding labor market environment, CEOs and senior management are boldly stating the obvious: They want workers back in the office.

Perhaps their confidence is premature. A McKinsey & Company article reported that by the end of May 2022, there were 11.3 million job openings just in the US. While the Bureau of Labor Statistics reports a slight decrease in the number of openings in December 2022 (just over 11 million), the sheer number of openings states the obvious: It is still an employee-driven market.

Another thing that organizations need to keep in mind as they move forward: what happens to all the effort and investment into adapting their companies and people to a new work culture? Now that employees are committed and producing, does it make sense to turn away from the effort?

Tough questions, but fortunately the answers are in the numbers. There is plenty of data available to show that hybrid work has distinct advantages not just for the employees, but for the health of the entire business.

Here’s why:

Hybrid work cultures attract top job seekers and help retain good employees. Particularly in the insurance industry, which is having a tougher struggle than most industries amid the labor market woes, offering remote work can expand the talent pool and attract job seekers. By removing geographical limitations of most traditional job searches, you can find the right fit for your opening.

Hybrid work is sought after. As more companies bring employees back to the office, studies show that could be a costly mistake. One study reveals that 37% of male and 35% of female workers would start looking for a new job if they were required to return to the office. An astounding 83% of workers say they prefer to work remotely even 25% of the workweek. Another study found that 47% of employees would leave their jobs if offered hybrid work in another company.

Hybrid work keeps employees on board. Likewise, when you offer your employees hybrid work options, they are more likely to be satisfied and stay with your company.

22 | Q2 2023 |

AGENCY OPERATIONS

One study by Quantum Workplace shows that 81% of hybrid employees are highly engaged – 78% of remote workers are equally engaged.

Hybrid work improves productivity.

Global Workplace Analytics data show that remote workers are anywhere from 3540% more productive than their in-house colleagues, a result that over two-thirds of employers are reporting seeing in their own remote workers.

Hybrid work improves communication. Hybrid work forces companies to concentrate on an area that has seen little focus – employee communication. Because remote work requires new ways of collaborating, organizations learned quickly how to best communicate with employees and just how important targeted communications was. Meetings became brief and topic-driven.

Employees collaborated via messaging apps and video calls. Managers checked in much more frequently than when employees were in-house. Communication actually increased among the workforce during pandemic lockdowns and conversations were more intentional.

Removing hybrid work options removes those benefits. It also makes finding employees to fill empty positions that much more difficult. That’s why adopting a hybrid work culture can give your organization a competitive advantage, especially over those organizations that require in-office attendance.

It can also benefit your company to embrace the hybrid work model. Employees are more motivated, job seekers are more interested, and productivity and communication are noticeably improved. Talk about a business boost.

| Q2 2023 | 23

Donate to Oregon Insurance Political Action Committee today! M A K E Y O U R V O I C E H E A R D E n s u r e y o u r b e s t i n t e r e s t s a r e r e p r e s e n t e d i n t h e h a l l s o f t h e s t a t e C a p i t o l . Y o u r s t a t e p o l i t i c a l a c t i o n c o m m i t t e e p l a y s a r o l e i n t h e B i g I O r e g o n ' s l e g i s l a t i v e s u c c e s s a n d e m p o w e r s m e m b e r s t o p a r t i c i p a t e i n t h e p o l i t i c a l p r o c e s s . b i t . l y / o r e g o n p a c V i s i t t o d o n a t e t o O I P A C t o d a y . 24 | Q2 2023 |

Educating the Public on the Insurance Industry

By: Roger Beyer Big I Oregon Lobbyist

This article was written March 2, 2023.

I began representing Big I Oregon in 2011, and since that time, in every session, there have been one or more bills to bring the insurance industry under the authority of the Unlawful Trade Practices Act (UTPA). Doing this would subject the industry to dual regulation by both the Department of Consumer and Business Services, as currently, and the Department of Justice. The bills have been in various forms but always have the same idea supporting them: the industry is not treating consumers fairly and needs additional regulation to make that happen.

I believe this stems from two predominate reasons: 1) the Oregon Trial Lawyers are always looking for new ways to bring lawsuits. This will never change.

The Oregon Trial Lawyers Association raised over $250,000/year through their PAC. OIPAC, our association’s PAC, has averaged about $1,200/year in contributions from our entire industry over the past three years. 2) both lawmakers and the general public have a deep lack of understanding of how insurance works, and coupled with that is mistrust of the industry generally. This second reason seems solvable if the industry would work on it.

The role of producers (agents) seems to really be misunderstood by both legislators and the public. You and I know that you are there to be an advocate for your clients, but that is not well understood by others. This became very evident earlier this year when, during a public hearing on a bill, a legislator asked a witness if they had contacted their agent when in a dispute over a claim. The response was “of course not, they work for the insurance company”. That pretty well sums up what the attitude here is, but it also opened my eyes.

26 | Q2 2023 | LEGISLATIVE UPDATES

What can you as agents do to change that perception?

To follow this up, I began to meet with legislators and let them know what the role of an independent agents is. I believe this has been paying dividends, as two new amendments to these dual regulation bills surfaced. Both amendments narrow the bills to limit this dual regulation to only the claims settlement processes, which agents don’t participate in. This tells me that when people become aware of the role of agents, they realize you are not part of the problem and actually can be part of the solution. A good beginning, but the job is not done.

As I see this now, Big I Oregon as your organization and each of you individually have an opportunity to change this public perception. The insurance companies are working to improve their image in the public, and this may help. Agents, once the public hears the truth, can more quicky improve their image than an insurance company can.

Many of you participate in civic activities in your own communities already but may not be telling the story about what you can do for them as individuals. If you want to help change this negative perception, now is the time to act. Let your clients know that you are there for them and do this before they have a problem. For most people, insurance is considered a necessary element, but they never want to find out if it worksone of those things you hope to never need!

As an association, should Big I Oregon take on a public relations role to help change this perception? It may be time for that topic to be discussed. If so, Big I Oregon would need to create a new mission which would mean increased staff and budget. The question would be, is this the proper role for your statewide organization or is this better suited for individual independent agencies? I am not qualified to answer that question. I only bring it up as I see the need to educate the public on the issue. I would encourage each of you to think about this and communicate your ideas to the Big I Oregon Board Members.

A trusted supporter of the Big

| Q2 2023 | 27

Personal l Commercial l Flood

“I” Oregon

HIRE THE RIGHT

YOU’RE INDEPENDENT, BUT YOU’RE NOT ALONE

Big “I” Hires℠ has curated resources to help you find, hire, assess and engage your team. When it’s time to assemble your dream team, the Big “I” has your back with cutting-edge tools that make hiring easy!

WWW.BIGIHIRES.COM

| Q2 2023 | 29

EMAILING INSURANCE DOCUMENTS TO CLIENTS? READ THIS!

By: Mallory Cornell IIAW Vice President & Swiss Re Approved Auditor

In 2000, the Electronic Signatures in Global and National Commerce Act (E-Sign Act) was signed into law and allowed for the use of electronic records and signatures to satisfy any legal requirements to provide information in writing. It is important to remember even 23 years later, that the information and signatures are only accepted if the consumer has consented to receive this information electronically and has not declined or withdrawn their consent.

The million-dollar question: have you obtained e-delivery consent from your customer?

As an agency, if you are sending policies, notices, endorsements, or obtaining electronic signatures on documents, consent for electronic delivery must be

on file for that customer. Furthermore, documents such as termination of health insurance or benefits of life insurance (excluding annuities) may not be provided solely via electronic delivery.

What is included in the electronic delivery consent?

The customer must be provided clear statements advising them of the following*:

1. The right or option for the consumer to receive documents in paper form;

2. The right to withdraw the consent to electronic delivery and any conditions, consequences, or fees associated with such withdrawal;

3. A description of the procedures that the consumer must follow to withdraw the consent to electronic delivery and to update information needed to contact the consumer electronically;

30 | Q2 2023 |

E&O

4. A description of how the consumer, after consenting to electronic delivery, may obtain a paper copy of any record and whether any fee will be charged for such a copy;

5. A statement regarding whether the consent applies only to a particular transaction or category of documents;

6. A description of the hardware and software requirements for access to and retention of documents delivered electronically.

It is essential to remember that the customer must confirm in writing their consent to electronic delivery. This means you must obtain a signature on an electronic delivery consent form; not an email stating consent.

By obtaining electronic delivery consent, the agency can operate more efficiently and oftentimes save money on printing, mailing, and processing costs. More customers are preferring electronic communications, so it is important to not only receive consent but to provide customers with guidance and information on how the agency will be communicating.

If you would like to receive a sample consent form or to update your workflows, please contact Mallory Cornell, Swiss Re Approved Auditor, at mallory@iiaw.com.

*Information obtained from the “Procedure for Electronic Delivery of Insurance Documents Pursuant to the Federal eSign Act” Big I Agents Council for Technology, May 14, 2021.

Workers’ Compensation

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com.

| Q2 2023 | 31

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/ Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

Workers’ Compensation • Transportation – Liability & Physical Damage • Construction Liability • Fine Art & Collections Homeowners – Including California Wildfire & Gulf Region Hurricane • Structured Insurance • Financial Lines • Surety Aviation & Space • Environmental & Pollution Liability • Real Estate • Reinsurance • Warranty & Contractual Liability Infrastructure • Entertainment & Sports ...And More To Come. MORE TO LOVE FROM APPLIED.® MORE IMAGINATION. ©2023 Applied Underwriters, Inc. Rated A- (Excellent) by AM Best. Insurance plans protected U.S. Patent No. 7,908,157. It Pays To Get A Quote From Applied.® Learn more at auw.com/MoreToLove or call sales (877) 234-4450

RUSS SCHWEIKERT President Agency/Company Relations Chair Ashland Insurance, Inc. Ashland, OR 29 Years

LYNDSAY KOOISTRA Immediate Past President

Membership Chair LaPorte Insurance Portland, OR

DEBORAH MOHR Vice President Deborah Mohr Consulting Forest Grove, OR 27 Years

JENNIE WEILAND President-Elect Events Advisory Chair HUB International Northwest Portland, OR 22 Years

TIM CUNDARI Finance Chair Education Chair Cundari Insurance Portland, OR 28 Years

STEPHEN SMELLEY National Director

Product & Services Chair Goldfinch Consulting Beaverton, OR 36 Years

TYRA DRESSEL Executive Director Big I Oregon Portland, OR 30 Years

RUSS SCHWEIKERT President Agency/Company Relations Chair Ashland Insurance, Inc. Ashland, OR 29 Years

LYNDSAY KOOISTRA Immediate Past President

Membership Chair LaPorte Insurance Portland, OR

DEBORAH MOHR Vice President Deborah Mohr Consulting Forest Grove, OR 27 Years

JENNIE WEILAND President-Elect Events Advisory Chair HUB International Northwest Portland, OR 22 Years

TIM CUNDARI Finance Chair Education Chair Cundari Insurance Portland, OR 28 Years

STEPHEN SMELLEY National Director

Product & Services Chair Goldfinch Consulting Beaverton, OR 36 Years

TYRA DRESSEL Executive Director Big I Oregon Portland, OR 30 Years