“I think it will be a correction in terms of multiples that people are willing to pay for specific industries, particularly in the later stages.”

dotcom boom. “That risk of two people sitting in their living room with an idea, trying to launch a startup and then raise funding for it, isn’t there as much today as it was in 2001,” Mehta says. “We have the right operations in place.”

But even in early stages, the valuation is less relevant than the risk, in accordance with Lenet’s sentiment. Also, the risk is declining. While tech is definitely still a very risky asset class, says Mehta, there are more groups that are spending time de-risking it, as venture firms themselves are building out their own platform functions while providing their portfolio companies with experienced legal teams, go-to market teams, marketing teams and more. He notes that it is a lot cheaper to start a tech company now than during the

“Those longer term investors that are really smart and kind of strategic about this entire thing are looking at it like, ‘Alright, this is a horizon of seven to 10 years. So, despite what’s happening in the public markets, we believe that there will be valuable companies that are getting started today.’ They need to have a long-term perspective despite market fluctuations, interest rates, inflation and because they just need to blend their funds.”

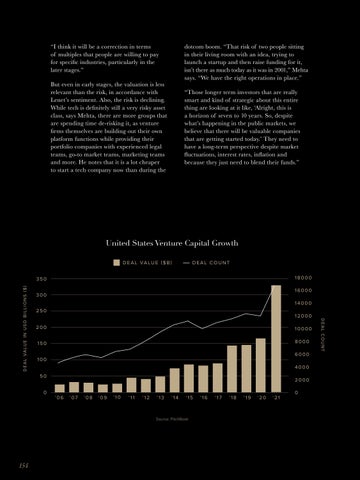

United States Venture Capital Growth D E A L VA L U E ( $ B )

DEAL COUNT 18000 16000

300

14000 250

12000

200

10000

150

8000 6000

100

4000 50 0

2000 ’06

’07

’08

’09

’10

’11

’12

’13

’14

’15

Source: PitchBook

154

’16

’17

’18

’19

’20

’21

0

DEAL COUNT

D E A L VA L U E I N U S D B I L L I O N S ( $ )

350