Dataentryerrorsinthecontextof bookkeeping refer to mistakes made during the process of manually inputting financial information into accounting systems.Theseerrorscanoccurfor various reasons and may have significant consequences for the accuracyoffinancialrecords. Data entry errors can have cascading effects on financial accuracy and decision-making. By understanding the common types, causes, and implementing preventive measures, businesses can minimize the risk of data entry errors and maintain more accurate financial records. Regular reviews and continuous improvement in processes are essential components of effective data entry management www.annaporanaapt.co

Neglecting reconciliations, particularly bank reconciliations, is a common bookkeeping mistake that can have significant implications for the accuracy of financial records. Reconciliations involve comparing financial transactions recorded in a company's accounting system with external statements, such as bank statements, to ensure they match. Here's an explanation of neglecting reconciliations and its consequences

www.annaporanaapt.co

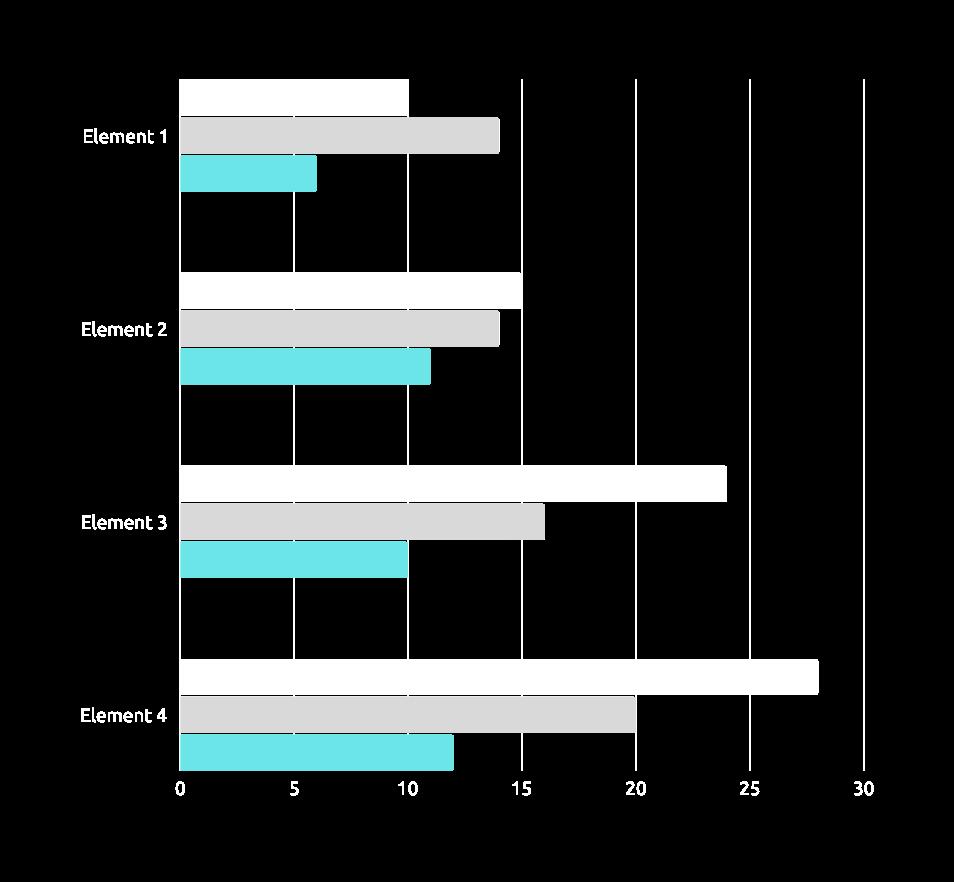

CASH FLOW ISSUES INCREASED RISK OF FRAUD

Failure to reconcile bank statements may lead to difficulties in accurately tracking cash balances.

Neglecting reconciliations can create opportunities for fraudulent activities to go undetected

INABILITY TO DETECT ERRORS DIFFICULTY IN TRACKING OUTSTANDING TRANSACTIONS

Neglecting this process may result in the perpetuation of errors and inaccuracies in financial reports

Reconciliations help track outstanding transactions, such as checks that have not cleared

Misclassifying expenses refers to the incorrect assignment or categorization ofcostswithinacompany'saccounting system. Proper classification is crucial for accurate financial reporting, budgeting, and analysis. When expenses are misclassified, it can lead to distorted financial statements, inaccurate budgeting, and challenges in understanding the true financial healthofthebusiness.. Data entry errors can have cascading effects on financial accuracy and decision-making. By understanding the common types, causes, and implementing preventive measures, businesses can minimize the risk of data entry errors and maintain more accurate financial records. Regular reviews and continuous improvement in processes are essential components of effective data entry management

www.annaporanaapt.co

"Forgetting to record transactions" in the context of bookkeeping refers to theunintentionalomissionoffinancial transactions from a company's accounting records. This oversight canoccurforvariousreasonsandcan havesignificantconsequencesforthe accuracy of financial statements and decision-making.

By implementing these preventive measures, businesses can reduce the likelihood of forgetting to recordtransactions,ensuringthattheirfinancialrecords are complete, accurate, and compliant with relevant standards.

Causes of Forgetting to Record Transactions

How to Avoid Forgetting to Record Transactions

1) Volume of Transactions

2) Human Error

3) Complexity of Transactions

4) Inadequate Systems

5) Staff Changes

1) Establish Clear Procedures

2) Use Accounting Software

3) Regular Reconciliation

4) Inadequate Systems

5) Documentation

"Notbackingupdata"referstothefailureto create copies or duplicates of important digital information, including financial records, files, and databases. Backing up dataisacriticalpracticetopreventdataloss

due to various potential risks such as hardware failure, data corruption, cyberattacks,oraccidentaldeletions

By adhering to best practices and regularly backing up data, organizations can minimize the risks associated with data loss and ensure a more resilient and secure data management strategy.

"Ignoring petty cash transactions" refers to the failure to properly document and account for small, incidental expenses in a business's financial records. Petty cash is a fund set aside to cover minor, day-to-day expenses that are usually too small to warrant writing a check or initiating an electronic payment. When petty cash transactions are ignored or not adequately recorded, it can lead to various issues in financial management.

In conclusion, addressing common bookkeeping mistakesthroughsystems,training,andtechnology is essential for businesses. By implementing efficient processes, leveraging modern accounting software, and investing in staff education, organizations can maintain accurate financial records. Regular reviews, internal audits, and a commitment to best practices contribute to ongoing improvement. Accurate financial records facilitateinformeddecision-making,budgeting,and regulatory compliance. Ultimately, proactive bookkeeping is a strategic imperative for business success, instilling confidence among stakeholders and ensuring resilience in a dynamic economic landscape.

www.annaporanaapt.co