Official Local Voters’ Pamphlet

Registration Deadlines:

These deadlines apply to new registrations & voter updates!

Mail: February 3

Online: February 3

In-Person: February 11

Military & Overseas Ballots Mailed: January 8

Ballots Mailed: January 22

Additional Resources:

Local Election Information www.bentoncountywa.gov/auditor

County Information www.bentoncountywa.gov/auditor

State Election Information www.sos.wa.gov

Campaign Finance Information www.pdc.wa.gov

Published by the Benton County Auditor

February 11, 2025 Special Election

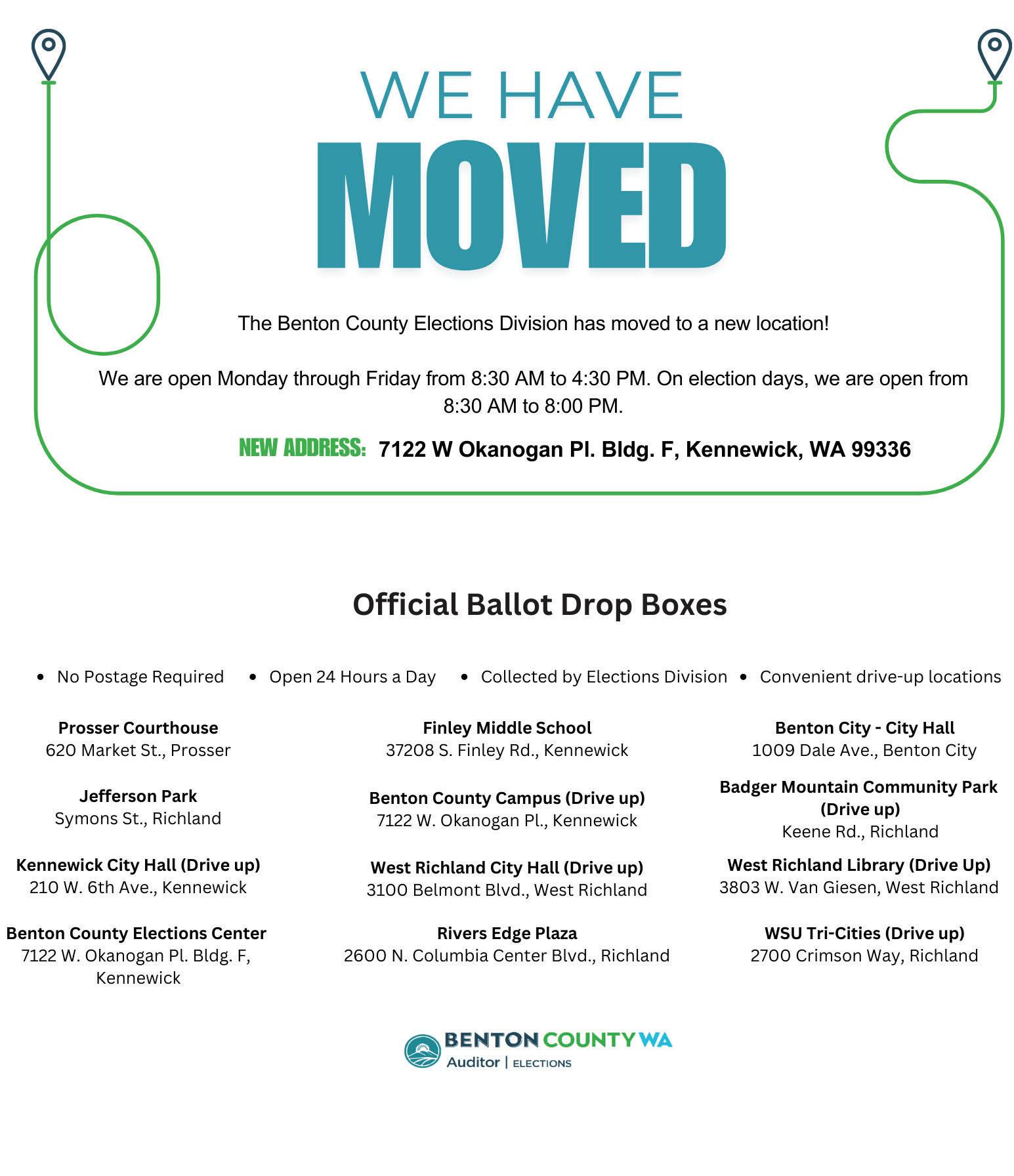

Ballot Drop Box Locations:

Courthouse 620 Market St., Prosser

Benton City - City Hall 1009 Dale Ave., Benton City

West Richland Library (Drive up)

3803 W. Van Giesen St., West Richland

West Richland - City Hall (Drive up) 3100 Belmont Blvd., West Richland

Jefferson Park (Drive up) Symons St., Richland

WSU Tri-Cities (Drive up) 2770 Crimson Way, Richland

Rivers Edge Plaza (Drive up) 2600 N. Columbia Center Blvd., Richland

Benton County Elections Center 7122 W. Okanogan Pl. Bldg. F, Kennewick

Badger Mountain Community Park (Drive up) 350 Keene Rd., Richland

Benton County Campus (Drive up) 7122 W. Okanogan Pl., Kennewick

Kennewick - City Hall (Drive up) 210 W. 6th Ave., Kennewick

Finley Middle School (Drive Up - In Parking Lot Streetside)

37208 S. Finley Rd., Kennewick

Dear Benton County Voters,

We are pleased to present the 2025Benton County Local Voters’ Pamphlet for the February 11, 2025 SpecialElection! This winteryou are going to have an opportunity to shape the future of our community by participating in the election process. You will be voting on measures that affect you, your family, and your neighborhood. When you vote, you have a direct say in our government at the local, state, and federal level.

This pamphlet is designed as a reference tool to help you make informed decisions. Inside you’ll find useful information about voter registration, deadlines for returning your ballot, and ballot drop box locations. This pamphlet includes ballot measures and pro and con committee statements for ballot measures. Please note that we do not make edits or corrections to any statements.

To be eligible to vote in a special election in a jurisdiction, you must be a registered voter and live in the participating district.

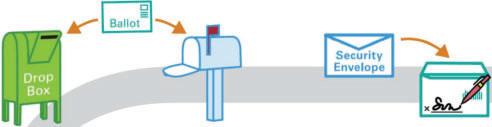

Your Signature Matters! Two of the most common reasons ballots are unable to be processed are that they are returned without a signature,or with a signature that does not match what we have on file.

We want to help every eligible person register to vote and every registered voter receive their ballot. The earlier the Elections Division is contacted by individuals who need a replacement ballot, want to register to vote and receive a ballot, or have related issues, the more options there will be available to provide assistance. You can call us at (509) 736-3085, send an email to elections@co.benton.wa.us, visit our website –www.bentoncountywa.gov/auditor, or come intoone of our offices at:

Benton County Elections Center, 7122 W. Okanogan Pl. Bldg. F, Kennewick Auditor’s Office, Benton County Courthouse, 620 Market St., Prosser, WA

Both offices are open weekdays8:30 a.m.-4:30 p.m., and on Election Day 8:30 a.m. -8:00 p.m.

The Benton County Elections Division is dedicated to assisting all voters, candidates, and jurisdictions in the election process while ensuring elections are conducted securely, accurately, and transparently in compliance with the laws of the State of Washington. I hope you find this Voters’Pamphlet useful, and of course, do not hesitate to contact my staff or me with any questions.

y

Brenda Chilton Benton County Auditor

Local Ballot Measure

Richland Public Facilities District

Proposition 1

SALES AND USE TAX FOR PERFORMING ARTS CENTER

The Richland Public Facilities District Board of Directors adopted Resolution No. 03-2024 concerning constructing and operating a performing arts center within the District. This proposition would authorize a sales and use tax increase of 2/10ths of 1 % for the purpose of paying costs associated with the financing, design, construction, equipping, operation, and maintenance of a performing arts center and associated capital facilities and would be authorized for 30 years.

SHOULD THIS PROPOSITION BE APPROVED?

Yes No

The Official Ballot Title was written by the Richland Public Facilites District as required by law. The Benton County Auditor is not responsible for the content of arguments or statements.

Pro Committee & Contact Information

Committee for a Performing Arts Center

Carol Moser

Art King

Joel Rogo

Committee Contact: 509-539-9891 moserzone@charter.net https://yes4mcpac.org/vote-yes/

Explanatory Statement

PROPOSITION NO. 1 – SALES AND USE TAX FOR PERFORMING ARTS CENTER

This proposition authorizes an additional two-tenths of one percent sales and use tax (2¢ on a $10.00 purchase) in Richland, for the costs associated with designing, constructing and operating a performing arts center and associated capital facilities. The measure would end after 30 years and fund most of the approximately $80 million needed to develop the facility, which is likely be financed over 30 years. The facility would be located in Richland and is planned to include an 800-seat auditorium and multi-use community space, subject to budget adjustments. The associated capital facilities are adjacent structures, such as walkways and plazas, that could potentially be built to improve access and operation of the performing arts center itself.

Con

Committee

& Contact Information

Melissa Lough

Committee Contact: 509-906-4954 melissa.lough@outlook.com

Pro Committee Statement

The Mid-Columbia Performing Arts Center is more than a building—it will transform the Tri-Cities into a cultural and economic hub that serves everyone. Voting YES for a 2-cent tax on every $10 of goods and services purchased in Richland ensures that this vision becomes a reality for our community.

With over 300,000 residents, the Tri-Cities is one of Washington State’s largest metropolitan areas, but it lacks a dedicated performing arts center. This absence limits access to diverse cultural experiences, stifles the growth of local talent, and forces many residents to travel outside the region for arts and cultural events. The Mid-Columbia Performing Arts Center is the solution our community needs.

The Center’s ~800-seat theatre is designed specifically for the many established regional performing arts groups, mid-sized national touring groups, and educational arts events. It will offer a professional venue for plays, concerts, festivals, and dance performances; a stage for community groups and youth programs; and a central hub for celebrations, cultural events, and educational activities.

The Center will boost tourism, generating increased spending on food, lodging, and shopping and provide employment during construction and operations. Its location next to the REACH Museum sets the stage for a vibrant cultural district.

Our quality of life will be improved by the Center by offering affordable, high-quality cultural experiences close to home; creating a comfortable, accessible venue with excellent acoustics, ample parking, and a welcoming environment; and building a cultural legacy for future generations to enjoy.

Pro Committee Rebuttal Statement

Only two of >30 community groups surveyed indicated an occasional need for >800 seats. A theatre that could host large touring shows would be prohibitively expensive. Not considering cost in determining facility size is fiscally irresponsible. Richland has a long-term lease from the Army Corps for the preferred site and supports building it there. Private funding follows public funding for obvious logistic reasons. Voting no won’t result in a larger facility, but no facility.

Con Committee Statement

Vote NO on Richland PFD. The public deserves an informed vote. While we support a performing arts center, this proposal places a financial burden on all residents for an impractical facility.

The proposed 800-seat theater does not satisfy the needs of our community. Many local performing groups exceed the capacity of the largest local theaters (example: 1500 seats at Richland High.) Cost should not be the driver when determining the right size of this facility.

The plan does not allow for the Off-Broadway/Concerts many community members expect. The plan only projects 25 of 143 performances annually to be out-of-town performances, and the size of the theater greatly restricts what acts can perform.

There is no current lease/sale agreement in place for the proposed location, next to the REACH Museum. The land is currently owned by the Army Corps of Engineers, and the City of Richland/Richland PFD have not negotiated an agreement for this land. This groundwork should have been done before asking taxpayers to fund this project.

The current proposal does not disclose how much private funding been raised for the project to date. We would like to see significant private donations to illustrate community support before asking for the public to fund this project.

Public funds should be spent wisely and voted on by informed voters.

Vote NO on the Richland PFD sales tax increase. Let’s find responsible ways to invest in our community without increasing the financial strain on those who can least afford it.

Con Committee Rebuttal Statement

The 800-seat theater proposal is undersized. The limited seating restricts what acts can perform, which limits the cultural and economic benefit to our community. Prior local studies and community engagement recommended a seating capacity of ~2,000.

Comparable theaters used by the Richland PFD are mainly located in suburban communities of major metropolitan cities. These aren’t comparable. Approval will tie-up PFD community project funding for 30-years. Vote “No”, our community deserves a better plan.

School District No. 52 | Proposition No. 1

Local Ballot Measure

Kiona-Benton School District No. 52

Proposition No. 1

EDUCATIONAL PROGRAMS AND OPERATION REPLACEMENT LEVY

The Board of Directors of Kiona-Benton City School District No. 52 adopted Resolution No. 6-2024, concerning a proposition to finance educational programs and operation expenses. This proposition would authorize the District to levy the following excess taxes, in place of an expiring levy, on all taxable property within the District, for educational programs and operation expenses not funded by the State (including athletics, music, technology support, special education, class size, nurses, counselors, safety staff, advanced courses, and extracurricular activities):

Explanatory Statement

PROPOSITION NO. 1 – EDUCATIONAL PROGRAMS AND OPERATION REPLACMENT LEVY

Passage of Proposition No. 1 would allow Kiona-Benton City School District to replace an expiring educational programs and operation levy. The taxes collected by this replacement levy will be used to pay for expenses of educational programs and operation that are not fully funded by the State of Washington. These expenses include, but are not limited to: technology; athletics; smaller class sizes; school safety; instructional materials; special education; maintenance; student activities; teaching and support staff; and other educational programs and operation expenses. Taxes collected by the proposed levy will provide approximately 7.7% of the District’s annual General Fund budget. Further information is available at the District’s website https://www.kibesd.org/.

all as provided in Resolution No. 6-2024. Should this proposition be approved?

LEVY YES

LEVY NO

The Official Ballot Title was written by Kiona-Benton School District No. 52 as required by law. The Benton County Auditor is not responsible for the content of arguments or statements.

The proposed replacement levy would authorize the collection of taxes to provide up to $2,367,666 in 2026 and $2,545,241 in 2027. The levy rate required to produce these levy amounts is estimated to be $1.50 per $1,000 of assessed value. The exact levy rates and amounts to be collected may be adjusted based upon the limitations imposed by State law at the time of the levy. Exemptions from taxes may be available to certain homeowners. To determine if you qualify, call the Benton County Assessor at 509-786-2046.

Con

Committee & Contact Information

No Committee Information or Statement Submitted Pro Committee & Contact Information

Dale Thornton Committee Contact: 509-713-4592

Pro Committee Statement

Residents of Kiona-Benton City school district need quality investment in student educational planning. Voting “YES” bridges the gap between federal funding and state funding enabling a well-rounded educational experience for all students. The state finances just a basic K-12 standard education with no extracurricular activities such as music, drama, clubs nor vocational training. No sports, no behavior specialists, no technology upgrades, no training for staff, not even field trips. The levy “YES” vote is reasonable, valuable and benefits our whole community.

This levy does not create a new tax or raise anyone’s payments. This is a replacement levy that collects the same estimated rate on assessed property value as the current levy continuing the necessary funding to sustain important programs and operations for the next two years. School district tax rates on Ki-Be School District residents have continually declined over the past ten years to a new low with the previous school bond now paid off

Prior to the expiring levy, Ki-Be experienced a year without levy funding and the resulting lack of financial support convinced the community to support the schools, let’s not repeat that loss. The benefits of investing in our schools extends far beyond an educated society. Strong schools are a foundation to a strong community attracting further investments and producing economic structure and vitality.

Please join Ki-Be residents supporting Quality Schools in voting “YES”!

Local Ballot Measure

Finley School District No. 53

Proposition No. 1

REPLACEMENT EDUCATIONAL PROGRAMS AND OPERATION LEVY

The Board of Directors of Finley School District No. 53 adopted Resolution No. 2024-04, concerning a proposition to finance educational programs and operation expenses. This proposition would authorize the District to levy the following excess taxes, replacing an expiring levy, on all taxable property within the District, for support of the District’s educational programs and operation expenses not funded by the State of Washington:

Explanatory Statement

PROPOSITION NO. 1 – REPLACEMENT EDUCATIONAL PROGRAMS AND OPERATION LEVY

Passage of Proposition No. 1 would allow Finley School District to levy taxes for a twoyear period to pay for expenses of educational programs and operation that are not fully funded by the State of Washington. These expenses include, but are not limited to: teaching and support staff; school safety; instructional materials; special education; student programs and activities; band; art; drama; athletics; building maintenance and operations; smaller class sizes and other educational programs and operation expenses. Further information is available on the District’s website at https://www. finleysd.org/district/levies

all as provided in Resolution No. 2024-04. Should this proposition be approved? LEVY YES

LEVY NO

The Official Ballot Title was written by Finley School District No. 53 as required by law. The Benton County Auditor is not responsible for the content of arguments or statements.

Pro Committee & Contact Information

Pro Levy Committee

Rory Bush

Committee Contact: 509-222-9512 rory329@gmail.com

The proposed two-year levy would authorize collection of taxes to provide up to $2,205,163 in 2026 and $2,260,292 in 2027. The levy rate required to produce these amounts is estimated to be $2.50 per $1,000 of assessed value. The exact levy rates and amounts to be collected may be adjusted based upon the limitations imposed by State law at the time of the levy. Exemptions from taxes may be available to certain homeowners. To determine if you qualify, call the Benton County Assessor at 509-7862046.

Con Committee & Contact Information

Con Levy Committee

Karen Skellenger

Committee Contact: 509-947-4346 ksskellenger823@gmail.com

Pro Committee Statement

Like many of you, my family and I have been part of the Finley community for decades. Our district is filled with multigenerational alumni, and many of our students have parents, grandparents, and even great-grandparents who graduated from Finley Schools. I encourage you to vote YES to replace the current educational programs and operations levy.

This levy is vital to maintaining the high-quality education our students deserve. It will fund critical programs such as agriculture shop, welding, athletics, and essential support staff and resources. These programs are essential for providing a well-rounded education and preparing students for success in both college and career. The levy will also help maintain smaller class sizes and ensure access to necessary learning materials and support services for all students.

Our district is committed to being fiscally responsible and transparent with the community. We take pride in ensuring that every dollar is spent wisely to benefit our students. By voting YES, you’re investing in the future of our children and ensuring they receive the best education possible, just as past generations did.

Please note that this is not a new levy, but a replacement for the levy that expires at the end of this school year. Your support is an investment in the continued success of our students and the educational foundation that has served our district for generations. Please vote YES to replace the current levy and help protect the future of our schools and community.

Pro Committee Rebuttal Statement

Renters support school funding through rent, as property taxes are included in rental costs. Without levies, Finley students lose essential resources like staff, extracurriculars, and sports programs, impacting their education and the broader community. Strong schools improve property values and create a stable, thriving community for all. Finley students deserve the same opportunities as those in other districts. Supporting levies is a crucial investment in our students, their futures, and the success of our community.

Con Committee Statement

I am submitting my objection to passing 2 levies come the 2025-2026 school year for the Finley School District. As a taxpayer, these levies are funded thru property taxes and I am opposed to the levy as it does not include people who have children who attend Finley School District yet do not participate in the taxation as they are renters of homes and not the owner. This to me is an unfair tax to the people who own vs. rent their homes. If the legislation figures out how to tax all the people in the district the same regardless of home ownership then this would be a fair tax and then everyone would have “skin in the game”.

Also, for example this 2024 school year the Varsity football team played several games away from home and when games are over 200 miles away one direction this leaves the families who want to attend games unable. This is ridiculous logistics for a 2B school. When the levy was voted down in the 2022-23 year we played schools in a 100 mile radius. This was achievable for families to attend.

As a homeowner, we paid over $1596 in taxes to the school district 2024. I did the math. So no, I do not want an increase in taxes. I will be voicing my objections at the school board meetings and hope to change the minds of enough people who own homes to vote the tax down.

Con Committee Rebuttal Statement

No Committee Information or Statement Submitted

School District No. 53 | Proposition No. 2

Local Ballot Measure

Finley School District No. 53

Proposition No. 2

CAPITAL LEVY FOR SAFETY, SECURITY AND EDUCATIONAL TECHNOLOGY IMPROVEMENTS

The Board of Directors of Finley School District No. 53 adopted Resolution No. 2024-05, concerning a proposition to finance safety, security and educational technology improvements. This proposition would authorize the District to levy the following excess taxes, on all taxable property within the District, to make safety, security and school facility improvements and fund the acquisition, installation, implementation and modernization of educational technology equipment, infrastructure, systems and facilities:

Collection YearEstimated Levy Rate/$1,000 Levy Amount 2026$0.23$202,875 2027$0.23$207,950

all as provided in Resolution No. 2024-05. Should this proposition be approved?

LEVY YES

LEVY NO

The Official Ballot Title was written by Finley School District No. 53 as required by law. The Benton County Auditor is not responsible for the content of arguments or statements.

Pro Committee & Contact Information

Pro Levy Committee

Rory Bush

Committee Contact: 509-222-9512 rory329@gmail.com

Explanatory Statement

PROPOSITION NO. 2 – CAPITAL LEVY FOR SAFETY, SECURITY AND EDUCATIONAL TECHNOLOGY IMPROVEMENTS

Proposition No. 2 authorizes a two-year capital levy to support the modernization and remodeling of school facilities. It will allow the Finley School District to (1) make safety, security and facility improvements throughout school facilities (including acquiring, installing, replacing, implementing and modernizing life safety and security systems and making other facility and infrastructure improvements throughout school facilities) and (2) acquire, install, implement and modernize educational technology equipment for students and staff, infrastructure, systems and facilities. Further information is available on the District’s website at https://www.finleysd.org/district/levies

The proposed two-year levy would authorize collection of taxes to provide up to $202,875 in 2026 and $207,950 in 2027. The levy rate required to produce these amounts is estimated to be $0.23 per $1,000 of assessed value. Exemptions from taxes may be available to certain homeowners. To determine if you qualify, call the Benton County Assessor at 509-7862046.

Con Committee & Contact Information

Con Levy Committee

Karen Skellenger

Committee Contact: 509-947-4346 ksskellenger823@gmail.com

Pro Committee Statement

As a community with deep roots and several generations of alumni, we understand the importance of providing our students with the best possible education and resources. I encourage you to vote YES on the new capital levy for safety and technology for the Finley School District.

This levy is essential to ensuring our schools are safe, secure, and equipped with the technology necessary for 21st-century learning. Funds from this levy will enhance school safety measures, including security systems and updates to aging infrastructure, providing peace of mind for students, staff, and families. Additionally, it will support the continued integration of technology in the classroom, allowing our students to access modern learning tools and prepare for future careers in an increasingly digital world.

Our district is committed to managing funds responsibly and being transparent with the community. We will ensure that every dollar is used efficiently to improve the safety of our schools and enhance educational opportunities through technology. By voting YES, you are investing in a safe and innovative learning environment for our children.

Please vote YES to approve the capital levy for safety and technology. Your support will help ensure that Finley School District remains a place where students can learn and grow in a secure, modern, and well-equipped setting. Let’s continue to provide our children with the tools and environment they need to succeed.

Pro Committee Rebuttal Statement

Renters support school funding through rent, as property taxes are included in rental costs. Without levies, Finley students lose essential resources like staff, extracurriculars, and sports programs, impacting their education and the broader community. Strong schools improve property values and create a stable, thriving community for all. Finley students deserve the same opportunities as those in other districts. Supporting levies is a crucial investment in our students, their futures, and the success of our community.

Con Committee Statement

I am submitting my objection to passing 2 levies come the 2025-2026 school year for the Finley School District. As a taxpayer, these levies are funded thru property taxes and I am opposed to the levy as it does not include people who have children who attend Finley School District yet do not participate in the taxation as they are renters of homes and not the owner. This to me is an unfair tax to the people who own vs. rent their homes. If the legislation figures out how to tax all the people in the district the same regardless of home ownership then this would be a fair tax and then everyone would have “skin in the game”.

Also, for example this 2024 school year the Varsity football team played several games away from home and when games are over 200 miles away one direction this leaves the families who want to attend games unable. This is ridiculous logistics for a 2B school. When the levy was voted down in the 2022-23 year we played schools in a 100 mile radius. This was achievable for families to attend.

As a homeowner, we paid over $1596 in taxes to the school district 2024. I did the math. So no, I do not want an increase in taxes. I will be voicing my objections at the school board meetings and hope to change the minds of enough people who own homes to vote the tax down.

Con Committee Rebuttal Statement

No Committee Information or Statement Submitted