CONTRIBUTING WRITERS

LYNDA FERNANDEZ PABLO ALVAREZ

PRODUCTION MANAGER CLAUDIA BERNAL

CREATIVE DIRECTOR ADRIANA OSORIO

ADVERTISING SALES KERRI TRAPANI JOSE TREJOS

ADVERTISING SALES SALES@BEIGEBOOKS.COM

LETTERS TO THE PUBLISHER FEEDBACK@BEIGEBOOKS.COM

MAILING ADDRESS 8200 NW 41ST STREET, SUITE 200 DORAL, FL 33166

MAIN OFFICE 786.326.5758

Advertising rates furnished upon request. Real Estate Beige Book is published bi-monthly by One World Media LLC. No portion may be reproduced in part or full by any means, without the written consent of the publisher. One World Media LLC assumes no responsibility for loss, damage, or any other injury as to unsolicited artwork, photographs or any other unsolicited material. One World Media LLC is not liable for the content of advertisements. All advertising is subject to approval. One World Media LLC reserves the right to refuse any ad for any reason whatsoever.

Recent Fed’s announcement to keep interest rates low and boost the economy looks promising for now, prolonging housing’s recovery. The U.S. economy has been performing well enough to perhaps justify a rate hike “and we expect it to continue to do so,” Federal Reserve Chairwoman Janet Yellen said shortly after the Fed’s policy-setting committee released its latest statement following a two-day meeting. But Yellen added that “the outlook abroad appears to have become less certain,” driving down U.S. equity prices, pushing up the dollar, and tightening financial conditions in a way that may slow U.S. growth regardless of what the Fed does. “In light of the heightened uncertainty abroad... the committee judged it appropriate to wait,” Yellen said. “Given the significant economic and financial interconnections between the U.S. and the rest of the world, the situation abroad bears close watching.” I believe concerns about China were pivotal. Most homeowners focus on changing mortgage rates because they have a direct influence on real estate prices.

So, while the world keeps an eye on the Feds’ next move local Developers watch buyer’s demand for new-construction sales in South Florida. Miami continues to attract international and domestic home buyers looking to live in a global city with worldclass amenities and a diversified economy. Strong sales in the preconstruction condominium

Miami market continue to reflect significant demand for new properties, according to the latest New Construction Market Status Report released by Cranespotters. com.

On our cover, Mr. Henry Torres, founder and CEO of the Astor Group, has been leading a growing market shift towards city-centric residences, building in locations with excellent proximity to museums, restaurants, shopping centers, entertainment districts, and more.

Visit the Miami New Construction Show (October 22-25) at the Miami Beach Convention Center to learn more about our dynamic real estate market, access to detail new construction projects information, and meet unique service providers – from design and remodeling to immigration services. Take advantage of the low interest rates while supplies last, enjoy the sun and, as always, God bless.

Detroit, MI

Las Vegas, NV

Los Angeles, CA

Fort Lauderdale, FL Naples, FL

The below data reflects the top countries (outside the U.S.) where consumers were the most engaged on realtor.com® & realtor.com® International and the top U.S. markets in which they were searching.

Los Angeles, CA Orlando, FL New York, NY Kissimmee, FL Houston, TX

New York, NY

Los Angeles, CA Detroit, MI

Las Vegas, NV Houston, TX

Brazil

Miami, FL Orlando, FL Los Angeles, CA New York, NY Boca Raton, FL

Los Angeles, CA

San Antonio, TX Colorado Springs, CO Miami, FL Cape Coral, FL

San Diego, CA

San Antonio, TX

Laredo, TX

El Paso, TX

Chula Vista, CA

New York, NY

Los Angeles, CA Chicago, IL

Las Vegas, NV San Jose, CA

Los Angeles, CA Miami, FL New York, NY San Francisco, CA Miami Beach, FL

Miami, FL New York, NY Los Angeles, CA Miami Beach, FL Detroit, MI

San Diego, CA Honolulu, HI

Fort Scott, KS Los Angeles, CA San Antonio, TX

Sep 15, 2015 MIAMI — NColombia leads all foreign countries searching online for South Florida real estate, according to new statistics from the MIAMI Association of REALTORS® (MIAMI), the nation’s largest local Realtor group. Colombia overtook Brazil as the top country using MIAMI’s search portal, Miamire. com, in July 2015. Brazil had led all international consumers using Miamire.com for 13 consecutive months.

Colombia’s rise to first place marks the first time the South American country has topped the Miamire.com monthly web searches since May 2014. Colombia had finished second to Brazil the last six months. The newly-released statistics also detail increased interest in South Florida properties from countries such as Venezuela and France.

“Colombian home buyers have a long history of purchasing South Florida real estate, so the fact Colombia has overtaken Brazil for the most web property searches is not a surprise,” said Christopher Zoller, a 27-year Miami-based Realtor and the 2015 Residential President of MIAMI. “Colombians are so comfortable here in Miami. Our tremendous diversity, world-class shopping, and global business center not only attract Colombian buyers, but all consumers – international and domestic.”

Colombian home buyers purchase the fourth-most South Florida real estate among all foreign countries, according to the 2014 Survey of International Home Purchases conducted by the National Association of REALTORS® (NAR) for the MIAMI Association of REALTORS® (MIAMI). The South American nation of 48 million residents registered 8 percent of all foreign South Florida deals last year. Venezuelan, Argentinian, and Brazilian buyers comprised South Florida’s top-three foreign markets.

Colombians moving to South Florida are often upper-middle-class families who want to enjoy their prosperity earned in their homeland as professionals and entrepreneurs. Colombians spend the third-highest purchase price on South Florida properties among all foreigners, spending $420,000 on average. The average sale price for all buyers in Florida is $245,000.

Venezuelan and French consumers increased their online interest in South Florida real estate in July 2015. Brazil finished second while Venezuela and France finished third and fourth, respectively.

Venezuela hadn’t finished this high in the monthly searches since it took third place in March 2015. France, meanwhile, had never finished in the top-four in web searches on Miamire. com. France had the ninth-most web searches for South Florida property in June 2015.

The top-10 countries visiting Miamire.com in July 2015:

1) Colombia, 2) Brazil, 3) Venezuela, 4) France, 5) Argentina, 6) Canada, 7) India, 8) Peru, 9) Spain, 10) Italy.

The top-10 countries visiting Miamire.com in July 2014:

1) Brazil, 2) Argentina, 3) Venezuela, 4) Canada, 5) Colombia, 6) India, 7) France, 8) Germany, 9) Mexico, 10) Italy

The top-10 countries visiting Miamire.com in July 2015:

1) Colombia, 2) Brazil, 3) Venezuela,

4) France, 5) Argentina, 6) Canada, 7) India, 8) Peru, 9) Spain, 10) Italy

One of the world’s top global cities, Miami is also a top choice for American real estate consumers. The top-10 states searching Miamire.com in June: 2015: 1) California, 2) New York, 3) Texas, 4) Georgia, 5) Illinois, 6) North Carolina, 7) Pennsylvania, 8) Michigan, 9) Tennessee, 10) New Jersey 2014: 1) California, 2) Texas, 3) Georgia, 4) New York, 5) Virginia, 6) Illinois, 7) Pennsylvania, 8) Michigan, 9) North Carolina, 10) Tennessee

Nationally, Miami is consistently one of the top markets for most of the highest ranking countries searching for property in the U.S. – including Brazil, Germany, and France. In July 2015, Miami or Fort Lauderdale was a top market for consumers in 12 out of the top 20 countries searching for U.S. properties. The top countries (outside the U.S.) where global consumers were most engaged on Realtor.com® & Realtor. com® International

and the top-five U.S. markets they searched in July 2015:

1. *Canada: New York, Los Angeles, Las Vegas, Fort Lauderdale; Orlando

2. United Kingdom: Los Angeles, New York, Orlando, Kissimmee, FL, Davenport, FL

3. Australia: New York, Los Angeles, Las Vegas, San Francisco, Beverly Hills, CA

4. *Brazil: Orlando, Miami, New York, Los Angeles, Kissimmee, FL

5. *Germany: Los Angeles, New York, Miami, San Antonio, Las Vegas

6. Mexico: San Antonio, San Diego, El Paso, TX, Houston, Chula Vista, CA

7. India: New York, Chicago, Los Angeles, San Jose, CA, Dallas, TX

8. *France: Miami, Los Angeles, New York, Miami Beach, San Francisco

9. *Italy: New York, Miami, Los Angeles, Miami Beach, Tampa

10. Japan: San Diego, Honolulu, Los, Angeles, San Antonio, TX, New York

11. *Spain: Miami, New York, Los Angeles, Fayetteville, GA, Miami Beach

12. South Korea: New York, Los Angeles, San Diego, Irvine, CA, Las Vegas

13. *Netherlands: Los Angeles, New York, Miami, Las Vegas, Houston, TX

14. Philippines: Las Vegas, Los Angeles, New York, Chicago, Brooklyn, NY

15. *Sweden: Los Angeles, New York, Miami, Fort Lauderdale, San Francisco

16. *Turkey: New York, Los Angeles, Miami, Boston, Tampa, FL

17. *Israel: New York, Los Angeles, Miami, Fort Lauderdale, Boca Raton, FL

18. Ireland: Los Angeles, New York, Orlando, Chicago, Beverly Hills, CA

19. *South Africa: New York, Los Angeles, Miami, Houston, Chicago

20. *Austria: Los Angeles, New York, Washington, DC, Malibu, CA, Miami

*Denotes countries that have Miami or Fort Lauderdale as a top-five market for real estate searches

In July 2015, Miami ranked third among the top-10 overall most searched U.S. cities by non-U.S. consumers. Fort Lauderdale ranked sixth. Combining Miami and Fort Lauderdale would have likely increased South Florida’s ranking

1) New York, 2) Los Angeles, 3) Miami, 4) Orlando, 5) Las Vegas, 6) Fort Lauderdale, 7) Houston, 8) San Francisco, 9) San Diego, 10) Chicago

MIAMI, FL – New York City-based Bonhams Auction House has partnered with Biscayne Beach condominiums to showcase “The Art of Fashion”, taken from Bonhams’ fashion photography vault, including iconic works by David LaChappelle, Frank Horvat, Kelly Klein, Miles Aldridge, Irving Penn and more, displayed during the 13th annual Art Basel Miami last December. Biscayne Beach’s sales gallery is located at 254 NE 30th Street in Miami’s East Edgewater neighborhood.

“Unique partnerships are something we are passionate about at Biscayne Beach,” said Reid Boren, partner at Eastview Development Group. “Partnering with Bonhams is another collaborative effort, similar to what we have done with Thom Filicia and his design work, Tutto Il Giorno with their restaurant, and now Bonhams Auction House during Art Basel. As the winter season kicks off, we wanted to bring our real estate project and the art world together for a one of a kind preview auction exhibition that ties the two worlds. Both have a great impact on the city of Miami and we are excited to showcase some of the leading contemporary fashion photographers at our Biscayne Beach Sales Center.”

The Greater Downtown neighborhood has emerged as the new frontier for Art Basel, with a booming arts and culture scene that has rapidly developed over the past few years. Bonhams- a global force in the auction market and one of the top three largest auction houses in the world- made their Miami debut in the luxury condo’s sales gallery.

“We chose Biscayne Beach as our first Miami presence partly due to the thousands of local and international guests that visit the area during Art Basel,” says Jon King, Vice President and Director of Business Development for Bonhams in Florida. “It’s the perfect location to debut our collection of contemporary art with a cosmopolitan edge.”

Fresh off being selected as the official auction house for the estate of renowned actress Lauren Bacall, Bonhams exhibited rare sculptures by Robert Graham, and maquettes from Henry Moore.

Biscayne Beach, the joint venture between Eastview Development and GTIS Partners, is a 51-story, 399 unit luxury condominium located at 711 NE 29th Street, directly on the water fronting Biscayne Bay, in Miami’s East Edgewater neighborhood – just north of Downtown Miami and directly across the bay from Miami Beach, between the Julia Tuttle and McArthur Causeways. Edgewater’s artistic surge is felt across the Greater Downtown Miami landscape, complementing the population spike, and burgeoning bar and restaurant scene. The adjacent Design District is home to trendy highend shopping brands like Hermés, Prada, and Dior, with some of the city’s most unique artistry coming from the nearby Midtown and Wynwood neighborhoods. Just a few minutes away, world-class venues including the Perez Art Museum Miami, the upcoming Patricia and Phillip Frost

Museum of Science, and the highly anticipated Brickell CityCentre bring Miami’s ultimate offerings in terms of the arts, culture, luxury shopping, and entertainment. Construction of Biscayne Beach began in June 2014 with completion slated for December 2016.

About Biscayne Beach:

Biscayne Beach is a 399-unit luxury condominium being developed in the heart of Miami’s East Edgewater district by a joint venture between West Palm Beach’s Eastview Development and New York-based global real estate investment firm GTIS Partners. Featuring designs by celebrity interior designer Thom Filicia, the 51-story tower will bring the beach to the city’s urban core with a private members-only beach club fronting the waters of Biscayne Bay –complete with white sand, water access and premium amenities. Located at 711 NE 29th Street, Biscayne Beach broke ground June 2014, with completion slated for 2016. Learn more at www. biscaynebeachresidences.com.

combined over 120 years of experience in developing, financing and marketing residential and commercial real estate projects across the United States. Eastview’s development portfolio spans projects across the country, including condominium, office and multifamily developments in Florida, as well as office and multifamily projects in New York State. Eastview Development is based in West Palm Beach, Florida. Learn more at www.eastviewdev.com.

office, industrial and hotel projects. For further information, please visit www. gtispartners.com.

About

Development: Eastview Development is a real estate development firm whose principals have

GTIS Partners is a global real estate investment firm headquartered in New York with offices in Los Angeles, San Francisco and São Paulo, Brazil. GTIS Partners has 68 employees and currently has approximately $3 billion of assets under management. To date, the firm has committed capital to residential, retail, industrial, office, hotel and mixed-use projects in the U.S. and Brazil. In the U.S., GTIS has invested in over 70 projects across 20 states, ncluding 55 projects in the residential sector. In Brazil, GTIS has invested in 38 projects comprised of approximately 15,000 residential units developed or planned, and six million square-feet of

Bonhams, founded in 1793, is one of the world’s oldest and largest auctioneers of fine art and antiques. The present company was formed by the merger in November 2001 of Bonhams & Brooks and Phillips Son and Neale UK. In August 2002, the company acquired Butterfields, the principal firm of auctioneers on the West Coast of America. Today, Bonhams offers more sales than any of its rivals through two major salerooms in London - New Bond Street, and Knightsbridge - and a further four throughout the UK. Sales are also held in San Francisco, Los Angeles, Carmel, New York and Boston in the USA; Toronto in Canada; and in Switzerland, France, Monaco, Hong Kong and Australia. Bonhams has a worldwide network of offices and regional representatives in 25 countries offering sales advice and valuation services in 57 specialist areas. For a full listing of upcoming sales, plus details of Bonhams specialist departments, go to www.bonhams.com.

WALTER OVERSEES THE OVERALL OPERATIONS OF THE COMPANY WHILE MOSTLY FOCUSING ON MARKETING, RECRUITING AND FINANCE ACTIVITIES WITHIN THE COMPANY. HE HAS BEEN STRONGLY INVOLVED IN THE FAMILY BUSINESS. HE HAS ALSO PARTICIPATED ACTIVELY IN SENIOR MANAGEMENT AND BOARD POSITIONS OF BLUE CHIP COMPANIES IN ARGENTINA.

By Pablo Alvarez Real Estate Beige Book

By Pablo Alvarez Real Estate Beige Book

What’s your take on the Brickell / Downtown rebirth?

Brickell has actually never stopped growing, Downtown is now going through a new stage, this neighborhood has always existed but it was never really considered high-end, it was more of a commercial district. Now there are a lot of changes happening in Downtown, we can see a lot of new high-end buildings and every year the area is getting better and better. In regards to Brickell, with the construction of Brickell City Center, it has taken a new way of growing that I think is consolidated by being seen by public as the best destination in Miami. The only thing Brickell was missing was high-end shopping and now with Brickell City Center, that circle has been completed. I think some of the best restaurants; buildings, commercial office bases and high-end financial institutions are there. All the young people that want to share the excitement of Miami and that don’t want to be in Miami Beach choose Brickell. The transformation that is taking place now and with the change that will happen within the next three years people won’t know what Brickell will be come.

Q. What are your expectations for home sales, prices and market conditions?

A. It is always difficult to predict the future, but I think if you look at it long term, the prices in Brickell will continue to rise. We don’t know how much it will rise per year, but when you compare high-end apartments in Miami with $400 per square feet, it is still cheaper than Latin America so the perception is that the value is still there. Also, Miami is still fairly affordable compared to the rest of the U.S. market for example, Los Angeles, New York and Washington D.C. will be come.

Q. Survey data indicates that Argentineans make up 12%of all international buyers in Miami, the second largest pool of buyers after Venezuelans. Do you have strategic alliances in place in your home country?

A. Fortune International Realty has offices in Argentina, where we have a team of 20 people working. In Argentina we have done a large amount of sales and I believe that we will continue to grow because we travel there very often, our name is well recognized and because we have developed strategic ways to market ourselves. Nevertheless, it will always depend on the economical situation. At the moment, it’s less affordable for the Argentineans to buy in Argentina, because the depreciation, the currency makes the properties more expensive. Argentineans already have a long track record, not only of buying in Miami but falling in love with Miami and we believe that this will continue to happen.

Q. Since founding Fortune International Realty in 1983, the company has extended to include real estate brokerage, property management, new development sales, and new developments. What’s next for FIR?

A. The key element of the company has always been to find new quality people to join us. We cover everything from simple brokerage firm, to sophisticated developments, to representing other developers; we do a lot in terms of collaborations with developments as far

as servicing them as their consultants. So for us at Fortune International Realty, our goal is to find ways to attract ‘new energy’ to the company by hiring qualified people in the different areas, so we can continue to grow in a coordinated fashion.

Q. Regarding today’s Broker’s role, everyone has easy access online to all information (listings, photos, assessment values, etc.), how do you find new ways to add value in a role that is dramatically different from the time when Brokers controlled all the information?

A. In Fortune International Realty, we believe that this goes back to quality service. Real Estate will evolve with technology like other businesses do, but at the end of the day it is a service industry. It is based on the quality service you give to your clients and I think that as long as you have a good group of people that can give an excellent level of service to clients, you can find ways to evolve. Even though things have changed with the Internet, compared to how we did real estate 30 years ago, I believe that when the client has to make a face-to-face decision, with somebody that is advising them on how to invest their money, I think that the personal relationship will still be there in years to come and will

determine how excellent servicing to your clients is and that will dictate how well the people will do in the industry.

Q. Which charities you support, and why?

A. Fortune International Realty always works with St. Jude’s Hospital. We love the way they work and we believe that they have done a tremendous job in helping kids all over the world. Miami has been the port of entry for many kids in Latin America that seek other places for alternative treatments, and St. Jude’s is one of them. Fortune International Realty is also getting very active with charity events all throughout Latin America. We also try to get involved in as many activities as possible, in every small way that we can join forces with people that are helping out in the community.

Q. What is your favorite destination for family vacation or getaway?

A. My favorite destination for family vacation is Miami. Every time someone comes to visit, they say that we are lucky to be living here, but I always say that the only problem for people living in Miami is that it is hard to find an hour a day to spend time with our families because we are always so busy working. MIami is probably one of the best places to take your vacation.

Q. The Astor Companies has built over 1,000 residences integrating luxury, quality, design and value – currently in the Gables, the Roads, and Calle Ocho. Are most of the buyers’ locals or international investors?

A. About 50% of our buyers are locals, and about 50% are foreign buyers.

Q. Where is the next big development pocket for Astor?

A. Our next project will be in Coral Gables.

Q. Will Astor expand into rental projects, retail, or mixed-use projects?

A. We have mixed-use projects as part of our future expansions.

Q. The economy appears to be gaining enough momentum to help provide the support that the housing market has needed for stronger recovery. How do you see the housing outlook for the next five years? ?

A. If interest rates remain low, the next five year should be very good.

Q. Would you build in your homeland if conditions improve?

A. Yes, we would consider the possibility of building there in the future.

Q. Your favorite vacation getaway?

A. The Bahamas!

Oral representation cannot be relied upon as correctly stating the representation of the Developer, for correct representation, make reference to the documents required by section 718.503 Florida Statutes, to be furnished by the Developer or Buyer or Lessee. Not an offer where prohibited by State Statutes. Plans, features and amenities subject to change without notice. All illustrations and plans are artist conceptual renderings and are subject to change without notice. This advertisement does not constitute an offer in the states of NY or NJ or any jurisdiction where prior registration or other qualification is required. EQUAL HOUSING OPPORTUNITY.

LISTING

HOMESTED

List Price: 315000

Address: 24865 SW 119 AV

Beds: 4 Baths: 2 SF: 2295

Impeccable 4 bedroom home in Hemingway Point! This beautiful home was built in 2014 and is in MINT condition! Fully upgraded.

Listing Agent’s Name: Amaya Castro Agent Phone: 305-245-3650

HOMESTED

List Price: 270000

Address: 27682 SW 139 PL Beds: 3 FBaths: 2 SF: 2746

The one is so beautiful. It will wow the pickiest of buyers. It was the builder’s model home with custom decorating touches that can stay with the house.

Listing Agent’s Name: Nancy Prewitt Agent Phone: 305-323-1104

MIAMI

List Price: 334000

Address: 12224 SW 101 TER. Beds: 5 FBaths: 3 SF: 3496

Prime kendall location.near schools and shopping. exquisetely appointed. 5 bedrooms,3 baths residence.

Listing Agent’s Name: Liliana Zaldivar Agent Phone: 305-300-3996

HOMESTED

List Price: 340000

Address: 14105 SW 278 ST Beds: 7 Baths: 4 SF: 3642

Wow! Breathtaking 7 bedroom, 4 bathroom home with over 3600 sq ft! This beautiful home features a spacious layout, with plenty of closet space

Listing Agent’s Name: Amaya Castro Agent Phone: 305-245-3650

MIAMI

List Price: 334000

Address: 9404 SW 185 ST Beds: 4 FBaths: 2 SF: 2301

Wow! Beautiful 4/2 in a great neighborhood! This spacious home has been recently renovated. Freshly painted with neutral colors throughout.

Listing Agent’s Name: Amaya Castro Agent Phone: 305-245-3650

MIAMI

List Price: 475000

Address: 9716 SW 92 TE Beds: 3 FBaths: 2 SF: 2211

Located in highly sought after Cherry Grove. enter this custom 3/2 via a private courtyard.

Listing Agent’s Name: Julio Perez Agent Phone: 305-979-7100

MIAMI BEACH

List Price: 1200000

Address: 1623 COLLINS AV # 320 Beds: 2 FBaths: 2 SF: 1180

Ocation! direct ocean view, rare, steps to lincoln road, beachside. walk in & see water! Walk-in closet. maint fee is only $635 month!

Listing Agent’s Name: Elaine Sisman Agent Phone: 305-975-7781 www.ElaineSisman.com

MIAMI BEACH

List Price: 199000

Address: 1611 MICHIGAN AV # 24 Beds: 0 FBaths: 1 SF: 491

Fantastic Location next to Lincoln Road in a Spanish style multi fam building. The apartment was recently complete renovated .

Listing Agent’s Name: Alexander Rahe Agent Phone: 305-319-9574

MIAMI BCH

List Price: 849000

Address: 100 LINCOLN RD # 1043 Beds: 1 FBaths: 1 SF: 845

Where Lincoln road meets the ocean!

Enjoy comfort and elegance in this Spacious and Renovated 1 Bedroom at the famous Decoplage.

Listing Agent’s Name: Stefan Latt Agent Phone: 786-664-8290

MIAMI BEACH

List Price: 549900

Address: 2555 COLLINS AV # 2400 Beds: 1 FBaths: 1.5 SF: 798

Just Reduced - Owner Motivated! Rare opportunity at coveted Club Atlantis. 24th floor direct ocean corner unit. Overlooks the bay and the city.

Listing Agent’s Name: Katja Haunschild Agent Phone: 305-724-4186

MIAMI BCH

List Price: 3100000 Address: 1060 Stillwater DR Beds: 5 FBaths: 4 SF: 4719

Spacious house on the Bay. The home is situated in the gated and centrally located community. Modern design with light and bright indoor spaces, a large pool.

Listing Agent’s Name: Stefan Latt Agent Phone: 786-664-8290

MIAMI BCH

List Price: 622000

Address: 6365 COLLINS AV #1409 Beds: 1 FBaths: 1.5 SF: 808

Vacation Home in Miami Beach ready to move in. Delight in the gentle breezes overlooking the shimmering sands & turquoise waters of Miami Beach.

Listing Agent’s Name: Liede DeValdivielso Agent Phone: 786-306-4378

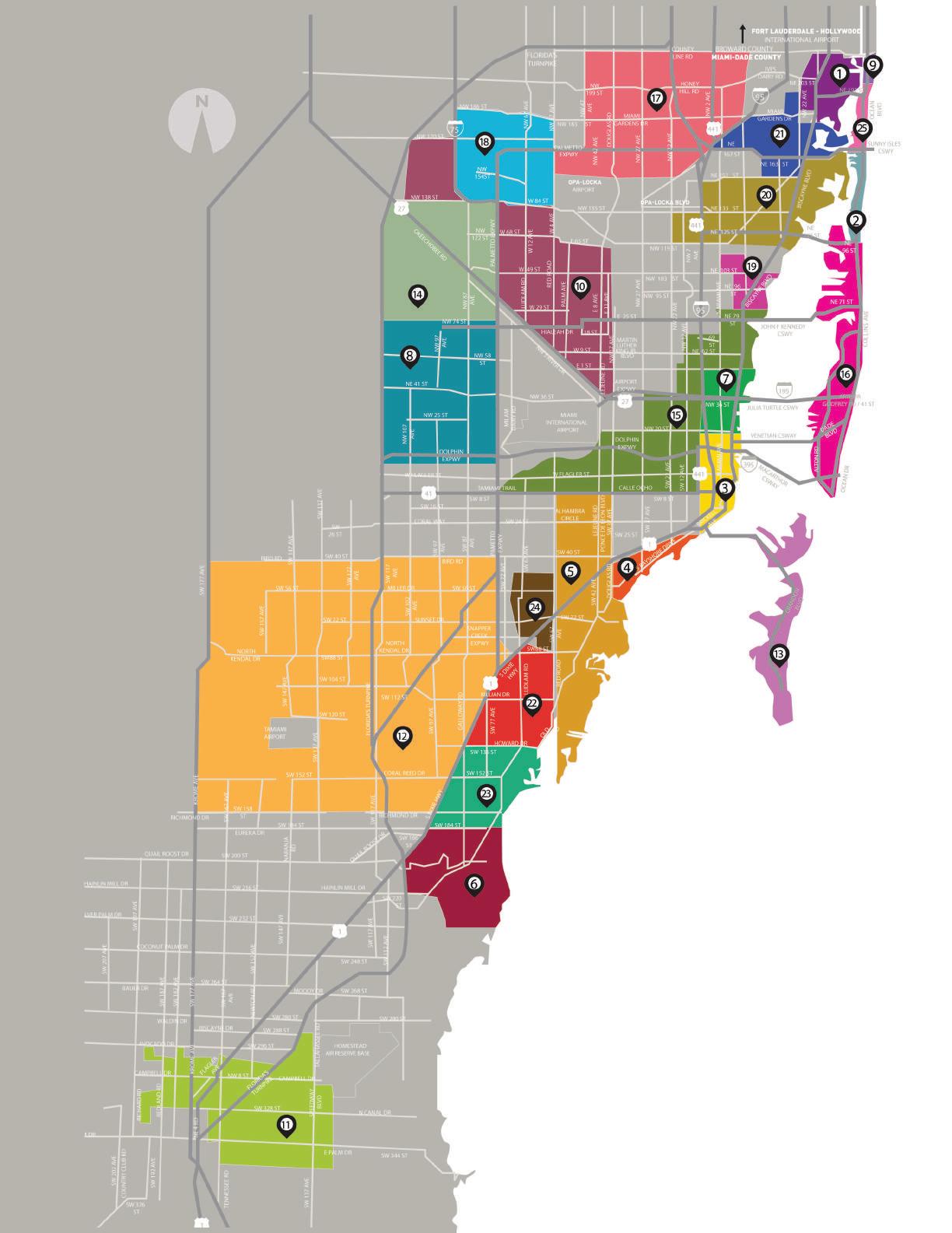

Miami-Dade County encompasses more than 2,000 square miles (larger than the states of Rhode Island and Delaware). One-third of Miami-Dade County is lcated in Everglades National Park. Our community is located along

the southeast tip of the Florida peninsula. It is bounded by Biscayne Bay and the Atlantic Ocean to the east, Everglades National Park to the west, the Florida Keys to the south, and Broward County to the North.

The average home price in Miami-Dade County is $320,000, which is 43.8% higher than the average sold price in Miami-Dade County ($222,500). The average home price per square foot in Miami-Dade County is $221 and about 3% of all homes in Miami-Dade County sold in the last 6 months. For Miami-Dade County home values, real estate prices, and city market trends, research the 759,315 property records or search our 20,979 recently sold or 23,906 homes for sale listings. The listings and properties in Miami-Dade County are only a part of the 7,955,571 properties and 263,531 homes for sale in Florida.

1,979

Because of this, the average home price and average home value of Miami-Dade County also influence the average home price $199,000 and average sale price $174,900 of Florida. Listing counts, Miami-Dade County home prices and home values in Miami-Dade County are sourced daily from listing and property data on realtor.com®, which is the most up-to-date and accurate aggregation of real estate listings in the industry and includes approximately 800 regional MLSs and is the official website of the National Association of Realtors®.

Gross Domestic Product, a measure of economic activity in a country. It is calculated by adding the total value of a country’s annual output of goods and services. GDP = private consumption + investment + public spending + the change in inventories + (exports - imports).

Source: World Bank

A measure of money supply that includes cash and checking deposits (M1) as well as near money. “Near money” in M2 includes savings deposits, money market mutual funds and other time deposits, which are less liquid and not as suitable as exchange mediums but can be quickly converted into cash or checking deposits. The Federal Reserve uses this data to assess current economic and financial conditions, and to help alter its monetary policy, which includes raising and lowering interest rates.

Source: Federal Reserve

UNITED STATES GDP BILLIONS OF U.S DOLLARS

A comprehensive measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. The CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them; the goods are weighted according to their importance. Changes in CPI are used to assess price changes associated with the cost of living.

Source: U.S. Bureau of Labor Statistics

How good consumers feel about their economic prospects. Measures of average consumer confidence can be a useful, though not infallible, indicators of how much consumers are likely to spend. Combined with measures such as business confidence, it can shed light on overall levels of economic activity.

Source: University of Michigan

Housing starts are highly sensitive to changes in mortgage rates, which are affected by changes in interest rates. Although this indicator is highly volatile, it represents about 4% of annual GDP, and can signal changes in the economy and the effects of current financial conditions. Analysts and economists know to watch for longer-term trends in housing starts.

Source: U.S. Census Bureau

The number of people of working age without a job is usually expressed as an unemployment rate, a percentage of the workforce. This rate generally rises and falls in step with the BUSINESS CYCLE--cyclical unemployment.

Source: U.S. Bureau of Labor Statistics

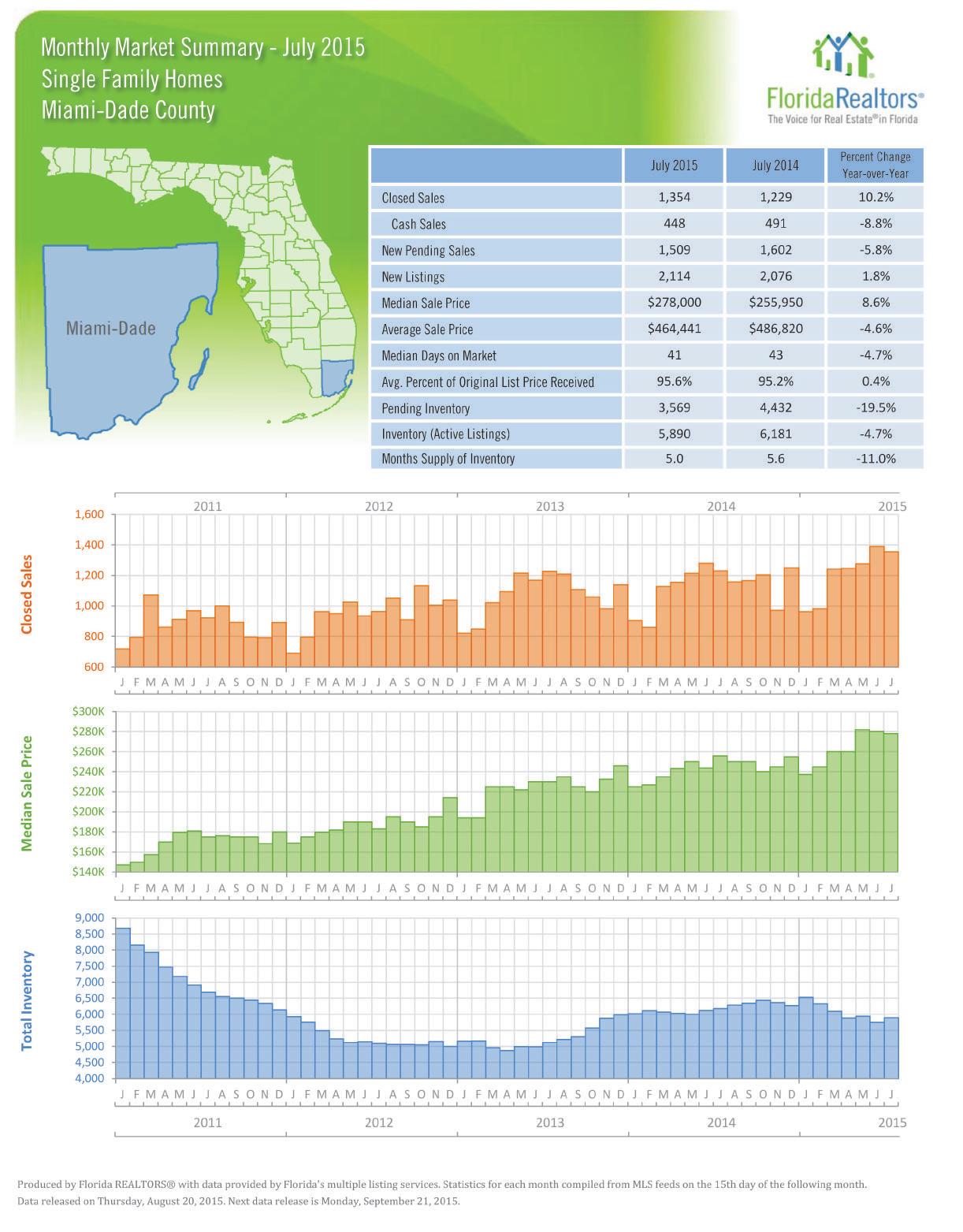

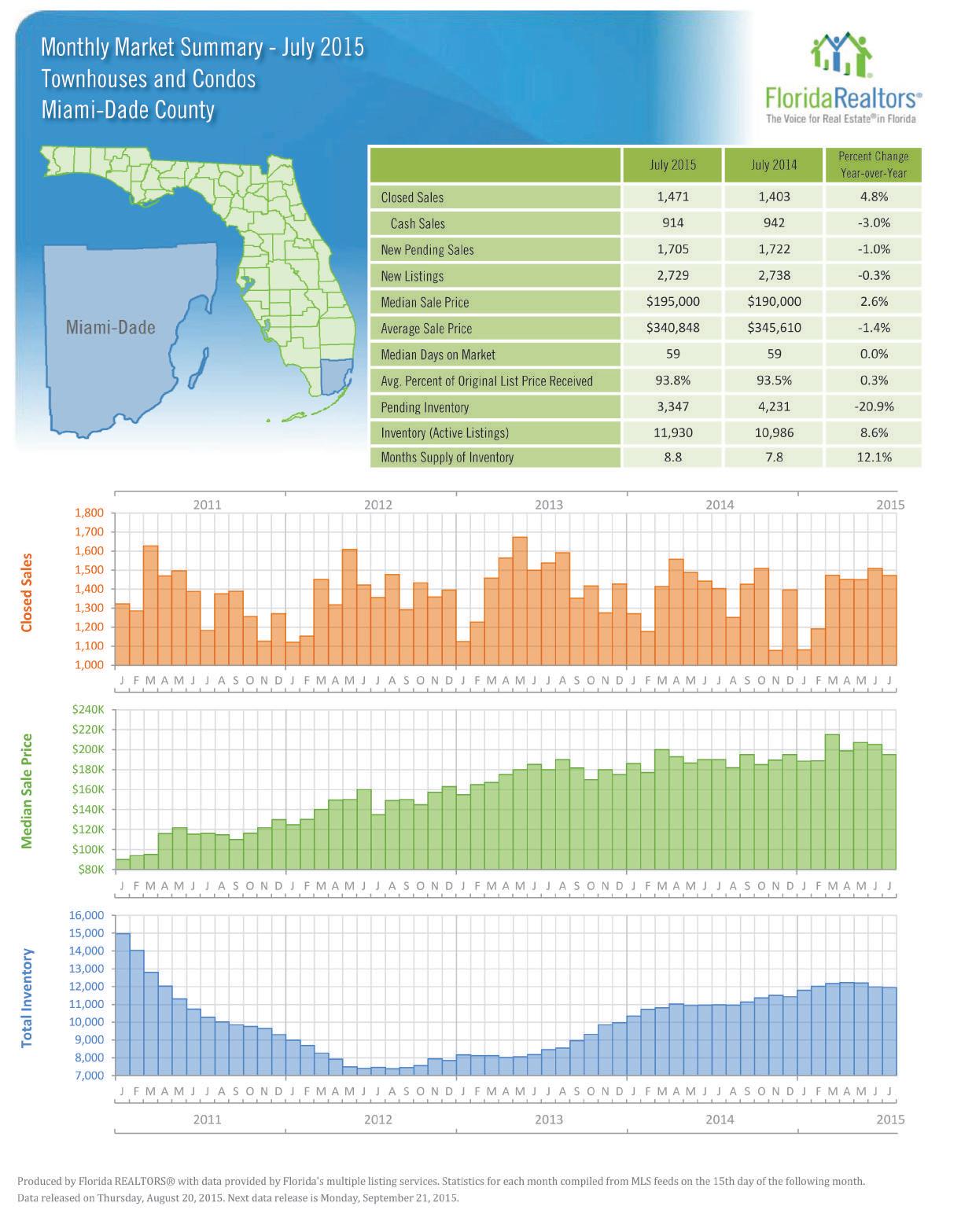

Produced by Florida REALTORS® with data provided by Florida’s multiple listing services. Statistics for each month compiled from MLS feeds on the 15th day of the following month.

Source: Florida REALTORS®

For more than 35 years, Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) has informed consumers on the trends in conventional, conforming mortgage rates offered by hundreds of lenders nationwide.

Source: Freddie Mac

At Susan G. Komen® Miami/Ft. Lauderdale, we’re always thankful for your continued support – support that saves lives! Did you know that one in eight women will be diagnosed with breast cancer in their lifetime? But you can help change that because just $100 will pay for one woman’s mammogram in our community, one woman with nowhere else to turn.

Please visit www.komenmiaftl.org/donate today, and help us continue to celebrate life!