Fall 2022 | Volume 31 Number 2 32 years Published 3 Times a Year by the BC Notaries Association

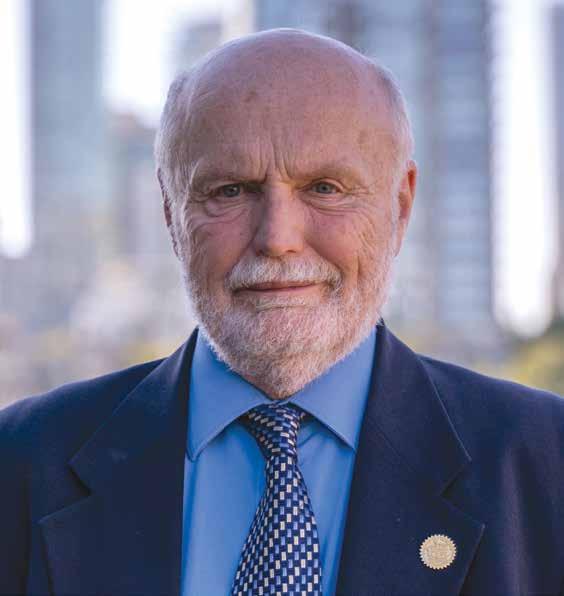

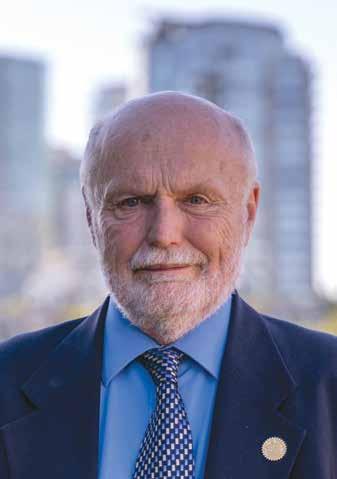

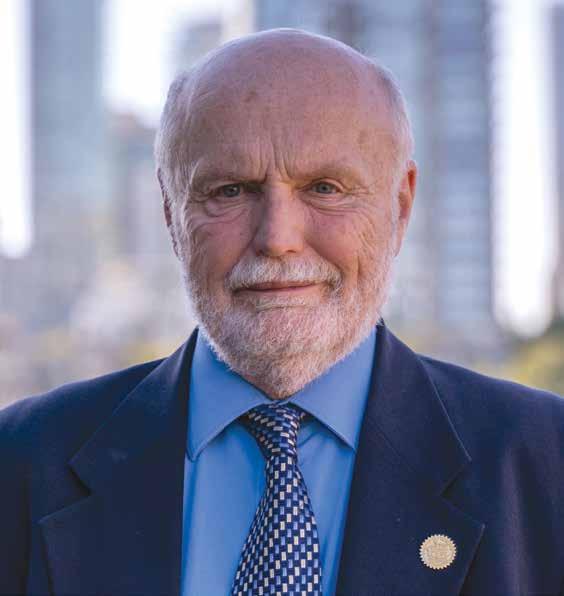

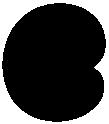

Ron Usher: General

Counsel

for the SNPBC,

Commissioned Notary Public Publications Mail Agreement: 40010827 BC Notaries MONEY LAUNDERING/FRAUD THEME Photo credit Daniel Usher Photography, Vancouver

I give to my community and with Vancouver Foundation, my giving lasts forever. 79 years ago, a single gift started Vancouver Foundation and that gif t is still making a difference in the community today. We can help you create a fund that gives forever. Get started at vancouverfoundation.ca/create or call Calvin at 604.629.5357 vis it communityfoundat io ns.ca 79

WE VALUE BC For more property information and assessment highlights, visit bcassessment.ca If you have questions or want more information, contact us at 1-866-valueBC or online at bcassessment.ca The deadline to file an appeal for your assessment is January 31, 2022. If you’re among BC’s approximately 2 million property owners, you should receive your 2022 property assessment in the mail early in January. If you haven’t, call us toll-free at 1-866-valueBC. Access and compare property assessment information using our free assessment search service at bcassessment.ca. The 2022 assessments are based on market value as of July 1, 2021. Insurance by FCT Insurance Company Ltd. Services by First Canadian Title Company Limited. The services company does not provide insurance products. This material is intended to provide general information only. For specific coverage and exclusions, refer to the applicable policy. Copies are available upon request. Some products/services may vary by province. Prices and products/services offered are subject to change without notice. ®Registered Trademark of First American Financial Corporation. Your clients rely on you for your expertise. You can rely on us. With experienced residential and commercial underwriting teams and Certified Fraud Examiners on staff, we’ve got you covered. Choose the partner that can do more for you today. FCT.ca More than a policy. More protection. More solutions. More experience.

PUBLISHED BY THE BC NOTARIES ASSOCIATION click on an article or page number. When Reading the PDF Online 4 Download the magazine to your device for offline reading. https://www.bcnotaryassociation.ca/resources/ scrivener/ Read The Scrivener online. Photo credit Daniel Usher Photography, Vancouver The Cullen Commission 12 John Mayr, Marny Morin The Many Aspects of Fraud 14 Nigel Atkin What Makes Real Estate Appealing to Money Launderers? 16 Chris Walker The Smell of Money 21 Filip de Sagher Cybercrime Begone! 24 Kim Krushell Real Estate Title Fraud... HOW IT HAPPENS. HOW TO DETECT IT. HOW TO PREVENT IT. 26 Amanda Magee Working Together to Prevent Fraud 29 Connie Bird, Christina Cheung Fraud Flag Alert on Your Real Estate Transactions 30 Marie Taylor Profiling Fraud and Money Laundering 32 Ian Callaway BC Student Scammed 39 Daphne Bibbings SENIORS Don’t Be So Polite! 40 Lori McLeod Pirates and Their Safe Havens: PRECURSORS OF MONEY LAUNDERING 42 Peter Zablud, AM, RFD Pet-Purchase Frauds 46 Ian Callaway BC NOTARIES This Year Make-A-Will Week was October 2 to 8. 47 Morrie Baillie A Bit about the Life of Fariborz Khasha, 48 BCNA: 2022 and 2023 Installation of the BC Notaries Class of 2022 52 THEME BC NOTARIES MONEY LAUNDERING/FRAUD CEO, BCNA Autumn Update 6 Chad Rintoul PRESIDENT Money Laundering and Fraud 7 Daniel Boisvert KEYNOTE Please Take Care 8 Val Wilson COVER STORY Inside The Cullen Commission 10 Ron Usher BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

The

The Scrivener: What’s in a Name?

“A professional penman, a copyist, a scribe . . . a Notary.” Thus the Oxford English Dictionary describes a scrivener, the craftsman charged with ensuring that the written affairs of others flow smoothly, seamlessly, and accurately. Where a scrivener must record the files accurately, it’s the Notary whose Seal is bond.

chose The Scrivener as the name of our

the Notary’s role in drafting, communicating, authenticating, and getting the facts straight.

strive to publish articles about points of law and the Notary

for the education and enjoyment of our members, our allied

in business, and the

in

The Scrivener

email: scrivener@bcnotaryassociation.ca

www.bcnotaryassociation.ca

Send

scrivener@bcnotaryassociation.ca.

All rights reserved. Contents may not be reprinted or reproduced without written permission from the publisher.

This journal is a forum for discussion, not a medium of official pronouncement. The BC Notaries

does not, in any sense,

or accept

for opinions expressed by contributors.

CANADA POST: PUBLICATIONS MAIL AGREEMENT No. 40010827

Postage Paid at Vancouver, BC

RETURN UNDELIVERABLE

ADDRESSES

CIRCULATION DEPT.

BC NOTARIES ASSOCIATION

201, 2453 BEACON AVENUE

BRITISH COLUMBIA V8L 1X7

WWW.BCNOTARYASSOCIATION.CA

CANADIAN

TO

SUITE

SIDNEY,

photographs to

Association

endorse

responsibility

Published by the BC Notaries Association Editor-in-Chief Val Wilson BCNA CEO Chad Rintoul Administrative Coordinator Olivia Kuyvenhoven Courier Lightspeed Courier & Logistics Production fractal design inc. (fractal.ca) THE MiX

website:

We

magazine to celebrate

We

profession

professionals

public

British Columbia. 5 THE MIX Original Recipe 54 Decision-Making by Strata Corporations in British Columbia 55 Elaine T. McCormack, Emily Sheard

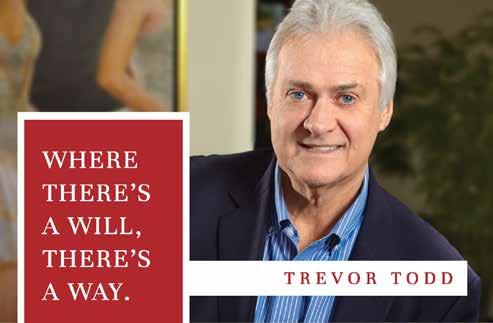

Doctrine of Illegality In Estates 62 Trevor Todd STROKE 101 64 Mark Charland The Story of The Stolen Church and Stolen Bell 66 Ron Hyde Legacy for Tomorrow, A Tax Break Today 68 Natasha van Bentum AGEISM and Creating Age-Friendly Services 70 Sara Pon Mental Health Awareness in the Workplace 72 Esha Shoker 2022 REFBC Land Awards 74 Stephen Hui Auto and Technology 76 Akash Sablok PEOPLE: Honours and Events 78 5Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

Autumn Update

The British Columbia Notaries Association has recently completed our membership renewal for the current member year. I am delighted to report that 96 per cent of practising BC Notaries are members of their professional association!

I find that incredible level of support particularly important as the province moves forward with plans to unify legislation and regulation of the legal professions.

On September 14, 2022, the Ministry of the Attorney General publicly circulated the Legal Professions Regulatory Modernization Intentions Paper. In that document, Government noted its intention that BC Notaries should have a core scope of practice set out in the new statute, and that mechanisms should be established to allow that scope of practice to be expanded without the need for legislative change.

As such, that authority would rest with the new regulatory body who may also have the latitude to introduce a flexible licensing framework for Notaries, meaning the regulator could “customize an individual licence based on their specific training and expertise.”

The ability of the new regulator to control extended scope of practice for Notaries, as well as potentially introduce limited licensing for Notaries, illustrates the importance of the new governance structure.

How will the Board of Directors of the new regulator be comprised? Government is suggesting the Board should be made up of Directors who are elected by licencees (lawyers, Notaries, and paralegals); some may be appointed by members of the Board and others (a minority) appointed by Government.

On first review, a preferred method of comprising the elected portion of the Board would be to ensure there is a provision to include an equal number of lawyers, Notaries, and paralegals on the Board, so as not to see one group of licencees dominating the Board structure.

The future of the Notary Foundation is also contemplated in the intentions paper, noting the amalgamation of the Notary Foundation and the Law Foundation may be an outcome of that process.

The Notary Foundation has been a significant financial supporter of continuing education initiatives designed uniquely for BC Notaries and the BCNA will closely follow the dialogue on the future of the Notary Foundation.

At the recent British Columbia Notaries Association Annual General Meeting, Ministry of the Attorney General Deputy Minister Shannon Salter spoke to members about that initiative and noted that the Intentions Paper is open for public consultation until November 18, 2022.

The BCNA has been engaged with its Legislative Review Task Force to provide draft comments and, in consultation with members, will put forward consolidated feedback to the province on behalf of the profession.

Scrivener readers, as allies of the profession, are also encouraged to provide comment. For those reading the online edition of The Scrivener, here is the link. https://engage.gov.bc.ca/govtogetherbc/consultation/ legal-professions-reform/

The BCNA AGM also provided a good opportunity to review the Continuing Education initiatives of the past year and look ahead to upcoming events such as the New Notaries Career Fair coming this February; it provides a virtual opportunity for students in the Simon Fraser University Master of Arts degree in Applied Legal Studies Program to meet potential future employers or business partners.

The BCNA Annual Conference, scheduled for April 21 to 23, 2023, in Kelowna was also highlighted as a chance to reconnect with colleagues and sponsors. Please save the dates. We are overdue to get together! s

Respectfully, Chad Rintoul

CEO, BC NOTARIES ASSOCIATION

Chad Rintoul

Tracey Scott Photography

6 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

Money Laundering and Fraud

Itrust that all our readers had a wonderful Summer and were able to travel and enjoy life this year . . . more than the previous 2 years permitted. I wish everyone a safe—and hopefully a COVID-free Winter.

The theme of this edition of The Scrivener is Money Laundering and Fraud—and what a hot topic it is lately! Not a week goes by without a breaking news story.

The Cullen Commission Report, released in June 2022, focused on the challenges of identifying and tracking money laundering in British Columbia. To acquaint yourself with the robust investigation process, I encourage you to read the Report’s Executive Summary. https:// cullencommission.ca/com-rep/

In the Summary, the Report made it clear that trust accounts are sometimes used by criminals for money laundering purposes. Chapter 29 of the Cullen Commission Report specifically discussed BC Notaries and made some recommendations to offset the possible risks around Notaries’ trust accounts being used for money laundering purposes.

Our Regulator—The Society of Notaries Public of British Columbia—is adept at maintaining, enhancing, and enforcing the Rules around the use of our trust accounts. For as long as BC Notaries have been handling clients’ money via trust accounts, The Society’s Rules have guided the types of funds permitted and the conditions under which trust funds

must be held. Those Rules have been the cornerstone for fending off individuals who might wish to profit from money laundering through Notaries’ trust accounts. I wish to personally thank our Regulator for the time and the detailed information provided to the Cullen Commission.

Lawyers remain exempt from the legislation of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, SC 2000, c 17 (PCMLTFA), and the subsequent reporting requirements to FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). The FINTRAC requirements and reporting procedures that apply to BC Notaries serve to create an additional layer of protection for Notaries’ trust accounts by deterring fraudsters.

I encourage every member of our BC Notary Association to continue to be diligent and make an appropriate report to FINTRAC, the moment any signs of money laundering or fraud are spotted.

BC Notaries are highly responsible legal professionals. I am confident that we will continue to do our part in the fight against this insidious form of criminal activity.

ANNUAL GENERAL MEETING 2022

Our AGM was September 24. I was thrilled to welcome Deputy Attorney General Shannon Salter to open our meeting and give us a much-needed update on the unified legislation that will see one Regulator for all legal services in our province. She discussed how the legislation will benefit both the

Daniel Boisvert

public and the professions and briefly described how the legislation would contain mechanisms to expand BC Notaries’ scope of practice.

Finally, and I think most important, Deputy AG Salter assured us that our unique identity as Notaries Public would be preserved in the legislation. I wish to thank her for her time and for being open and candid with her comments.

We also did some housekeeping at the AGM with our Notary Bylaws, taking the final step of removing our ties with our Regulator; The Society of Notaries Public is no longer a member of the BCNA. That ensures both entities are fully independent of each other.

The BCNA has come a long way in a short time. I am very proud of my Board’s commitment to moving the Association forward. Thank you to our CEO Chad Rintoul and his team.

I look forward to seeing all our members in Kelowna in April 2023, our first in-person Continuing Education Conference in quite some time.

PRESIDENT, BC NOTARIES ASSOCIATION

Shannon Salter

7Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

Val Wilson Editor-in-Chief

Crime, fraud, and corruption have been endemic in all societies since the dawn of history. These days, all the world’s developed and developing countries, regardless of their political and economic systems, must face up to and deal with those problems.

Here’s the link to the Canadian Anti Fraud Centre (CAFC). You’ll find many resources and articles. https://www.antifraudcentre-centreantifraude.ca/ index-eng.htm

More Helpful Links

• BC RCMP: http://bc.rcmp-grc.gc.ca/

• Service Canada: https://www.canada.ca/en/ employment-social-development/corporate/ transparency/access-information/fraud-awareness. html

• BC Securities Commission: Investment Caution List | BCSC https://www.bcsc.bc.ca

• Canadian Securities Administrators’ National Registration Search: https://info.securitiesadministrators.ca/nrsmobile/nrssearch.aspx

ALERT

Don’t

even

A thief will find it handy, too. A man I know

it’s

important items on top of the frig—keys, wallet, driver’s licence, vehicle ownership, and passport. While

family slept upstairs, an intruder entered their home, discovered the frig trove, put their treasures into the family’s car, then stole it to get away. s

leave valuables in plain sight in your home,

if

handy for you.

kept

the

Enjoy this issue! Please Take Care

www.wildmanphotography.com KEYNOTE Greg Litwin, Notary Public • Over 35 Years’ Experience • Wonderful Reputation • “Excellent Service at a Fair Price” Voted by his Community “Best Notary in the South Okanagan for the past 3 consecutive years” Semi-retired, Greg practises as a Roving Notary around the Province. • In Strong Demand • Currently taking bookings for 2023 “I treat Each Business with Care, as if it were My Own Practice.” HAVE SEAL . . . WILL TRAVEL! Phone 250-770-0723 greg@greglitwin.com 8 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

Inside The Cullen Commission

The Society of Notaries Public of BC (The “Society”) was one of 16 organizations granted “standing” to become formal participants in the Commission of Inquiry Into Money Laundering in British Columbia (the “Commission”).

I was honoured to be counsel for The Society throughout the Inquiry. We presented at the initial public meeting in Vancouver before making formal opening and closing presentations to the hearings.

Before the start of the hearings, we provided Commission staff with information on the details of real estate transactions in BC and the involvement of BC Notaries Public in real estate transactions. During the hearings, we had the right to cross-examine witnesses and review all presented evidence.

Our involvement was critical as the role of Notaries as legal service providers is unique to this province. Consequently, we could not assume that the many national and international experts and authorities consulted by the Commission would be familiar with our BC real estate system and the practices of BC Notaries and lawyers as they carry out transactions here.

As a result, the Commission needed to consider the specifics of how transactions are completed in BC and how funds flow among buyers, sellers, real estate firms, lenders, Notaries, and lawyers. John Mayr (Society CEO) and Marny Morin (statutory Secretary of The Society) appeared as witnesses and provided valuable evidence on those points.

The Commission’s mandate was to enquire, which inevitably meant matters would become apparent that pushed the boundaries of the initial “terms of reference.”

The hearings took place over 130 days involving 199 witnesses and 1060 exhibits. The transcripts and exhibit materials are still available on the Commission website (cullencommission.ca) and total over 450 Gigabytes of text as well as video recordings of all the hearings. The final commission report is an 832,071word, 1800-page tome. I recommend reading at least the Executive Summary and the consolidated list of recommendations.

It is common in BC for Notaries and lawyers to be involved in a transaction, acting for the different parties. That includes representing sellers, buyers, and mortgage lenders. Though the Courts have found that the standard of professional care is the same for BC Notaries and lawyers, there are significant differences that go to the central concerns of the Commission. Most important, BC Notaries are the only legal service providers in Canada subject to the requirements of the Financial Transactions and Reports Analysis Centre of Canada (“FINTRAC”).

The Commission’s mandate was to enquire, which inevitably meant matters would become apparent that pushed the boundaries of the initial “terms of

COVER STORY

Ron Usher

COVER STORY

photo: Ron Usher

North side of False Creek, Vancouver, B.C.

10 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

reference.” Commissioner Cullen had to come to grips with many difficult-to-reconcile issues throughout the hearings.

The complexities faced by the Commission included the following.

• A local (BC) mandate looking at global issues in an increasingly borderless world

• The limits of Provincial authority and the many national and federally regulated agencies

• Considering our Provincial systems, for example, our BC Land and Corporate Registries, in light of evidence regarding quite different governmental and business practices in other jurisdictions

• Some pressure to come up with a simple, satisfactory explanation to opaque and complex issues

• The frequently made suggestion that “the answer” lies in the improved capture and analysis of enormous amounts of transparently available information vs. the cost, complexity, and privacy implications of such an effort

• The enormous difficulty our justice system has had prosecuting and punishing money launderers given the legal, structural, and financial barriers faced by many dedicated system participants dealing with criminals without those constraints

participant along with 36 other agencies in the Counter Illicit Finance Alliance of British Columbia ( “CIFA”), an “RCMP-led, financial information sharing partnership, to bring together public and private organizations to combat money laundering and other financial crime.” In addition, The Society is a regular participant in the meetings of the BC Interagency Fraud Group.

The Society has continued to work even more closely with FINTRAC. It has formalized that relationship in a “Memorandum of Understanding” to facilitate and coordinate our mutual responsibility for the monitoring and reporting required of BC Notaries Public.

It is clear from the Cullen hearings and reports that new legal frameworks are needed to appropriately balance privacy and human rights concerns with investigative and prosecutorial effectiveness based on enhanced and effective coordination and sharing of information. The Society will be actively involved as those discussions proceed over the next few years.

The final Cullen Report topped 1804 pages.

The report makes 101 recommendations that now need to be considered by the provincial government. That will take some time as the recommendations have considerable legislative, regulatory, and budget implications.

On September 28, 2022, David Eby KC, the former Attorney General and now a candidate for the leadership of the NDP, released his housing platform that gives a view into his priorities for implementing the Cullen recommendations.

Regardless of the timetable for that work, there have already been significant and useful outcomes from the work of the Commission. The level of coordination and cooperation among agencies has improved significantly. The Society has been pleased to be an active

During the hearings, the new Land Owner Transparency Act came into force and all BC Notaries became familiar with the necessary filings into the Land Owner Transparency Registry (“LOTR”). Though the primary intent of the LOTR is to enhance AML capabilities, it has had the very beneficial unintended effect of requiring property owners to more fully consider how they wish to hold title and interests in land. The discussions will undoubtedly avoid future legal disputes, reduce friction between and among family members, and provide clarity regarding tax obligations. Not surprisingly, LOTR and other new real estate transaction filing requirements have added complexity and cost to all real estate transactions.

Commissioner Cullen notes at page 2 of his Report that “Money laundering is also an affront to law-abiding citizens who earn their money honestly and pay their fair share of the costs of living in a community. These costs are being borne by all system participants.” That is undoubtedly the case. The challenge will be ensuring that efforts to increase anti-money laundering effectiveness do not unduly burden the everyday transactions of those concerned citizens. s Ron Usher is the General Counsel for The Society of Notaries Public of British Columbia and a Commissioned Notary Public.

11Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

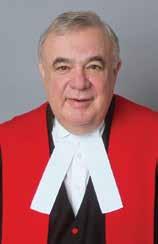

The Cullen Commission and The Society of Notaries Public of BC

John Mayr

Marny Morin

John Mayr

Marny Morin

The Society of Notaries Public (SNPBC) was granted standing at the Commission into Money Laundering in British Columbia and participated fully in the hearings.

The Society made written submissions and both Ms. Morin as Secretary, and Mr. Mayr as Executive Director, gave evidence to the Commission. Ron Usher acted as counsel for The Society and attended all the hearings.

The Cullen Commission released its final Report on Wednesday June 15, 2022. The Report includes 101 recommendations. Of those, 3 are directed to BC Notaries Public. The Report dedicates 17 pages to the evidence, testimony, and findings of the Commission and includes a brief history, lists the scope of practice, and speaks to the regulation of members by The Society.

The recommendations made by the Commission and The Society’s responses are as follows.

Recommendation 66

I recommend that the Province, in consultation with The Society of Notaries Public of British Columbia, raise the maximum fine that can

be imposed when a member of The Society is guilty of misconduct as set out in the Notaries Act.

Given the Ministry of the Attorney General’s (MAG) announcement to create a single regulatory body for legal professionals in BC, it is somewhat unlikely that the MAG would engage in the legislative process to amend the Notaries Act. It is anticipated that the new legislation will address this recommendation.

Recommendation 67

I recommend that The Society of Notaries Public of British Columbia require its members to obtain, record, and keep records of the source of funds from their clients when those members engage in or give instructions with respect to financial transactions.

The recommendation that The Society requires members to make and maintain records related to source of funds would require an amendment to the Rules of The Society.

The Rules do not require approval by the Attorney General and changes may be implemented by the Directors. This recommendation is consistent with current Law Society of BC Rules for source-of-funds determination. The Commission makes the following recommendation to the

Law Society with respect to source of funds declarations.

Recommendation 56

I recommend that the Law Society of British Columbia amend its client identification and verification rules to explain what is required when inquiring into a client’s source of money. The rules should make clear, at a minimum

• that the client identification and verification rules require the lawyer to record the information specified in the Fall 2019 Benchers’ Bulletin;

• the meaning of the term “source of money”; and

• that lawyers must consider whether the source of money is reasonable and proportionate to the client’s profile.

Amending the Rules of the SNPBC to meet the purpose and intent of the Recommendation will be considered by the Board of Directors of The Society. Source of funds declarations are a recognized tool to combat money laundering.

Recommendation 68

I recommend that The Society of Notaries Public of British Columbia educate its members on the money laundering risks relating to private lending, through educational materials or other means.

MONEY LAUNDERING/FRAUD

12 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

Recommendation 68 seeks to enhance the education of members with respect to money laundering and private lending.

Private lending is the subject of Recommendations 31 and 32. The Commission found evidence of money laundering through private lending and identified that Notaries Public may be engaged in real property conveyances that may involve private lenders. Given the evidence and findings of the Commission, and the increasing incidence of private lending, there is merit in adopting this recommendation and ensuring that the Notary education program includes components to educate members of the risks of money laundering related to private lending.

of BC’s efforts related to AML (Anti Money Laundering). Contrary to the often-expressed opinion that lawyers are not subject to antimoney laundering Rules, the report acknowledges the good work of the Federation and LSBC in addressing concerns that lawyers were, wittingly or unwittingly, engaged in activities that facilitated money laundering in Canada and British Columbia.

Services a BC Notary Can Provide

A. PROPERTY MATTERS

and

Refinancing

Transfers

Covenants, and Rights of

Statutory

...the report acknowledges the good work of the Federation and LSBC in addressing concerns that lawyers were, wittingly or unwittingly, engaged in activities that facilitated money laundering in Canada and British Columbia.

Notaries should consider each of the recommendations made by the Commission to the legal profession and legal regulator to investigate the applicability and relevance of each of the recommendations to notarial practice.

C.

The Commission Report deals extensively with lawyers, the Law Society, and related organizations. Recommendation 53 through 65 all relate to the regulation of lawyers and legal practice. The text of the Commission’s Report detailing issues related to independence are illustrative of the challenges that the Government will have to consider in the construction of the statute for the proposed single legal regulator. Starting at page 1108 and continuing for approximately 100 pages, the Commission provides a significant overview of national and provincial regulatory challenges and initiatives.

That section includes positive comments about the Federation of Law Societies and the Law Society

The report of the Commission is a valuable tool in strengthening the regulation of Notaries Public, legal services providers, and the systems related to real property in the province of BC. The Society of Notaries Public and the profession, having established systems and processes designed to protect the public and comply with federal and provincial legislation, fared well in the context of the Commission’s Report.

As a regulatory body, we must continue to deepen our commitment to AML measures while protecting the independence of The Society and the profession in the delivery of services to the public. s

Submitted by SNPBC Secretary Marny Morin, and Executive Director John Mayr.

1. Residential

Commercial Real Estate Transfers 2. Mortgage

Documentation 3. Manufactured Home

4. Easements,

Way 5. Builder’s Liens 6. Subdivisions and

Building Schemes 7. Zoning Applications B. PERSONAL PLANNING 1. Wills Preparation 2. Powers of Attorney 3. Representation Agreements 4. Advance Directives 5. Wills Notice Searches 6. Estate Planning

NOTARIZATION/DOCUMENTS 1. Affidavits for All Documents required at a Public Registry within BC 2. Certified True Copies of Documents 3. Execution/Authentications of International Documents 4. Notarizations/Attestations of Signatures 5. Insurance Loss Declarations 6. Personal Property Security Agreements 7. Statutory Declarations 8. Authorization of Minor-Child Travel 9. Letters of Invitation for Foreign Travel 10. Passport Application Documentation D. BUSINESS 1. Business Purchase/Sale 2. Commercial Leases and Assignment of Leases 3. Contracts and Agreements E. SOME BC NOTARIES PROVIDE THESE SERVICES. 1. Marine Bills of Sale and Mortgages 2. Marine Protests 3. Marriage Licences 4. Mediation 5. Real Estate Disclosure Statements There are Notaries to serve you throughout British Columbia For the BC Notary office nearest you, please call 1-604-676-8570 or visit www.bcnotaryassociation.ca. Note: Not all Notaries provide all services listed. Please check with your Notary before making an appointment for services.

13Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

The Many Aspects of Fraud

When fraud is mentioned, most of us think of the financial or fiduciary aspects.

We also want to know there are laws and regulations to protect our interests, personally and in the wider interests of governed society. We need to be assured that the confidential services that we use have well-trained professionals whose duties are driven by shared values of undivided loyalty, due diligence, reasonable care, and the full disclosure of any conflicts of interest.

We want to feel confident that those who commit fraud at any level in society—those who ripped us off or who broke the law according to the current legislation and regulations—will face the consequence of their actions, that no one is above the law, and that we live in a system that does in fact deliver justice.

We also want to be assured that the penalties for committing various frauds are strong enough to efficiently thwart those who knowingly break said laws and effectively serve to educate or otherwise deter potential wrong-doers.

But few of us go into the aspects of knowing and dealing with deliberate or otherwise perpetrated

fraud in other areas—those of our evolving culture and our wider societies’ beliefs or values.

Many frauds in history were committed by individuals and their institutions for conquest, power, and financial gain.

Examples include all areas of society from academic credentialism, to misleading consumers of product reliability, to exploiting the downtrodden and the inexperienced and ignorant. The concept of “never give a sucker an even break” is tried and true and criminally overused in many societies.

Fraud is actively disseminated by climate-change deniers, politicians, and others—mobsters and oligarchs alike—who have weaponized many forms of propaganda to dupe and mislead people through lies and disinformation to secure power and further service greed.

Nigel Atkin

Fraud in the Individual

Another aspect of fraud resides in the individual, in all of us, you and me, as part of culture, outdated teachings, effective propaganda, or subtle all-consuming indoctrination. Living a fraud can affect who and why we are.

Admittedly, when the rate of change is too fast, most people resort to fundamental beliefs. The way it used to be seems more comfortable than boldly stepping wisely into the future.

Is it our individual and collective duty to adopt best practices—to speak up, to leave in the past old ways that now rob us of efficiency and pollute the air?

Fraudulent ideas within us often stay benign, dormant, even unrecognized until they are self-examined—by you and me, politicians, those in business, and academics alike.

Personal reflection can be caused by dramatic events in our lives—sickness, inevitable old age, surviving some grand accident or force of nature, pandemic lockdowns and other isolation, more violent weather incidents, war or insurrections—even in our own country, while we embrace truth and reconciliation.

Knowing our options better can be generated by a potential

MONEY LAUNDERING/FRAUD

Is it our individual and collective duty to adopt best practices—to speak up, to leave in the past old ways that now rob us of efficiency and pollute the air?

14 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

a new relationship, retirement, higher education, and life’s experience. Sometimes a good book is all our growing awareness really needs; even a vacation to a more efficient country can help.

many good lives, well reflected, the highest of ethical journeys—to know oneself—is an ongoing, neverending pursuit to adapt to the forever transformation both within ourselves and all around us.

we grow, learn, and actively witness our widest environments, we adapt and change with new information. That constant demands psychological and often physical mobility. Most of us can handle the challenges.

our lives today, the great wheel of time is turning and our dogmatic intransigence to passé attitudes, beliefs, and behaviours requires an evolution of thinking. As one of my old friends said, “In times of great change, the most important thing to change is your mind.”

In times of widespread corruption, be it in money laundering and other high crimes, widespread disinformation, or the fraudulent inconsequence of climate change, individuals and institutions need to go to their intelligent, critical-thinking core values—the way many of us were raised and educated.

Society needs to embrace the finest of many good options available in democratic decision-making. As well we need leaders to choose the least-worst possible options to serve ourselves, society, and wider institutions as best we can. s Nigel Atkin teaches the Evolution of Public Relations course online at UVic. He offers onsite workshops to leverage human capital and exploit the multiplier effect of becoming better communicators.

want to believe

will remain

sometimes

into old age

just doesn’t

dementia

need

– Janet Lancey

ECF • Age is Just a Number Scrivener Magazine 1/4 page ad - 4.9”w x 4.75”h We all

that we

healthy

but

that

happen. Whether you are 52 with

or

care at 105, aging can take away so much. Your donation to the Eldercare Foundation funds community programs and education that help people stay in their own homes longer; funds therapy programs, equipment and home-like enhancements for extended care residents; and gives back dignity and happiness. Leave a legacy of care, comfort and quality of life. Please consider a planned gift to the Eldercare Foundation today. 1450 Hillside Ave.,Victoria, BC V8T 2B7 250 370-5664 • www.gvef.org Registered Charity #898816095RR0001 career change,

In

As

In

Your legacy could be her childhood variety.bc.ca Helping BC’s kids with special needs one child at a time “Taking care of my loved ones in my Will has always been important but I also knew I needed to include the incredibly brave children helped by Variety. It makes me happy knowing that in my small way, I’m leaving the world a better place.”

Violet, 4 Contact Jennifer Shang at 604-268-4038 or email jennifer.shang@variety.bc.ca or visit variety.bc.ca/donate-now/planned-giving/ Learn how to leave a legacy gift to Variety including how to create your will for free 15Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

What Makes Real Estate Appealing to Money Launderers?

BOTH GLOBALLY AND LOCALLY

What is Money Laundering?

Defining money laundering is a fairly simple concept—taking funds generated by criminal, corrupt, or terroristfocused activity and entering those illegal funds into the legitimate economy—whether that means putting the proceeds into a financial institution, investing them into the stock market, or purchasing low and high-end goods.

In each circumstance, the hope by the criminal is to turn the proceeds of crime into a legitimate holding and to do that in a manner that can avoid suspicion about what they are doing and why they are doing it.

In this article, I want to take a brief look at how money launderers and property ownership, both globally and locally, make for perfect bedfellows, and why regulatory bodies at all levels recognize the need to implement compliance practices to control such practices and engage those professionals involved in the conveyancing process to proactively assist in the application of those practices.

There are common vulnerabilities across countries, where the purchase and sale of real estate attracts criminals and criminal groups...

• Seventy-eight per cent of those evaluated countries’ real estate sectors were found to have a poor level of understanding of the relevant real estate ML/TF risks.

The FATF stressed that identifying ML/TF risks in the real estate sector and clearly communicating those findings are important elements of any overall strategy by countries and their regulated sectors to manage AML/CFT control effectiveness.

The Global Perspective

Real estate, residential or commercial, is an attractive opportunity, according to the Financial Action Task Force (FATF), for dirty money to be cleaned. In its most recent report on the topic, “Guidance for a Risk-Based Approach to the Real Estate Sector” (July 2022), the FATF noted the following.

• Sixty-nine per cent of the countries assessed during the FATF 4th round of mutual evaluations identified the real estate sector as having a medium to high Money Laundering/ Terrorist Financing (ML/TF) risk.

It is well known that Money Laundering/Terrorist Financing risk can be inherently unique to each country and can vary with regards to the different types of property involved, e.g., commercial, residential or other. There are common vulnerabilities across countries, where the purchase and sale of real estate attracts criminals and criminal groups, given the advantages of investing in property and the value of such an asset. Specifically, that asset in today’s economy can increase in price and make money, besides serving as the perfect way to transfer the proceeds of crime into a nonsuspicious, widely accepted, and legitimate holding—a home, a cottage, a commercial building.

Chris Walker

MONEY LAUNDERING/FRAUD 16 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

So, what are some of the ML/TF advantages and risks when it comes to money launderers participating in the real estate sector today as discussed by the FATF in its 2022 global review?

• Real estate transactions in the majority of cases are singular activities, rarely repeated with any degree of frequency. Consequently, players in the real estate conveyancing-world do not have any purchaser/ seller track record to turn to as part of any client due diligence (CDD) process. The lack of transaction histories can serve as a veil of secrecy for the criminal, enabling the transaction to proceed with few red flags being raised.

• The lack of transparency into beneficial ownership information allows criminals to abuse nominees as well as legal persons and arrangements— such as shell companies and trusts—successfully hiding their involvement in ML/TF activities. The obfuscation of true ownership is also a well- known practice for individuals who simply have legitimate reasons for wanting to ensure their privacy or possibly for legitimate tax planning purposes.

• Current and past practices in many countries have shown that purchasing real estate also offers secondary benefits for criminals and corrupt Politically Exposed Persons (PEPs), such as helping with attempts to secure residency and/or citizenship, conveying social respectability and providing an immediately available asset with the strong potential, in today’s market, to appreciate in value.

• Real estate is a stable investment and an appreciating asset that can generate returns. Both

commercial and residential property offer an attractive tool for criminals. Canadian law enforcement has reported that criminal networks and drug traffickers have purchased real estate for their use as supply houses or as a location to grow, manufacture, or distribute illicit narcotics.

• The FATF reported that some PEPs have sought to launder illgotten funds into the real estate sector in both the residential and commercial sectors. PEPs that misuse their positions for personal enrichment present a high ML risk to the real estate sector and the larger financial sector more broadly, given the PEP connections to governmental entities and possible access to government funds.

• Criminals are known to falsify information—such as asset holdings, falsified or stolen identities, and income information —to obtain a loan from a bank or other lender. In those instances, criminals may have no intention of using the funds to acquire a property and may only seek to use the real estate loan to disguise the origin of funds for another use. Or illicit proceeds may be used to pay off those loans, allowing criminals to place their ill-gotten gains into the financial system through a common, acceptable means.

The FATF Guidance included numerous casestudies of money laundering in the Real Estate Sector to highlight the application of the various red flags discussed.

• In some instances, a criminal can rely on complicit bankers and lending professionals to help obtain a mortgage and ultimately help them avoid detection. They may also seek out straw buyers or nominees to make the application for the mortgage—further distancing the criminal from the transaction and possible exposure through background checks and transaction due diligence.

• Commercial real estate may be especially vulnerable to money laundering due to the increased prevalence of legal entities and vehicles used by corporate buyers and sellers that seek out these properties for investment and revenue. Additionally, the high value of those properties may also require multiple types of financing that may complicate efforts to identify the source of funds used to purchase the property.

• Criminals may seek to launder funds by paying for property at a higher or lower value than the true property value. That red flag suggests the property may not be intended for a legitimate reason and that the transaction is designed to hide illicit activity or gains. As an unplanned sideeffect, the inflated value has also been shown to contribute significantly to the increase in housing costs currently running rampant in various parts of the world, including Canada.

The FATF Guidance included numerous case-studies of money laundering in the Real Estate Sector to highlight the application of the various red flags discussed. Here is a brief summary of one from the USA.

17Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

Services a

Notary Can Provide

In February 2021, a real estate attorney in Kentucky pleaded guilty to money laundering charges for purchasing real estate with the intention of using the purchases to disguise the proceeds of illegal sports betting. The attorney conspired with another individual engaged in illegal betting to disguise the illicit proceeds through investments in commercial real estate. As part of the scheme, the attorney used funds that he knew were derived from illegal betting to purchase companies that held real estate properties. When purchasing those properties, the attorney deliberately concealed the involvement and ownership of the individual involved in illegal gambling.

Dr. German’s findings with respect to real estate and money laundering were expanded by a further study on the sector prepared by a panel of experts chaired by Maureen Maloney, Professor of Public Policy at Simon Fraser University.

Justice Cullen kicks off his discussion on money laundering and its connection to the BC real estate industry with a rather poignant statement about the relationship between both. Specifically, Cullen writes.

The Local Perspective

In Canada, the Cullen Commission recently released its final Report (June 3, 2022) setting out the findings and Recommendations arising from the 37-month public inquiry into Money Laundering in British Columbia.

The initial impetus for the Commission arose from two earlier Reports by Dr. Peter German into possible money laundering in BC’s gaming industry, which quickly factored in the province’s real estate sector as a key element in what was dubbed the “Vancouver Model”’ of money laundering.

In the public discourse around money laundering in this province, skepticism has been expressed about the prevalence or even existence of money laundering in real estate. … In order to dispel any lingering doubts about the existence of money laundering in the real estate sector, I have set out in this chapter a review of the intergovernmental, governmental, and academic consensus on the prevalence of money laundering in real estate. This chapter also canvasses the commonly understood typologies involving the use of real estate to launder the proceeds of crime. One of my purposes in doing so is to illustrate that, in the real estate sector, money laundering transactions are usually one or more steps removed from the physical cash that some members of the public may associate with the words “money laundering.” While money laundering typologies involving real estate do not conjure up dramatic images of hockey bags or suitcases of cash

emptied onto the desks of Realtors, that does not mean that money laundering is not happening in this sector. A focus on physical cash when considering

being

Justice Cullen then went on to discuss the benefits/advantages to money launderers when they invest in the BC real estate market,... A. PROPERTY MATTERS 1. Residential and Commercial Real Estate Transfers 2. Mortgage Refinancing Documentation 3. Manufactured Home Transfers 4. Easements, Covenants, and Rights of Way 5. Builder’s Liens 6. Subdivisions and Statutory Building Schemes 7. Zoning Applications B. PERSONAL PLANNING 1. Wills Preparation 2. Powers of Attorney 3. Representation Agreements 4. Advance Directives 5. Wills Notice Searches 6. Estate Planning C. NOTARIZATION/DOCUMENTS 1. Affidavits for All Documents required at a Public Registry within BC 2. Certified True Copies of Documents 3. Execution/Authentications of International Documents 4. Notarizations/Attestations of Signatures 5. Insurance Loss Declarations 6. Personal Property Security Agreements 7. Statutory Declarations 8. Authorization of Minor-Child Travel 9. Letters of Invitation for Foreign Travel 10. Passport Application Documentation D. BUSINESS 1. Business Purchase/Sale 2. Commercial Leases and Assignment of Leases 3. Contracts and Agreements E. SOME BC NOTARIES PROVIDE THESE SERVICES. 1. Marine Bills of Sale and Mortgages 2. Marine Protests 3. Marriage Licences 4. Mediation 5. Real Estate Disclosure Statements There are Notaries to serve you throughout British Columbia For the BC Notary office nearest you, please call 1-604-676-8570 or visit www.bcnotaryassociation.ca. Note: Not all Notaries provide all services listed. Please check with your Notary before making an appointment for services.

BC

18 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

the risks of money laundering reflects a misunderstanding of how various money laundering typologies work. In the real estate sector, that sort of focus on cold cash can lead to a failure to appreciate the magnitude of the risk and to recognize indicators of money laundering. (Chapter 15, page 772)

• The potential for income generation via rental income or the appreciation of property

• The opportunity for further money laundering via real estate, such as by construction on the property

• The fact that taking out a mortgage to pay for real estate provides an opportunity to use illicit funds to service that debt and legitimize the money that is moving into financial institutions

The regulatory pressure on financial institutions to avoid doing business with potential money launderers that has led to reforms that have encouraged launderers to seek alternate means of laundering—buying and selling real estate

• The ability to develop influence and power at a local level, such as in cases where a large real estate portfolio is owned in a small town or neighbourhood

Apart from those practical benefits, Justice Cullen noted structural and regulatory factors are also serving as incentives to money launderers for using real estate to launder funds, for example.

Justice Cullen then went on to discuss the benefits/advantages to money launderers when they invest in the BC real estate market, including the following.

• The enjoyment of the property, both in terms of residing/ conducting business on the property, and as a display of one’s success

• The benefit of having a location at which to conduct criminal activity

• The fact that a large amount of money can be laundered with a single transaction, due to the high value of real estate relative to other goods

• The relatively low transaction costs, as compared to other methods of money laundering

• The perception of real estate as a safe investment

• The regulatory pressure on financial institutions to avoid doing business with potential money launderers that has led to reforms that have encouraged launderers to seek alternate means of laundering—buying and selling real estate

• The ability to manipulate the price of real estate

• The current ease of maintaining privacy, because of the lack of transparency in public corporate and land registries

• Conflict for real estate professionals who are expected to balance expectations of performing due diligence as to the source of funds, but also attract clients and earn a living through their commissions

• Minimal reporting of suspicious transactions, whether on the part of the opposite party in the sale or on the part of real estate professionals

19Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

enforcement and insufficient sanctions for facilitating money laundering in real estate

The common features of the benefits identified globally and those noted in the Cullen Commission reinforce the belief that real estate is a perfect market to clean dirty money regardless of where one lives in this world. It also suggests that the benefits can outweigh the risks money launderers face by dabbling in the market.

Finally, as an example of money launderers at work in Canada, here is a summary of a further case study submitted by Canada’s ML/TF regulator, the Financial Transactions and Reports Analysis Centre (FINTRAC) and reported in the 2022 FATF Guidance.

Jane Doe contacted real estate broker Mary Smith to enquire about two properties she was considering for a purchase.

Jane stated that she worked as a server in a restaurant. Mary conducted research into the two properties and emailed Jane with pros and cons for each. They made appointments for viewings. On the day in question, Jane advised Mary by email that she was unable to attend due to illness, and that in any case she had already decided to purchase the $800,000 home. Jane explained she was in the middle of a custody battle and was in a rush to buy a house in order to demonstrate she was capable of providing for her two children. Mary was taken slightly aback by her choice of the more expensive home and her willingness to buy without first viewing the house or having anyone else inspect it. Concerned about the choice, Mary pointed out that the

selling price was overvalued by $50,000 and that she was in a good position to benefit by making a first offer under the asking price, but that in any case it would be important for Jane to visit the house to ensure it met her needs. Jane emailed Mary to let her know that given her pressing need to find a home for her children, she had already made up her mind and directed Mary to offer the asking price.

checked personally. She offered to drive over to pick-up the deposit cheque and validate her brother’s identification at the same time. Mary also requested bank and lawyer information as part of the standard financing and legal steps. Jane explained that they preferred to mail out the deposit cheque because her working hours at the restaurant were unpredictable. Jane sent the deposit cheque signed by her brother, faxed a copy of her brother’s driver’s licence, and provided only the mortgage pre-approval with none of the required details.

Mary explained that to writeup an offer, Jane would have to provide a deposit and identification. At that point, Jane emailed Mary and unexpectedly advised her that her brother would actually be mortgaging the house because he would be living with them. Mary offered to make the 45-minute drive to meet them and write the offer, however Jane requested that she be emailed the form with the purchaser’s name blank in order to enter her brother’s name. Her brother was arriving from overseas on May 1 and would fill in the details when he got here. They would then scan the offer and email it back to Mary. Mary explained that the brother’s ID would need to be

Mary called Jane and started to explain once again that the brother’s identification document would have to be validated in person in order to proceed. At that point, Jane became very defensive and threatened to find another real estate agent. Mary explained that without proper ID validation, it would not be possible to go through with the deal. Jane informed Mary that her brother had decided to cancel the deal and requested that her brother’s deposit be put into his bank account.

A suspicious-transaction report was subsequently submitted to FINTRAC, outlining the details of the process from start to finish. It is clear from this case study that numerous money laundering red flags surfaced throughout the process, which eventually culminated in the Broker, Mary, submitting her suspicions through an STR (Suspicious Transaction Report) to FINTRAC. s

Prepared By Christopher R. Walker

M. Criminology, CAMLI-PA President, About Business Crime Solutions, Inc.

• Lax

The common features of the benefits identified globally and those noted in the Cullen Commission reinforce the belief that real estate is a perfect market to clean dirty money...

20 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

Graffiti on a wall excavated from ancient Rome asserts that “baths, wine, and sex corrupt our bodies, but baths, wine, and sex make life worth living.”

A bit of escapism, a bit of hedonism; the pleasures sought throughout history on every continent can help make life on earth tolerable. Why wait for Paradise Promised?

That was never more the case than in the early 20th century after those two ferocious killingmachines had visited earth: The Great War and the Spanish Flu. In a knee-jerk reaction to the past doom and gloom, the Roaring Twenties made its entry. The economy boomed and modern technology found its way in daily life. Moving pictures! Automobiles! The radio!

Josephine Baker danced the Charleston and Charles Lindbergh flew his Spirit of St. Louis across the Atlantic. It was the Age of the Lost Generation in literature—F. Scott Fitzgerald wrote The Great Gatsby and Art Deco in architecture; construction started on New York City’s iconic Chrysler building.

Women got the vote and Coco Chanel led the way to their freedom. One of the main ingredients that

The Smell of Money

fueled that energy and creativity and all that Jazz? Prohibition. Alcohol was banned via an amendment to the US Constitution no less, and enforcement started in 1920.

That religious crusade in the name of public morality, however, failed miserably. The Anti-Saloon League was defeated by Harlem’s Cotton Club: Illegal bars—the Speakeasies—thrived and corruption was rampant. The government had underestimated their subjects’ desire for the forbidden fruit.

Prohibition might have been well intended but its multiple negative consequences led to its repeal less than 15 years later. Two major results of this experiment are still with us: Organized crime established deep roots and the

Filip de Sagher

government shifted its focus from pursuing crimes to tracking the financial proceeds of those crimes.

Thus it was that the gangster Al Capone was finally put behind bars, not for theft or murder or for illegally producing/transporting/ selling alcohol, but for tax avoidance. He made so much money from booze, he set up laundromats across Chicago and mixed the two revenue-streams to disguise one source from the other.

The term money-laundering was born.

For the authorities, it was a fundamental change in their methods of catching the bad guys. “Follow the money” was their new motto. Illegal sources there were aplenty: Alcohol, drugs, gambling, cigarettes, prostitution . . . and they killed 2 birds with 1 stone, too: The resulting catch conveniently filled their treasure chest at the same time.

One can say that after about 1900 years, money acquired a smell. It was indeed that many years ago the Roman Emperor Vespasianus (aka Vespasian) famously tabled the saying that money did not smell— pecunia non olet.

At the time, the produce of Rome’s public urinals was collected because it was used as a cleaning element in the laundering of the

One can say that after about 1900 years, money acquired a smell. It was indeed that many years ago the Roman Emperor Vespasianus (aka Vespasian) famously tabled the saying that money did not smell— pecunia non olet.

MONEY LAUNDERING/FRAUD 21Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

Charitable Number: 11881 9036

Clayton Norbury cnorbury@spca.bc.ca 1.855.622.7722 ext. 6059 foreverguardian.ca

togas of the Romans. His son Titus found this disgusting until Vespasianus held a coin under his nose and asked him whether it smelled.

The Emperor taught his son that the value of money remained the same, whatever the origin. No longer. The experience gained during those interwar years told the government differently. Money gained from illegal activities did have another value. It did smell and stood out from good money, in that it led back to unlawful transactions.

Actor Leonardo DiCaprio, I presume unwittingly, connected those dots in the same year when impersonating The Great Gatsby of the ‘20s in the eponymous movie and Jordan Belfort of the ‘90s in the movie The Wolf of Wall Street—an imperial lifestyle smells and since those years, increasingly so.

With the dawn of the new Millennium, the chase was on to bring dirty money and its handlers to the cleaners. From Alcohol [sic] Capone and his laundromats, to fiscal paradises built on drugs, money laundering became THE crime to prosecute. s

My Muses

Watching: The Untouchables (1987) and Boardwalk Empire (HBO series)

Reading: Last Call: The Rise and Fall of Prohibition by Daniel Okrent and The Sun Also Rises by Ernest Hemingway

Tasting: Gin, vermouth, and Campari in equal parts. Pour over rocks. Stir. Add orange wedge. The “Negroni Cocktail” was named after Count Camillo Negroni in 1919. s Notary Public Filip de Sagher is the Manager of Complaints at The Society of Notaries Public of British Columbia.

The BC Notaries Association Employee Benefits Association Plan For a no-obligation free quote, contact Charles Choi Charles.choi@mercer.com A business of Marsh McLennan welcome to brighter You and your clients can help protect wild animals and provide aid when they are in need. Contact us today to learn more about how they can leave a gift in their Will.

RR0001

This year, help them plan to share their everlasting love. 22 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

Do you know who you are doing business with?

Fraudsters

step

As

Treefort’s

of

Analyses

who

say

with peace of mind, taking

regulator’s

Online solution that exceeds the requirements

your

client identification and verification guidelines

100+ data points to confirm identity AND provides key fraud indicators Conforms with the industry’s security and data privacy standards Results are presented to you in an easy to read report Canada wide live Customer Support, 5 days a week, 8am to 8pm

Find us on LinkedIn Treefort Technologies www.treeforttech.com

continue to demonstrate their ability to stay one

ahead of traditional identity validation methods, which has led to a significant rise in fraud victims and dollars lost in Canada

a professional responsible for the successful closing of a real estate transaction, you carry the burden of confirming that the parties involved are

they

they are.

digital identity validation solution provides you

identity validation to the next level:

Cybercrime Begone!

Today, undertaking the standard due diligence for Know Your Client (KYC) obligations does not guarantee new clients are who they say they are.

The reality is, any new potential clients could be fraudsters, representing themselves using sophisticated fake ID and banking, credit, and other falsified documents. Often fraudsters use Government-issued ID that can only be identified as fake using digital identity technology.

Cybercriminals today are far more sophisticated, organized, and global than their “oldtime criminal” counterparts. Further, one of their new prime targets is residential real estate, with a recent wave of mortgage-related cyber-fraud perpetrated in Ontario and Quebec earlier this year

The Cullen Commission Report, released by the BC Provincial Government in June 2022, has specific warnings about identity theft. “Identity crime—such as identity theft and identity fraud—is prevalent in Canada; it is of particular concern because stolen identities are often used to support the conduct of other criminal activities. Stolen identities can also assist money laundering operations by giving offenders fake credentials to subvert customers’ due diligence safeguards.” (page 45)

Cybercrime includes different types of digital crimes such as ransomware, digital identity theft, and money laundering.

How Much Damage is Cybercrime Costing Us?

• According to Cybersecurity Ventures, the world’s leading researcher for the global cyber economy, cybercrime-related activities cost the world USD$6 trillion in 2021.

• Cybercrime is one of the fastest-growing crimes worldwide. It is estimated global cybercrime damages will increase to USD$10.5 trillion by 2025, according to a 2020 article published by Cybercrime Magazine.

Cybercrime is one of the fastest-growing crimes worldwide. It is estimated global cybercrime damages will increase to USD$10.5 trillion by 2025, according to a 2020 article...

• A study performed in 2018 by Bromium Inc., a subsidiary of Hewlett Packard, revealed criminality platforms and a booming cybercrime economy have resulted in USD$1.5 trillion in illicit profits acquired, laundered, spent, and reinvested by cybercriminals and that the cybercrime profits were 3X larger than profits generated through the illegal drug trade.

• Looking specifically at money laundering:

0 Worldwide between $800 billion and $2 trillion is laundered annually.

0 The authors of “Combatting Money Laundering in B.C. Real Estate,” commissioned by the Government of BC, estimated that approximately $46.7 billion was

MONEY LAUNDERING/FRAUD

Kim Krushell

24 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

laundered through the Canadian economy in 2018, with BC accounting for around $7.4 billion.

Those statistics highlight why we can no longer ignore what is happening with cybercrime—we must start protecting ourselves!

Quick Tips to Consider

1.

Implement more stringent Know Your Client (KYC) and Identity Validation (IDV) procedures with all new clients. A digital IDV service that meets or exceeds the regulator’s standards for identifying an individual can help in that regard.

2. Educate employees about cybercrime. If possible, hire an expert to provide training on cybersecurity. Implementing phishing awareness or other programs can help to ensure staff remain diligent and aware of their virtual surroundings and attempts by outside forces to harm or access your systems.

3. If outsourcing IT management, ensure cybersecurity policies and practices are in place and have suitable insurance coverage.

4. Explore obtaining cybersecurity insurance. While costly, it can provide you and your business with peace of mind.

5. Create security policies and practices.

6. Secure all your networks and databases to protect against ransomware. Have data backed up in the cloud.

7. Always use two-factor authentication for any software products.

8. For accounts you sign into, use lengthy pass phrases rather than the standard 6-to-8-character password.

9. If there is a data breach, inform clients immediately; that is required for all businesses across Canada as per the Federal Personal Information Protection and Electronic Documents Act (PIPEDA) and in Provincial Privacy Legislation.

10. Check out the Canadian Centre for Cyber Security. The federal government developed the Centre to assist businesses, organization, and individuals to determine your cybersecurity risk. https://www.cyber.gc.ca

Cybercrime is an escalating risk in both our personal and professional lives. We need to be particularly diligent to avoid being impacted by today’s sophisticated cybercriminals. s

Kim Krushell is Co-Founder of Treefort Technologies, a Canadian tech company at the forefront of digital ID verification.

https://treeforttech.com

Brighter futures. One home at a �me.

At EFry, we know a safe home is the founda�on of stable life. Need is growing.

Five �mes more homeless children require our help than just 3 years ago. We’re responding with more shelters, ultra-affordable housing and child-focused programming.

You can help. Visit: efry.com/donate-now

visit efry.com/donate

25Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

Naturally, her first reaction was shock—her second, confusion. How could she owe $700,000? She had never even heard of that lender.

Agitated, Joanne contacted the lender, apprehensive about what it meant for her and how it could be resolved. Her call made the lender’s representative worry, too.

Fortunately for Joanne, when she purchased her property, she obtained an owner policy of title insurance. After filing a claim with her insurer, the claim was investigated and determined the ID and documents provided for the new mortgage were fake.

There was no doubt Joanne was impersonated and her property title encumbered with a mortgage in which she had no involvement. Luckily, Joanne was able to rely on her title insurance policy to remedy the situation.

Unfortunately, title fraud is becoming more and more common and often perpetrated through a process resembling something similar to the following.

• A fraudster steals the identity of the legitimate owner of the property.

• Using the stolen identity, the fraudster obtains mortgage

Real Estate Title Fraud...

HOW TO PREVENT IT.

financing through a bank, financial institution, or private lender.

• In many cases, the mortgage is short-term with no payments required until maturity (interest is deducted up front). The delay helps fraudsters launder stolen funds so they are virtually untraceable. The unsuspecting true property owner does not know about the mortgage until maturity, when he/she receives notices from the lender demanding payment.

• The property owner is faced with the stressful and costly burden of proving he/she is the victim of title fraud and should not be required to repay the forged mortgage.

• Similarly, the lender is confronted with the reality that the fraudster may not be found and will be unable to enforce its interest or recover its losses. Upon discovering the possibility a mortgage was obtained on the property through identify theft, lenders with title insurance should file a claim.

With fraudsters and technology becoming more sophisticated and deals flowing in greater volumes and faster than ever before, it is becoming increasingly difficult for even the most experienced real estate professionals to detect something is amiss.

Title insurance can protect property owners and lenders against losses resulting from many forms of real estate title fraud.

Education is also key. The more informed we become about preventing title fraud, the better title insurance companies and industry professionals can

• protect property owners and lenders against losses;

• preserve the reputation of the professionals involved in a transaction; and

• maintain the integrity of the real estate system as a whole so it does not become an easy target for fraudsters and money laundering schemes.

We all need to be wary. Diligent BC legal professionals, in particular, are an irreplaceable part of the transaction and the first line of defence against title fraud.

Red Flags

• The deal doesn’t make sense. For example, an elderly person who has owned a property mortgagefree for a long time needs a large high-interest-rate mortgage.

• The property is mortgage-free; the owner has a good credit rating.

• The legal professional is being asked to direct the majority of the closing funds to parties other than the registered titleholders or prior

One morning in April, “Joanne” opened her mail to find a demand letter from a lender, notifying that her mortgage had gone into default and the lender was commencing enforcement proceedings.

MONEY LAUNDERING/FRAUD

Amanda Magee

HOW IT HAPPENS. HOW TO DETECT IT.

26 BC Notaries Association Volume 31, Number 2, Fall 2022TABLE OF CONTENTS

registered encumbrancers or funds are being wired overseas.

• A title search reveals unusual title activity, including frequent mortgaging.

• Aspects of the ID documents appear suspicious. Signatures are inconsistent; the borrower’s stated age and appearance don’t match the photo; misspellings of the borrower’s name; fonts and spacing of the ID don’t match the borrower’s ID the legal professional knows is legitimate.

• Pressure to close quickly.

• The client appears anxious for funds or is willing to accept a high-interest-rate mortgage, particularly if the property is mortgage-free or the client is using the proceeds for “investments.”

• There is a request for a shortterm mortgage—1 year or less— no regular payments required.

• There is a lack of Canadian or provincial government-issued photo ID.

• The client is new and will not connect consistently and/ or doesn’t want to participate in a video call or face-to-face meeting.

• The property is vacant or tenanted.

• The purchase and sale contract is private, has unusual deposits, and a quick closing

• Family members or friends are pressuring the titleholder to obtain a mortgage.

• Power of Attorney is being used.

Transactions involving private lenders are inherently at greater risk; should be given extra attention.

Additional Scenarios Warranting Closer Examination

• When acting for the lender, the legal professional is asked to

register mortgages without ever receiving funds to disburse.

• The legal professional is provided repeat referrals involving mortgages with unusual elements.

• The property has an existing institutional mortgage on title; balance owing is much lower than the registered amount, yet borrower is seeking private funding instead of going back to institutional lender.

• Multiple short-term private mortgages are on title; legal professional is being asked to pay out another recently registered private mortgage.

Title fraud is a serious matter. It’s up to all of us in the industry to work together to prevent it. s

Amanda Magee is Vice President of Business Development for Stewart Title’s Western Canada Operations.

Working Together to Prevent Real Estate Title Fraud

With real estate title fraud a growing concern, Stewart Title is proud to work in partnership with BC Legal Professionals to detect and prevent fraudulent transactions from closing. Our in-house title fraud prevention processes have been developed over years of exposure to a wide variety of title fraud schemes and can help reduce the likelihood of title fraud—protecting property owners, lenders, and the professionals acting on their behalf.

As an industry, we can now use technology to our best advantage. Stewart Title acquired a majority stake in Treefort Technologies. Treefort’s ID verification tool helps legal professionals and lenders verify ID more quickly than traditional means, which can be difficult and time consuming.

To learn more, visit stewart.ca or contact your local Business Development Manager.

27Volume 31, Number 2, Fall 2022 The Scrivener | www.bcnotaryassociation.ca TABLE OF CONTENTS

• Convenient online course format • Broad range of valuation and real estate business topics • Guaranteed Appraisal Institute of Canada’s Continuing Professional Development credits Business Development Series: Eight courses designed to provide practitioners with the entrepreneurial and practical skills to establish and successfully operate a real estate business. Entrepreneurship and Small Business Development Business Strategy: Managing a Profitable Real Estate Business Succession Planning for Real Estate Professionals Organizing and Financing a Real Estate Business Accounting and Taxation Considerations for a Real Estate Business Marketing and Technology Considerations for a Real Estate Business Human Resources Management Considerations in Real Estate Law and Ethical Considerations in Real Estate Business To find out more, visit: realestate.ubc.ca/CPD tel: 604.822.2227 / 1.877.775.7733 email: cpd@realestate.sauder.ubc.ca Creative Adaptable Analytical

Working Together to Prevent Fraud

Brian and Helen purchased their home

in 2013 for $665,000. In 2021, Brian accepted a job transfer out of the country, leaving their home empty.

In 2022, their home was listed on the MLS by fraudsters, posing to be the real owners. Three weeks later, it sold and closed for $1,700,000. On closing, a $300,000 balance on a secured line of credit was paid off and fraudsters absconded with $1,400,000 and left Brian and Helen without their home.

For years, fraudsters have been committing fraud against innocent lenders and homeowners. Being embroiled in a fraud causes undue stress for all involved and is a reason insurance premiums continue to rise.

Beautiful British Columbia is a prime international target for fraudsters because of our wellknown expensive real estate. With more real estate transactions, the greater the likelihood the borrowers or vendors will not be who they say they are.

In 2022, vendor-impersonation frauds have risen to the top as the costliest claims in Canada. How confident are you that the people you are dealing with in your real estate transactions really are who they say they are? Fake governmentissued ID is very difficult to spot and very easy to get.

A strawman is a person a criminal mastermind hires to make an appearance for the signing of documents.

A strawman is a person a criminal mastermind hires to make an appearance for the signing of documents. That individual gives the money received from the sale or refinancing of the property to the mastermind. Recently, a strawman was arrested with 12 identities in his possession and a ticket out of the country, dated 2 weeks from his arrival here.

The next time you close a real estate transaction, consider these points.

1. Mortgage lenders require title insurance but many BC homeowners are left uninsured and exposed to loss. Always buy an owner policy.

2. Homes that are mortgagefree, owned by an investor or nonresident, and those that are vacant are the prime targets for fraudsters. It is essential that the vendor’s identities are validated to protect the purchaser from falling victim to vendorimpersonation fraud.