Queensland's minerals landscape | Investment and global markets

Risk, technology and innovation | BBMC Updates Environment and rehabilitation| People and partnerships

Queensland's minerals landscape | Investment and global markets

Risk, technology and innovation | BBMC Updates Environment and rehabilitation| People and partnerships

EDITOR

Jodie Currie jodie@bbminingclub.com

CONTENT CURATORS

Sarah-Joy Pierce sarahjoy@strategicminingcomms.com

Debbie Wolhuter deb@joyfulcommunications.com.au

GRAPHIC DESIGN

Holly Williams holly@kingstcreative.com.au

ADVERTISING yearbook@bbminingclub.com

WEBSITE www.bbminingclub.com/yearbook

FIND US ON FACEBOO K & LINKEDIN Search 'Bowen Basin Mining Club'

CONTRIBUTING WRITERS

Janette Hewson, Tania Constable, Kim Wainwright, Warren Pearce, The Hon. Dale Last MP, Senator

Susan McDonald, Stuart Bocking, Matt Anderson, Michelle Manook, Matt Latimore, Paul Flynn, Nick Rees, Jason Economidis, Steve Kovac, Christopher Clark, Michael Jones, Shane McDowall, Mick Storch, Dr Ben Seligmann, Geoff Sokoll, David Milling, Jason Fittler, Melanie Saul, Jodie Thompson, John Watson, Madeline Simpson, Tom Reaburn, Emily Collins, Tayla Spier, Sylvia Bhatia, Anton Guinea, Dr Sean Brady, David Dodd

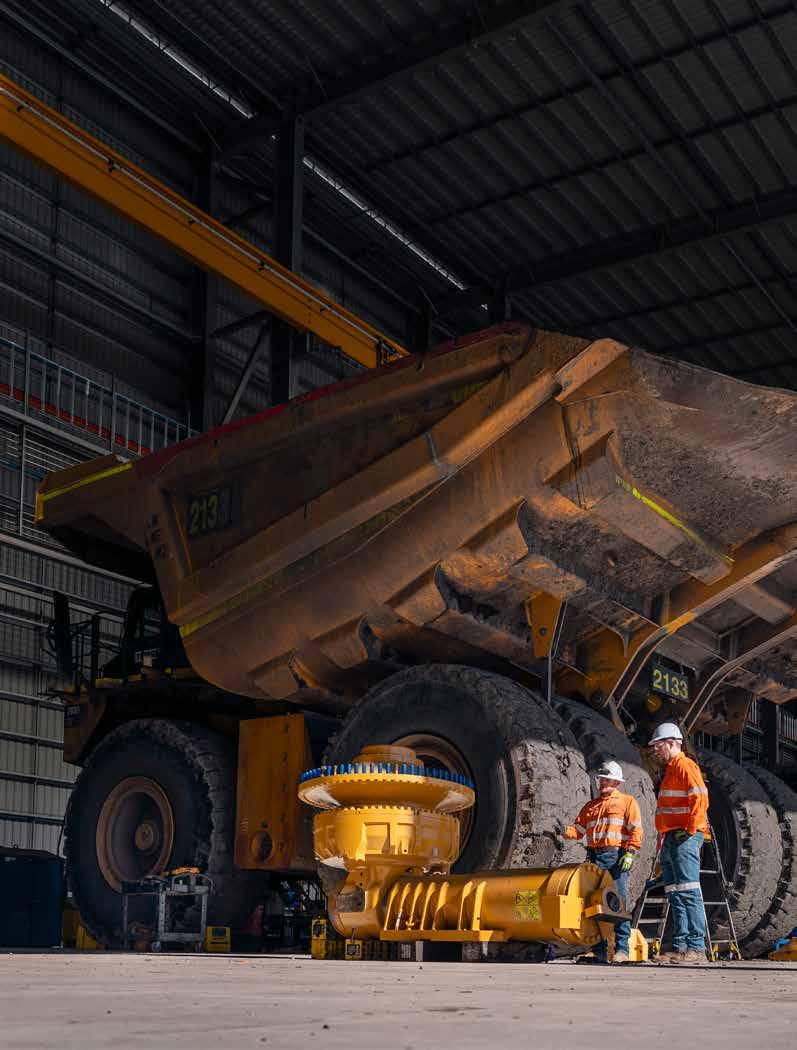

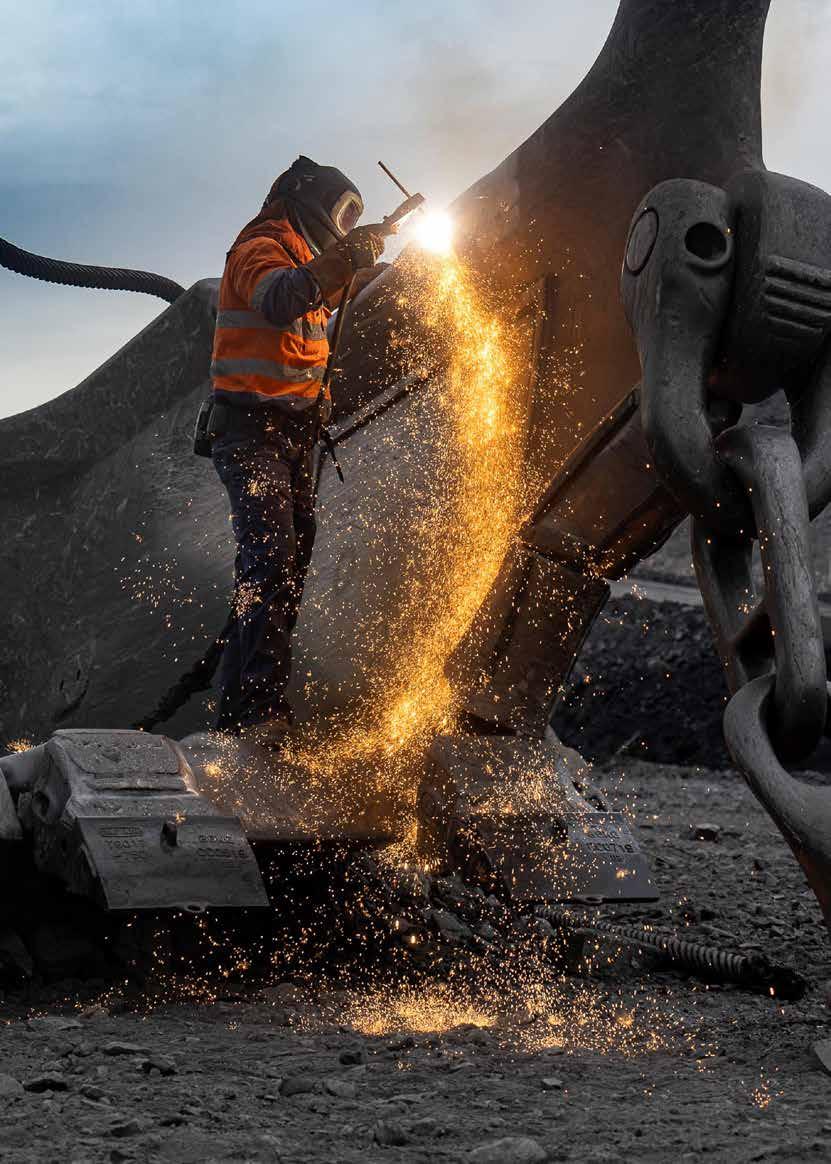

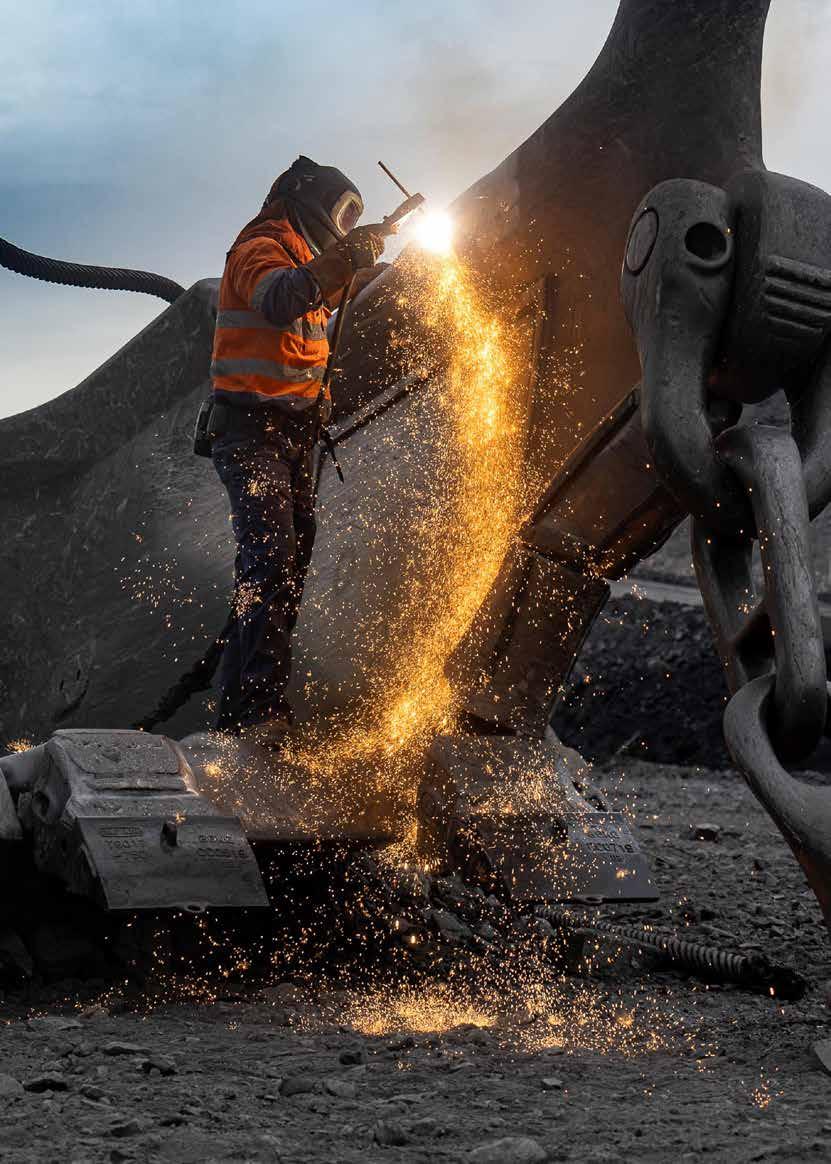

Image credit: Peter Turnbull | Turnbull Photography

Professional images throughout supplied by:

Pure Gold Films

Turnbull Photography

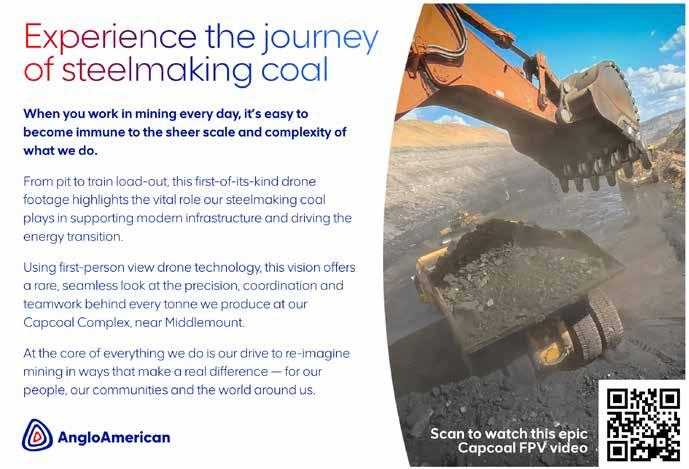

Anglo American

Hastings Deering

Kestrel Coal

Komatsu

Liebherr

Thiess

Whitehaven Coal

Want to be a part of the 2026 Yearbook? See bbminingclub.com/yearbook for advertising and contribution opportunities.

The Bowen Basin Mining Club Yearbook is published by the Bowen Basin Mining Club Pty Ltd, PO Box 2620, Chermside Centre QLD 4032.

Every effort has been made to ensure that the information contained in this publication is accurate at the time of publication (December 2025). The Bowen Basin Mining Club and its agents accept no responsibility for the accuracy or completeness of the contents and accepts no liability in respect of the material contained in the yearbook.

The Bowen Basin Mining Club recommends that users exercise their own skill and care in evaluating accuracy, completeness, and relevance of the material and where necessary obtain independent professional advice appropriate to their own particular circumstances.

In addition, parties, their members, employees, agents and officers accept no responsibility for any loss or liability (including reasonable legal costs and expenses) or liability incurred or suffered where such loss or liability was caused by the infringement of intellectual property rights, including the moral rights, of any third person.

We proudly support the Bowen Basin Region where we live and work.

Your local partner for rental equipment when undertaking Dragline and CHPP Shutdowns, Shovel and Excavator Shutdown or Rebuilds, Exploration and Drilling Programs, Greenfield Mine Site Development, Industrial Tooling Solutions - Gang Boxes or Containerised Tooling Solutions.

Scan the QR code to contact one of our local specialist teams.

jodie currie

As you open the 8th edition of the BBMC Yearbook, you’re looking at a different snapshot of Queensland’s coal industry compared to previous years. Anyone who’s been around the industry for more than a few years understands the ups and downs of the Bowen Basin, as ours is a truly cyclical industry. But the purpose of this Yearbook is to provide a snapshot of the year that was, and we deliver on that with realistic commentary on current policy settings, reflections on innovations that showcase the best of our industry, and clear steps forward for our future.

Key themes in 2025

Ideology driving policy without regard for the fundamentals

You can’t miss it - there’s plenty that our industry has to say about misguided policy based on ideology without consideration for basic energy economics. If you need reminding of that, there’s a wealth of knowledge in these pages about the state of global demand for coal and where Australia and Queensland’s products fit into that picture. From Matt Latimore (page 38), Paul Flynn (page 42) and Michelle Manook (page 35) painting a picture of overseas demand for coal to a sobering reminder of the state of the exploration and projects pipeline (from the MCA on page 10 and the QEC on page 13), it was important to us to bring a holistic view of how Queensland coal powers global success - and has the potential to continue to do so for quite some time, given the right policy settings and certainty for investors.

Collaboration driving innovation

These pages also hold fascinating stories of industry collaboration and innovation, from the Grosvenor mine re-entry (page 67) to the on-site trials of ‘Hydrogen on-Demand’ to increase diesel efficiency. As Mick Jones from Baralaba puts it (page 62), innovation doesn’t always mean reinventing the wheel -

sometimes it means improving the wheel we already have.

You’ll also find some excellent stories of rehabilitation and post-mining land use, as the Bowen Basin enters an era of rehabilitation with large projects like Newlands closing (page 110), and the progressive rehabilitation of Dawson Mine (page 100).

People driving the future

From the first article to the very last, people and skills are a significant area of challenge for the Bowen Basin. Reframing mining is essential for the continued operation of our industry - whether that’s by supporting the QRC’s ‘A little bit of Queensland goes a long way’ campaign, or getting better at correcting outdated perceptions to win the next generation of talent. Our industry holds crucial importance to life as we know it, makes a difference to the environment and offers a fantastic career where no two days are the same - it just needs the right people.

Late in 2025, I was invited as a guest of FutureCoal to Michelle Manook’s address at the National Press Club in Canberra. Michelle’s address was a rousing call to advocacy not just for coal, but for sensible energy policy grounded in practical reality, not a ‘moral test’. Working in coal doesn’t mean we

spend our days dreaming up ways to pollute the environment - in fact, quite the opposite. Tomorrow’s (and even today’s) low-emissions coal technology provides stable baseload power and is the foundation of a global value chain that underpins steel, cement, aluminium and fertilisers - all necessary for global growth and civilisation.

As an industry, we can sometimes focus on just getting the next tonne out of the ground and miss this bigger global picture. As we move into 2026, I urge you to understand the important contribution you make to our industry, no matter where you sit in the supply chain. From there, you can become the voice that our industry needsadvocating and bringing your friends, neighbours and colleagues along on the journey.

2026 holds many exciting opportunities for us to continue telling the story of the Bowen Basin’s excellence and the big picture of coal - from big biennial events like the Queensland Mining Awards to the Queensland Mining and Engineering Exhibition (QME), right down to the everyday conversations you have at the school gate, across the table and around the sporting fields.

Be loud, be proud, and help us build an industry that will be here for generations.

Janette Hewson, Chief Executive Officer Queensland Resources Council

While resources remained a cornerstone of our state's economy, 2025 has presented challenges for the Bowen Basin, a longtime powerhouse of Queensland’s resources sector. The sector has needed to be resilient in the face of headwinds from lower coal prices, skyrocketing costs and the world’s highest royalty rates.

These conditions have meant some companies have made tough decisions, including job losses and curtailing investment in Queensland.

The producers that make up the heart of the industry know that when the conditions are right, the Bowen Basin can offer a long and prosperous future for the state and for Australia. Rich reserves of high-quality coal that will remain in demand for decades can continue to support more local jobs and deliver economic benefits for all Queenslanders.

Our mining industry is driven by world-class innovation and a highly skilled workforce, but state and federal governments have a key role to play in supporting our sector’s success by getting policies and regulations in place.

At the State level, there has been some welcome progress through starting to streamline the approvals process and opening up new land for exploration and development. But the world’s highest coal royalty rates remain a significant concern and impediment to new investment.

At the Federal Government level, industry waits with some trepidation for the outcome of the reforms to environmental laws. It is crucial that duplication and overregulation is removed so we can get new and mine life extension projects up and running sooner.

Economic Contribution

The resilience of Queensland’s resources sector was revealed in the release of the Economic Contribution Report for the 2024-25 financial year.

Our industry has always been proud of the significant contribution it makes to the strength of Queensland’s economy and the regions, and despite some challenges, the past year was no different.

Coal, gas, metals and critical minerals contributed a total of $115.2 billion to the economy and supported 554,728 jobs. That includes those working directly in the industry and people working in associated industries that rely on the resources sector.

It’s down from the $120.2 billion from the previous year but again confirms our sector’s position as Queensland’s largest contributor to the state.

The amount spent by resources companies in Queensland with local businesses and community organisations was steady at $35.8 billion. Despite the challenges some have faced, there is the constant focus to buy local and support the communities where our sector operates. In fact, the number of organisations our sector supported increased

in 2024-25, reflecting the industry's strong commitment to supporting regional communities.

Coal contribution

Coal remains the mainstay of the Queensland resources sector, but the numbers reveal the extent of some of the current challenges facing producers from rising costs and lower prices.

Its contribution declined from $85.3 billion the previous year to $76 billion, which is still an impressive 15% of Queensland’s total Gross Regional Product. The sector supported a total of 363,059 jobs, including 49,385 directly, which is 12% of all jobs in Queensland.

Queensland coal operators continued their strong support of communities across the state. They spent a total of $23.8 billion with

8,368 local businesses and 825 community organisations.

Our value to Queensland

For all the economic contributions we make and the resources we provide for everyday items, the sector uses just 0.1% of Queensland’s land mass. This little bit of Queensland is the message we’re sharing in the QRC’s latest campaign to build awareness for the significant contribution the industry makes using 0.1% of the state's land mass.

The top-down approach to Queensland operations, including coal, provides the context for the sector’s positive impact on communities across our state through jobs and economic benefits.

QRC regularly undertakes research to check the

sentiments of Queenslanders and their thoughts and opinions about mining. The new campaign will build on the encouraging results from our recent research that found an increasing number of Queenslanders understand the importance of the resources sector to our way of life. The number who agree that mining, including coal, is important to maintaining our way of life rose from 69% a year ago to 75%.

Encouragingly, 88% of people believe that mining has a long-term future in Queensland.

Government engagement Trade delegation

The demand for Queensland’s high-quality coal was evident on a recent trade delegation with Premier David Crisafulli to India and Japan this year. India

and Japan are key markets for Queensland coal exports, and both countries are looking to secure long-term supply arrangements, which is positive news for our industry.

Japan has a decades-long relationship with Queensland and a strong commitment to the Bowen Basin. India’s demand forecast is underpinned by the country’s energy and infrastructure needs as they continue to develop and urbanise.

There are other countries throughout Asia that have similar needs, which means there will be long-term opportunities for Queensland’s coal sector. Trade delegations like these provide a vital link with our trading partners and an opportunity for our government to hear firsthand about Queensland’s long-term competitiveness.

QRC has continued to engage with the Queensland

Government on a range of issues important to the resources sector throughout the year, including ways to rebuild investor confidence

Over the course of 2025, I have enjoyed travelling to the many regional centres across Queensland that help drive the success of our resources sector.

From Moranbah to Mackay and Rocky to Emerald, it’s always a pleasure to be welcomed by our many regional partners, along with the hard-working people in our sector who make up these regional communities.

On behalf of our members, thank you for your continued support in making the Queensland resources industry successful.

I look forward to 2026 and continuing to work with our regional partners across Queensland.

Our mining industry is driven by world-class innovation and a highly skilled workforce, but State and Federal governments have a key role to play in supporting our sector’s success by getting policies and regulations in place.

At Hastings Deering, businesses working within the mining industry can now take advantage of a new industry leading warranty with every Cat® Certified Rebuild. Get ‘as-new’ performance and benefit from the multiple lives designed into Cat machines, at a fraction of the cost of buying new.

While commodity prices rise and fall, while economic uncertainty only increases, while government intervention continues to constrain us rather than enable us, while nations actively wage war on our competitivenessthere is one truth that remains constant.

The world continues to have an insatiable appetite for Australia’s bulk commodities, our mineral wealth, our sources of energy, our mining expertise and our ingenuity.

We rightfully boast of the immense opportunities before us – opportunities to build on decades of success in our sector that have brought prosperity to all Australians, to transform our mineral wealth into technologies and innovations, jobs and careers that will define the future.

These opportunities cascade through our sector.

Every new mining job generates 6.14 additional jobs across the economy. And for every $1 million in added demand, $2.36 million in extra output is required, fuelling growth for the businesses that support and collaborate with mining.

The Centre for International Economics estimates that the expansion of mining this century has increased household incomes on

average by $19,000 compared to what they would otherwise have been.

The MCA won’t shy away from the facts: last year, mining delivered $4.5 billion more in company tax than Treasury forecast, and stronger-than-expected commodity prices pushed nominal GDP up to 4.1%.

But while we see opportunity, we must confront the challenges that stand in the path to realising them. We must be honest about the hurdles we need to overcome, for our success is Australia’s success and our progress is Australia’s progress.

Australia has the resources, expertise, and global reputation to remain a powerhouse of the world economy. But Australia must act now. The trend is clear: while mining continues to be the backbone of the economy, investment is stalling. Australia is living off its past investments, rather than building for the future.

Mining has accounted for 30% of Australia’s capital investment over the last decade, yet real net capital stock has plateaued at a time when it should be surging.

Nominal investment growth is largely being driven by rising project costs and sustaining capital – not by new project development. Foreign Direct Investment (FDI) in Australian mining from OECD sources has collapsed –falling from an aggregate of US$50 billion in 2013 to just US$7.5 billion in 2022.

Meanwhile, Canada – our direct competitor for mining capital – has maintained strong OECD investment flows, with new FDI into Canadian mining exceeding US$10 billion in both 2021 and 2022.

We must focus on the industries that will drive productivity in the decades ahead. One of the greatest opportunities before us is Australia’s role in supplying the world with critical minerals.

We hear a lot about the value of projects coming through the pipeline, but the reality is that only one in 20 major resource projects in Australia progresses from feasibility to final investment decision each year. And even for those that do, S&P estimates that the average lead time to production is now 18 years – up from just 13 years for mines that started 15 years ago. The system is slowing, not improving.

Australia is a resource-rich country, but the investment environment is making us a riskier bet for capital. And in a sector where investors have choices, money is mobile.

We must focus on the industries that will drive productivity in the decades ahead. One of the greatest opportunities before us is Australia’s role in supplying the world with critical minerals. The minerals industry is key to achieving a net zero carbon future as without mining and minerals processing, there is no clean energy transition. These minerals – including copper, nickel, lithium, cobalt, rare earths – are essential for the technologies that will power the future: electric vehicles, renewable energy, and advanced manufacturing.

The world is not short on demand for minerals – but investment is cautious. Capital will only flow to countries that provide the right environment to do business.

In the MCA 2025 Tax Plan, we are advocating for the Junior Minerals Exploration Incentive to be made permanent and expanded. This initiative has helped level the playing field between junior explorers and large companies that can deduct exploration expenditures from taxable income earned from mining activities. But the annual cap and structure limit its effectiveness. Raising the cap and improving certainty in credit allocation will unlock more investment and drive new discoveries.

The MCA is also pushing for accelerated depreciation for all businesses in the room to encourage new investment, and a broad-based 20% investment allowance.

Mining has always been at the heart of our national prosperity, and it must remain so. But prosperity is not guaranteed. Investment is not guaranteed. Competitiveness is not guaranteed. We cannot afford to be complacent – not when other nations are moving faster, cutting red tape, and making it easier to do business.

We need policy settings that encourage investment, not drive it away.

Australia should be the world’s preferred mining and investment destination, as it used to be – a country that backs its resources sector, embraces opportunity, and secures its future prosperity.

The threat of higher taxes on our industry is not an embellishment.

We have built one of the strongest mining industries in the world. Now, we must fight to keep it that way.

Despite the headwinds, explorers continue to rate Queensland’s geology as world-class. The opportunity is there; we just need to unlock it.

Kim Wainwright, Chair

Queensland Exploration Council

Queensland’s worldclass resources sector underpins our state’s economy, regional communities, and national prosperity. However, the hard truth is that there’s not enough exploration to ensure a pipeline of new projects to ensure the future success of Queensland’s resources sector, and urgent action is needed to turn it around.

Queensland production remains strong, but we need new mines to replace those tonnes needed for the energy transition, medical equipment and emerging technologies. Few new discoveries are being made in Queensland to secure the state’s future supply.

As existing deposits approach end-of-life, the replacement horizon is narrowing. Greenfield exploration is the only way to replenish Queensland’s resource base, extend mine life, and sustain the many thousands of jobs, regional investment, and critical export earnings. Without new discoveries, Queensland risks losing its position as a national leader in resource development and a key contributor to national resource and mineral supply security.

Why exploration matters

Exploration is more than finding the next big mine; it’s the foundational industry that supplies Australia’s industrial and strategic future. Every tonne of critical minerals in our supply chain, every petajoule that powers the electricity grid, and every tax dollar that funds hospitals and schools begin with exploration.

Greenfield exploration now accounts for just 21% of Queensland’s total mineral exploration spend, the lowest in the 15 years of tracking by the Queensland Exploration Council’s (QEC) Exploration Scorecard. This steady retreat from new discoveries towards brownfield activity puts the long-term viability of Queensland’s resources sector at risk.

Exploration is also the foundation of innovation and scientific advancement. It drives geoscience mapping, new drilling technologies, and data analysis that benefit multiple sectors, from environmental monitoring to groundwater management. Investment in exploration delivers long-term dividends that extend well beyond mining.

Queensland can’t carry the load alone

The east coast gas market crunch is real, and Queensland has been doing the heavy lifting. Petroleum exploration in Queensland fell 12% in 2024–25, even as the domestic market tightens and legacy basins like Gippsland decline. For over a decade, Queensland’s coal seam gas fields have sustained both domestic demand and LNG exports, supporting thousands of jobs and regional economies.

But it is neither technically nor economically feasible for Queensland to shoulder the burden indefinitely. The higher costs of coal seam gas production, coupled with transport and infrastructure constraints, require more market players in the right geographical locations to secure a reliable and affordable supply across Australia. Without new greenfield discoveries across the east coast, particularly in underexplored basins, future supply shortfalls are inevitable.

A global competition for capital Exploration is capitalintensive and high-risk, requiring early-stage investors who are willing to back vision and geology long before returns are visible. Yet capital is increasingly difficult to secure. Explorers are competing globally for investment against jurisdictions with faster approvals, clearer policy signals, and targeted incentives.

Increasing costs of exploration, along with lengthy environmental approvals and permit processes, are deterring investors and limiting the ability of junior explorers to get boots on the ground. Juniors are the lifeblood of discovery, responsible for most major finds in Australian history; yet they are the most exposed to risk and cash flow pressure.

Greenfield exploration is inherently riskier than brownfield activity, but it is where the next generation of Tier 1 deposits will come from. Government support is essential to reduce the risk for early-stage investors, attract private capital, and sustain the skills pipeline that underpins the sector.

Mechanisms such as the Collaborative Exploration Initiative (CEI) grant, flowthrough share schemes, and exploration incentive credits have proven successful in both Queensland and other jurisdictions.

Encouragingly, green shoots are appearing as the Queensland Government moves to streamline project approvals and provide greater departmental assistance to explorers, through the establishment and following actions of the Resources Cabinet Committee.

Despite the headwinds, explorers continue to rate Queensland’s geology as world-class. The opportunity is there; we just need to unlock it. Exploration tenure is at an all-time high, with 2,173 exploration permits for minerals granted as of June 2025, signalling strong sector engagement across commodity groups. However, tenure alone doesn’t deliver supply. Without infrastructure, timely approvals, and investment certainty, these projects risk stalling before they start. Greenfield exploration is only the first step; turning potential into production requires coordinated action from government, industry, and investors.

A strong exploration sector depends on fair and balanced policy settings, one that reward risk, cuts red tape, and ensures the regulatory process is efficient, transparent, and consistent. Streamlined approvals, competitive fiscal settings, and investment in regional infrastructure (roads, ports, power, and data) are critical to turning tenure into tangible results.

If we fail to act, the consequences will ripple across the economy. Without new discoveries, Australia’s resources production base will shrink, regional jobs will decline, and the government revenue that funds essential services will erode. More critically, we will lose strategic autonomy over the minerals and energy that underpin economic security.

Queensland’s geology holds extraordinary potential. The challenge is to match it with vision, investment, and action.

Warren Pearce, Chief Executive Officer Association of Mining and Exploration Companies (AMEC)

Australia’s resources sector remains one of the most diverse and resilient in the world. From coal and iron ore to copper, lithium, and rare earths, our industry continues to anchor the national economy while adapting to meet new global demands.

In Queensland, that diversity is especially visible. The state’s coal industry continues to deliver immense economic strength, providing essential power and keeping regional communities alive. And the billions contributed via royalties represent 24% of all government revenue last year - revenue that is used to fund hospitals, schools, and essential infrastructure. Yet, even as it powers the present, Queensland is also positioning itself for the future.

Across the Bowen Basin, traditional energy exports remain a cornerstone of prosperity. Meanwhile, in regions like Mount Isa, Julia Creek, and Townsville, a new generation of critical minerals projects are emerging, from copper and vanadium to rare earths. And it is becoming quite clear that Queensland is not choosing between the old and the new. It is ‘walking while chewing gum’ by building on both.

For decades, Queensland’s metallurgical and thermal coal exports have been world-class. In the 2024 financial year Queensland exported almost 200 million tonnes of coal to more than 30 countries, including China, Japan, India, and key European markets. The state government says this export is a premium resource that is essential for about 75% of the world’s steel mills.

These industries have built regional economies, supported tens of thousands of families, and helped Australia weather global economic storms.

So even in an era of energy transition, the reality is that coal remains vital. Metallurgical coal will continue to be critical for steel production for decades to come, and developing nations still rely on thermal coal as they balance growth with decarbonisation. Queensland’s industry has evolved to meet the highest environmental and safety standards, positioning it as among the most responsible producers in the world.

It is precisely this foundation that now enables Queensland to diversify successfully. The same railways, ports, and skills that supported established mining sectors are now helping the state lead in copper, vanadium, graphite and rare earth exploration.

At the beginning of 2025, the Federal Parliament passed the Critical Minerals Production Tax Incentive (CMPTI), as part of the Federal Government’s Future Made in Australia policy. Leaving the politics aside, this injection of $7 billion over 10 years represents a landmark development for our nation, and an opportunity for Queensland.

AMEC’s advocacy helped secure this 10% production credit for companies processing critical minerals domestically, delivering much-needed confidence to investors and downstream developers.

For Queensland, it complements, without replacing, the state’s existing strengths. The regions that once built the backbone of the traditional

resources industry are now expanding their expertise into new frontiers. These commodities are central to the energy transition and global decarbonisation.

This is highlighted by the CopperString project, now estimated to be worth around $14 billion, with the state government committing $2.4 billion. CopperString will provide affordable, reliable and sustainable energy to the state’s North West region, and deliver jobs and economic growth to industry and regions.

It’s an example of how the reliable revenues of traditional commodities like coal, are helping to fund the next phase in the state’s resource industry.

This year’s meeting between Prime Minister Anthony Albanese and U.S. President Donald Trump also signalled a major milestone for the resources sector. The resulting $8.5 billion Australia–U.S. Critical Minerals Framework underlines just how strategically significant our resources have become.

It wasn’t just a handshake over trade, it was an alignment of national interests. The agreement recognised Australia’s unmatched capacity to provide secure and reliable supply chains for the materials that power modern economies and defence technologies.

Queensland’s copper, graphite, and vanadium projects, along with Western Australia’s lithium and rare earths, stand at the centre of this opportunity. Together, they form the foundation of an Australian supply chain that can fuel everything from electric grids to global manufacturing.

This agreement is the culmination of years of advocacy and policy groundwork that highlight how integral Australia’s explorers and miners are to the global future. AMEC has been proud to represent member companies at the table throughout this evolving dialogue. And it should be noted, the key role Australia’s Federal Resources Minister, the Hon. Madeleine King played in achieving this outcome for Australia.

It started with the development of Australia’s critical mineral strategy, and successive commitments to prepare and position Australian industry to take advantage of this opportunity. It now opens the door to new international investment and builds on the CMPTI.

While the policy landscape has delivered major wins, it has also brought continued complexity. Across the nation, environmental reform has dragged out over the last five to six years. This has left companies and investors perplexed and frustrated, at what looks like a never-ending string of red and green tape.

However, as the Federal Government reshapes the Environment Protection and Biodiversity Conservation Act (EPBC), there are positive signs that this sorry tale is soon to be put to bed.

Queensland Senator and Minister for the Environment, the Hon. Murray Watt is leading the charge, moving swiftly to reset environmental regulation, formerly known as ‘Nature Positive’.

After consultation with industry and relevant stakeholders, the proposed changes are now before parliament and a Senate inquiry. Hopefully, Minister Watt can strike a deal with the parties of government to bring this long-winded disruption to a conclusion.

The goal should not be to add new layers of process but to remove duplication, accelerate decision-making, and maintain world-class standards.

The exploration and mining industry understands the important role we play in protecting the environment. This can be balanced by sensible policy, with efficiency at its core, to create greater productivity for Australia.

Looking ahead and taking note of the global competition from governments around the world for access to the minerals that will define the next century, the concept of a national Critical Minerals Strategic Reserve has gained momentum.

Done poorly, such a reserve risks distorting markets. Done well, it can provide price stability, underpin financing, and encourage processing within Australia. It will also serve as another pillar in our burgeoning relationship with the United States.

For Queensland, this could mean more investment in the North West Minerals Province, more domestic refining capacity, and greater regional diversification, all supported by the continued strength of traditional exports.

The partnership between established industries and emerging ones is not just desirable, it is necessary. The steel made from Queensland’s metallurgical coal will help build the infrastructure needed for renewable technologies. The copper and vanadium extracted from the same regions will help transmit and store clean energy.

The industry’s evolution is not about replacing one commodity with another but about broadening our national portfolio. And it happens with the innovation and hard work of the people working day and night in our great resource sector.

These outcomes don’t happen by chance. It’s our role as a national advocacy body, to ensure we get the framework right, so that people and companies can get on with the job and translate that work in the field into strong results for our state and country.

That’s what our team at AMEC are motivated to do, with determined advocacy, to ensure explorers and midtier miners have a seat at every table that shapes our future.

Queensland’s coal and traditional commodities will continue to power Australia’s economy for many years to come. They are the foundation on which new opportunities are being built. Critical minerals are not a departure, they are an expansion of the same success story.

The recent Albanese–Trump agreement reminds us that the world is watching for Australia’s capability and looking to invest in it. The responsibility now is to deliver policies that provide certainty, fairness, and competitiveness for every part of the industry.

Our mission remains unchanged: to advocate for balance, to protect the present, and to help shape the future. Because the story of Australian mining has never been about one resource. It’s about the people, companies, and communities that continue to power the nation forward.

The work is not finished, but with the momentum of past success, and the support of our members, we are ready for the challenges ahead.

The industry’s evolution is not about replacing one commodity with another but about broadening our national portfolio. And it happens with the innovation and hard work of the people working day and night in our great resource sector.

At Whitehaven, we’re committed to supporting the communities that support us—especially across Central Queensland.

We continue to invest directly in the regions where we live and work, with $2.1 million dedicated to local partnerships and community initiatives in FY25.

It’s all part of our promise to help regional Queensland thrive. Learn more about the difference we’re making at whitehavencoal.com.au

Central Queenslanders know all too well about the impact of policy uncertainty, unpredictable decisions, and investment bottlenecks. But that era is over.

Under the Crisafulli Government, we are restoring the confidence our sector needs to thrive by cutting red tape, clearing approval backlogs and getting the fundamentals right.

While I write my contribution to this year’s Bowen Basin Mining Club’s Yearbook as the Minister for Natural Resources and Mines, my most important job is serving as the Member for Burdekin. It’s an electorate that spans across Middlemount and Moranbah, from Clermont to Collinsville. So I don’t need a briefing note to understand what the resources sector means to our region. I live it every day.

When the resources industry is strong, Queensland is strong. And when investment flows into the Bowen Basin and beyond, the benefits are felt far beyond the mine gate.

My message to miners, investors, contractors and communities has been clear from day one: Queensland is open for business. And we’re backing that message with action.

Queensland is open for business. And we’re backing that message with action.

We’ve renewed 11 coal mining leases in our first year in office, matching 44% of what the previous government managed in an entire four-year term. We’re also approving new petroleum leases and delivering critical support for mineral exploration and project development through the land release review I commissioned earlier this year.

But it’s not just about the volume of approvals. It’s about the certainty of decision-making. Whether the answer is yes or no, proponents deserve timely, predictable responses. We all know delays cost jobs and ambiguity kills projects. That’s why I’ve stood up the Resources Cabinet Committee, a dedicated forum bringing together the key Ministers across Resources, Environment, Planning, and Energy, to clear the pipeline and drive practical reforms across the system. We’re already seeing the dividends of restored confidence.

Earlier this year, Bravus Mining & Resources announced a $50 million expansion at the Carmichael mine, setting the stage for over half a billion dollars in future works and 600 new regional jobs. That investment stretches well beyond the mine site, supporting contractors in Townsville, suppliers in Rockhampton, and apprentices in Mackay.

Global demand for our highquality coal remains strong, especially from major Asian economies seeking reliable baseload energy. Demand for coal has nearly doubled since 2000, and around half of the world’s coal demand is driven by China, India and SouthEast Asia. These economies show no sign of slowing down, and that’s good news for our part of the world.

Few places on earth are better positioned to meet that demand than the Bowen and Galilee Basins. We’ve got the world’s best coal reserves and the rail and port infrastructure to deliver what our global export partners need.

At the same time, the world is looking to Queensland for the critical minerals and metals like copper, zinc, vanadium and rare earths, needed to power defence systems, advanced manufacturing, and the global energy transition.

In North-West Queensland, we’re delivering a $400 million investment in the Mount Isa copper smelter and Townsville refinery alongside the Commonwealth, securing more than 1,000 regional jobs and anchoring copper and minerals processing in the state’s north.

We’ve also secured commitments to unlock access to copper tailings at the Mount Isa Mine and to fast-track projects like Glencore’s Black Star Open Cut and the Eva Copper development, as well as delivering targeted rail incentives for emerging phosphate producers, helping them reduce costs and scale up operations.

I’m focused on growing our resources sector. And you can’t grow the resources sector without a skilled workforce to match. Everywhere I go, whether it’s Moranbah, Mount Isa or Mackay, I hear the same thing: we need more workers.

To meet that demand, the Crisafulli Government has expanded the Queensland Minerals and Energy Academy (QMEA) into 50 more schools, reaching an additional 10,000 students. For the first time, QMEA will also deliver programs in primary schools, helping spark early interest in STEM and the resources sector.

This is not just about promoting great career pathways. It’s about giving regional kids the chance to stay in their communities, build a future, and raise their families near home.

The Crisafulli Government is unashamedly pro-resources, and we’re demonstrating that by setting clear, stable expectations, then getting out of the way of those who meet them. My focus is on turning approvals around faster, while maintaining strong environmental and safety standards and giving every project proponent a fair go.

We know what’s at stake, and we have no intention of letting opportunities pass us by.

ROCKHAMPTON GREW DURING A GOLD RUSH IN THE 1850S AND IS SOON TO BE A GLOBAL LEADER IN THE RECOMMERCIALISATION OF DECOMMISSIONED MINES.

WITH UNTAPPED RESERVES OF PYRITE FOR SULPHURIC ACID PRODUCTION, GOLD, VANADIUM, COPPER, MOLYBDENUM, NICKEL, COBALT, TITANIUM AND MAGNESIA, NOW IS THE TIME TO STAKE YOUR CLAIM AND SECURE YOUR FUTURE.

WE WERE MINING ‘CRITICAL MINERALS’ BEFORE THE TERM EXISTED WHY ROCKHAMPTON?

EXPANSION & DIVERSITY

Improved economic resilience for Bowen Basin businesses

LOGISTICS

Access to international airport and deep water ports for easy exports

ENERGY & WATER

Tap into our affordable and ample water and energy supplies

READY TO STRENGTHEN AND DIVERSIFY YOUR BUSINESS? THE ROCKHAMPTON REGION IS CRITICAL TO YOUR SUCCESS. CONTACT THE ADVANCE ROCKHAMPTON TEAM TO START YOUR EXPLORATION.

STRENGTH & SECURITY

Resilient location at the Gateway to Northern Australia

Ilove Australian coal, but most of all, I love Queensland coal.

Everywhere I go, I repeat this message, because we all have a reason to love Australian coal.

Coal mining in Queensland has trained apprentices into mining experts, supported thousands of families in wellpaid jobs, grown small businesses into bigger businesses and it has powered our nation for generations, and powered our neighbours for centuries.

The mining of coal has generated millions of dollars in royalties, payroll

tax and company tax to the benefit of Australians, and the export of coal has ensured our balance of trade allows Australians to buy the home goods we enjoy. High-energy Australian coal is used in the steel mills of Europe and Asia and the next generation of high efficiency-low emissions power plants in Japan and China. As the world continues to urbanise and industrialise, Australian coal will be on the front lines of this revolution.

Across the globe, people are beginning to realise that we cannot solely rely on one or two forms of energy – we need all forms of energy, available right here, right now. It is abundantly clear that the growth in global energy

demand is skyrocketing, and we have an opportunity to capitalise on that.

In 2024 the International Energy Agency (IEA) projected that:

• global coal demand would rise by 1.5% to reach a new record (in quantity, not in price); and

• global coal production would grow by 1.4% to an all-time high.

In 2024 coal use for power generation reached its highest recorded level; and global coal trade reached a new all-time high.

In 2025, global coal production is expected to rise again, setting another new record. The IEA’s most recent

World Energy Outlook 2025 shows oil and gas demand increasing out to 2050 and beyond, with coal demand peaking but remaining strong at just under 5 billion tonnes annual demand in 2050.

What an impressive set of statistics for an industry activists claim is dying.

Developing nations are looking to industrialise; major economies are turning towards the rollout of data centres as artificial intelligence steps onto the world stage; governments are grappling with the social and economic cost of severe energy price rises, thanks to rushed policy changes. Australia has the expertise, the workforce, and the resources to continue fuelling the world.

In the 1970s Premier Sir Joh Bjelke-Petersen transformed the Queensland economy with massive investments in State infrastructure and development, including the expansion of our great electrified rail network into the Bowen Basin. This foresight and leadership have both powered our State and our economy, and over five decades later, Queenslanders still enjoy strength, growth, and prosperity thanks to this.

Our coal mines gave Queensland affordable, reliable power, which grew our manufacturing sectors, transformed our State, and brought new jobs and opportunities to the regions – because energy is the economy. It is clear that Queensland would not be the place it is today without this foresight and investment.

With decades of experience across mining, earthmoving and heavy equipment, Slattery Auctions delivers real results. Access the power of Slattery Auctions and Grays combined with Australia’s largest auction audience. 1M+ Monthly visitors | 250K+ active bidders & 13M+ bids per Year | 3.3M+ customers

We cannot let short-term mentality override sensible policymaking. Government should be fostering and encouraging new investment, not penalising those who took a risk decades ago, or picking winners as assets come under pressure.

In 2025, we must ensure that the decisions we are taking now produce a better Queensland in 2075. We need to ensure that Queensland can bring in the investment and productivity to bring us further strength. But where is that long-term vision now?

Federally, we have a Labor Government that continues to intervene in our energy market and our economy, with little regard for the damage it is doing to our investment environment or the impacts on our businesses. They think they know better than business, and act without regard for the hundreds of thousands of current and future jobs, the taxes and royalties that fund government spending like Medicare, that they put at risk with their actions.

Closer to home, the impacts of Queensland Labor’s coal royalty hike are being felt right now. There is an exodus of investment, whether for new projects or expansions, from Queensland to other states and countries, thanks to the punishing nature of this hike.

All mining projects – but particularly coal – need billions of dollars of capital raised before the first shovel even hits the ground. It requires years of negotiating through arduous approvals projects, negotiations with

landholders and traditional owners, secure offtake agreements and customers, and this all comes at a massive cost, before a single dollar of revenue is raised. Once all this has occurred – barring any vexatious litigation from anti-mining activists – these companies have to grapple with huge cost of production pressures, thanks to skyrocketing energy prices, and continue to pay some of the highest wages in the country.

All this just to get to production – and then the coal price crashes. It is not easy to start a new mine in 2025, and this should be of great concern to anyone invested in the future growth of Queensland.

Our mining companies take huge risks investing in our great resources, and these investments have helped transform both the regions and Brisbane.

The security of these investments lies with a stable, clear regulatory regime, and a clear pathway from first discovery to production. We cannot continue to change the goalposts for mines and companies as they try to navigate our approvals landscape – it already takes on average 16 years for a mine to reach production.

To secure future investment in our great resources industry, we must look back to the actions of 1960 Queensland – long-term, strategic planning, over short-term sugar hits. These investments are slow-burn ones; there will always be good years and bad years, but the strength of our industry is built on long-term plans and regulatory stability. This will secure our investment pipeline for the future.

We cannot let short-term mentality override sensible policymaking. Government should be fostering and encouraging new investment, not penalising those who took a risk decades ago, or picking winners as assets come under pressure.

We can all feel the costof-living pressures biting us right now – and our mining sector is feeling those too. Skyrocketing energy prices, spiralling labour costs, anti-productivity industrial relations policies, a stagnant approvals process and continued market interventions are all destabilising Queensland’s investment environment.

There is hope on the horizon however, because I have faith in Queenslanders.

The Crisafulli LNP Government is bringing sensible policy back to Government decision making, working hard to deliver for Queenslanders, and getting the investment settings right to restart productivity in our great State.

Advocates like the Queensland Resources Council and Coal Australia are making sure that decision makers right across the political spectrum are hearing your voice, and fighting for the Bowen Basin.

More broadly, the discussion around energy, emissions, and what role Australia plays in the global picture is changing. Sensible policy must trump ideology, and prioritise affordable, reliable energy for Australians whilst still bringing down emissions in a sensible, deliberate manner.

I am resolute that there is still a future for Queensland coal. I have never shied away from this, and will continue being your voice in Canberra, along with Andrew Willcox, Michelle Landry, Colin Boyce, Phil Thompson and Senator Matt Canavan, because when the Bowen Basin is strong, Queensland is strong.

What a year it has been – when I reflect on last year’s column by Coal Australia’s Founder Nick Jorss, I had just come on board as CEO, no pressure.

He had helped lay a terrific platform for Coal Australia, and it has been a remarkable twelve months with our Friends of Coal now going past 110,000 people. Each week, they receive an update on our activities, how we shape the positive messages for our coal mining communities, and observations on what is occurring in the coal, energy, infrastructure, and steel production spaces.

The facts speak for themselves and have become a series of ‘inconvenient truths’ for those who would demonise coal or seek to downplay its importance and relevance to a modern economy like Australia’s.

Here are just a few.

• Global coal consumption for the calendar year 2024 reached record levels at 8.8 billion tonnes, and it is set to push past 9 billion tonnes in this calendar year.

• Coal continues to generate the bulk of electricity going into the east coast energy market.

• The life spans of coal-fired power stations are being extended in Victoria and NSW.

• Modelling by respected firm Arche Energy shows coal remains the cheapest and most reliable form of baseload electricity.

• The release of the Queensland government’s Energy Roadmap 2025 recognises this modelling with a plan to use more coal, for longer.

This is precisely the transition we need –transitioning energy policy from fantasy to reality, with coal very much at the centre of it.

First-world near-neighbours such as Japan and South Korea recognise this, and while they are signatories to emissions reduction targets, they continue to demand Australia’s quality thermal coal. Many other countries are following suit.

The bubble has burst on the hydrogen myths for so-called ‘green’ steel production, with our world class steel-making coal in high demand.

And the banks, financiers, and major super funds are suddenly taking a much closer look at coal mining operations again.

A big part of Coal Australia’s mission is to tap into our coal mining communities to promote the importance of coal. This year we have travelled to Muswellbrook, Singleton, Wollongong, Newcastle, Rockhampton, Mackay, Moranbah, Middlemount, Brisbane, Sydney, Canberra, and even Singapore, to name the first ones that spring to mind.

Coal Australia’s range of merchandise is growing in popularity, particularly the shirts, caps and stubby holders, and it is a fun part of our grassroots advocacy in support of coal mining communities.

As a national body, we now have dedicated staff in Brisbane, Newcastle and the Hunter, Central Queensland, Canberra, and Sydney.

During the run-up to the May federal election, Coal Australia held a series of dedicated ‘Meet the Candidate’ town hall events, covering key electorates in the Newcastle-Hunter region, Wollongong and the broader Illawarra, and Rockhampton. The discussions centred on energy security and the importance of coal, among other hot topics, such as offshore wind farms.

The candidates were drawn from across the political spectrum – yes, even the Greens. Our political engagement continues at a federal level, while Coal Australia regularly meets with key players in the NSW and Queensland parliaments as well.

This is all about building support for coal and to reinforce the reality of global demand for coal at a time when the facts can be overshadowed by political rhetoric at home.

This is all about building support for coal and to reinforce the reality of global demand for coal at a time when the facts can be overshadowed by political rhetoric at home.

When you travel overseas and talk to key customers for Australian coal, they cannot believe the debates that play out here and are genuinely concerned about potential risks to ongoing supply.

And while the facts stack up for coal, the challenges remain – Coal Australia continues to engage with the Queensland government over the state’s unsustainable royalty regime. The impacts are being felt right across the sector, with mine closures, a pullback in production, and tragically, job losses. No one wants to see this, and that’s why the issue is core business for Coal Australia.

The Federal government’s reforms to environmental and project approval laws are another important issue, alongside the creation of a Commonwealth Environment Protection Agency. Given that the existing state-based EPAs are already flexing their policy muscles, particularly in NSW, we must avoid duplication and over-regulation.

Next year there will be a review of the Safeguard Mechanism which imposes obligations on coal miners to reduce their emissions – that is another key issue for Coal Australia.

It is worth noting that our member producers are already doing a lot of work in this space and in NSW, emissions from coal mining are being reduced at a higher rate than the state average; another inconvenient truth for our detractors.

Coal Australia also works with other resources industry bodies in a constructive and collaborative way, adding another key voice to national and state debates on issues impacting our coal mining communities.

There is so much of which our sector can be proud - the positive impact our producer members play in improving the collective skills and knowledge base of our workforce; the direct and indirect jobs we generate; the prosperity we deliver; the associated businesses that thrive when coal mining thrives; the positive role we play in electricity generation not just locally, but for developing countries too; and the importance of steel production for the infrastructure that drives economies.

Coal delivers this in spades – and very big trucks too.

Thanks to our Chairman Rob Bishop, Founder Nick Jorss, our Board of Directors and our dedicated team who go above and beyond because of their belief in, and passion for, the importance of coal.

Coal Australia will continue to advocate in support of coal, and our current positive media campaign is all about keeping our coal communities strong.

The rise of critical minerals such as lithium, cobalt, and rare earth elements has become central to global narratives around the clean energy transition. These minerals are marketed as the building blocks of a decarbonised future, underpinning renewable energy systems, batteries, and electric vehicles.

However, what is ‘critical’ globally may not align with what is critical regionally. Nowhere is this tension more evident than in Queensland’s Bowen Basin, where coal mining underpins both the economy and community identity.

Coal’s dominance in the Bowen Basin

Coal remains the backbone of Queensland’s resource economy, particularly in the Bowen Basin - the world’s largest metallurgical coal-producing region.

Bowen Basin 2025 Snapshot

These figures show a resource economy heavily anchored in coal. Over 90% of the Bowen Basin’s mining jobs - and nearly 80% statewide - depend directly on coal. Any decline in the sector, therefore, carries deep employment and economic risks for regional Queensland.

These numbers point to a workforce heavily anchored in coal production, both operationally and socially, which means any shift away from coal has significant implications for regional employment.

Critical minerals: emerging but small scale

Australia holds major global resource shares, estimated as around 27% of the world’s known lithium resources, 22% of nickel, and 21% of cobalt. But to commercialise these to a scale and size that would offset Australia’s current three largest economic contributors, iron ore, coal and LNG, the critical minerals industry needs a clear strategy.

Despite this, Queensland’s critical minerals workforce remains small. The Australian Critical Minerals Strategy 2023–2030 positions the sector as a national growth priority, but there are no robust job forecasts for Queensland, and current operations remain modest compared with coal.

Critical minerals projects are often capital-intensive but less labour-intensive than coal mining. This means that even if production grows, employment opportunities may not scale proportionally, creating a transition gap for workers in regions like the Bowen Basin.

risk and regional exposure

The Bowen Basin’s dependence on coal creates several key transition risks:

Workforce mismatch The coal workforce (~47,000 FTE) is operational and service-orientated, while critical minerals demand technical and processing skills. Direct redeployment is limited without major retraining programs.

Job volume gap Current and near-term critical minerals employment is far smaller than coal, meaning displaced workers may not find locla replacements.

Regional economic dependancy

Local businesses - transport, retail, accommodationrely heavily on mining activity. Reduced coal output would ripple through the local economy.

Fiscal and export exposure Coal royalties and export earnings underpin Queensland's fiscal capacity. Declines here could constrain state-funded infrastructure and services.

Critical minerals offer a potential long-term opportunity for Queensland, but in the short to medium term, they present a transition risk, not a substitute for coal-dependent regions like the Bowen Basin.

Policy priorities for a managed transition

If the goal is a sustainable and equitable energy transition, government and industry must balance national decarbonisation objectives with regional realities. Key steps include:

1. Develop credible transition pathways

Large-scale retraining and certification programs targeting coal-region workers for critical minerals processing, battery manufacturing, or mining services.

2. Set quantitative, region-specific targets

Define job creation and investment benchmarks for Central Queensland’s critical minerals sector.

3. Support industrial diversification

Encourage downstream processing (e.g., refining, precursor materials) near existing coal towns to anchor jobs locally.

4. Stabilise coal regions during transition

Implement staged decline policies, redeployment incentives, and local investment funds to manage change without social disruption.

5. Align incentives and infrastructure

Adapt royalties, training subsidies, and infrastructure funding to sustain regional prosperity through the transition.

Critical minerals offer a potential long-term opportunity for Queensland, but in the short to medium term, they present a transition risk, not a substitute for coal-dependent regions like the Bowen Basin.

Without targeted, data-backed policy intervention, the shift toward a ‘critical minerals economy’ could destabilise core mining communities, undermine local employment, and erode the fiscal stability built on coal exports.

A just transition for Queensland’s coal heartland must therefore prioritise people and place as much as minerals and markets.

Michelle Manook, Chief Executive Officer FutureCoal

Reality has, at last, mugged ideology everywhere in the world – except Australia.

But even here the story is now beginning to change. Transformative innovations that characterise today’s coal value chain, from mining to burning, are evidence-based proof that coal is a genuine partner with renewables on the path to a cleaner environment.

But what is it that the Federal Government, driven by eco-extremists, cannot come to terms with as it faces the energy crisis engulfing Australia’s east coast?

Having failed to deliver its promised $275 reduction in electricity prices and now proposing to force suppliers to give consumers three hours of free electricity each day, it still denies one absolute fact: coal keeps the lights on for Australians.

Coal doesn’t just power the nation, it funds it. The industry provides the massive royalties that sustain essential public services. In Queensland alone, coal royalties have delivered $31 billion over the last three years. Nationally, coal exports were worth $91.4 billion in 2023–24 and supported more than 170,000 direct and indirect jobs.

Yet the same government quietly pockets those billions while pursuing the fantasy of a renewables-only future, an ideology long out of step with global reality. Around the world, governments now recognise that energy affordability and security must sit alongside climate goals.

Global strategists like McKinsey now concede that coal will remain central to global energy systems well into 2050. But as other countries move ahead with innovation and abatement, Australia is being left behind by the very countries that once followed its lead. Last year, I wrote that “Australia stagnates while the rest of the world innovates.” Returning home now, I can say with certainty that the gap has only grown wider.

Over the past year, I’ve travelled through the world’s key coal markets - China, India, ASEAN, the United States, and South Africa. In every one of these nations, coal is being redefined through innovation and technology, guided by governments that understand sustainability must begin with the ability to sustain.

Nowhere was that lesson clearer than when I left Australia and travelled to China. China leads not only in renewables, hydrogen, and chemicals, but also in coal innovation. From the world’s largest carbon capture and storage facility on a coal plant, to industrial-scale coal-to-hydrogen and coal-to-chemicals projects, China demonstrates what’s possible when technology and policy align.

Yet Australia continues to recycle the same outdated debates, blind to coal’s evolving potential - its role in powering economies, sustaining jobs, and advancing low-emission technologies.

Even some of the world’s most influential voices are shifting their perspective. Bill Gates, the Microsoft co-founder and leading philanthropist, recently wrote that it is time to put “human welfare at the centre of climate

strategies” - to focus on improving lives rather than chasing short-term emissions targets.

“When the climate debate becomes driven by doomsday thinking,” Gates said, “it diverts attention and resources from the most effective things we can do to improve life in a warming world.”

That sentiment reflects the same principles that guide FutureCoal, a commitment to innovation, stewardship, and practical solutions that balance environmental responsibility with human progress.

Energy is the lifeblood of economic growth and human advancement. Across the world, nations are recognising this truth and acting on it.

So, ‘what is it that Australia knows that other countries do not?’ Or should the question be ‘what is it that other countries know that Australia does not?’

• India is investing A$1.5 billion in coal gasification to strengthen energy independence and industrial growth.

• Japan operates one of the world’s most efficient coal fleets while pioneering the use of coal with hydrogen and ammonia, even proving that hydrogen can be shipped by sea.

• The United States, once turning away from coal, is now investing nearly A$1 billion to modernise plants and expand research into coal-to-critical minerals, carbon fibre and graphene, recognising coal not only as an energy source but as a platform for advanced materials industries.

• Germany, once the poster child for coal phase-out, has delayed plant closures after shutting its civil nuclear fleet, protecting its citizens and industries from energy insecurity and the infamous Dunkelflaute — the ‘dark wind lull.’

But there are some who share Australia’s energy delusion and the painful effects of rushed and poorly planned transitions.

In April, Spain and Portugal suffered widespread blackouts as grid stability collapsed.

In Britain, so-called ‘green levies’, once promised to cut household bills, are now doing the opposite. The Office for Budget Responsibility projects these charges will rise by 50% within five

years, climbing from around $20 billion today and adding roughly $600 to the average household bill.

Across mainland Europe, soaring energy prices have forced governments to reopen coal plants and reconsider the pace of renewables-only strategies. What was once hailed as progress is now being recognised for what it is - overreach.

Will Australia learn that lesson? Is ‘sorry’ the hardest word to say in politics?

Here at home, a new narrative is beginning to surface as ideological puritanism starts to fracture under the weight of real-world experience.

As The Wall Street Journal recently noted, uneven subsidies for renewables have distorted energy markets and pushed reliable generation offline, leaving grids fragile, weather-dependent, and unable to meet demand.

Does any of that resonate with the Australian experience?

The new reckoning is now unfolding in the financial world. The once-celebrated Net Zero Banking Alliance has quietly retreated, and the Net Zero Asset Managers Initiative, representing nearly $135 trillion in assets, has been suspended. These developments confirm what we at FutureCoal have said all along: exclusionary finance is not always sustainable or pragmatic finance.

Investors are rediscovering what developing and industrial nations have always known, that genuine environmental progress must go handin-hand with stable economic growth underpinned by energy security.

That is precisely what FutureCoal’s Sustainable Coal Stewardship (SCS) framework seeks to achieve.

SCS houses proven technologies including high-efficiency, low-emission (HELE) power plants, carbon capture and storage (CCS), coal-to-hydrogen and coal-to-chemicals (such as ammonia and plastics), responsible mining, and the production of advanced carbon materials like carbon fibre and graphene.

Australia, with its vast reserves, research capability and technical expertise, is perfectly positioned to lead the next phase of coal innovation. Instead, it continues to debate whether coal should exist at all.

Policies like the Safeguard Mechanism risk turning Australia into a spectator to the very industry that helped build the nation, exporting what it is too afraid to use while importing the consequences of its own uncertainty.

At FutureCoal, our mantra has always been clear: it’s about phasing out emissions, not phasing out the fuel itself, a distinction that is crucial for any sustainable and effective environmental approach.

Those of us across the coal value chain must continue to drive awareness of this new narrative, of SCS, and the opportunities it creates for Australia’s economy, energy security, and technological leadership.

Australia must not let Donald Horne’s words from sixty years ago become true again. He called Australia “the lucky country” lamenting, ironically, that it was “a second-rate nation built on luck, not innovation or ambition.”

Coal has a proven track record of innovation. It has never relied on luck, only on hard work, ingenuity, and progress.

Australia, with its vast reserves, research capability and technical expertise, is perfectly positioned to lead the next phase of coal innovation. Instead, it continues to debate whether coal should exist at all.

Today’s equipment is being designed to run faster and longer, typically under hotter and harsher conditions. Rykon is our new line of calcium sulfonate complex grease designed to maximise the performance of equipment across a variety of industries.

Today’s operations demand superior performance in conditions such as heavy loads and extreme pressure.

ASTM D2596 WELD LOAD TEST

Excellent performance under heavy loads and shock load.

Rykon Exceeds industry standard by more than double with a load weld of

better wear protection ‡ compared to industry standards

better spray-off performance† compared to industry standards

Oxidation and thermal stability

Excellent performance in high ambient temperatures.

Water performance

Rust and corrosion resistance

Superior protection from moisture, to prevent rust and corrosion.

Rykon stays in place to protect your equipment, exceeding water washout test industry NLGI standards.

706

Low temperature pumpability

Keep your equipment protected in freezing temperatures.

Outstanding wear performance under heavy loads

Demonstrates better performance against wear scarring.

Matt Latimore, Founder and President

Strategic planning for Australian resources requires clear-eyed analysis of both near-term market dynamics and longterm structural shifts. Over the next three decades, government industrial policy in China and India will determine the trajectory of metallurgical coal demand, while critical minerals increasingly drive investment decisions beyond that horizon.

This analysis examines the speed, direction and practical constraints of these changes in China and India, and what they mean for Australian steelmaking coal and critical minerals demand through to 2050.

The short to medium term

The government policies of China and India, the world’s two largest steelmakers, are likely to be the most significant drivers of both the speed and direction of travel of the Australian resources sector over this period.

In both China and India, governments are taking a key role in deciding production capacity, method of steelmaking, and the types and quality of steel being produced.

China

China produces over 1 billion tonnes of crude steel annually, around 54% of global production. At present, according to reports, around 85 to 90% of this is made using Blast Furnace-Basic Oxygen Furnace technology, using metallurgical coal.

Those watching the Chinese steel market know the Chinese Government’s view that self-reliance in steel production, including the use of scrap, will place the country in a better position with respect to its national strategic interests. Their Government is also seeking to reduce emissions to improve the country’s overall environment and standard of living.

Consistent with this, in August this year, the Chinese Government released its 'Two-Year Work Plan for Stabilising Growth in the Steel Industry', which sets a new target for 30% of its steel production to be from electric arc furnace by 2035.

China’s 15th Five-Year Plan was also released recently. The plan sets the national agenda for economic decision-makers across large-scale and long-term policy objectives. Key

takeaways of the plan are a continued focus on technological development and self-reliance (for example in semiconductor chips), while building a “modern industrial system with advanced manufacturing as the backbone" and accelerating "high-level scientific and technological self-reliance."

In the real economy the Chinese government wishes to reduce its reliance on property construction to drive economic development by reorienting the economy to domestic consumption, and higher quality, more advanced manufacturing exports. This will decrease steel consumption intensity domestically, in turn requiring less steel production.

As their steel production diminishes, metallurgical coal use will also reduce. In the initial phases of this adjustment, our expectation is that this reduction will result in the closure of higher-cost domestic mining operations as they are not competitive compared to the seaborne market. The result is likely to be that reduced consumption of steelmaking coal in China won’t disrupt the country’s demand for seaborne coal.

As the Work Plan progresses, efforts will be made to increase China's production of steel made using renewable electricity and scrap steel. However, significant time, resources and investment will be required to build the new plant and

infrastructure required for Electric Arc Furnace (EAF) and Direct Reduced Iron (DRI) steel production and for processing scrap steel. While the determination of the Chinese government and industry is well known, reaching 30% electric arc furnace steel production is a complex and exceedingly difficult challenge. According to some reports, the Government’s workplan may already be 5% behind on its 2025 target for EAF uptake.

At the same time there are two key factors which create an incentive for China to maintain its existing use of blast furnaces for steel production. The government’s latest five-year plan emphasises a strong manufacturing sector, and China's massive installed base of blast furnaces.

Both these factors signal a continued reliance by Chinese steel mills on metallurgical coal across the next 10 to 20 years.

India is experiencing a resurgence in dynamism, optimism and economic development, which many see as a parallel to the country’s Golden Age under the Gupta Empire during the fourth, fifth and sixth centuries.

Key to the Indian Government’s economic strategy is massive growth in steel production. This was a top talking point of business leaders and government officials during Premier Crisafulli’s inaugural Trade Mission to India, which I was pleased to attend.

India’s Government has targeted production of 300 million tonnes by 2030, which is an increase from current production of around 50%. By 2047, their Government has said the country will increase its annual steel production capacity to 500 million tonnes.

India’s fleet of blast furnaces are relatively young, with an operational life of 20 to 25 years, while nearly all of the new steel mills currently planned or under construction - which are being built to support increased capacity targets - will also be blast furnaces. Given a lack of domestic

sources of metallurgical coal, imported coal will be required to support the country's production increases, much of it from Australia.

Importantly, India is also making significant strides to reduce its emissions. By the end of this decade, the country aims to generate 500 gigawatts of clean energy - enough to power approximately 300 million homes - and has installed around 100 gigawatts of solar energy over the past decade. To place this in context, Australia’s total peak energy demand is only 35 to 40 gigawatts.

Firstly, government policy will continue to have an outsized influence on the levels of steel production from the world’s top two steel producers, China and India.

Secondly, while China will make the move towards ‘green’ steel, these steelmaking methods are likely to result in a higher-cost product. The country’s transition to production of steel using renewable energy may take time and add expense – particularly given the country’s desire to maintain its position in manufacturing.

Thirdly, India’s rapid expansion in steel production capacity is likely to rely on blast furnace technology. Indeed, given the planned rate of growth in production capacity, India’s metallurgical coal demand, sourced from seaborne trade, may make up for, or even exceed, any reduced demand stemming from the Chinese Government’s industrial policy initiatives.

In contrast to the short to mediumterm outlook, the long-term horizon is likely to be influenced by a different set of resources and commodities.

The future of resource project investments will lean towards critical minerals and rare earths. Over the next 20 to 30 years, we see a very bright future for Australian resources to support global supply chains requiring these minerals.

Critical minerals, including vanadium, copper and graphite, used in electric motors, energy storage and energy transmission, will all experience increased demand and probably a lag in the production required to meet this demand.

Australia is uniquely endowed with a range of rare earth minerals which are central to many technologies at the centre of our daily lives, such as smartphones, touchscreens and EVs. They are also important for certain hightech applications like lasers, computers, fibre optics and defence.

We are working to investigate and explore new sources of these minerals while also investing in Australian companies to help them to prove and develop their own reserves. We look forward to bringing more of these incredibly important minerals to market.

It is also important to build and strengthen the capital pool available for critical minerals and rare earths projects.

An Australia-focused fund will increase our production of these resources, and also the refining facilities that will enable our resources to plug into global supply chains across North Asia, North America and Europe.

We welcome the recent $13 billion investment in critical minerals, recently agreed between President Trump and Prime Minister Albanese. The agreement underscores the global momentum and strategic alignment necessary to increase and accelerate the production of critical minerals, and confirms we are on the right track.