Resilience in Action

Turning Adversity into Opportunity

A Year of Resilience

Resilience. By definition, it is the process of effectively adapting to difficult or challenging circumstances. 2023 was a year characterized by resilience, demonstrated by our BayCoast organization. Through times of economic uncertainty, our entire team came together to swiftly adjust and adapt, so we could continue doing what’s Just Right for our neighbors here on the South Coast.

It may not have been easy, but our efforts to persevere are most certainly worth it. We strategically charted a calculated course to control growth in order to get us through challenges brought on by a financial environment in flux, while never losing sight of our critical mission – to provide exceptional service and solutions for our community.

We were not alone as we endeavored to withstand challenges presented in 2023. Many of our neighbors exhibited that same strong resilience to overcome adversity.

Burns Power Tools, a local company with four decades of service to our community, is an example of what it means to be resilient, after a fire devastated their long-time family business. You’ll learn how the company’s trusted relationship with BayCoast Insurance helped them through an emotional recovery.

There’s also the inspiring story of the San Miguel School in Providence, Rhode Island, educating young boys from challenging environments. You’ll read how encouraging a sense of belonging in the classroom is helping these resilient students achieve their full potential.

And then there’s the story of Old Colony Habitat for Humanity and the resilient single mother whose life was forever changed when her name was drawn in a lottery to receive a brand new, affordable home for her and her two children.

We hope you enjoy these stories and much more, as you experience this year’s Annual Report in a new, interactive way. I invite you to scan the QR codes provided for in-depth interviews, videos and additional information about the tremendous accomplishments of our BayCoast community throughout the past year.

As we move forward, we have exciting initiatives planned in the months ahead. I would like to express my gratitude to everyone across the organization for your unwavering support and dedication. Your resilience is a testament to who we are and what the BayCoast name represents. Together, we will continue to be a trusted resource for our valued South Coast community.

Respectfully,

NICHOLAS M. CHRIST President & CEO BayCoast Bank

NICHOLAS M. CHRIST President & CEO BayCoast Bank

“Four Generations, Up In Flames”

BayCoast Insurance Helps a Local Family Business Rise from the Ashes

Four generations. That’s a long time to be in business. Burns Power Tools has been proudly serving our community since 1934. Initially founded as a saw shop in Fall River, Massachusetts, the company has grown to become a major supplier to the construction and woodworking industries, specializing in industrial power tools, heavy-duty machinery, and full-service sharpening and repairs.

Burns Power Tools recently relocated to Tiverton, Rhode Island, after being forced to leave its longtime location on Mariano Bishop Boulevard in Fall River, where the Burns family rented space for their business. The reason for the move? The company, which has survived major global events, including the Great Depression, World War II, and a worldwide health crisis, fell victim to a devastating five-alarm fire in November of 2022, right before the start of the holiday season. Zach Burns, President of Burns Power Tools and great-grandson of the company’s founder, John J. Burns, recalls the night he got a phone call from his security company, notifying him that his family business was on fire.

“I lived about 15 minutes away. I jumped in my car, and I remember coming off the exit of the highway and I could smell it. You could see the smoke and flames. Immediately, our employees started to

It’s important to remember that this is not just an insurance policy. You’re understanding the people and the business behind the policy.

BERNARD J. MCDONALD VP, Commercial Lines BayCoast Insurance

BERNARD J. MCDONALD VP, Commercial Lines BayCoast Insurance

show up. We all were standing in the parking lot next door, watching it all go.”

“The fire was just devastating,” adds Burns. “We were at rock bottom with the uncertainty of the situation. We were scared.”

Burns says the fire couldn’t have happened at a worse time. “We were having our best year ever in 88 years and were excited to go into the holiday season…and then all of a sudden, we were all left in disbelief saying, what’s next?”

Burns, along with his company’s bookkeeper, Stacie Barbosa, recall a critical decision made a few years earlier that may have saved the business.

“When I started at Burns Power Tools in 2020, we made a list of things to review to improve the company,” said Barbosa. Burns’ insurance policy was one of the items on that list.

“We were up for renewal, and it had been a while since we had reviewed our coverage,” adds Burns. “We met with insurance agents, including (Bernard)

B.J. McDonald from BayCoast Insurance,” continues Barbosa. “B.J. came in and really got to know who Burns Power Tools (was) and came back with

and the business behind the policy.”

“Building a strong relationship with the customer is important. Earning their trust is important,” adds McDonald. “I am fortunate that Zach trusted me with protecting his business.”

“I have B.J.’s cell phone number and can call him anytime with questions. It’s just so nice to have that relationship at a commercial level,” adds Barbosa. “B.J. was there for us, and even came in to help us scan receipts for the insurance company…hundreds of receipts.”

ZACHBURNS President Burns Power Tools

imagine going through this journey without BayCoast Insurance. They helped us tremendously.”

Burns agrees and says he is thankful to have rebuilt his business with the help of BayCoast Insurance.

“We are extremely grateful to BayCoast Insurance for allowing us to keep doing what we love.”

We are extremely grateful to BayCoast Insurance for allowing us to keep doing what we love. Watch the video here!

We proudly congratulate Jim, Casey, and Taryn on their well-deserved honors. Each achievement reflects our dedication to excellence at BayCoast. We applaud their success, which beautifully mirrors the spirit of our mission and values.

NICHOLAS

M. CHRIST President & CEO BayCoast BankCelebrating

Honoring Jim Wallace

Recipient of the Roger Valcourt Outstanding Citizen Award

BayCoast Bank and One SouthCoast Chamber joined for the Roger Valcourt Outstanding Citizen Award Dinner, a special event recognizing Jim Wallace’s remarkable community contributions.

A lifelong banker, Jim embarked on his career in 1982 with the Bank of New England. With over 40 years of experience, he held key roles in accounting, information management, and bank operations at various local financial institutions before becoming an integral part of BayCoast Bank in 1990.

The Outstanding Citizen Award, named in memory of Roger Valcourt, pays homage to a person of great character and commitment to the community. Valcourt, who passed away in 1979, left a legacy of excellence. The Chamber continues to honor his life and achievements through the annual presentation of the Outstanding Citizen Award.

This joint celebration by BayCoast Bank and One SouthCoast Chamber showcased not only Wallace’s exceptional career but also the continued spirit of community and excellence that defines both organizations.

Accomplishments

Celebrating

Casey Brouthers

Two-Time Recipient of the Emerging Leader Award

Casey Brouthers, First Vice President, Associate General Counsel at BayCoast Bank, was honored with the 2023 Emerging Leader Award from both the American Bankers Association (ABA) and the Massachusetts Bankers Association. Recognized nationally, Casey was among twelve banking professionals acknowledged by the ABA at their annual convention in Nashville, TN, for their commitment to achievement and community service. Earlier this year, the Massachusetts Bankers Association also recognized Brouthers as an Emerging Leader.

Licensed in Massachusetts and Rhode Island, Brouthers joined BayCoast Bank in 2020, progressing from Vice President, Regulatory Policy and Enterprise Risk Strategist to FVP, Associate General Counsel. She is actively engaged in local organizations, advocating for banking associations, and volunteering for financial literacy programs. Brouthers exemplifies BayCoast Bank’s commitment to excellence and community values.

Recognizing

Taryn Cabral

Live United Recipient from the United Way of Greater Fall River

BayCoast Bank’s Talent Acquisition Specialist, Taryn Cabral, received a special honor from the United Way of Greater Fall River (UWGFR) for her outstanding service as the Chair of the UWGFR’s Annual Campaign during the 2022-2023 term. Cabral, along with dedicated community volunteers, played a pivotal role in surpassing the nonprofit’s campaign goal, leading to their notable recognition.

Cabral received the prestigious Live United award at the celebratory event, acknowledging her significant contributions as the Annual Campaign Chair. Her active involvement in various fundraisers exceeded the previous year’s fundraising achievements, generating funds that were subsequently reinvested in more than 70 crucial programs and services. These initiatives supported health, education, financial stability, and basic needs within the community.

Embracing Diversity, Championing Inclusiveness

Honoring Every Voice and Perspective

At BayCoast Bank, we value diversity and inclusion as an integral part of our commitment to serve the unique needs of individuals and businesses across Massachusetts and Rhode Island. Our belief in the strength of community involvement drives us to foster a culture of belonging, encouraging our employees to respect and celebrate the differences among us.

We take pride in supporting the communities where we live and work. By getting involved and helping our neighbors, we can encourage a broad range of perspectives and ideas that can lead to increased innovation and creativity.

This year, we marked a milestone by launching a new page on our website, reinforcing our commitment to accessibility and inclusivity. Through Americans with Disabilities Act (ADA) enhancements and multilingual capabilities, we are better serving our community through a more user-friendly experience.

Empowerment begins with equitable access to financial services. I am committed to ensuring that DEI principals are integrated deeply within our core values and seamlessly woven into the very fabric of our strategy, guiding our day-to-day operations.

HELENA L. MORONTA FVP, Diversity, Equity, & Inclusion Officer BayCoast Bank

Enriching the Workplace

Making Waves with Our Employee Resource Groups

We value our employees’ diverse experiences and perspectives and how they enrich the workplace. That’s why we have established Employee Resource Groups (ERGs) to provide supportive spaces where our BayCoast family can connect, share experiences, and contribute toward our goal of diversity, equity, and inclusion.

Young Professionals

A community that unites individuals who are early in their careers with seasoned professionals to foster development, networking opportunities, and real-life experiences.

Women’s Empowerment

A safe and inclusive space where employees come together to discuss their experiences, share knowledge, and collaborate on initiatives that promote gender equality, diversity, and inclusion.

Working Parents, Single Parents, & Caregivers

A support network for individuals who balance work responsibilities with raising children or caring for dependents. This is a forum to share stories, advice, and tips on navigating life’s challenges.

Voice of The Associate

A dynamic forum for employees to express opinions, raise concerns, and offer suggestions to improve the workplace, empowering BayCoast team members to have a voice and collaborate.

Inspiring a Sense of Belonging in the Classroom

education in our community, proudly provided a grant to the San Miguel School in Providence, Rhode Island, supporting their efforts to strengthen a sense of belonging in the classroom. Founded in 1993, San Miguel provides a middle school education for boys who come from challenging and diverse backgrounds. The school promotes a culture that emphasizes citizenship, service and personal responsibility in a caring and nurturing environment.

“Students are more academically successful and engaged when they feel connected to their school and community,” said Mel Bride, current Director of Advancement and Strategic Partnerships and Incoming Executive Director at San Miguel. “With BayCoast’s support, we were able to engage

a consultant who worked with our board and staff on the importance of building an inclusive school community where all members are seen and valued for their unique qualities. Learning in an inclusive community gives our students a clear advantage as they pursue their academic and personal goals beyond middle school. Our hope is to be the most welcoming and supportive place we can be for our students, and this grant will help us achieve that goal.” BayCoast’s support will help ensure that the school is providing meaningful, diverse and equitable programming, while encouraging students as they build their own a sense of self.

“We are thrilled to provide this important grant to the San Miguel School, “ said Helena Moronta, First Vice President, Diversity, Equity and Inclusion (DEI) Officer for BayCoast Bank. “Learning about our differences allows students to explore perspectives and opinions they may not have otherwise considered, giving them an opportunity to think critically and examine the world in fresh new ways. This lays the foundation for meaningful conversations, which can foster stronger relationships and understanding.”

Notes Bride, “BayCoast has such an awesome reputation for working in the communities we care about. We are grateful for their support. Very grateful.” Inspired by the pillars of faith, service, and community, young men at San Miguel are encouraged to learn and serve, and to grow to reach their full potential. The school currently serving 64 students in grades five through eight.

At BayCoast, our commitment to community is at the very heart of what we do. Whether it’s providing a grant or volunteering our time, supporting the neighborhoods where we live, and work is a large part of our culture. It’s not just the right thing to do, it’s who we are as an organization.

JOHN MCMAHON SVP, Community Engagement BayCoast Bank

JOHN MCMAHON SVP, Community Engagement BayCoast Bank

Home Sweet Home

Single Mom Selected for Old Colony Habitat Home. Community Project

Supported by BayCoast.

In the 1939 classic film, The Wizard of Oz, Dorothy famously proclaimed, “There’s no place like home.”

Having a place to call home is part of the American Dream, a dream many hope they can achieve, including Malkis Amaya. Born in El Salvador, Amaya came to the United States with her parents at the age of 10, hoping for a better life. As Amaya grew older, she realized that even with a full-time job, purchasing a house and affording a monthly mortgage on her own would be out of reach.

But in June of 2023, that seemingly elusive dream of homeownership came true for the 35-year-old single mother of two children, 16-year-old daughter Veronica and eight-year-old son Allan. How did it happen? Malkis Amaya quite literally won a lottery.

Amaya applied to enter a lottery being held by Old Colony Habitat for Humanity. The nonprofit organization, whose mission is to provide affordable housing for families in need, was in the process of building a 1,440 square foot, three bedroom, two bathroom Colonial-style home on Pike Avenue in Attleboro, Massachusetts, with generous support from community volunteers and donors including BayCoast Bank.

Amaya, who had to meet certain financial criteria to enter the lottery, was stunned when her name came up as the winner of the drawing.

“I have happiness in my heart because this is a dream come true,” said Amaya.

“One day, when I get old, I am going to be happy knowing that (my kids) will have a place…they will always have this house. I want it to be a part of their story.”

The beautiful new home has everything the Amaya family dreamed of – a large backyard, a bedroom for each of the children, and a primary bedroom for Malkis, along with plenty of space for their dog, Yogy. The home comes with a key benefit – an interest-free loan, making monthly payments much more affordable.

Old Colony Habitat for Humanity CEO Kimberly Thomas says it is so rewarding to see local families have a home they would otherwise have not been able to afford, without Habitat’s help.

“We serve 24 cities and towns, changing people’s lives for the better,” said Thomas. “We are grateful to our community partners like BayCoast Bank. They understand our mission of a hand up, not a hand out. The bank had volunteers on site during the build, offering their

help and they did such a fantastic job. It was great to see the camaraderie –everyone doing such great work for the Amaya family,” adds Thomas.

“I would like to thank everyone for giving of your time to help build this home,” said Amaya. “I know (the volunteers and builders) will all have blessings in their lives because of their kindness.”

Before moving to Pike Avenue, the Amaya family lived in a cramped two-bedroom apartment in North Attleboro, Massachusetts. “Rent-wise, it is getting more and more expensive. I was trying to save up money somehow because I really

We are grateful

KIMBERLY THOMAS Chief Executive Officer Old Colony Habitat for Humanity

KIMBERLY THOMAS Chief Executive Officer Old Colony Habitat for Humanity

to our community partners like BayCoast Bank. They understand our mission of a hand up, not a hand out. The bank had volunteers on site during the build, offering their help and they did such a fantastic job.

desperately wanted a house for my kids so they could have memories,” said Amaya.

Malkis’ daughter Veronica says their previous living quarters were uncomfortable, as the high schooler had to share a room with her elementary-school aged brother.

“It was very hard to concentrate and do my homework,” said Veronica Amaya.

“It’s so great to have this new space, to be able to focus on my work and not feel so stressed.”

“We have a fresh start,” adds Veronica. “We’ve been through a lot and it’s so good to finally see my mom happy.”

Habitat’s ReStore Helps Fund Community Projects

Did you know Old Colony Habitat offers a unique shopping experience for our entire community? Visit their ReStore location at 9 Washington Street in Attleboro, Massachusetts. ReStore is a retail store that accepts donations of new and gently used furniture, appliances, building materials and more. The public is invited to browse all the treasures that are generously donated. From dining room tables, solid wood desks, kitchen cabinets, sofas, lamps and chairs, you never know what you’ll find. Inventory changes frequently as new items come in daily. All proceeds benefit Old Colony Habitat for Humanity, including their home builds and other critical projects that help provide affordable housing for our neighbors in need. Want to shop, donate, or volunteer? Check out ReStore in person or online at oldcolonyhabitat.org today!

Learn more here!

Building a Sense of Community

Swansea YMCA Makes a Splash!

BayCoast Bank proudly supported the Stoico/FIRSTFED YMCA’s newest attraction – a 2,400 square foot splash pad in Swansea, Massachusetts. Unveiled at an August ribbon-cutting ceremony, the splash pad, sponsored by BayCoast Bank, promises family fun with a giant slide and multiple spray zones. Scott Munro, Swansea YMCA board member, envisions this as just the beginning, aiming to build a worldclass natatorium with continued community backing.

Nestled on 36 scenic acres, the Stoico/FIRSTFED YMCA offers diverse indoor and outdoor activities.

BayCoast Bank’s President and CEO, Nicholas M. Christ, expressed joy in contributing to the splash pad’s development, providing local kids with hours of fun.

To support this community endeavor, visit ymcasouthcoast.org

Community Night Out

In a vibrant show of community support, members of the BayCoast family came out to celebrate Bristol’s 2nd Annual Community Night Out. Co-sponsoring the event, we engaged in the popular Cops vs. Kids Basketball Free Throw Contest, adding to the festive atmosphere coordinated by Sergeant Ricardo Mourato and Patrolman Brandon Correia.

Highlighting our commitment to Bristol, BayCoast Bank previously donated 15 lock boxes to the Bristol Police Department’s successful Lock Box Program. Sgt. Mourato emphasized the program’s significance in aiding elderly and disabled residents during emergencies. Since its inception in November 2016, the program has installed 120 lock boxes, a testament to community support.

Nicholas M. Christ, President and CEO of BayCoast Bank expressed gratitude for the opportunity to support this crucial safety initiative.

Catching Up

Where Are They Now? >

Sweet Honor

As Lemonade Day’s long-standing “main squeeze” sponsor, BayCoast Bank recognizes its role in helping to inspire young entrepreneurs. Starting at age eight, Brenten Clarke of Fall River, Massachusetts, actively began participating in Lemonade Day South Coast, a program initiated by radio station Fun 107. For the past eight years, Brenten and his family have set up their stand in front of BayCoast Bank’s Robeson Street branch. His lemonade stand, “Lemons From Heaven,” consistently contributes to local charities.

In 2023, he directed all proceeds to South Coast Oncology in honor of his grandmother, who is battling kidney cancer. Upon learning of Brenten’s mission, the bank offered a matching donation to South Coast Oncology, reinforcing our commitment to the community, proudly supporting Brenten’s fundraising efforts.

Maria’s Portuguese Table Gains National Exposure

three nominations for the Taste Awards, which are considered scholarship recipients, Ashley Del Rio, Raylyn Gant, Marissa Burgos, Selena Boleates, and Janae Medeiros, who graduated

Nursing with key support from BayCoast Bank. We are proud

BayCoast Scholars Graduate, Move on to UMass

The BayCoast Scholars celebrated their graduation in 2023 at Bristol Community College. The innovative program, in partnership with Bristol and UMass Dartmouth, provides free college degrees and career experience to local high school students from underserved backgrounds. Congratulations!

Financial Education

13 credit for life schools

Hands-On Learning for the Real World

1,239 credit for life students

10 industry tours

84 financial workshops

BayCoast Bank is proud to highlight the remarkable contributions of Assistant Vice President, Financial Literacy Education Officer Lucia Rebelo, with the full support of our entire BayCoast family of volunteers. Throughout the past year, Rebelo has played a pivotal role in spreading awareness of financial empowerment across our community. Her dedication to providing valuable resources and educational programs has not only benefited individuals but has also played a crucial role in the bank’s growth and commitment to community development.

Credit for Life

Local high schoolers simulate life as a 25-yearold adult by being assigned a career, salary, and credit score. They are then challenged to manage a budget for necessities such as food, housing, clothing, and healthcare. The goal of this immersive program is to help students learn financial skills for the real world.

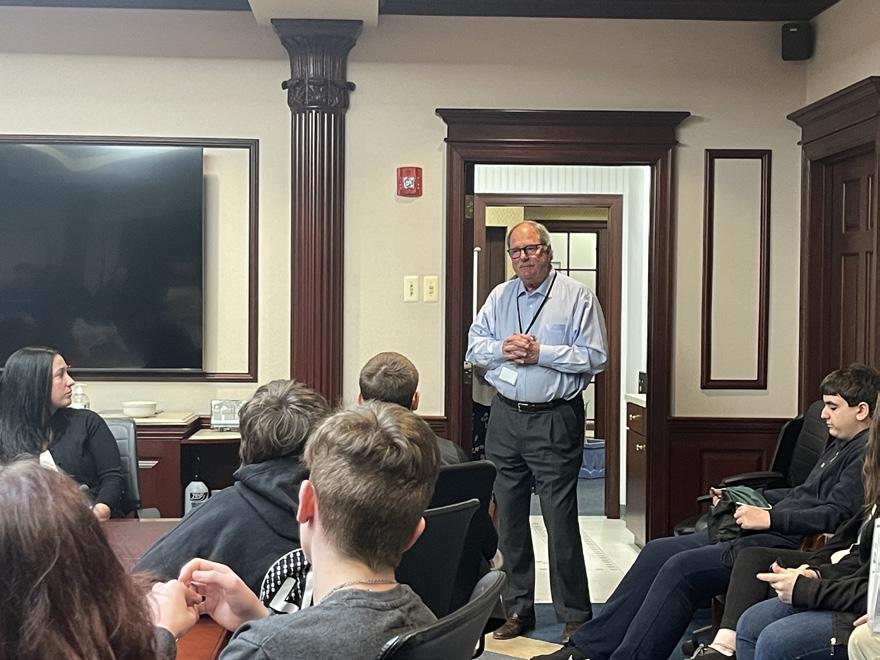

Industry Tours

We partner with local schools to arrange behind-the-scenes tours of BayCoast corporate offices, giving students insight into how the bank and its affiliates serve the financial needs of our community. Attendees engage with staff to explore career opportunities and learn about daily operations in multiple departments, such as Information Technology, Human Resources, Marketing, and more.

School Banking

This program is designed to give students in Pre-K through Grade 8 the opportunity to learn the basics of saving money. Bank representatives visit participating schools on a regularly scheduled “Banking Day” and help students open their accounts, fill out deposit slips, and accept deposits. Students learn first-hand how to save money and how banks work while having the opportunity to speak with bank staff.

Financial Education Workshops

BayCoast takes pride in hosting Financial Education workshops using the FDIC’s Money Smart program, catering to learners of all ages to improve their money management skills and foster positive banking experiences. Our workshops cover topics such as cybersecurity and are held at various venues like libraries and retirement homes.

The financial literacy programs we provide offer money management skills that will last a lifetime.

LUCIA REBELO

Financial Literacy Education Officer

BayCoast Bank

Building Confident Leaders through Financial Literacy

Giving the members of our community the power to build a secure financial foundation is the goal of BayCoast Bank’s financial literacy programs. We believe the stronger our financial capabilities, such as tracking personal spending, budgeting, and controlling debt, the more confident we can become, making more informed financial decisions that can lead to a fulfilling life with greater stability.

BayCoast Bank is proud to work with YouthBuild Preparatory Academy (YBPA) in Providence, Rhode Island, which provides an educational experience focused on engaging young men of color, preparing them to be confident, civically engaged leaders. The Academy promotes social and emotional wellness for each student, providing academic support while serving the unique needs of students from urban core communities.

The Academy’s model is comprised of academic coursework and applied learning that creates community leaders who successfully transition into meaningful post-secondary careers and educational programs. The collaboration between BayCoast Bank and the Academy ensures that young people stay engaged in learning, while having access to critical

educational opportunities, which include financial literacy.

The financial literacy class at YBPA, which is supported by BayCoast Bank, gives students the knowledge and skills they need for responsible money management. The Money Smart curriculum provided by BayCoast, consists of 12 modules with a variety of topics to help young adults confidently control their finances, including: budgeting, understanding and effectively using credit, managing debt, and more. At the completion of the Money Smart program, students participate in a Credit for Life Fair, where they put their financial knowledge into practice, to see if they can manage a budget and survive the monetary challenges that await them in the real world.

“The financial literacy programs we provide YBPA offer money management skills that will last a lifetime,” said Lucia Rebelo, AVP, Financial Literacy Education Officer for BayCoast Bank. “We are so proud to partner with YouthBuild and offer these interactive programs that are essential to building strong financial habits and allowing students to be proactive about their financial futures.”

Students say they are energized by the Credit For Life program, which for many, has inspired an entrepreneurial spirit. “My experience doing the Credit for Life Fair was very insightful. I learned how to budget and how to be smart with my money,” said student Dayanara Felix M. “I definitely would recommend this to anyone.”

“The YouthBuild Preparatory Academy hopes to continue its partnership with BayCoast Bank as we strive for two objectives – dropout prevention and recovery – through the school’s unique liberatory education and the Bank’s engaging financial literacy programs,” said Venus Wolo, Director of Workforce Development and Partnerships. “We are grateful for BayCoast’s support.”

Community Banking

BayCoast Bank’s Community Banking division demonstrated adaptability and resilience in 2023, undergoing significant transformations by shifting from traditional tube drive-ups to ITM drivethrus, prioritizing customer convenience. Additionally, the bank’s commitment to financial security is evident through full insurance coverage provided by the Federal Deposit Insurance Corporations (FDIC) and Depositors Insurance Fund (DIF), as well as internal growth initiatives, emphasizing promotions from within and leadership opportunities for employees.

ITM Evolution

Enhancing the Customer Experience

In response to the evolving landscape of banking technology and changing customer preferences, BayCoast Bank’s Community Banking division initiated a transformative endeavor to modernize our drive-thru services. The strategic move involved the replacement of traditional tube drive-ups with state-of-the-art Interactive Teller Machines (ITMs). This technological evolution not only aligns with contemporary banking trends but also positions BayCoast as a forward-thinking institution dedicated to meeting the dynamic needs of our community.

The successful implementation of ITM drivethrus in several key locations underscores our commitment to enhancing the overall customer experience. ITMs offer a seamless blend of digital convenience and personalized service, allowing customers to interact with a live personal banker through video chat, ensuring a more engaging and efficient transaction process. As we navigate

this technological shift, our commitment remains steadfast, with plans to complete the ITM drivethru transition across all relevant branches in the upcoming year or two.

ITM service extends beyond the branch’s normal business hours, providing accessibility to customers on weekdays from 7am to 7pm and Saturdays from 8am to 2pm. When the ITM is not available, the machine seamlessly transitions to function as a regular ATM.

The transition to ITM drive-thrus represents more than just a technological upgrade – it symbolizes our responsiveness to the evolving expectations of our customers. By embracing advanced technology, we are not merely adapting to change but proactively shaping the future of our banking services. This dedication fosters a more connected and streamlined experience for all those we serve, reinforcing BayCoast Bank’s position as a leader in innovative and customer-centric banking solutions.

We are dedicated to building a resilient workforce by instilling a culture of continuous learning.

MATTHEW PAYETTE

SVP, Chief Community Banking OfficerBayCoast Bank

Financial Security

100% Deposit Insurance

At BayCoast Bank, financial safety is our legacy. With over 170 years of trust, we guarantee that 100% of deposits are fully insured through both the FDIC and DIF. Established in 1851, BayCoast’s commitment to ensuring a secure banking environment for our customers is as strong as ever.

The FDIC covers deposits up to $250,000 per depositor, backed by the full faith and credit of the United States government. The DIF, unique to Massachusetts statechartered community banks, further insures all deposits above the FDIC limit, providing complete coverage for all deposits at BayCoast Bank. Customers can rest easy knowing that, with our combined FDIC and DIF deposit insurance, their financial well-being is protected.

Investing in Leadership Development

Nurturing Talent and Promoting from Within

BayCoast Bank takes immense pride in promoting from within and investing in leadership development. This strategy has been critical for cultivating a thriving and dynamic organizational culture within the Community Banking division.

Leadership roles demand a unique skill set beyond technical expertise, encompassing emotional intelligence, strategic thinking, and effective communication. By investing and developing leaders from within the organization, we expand resilience and adaptability.

The recent promotions of Jana Dubova, Alize Gomes, Ana Teixeira, and Jerome Wills exemplify BayCoast Bank’s commitment to nurturing its internal talent pool. These individuals have ascended from within the ranks, showcasing confidence in our employees.

The Community Banking division has initiated extensive leadership programming in collaboration with training partners, establishing a robust succession plan and emphasizing BayCoast’s commitment to providing employees with the tools and opportunities needed for professional growth.

“We are dedicated to building a resilient workforce by instilling a culture of continuous learning,” says Matthew Payette, SVP, Chief Community Banking Officer. “It’s not just a strategic choice. It’s our commitment to nurturing a workplace culture marked by growth and improvement.”

As BayCoast forges ahead with a strategic focus on internal employee development, we are shaping our current workforce and securing a prosperous future for the bank and our dedicated employees. The commitment to nurturing talent from within is a powerful driver for sustained success, creating an environment where individuals can thrive, contribute significantly, and leave an enduring legacy within the organization.

Tech This Out!

Advancements in Automation and Security Lead to Improved Efficiencies

Easy Money Transfers

Need a fast, smart, and secure solution to send cash? In 2023, BayCoast Bank introduced Easy Money Transfers, a new Person-to-Person (P2P) payment system that offers faster, more advanced options conveniently integrated within our secure online and mobile banking software. With just an email address or mobile number, users can send money in real time without the need for a separate app and choose how payments are delivered. Proactive security measures such as one-time passwords and real-time fraud detection ensure a seamless and secure experience.

Contactless Debit Cards

In a move to enhance convenience and promote security for our customers, BayCoast Bank introduced contactless debit cards in 2023. These innovative cards revolutionize the way transactions are conducted, allowing users to make payments simply by tapping their card on a payment terminal without the hassle of inserting their card into a machine. With contactless technology, customers can enjoy a seamless and expedited payment experience, reducing transaction time and eliminating the risk of card skimming. By prioritizing security and ease of use, our contactless debit cards embody our commitment to delivering modern and efficient banking solutions for our valued customers.

Efficiency at Scale

Efficiency remains paramount in our pursuit of excellence. In 2023 alone, streamlined workflows developed by the Information Systems department allowed the organization to successfully close 83,000 tickets, saving an average of 10 minutes per case. This translates to a staggering 13,800 hours saved, a testament to our unwavering commitment to convenience for our customers and our steadfast resolve to remain lean and efficient amidst our continued growth.

Automation for Empowerment

The integration of automation has not only optimized our operational processes but has also enabled us to redirect our focus toward delivering personalized services to our customers. By automating mundane tasks and enhancing access to information across the organization, we have fostered a deeper understanding of our customers’ needs while upholding the highest standards of security and data privacy.

Fighting Fraud Knowledge is Power

Fraudulent Calls, Texts, & Emails

2023 saw a rise in reports of fraudulent phone calls, texts, and emails appearing to come from the bank. They were really coming from scammers, claiming to detect fraud on customer accounts, requesting verification of personal information by directing customers to fake websites, oftentimes containing variations of our URLs. Customers are cautioned to never share sensitive information such as online banking credentials, account numbers, debit card details, their CVV or PINs. BayCoast Bank will never send links asking customers to log in or ask customers to confirm personal information.

Fraud Detection Technology

In 2023, BayCoast focused on streamlining processes and fortifying security measures, deploying a new fraud solution that has enabled us to proactively detect and manage fraudulent activities, a task previously undertaken manually. Enhancements in the charge-off process and the implementation of a commercial audit tracking solution have further bolstered operational resilience.

Look Out for Skimmers

Fraudsters are getting smarter. That’s why it is crucial to remain vigilant and pay attention to skimmers, deceptive devices commonly installed on ATMs, gas pumps, and other unattended point-of-sale devices. Although many ATMs, including those at BayCoast, have implemented anti-skimming mechanisms, the public is still susceptible to the various methods employed by fraudsters. Criminals take advantage of busy periods to capture unsuspecting consumers, so stay alert and report any suspicious activity or tampering observed on devices to ensure the protection of personal and financial data.

Commercial Lending

Connecting to Our Community

A Strategic Approach

2023 was a period of controlled growth for BayCoast Bank’s Commercial Lending division. Faced with the challenges of rising capital costs and increased interest rates, our strategic decision to manage the balance sheet became imperative for preserving liquidity and strength. Despite these hurdles, the division remained accommodating to its customers.

Moving forward, the Commercial Lending division maintains an optimistic outlook, focusing on nurturing existing relationships, deepening connections, and adapting strategies for continued resilience and support to customers and the community.

Introducing the Small Business Lending Unit

BayCoast was pleased to announce the establishment of a new Small Business Lending Unit. Led by Stephanie Melo Terra, this unit is dedicated to assisting small businesses in navigating the complexities of the banking industry. By focusing on existing relationships and providing support, BayCoast aims to contribute to the success of our small business community.

CARL TABER EVP, Chief Lending Officer BayCoast Bank

Relationships keep us deeply connected to our community, foster trust, and ensure that we build a future, together.

$499,476 total amount given $ 42 total number of loans

Opening Doors for First-Time Homebuyers

BayCoast Mortgage Offers Down Payment Assistance (DPA) Program

Owning property can be a great way to invest in your future, giving you a sense of pride, security, and accomplishment. After all, buying a home is considered an important part of the American Dream. Unfortunately, the state of our postpandemic economy has provided a sobering reality check. With today’s uncertain fiscal climate, combined with changing interest rates and low inventory in the local real estate market, many individuals and families are making the difficult decision to put homeownership on hold.

But BayCoast Mortgage, a leading lender wholly owned by BayCoast Bank, is helping to change that. In an effort to help make homeownership more affordable in our community, BayCoast Mortgage made a welcome move to help eligible borrowers pursue their goal of purchasing a home with the return of its highly successful Down Payment Assistance (DPA) program, which offers down payment help to qualifying borrowers in Massachusetts and Rhode Island who are purchasing a home within BayCoast Bank’s Community Reinvestment Act (CRA) Assessment Area. A total of $500,000 was earmarked for the DPA program, which launched on November 6, 2023. Program funds in the amount of $200,000 will be provided

as grants. The remaining $300,000 will be accessible to eligible borrowers as an interestfree loan, with repayment starting in the sixth year. To qualify, borrowers must meet income and purchase limits. Applicants will be notified of eligibility and grant/loan amount at the time of mortgage approval. Any funds will be available to qualified buyers at the time of closing. The DPA program will conclude once allocated funds are depleted.

“At BayCoast Mortgage, we recognize the financial challenges many first-time homebuyers face,” said Nicholas L. Christ, President and CEO of BayCoast Mortgage. “Saving for a down payment on a home can take years. Our DPA program is the key to opening more doors, especially for those at low-to-moderate income levels, who may have thought homeownership simply wasn’t possible.”

The return of BayCoast Mortgage’s DPA program follows a highly successful round one, which

Our Down Payment Assistance Program is the key to opening more doors to those who may have thought homeownership simply wasn’t possible.

NICHOLAS L. CHRIST President & CEO BayCoast Mortgage

NICHOLAS L. CHRIST President & CEO BayCoast Mortgage

debuted in August of 2022, ultimately helping more than three dozen first-time homebuyers in Massachusetts and Rhode Island purchase their dream homes. Round one was initiated to help meet the financial needs of the local community, ensuring that homeownership is within reach for more individuals and families in Southern New England.

The initial DPA program had impressive results. A total of 42 borrowers – 21 in Massachusetts and 21 in Rhode Island – realized their goal of homeownership through the DPA program. Breaking down the statistics by county, the most significant number of DPA grants was in Bristol County, MA, with 20, which included the cities and towns of Fall River, New Bedford, Taunton, Fairhaven, Acushnet, and South Dartmouth. There was one additional DPA grant in Lakeville, MA, located in Plymouth County, MA.

Providence County was at the top of the list for Rhode Island, with 12 DPA grants. Overall in RI, qualified borrowers in the cities and towns of Providence, North Providence, East Providence, Riverside, Tiverton, Newport, Cranston, Warwick, West Warwick, Cumberland, Pawtucket, Richmond, and South Kingstown, RI, were helped by the program.

“The Down Payment Assistance program offered by BayCoast Mortgage is life changing,” said Evelyn Ranone, First Vice President, CRA Officer for BayCoast Bank. “Buying your first home can be a very emotional experience. It is gratifying to know we are truly helping members of our community achieve the American Dream by making homeownership more affordable.”

BayCoast’s Down Payment Assistance Program Helps New Parents Afford Dream Home

Mario Botelho always dreamed of owning a home, but with rising prices and fierce competition in the South Coast real estate market, finding the perfect place to settle down with his growing family, while saving up for a down payment, were big hurdles.

“My home search was horrible, just horrible. It was taking a very long time to find something and I honestly thought I wouldn’t find a home,” said Botelho. As a new father to a one-year-old, finding a home was a top priority for Botelho and his girlfriend Veronica. When they finally did locate a property to purchase in Tiverton, Rhode Island, Botelho says he was preparing to finance it through another mortgage company.

“I was going with another lender at the time,” said Botelho. “The deal was almost done, but then a friend reminded me that Tim was in the mortgage business, so I gave him a call.”

Tim Long, Vice President and Senior Loan Officer for BayCoast Mortgage, and Botelho knew each other as kids, growing up in Fall River, Massachusetts. Tim suggested Botelho look into BayCoast’s highly successful DPA program, which was established to help qualifying buyers in the community afford their first home.

“Mario’s income didn’t fit the other lender’s down payment assistance requirements, but for BayCoast’s in-house, custom DPA program, Mario fit the criteria perfectly,” adds Long. “He and his girlfriend were initially in disbelief, but we made it happen for them. BayCoast saved the day!”

“The DPA grant has made an unbelievable difference,” said Botelho.

“Tim was amazing and the entire experience with BayCoast was great. We are extremely happy.”

Becoming BayCoast

“Leaning In” to a Reputation of Excellence

What’s in a name?

You may recall that famous line written by William Shakespeare. If you ask Patrick Long, President and CEO of BayCoast Insurance what’s in a name, you’ll probably get a thoughtfully crafted, highly descriptive answer.

After all, it’s been on his mind for quite some time.

The insurance company’s name change tops the list of achievements in 2023. After being known as Partners Insurance Group since 2010, Partners, one of the South Coast’s leading independent insurance agencies and a wholly owned subsidiary of BayCoast Bank, became BayCoast Insurance.

For Long, that name change was a long-time coming.

“For more than a decade, the BayCoast name has grown to become one of the area’s most recognizable brands. As BayCoast continues to thrive, so too has our insurance agency. With our aligned mission, culture, vision and values, changing our name to BayCoast Insurance simply made sense,” said Long.

“To me, it’s more than just a name change. We are leaning in to our collaboration with BayCoast and our affiliate partners.”

While Long is excited about the new name, he says it is important to remember the agencies that helped build our success.

“The agencies and families that preceded what is now BayCoast Insurance represented generational relationships built on trust and performance. We are proud of

those who came before us and the exceptional level of professionalism they provided to our community,” says Long. “We take the responsibility of maintaining those relationships very seriously.”

BayCoast Insurance has experienced exciting growth with the recent additions of two Massachusetts insurance agencies, Hadley Insurit Group (HIG) of Fall River, in December of 2022, and E.P. Tremblay and Sons Insurance Agency, Inc., of Somerset, in May of 2023. Both HIG and Tremblay Insurance were duly recognized for industry excellence and customer satisfaction.

Despite the challenging economic environment in 2023, those acquisitions, along with the dedication demonstrated by BayCoast Insurance’s knowledgeable team members, added to the company’s opportunity for growth. The numbers tell the story.

“Our total commissions increased 60% from 2022 to 2023, and while we have seen growth in both our personal and commercial lines of business, a look at trends over the past ten years shows significant revenue allocation on the commercial side,” notes Long. “Our sales velocity and overall retention rate percentages are exceptional. A conscious focus on organic commission growth, service enhancement, and calculated retention techniques over the last four years have also shaped favorable returns,” he adds.

In a year where insurance costs were up, how does Long account for the success the agency has experienced in 2023?

With our aligned mission, culture, vision and values, changing our name to BayCoast Insurance simply made sense. We are leaning in to our collaboration with BayCoast and our affiliate partners.

PATRICK D. LONG President & CEO BayCoast Insurance

PATRICK D. LONG President & CEO BayCoast Insurance

“As a team, we’ve done an excellent job building and maintaining a supportive culture predicated on performance and accountability. We’ve streamlined business processes to make different facets of our operation more efficient while maintaining our commitment to the exceptional customer experience. Through collaboration with our Solutions Center, we were able to place more of a focus on providing consultative guidance to our clients. While price is important, having the opportunity to spend time with the customer and fully explain their coverage options was very important.”

Adds Long, “When it comes to having a conversation with a potential client, we want that chance to earn their business. Our consultative advice is reassurance that we are here to help.”

A Strong Finish for Plimoth

Assets Under Administration In Millions

Economists were forecasting it. Many were bracing for it. But despite widespread expectations, a recession never happened in 2023.

What did happen, was an unexpected upswing in equity markets, giving Plimoth Investment Advisors (PIA) a welcome lift, surpassing net income projections by 20% for the year. “We had a much stronger 2023 than anticipated,” said Steven Russo, President and CEO of Plimoth Investment Advisors. “A Strong market recovery during the year and steady account growth combined to help us close 2023 on a positive note.”

PIA relied on a number of key strategies to remain strong amidst the challenging and unpredictable economy. At the top of that list? Building relationships and educating our community.

“We know how important it is to build relationships within our community and here at Plimoth Investment Advisors, we want to be a trusted resource for our clients and community neighbors.

Giving people the tools they need to understand their finances is critical, especially when it comes to investing for retirement. We are here to help.”

Adds Russo, “When we provide information, we empower them to make critical financial decisions that are important to their unique life situations. Over the past year, we offered many educational opportunities, including our Mid-Year Economic Breakfast and a virtual Social Security seminar, both of which were very well-attended. Because of the positive feedback we have received, we are planning to expand our educational initiatives in 2024 by hosting a seminar on the topic of Medicare. Medicare and Social Security are the two big government benefits programs that adults who are approaching retirement age want and need to better understand.”

PIA’s Social Security seminar was run by a consultant who previously worked for the Social Security Administration, offering valuable insights.

“He explained how these benefits work, when you can file, as well as the impacts of filing early for payments or delaying,” notes Russo. “He also addressed the topic of spousal benefits and other special benefits under the program, making this a very comprehensive seminar covering the basics of what adults approaching retirement age should understand when it comes to Social Security benefits.”

Looking ahead, educating our community will continue to be a big push in 2024. “We’re already lining up programs for next year, with topics including Medicare, investing, the basics of trusts, estate planning and more. At the end of the day, it’s all about giving people the information they need to make the most informed decisions possible.”

Back to the Basics

How Old-Fashioned Communication is Driving Business

While we may be living in a progressive new world, sometimes, doing things the old-fashioned way has its advantages. Just ask the staff at Priority Funding. While technology may have its place in our daily lives, we are reminded that it should not necessarily replace our old ways of communicating. It’s hard to gauge a person’s emotions or even intent, when you’re just sending messages online and not seeing someone face-to-face.

Christopher Schofield, President and CEO of Priority Funding knows this all too well. At a time when interest rate volatility dominated the headlines in 2023, most lenders were trying to figure out how to overcome market challenges and persevere.

The answer for Priority Funding was to get back to the basics.

“We went on the offensive,” said Schofield. “We knew it would be a tough year, so we said we’re going to have more contact with our sources than ever before. We’re going to drive business by getting in front of them –having meetings and seeing people face-to-face. I feel like it’s an oldfashioned approach, but it works.

We stayed out in front of our customers. There’s no question that being there, being present, was one of the keys to our success.”

Another critical way Priority Funding dealt with the challenging economy and the anticipated slowdown in loan volume? The team embraced BayCoast Bank’s Strategic Planning Initiative.

“We got creative and were able to streamline efficiencies. The effort has paid off,” notes Schofield.

“We reallocated resources where they were needed most,” adds Matt Strand, Executive Vice President, Chief Operating Officer. “It was all hands on deck, and our team did a phenomenal job.”

The proof is in the numbers.

“2023 was a very successful year for Priority Funding,” said Schofield. “We came in at 91% of our projected net income goal. I am very proud of how we operated in the market, especially with the challenges we had, but our entire team came together. It was a fantastic effort throughout our organization.”

TEAMWORK MORTGAGE

Priority Funding experienced a key milestone in 2023, with expansion into Indiana and Idaho. Their affiliate, Teamwork Mortgage, added three states to its lending footprint – Idaho, Oregon and Washington. At Teamwork, there was a change at the helm, with the retirement of one of the previous owners. Cody Engelbrecht was promoted and has taken over Teamwork’s Mesa, Arizona office. He now serves as Assistant Vice President, Branch Manager. “Cody is great. He’s an extremely hardworking individual and very well-liked by his team,” said Strand. “He also has great balance – he’s very intelligent and has a good sense of humor.”

Another big move for Priority Funding in 2023, was quite literally a move to a larger office, located at 287 Turnpike Road #285 in Westborough, Massachusetts. “This was a really big change for us,” said Strand. “We have a great new space, which allows for better collaboration. It’s worked out very well for us.”

$4.2M net annual income

1,429 total units funded

By

2,376 cra hours

3,363 non-cra hours

5,739 total hours volunteered

Mortgage Market Share

Rankings By City/Town dartmouth, ma rehoboth, ma #2 acushnet, ma berkley, ma dighton, ma little compton, ri somerset, ma swansea, ma westport, ma

2023 Housing Assistance Programs

2023 Total Loans by Assessment Area

BayCoast Community

Trustees, Corporators, & Officers

NARRAGANSETT FINANCIAL CORPORATION TRUSTEES

Maria L. Aguiar, CPAˆ

Nicholas M. Christ* President & Chief Executive Officer

Gail M. Fortes

Kenneth D. Furtadoˆ

Richard K. Gunther*

Chairman

Paul M. Joncasˆ

David N. Kelley II* Clerk

Steven W. Kenyon, CPA*

Alternate Clerk

Ronald J. Lowenstein* Vice President

Eric B. Mack, Esq.

Mary Louise Nunes, CPAˆ

Christopher J. Rezendes

Lawrence R. Walsh*

Treasurer

HONORARY TRUSTEES

John Friar II

Donald F. LeSage

CORPORATORS

Samuel K. Ackah

Susan E. Adamowski

Maria L. Aguiar, CPA

Michael Amaral

Denis J. Auclair

Christopher P. Audet

Bobby Bailey

Anthony M. Baird

F. Nelson Blount

Robert F. Bogan

Robert A. Bogle, Jr.

Stephen H. Boothman

Zelma A. Braga

Kerry Britland

Ivan Brito

Peter C. Bullard, Esq.

William G. Camara, Esq.

Nicholas M. Christ

James W. Clarkin, Esq.

George A. Collias

Amanda DeGrace

Robert A. Delaleu

Yolanda Dennis

Richard P. Desjardins, Esq.

Dawn M. Doraz

John F. Duclos

Leah Ehrenhaus

Constance M. Everson

Shayna Fel

Barbara Ann Fenton

John Ferreira

Louis P. Filippelli

Gail M. Fortes

John Friar II

Kenneth D. Furtado

Cheryl A. Gesner

Nancy J. Goulart

Rontell C. Grant

Nicole R. Gray, CPA

Richard K. Gunther

Bruce N. Hague, CPA, Esq.

Erin B. Harrington

William G. Heaney

Mark Hellendrung

Raymond C. Holland, Jr., Esq.

Thomas C. Hoye Jr.

Susan Jenkinson

Dr. Christopher S. Joncas

Paul M. Joncas

Stephen R. Karam, CLU, ChFC, REBC

James H. Kay

Ann Elizabeth Keane, AIA

David N. Kelley II

Steven W. Kenyon, CPA

Heather Ketcham

Kevin R. Kiley, MSCM, CDFM

Elizabeth Kinnane

John P. Kinnane

Pamela R. Kuechler

R. Christian Lafrance

Arlyne Laurence

Stuart A. Lawrence

Brian Lecomte

Donald F. LeSage

Mitchell E. LeSage

Elaine R. Lima

Ronald J. Lowenstein, Esq.

Julia Westgate Lown

Eric B. Mack, Esq.

Mary-Louise Mancini

Lynne Mastera

Richard A. Mateus

Meg Mayo-Brown

Daniel M. McDonald, Esq.

Colette L. McKeon

Bonnie Davis-Mendes

Davis Jayson Mendes

Catherine M. Messier, CPA

Rhonda Mitchell

Eugene A. Monteiro

Edward S. Myles

Carol A. Nagle

C. Allen Norman III

Mary Louise Nunes, CPA

Joanne E. O’Day

George Oliveira

James V. Palumbo

Melissa K. Panchley

Margaret Patricio

Susan R. Pimentel

Pierre A. Plante

Alan E. Pontes

E. Jeffrey Pontiff

Denise M. Porché

Charles E. Reed, Esq.

William M. Reis

Christopher J. Rezendes

John P. Riley

Elizabeth A. Rivera

Tony Rivera

Bruce A. Rose, EdD

Cynthia A. Rose

James P. Sabra

Mary L. Sahady, CPA

Winthrop Sanford

Harlan Shabshelowitz

Peter N. Silva

Arthur Silvia, Jr.

Dr. Philip T. Silvia, Jr.

June A. Smith, Esq.

Kimberly J. Smith

Dr. Robin A. Smith

Bernadette M. Souza

Darlene A. Spencer

Nancy J. Stanton, Esq.

Lynne Marie Sullivan

Elizabeth R. Traynor

Mary Treseler

Omari L. Walker

Lawrence R. Walsh

Elizabeth P. Wiley

Lawrence T. Wilson, Jr.

Richard Wolberg

Melissa Wordell

Allison Yates-Berg

Matthew M. Zenni

BAYCOAST BANK DIRECTORS

Maria L. Aguiar, CPAˆ

Nicholas M. Christ*

President & Chief Executive Officer

Gail M. Fortes

Kenneth D. Furtadoˆ

Richard K. Gunther* Chairman

Paul M. Joncasˆ

David N. Kelley II* Clerk

Steven W. Kenyon, CPA* Alternate Clerk

Ronald J. Lowenstein* Vice President

Eric B. Mack, Esq.

Mary Louise Nunes, CPAˆ

Christopher J. Rezendes

Lawrence R. Walsh* Treasurer

HONORARY DIRECTORS

John Friar II

Donald F. LeSage

SENIOR MANAGEMENT

Nicholas M. Christ

President & Chief Executive Officer

Daniel DeCosta

Executive Vice President, Chief Information Officer

Marie A. Pellegrino

Executive Vice President, Chief Financial Officer & Treasurer

Steven A. Russo

Executive Vice President

Carl W. Taber

Executive Vice President, Chief Lending Officer

James F. Wallace

Executive Vice President, Chief Operating Officer

Robert H. Bergdoll, Jr.

Senior Vice President, Chief Marketing Officer

Scott P. Lopes

Senior Vice President, Chief Human Resources and Talent Officer

John P. McMahon

Senior Vice President, Community Engagement

Matthew J. Payette

Senior Vice President, Chief Community Banking Officer

Gary J. Vierra

Senior Vice President, Chief Risk Officer

SENIOR VICE PRESIDENTS

Ann M. Auger

June D. Goguen

David S. Herzfeld

Paul A. Leveillee

Betty-Ann Mullins

Nancy L. Silva

FIRST VICE PRESIDENTS

Kevin M. Braga

Kevin J. Briggs

Casey N. Brouthers

Melissa J. Byers

John F. Clark

Connie J. Dagwan

Nancy S. Fernandes

Paula A. Freitas

Kristyn M. Glennon

David A. Hutchinson

Helena L. Moronta

Evelyn T. Ranone

Sandra M. Resendes

Wayne A. Swenson

VICE PRESIDENTS

Stephen C. Baker

Richard A. Banks

Susan L. Bosley

Edward Branco

Kelly Carreiras

James G. Clarkin

Tracie J. Corcoran

Jana Dubova

Elizabeth P. Ferreira

Matthew D. Flanagan

Kerri A. Gomes

John J. Gonet

Christopher R. Haley

Nadim F. Kassir

Matthew D. Kerr

Michael J. Letendre

Scott L. Martin

Kathleen M. Medeiros

Jay M. Moniz

Jared A. Mota

Michael O’Leary

Michael E. Paiva

Gregg J. Pontes

Michelle Rivera

Cheryl A. Roberts Nogueira

Linda Rodriguez

Diana M. Taxiera

Stephanie Melo Terra

Carlos A. Viana

Elizabeth A. Voss

Stephanie Oster Wilmarth

ASSISTANT VICE PRESIDENTS

Sean H. Bettencourt

Mitchell R. Brouillard

Sandra M. Cadorette

Monique L. Campeau

Rui J. Campos

Rebecca L. Caron

Robin T. David

Kevin E. Fernandes

Teddi L. Ferreira

Michelle Gancarski

Kerrie L. Henderson

Rebekah R. Holland

Dalila C. Laberge

Kara M. Marley

Suzette C. Mello

Gina B. Palmer

Emma A. Pontes

Lucia Rebelo

Christy L. Rego

Tyler J. Rocha

Ashley F. Silva

Jill W. White

ASSISTANT TREASURERS

Patricia Andrade

Robyn R. Andrade

Joe M. Costa

Sonia T. Couto

Nicholas J. DeSena

Olga Fernandes

Alize G. Gomes

Amy M. Hernandez

Xenia M. Ledoux

Sandra Letendre

Claudia M. Medeiros

Michael Medeiros

Andrew R. Murphy

Helen Pereira

Cidalia M. Silva

Maria H. Siravo

Diane M. Tavares

Ana S. Teixeira

Jerome B. Wills

OFFICERS

Jordan A. Abat

Brian M. Akeke

Kadi Alexander

Sally Almeida

Nicholas A. Andrade

Stephanie M. Barbosa

Samantha A. Bramelus

Kelly A. Cabral

Jessica R. Carvalho

Lorna L. Couto

Monica C. Creador

Richard C. DeAlmeida

Kevin Flateau

Timothy R. Girard

Ryan M. Gonsalves

Joanne M. Hudon

Alex W. Lapointe

Filomena F. Lopes

Heather E. Manchester

Jason L. Martin

Ryan E. Matteson

Jamie L. Medeiros

Andrea M. Pereira

Kaitelyn A. Ploude

Eric J. Santos

BAYCOAST FINANCIAL SERVICES, LLC

BOARD OF MANAGERS

Nicholas M. Christ

Richard K. Gunther

David N. Kelley II

Steven W. Kenyon, CPA

Ronald J. Lowenstein

Lawrence R. Walsh

PRESIDENT & CHIEF

EXECUTIVE OFFICER

James F. Wallace

FIRST VICE PRESIDENT

Paul M. Cloutier

VICE PRESIDENT

Nathan J. Rego

TREASURER

Marie A. Pellegrino

CLERK

Diana M. Taxiera

BAYCOAST MORTGAGE COMPANY, LLC

SOLE MEMBER BayCoast Bank

PRESIDENT & CHIEF EXECUTIVE OFFICER

Nicholas L. Christ

SENIOR VICE PRESIDENTS

Daniel J. Briand

Peter J. Curtin

Neil W. Jackson

Shawn L. Rioux

FIRST VICE PRESIDENTS

Daniel S. Long

VICE PRESIDENTS

Stephan A. Cabral

Robert C. Cinquegrana

Rico A. Conforti

Paul K. Faggioli

Heather M. Francis

Sandra Gouveia

Tammy L. King

Daniel P. Kirschner

Timothy R. Long

Barbara A. Rood

Donna A. Sinclair

Michael L. Taveira

Simon Theberge

Marc G. Walz

ASSISTANT VICE PRESIDENTS

Maria G. Andrade

Michael J. Borkowski

Adam Connell

Sonia DaCosta

Kevin M. Fitzpatrick

James H. Rafuse

David N. Viglucci

Nicole Yankee

OFFICERS

Caitlyn M. Andrutis

LOAN OFFICERS

Jerry M. Capone

Debra J. Lambert

Steven N. Yokell

TREASURER

Marie A. Pellegrino

CLERK

Diana M. Taxiera

BAYCOAST INSURANCE, LLC

BOARD OF MANAGERS

Maria L. Aguiar, CPA

Nicholas M. Christ

Gail M. Fortes

Richard K. Gunther

Lawrence T. Wilson, Jr.

PRESIDENT & CHIEF EXECUTIVE OFFICER

Patrick D. Long

EXECUTIVE VICE PRESIDENT

Lori A. Chaput

VICE PRESIDENTS

Kristine H. Audette

Paul C. Burke

Kristine L. Gomez

Christopher M. Hadley

Bernard J. McDonald

Michelle McDonald

Jocelyn M. Oliveira

Ann Marie Pacheco

Devin M. Stein

ASSISTANT VICE PRESIDENT

Thomas R. LePage Jr.

Eileen A. Manchester

TREASURER

Marie A. Pellegrino

CLERK

Diana M. Taxiera

PLIMOTH INVESTMENT ADVISORS

CHAIRMAN OF THE BOARD OF MANAGERS

Nicholas M. Christ

REPRESENTATIVES TO BOARD OF MANAGERS

Maria L. Aguiar, CPA

Nicholas M. Christ

Richard K. Gunther

Steven W. Kenyon, CPA

George Oliveira

Steven A. Russo

Lawrence R. Walsh

PRESIDENT & CHIEF EXECUTIVE OFFICER

Steven A. Russo

SENIOR VICE PRESIDENTS

Edward J. Misiolek

Teresa A. G. Prue

Louis E. Sousa

Gary J. Vierra

FIRST VICE PRESIDENT

Mark J. Gendreau

VICE PRESIDENTS

Jeffrey G. Carter

Nicole C. Dagle

Debra T. Maltais

Kristyn M. Glennon

Thomas B. Miller

Peter J. Morris

Carol A. Simmons

Alyce Vallee

David T. Weston

ASSISTANT VICE PRESIDENTS

Danielle L. Chiappinelli

Patrick M. Lynch

TREASURER

Marie A. Pellegrino

CLERK

James F. Wallace

PRIORITY FUNDING, LLC

SOLE MEMBER BayCoast Bank

PRESIDENT & CHIEF

EXECUTIVE OFFICER

Christopher S. Schofield

EXECUTIVE VICE PRESIDENT

Matthew B. Strand

VICE PRESIDENT

Lisa S. DeSimone

Anthony G. Silcox

SENIOR REGIONAL MORTGAGE

LOAN OFFICERS

Joseph S. Esola

John P. Kelleher

Gary D. Manyak

AVP BRANCH MANAGER

Cody S. Engelbrecht

REGIONAL MORTGAGE

LOAN OFFICERS

Melissa R. Abolofia

Bryan D. Fellows

Brian G. Hines

Robert L. Pettet

OFFICERS

Charles F. Engelbrecht

Mariah B. Snyder

TREASURER

Marie A. Pellegrino

CLERK

Diana M. Taxiera

508-678-7641 baycoast.bank

Member FDIC Member DIF BayCoast Bank NMLS #403238. ®

877-466-2678 baycoastmortgage.com

Rhode Island Licensed Lender. Exempt from licensing in Massachusetts. BayCoast Mortgage NMLS #1082048.

508-747-6596 plimothinvestmentadvisors.com

Investment Products and Services Are Not Bank Guaranteed, Are Not FDIC or DIF Insured, May Lose Value.

508-678-7641 baycoast.bank/bcfs

Investment Products and Services are Offered Through OSAIC, INC. Member FINRA/SIPC.

877-393-5511 priloan.com

Priority Funding NMLS #3318.

I NSU R A NCE ®

508-491-3100 baycoastinsurance.com

Insurance Products and Services Are Not Bank Guaranteed, Are Not FDIC or DIF Insured, May Lose Value.

480-635-1101 teamworkmtg.com

Teamwork Mortgage NMLS #162047.