FORECAST EC NOMIC

FOR 2025 and 2026

AN EXECUTIVE SUMMARY

Prepared By: Loren C. Scott, Professor Emeritus of Economics at LSU President, Loren C. Scott & Associates, Inc.

Presented by the Greater Baton Rouge Business Report in conjunction with the Louisiana Business Symposium

Loyal

to Louisiana businesses. Loyal to Louisiana workers.

From taking on the risks of Louisiana businesses with stable, reliable workers' comp coverage to offering expert guidance on accident prevention for safer Louisiana workplaces, at LWCC loyalty to Louisiana drives everything we do.

is loyal to the future of our home state, because it’s more than just our job to make sure Louisiana thrives. It’s our purpose.

Louisiana Firefighter

SHAPING TOMORROW’S AI STRATEGY

CUTTING-EDGE EDUCATION

Seize the AI Advantage: Equip your team with the latest skills that redefine industry standards. Act now to lead the charge.

STRATEGIC LEADERSHIP

Innovate to Dominate: Embrace visionary leadership that turns disruption into your most powerful tool for success.

GROUNDBREAKING SUCCESS

Accelerate Your Growth: Implement AI-driven strategies that boost your bottom line and propel your business forward. Don’t wait—start winning today.

FORECAST EC NOMIC LOUISIANA

NOTE: This publication contains highlights and excerpts from the 2025-2026 Louisiana Economic Forecast. The complete LEF is available for purchase at lorencscottassociates.com.

MERCI BEAUCOUP

THE PARIS OLYMPICS brought up memories of 18 college hours of French taken back in … well, a long time ago. One of the first phrases you learn is “Merci beaucoup.” No matter the language, it is important to know how to express thanks. There are a lot of people deserving of this French phrase.

We are especially thankful to our 11 sponsors. Without their financial support, there is no forecast. Three of them—Blue Cross Blue Shield of Louisiana, Cleco, and Roy O. Martin—are very generous Platinum Sponsors and the remaining vital eight are our Gold Sponsors—Acadian Companies, BRF, Cyber Innovation Center, Entergy, HomeBank, the Port of Baton Rouge, Syrah Resources, and Turner Industries. Many thanks to you all for saying “yes.”

Merci beaucoup came immediately to mind when I reflected on all the phone calls answered and the tedious data gathering at individual firms by economic developers, staff at ports, and so many others. The staff at Secretary Susan Bourgeois’s Louisiana Department of Economic Development figured critically in this work, and we give a special shout-out to Paige Carter and Ileana Ledet for a lengthy review of announcements across the state. (A non-exhaustive list of persons who gathered data for us is available in the complete report at LorencScottAssociates.com.)

This list does not include those of you at private firms who took our calls at busy times and answered our questions patiently and with trust. Your information added untold value to the forecast. We really appreciate your time and effort.

The appearance of the final product can be traced to the very professional editorial work done by Stacy Gaskin and Mary Jo Neathery. We can always depend on a great visual layout of the front and back covers by master graphic designer Steve Radcliffe.

One can learn the art of thankfulness by watching people. Anyone who knows the owner of the Baton Rouge Business Report knows the guy exudes thankfulness. Owner Julio Melara always does things top-notch, and a classic example is the Top 100 Luncheon where Julio allows us to premier our forecast each year. Merci beaucoup (and gracias), my friend.

Finally, those of you who know us, know that my wife Peggy and I work very much as a team, especially on the LEF. Her vast business knowledge base makes her the perfect person for bouncing off ideas and suggesting improvements. I know I repeat myself, but she is the smartest business person I know.

—Loren C. Scott

Publisher: Julio Melara

EDITORIAL

Chief Content Officer & Executive Editor: Penny Font

Corporate Media Editor: Lisa Tramontana

ADVERTISING

Sales Director: Kelly Lewis

Account Executives: Emma Dubuc, Nancy Bombet Ellis, Meredith LaBorde, Ethan Shipp, Matt Wambles

Digital Operations Manager: Devyn MacDonald

Customer Success Manager: Paul Huval

STUDIO E

Director: Taylor Gast

Creative Director: Timothy Coles

Content Strategist: Emily Hebert

MARKETING

Marketing & Events Coordinator: Mallory Romanowski

ADMINISTRATION

Business Manager: Tiffany Durocher

Business Associate: Kirsten Milano

Receptionist: Cathy Varnado Brown

CREATIVE SERVICES

Director of Creative Services: Amy Vandiver

Art Director: Hoa Vu

Senior Graphic Designers: Melinda Gonzalez Galjour, Emily Witt

Graphic Designers: Ellie Gray, Sidney Rosso

AUDIENCE DEVELOPMENT

Audience Development Director and Digital Manager: James Hume

Audience Development Coordinator: Ivana Oubre

Audience Development Associate: Catherine Albano

A publication of Melara Enterprises, LLC

Chairman: Julio Melara

Executive Assistant: Brooke Motto

Vice President-Sales: Elizabeth McCollister Hebert

Chief Content Officer: Penny Font

Chief Digital Officer: Erin Pou

Chief Operating Officer: Guy Barone

Chairman Emeritus: Rolfe H. McCollister Jr.

LOUISIANA BUSINESS SYMPOSIUM

Special thanks to our sponsors!

LWCC IS A private, mutual workers’ compensation insurance company committed to helping Louisiana thrive. Our stable, reliable insurance coverage is available to Louisiana businesses large and small, regardless of industry classification. Together with our agent partners, we are proud to support over 18,000 policyholders in creating safety cultures and practices to reduce workplace accidents.

As a mutual insurance company, LWCC’s policyholders are members, meaning that they are both protected from loss and able to share in the company’s financial success through our dividend program. LWCC’s dividend program is one of the most consistent in the industry, and has returned $1.4 billion to policyholders

AT MERCEDES-BENZ of Baton Rouge, we’re excited to say that inventory is back to prepandemic levels. We thought this day would never come, but here we are. The best part about this is that you have the luxury of choice when deciding to do business with our store. Not only do we have something for everyone, but we also have an additional 5 Mercedes-Benz stores in our group to ensure you get the exact vehicle to meet your family’s desires, and the lineup has never been better. Our most popular models, the GLC, GLE, and GLS SUV’s are selling well with over 70 available on the ground. Baton Rouge consumers are in high demand of luxury SUVs and we have the supply to match. MercedesBenz of Baton Rouge has the most offerings from the smallest crossover in the GLA-Class to the prestigious G-Wagon, which will be offered with an all-electric powertrain later this year. A few in between are our top sellers. Like the mid-size GLC and GLE classes. Both winning IIHS Top Safety Pick awards and being offered with a plug-in hybrid for the best of both worlds. Families needing the most room enjoy the 3-row GLS-Class with captain’s chairs. The coupe and sedan lineup is also offering many new options. For the first time ever, we have launched the all-new CLE coupe and cabriolet. This model replaces both the C and E-Class coupes and convertibles into one sleek and sporty ride. The C, E, and S-Class sedans offer performance, comfort, and luxury in 3 different sizes. Or if performance is your niche, check

since 2003, enabling them to invest in their businesses and their employees. This funding to Louisiana policyholders directly supports Louisiana’s economy, and LWCC is proud to play a role in helping them and our state thrive.

LWCC’s mutual structure also means that we take a relationship-first approach with our stakeholders, and make decisions that will benefit our policyholders, their workers, and our home state long into the future. LWCC is Louisiana Loyal. Always.

KRISTIN W. WALL President & Chief Executive Officer LWCC

out all of the amazing AMG vehicles that have blistering speed, handling and braking! Like I said, something for everyone, and with the great interest rates, lease notes, and cash incentives, the choice is more attractive and affordable than it has been in the last 4 years.

We hope you consider stopping in at Mercedes-Benz of Baton Rouge to see what we have to offer. After winning our 11th prestigious Best of the Best award and becoming the largest MB luxury retailer in the state of Louisiana, our team is inspired to show you why great things keep happening here. Our culture empowers our employees to take care of clients and give them the best experience possible. Many of you know someone who works here due to our impeccable history with tenure. Our involvement in the Baton Rouge community has kept us focused on making this a better place to live with your support. When choosing to do business with a local company, please consider how much they give back to your local charities and nonprofits. It’s rare you can go to an event and not see MBOBR as a sponsor or many of our beautiful vehicles at the event. In closing, I would like to thank the Business Report and all the great community leaders out there focusing on the Capital Region’s future success!

NICK PENTAS General Manager/Co-owner Mercedes Benz of

Baton Rouge

LOUISIANA BUSINESS SYMPOSIUM

Special thanks to our sponsors!

AT DISRUPTREADY, we’re proud to call Louisiana home and we’re not just embracing the future— we’re building it. Whether your business is feeling lost in the AI shuffle, unsure of where to start, or you’ve got a solid strategy and need expert execution, we’re your go-to guide. From startups to established giants, we help businesses of all sizes harness the power of AI and emerging tech to drive growth, streamline operations, and leapfrog the competition. Think of us as your tech-savvy, results-driven

partner, cutting through the noise to deliver real, measurable impact. Don’t get left behind. Whether you’re in the “we don’t even know what we don’t know” crowd or you’re ready to take the next big leap, DisruptREADY is here to turn your challenges into opportunities. The future waits for no one—let’s disrupt it together!

HENRY

HAYS CEO

DisruptREADY

HEADQUARTERED IN Baton Rouge, Louisiana, b1BANK was founded in 2006 as a community bank offering boutique service to Louisiana businesses and entrepreneurs. Today, we remain a community-focused bank but with $6.7 billion in assets and a multistate footprint, equipped to provide diverse product sets and meaningful service to our growing network of clients.

b1BANK is dedicated to the communities we serve. Our team assisted clients, employees and communities as they navigated changes in the economic climate, multiple natural disasters and a pandemic (COVID-19) across our footprint. In addition to ongoing financial support for local organizations, our b1COMMUNITY initiative supports employee volunteer efforts by allotting paid volunteer leave to each b1BANK team member to spend time supporting meaningful causes in their community. In 2023, our teams spent over 11,000 hours (1.25 years) providing nonprofit organizations across our footprint with hands-on support.

WE ARE DEEPLY honored to be part of this year’s Louisiana Business Symposium. We sincerely thank you for your unwavering support, which has made WAFB your most watched local news station.

Our dedicated team of journalists strives every day to deliver accurate information that empowers you to make informed decisions for your family, business, and well-being. In a rapidly changing broadcasting environment, we remain committed to ensuring our content is accessible on all platforms, from traditional television to the digital sphere.

Our not-for-profit b1 FOUNDATION supports entrepreneurship, economic development and financial education. The Foundation has mentored over 700 small businesses and conducted training classes to help over 2,900 entrepreneurs start or grow their business. Last year, we opened the Gov. Charles “Buddy” Roemer Small Business Center in Baton Rouge. The space provides free financial education and counseling services as well as rental offices for small businesses and start-ups.

b1BANK is publicly traded, listed on the Nasdaq Global Select Market under the symbol “BFST,” was awarded #1 Best-In-State Bank, Louisiana by Forbes and Statista, and is a multiyear winner of American Banker’s “Best Banks to Work For.”

JUDE MELVILLE

Chief Executive Officer

b1BANK

Our results-driven sales team is equipped with the knowledge and tools to explore new and innovative ways to help your business reach new audiences by integrating these platforms. We recognize that local businesses are the backbone of our community, and we are here to support your success.

JOE SCIORTINO Vice President & General Manager WAFB

LEARN | CONNECT | GROW

All rising professionals, entrepreneurs, executives, and small business owners are invited to join us in taking their leadership up a notch. Business Report’s Executive Leadership Academy is a transformative program that will take your career and your organization to new levels of success.

THE LEADERSHIP ACADEMY WAS A GREAT opportunity for me to learn not only about myself and how I can better myself as a leader, but also to learn from other talented young professionals that represented many different industries in the Baton Rouge area.The instructors were interactive, impactful, and relevant with case studies we discussed in class and thorough with their explanations.”

NYOKI MOKEBA Performance Contractors, Inc.

EACH CLASS HAD PRACTICAL INFORMATION that I could immediately take back to the office and apply. I also enjoyed being surrounded by incredible classmates that led to great discussions and sharing of perspectives. I have many pages of notes that I know I will reference for many years to come.

KATI HODGES, Premier Geotech & Testing

THE EXECUTIVE LEADERSHIP ACADEMY is one of the best things I have done in my career for professional development. The course content was excellent with a ton of practical applications. Being able to network and collaborate with other professionals across industry type was of great value.”

EVAN SCROGGS, Lee & Associates

“Producing the LEF over the past 4 decades involved talking to hundreds of unbelievably cooperative business leaders and economic developers. I get a tangible emotional bump every time I run into one of them while traveling across Louisiana. A wonderful side benefit of the LEF is that it has blessed me with hundreds of new friends. Who wouldn’t want to keep doing this?”

LOREN C. SCOTT

Dr. Loren C. Scott is the president of Loren C. Scott & Associates, Inc., a 43-year-old economic consulting firm that conducts impact studies, policy analyses, and litigation support for several private/public companies and governmental bodies, including BP, Capital One Financial, Entergy, ExxonMobil, JP Morgan Chase, Nucor, Sasol, and Chesapeake Energy. A frequent public speaker, he gives about 50 speeches each year across the country on the state of the economy.

Dr. Scott is an energy specialist on the National Business Economic Issues Council, a group that includes experts who cover international trade, Washington economic policy, retail trade, trucking, steel, chemicals, and more. He has been interviewed on CNBC, MSNBC, and Bloomberg TV, in addition to several local TV stations, and his work has been cited in publications such as The Wall Street Journal, Forbes, The Los Angeles Times, The New York Times, USA Today, Moscow Times, and The Financial Times.

His career began in 1969 at Louisiana State University where he rose through the ranks from assistant professor to the prestigious Freeport McMoran Endowed Chair of Economics and the Director of the Division of Economic Development and Forecasting. From 1983 to 1996, he was chairman of the LSU Economics Department and is presently Professor Emeritus at LSU. He has received seven awards for outstanding classroom teaching and has authored numerous peer-reviewed publications.

Louisiana could see a breakthrough in annual employment levels

IT

DEPENDS …

“The greater the uncertainty, the wider the confidence band around the forecast.”

This is a fundamental principal of statistics. In this report, forecasts will be presented for the Louisiana economy, its nine MSAs, and the rural section of Louisiana. The forecasts are repeatedly referred to as “middling,” a term suggesting, “Here is our best shot, but there is a very wide variance in what might actually happen.”

Two major uncertainties cloud our view of the future. The largest is the presidential election. Louisiana is still a very fossil-fuel oriented state. One candidate is very anti-fossil fuels, and the other is very pro. There is a huge gap in their positions. Second, is the national economy in a recession or will the Fed be able to manage

a “soft landing” in its fight against inflation?

Regarding the presidential election, forecasts are presented with the understanding that actual employment will vary significantly around our point forecasts depending on who is elected. This is especially so for all of Louisiana along and below I-10 and the Shreveport-Bossier MSA. It is further assumed the Fed will manage a soft landing, or if a recession occurs, it will be short and shallow.

It is assumed that oil prices— mainly through OPEC management—will hover in the $80-$82 a barrel range, and that natural gas prices will rise from unusually low levels in 2024 to about $3.10 per mmBTU in 2026 due to increased demand from LNG exporters. The price gap between U.S. natural gas and prices in Asia and Europe will continue to

spur a major industrial boom in south Louisiana.

With these assumptions in mind, the forecast for each area of the state is as follows:

FORECAST

The New Orleans MSA is only 77% recovered from the COVID shutdown, held back by a lagging convention business and still weak exploration activity in the Gulf. We are projecting 6,200 new jobs in 2025 (+1.1%) and 6,000 jobs in 2026 (+1.1%).

Some $37.1 billion in announced industrial projects await an FID and over $5 billion in public construction projects will drive this growth. The presidential election will be very consequential to this MSA.

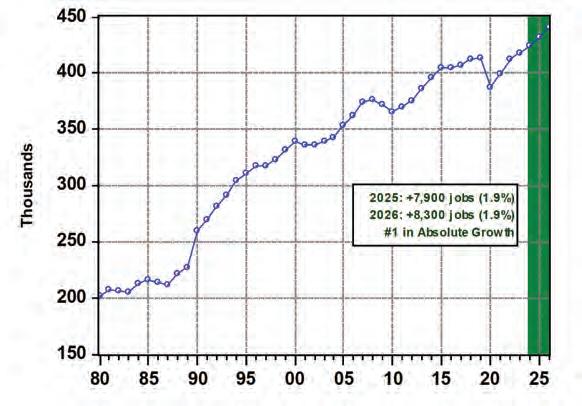

• 100% recovered from COVID since late 2022, some 7,900 jobs in 2025 (+1.9%) and 8,300 new jobs in 2026 (+1.9%) are

projected for the Baton Rouge MSA, where our optimism is based on $18.2 billion in announced projects having a high probability of breaking ground over 2025-26.

Opening of the Amazon fulfillment center could add 1,000 jobs, and two riverboat casinos moving landside appears to be growing the gaming market.

• The Lafayette MSA (100% recovered from COVID shutdown) is projected to add 1,800 jobs in 2025 (+0.9%) and 2,600 new jobs in 2026 (+1.3%). Continuing weak drilling activity in the Gulf has kept this MSA 16,000 jobs below its 2014 peak. SafeSource Direct, First Solar, and good prospects from Lafayette’s other Big 5 companies will boost employment. The presidential election will be very consequential to this very fossil-fuel orientated MSA.

• Steady job growth (after a negative 2024) is projected for the Shreveport-Bossier MSA, with the job count up 2,300 jobs (+1.7%) in 2025 and 2,300 jobs (+1.3%) in 2026. Growth will be spurred by nice employment

gains at Fibrebond, Troubled Muse, and the new Live! Casino. Two large capital projects at the Port of Caddo-Bossier will generate job gains. The area is ripe for a new data center. The future for the Haynesville Shale depends crucially on the presidential election.

• Arrested recovery from four significant natural disasters has caused the Lake Charles MSA to have the poorest recovery from the COVID shutdown (only 50% back) in the state. We are projecting 3,500 new jobs (+3.6%) for 2025 and 4,600 new jobs for 2026 (+4.6%). These optimistic projections depend heavily on at least three proposed LNG projects breaking ground out of the $60.4 billion in projects awaiting an FID. No area of the state will be more impacted by the presidential election than this one.

• Despite the added terrible hit from Hurricane Ida, the Houma MSA is 91% recovered from the COVID shutdown. We are projecting 1,300 new jobs (+1.7%) in 2025 and another 1,300 jobs (+1.5%) in 2026 for this MSA.

The drag of the poor rig count in the Gulf is holding the region back some, but some maintenance/repair/painting work on the growing number of platforms in the Gulf is generating significant new business in the MSA. Ship builders hiring again, a quarter of a billion dollars in projects at Port Fourchon, and the CPRA spending will energize the region over the next two years. The presidential election will be very consequential to this MSA.

• A possibly transformative data center could really boost employment in the Monroe MSA. We are projecting the MSA will add 800 jobs in 2025 (+1%) and 700 jobs in 2026 (+0.9%). Recent trends at ULM and continuing evaporation of Lumen jobs remain a problem for this economy. This economy should be only marginally impacted by the presidential election.

• Potential FIDs from Beaver Lake Renewables, Diamond Vault, and a possible data center are bumping up our numbers for the Alexandria MSA. We are projecting 600 new jobs in 2025

(+1%) and +1,400 jobs (+2.2%) in 2026. As of May 2024, Alexandria is fully recovered from the COVID shutdown.

• We are projecting robust growth for the smallest MSA in the state, with 700 new jobs in 2025 (+1.4%) and 700 new jobs in 2026 (+1.4%) for the Hammond MSA. More jobs among the region’s distribution companies, manufacturers, and North Oaks Heath System will drive this growth. SLU’s impacts will be stabilizing.

• We are forecasting 2,300 jobs in 2025 (+1%) and 2,100 jobs in 2026 (+0.9%) in Louisiana’s 29 rural parishes. Major capital projects underway, and a number awaiting an FID are propelling these forecasts.

• Summing the projections across all nine MSAs and the rural area, we are projecting that the state will add 28,300 jobs in 2025 (+1.4%) and 30,000 jobs in 2026 (+1.5%). If these forecasts are near the mark, in 2026, Louisiana will break through that 2,000,000 annual employment level for the first time in its history.

YOUR PARTNER IN POWERING ECONOMIC DEVELOPMENT

Plug into Powerful Support

Industry electrification and renewable energy impacts require a strategy reset. As companies prioritize a clean energy future, Cleco Power is reinvigorating its economic development strategy and is here to support your corporate goals.

Cleco and its dedicated economic development team are laser-focused on preparedness, making significant investments to offer clean and renewable energy and engaging with local education and talent initiatives to power Louisiana’s present and future.

100

Cornelison

Marketing and Economic Development 405-823-4135 | richard.cornelison@cleco.com

clecodev.com

Source: Loren C. Scott.

EXECUTIVE SUMMARY TABLE

IN THE TOOLBOX TO BRING INFLATION

DOWN, THE

FED

HAS BEEN USING TWO TOOLS: SELLING BONDS TO REDUCE THE MONEY SUPPLY AND RAISING INTEREST RATES.

Ideally, the Fed would like to arrest inflationary pressures without sending the economy into a recession.

The national economy’s impact on Louisiana

Forecasting is always a muddy business with uncertainty attacking from all angles. Every state in the nation is impacted to some extent by the national economy, Louisiana less so than most. In recent years, a looming presidential election could swing a state’s economy hard in one direction or the other.

Louisiana’s heavily fossil-fuel oriented economy will make this election especially consequential. Highly unpredictable oil prices lend particular uncertainty to exploration in the Gulf of Mexico, to which many Louisiana industries are directly connected. Abundant natural gas supplies— available at prices much lower than in other countries—can spur multi-billion dollar industrial projects if regulations and speedy permitting allow. Sometimes, out of the blue, comes a booming industry with projects costing in the billions and many very high-wage jobs that can

transform an area of the state. That is very much a possibility for Louisiana over the next two years.

NATIONAL ECONOMY: THREE ALARMS

You are relaxing in bed. Suddenly, the security alarm begins to blare. Then the fire alarm goes off. Almost immediately, the smoke alarm starts to emit its high whistle. Holy cow, something bad is happening! This is exactly what was happening this time last year (2023). Three major alarms were going off, and economists were almost universal in predicting something bad was about to happen—specifically a recession.

The loudest of the alarms was the movement of the Leading Economic Indicators. The LEI tends to start dropping roughly six months before the economy enters a recession, and it begins to rise about six months before

the economy starts rising out of the trough. Note in Figure 1 that the LEI (the blue line) has been falling since early 2022. Since 1985, every time the LEI fell significantly, a blond bar appeared in Figure 1. The blond bars represent recessions. The red line represents the coincident economic indicators, always going down right after the LEI went down—until the alarm went off this time. The red line is still persistently moving upward while the LEI is moving solidly downward.

While the LEI alarm was going off, so was the inverted yield curve alarm as seen in Figure 2 of the complete LEF. Every time the rate on the one-year Treasury exceeded that of the 10-year Treasury, that is, every time the blue line dropped below zero, a blond bar (a recession) appeared. The yield curve has now been inverted for over two years, yet no blond bar has materialized.

Figure 1: Leading Index vs. Coincident Index 2016=100

Source: Wells Fargo Economics Group

Finally, the third alarm shrilly screaming has been the ISM Manufacturing Composite Index, an indicator of the health of the country’s manufacturing sector.

FED PULLING AT RECESSION DOOR

Expectations for a recession were further spurred by the contracting efforts of the Federal Reserve System (the Fed) in its efforts to stem inflation. In June 2022, a news release by the Bureau of Labor Statistics indicated the consumer price index (CPI) was rising at a rate of 9.1%. The Fed has a mandate to keep inflation in the 2% range. To bring inflation down, the Fed has been using two tools: (1) selling bonds (open market operations) to reduce the money supply and (2) raising interest rates.

Both of these policy moves have a contractionary effect on the economy. For example, in 2021-IV the conventional mortgage rate was 3.2%. By 2024-II that rate had risen to 6.9%. For a median existing home in the U.S, the monthly mortgage payment had jumped from $980 to over $2,300. The results were predictable. Home sales

in the U.S. declined from 6.12 million in 2021 to 4.09 million in 2023—a 33% decline. Home sales declined not only because that monthly payment had soared by 135%, but also because buyers’ expectations were that rates would soon fall considerably once the Fed’s actions tamed inflation. Why make this big purchase now when rates may be 2-3 percentage points lower in another year or so.

Housing starts in the U.S. also experienced a decline, falling from 1,628,000 in May 2022 to

1,353,000 in June 2024—a 17% decline. On top of this, businesses in the nation had the same type thoughts as home buyers. Higher rates drove up the cost of a planned new facility or expansion of an existing one. Why not defer those expenditures until rates are much lower? This did occur, but to a much milder extent than the impact on home sales and housing starts. Private domestic investment spending fell from $812.3 billion in 2022II to $776.8 billion (-4.4%) in 2024-II.

For a median existing home in the U.S., the monthly mortgage payment jumped from approximately $980 to over $2,300.

HOME SALES HOME SALES

IN THE U.S. DECLINED FROM 6.12 MILLION IN 2021 TO 4.09 MILLION IN 2023, A 33% DECLINE. BUYERS’ EXPECTATIONS WERE THAT THE RATES WOULD SOON FALL CONSIDERABLY ONCE THE FED’S ACTIONS TAMED INFLATION.

A SOFT LANDING?

Ideally, the Fed would like to arrest inflationary pressures without sending the economy into a recession. That is, the Fed would much prefer a soft landing to a recession. A year ago, most forecasters felt a mild recession was inevitable, especially given the signals coming from the housing and business investment sectors.

In the last 12 months those tables have turned, and now most forecasters believe much more in a soft landing—low growth rates in real gross domestic product (RGDP), but not negative ones.

This is the story told in the RGDP numbers in Table 1. This table contains two quarters of actual data on RGDP growth rates (the first two quarters of 2024), followed by quarterly projections (in green) from two forecasting units. The middle column shows the forecasts by the Wells Fargo

Group. The last column is the average (consensus) of the projections of 27 different forecasting units (including Wells Fargo).

Attention is first called to the latest actual RGDP growth rate for 2024-II, a very healthy 2.8%. What made this growth rate so surprising was that it occurred with the three alarms going off and the weak performance in the housing and business investment sectors.

Recall that RGDP is composed of four different types of spending—personal consumption expenditures, government spending, business investment spending, and net foreign spending. The largest component by far, comprising two-thirds of the total, is personal consumption expenditures (PCE). This component has been unexpectedly resilient. Of the 2.8% increase in 2024-II, PCE contributed 1.6

percentage points. It is our belief that consumers were able to maintain their spending behavior despite the higher interest rates and reductions in the money supply because they were still able to draw down on the enormous excess savings created by COVID stimulus monies and enhanced child tax credits at the time.

Scanning down the projections in Table 1 from 2024-II to 2025IV, one can see that forecasters believe that this excess savings buttress is about exhausted, and PCE will not be able to carry its power over into the next few quarters. However, there are no red numbers in Table 1. These forecasters see no recession in the near term. Expectations are for a soft landing. A soft landing is obviously much better for the Louisiana economy than a recession, no matter how mild.

ARE WE OUT OF THE WOODS?

The green numbers in Table 1 should be greeted with no small amount of skepticism. The more uncertain the environment, the

less reliable the forecast. The fact that 2024 is a presidential election year throws an enormous amount of uncertainty into the future. Indeed, there are two other significant, but very reliable,

Table 1: RGDP Forecasts

alarms out there that should make one uneasy to say the least. The first of these is the behavior of discretionary spending by consumers, and the second is the unemployment rate.

GREAT EXPECTATIONS EXPECTATIONS

ARE FOR A SOFT LANDING, AND THAT IS MUCH BETTER FOR THE LOUISIANA ECONOMY THAN A RECESSION, NO MATTER HOW MILD.

*U.S. Economic Outlook, August 7, 2024. **Consensus Forecast-USA, July 8, 2024.

Expanding and developing research, entrepreneurship and high-growth businesses in Northwest Louisiana.

Thank you, Blue Cross and Blue Shield of Louisiana employees, for putting Lousiana first.

Because of your hard work in the community, our company has been recognized as one of the 50 most community-minded companies in the country by former President George H.W. Bush’s Points of Light organization. This is the sixth year in a row you’ve won this honor!

Last year, Louisiana Blue employees volunteered more than 45,000 hours to neighbors and communities in Louisiana.

Powering the possibilities in Louisiana

We’re more than a utility company. We’re partnering with state and local agencies to help create jobs and attract capital investment in the communities that we serve. We’ve invested millions of dollars to expand our infrastructure, develop shovel-ready sites, support workforce development programs, and promote Louisiana as the best place to grow your business. All while maintaining the most reliable and affordable energy in the country. No wonder Site Selection magazine has named us a Top Economic Development Utility 16 years running. Learn how Entergy can power your efforts at goentergy.com/LA

The demand for oil is highly inelastic, that is, the demand curve for oil is very steep. So just a small change in supply causes a large change in price.

DEMAND FOR OIL A MIXED BAG

When examining the demand for oil, one encounters two forces pulling in opposite directions. Pulling oil prices down would be the much slower growth in the U.S. economy—the soft landing described previously. Closely connected to that is the fact that if the U.S. economy slows down, inevitably the global economy does as well.

There is another factor, however, pushing the demand for oil upward—increased fuel use by the 99,800 ocean-going ships plying global waters. Two problems are pushing this demand upward. First, unusual drought conditions on the lakes feeding the water into the Panama Canal have limited ships going through the Canal from 40 down to 25 a day. Ships that do not want to set in a 15-day hold outside of the Canal are basically faced with three choices. One is to go around the tip of South America via Cape Horn to get to Asia. This adds some 21 travel days to the trip.

An alternative is to go eastward through the Mediterranean through the Suez Canal into the Indian Ocean to Asia. This adds 10 travel days versus the Panama Canal, but it involves the second serious problem. Houthis rebels have been firing on and boarding ships going through the Suez Canal. So, ships have taken a third option: Transversing the tip of Africa via the Cape of Good Hope to Asia. This adds 20 travel days to a Panama Canal alternative.

All of these alternatives involve more travel days and more fuel consumed. Allocated across 99,800 heavy fuel consuming vessels requires a lot of oil.

THE SUPPLY SIDE WATCH THOSE SAUDIS

As alluded to earlier, it is the supply side that provides the most grief to oil price forecasters. At this writing, the Saudis have led OPEC in a supply cut of two million barrels per day in order to keep oil prices in the $80 a barrel range. This cut was recently extended through the end

of 2024. One might reasonably ask why would such a small cut in world consumption of 100 million barrels per day have such an outsized impact on oil prices? The reason is that the demand for oil is highly inelastic, that is, the demand curve for oil is very steep. That means just a small change in supply causes a large change in price.

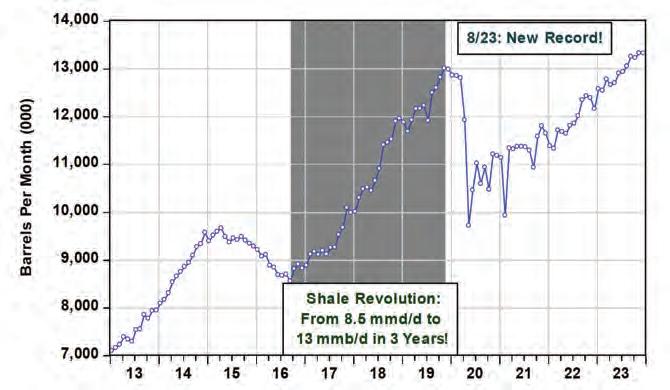

One reason this OPEC supply cut was necessary was what was happening to U.S. oil production as seen in Figure 7 (next page). Notice what was happening to oil production in the U.S. from 2014 through mid-2016. Oil production was dropping due to the age of our fields and we were becoming more and more dependent on the Middle East for our petroleum. The technological revolution known as fracking, dramatically changed U.S. fortunes. The nation’s oil production increased from 8.5 mmb/d to over 13 mmb/d in just three years. By late 2019 the U.S. was the largest oil producer in the world and was a net oil exporter.

HIGH DEMAND ANOTHER FACTOR IS PUSHING THE DEMAND FOR OIL UPWARD— INCREASED FUEL USE BY THE 99,800 OCEANGOING SHIPS PLYING GLOBAL WATERS.

YOUR LOCAL VIDEO PRODUCTION COMPANY

Launch Media is an award-winning visual communication and video production company. We create dynamic visual experiences and content, helping our clients achieve success with moving images. We’re ready to work with you from concept to distribution to create impactful visuals for your business.

VIDEO PRODUCTION | POST PRODUCTION

PROJECTION MAPPING | MOTION GRAPHICS

CREATIVE SERVICES | AUGMENTED REALITY

CONTACT US TODAY AT CONTACTUS@LAUNCHMEDIA.TV

NATURAL GAS PRICES BEHIND AN INDUSTRIAL BOOM

It will surprise some to learn how important natural gas prices are to the immediate future of the Louisiana economy. Billions of dollars in industrial projects are under construction in Louisiana, and even more billions will start construction over the next two years.

NATURAL GAS PRICES LOW, BUT MOVING UP

The LEF includes a chart that traces the price of natural gas at the Henry Hub in Louisiana from 1980-2024 (actual), along with

forecasts for 2025-26. Natural gas prices were unusually low in 2024, averaging $2.25 per million BTU (mmBTU). Two factors contributed to this low figure. First, there was a significant increase in natural gas production in the U.S. Natural gas production in the U.S. comes from two broad venues. On the one hand are the “dry” plays, such as the Haynesville Shale Play in Northwest Louisiana. When drilling takes place in these plays, only natural gas is harvested.

On the other hand, there are the “wet” plays, such as the Permian Basin and the Bakken Play in North Dakota. The focus

of wet plays is to harvest oil, but in the process of harvesting the oil, “associated” natural gas is produced. Note in Figure 7 the rapid rise in oil production in the U.S. That means there was also a commensurate large increase in natural gas production. All that increased supply put downward pressure on natural gas prices.

A second factor contributing to lower natural gas prices was a weak demand for the fuel for heating purposes in winter 2023. An El Nino weather pattern occurred for the first time in four years, causing unseasonably mild temperatures in the northern tier of the U.S.

Source: Loren C. Scott & Associates, Inc.

WEATHER ALERT THE ECONOMIC FORECAST NOTES A WEAK DEMAND FOR FUEL FOR HEATING PURPOSES IN WINTER 2023. AN EL NINO WEATHER PATTERN OCCURRED FOR THE FIRST TIME IN FOUR YEARS, CAUSING UNSEASONABLY MILD TEMPERATURES IN THE NORTHERN TIER OF THE U.S.

LOUISIANA’S EMPLOYMENT

TOOK A SERIOUS BODY BLOW WHEN THE SHUTDOWN OCCURRED, LOSING 285,800 JOBS (-14.3%) VIRTUALLY OVERNIGHT. THE STATE REMAINS ABOUT 25,100 JOBS (-8%) BELOW ITS PRE-COVID EMPLOYMENT LEVEL.

DATA CENTERS:

TRANSFORMATIVE WAVE?

As we go into 2025-26 there is a possible new player in town that could be transformative to areas of the state that desperately need transformation. A sudden, huge increase in demand for data centers has emerged due to the spread of AI and the increased cloud usage.

These are very expensive projects that vary widely in size. Generally, every 100-megawatt center equals about $1 billion in costs, with some scalability as the center gets larger. A 600-megawatt center would cost about $6 billion. Of that total, about $2 billion would be for infrastructure and $4 billion for the equipment in the center. This size facility would employ 300-500 people, 35% of which would be security personnel. The average pay would be a lofty $130,000 annually.

A center takes about 12-14 months to build. The ones being chased by Louisiana at this time would start construction as early as 2025-H2. What are Louisiana’s chances of landing one or more of these projects?

First, data centers are not new entrants to the U.S. market. RBN Energy recently published a blog on this topic and referenced

a study recently done by the Electric Power Research Institute (EPRI). Eighty percent of the data center load is concentrated in only 15 states. What is particularly telling is the absence of any centers in Louisiana. Why would Louisiana have any chance of landing one or more of these centers? The state does bring significant advantages to the table. Louisiana has transmission line capacity and has not exhausted its power capacity, as is the case for many states in the northeast. Power in Louisiana is very reliable since it is largely gas-driven electric power. Certain areas of the state have a lot of open space and access to water.

Louisiana has two important negatives to overcome: (1) heat and humidity, and (2) hurricanes. This eliminates the southern tier of Louisiana for consideration. This still leaves the north central and northern areas of the state viable. The appetite for power may be able to overcome the heat/humidity issue. This could be transformative for a region of Louisiana that has struggled with economic development of late. North Louisianans, keep your fingers crossed!

RECOVERY FROM COVID SHUTDOWN

While not a “driver” for the future of the Louisiana economy, it is important for people to know where the state’s employment stands after the colossal collapse associated with the COVID shutdown in the Spring of 2020. Louisiana’s employment took a serious body blow when the shutdown occurred, losing 285,800 jobs (-14.3%) virtually overnight. Louisiana is perhaps the only state in the country that has not fully recovered those lost jobs. The state remains about 25,100 jobs (-8%) below its pre-COVID employment level.

It is important to note that this shortfall is not being experienced statewide. In the complete LEF, projections for each of the state’s nine MSAs are provided. As it turns out, 5 of the nine MSAs have fully recovered all jobs lost from the shutdown. The primary reason that the state as a whole has fallen short is heavily centered in New Orleans (77% recovered) and Lake Charles (50% recovered), which remain well below the recovery target. Houma (91%) recovered) and Shreveport-Bossier (95% recovered) are very close.

IM PORTANT

Louisiana’s five deep draft ports on the Lower Mississippi River represent “one of the busiest port complexes in the world.”

In a coordinated effort, these five ports have commissioned an independent firm to develop a market analysis and strategic plan to identify new cargo opportunities and expand international trade.

This historic cooperative undertaking will be led by Martin Associates Economic & Transportation Consultants under the direction of the World Trade Center New Orleans.

Cargos in the analysis include containerized cargo, break bulk and project cargo, as well as bulk cargo. Interviews with key maritime stakeholders, the market analysis, and logistics cost analysis will help create a cargo development strategy to help the five ports along the Lower Mississippi River to successfully compete regionally and internationally.

POPULATION GROWTH

THREE OF THE TOP EIGHT FASTEST GROWING PARISHES IN THE STATE, IN TERMS OF POPULATION, OVER 2010-2020 WERE IN THE BATON ROUGE MSA—ASCENSION (+18%), WEST BATON ROUGE (+14.4%) AND LIVINGSTON (+11.4%).

Industrial construction fuels growth in the Capital City

The Baton Rouge MSA is the second largest in the state behind the New Orleans MSA. This MSA contains the largest number of parishes (9) of all the MSAs: East Baton Rouge, West Baton Rouge, Livingston, Ascension, Iberville, St. Helena, Pointe Coupee, East Feliciana, and West Feliciana. Next year the MSA will become even larger when Assumption Parish is added to its makeup.

According to the Bureau of Economic Analysis, in 2020, East Baton Rouge Parish had the highest population in the state at 456,781. Interestingly, three of the top eight fastest growing parishes in the state, in terms of population, over 2010-2020 were in this MSA--Ascension (+18%), West Baton Rouge (+14.4%) and Livingston (+11.4%).

A combination of (1) access to the Mississippi by deep draft

ships, (2) access to plentiful natural gas, and (3) access to salt domes for brine makes this region a haven for the petrochemical industry.

Louisiana is the 6th largest producer of chemicals—especially first-stage bulk chemicals that can be moved via oceangoing ships—and the Baton Rouge MSA is their largest home in Louisiana. Huge national and international firms like BASF, Dow, ExxonMobil, Eastman, Westlake, and others have very large facilities located within this MSA’s boundaries.

Louisiana has an enormous pipeline network in the state, enough miles of pipelines to circle the globe four times. Access to those pipelines and access to the river to move their products helped Baton Rouge land the nation’s fourth largest refinery, ExxonMobil, and across the river a smaller lube plant (ExxonMobil)

and another smaller refinery (Placid).

The combination of the chemical plants and refineries is typically referred to as the petrochemical industry. These are very capital-intensive facilities located largely outdoors. A vast industrial construction industry—the largest in the state—resides within these plants daily to maintain them. In some cases, the number of “resident contractors” working at a plant equals the number of people wearing the petrochemical company’s shirt. Huge contracting firms such as Turner Industries, Performance Contractors, ISC, MMR, and Cajun Contractors make their headquarters in Baton Rouge. Baton Rouge is as far up the Mississippi River as deep-draft ships can go, stymied by the Old River Bridge in north Baton Rouge. Inside this region is the nation’s 8th largest port, the Port

of Greater Baton Rouge. Louis Dreyfus has a large grain elevator at the port, and Drax Biomass runs its wood pellets through the port heading for power plants in Europe.

Government plays an outsized role in this MSA since Baton Rouge is the home of the State Capitol and its vast office complexes. Two state-supported universities are in Baton Rouge, LSU and the historically black college, Southern University. Started up only a few years ago, Baton Rouge Community College is among the more successful of the community colleges in the state. East Feliciana Parish is the home to the large East Louisiana Mental Health System and the Villa Feliciana Medical Complex, which between them employ 1,505 people with an annual budget of $253 million.

COVID SHUTDOWN FAR IN REARVIEW MIRROR

Unlike the New Orleans MSA, the Baton Rouge MSA recovered all the 57,000 jobs lost (-14%) due to the COVID shutdown by July 2022 and has been on an unbroken job path upward ever

Figure 27

Baton Rouge MSA Non-Farm Employment Forecast: 2025-26

since. The post-COVID recovery line path for this MSA is the envy of every other MSA in the state, with the possible exception of Hammond. This fine record was achieved despite the fact that the BLS revised the MSA’s 2023 data and removed about 5,000 non-farm jobs previously thought to exist in that year.

FORECAST FOR 2025-26

We are projecting the Baton Rouge MSA will continue on its strong job growth path for the next two years, adding 7,900 jobs in 2025 and 8,300 jobs in 2026— annual growth rates of 1.9%. These 16,200 new jobs would represent the fastest absolute growth rate of all the MSAs in the state.

HIGH JUMP

A SURVEY BY THE GREATER BATON ROUGE INDUSTRIAL ALLIANCE SUGGESTS THAT THE NUMBER OF SKILLED WORKERS NEEDED IN THE REGION WILL NEARLY TRIPLE IN THE COMING TWO YEARS.

THE LINCHPIN: INDUSTRIAL CONSTRUCTION

The most important driver of the Baton Rouge MSA economy will most assuredly be industrial construction. We have tabulated $10.5 billion in projects under construction and another $18.1 billion in projects awaiting an FID. There are two crucial points about these two bundles. First, unlike the case in the New Orleans MSA, the anti-chemicals NGOs are listened to, but do not carry the same level of influence accorded them in the sister MSA to the south. Second, the largest industrial contractors in the state—Turner Industries, Performance Contractors, MMR, Cajun Contractors, and ISC—are headquartered in Baton Rouge, so the region gets the benefits

not only of the workers at the site, but the “overhead” worker benefits as well. A large demand for skilled industrial craft workers is on its way.

A survey by the Greater Baton Rouge Industrial Alliance suggests the number of skilled workers needed in the region will leap from 17,036 in 2024-I to a peak of 47,208 in 2026-II, a remarkable tripling of skilled labor needs. According to the survey, skilled labor demand will remain above 40,000 through 2026.

This extraordinary jump in skilled labor demand is being driven by the large number of projects in the New Orleans MSA and also by the equally large number of projects in the Baton Rouge MSA. The following is a nonexhaustive

list of projects presently under construction in this MSA:

• In Burnside, work has begun on the $7.0 billion Air Products blue hydrogen Project. Once operational in 2026, the facility will employ 170 people at an average annual wage of $93,000.

A factor that makes this a “blue” hydrogen facility is the fact that it will have a carbon capture and sequestration component.

• In West Baton Rouge, Shintech is continuing with its steady expansions in PVC production lines. The present $1.3 billion expansion will be completed soon, retaining 500 people and adding 30, paying an average of $86,000 annually. Shintech has two smaller projects in progress: (1) a $50 million project focused on logistics, and (2) a $35.5 million

project for additional brine capacity. Once these projects are completed, recent history—and Shintech’s abundant available land for expansion—suggests further announcements will be forthcoming.

• BASF is nearing completion (in 2025) of a $780 million MDI plant in Ascension Parish. The company’s large complex employs about 900 BASF employees and resident contractors, and this project will add 22 jobs to that total. Another group of small expansions will come just around the corner.

• In Iberville Parish, Kindle Energy is constructing a $740 million advanced class, combined-cycle power plant that will use hydrogen for 50% of its fuel. Scheduled for startup in

AMAZON THE JOB GENERATOR

The much-anticipated grand opening of the Amazon Fulfillment Center in Baton Rouge took place August 1, 2024. The $200 million robotic fulfillment center is located at the old Cortana Mall site and is 3.5 million square feet in size—twice the size of the original Cortana Mall. Five hundred new jobs have already been established at the center and another 500 is projected over the next two years.

2025, the plant will employ 20-25 people.

• Shell is about midway through construction of a $121.7 million boost to its catalyst plant in Port Allen. This project will add 17 jobs at the site at an average annual wage of $94,000.

• In Baton Rouge, Honeywell has a $91.4 million expansion underway that will add 30 jobs at its plant.

• CF Industries is spending $75 million on upgrades to its Donaldsonville plant to produce more diesel exhaust fluid and merchant grade nitric acid. Construction should continue through 2025 and result in two more permanent jobs to add to the present workforce of 541.

• Also in Baton Rouge, Albemarle is spending $53 million on equipment and materials upgrades.

• Kinder-Morgan should complete a $50 million

expansion in Geismar in April 2025 that will add nine new cone-roof tanks to store renewable diesel feedstocks. The company’s Geismar River Terminal, which presently employs 400, will add six new jobs.

• By early 2026, WR Grace will complete a $32 million project to streamline its production process and add storage units and loading equipment. At least five smaller (but still important) projects are underway in this region. Two of these are in Livingston Parish. Premier Concrete Products is spending $10 million to add a state-of-the-art precast concrete pipe production unit that will add 33 jobs to its present 90 labor force. Pipe & Steel Industrial Fabricators is undergoing a $4.3 million expansion focusing on equipment and technology upgrades. The project will result in 32 new jobs.

THE BIG PICTURE

See the complete LEF for more details on: global gas prices, road lettings across the state, consumer spending, population changes and much more. Go to Lorencscottassociates.com

In New Roads, Industrial Fabrics is spending $8 million on a new site that manufactures products that reduce erosion of soil and sediment into drainage ditches. The company’s present workforce of 44 will increase by 25 jobs. In West Feliciana Parish, Howell Foundry will more than double its 22-person workforce with a $7.4 million upgrade to its processing unit. Finally, in Port Allen, CORTEC is spending $750,000 on equipment to improve efficiency, adding three jobs.

In addition to these industrial projects, ground was broken in March 2024 on the $148 million Lake Interdisciplinary Science Building on the LSU campus. This 200,000-square-foot, 4-story building is a result of a collaboration between Our Lady of the Lake Health System and LSU to provide an epicenter for academics, research, and industry collaboration across five disciplines: mathematics, physics/ astronomy, geology/geophysics, chemistry, and biological sciences. In addition, there is the $141 million being spent to move the Belle Casino onto land.

This MSA has an even larger bundle of projects that have been announced, but which have yet to issue an FID. We have tabulated $18.1 billion worth of potential projects on this list, six of which are multi-billion-dollar projects.

CASINO-TO-LAND GROWS THE MARKET

This MSA, with its three casinos, is actually the smallest casino market in the state. Texans do not drive past the Lake Charles or Shreveport casinos to come to Baton Rouge, nor do folks from Mississippi drive past the New Orleans market, or Arkansas residents drive past the Shreveport-Bossier casinos. The Baton Rouge casino market is primarily local.

Figure 31 on the next page follows the quarterly gross gaming revenues (GGR) from all three casinos from 2014-I through 2024-II. In FY24, the casinos generated $262.8 million in GGR in this market. The casinos employed 1,333 employees, making the industry one of the significant employers in the area.

LEGISLATIVE CHANGE

An important change took place in this market in the last year. The Louisiana Legislature

made it possible—under certain requirements for a riverboat casino to move its operations onshore. This option was first taken by the Isle of Capri (now Horseshoe) Casino in Lake Charles. In August 2023, Baton Rouge’s Hollywood (now Queen) Casino completed the onshoring process.

Interestingly, this move has so far proven to increase the GGR in the region. The Queen has experienced a major boost in its GGR since moving on land. In the 10 months prior to the move, the Queen’s average monthly GGR was $4.3 million. In the 10 months since moving on land, its GGR has averaged over $7.2 million a month, a stunning 67% increase.

There was some cannibalization of GGR from the other two casinos in the market. The L’Auberge Casino average take dropped about $300,000 (-2%), and the Belle Casino average GGR declined by just over

$400,000 (-9%). However, most of the Queen’s gain came from growing the total market by $2.4 million. These numbers cover the 10 months (not one month’s) of data since Queen’s onshore move, suggesting the growth in the market may be permanent. Which raises the question of what will happen when the second riverboat—the Belle—moves on land? This casino is owned by the same group that owns the Queen. In fact, the Belle will be rebranded with a new “Queen” name once it opens in its new home. Construction has begun on a $141 million move that will involve renovation of all 10 floors of the casino hotel, and moving the gaming space into one-third of the Atrium at Catfish Town. Opening date is scheduled for September 2025. The new casino will be more of a boutique type, smaller than the Queen. It will be interesting to see if this change grows the local gaming market even more.

THE QUEEN’S ONSHORE MOVE RAISES THE QUESTION OF WHAT WILL HAPPEN WHEN THE SECOND RIVERBOAT—THE BELLE—MOVES ON LAND. THIS CASINO IS OWNED BY THE SAME GROUP THAT OWNS THE QUEEN.

HOME STRETCH

WE ARE HOPEFULLY ENTERING THE LAST YEAR AND A HALF OF WORK ON THE COMITE RIVER DIVERSION CANAL, A PROJECT THAT SHOULD DRAMATICALLY REDUCE FLOODING CONDITIONS IN BATON ROUGE.

ROAD LETTINGS AND MORE

The Baton Rouge MSA has done well in securing road lettings from the Legislature for FY24-FY26. The total lettings are $778 million, up from $653.2 million last year (+19%). Among the larger projects are:

• $165 million to continue work on the LA1 to LA415 connector

• $96.5 million for the LA1 Port Allen bridge replacement

• $65.2 million for work on

I-110 from North Street to Plank Road.

The separate $716 million for phase 1 of the widening of I-10 from Washington Street to Essen is underway. We are hopefully entering the last year and a half of work on the $1.4 billion Comite River Diversion Canal, a project that should dramatically reduce flooding conditions in Baton Rouge. Finally, from a public construction standpoint, the CPRA will be injecting millions into the

MSA economy over FY25-FY27. The amounts presently allocated are:

• FY25: $74,107,984

• FY26: $43,120,000

• FY27: $104,530,000

The largest of these expenditures will be on a project to re-introduce the Mississippi River into Lake Maurepas Swamp. In addition to these, Ochsner will be spending $30 million on upgrades at its facilities over our forecast period.

Across all nine MSAs and the rural areas, it’s projected that Louisiana will add 28,300 jobs in 2025 and 30,000 jobs in 2026.

Drew Brees b1BANK Client