39 Surge protection

South Louisiana maintenance turnarounds could max out the labor force when owners pull the trigger this year.

42 The Amazon effect

How the e-commerce tech company is changing customer expectations in the industrial supply chain.

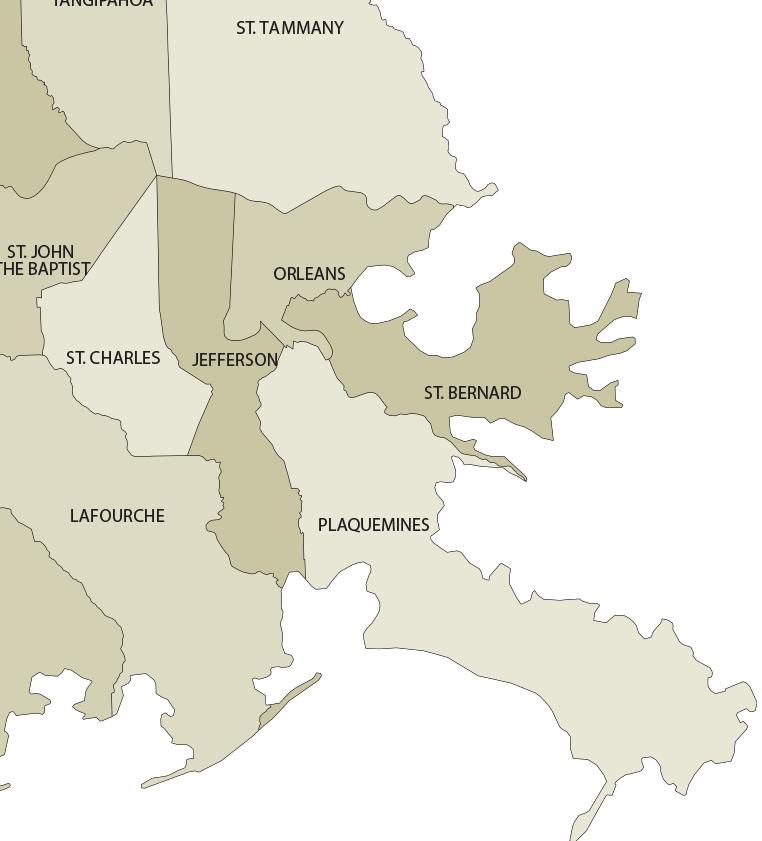

50 The boom at a glance

Our maps of the projects driving industrial growth.

54 The Toughest Challenge

Shell Norco site manager Tammy Little on her leadership epiphany

SPECIAL

26 Executive Outlook

We invited industry and construction leaders to share their organizations’ perspectives on the challenges and opportunities they anticipate in 2023 and the lessons they have learned in the past year.

45 Leaders of Industry

10/12 Industry Report shines a light on regional

Publisher: Julio Melara

EDITORIAL

Chief Content Officer: Penny Font

Editor: Sam Barnes

Contributing Photographers: Cheryl Gerber, Don Kadair, Leroy Tademy

ADVERTISING

Sales Director: Kelly Lewis

Account Executives: Emma Dubuc, Meredith LaBorde, Angie Laporte, Matt Wambles

Advertising Coordinator: Brittany Nieto

Digital Operations Manager: Devyn MacDonald

Customer Success Manager: Paul Huval

STUDIO E

Director: Taylor Gast

Multimedia Strategy Manager: Tim Coles

Corporate Media Editor: Lisa Tramontana

Content Strategist: Emily Hebert

Account Executive: Judith LaDousa

MARKETING

Marketing & Events Coordinator: Taylor Falgout

Marketing & Events Assistant: Hillary Melara

Events: Abby Hamilton

PRODUCTION/DESIGN

Production Manager: Jo Glenny

Art Director: Hoa Vu

Senior Graphic Designers: Melinda Gonzalez Galjour, Emily Witt

Graphic Designer: Ashlee Digel

ADMINISTRATION

Business Manager: Tiffany Durocher

Business Associate: Kirsten Milano

Office Coordinator: Sara Hodge

Receptionist: Cathy Varnado Brown

AUDIENCE DEVELOPMENT

Audience Development Director and Digital Manager: James Hume

Audience Development Coordinator: Ivana Oubre

Audience Development Associate: Catherine Albano

A PUBLICATION OF LOUISIANA BUSINESS INC.

Chairman: Julio Melara

Executive Assistant: Brooke Motto

Vice President-Sales: Elizabeth McCollister Hebert

Chief Content Officer: Penny Font

Chief Digital Officer: Erin Pou

Chief Operating Officer: Guy Barone

Chairman Emeritus: Rolfe H. McCollister Jr.

SUBSCRIPTIONS/ CUSTOMER SERVICE 9029 Jefferson Highway, Suite 300 Baton Rouge, LA 70809 225-928-1700 • FAX 225-928-5019 1012industryreport.com

email: circulation@businessreport.com

Volume 8 - Number 1

Report cannot be responsible for the return of unsolicited material—manuscripts or photographs, with or without the inclusion of a stamped, self-addressed return envelope. Information in this publication is gathered from sources considered to be reliable, but the accuracy and completeness of the information cannot be guaranteed. No information expressed here constitutes a solicitation for the purchase or sale of any securities.

A new infusion of cash will whittle away at infrastructure needs critical to industry. But the list remains lengthy.

It is by no means a new problem. Louisiana’s infrastructure “scorecard” consistently has ranked low for years. But as recent as 2022, the state continued to receive low national marks on its infrastructure—a D+ the last time around—based upon data collected by a team of more than 50 civil engineers who studied 11 major components of the state’s infrastructure for more than 18 months.

At last tally, the state has some 1,634 bridges and more than 3,411 miles of highway in poor condition, and commute times have increased by 9.3% on average since 2011.

That has dire implications for the industrial sector along the 10/12 corridor.

Of course, roads and bridges are just one piece of the infrastructure puzzle. Waterways, ports, rail and power each have their “weak links” in need of attention. Fortunately, progress is being made, with hope coming from the promise of public-private partnerships, new state money and an influx of cash from the $550 billion Infrastructure Investment and Jobs Act. Our cover story in this issue details the highpriority needs for industry, beginning on page 18.

The drumbeat for state regulatory primacy over Class 6 permits for carbon capture and sequestration, or CCS, wells is growing decidedly louder. The reason is simple: There have been no permits issued by the EPA to date for wells in Louisiana.

In January, Gov. John Bel Edwards criticized the federal agency for moving too slowly to allow states to permit and oversee carbon-reduction projects, which has slowed millions of dollars in investments designed to tackle greenhouse gas reduction.

Louisiana’s Department of Nat-

ural Resources feels it can significantly speed up the permitting of CCS projects if allowed to handle the process, and subsequently free up numerous projects with multimillion-dollar price tags.

In October, CF Industries entered into the largest-of-its-kind commercial agreement with ExxonMobil to capture and permanently store up to 2 million metric tons of carbon emissions annually from its manufacturing complex in Donaldsonville. The plant is investing $200 million to build a carbon dehydration and compression unit, which ExxonMobil will then transport and permanently store in secure geologic storage it owns in Vermilion Parish.

To get it there, ExxonMobil signed an agreement with EnLink Midstream to use EnLink’s transportation network. Many of

8,000 industrial workers in the Baton Rouge area alone, largely due to several impending capital projects in the chemicals and renewables sector.

David Helveston, president and CEO of Associated Builders and Contractors’ Pelican Chapter in Baton Rouge, says many of his members are already at full employment, and a presumed influx of work will make it difficult for them to find sufficient qualified workers.

Adding to the problem is a lack of workers at a national scale. The construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor, according to ABC’s national office.

There is a silver lining: The surge will likely benefit the Louisiana economy, meaning the industrial work could help the state ride out any impending national recession. In fact, Scott expects the economy to grow as most states see declines. Get details on page 37.

EnLink’s pipeline are duplicative, which means the company can use its existing network for carbon transport. The actual conversion process is not terribly complicated and will be consistent with how EnLink already operates. We have the story beginning on page 28.

Twin surges in maintenance turnaround activity this spring and fall, combined with a growing number of capital projects about to launch, could put a significant strain on manpower along the 10/12 corridor in 2023 and 2024.

Baton Rouge economist Loren Scott expects a spike of some

It seems like a simple notion. The intention of “change management” is to prepare, equip and support employees for change. But ExxonMobil’s corporate change management officer, Julie Heinz, says it’s a pointless endeavor if you can’t show them that the “future state” will be better than the “current state.”

She insists it doesn’t have to be a confusing or painful process. She guides employees through the rigors of change by providing understanding and support. ExxonMobil is a bit of a leader in the change management space.

As a corporation, they’ve found that change management is a competency that everyone needs to have the resilience and capacity to innovate in an effective manner. Read more about the company’s approach on page 32.

All rising professionals, entrepreneurs, executives, and small business owners are invited to join us in taking their leadership up a notch. Business Report’s Executive Leadership Academy is a transformative program that will take your career and your organization to new levels of success.

Business Report’s Leadership Academy was by far the best training I’ve ever done and the only one I’ve ever left wanting more! The course was well structured, and the guest CEO speakers were very insightful”

BRYAN

The Leadership Academy was an incredible experience. I gained so much knowledge about how to be a great leader, and I was immediately able to apply that knowledge to my career. It allowed me to expand my professional network and to learn from others outside of my field.”

The Leadership Academy allowed me to grow- both personally and professionally- while connecting with a wide array of peers in the Greater Baton Rouge area. Cultivating relationships with these folks from such diverse backgrounds and industries proved to have immense value throughout the program. Highly recommend!”

MYLES LAROUX,

MYLES LAROUX,

LSU and six major Louisiana ports, including the Port of Greater Baton Rouge, plan to work together to develop talent, perform research and promote business development related to port cybersecurity.

The effort counters the ever-present risk of cyberattacks to critical infrastructure while supporting one of LSU President William Tate’s five top research and scholarship priorities for the state’s flagship university. Tate has said he wants to draw on LSU’s early history as a military school to produce “cyber soldiers” to counter digital threats.

Jay Hardman, executive director of the Port of Greater Baton Rouge, has described the potential for cyberattacks as a “constantly evolving threat.” A recent Jones Walker report found that despite 90% of port and terminal respondents reporting preparedness,

74% indicated that their systems or data had been the target of an attempted or successful breach within the past year.

The agreement between LSU and its port partners outlines opportunities for students and faculty to work with the ports to

solve ongoing and emerging cyber challenges. It includes the potential development of cybersecurity testbeds, which are controllable cyber environments for experiments, and joint research to protect port systems as well as broadened collaboration with state and federal security and law enforcement agencies. Primarily, the partnership unites university and port assets to support homegrown cyber talent development for Louisiana.

“Like our students and research expertise, Louisiana’s port system impacts every corner of the state and has national and global reach,” said LSU President William F. Tate IV. “The Scholarship First Agenda elevates domains that meet citizens’ most pressing needs and define Louisiana’s role in the world. These areas: agriculture, biomedicine, coast, defense— including cybersecurity—and energy all converge in Louisiana’s ports.”

Last year, National Security Agency, or NSA, designated LSU as a Center of Academic Excellence in Cyber Operations, or CAE-CO, positioning it as one of the most technical cybersecurity schools in the country.

1. Port Fourchon on the Gulf of Mexico 2. Port of Greater Baton Rouge 3. Port of New Orleans 4. Port of South Louisiana 5. St. Bernard Port LSU President William F. Tate IV met with Louisiana port leaders and key agencies to announce the historic agreement. EDDIE PEREZ, LSU • Louisiana ports carry one-fourth of all waterborne commerce in the United States. • Port Fourchon services nearly 100 percent of the Gulf of Mexico’s deepwater energy production and secures nearly one-sixth of the country’s oil supply.In March, Louisiana-based energy services company Danos finalized the acquisition of Wood’s offshore labor supply Gulf of Mexico operations. This is the Gray-based firm’s fourth acquisition since 2014. Its 2,700 employees serve nearly 175 customers across 21 states and the Gulf of Mexico. Read more about the company’s plans in our interview with Paul Danos on page 15.

In April, Entergy announced that it had signed an agreement with global offshore wind company RWE to jointly evaluate the delivery of offshore wind energy to industrial customers in Texas and Louisiana. RWE and Entergy have agreed to assess key areas to define an optimal route-to-market including: market demand for carbon-free energy for customers of Entergy Louisiana, Entergy New Orleans and Entergy Texas; resource economics; transmission analysis to ensure reliability; economic impacts extending to direct and indirect job creation; and curricula to prepare the workforce of the future.

Issue

BY THE NUMBERS

The amount CF Industries agreed to pay Incitec Pivot Limited to acquire its ammonia production complex in Waggaman. The facility has a capacity of 880,000 tons of ammonia annually.

More than 100 abandoned oil wells, which can leak chemicals and threaten the environmental health of an area, have been plugged in Louisiana in recent months using federal funding, Gov. John Bel Edwards announced. There are more than 4,500 orphaned wells in Louisiana.

THERE’S LITTLE DOUBT that Louisiana is now primarily a natural gas, not oil, producer, according to speakers at the Louisiana Oil & Gas Association’s annual meeting earlier this spring. The proliferation of wells in the Haynesville Shale play, prompted by the growing need for natural gas by LNG export facilities, is the reason.

Speaking at the Lake Charles event, Tom Harris, secretary of the Louisiana Department of Natural Resources, says the Office of Conservation issued 807 drilling permits in 2022, an increase of 44% over 2021. And the number continued to accelerate throughout the year. “This marks the first time since 2014 the state has issued more than 800 permits,” Harris says. “It’s certainly the

most encouraging news I’ve been able to share in some time.”

In 2022, Louisiana produced more than 3.7 trillion cubic feet of natural gas, the highest volume since 1975 and double what was produced six years. Harris says recent global events, such as the Russian invasion of Ukraine, have served as a reminder that oil and gas “remains the lifeblood of the global economy, despite advancements in renewables,” he adds. “There’s nothing out there right now that’s ready to take its place, and that’s lead to an increase in oil and gas exploration here in Louisiana.”

Nick Dell’Osso, president & CEO of Chesapeake Energy Corp. in Oklahoma City, told attendees that the close proximity of Haynesville Shale to

BankPlus is a true community bank. We make all our banking decisions locally, driven by a 100-year mission to put our customers and communities first. From personal checking and mortgages to small business services and commercial lending, we combine the latest technology with individualized service to provide solutions to make your life easier. bankplus.net

“Even though unemployment rates are low in Louisiana and Baton Rouge, there are still workers getting on planes to go to Texas for work. We think there’s an opportunity to bring those workers home.”

an increasing number of LNG export facilities prompted his company to invest heavily in the play. He says Chesapeake is uniquely positioned to meet growing LNG demand in southwest Louisiana. “I couldn’t be more excited about our strategy and future as a company in an industry that is so fundamentally important to the geopolitical and economic landscape of the world,” Dell’Osso says. “We continue to grow our position and deliver at a level at Hayneville that no one could have imagined five or six years ago.”

He predicts that by 2025 a fundamental step change will occur in demand for natural gas. “I expect 6 percent growth in demand for a commodity that historically doesn’t see growth of that magnitude,” he adds. “It’s a huge number.”

DNR’s Harris also briefed attendees on the status of state Carbon Capture & Sequestration initiatives, adding that the growing backlog of permits for Class 6 sequestration wells is hindering investment. Nationally, the EPA has issued only six Class 6 permits in six years’ time, none of which are in Louisiana. “That’s not a time frame where

businesses can make final investment decisions with any confidence,” he adds. “Companies deserve a faster turnaround.”

Harris hopes that DNR will soon be given regulatory primacy, which could help free up the backlog. “We submitted that application in 2021 and we’re still waiting on word from the EPA,” he adds. “I can tell you that it’s definitely high on the governor’s priority list. State agencies will be better able to streamline processes and get permit applications turned around quickly.”

Harris says once that happens Louisiana will likely become a regional leader in CCS given its existing pipeline infrastructure, petrochemicals industry concentration and geological storage locations. “It seems like a custom built opportunity with immediately recognizable benefits,” he adds. “Over the past several years, we’ve seen stepped up interest in the concept of CCS, with companies making real investment decisions toward turning carbon management into reality. Market forces and policies are driving the industrial sector to do something with waste carbon.”

Winning over today’s customers requires salespeople to be BOLDER, HIGHLY INNOVATIVE, and MORE SKILLED than ever before. Business Report’s Selling Academy will sharpen your sales skillset, re-energize you and grow your confidence in new ways. We’ll touch on the latest selling techniques, how to reframe your mindset, and tap into your sales potential to make the most of your personal skillset.

The SELLING ACADEMY will help you:

Develop and maintain the right mindset to flourish in sales

Increase your closing ratio

Give you the tips and skills to overcome objection

Build relationships that lead to more sales

Develop the art of asking effective questions to reveal customer needs … PLUS much more!

Paul Danos took a bit of a winding path to his role as CEO of Danos in Gray, Louisiana. That’s because his father and uncle had created some very specific rules to follow should he or his brothers, representing the third generation, choose to work for the company.

Rule No. 1? “We had to work somewhere else first,” Danos says.

So in the years following his graduation from LSU, he worked for Arthur Andersen in Houston, then later for a pipeline company. While there, he gained some valuable exposure to the energy industry.

After earning his MBA at Stanford University in 2005, he returned to Danos as a project manager in the construction division. “I then had to abide by another rule: I could only hold a job that I was qualified to fill,” he adds. “It couldn’t be some ‘made up’ position.”

He worked his way up from there, serving as executive vice president from 2010 to 2017, then co-CEO over strategic planning, business development and the production operations service line from 2017 to 2020.

Today, Danos leads the vision and strategy development and provides leadership to the other executives, who in turn lead strategy and operational execution.

Apart from work, he serves as the chairman of the National Oceanic Industries Association, and recently served as president and board member of the South Central Industrial Association.

Have you come to appreciate those rules?

I learned the value of hard work. I worked part-time in school shoveling horse manure,

working in our Leeville fabrication shop, doing pipeline work in Fourchon, and working on a lift boat in Venezuela. I came to appreciate what our people do in the field. Those manhours are executed by some wonderful people. Having a personal relationship with them and understanding the value of what they do … I can’t underestimate the value of that.

Having that appreciation helps me make better decisions. I realize the impact that every decision will have on the front-line crews. And when people know that part of our story that we weren’t just handed a job in the company it gives us some credibility and an ability to connect with our workers.

What’s most challenging about your current position?

Running a business is not just about numbers and profit. It’s about the people. We have 2,500 employees and most of them have a family to support. Having grown up in this business, I know a lot of them personally. I feel a sense of weight and responsibility because of that. When the market collapsed in 2020, I made a point every day to find someone that we had to lay off and just talk to them. That way it stayed real and personal.

Preparing for the future of oil and gas is another challenge. We’re bullish in oil and gas because we know the world will still need it for decades to come, but we’re also excited about the transition to renewables. We’re looking into solar and opportunities for wind and doing work around coastal restoration.

Still, we believe that there are opportunities to continue providing low-cost, clean energy

from fossil fuels for a long time. A focus on technology that will allow us to do it in a low-carbon way.

What do you find most rewarding?

We’re in the people business. It’s part of who we are. What’s most rewarding to me is when I have an opportunity to engage with everyone, from the management team down to the front line folks.

I can’t tell you how often I hear people thank us for operating a family-owned, private business in a way that encourages growth and professionalism. We’re 76 years old, and there’s never been a time in our history when we’ve been more committed to being a family-run business.

But it’s also a challenge. Family businesses are great when they’re run correctly. Otherwise, they can be extremely dysfunctional.

What are your biggest concerns?

I’m concerned about the current administration’s view of oil and gas. There’s no quick flipping of a switch that will move us from oil and gas to renewables in a way that is affordable and reasonable, and that will meet our energy needs. Putting pressure on our industry and overregulating it in an attempt to get us to move too fast is going to create a catastrophe.

We need to agree to a transition that is smooth, feasible and paced correctly.

My faith and my church are important to me. I also have four daughters, so my girls and my family are a huge part of my life. Apart from that, I’ve got a few acres around my house, a tractor and some bees, so I spend a lot of my time with a chain saw in my hand or messing around with my bees. That’s what keeps me sane and grounded.

This spring, ExxonMobil celebrated the successful startup of its new polypropylene production unit at the Polyolefins Plant in Baton Rouge. The unit increases polypropylene production capacity along the Gulf Coast by 450,000 metric tons per year, meeting growing demand for high-performance, lightweight and durable plastics, particularly for automotive parts that can improve fuel efficiency and reduce vehicle emissions. Polypropylene, a polymer with several applications, is also used to improve the safety and efficiency of everyday products like medical masks and food packaging.

ExxonMobil maintained its investments in this advantaged project through the COVID pandemic and related economic downturn. The total capital investment was more than $500 million, and the unit start up was according to planned cost and schedule. During construction, the project employed more than 650 workers and with full operational status, requires an additional 65 full-time ExxonMobil jobs.

“With the startup of this new production unit, we are well positioned to responsibly meet the growing global demand for these high-performance polymers,” said Karen McKee, president of ExxonMobil Product Solutions. “The ingenuity of our people and our investments in technology enable us to produce high quality products that are essential to daily life.”

ExxonMobil’s integrated operations in Baton Rouge include a more than 500,000 barrel-per-day refinery, as well as chemical, lubricants, polyolefins and plastics manufacturing. ExxonMobil has more than 5,500 employees and contractors in the Baton Rouge area and its operations account for approximately one in every 10 jobs in the region.

South Louisiana’s confluence of waterways, rail, pipelines and interstates was undoubtedly the reason for industry to locate here. Unfortunately, the “to do” list of infrastructure enhancements needed for the state to remain competitive is problematically long.

The $1 trillion federal infrastructure bill, passed in late 2021, provided a glimmer of hope for some of Louisiana’s backlogged projects, as it came with a promise to funnel billions to states and local governments to upgrade outdated roads, bridges and transit systems. Of particular note was the bill’s intention to repair and

rebuild thoroughfares and bridges, meliorate airports and ports, invest in passenger rail, improve infrastructure resiliency and fortify the power infrastructure.

For Louisiana, it has freed up funding for some long-delayed, long-overdue projects.

Nevertheless, Shawn Wilson, former secretary of the Louisiana Department of Transportation and Development, says getting the most out of any infrastructure funding measure will require strategic alliances among multiple infrastructure modes. “We need to leverage our resources and work together, whether that be industry, the ports, roads, etcetera to create a plan, and we need to be able to

A new infusion of cash will whittle away at infrastructure needs critical to industry. But the list remains lengthy.

fund that plan to remove bottlenecks and maximize efficiencies,” Wilson says.

Unfortunately, the state must play catchup first. As recent as 2022, Louisiana continued to receive low national marks on its infrastructure—a D+ from the American Society of Civil Engineers—based upon data collected by a team of more than 50 civil engineers who studied 11 major components of the state’s infrastructure for more than 18 months.

That has had dire implications for the industrial sector along the 10/12 corridor. “When you look at our 16,000 miles of roads, 12,000 bridges and six Class 1 railroad and airports … our economy is based upon the infrastructure that we have, not the infrastructure that we need,” Wilson says. “We’re faced with a difficult decision: whether to maintain what we have today or invest in the next five to 10 years in a new mobility solution. It’s a

problem brought about by generational inaction.”

Of course, roads and bridges are just one piece of the infrastructure puzzle. Waterways, ports, rail and power each have their “weak links” in need of attention.

There are perhaps no bigger “weak links” in the state than the I-10 bridges in Lake Charles and Baton Rouge. They’re well-known daily sources of congestion, primarily because they were built at a time when traffic counts were

significantly lower.

George Swift, president and CEO of The Southwest Louisiana Economic Development Alliance, says it’s no secret that the I-10 bridge replacement in Lake Charles has been a top priority for years. The bridge was initially constructed in 1952 with a predicted 50-year life span and traffic load of 37,000 crossings per day. Today, the average daily crossings exceed 80,000.

“Everyone in industry is concerned about the condition of the bridge,” Swift says. “Even though it’s structurally sound, the bridge

is unsafe because of steep inclines, no turnoff lanes and no lights. That’s our number one project, and I’ll put that up against any in the state.”

Highlighting its importance at the federal level, U.S. Secretary of Transportation Pete Buttigieg visited the site in February to announce the awarding of a $150 million grant to help fund the replacement of the outdated bridge. In total, about $800 million has been allocated for the bridge so far.

Unfortunately, the costs continue to escalate.

“The cost estimate was originally $800 million,” Swift says. “Now, it’s $1.5 billion. We’re hoping to get this executed this year, because the longer we wait the more it will cost.”

The public-private partnership (P3) project will span from the I-10/I-210 west interchange to the east side of the Ryan Street exit ramp, as well as improve LA 378 from I-10 to Sulphur Avenue

“We’ve had billions of dollars of investment in the LNG facilities in Cameron Parish, but we’re relying on a ferry to cross the ship channel.”

GEORGE SWIFT, president and CEO

The Southwest Louisiana Economic Development Alliance‘ACE IN THE HOLE’: In December, Port NOLA received $800 million in funding from Ports America and Mediterranean Shipping Company’s investment arm Terminal Investment Limited. The $1.8 billion facility is slated to begin construction in 2025, with berths opening in 2028.

in Lake Charles. The state is expected to select a developer for the project by fourth quarter 2023, with construction slated for 2025.

Apart from the bridge, there are other weak links in need of attention, Swift says. “We’ve had billions of dollars of investment in the LNG facilities in Cameron Parish, but we’re relying on a ferry to cross the ship channel,” he adds. “A bridge over the ship channel is what’s needed, but we need to start working on that now, because that could take many years.” He also points to several two-lane feeder roads that need widening to adequately service the industrial market.

No progress has been made on the efforts to date. “It needs to be on our radar,” Swift says, “and it becomes more evident virtually every week.”

Scott Kirkpatrick, executive director for the advocacy group Capitol Region Industry for Sustainable Infrastructure Solutions,or CRISIS, says while there has been some progress among all three “core” infrastructure needs identified by his group in 2016—a

new $2 billion I-10 bridge south of Baton Rouge, the $72 million widening of I-10 through Baton Rouge and a $1 billion surface road program—the condition of the city’s infrastructure remains severe.

I-10 through Baton Rouge to the industrial corridor has remained a source of congestion and traffic slowdowns for years, significantly impacting the flow of people, goods and services. “Some progress has been made,” Kirkpatrick says. “The widening of I-10 in Ascension has been completed and that was an early win for us. There are some other surface projects—for example, the I-10/ Picou Lane Interchange that’s under way—but we’ll have to wait a while before the full benefits are realized.”

He’s most excited about the

“tremendous momentum” building around the proposed new Mississippi River bridge south of Plaquemines. Currently, the project is in Phase 2 of environmental assessments, and the eventual location of the bridge has been narrowed to three locations, all south of Plaquemine and crossing the river into St. Gabriel.

Kirkpatrick expects a final location to be selected within the next two years. “We think the public-private partner solicitation process will begin in 2023,” he adds. “It’s a long process, but DOTD has indicated the process will be begin this year.”

Ascension Parish hopes to be ready for the bridge when the time comes. Robert Burgess, president of the Ascension Chamber of Commerce, says additional infrastructure will be needed in

“The Bureau of Ocean Energy Management has proposed the first offshore wind lease in the Gulf and the majority of the acreage sits just 30 miles from where the Calcasieu Ship Channel hits the Gulf.”

RICKY SELF, executive director, Port of Lake Charles

“We think the publicprivate partner solicitation process will begin in 2023. It’s a long process, but DOTD has indicated the process will be begin this year.”

SCOTT KIRKPATRICK, executive directorfor the advocacy group Capitol Region Industry for Sustainable Infrastructure Solutions, of efforts to fund a new Mississippi River bridge south of Plaquemines

1. I-10 bridge, Lake Charles

In total, about $800 million has been allocated for the bridge. Unfortunately, the costs continue to escalate. Now at a cost of $1.5 billion, the public-private project will span from the I-10/I-210 west interchange to the east side of the Ryan Street exit ramp and will improve LA 378 from I-10 to Sulphur Avenue in Lake Charles.

2. New I-10 bridge south of Baton Rouge

Currently, the project is in Phase 2 of the environmental assessment, with the eventual location of the bridge narrowed down to three locations, all south of Plaquemine and crossing into St. Gabriel. The bridge will primarily service the industrial corridor south of Baton Rouge.

3. I-10 through Baton Rouge to the industrial corridor

The interstate system through Baton Rouge and points south remains a source of congestion and traffic slowdowns, significantly impacting the flow of people, goods and services to the industrial sector.

4. La 3127 Extension, Donaldsonville

The extension of LA 3127 around Donaldsonville along with other planned improvements are critical to supporting future investments.

5. St. Bernard Transportation Corridor

Future elevated expressway to route truck traffic from PortNOLA’s new Louisiana International Terminal to and from the facility. The port received $50 million in capital outlay bill last year from the state.

6. New Orleans-Baton Rouge Intercity Passenger Rail

Like many infrastructure needs in the state, an inter-city passenger rail has long been touted as a vital for future commerce, but little has been accomplished.

Entergy Louisiana has filed a 10-year, $9.6 billion plan – Entergy Future Ready – with the PSC that will replace existing electrical infrastructure with more resilient and durable equipment. Entergy is also applying for grants under the Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) program.

The port already operates a facility just 23 nautical miles from the Gulf with no air draft restrictions and direct access to the federally maintained deep draft Calcasieu Ship Channel. That’s important, since turbine blades can measure from 350 to 425 feet.

In the oil and gas-dependent Houma/ Thibodaux region, no infrastructure discussion is complete without addressing the completion of the LA 1 Improvement Project and I-49 extension, in the creation of a vital north-south route.

his parish to accommodate the bridge as well as facilitate the construction and operation of a planned RiverPlex MegaPark near Donaldsonville.

An $80 million 8.3-mile, 4-lane highway extending LA 3127 from LA 70 to LA 1 tops the list.

Burgess says it would route freight traffic around Donaldsonville, increase regional connectivity and enhance safety. An additional $22 million LA 1/LA 3127/Energy Transition Parkway Interchange would provide a directional interchange of the three highways, which would benefit the flow of industrial traffic.

They’re still pursuing funding for the initiatives, however. “The proposed LA 3127 Extension project would not only provide access to the planned industrial RiverPlex MegaPark, but also increase regional connectivity to the planned Mississippi River Bridge,” Burgess says.

Meanwhile, Louisiana’s port directors warn that significant port investments will be needed if they are to remain competitive in an increasingly crowded field.

Jessica Ragusa, deputy director of governmental affairs at Port NOLA, says the port’s new $1.8 billion Louisiana International Terminal is their “ace in the hole,” as it will enable the port to accept Panamex and New Panamax mega-vessels and be capable of

handling 2 million twenty-foot equivalent units (TEUs) annually.

“We’ve already got the 50-foot draft we need thanks to the Corps of Engineers, but if we’re not ready with the terminal we’ll get left out of the game,” Ragusa says. “That’s our top priority right now.”

In December, the facility received $800 million in funding from Ports America and Mediterranean Shipping Company’s investment arm Terminal Investment Limited. The $1.8 billion facility is slated to being construction in 2025 and the berths open in 2028.

“We’ll be able to handle the largest vessel capacities. That’s the need. We’re seeing these vessels starting to come into the market and if we don’t have the facilities to accept them then we’ll no longer be in the container business, and neither will the state of Louisiana.”

PortNOLA is also raising funds for the St. Bernard Transportation Corridor, an elevated expressway that will connect the terminal to major traffic routes.

The port received $50 million from the state’s capital outlay bill last year for the corridor, but Ragusa says that they’ll need to build a comprehensive grant funding strategy as well as pursue other funding strategies such as a toll road.

“The timing is very complex,” she adds. “For example, we might receive a grant but not be able to

“Instead of taking weeks to get the system back up after a major hurricane or other event, we’ll be able to do it in days. That’s the objective of a more resilient grid.”

PHILLIP MAY, president and CEO,Entergy Louisiana CHERYL GERBER

spend it until 2026, so we’re developing a grant strategy to take full advantage of the opportunities.”

The Port of Lake Charles has its own plans to capitalize on a rapidly changing market, albeit in a decidedly different way. Ricky Self, port executive director, says his biggest future need will be enhancing port facilities to prepare for a burgeoning offshore wind market.

The port’s Industrial Canal site “checks all of the boxes,” Self says. “The Bureau of Ocean Energy Management has proposed the first offshore wind lease in the Gulf,” he adds, “and the majority of the acreage sits just 30 miles from where the Calcasieu Ship Channel hits the Gulf.”

The port’s Industrial Canal site is situated just 23 nautical miles

from the Gulf with no air draft restrictions and direct access to the federally maintained deep draft Calcasieu Ship Channel. That’s important, since turbine blades can reach anywhere from 350 to 425 feet long. “We have about 50 acres and more than 3,000 linear feet of shoreline available,” he adds.

Before that can happen, the port will need to perform significant upgrades the site, as well as extend its port-owned rail system at a cost of about $135 million.

The funding for the effort remains in limbo—the port applied for a Port Infrastructure Development Program grant to fund the study, but the application was denied.

“We feel that if we apply for the actual construction of the facility, it could be successful,”

Self says. “We anticipate that once the operator, port and state are at the table, that will go a long way toward getting this funded.”

In the oil and gas-dependent Houma/Thibodaux region, no infrastructure funding initiative is satisfactory unless it addresses the I-49 extension and completion of the LA 1 Improvement Project. That’s because the area badly needs a north-south corridor access route, not only for transporting goods and services but as an evacuation route.

Last fall, state and local officials officially broke ground on a key piece of the I-49 Lafayette Connector project, giving the area some hope that the interstate could be completed in the next

several years. The $136-million Ambassador Caffery Parkway interchange will include elevated frontage roads, U-turn movements and widening the reconstruction of Ambassador Caffery to account for the new interchange.

The connector is a future 5.5mile segment of highway that will extend I-49 from I-10 to the Lafayette Regional Airport. The connector is a key component of I-49 South, which will function as a critical hurricane evacuation route, complete a major energy and trade corridor to the nation and enhance safety by providing new interstate connectivity within the Lafayette region and to New Orleans.

Finishing the elevated sections of the La. 1 Improvement

Project is equally important, as it would provide a critical route to Port Fourchon and the Louisiana Offshore Oil Loop (LOOP). There’s been progress there as well, as state leaders recently broke ground on Phase II of the La. 1 construction program, which will elevate 8.3 miles of the highway from Leeville to Golden Meadow. Once complete, there will be 19.3 miles of elevated expressway between Golden Meadow and Port Fourchon.

Unfortunately, the oil and gas industry in the region won’t benefit from the La. 1 project until the highway spans are complete. In the meantime, should the highway be incapacitated by a storm, the impact on the nation’s economy could be catastrophic.

Electrical infrastructure resiliency in Louisiana has been top of mind ever since the storm-battered years of 2020-21. Without question, the task of restoring power in the wake of multiple catastrophic hurricanes was an unprecedented challenge for Entergy. Hurricane Ida alone damaged a

record-breaking 30,000 power poles.

After making landfall near Fourchon, Ida traveled northward, wreaking devastation in countless communities along the way and significantly impacting the New Orleans and Baton Rouge metro areas. “

There were nearly 1 million customers without power,” says Phillip May, president and CEO of Entergy Louisiana. “Because of its path, Ida affected a very large number of customers.”

May says while the electrical infrastructure built since Katrina “weathered the recent storms quite well, we’re seeing an acceleration of storm severity and frequency … and that’s cause for concern.”

As such, last year Entergy Louisiana filed an “Entergy Future Ready” resiliency plan with the state Public Service Commission. The 10-year, $9.6 billion plan aims to replace electrical infrastructure across Louisiana with a newer, more resilient electrical grid. Entergy is also applying for grants under the Department of Energy’s Grid Resilience and

If given the green light, the project will touch more than 9,600 distribution and transmission projects across the state. “We have 1 million poles south of I-10, so the program will take a while,” May says. “It doesn’t mean that the power will never go out, but we’ll have the ability to quickly respond and get the power back on, particularly to our critical customers.

“Instead of taking weeks to get the system back up after a major hurricane or other event, we’ll be able to do it in days. That’s the objective of a more resilient grid.”

The first phase of the plan will call for $5 billion in resiliency enhancements over five years. May hopes to have a decision from the PSC by end of this year. “That would kick off the initial phase of the plan the first part of 2024,” he adds.

Entergy collaborated with utility providers in Florida for assistance in developing the plan. “We looked at all hurricane data over the last 50-plus years, including every transmission structure, pole,

line or device and put together a model. We then had hurricanes track over the system to determine what damage we could expect on that system.

“We also executed accelerated storm scenarios. That’s how we prioritized and developed those 9,600 distribution and transmission projects.”

Like many of the state’s infrastructure needs, a proposed intercity passenger rail route between New Orleans and Baton Rouge has long been touted as vital for future commerce, but plagued by multiple stops and starts.

However, the Baton Rouge Area Chamber, GNO Inc., and the SOLA Super Region Committee are calling the recent approval of the Canadian Pacific Railway and Kansas City Southern merger the “most important step forward” for creating the long-proposed passenger rail link.

“The Surface Transportation Board decision specifically cited that CPKC has committed to supporting Amtrak’s plan for

expanded passenger rail service, and that this helped win Amtrak’s endorsement of the merger,” the joint statement says.

e groups also pointed to Amtrak’s national statement on the announcement, which said that CP “has committed to support Amtrak’s e orts to work with the Southern Rail Commission, states and other stakeholders for … establishing Amtrak service between New Orleans and Baton Rouge.”

At the recent Southern Rail Commission quarterly meeting, representatives from the state’s transportation department updated stakeholders about federal funds the state is pursuing.

e state has hired consultants to begin the federally required environmental studies for the route and has also submitted a grant application for funding to help replace the Bonnet Carre bridge.

e project, which could top $260 million, already has a few funding sources. e federal

Infrastructure Investment and Jobs Act, passed in 2021, supplied funding for Amtrak to further its 15-year corridor vision plan, including the proposed passenger rail between the Baton Rouge and New Orleans.

Last year, U.S. Rep. Garret Graves’ o ce announced that the Baton Rouge-to-New Orleans rail project would receive $20 million in federal funding for real estate acquisition, design and construction of the Baton Rouge and Gonzalez train stations.

e $20 million RAISE grant represents only a portion of the $36.95 million Baton Rouge and Gonzales have jointly sought in federal funding for the stations. Including local matches, the total cost for the two stations would be $46.6 million.

e Legislature last year also approved $12.5 million in unspent federal American Rescue Plan dollars to provide service between Baton Rouge and Sorrento.

We invited industry and construction leaders to share their organizations’ perspectives on the challenges and opportunities they anticipate in 2023 and the lessons they have learned in the past year.

Issue Date: Spring 2023 Ad proof #4

• Please respond by e-mail or phone with your approval or minor revisions.

• AD WILL RUN AS IS unless approval or final revisions are received within 24 hrs from receipt of this proof. A shorter timeframe will apply for tight deadlines. • Additional revisions must be requested and may be subject to production fees.

REACHING MILESTONES ARE on the horizon for Five-S Group in 2023 with ten years in business this July. Five-S provides turnkey civil solutions to help our client’s plans become reality. We are the #dirtmafia and have achieved a diversified portfolio of civil site construction services and construction material supply projects. We broke into the petrochemical market following our work at Sempra’s Cameron LNG export facility in Hackberry. Since then, Five-S has supported the development of numerous US LNG Export facilities to supply clean energy around the world. Change is happening in the Gulf South Region. We have been at the forefront of expanding our fleet, portfolio, and our services. With the renewable energy market expanding, Five-S identified and prepared for this change when the petrochemical market was disrupted by the pandemic. We are currently performing a wide range of civil construction capabilities on solar farm infrastructure projects in Texas and Louisiana. We anticipate an unprecedented amount of opportunities to come in 2023. History is being made as many Flood Risk Reduction projects are underway. We have contributed with our own efforts on the Comite Diversion Canal and the West Shore Lake Ponchartrain projects with the U.S. Army Corps of Engineers, excavating and embanking millions of yards of material for these critical infrastructure missions. Supporting both the private and public sectors, Five-S continues its mission of building better people and better projects from the ground up.

Issue Date: Spring 2023 Ad proof #3

• Please respond by e-mail or phone with your approval or minor revisions.

• AD WILL RUN AS IS unless approval or final revisions are received within 24 hrs from receipt of this proof. A shorter timeframe will apply for tight deadlines.

• Additional revisions must be requested and may be subject to production fees.

Carefully

Premiere Corrosion Solutions

CUSTOMERS NEED A CHANGE in the way they are supported moving into 2023 and beyond.

Having served the corrosion solutions industry for the past 15 years, my ultimate goal has been to make my clients job easier by advising them on and providing the best solutions to their corrosion problems. This hasn’t changed today but the face of my customer landscape has and is rapidly changing.

With the baby boomers increasingly leaving the workforce, a new generation of employee is taking over the industrial landscape, and they’re counting on solutions providers to be the subject matter experts.

It’s our responsibility to guide them to the right solution rather than offering a menu of choices.

Knowing and asking the right questions to gain a holistic view of the problem is what customers are looking for moving into the future.

Being a trusted advisor is the new face of solution providers. Premier Corrosion Solutions (PCS) with our strategic group of Principals is armed and ready with the right questions to ask to help solve our clients most difficult corrosion problems.

PCS is the gulf coast’s trusted and preferred corrosion solutions provider.

Issue Date: Spring 2023 Ad proof #2

• Please respond by e-mail or phone with your approval or minor revisions.

• AD WILL RUN AS IS unless approval or final revisions are received within 24 hrs from receipt of this proof. A shorter timeframe will apply for tight deadlines.

2023 IS SHAPING UP to be another great year for GBRIA. The year began with enthusiasm for GBRIA’s program of work and our many networking events. Our Annual Meeting in February and Safety Excellence Awards attendance in March were the highest ever and our members and partners are looking forward to more collaboration this year through events such as our Industry Expo in June and others. Demand for industry products is growing in a post-pandemic world despite some major uncertainties from the war in Ukraine, interest rate, supply chain and labor shortage issues. Companies view Louisiana as an ideal place to invest in energy transition and carbon reduction and we are seeing billions upon billions of dollars of investment coming in to build clean energy solutions, advanced manufacturing for new technologies like cleaner batteries for electric cars and chip manufacturing and more. Our partnerships with area educational institutions such as high schools, LCTCS, ABC and the Alliance Safety Council are working hard to recruit and train needed skilled craftspeople. Our latest labor forecast shows that demand will remain high for skills such as welders, scaffold builders, millwrights, pipefitters, engineers and technology professionals of all types. Louisiana’s industrial workforce achieves the highest productivity in the industry and we are proud to help with amazing partnerships that GBRIA and its members have with educators, government, and our community.

• Additional revisions must be requested and may be subject to production fees.

Carefully check this ad for: CORRECT ADDRESS • CORRECT PHONE NUMBER • ANY TYPOS

This ad design © Melara Enterprises, LLC. 2023. All rights reserved. Phone 225-928-1700

FOR OVER 50 YEARS, RelaDyne has offered the most diversified and comprehensive portfolio of industrial and sustainable services, equipment, and products to provide ultimate plant and operational efficiency. Being the largest Shell, Chevron and P66 lubricant distributor and reliability solutions partner provides our customers the ease of obtaining products to meet their lubricant and fuel needs without concern of supply issues. Our multiple domestic and international hubs provide our teams the ability to cover massive geography for every industrial sector.

Our services are categorized in six areas: product cleaning, system cleaning, equipment rentals, fueling services, embedded technicians, and ESG. We serve nearly every relevant industry – petrochemical, refining, power generation (including nuclear), hydrogen fuel cell, LNG, steel and metalworking, pulp and paper, manufacturing, marine, oilfield, alternative, fuel, and automotive.

I am excited about our contracted service projects in the Gulf Coast area as our projections are pointing towards record high levels for the next several years in startup and commissioning services along with traditional outage work, plant expansions, and new alternative energy plant developments. With the Industrial transition to carbon footprint reduction, RelaDyne’s strategic offering of carbon neutral lubricants along with our Industrial Sustainability Services allow us to provide world class service for every major project in the 10/12 Industry corridor.

THERE IS PLENTY to be optimistic about regarding US Gulf Region industrial activity in 2023. Rex Industrial is fortunate to be in a hotbed of oil, gas, chemical, and renewable projects vital to keeping the world moving. We have seen a strong demand for products and services to start the year. Supply chain constraints have eased but the skilled labor market remains tight.

Looking forward, we expect the general economic slowdown from rising interest rates to have minimal effect on business in the near term; in particular, clients in the Midstream and Downstream Markets have proven to be resilient. If rates stabilize by Q3 we should see an increase in activity at the end of the year and in 2024. More importantly, we want to see WTI in a range between $60bbl and $100bbl.

Regardless of where we are in the business cycle, it is always a good time to be an innovator. Innovation is the only way to achieve significant reductions in prices, lead-times, and coordination efforts. See some of our innovative products and how we use software to streamline design, engineering, and procurement (D.E.P.) at www.RexIndustrial.com.

Issue Date: Spring 2023 Ad proof #2

• Please respond by e-mail or phone with your approval or minor revisions.

• AD WILL RUN AS IS unless approval or final revisions are received within 24 hrs from receipt of this proof. A shorter timeframe will apply for tight deadlines.

• Additional revisions must be requested and may be subject to production fees.

Carefully check this ad for: CORRECT ADDRESS • CORRECT PHONE NUMBER • ANY TYPOS This ad design © Melara Enterprises, LLC. 2023. All rights reserved. Phone 225-928-1700

SHELL HAS A proud and rich history in Louisiana, with more than 100 years partnering with communities throughout the state and along its working coast. Last year, Shell celebrated the 55th Anniversary at its Shell Geismar facility, where Dai Nguyen serves as General Manager. Louisiana is already home to a wide range of Shell activities, from oil and gas exploration and production to pipeline supply and distribution, from refining and chemicals to LNG for transport. But they’re on the verge of a transition to a sustainable future with their Powering Progress strategy.

Though Nguyen is a Louisiana native, he took a very roundabout way to return home. After graduating from Tulane University with a degree in chemical engineering, he has held a myriad of roles around the globe for Shell in his 32 years. Nguyen was excited to return to Louisiana to lead the Geismar site as part of Shell’s strategic plans featuring Louisiana as its epicenter for the future. Although focused on growing Shell’s business in Louisiana, Nguyen is equally committed to growth in his community. Apart from Shell, he is on the board of directors for the Capital Area United Way, the Baton Rouge Area Chamber, Louisiana Chemical Association and The Arts Council of Greater Baton Rouge. He also promotes investing in childhood education.

Permitting delays and emerging community battlegrounds are slowing the ‘gold rush’ for capture, usage and storage.

Agrowing number of carbon capture and sequestration projects are at the proverbial starting gate in Louisiana, but the Class 6 permits needed to store the substance remain in limbo.

Adding insult to injury, the state’s efforts to gain regulatory primacy over the permitting have stalled, a full year and half after the Louisiana Department of Natural Resources submitted the request to EPA’s Region 6 headquarters in Dallas.

Giving Louisiana primacy would “most definitely speed the process,” says Patrick Courreges, communi-

cations director at the Louisiana Department of Natural Resources. “We are still waiting for any type of word, whether an approval, denial or even feedback. Last summer, it moved from the regional office to EPA headquarters for review, and that’s where it still sits. We’re not getting any updates or timetables.”

The permitting logjam has delayed billions of dollars in potential CCUS (Carbon Capture, Utilization and Sequestration) investment.

According to EPA’s Region 6, there are currently five companies with pending Class 6 permits at proposed Louisiana sequestration

sites: Oxy Low Carbon Ventures LLC in Allen Parish, Gulf Coast Sequestration in Calcasieu and Cameron parishes, Hackberry Carbon Sequestration LLC in Cameron Parish, Capio Sequestration LLC in Pointe Coupee Parish and CapturePoint Solutions LLC in Rapides Parish.

That’s frustrated Gov. John Bel Edwards, who in January criticized the slow playing of the process in a letter to EPA Administrator Michael Regan.

“More information on the progress of Louisiana’s Class 6 application would help encourage potential CCS operators to make firm investment decisions,”

Edwards says in the letter. “We are now seeing concepts begin to turn into investment decisions, but a recurring question is if and when Louisiana will receive primacy.”

DNR Secretary Tom Harris reiterated frustrations over the process during the Louisiana Oil & Gas Association’s recent annual meeting in Lake Charles. “Nationally, the EPA has issued only six Class 6 permits in six years’ time, none of which are in Louisiana,” Harris says. “That’s not a time frame where businesses can make final investment decisions with any confidence. Companies deserve a faster turnaround.”

Giving LDNR regulatory

primacy could help free up the backlog and catapult Louisiana into a regional CCS leader, Harris says, given the state’s existing pipeline infrastructure, petrochemicals industry concentration and geological storage locations.

“It seems like a custom-built opportunity with immediately recognizable benefits,” Harris adds. “Over the past several years, we’ve seen stepped up interest in the concept of CCS, with companies making real investment decisions toward turning carbon management into reality.”

To date, DNR has received Class 5 permits for injection well tests (often a necessary precursor

to a Class 6 permit) from Louisiana Green Fuels in Caldwell Parish, Capio in Pointe Coupee Parish, Oxy Low Carbon Ventures in Allen and Livingston parishes; Air Products in Livingston and St. John parishes, Shell in St. Helena Parish, CapturePoint in Vernon Parish, River Parish Sequestration in Assumption Parish and Denbury Carbon Solutions in Ascension Parish.

If and when it gains primacy, DNR plans to triple the size of its regulatory staff from three to nine to prepare for the initial rush in applications. “Louisiana is pretty unique, and we have the knowledge of our geology,” he adds. “There are more time efficiencies, too, because we have more people to dedicate to that. Region 6 only has so many people to cover four different states.”

Eric Smith, director of the Tulane Energy Institute in New Orleans, blames politics for the delays. “They’re concerned that states such as Louisiana and Texas will minimize the risk and proceed to do what they want to do,” Smitha adds. “I don’t think that’s likely. We have a pretty good safety record with that kind of thing, and we very rarely have problems with pipelines.

“You’ve got all this money waiting to be spent but no one can spend it because the government won’t get out of the way. My guess is that they’ll slowly turn over primacy to states that are loyal to the administration.”

Concerns over the sequestration piece of the puzzle might be part of the reason for the delays. “The big prize that everyone is after, including the federal government, is drilling these Class 6 wells into saline aquifers deep below the surface, then pumping the carbon into those,” he adds. “They’re virtually everywhere if you can drill deep enough.

“The problem is we don’t have reams of data on that. The concern is that the carbon will perambulate until it finds a fault line or old well and emerges at the surface.”

LOW-HANGING

A cadre of LSU professors

researching CCUS say a “gold rush” is coming, once permits begin getting the green light, fueled by government carbon tax credits. The 2022 changes to Section 45Q of the U.S. IRS code provide up to $85 per ton of carbon permanently stored and $60 per ton of carbon used for enhanced oil recovery or other industrial uses.

“My guess is that it would only cost between $5 to $10 per ton for sequestration at a site, but the credit is about $85 per ton,” says John Flake, professor of chemical engineering. “The gold rush is coming if you have a place to sequester.” What’s more, Louisiana’s existing network of pipelines can be used to transport the carbon to a sequestration site.

But Flake, along with John Pendergast, a professional in residence in the Department of Chemical Engineering, and Dick Hughes, a professional in residence in the Department of Petroleum Engineering, say it’s not all about money. The environmental benefits of carbon capture – particularly in the greater Baton Rouge area –can’t be ignored.

The “low hanging fruit,” they say, is the abundance of large-scale chemical plants that are already removing carbon as part of their processes.

“The production of ethylene oxide and ammonia already requires the removal of carbon dioxide, whereby it’s stripped out of the solution and vented as pure carbo dioxide,” Flake says. “That’s done every day within 50 miles of the LSU campus.”

CF Industries’ Donaldsonville plant, for example, is the world’s largest producer of ammonia. “They have to remove that carbon, and it’s an enormous amount,” Flake says. “That one plant is likely already removing 10 billion kilograms of carbon per year.”

Refineries and power plants, on the other hand, face a much higher barrier to entry. That’s why most of the initial investment will be focused on those plants already stripping the carbon from their processes.

“It might cost a power plant 30 percent of its power production to do that,” Pendergast says. “They’d spend hundreds of millions to

billions to capture the carbon, and it would cost them about a third of your power. There has to be an additional incentive there, above the $85 per ton credit.”

As for the sequestration of the carbon, Louisiana has an abundance of geological formations already available. While depleted oil and gas reservoirs could be used, Hughes says, “the problem is that we have a lot of wells at those locations and those are usually potential leak sites. We typically avoid those.”

Most developers are instead seeking saline or brine formations. “Lake Maurepas is an interesting location,” Hughes says. “It has few well penetrations and the geologic environment is relatively flat. It also has high porosity and permeability, which means the amount of carbon you can inject is higher.”

Flake says the utilization of captured carbon as an alternative

to sequestration remains in its infancy. “That’s more research and less application at the moment,” Flake says. “There’s no commercial utilization process at large scale.”

He’s most excited about the potential of carbon as a low-cost fuel source. Flake is researching ways to utilize carbon dioxide as

an alternative fuel in the conversion of ethane to ethylene, which is used in everything from plastic products to clothing to detergents and hand soaps.

“With ethane, you’re already using a fossil fuel (ethane is derived from natural gas), then you have to utilize a lot of energy to convert

it to ethylene,” he adds. “For every kilogram of ethylene you make, you generate about a kilogram of carbon.”

The goal, therefore, should be to capture and utilize carbon as a feedstock. While that currently is an expensive proposition, Flake says there could be other methods of utilization not necessarily derived from an industrial process.

LSU recently received $5 million of a $50 million grant from the U.S. Economic Development Administration grant to research and develop a clean hydrogen cluster in south Louisiana, of which Flake’s department will receive about $3 million for researching carbon utilization.

“The gold rush is coming if you have a place to sequester.”

JOHNFLAKE, professor of chemical engineering, with John Pendergast, a professional in residence in the Department of Chemical Engineering, and Dick Hughes, a professional in residence in the Department of Petroleum Engineering

Department of Natural Resources, on Louisiana’s efforts to gain regulatory primacy over permitting from the Environmental Protection Agency

Meanwhile, several projects are at the starting gate and ready to pull the trigger if and when their permits are approved. Most prominently, CF Industries entered into a largest-of-its-kind commercial agreement in 2022 with ExxonMobil to capture and permanently store up to 2 million metric tons of carbon emissions annually from its Donaldsonville manufacturing complex.

In preparation, CF Industries is building a $200 million carbon dehydration and compression unit to enable captured carbon to be transported and stored. ExxonMobil has also signed an agreement with EnLink Midstream to use the pipeline company’s transportation network to deliver carbon to permanent geologic storage in Vermilion Parish. Startup for the project is scheduled for early 2025.

C. Blake Phillips, senior manager of carbon solutions at Dallas-based EnLink, says his company’s existing 4,000 miles of

PERMITTING DELAYS aren’t the only thing standing in the way of CCUS investments.

“Our industry needs to do better at educating the public about the safety aspects of the CCUS industry, as well as its importance,” acknowledges C. Blake Phillips, senior manager of carbon solutions at Dallas-based EnLink says. “Louisiana can be a place where products are manufactured with a low carbon intensity. We need to ensure that people understand and trust this industry and know that it can be done safely and reliably.

“The skillset needed to make that happen has existed in Louisiana for decades.”

the company. Ultimately, Air Products plans to open a $4.5 billion hydrogen manufacturing complex in Ascension Parish by 2026 that would store its carbon output a mile beneath Lake Maurepas.

“We are pleased with the ruling, and we remain committed to continuing to share information with all local parish councils, elected and regulatory officials and local residents about Air Products’ clean energy project and its environmental and economic benefits, and employment opportunities,” say Art George, Air Products’ communications director, in a statement.

natural gas pipelines in Louisiana are already operating at adequate pressures for carbon. Additionally, they’ll only need to move the product some 60 miles from the source to the sequestration site, so the pressure loss will be relatively low.

EnLink’s existing 36-inch pipeline running from Belle Rose to Week’s Island will be converted from natural gas to carbon service in preparation for the project. Some of the pipeline will need to be replaced, but Phillips expects that to be minimal. “Some valve sites might need to be upgraded due to their metallurgy, but there will only be minimal work due to the suitability of the existing pipeline.

“It will have very low, non-material impact on our business because of the redundancy in the pipelines and available capacity,” Phillips says, “although we will have some new build in association to get into Exxon’s facility.”

EnLink has also announced letters of intent with Oxy, ConocoPhillips and Talos Energy.

Unfortunately, public concerns have already led to delays. In Livingston Parish, Air Products was initially blocked from initiating its Class 5 injection wells at Lake Maurepas by the parish government body, but later cleared by a federal judge.

Air Products had sued Livingston Parish’s government in October for adopting a 12-month moratorium on the injection wells—which are used to inject non-hazardous materials underground—and detonation of charges for seismic testing, despite the company having received permits from state agencies to perform both in Lake Maurepas within the parish’s bounds.

The project was the subject of controversy for the better part of 2022. Those opposed to the Air Products project also expressed fears on how carbon capture and sequestration could affect Lake Maurepas’ wildlife and recreational boating industry.

Seismic testing in the lake began in December and will run through the spring. The two Class 5 injection wells slated for this project will be built within the bounds of Livingston and St. John parishes to collect geotechnical data for

There are other battle lines being drawn at the legislative level. Most recently, Rep. Robby Carter, D-Amite, pre-filed a bill for the upcoming 2023 Louisiana legislative session that would remove eminent domain rights given to private companies 14 years ago allowing them to seize private property for carbon pipelines.

For Carter, whose district includes East Feliciana, St. Helena and Tangipahoa parishes —where some of the carbon capture projects have been proposed—the issue isn’t just about property rights. Carter is concerned about the safety of the process and has questions about the projects’ energy and water usage, among other things.

Still, there are plenty of CCUS proponents at the state level. The first year of Louisiana’s Climate Action Plan to reduce greenhouse gas emissions to net zero by 2050 was marked by industry commitments to spend billions on facilities to help the state meet that goal, according to a report approved in February by Gov. John Bel Edwards’ Climate Initiatives Task Force.

A portion of the more than $21 billion in new or expanded industrial projects will go toward the creation of carbon capture and storage facilities.

“We are still waiting for any type of word, whether an approval, denial or even feedback.”PATRICK COURREGES, communications director, Louisiana

Change is inevitable in life and in business, but Julie Heinz at ExxonMobil says it doesn’t have to be a confusing or painful process. As ExxonMobil’s corporate change management o ce manager, Heinz guides employees through the rigors of change by providing understanding and support in a manner that will give it “stickability.”

Her Baton Rouge o ce, created in 2021, seeks to deliver optimal value during the implementation of any new initiative, solution or project by enabling employees to more seamlessly adopt those changes. Heinz has four direct reports, but also facilitates a global community of change leaders. In turn, a “hub-andspoke” model, comprised of various change teams across ExxonMobil’s portfolio, works

speci c initiatives within individual parts of the organization.

Heinz is passionate about establishing enterprise-wide change management practices and is a certi ed Prosci change management practitioner and trainer. “A lot of my people don’t necessarily have a change management background,” Heinz says. “I look for people who are eager to learn and adapt quickly. Strong commu-

nication skills are important. Analytical skills are also a must.

“When it comes to implementing change, we’re not the domain experts. In our role, we help people think through how they adapt to change, coordinate activities to integrate the change, and guide them through exercises and assessments to determine the impact of the change.”

1. Leadership must endorse the change.

2. Answer the “why”: Why is change necessary?

3. Show the team that the future state will be better than the current state in a way that’s compelling and true, and in a way that resonates with them.

4. Support them through the transition process. Equip them for the change with necessary training or tools.

5. Embed the new technology or process into the onboarding process for those roles and incorporate it into business practices and our governance and sustainment mechanisms.

How one energy company is helping its team become more adaptable to the rigors of change.

Change management is a strategic approach to preparing, equipping and supporting people for change. In the world, the rate of change is exponential. It’s never stopping and never slowing down. We need to be able to adapt and quickly capture the value of what we’re trying to do so we can move in the direction we need to move as a competitive organization.

Is it a new concept for the industrial sector?

Based upon my own observations, ExxonMobil is a bit of a leader in this space. As a corporation, we’ve gone through a maturity journey. We’ve found that change management is a competency that we all need as employees. We need to have the resilience and capacity to change in an effective manner.

Historically, change management was given a lower priority. But we now realize that if we don’t have the right solution with the right process and strategy behind it and aren’t supporting our people to understand its value and the case for change, we won’t get the value. That value proposition is what makes change management critical. We want to have a work force that has clarity and is energized with the direction we’re going.

What are the steps in the change management process?

Step one is endorsement by leadership. Having a leader endorse the new strategy and convey to the employees that we’re going to guide them through the pro cess and support them … that’s a big part of it. You must also answer the “why.”

If you can’t show them that the future state will be better than the current state in a way that’s compelling and true, and in a way that resonates with them, they’re not going to come aboard. Therefore, it’s incumbent upon us to convey that we’re rolling things out that will make their lives more productive and better as employees, or it will generate some value to the corporation.

Next, we must support them through the transition process, provide them with any necessary training or tools that they’ll need, and equip them for the change.

The sustainment piece is equally critical. You can’t just roll something out and expect it to stick forever. People often change jobs, so we need to make sure the new technology or process is imbedded into the onboarding process for those roles. It should also be incorporated into our business practices and our governance and sustainment mechanisms. When we put all these pieces together, we create the right recipe for getting folks to really adopt the change.

Any recent examples of how change management processes are working for ExxonMobil?

ExxonMobil recently announced some significant organizational changes that will create a Global Business Solutions organization and a Centralized Supply Chain organization. These will have a huge organizational impact, but will require a shift in mindset to be effective. Through our change management processes we’re making sure that our people understand how we need to think differently and use these different processes. We want to ensure that they understand how the future state is better than the current state.

How do you measure the success of what you’re doing?

Measurement is definitely a part of it. Sometimes it’s qualitative, but at times it’s quantitative. For example, after implementing a new mobile application for instrument calibrations in the field, we were able to monitor usage of that system to gauge our success. However, when you’re implementing something that’s a process or mindset change, it can be a bit tougher. We use the ADKAR (Awareness, Desire, Knowledge, Ability and Reinforcement) model, a well-known industry standard for change management. We strive to help our employees understand the case for action (Awareness), gauge their willingness to adopt the change (Desire), equip them with the information or tools they need (Knowledge), guide them through the process of adopting the change (Ability) and provide support upon implementation (Reinforcement).

If we are implementing change at a particular site, one of the first things we’ll do is meet with key stakeholders to build awareness and desire. I’ll tell them what we’re doing, why we’re doing it and why it’s valuable in order to get their support. We’ll follow up with some simple questions across various people groups and across time to gauge whether we’ve been effective in adopting the change.

I always say, “Don’t ask for feedback if you’re not going to do anything with it.” Can we address every piece of feedback? No, but at least we can tell them why and help them understand the context a little better. Or perhaps the resistance is for a very good reason. Maybe there are multiple changes planned during the same quarter and they’re overwhelmed.

I think it’s a condescending comment to say people hate change. I think that they don’t like unnecessary change or poorly planned change, but if something is a good solution, solves problems for them, is easy to use, and they have the right support, they’ll come along. We need to make sure that the change solves a real problem. That makes change management so much easier for us.

ExxonMobil change management leader Julie Heinz10/12 Industry Report sat down with JULIE HEINZ to discuss the purpose of change management and what she’s discovered since taking over her role in 2021.

SEMS, Inc. is committed to attracting, training, and retaining highly skilled employees that are responsive to our client’s needs, always bringing forth a total quality management team

Family. Reliable. Safety. Passionate. Responsive

Our superior safety record is proof of our commitment to a culture of safety on every project.

Head Quarters: Baton Rouge, LA

Memphis, TN | Mandeville, LA | Shreveport, LA | Jackson, MS