ISSUE 24 NOV/DEC 2022 + Blazing a trail for women p22

Up to 75% LTV available Expanded acceptable asset classes No maximum loan size Product and criteria information correct at time of print (01.12.2022)

Partner with a specialist When specialist knowledge, flexible lending and strong broker relationships combine, you get a special effect! Refurbishment lending is one of a number of short-term funding specialisms in which UTB excel. • Conversions and refurbishments • Light (internal) & heavy (structural) works acceptable. • 100% of works costs available • Funding in stages available UTBANK.CO.UK BRIDGING FINANCE PURCHASE | CAPITAL RAISE | CONVERSION & REFURBISHMENT | DEVELOPER EXIT THE SPECIALIST EFFECT

CBP008214 To read about our commitment to the environment and sustainable print publishing, please visit https://bridgingandcommercial.co.uk/page_magazine. Acknowledgments Editor-in-chief Beth Fisher Creative direction Beth Fisher Sub editor Christy Lawrance Senior reporter Andreea Dulgheru Reporter Kit Million Ross Contributors Stephanie Baxter Christopher Marchant Photography Alexander Chai Sales and marketing Beth Fisher beth@medianett.co.uk Special thanks Scott Angus, HTB Andy Reid, Pivot Amanda Overland, Sancus Extra special thanks Caron Schreuder Printing The Magazine Printing Company Design and image editing Russ Thirkettle, Carbide Finger Ltd Bridging & Commercial Magazine is published by Medianett Publishing Ltd Publishing director Beth Fisher beth@medianett.co.uk 0203 818 0160 Follow us: Twitter @BandCNews | Instagram @BridgingCommercialMagazine

Relationships and trust are often described as the foundation blocks of the specialist lending industry—and for good reason. With the economic environment uncertain amid rising rates and costs, brokers are needed more than ever to solidify the best and most reliable finance partnerships for their clients. This is why we’re ending the year by celebrating a variety of unique personalities within the market.

The People Issue provides interviews with key professionals about their journey in the sector and who inspired them along the way [p10], why specialist advice will become increasingly important in 2023 [p46], and why having a background in both lending and broking offers an advantage [p80].

We look at how female leaders can help encourage and inspire more women into the financial services industry [p22], why neurodiversity should be embraced [p88] and the topic on everyone’s minds right now—should clients be fixing their bridging loans? [p30]

We also interview those who have recently taken new leadership roles, including UTB’s new director of bridging Sundeep Patel [p38], Sancus’ UK managing director Richard Whitehouse [p74], and Spring Finance’s CEO Gavin Diamond [p66].

As discussed in this issue’s In Conversation roundtable [p52], borrowers will need to invest in quality and reliable advice, backed by solid industry experience, to ensure their projects are fully funded and successful in a volatile market. One expert summed this up perfectly: “The brokers who’ve been around for a while—specialist advisers and consultants who’ve come back into the market from the banking world—are going to be sought after because their knowledge is based on reality.”

Beth Fisher Editor-in-chief

Nov/Dec 2022 3

The Sun and Moon

Two things you can always depend on being there.

Well now there’s a third.

West One’s fast, flexible and reliable service, gets the funding your clients need, when they need it.

Even in an uncertain market, we provide multi-product financing packages that can overcome the challenges in the most complex of cases for residential-led, semi-commercial and commercial projects.

You can always rely on West One.

So, give us a call today on 0333 1234556 to discuss your case, regardless of its complexity or your client’s level of experience.

to see

guide

Bridging Loans Buy-to-Let Mortgages Development Finance Second Charge Mortgages

is 09425230.

Scan

our product

West One is a trading name of the underlying firms, who are registered in England and Wales and have their registered office address at The Edward Hyde Building, 38 Clarendon Road, Watford, WD17 1J. West One Loan Ltd is authorised and regulated by the Financial Conduct Authority (firm reference number 510024), their company registration number is 05385677. West One Secured Loans Ltd is authorised and regulated by the Financial Conduct Authority (firm reference number 776026), their company registration number

West One Development Finance Ltd is not authorised by the Financial Conduct Authority, their company registration number is 11242570 Aura Finance Ltd is authorised and regulated by the Financial Conduct Authority (firm reference number 709675), their company registration number is 08326315. Certain types of loans are not regulated, for example loans for business purposes or certain buy-to-lets.

10 16 22 30 38 52 66 80 90 96

Bridging & Commercial 6

A lot of women want to see role models and that the path has been trodden, and how it can be done”

p22

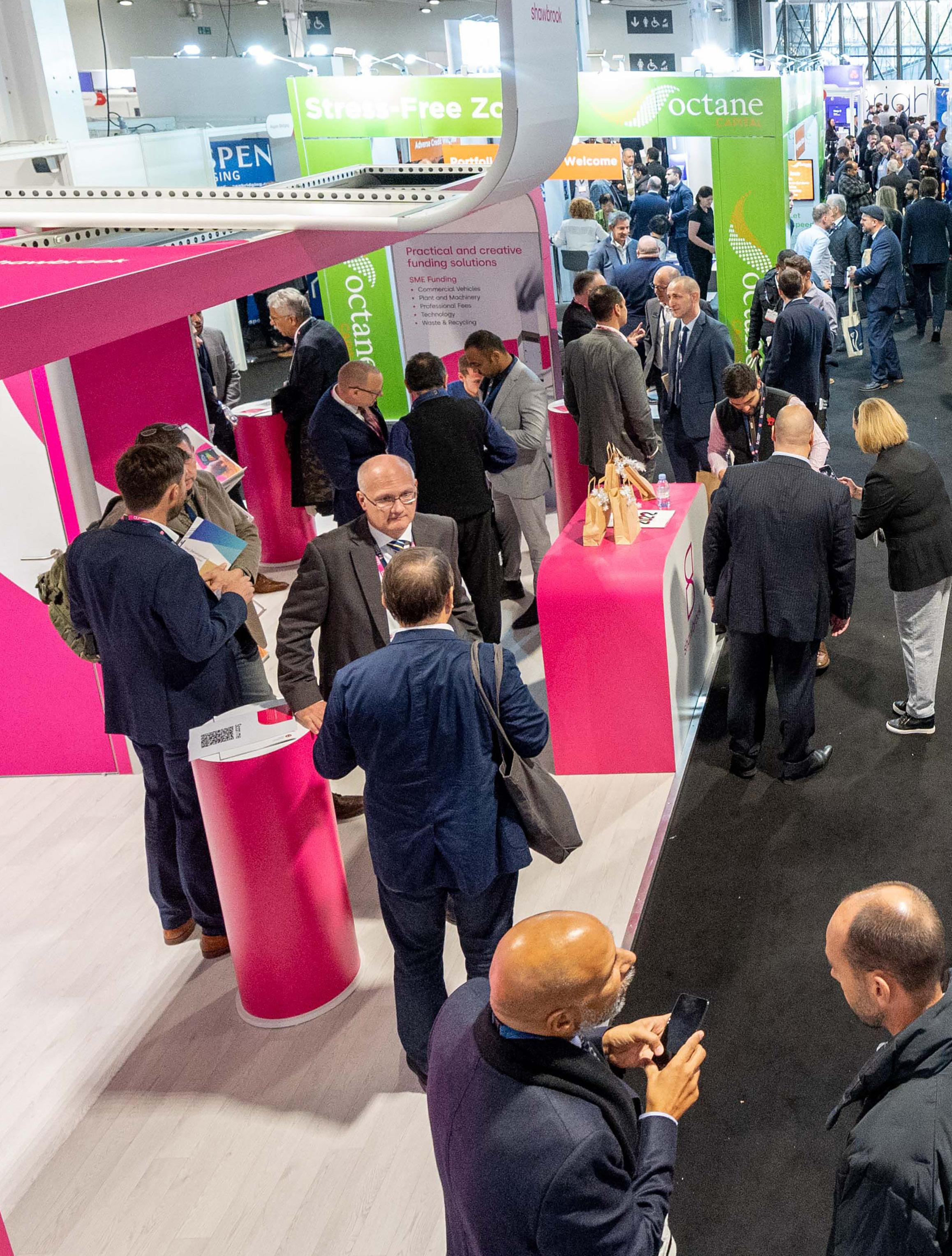

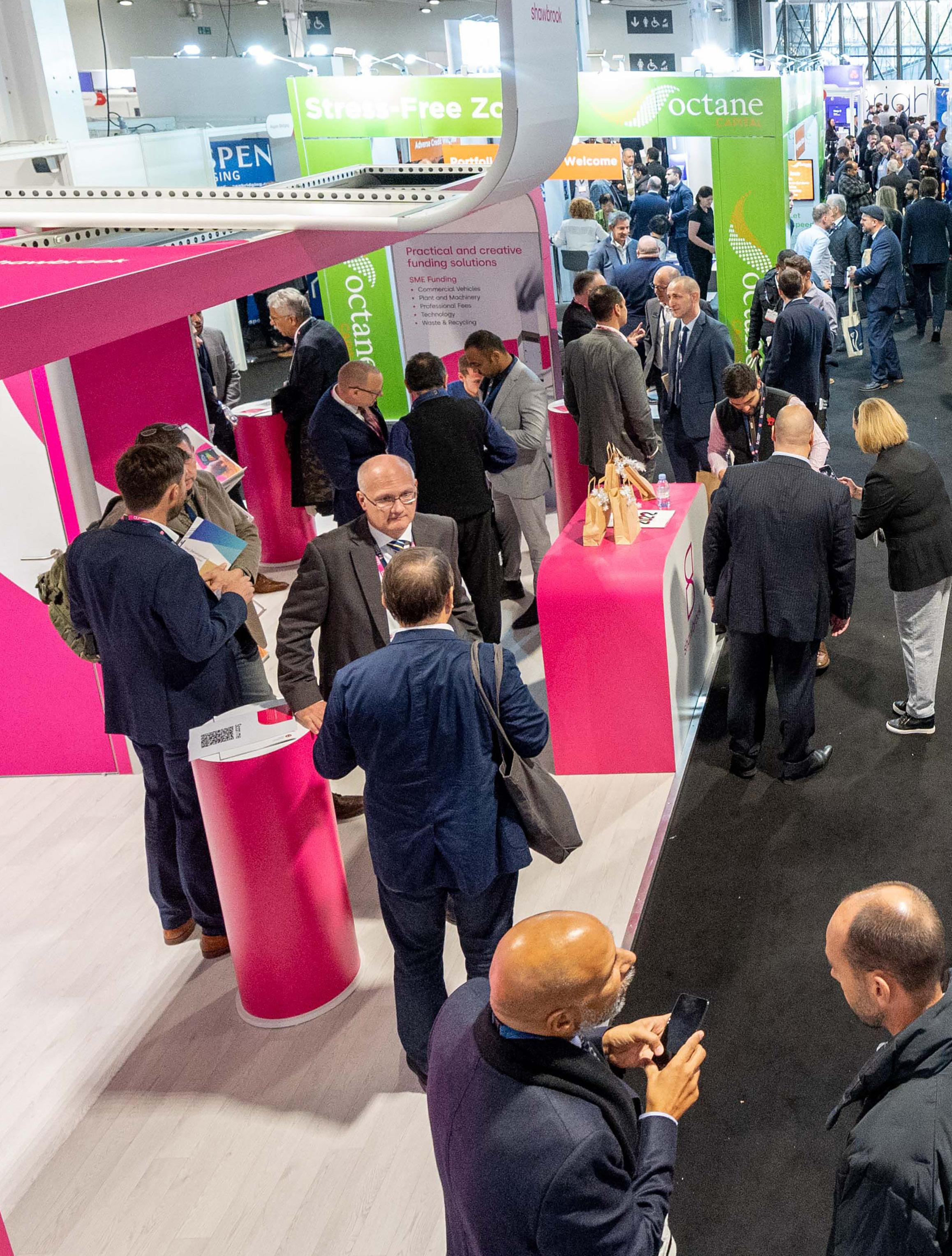

The Cut Who inspired who? News Happy birthday, Redi Finance! Exclusive The key to welcoming more women in development finance Zeitgeist Riding the curve on a variable rate Feature United Trust Bank / Arc & Co In Conversation It’s all about the maths Interview Gavin Diamond / Richard Whitehouse View Changing perspectives/ Embracing neurodiversity Limelight 1,400 professionals gather in London Backstory Tom Cantor

Blackfinch Investments Limited is authorised and regulated by the Financial Conduct Authority. Registered address: 1350-1360 Montpellier Court, Gloucester Business Park, Gloucester, GL3 4AH. Registered in England and Wales Company Number 02705948. • Lending against both residential and commercial property • Loan term typically from 6 to 24 months • Loan amounts typically £1m to £25m • Loan to value (LTV) up to 75% • Loan to cost up to 90% • Geographical coverage across the UK Get in touch today on propertyenquiries@blackfinch.com and see how we can help you Fully-Funded Lender Fast and Flexible Approach ESG-Aligned Principles In-House Legal Team Looking for a Bridging & Development Finance partner? At Blackfinch Property, we’re dedicated to helping rejuvanate local areas and economies

Bridging & Commercial 10

Who is your role model?

Everyone has somebody who inspires them—their own real-life superhero. Some of the industry’s notable figures, each with over 15 years of experience, name those who helped them reach where they are today

The Cut

Nov/Dec 2022 11

One of the first role models who comes to mind is David Anderson, former chief executive at Yorkshire Building Society, where I started my career as a graduate trainee. Despite his position in a business with thousands of employees, he was very personable and charismatic, and set out leadership qualities I admired. He made a big impression on me as a young manager. I’ve also taken inspiration from the current board of directors at Enra Specialist Finance—Danny Waters, Stephen Hogg and Emily Gestetner—who all have such a strong work ethic, are very driven and always lead by example. They command huge respect from the senior leadership team and the wider business, and their constant drive for success inspires and motivates others. The fast paced nature of the specialist finance market means you can never afford to be complacent. The people who I have learnt the most from have taught me that you’ve got to strive to be the very best at what you do.

I was fortunate enough to be employed by Stephen Knight in the mid-1980s as his number two at CitiBank, back when the major insurers were also mortgage introducers to the bank for non high-street cases. Stephen encouraged and advised me on the best way to run a team, dealing with six of the largest insurers who, in their own way, were tough taskmasters—and entitled to be so, given the enormous mortgage volumes they delivered. He was keen to impart his vast lending knowledge and lateral thinking prowess to all he worked with and, in the period I was in his team, I learned more than at any point in my career to that date, and it has stood me in good stead ever since. In later life, like many, Stephen suffered due to the recession and, indeed, became quite unwell. In the times I have met him since (sadly few in recent years) Stephen highlighted the importance of taking nothing for granted, and of taking good care of your customers and working closely with those in your team to build the same ethos throughout.

It’s always difficult to select just one role model. Professionally, there have been a few successful industry figures who I have admired and learnt a lot from, and who all believed in me— this support has had a big impact on my career. Kelvin Cooper (former MD at Solent Mortgage Services), Roger Morris (director of sales and distribution at Tandem Bank) and John Prust (former sales and marketing director at Southern Pacific Mortgage Ltd) are all infectious in their passion for people and very inclusive in how they treat others. This has taught me that, despite what you think, people are always the most important, whether they are your team, your customers or your stakeholders. Treating people how you would like to be treated is crucial. My parents also instilled a fantastic work ethic in me, as my mother was a working mum, which definitely had an influence on me. Apart from this, someone I have always admired is Madonna. While she’s not everyone’s cup of tea, she is a strong woman who worked hard to get what she wanted.

Khadr Founder of Provide Finance

Khadr Founder of Provide Finance

There is an assumption that when you ask people about their role models, you will hear them mention a famous entrepreneur, world-class athlete or public figure. But, in my experience, the people who have the most significant and positive impact on us are those who we engage with on a day-to-day basis—teachers, line managers, family members— these are the people who provide us with inspiration and make our dreams and aspirations a possibility. I am no exception to this rule. I’ve had the pleasure of meeting some exceptional people both within the finance industry and outside it, who have been so supportive and caring, and together they have all been my role models in one shape or form. Also, they are all very modest people, so I wouldn’t want to embarrass them by naming them. I have been incredibly lucky to have watched their career progression over the years and this has motivated me and made me realise just what can be achieved with a bit of self-belief, hard work and support from nurturing leaders. They also taught me to be brave and to not be scared to take a chance. Some decisions will pay off and others might fail spectacularly, but you’ll never know unless you try.

The Cut

Marie Grundy

MD for residential and second-charge mortgages at West One

Vic Jannels

CEO at the ASTL

Roz Cawood Director of sales at Hope Capital

Miranda

Bridging & Commercial 12

Tanya Elmaz

Head of intermediary sales for commercial finance at Together

Different people inspire me—I feel that you need more than a single role model in life to truly grow. However, I would have to say that Margaret Thatcher has always been an icon to me, with her hard-working, intelligent and resilient demeanour. Another person would be Madonna, who dazzled me with her Billboard Women of the Year speech some years back. Both these ladies have inspired me for similar reasons: it is a combination of their achievements and their dedicated work effort. They are both trailblazers, unperturbed by obstacles. Both have had to succeed in a male-dominated environment and have achieved excellence. They represent integrity, determination and confidence. I love women who have an opinion and are not afraid to speak up. This is something I have tried to emulate throughout my life and career, and something I would encourage other women in financial services to do.

Rob Lankey Chief commercial officer at GB Bank

Over my career, which now stretches to 35 years, I can think of at least half a dozen people who played a prominent role in shaping the person I’ve become today and the career I feel privileged to enjoy. However, my biggest role model is David Jervis, former senior executive at Norwich and Peterborough Building Society. David showed me the importance of trying to do the right thing by people, the critical role integrity plays in everything you do, and how you must pay attention to detail no matter how senior your role is. His determination to do the right thing, underpinned by honesty and integrity and his work ethic, helped shape the person I became when I had my first chance to launch a commercial lender to the market in 2007. Without David’s influence on my career, I don’t think that opportunity would have come and, from that, Aldermore was born two years later—the rest, as they say, is history. The way David did his job showed that you must care about the future you’re trying to create and I’ve always lived by that outlook. If you don’t care about this, you can’t possibly engage or inspire people to go where you’re heading.

Colin Sanders CEO at Tuscan Capital

In my 40 years in financial services, I have benefited from quite a few influential characters but, if I had to name just one, it would have to be David Johnson, founder of Commercial First. I was lucky enough to have been involved in several of his business successes and we later became work partners and family friends. Anyone involved with David’s businesses will know that he was charming, driven, commercially smart and had the ability to stay focused on what mattered. There’s one particular lesson I got from him when I was CEO at GE Home Lending, and he was about to leave the business to set up Commercial First. I was feeling overwhelmed by the workload and the conflicting objectives of running a business for a US corporate giant, but David advised me to just do one thing at a time—a tip I have frequently used whenever I’m feeling overwhelmed by a mounting workload. Sadly, David passed away in 2013, but his advice and his many other nuggets of wisdom have stayed with me and there isn’t a day goes by without me thinking of him. The industry certainly benefited from having a character like David in it and I know I’m not alone in missing his charm and infectious laugh.

The Cut

Nov/Dec 2022 13

Secured Finance Lawyers. Neil Kelly Partner E: neilkelly@msbsolicitors.co.uk Brad Armstrong Partner E: bradarmstrong@msbsolicitors.co.uk

Expert

meet our team @MSBSolicitors MSBSolicitors MSBSolicitors Ready to act. Darren Barwick Partner E: darrenbarwick@msbsolicitors.co.uk Jack Medlicott Partner E: jackmedlicott@msbsolicitors.co.uk

Living the UK dream

WORDS BY ANDREEA DULGHERU

Meir Peer followed his heart when he quit New York for Manchester, restarting his career from scratch. Several years later, the founder and managing director of brokerage Redi Finance talks about navigating his way through his financial world travels

Working in specialist finance and running a brokerage was not originally on Meir’s radar. Living in New York, he was planning a career in journalism. However, that all changed when a friend approached him with an opportunity that would set him on the path to the finance world—an interview for a job at JP Morgan Chase Bank.

Although the application process was complicated and risky, comprising a lot of training, a test and a hefty $2,200 bill if he failed the exam, Meir took the gamble. After weeks of studying in the windowless basement of the bank’s Wall Street headquarters, the hard work paid off and he joined the firm as a personal banker.

The next big change came a few years later, when Meir proposed to his long-distance partner, a Mancunian primary school teacher. He then took a job with Santander, which was just entering the US market in New York, in the hope of getting a transfer to one of their UK branches, but to no avail.

In the end, Meir dropped everything in the name of love and left the Big Apple for the North West of England.

Starting over “My US licences meant nothing here, so I had to start from scratch,” he recalls. “I was a bit taken aback because I worked really hard for these and, back in the US, people would look at my CV and think I was really good. But I put my ego aside and gave it a go in this sector, and I really enjoyed it.”

It so happened that his mother-in-law was a broker at Bridgewater Acceptances, and it was through her that Meir got his breakthrough in the UK specialist finance sector. She introduced him to Together’s commercial CEO, Marc Goldberg. “When I had the interview, Marc was very straightforward and told me that since this was a new sector for me, I’d have to learn the ropes and start from the bottom and, if I was good, I’d move up. I couldn’t live off savings anymore, so I gave it a go,” Meir remembers.

During his time at the lender, Meir got to learn about the specialist finance market through training as well as on the go. It was also at Together that he formed a close bond with fellow commercial underwriters Michael Stratton (now founder and CEO of MS Lending Group) and Paul Delmonte (now a key account manager at United Trust Bank). “I was surrounded by good people and I really enjoyed my time there.”

Almost two years later, Meir swapped his role at Together to work at Roma Finance as a bridging specialist, after which he joined Ultimate Finance in 2018 as a regional director. “I loved working at Ultimate Finance,” says Meir. “It was a bit challenging, but I adored the atmosphere, team and flexibility. They were ahead of the times when it came to work-life balance, which was great as I had two young kids to take care of.”

Sadly, the good times came to an end when the Covid-19 pandemic hit the market, and Meir was let go from the firm after a couple of months of being on furlough.

Building a brokerage

Although tough at the time, the pandemic was a blessing in disguise for Meir as it put him on the road to become a broker.

While on garden leave, he received numerous enquiries from previous clients, intermediaries, and other connections he had made throughout his career, asking questions or requesting his help to obtain the finance they required.

“A lot of lenders pulled out of the market, so I was getting all these messages from people who needed help. They were pretty desperate, but I couldn’t do anything while on garden leave. It was almost like I was building a pipeline in the background,” explains Meir.

Once his job had gone, Meir started approaching his numerous contacts in the industry, including underwriters and BDMs, so he could address these unmet needs. “I didn’t have a work email, a name for a company, or anything of that nature—I would just pick up the phone and call underwriters or BDMs directly to ask for help placing deals, and that got me going. This is a very competitive market, but I do find that people are really nice and help each other out.”

For Meir, the switch to becoming a broker came organically out of his desire to help people. After placing several deals, he decided it was time to make it official and created Redi Finance—named after his two children, Remi and Gadi. “I am living the dream,” says Meir with pride in his eyes. “I’m an immigrant who didn’t have a job when I got here, but now I have my family, a business that’s doing really well, and I like to think that I’m known as someone who’s good in the industry. I’m very proud of where I am now.”

Despite how it may appear, it is not all positive, as Meir candidly shares the difficulties that come with running your own business. “A lot of people think that when you’re self-employed, you can do whatever you want, but that’s not true if you want to be successful. It’s very hard to switch off—you may want to go on a holiday with your family or save the weekends for them but, sometimes, you have to also take your laptop with you and work,” he explains. Nonetheless, he is grateful that he is able to change his schedule to be there for his family. “To me, being successful isn’t just being comfortable financially, but also having freedom and flexibility. Knowing that I can pay the bills, take a vacation with my family and provide for them is amazing, but the ability to be present for my kids at school events or having lunch with my wife without needing someone else’s permission is the cherry on top.”

Right time to think big Fast-forward to the present day, Redi Finance is celebrating its second anniversary. Reflecting on the success of the business, Meir tells me that the brokerage has evolved in an interesting way in terms of the deals it has been arranging. In its first year, around 75% of the total business was bridging finance—Meir’s bread and butter. However, things changed in the second year, particularly in the past couple of months; the BTL and development finance deals started to pick up, and now comprise half of Redi Finance’s overall business.

“I was doing loads of bridging deals but, naturally, people need to then come off these and onto term deals,” he explains.With the brokerage’s business becoming more complex, Meir is now looking to expand his team to have dedicated advisers for the different specialist finance areas to ensure Redi Finance provides the best service for its clients.

Not only that, but the company is also working hard to receive FCA authorisation to become a regulated broker, which it expects to achieve in Q1 2023. Once this is sorted, Meir is considering welcoming independent financial advisers to trade under the Redi Finance umbrella.

As for Meir’s ultimate dream for the brokerage, it’s simple— bringing New York to Manchester in the form of a high-rise headquarters on Bury New Road (and maybe even brokering the development finance for the build) within the Jewish community that has been supporting him on his journey.

“Redi Finance is two years old now, and I think this is the right time to think bigger—I’ve got the plan outline and it’s really just bringing it to life,” says Meir.

“It’s a tough time now because of everything changing so often, but we’ll see what the future holds and, if all goes to plan, I’m hoping for some big things for Redi Finance.

News

Nov/Dec 2022 17

For a relationship focussed approach Simply email us and one of our team will be directly in touch contact@sancus.com > Residential > Semi-Commercial | Mixed Use > PRS Schemes | Auctions | HMO’s > Light to Heavy Refurbishment > Multiple Assets sancus.com LTV/LTC/Refurbishment costs 75%/85%/100% up to 24 months with competitive introducer fees Bridge by Sancus Certainty of delivery and deep property expertise Loans from £500,000 to £5,000,000 Bridge by Indicative criteria only, each loan application is considered on its merits. Sancus Lending (UK) Ltd is regulated by the FCA, firm reference number 593992. Risk Warning: If you are co-funding you could lose part or all of your capital. Indicated returns, unless otherwise stated are shown before any provision for bad debts and may be subject to tax. Sancus do not provide private mortgages. Sancus Lending (UK) Limited (company number 7534003), registered office 3rd Floor, The News Building, 3 London Bridge Street, London, SE1 9SG. Authorised and regulated by the FCA (FRN: 593992). Part of Sancus Group Holdings Limited which is registered in Guernsey.

LDS removes sales risk, opening up access to finance, reassuring developers, lenders and brokers in uncertain times. Remove Uncertainty reigns across almost every component of the housing market, especially new build, which is even more acute for SME housebuilders Scan the QR code to find out how LDS removes uncertainty and is the catalyst to bring forward much needed new housing in all market conditions. info@LDSyoursite.com 0333 006 7799 uncertainty Get an instant Sales Guarantee at LDSyoursite.com

The Platform for Development Finance and Bridging Lenders

soprabanking.com/aurius-df

Aurius-DF from Apak Group, a Sopra Banking Software company, is the only solution specifically designed to meet the needs of the Development Finance market.

Lending for Development Finance presents unique challenges:

• the flexibility demanded by the highly changeable nature of the projects being funded

• the need to monitor complex deals to make sure they stay within their agreed parameters

• the involvement of brokers and multiple third party professionals

• the requirement for close management of the relationship with the developer

• the di culty of producing clear, consolidated business information in order to be able to manage risk and predict cash flow

Meeting these challenges is vital to a successful Development Finance lender in order to manage risk and increase e ciency. This helps control the cost of managing these complex loans which ultimately increases the margins available in this competitive and dynamic market.

Based on Apak’s Aurius platform, Aurius-DF meets the business needs of Development Finance lenders by providing market specific functionality, including: • Loan Schedule Modelling (both pre-approval and in-life) • Facility Limit, Advance Limit and Loan Tranche Management • Tracking of involved Brokers, Third Parties and Professionals • Guarantees and Security Monitoring (including tracking constantly moving LTVs) • Notes and Diary Management

On top of the Development Finance specific functionality, Aurius-DF clients benefit from access to all the underlying Aurius platform capabilities: • Open API access through the Aurius connectivity suite • Configurable, embedded workflow and document management • Tried and tested accounting, payments and transaction handling

Delivered using a cloud-based Software as a Service model, unlike traditional software delivery models, lenders have a low cost of entry and pay based on the amount of business handled by the solution.

Want further info?

Continue the conversation and contact us at apak.info.team@soprabanking.com

L-R: Alex Upton and Uliana Kuzmis

L-R: Alex Upton and Uliana Kuzmis

BLAZING A TRAIL FOR WOMEN

Hampshire Trust Bank (HTB) has many divisions led by women, but it recognises more encouragement is needed in the sector to attract more to the development finance workforce. Alex Upton and Uliana Kuzmis discuss setting examples and how hiring the best will result in more women holding senior roles

Words by andreea dulgheru

Exclusive

Nov/Dec 2022 23

At the end of September, HTB

warmly welcomed Uliana Kuzmis as deputy managing director for development finance, who will be working together with the division’s MD, Alex Upton, to continue the bank’s growth.

“This is the best move that I have taken in my career,” declares Uliana. “Alex and I are two pieces of the same puzzle—she is everything that I’m not, and I’m everything she isn’t, so together we complement each other’s strengths.”

While men often dominate the development finance sphere, Alex tells me that four of the six senior roles in HTB’s development finance division are held by female employees (herself and Uliana included), something of which she is incredibly proud.

According to Alex, for HTB, sex equality is not a one-time-only thing, but a staple across the entire business. “If we look at our divisions, 50% of them are run by women. But this isn’t a tick-box exercise for us—we’re all about celebrating talent and rewarding people for the good job they do, irrespective of gender. I think that’s the best way to build a business.”

Unfortunately, the same cannot be said about the wider financial market. According to government research, while one-third of board positions in the UK’s FTSE 100 companies are held by women, only 15% of finance director roles within these firms are held by female employees. “There’s still a long way to go, and a lot more needs to be done,” acknowledges Alex.

Passing the torch

The specialist bank is determined to continue playing its part and encourage women to join the development finance sector—and Alex believes the key to this is having a strong leadership team with a large female component, which will attract more women to enter this sector: “I think a lot of women want to see

role models, to witness that the path has been trodden and how it can be done. We need to inspire them that this is an industry in which they can learn new skills, develop and thrive.”

This approach stems from Alex’s personal career experience. She fondly recalls her boss in her first finance industry role at 17 years old—a regional manager at Santander—who remains one of her biggest role models. “I was just in awe of everything she did, and I learned so much from her. A while ago, a woman in a senior position was quite rare, but she really knew her stuff and she broke the mould of what was needed in finance. I still, to this day, ask myself, ‘What would she do?’ in different situations.

“I think that if I didn’t have her as my boss at the time, I wouldn’t be sat here today—she was the one that made me think I could get to this position. That’s the impact you can have on people, and this is the responsibility we have. Women look up to other women, and we need to remember how much influence we can have on people and how much we can shape their careers.”

And it seems that this strategy is working— indeed it convinced Uliana to join the bank. “When I was approached by a headhunter and the name HTB was mentioned, the first thing I thought about was an interview that I came across two weeks prior on LinkedIn with Louisa Sedgwick, the bank’s managing director of specialist mortgages.

“I thought it was brilliant—I had never met the woman before, but I was so inspired by her that I agreed to talk to the recruiter about this opportunity because of the way the bank treats women. I thought it was a firm that demonstrates women’s value in the financial industry and really puts them forward, which is such an important value for me.”

Sharing Alex’s views on the importance of visibility of female leaders in the industry,

Exclusive

Bridging & Commercial 24

“This isn’t a tick-box exercise—we’re all about celebrating talent and rewarding people for the good job they do, irrespective of gender. I think that’s the best way to build a business”

Uliana is also determined to play her part to ensure others are inspired by her story and achievements, precisely how she was when she made the decision to join the bank. “I believe myself, Alex and others have a duty of care to future female leaders in the industry.”

Risks and barriers

Apart from having women in senior positions to inspire others, there’s another vital factor when it comes to recruiting more women in development finance—the ability to cater to the candidate’s needs to achieve a work-life balance.

“I think that women are more risk averse generally—it takes quite a lot to convince somebody to jump to a different employer, so flexibility is key to them,” says Alex. “That’s something that HTB does really well. For example, we recently recruited our first female lending director who asked for the role to be part time. This isn’t initially what I had in mind but, of course, we made it happen so she could get the flexibility she needs.”

Efforts do not stop at recruitment. Uliana makes it clear that it’s not enough to just hire more women—they must also be trained and supported to reach their goals. “Women perceive themselves differently—they don’t promote themselves as much as men would, and they may not be as loud as them, but that doesn’t mean they don’t have potential. And I think that being female ourselves [her and Alex], we are able to see through all these barriers and understand what we need to do to discover and unravel other women’s potential. It’s not about prioritising them over men; it’s about helping them stand up, become more confident and shine.”

This is why Uliana has designed and implemented an extensive training programme for the whole team which, she hopes, will help more junior female members within the team to grow and develop themselves at their own pace. “Some of the training is

delivered by me while, for the rest, we’ll be bringing in the best people in the industry.

“We’re also looking to have sessions around personality assessment and personal branding, which for women is a lot more important because they may not even realise how they are perceived. The next step from that is working on their weaknesses and helping them develop their strengths.”

This training builds on the one-on-one mentoring programme HTB introduced 18 months ago, which was created in response to feedback from a number of women who felt there was a glass ceiling stopping their career from evolving. “Everything that Uliana is doing right now and the investment that we put into our people are to ensure they’ve got the skills and confidence to prepare them for what it is they want to do next,” says Alex.

And it seems that the bank’s training programme is paying off. In addition to welcoming its first female lending director in December, Alex exclusively reveals that HTB has promoted a number of women—including Chloe Stidston-Lewis to head of business processing and controls, Stephanie Hester to senior relationship manager, Ellie Allen to portfolio manager, and Gemma Phypers to senior credit quality assurance manager.

While HTB is on the right path, there is still a lot more that can be done within the overall development finance industry when it comes to gender diversity and inclusivity—and Alex is encouraging all firms to evaluate and improve their approach to this. “On top of thinking about who we recruit externally, it’s also how you evolve the women already in your company. Firms need to focus on making sure women get the same development as their male counterparts—I don’t think it’s equal at the moment; every company should be thinking about mentoring the women within their divisions.”

Exclusive

Nov/Dec 2022 25

“It’s not about prioritising women over men; it is about helping them stand up, become more confident and shine”

Why is previous knowledge of lending throughout the cycles so important in today’s economy?

As more traditional and less well funded lenders retrench from the development lending space, we are witnessing a growing liquidity gap in the market, which offers an opportunity for those experienced, specialist lenders, who are better equipped to navigate the credit risk element of a real estate scheme. Small- to medium-sized developers have continued to struggle for access to finance post-2008, and the role of specialist lenders has increasingly addressed the market gap.

How crucial is it for developers to have an experienced team around them, and how can this help increase profit margins?

Experienced developers have the expertise that covers the lifecycle of a scheme, from planning to delivery, managing stakeholder relationships and procurement issues. Most often, we find that they haven’t got the knowledge to structure capital commitments and to reflect project risks and profitability.

Developers would hugely benefit from a team around them that understands capital and development finance to manage risks and increase profit margins.

In a high inflation environment, this is more critical than ever, as underwriting assumptions can change very quickly.

How have the roles of development

lenders and brokers changed over the past 18 months, and do you expect them to further evolve?

Against a backdrop of higher material, energy and construction costs, rising interest rates and overall economic uncertainty, lenders have had to act more like equity investors. Lending is a relatively simple process, involving due diligence and documentation. However, more focus will have to be placed on risk management, where lenders must understand the collateral and potential challenges along the way, in terms of project delivery. Close monitoring of the construction process and a collaborative relationship with developers will be required of most lenders which are navigating current challenges.

How does an understanding of the development finance sector assist you with making credit decisions, even if scenarios are unforeseen?

Unlike shares and stocks, property development is a more complex investment. Market dynamics can impact the physical delivery of the asset, which means grasping the risks associated with construction, procurement, industrial supply chains and exit routes in order to manage risk credit decisions, is required. With so many moving parts, knowledge of property development and the finance of it is vital for protecting investors’ capital.

The speed and severity of interest rate rises—from 0.25% at the end of 2021 to 3% today—has required lenders to draw on all their experience in order to correctly price new facilities.

Why did you decide to launch your software platform

Hilltop Credit Stream?

Hilltop Credit Stream, our innovative real estate credit acquisition software, allows us to underwrite deals faster and manage information all in one platform. It blends technology with clear communication and collaboration. In order to scale our business both in the UK and Europe, we needed to create a standardised way to process and gather the necessary information. By using a host of integrations to our platform, we can access market data quickly and carry out the due diligence efficiently. The platform also allows us to include deal collaborators, so it’s like everyone working around the table in real time. Once a credit paper is produced and a deal closed, Hilltop Credit Stream also manages drawdowns through its portfolio management tools.

Advertorial

Bridging & Commercial 26

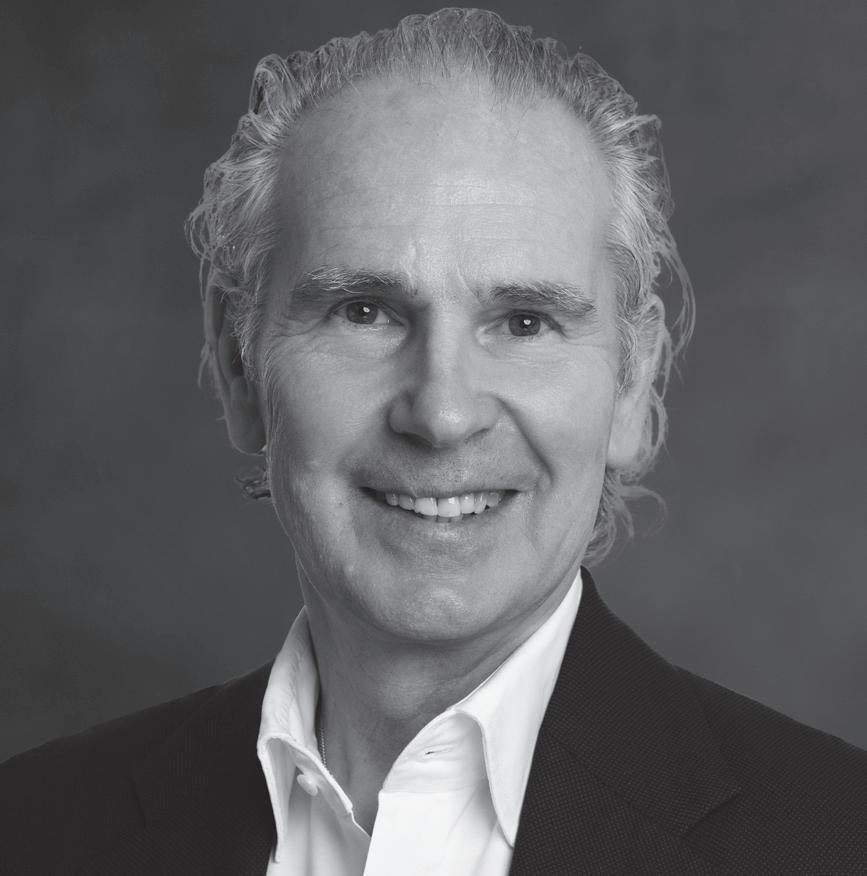

Paul Oberschneider, CEO at Hilltop Credit Partners

STREAMLINING COMMUNICATION

Why having an experienced team around you is key

How does Hilltop Credit Stream help developers communicate more efficiently with everyone in the transaction chain?

Our innovative platform is designed to help borrowers access capital efficiently and allow cross collaboration between us, borrowers and collaborators. The advantage of using this technology is that it provides direct dialogue throughout the whole loan process. Borrowers simply sign up online and complete the three-stage application form—which can take as little as 48 hours to complete—for development loans of between £5m-100m. Hilltop Credit Stream was built for an entire development team: lawyers, brokers, executives, and underwriters. The platform also streamlines the loan application management; it evaluates each application, offers a medium for legal teams to exchange and review documents, and shows real-time origination, underwriting and funding data for the executive suite.

What has the feedback been like since its launch?

The results have been exciting. We have managed to cut down time spent on each deal by less than half from application to drawdown of funds. Users like the simplicity and developers can access funds faster than the traditional process and control the timeline. Repeat borrowers can get access to funding in under four weeks

by using Hilltop Credit Stream. This has the potential to completely transform the speed at which new housing is delivered— one of the biggest challenges facing the UK at the moment—given that the two stages where developers get held up the longest are the funding and planning stages.

What difficulties are you currently seeing in the development market and, in your experience, how can they be mitigated?

High inflation is forcing many residential schemes to be delayed. Political and economic uncertainty, coupled with rising mortgage rates, are putting downward pressure on the UK housing market—demand in October fell at the fastest pace since the start of the Covid-19 pandemic. However, demand and the need for new homes remains at an all time high in the UK and across major cities in Europe. The structural demand/supply imbalance is still there. In the residential for rent sector, we’re seeing more private landlords exiting the market due to the impact of higher rates and ongoing regulatory and tax changes, which creates an opportunity for institutional investors looking to increase their exposure to what is a growing asset class.

For lenders, the increased cost of funding has forced a number to completely scale back their activity, or pivot towards offering longer-term products.

What advice would you give to a developer and their broker if something goes wrong?

Immediately report the issues. As lenders, we can only help if we know the problem. Unwinding bad decisions later makes it difficult and costly.

Second, keep us updated at every stage of delivery. It’s much easier to solve an issue when we’re aware of the timeline of a development and its milestones.

What market opportunities and challenges are you expecting in 2023?

I see a growing opportunity for more creative capital. Markets will be more nuanced, risk will be different, but great investment opportunities still exist for experienced, but disciplined lenders. As we head into a recession and cost of living crisis, I expect the focus to shift from Build to Sell to Build to Rent, especially regional multi-family schemes that provide people with genuinely affordable accommodation. I also see a huge opportunity for fintech to speed up and filter through many more deals in a shorter space of time. Housing delivery is still critical, and the speed of financing from lenders such as Hilltop Credit Partners can help small- and medium-sized developments get off the ground.

Advertorial

Nov/Dec 2022 27

C M Y CM MY CY CMY K Are hiking interest rates stalling your property investment goals? Stay on top with Lendhub Get in touch today: 0203 657 1900 borrow@lendhub.co.uk

Bridging — to fix or float?

Words by Stephanie Baxter

Brokers and borrowers alike prefer the certainty of fixed-rate finance amid rising rates, but could floating bridging loans be more cost effective?

During September and October, many specialist lenders, including bridging financiers, pulled and repriced products in response to the market turmoil that followed the Bank of England’s succession of base rate rises and the then chancellor’s ill-fated mini-Budget.

Bridging loans have historically been based on fixed rates, but rapidly rising interest rates have led some lenders to start offering tracker products within their pricing strategy.

This has been partly driven by their desire to manage their balance sheet and P&L, but also somewhat motivated by pressure from their funders.

Some finance providers have launched pure floating rates, while others have introduced a mechanism that means if the base rate goes above a certain level, the fixed rate is transformed into a floating one.

Several lenders, including TAB, West One and Avamore Capital, have started offering floating rates—the latter which introduced them for the first time in October. D’mitri Zaprzala, co-head of Avamore’s management team, says: “We had not given a great deal of thought to floating until rates started to change over the summer. We tried to maintain fixed for as long as possible, but it just became really hard to manage. Post mini-Budget— when rates went absolutely crazy for a while—it became very clear that it was almost impossible to offer fixed rates with any element of certainty.”

Specialist lender Atelier also unveiled variable rates for the first time. “We are now living in an environment where the era of free money has gone,” says joint CEO Chris Gardner. “Interest rate movements will become business as usual, just like they were before the financial

Zeitgeist

A LENDER’S

FUNDS IS FLOATING UPWARDS, BUT IS LENDING AT A RATE WHICH IS STATIONARY, IT WOULD, OF COURSE, PUT THEM UNDER PRESSURE” Bridging & Commercial 32

“IF

COST OF

crash. We’ll probably enter a period of stability in the long term, with a base rate somewhere between 3% and 4%.”

The potential problem for many bridging lenders is that the returns to their investors for their funding lines are typically based on a variable rate, which means loans fixed before the rate rises erode their margins.

Chris says lenders face a big period of change: “Bridging lenders will either need to use financial instruments, such as hedges and swap rates, to guarantee their cost of capital and continue to offer fixed rates— or they’ll have to switch to a variable rate model or offer [them] as an option.”

Going forward, can bridging lenders exposed to tracker credit lines survive? “If a lender’s cost of funds is floating upwards, but is lending at a rate which is stationary, it would, of course, put them under pressure,” claims D’mitri.

For Matt Watson, CEO and founder of Tenn Capital, financial viability depends on the core of each lender’s business. “Some finance providers are incredibly well capitalised and established, and have models in place where they feel able to offer fixed-rate deals—certainly in the near term. They can ride out the storm and use it as a tool to capture growth, because large portions of the market prefer the certainty of a fixed rate.”

Some finance providers are now offering a product whereby a loan is agreed, but the rate can float up to the time completion occurs, from which point it moves to a fixed-rate deal. For example, Avamore will fix the rate on the day of completion, and the base rate on that day will dictate what is charged. “We thought it was very important to be open and honest with our borrowers and brokers alike. It would have been disingenuous of us to say ‘here’s your fixed rate’, knowing full well that if rates continue to change, we’d have to change that fixed pricing,” says D’mitri.

Variable rates advantages

For borrowers, the key advantage of opting for a variable rate is that they can currently be cheaper than fixed rates. For example, Avamore offers floating rates that are between 1-1.5% cheaper than the equivalent fixed rates.

However, Lucy Barrett, managing director at Aria Finance, points out that borrowers opting for a variable rate take the risk that they could later exceed the fixed price. She therefore thinks it is a good idea for lenders to give borrowers a choice and let them decide what is right for them based on their unique situation. “No one knows if tracker rates will be cheaper than fixed rates for bridging loans—and it’s the same with mortgages,” D’mitri says. “If you took a tracker mortgage back in the early 2000s, they did well because rates came down for a period of time. Who knows whether you will be better off pound for pound with a fixed or floating rate? But, on day one, the floating rate will be cheaper than fixed, where you would be paying a premium to protect yourself against rising rates.”

Avamore has seen more demand for its floating rate loans than it expected. “If the price point was the same, you’d probably take the fixed rate—that’s just nature,” D’mitri shares. “But because there is a price differential between the two, floating has become more popular than we probably thought it was going to be.”

Borrowers are also more likely to opt for floating rates when they need very short-term bridging finance. If a borrower believes they will be repaying the loan within six months, it is expected they will go for a floating rate, states D’mitri— however, if they think it will take longer, they may well opt for a fixed rate.

Ultimately, the choice will come down to whether the price differential is wide enough to make the floating rate attractive and appear a better bet. Lucy agrees, adding that if a borrower thinks they will be in and out quite quickly, they are likely to take the view that the variable rate suits them as they will get the benefit of slightly lower pricing. She says: “They may think ‘I’ll be out of this in two months’. So, even if the rate does go up, the risk [of floating] is quite low, as the rate is unlikely to change that much in just two months. However, if somebody thinks they need the whole 12 months, perhaps because they’re waiting for planning permission that is out of their control… [they may fix as] a lot can

happen in 12 months. Those clients would likely want a bit more certainty around what their interest costs would be.”

Is floating worth it?

SPF Private Clients director and head of short-term finance Amadeus Wilson sees little benefit for borrowers from tracker rates currently, claiming there is barely any difference between variable and fixed rates on most bridging loans.

“With floating mortgage rates, at the moment borrowers could be rewarded for taking the risk if rates don’t go above 5%. But, where bridging lenders offer both fixed and floating, there’s not a big enough discount right now for us to give advice to borrowers to take the floating option. The rates are almost identical on loans. We’ve made exactly zero applications for floating rates in the past 10 weeks or so [as of 7th November].”

Amadeus points out that while borrowers could get a 75% LTV on a fixed-rate product from most bridging lenders, they may only get up to 70% LTV on a floating rate. “The rationale behind that is, if rates go a lot higher, lenders do not want borrowers to have more than 75% LTV because, when you insert a bridging loan, your liabilities could be much worse than you predict,” he explains.

For example, with interest rates moving around, a 70% LTV could quite easily become 72-73%, which creates difficulties for both lender and borrower. According to Chris, this might mean the borrower will have to service some of the interest or they could be in breach of the LTV covenant in their agreement. “If the loan starts off with a 70% LTV and interest rates going up brings it to 73%—and then property prices fall—it could start to get very hard.”

Given that the average bridging loan is for circa 12 months, introducing a floating rate in a market where rates are likely to sharply rise is a difficult sell to borrowers. And brokers typically prefer to give their clients certainty over their cost of funds.

That is why Glenhawk has decided not to introduce variable rates, says commercial director Michael Clifford. He claims that variable rates on bridging loans have not been introduced in the

Zeitgeist

Nov/Dec 2022 33

“THERE’S NOT A BIG ENOUGH DISCOUNT RIGHT NOW FOR US TO GIVE ADVICE TO BORROWERS TO TAKE THE FLOATING OPTION”

regulated market. “We offer regulated and unregulated bridging loans and, if we give some consideration to the FCA’s Treating Customers Fairly principles or its upcoming consumer duty [initiatives], trying to rationalise the benefit to a borrower of taking a floating rate when prices are only going to float upwards is difficult, because the benefit is all lender focused,” he says.

Another issue is that, in the structure of bridging lending, a lot of it is done on a retained-interest basis. “So, in a rising interest rate environment, will there be in effect margin calls from lenders asking borrowers to add more cash into the deal at any unknown point in the future?” ponders Michael. “Or, at the exit, is there going to be a call for more cash to make up the difference in the floating rate and between origination of the loan and the exit? These are risks that are difficult to quantify and sell to a client.”

Amadeus adds that the operational difficulty with floating rates is calculating interest over different periods, which introduces a degree of heavy administration on lenders’ platforms.

Price is, of course, one of the most important factors that makes a deal attractive. But, for Matt, it is not the be-all and end-all. “There are other things that go along with it, such as certainty of funding, efficiency of the execution process, and clear and direct communication with both the adviser and end client—these things are equally important,” he says.

Looking ahead

Strong demand from brokers and borrowers for fixed-rate loans is very likely to continue over the next few months. But there will possibly come a point as interest rates begin to settle that people take an educated gamble to ride the curve on a variable rate.

Glenhawk would consider introducing floating rates, only if this would add value for clients and if interest rates were fairly comparable. “[With floating rates], there is the opportunity for borrowers to benefit from a benign or falling interest rate environment as we move forward, as well as mitigating earlier rises in interest rates,” highlights Michael.

“So there’s a fair trade-off between lenders and borrowers in those scenarios, and we may move into that [space] after Q1 2023. If we consider where yield curves and interest rates may go, perhaps there may be an opportunity for us to do something with a longer-term product on a floating rate.”

Zeitgeist

Bridging & Commercial 34

Confronting the EPC Challenge:

The path to a sustainable rental market

Our new whitepaper analyses the impact of the rising cost of living on the UK’s private rented sector, as it has added a new dimension to the energy efficiency conversation.

While changes to the Energy Performance Certificate (EPC) regulations are still proposed for 2025, the growing importance of energy efficiency for tenants can’t be ignored.

Download our new report for the latest insights on how the market, including brokers, can face into the EPC challenge and help build a more sustainable rental market.

Download the report now

property.shawbrook.co.uk

It’s about relationships. Find out more at allica.bank/introducers or give us a call on 0330 094 5555 Allica Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (FRN: 821851). Registered office: First Floor, Eldon House, 2-3 Eldon Street, London EC2M 7LS. Registered in England and Wales with company number 7706156. 98% OF BROKERS SAID THEIR ALLICA BANK BUSINESS DEVELOPMENT MANAGER WAS GOOD, VERY GOOD OR EXCELLENT. Source: Allica Bank’s Q1 2022 Broker Survey of 143 brokers WINNER - COMMERCIAL LENDER OF THE YEAR HIGHLY COMMENDED - SERVICE EXCELLENCE, LENDERS Lending is about more than just the numbers. With Allica Bank, every broker has an expert relationship manager to help find the best solution for their customers. Paired with our bespoke Introducer Portal, you can expect clarity, consistency and collaboration every step of the way.

Adding value with a one-team ethos

United Trust Bank’s new director of bridging enjoys the challenges and commercial sharpness specialist finance demands. In an interview with Bridging & Commercial, Sundeep Patel discusses the power of human connection at all levels and his focal points for success

Words by andreea dulgheru

Words by andreea dulgheru

Feature

Bridging & Commercial 38

Sundeep Patel

Sundeep Patel

s a child, Sundeep spent many days cycling from his home in Bermondsey to the City of London. Little did he know that this would eventually be his route to becoming an expert in specialist finance.

Inspired by the glamorous business life in the city, as well as by his uncle who worked for Barclays Bank—quite a difference from his family of business owners—Sundeep knew from a young age that he wanted to pursue a career in finance. Determined to succeed in his chosen profession, he completed his Bachelor degree in Economics and Financial Services at London Guildhall University (now London Metropolitan University), after which he got his first job at Allied Dunbar (since taken over by Zurich Insurance Group) as a trainee financial adviser. Unfortunately, his time there was short lived, as his mentor fell terminally ill, and Sundeep moved to Halifax, working on the London mortgage desk. “That was a great entry into mortgages. I learned to process, screen, and underwrite and did that for two and a half years until I eventually became the team leader for the London desk, which was brilliant,” he says. Later on, Sundeep decided to change careers when he joined CMG Advice as a mortgage operations manager. There, he spent seven years helping independent financial advisers, building

management team, who definitely inspired me to build my confidence in specialist lending, but also helped me provide education to mainstream brokers on solutions available to them.”

A commercial mind

Throughout his time at Precise Mortgages, it became clear to Sundeep that specialist finance was the area for him, as he enjoyed being commercially minded. “With specialist finance, you have to listen and understand the deal and, sometimes, you have to chisel the deal so it works. “Specialist finance is fast moving, and you have to be equally agile, using your common sense and commercial edge to reach an outcome, which is something I really like. No two days are the same, it’s exciting and challenging and that still gives me a buzz.” Sundeep’s final stepping stone to becoming the specialist finance expert he is today was his move to Together at the end of 2018. “As it is a non-bank lender, that took me to the deep end of specialist lending, where I had full exposure of all types of commercial assets,” he elaborates. To succeed at Together, Sundeep had to adapt to a different mentality and his quick, commercial thinking was thoroughly tested, which he enjoyed. He also had the chance to work with

lender relationships, and managing a team of administrators—while still only in his 20s. “That taught me a lot of the skills that I now possess, and this is how I was introduced to lenders and building relationship skills,” he explains.

Specialist shift

As the credit crunch arrived and the market became challenging, Sundeep decided to go back to his lender roots and joined RBS, where he got his first taste of specialist finance, working for the bank’s One Account proposition, then within the intermediary partners team for almost seven years in total.

However, it was his time at Precise Mortgages, which he joined afterwards, that accelerated his journey into specialist lending.

At Precise, Sundeep had the chance to work with industry heavyweights Roger Morris, Alan Cleary, Richard Lawton and Colin Barrett, to whom he is grateful for the support and help they gave him to thoroughly understand specialist finance.

“It really opened up my eyes to this market,” he says. “I was lucky again, working with great colleagues in a very supportive senior

and learn from the lender’s commercial CEO Marc Goldberg—yet another important mentor. “He is arguably one of the best dealmakers in the industry I’ve ever met; he has a passion for business which is extremely infectious. I was blessed again to have the opportunity to work with someone like that.”

Survival skills

Two years later came a disruptive challenge to lending: the Covid-19 pandemic. At the beginning of the first lockdown, Together was forced to temporarily halt new loan applications across its product range, as well as change the way it operated to maintain a sustainable, responsible business. “To be honest, the pandemic was probably the most difficult period of my career to date,” recalls Sundeep. “Our number one priority was finding the best way to take care of our staff (around 750 people at the time), as well as looking after the business. It was a steep learning curve for me and for Together, but it was something we took extremely seriously. “I also learned to not be afraid to be outspoken

Feature

Bridging & Commercial 40

“I genuinely think if you can connect to people on all levels, then you’re going to get the best out of them”

when true change was required for the sustainability of the business, as long as the suggestions were sensible and thought through.”

Despite the difficulties, Sundeep forged ahead with determination and continued his job to support both Together’s clients and its team members—and his hard work was rewarded when he was promoted to head of intermediary sales in September 2020, and later to director of sales in January 2021.

“The pandemic and post-pandemic period

“We have a strong reputation for delivering on our regulated bridging with an excellent fast-track process, and we will continue to protect this offering and expand our distribution via our portal,” he says.

Unregulated expansion plans

He sets out the ambitions moving forward: “A clear growth goal for us is to strengthen our unregulated proposition, and we have taken steps already with our competitive

definitely showed me I wasn’t just a dealmaker, but also someone who can manage a channel and interact with all parts of the business.”

The tough times during the pandemic confirmed to Sundeep the importance of having a tight-knit culture—or, as he coins it, a “one-team ethos”.

He explains that one of his missions when assigned to run Together’s sales channel was to ensure that everyone was approachable and that there were no barriers restricting communication between staff at all levels.

Values and culture

A few months ago, Sundeep felt it was time for a career change. “It was a very difficult decision. I absolutely loved what I’d built [at Together] and I was very proud of it, but I realised I needed something new,” he explains.

In November, Sundeep joined UTB as the firm’s director of bridging. “UTB has very clear values at its core, which it prioritises over many other factors, and that really resonated with me,” he says.

“The strategic vision that was presented to me was also an important factor, as it excited me and made me feel I could add value to the bank’s ambitions in a sustainable way.”

Back home

For Sundeep, joining UTB felt like returning home—not just because the bank’s head office is around two miles from where he grew up, but also because of the warmth shown by the lender’s people.

“Straight away, I felt a connection to my new boss Mark Stokes [UTB’s chief commercial officer]. I also met Harley Kagan [UTB’s CEO], who is very commercially minded, which appealed to me. They are a great team,” he says.

In his new role at UTB, Sundeep will be overseeing the entire bridging operation, working together with the division’s head of underwriting Nikki Brett and head of sales Owen Bentley to further build on UTB’s success this year and continue to grow its short-term lending business.

refurbishment product range. We’re developing a strategy for delivery throughout 2023—we want to get it right, so partner input will be vital alongside the market insight we have. I am committed to providing the leadership and direction to meet our growth ambitions.”

In addition to his work on the business side, Sundeep is determined to apply all the lessons learned at Together—where he was part of the lender’s wellbeing network—and support the one-team ethos within UTB, as he believes this adds significant value to the business.

“I genuinely think if you can connect to people on all levels, then you’re going to get the best out of them,” he states, emphasising he’ll always be there to help his team members whenever they need it, just as he was supported by his mentors throughout his career.

“I know it’s a cliché—especially as nobody has their own office at UTB anyway—but if I had a door, it would always be open. I want everyone to feel that they can approach me to talk about anything. I personally get a lot of satisfaction in developing people, and I want people to feel proud of working for UTB. This is their business—my job is to help them excel and build rewarding, successful careers with a good work-life balance. I’ll give them the tools and opportunities to do that, as well as guidance and advice when they’re needed. I want everyone to be empowered—the more you do that, the prouder people are in their work and the more they feel like they’re part of the journey to achieving our strategic objective.”

Despite the current economic volatility, Sundeep is confident in the bank’s ability to support the market in a sustainable manner, thanks to its strong foundation and stable funding model, as well as its united team— and he is determined to do everything he can to continue the firm’s development.

“I’m not scared of a challenge, never have been, and I don’t think I ever will be. If I focus on people, partners, products and risk, and keep it simple, it will come right.”

Feature

Nov/Dec 2022 41

“The pandemic and post-pandemic period showed me I wasn’t just a dealmaker, but also someone who can manage a channel and interact with all parts of the business”

SPECIALIST DEBT AND EQUITY ADVISORY SIGNIFICANT TRACK RECORD & DEPTH OF EXPERTISE STRONG NETWORK & MARKET COVERAGE CLIENT CENTRIC & INDEPENDENT APPROACH INNOVATIVE & VALUE ADD SOLUTIONS

enquiries @ arcandco.com Andrew Robinson +44 (0) 203 205 2121 Edward Horn-Smith +44 (0) 203 205 2126 www.arcandco.com EDWARD HORN-SMITH MANAGING DIRECTOR ANDREW ROBINSON CHIEF EXECUTIVE OFFICER

WHY EXPERT KNOWLEDGE WILL BE KEY IN 2023

The year ahead is looking volatile, with rising interest rates and pricing, and the cost of living crisis. We asked the heads of three specialist finance departments at debt advisory Arc & Co to share what they expect to see in 2023, as deals— and finding the cash to back them— become more complex

Commercial

Edward Horn-Smith Managing director at Arc & Co

Edward began his career in the real estate team at Tesco, moving to Arc & Co in 2009 to form the commercial and development team. Since then, he has created a strong reputation for debt structuring.The commercial and development team has grown year on year and has helped clients secure in excess of £2bn of finance over the past five years.

On adjustments this year

The market has seen the fastest changes in the pricing of money since 2008. Base rates have gone from 0.25% to 3% over the past six months but, more fundamentally, we have seen forward yield curves go from under 1% to peak at 5.5% for fiveyear money. When you look at it on that basis, you’ve got the cost of borrowing quadrupling in the space of 12 months.

On trends and hurdles in 2023 Educating borrowers about the market will present both challenges and opportunities over the next year. We have had an arbitrage between unleveraged real estate and leveraged internal rates of return (IRRs) for 12 years now—and that disappeared over the past six months. The arbitrage between real estate that’s yielding 4% and the leveraged IRR of 8% has gone from the near to mid term, and the outlook now is going to be about restructuring and deleveraging and helping our clients with the existing situations they are in.

Every asset class within the commercial sector has its own set of challenges. Post Covid, a lot of people have not returned to the office, which has led to repurposing office use and a change in the way they are designed. People go out less often, which has affected the leisure industry, and hospitality has been impacted by affordability. The businesses in those sectors are facing not only potentially lower income as their customers struggle with affordability through the increased cost of living, but also their own rising costs from energy prices to inflation. For a landlord that has leases that are retail price index-linked, there is increase after increase. When that becomes unaffordable, you may as well tear that lease up. New leasing structures will have to be considered, which will then have a knock-on effect on finance. There are multiple challenges throughout the

commercial sector, and navigating them will be about sticking to the fundamentals of lower leverage, adding value, a solid business plan and being able to adapt quickly to the market environment.

On what borrowers need to consider now

The cost of borrowing has quadrupled in some instances and, due to interest cover ratios, customers can’t borrow what they used to be able to. We have been in an upward trend of borrowing because it has been so cheap and, now for the first time since 2008, we are going to have to start deleveraging—this will be the challenge for the next 12-24 months.

On using an experienced broker

The market that we are in today is fundamentally different from the one we were in six or even three months ago, and I have no doubt that in another six months it will be different to the one we are in today. To stay up to date with who is lending and to achieve best pricing, best LTV and best covenants, taking the best third-party advice is essential.

Feature

Nov/Dec 2022 47

“We have been in an upward trend of borrowing because it has been so cheap and, now for the first time since 2008, we are going to have to start deleveraging”

Development

Julian King Director at Arc & Co

Julian began his career in property after graduating from Oxford Brookes University, working for South Kensington Estates. He then moved into development, establishing a career as a land buyer. He has purchased sites across multiple asset classes, including residential, commercial, retail, retirement and student accommodation. Since joining Arc & Co, Julian has structured complicated debt structures for clients, while advising them on corporate strategy and delivering their business growth plans.

with their site acquisitions are now well placed to purchase land at better values, accurately appraised in today’s market, looking ahead over the next 24 months.

On slowdown predictions

There will undoubtedly be a slowdown in 2023, but I don’t think it will be the car crash that some are predicting. I think it’s reasonable to expect the housing market to cool by 10% over the next year, but I think this will be polarised. We are currently seeing strong activity on housing above £1.5m, with many properties being sold to cash buyers or to those with lower LTV mortgages (less than 50%); the buyers who have higher disposable incomes are

also strong, with lenders looking to invest in the right projects and developers. As a result, the LTVs, for the most part, also remain strong. Time is the biggest factor, and we are seeing the average length of facilities increase, many of which are 24 months—even for smaller developers. This takes the pressure off the sales period, allowing for more time to sell the units. Nonetheless, this does mean more interest has to be factored into the facility, resulting in less day-one funding (with a lower LTV on purchase), meaning that developers have to utilise higher levels of equity upon completion.

With the pressures over the past 1218 months on build prices and longer sales processes due to higher volumes, many facilities have had to be extended to accommodate the change in market conditions. Lenders have supported this and worked proactively as, ultimately, this affects their security over the asset. Our experience in the market allows us to work with both borrowers and lenders in a collaborative way to ensure that the risks are managed accordingly for both parties and the projects are completed and sold successfully.

On using an experienced broker

On current developments

The past 12 months have been a challenging time for developers who secured sites during the pandemic and fixed build contracts with their contractors on prices that no longer reflect the costs of delivery. As a result, developers have had to grapple with contractors having to absorb these costs, many of which are unable to do so. In addition to the increase in build costs, there has been a major shortage of labour, further adding to cost pressures. The price of land has yet to adjust in many cases and some developers have offset this by improving planning and density to increase value and absorb costs. Developers who have been fastidious

less affected by the increased cost of debt. Those who are more reliant on higher LTV mortgages (more than 85%) either have to put more equity into the purchase or will have to buy lower-value housing, which will result in a faster cooling at this end of the market. Overall, I foresee more of a stagnated housing market with limited stock and lower transaction volumes.

On mitigating risk and securing the right leverage

Both leverage and price are factors for risk and how it is perceived. The price of debt has grown in line with the Bank of England base rate, but margins have remained broadly the same. Liquidity is

The market is still in a period of change, with further rate rises to come before the end of this year—and it’s unlikely we will see any form of stabilisation until Q1/ Q2 2023. This is the most challenging period for both borrowers and lenders to accurately assess the risk. As we have a holistic view of the market, we can ultimately advise our clients and manage expectations to ensure our advice and the decisions they make are transactable in today’s changing market. Development is less affected than other areas of the property market as there is a drawdown profile with funds being delivered over a period of time. Time is always key to ensuring a smooth process from purchase, delivery and sales to successfully completing a development. Our expertise helps us manage our clients’ time and therefore their risk and exposure, providing a layer of protection in a changing environment. Minor changes can lead to big variants and expense. It’s essential that borrowers can pivot and restructure where refinance may not be possible. This is where it’s vital to work with an experienced adviser who can provide the level of support and comfort required.

Feature

Bridging & Commercial 48

“The past 12 months have been challenging for developers who secured sites during the pandemic and fixed build contracts on prices that no longer reflect the costs of delivery”

Bridging

Matthew Yassin Director at Arc & Co

Matthew joined Arc & Co with 20 years’ experience in the property and finance industry. He started his career at Lloyds Corporate Banking before moving to Barclays Wealth Management. Most recently, he worked as a specialist finance partner at Coreco Group. Matthew provides expert advice on commercial and development lending, and has specialist knowledge of the hotel and leisure sectors.

On bridging market consolidation

The bridging sector has seen a huge explosion of new lenders over the past five to seven years due to the development of the short-term finance market and the need for investors to find a good riskadjusted return. As the economy becomes volatile, investors become more cautious and funding lines dry up. I would therefore predict the bridging lending market to reduce in size over the next 12-18 months.

On floating interest rates

The standard norm has been a fixed price per month in the bridging market. The recent spike in SWAP rates, CAPs and hedging has led to the arbitrage between floating and fixed rates being greater. This has paved the way for lenders to quickly launch products that have been cheaper than the fixed competition—and allowed them to gain market share.

Bridging loans are typically for up to 12 months, with the average term being nine months, which means the risk of an interest rate dramatically increasing in this time is small. However, the base rate has gone from 0.25% to 3% in the past six months, and the sharp rise in borrowing costs in the loan term could put clients in breach of their LTVs and borrowing covenants. This could also impact the possibility of a clean exit. While the product is certainly an option, bridging is used as transition finance—and I believe you need certainty in this type of funding.

On top challenges this year

Funding lines

The majority of funding in the bridging market comes from either the loan-on-loan model or the securitisation market—not balance sheet lenders or committed capital. This means that finance providers have been more open to external factors, which they cannot control, and they cannot be certain

of their lending capital. Most of lenders’ funding is loaned to them on a variable rate basis, which has increased lending costs as, internally, they need to arrange a hedge or CAP facility—the price of these has dramatically escalated and therefore has upped the loan cost to the client or taken a tight grip on lenders’ profit margins.

Exit values

The bridging market is short term and loans are heavily dependent on the exit. Valuations are being put under a lot of scrutiny, so getting comfortable at the higher LTVs has been difficult.

Mortgage market

The reduction in mortgage products, rise in borrowing rates and decrease in overall affordability for the consumer has negatively impacted both the investment and residential markets as consumers

cannot borrow as much as they could before. This has led to fewer buyers, which are usually the exit for bridging finance.

On repossessions in 2023

When a market enters recession, it is inevitable that repossessions will increase. However, lenders operate in different ways and this is usually a result of how much equity/balance sheet they have and how they are funded. A lender will usually want to try to work out the loan in the short term; this is usually done by asking the borrower to inject more capital or provide more security. If this is not an option, the lender will have to inject more capital to cure the loan book if they have a loan-onloan arrangement. If none of these options can be met, then administrators will be appointed. The rate of this happening may increase due to the predicted drop in values and the market being sticky on either sales or alternative take-out finance.

On using an experienced broker

An experienced and knowledgeable adviser will make sure they understand the client’s goals from the outset; the broker can then advise the client on the correct type of funding and highlight the risks and pitfalls of each option. In today’s volatile market, it’s as important as ever to be able to navigate and advise your clients in the most up-to-date and educated way.

Feature

Nov/Dec 2022 49

“Sharp rises in borrowing costs could put clients in breach of their LTVs and borrowing covenants. This could impact the possibility of a clean exit”

SUPPORTING

institutional funding

funding

market