Chairman’s Report

The year 2017 will be remembered as a positive one for the financial markets and the economy in general. In fact, the central bank policies have borne their fruits and the stock markets have set historic records, starting with the US. At the opposite spectrum, we witnessed a weakening dollar against the euro and the Swiss franc, which surprised most traders, at least with respect to the way in which it occurred. Even the economies of the major countries showed significant growth, such as the Swiss economy, which demonstrated all of its strength and energy. In particular, the industrial sector, encouraged by the weakening Swiss franc against the euro, once again showed its ability to quickly adapt to market requirements. And the performance of Swiss securities, particularly those of highly specialised medium-sized companies, is a clear demonstration of this. In such a favourable scenario, even our Bank recorded higher positive results than expected. This was made possible by good team work and, in this respect, it is important to note the significant contribution by our management operations, which stood out for their excellent returns, first in favour of our clientele and, consequently, also benefiting the Banca del Sempione Group’s income statement. We expect this trend to continue in the future. A specific objective of the Bank will be to invest time as well as technical and human resources to improve our performance in the fundamental realm of asset management. This will enable us to attract new clients, with a focus on the institutional segment, which pays significant attention to the search for quality products. We believe this attitude is essential to ensure the future satisfaction of all stakeholders, even in the presence of potential difficulties that could arise on the financial markets in 2018, impacted by the expectation of a hike in interest rates. With regard to the individual balance sheet and income statement items, please see the comments provided below. Lending operations and Interest Income The results of this specific sector were impacted by a continued situation of negative rates for the Swiss franc and the Euro, the two currencies in which most of our loans are expressed. Therefore, the interesting and targeted efforts to increase income could not generate economic returns proportional to the growth in assets. We expect the situation to improve in 2018. Commission income As highlighted in the first part of the report, the figure in question shows a considerable increase thanks to the work of our investment managers, who were able to generate significant performance on managed products, with consequent economic returns for the bank. Trading operations The figure in question improved over the prior year, demonstrating the right decisions made and announced in the previous report. The operations implemented to protect positions in US dollars against the Swiss franc and the Euro also facilitated a significant increase in the volumes traded. Operating costs From this standpoint, the implementation of several procedures sustained by new technologies has streamlined the relative operating processes, improving the specific efficiency and achieving various degrees of savings without burdening the income statement. Our commitment for the future will head in this direction: exploiting new technologies to obtain greater efficiency and limit fixed costs. Personnel costs are up, following qualitative investment in professionals, which significantly contributed to the excellent results of our managed products.

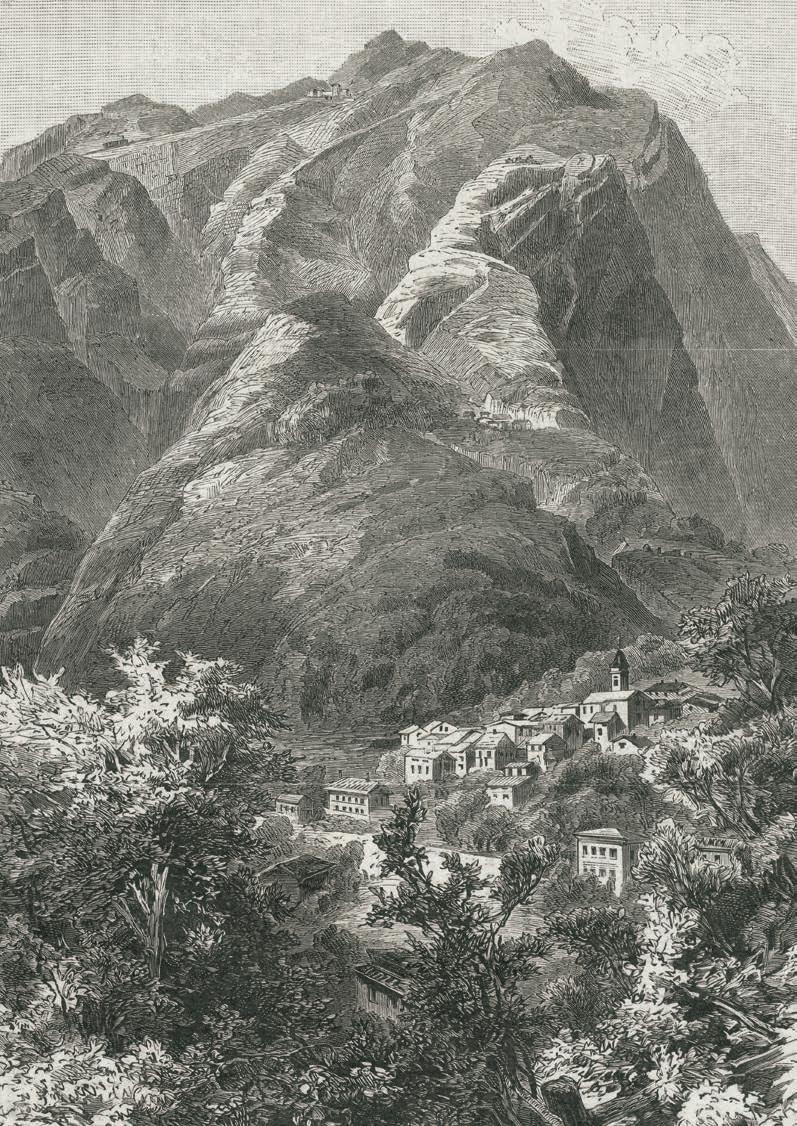

Previous page: Turro area, Muggio To the left: The river Breggia

Annual Report 13