Baltic Transport

SUSTAINABILITY

Customers’ willingness to pay can turn the tide toward decarbonized shipping

TECHNOLOGY

Trends that will quench the maritime industry’s thirst for tech-led advancement

SUSTAINABILITY

Customers’ willingness to pay can turn the tide toward decarbonized shipping

TECHNOLOGY

Trends that will quench the maritime industry’s thirst for tech-led advancement

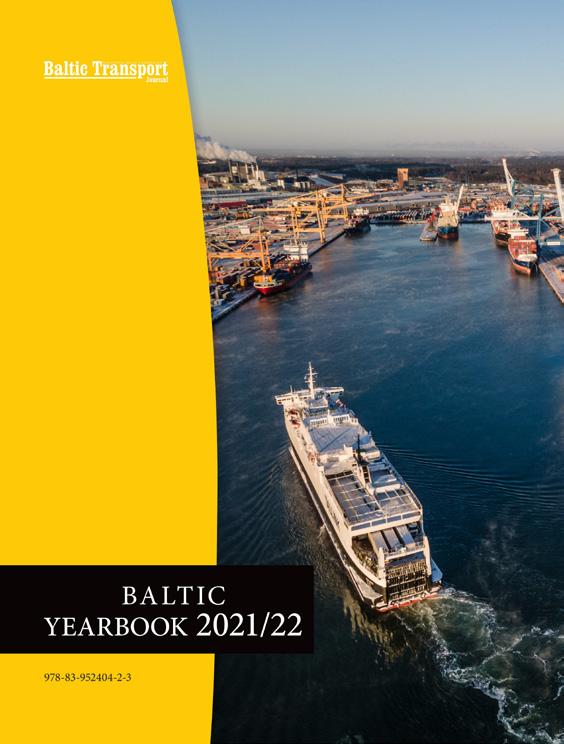

The Port of HaminaKotka is a versatile Finnish seaport serving trade and industry. The biggest universal port in Finland is an important hub in Europe and in the Baltic Sea region.

Welcome to the Port of HaminaKotka!

Another year is behind us, another one under our moving feet. The past 12 months wouldn’t be terrible if it weren’t for 24 February: rounding up last year’s transport highlights felt like watching a split-screen, with two distinct realities flashing in front of our eyes. From our industry’s perspective – minus the Russian aggression – the year 2022 was pretty decent as many positive developments took place, mainly out in the sea, but on land too. Logistics became a political thing in a more pronounced way than it has been thus far. In the current atmosphere, that’s perhaps a welcomed transformation. Politics and transport are gearing up to deal with whatever the future will bring (that is, whatever we geared it for in the past). Regarding the former, the piece from the Legal column explains what can be expected in the field of (scrutinising) state aid in the EU, an area of utmost interest to ports. Concerning the latter, we prepared a read in the Technology section that goes through groundbreaking tech trends that are already breaking the ground on how things are shipped globally. Sustainability hosts articles that spotlight other tendencies re-shaping our industry, most notably the shippers and customers’ increased interest in climatefriendly transportation or the push towards alternative green fuels (and here, I recommend a read from Technology about nuclear barges). The column also houses a very Baltic piece – on a Finnish group of companies set up with the intention to make shipping green many, many years before it became drip. Maritime includes a variety of reading proposals – on cold ironing, the evolving reefer market, minimising and hopefully eliminating once and for all the instances when seafarers die by entering enclosed spaces on board vessels, and the why’s and how’s of better cooperation for increased uptake of clean technologies in shipping. In a similar fashion to last year’s BTJ Trip in Sweden, we write in Events about Stena Line’s newest Baltic flagship, Stena Ebba , and her unique christening at the beginning of this year in Karlskrona (and, in general, 2022 brought about many more reasons for ferrying in the Baltic). In Collector’s corner, we stoop over the limitations of being an art admirer with millions to spend. Last but not least, Transport miscellany – and more precisely, as our Roving Editor Marek Błuś calculated, its 100 th edition! The entries were written in January, so this time no transport-booze stories (#dryjanuary), which doesn’t mean we didn’t prepare an exceptional selection of trivia! Modern wind-assisted propulsion being already a thing in the 1920s, seafaring/tough family life art from Norway, the Swedish army landing on the Åland Islands, and an aeroplane that flew from Finland to Australia (losing something subtle in the process).

I wish you nothing but a fantastic peruse!

Przemysław Myszka

Publisher

BALTIC PRESS SP. Z O.O.

Address: ul. Pułaskiego 8 81-368 Gdynia, Poland office@baltictransportjournal.com

www.baltictransportjournal.com www.europeantransportmaps.com

Board Member BEATA MIŁOWSKA

Managing Director PRZEMYSŁAW OPŁOCKI

Editor-in-Chief PRZEMYSŁAW MYSZKA przemek@baltictransportjournal.com

Roving Editor MAREK BŁUŚ marek@baltictransportjournal.com

Proofreading Editor EWA KOCHAŃSKA

Contributing Writers

WADE BARNES, IGNACIO BENÍTEZ, DUSTIN BURKE, KUN CHEN, KAI-DIETER CLASSEN, ERIK DAGORN, CAMILLE EGLOFF, JOSE ESTEVE, PETER JAMESON, REZÁ KARIMPOUR, MIKKEL KROGSGAARD, ANDERS MADSEN, SEAN MCLAUGHLIN, SANJAYA MOHOTTALA, JONATHAN MUMMERY, ULRIK SANDERS, FITZWILLIAM SCOTT, TRISTAN SMITH, RIINU WALLS

Art Director/DTP DANUTA SAWICKA

Head of Marketing & Sales PRZEMYSŁAW OPŁOCKI po@baltictransportjournal.com

If you wish to share your feedback or have information for us, do not hesitate to contact us at: editorial@baltictransportjournal.com

Contact us: PRZEMYSŁAW OPŁOCKI tel.: +48 603 520 020

26 Sponsored by … a foreign government

– The international dimension of state aid law: targeting non-EU subsidies by Kai-Dieter Classen

Innovation Outlook. Sustaining Innovation for a Net-Zero Carbon Environment Enabled by a Digital Ecosystem 78 Events: Stena Ebba – christened by Przemysław Myszka and Przemysław Opłocki

22 According to the rules

Towards Ukraine’s recovery by Przemysław

Myszka

28 In this together –

The road to zero-emission shipping by Fitzwilliam Scott

30 Achieving tangible safety improvements – Enclosed space deaths under scrutiny by Fitzwilliam Scott

32 Many challenges, significant opportunities – Dynamar’s reefer market analysis & outlook by Jonathan Mummery

38 Birds of a feather (should) flock together –

Barriers to practical collaboration hinder cleantech uptake in shipping by Sean McLaughlin

40 Cold ironing for all

– The EALING project’s recommendations for a harmonised implementation framework for onshore power supply facilities in European ports by Rezá Karimpour and Ignacio Benítez

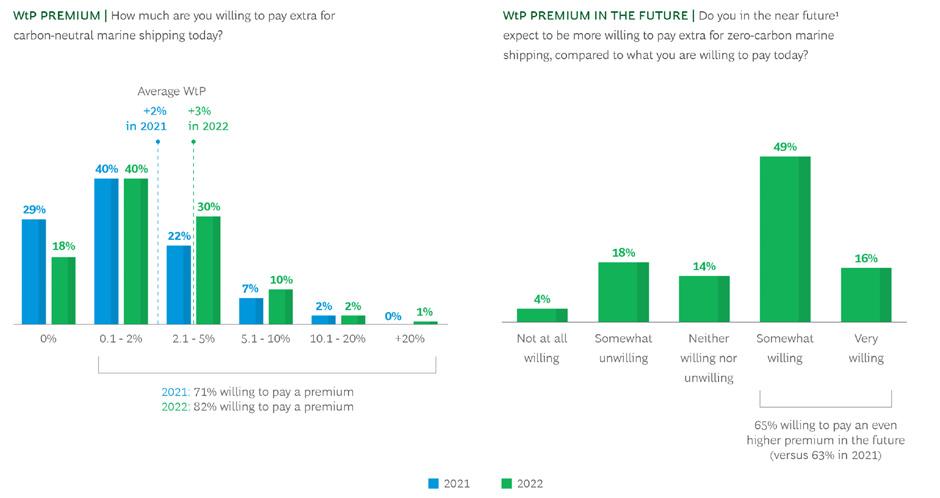

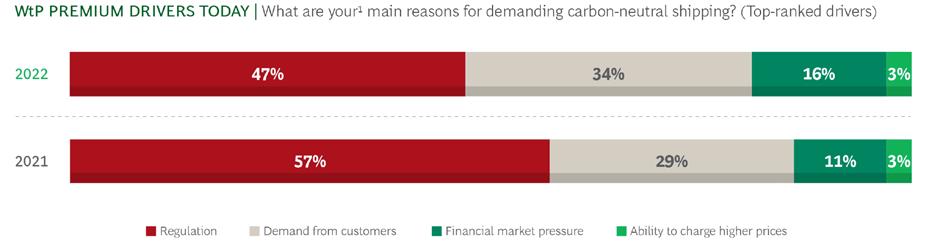

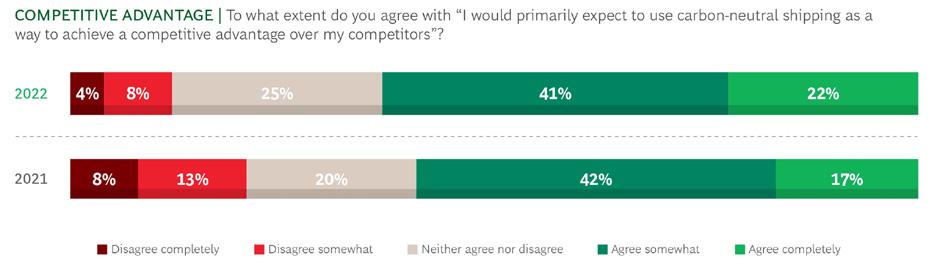

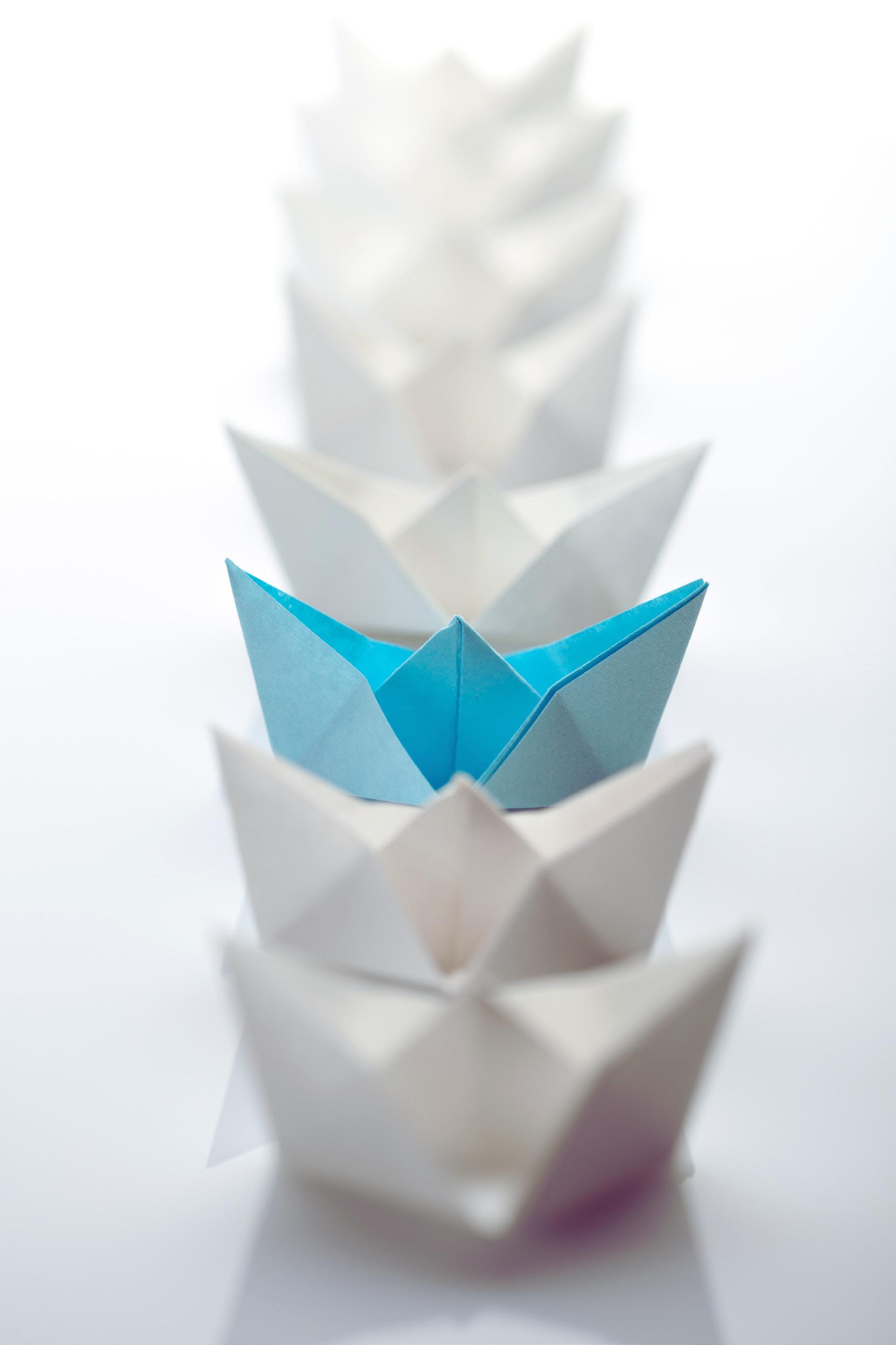

42 The environmental premium

– Customers’ willingness to pay can turn the tide toward decarbonized shipping by Peter Jameson, Camille Egloff, Ulrik Sanders, Mikkel Krogsgaard, Wade Barnes, Sanjaya Mohottala, Anders Madsen, and Dustin Burke

46 Aligning with 1.5 degrees: Managing the risks and opportunities for shipping and the companies in its value chain

by Tristan Smith50 Green – from the very beginning

– Meriaura on biofuels, carbon-neutral sea transportation, data-led shipping operations & emission reduction, one EU ETS for all, and a host of other climate-friendly initiatives

by Riinu Walls

by Riinu Walls

53 Baltic transport 2022 highlights by Przemysław Myszka

68 Plans for 2023 and current issues discussed during BPO’s meeting

68 Baltic Ports For Climate – OPS studies

69 BPO as a partner in the Baltic Supply Chains for the Baltic Sea Region project

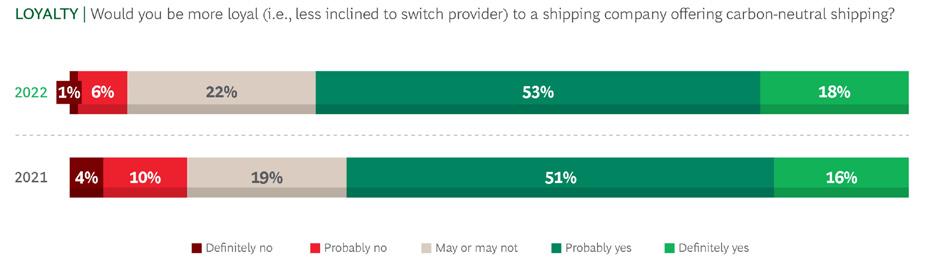

70 Watershed of innovation

– Trends that will quench the maritime industry’s thirst for tech-led advancement by Ewa

Kochańska

Kochańska

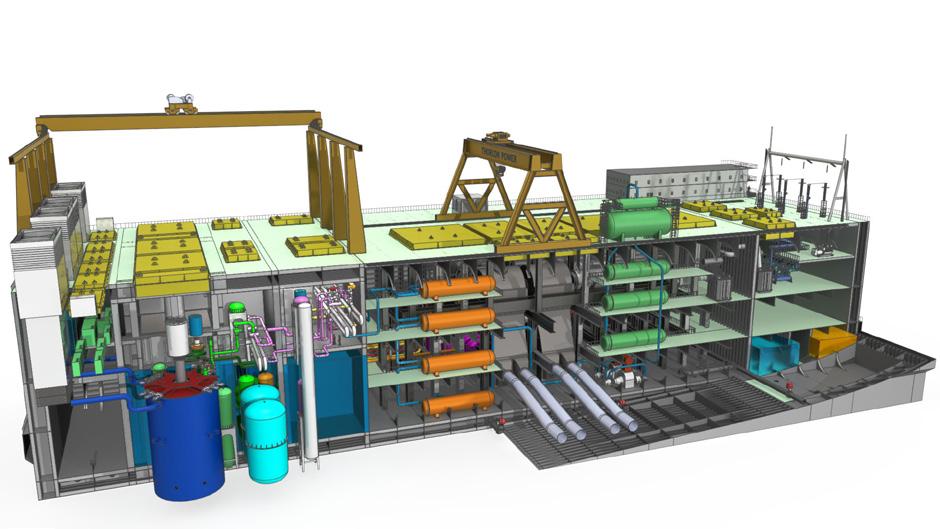

76 Ensuring safe innovation

– Technical qualification of nuclear power barge draws on both marine and land-side expertise by Jose

Esteve, Erik Dagorn, and Kun ChenGreenTech for Ports and Terminals Conference , 22/02/23, DE/Hamburg, greentech.ptievents.com

GreenTech will be joining our calendar of dedicated events for C-level port & terminal representatives as our first and long-awaited live edition for sustainable, smart ports. With nearly a decade of experience hosting flagship events for Ports and Terminals, PTI is pleased to launch this platform for our community to collaborate and share knowledge which will empower ports & terminals to decarbonise and strive for net zero status in the coming decades.

Transport Week 2023, 14-15/03/23, PL/Gdynia, www.transportweek.eu

Expert speakers and a fantastic audience will once again tackle topics that shape the current face of the transport sector, from geopolitics, through market analysis to infrastructure development. Transport Week 2023 will feature the first edition of the Baltic Ports for Climate conference, organized in cooperation with the Baltic Ports Organization. The event will focus on an in-depth analysis of the progression of climate change in the Baltic Sea region, as well as showcase various climate-related projects currently underway in Baltic ports.

Container Terminal Automation Conference, 4-15/03/23, DE/Hamburg, ctac.ptievents.com

CTAC 2022 returned for its 6th edition in 2022, marking a comeback to live events for the container terminal industry. The event provided the best forum for networking, learning and knowledge sharing. CTAC will be back again in 2023, so register your interest to secure a super early bird discount before it’s too late!

Intermodal Freight Forum Europe , 11/04/23, intermodal.ptievents.com

In February 2022, PTI’s Intermodal Freight Forum Europe covered the pressing challenges and trends in intermodal freight transport – from data standardisation, to addressing the lack of capacity in ports and rail, as well as digitalisation and interconnectivity in the supply chain.

transport logistic , 9-12/05/23, DE/Munich, www.transportlogistic.de/en

transport logistic will once again be held in Munich from May 9 to 12, 2023. Being the world's leading trade fair for logistics, mobility, IT and supply chain management, it unites the entire industry. Ten halls at Messe München will be turned into a 110,000-m² hub for international innovations and contacts.

Smart Digital Ports of the Future , 16-17/05/23, NL/Rotterdam, sdp.ptievents.com

For the first time since 2019, Smart Digital Ports of the Future returned to a live, in-person event in May 2022 in Rotterdam. The event was attended by the industry’s leading innovators and representatives from the world’s smartest ports. In 2023, Smart Digital Ports of the Future will return to Rotterdam even bigger and better. Register your interest to cut a hefty discount off the event tickets when they go live.

ESPO Conference 2023, 1-2/06/23, DE/Bremen, www.espo.be

This year's edition, the 19 th overall in the history of the European Sea Ports Organisation, will combine broadening-the-lens sessions with hands-on debates – as always focusing on the most pivotal issues surrounding Europe's harbours.

TOC Europe 2023, 13-15/06/23, NL/Rotterdam, tocevents-europe.com/en/home

With an unrivalled 40+ year heritage, here is the place to learn from and network with the world’s leading port decision-makers, policy experts, solution providers and more underneath one roof, enabling you to both supercharge your strategies and make your port operation visions a reality. Whether your focus is on adapting to the unpredictable economic climate and current shockwaves of the pandemic or simply embracing the exciting new technologies revolutionising the sector, join us on the road back towards growth at the essential container supply chain event.

The winner of the prestigious safety award made possible by the collaboration of ICHCA International (ICHCA) and TT Club for the fifth time was announced as A.P. Møller – Mærsk for its APMT Vessel Inspection App. The winner and fellow short-listed entrants, Exis Technologies and Intermodal Telematics, were present at the ceremony to showcase their innovations. ICHCA and TT Club are delighted that the now well-established industry accolade with its strenuous process of entering and judging has once more celebrated safety innovation within the cargo handling and transport sector. There is now a real focus by organisations across the world on constantly searching for better solutions to the challenges of improving safety. At the first ‘live’ Innovation in Safety Awards ceremony for four years, held in London on 23 February 2023, all three finalists gave presentations of their ground-breaking initiatives, which through their variety of applications reflected the broad categories represented by the 20 award entrants drawn from 13 countries, and covering such diverse fields as digitalisation processes, learning and predictive data application as well as safer physical operations and equipment. The winning innovation was the APMT Vessel Inspection Mobile App. “We are delighted with this recognition for the safety app we have developed in-house in collaboration with Maersk,” said Jack Craig, Chief Operations Officer at APM Terminals. “The app provides a standardised digital platform for terminals to carry out vessel inspections, highlighting potential critical risk. It underpins our continuous focus on safety throughout our operations and is a great example of how we can smartly deploy technology to be even better at this.” Joining the APMT Vessel Inspection Mobile App on the shortlist and presenting its Hazcheck Detect innovation was Exis Technologies. Their Chief Information Officer Mike Durkin said, “Hazcheck Detect can be accepted by competing carriers, offering the same technical solution with similar rules and immediate outcomes for cargo screening. This is critically important to prevent misdeclared and undeclared cargo being accepted or cancelled and re-booked on alternate carriers. We are honoured to be short-listed for this award among a host of impressive entries.”

Intermodal Telematics BV (IMT) and its innovative Tank Container Temperature Monitoring made up the finalist’s podium. “Safety remains a very hot topic across the tank container transport sector,” said Bernard Heylen, Sales Director at IMT. “With our multiple temperature alerting system we offer a digital answer to the increasing demand to transport dangerous goods safely and monitor them remotely. We continue to work in the interests of improved service quality, and in maintaining social responsibility by preventing dangerous incidents.” Welcoming delegates (and online participants) to the awards ceremony and its accompanying safety seminar, ICHCA’s CEO Richard Steele underlined the aims of the ongoing innovation in campaigning safety, of which the awards are a critical part. “We, of course acknowledge safety innovation – especially at a time of increased operational demand on global cargo handling. However, this is much more than a celebration. Our mission is also about learning and thought leadership. Our priority is to share these ideas with a wide audience, improving how we all can commit to continuous improvement in health and safety. The award highlights direct evidence that our industry is actively innovating and changing.” Steele went on to recognise the awards sponsor, “If you want evidence of industry commitment, look no further than the TT Club. Not just sponsors in name but actively rolling up their sleeves and proactively driving an innovation and continuous improvement agenda.” TT Club has been a driving force behind these awards since their inception and is very much committed to improvement in safety as a whole. Peregrine Storrs-Fox, TT Club’s Risk Management Director, commented, “We are delighted that the award has continued to attract substantial interest around the globe and across the industry, again demonstrating a passion to enhance safety and dynamic action to make this reality. We are pleased to report that this passion is shared by such a diverse group of operators and suppliers, with this year also featuring submissions designed for environmental protection and monitoring.” The event announcing the winners was enhanced by a seminar which featured two discussion panel sessions on managing personal injury risk and minimising damage in cargo in transit with speakers from DP World, Rombit, ConnexBird and the Safetytech Accelerator as well as TT Club and ICHCA. The vastly experienced Morten Engelstoft delivered the keynote speech (a recording of the proceedings is available on request). “The Awards have been, and remain pivotal to our safety campaign,” emphasised Storrs-Fox. He furthered, “However through our own, and our colleagues at ICHCA’s cooperation with conference and exhibition organisers TOC, I am pleased to announce that the Safety Village initiative launched at TOC Europe last year will be repeated and enlarged at the same event in Rotterdam in June.” The TT Club Safety Village will once more be the venue for workshops and panel sessions throughout the three days of the TOC Europe event (13-15 June 2023). It will also provide opportunities for companies to showcase their innovative safety devices, processes and products. “Providing a focal point for discussion and promotion of such innovations at a leading industry forum will continue to benefit the cause of safety in the supply chain and the development of new solutions to manage significant risks,” concluded Storrs-Fox.

As such, the Swedish seaport has a new freight handling record. A total of 272k TEUs went through Helsingborg’s quays last year (-0.4% year-on-year). Container rail traffic totted up to 28k 20’ (+16.7% yoy) while passenger traffic advanced by 57% yoy to over 6.0m travellers.

The German Baltic seaport took care of 6.42mt general cargo (+1.1% year-onyear, of which ferry cargo: 6.4mt, +1.2% yoy) and 1.24mt of goods in bulk (+2.2% yoy). A total of 190,928 trucks & trailers went through Kiel’s quays (-8.9% yoy), as well as 22,753 TEUs (-20.9% yoy), 20,199 vehicles (-26.2% yoy), and 6,535 busses (+34.2% yoy). Kiel’s 2022 rail intermodal traffic totted up to 28,930 units (-5.6% yoy). Passenger traffic advanced 149.5% on the 2021 result, with 2,341,798 travellers served by the Port of Kiel last year (including 836k cruise guests).

Exports totalled 11.28mt (+2% year-on-year) while imports – 4.99mt (+41.7% yoy). At the same time, cabotage traffic totted up to 734.2kt (+332% yoy). With 629,332 TEUs, the Finnish seaports’ 2022 container traffic surpassed the 2021 result by 6%.

Turnover of coal noted the sharpest increase of 175% year-on-year to 13.2mt. Liquid bulk rose by 34.9% yoy to 25.5mt, general cargo by 0.4% yoy to 23.5mt (of which containerised: 20mt, down 2.9% yoy), and grains by 18.8% yoy to 1.9mt. The handling of other dry bulk goods contracted by 8.9% yoy to 4.1mt. Fewer containers went through Gdańsk quays, a decrease of 2.2% yoy to 2,072k TEUs. With 195k travellers, the seaport’s passenger traffic was up 18.9% on the 2021 result.

36.81mt handled in 2022 (+10.8% yoy)

The handling of liquefied natural gas rose the most – by 54.6% year-on-year to 4.44mt. The Polish ports also took care of 17.72mt of general cargo (-3.4% yoy; excl. timber), of which ferry cargo accounted for 14.46mt (-3.1% yoy), 7.48mt of liquid bulk (+42.5% yoy), 4.31mt of coal (+50.8% yoy), 3.31mt of other dry bulk goods (+11.2% yoy), 2.11mt of ores (+11.4% yoy), 1.65mt of grains (-7.6% yoy), and 229kt of timber (+92.6% yoy). Container traffic totted up to almost 75.4k TEUs (-8.2% yoy).

1,047,941 TEUs handled in 2022 (+57% yoy)

The entire general cargo segment rose by 10.5% year-on-year to 17.9mt. Turnover of liquid bulk also advanced last year, up 17.1% yoy to 8.2mt. On the other hand, dry bulk traffic contracted by 55.4% yoy to 10mt. In total, the Lithuania seaport took care of 36.1mt, noting a decrease of 20.8% on the 2021 result. Some 337k passengers (including 47k cruise vs 1,076 in 2021) went through Klaipėda’s quays in 2022.

885k TEUs handled in 2022 (+6.9% yoy)

The Swedish seaport’s rail container traffic advanced 12.4% year-onyear to 515k 20’. On the other hand, fewer ro-ro cargo units and vehicles were handled, down 0.7% yoy to 561k and 6.3% to 238k, respectively. Gothenburg’s passenger traffic, ferry & cruise, was up 84.8% on the 2021 result, totalling 1,414k travellers. The port also handled more liquid and dry bulk goods: +16.8% yoy to 22.3mt and +46.5 yoy to 375kt.

Tonnage-wise, the Estonian port took care of 2.12mt of containerised freight last year, an increase of 12% year-on-year. On the whole, however, Tallinn’s cargo traffic contracted by 20.7% yoy to 17.76mt, including 6.89mt of wheeled (ro-ro) freight (+6.2% yoy), 5.16mt of liquid bulk (-41.6% yoy), 2.95mt of dry bulk (-37.2% yoy), 611kt of break-bulk (+26.1% yoy), and 32kt of non-marine cargo (vs 1.0kt in 2021). International passenger traffic nearly doubled last year, advancing by 98.4% to 7.03m (including 172k cruise travellers, up 173% yoy). The Port of Tallinn’s domestic ferry traffic subsidiary TS Laevad carried some 2.3m passengers on the Saaremaa and Hiiumaa lines (+4.3% yoy).

With this result, the Finnish seaport struck its new all-time cargo traffic high. Unitised freight, accounting for the bulk of Helsinki’s flows, totted up to 12.6mt (+3.8% year-on-year), including 8.81mt of wheeled (ro-ro; +5.1% yoy) and 3.81mt of containerised cargo (+1% yoy). Unit-wise, 702,228 trucks & trailers (+5.7% yoy) and 491,793 TEUs (+5.4% yoy) went through Helsinki’s quays. The seaport also took care of 1.56mt of dry bulk (+13.2% yoy) and 879.5kt of break-bulk (+22.3% yoy). Passenger ferry traffic was up 113% on the 2021 result, counting 7,951,241 travellers. Cruise added 162,352 (vs 10,909 in 2021). In addition, 1,409,786 private vehicles were brought on board ferries.

7.61mt

yoy)

Dry bulk, the main commodity passing the Latvian seaport’s quays, rose by 8.2% year-on-year to 5.11mt. With 2.18mt (+22% yoy), general cargo came in second, followed by 318.2kt of liquid bulk (-41.7% yoy). The 7.61mt result is the port’s new all-time high. Liepāja also served 85,422 passengers (including 2.5k cruise), an increase of 91.6% on the 2021 figure.

Wheeled cargo, Rostock’s prime traffic, totted up to 17.7mt (-1.7% yearon-year), followed by 7.2mt of dry bulk (+4.3% yoy), 3.45mt of liquid bulk (+11.3% yoy), and 625kt of other general cargo (-8.1% yoy). The German Baltic seaport’s 2022 ro-ro traffic amounted to 597.1k units (+0.3% yoy), including 410k trucks (+0.7% yoy), 169k trailers (+5% yoy), and 18.1k railcars (-33.2% yoy). Rostock’s rail intermodal traffic totalled 130k units (+7.4% yoy). The port also welcomed 2.5m ferry (+47.1% yoy) and 294k cruise travellers (+194% yoy). Some 628k (+46.4% yoy) private vehicles were transported on board the ferries visiting Rostock.

23.52mt handled in 2022 (+9.4% yoy)

The handling of dry bulk, the Latvian seaport’s leading trade, advanced by 20.6% year-on-year to 14.5mt. With 7.55mt (+4.8% yoy), general cargo came in second, followed by 1.47mt of liquid bulk (-35.3% yoy). Riga’s container traffic rose by 10.8% yoy to 460,689 TEUs. The port also welcomed 75,737 passengers (vs 2,011 in 2011).

Ferries serving the Swedish seaport’s traffic also transported 372.5k private vehicles, an increase of 23.8% on the 2021 figure. Fewer trucks & trailers went through Trelleborg’s quays (-1.9% year-on-year to 855,949). Railcars by ferry traffic with Rostock also contracted (-33.2% yoy to 18.1k). On the other hand, the port’s rail intermodal traffic was up +4% yoy to 35,462 cargo units.

First, the Finnish Port of Pietarsaari’s heavy-duty cargo handling fleet is now bigger with a Liebherr LHM 500 mobile harbour crane, offering a 140t lifting capacity. Second, the subsidiary of KWH Logistics, operating in the Port of Vaasa’s Vaskiluoto Harbour, took hold of an LHM 600 mobile harbour crane. The €7.0m investment was produced by Liebherr in Rostock and delivered on 22 December 2022, increasing Blomberg Stevedoring’s Liebherr fleet to three. The brand-new machinery can lift 208t and up to 300t in tandem. Third, after an incident in the Kiel Canal that damaged the LHM 600 mobile harbour crane ordered by the Port of Esbjerg, the manufacturer delivered an LHM 800 High Rise (HR) on short notice instead. Thus, the Danish seaport now operates two LHM 800 (the first was handed over in 2019), capable of tandem lifts to 616t. The HR version offers 92 m of lifting capacity. Liebherr said at the beginning of January 2023 that a new LHM 600 would also be delivered as soon as possible. The latest LHM 800 increased Esbjerg’s Liebherr fleet to seven machines. Fourth, Liebherr supplied the Salerno Container Terminal (SCT) with a mobile harbour crane of the HR version of LHM 600. The 58 m outreach machine with twin-lift spreaders offers a 2 x 32.5t capacity. “The new crane is outfitted with a tower extension of 12 metres. Cranes of this variety benefit from a better view of the cargo/containers thanks to a higher cabin, which is at 37.1 metres in case of the new crane. The pivot point is also higher, allowing for larger ships to be served,” the manufacturer highlighted in a press release. Liebherr also underscored the speed at which the delivery was executed – the order was placed in November last year, with SCT accommodating the LHM 600 HR on 29 December 2022. The newest piece of heavy-duty equipment joined SCT’s two other LHM 600s and two LHM 800s, both HR. Lastly, before the end of this year’s January, EUROGATE shared that its Container Terminal Wilhelmshaven (CTW) will receive two automated dual trolley ship-to-shore from Liebherr (alongside remote operator stations). The cabinless gantries will have a primary outreach of 73 m, a lift height of 54.5 m, a span of 30.48 m, and an operational backreach with a secondary trolley of 26 m. “Designed for tandem operation, the primary trolley delivers containers automatically to the pinning platform. The containers rest on frames whilst the twist locks are removed. Once the pinning personnel leave the platform, they activate the secondary trolley, which automatically delivers the container to the land side AGVs [automated guided vehicles],” Liebherr Container Cranes explained in a press brief.

The PSA-operated container terminal from Gdańsk has ordered 20 automated sideloaded stacking cranes for the under-construction 1.7m TEUs/year expansion. The machinery will offer a span of 32 m and two cantilevers of 8.5 m in length each. The lifting height will be 1-over-6. The cranes’ structures will consist of a double girder gantry with Künz’s patented trolley, equipped with a 4-drum hoist with direct outgoing ropes to the headblock. The headblock will be, in turn, equipped with micro motion, allowing for fine positioning in the trolley and crane travel direction. The system also corrects a possible skew. ABB will supply the electrical equipment, including automation. The ABB technology consists of 3D laser systems with cameras that allow loading and unloading automatically in the truck area and the container stack. After collaborating on many stacking crane projects for endloaded terminals, ABB and Künz will now deliver the first equipment for a sideloaded terminal in Europe. The cranes will be delivered in several phases beginning in early 2024. The final cranes will be completed by the end of H1 2025. The manufacturer plans to go live on the terminal in Q2 of 2024.

Lotus Demolition has started tearing down the 1960-commissioned facility, used as a passenger terminal for high-speed vessels sailing to Tallinn since the 1990s. The demolition of the terminal, designed initially as a warehouse (hence its name meaning “warehouse” in Finnish), will be completed by early July this year. Waste will be transported from the site outside ship unloading hours to minimise the disturbance caused by the demolition to the harbour area and road network. Moreover, the Port of Helsinki underlined in a press release, “As much of the demolition waste as possible will be sorted and recycled. Steel and other metal waste will be directed to further use, and concrete structures free of detrimental elements will be refined to make earthwork materials. The climate impact of the demolition site and the waste generated within, or the carbon footprint of the site, will be calculated to determine the best methods for emission reduction and the environment.” Makasiiniranta, the area housing the Makasiini Terminal, will undergo changes when passenger traffic from the South Harbour is transferred to Katajanokka and the West Harbour following the port development programme. The City of Helsinki is planning to develop the site with an architecture and design museum, likewise a beachfront boulevard.

Scandinavian Biogas’ SEK760m investment (about €68m) will have a production capacity of 120GWh, catering to the transport sector (maritime & heavy overland). The facility will be erected by the Portuguese Efacec and the Swedish Multibygg in Mönsterås in southeastern Sweden. The Swedish arm of Wärtsilä will provide the gas upgrade and liquefaction technology. Local farmers initiated the manure-fed biogas project in Mönsterås in 2016, with Scandinavian Biogas getting involved two years ago. The parties formed a jointly-owned company responsible for designing, building, and managing the planned biogas plant. The Swedish Environmental Protection Agency’s Climate Leap Initiative granted the project SEK154m (€13.8m) in economic support in 2021. “The biogas project in Mönsterås will be the first in line of the projects that we will develop in collaboration with local farmers. We believe that local ownership is important, to make sure that parts of the future revenues also remain local. The benefits of liquefied biogas with manure as feedstock are obvious and enable a green transition for locally produced food products as well as for heavy transports. This is another important step for us at Scandinavian Biogas towards our long-term vision of a total production capacity of 3.0TWh by the year 2030,” Matti Vikkula, CEO of Scandinavian Biogas, underscored.

The Kouvola Rail and Road Terminal, built by the City of Kouvola and operated by Railgate Finland in the country’s southeast, was officially commissioned. The 150k-TEUs/year handling capacity facility spans over 42 ha (including a 10 ha cargo yard) and offers a sidetrack that can accommodate trains 1,100 m in length. The investment, part of the EU TEN-T Core Network, was carried below the original budget, down €6.0m to €34m. The city provided approximately €23.6m, the EU about €6.8m, and the Finnish State around €3.5m. The developers of Kouvola RRT employed several sustainable measures while erecting the facility. These included using recycled asphalt and concrete, while crushed stone and surplus masses excavated from the rocky hill in the area were utilised as far as possible on the construction site. At the same time, the City of Kouvola says, “The effects of the RRT project on the surrounding nature and species have been regarded. A lot of waste brought to the area over time has been disposed of. Pathways were left for the local fauna, such as flying squirrels, to enable connections between different territories. The groundwater area has been considered in the selected solutions and future terminal operations.” The dry port is part of the area’s 170 ha big development site. Next to Kouvola RRT sits the road & rail 17 ha big Kouvola Cargo Yard, also owned by the city (and managed by Kouvolan Yritystilat).

The floating storage regasification unit (FSRU) Exemplar has been connected to the Finnish grid in the Port of Inkoo, ready to receive gas for distribution in Finland and the Baltics. The 291 m long, 150.9k m 3 capacity (68kt of liquefied natural gas, LNG, when fully laden, translating to some 1,050GWh) Exemplar has been chartered for ten years from the Texan Excelerate Energy. The floating terminal has an annual regasification capacity of 40TWh, which according to Gasgrid, exceeds the country’s yearly demand (25.1 TWh in 2021 per the company’s data). The FSRU, operated by Gasgrid Finland’s subsidiary Gasgrid Floating LNG Terminal Finland, is connected to the bidirectional Balticconnector pipeline, the other end of which is in the Estonian Paldiski. Excelerate Energy, through its recently formed Finnish subsidiary, Excelerate Finland Gas Marketing, has executed an agreement to sell commissioning volumes and regasification capacity rights during the commissioning phase. Through this agreement, Excelerate Finland will be able to provide natural gas to downstream customers in Finland and other Baltic countries. Gasgrid underlines that no Russian gas will be handled at the Inkoo terminal; moreover, the investment will help Finland to permanently phase out its dependency on Russian gas.

Ferus Smit’s shipyard in Westerbroek will construct four multipurpose 5,100 dwt freighters and four 7,999 dwt tankers. The former will be of the 1B ice-class Troll-Max design: for operating in the Trollhätte canal and on lake Vänern in Sweden. The latter will be of the 1A ice-class R-class, to be operated by Erik Thun Group’s Thun Tankers in coastal traffic in Northern Europe. Deliveries will start in October 2024. The four tankers come atop the two R-class ships ordered by Thun Tankers in the spring of 2022, slated for delivery by Ferus Smit in H1 2024.

At the end of last year, MT Højgaard Denmark completed the development of Galløkken and the second phase of the port expansion. For the past year and a half, MT Højgaard Denmark has worked on expanding the outer pier in the industrial part of Rønne’s seaport by 475 meters and establishing an additional 300-meter heavy cargo quay with 50k m2 of hinterland. The two tasks – and the expansion of Galløkken – resulted in a total of approximately 100k m2 of new port areas. The next stage of developing the Danish island seaport includes adding a 10 ha multi-purpose project area for, a.o., offshore projects. After regulatory considerations, the port authority plans a tender round for the project during 2023.

After 53 days of voyage from the Far East, Peter Pan called to Travemünde’s Skandinavienkai on 23 January 2023, from which she departed for Trelleborg on the night of 31 January. The new Peter Pan is a sister ship of the April 2022-introduced GT 56k Nils Holgersson. The gas-run ro-pax newbuilds offer room for 800 passengers and 4,000 lane metres for cargo. The duo also features several emission-reduction solutions, including energy-saving air conditioning, heat recovery, LED lighting, and an AI algorithm that advises the crew on the optimal parameters of operating the ferries. On her way from Yantai, Peter Pan carried construction machinery to Zeebrugge. In the Belgian port, she took 750 cars for unloading in Rostock. It is the sixth Peter Pan in TT-Line’s fleet’s history; the previous one was renamed Tinker Bell

The German Baltic ferry line from Lübeck will start sailing to and from the Swedish seaport in April this year. The company will link Karlshamn and the Lithuanian Klaipėda up to six times/week, with the crossing time at around 13 hr.

Stena Line’s newest E-Flexer ferry was deployed on the route in question on 2 January 2023, joining her sister ship Stena Estelle. Each of the two 240 m long newbuilds offers room for 1,200 passengers (across 263 cabins) and 3,600 lane metres for freight. Stena Line’s Gdynia-Karlskrona crossing is also served by Stena Spirit

On 5 April 2023, the Dutch-Icelandic Samskip will start a new sea container service, connecting the ports of Gothenburg, Aarhus, Runavík, Reykjavík, Grundartangi, Vestmannaeyjar, Rotterdam, and Cuxhaven.

As of 6 February 2023, the company’s trains travel between Köln and Malmö four instead of three times per week. The service, suitable for P400 trailers as well as for carrying dangerous goods and waste, connects the Köln Eifeltor and Mertz Transport terminals. Hupac says that taking the Köln-Malmö rail service spares the environment 1.4t CO2 emissions per road consignment.

The Swedish arm of ColliCare has, earlier than planned, set in motion its trailer train connecting Cremona in northern Italy with Skaraborg in central Sweden. Initially, the service was to kick off this spring; however, the first set departed on 4 February 2023. Hector Rail and BLS Cargo provide traction for the once-a-week, two-day transit time round-trip. Southbound transports mainly include paper & pulp, while in the opposite direction – eatables. According to the company, going by rail will emit 89% CO2e less than hauling the goods by road. Since 2017, ColliCare has been running another north-south weekly rail service: between the Italian Parma and the Norwegian Rolvsøy.

CRIST’s shipyard in Gdynia handed over L-317, the third hybrid for the Finnish domestic traffic ferry operator, on 20 January 2023. The 70.2 by 13.9 m ship offers room for 200 passengers and space for 52 private vehicles (or a smaller number of trucks) across the Nauvo-Korppoo route. The newbuild primarily sails on batteries, recharged in a manner of minutes while berthed. The Norwegian LMG Marin and the Polish StoGda Ship Design & Engineering codesigned the ferry. Previously, CRIST constructed for FinFerries Elektra (2017) and Altera (June 2022).

The subsidiary of the Gotland Company decided not to operate across the Nynäshamn-Visby-Rostock route in 2023. The shipping line lists high bunker prices and difficulties securing sufficient cargo volumes as the reasons behind the termination. In addition, because of the lower freight traffic, Hansa Destination didn’t receive the so-called eco bonus in its entirety – SEK26m instead of 74.2m – an aid announced by the Swedish Transport Administration in 2018 for companies that reduce road congestion, contribute to air depollution, and lower greenhouse gas emissions. Gotland Company said it will revaluate reinstalling the service in 2024.

Tallink & Silja Line’s newest ferry was put on the Helsinki-Tallinn crossing on 13 December 2022. The 212.4 by 30.6 m ro-pax – offering room for 2,800 passengers and 3,190 lane metres for cargo – served nearly 32k travellers during her first week, with the most coming from Finland (15,341) and Estonia (9,996). Rauma Marine Constructions built the GT 50,629, dual-fuel (gas-driven) ship. The ferry can connect to an onshore power supply. Tallink & Silja Line’s Helsinki-Tallinn route is served by MyStar, Megastar, and Star (which joined them on 1 January 2023 after undergoing technical maintenance). They offer 16 daily departures from Monday to Friday.

Viking Line sold (for €11.25m) the ferry to the Greek Aegean Sealines Maritime, who employed the 1980-built-in-Turku ship in the Aegean Sea. Rosella was lately serving the Kapellskär-Mariehamn service of Viking Line, with her last crossing taking place on 8 January 2023. Though kept in good condition, Rosella couldn’t further keep up with Viking Line’s policy on minimising its environmental impact. Faced with high bunker prices and the incoming emission trading, the company decided to dispose of older tonnage. Meanwhile, Viking Line denied that reflagging Viking XPRS to the Finnish flag had anything to do with putting her on the Kapellskär-Mariehamn route. As such, the service’s future remains unknown.

The first train, carrying electronic parts made in Vietnam, was launched on 31 December 2022. On its way to Central Asia, the set crossed the Chinese Pingxiang and Xi’an. The main reason behind establishing the new corridor is to halve the shipping time – from about 50 days by sea to 25 by rail.

Following the green light given by the General Administration of Customs of China for a road-to-rail shift, a train set of 25 reefers from Laos’ capital in Vientiane crossed the border in Boten-Mohan, arriving in Chongqing after a four-day transit time. Another fruit train (between Vientiane and the Chinese Huaihua) was put in motion shortly thereafter.

DB Cargo Eurasia has launched crossing per month, but the company plans to make it a weekly or biweekly round-trip in Q2 2023. The first train set, which departed in late December 2022, carried consumer & industrial goods (car parts, electronics, heating equipment, and machinery).

An agreement has been reached at the International Maritime Organization to lower the current 0.5% limit of sulphur content in marine fuel to 0.1%, effective 1 May 2025. Making Med a stricter Sulphur Emission Control Area (SECA) will, according to estimates, lower the air level of sulphur oxides by almost 80% and likewise cut harmful fine dust (PM2.5) emissions by nearly a quarter. These drops should prevent at least 1,000/year premature deaths and reduce new cases of childhood asthma by 2,000/year (the European Commission, COM, says that 300k/year premature deaths are attributable to air pollution in the EU). COM will also continue to support other initiatives by the littoral EU States to create additional emission control areas to cover all EU waters, including through regional sea conventions.

The European Commission (COM) has increased the budget from €330m to €616m and sped up the grant handover to projects tasked with supporting the transportation of troops and equipment along the TransEuropean Transport Network (TEN-T). “The results of our second call on military mobility under Connecting Europe Facility reflect the need of the European Union’s Member States to improve the dual use of our transport system. It was a highly competitive and oversubscribed call, with winning projects in 17 countries. I am pleased that some of the projects in Germany, Romania and Poland directly address improving the infrastructure on the Solidarity Lanes, our corridors used for Ukraine’s imports and exports,” Adina Vălean, Commissioner for Transport, underlined. Examples of the 35 projects include the upgrade of six rail bridges and the construction of two low-speed track sections for longer and heavier trains in Germany on the North Sea-Baltic TEN-T Core Corridor; the purchase of a multiuse hybrid icebreaker for the Port of Riga; the upgrade of two stretches of road along the Via Baltica close to the Lithuanian-Polish border; the modernisation of the Port of Constanța’s rail infrastructure; and the construction of a new bridge over the Prut River connecting Romania and Moldova.

The European Council has adopted its new General Approach towards the EU’s Trans-European Transport Network (TEN-T), opening the road for the European Commission to work on the revision of the TEN-T Regulation. Cargo traffic-wise, the new TEN-T calls for, among others, more transhipment terminals, improved handling capacity at freight terminals, and longer trains. The new TEN-T will also strengthen transport links with Ukraine and Moldova to increase the capacity of the so-called Solidarity Lanes used for imports & exports between the two and the EU. Another revision is praised by the European Sea Ports Organisation (ESPO), namely the new criterion of becoming a TEN-T Comprehensive Port. On top of the current volume criterion (0.1% of the EU total volume of port cargo), a port can also be part of the Comprehensive Network if “its total annual cargo volume (bulk and non-bulk) exceeds 500,000 tonnes and its contribution to the diversification of EU energy supplies and to the acceleration of the roll-out of renewable energies is one of the main activities of the port.” ESPO’s Secretary-General, Isabelle Ryckbost, commented, “[…] On average, 40% of the commodities going through Europe’s ports are sources of energy. Ports play an increasingly important role in ensuring both the supply of energy and the acceleration of the energy transition. This important role certain ports are playing cannot always be measured in tonnes or TEU. Yet it is essential to consider these ports in the TEN-T, being part of a critical and important supply chain.” The European Parliament is set to finalise its position at the beginning of this year, clearing the way to conclude the co-decision process and adopt the new TEN-T Regulation at the end of 2023. The new Regulation should be operational in 2024.

The ports of Cuxhaven, Eemshaven, Esbjerg, Humber, Nantes-Saint Nazaire, and Oostende have joined forces to speed up the green transition to meet Europe’s offshore wind deployment targets. “[…] the six of us signed a declaration stating that we will do everything we can to support Europe’s ambitious aims. In May, the politicians set the framework with the original declaration, and today we’ve started to act on the challenge they gave us all by raising sky-high the targets for offshore wind,” Dennis Jul Pedersen, the Port of Esbjerg’s CEO, commented on the occasion. The Esbjerg Declaration from May 2022 saw Belgium, Denmark, Germany, and the Netherlands pledge to deliver a minimum of 65GW of offshore wind energy capacity by 2030. “[…] In other words, Europe aims to install well over five times as much offshore wind in the next eight years as we have built during the previous twenty […]. This target puts great pressure on European wind ports because there is currently not enough port capacity to install all these offshore wind farms by the deadline,” said the signatories of the European Offshore Wind Port Declaration in a press release. The parties will share best practices, e.g., using the digital twin technology to increase handling capacity without physically enlarging their harbours. They will also collaborate on getting around the issue of, e.g., space shortages, such as when one port only has space for half a project, another may have room for the other.

• With the help of the Finnish Kempower and Soltech’s E-Mobility, Göteborgs Lastbilcentral (GLC) has commissioned the 15 fast-charging points facility in Gothenburg. The SEK8.0m investment (around €710k) offers 1.0MW of capacity. The station will aid GLC, which operates a fleet of 350 vehicles, in reducing its CO2 emissions by 70% by 2026 (vs 2010 levels; the Swedish transport company intends to become climate-neutral by 2035). Tomi Ristimäki, CEO of Kempower, said, “We are delighted to see this project go live. Commissioning one of Sweden’s largest private e-truck charging stations highlights the

power of bringing ambitious Nordic companies together. We see the electrification of buses and trucks developing fast in the coming years, and projects such as this are meaningful ways to electrify transport.”

In Denmark, E.ON Drive Infrastructure will erect two e-truck charging stations: in Hirtshals and Høje Taastrup. The former will be located at the Hirtshals Transport Center, next to the Port of Hirtshals, and the facility will feature three 400kW fast chargers into which six trucks can plug (with the option to upgrade the loading bays to 1.0MW). E.ON’s stations should be ready by the end of this year. •

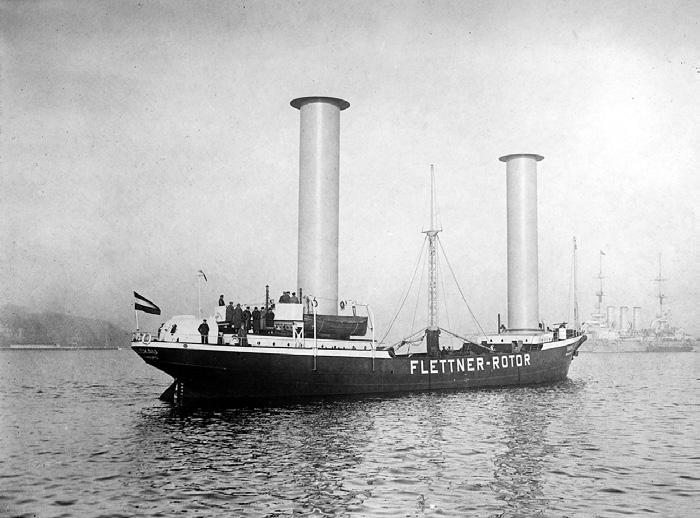

• The French shipowner & operator will see its medium-range tanker Alcyone retrofitted with two 35 m tall and 5.0 m in diameter Flettner rotors. The 50k dwt, 2022-built ship, currently charter-working for TotalEnergies, will receive Norsepower’s Rotor Sails in Q4 2023 or Q1 2024. The sails will be provided by the manufacturer’s new production hub in China in December this year. According to calculations, the

‘Flettners’ will lower Alcyone ’s fuel consumption by an average of 8% on her crossing from South Korea to French Polynesia, “[…] with the potential for further savings using voyage optimisation reaching up to 2,000 tonnes of CO2 per annum,” says Norsepower. Another Finlandbased company, Deltamarin, has been contracted to provide Socatra with a conversion basic design package for installing the two rotors. •

• Together with Umeå Energi, the company has conducted a feasibility study on setting up a marine e-fuel production site at the Dåva cogeneration plant. According to the study, there are “excellent conditions” for establishing Sweden’s third electrofuel facility for the maritime sector in Umeå. All documents required for an investment decision are planned to be ready in 2024, with an expected production

of 100kt/year starting in 2026. The plant will see some 230kt/year of CO2 captured. “The transition to electrofuels in the maritime sector, which uses 300 million tonnes of fossil fuels every year, is very urgent. With electrofuel replacing today’s fossil fuels, carbon dioxide emissions can be reduced by over 90%,” Claes Fredriksson, Liquid Wind’s Founder & CEO, highlighted. •

• The Hamburg-based terminal operator has invested in the FERNRIDE tech start-up from Munich, granting it access to its sea container facility in Tallinn’s Muuga Harbour. There, FERNRIDE will trial its solution (for the first time in a container terminal) for the gradual automation of trucking operations. Specifically, trucks & tractors will be equipped with sensors and cameras to be remote-controlled via mobile networks. Teleoperators at a computer workstation resembling a vehicle cockpit

will take remote control of the machinery. They will receive and send targeted commands online by controlling the gas pedal, brakes, steering wheel, and joystick. FERNRIDE says the algorithms can be further trained using real-time operational data to roll out additional autonomous functions. The pilot will start in early 2023 to determine the technology’s operational reliability in automated container handling and to validate the solution’s viability for future business opportunities. •

• HHLA has commissioned Linde Engineering to build the facility within the premises of the test centre for hydrogen-powered port logistics at the Container Terminal Tollerort. The 2023-ready station will feature an energy-efficient 450 bar high-pressure ionic compressor to get heavy goods vehicles and terminal equipment fuelled with hydrogen. The new

infrastructure will be part of HHLA’s Clean Port & Logistics innovation cluster, established to test hydrogen-powered equipment in harbour technology and port logistics. The cluster is sponsored by Germany’s Federal Ministry of Transport and Digital Infrastructure as part of a national innovation programme for hydrogen and fuel cell technology. •

• The Estonian seaport and the country’s heat & energy producer have signed a memorandum of understanding to accelerate the development of the regional offshore wind energy (OWE) industry. The partners will jointly work on developing, constructing and maintaining OWE farms in the Baltics. The Port of Tallinn intends to add an installation quay in

its Paldiski South Harbour: the €53m investment will see the set-up of a 310 m long quay and adjacent 10 ha yard. Utilitas Wind is working on the Saare-Liivi OWE farm in the Gulf of Riga, to be ready in 2028. The first stage of development will include installing 80 turbines with 1,200MW total capacity (over 5.0TWh of expected annual electricity generation). •

• With the help of the California-headquartered Moffatt & Nichol, the Danish seaport has developed a digital twin, thanks to which Esbjerg will be able to handle 4.5GW of offshore wind components by 2025 (steadily increasing its capacity from today’s 1.5GW when the required changes are completed, a.o., rebuilding of various access roads). “There is no reason to think we’ll stop at 4.5GW, and the same goes for increasing

capacity in the rest of Europe. And that’s before we even start expanding the ports,” Dennis Jul Pedersen, the seaport’s CEO, underlined. His port has also signed the European Offshore Wind Port Declaration, in which it joined forces with the ports of Cuxhaven, Eemshaven, Humber, Nantes-Saint Nazaire, and Oostende to speed up the green transition to meet Europe’s offshore wind deployment targets. •

• The Polish energy company has received the permit to start constructing the offshore wind energy (OWE) installation facility, which is due for commissioning in 2025. The terminal located in the Port of Świnoujście will feature two berthing places, each 250 m long. The facility will not only handle single OWE components but also make

it possible to assemble larger elements, including 100 m tall towers. PKN ORLEN’s terminal in Świnoujście will assist in the set-up of the company’s 1.2GW Baltic Power first offshore wind farm some 23 km off Poland’s coast near Choczewo and Łeba (a joint project carried out with the Canadian Northland Power, planned to come online in 2026). •

• The parties have signed bareboat and time charter contracts for two 7,500 m3 liquefied CO2 carriers. The 130 by 21.2 m ships will be delivered in 2024, the same year Northern Lights’ carbon storage operations are set to commence. The London-based subsidiary K Line LNG Shipping will manage the two carriers, transporting liquefied CO2 from industrial emitters, including the Norcem Brevik and Hafslund Oslo Celsio carbon

capture facilities, to the Northern Lights CO2 receiving terminal in the Norwegian Øygarden. Afterwards, the CO2 will be pumped via a pipeline for permanent storage in a geological reservoir 2.6 km under the seabed. Northern Lights and K Line will jointly establish operational procedures for safely transporting liquefied CO2. The ships are classified by DNV and will be registered in Norway and operated under the country’s flag. •

• Horizon Europe has granted €9.0m to the 11 project partners behind the pure car truck carrier (PCTC) to be powered by wind. Over the next five years, all aspects of planning, building, and operating the wind-powered vessel will be carried out. Wallenius Wilhelmsen, who will operate Orcelle Wind, expects to start commercial sailings

in late 2026/early 2027. The 220 m long PCTC will offer a 7,000+ vehicle capacity; she will also be able to transport other rolling cargo, likewise break-bulk. As part of the Horizon Europe funding, the project will also see the installation of a wing sail test rig on an existing Wallenius Wilhelmsen vessel in mid-2024. •

Sustaining Innovation for a Net-Zero Carbon Environment Enabled by a Digital Ecosystem

ALTERNATIVE ENERGY | Widespread Adoption of Alternative Power

Increased prevalence of hydrogen fuel cells, hybrid systems and nuclear energy

Improved efficient power generation technology from alternative energy sources

Safe and sustainable byproduct waste management

ALTERNATIVE FUELS | Alternative

Fuels Generation and Adoption at Scale

Global adoption of low- and zero-carbon fuels

• Scaled up zero-carbon fuel generation and distribution

• New efficient zero-carbon fuel engines

ELECTRIFICATION | Mature Green

Electrification Infrastructure

• E xpansion of electrification infrastructure

• Improved storage for short haul and deepsea use

• Enlargement of distribution substation network

CARBON CAPTURE | Mature Carbon

Capture Value Chain

• Global adoption of carbon capture technologies

• Increased reach of carbon capture transport network

• E xpansion of storage infrastructure

GREEN ECOSYSTEM | Green Maritime

Ecosystem

• Green trending for manufacturers, shipyards and ports

• Certified green ships and operators

• Green labeled ship cargo

BLUE ECONOMY | Carbon Neutral Blue

Economy

Increased installation of blue technologies: space ports, aquafarms and wave energy generators

Continued development of offshore charging substations infrastructure

Floating offshore windfarms at scale

Investigation/Early Adoption of Alternative Energy Sources

Investigation/Early Adoption of Alternative Energy Sources

• Hydrogen fuel cells

• Hydrogen fuel cells

• Hybrid systems

• Nuclear

Testing and Early Adoption of Alternative Fuels

Testing and Early Adoption of Alternative Fuels

• Ammonia

• Ammonia

• Methanol

• Methanol

• Biofuels

• Biofuels

• Hydrogen

• Hydrogen

Continued Adoption

•Hydrogen hub

•Modular nuclear reactors

Scaling

Scaling

•Reduced carbon emissions managed through use of alternative fuels and carbon capture

•Reduced carbon emissions managed through use of alternative fuels and carbon capture

Utilization for Short Haul

•Onsite/onboard energy storage

•Port and o shore buoy charging stations

Source: ABS Technology Trends. Exploring the Future of Maritime Innovation

•Lithium-ion batteries

batteries

•Non-lithium-ion batteries

•Non-lithium-ion batteries

•Ceramic

•Ceramic batteries

•Dominant zero-carbon fuel generation

•Dominant zero-carbon fuel generation Widespread adoption of alternative power

Limited

Deep-Sea Shipping

•Charging infrastructure

•Charging infrastructure

•Improved onsite/onboard storage

•Improved onsite/onboard storage

Technology and Infrastructure

•Utilization of solid pellets

•Storage in empty oil or gas reservoirs, natural caverns

Alternative fuels generation and adoption at scale

Alternative fuels generation and adoption at scale

Widespread adoption of alternative power

O shore Infrastructure to

•Onsite

Diversified Use of Ocean Space

•O shore spaceports and recovery vessels

•Windfarms

•Aquafarms

•Wave energy conversion

•Onsite

2050 GOALS

Fully transparent energy consumption and carbon footprint • Adoption of zero-carbon fuels at scale • Full electrification of inland, short haul • Partial electrification of deep-sea shipping • Mature carbon capture value chain

Investigation/Early Alternative Sources

cells Continued Adoption

Remote Inspection and Dashboards

Remote Inspection and Dashboards

•3D scanning

•3D scanning

•Virtual training simulators

•Virtual training simulators

•Drone inspection

•Drone inspection

Improved Visualization Tools

Improved Visualization Tools

Monitoring with Machine Learning (ML)

Monitoring with Machine Learning (ML)

•ML for edge computation

•ML for edge computation

DIGITALIZATION

Control of connected vessels at fleet via digital twins • Data management • Connected system models • Virtual/real tie ins (visualization technologies) • AI-enabled self-correcting systems • Virtual immersive ship models

hub nuclear

Widespread adoption of alternative power

APPLIED RESEARCH

•High-fidelity virtual simulators with AIgenerated scenarios

Carbon neutral blue economy

Carbon neutral blue economy

Infrastructure

Blue

Infrastructure Support Blue Economy windfarms charging infrastructure

Space and conversion

•High-fidelity virtual simulators with AIgenerated scenarios

•Inspections with edge computing

•Inspections with edge computing

Self-learning System Robotics

Self-learning System Robotics

• Human-level NLP

• Human-level NLP

• Autonomous bot

• Autonomous bot

• Self-correcting systems

• Self-correcting systems

• Quantum computing

•Conversation natural language processing (NLP) Virtual immersive ship models

•Conversation natural language processing (NLP) Virtual immersive ship models

Self-aware and cognitive systems

Complex integrated energy management systems • New materials and processes • Improved ship connectivity • Increased application of autonomous functions • Real time performance optimization • Fully integrated green ecosystem • Expanded blue economy

• Quantum computing

Self-aware and cognitive systems

Fleet level control via interconnected digital twins

Fleet level control via interconnected digital twins

Connected unmanned autonomous vessels

Connected unmanned autonomous vessels

Real-time fleet performance optimization

Application of advanced materials and processes

Application of advanced materials and processes

New Materials and Applications

New Materials and Applications

•Onsite additive manufacturing for spare parts

•Onsite additive manufacturing for spare parts

•Lower cost/fit for purpose materials

•Lower cost/fit for purpose materials

•Self-healing materials

Self Learning Digital Twins

Self Learning Digital Twins

• Data-seeking

• Data-seeking

• Environmentally aware

Realtime Vessel Monitoring

Realtime Vessel Monitoring

• Voyage planning and optimization

• Voyage planning and optimization

• Day-to-day operational decision support

• Environmentally aware

• Control of physical asset

• Control of physical asset

• Self-replicating digital twins

Investigation/Early Alternative Sources cells Continued Adoption hub nuclear 2025 2030 20 50 2040

• Day-to-day operational decision support

• Self-replicating digital twins

Increased Ship Connectivity

Increased Ship Connectivity

•Complex autonomous functions

•Complex autonomous functions

•Reduced manning

•Reduced manning

•Seafarer knowledge, skills and ability transition

•Seafarer knowledge, skills and ability transition

Vessel System Level Performance Optimization

Vessel System Level Performance Optimization

•Fast solvers for high-fidelity models

•Fast solvers for high-fidelity models

•Advanced SIM-based decision-making

•Advanced SIM-based decision-making

• Enhanced reliability, availability, maintainability and safety (RAMS)

• Enhanced reliability, availability, maintainability and safety (RAMS)

Ship Connectivity Infrastructure

New Materials Manufacturing Methods

New Materials Manufacturing Methods

•Onsite additive manufacturing for non-critical parts

•Onsite additive manufacturing for non-critical parts

•High magnesium steel

•High magnesium steel

Ship Connectivity Infrastructure

•Smart and autonomous functions

•Smart and autonomous functions

•Increased support activity with low orbit satellites

•Increased support activity with low orbit satellites

Component Level Performance Optimization

Component Level Performance Optimization

•Multiphysics/multi-domain optimization

•Multiphysics/multi-domain optimization

•Virtual testing and commissioning

•Virtual testing and commissioning

DIGITALIZATION PLIED RESEARCH

VISUALIZATION TECHNOLOGIES |

Virtual Immersive Ship Models

• Global adoption of augmented and virtual reality inspection tools

Personnel training through immersive simulators

Remote control through visualization technologies

ARTIFICIAL INTELLIGENCE | Self-aware and Correcting Systems

• Technological advancements and adoption of self-diagnostics and self-repair

• Global application of quantum computing

• Increased presence of autonomous bots

VIRTUAL ASSETS | Fleet Level Control via Digital Twins

• Transition to fleet level virtual asset

• Global adoption of model-based systems engineering standards

• Improved cloud and edge computing

AUTONOMOUS OPERATIONS | Connected Unmanned Autonomous Vessels

Increased use of autonomous functions

• Real-time decision support through advanced SIM-based analysis

• Diversification of seafarer knowledge, skills and ability

• Enhanced broadband coverage, speed and cybersecurity

• Increased complexity of autonomous functions

VESSEL PERFORMANCE | Real Time Fleet Performance Optimization

• Wide-spread adoption of energy saving devices to maximize vessel performance

Enhanced high fidelity performance optimization at the vessel system level

Higher fidelity analysis enabled by generative design

MATERIALS | Application of Advanced Materials and Processes

Application of onboard additive manufacturing for repair and part replacement

Serialized additive manufacturing through blockchain

Adoption of lower cost/fit for purpose materials

• New self-healing materials

According to the Reconstruction of Ukraine report released by the Warsaw Enterprise Institute (WEI) in November 2022, a minimum of 750 billion US dollars will be required over ten years to recover the country from Russia’s war of aggression launched on 24 February 2022. Securing such an amount of money will be an enormous challenge – even if $300b+ will come in the form of Russian assets that got frozen outside the country following its unlawful attack – not to mention putting it to effective use, which will include domestic and foreign coordination and control. However brutal it might sound when bullets still fly, Ukraine can build back better – and stronger future-wise – as a modern EU economy within the country’s pre-2014 borders and without self-serving oligarchisation and the corruption its sows, and crucially – free from Kremlin’s meddling.

Ukraine has received $100b from 850 sources by 16 August 2022, chiefly of military and humanitarian support, counts Devex, a social enterprise and media platform for the global development community from Washington, D.C. “However, we know that this is not the total support that has been provided to Ukraine,” WEI experts note. They further, “It should be recognised that part of the support has already been partially used in Ukraine’s reconstruction process. This is especially true of critical infrastructure, which suffered mainly in the first month of the war and had to be rebuilt immediately to allow the community to function in a quasi-normal way.” The current rebuilding process does not involve large-scale transport infrastructure, mainly for it not to be used by the aggressors in their war effort. Rebuilding

these bridges, key roads, and railways will have to wait until they are threatened no more (by July 2022, some 305 bridges, 6.5k km of railways, and 24.7k km of roads were destroyed).

Shortly after the launch of WEI’s analysis, The Kyiv Independent reported in late November 2022 that the US would provide $4.5b direct budget support, while the EU would give $2.5b for reconstruction. According to the United States Department of the Treasury, that sum levelled the country’s all-grant aid to $13b. “These funds will […] help the Government of Ukraine defend against Russia’s illegal war by bolstering economic stability and supporting core government services, including wages for hospital workers, government employees, and teachers as well as social assistance for the elderly and vulnerable,” said Treasury Secretary Janet Yellen.

At the same time, the EU announced its plans to provide €18b (some €1.5b/month) to Ukraine in 2023: “For urgent repairs and fast recovery leading to a successful reconstruction. We will keep on supporting Ukraine for as long as it takes,” Ursula von der Leyen, the European Commission’s (COM) President, underlined.

In October 2022, the Kyiv School of Economics said Russia devastated some $127b worth of infrastructure since its aggression. This sum is short of the damage caused by the Russian missile attacks the following November (and later ones) that primarily targeted Ukraine’s power-generating facilities (constituting yet another war crime, as per the Geneva Conventions, committed by the Kremlin and its accomplices; the first five mass attacks damaged some 40% of the country’s energy system).

“[…] there is no denying that the support of individual countries, institutions and especially the private sector will be

greater the more secured Ukraine’s postwar situation,” reads Reconstruction of Ukraine . As such, WEI brings forth three

scenarios. First, freezing the conflict, with Ukraine still facing a hostile Kremlin and unexplained border situation. Second,

“peace with stipulations on the borders and bilateral relations of Russia and Ukraine,” but with a cabinet in Moscow continuing to plot anti-Ukrainian schemes. Lastly, ‘clean peace,’ i.e., driving off the attackers, securing pre-2014 borders, and resetting relations with a post-putinist government. Consequently, the scenarios rank from the least to the most favourable in terms of getting Ukraine’s reconstruction rolling with sufficient funding. It goes without saying that public & private organisations will be the more eager to inject recovery money, the less likely it is that the Russians will blow it away again.

“So far,” – WEI authors say – “the promises of support look extremely promising and bring some optimism, as the reconstruction plan is to be implemented even if the conflict does not cease.” Arguably, the major victories the Ukrainians struck in the south-east and west-south of the country in the autumn of 2022 fuel this optimism. With an increasing number of modern heavy armaments, intelligence and knowhow supplied by the West, Ukraine is showing more and more often that it can advance, sparking hope that regaining the annexed regions is well within reach. This staunch resistance will also have its consequences once the war is won and Ukraine progresses towards full EU membership from today’s candidate status: the military and the arms industry (alongside sectors catering to their needs) will continue requiring development to deter any future threat.

Reconstruction of Ukraine details the Ukraine Recovery Conference URC2022,

held in Lugano in early July last year, as the most comprehensive event on the prospects of rebuilding the country up to date. URC2022 rallied the country’s allies that condemned the aggression and started backing Ukraine with arms, along with several international organisations such as COM, the Council of Europe, the European Bank for Reconstruction and Development, the European Investment Bank, and the Organization for Economic Co-operation and Development.

The parties agreed on the recovery governing principles, summed by WEI as cooperation; domestic reforms; transparency, accountability and the rule of law; self-governance and social co-responsibility for decisions; reconstruction with the participation of all stakeholders; gender equality; and sustainable development. These strike Ukraine’s pain points, say WEI experts, especially “[…] the need for internal reforms, placing them, not coincidentally, second among the objectives, as Ukraine’s problems of corruption, malfunctioning democracy, monopolisation and oligopolisation of the market, including the privileging of oligarchs, were known even before the outbreak of war in 2014.”

Before the war, Ukraine was used as a contrast to accentuate the development other post-Iron Curtain economies achieved after 1989/1991, notably whose efforts allowed them to join NATO and the EU. It is not that the Ukrainians didn’t fight for their country – the Orange Revolution and especially Euromaidan brought about the hope of a profound change for the better.

Long story short: Ukraine regained independence following the dissolution of the Soviet Union. Like other European nations formerly under Moscow’s heel, the country wanted to westernise. Yet, entire industries & regions were captured by men who started earning exorbitant sums of money, consequently channelled towards politics and media (read: instruments of rule).

This situation created a vicious circle of corruption, symbolised by the outcast president Viktor Yanukovych and his golddropping Mezhyhirya Residence, nowadays a museum (and a shelter for the residents of nearby villages since late February 2022). The successor, Petro Poroshenko (also an oligarch), was charged with state treason in late 2021, accused of aiding & financing terrorists by organising the purchase of coal from separatist-controlled areas of Ukraine together with another

oligarch (and a personal friend of putin) Viktor Medvedchuk.

Yet another oligarch, Ihor Kolomoyskyi, supported the campaign of Ukraine’s current president, Volodymyr Zelenskyy, apparently wanting to play king-maker and pull strings from the back seat (among others, to get his PrivatBank back – nationalised under Poroshenko in the wake of some $5.5b in financial frauds), a move that backfired as Zelenskyy proved to be an independent individual. “As business sharks, you must have nerves of steel. I’m surprised you don’t feel that the country has changed and is starting a new chapter in history. According to the new rules. Not even that, just – according to the rules. You can accept them: be a big, transparent business with the support of the state, or you will be out of the game,” Zelenskyy said in 2021.

But the system and the Kremlin struck back. In the 2021 edition of the Legatum Institute Prosperity Index, Ukraine found itself in the 78th spot (out of 167), down from 64th in 2013. We are talking about the Baltic’s neighbour, with the region’s countries regularly occupying top places (Denmark’s 1st and Sweden’s 3rd in 2021), with the region’s EU “worst” Poland placed at 36th. This shows how deeply rooted are Ukraine’s problems, even excluding the “state sponsor of terrorism” to its east (as declared by the European Parliament on 23 November 2022, with national assemblies of Estonia, Latvia, Lithuania, and Poland doing so even earlier).

Then again, Ukraine ranked pretty well in the 2020 edition of the Global Innovation Index – 45 out of 131, up two places on the anterior ranking and landing on the silver spot in the lower-middle-income group. In 2022, the country was placed in the 57th spot and 4 th in its income cohort. Interestingly, “Despite the war, the Ukrainian IT sector recorded an increase in service exports by 23 percent in the first half of 2022 compared to the same period in 2021. Even at the height of the Russian onslaught in early March 2022, Ukraine’s IT sector maintained 96 percent of its service exports, an unprecedented phenomenon,” highlights Reconstruction of Ukraine . The country’s Ministry of Digital Transformation wants Ukraine to become Europe’s fifth in the number of start-ups. To that end, works on favourable tax e-residency are underway for IT professionals.

Whereas pre-war, the deoligarchisation of Ukraine and connected anti-corruption efforts have brought about limited successes only – though a significant piece of legal work from September 2021 was intended to ban oligarchs from funding political parties – in July 2022, news broke out that Kolomoyskyi and other tycoonocrats may be stripped of Ukrainian citizenship, with their fortunes confiscated.

The war has, therefore, created a new environment, say Reconstruction of Ukraine ’s authors; one in which Zelenskyy rules with decrees that make it easier to cut the Gordian Knot of oligarchisation. Called “the great purge,” it may help the country eliminate one of the biggest plagues haunting it for three decades. Among many other things, postwar reconstruction is to bolster Ukraine’s small- and medium-sized enterprises

(SMEs), the backbone of any modern economy. Privatisation will play a key role in market liberalisation, too, with 420 companies up for sale and only 100 to be left in the hands of the state.

That said, reports the Ukrainian Economic Truth, there is also the risk of managers who run state-owned enterprises delivering such poor results that will drive down their companies’ appraisals, enabling them to take over

The recovery will come in a few waves. The cabinet in Kyiv speaks of $65b out of that $750b+ figure making for immediate costs: defence, energy supplies, running the government, and supporting SMEs. WEI underlines in this context, “Maintaining state liquidity is crucial to maintaining Ukraine’s credibility as a debtor. Undoubtedly, the non-bankruptcy of Ukraine, as well as the absence of excessive debt, will contribute to faster recovery of macro economic stability after the war, as well as sustain the potential of Ukrainian companies […].”

Second, a five-year reconstruction is expected to start as early as this year, with some $300b spent on infrastructure (energy, housing, and transport) and further upgrading the country’s deterrence capabilities. “Government documents assume that subsidies will be necessary, as well as development support, bank guarantees so as to enable companies to raise capital. Reduced post-war economic activity will […] keep budget revenues low, not much higher than during the war. This will cause the Ukrainian government, in part, to have to be financed from outside in order to remain liquid and credible,” reads

Finally, after those five years, the focus will shift from recovery to modernisation, with $400b+ channelled towards not only heavyduty projects but also social infrastructure: the health care system, education, culture, and sports. Also, “[…] investments in green energy and energy independence will become increasingly important,” say the experts from WEI. Ukraine is to become like other EU countries – growing towards a green economy, leaving behind its heavy reliance on fossil fuels and oligarchic conglomerates to keep the wheels spinning. In this context, there are talks about re-establishing a connection from the 1980s between Ukraine and Poland for electricity transmission from the former’s nuclear power plants (some 7.0GW of export capacity, according to Polish MP Przemysław Koperski, cited by WEI).

Alongside that movement, another systemic change is to take place: decentralisation. More power is to be handed over to local authorities, who are to actively partake in the reconstruction as they and their communities, including NGOs, should

have a better understanding of what needs fixing. WEI cites PAX, the largest Dutch organisation for peace with experience in post-war recovery across the Balkans, Colombia, the Middle East and sub-Saharan Africa, saying that “[…] reconstruction has the best results if it is planned and led by local authorities, with the participation of the local community, and if it is citizenoriented, for human capital will be the most important pro-development factor once reconstruction is complete.”

Though Ukraine implemented the anticorruption Prozorro and Dozzoro systems in 2015, likewise set in motion a few institutions tasked with fighting graft, the state still ranks poorly – landing the 122nd place (out of 180) in the 2021 edition of Transparency International’s Corruption Perceptions Index. Certainly, here, too, the Baltic Sea region can lend a helping hand, as Denmark and Finland ranked 1st , Sweden – 4th, and Germany – 10 th. Since the current president “[…] took office in 2019 until the outbreak of the war, not much has changed either. The Constitutional Court of Ukraine and the parliament were used to paralyse the activities of all anti-corruption bodies,” highlights Reconstruction of Ukraine. Here again, WEI experts make it explicit that oligarchisation and corruption go hand-in-hand, as “a significant number of deputies and other public officials act on behalf of the oligarchs who finance them, or more precisely, corrupt them. This causes a certain spiral of corruption that is difficult to break, aimed at sustaining the influence of the oligarchs.”

The society is throttled by large- and small-scale corruption alike, with 24% of Ukrainians saying in a survey from 2020 that they were asked for a bribe at least once during the year. However, there are also positive news bits, such as “[…] the possibility of dealing with an increasing number of issues over the Internet, thanks to which the official is separated from the client, significantly reducing the risk of corruption.”

It will likely be that those funding Ukraine’s recovery, America and Europe, will insist on implementing an anti-corruption scheme that mirrors the world’s strictest, such as the US Foreign Corrupt Practices Act, the UK’s Bribery Act of

the enterprises for a fraction of what they are truly worth. Consequently, a new wave of oligarchs will emerge. Again, the €750b+ recovery fund isn’t needed for Ukraine’s reoligarchisation but for its reconstruction.