An annual service call will ensure backup power is available when needed.

Whole house generators require periodic maintenance to remain in top operating condition. Most generators are designed to automatically perform a self-test several times a month. The self-test checks for proper operation as well as charges the battery.

If your generator is not currently on a maintenance contract, or may need maintenance before the next hurricane season, Pensacola Energy encourages you to contact a qualified generator contractor for preventative maintenance.

Learn more at PensacolaEnergy.com or call 850-436-5050.

Please consider using natural gas for your outdoor grill, cooktop and water heater. These appliances will operate without electric power and can reduce the load on your generator. You can earn up to $3,000 in rebates when converting to natural gas appliances.

2024 Home Builders

Association of West Florida Board of Directors

Dax Campbell, Campbell Construction & Company, President

Austin Tenpenny, Adoor Properties, First Vice President

Jennifer Reese, Reese Construction Services, Treasurer

Heath Kelly, Heath Kelly Construction, Secretary

Josh Peden, Hudson, Peden & Associates, Financial Officer

Lindy Hurd, First International Title, Past 2nd VP, Sales Council Chair

Kevin Sluder, Gene’s Floor Covering, 3rd Vice President

Paul Stanley, The First Bank, 2nd Vice President

Amir Fooladi, Encore Homes by ParsCo, Immediate Past-President

Stephen Moorhead, Moorhead Law Group, Legal Counsel

Bill Batting, REW Materials

Jim Bouterie, Pensacola Energy

Rick Byars, Florida Power & Light

Mickey Clinard, Renasant Mortgage

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design, Cost and Codes Chair

Shellie Isakson-Smith, SWBC

Mary Jordan, Gulf Coast Insurance, Tradesman/Education Council Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Chair

Marty Rich, University Lending Group

Wilma Shortall, The First Bank

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

Janson Thomas, Swift Supply

Chad Edgar, Joe-Brad Construction

Joseph Everson, D.R. Horton

Fred Gunther, Gunther Properties

Drew Hardgrave, Landshark Homes

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Tomas Ondra, Ondra Home Building

Shon Owens, Owens Custom Homes & Construction

Josh Rayls, Holiday Builders

Douglas Russell, R-Squared Construction

Monte Williams, Signature Homes

Anton Zaynakov, Grand Builders

Blaine Flynn, Flynn Built

Edwin Henry, Henry Homes

Shelby Johnson, Johnson Construction

Russ Parris, Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim, Westerheim Properties

Doug Whitfield, Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

Executive

Art

Assistant

Editorial

Sales

Our community is experiencing a growing housing affordability issue. Home prices are 5% higher in some Northwest Florida markets for new home construction compared to this time last year. These factors can be attributed to a number of reasons. One of the reasons is population growth. When there is an increase in population, the demand for housing also rises driving up prices. Northwest Florida is a desirable location for many people due to its beautiful beaches, pleasant climate, and recreational opportunities. There is very low inventory of existing homes for sale so many buyers are looking to new home construction. The high demand affects affordability along with the higher interest rates and cost of home insurance we are seeing. The HBA urges our elected officials in Tallahassee to work on reforming home owners insurance in the state and our partners at NAHB in DC are advocating for the Fed to lower interest rates at their upcoming meetings this year. Making housing more attainable for the residents in Escambia and Santa Rosa County is vitally important to the quality of life in our community.

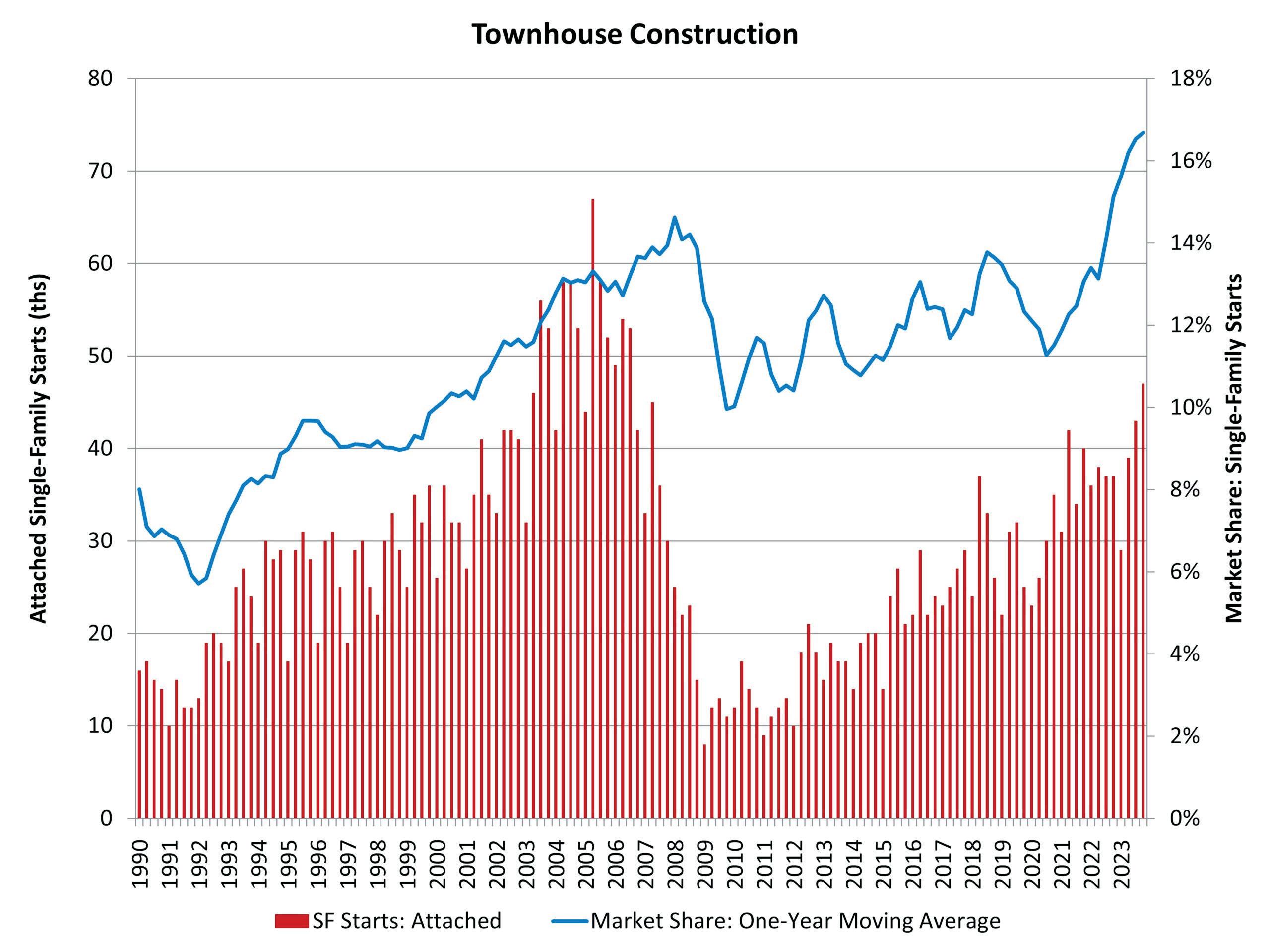

Despite weakness for single-family construction in 2023, townhouse construction recorded the best quarter for starts in more than 17 years.

According to NAHB analysis of the most recent Census data of Starts and Completions by Purpose and Design, during the fourth quarter of 2023, single-family attached starts totaled 47,000, which is 27% higher than the fourth quarter of 2022.

This represents an acceleration over the last four quarters, during which townhouse construction starts totaled a strong 158,000 homes, which is almost 7% higher than the prior four-quarter period (148,000). Townhouses made up almost 20% of total housing starts in the final quarter of 2023.

Using a one-year moving average, the market share of newly-built townhouses stood at 16.7% of all single-family starts for the fourth quarter. With the recent gains, the four-quarter moving average market share is the highest on record, for data going back to 1985.

Prior to the current cycle, the peak market share of the last two decades for townhouse construction was set during the first quarter of 2008, when the percentage reached 14.6%, on a one-year moving average basis. This high point was set after a fairly consistent increase in the share beginning in the early 1990s.

The long-run prospects for townhouse construction are positive given growing numbers of homebuyers looking for medium-density residential neighborhoods, such as urban villages that offer walkable environments and other amenities. Where it can be zoned, it can be built.

Source: NAHB Eye on Housing

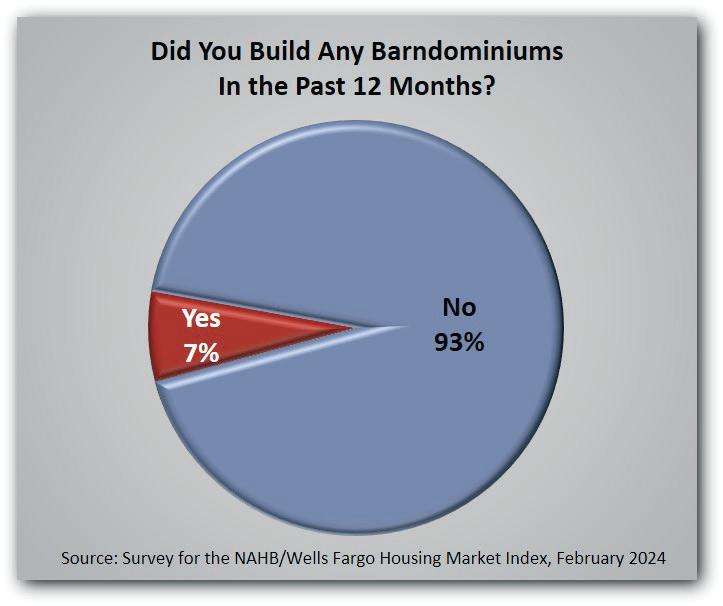

Over the past decade, use of the term “barndominium” (indicating a structure that is, in some sense, a combination barn and condominium) has become increasingly widespread in real estate media outlets. In fact, the term has become popular enough for NAHB to include a question about it in its survey for the February 2024 NAHB/Wells Fargo Housing Market Index. In response to that survey, a total of 7% of single-family builders reported that they did, indeed, build barndominiums sometime during the past 12 months.

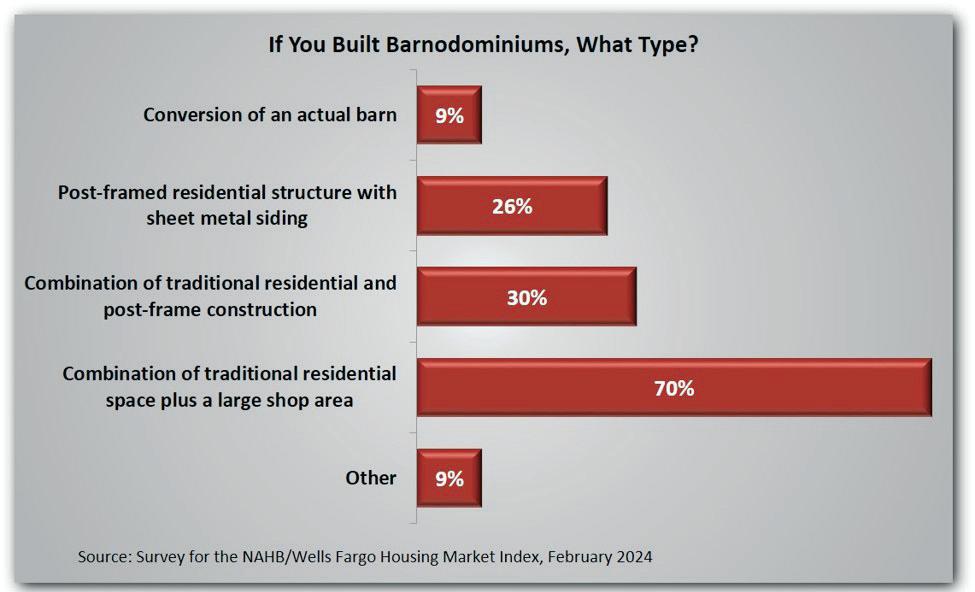

That result, however, leaves open the question of what a builder means by a barndominium. Unlike a term with a consistent definition maintained by, say, an academic organization or government agency, “barndominium” has meant different things to different reporters over the years.

When the term was first gaining popularity, reporters were usually using it to describe a metal frame structure that was used as a primary residence. But that usage has been far from consistent.

When NAHB’s builders were asked about the type of barndominiums they built, the vast majority (70%) indicated that their barndos were a combination of residential space and a large shop area—a criterion that doesn’t even consider the structure’s framing. The percentages referring to framing-based criteria were smaller but still significant: 30% of builders reported that their barndos were a combination of traditional residential and post-frame construction, and 26% said they were post-framed residential structures with sheet metal siding (26%). Only 9% said their barndos were created by actually converting a barn into a primary residence.

Whichever of these techniques a builder uses, the result of creating a barndominium is a new housing unit which, in the typical jurisdiction, requires a residential building permit.

Source: NAHB Eye on Housing

HBA Spring Golf Tournament

on Thursday, April 18th at 12 noon

Scenic Hills Country Club

4 person Team - $500

Click here to register and select sponsorship

**SOLD OUT** $1,950

Lunch Sponsor |

•

•

•

• Opportunity to provide items for swag bag Awards

Reception Sponsor | $750

• Signage at clubhouse/event check-in

• Verbal recognition at event

• Recognition in Cornerstone and on Facebook

• Opportunity to provide items for swag bag

Beverage Cart Sponsor (2 )| $750

• Signage at clubhouse/event check-in

• Verbal recognition at event

• Recognition in Cornerstone and on Facebook

• Opportunity to drive a beverage cart that serves drinks to golfers, while also providing a chance to network. (drinks provided)

• Recognition in Cornerstone and Facebook

• Winners will receive prizes on behalf of sponsor

$100 each player on 1st Place team

$75 each player on 2nd Place team

$50 each player on 3rd Place team

Hole Sponsors (12 available) | $500

• Signage at hole/tee.

• Set up and staff your hole/tee. You can provide swag and entertainment for all who pass by. Hole/Tee must be staffed.

**SOLD OUT** Longest Drive Sponsor | $300

• Signage at contest tee

• Winners will receive $50 prize on behalf of sponsor

Closest to the Pin Sponsor | $300

• Signage at contest tee

• Winners will receive $50 prize on behalf of sponsor

Four national trade associations petitioned the White House to make improvements in its implementation of “made in America” requirements for construction products and materials. They noted their members have encountered significant difficulty in navigating the White House Office of Management and Budget’s (OMB) “opaque and unbalanced implementation,” risking delays and cost increases for vital housing, transportation, and water infrastructure projects funded by the Infrastructure Investment & Jobs Act.

The infrastructure law, which was enacted in 2021, includes the Build America, Buy America Act, which expands longstanding domestic preference requirements for construction projects that incorporate federal dollars.

“Our coalition fully supports the Act’s laudable core purpose of strengthening domestic manufacturing,” the trade groups said. “Unfortunately, OMB’s focus on managing virtually every aspect of the Build America, Buy America Act requirements is not practical and causes confusion and delay with federal agencies that fund construction projects.”

In particular, the groups note continued uncertainty surrounding the waiver process. The Buy America provisions allow for these exceptions if domestically made products are unavailable or significantly more costly. However, under executive order, OMB must review the hundreds of waiver requests made to federal agencies each year. While OMB has a 15-day target for these reviews, the process often proves to be lengthy and unpredictable as the politics of these waivers can lead to bureaucratic inertia. For example, the Illinois Department of Transportation submitted a waiver on May 21, 2021, that was not posted for public comment until more than two years later, on August 28, 2023. Such uncertainty with the waiver process threatens project delays, cost increases, and even project cancellations.

The groups’ filing calls for more timely waivers, given the record number of projects utilizing federal funding, short-term deficiencies in domestic manufacturing capabilities, increased materials costs and unpredictable lead times for key components. The trade groups put forth recommendations to ensure an effective and “depoliticized” waiver process by allowing all such requests to be treated equally and transparently. If a waiver is granted, it does not mean that a Democratic or Republican administration does not care about domestic manufacturing or American jobs; it means that they also care about American construction jobs and want to rebuild America’s infrastructure, the groups note.

The associations said OMB should focus on implementing the requirements at a generalized level and empower federal agencies with broad discretion to fill in the details. They also urged federal officials to create a database listing construction materials and products that are Build America, Buy America Act compliant.

“OMB needs to change course and foster a deliberative, data-driven implementation process that not only prioritizes domestic manufacturing but also provides adequate consideration for the timely and successful delivery of essential infrastructure projects,” the groups said in their filing. “Failure to act will result in the IIJA’s inability to fulfill its infrastructure promise to the American people.”

The groups filed a formal petition for a new rulemaking under the Administrative Procedures Act and a request under the Paperwork Reduction Act to review the way the administration collects Buy America waivers. The groups are the American Public Transportation Association; the American Road & Transportation Builders Association; the Associated General Contractors of America; and the National Association of Home Builders.

Source: NAHB

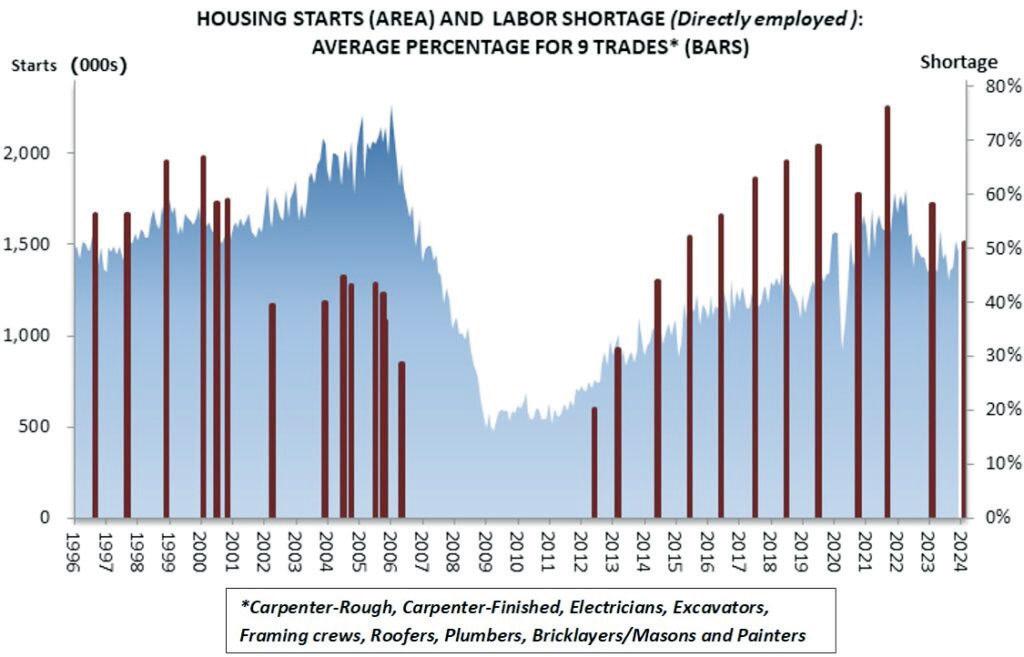

With home building volumes lower, labor shortages have eased considerably since record levels set in 2021 but remain relatively widespread in a historic context, according to results from the latest NAHB/ Well Fargo Housing Market Index (HMI) survey.

The February 2024 HMI survey asked builders about shortages in 16 specific trades. The percentage of builders reporting a shortage (either some or serious) of labor they employ directly ranged from a low of 33% for landscape workers to a high of 65% for those performing finished carpentry.

The finished carpentry shortage was down from 72% in 2023 and an alltime high of 85% in 2021 but remains higher than it was at any time during the 2004-2006 housing boom (when it reached a temporary peak of 58% in July 2005). Most of the labor shortage percentages in the above figure follow a similar historic pattern.

In the typical case, most of the physical work required to build a home is performed not by laborers employed directly by the builders, but by subcontractors. As a 2020 NAHB study showed, builders on

average use two dozen different subcontractors and subcontract out 84% of their total construction costs to build a single-family home.

The February 2024 HMI survey also collected information about shortages of subcontractors. The percentage of builders reporting a shortage of subcontractors ranged from 35% for building maintenance managers to 63% for finished carpenters.

For all 16 trades, the shortage percentages for subcontractors and labor directly employed were fairly similar. Averaged over the nine trades

that NAHB has covered in a consistent way since the 1990s (carpenter-rough, carpenter-finished, electricians, excavators, framing crews, roofers, plumbers, bricklayers/masons, and painters), the share of builders reporting shortages in February 2024 was 52% for labor directly employed and 51% for subcontractors.

The two numbers have not always been this close. After 2012, as housing markets started to recover from the Great Recession, a 5- to 7-point gap opened up between the 9-trade average shortage of subcontractors and labor directly employed by builders, with the subcontractor shortages being consistently more widespread. NAHB’s analysis at the time indicated that workers who were laid off and started their own trade contracting businesses during the Great Recession started returning to work for larger companies—improving the availability of workers directly employed by builders while shrinking the pool of available subcontractors. After persisting for a decade, the subcontractor-direct labor gap finally narrowed in 2023 and disappeared entirely in 2024.

The current 9-trade average shortage of 52% for labor directly employed is down from 58% in 2023 and a record-high 77% in 2021 but remains elevated in historical perspective—especially when considered relative to housing starts.

During the boom period of 2004-2006, total housing starts were consistently over 1.8 million annually—as high as 2.0 million in 2005. Despite this high rate of construction, the 9-trade shortage percentage never exceeded 45% during the boom. In comparison, the current shortage percentage of 52% occurred against a backdrop of 1.4 million starts in 2023 and an annual rate of 1.3 million recorded so far in January of 2024.

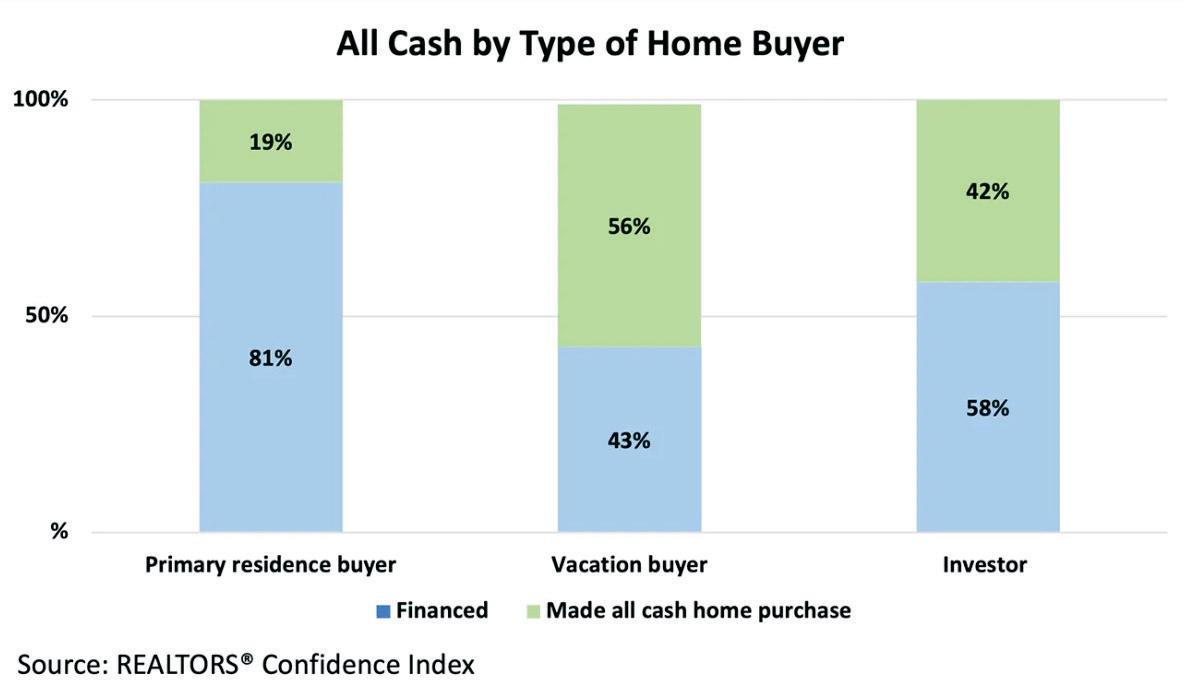

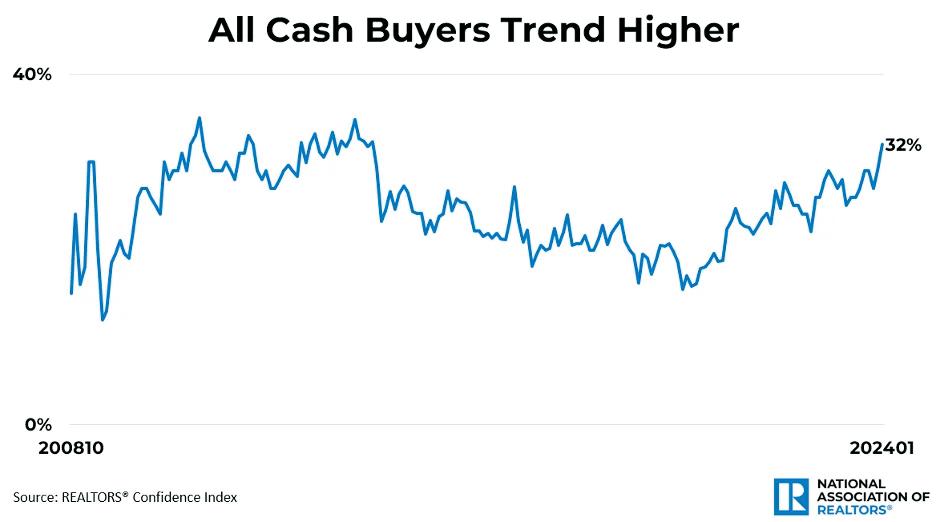

While mortgage interest rates have risen from their all-time lows in recent years, the share of all cash buyers is growing. all cash home buyers have trended up significantly in recent months. Since October 2022, all cash home buyers who did not finance their recent home purchase have been more than one-quarter of the real estate market. In January 2024, all cash buyers now stand at 32% of home sales. The last time the share of all cash buyers was this high was June 2014.

So, who are these home buyers? Data from the last six months of the REALTORS® Confidence Index shows they are more likely to be vacation buyers and investors. However, primary residence buyers are actively purchasing using all cash.

Looking at primary residence buyers, all cash purchases have increased in the last two years. These housing consumers owned a home, sold it, and then they could purchase their next property without a mortgage. The freedom to make this purchase was likely due to the large amount of housing equity they have earned as home prices have increased in recent years.

In 2003, just 10% of repeat primary residence home buyers were able to make an all cash home purchase, while in 2023, 26% of repeat buyers were able to skip

a mortgage payment. This remains uncommon among first-time buyers. However, 6% of first-time buyers made an all cash purchase in 2023 compared to 4% in 2003.

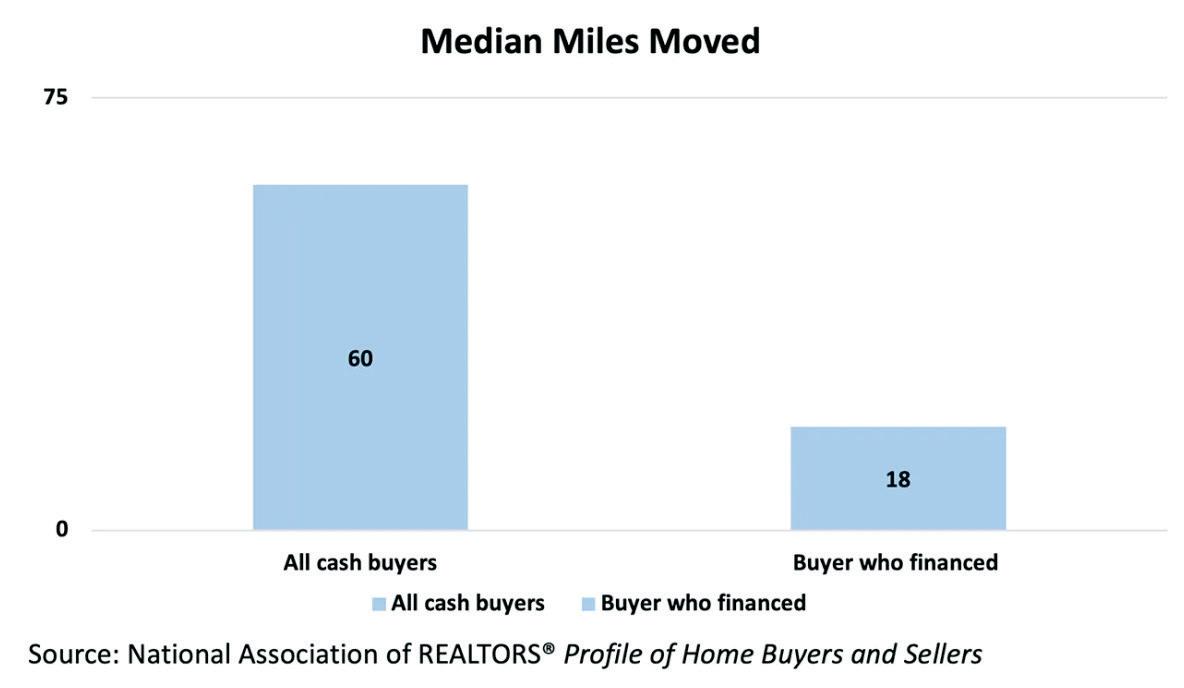

Aside from the housing equity, one explanation for these primary residence home buyers to be able to pay all cash is they are more likely to move long distances. For all cash primary residence buyers, they moved a median of 60 miles, with 29% moving 500 miles or more. In comparison, among those who financed their home purchase, only 16% moved 500 miles or more, and the median distance moved was just 18 miles. While long-distance moves were most popular during the beginning of the COVID-19 pandemic, they are still occurring, especially among retirees and those able to work fully remotely.

As home prices are expected to increase throughout 2024, due to limited housing inventory and high demand to purchase homes, these all cash buyers are likely to still be prevalent in the market as homeowners earn more housing equity. In January, the typical home received 2.7 offers. If multiple offers continue, these all cash buyers will likely win bidding wars. Those who are financing may not be the winning contract on the home.

Source: National Association of Realtors

We

•

•

•

•

•

•

•

•

•

We are a full service civil engineering consulting firm specializing in the design and permitting of:

Family Residential Developments: The Preserve at Deer Run, Forest Bay Estates, Residence at Nature Creek

•

Family Residential Developments: Utopia Cottages

Commercial Developments: Slim Chickens, Perdido Auto Spa, St. Michael’s Brewing Company, Home 2 Suites

evelopments: Black Gold Asphalt Plant, Roads, Inc.

mprovements Projects: Capital Drive Drainage Improvement Project, Escambia Co.

full service civil engineering consulting firm specializing in the design and permitting of:

Recreational Developments: Mahogany Mill Boat Ramp, Escambia Co.

Medical/Healthcare Developments: Ullman Eye Consultants, Fulcrum at North Davis

Development: Gulf Breeze Fire Station, City of Gulf Breeze

Residential Developments: The Preserve at Deer Run, Forest Bay Estates, Residence at Nature Creek

Residential Developments: Utopia Cottages

Developments: Slim Chickens, Perdido Auto Spa, St. Michael’s Brewing Company, Home 2 Suites

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.