7

So many people talk about the management of money, but, really, before you even talk about any of that, you have to get the why, the question behind the question, understanding what our clients need so we can offer our perspective and serve as guides on their wealth journey.

8

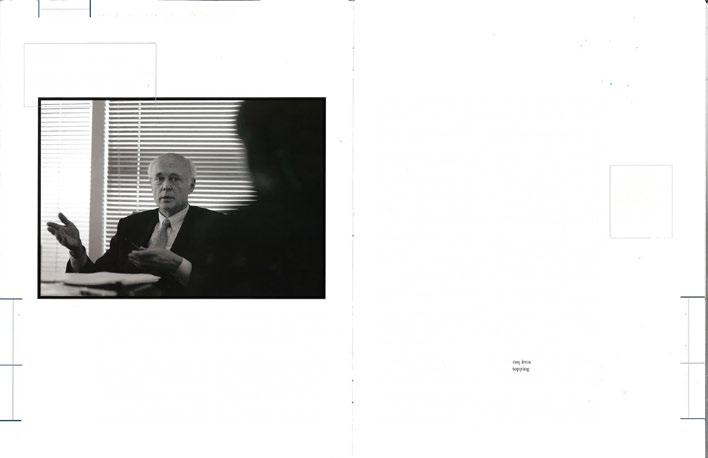

Brittain Prigge, President, CFA

Greetings,

Thank you for your interest in our firm. Whatever propelled you to this moment — whether you are a first-generation wealth creator or the steward of multi-generational family wealth — we’re glad you’re here.

Wealth represents opportunity. It opens doors, sparks possibilities, and provides the means to decide the impact you’d like to have on your family and your community. This can often feel burdensome. How can you protect and grow the wealth you’ve worked so hard to build?

We believe you need a trusted advisor, someone who has been in your shoes, someone you can count on to navigate what lies ahead. Since 1987, Balentine has been that trusted advisor for families just like yours.

As fiduciaries, we put our client’s interests first, working alongside you to help you reach your goals. As entrepreneurs ourselves, we have firsthand experience with the issues our clients face. Overall, we strive to manage your wealth the way we’d want someone to manage ours.

Over more than 35 years, this approach to serving our clients has never changed, though our relationships have evolved to provide deeper, more complex guidance around their wealth and legacy.

Choosing the right partner to guide your wealth journey is a significant decision, and we appreciate that you’re considering our firm. We hope that this book illustrates for you the expertise we bring to our work, the sincerity with which we care for clients, and the impact we strive to make in the lives of our clients and our community.

Sincerely,

Robert Balentine, Chairman

9

Why

How can I protect and grow the wealth I’ve worked so hard to build? 7 Balentine’s Services How can I simplify my financial picture? Financial Planning 11 How does Balentine manage money? Public Markets 15 Private Markets 17 How does my business fit into my overall plan and goals? Business Advisory 19 How do I manage the complexities of my family’s significant wealth? Multi-Family Office 22 Starting Your Balentine Journey What is it like to be a Balentine Client? Your Client Experience 25 Who is Balentine? Our Story XX Life at Balentine XX Disclosures XX 10

Balentine?

How can I protect and grow the wealth I’ve worked so hard to build?

A wealth of perspective working for you.

Wealth represents opportunity. It opens doors, it sparks possibilities, and it provides the means to decide the impact you’d like to have on your family and your community. Whether you’re a first-generation wealth creator or the steward of a multi-generational family, this can feel burdensome.

At Balentine, we build long-term, trusted relationships based on expertise, sincerity, and impact so that you have the wealth of perspective you need each step of the way.

A partnership to plan, preserve, and perpetuate wealth.

Whether you’ve started a business, inherited substantial assets, or steward an institution, we can help you build what comes next.

We have a deep bench of subject-matter experts, and as a client, you get access to our entire team — and receive our combined decades of experience.

11

Balentine is a firm that listens. They focus on continually making it a better company by focusing on their clients and how to serve us better. As a client, I think that’s incredibly important and exciting.”

— Andy Vabulas, Balentine Client

Entrepreneurial Focus

We are entrepreneurs ourselves, so we can relate to the most complex nuances of business ownership — and offer valuable insight into helping you maximize your impact.

Customized Approach

As true fiduciaries, we put your best interests first and develop a custom plan for each relationship.

Employee-Owned

We prioritize collaboration over competition. We are also fee-only, which means we never receive a commission.

12

Balentine clients were not compensated via credits or other benefits from Balentine for providing testimonials.

13

It’s said that the money line runs very close to the heartline. As a fiduciary, we are in a position of trust, and it’s incumbent upon us to operate with absolute integrity and excellence. We may not always know all the answers, but we do know where to find them. And our clients can always count on us to give them unfiltered, unvarnished truth.

— Robert Balentine, Chairman

14

How can I simplify my financial picture?

We’ll help you outline your goals, evaluate the right path, and implement your desired financial strategy.

There are so many pieces to my finances — where do I begin?

Your financial world is complex but understanding it doesn’t have to be. That’s why we address each area at a time, when it’s relevant, to help you understand where you are today without it being overwhelming, so that you can take the next best step.

What will my financial plan involve?

Planning encompasses a plethora of areas, with varying degrees of importance, urgency, and complexity based on your age, life stage, career, and individual situation. We begin with understanding where you are today and where you’d like to be in the future. Then, we’ll help address your most pressing needs first, keeping other areas in our peripheral to undertake when the time is right.

Consider an orchard with different varieties of fruit trees at many stages of development. Managing the orchard requires maintenance in the short term — which trees need pruning and which ones are ready to harvest?

It also requires planning for the long term — how do needs change between the different varieties of trees, and what accommodations does each type of tree need to grow successfully?

We view your financial plan in the same way. Our plans aren’t shelved documents referenced annually. Rather, we take a holistic view of the different areas of planning, deciding where to start based on your specific needs and continually evaluating which areas need attention and updates so that you can enjoy the bounty of your hard work.

FINANCIAL

PLANNING

Investment Management 15

Philanthropy

Financial Planning Priorities

Taxes

Asset Protection

Cash Flow

Balance Sheets

Income Replacement

Estate and Legacy

16

How do I protect my family’s future for generations to come?

We help families preserve their wealth and perpetuate their legacy by improving communication, alignment, decision-making, and stewardship.

What is my “Why?”

Defining your legacy provides the foundation for perpetuating wealth across generations. We’ll help you answer questions to articulate your legacy, such as:

Who are you beyond your finances? How do you wish to be remembered? Then, we’ll codify it through family mission and values statements.

17

FAMILY DYNAMICS

How do I talk to my family about wealth?

We encourage families to have crucial conversations rooted in empathy, transparency, and vulnerability. These exchanges allow families to strengthen bonds, reinforce values, and create memorable experiences. We can help by mediating family meetings, hosting regular forums for open communication, and providing resources.

PHILANTHROPY

What imprint will my family leave on our community?

Giving money away can be just as hard as making it. We help families construct plans to support their legacies far into the future. Starting with your family’s mission and values, we’ll create governance documents, a strategic philanthropic plan, and a social impact plan.

EDUCATION

How do I ensure my family is prepared to steward our wealth and legacy?

Financial literacy is paramount. We lead an ongoing education initiative to meet family members wherever they are in their learning and equip them as capable decision-makers ready to confidently steward the family legacy.

Legacy is what resonates after you’re no longer here. It is the bridge between your past and your family’s future…

With this understanding of legacy, you can achieve higher levels of personal fulfillment from your wealth and prepare your loved ones to carry your vision into the future.”

18

— Robert Balentine, Chairman and Adrian Cronje, Ph.D., CFA, CEO First Generation Wealth

How will Balentine protect and grow my assets?

Balentine has delivered flexibility in developing an investment strategy that complements our existing investments. While we could go anywhere for advice, we find Balentine is the perfect mix of a boutique’s approach to client service with the depth of expertise found in large organizations.”

clients

not compensated via credits or other benefits from Balentine for providing testimonials. 19

— Todd & Laura Olson, Balentine Clients

Balentine

were

Tailored Approach

We will build your custom strategy around existing assets to ensure your full financial picture accommodates your specific risk tolerance, goals, and tax situation. Our centralized process ensures portfolios are informed by our best thinking, providing each one with exclusive access to curated private capital opportunities and our institutional-quality investment model.

Experienced Team

Our investment decisions are driven by a core team, XX% of whom have worked together for XX years. With advanced degrees in econometrics, business, and finance; Chartered Financial Analyst® and CERTIFIED FINANCIAL PLANNER™ designations; and an average of XX years at the firm and XX years in the financial industry, our team is intelligent, experienced, and collaborative.

Proven Results

In addition, our work delivers results, and it has persevered through multiple market cycles. Our data-driven, proprietary model utilizes momentum to identify broader market trends, not pick individual stocks. As dedicated fiduciaries, you can rest assured that our goals are always aligned with yours. In addition, we believe in our process — our employees are invested in the same strategies as our clients.

Our experienced team has developed what we consider to be a disciplined, objective, model-driven investment process. We’ve seen market volatility time and again, and we take seriously our responsibility to help you through.

20

Thoughtful Private Capital Opportunities

21

Private capital can provide excess return and diversification from other investments, helping to protect and grow wealth for generations.

At Balentine, we identify meaningful private capital opportunities with a patient, thorough, and thoughtful approach. We’ll construct a customized strategy that aligns with your liquidity needs, portfolio size, and time horizon. We don’t receive incentives or kickbacks for recommending certain funds, so you can feel secure that your investments are aligned with your best interests.

As your portfolio grows, we will provide additional investment opportunities, including broadening exposure across sub-asset classes, and co-investing directly alongside world class managers. All the while, we will identify themes that we believe are poised to outperform for future generations.

How do you assess and integrate direct deal opportunities?

22

When approached with a direct investment opportunity, you may wonder how to determine whether it is the right fit for you. With decades of experience in the private capital space, including as private equity investors, we will help you assess opportunities in an unbiased manner that keeps in mind your total inancial picture, today and for generations to come.

How does my business fit into my overall plan & goals?

For entrepreneurs, your passion is your business. As entrepreneurs ourselves, we understand that a closely held business an integral piece of your full financial picture and intertwined with the financial decisions you make for your family. You may have questions like:

How do I balance investments with business operations?

What are best practices for family-owned business?

How do I balance competing priorities within the family for the business?

How do I meet the differing — and sometimes directly opposing — needs of different generations within my family?

What is the place of my business within my family?

As you navigate what’s next for your family and your business, you may benefit from our independent and experienced team. We’re purposefully built to put client interest first, and we have decades of experience guiding entrepreneurs and deep resources built for families of wealth.

23

A Wealth of Perspective: Balentine’s Integrated Approach

Planning decisions are interwoven and complex between the business and the family, so we take a holistic and integrated approach to building your custom strategy.

THE FAMILY BUSINESS

THE BUSINESS OF THE FAMILY

Vision

Industry Dynamics

Competitive Positioning

Strategic Initiatives

Resources

Capital Considerations

Distribution Policy

Leadership & Demographics

Structure

Aligned Incentives

Company Culture

Succession Planning

Vision

Family Dynamics

Values & Philosophies

Goals Based Objectives

Resources

Personal Assets & Net Worth

Lifestyle & Peace of Mind

Family Leadership & Education

Structure

Optimal Shareholder/Assets

Legal Documentation

Legacy & Communication Planning

24

25

How do I navigate the complexities of my family’s significant wealth?

Families of significant wealth have specific needs, so we’ve assembled a cadre of subject-matter experts to provide you with comprehensive services in one coordinated offering.

Should I be considering a family office?

We understand that it takes alignment within your family and your advisory team to unlock the growth of your business and family. For a generation, we have helped some of the largest families in the country improve alignment, communication, decision-making, and stewardship.

My family enterprise is unique. How can I have a custom approach?

We’ll help you uncover your “why,” build a tailored offering to accommodate your family’s specific needs, and mobilize our firm’s resources, leaning on internal expertise and trusted external advisors, to create your custom family office.

How can you meet my needs today while laying the groundwork for future generations?

Our boutique approach enables us to provide custom solutions for each relationship, supporting immediate, medium-term, and long-term needs. In addition, we seek to ensure the continuity of our approach across generations through succession planning.

How do you meet the needs of the family enterprise while also meeting the needs of each individual and generation?

We understand different family members or generations of the family may have very different goals and objectives, so we work with family units separately while also understanding the buying power of the full family.

26

27

I think our two biggest strategic assets are our people who ride up and down the elevator every day and the culture that stitches them together.”

28

— Adrian Cronje, Ph.D., CFA, CEO

Our experienced team has developed what we consider to be a disciplined, objective, model-driven investment process. We’ve seen market volatility time and again, and we take seriously our responsibility to help you through.

Exclusive Excellence

Balentine clients have access to a cadre of long-standing, institutional-quality expertise, likeminded peers, and capital strategies.

Entrepreneurial Perspective

We are 100% employee owned, so we are in a unique position to offer especially valuable insight into helping entrepreneurs maximize their impact.

Personalized Alignment

We take the time to understand your needs and values, then deploy the collective and specific expertise of our team to deliver a customized approach.

What is it like to be a Balentine Client?

What is it like to be a Balentine Client?

29

Your Transition to Balentine

At the beginning of your Balentine journey, we strive to create a solid foundation for a long-lasting relationship — so when you’re ready to become a client, our dedicated transition team will work with you to ensure your move is as seamless as possible.

Proactive Leadership

We accept the responsibility of leading your financial life: aligning the right partners and approaches to serve your best interests in an integrated way.

Familial Connection

The Balentine name is our family business, and we understand that those roots run deep. We seek to become a trusted extension of your family.

Balentine helps us by asking the right questions; they guide us without imposing their thoughts. They keep us on the right track and come with solutions and tools for what we want to do.”

— Marc Noël, Balentine Client

Balentine clients were not compensated via credits or other benefits from Balentine for providing testimonials.

30

WHO IS BALENTINE? Our

Story

More than three decades ago, Robert Balentine and his father, Bob, founded Balentine & Company, (the predecessor to today’s Balentine) out of a shared desire and commitment to building a fiduciary firm that manages money the way they wanted someone to manage theirs.

Today, Balentine has the privilege of being a leading company filled with experts with talent and heart who manage billions of dollars — but more importantly, who share deeply in your wealth and legacy journey. Built on this foundation, we partner with entrepreneurs and families of significant wealth to preserve and propel that which they’ve worked so hard to build.

1987 A Better Way: Robert and Bob Balentine early advocates of the Fiduciary model 1995

31

Acquiring Reiser & Associates 2002 Wilmington Trust & Balentine Acquisition

▶ Barron’s Top 1200 Advisors & Barron’s Top 100 Independent Advisors

▶ Atlanta Business Chronicle Top 25 Financial Planning & Advisory Firms & Top 25 Money Managers

▶ Atlanta Business Chronicle Women of Influence: Jennifer Dangar, Brittain Prigge

▶ Atlanta Business Chronicle Most Admired CEO: Robert Balentine, Adrian Cronje

▶ Atlanta Business Chronicle 40 Under 40: Robert Balentine, Adrian Cronje, Mark Bell

▶ Atlanta Magazine: The Atlanta 500

Robert Balentine

▶ Forbes’ America’s Top Wealth Advisors

▶ Forbes’ Top 50 Fastest Growing RIAs

▶ Inc. 5000 Fastest Growing Private Companies

▶ Pensions & Investments’ Best Places to Work in Money Management

▶ Triangle Business Journal Corporate Leadership Award: Rob Ragsdale

Balentine opens second office in North Carolina

New Beginnings: Balentine relaunches Balentine LLC

The Art & Science of Investing

Balentine surpasses $7 Billion in Assets under Advisement

2009 2011 2023

32

WHO IS BALENTINE?

Life at Balentine

We are a collaborative group of professionals in Atlanta and Raleigh committed to uncompromising excellence and continuous improvement, relationships anchored in integrity and mutual respect, and an entrepreneurial spirit.

The Balentine Way

The Balentine Way

Demonstrate a Passion for Excellence

Honor Commitments

Practice Blameless Problem-Solving

Get Clear On Expectations

Have a Growth Mindset

Find a Way

Be Kind

Listen Generously

Speak Straight

Be Responsive

Share Information

Relentlessly Improve

Be a Mentor

Be Curious

Look Ahead and Anticipate

Embrace Diverse Perspectives

Walk In Others’ Shoes

Make Every Interaction Count

Communicate To Be Understood

Be a Lifelong Learner

Assume Positive Intent

When In Doubt, Communicate Personally

Show Meaningful Appreciation

Make Informed Decisions

Be a Brand Ambassador

Invest In Relationships

Be Process-Oriented

Think and Act Like an Owner

Give Back. Pay It Forward

Keep Things Fun

These 30 Fundamentals guide how Balentinians strive to treat clients and each other. Each week, we highlight a different Fundamental for self-awareness and continual improvement, serving as a real and transparent way to continue growing as individuals and as a firm, and being intentional about our culture. Since they were introduced, The Balentine Way has become a part of the fabric of our firm.

33

Serving Our Community

Giving back to our community is woven into our business. We aim to provide resources to fortify the causes our employees and clients are passionate about to affect change. As a result, every member of our team is engaged in giving back so that our time, talent, and resources can help improve our communities.

Brittain’s annual tradition:

Covenant House Sleepout

Robert volunteering with the Rotary Club of Atlanta, where he served as past President

David and Ben lead discussions at Kennesaw State University

Mark leads seminar for Emory University students

Robert volunteering with the Rotary Club of Atlanta, where he served as past President

David and Ben lead discussions at Kennesaw State University

Mark leads seminar for Emory University students

34

Adrian, co-founder of A+ Squash, leads facility opening ceremony

Disclosures

Balentine LLC (“Balentine”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Balentine’s investment advisory services can be found in its Form ADV Part 2, which is available upon request.

Designations

Chartered Financial Analyst® (CFA®) are licensed by the CFA® Institute to use the CFA® mark. CFA® certification requirements: Hold a bachelor’s degree from an accredited institution or have equivalent education or work experience, successful completion of all three exam levels of the CFA® Program, have 48 months of acceptable professional work experience in the investment decision-making process, fulfill society requirements, which vary by society. Unless you are upgrading from affiliate

Awards

Atlanta’s Top 25 Financial Planning and Advisory Firms (2012–2021). Atlanta Business Chronicle has named Balentine one of Atlanta’s 25 Largest Financial Planning and Advisory Firms, based on total assets under management for its Atlanta office, on ten consecutive occasions.

The Atlanta Business Chronicle’s Top 25 Financial Planning and Advisory Firms award consists of 25 firms. Firms were ranked by total assets under management for Atlanta offices as part of the selection criteria. For each business, the following is listed: total AUM, total discretionary assets, total non-discretionary assets, total assets managed companywide, and the number of professionals in the area. The list of firms was locally researched by Patsy Conn of the Atlanta Business Chronicle. The total number of applicants was not disclosed. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

Atlanta’s Top 25 Money Managers (2012–2021). Atlanta Business Chronicle has named Balentine one of Atlanta’s 25 Largest Money Managers, based on total assets under management (discretionary) for its Atlanta office, on ten consecutive occasions.

The Atlanta Business Chronicle’s Top 25 Money Managers award was comprised of 25 businesses. The total number of applicants who submitted responses and/or percentage who received the rating was not disclosed. As part of the selection criteria, businesses were ranked by total assets under management for Atlanta office (discretionary). For each business, the following is listed: total AUM for Atlanta office (discretionary), amount of equity based on total assets, amount fixed income of total assets, number of CFAs in Atlanta, total Atlanta staff, and a partial list of investment styles or products offered was also disclosed. The list was locally researched by Patsy Conn of the Atlanta Business Chronicle. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

Atlanta Business Chronicle Most Admired CEO Award — Robert Balentine (2018) and Adrian Cronje (2023). Robert Balentine was named one of Atlanta Business Chronicle’s Most Admired CEOs in 2018. Adrian Cronje was named one of Atlanta Business Chronicle’s Most Admired CEOs in 2023. These awards recognize established local leaders who have a strong vision for their companies, have shown commitment to culture in the workplace, and made significant contributions to the metro Atlanta community. The Atlanta Business Chronicle’s 2018 Most Admired CEO award was comprised of 21 categories in addition to a Lifetime Achievement Award Winner. Within each category, two winners were selected. No individual could repeat the same category two years in a row and a reader’s choice award was no longer included. Additionally, the rules state that there can only be one submission in each category per person, and 42 executives were included; however, a total number of applicants was not disclosed. The selection criteria was divided into three components: How has the leader contributed to the company’s financial success?; how has the leader created a great work culture?; and how has the leader made contributions to the community? Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

Atlanta Business Chronicle’s Top 40 Under 40 — Adrian Cronje (2010) and Mark Bell (2013). Adrian Cronje was ranked one of Atlanta’s Top 40 Under 40 by Atlanta Business Chronicle in 2010. Mark Bell was ranked one of Atlanta’s Top 40 Under 40 by Atlanta Business Chronicle in 2013. Each year, this list honors the region’s up and coming business and community leaders.

The Atlanta Business Chronicle’s Top 40 Under 40 award that is comprised of individuals under the age of 40. To be considered, nominees must be: under 40 years of age, hold a position of leadership, have made significant career achievements during the previous year, and have had substantial involvement in community service outside of day-to-day job performance. The total number of applicants was not disclosed. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

Atlanta Business Chronicle’s Women of Influence (formerly Women Who Mean Business). Brittain Prigge has been named to the list of 2020 Women Who Mean Business by the Atlanta Business Chronicle. This award recognizes women who are leaving an indelible mark on the Atlanta business community.

The Atlanta Business Chronicle’s Women Who Mean Business award is comprised of 21 women who drive Atlanta business across different industries and professions. It is awarded to individuals selected for: making significant strides in their careers, making a difference in their communities, blazing a trail for others, and leaving an indelible mark on the Atlanta business community. The total number of applicants was not disclosed. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

Atlanta Magazine’s The Atlanta 500 Award. Robert Balentine has been named one of Atlanta’s 500 most influential leaders by Atlanta Magazine. This annual list recognizes individuals shaping Atlanta culture — not only CEOs, but the people influencing what Atlantans eat, the music they listen to, and the causes they embrace.

37

Barron’s Top 100 Independent Advisors — Robert Balentine (2014–2022). Robert Balentine has been named to Barron’s list of Top 100 Independent Advisors for nine consecutive years. In 2020, Robert was the highest-ranked independent advisor in Georgia and in 2022, he was listed within the Top 10 Advisors on the list. Barron’s annual ranking reflects the volume of assets overseen by the advisors and their teams, revenues generated for the firms, and the quality of the advisors’ practices.

The Barron’s Top 100 Independent Advisers Award is based on the top quantitative standouts from the Barron’s Top 100 Independent Advisers Survey (the “Survey”) which verifies that data, applies its rankings formula to the data, and names designees according to assets, revenue and quality of practice. Advisors who wish to be ranked fill out a 102-question survey about their practice. Barron’s verifies that data and applies its rankings formula to the data to generate a ranking, based on assets, revenue and quality of practice. Balentine was eligible for the Barron’s Top 100 Independent Advisers Award since it participated in the Survey and met the requirements for assets under advisement and plans under advisement. The award may not be representative of any one client’s experience because the award reflects quantitative standouts and was not a survey or representation of a client’s experience. The award does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

Barron’s Top 1,200 U. S. Financial Advisors Ranked by State — Robert Balentine (2014–2022). For seven consecutive years, Robert Balentine has been the highest-ranked independent advisor representing Georgia in Barron’s annual listing of advisors by state. Factors included in the ranking of advisors are AUM, revenue produced for the firm, regulatory record, quality of practice, and philanthropic work.

The Barron’s Top 1,200 U.S. Financial Advisors Ranked by state award is comprised of 1,200 advisors based on data provided by around 4,000 of the nation’s advisors. Factors considered in the rankings included: assets under management, revenue produced for the firm, regulatory record, quality of practice and philanthropic work. Investment performance is not an explicit component because not all advisors have audited results and because performance figures often are influenced more by clients’ risk tolerance than by an advisor’s investment-picking abilities. The rankings are meant as a starting point for clients looking for an advisor — a first-pass vetting that can help investors narrow a search. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

The Forbes ranking of America’s Top Wealth Advisors Award — Robert Balentine (2016–2018). Robert Balentine has been named to Forbes list of America’s Top Wealth Advisors over three consecutive years. The Forbes ranking, developed by SHOOK Research, is based on an algorithm of qualitative criteria. Those advisors that are considered have a minimum of seven years’ experience, and the algorithm weighs factors like revenue trends, AUM, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients.

The Forbes ranking of America’s Top Wealth Advisors Award, developed by SHOOK Research, is based an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years’ experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience, and those that encompass best practices in their processes and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. The award does not imply a certain level of training and is not indicative of Balentine’s future performance. The process is conducted by Forbes and SHOOK Research. Neither Forbes nor SHOOK receive a fee in exchange for rankings. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

The Inc. 5000 is an editorial award that ranks companies by overall revenue growth over a three-year period. The award is given by Inc. Magazine and recognizes America’s fastestgrowing private companies. All 5000 companies are featured on Inc.com. Eligibility requirements include revenue generated by March 31, 2019, revenue of at least $100,000 in 2019, revenue of at least $2 million in 2022, be privately held, for profit, based in the U.S. and independent. To make the list, applicants must also submit an application on Inc.com and pay an application fee. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance.

Pensions & Investments Best Places to Work in Money Management (2012, 2015–2022)

Pensions & Investments has named Balentine one of its Best Places to Work in Money Management on eight separate occasions. Pensions & Investments partnered with Best Companies Group, an independent research firm specializing in identifying great places to work, to conduct a two-part survey process of employers and their employees.

The Pensions & Investments Best Places to Work in Money Management award was the result of a two-part survey of employers and their employees conducted by Best Companies Group, an independent research firm specializing in identifying great places to work. The first part consisted of evaluating each nominated company’s workplace policies, practices, philosophy, systems, and demographics. This part of the process was worth approximately 25 percent of the total evaluation. The second part consisted of an employee survey to measure the employee experience. This part of the process was worth approximately 75 percent of the total evaluation. The combined scores determined the top companies. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The survey is conducted by Best Companies Group on behalf of Pensions & Investments. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

The Atlanta 500 award recognizes the 500 most influential leaders in Atlanta and is presented by Atlanta Magazine. The list consists of eight different categories: Business; Professionals; Real Estate; Government & Infrastructure; Arts, Sports & Entertainment; Education & Healthcare; Restaurants & Hospitality; and Religion, Nonprofits & Advocacy. The Business category includes Banking & Finance, Investment Advisors & Funds, Private Companies, Public Companies, Retail, and Technology. The 500 Atlantans recognized in this annual publication, are selected by Atlanta Magazine’s editors who consult experts across different sectors while also taking into consideration nominations from the public. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

The Triangle Business Journal Corporate Leadership Award recognizes top CEOs and executives and is awarded by the Triangle Business Journal (TBJ). Those who are recognize include CEOs, presidents, C-Suite titles (report directly to CEO/President), and regional heads of larger companies. There are two categories: 1-249 employees and over 250 employees. Eligibility requirements include strong financial performance, a key role in the success of the business, and community involvement. All nominees (excluding CEO/Presidents) must report directly to the CEO/President and must also reside in one of 16 counties that comprise the Greater Triangle region. Winners are announced on TBJ’s website and individually contacted via email. Ratings are not representative of any one client’s experience because the rating does not include a survey of clients or information on client experience. The rating does not imply a certain level of training and is not indicative of Balentine’s future performance. Balentine did not pay a fee to participate in this program or to receive recognition on this list.

38

What is it like to be a Balentine Client?

What is it like to be a Balentine Client?

Robert volunteering with the Rotary Club of Atlanta, where he served as past President

David and Ben lead discussions at Kennesaw State University

Mark leads seminar for Emory University students

Robert volunteering with the Rotary Club of Atlanta, where he served as past President

David and Ben lead discussions at Kennesaw State University

Mark leads seminar for Emory University students