The integration of Environmental, Social, and Governance (ESG) criteria into the distribution of carried interest has gained traction as a means to incentivize fund managers towards socially and environmentally responsible investments. While traditional carried interest structures focus solely on fund performance, the inclusion of ESG considerations adds an additional layer to this conventional model. By aligning financial incentives with sustainable objectives, this mechanism encourages the allocation of capital towards socially responsible investments

The strong focus on sustainable finance has significantly contributed to the growing importance of ESG factors in investment practices. ESG and sustainability have been a focus area in the US private equity market for several years. The later years, ESG has been subject to legal regulation both at the national and EU levels, stemming from the EU's action plan for sustainable finance. The purpose of the action plan includes facilitating the reallocation of private capital towards sustainable investments, financing the green transition, promoting investor protection, and combating greenwashing. Hence, the prevalence of ESG in the financial sector is an emerging focus.

In response to increasing investor demand, carried interest structures are now being adapted to incorporate ESG criteria, and it is presumed that the demand will increase the forthcoming years. Given these developments, this article delves into the potential tax implications of linking ESG and carried interest and shed light on important considerations for participants in the financial markets, exploring the potential for linking ESG to carried interest.

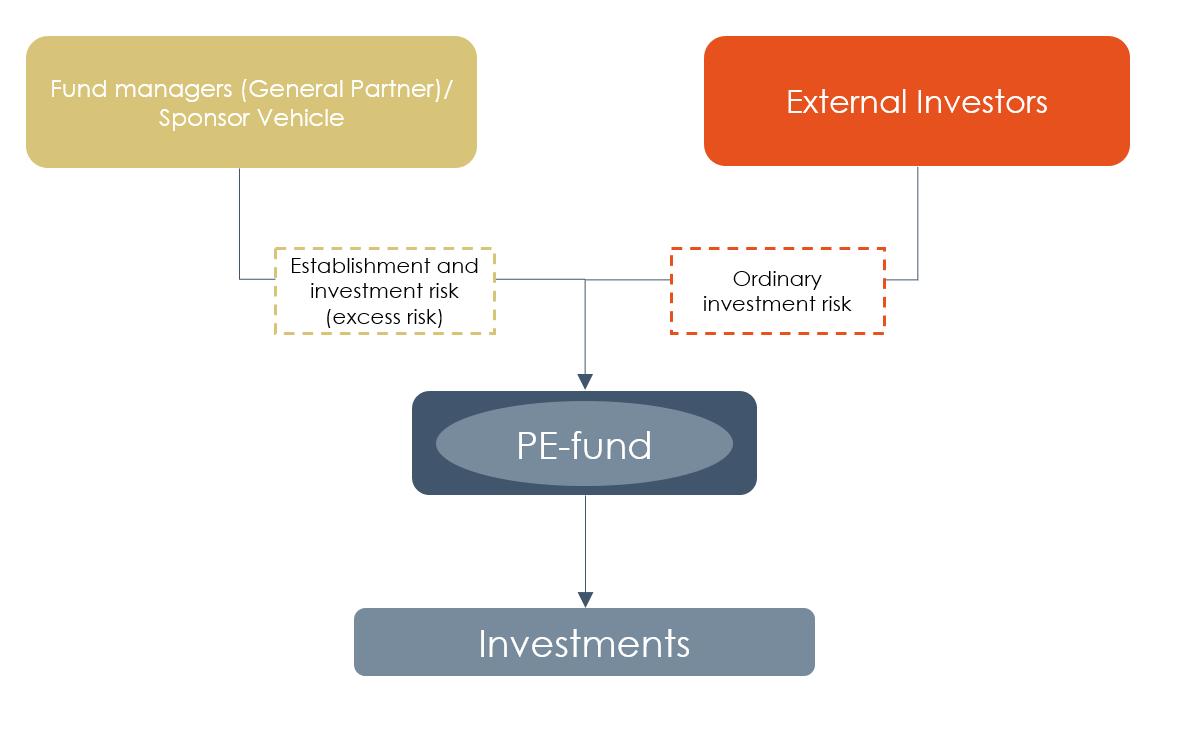

Carried interest refers to a portion of profits from an investment fund, that is allocated to the fund manager determined by the fund performance. This is commonly seen in private equity funds, venture capital funds, and hedge funds. The capital invested in the fund by the fund manager is subject to the financial risk associated with establishment of the fund. This is a risk that the external investors are unable and unwilling to assume. In consideration for this initiative and this risk, the promoters will normally negotiate a special profit-sharing right for themselves if the fund is a success, namely carried interest This structure aligns the interests between the fund manager and the external investors in the fund, as it allows the fund manager to share the profits of successful investments beyond their initial capital contribution and management fees.

Typically, the distribution of carried interest is subject to a specific arrangement defined in the fund's partnership agreement. The agreement outlines the percentage or proportion of profits that the investment managers are entitled to receive as carried interest, usually around 10-30% (commonly 20% in regular private equity funds). It is important to note that carried interest is normally distributed after investors have received their initial capital contributions and a predetermined minimum return, known as the hurdle rate, which is typically 5-12% (usually 8%

in regular private equity funds) p.a. on contributed capital to the fund from time to time The specifics of carried interest arrangements, including the allocation, vesting periods, and tax treatment, can vary significantly based on the fund structure, jurisdiction, and individual agreements between the general partners (fund managers) and limited partners (investors)

A key issue is how to tax carried interest. The tax treatment of carried interest has been a subject of debate and controversy in various jurisdictions. In many countries, carried interest is subject to capital gains tax rates and other countries ordinary income tax rates, resulting in differences in tax liabilities. Critics argue that carried interest should be taxed as ordinary income based on a view that it is compensation for services provided by investment managers. In our view, if structured correctly, carried interest is a form of investment income and should be taxed at the capital gains rate, as it represents a share of the profits generated from successful investments. Given the importance of correct structuring to apply capital gains tax treatment of carried interest, it is crucial to thoroughly examine whether there are potential tax implications when incorporating ESG factors into the entitlement to carried interest.

1.3 What is ESG- Linked carried interest, and who is it relevant for?

The purpose of linking ESG to carried interest is to incentivize managers to make sustainable investments and other investments which fulfil certain agreed-upon ESG-criteria

ESG-linked carried interest is a way to align the fund managers interests with the investor’s interests beyond their economic ambitions. The consequence is that the fund manager, in addition to delivering returns, must adhere to additional requirements to receive the full amount corresponding to the agreed-upon carried interest. Today, ESG-linked carried interest may be of particular interest to emerging managers seeking to differentiate themselves and

attract capital. However, it is anticipated that numerous investor groups, notably institutional investors such as pension funds, foundations, and insurance companies, will in forthcoming years actively pursue financial products characterized by a sustainability profile. This may create a market contraction for alternative product offerings. Various asset classes, including private equity and hedge funds, may therefore benefit from integrating ESG factors into their carried interest arrangements. This is particularly relevant for sectors such as impact investing, renewable energy, transition investments, and blue sustainability initiatives. Generalists buyout and venture capital strategies may find ESG-linked carried interest less appealing.

2.1 Regulatory landscape

Currently, there is no legal requirement to link carried interest to ESG factors. ESG-linked carried interest must be incorporated through governing documents, and the model for the ESG-linked carried interest mechanism will often be determined by investors’ demands

2.2 Measurement and r eporting

Unlike financial metrics such as IRR, ESG metrics often involve subjective or qualitative assessments. Establishing realistic ESG targets is important, ensuring that the fund managers have a strategy and documented approach to achieving those targets. Target achievability may be hard to point out, in addition to striking a balance between challenging objectives and reasonable expectations.

If carried interest is linked up to impact goals, the amount of the carried interest may increase or decrease based on the attainment of predefined targets, providing rewards or penalties accordingly. Targets can be tailored to each specific investment or agreed upon at the portfolio level, potentially weighted by asset size. Targets could include carbon emission reduction goals, meeting minimum taxonomy-aligned investment requirements, or other quantitative metrics Targets could also be linked to emerging standards that outline requirements related to impact objectives and compensation, such as the SDG Impact Standards A portion of the total carried interest will be tied to achieving impact goals, with specified multipliers determining the increase or decrease in carry based on the extent of impact.

To illustrate, it is assumed that 25% of the aggregate carried interest is contractually tied to impact goals. The investment manager will only receive the total amount of carried interest if the impact goals are achieved. If not, the ESG-linked carriedinterest(illustratedbythegreyarea)maybe retained.

Further, the aggregation and weighting of individual investments can be used to calculate a portfolio-level ESG score, which could be assessed on a pass/fail or sliding scale basis. Minimum and maximum thresholds for impact carry can be established, ensuring both a baseline requirement and an upper limit. Non-achieved carried interest, because of not reaching the impact goals, can be redistributed, or reallocated accordingly. Moreover, similar ESG-linked incentives should be considered for portfolio management remuneration to maintain alignment throughout the investment process.

To ensure credibility and reliability, it may be important to have independent third-party verification and validation of the impact claims associated with carried interest arrangements. This could involve rating agencies or certification bodies that assist fund managers to determine sufficiently challenging targets and also to assess the actual impact achieved by investments. These entities may play a critical role in providing confidence and credibility to impact-linked carried interest models in the future The European Commission is in the process of developing a regulatory framework concerning providers of ESG assessments. The availability and validity of data sources are also important considerations, as estimates and alternative data may need to be utilized in cases where comprehensive data is not readily available.

There are potential challenges and concerns regarding ESG-linked carried interest. For instance, focusing solely on a single ESG aspect, such as avoided emissions in a renewable energy fund, may overlook other ESG-related issues A holistic approach that considers multiple ESG factors is crucial to avoid narrow impact assessments. Another concern is the risk of impact washing or greenwashing, where carried interest structures may not genuinely align with impactful investments. The complexity of calculating and distributing carried interest is further amplified with the introduction of ESG-linked components, which may result in increased costs and administrative burden.

Section 5-1 of the Norwegian Taxation Act (the Tax Act) provides that any benefit gained from “employment, capital or business activities” shall be regarded as taxable income. Whether an income is classified as employment-, capital- or business-related income will have great impact on the tax payable by the recipients. While employment income is taxed up to 47.4% for the recipients (with additional employer’s national insurance contribution), business income is taxed at 22% or 25% (the latter if the company is subject to the finical tax rate). Even though the marginal tax rate for capital income is 22%, capital income from qualifying investments is compromised by the Norwegian participation exemption for qualifying companies and will thus only be taxed at a rate of 0.66%. This shows that there is great benefit in being able to classify carried interest as capital income comprised by the participation exemption (as this allows for reinvestments in new fund structures in accordance with investor requirements without any tax leakage).

How to draw the line between employment, capital or business activities is not further regulated in the Tax Act. Hence, one would need to look to the preparatory works and the relevant case rulings

In 2015, the Supreme Court's decision in the “Herkules case” determined that carried interest should not be treated as employment income for the individual promoters (the individuals actively involved in the investment advisor/fund manager). Hence, the question is whether carried interest should be taxed as income from capital or business income. In our opinion, the tax treatment should be assessed on a case-by-case basis, considering the specific structure. Genuine agreements should be respected by tax authorities. When determining whether carried interest should be considered income from capital or business income, the key factors will be the capital invested and the associated risks, including the structure of the carried interest rights. Based on rulings of the Norwegian supreme court 1, it can be said that if sufficient financial risk forms basis for the entitlement to receive carried interest, such returns should be considered capital income.

In principle, the amount of capital invested should not be the deciding factor. If one has invested the necessary capital to establish and develop a business, assuming the full risk of loss, they should be treated as an owner for tax purposes. Based on the establishment risk and investment risk taken by the promoters, any distributions of carried interest could be considered capital income

1 In particular, Rt. 2015 s. 1260 (Herkules) and Rt. 2000 s. 758 (Kruse Smith).

Establishment risk refers to the costs for establishing the fund. If the fund is successfully established, these costs (or depending on negotiations with the external investors, a portion of the costs) can be covered by the fund. However, if the fund is not successfully established the promoters are liable and must themselves pay the whole establishment cost. In addition to the establishment risk, tax authorities and courts tend to require a significant capital investment with associated risks to classify carried interest as income from capital. The applicable threshold is uncertain, but in the current market, promoters typically invest around 1-5% of the total commitment of the fund, which can be a substantial amount. The capital investment from the promoters is a basic private equity principle, so-called “skin in the game”. The promoters invest their own funds (active capital) in the fund structure alongside the external investors (passive capital). Since the promoters are required to make such investment in the fund structure along with the external investors, they assume an investment risk as their own funds may be lost. By investing in the fund, the managers align their economic interests with the investors

Promoters often choose to invest through the fund's general partner, which has unlimited liability for fund obligations, or a designated sponsor entity that assumes liability for establishment costs. Promoters' capital may also be subordinated, fully or partially, to investors' capital upon repayment of paid-up capital or even the return threshold. Further, the promoter’s investments are normally locked in the fund through its lifetime, while the external investors can realise its investment in the fund in the secondary market. The promoter’s investment therefore carries additional risk in comparison with the external investor’s capital investments.

Provided that the promoters take sufficient establishment and/or investment risk as described above, any carried interest should, in our opinion, be classified as capital income for Norwegian tax purposes. The question at hand is whether this conclusion changes when carried interest entitlement is linked to impact goals

3.2 Taxation of ESG- linked carried interest

3.2.1 Capital income or business income?

As set out above, the classification of carried interest as capital or business income will rely on the factual circumstances, and an interpretation of the agreement between the investors and the fund manager. The most relevant factor is whether the promoters have taken sufficient financial (establishment and/or investment) risk as basis for the right of carried interest. When adding impact goals to the right to receive carried interest, one will need to consider whether the impact goals are directly tied to the fund managers' work responsibilities, or whether the impact goals are related to other factors. Whether impact goals are reached, or not, are to a large extent dependent on the employees and management of each portfolio company, market fluctuations, and several other factors that the fund manager is in no (or limited) control of. Therefore, it is our view that ESG-linked carried interest should not be considered gained by the business activity of the fund manager

It should also be emphasized that the fund portfolio might deliver substantial financial returns to the fund and still not (fully) meet the impact goals set (or meet the impact goals but not deliver sufficient financial returns to distribute any carried interest). Again, it is the financial risk taken by the fund manager which forms the basis for the entitlement to carried interest and the financial performance of the portfolio will be decisive for whether any carried interest is payable. Hence, where the impact goals are linked to release of (a part of) carried interest (and not the entitlement as such), this should not affect the Norwegian tax treatment of carried interest.

ESG-linked carried interest is a process of tying (a portion of) fund manager return on investment to impact performance of the fund’s investments, and by doing so, tilting the arguably most powerful incentive for fund managers towards environmentally responsible investments. However, it also poses some challenges and complexities in terms of design, implementation and governance, requiring a clear and transparent communication and collaboration between the investors and the fund managers. Given the lack of regulation, selecting metrics and targets may be the most challenging part of designing the ESG-linked carried interest mechanism The level of ambition will, to a large extent, be based on investors’ demands, leaving room for a misalignment between incentives and intentions. The role of independent third-party verification and validation is likely to increase, in order to ensure a robust, fair and flexible framework for setting, measuring and rewarding the ESG performance Using ESG as a standard metric for carried interest payout may not be an appropriate model for all fund strategies, but the increasing appeal of ESG linked carried interest for investors illustrates that ESG is a force that continues to shape the private equity market.

The Norwegian tax treatment of carried interest depends on how the carried interest generating investment is structured. Structured correctly, with sufficient establishment and/or investment risk, carried interest is treated as capital income for Norwegian tax purposes subject to the participation exemption. The inclusion of ESG considerations should in our opinion not affect this tax treatment, as it is the financial risk taken by the carried interest recipient that forms the basis for the entitlement to carried interest and the financial performance of the portfolio will be decisive for whether any carried interest is payable

• Legal advice for asset managers has been a key component of BAHR’s commercial law services since the very inception of the Norwegian asset management industry. Our focus on the industry resulted in BAHR in 2008 establishing a separate practice group that is exclusively dedicated to asset management & private equity.

• The practice group is chaired by BAHR partner Peter Hammerich, who has for more than two decades together with his team, and in close collaboration with our other practice groups, been a trusted advisor to a number of the most highly regarded and active players in the Nordic asset management industry. All in all, the group’s partners, specialist partners, senior associates and associates have more than 197 years’ experience in providing legal advice on asset management, as well as on matters for and relating to the asset management industry.

• Our extensive involvement and long-standing presence in this market mean that BAHR has accumulated comprehensive experience in relation to the structuring, establishment and operation of asset management providers and investment funds, as well as the acquisition and sale of portfolio investments.

• We assist Norwegian and international investment providers on issues relating to all aspects of their operations, including the organisation and establishment of asset management providers, regulatory matters, incentive schemes, investment solutions and investment funds, as well as their ongoing investment operations – both in Norway and internationally.

• A significant part of our practice is providing assistance to Norwegian and international private equity investors in relation to various investment types and investment stages – from the establishment/growth phase, via the acquisition of unlisted and listed companies, to sale or other forms of exit.

• BAHR also provides legal advice to professional/international wealth management clients in relation to the organisation of their operations, the establishment of products (fund structures, etc.), the tax treatment of investments, etc. In recent years, Norwegian family offices have matured and become much more professionalised, and the practice group has increasingly been engaged by various family offices. We assist a number of wealthy high-profile families on all legal issues that may arise, including structuring, corporate governance, mandate/strategy (asset management model), tax, co-investment arrangements, investments, etc.