Strategic decisions that influence the outcome of the game

Suppliers in the global avocado market face their seasons with a clear focus on how their decisions will impact the business in the medium and long term.

AVOCADO: THE NUMBERS AND PERSPECTIVES OF AN INDUSTRY ALWAYS ALIVE

If we were to take a quick flight over the world of avocados, certain images would stand out clearly.

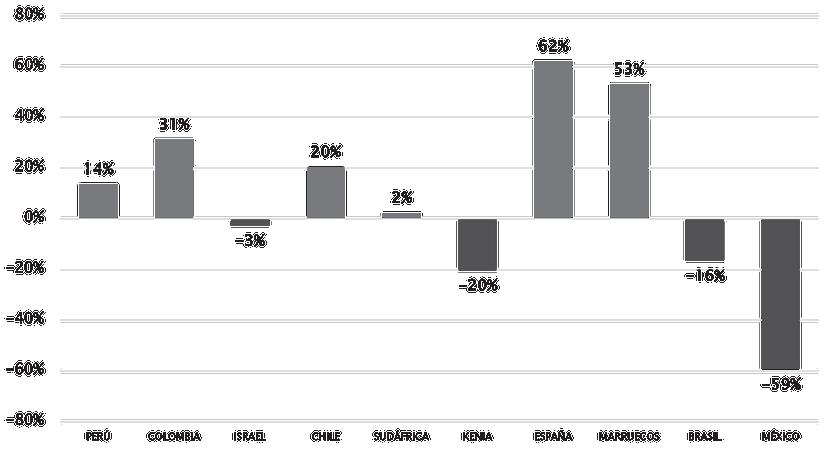

Peru has regained its export strength, showing growth of over 35% in shipments to different markets compared with the previous season. Mexico remains the undisputed powerhouse in the U.S. market, yet an interesting phenomenon is beginning to emerge: the expansion of consumption growth that opens the door for other suppliers—provided they can read the opportunities offered by retail’s diversifying consumption formats.

We would also see which parts of the main consumer market are experiencing increased demand, driven by post-pandemic population growth or by factors not always strictly tied to avocados.

Colombia continues its upward path, projecting to close 2025 with 440 million pounds. At the same time, we’d learn that the experience of some can serve others, as in Chile’s case—an origin recognized for its know-how in sustainability, which it can pass on to younger players in the industry.

On this journey, our attention would be drawn to countries with great potential that are signaling a stronger role, such as Ecuador, aiming to triple its production; Morocco, which faces major challenges due to its climate but holds undeniable strategic value for European importers; and even Brazil, which has

Por SEBASTIÁN

DE LA CUADRA CEO AVOBOOK

already doubled exports in an early-stage push for Hass development.

We would also look to Asia, where stagnation in China and Japan is offset by opportunities in markets such as Korea, where avocados are becoming part of the local culinary scene, and certain Middle Eastern destinations, where attractive prices are motivating exporters.

That is the journey we bring you in this new edition of AvoMagazine, where our goal is to help readers understand the dynamism of this global industry—an industry that moves its numbers at lightning speed.

Understanding these shifts allows us—as we always say—to make better decisions, building the business on a foundation of concrete data and informed perspectives.

Within these pages you will hear the voices of leaders who understand how avocados move around the globe, people who are on the front lines every day connecting the entire avocado chain: growers, packers, logistics operators, importers, local distributors, and retail.

We are confident that our content will help capture a clear snapshot of an industry that always finds ways to show just how alive it really is.

This is

Chile: The “Benchmark” of sustainability for the global avocado industry

PREMIUM REPORT

Ecuador’s bet: projects to triple production and enter the U.S. Market

PREMIUM REPORT

X-Ray of the U.S. market: The sizes that dominate and the local markets on the rise

Is Asia still an attractive market for the avocado giants?

PREMIUM REPORT

Morocco bets on strength and proximity to Europe to sustain its campaign

Read the english version

Argentina becomes the most dynamic market in South America

Brazil doubles its exports and seeks to consolidate in South America and Europe

Avocados from Colombia: how to keep growing in the U.S. and European Markets?

Avocado transition in Europe: between Peru’s exit and the rise of new origins

Don’t be surprised if, in the coming years, Peru extends its season until mid-october

REPORT

Founder & CEO

Sebastián de la Cuadra I.

Managing Director

Pablo Olivares M.

Editor-in-Chief

Paulina Ormazábal M.

Data Analysts

Tomás de la Cuadra V. Diego de la Cuadra V.

Journalists

Claudio Espejo B. Trinidad Navarro T.

Commercial Managers

Diego de la Cuadra V. Jorge Molina D.

Design & Layout

Pamela Pérez R.

Digital Support

Esteban Pastenes G.

AvoMagazine is a print and digital publication established as the most reliable and up-to-date source on the global avocado market. Its pages feature specialized articles, expert commentary, and exclusive interviews with key industry figures.

With distribution in more than 45 countries, AvoMagazine has become the essential guide for producers, exporters, importers, and other leading players in the avocado industry.

Our mission is to provide valuable and relevant information to help readers make informed decisions and stay ahead of the latest trends and developments in the global avocado market.

Head of Sourcing (+57) 322 367 6218 admin@montanafruits.com.co montanafruits.com.co CONTACT

Montana Fruits strengthens its position with Frutura in the global hass avocado market

In just six years, Montana Fruits has positioned itself as a leading company in exporting Colombian Hass avocados to the most demanding markets in Europe and the United States. Its commitment to quality, sustainability, and close collaboration with growers has been the driving force behind building a solid network of strategic allies across the country.

The big leap came eight months ago, when Montana Fruits sealed an alliance with Frutura, one of the world’s largest platforms for fresh fruit marketing, with a presence in Latin America, the United States, Europe, and Asia. This partnership not only strengthens Montana’s operations but also transforms it into a global player—leveraging resources, expertise, innovation, and international distribution channels.

“With the arrival of our new partners, we expect to see continuous growth in the coming years. This goes hand in hand with our growers, which is why we are working on a strategy to support

them with our technical knowledge and financial capacity, so they can manage both harvests without compromising quality,” explains Mauricio Moranth Zuluaga, CEO and founder of Montana Fruits.

The true value of this alliance lies in shared benefits: while Montana and Frutura expand markets and close programs in advance to guarantee fruit sales at competitive prices, allied growers gain access to technical support, financial backing, and long-term partnerships that allow them to project stability and growth.

“We have a highly trained team ready to meet growers’ needs, and we are confident we will grow together as producers and as a company in this new stage,” Moranth concludes.

With this consolidation, Montana Fruits, now a Frutura Company, reaffirms its purpose of being a trusted partner— driving the progress of its growers and paving the way for Colombian Hass avocados on the global stage.

Mauricio Moranth Z. Chief Executive Officer / CEO

In the U.S., small-sized avocados dominated sales during high-consumption dates

So says Emiliano Escobedo, Executive Director of the Hass Avocado Board (HAB), who analyzes with AvoMagazine the current moment of the fruit in the U.S., highlighting emerging consumption formats.

The Executive Director of the Hass Avocado Board in the United States, Emiliano Escobedo, is clear: avocado demand is diversifying. In this conversation with AvoMagazine, he delves into the evolution of how avocados are perceived—pointing out that they are “already part of the American’s daily diet.”

He also explains how demand is shifting toward smaller sizes during periods of high consumption, which has led supermarkets to create new presentation formats.

– How has the perception of avocados changed in the U.S. in recent years, and what impact has this had on consumption?

“It has changed profoundly, moving

from being an exotic food to becoming an essential product in the daily diet. Its main purchase driver is the nutrition message: consumers value its content of healthy fats, fiber, vitamins, and minerals, recognizing the benefits for heart health, digestion, and blood sugar control. It has also become a pop culture icon—featured in memes, festivals, social media, and national celebrations—which reinforces its constant presence in everyday life. This combination of factors has fueled sustained consumption growth.”

– What marketing and promotion strategies are proving effective in increasing consumption?

“Marketing strategies must focus on education and on creating new consumption opportunities. Highlighting

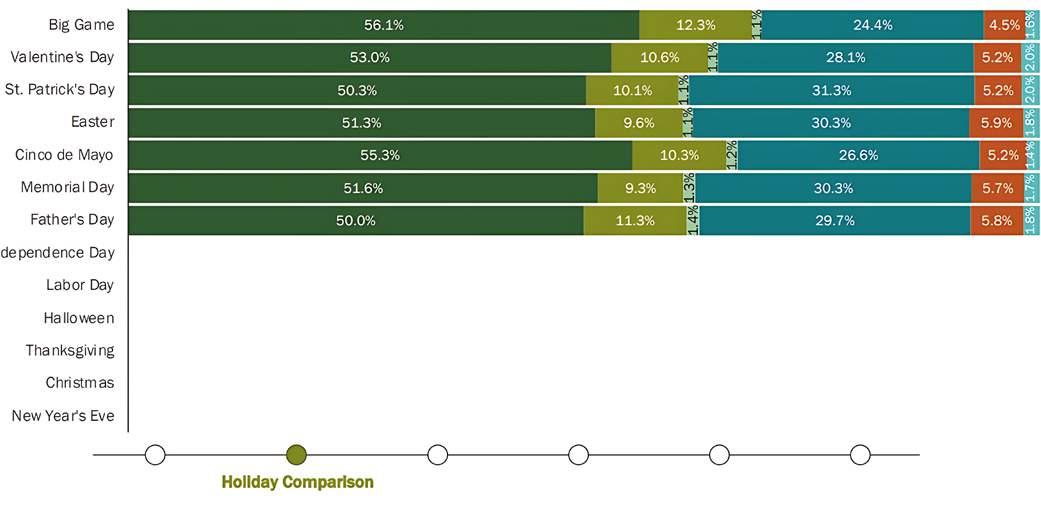

PLU Volume (lbs.) Share by Holiday

the nutritional value—such as healthy fats, fiber, and vitamins—remains the main purchase driver.”

– How do you attract new buyers who are seeking experiences more than just products?

“A key tactic is promoting innovative recipes that adapt to different cultures and traditions, inspiring consumers to incorporate avocados into their daily diet, and offering creative ideas to increase consumption through new ways of enjoying the product, such as reinventing avocado toast or guacamole, which are two of the main consumption forms. Tastings, social media tutorials, combos, and promotions can encourage trial and repeat purchase, while linking avocados to celebrations and cultural events reinforces their re-

Sizes Consumed During Key Dates in 2025 in U.S. Supermarkets

Source: Hass Avocado Board (HAB), United States.

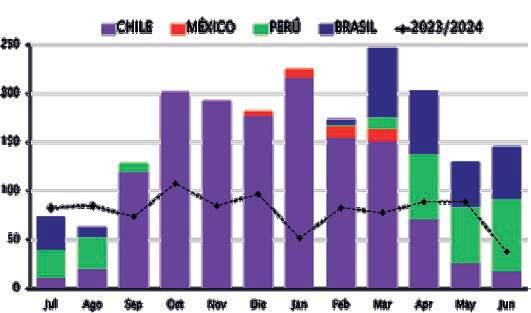

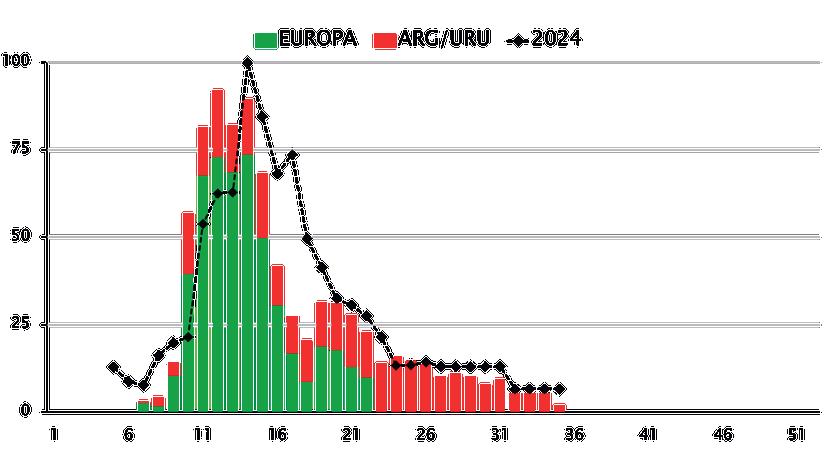

PRODUCERS SEASONALITY

PRODUCTORES

EMILIANO ESCOBEDO, Executive Director of the Hass Avocado Board.

levance and everyday presence in consumers’ lives.”

– Which sizes have the greatest opportunities in the U.S. market and why?

“For several years, the most popular PLU in supermarkets was 4225, equivalent to sizes 48’s and 40’s, a trend also observed in restaurants. However, with the shift in size curves and greater availability of 60’s (PLU 4046) and smaller sizes in recent years, an opportunity has emerged to provide the market with what is currently being produced. In supermarkets, this change is reflected in the growth of PLU 4046, especially in the bagged avocado segment. According to our latest study, 4and 5-count small packs represented more than 54% of unit sales of bagged avocados—mainly because they fit daily consumption and snacking needs. In contrast, when purchasing larger quantities for dishes like guacamole, consumers tend to choose bigger avocados.”

– So, supermarkets have had to adapt to this shift in demand.

“In supermarkets so far in 2025, during high-consumption dates—from the Super Bowl through Father’s Day— small sizes (4046) generated the highest sales volumes across the board, followed by bagged avocados. Although 48’s (4225) remain preferred in several retail channels and in HORECA (Hotels, Restaurants, and Catering), supermarkets are increasingly recognizing the value of offering a wider range of sizes and formats, capable of meeting different consumer needs and capturing new sales opportunities.”

ESTACIONALIDAD

PRODUCING COUNTRIES

PAÍSES PRODUCTORES AGUACATE HASS

SEASON CALENDAR – MAIN PRODUCING NATIONS

HECTÁREAS

AVOCADO-PLANTED HECTARES BY COUNTRY / REGION

Chile: THE BENCHMARK of Sustainability for the Global Avocado Industry

Seven years ago, the Chilean Avocado Committee launched a plan that today shows concrete results in water-use reduction, energy efficiency, and community engagement, among other commitments made by its members.

A decade ago, sustainability was not at the center of the industry’s agenda. Consecutive dry years limited water availability, while environmental campaigns with high levels of misinformation targeted Chilean avocado exports abroad. The combination of production and reputational challenges, along with the shift of avocado cultivation to southern regions, highlighted the need to integrate sustainability into production practices.

The Chilean Avocado Committee took on this task with the goal of producing objective data and building management systems. In 2018, together with the Water Center for Arid and Semi-Arid Zones of Latin America and the Caribbean (CAZALAC) of UNESCO, it published its first study on water resources and environmental impact. The United Nations highlighted that avocado cultivation in Chile contributes to 14 of the 17 Sustainable Development Goals (SDGs). “We decided not to settle with a positive diagnosis but to take it as a starting point for further improvement,” recalls Francisco Contardo Sfeir, Executive President of the Committee.

SELF-ASSESSMENT AND COMMITMENTS

In 2022, the first Study on the State of Sustainability in the Avocado Industry in Chile was conducted by the consultancy Sustenta +. The survey, which included corporate representatives and field workers, became the foundation for 14 public sustainability commitments signed by members. “We set a goal that in 24 months there would be measurable improvements through practices forming a sustainability management system. In 2024 we measured again, and the results were much higher,” explains Contardo. Activities included workshops, working

groups, and technology transfer among members.

PROGRESS IN PRACTICES

The 2024 analysis shows an average improvement of 64% in sustainability practices. In water management, indicators reached 92% (+13 points versus 2022), with notable advances in reducing water use and providing community water supply. In energy, the share of farms implementing measures to reduce fossil fuel use rose from 33% to 60%, while 67% (+20 points) adopted renewable energy practices and 86% applied energy-efficiency initiatives. Around 60% of members now have a formal community engagement plan integrated into corporate governance, embedding sustainability into the DNA of the industry.

CHILE AS A GLOBAL REFERENCE

Chile’s experience is increasingly recognized as an international benchmark. “At the 10th World Avocado Congress in New Zealand in 2023, we were the only origin to present on sustainability. Afterward, it was acknowledged that Chile was the most advanced in the field,” says Contardo. In 2024, at Territorio Aguacate, Chile was invited to the panel “Inspiration Cases” to share its progress with the Colombian industry. According to Contardo, “Chile has become the benchmark of sustainability” in the global avocado sector. “In companies, decisions are made vertically. In associations, we must convince and inspire—and that is what we are doing. I always highlight our members because without their commitment and willingness, none of this would have been possible. They truly put on the sustainability jersey,” he concludes.

MÉXICO (MICHOACÁN)

MÉXICO (MICHOACÁN)

MÉXICO (MICHOACÁN)

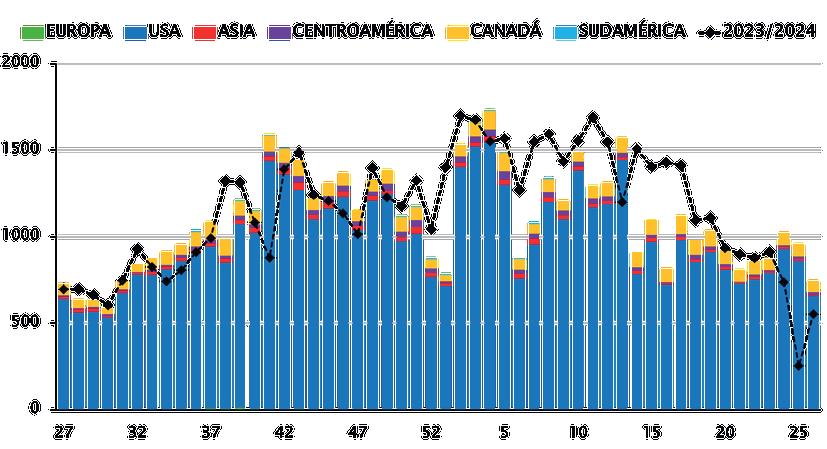

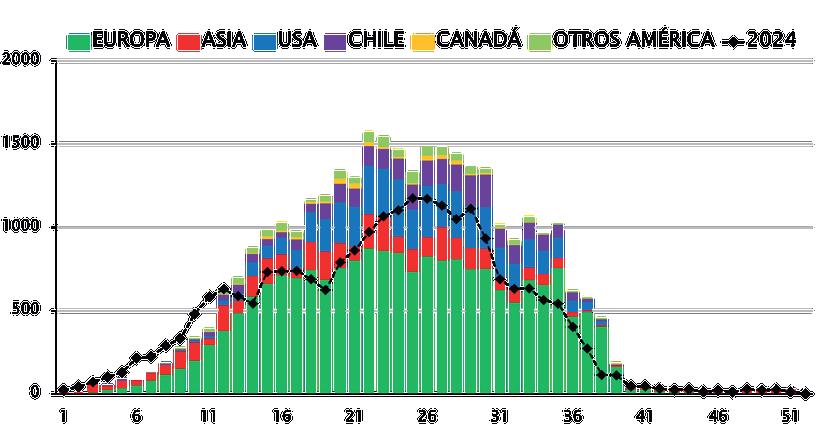

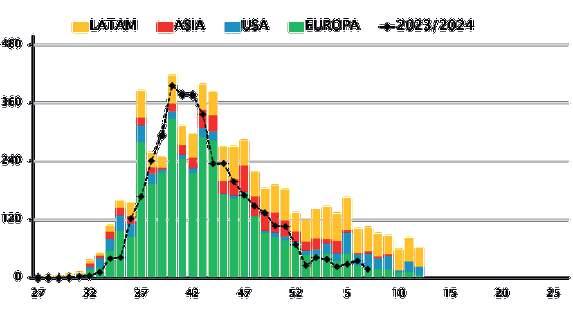

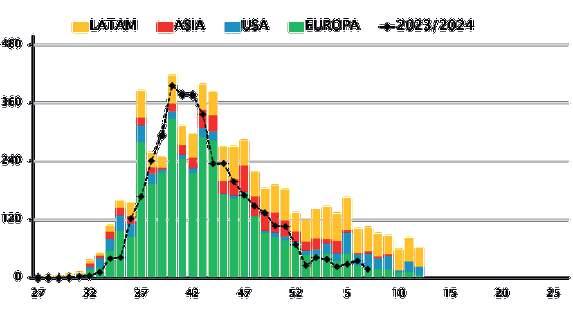

TOP MARKETS 2024/2025

TOP MERCADOS 2024/25

57.218 Embarques (FCL/camiones) exportados Temporada 2024/2025

57.218

Shipments (FCL / trucks) exported. 2024/2025 season.

Trucks/FCL

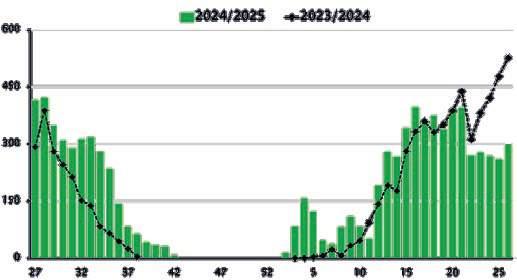

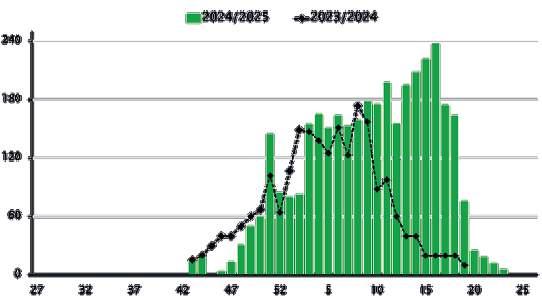

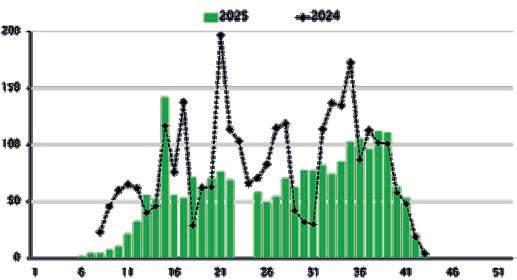

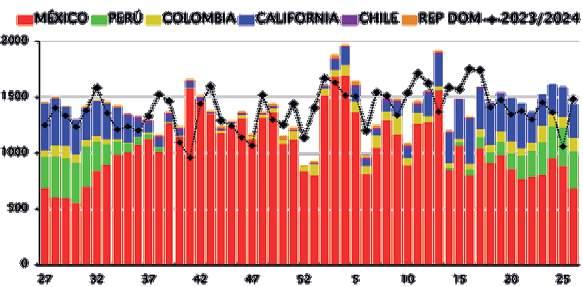

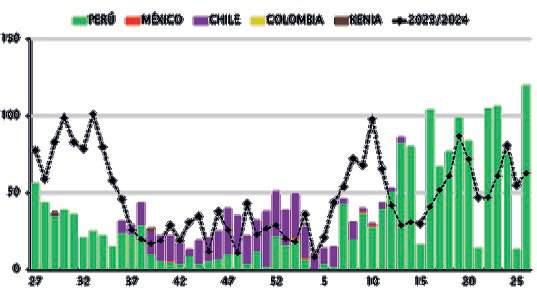

EMBARQUES SEMANALES DE AGUACATE HASS 2024/25

WEEKLY SHIPMENTS OF HASS AVOCADO 2024/2025

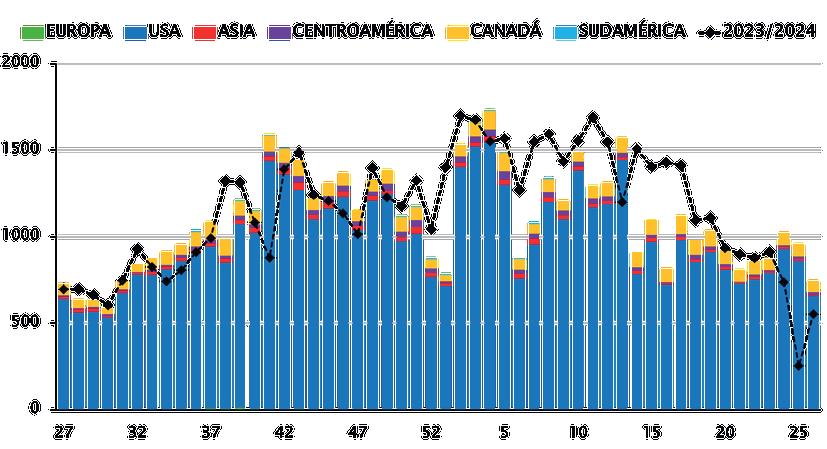

MÉXICO (JALISCO)

7.328

7.328

MÉXICO (JALISCO)

TOP MERCADOS

2024/25

MERCADOS 2024/25

TOP MARKETS 2024/2025

7.328

Shipments (FCL / trucks) exported. 2024/2025 season.

MÉXICO (JALISCO)

WEEKLY SHIPMENTS OF HASS AVOCADO 2024/2025

Exportaciones

PRODUCERS

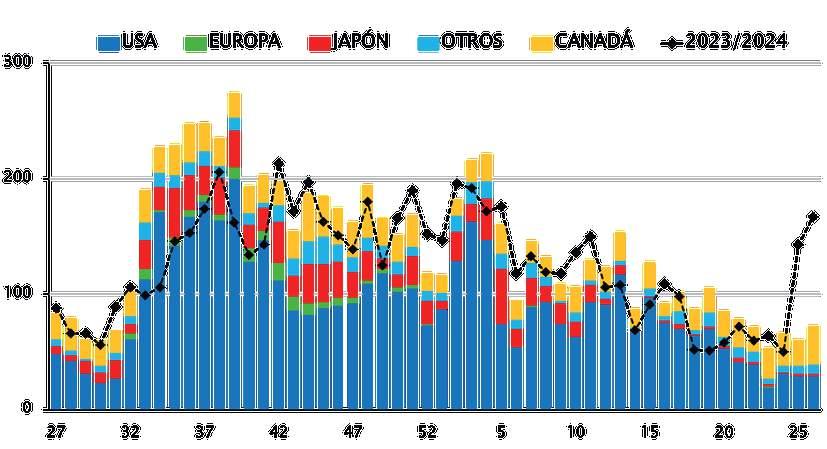

COLOMBIA

6.502

Containers exported. 2024/2025 Season.

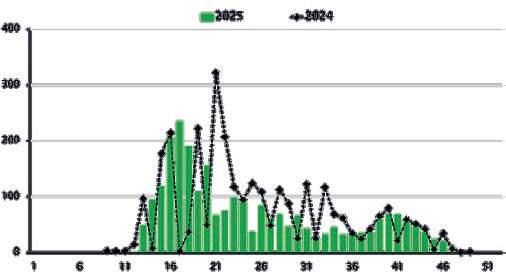

MARKETS 2025* EXPORTS BY YEAR* * Up to week 36/2025 * Up to week 36/2025 WEEKLY EXPORTS OF HASS AVOCADO 2024/2025

COLOMBIA

Fabricamos e integramos soluciones innovadoras respaldadas por nuestra experiencia. Acompañamos y asesoramos a nuestros clientes en la operación, brindando un excelente ser vicio postventa. En somos especialistas en maquinaria para proceso de AGUACATE.

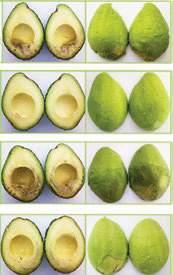

Mantención de la calidad de la fruta durante el traslado hasta llegar al mercado de destino.

Reducción del pardeamiento externo, interno y vascular durante el almacenamiento.

INNOVACIÓN

EN POSTCOSECHA PARA AGUACATES

AgroFresh es líder mundial en soluciones pre y post cosecha diseñadas para mejorar la calidad y extender la vida útil del aguacate, ayudando así a reducir las pérdidas y maximizando su rentabilidad. Con más de 40 años de experiencia otorgando soluciones de confianza al sector exportador, AgroFresh se basa en la ciencia e innovación para enfrentar los desafíos de la cadena de valor, ofreciendo un portafolio integrado de soluciones desde la cosecha, almacenamiento, líneas de proceso hasta herramientas digitales de vanguardia

Como pionera en la introducción de tecnologías revolucionarias como SmartFresh™ , el primer uso comercial de 1-MCP para extender la vida post cosecha de frutas frescas, AgroFresh pro porciona a productores y exportadores el respaldo necesario para proveer fruta fresca, de alta calidad y sostenible desde el campo al consumidor.

Preserva la frescura y calidad, otorgando al consumidor un excelente comportamiento de consumo.

AVISO: AgroFresh no ofrece ninguna garantía en cuanto a la integridad o exactitud de la información aquí contenida. Los destinatarios deben determinar por sí mismos su idoneidad para sus fines antes de utilizarlo, y nada de lo aquí contenido debe interpretarse como una recomendación para utilizar cualquier producto, proceso, equipo o f ormulación que entre en conflicto con cualquier patente. AGROFRESH NO OFRECE GARANTÍAS DE NINGUNA NATURALEZA, EXPRESAS O IMPLÍCITAS, YA SEA EN RELACIÓN CON LA COMERCIABILIDAD, LA IDONEIDAD PARA UN FIN DETERMINADO, LA NO INFRACCIÓN O CUALQUIER OTRA CUESTIÓN, TODAS LAS CUALES QUEDAN EXPRESAMENTE EXCLUIDAS.

Testigo

Maduración interna a los 60 días

Maduración

Ecuador bets on avocados: aims to triple production and open

the U.S. MARKET

Ecuador is seeking to join the club of major avocado exporters, with between 7,000 and 8,600 hectares planted and exports that are still in early stages. According to Diana Freile, head of Irubiterra, and Santiago Pinto, director of Iteranza, the country aims to triple its production within five years, strengthen its position in Europe, and open the U.S. market—building on its agroclimatic advantages, logistics capacity, and certifications.

Recognized as an agro-export leader in bananas and shrimp, Ecuador is now carving a path in Hass avocados. Although still far from giants like Mexico, Peru, or Colombia, the Andean nation is laying the groundwork to become competitive thanks to its unique growing conditions, infrastructure, and market-opening strategy.

The Ministry of Agriculture reports around 7,000 hectares of avocado, with exports generating barely 3 million dollars. Iteranza expands this view: there are 8,600 hectares between Hass (40%) and Fuerte (60%), with an annual production of 45,000 tons, of which only 8% is exported.

Nearly 90% of production is concentrated in the northern highlands (Imbabura, Carchi, and Pichincha), with the remainder on the coast. The orchards, located between 1,800 and 2,500 meters above sea level, benefit from rich volcanic soils and well-distributed rainfall—conditions that favor healthy crops,

larger fruit sizes, and superior quality.

The sector faces a key dilemma: expand acreage or boost productivity. Current yields average 5.5 tons per hectare, but Pinto projects that, with technical improvements, production could grow 30–40% annually. The goal is to reach 7.1 tons per hectare by 2026 and between 15 and 18 tons within five years. At the same time, the plan is to plant more than 2,000 additional hectares within two years, consolidating Europe as the main destination while exploring Russia and Asia. China, South Korea, Japan, and Southeast Asia are seen as medium-term priorities.

A milestone occurred in August 2025, when APHIS, the U.S. sanitary agency, visited Ecuador to verify phytosanitary requirements. The industry expects to make its first shipment to the U.S. by the end of the year. “The United States is a natural destination for our exports, considering that transit time to the nearest port is just five days,” says Freile.

The national strategy rests on three pillars: quality, certification, and traceability. Ecuador’s geographic location provides ideal light, temperature, and rainfall, reflected in the fruit’s excellent organoleptic qualities. The sector is also promoting the certification of Good Agricultural Practices (GAP) and robust traceability systems. Although production can occur year-round, the goal is to focus on strategic shipping windows— late in the year and early in the next—to avoid overlapping with Peru’s season.

In logistics, Ecuador brings strong export experience in bananas, shrimp, tuna, flowers, mangoes, and broccoli. Its ports of Guayaquil and Posorja offer established routes to both the U.S. and Europe. “Guayaquil is the leading port in South America for international trade, and leveraging that expertise is not difficult,” explains Pinto. Transit times are under 10 days to the U.S. West Coast, 15 days to the East Coast, and similar to Europe.

Additionally, Ecuador boasts one of Latin America’s most developed road infrastructures, allowing fruit to be transported in optimal conditions from growing areas to ports—without deterioration or delays.

The combination of agroclimatic advantages, logistical capacity, and market access places Ecuador in a clear takeoff position. Though volumes remain modest today, projected productivity gains, new plantings, and the imminent entry into the U.S. market mark a turning point. If the country consolidates these steps, it could soon leave behind its marginal role and join the select group of major global avocado exporters.

CALIFORNIA

CALIFORNIA

8.802

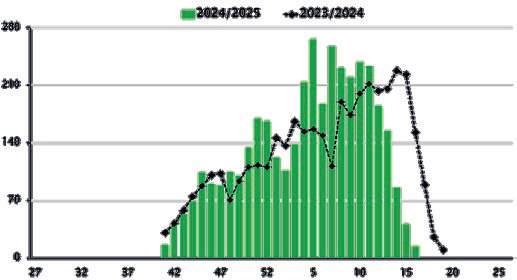

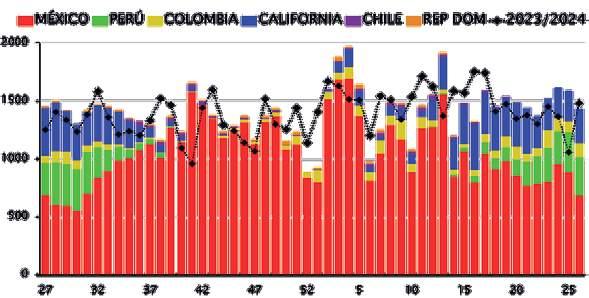

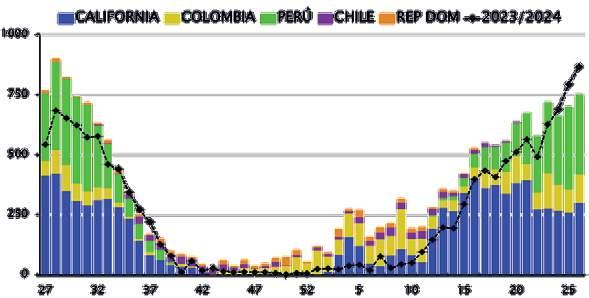

SUMINISTRO SEMANAL DE AGUACATE HASS 2024/2025 HACIA EE.UU.

SUMINISTRO SEMANAL DE AGUACATE HASS 2024/2025. HACIA EE.UU.

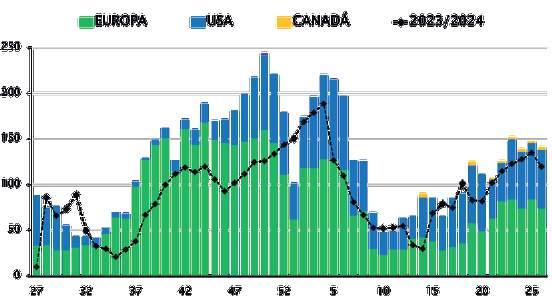

ESPAÑA

3.524

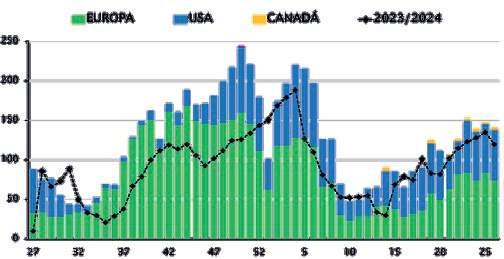

SUDÁFRICA

2.553

1.874 Trucks (40000 lb) 2024/2025 Season Trucks a Europe. 2024/2025 season.

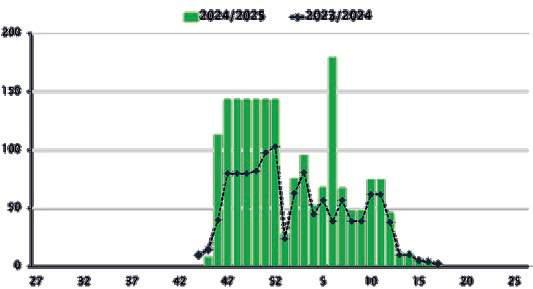

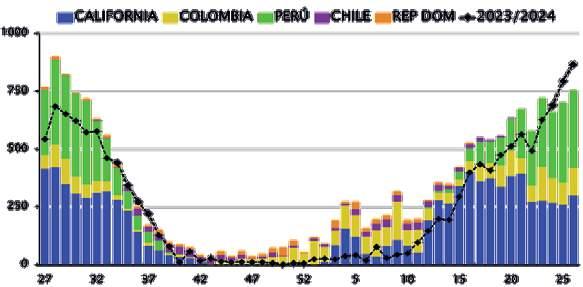

SUMINISTRO SEMANAL DE AGUACATE HASS 2024/2025. HACIA EUROPA

3.832

EXPORTS SEMANALES DE AGUACATE HASS 2025. HACIA EUROPA

DE

HASS

MARRUECOS

Containers exported to Europe 2025 Trucks a Europe. 2024/2025 season.

HACIA EUROPA EXPORTACIONES SEMANALES DE AGUACATE HASS 2025 HACIA EUROPA

WEEKLY EXPORTS OF HASS AVOCADO 2024/2025. HACIA EUROPA

ISRAEL

ISRAEL KENIA Y TANZANIA

KENIA Y TANZANIA

2.143 Containers to Europe 2024/2025 season. Containers exported to Europe 2025

Phartec Produce SAC: SUSTAINABLE AGRICULTURE FOR THE WORLD

Phartec Produce SAC is the result of a shared vision: founded to develop an agro-export business committed to meeting both national and international market standards, offering products that embody quality, trust, and commitment.

This year, Phartec celebrated its 25th anniversary since its founding, and we have expanded our vision toward agro-exports to continue fostering a circular economy as a business group. That is why Phartec Produce was created, together with our partners Mario Bazán and Martín López.

Sebastián

Lerzundi – CEO

OUR OPERATIONS

From the very beginning—and even before its official founding—the team, with more than ten years of experience, most of them working together in previous ventures, has collaborated closely with local farmers, supporting their growth, ensuring fair relationships, and fostering sustainable development together.

Our main partners range from small growers with just 1 hectare in the highlands to producers with 65 hectares on the coast, across the various crops we manage throughout the country. We also work with renowned packing plants in both northern and southern Peru, suppliers of top-quality materials and services, and, of course, world-class clients at destination.

Our team is focused on delivering quality service, carefully addressing the needs and requirements of both our growers and our global customers. More than suppliers, we see ourselves as strategic allies, committed to building long-term relationships and centering our approach on reliability.

At Phartec Produce, sustainability is a real commitment: we promote environmentally responsible practices, comply with national regulations and those of our destination markets, and drive both formalization and innovation in every process—always contributing to the development of the farming communities we work with.

One of our greatest strengths, as mentioned earlier, is the extensive experience of our team, most of whom have been working together for a decade. This track record allows us today to be a solid and robust company.

Thanks to this, we can confidently say that we are growing step by step, organically and without losing sight of our main goal: to be a trusted partner.

Martín López, Deputy General Manager

COMMERCIAL ACTIVITY

As a company, during our first three years of operation, we have traveled across Peru, collaborating with numerous growers and steadily increasing our export volumes. In 2025, we are reaching nearly 200 FCL of Hass avocados, close to 100 FCL of fresh green asparagus (equivalent), and have also started commercial trials with mandarins.

Looking ahead, we plan to further develop the citrus category, with a goal of reaching 30 FCL of mandarins by 2026, and beginning exports of our own Tahiti lime fields in 2027 through Phartec Green, a company within the Phartec Group.

OUR GROWTH

Hass Avocado (FEB–SEP)

In our first year (2023), we shipped 70 FCL of Hass avocados, growing successfully to 125 FCL, and by the end of September 2025, we are closing with 190 FCL, with a target of 250 FCL for 2026.

Fresh Green Asparagus (APR–DEC)

In our first year (2023), we shipped 55 FCL of fresh green asparagus, increasing to 67 FCL, and expect to close this year with 90 FCL. Our goal is to achieve a growth rate of 20–25% by the end of 2026.

Mandarins (JUN–AUG)

We started 2025 with four commercial trial shipments (4 FCL) and already have commitments for 30 FCL in 2026.

Tahiti Lime

Through Phartec Green, part of the Phartec Group, we have planted Tahiti lime in northern Peru. Production and exports are expected to begin in 2027.

COMMERCIAL WINDOW

Our main commercial strength lies in our ability to offer clients products that fill seasonal supply gaps in some cases, and in others, a complete production window.

For instance, in the case of avocados, we are known for beginning exports early in the season from February (week 5) and continuing until the end of September (week 40), maintaining a quality standard fully aligned with our clients’ expectations.

Finally, since several of our growers manage more than one crop, we are also evaluating the resumption of pomegranate exports in the near future.

Mario Bazán, General Manager

Mario Bazán, General Manager; Sebastián Lerzundi, CEO; Martín López, Deputy General Manager.

UNITED STATES: new regions become attractive as consumption rises

Avocado consumption in the U.S. has undergone a geographic and cultural expansion that even industry insiders find striking. While California remains the historic leader, it belongs to the traditional areas where consumption has slowed or grown only slightly. Other regions that once seemed less attractive are now offering strong opportunities.

Looking at entry routes, most of the volume from Mexico comes in through Texas, while imports from Peru, Colombia, Chile, and other South American countries enter mainly through northeastern ports such as Philadelphia. To a lesser extent, avocados also arrive via Los Angeles and Miami.

Focusing only on fruit handled at retail, figures from the Hass Avocado Board (HAB) show that between 2021 and 2024, volumes grew 5.2% across the United States.

According to HAB Executive Director Emiliano Escobedo, speaking to AvoMagazine: “When it comes to consumption, the most relevant markets are still concentrated in California, where avocados have always been produced and which

The positioning of avocados as a superfood, combined with commercial strategies and the unexpected demographic shifts of the past four years, has driven volume growth in areas that previously showed no such behavior.

remains the most important. But also the states surrounding California, such as Arizona, Colorado, Nevada, and up the northern coast to Washington. Texas is also a key market in terms of volume, as is New York, in the Northeast.”

Several factors have fueled rising demand in regions outside the traditional strongholds.

STRONGEST GROWTH IN CONSUMPTION

HAB data show that the region with the highest percentage increase in avocado volume is the Southeast, which includes five states: Mississippi, Alabama, Georgia, South Carolina, and Florida. This territory, home to more than 48 million people, recorded a 5.3% population increase between 2021 and 2024.

“It’s one of the highest population

EMILIANO ESCOBEDO, Executive Director of the Hass Avocado Board

increases nationwide, considering that overall U.S. growth was 2.5%. After COVID-19, many people moved to states with somewhat more open policies. Florida and Texas stand out in that regard. I believe that’s part of what has driven higher consumption,” explains Escobedo.

Indeed, between 2021 and 2024, the Southeast registered a 14% increase in avocado volumes sold at retail. The region reached a 15% share of total U.S. market volume, surpassing California by nearly one percentage point.

“It has become a very important zone, especially compared to what it was 10 years ago. This growth isn’t just due to population increases. It’s also influenced by the shift of several supermarket chains toward promoting Hass avocados,” Escobedo notes.

For example, Florida produces a green avocado variety that also arrives in significant volume from the Dominican Republic. Previously, supermarkets heavily promoted those varieties, but now there

has been a transition toward promoting Hass. That shift is already showing positive impacts.

“At the same time, the health message—emphasizing the benefits of avocados—has consolidated as the main purchase driver, according to consumers. In addition, the growing presence

Avocado

consumption in the U.S. has undergone a geographic and cultural expansion that even industry insiders find striking.

of international cuisine restaurants and fresh healthy dining in key Southeastern cities is pushing avocados as an essential menu ingredient,” says Escobedo. The Mid-South states show the second-highest growth, at 9.1%, while the Plains region posted an 8.7% increase, though it represents just 6% of the U.S. retail avocado market.

MORE STAGNANT MARKETS

One of the markets that has stagnated is California, which saw only 2.4% growth between 2021 and 2024. The Great Lakes region (bordering Canada) recorded a more moderate increase of 5.9%. All the regions showing declines are in the Western U.S. Escobedo explains: “It’s practically all the states westward up to Colorado, excluding California. So, Nevada, Arizona, Colorado, Washington, Idaho, Oregon—they’ve all experienced a slowdown averaging 3.1%.”

Opportunities in

California and the South Central: New Sales Formats

In the South Central states, where avocado consumption is already highly developed, growth has been slower, increasing by just over 4%. The same is true in California.

Despite demand being well covered, there are specific opportunities that could stimulate broader growth, replicating what has been achieved in regions where avocado consumption has surged the most.

As Escobedo points out, “In California, bagged sales represent a smaller share of the total compared with the Northeast. That’s an opportunity, because nationwide, recent growth has been driven mainly by bag presentations.”

“In supermarkets, this shift is reflected in the growth of PLU 4046, especially in the bagged segment, which has seen a sharp increase. We conducted a study and found that 4- and 5-count small avocado bags now represent more than 54% of unit sales of bagged avocados. These are smaller avocados. We also saw significant growth in the 7-count bag, which increased by more than 1,200%. In our view, this format is ideal for those looking for a personal portion for each day of the week. It’s been a very interesting boom,” explains Emiliano Escobedo.

The HAB also conducted a survey to understand consumer perceptions of which sizes are gaining demand, confirming that many buyers prefer small avocados for daily consumption.

Fuente: Has Avocado Board (HAB) de Estados Unidos.

Is Asia Still an Attractive Market FOR AVOCADO GIANTS?

“While Peru and Chile consolidate their presence in Asia, Mexico retreats in the face of logistical risks and the appeal of the U.S. market, in a scenario that combines opportunities and challenges for major suppliers.”

Avocado exports to Asia show clear contrasts: while Peru and Chile consolidate their presence, Mexico withdraws due to logistical risks and the strength of the U.S. market. With data from Avobook and insights from André Vargas, Antonio Villaseñor and Ricardo Vega López, the analysis reveals both the continent’s growth potential and the barriers faced by major suppliers.

Asia’s role in the global avocado industry has been marked by advances and setbacks. Shipments from Mexico, Peru and Chile to Japan, China and South Korea reflect differing dynamics. Mexico continues on a downward trend, with almost no participation in China. Peru reached in 2025 a volume close to that of 2023, confirming consistency in the region. Chile, for its part, has achieved stability, although it remains uncertain whether this year’s volume will surpass that of previous seasons.

TARIFF ADVANTAGES AND MARKET OPPORTUNITIES

For André Vargas, Global Procurement Manager at South American Express Co. and Commercial Director at Fruwer Produce LLC, Asia’s appeal is beyond question: “The continent is facilitating the return of suppliers by offering greater market access and tariff reductions.” South Korea has extended temporary exemptions benefiting countries with higher costs; Japan opened its market in 2024 to avocados from the Philippines to diversify origins; and in recent years China has authorized suppliers such as Kenya and South Africa.

Vargas notes that Asian demand is growing and distribution systems are increasingly modern, though per capita consumption remains low, particularly

in China. “Intensive marketing campaigns are needed to promote avocado and boost consumption, but current efforts are very limited,” he says.

In China, consumption is concentrated in the fresh segment —salads, rice bowls, and beverages like smoothies— but the fastest growth is projected for processed products: guacamole, snacks, and avocado oil. In Japan, the fruit has become integrated into sushi and salads, while also expanding into cosmetics and preparations like guacamole.

QUALITY AND SIZES: KEYS TO PROFITABILITY

According to Vargas, profitability depends on sending premium fruit in branded boxes. In 2025, China once again became strict on external quality after two more flexible years. Japan, meanwhile, remains a high-value market with rising retail prices, but demands consistency and presentation.

As for sizes, in China and Asia the 20 and 22 calibers are in steady demand, while 26 and 28 are growing, especially in foodservice. Japan prefers homogeneous, clean-skinned fruit, with me-

dium calibers for retail. Chile, in its foray into Asia, has positioned premium fruit with its best opportunities in sizes 20 to 26.

MEXICO: RISKS AND PRIORITIES

From Mexico, the assessment is different. Antonio Villaseñor, director of Aztecavo, explains that the retreat is linked to its business model: packers purchase fruit at a fixed price, which makes long transit times —two to three weeks— a high risk. “The cost of quality is very high when there are claims; no exporter wants to take those risks,” he emphasizes.

As a result, Mexico prioritizes the U.S. market, where proximity reduces logistical risks, claims are minimal, and consumption continues to grow at double-digit rates. In addition, for much of the year Mexico is the only available supplier.

A STRUCTURAL VIEW: CONCENTRATION IN THE U.S.

Ricardo Vega López, general director of Frutícola Velo, recalls that since

the late 1990s Mexico began to reduce its presence in Europe. He explains that the strong domestic market —with apparent consumption above 9 kilos per capita— forces exporters to buy firmly from producers and pay a price premium to compete with local demand. In Europe, however, consignments prevail, increasing risks for Mexican exporters.

On top of this is the logistical factor: Mexican avocados cannot withstand trips longer than 30 days without physiological damage, a critical issue when shipping to distant destinations often exceeds that timeframe. “This has caused major losses for exporters, who have opted for closer markets,” notes Vega López.

The focus on the U.S. is also explained by its sheer size. In the late 1990s, apparent consumption stood at over 200,000 tons; today projections point to 1.5 million tons in the short term. Proximity gives Mexico a competitive advantage in the U.S., Canada and Central America, where fruit arrives in less than

a week in optimal condition.

The challenge, according to Vega López, is for Mexico to sustain production growth to meet both rising domestic and external demand. Meanwhile, local production in Central America is beginning to expand and could erode Mexico’s market share.

A CONTINENT OF CONTRASTS

The outlook confirms that Asia represents a market with enormous growth potential, especially for Peru and Chile, which have managed to position themselves consistently. Mexico, by contrast, concentrates its strategy on nearby markets, backed by expanding consumption and lower logistical risks.

Asia will remain an attractive destination, but its development will depend on marketing strategies, supplier diversification and consistent quality —key factors for avocado to firmly establish itself across the continent.

Argentina Becomes the MOST DYNAMIC market in South America

Argentina has emerged as the most dynamic market in the region, driven by steadily growing consumption and by imports in 2025 that doubled—and in some cases tripled—the volumes seen in 2024. The country has become a key destination for exporters from Chile, Peru, Brazil, Colombia, and, more recently, Mexico.

AVOCADOS NOW EMBEDDED IN ARGENTINA’S DIET

The boom is explained by the firm incorporation of avocados into Argentine eating habits. Miguel Bauzá, manager of Don Jaime, confirms: “Avocado consumption in Argentina grows year after year. Today it’s part of the daily diet,

something that didn’t happen before.”

Still, he warns about the macroeconomic context: “If the economy improves, consumption should increase further. This year, with Chile’s expectations, there will be more volume, but not necessarily the profitability expected, since the domestic recession puts pressure on prices.”

Supply is broad and diversified. While there is local production in Tucumán, Salta, Jujuy, and Catamarca, the market is sustained mainly by imports. Juan P. Vanzini of Conosur S.A. explains: “The main origins supplying Argentina are Chile, Brazil, Peru, Colombia, and Mexico.” Entry is regulated by SENASA’s Afidi, which sets phytosanitary requirements and a minimum of 23% dry mat-

ter at the start of the season.

On Mexico, Bauzá points out that entry windows are limited and performance hasn’t always been strong. Vanzini, however, emphasizes: “Mexico is already entering Argentina,” consolidating itself as one more player in the offer.

A MARKET FRAMED BY REGIONAL TRADE

According to the International Economic Center (CEI) of the Ministry of

Foreign Affairs, Latin America was the main destination for Argentine exports in 2023, with 34% participation. Brazil and Chile stand out as key partners— both buyers and suppliers—helping explain their central role in avocado supply to Argentina. Seasonal complementarity and logistical proximity make the region a natural ally to sustain this growth.

EVOLUTION OF IMPORT VOLUMES

According to Avobook, in 2025 import volumes tripled—or at least doubled—those of 2024: “In January, more than 200 shipments arrived from Chile, along with some from Mexico, before declining through April, when Peru and Brazil entered with very similar shares.”

The evolution highlights a shift in the weight of supplying origins: “Chile decreased compared to the previous month, Brazil held steady, and Peru increased until July with more than 160 shipments, while Brazil reached 50,” explains De la Cuadra.

So far in 2025, market share has been: Chile 48%, Peru 28%, Brazil 21%, and Mexico 3%. In 2024, Chile accounted for 64%, showing how Peru and Brazil have gained ground.

Sustained consumption growth, a diversified supplier base, and expanding value projections reinforce Argentina’s role as the most dynamic avocado market in South America. The challenge ahead will be balancing rising demand with a stable and competitive supply.

COMPARISON OF AVERAGE PRICES BY SIZE 2024/25: USA VS. EUROPE

COMPARISON OF PRICES FOT 2024/25: USA (#48) VS EUROPA (#18)

COMPARACION PRECIOS FOT 2024/25: USA (#48) VS EUROPA (#18)

EUROPA

Morocco Bets on Resilience and Proximity to Europe to Sustain Its Avocado Campaign

Morocco begins the 2025/2026 campaign in a challenging environment marked by reduced volumes due to climate factors, but relies on its strength and proximity to Europe to sustain supply.

Morocco’s avocado industry faces the 2025/2026 season in a challenging environment, marked by reduced volumes due to climatic factors. Far from a critical outlook, industry associations and growers highlight the sector’s structural resilience, steady expansion of new orchards, and strategic proximity to Europe as key pillars for ensuring a stable and reliable supply to major international markets.

According to the Gharb Avocado Growers Association, national production is expected to fall to around 80,000 tons, compared with earlier estimates of 140,000 to 160,000 tons. This represents a 40–50% drop from initial projections. However, the Moroccan Avocado Association (MAVA) suggests the overall impact may be less severe, noting that while some regions were heavily affected, others are maintaining adequate yields.

Morocco currently has 14,000 hectares planted with Hass avocados, of which 8,000 are already in production, and about 2,500 hectares are added annually, according to MAVA. The main growing area lies between Larache and Rabat, where shallow wells provide access to water, mitigating the drought risk often associated with the country.

Yassin Chaib, manager of Mavoca, emphasized the importance of sending a message of calm to markets: “It’s true that some fruit has dropped in certain regions, but every year many new orchards come into production, which compensates for the loss. What we must avoid is creating concern with disproportionate figures that don’t reflect

the reality of the sector,” he stated.

Chaib also underlines the growing professionalism of Moroccan avocado production: “The Moroccan industry has shifted from being almost entirely dependent on Spanish exporters to having local companies that now trade directly with the Netherlands, France, or the UK. That independence strengthens the sector.”

HARVEST WINDOW AND FRUIT QUALITY

Morocco’s production window coincides with Spain, Portugal, and Israel, beginning in December when dry matter content reaches about 23%. However, the temptation to harvest early remains a challenge. “Some growers may be tempted to pick ahead of time, which could compromise fruit quality,” explained Sebastián de la Cuadra, CEO of Avobook, after his recent visit to the country.

Under normal conditions, Morocco’s export window runs from December through April. This year, however, many growers are expected to delay harvesting Hass until January or even March in order to capture stronger international prices.

The country has also shifted its commercial strategy. While much of its production was once delivered to Spanish companies, local exporters now sell directly to European markets such as the Netherlands, France, and the UK—strengthening Morocco’s market independence.

Geographic proximity remains one of the country’s greatest competitive advantages. “Morocco enjoys an incredible edge by being just a day away from European markets, allowing for almost immediate returns and minimizing the risks associated with cold storage,” highlighted de la Cuadra.

OUTLOOK FOR THE COMING SEASON

Despite heat-driven declines, the industry remains optimistic about growth. De la Cuadra notes: “The next harvest could be similar to the last, with the potential for a 30% increase in production. However, much will depend on how extreme Mediterranean heatwaves impact orchards in the coming weeks.”

The domestic market also plays an important role. In the country’s north, avocados are widely consumed in smoothies, creating opportunities for expanding local demand.

With output adjusted by climate pressures but bolstered by expanding orchards, a diverse grower base, and unparalleled proximity to Europe, Morocco continues to consolidate its position as a reliable and competitive origin in the global avocado market.

“The country has tremendous potential to keep growing and improving year after year. It’s very similar to what we see in Michoacán with the U.S.,” concludes de la Cuadra.

Brazil doubles its Hass avocado exports and seeks to strengthen its position in South America and Europe

Brazil has emerged as a rising origin with strong growth potential in the Hass avocado market. Over the past three years, its exports have increased by more than 100%, jumping from around 10,000 tons per year to nearly 25,000 tons. This leap has been made possible thanks to the expansion of cultivated area and the entry into production of new orchards, explains Adilson Penariol, partner/director of AvoPrime Frutas S.A. and president of the Brazilian Avocado Association (Abacates do Brasil, AAB).

“In the coming years, this growth curve should be significantly driven by the maturation of more hectares, allowing us to surpass 50,000 tons,” anticipates Penariol.

Avobook’s analysis confirms this momentum, although with nuances. Between 2023 and 2024, Brazil’s Hass avocado exports grew by around 10%, with Europe as the main destination, accounting for 61% of shipments, while Mercosur countries received 39%, led by Argentina as the top market and Uruguay in second place.

Betting on the domestic market While exports have been Brazil’s calling card on the global map, Penariol emphasizes that current efforts are also focused on strengthening the domestic market. “We are working with supermarkets to enhance the Hass avocado consumption experience, running campaigns with chefs and nutritionists to highlight the fruit’s quality in simple and tasty recipes, as well as partnering with medical associations, especially the College of Cardiologists, to underline the health benefits of avocado,” he explains. The goal is for avocado not only to gain ground abroad but also to secure its place on Brazilian tables as a versatile and healthy food.

The 2025 harvest was also marked by

a milestone: the possibility of sending Brazilian fruit to Chile for the first time. However, documentation issues delayed the process until late May, when most orchards had already been harvested or were in advanced stages.

Adding to this were adverse weather conditions between the spring of 2024 and the summer of 2025, with drought and high temperatures limiting the availability of export-quality fruit. As a result, only one shipment was completed, in collaboration with Carlini Avocados and Baika, coinciding with an event in Santiago. The feedback was encouraging: those who tasted the product praised its quality and flavor.

Looking ahead to upcoming seasons, Brazil’s export strategy is focused on South America and Europe. In the region, besides consolidating Argentina and Uruguay, the Chilean market stands out as a priority, with shipments planned between February and September— particularly from late March, when the local harvest winds down and Brazil’s dry matter levels reach the quality standards importers seek.

In Europe, shipments between February and April achieve better prices, as Peru is not yet strongly present during that period. From April onward, competition intensifies, and Brazil aims to position its fruit based on differentiated quality compared to Peruvian exports.

Production diversity by altitude Brazil’s Hass avocado production is spread across four main regions, each with its own characteristics that define harvest windows and quality. In the lowland areas of São Paulo, Minas Gerais, Paraná, and Espírito Santo, at altitudes of 400–600 meters, production is early and commands higher prices, though with greater climatic risk due to high temperatures.

ADILSON PENARIOL, Partner/Director of AvoPrime Frutas S.A. and President of the Brazilian Avocado Association

At mid-altitudes of 600–850 meters, also in São Paulo, Espírito Santo, and Minas Gerais, harvest comes shortly after, yielding better quality and more stable fruit, though at lower prices. In southern and northwestern Minas Gerais, at 900–1,200 meters, production offers high-quality fruit with harvest windows that can stretch from February to August, depending on the microclimate.

Finally, in southern Minas Gerais, above 1,300 meters, harvest begins in June and can extend into September and even October in the highest areas. Here, fruit matures on the tree for 9 to 13 months, resulting in higher oil concentration and a distinctive flavor.

COLOMBIAN AVOCADO: How to Keep Growing in the European and U.S. Markets?

Colombian Hass avocado production is expected to reach 440 million pounds by 2025. The number of certified orchards for the U.S. is growing, while experts emphasize the importance of maintaining quality, protecting origins, and diversifying toward Asia and South America.

In recent years, Colombia’s Hass avocado industry has consolidated a leading role in international trade. Figures show that production continues to rise and that strategic plans aim to secure sustainable growth in the two main destinations: Europe and the United States.

According to Corpohass data, in 2024 Colombia produced 380 million pounds of Hass avocados, and by 2025 projections reach 440 million pounds, representing a 16% increase. This growth is accompanied by the expansion of orchards certified for U.S. exports: a year ago there were 439, and by 2025 that number has risen to 484, according to the Colombian Agricultural Institute (ICA).

For Manuel Michel, the decisive factor in competing in a scenario with multiple origins is quality. “The main strategy is to maintain consistent and reliable quality, as this is the key driver for competing effectively in any global market. Additionally, we are working to strengthen customer relationships and support retail-level promotion programs,” he says.

Along the same lines, Jorge Molina Duque agrees that origin differentiation is essential. “Colombia is focused on protecting its origin. That means quality, consistency, and strong export prac-

tices. The Colombia Avocado Board and the growers’ association have driven campaigns to boost the acceptance of Colombian avocados in the U.S., initially during off-season windows like la traviesa, but with the goal of offering year-round consistency,” he explains. Balancing markets and diversification

The goal of balancing shipments between Europe and the United States remains a priority. Michel recalls that so far in 2025, “between 40% and 45% of Colombian Hass avocados have gone to the U.S.; however, that percentage dropped at the end of the Traviesa season. The aim continues to be generating enough demand in the U.S. market during the main season so that exports remain around 50%.” Molina projects this balance even further: “Forecasts for 2029 point to an interesting equilibrium: 50% of Colombian fruit in the U.S. and 50% in Europe. While these remain the main destinations, efforts are already underway to develop the domestic market, and some exporters are looking with interest toward Asia and South America. Diversification will be key to sustaining growth.”

The production outlook also reflects changes in the sector’s structure. According to Molina, “large banana groups have invested in vast avocado

areas, and investors from Mexico and Guatemala have also entered the business in Colombia. However, after the returns seen in 2025, small producers —who make up the majority with less than five hectares— do not appear to be expanding, while medium-sized growers are instead seeking to make existing areas more productive rather than increase acreage.”

Industrialization as a strategic piece

Another topic under discussion is the role of industrialization as a complementary path for growth. Michel describes it as a decision that depends on each company: “For some companies, processing may represent an attractive and complementary alternative, while for others it may not be the best shortterm option. Corpohass includes the processed sector within its association, so efforts are actively underway to strengthen this area as an integral part of Colombia’s avocado industry.”

For his part, Molina emphasizes that it is indeed a strategic bet: “The industry can play a fundamental role: absorbing fruit, encouraging production, and cushioning supply peaks throughout the year. But for this to work, joint efforts are needed among exporters, processors, and the domestic market. It is a strategic piece of the value chain.”

MANUEL MICHEL, director gerente de Colombia Avocado Board

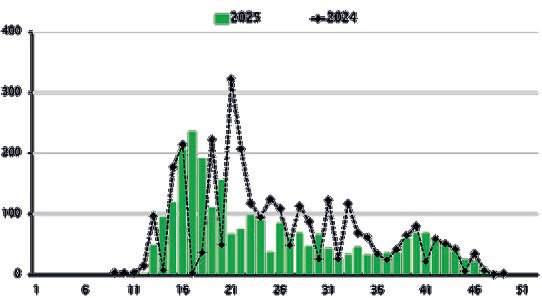

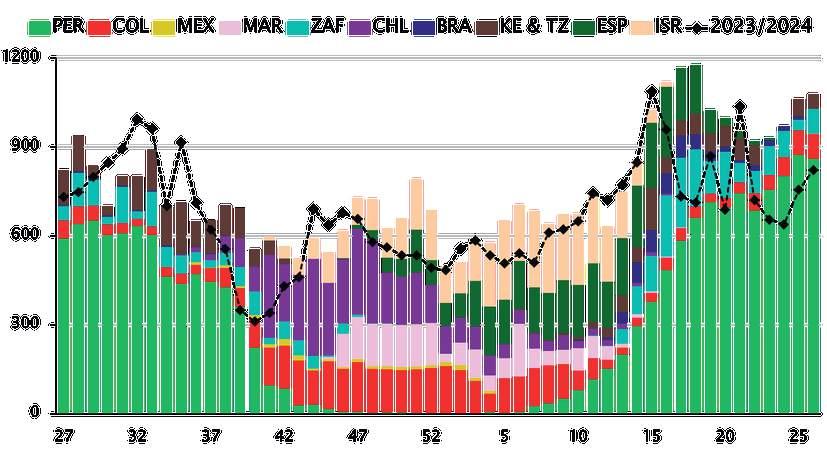

Avocado Transition IN EUROPE: Between Peru’s Exit and the Rise of NEW ORIGINS

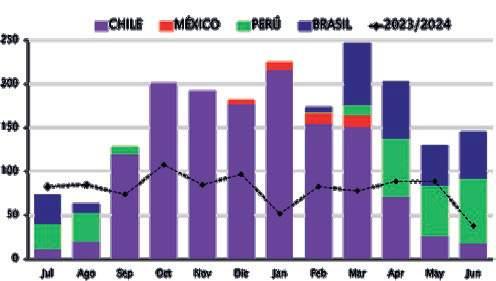

Peru’s withdrawal from the European market opens a transition period in which Chile and Colombia are set to take the lead, while prices remain stable for larger sizes and climb for smaller ones.

The European avocado market is going through decisive weeks. Peru, the main player of the season, is starting to step back, leaving room for other origins that must sustain supply and balance prices in a context marked by shifts in sizes and demand adjustments. According to Víctor Ruete, advisor to Tropical Millenium, a widespread shortage is not expected, though there will be “selective pressure by sizes.” In particular, he warns that the risk of shortages is concentrated in sizes 18

and smaller, which are already showing strain, while “in larger sizes, from 10 to 16, availability remains ample—though with more ripening challenges due to dry matter.”

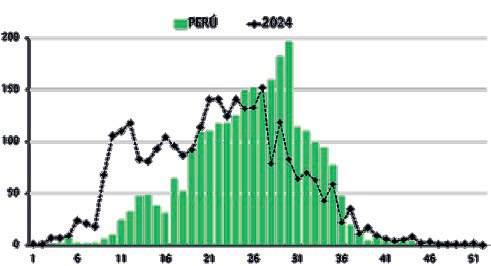

Data from Avobook confirm that Peru has been reducing its shipments in recent weeks. The peak was recorded in week 26, with about 860 containers arriving in Europe. Still, 2025 has exceeded the volumes exported in 2024, creating a stronger supply cushion in the first part of the campaign.

As for prices, signals are mixed. Ruete notes that September shows a stable spot market, with some increases depending on size: “Large sizes, from 10 to 16, remain stable thanks to higher availability, firm when quality supports it, but without increases; while medium and small sizes, from 18 and smaller, are rising due to limited supply and promotional commitments.” The Avobook team adds that, compared with week 37 of 2024, this year large sizes are priced lower, while small sizes are enjoying stronger quotations.

THE HANDOVER: CHILE AND COLOMBIA TAKE THE LEAD

The transition will unfold between weeks 39 and 44, when the mix of origins reshuffles. According to Ruete, once Peru exits, the market will reorganize with Chile at the forefront and

Colombia moving into its main bloom, bringing greater stability by late October or early November. “We expect a gradual normalization of prices toward the end of October, once the mix of origins and the size curve balance out and Morocco enters the market,” he highlights.

In this new scenario, Chile is already emerging as Europe’s leader, with peaks of up to 6 million kilos in a single week, though experiencing a temporary pause in week 38 due to national holidays. Colombia, meanwhile, will shift from its “travesa” bloom—shipping around 2 million kilos per week—to its main bloom, contributing a range of sizes, though mostly 20 and smaller. Other players will take more secondary roles: East Africa and South Africa will provide steady but not high volumes; Morocco will join from late October or November; Israel may bring Hass in November, depending on political and commercial conditions; and Mexico will remain focused on the U.S., with only a complementary presence in Europe.

The European avocado market is thus heading into a period of adjustment, where the key lies in managing the handover between origins and sizes. Peru’s exit opens the stage for greater prominence from South America and the Mediterranean, with attention focused on how supply and prices will respond in the year’s final stretch.

“Don’t Be Surprised if, in the coming years, Peru extends its season until mid-october”

So warns Omar Díaz, CEO of Westfalia Peru and Colombia, who affirms that this is one way to prevent price drops, especially now that Peruvian exports have risen by more than 30%.

Omar Díaz entered the avocado world 23 years ago, starting with the management of an orchard from scratch. He worked in the field of clonal tree seeds, and later, the company Lomas de Chilca took part in Peru’s very first avocado exports.

“For various reasons, the previous shareholders decided not to continue with Lomas de Chilca, so we launched a new company, Camet Trading, with the same team and facilities, dedicated solely to exports. I was a shareholder there, and in 2016, Westfalia acquired 50% of the company. In 2019, it took 100%, consolidating Westfalia Peru’s operations. But the company has a 23-year history,” Díaz explains.

The know-how built over two deca-

des led the multinational to keep Díaz as general manager and, three years ago, he also assumed leadership of Westfalia Colombia, an operation that has been running for 11 years. Today, Westfalia ranks second in avocado export volumes from Peru, giving Díaz a unique perspective on an industry that is closing the season with very strong numbers—over 30% growth compared to last year.

How diversified is Westfalia Peru–Colombia’s export portfolio?

“Thanks to Peru’s geographical location and the wide range of markets we serve globally, the Peruvian office is the most diversified of the group. We have a very strong position in Asia. We export heavily to Europe, since our

offices are based there. We also ship to the United States and Latin America. From Colombia, our largest volume goes to Europe, and we’re working hard to increase shipments to the U.S. We’re also making efforts to start exports from Colombia to Asia, but there we face additional logistical challenges, with longer transit times. On top of that, Colombian avocados have a slightly shorter post-harvest life than Peruvian fruit.”

Will that condition make it harder to project exports from Colombia to Asia?

“That’s right. However, I believe Westfalia is one of the key players working hard on quality in Colombia. We’re confident the country has all the

potential to deliver very high-quality fruit.”

CLOSING PERU’S CAMPAIGN AND ITS IMPACT ON PRICE

– How is Peru’s campaign closing in terms of overall numbers?

“This year has seen significant growth—over 30% in volume. We’ll reach nearly 700,000 tons. Although we should also note that 2024 had lower production compared to 2023. Still, the industry has the potential to keep growing thanks to planted areas. According to ProHass, Peru should eventually reach one million tons per year. We believe this could happen within two, three, or four years.”

– Is there enough market to absorb that much growth?

“The market keeps growing. Especially in May, despite the large volumes sent to Europe, the market absorbed them well. All the fruit was sold. Yes, it suffered a bit, but only for a short period of eight or nine weeks. Then it recovered.”

– Has that demand growth been enough to cushion price drops?

“The fruit was consumed. Maybe there wasn’t a big impact on the average price for the entire season. But during an 8- to 10-week stretch—basically June and July through early August—prices did fall. Not to the levels of previous years, when they dropped to 4 euros. This year, boxes were over 5 euros, with a better exchange rate. But to be clear: the market needs sales at around 8 euros to be competitively profitable for growers. That said, demand is still rising. The World Avocado Organisation (WAO) is doing a good job, but it needs more companies contributing to ensure greater funds for promotion.”

– Was the price impact due to many

origins in the market?

“It was mainly driven by Peru’s volume. South Africa, Kenya, and Colombia contributed too, but Peru provided more than 70% of the fruit at that point. Also, July and August coincide with Europe’s summer vacation, when consumption dips.”

– If Peruvian exports keep climbing, reaching toward one million tons, how should the industry face periods of oversupply to avoid structural devaluation?

“We’ve seen that during mid-season—shipments arriving from midMay through late July (arrivals in June through early August)—plantings must be controlled, because there isn’t much more room for growth at this moment. Maybe in a few years, yes, but not right now. On the contrary, it’s better to extend the season. For example, this year Peru kept exporting into September, something that didn’t happen before. And don’t be surprised if, in the coming years, exports continue until mid-October. Proof it can be done: in week 38 alone, over 500 containers left Peru.”

– Will this be a recurring phenomenon?

“It sets a precedent. Next year it will likely extend another week or two.”

– During the weeks of greatest balance between supply and demand, what price levels were reached?

“Depending on the year, prices can reach 13–14 euros. Currently, boxes are at 11–12 euros, especially for the best sizes. Last year at this time, prices were much higher. At the start of the season, prices may begin at 13 euros, then fall at some point to 5 euros, depending on export volumes, before rising again to 11, 12, or even 13 euros depending on what remains at the end. When prices go over 14 euros, consumption falls and it’s hard for them to climb further.”

Westfalia Peru and Colombia: From Orchards to a New Frozen Plant

Westfalia Peru operates its own packing plant along with four service plants in the country’s northern and eastern regions. While it does not have its own orchards, its leased fields cover approximately 200 hectares. In addition, the company works with associated growers who collectively manage around 4,500 hectares. This allows Westfalia to cover the entire Andean belt and, along the coast, from Chiclayo to Moquegua.

The latest development is the construction of a frozen processing plant in Chiclayo, scheduled to begin this year and expected to be operational by mid-next year.

In Colombia, between owned and leased fields, Westfalia manages about 600 hectares, while also working with numerous partner growers. The company also operates two packing plants. Together, these operations will allow Westfalia to close the year with exports of nearly 43,000 tons from Peru and 18,000 tons from Colombia.

OMAR DÍAZ, Gerente General de las operaciones de Westfalia en Perú y Colombia.

1.813

2.230

CHILE

WEEKLY IMPORTS OF HASS AVOCADO 2025

2.627

IMPORTS FROM PERU

Imported containers 2025

AVERAGE WEEKLY PRICE PER KG – SIZES #14–18 BY ORIGIN

ARGENTINA

MONTHLY IMPORTS OF HASS AVOCADO 2024/2025

AVERAGE WEEKLY PRICE PER KG –SIZES #18–24 (LOCAL FRUIT)

ARGENTINA

1.965 Imported containers july 2024 to june 2025

SHARE BY ORIGIN 2023/24 VS 2024/25