USA Financial Advisory Services Market Size- By Type, By Organization Size, By Industry Vertical- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Financial advisory services involve professional guidance and expertise provided by financial advisors or firms to individuals, businesses, and institutions. These services cover various areas, including investment advice, retirement planning, wealth management, tax planning, estate planning, risk management, financial education, budgeting,debtmanagement, andbusinessfinancialadvisory,andspecializedservices. Thegoalistohelpclientsmakeinformedfinancialdecisions,aligningtheirgoalswithrisk tolerance, and providing ongoing support. Clients seek these services to improve their financial well-being, achieve long-term objectives, and navigate complex financial marketswiththehelpofexperiencedprofessionals.

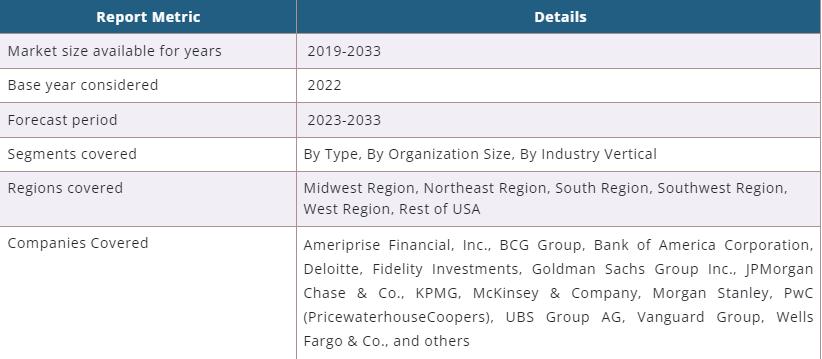

AccordingtoSPERmarketresearch, ‘USA Financial Advisory Services Market Size- By Type, By Organization Size, By Industry Vertical - Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ state that the United States Financial AdvisoryServicesMarketispredictedtoreachUSD161.68billionby2033withaCAGR of6.04%.

Several factors have influenced the US Financial Accounting Advisory Services Market Increasingawarenessoffinancialplanningthroughliteracyinitiativeshasdrivenmore peopletoseekguidancefromfinancialadvisors.Theshiftfromdefinedbenefittodefined contribution retirement plans, like 401(k)s, has created a demand for personalized advice in managing retirement savings. Mergers and acquisitions have led to industry consolidation, enabling firms to expand services and enhance competitiveness. Additionally, as wealth transfers between generations, effective estate planning and wealthtransferstrategieshavebecomecrucial,furtherdrivingthedemandforadvisory services.Thesefactorshaveshapedthemarket'sgrowthandevolution,emphasizingthe importanceoffinancialeducationandtheneedfortailoredadvicetomeetclients'diverse financialneeds.

However,theUSAFinancialServicesConsultingMarketfacessignificantchallengesand opportunitiesrelatedtodigitaltransformation.Whiletechnologyprovidespossibilities, adaptingtothisshiftandstrikingabalancebetweenhumaninteractionandautomated services poseschallenges. Additionally, cateringtodiversedemographicsegments, like Millennials and Gen Z, necessitates tailored strategies and services. The rise of roboadvisorsandautomationmaydisrupttraditionaladvisorybusinessmodels.Buildingand maintainingclienttrustamidmarketuncertaintiesrequireeffectivecommunicationand clienteducationefforts.Successfullynavigatingthesechallengesallowsfirmstoharness thepotentialoftechnology,meetclients'evolvingneeds,andfosterstrongrelationships basedontrustandeducation.

Request For Free Sample Report @ https://www.sperresearch.com/reportstore/usa-financial-advisory-services-market.aspx?sample=1

In addition, the COVID-19 pandemic had significant implications for the USA financial advisory services market. Temporary regulatory changes, such as relief measures and stimuluspackages,requiredadvisorstonavigateshiftingguidelines.Disruptionscaused difficulties in maintaining effective client communication. Some firms faced financial strain, leading to industry consolidation through mergers. Despite challenges, the pandemicaccelerateddigitaltransformationandemphasized thevalueofpersonalized advice during crises. Advisors who adapted to clients' changing needs and embraced digital tools were better equipped to navigate uncertainty. The pandemic tested the resilienceandadaptabilityoffinancialadvisoryservices,promptingfirmstoinnovateand respondeffectivelytounprecedentedcircumstances.

Furthermore,citieslikeNewYork,LosAngeles,Chicago,SanFrancisco,andBostonare knowntohaveasignificantconcentrationofhigh-net-worthindividuals,businesses,and

institutions that require sophisticated financial planning and advisory services. These urban centers offer a wide range of financial services and attract a diverse clientele, makingthemtheprimaryfocusformanyfinancialadvisoryfirmsseekingtoexpandtheir client base and grow their business. Additionally, some of the market key players are Fidelity Investments, JPMorgan Chase & Co., KPMG, McKinsey & Company, Vanguard Groupincludingothers.

US Financial Advisory Services Market Segmentation:

By Type: BasedontheType,USAFinancialAdvisoryServicesMarketissegmentedas; Accounting Advisory, Corporate Finance, Risk Management, Tax Advisory, Transaction Services,Others.

By Organization Size: BasedontheOrganizationSize,USAFinancialAdvisoryServices Marketissegmentedas;LargeEnterprises,Small&Medium-SizedEnterprises.

By Industry Vertical: BasedontheIndustryVertical,USAFinancialAdvisoryServices Marketissegmentedas;BFSI,Healthcare,ITandTelecom,Manufacturing,PublicSector, RetailandE-Commerce,Others.

By Region: This report also provides the data for key regional segments of Midwest Region,NortheastRegion,SouthRegion,SouthwestRegion,WestRegion,RestofUSA.

This study also encompasses various drivers and restraining factors of this market for theforecastperiod.Variousgrowthopportunitiesarealsodiscussedinthereport.

For More Information, refer to below link:-

Financial Markets Advisory (FMA) Market Outlook

Related Reports:

Asset and Liability Management (Alm) Market Size- By Component, By Deployment, By Enterprise Size, By Application, By End User- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Enterprise Asset Leasing Market Size- By Asset Type, By Leasing Type, By Organization Size, By Industry Vertical- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

SaraLopes,BusinessConsultant–U.S.A.

SPERMarketResearch

enquiries@sperresearch.com

+1-347-460-2899