Celebrating ANNIVERSARY Years

Building FBAA over three decades 10

THE FIRST YEARS

As FBAA celebrates 30 years in 2023, we look back at how the association got started and gained traction through the 1990s.

6 INDUSTRY UPDATE

With six pressing paper submissions to government currently underway, the FBAA continues progressing the interests of brokers and Australian loan consumers.

10 BROKER IN BUSINESS

From admin and loan processing in 2020 to being named FBAA Mentee of the Year in 2022, Nicci Backman is carving out her career as a broker.

16 HOME JACKPOT

Your client wants to buy a house. Great! As their broker you can be the hero, or heroine, and help them with some simple tips.

CONTENTS

What's on At

32 MEMBER BENEFITS

Explore the benefits, deals, offers and savings exclusively for FBAA members.

34 BROKER OF THE YEAR

George Samios of Madd Loans talks to us about how his win was the cherry on top of an incredible year.

38 WHAT’S ON

All the latest events and webinars happening at FBAA.

20 COVER STORY

Over the past 30 years the finance and mortgage broking industry has changed significantly. We look back at the FBAA’s origin story.

28 SOCIAL MEDIA MARKETING FOR FINANCE BROKERS

Social media is a powerful tool to help you reach and win clients.

CONTENTS

EDITOR & HEAD OF CONTENT

Peter White AM

MANAGING EDITOR

Krystal Camilleri

SUB-EDITOR

Janet White

STAFF WRITER

Rachel Licciardello

CREATIVE DESIGN & PHOTOGRAPHY

Glenn Hunt

Krystal Camilleri

ADVERTISING

Krystal Camilleri

TELL US WHAT YOU THINK

We appreciate hearing from readers. If you have feedback, news or a story idea you would like us to cover, please contact us using the below details.

NEWS, ADVERTISING AND ADMINISTRATION

e: editor@fbaa.com.au

p: 07 3847 8119

w: www.fbaa.com.au

All information and images are subject to copyright. No part of this publication may be reproduced without prior permission in writing to the Finance Brokers Association of Australia Limited. The views and opinions of the authors and advertisers do not necessarily reflect the opinions of the publisher.

While every effort has been made to ensure the accuracy of information at the time of publishing, the publisher accepts no responsibility or liability for errors, omissions or subsequent consequences including loss or damage from reliance on information in this publication.

4. FROM THE CHAIR A welcome from Tony Carter, Chairman.

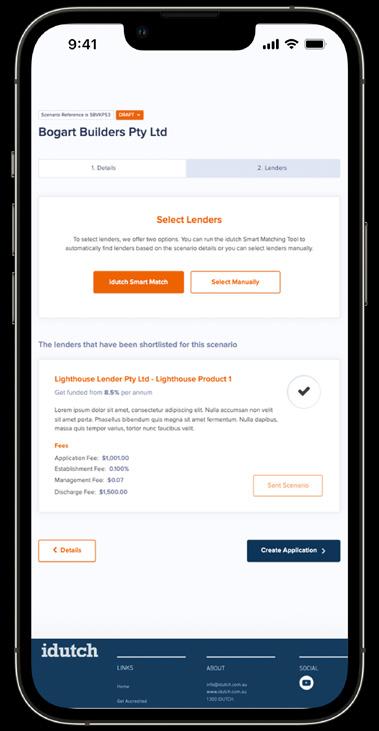

14. FBAA SOCIAL MEDIA POCKET GUIDE A pocket guide for getting your business on social media.

15. OUR MEMBER TRANSFER INITIATIVE Switching to the FBAA is easy. Here’s why.

27. THE ARTEMIS SPACE An FBAA supported women’s community.

42. FBAA MENTORING PROGRAM Mentoring the next generation of brokers.

FROM THE

Happy New Year for 2023 and hopefully this will be an excellent year for all FBAA members. There have been challenges over the past three years and now with many clients seeking refinancing in a rising interest rate market your time has never been more stretched.

In the hustle and bustle of a broker’s busy life, it is not unusual to hear of brokers who are living in the working moment and not taking time out to look inward at their business model or consider what is happening in the greater market. Very understandable and quite normal. It can lead, however, to too much inward perspective making it very difficult to accept or create changes necessary to keep up with a changing business world.

FBAA wants to challenge you to take some time out to think about your business and the greater finance industry market.

• Think about where you think the finance market will be five to 10 years from now.

• What will change in how major banks conduct their business?

• What does the second-tier lender market look like?

• What will be the role of aggregators?

• What level of education will be important to a professional broker?

• Will single-operator brokers continue to exist? Will they strategically merge with others?

• What will brokers need from their industry body?

• Will brokers select a market sector and specialise or be more broadly focused?

4 Broker Magazine

THE CHAIR

•What role will technology play that differs from today? Where is it headed?

These are just a few of the questions we all need to address if appropriate strategies are to be developed and implemented, ensuring the finance broker of today is still relevant to consumers and businesses requiring professional support in their funding needs.

To be part of the future solution, we ask that you take time to think about these and other questions concerning our collective future. Develop your view and write it down. Send it to FBAA at futuredirections@fbaa.com.au

We have already started the process and met with all State Presidents, the FBAA Board and some key FBAA staff in November. The next meeting, in February, is with key aggregators.

As we gather the input, including that received from brokers of all sizes, we will develop emerging themes. The outcome will be shared with members and used in our Education programs and Advocacy work with the Government, Aggregators and Banks.

Together we can lead the future rather than becoming victims of it. Only if individuals are prepared to put their views forward, helping create a powerful view of the future.

We welcomed Christine Green to the Board at the AGM in November 2022. Having served as the Queensland State President, Christine is already well known to those in Queensland.

5 Broker Magazine

We are looking forward to Christine’s insight and contribution to the work of the FBAA Board over the coming three years.

Tony Carter

Industry Update

With six pressing paper submissions to government currently underway, the FBAA continues progressing the interests of brokers and Australian loan consumers. Researching and investigating issues and preparing a strong case for government to review is how we achieve real change.

Broker

6

Paperwork Magazine

7 Broker Magazine

Paperwork

PAPERS IN DEVELOPMENT

At the FBAA National Industry Conference back in November, we spoke about the many papers the FBAA has in development regarding key issues concerning brokers. In 2023, we continue our work behind the scenes, preparing strong cases to help improve our industry FBAA members, brokers and Australian loan consumers.

The six key papers we are working on during the first half of this year regard clawbacks, offsets, unbundling products under RG 273, serviceability buffer rates, point of sale exemptions and comparison rates. These papers are in development, and will be submitted to government before the end of June. Some are closer to submission than others. All are major concerns for our industry, and a priority for the FBAA.

1. Clawbacks

We are currently completing due diligence and the workouts required for our paper on clawbacks. We continue gathering insight into whether lenders are profiteering from clawbacks, and our findings will help shape our paper to government. From this paper, the government will determine the appropriate next steps.

2. Net of offset commissions

We’re deep in our work putting together a case for net of offset issues. We are seeing some lenders adjusting and correcting when the payments are made post the offset account monies being used, but there is more work to be done. Our research has shown a 342% increase in brokers waiting 12 months or longer to be paid. This is unacceptable and needs to be immediately paid in the next commission run.

3. RG 273 issues

The current regulatory guide requires the

best interest duty (BID) to be applied to each product within a bundle, which is not practical. It also was not the intention of Treasury when BID was developed. We need to unbundle the issues this causes for brokers and borrowers. We are in the throws of finalising this paper.

4. Serviceability buffer rates

We are finishing our research for a paper on serviceability buffer rates. In October 2021, APRA raised the serviceability buffer to 3% above lender’s interest rates. With increased interest rates, this means many borrowers’ serviceability are now being assessed around 9%. Our position is that existing borrowers who already have loans, should not be pushed out of the market by excessive buffering rates – it penalises them and keeps them prisoner to their existing lender. We support a common-sense approach here.

5. Point of sale exemptions

We continue our work pushing for removal of point of sale exemptions for car dealerships. This is a fairly extensive and very technical paper, requiring a few months’ further work until we are ready to submit to government.

6. Comparison rates

Almost always, the comparison rate disclaimer is irrelevant to the actual loan being applied for. There needs to be some framework around this for customers, so that this rate actually makes sense in the market and the average loan sizes as well as being reviewed at least every two years. This is about creating transparency and accurate information for Australian consumers.

PD SUMMITS REVAMPED

We’ve listened to member feedback and have reviewed and revamped FBAA’s events. In 2023 we will deliver completely revamped and refreshed events, starting with our Professional Development Summits. Our focus is on

8 Broker Magazine

8 Broker Magazine INDUSTRY UPDATE

delivering higher quality events, designed to be even more meaningful and impactful. We will take our events to the next level, with increased content and value to ensure brokers get more out of each event you attend. While we will be holding fewer events in total, we will still deliver to each state around the country.

BETTER BUSINESS SUMMITS

The FBAA will continue our support of The Adviser Better Business Summit. We will travel around Australia with the summit through March, exhibiting at each event. If you plan to attend a Better Business Summit, look out for us and come say hi. Better Business Summits

2023: Brisbane, March 2; Western Australia, March 9; South Australia, March 16; New South Wales, March 23; and Victoria, March 30.

For more information go to: www.theadviser.com.au/better-businesssummit-and-awards/

Peter White AM Managing Director

Home loans that tick all the right boxes for essential workers

We serve education, emergency services and health workers nationally in all states and territories.

We’re one of a small number of banks participating in the Home Guarantee Scheme to help essential workers own their home sooner.

We understand essential workers like no other bank. Essential workers in education, emergency services, and healthcare who take up our Your Way Plus package will receive a reduced variable interest rate and if they’re a first home buyer the loan’s annual fees will be waived for the life of the loan.

Unlock nationwide access to hundreds of thousands of essential workers in niche industry sectors. Become an accredited Teachers Mutual Bank Limited broker today to access four customer-owned industry banking divisions.

To find out more or to become accredited contact broker@tmbl.com.au or 1300 86 22 65

Teachers Mutual Bank Limited ABN 30 087 650 459 AFSL/Australian Credit Licence 238981. Membership eligibility applies to join the Bank. All applications for credit are subject to our responsible lending criteria. Fees and charges apply. You can find our Consumer Lending terms and conditions available online or from any of our offices | BK02999-TMBL-0123

INDUSTRY UPDATE

10 Broker Magazine

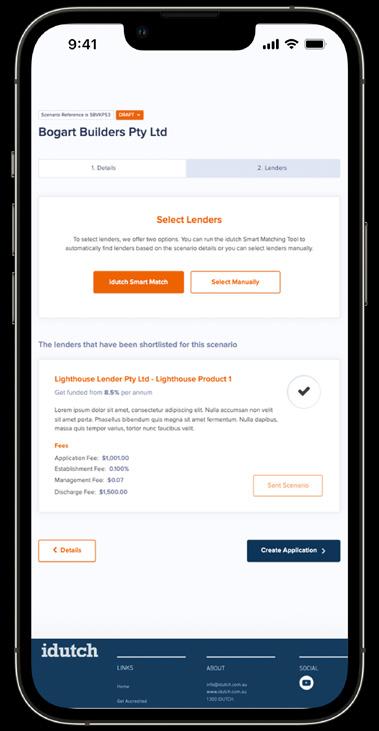

Broker in business: Nicci Backman

After joining the broking industry in 2020 as administration and loan processing, Nicci Backman made the leap into broking April 2021. Then in 2022 Nicci was named FBAA Mentee of the Year, a moment she describes as “surreal”.

Property and finance have always interested Nicci Backman. “I bought my first home at 19 years old, and knew I would enjoy a career in finance, I just didn’t know where to start,” reflects Nicci.

Before 2020, Nicci worked in radiology as a medical liaison officer. After having her daughter and becoming a single parent, she decided it was time for a change and took her initial steps into the broking industry. In February 2020 she joined Melbourne-based boutique brokerage Zella, starting out in an administration and loan processing role.

“I wanted to start in admin to learn the ropes of all angles in this career,” shares Nicci. “I believed that learning every aspect of the job would only help me to be as successful and knowledgeable as possible. But becoming a broker was always the goal.

“For me personally, the drawcard was a better work-life balance and more flexibility, with an employer who knew what it was like to be career-focused while also being a mum.”

Nicci knew the leap into broking would be a significant career change, but made the transition smoother by establishing a mentoring relationship with her friend Cait Bransgrove, Director at Zella. While she had a different mentor initially, Nicci says she found she would workshop deals with Cait, and realised the positive and close relationship they shared was contributing to Nicci’s professional growth.

“Cait took over mentoring me about a year ago now,” recalls Nicci. “Cait has a very similar drive to me, we share an outlook that we will do everything we can to help others, and that no situation is too hard.

“To receive the Industry Thought Leader of the Year award shows that my intentions translate – that people hear and understand what it is I am standing up for and why.”

– Peter White AM

11 Broker Magazine

“Initially I had to push myself out of my comfort zone with complex deals, which taught me to just go for it, and in doing so my skill level increased drastically. I believe it made me become the broker I am today.”

Nicci and Zella deliver all types of finance, from residential to commercial, asset and SMSF lending.

In November, Nicci was named FBAA’s 2022 Mentee of the Year. She describes the moment she won as “surreal”.

“I am one to always try my absolute best at everything I do, but I never thought I would earn my first broker award so soon in my career!”

Nicci’s advice to new brokers seeking a mentor is to find a mentor that motivates and challenges you, and whom you admire.

brings value

“Make sure you are working with a mentor that really brings value to your days, because you don’t know what you don’t know. You are relying on this person to be your role model in all aspects of your career –whether its advice on loan structures, compliance, how to be personable with clients, build relationships, stay motivated, and so much more. You need a mentor to teach you things you never would have considered, which will help you identify and establish a point of difference which is essential to growing.”

Nicci says helping clients achieve their dream purchases is “the best feeling ever”.

“It never ceases to amaze me how much influence we have over such a pivotal moment in people’s lives.”

12 Broker Magazine

“Make sure you are working with a mentor that really

to your days, because you don’t know what you don’t know.”

UPGRADE TO YOUR DIPLOMA Get recognised for your skills and knowledge with our recognition of prior learning pathway! and receive 10% OFF REGISTER HERE 03 9391 3643 info@aamctraining.edu.au AAMC Training Group is a wholly Australian owned Registered Training Organisation (RTO number 51428), operating nationally and internationally www.aamctraining.edu.au FNS50322

15 Broker Magazine

Help your client hit the home jackpot.

Your client wants to buy a house. Great! They want to buy in an area that suits them. Alright! As their broker you can be the hero, or heroine, and help them with the following tips.

Age and lifestyle

Your client’s stage of life will also play a determining factor in where they choose to settle down.

Young families will likely be searching for a property near to parks, playgrounds, schools, shopping centres and sporting fields.

Singles on the other hand may be looking to live near other singles, close to public transport, food and beverage venues, and entertainment precincts.

Empty nesters typically hope to downsize in quiet areas near to people who share similar values and interests.

Invite your client to research local demographics and census data to learn a little about the people that live in their desired area, including age, profession and family status. This will help to guide them in finding the perfect property and suburb for them.

16 Broker Magazine

Their budget

Your client’s budget will dictate what they can afford. While many buyers — especially first home buyers — have their hearts set on settling down in a particular area, their budget may not accommodate the price tags of the houses in that vicinity.

Encourage your client to take a look at house prices in neighbouring suburbs or those on the verge of areas that have experienced price hikes in recent years. They can check out future planning to see what infrastructure is being introduced to the area, and weigh up whether these improvements to the district will benefit their lifestyle and wallet in the years to come.

Ask a local

The quickest way to retrieve raw information about the suburb your client is considering buying a property in is to go directly to the source, and in this case, I mean speak to the locals.

Your client could spark up small talk with a cashier at the supermarket. There is no harm in asking questions to gain a better understanding of the way the suburb works, what is great, and what to look out for. Locals tend to be friendly and happy to assist — especially if they love their suburb.

Length of stay

Sometimes, buyers outgrow their properties and that’s ok. But the key is for your client to buy a home that suits their needs, within an area that meets their needs too.

A young couple with no plans to start a family within the next five years may be happy to settle into a two-bedroom apartment close to the city, whereas a couple planning to start a family are more likely to settle into a three-bedroom home in a suburb with all the amenities.

Encourage your client to consider if both the home and area they like meet their needs for their intended timeframe of ownership. If not, it’s a good idea to put some more thought into their buying decision.

I hope these tips help you to service your client’s needs at an advanced level. That’s what it’s all about — exceptional client service.

By Kitty Parker Director Kitty & Miles

Kitty & Miles is an award-winning buyer’s agency that saves residential property buyers countrywide from wasting valuable time and money when buying (and helps them not buy a dud!). Their services range from expert auction bidding assistance through to a complete end-to-end concierge service.

To get in touch visit www.kittyandmiles.com.au

18 Broker Magazine

“Invite your client to research local demographics and census data to learn a little about the people that live in their desired area, including age, profession and family status.”

Smart brokers choose OnDeck. In 1 hour, we’ll show you why.

At OnDeck, we know small business and we work fast to get your clients the solution they need, when they need it. No fuss.

With Lightning Loans® up to $150k, our decisions can be made in minutes and the funds available in as fast as 2 hours. And, unlike most of our competitors, we don’t need any upfront security.

Give us an hour of your time, and we’ll come back to you with a solution specifically tailored to your client.

Once you give OnDeck a try, you won’t look back. Contact us today to learn more about our Broker Partner Program

Get onboard: Visit ondeck.com.au/broker Email broker@ondeck.com.au

Call 1800 831 294

Celebrating ANNIVERSARY Years

THE FIRST 10 years

Built by brokers for brokers

This year marks 30 years since the FBAA officially formed in 1993. Over the past three decades, the finance and mortgage broking industry has changed significantly. One consistent though has been the FBAA representing the broker voice. We look back on the first 10 years of the association as it came together, found its feet and took its first steps to becoming the broking industry’s peak advocacy body.

20 Broker Magazine

21 Broker Magazine

In the 1980s and early 1990s, the broking industry was taking shape, a far cry from what we know today. Run through phone calls, faxes and faceto-faces, there was no email, no Google, no automated text message reminders for appointments, no offshore loan processing, no clawbacks. Back then brokers existed to give customers price comparisons for loans, and over the decades has evolved into the multi-faceted profession it is in 2023. The path from then to now has been shaped by the hand of the Finance Brokers Association of Australia (FBAA), the finance and mortgage broking industry’s peak advocacy body. Founding member and former board member, vice chairman and treasurer Chris Szigeti shares with us the association’s origin story.

Before relocating to the sunshine and sand of Queensland’s Gold Coast in 1988, Chris Szigeti was an equipment finance broker based in Melbourne and operating in Melbourne, Adelaide and Brisbane. He had come to broking from AGC (Australian Guarantee Corporation, which eventually turned into GE Money and Westpac). After breaking up a business partnership in Melbourne, Chris moved to Gold Coast to start a new business and discovered the broking landscape was very different. “Back then regulation was up to the individual states,” recalls Chris. “Every state did its own thing. In Victoria, brokers needed a broker’s licence which required a written application and physical interview, usually some sort of professional history in finance or banking and there were loose guidelines dictating what you couldn’t do. In Queensland, however, no licence was required, there was no regulation.” In some ways, it was like the wild west, with cowboy brokers writing their own rules.

While Chris was still relatively new to Queensland, he had established business connections and high-profile businessman Geoff Thomas AO invited him to a meeting for brokers. “It was June 1993, and it was freezing in the church hall in Bowen Hills where we had that very first meeting with just half a dozen brokers,” recalls Chris. “Our initial principle was to, firstly, be recognised by the government as an association representing our industry, and, secondly, enhance the credibility of brokers in the eyes of the lenders and the public at large. The public distrusted a lot of brokers, and we wanted those types out of the industry. We set out to establish professional standards.”

Brokers in the early 1990s didn’t have the market position they do today, with over 70 per cent of customers choosing brokers for mortgage loans. “We recognised we needed to lift the profile of brokers, we needed more influence over positioning brokers and building our industry’s identity,” says Chris.

“To put it into perspective, we met with the Minister of Consumer Affairs after that initial meeting to discuss the general industry and where brokers fit in, and the minister didn’t know what finance brokers were.”

The Finance Brokers Association of Queensland (FBAQ) was officially incorporated on November 12, 1993. After spreading word that a new association was forming, the founding members held a second meeting on November 16, 1993, this time with 18 brokers who each paid $50 to kickstart the association.

It was an association built by brokers from the ground up. “At the core of everything we did in those early years was the mantra ‘run by brokers for brokers’ and that really remains today,” says Chris. “We used to meet in different towns and cities, to promote membership, build camaraderie and share knowledge.”

Memberships grew throughout the 1990s, mostly in Queensland and New South Wales. Then in October, 2000, the FBAQ merged with a small association in Western Australia which had a couple hundred members. On October 17, the FBAQ officially changed to Finance Brokers Association of Australia (FBAA) to reflect its national presence.

“The FBAA has grown from this little acorn we planted with just 18 founding members, to a wellregarded industry advocacy body that represents more than 10,000 finance and mortgage brokers across every state and territory in Australia,” says Chris. “Today, ASIC, Treasury and government ministers reach out to the FBAA for consultation when making decisions about the broking industry –this is the profile we set out to build around brokers that 30 years ago.”

Professionalism was always front of mind for the association says Chris. “We had developed a code of conduct within the first 12 months,” he recalls, “and we established an insurance route for brokers to have professional indemnity insurance, because that was important for both brokers and loan customers. We

continued on page 24

22 Broker Magazine

“We met to discuss the general industry and where brokers fit in, and the minister didn’t know what finance brokers were.”

At Gateway we don’t believe that reducing your impact on the environment should cost you more. That’s why we’ve introduced two discounted Green Home Loans to reward your clients who have taken steps to reduce their home’s impact on the environment.

Our Green Plus Home Loan has been recognised by MOZO’s Expert Choice panel as Green Home Loan of the Year for 2022. The Green Plus Home Loan is designed to reward borrowers, who’s homes have been certified as 7 Stars or higher by NatHERS or the Residential Efficiency Scorecard, with a rate discount of at least 0.25% from our Premium Package 80% LVR product for the life of the loan.

Our Green Home Loan offers a rate discount of 0.15% for homes that have a Residential Efficiency Scorecard rating of 4 Stars up to a maximum 6 stars or have not been certified

but contain a wide range of environmental and energy efficient features like solar panels or certified insulation and double glazed windows.

Additionally, these products come with a 100% offset account which can be accessed with Gateway’s Eco Visa Debit Card. The Eco Visa Debit Card is the first from an Australian bank and made from plant materials unlike traditional PVC cards, meaning it’s kinder on the environment and produces significantly less carbon in its production.

If your clients are looking for a Bank that will recognise and reward their efforts to reduce their impact on the environment talk to our Gateway Broker Team to find out how our offering can help them reduce the impact on both their pockets and the planet.

If your clients’ homes are energy-efficient, they could save even more on their home loan thanks to our award winning discounted Green Home Loans.

Because home loans shouldn’t cost the earth.

Reward your clients for reducing

home’s impact

environment

your clients money with Gateway’s award winning

their

on the

Save

Green Home Loans.

Applications for finance are subject to our standard credit assessment criteria. Full T&Cs are included in the loan offer. Fees and charges apply. Gateway Bank Limited | ABN 47 087 650 093 | AFSL / Australian Credit Licence Number 238293 Get in touch 1300 302 474 gatewaybank.com.au/broker ADVERTORIAL

actually still have that professional relationship with Insurance Advisernet to this day.”

During the first 10 years, 1993 to 2003, Chris says there were many highs, such as growing the association membership and going national, but there were also challenges along the way.. All professions in Australia evolved with the introduction of computers and the internet in daily operations. “In the finance industry, the moment you think you know everything is when you’ve got to start again and reteach yourself. Every five years, something comes along that revolutionises the way we do things.”

It was during this same period that national legislation for brokers was developed, with the federal government’s announcement in 1997 of a Corporate Law Economic Reform Program. CLERP 6 related to financial services reform bill, including new licensing and disclosure requirements and was introduced in 2001. “That was a challenging time, navigating new legislation. Thankfully, this is something the FBAA has got very good at consulting on over the decades.”

Chris has held many roles with FBAA over its 30-year history – founding member (1993), unofficial Gold Coast representative (from 1993), Queensland State President (appointed 2006), board member and Treasurer (appointed 2009) and Vice Chairman (2013) until he retired from the board in 2021. “Having been voted to the board, I always felt I represented brokers at large

and I took that responsibility very seriously.”

Today, Chris is a lifetime member with FBAA (since 2014), and continues operating his private mortgage lending and super regulation funds business, CSA Finance Private Mortgages, from Gold Coast.

“How we do business has changed exponentially over the past 30 years,” reflects Chris. “In the earlymid 1990s, there was a bank branch on every corner. Today, branches are closing down left, right and centre as business shifts online.” What hasn’t changed though, is the need for great customer service and working through complex client situations, which is where brokers come in.

“Thirty years ago, brokers existed to provide price comparisons to loan customers. Today, the broker’s role is much more complex,” offers Chris. “We comply with much heavier regulation, we are on the lookout for issues such as money laundering, fraud, financial abuse, we must ensure the best interest duty is met.

“Having a highly-regarded advocacy body, an association that supports brokers with training, networking, mentoring, and everything else we need to keep improving has become essential – and that’s exactly what the FBAA is.”

with the FBAA Education Institute Pulling together training courses, Make business happen Partner with us to discover opportunities in SME lending. Call 1300 964 808

Imagine a community where you are not only able to hear other perspectives but also understand them.

Welcome to The Artemis Space, an FBAA supported women’s community to discuss the issues, challenges and needs you have in our industry.

The Artemis Space has been aptly named after the Greek Goddess of nature, women and archery. It symbolises reaching an objective with the greatest speed, accuracy and focus. Its intention is to create a safe and supportive community where women/womxn can have open-minded, matter-of-fact discussions to understand what holds you back in order to pave the way forward.

Join us and the women professionals in our broader industry to transform constructive discussions into practical change, wholeheartedly supporting you to connect, grow and thrive with excellence.

If you would like to be a part of the conversation, we meet monthly for 1 to 2 hours by video conference. To engage with a variety of views, we will rotate the composition of the groups, creating an opportunity for you to meet other likeminded people.

NOW

...and be part of ‘paving the way’

REGISTER

27 Broker Magazine

28 Broker Magazine 28 Broker Magazine

Social Media Marketing for Finance Brokers

Lots of businesses find it difficult to achieve results on social media, Yet, social media marketing can be a powerful tool to reach thousands each month and win clients. Here are valuable marketing insights to manage your time on social media effectively and succeed.

If you find it painful to get results on social media or hate doing it, join the queue. Social media marketing can, however, be a valuable investment to grow your business.

With all your responsibilities, from serving customers to talking to banks and everything in between, here are some valuable marketing insights to manage your time effectively and succeed.

29 Broker Magazine

Broker Magazine

Focus on paid campaigns

Organic posts for business pages are as good as dead. Based on research by We are social, Instagram engagement is less than 2% of your followers, while Facebook is .07%. It’s because the algorithms are continuously changing.

Unlike big brands with unlimited resources, you need to start advertising monthly to reach your target audience and get tangible results.

By incorporating campaigns into your strategy, you can expand your reach further and target specific users in the top, middle, and bottom of the customer buying funnel to generate high-quality leads.

Be consistent

A common issue among business owners is inconsistent posting. For example, one of our commercial finance clients wanted to improve her reach on Facebook but was sharing content irregularly, sometimes even weeks apart and reaching only a couple of hundred each month.

It takes a lot of time to create content, but if you aren’t consistent with it, that’s time wasted with no results to show for it.

On the other hand, our client Meezan Wealth is reaching between 35,000 to 50,000 through Facebook and Google Ads, proving that advertising campaigns are much more effective.

Combine social with Google Ads

Placing ads on Google can be beneficial since you reach audiences with a high intent to purchase from your business.

A budget between $1,000 to $3,000 minimum is required for advertising with keywords that your audience enters into Google. Then, with the correct settings, you can target people browsing for the solution you provide.

Google offers a wide range of campaign options, from text-based ads on search result pages to display ads (images) and videos.

However, Google Ads are not for novices. Working with someone skilled in Google Ads management is highly recommended to ensure you get the best results for your money.

Invest in Retarget Advertising

While social advertising drives traffic to your website, Retarget ads target anyone who visited your web pages but left without buying.

Retarget ads are those follow-me ads you see when you go to Jetstar or similar websites — these are powerful, automated sales follow-up mechanisms. As a result, you can drive those window shoppers back to your website to complete a purchase.

Analyse your performance

Sometimes you get so caught up in setting up and running campaigns that analysing the data becomes an afterthought, and this is how most lose their time and money. Analysing the data helps to make essential decisions to improve your ads.

You may need the help of an expert to learn to read the data and know what’s important and what’s not because it can confuse the untrained eye.

Success with social marketing can take months — even years! But if you’re committed to applying these insights, you’ll have no problem reaching your goals.

For further advice on social media marketing, contact the team at netStripes on 1300 10 8880 or visit www. netstripes.com

By Dinesh De Silva - CEO of netStripes,

By Dinesh De Silva - CEO of netStripes,

a digital and marketing solutions business in Sydney. He is a leading authority on Small and Medium Business Digital Innovation and is regularly called upon to share his insights as a thought leader.

30 Broker Magazine

Clients looking to get life back on track? scenarios@pepper.com.au Talk to us about debt consolidation loan options. 1800 737 737 Applications are subject to credit assessment, eligibility criteria and lending limits. Terms, conditions, fees and charges apply. ©Pepper Money Limited ABN 55 094 317 665 AFSL and Australian credit licence 286655.

32 Broker Magazine Exclusive for FBAA Members Explore the benefits, deals, offers and savings exclusively for members. DeLonghi La Specialista Maestro Espresso Machine Member Price: $1,618.00 Lifespan Kids 14ft HyperJump 4 Spring Trampoline Member Price: (ENQUIRE) 2XU Core Compression Tights Mens - Black/Silver Member Price: $127.50 SHOP NOW Via the FBAA Members Area 32 Broker Magazine

33 Broker Magazine

100% Hudson SunglassesMatte Havana/Bronze Member Price: $162.89

Apple 13-inch MacBook Air: M1 chip with 8-core CPU, 256GB Member Price: $1,446.35

Bang & Olufsen Beoplay E8 Sport, Black Member Price: $435.00

Asics GT 1000 10 WomensBlack Black Member Price: $153.00

Apple iPhone 12 128GB Member Price: $1,253.30

SuperCheap Auto eGift Card - $50 Member Price: $48

2022 BROKER OF THE YEAR

George Samios

After 10 years spent building his broker business, Madd Loans, George Samios decided it was time to step away from broking and focus on growing his business and inspiring the next generation of brokers. In November he took out the FBAA’s 2022 Broker of the Year award, a win he says was the cherry on top of an incredible year.

Congratulations on being named 2022 Broker of the Year — how did it feel to receive this accolade?

It was so humbling to actually finish off with Broker of the Year Award. It meant a lot to me, especially because mid-last year I stopped writing loans, stopped working as a broker and placed my focus on the business.

I decided that for us to continue growing the business, it’s hard for me to keep writing loans. I need to be focused on strategy and improving processes and procedures, making my staff come to work and love what they do.

It will be my staff up there winning awards next!

Madd Loans has been on a steady trajectory since you started the business back in 2012. Was moving away from writing loans always the goal?

No, it was actually, believe it or not, hard for me to stop doing meetings, because I loved doing home loans, loved helping people. I found myself for the first month or two feeling weird, like I didn’t know what to do. By the end of 2022, I got the hang of it.

Looking back on 2022, what were your ‘big wins’?

Last year we had a cracker, our biggest year ever. As well as helping thousands of people secure loans, we increased Madd’s brand presence. We were involved in home shows, we were a major sponsor of the Paniyiri Festival, we are everywhere in Brisbane at the moment – on the radio, on billboards, on YouTube where we’re getting some pretty good traction. We even upgraded our website. Last year was hectic.

On top of that, we managed to fit in a 500-person charity ball (the inaugural Madd Ball) where we raised $125,000 for the Children’s Hospital Foundation and gave away a car. The theme was ‘A Night in Greece’ and we turned the convention centre into Mykonos for the night. It was a great success. It’s an amazing feeling when you work out why you’re put on this planet, and I reckon giving back is a big part of why I’m here.

What can we expect from Madd in 2023?

This year will see significant growth for Madd Loans. We have about 20 staff operating out of our office

34 Broker Magazine

“If you want to really run as a broker, you need to be with a company that is running as well.”

HQ. We put on two more in January, and we’re looking to hire another six in February. In March, we will welcome a business banker to our team –she’s actually the best business banker I’ve met. This will allow us to open into commercial lending and business banking, which follows from what we already do which is mortgage broking and financial planning.

I’m a big believer in looking after people. My goal is for Madd Loans to be the biggest brokers in the country by having the happiest staff. Happy staff lead to happy clients, Happy clients lead to referrals.

We will also move from our 300-square-metre office into a 1000-square-metre office.

As part of our growth strategy in 2023, I am currently looking to acquire existing brokerages, so if you are looking to retire and want to sell to a mortgage broker who is proactive and will give your clients exceptional service, please get in touch.

What is the single most relevant piece of advice you would give to brokers wanting to grow their business this year?

Before you make any decision, you need to ask yourself, ‘What do I want?’ What is my version of winning?’ For me, my version of winning is having a

company which employs a hundred people and helps thousands of people.

In order for me to get to that, I use the philosophy of kaizen, which is continuous improvement through changes. Through this we are forever getting better at the way we do business, making everything we do client-centric, trying to make it easier for our clients to buy property. We are completely proactive in the way that we do business with our clients. We show them opportunity, we tell them when they have enough equity to buy again, we tell them when there’s a better rate for them, it’s automatic in our business.

You may come to broking because you want to be a lifestyle broker, write a few loans a month and play golf. But if you want to really run as a broker, you need to be with a company that is running as well. My advice is to work under a brand that is innovating, always getting better – kaizen.

If you are motivated, come join us at Madd. We’re always looking for good people, and you can be based anywhere in Australia.

36 Broker Magazine

Claim amount: $47,741

Claim reason: Bowel Cancer

“If we didn’t have the insurance in place, it would have been a lot tougher. There would have

been a lot less money and a lot more stress. It absolutely saved

us”.

Sea, 44 - Tasmania

HELP PROTECT YOUR CLIENTS’ HOMES, LIFESTYLES AND FUTURES. BECOME AN ALI GROUP AUTHORISED BROKER. *The current My Protection Plan has been available since 5 April 2021. The above is an example of a customer claim paid on a similar product distributed by Australian Life Insurance Distribution Pty Ltd ABN 31 103 157 811 AFSL 226403. Any advice provided is general in nature and does not take into consideration personal objectives, financial situation and needs. Consumers should consider these and the information in the Product Disclosure Statement (available along with the Target Market Determination, from www.aligroup.com.au) or speak to a financial advisor before making a decision about the suitability of the product. (c) ALI Group January 2023. WATCH SEA’S STORY HERE

What's on At

38 Broker Magazine

Feb 9

NETSTRIPES WEBINAR

Prospective clients are nearly always online and on the go – and you want your business to be top of mind for them. But when you’re trying to grow a brokering business, this ever-changing digital landscape can quickly become an overwhelming one.

Join this exclusive webinar as netStripes CEO Dinesh De Silva shares his knowledge on building a customised digital strategy, developing a brand, and how to get your digital marketing on autopilot.

Click the register now button to see and register for upcoming netStripes webinars.

Fine-tune your Business Strategy for Digital Success

Feb16

NETSTRIPES WEBINARS

In our first Insights webinar for the year, netStripes founder and CEO Dinesh De Silva shares his thoughts on the digital trends taking over 2023 that business owners need to keep an eye on.

Join our discussion as we dive deep into advertising, SEO and video marketing to cyber security and new services to help your business stand out as an innovative leader in your industry.

Click the register now button to see and register for upcoming netStripes webinars.

Digital Trends for Small Business

39 Broker Magazine

REGISTER NOW REGISTER NOW

MARCH 8

NETSTRIPES WEBINARS

Great marketing on social media can bring remarkable results to your business, create brand awareness and even drive leads and sales.

Join us as we delve into why some businesses aren’t getting leads, how to optimise advertising, and how to create a system that delivers consistent results for your business.

Click the register now button to see and register for upcoming netStripes webinars.

MARCH 8

INTERNATIONAL WOMEN’S DAY

Welcome to our first official FBAA event in 2023! International Women’s Day is a global day on Wednesday March 8 celebrating the social, economic, cultural, and political achievements of women. It also raises awareness about discrimination and taking action to drive gender parity.

So SAVE THE DATE and join us in the beautiful surrounds of Centennial Park. Details to follow...

Click the register now button to register.

How to Use Social Media Marketing to Grow Your Brokering Business International

REGISTER NOW

Day

REGISTER NOW

40 Broker Magazine

EMBRACE

EQUITY INTERNATIONAL Women’s

APRIL 27

NETSTRIPES WEBINARS

In today’s online world, having a customised website strategy is essential for carving out a niche online that lets you stand apart from your competition, and get in front of your ideal customers.

Join us as we discuss modern-day buying behaviour, digital marketing platforms, and how to customise strategies for businesses in the finance industry.

Click the register now button to see and register for upcoming netStripes webinars.

Website Strategies

That Win High Value Clients

NOW

REGISTER

Helping mentors inspire & challenge the next Generation of brokers

As a Mentor:

The FBAA Mentoring Program will provide you with the necessary tools to ensure the mentee achieves the skills and knowledge to be a competent and responsible finance broker.

As a Mentee:

The FBAA Mentoring Program will enhance your skills and provide specific knowledge and tools to help you excel as a finance and mortgage broker.

MENTORING PROGRAM

Learn More ONLINE PLATFORM Now Available 42 Broker Magazine

STATE PRESIDENTS 2023

Western Australia - State President

Nu-Age Vehicle & Asset Finance

Mobile: 0407 236 337

Email: wa@fbaa.com.au

South Australia & Northern Territory - State President

Nieuvision Financial Planning Mobile: 0402 201 510

Email: sa@fbaa.com.au

Victoria & Tasmania - State President

Opica Group Mobile: 0412 497 110

Email: vic@fbaa.com.au

Queensland - State President

Mortgage Now Mobile: 0414 628 111

Email: qld@fbaa.com.au

New South Wales & Australian Capital Territory - State President

Mortgage Rate Finder Mobile: 0450 573 336

Email: nsw@fbaa.com.au

Would you like more information on an FBAA event or PD Day thats happening in your local area? Maybe you have some feedback or an issue you would like to discuss?

Finance Brokers Association of Australia

Level 1, 1 Miles Platting Road, Eight Mile Plains QLD 4113

Post: PO Box 4792, Eight Mile Plains QLD 4113 Phone: (07) 3847 8119 / Email: info@fbaa.com.au / Web: www.fbaa.com.au

Jill Fleck

Kym Russell

Paul Biddle

Brett Spencer

Graham Doessel

43 Broker Magazine

44 Broker Magazine

Tony Carter

Chair | Director

Cert IV Finance, Graduate Management Qualification (GMQ) – UWA

Tony Carter has been involved with the motor and finance industry for more than 40 years. The last 20 years he has been Dealer Principal and Director of three motor dealerships. He has been engaged with finance since his early career days at AGC and was a licensed finance broker in WA from 2004 to 2013, ending as an ACL holder when he resigned from the motor dealership position. Today, Tony holds a credit representative role under his son’s company and runs his own vehicle and finance brokerage in WA.

Over the past 20 years Tony has been on three not-for-profit boards; BIZLINK (Chairman), Asthma Foundation WA (Chairman), and Asthma Australia (Director).

Special Responsibilities

Chair of the FBAA Board of Directors | Member of Finance, Audit Investment and Remuneration Committee | Member of Governance and Risk Committee | Chair of Nomination and Membership Committee | Member of Education Development Committee

| Leader of State President Liaison Advisory Group | Member of Concierge Advisory Forum

Principal Broker Brokerage WA

Phone: 0418 911 220

Email: tcarter@fbaa.com.au

Peter White AM

Managing Director | FBAA Life Member MAICD

Peter White AM has vast experience in banking and finance, spanning more than four decades. He is highly engaged with government and industry regulators, ensuring and protecting the future of our industry and dealing with regulatory matters of the day.

Peter’s activities with FBAA include representation on the Advisory Board of the Small Business Association of Australia, as Chairman of the Global Board of Governors for the International Mortgage Brokers Federation (IMBF), and the industry’s passionate advocate for mental health awareness. Peter was awarded as a Member of the Order of Australia (AM) in the June 2019 Queen’s Birthday Honours List, for his significant service to the finance sector and to the community.

Special Responsibilities

Government, media and strategy | Leader of Concierge Advisory Forum | Leader of Combined Industry Forum | Leader of International Mortgage Brokers Federation

| Leader of Education Platform Steering Committee | Member of Finance, Audit, Investment and Remuneration Committee | Member of Governance and Risk Committee

| Member of Nomination and Membership Committee | Member of Education Development Committee | Member of State Presidents Liaison Advisory Group | Member of Equity Release Advisory Forum

Phone: (07) 3847 8119 Email: pwhite@fbaa.com.au

KIM SZIGETI

Company Secretary | Director

JJP (Qual), DipFS, AFB, MAICD, GIA (Affiliated)

Kim Szigeti has vast experience in finance and mortgage broking, spanning more than 25 years. Kim joined FBAA in 2005, was Secretary to the Queensland Council from 2007 to 2009 and was elected to the Board in 2017. She was appointed to the position of Company Secretary in 2017.

Kim is a member of the Australian Institute of Company Directors and the Governance Institute. Over the years Kim has been involved in numerous volunteer positions within the community as Chairperson, Coordinator and Secretary to secure donations and organise events.

Special Responsibilities

Chair of Governance and Risk Committee | Chair of Education Development Committee | Member of Nominations and Membership Committee | Member of Education Platform Committee

Mortgages Can Do Phone: (07) 5592 2635

Email: kszigeti@fbaa.com.au

STEPHEN RASMUSSEN

Treasurer | Director | FBAA Life Member

B.Com (Prof Acct), Cert IV (FMB),CPFB, MAICD, FBAA Life Member

Stephen Rasmussen has been involved in the finance and banking industry for more than 40 years. He started in a branch environment, acquiring broad lending experience across retail and SME sectors, before starting his own broking business in 1995. Stephen joined FBAA as a member in 2000, was appointed Queensland and Northern Territory State President in 2009 and was elected to the Board as a Director in 2016.

Special Responsibilities

Finance, Audit, Investment and Renumeration Committee | Leader of Equity Release Industry Advisory Committee | Member of Governance and Risk Committee | Member of Combined Industry Forum

Principal Tailored Lending Concepts

Mobile: 0412 295 875

Phone: (07) 4637 0836

Email: srasmussen@fbaa.com.au

46 Broker Magazine

Director

BEc, MBA, GAICD, Grad Dip FP, Grad Dip App Finance & Investment

Clive Kirkpatrick is a successful executive with more than 30 years’ experience in banking and financial services both in Australia and offshore. He is experienced in strategy formulation and execution, business management, sales management and people leadership. Clive’s generalist background and sound understanding of marketing, product development, legal and compliance is supported by an MBA (Master of Business Administration). Clive has developed governance and directorship skills through GAICD and memberships and has a specialist knowledge and demonstrable capability in distribution.

Special Responsibilities

Member of Finance, Audit, Investment, Remuneration Committee | Member of Governance and Risk Committee | Member of Dispute Resolution Service | Member of Concierge Advisory Group

Director

Kircon PTY LTD

Mobile: 0439 564 885

Email: ckirkpatrick@fbaa.com.au

DipFMB, DipBA

Felicity Heffernan has been a business owner for 22 years, and run her own mortgage brokerage since 2007. Based in Newcastle, NSW, she is also the author of two books and speaks publicly on assisting people who want financial freedom. Felicity has served on the FBAA NSW State Council and as past NSW State President. She holds a strong advocacy position for the improvement of financial competencies to be lifted in Australia.

Special Responsibilities

Member of Dispute Resolution Service | Member of Nomination and Membership Committee | Member of State Presidents Liaison Advisory Group

CEO Property Loan Advisor

Mobile: 0417 024 300

Email: fhefferman@fbaa.com.au

Clive Kirkpatrick

Felicity Heffernan Director

47 Broker Magazine

An experienced board director, Barry is a Chartered Accountant whose roles have included chairing HBF Health, Bethanie Group and Bethanie Housing as well as Churches of Christ in WA. He was a board member with Plan B Group Holdings Limited, Plan B Trustees Ltd, HBF Health, HBF Insurance, Westcare, together with various committees of the Uniting Church in Australia and major not-for-profit sports associations. Formerly the Partner in Charge of the Corporate Recovery Division of KPMG in Perth, Barry is presently a partner at Chartered Accountants, Honey & Honey. Barry brings a high level of governance and financial analytical skills as well as expertise in the oversight of undertakings in a ‘for-purpose’ environment.

Special Responsibilities

Member of Governance & Risk Committee

Honey & Honey, Chartered Accountants

Phone: (08) 9382 3902

Email: bhoney@fbaa.com.au

Nick Wormald is a certified mortgage finance professional and business finance specialist, working with Australia’s up and coming entrepreneurs to unlock growth with the right application of finance. Based in Sydney, Nick is a speaker, author and youth mentor.

Accumulating over 22 years experience in business investment, business strategy and management, Nick currently leads a team of finance professionals in his own business. Nick has served on the FBAA NSW State Council and as past NSW State President.

Special Responsibilities

Member of Dispute Resolution Service

Grow Capital Mobile: 0488 810 555

Email: nwormald@fbaa.com.au

Barry Honey Director

Nick Wormald Director

Barry Honey Director

Nick Wormald Director

Christine Green has an extensive background in banking and finance with more than 20 years’ experience. Christine is a skilled business development manager, coach and mentor with a wealth of knowledge in both consumer and business lending.

Christine has served on the FBAA QLD State Council and is a former QLD State President. Christine encourages increased education and

Get finance against your trail income

One product with a simple goalto unlock the potential of your trail income without the need for a second mortgage.

Christine Green Director

Christine Green Director

www.TrailBookLoans.com.au

Celebrating ANNIVERSARY Years

By Dinesh De Silva - CEO of netStripes,

By Dinesh De Silva - CEO of netStripes,

Barry Honey Director

Nick Wormald Director

Barry Honey Director

Nick Wormald Director