Stain removal matters to your customers. But which stain removers perform best in today’s green environment? Wherever you live, California's environmental regs can guide you around future remediation nightmares – and to Wilson spotters. They’re VOC & Prop-65 compliant, chlorinated-solvent free, biodegradable and noncombustible, and they’ll deliver the stain free garments your customers desire!

Replace VDS with EasyGo® spray spotter. It quickly penetrates to absorb collar & cuff stains, perspiration, ground-in soil and more, all without brushing.

Replace traditional POGs with TarGo® EF. It removes tough oil based stains that remain behind.

Embrace your green future with these trusted Wilson stain removers. You'll build your reputation for quality – and keep your customers coming back.

To learn more, visit ALWilson.com or call 800-526-1188 A. L. WILSON CHEMICAL CO. Become a STAIN WIZARD at ALWilson.com

For GreenEarth,® use ||G|| Go®

“The support from CBS was great. Even before we signed up, they were responsive and flexible in their approach. They have helped our team become more efficient.”

“We’re moving faster. We’re moving better. We’re moving more efficiently. That means profitability”

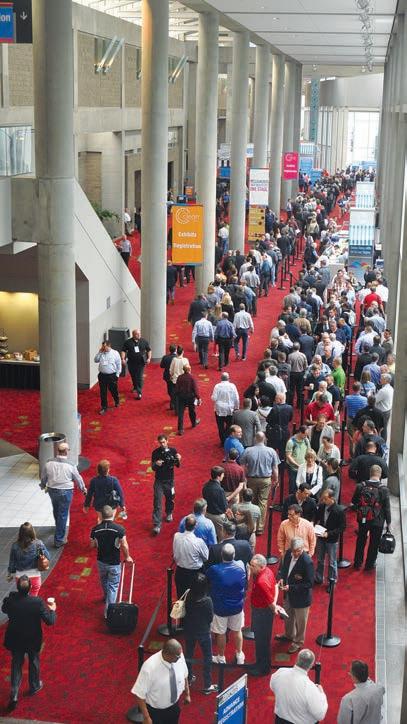

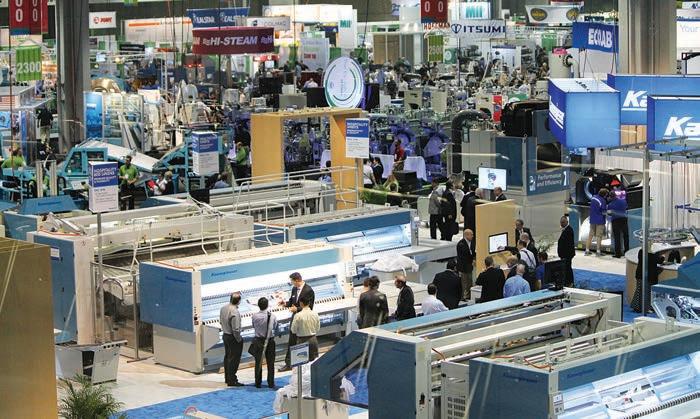

The “success” of Clean 2015 in Atlanta is certainly open to interpretation, whether an attendee or an exhibitor. Many times, it can be months or even years before a connection made on a chaotic show floor bears fruit, especially where an expensive piece of equipment is concerned.

But if you look at the key metrics from Atlanta and nothing else, the story they tell is extremely positive.

and greet guests. In the Georgia World Congress Center, they swallowed up 195,400 net square feet. Spread out in Hall B, I can attest that the show floor was big

When the first-day attendance topped 11,000 and reportedly exceeded that of the entire three-day show in New Orleans two years ago, sponsors and organizers had to have breathed easier.

Outside the numbers, we frequently heard reports from exhibitors taxed to keep up with the activity in and around their booths, at least during the first two days.

In the months leading up to Clean 2015, I watched the number of exhibitors surpass 300, then 350, then 400. I knew that was a good sign going in. The total ended up being 437, a figure that reminds me of Clean Shows before the Great Recession.

All those exhibitors need space to set up their wares

Publisher

Charles Thompson 312-361-1680 cthompson@ATMags.com

Editorial Director

Bruce Beggs 312-361-1683 bbeggs@ATMags.com

Production Manager

Roger Napiwocki

National Sales Director

Donald Feinstein 312-361-1682 dfeinstein@ATMags.com

Digital Media Director

Nathan Frerichs 312-361-1681 nfrerichs@ATMags.com

Main: 312-361-1700 Fax: 312-361-1685

There were a lot of unknowns for a Clean Show going back to Atlanta after 28 years. Short of polling each and every attendee, there’s no way to know if it was Atlanta, the Clean Show, or both that elicited this kind of response.

Whatever the reasons, the show’s strong performance means the industry will be returning to Atlanta six years from now. ADC

American Drycleaner (ISSN 0002-8258) is published monthly except Nov/Dec combined. Subscription prices, payment in advance: U.S., 1 year $39.00; 2 years $73.00. Foreign, 1 year $89.00; 2 years $166.00. Single copies $7.00 for U.S., $14.00 for all other countries. Published by American Trade Magazines LLC, 566 West Lake Street, Suite 420, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Drycleaner, Subscription Dept., 440 Quadrangle Drive, Suite E, Bolingbrook, IL 60440. Volume 82, number 2. Editorial, executive and advertising offices are at 566 West Lake Street, Suite 420, Chicago, IL 60661. Charles Thompson, President and Publisher. American Drycleaner is distributed selectively to: qualified dry cleaning plants and distributors in the United States. The publisher reserves the right to reject any advertising for any reason. © Copyright AMERICAN TRADE MAGAZINES LLC, 2015. Printed in U.S.A. No part of this publication may be transmitted or reproduced in any form, electronic or mechanical, without written permission from the publisher or his representative. American Drycleaner does not endorse, recommend or guarantee any article, product, service or information found within. Opinions expressed are those of the writers and do not necessarily reflect the views of American Drycleaner or its staff. While precautions have been taken to ensure the accuracy of the magazine’s contents at time of publication, neither the editors, publishers nor its agents can accept responsibility for damages or injury which may arise therefrom.

American Drycleaner, May 2015

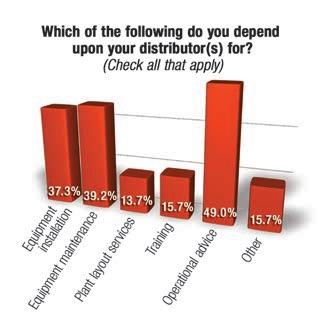

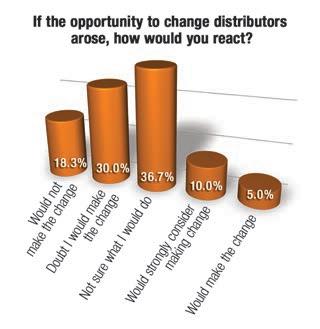

Approximately 77% of dry cleaners polled in April’s American Drycleaner Your Views survey are satisfied with their distributors, results show. Among those who are satisfied, 32.3% say they’re “very satisfied” and 45.2% say they’re “somewhat satisfied.”

Approximately 21% of respondents are “neither satisfied nor dissatisfied,” while 1.6% of respondents are “somewhat dissatisfied.” No one who took the unscientific survey reported they are “very dissatisfied.”

Distributors offer a wide variety of services for dry cleaners, so the survey asked subscribers which of the services they depend on (respondents could choose any or all from six choices). Results were mixed: operational advice was No. 1 at 49.0%, followed closely by equipment maintenance at 39.2% and equipment installation at 37.3%. Training (15.7%), “other” (15.7%) and plant layout services (13.7%) were the other choices offered.

When asked if they could get their distributor(s) to improve some aspect of their services, respondents mentioned things such as customer service, pricing, response time and inventory.

One respondent noted that “most reps have a large service area and do not have additional time to provide additional services.”

If the opportunity to change distributors arose, 18.3% “would not make the change” and 30% “doubt [they] would make the change.” Roughly 37% aren’t sure what they would do. Ten percent would “strongly consider making the change,” and 5% “would make a change.”

More than two-thirds of respondents are “very interested” (21.0%) or “somewhat interested” (48.4%) in attending open houses, service schools, etc., offered by distributors Approximately 9.7% are “neither interested nor disinterested,” 6.5% “have little interest,” and 14.5% “have no interest.”

While the Your Views survey presents a snapshot of readers’ viewpoints at a particular moment, it should not be considered scientific. Percentages may not add up to 100% due to rounding.

Subscribers to American Drycleaner e-mails are invited each month to take a brief industry survey they can complete anonymously. The entire trade audience is en-

couraged to participate, as a greater number of responses will help to better define owner/operator opinions and industry trends.

North Carolina Association of Launderers and Cleaners. Annual Convention, to be held May 23-25 in Wrightsville Beach, N.C. Call 704689-1301.

Ontario Fabricare Association. 2015 Conference, to be held June 5-6 in Port Credit, Ontario. Call 416-573-1929 or visit www.fabricare. org.

Rocky Mountain Fabricare Association. Dry Cleaning Alternatives Industry Trade Fair (co-sponsored by the Colorado Department of Health and Environment), to be held June 14 in Denver. Attendee info: call 303-692-3175. Vendor info: call 303-810-3508.

Wisconsin Fabricare Institute. State Conference and Fitzgerald Scholarship Golf Outing, to be held June 23-24 in Mequon, Wis. Call 414529-4722.

Textile Care Allied Trades Association. Annual Conference, to be held July 29-Aug. 1 in Napa, Calif. Call 973-244-1790.

Midwest Drycleaning and Laundry Association. Annual Convention, to be held Aug. 7-9 in French Lick, Ind. Call 765-939-6630.

Textile Rental Services Association. Annual Conference, to be held Sept. 9-11 in Isle of Palms, S.C. Call 877-770-9274.

International Drycleaners Congress. 2015 Convention, to be held Sept. 14-15 in Osaka, Japan. Call 403-685-4755.

Independent Textile Rental Association. 2015 Annual Convention, to be held Sept. 27-29 in San Diego. Call 706-637-6552.

Texcare Asia: International Trade Fair for Modern Textile Care. To be held Nov. 25-27 in Shanghai, China. Visit www.texcare-asia.com.

Topstories@www.AmericanDrycleaner.com forthe30daysendingApril15

Top News sTories 1. SBA Introduces New Online Lending Tool 2. Dry Cleaning Alternatives Fair Planned in Denver 3. New Small-Business Guide Features Brooklyn Dry Cleaner 4. Zengeler Cleaners Begins Build-out at New Chicagoland Store 5. Lapels ... Eyes International Expansion

Top columNs & feATures 1. What New Union Election Rules Mean for You 2. How to Craft a World-Class Customer Experience 3. Quiet: Class in Session 4. StatShot: February Drycleaning Sales Up in Much of Country Web eXCLUSIVe! 5. Primer on Protein, Tips for Tannin

Top sTories @ our sisTer siTes www.Americancoinop.com: 1. Educational Sessions Open to All Clean Show Attendees 2. Laundry City Serves Up ‘Five-Star’ Laundry Space 3. Atlas of Atlanta www.AmericanlaundryNews.com: 1. How to Thrive in Growing Long-Term-Care Market 2. Career Track: Industry Businesses Welcome New Personnel, Announce Promotion 3. Morning, Afternoon Educational Sessions Open to All Clean Attendees

American Drycleaner, May 2015 www.americandrycleaner.com

Are you facing the dilemma of how to most efficiently grow your business? Do you want more sales but don’t want to invest in additional locations? Do you want to minimize the risk of expanding your geographical coverage? If these challenges apply to you and you are not already in the route business, consider it. If you are already in the route business, the same considerations apply to expansionary deliberations.

Depending on a dry cleaner’s success at negotiating tenant improvements with its lease, a new physical location can involve significant expense. Small businesses have a distinct disadvantage in negotiating with

landlords on the price per foot, on the amount of footage leased, and on the various other “non-standard” items that can be negotiated by large tenants. Since the large tenants that drive traffic to centers must be wooed into the location with major concessions (in some cases, they are actually paid to open their stores, and have negative rent), the small tenants are the source of profitable operations for the landlord.

Between the security on the lease, the store design, the build-out and fixture costs, the promotional efforts, and the time the owners and team are diverted from the core business, a new store opening can be extremely expensive. That expense is just the beginning, because the counter must be staffed with well-trained customer sales reps for the full posted business hours.

Additionally, the ongoing expense of the lease, the common area maintenance (CAM) fees, the phone, security, computer, the supplies and the myriad other expenses that arise must be funded out of pocket until the store becomes a profitable enterprise, assuming that it ever does become profitable.

By comparison, the start-up costs on a route, although substantial, are

Our new generation of Point Of Sale system is designed for both small and larger cleaner stores. DryClean PRO Enterprise (DCPe) is even simpler to use than before. With user friendly screens and menus, DCPe will make your life easy. We offer, promise, and guarantee the best after sales support to our end users. Save time and money and add to your profits by contacting existing clients and reaching out to new clients through DryClean PRO Enterprise’s built in MARKETING and EMAILING functionality. You’ll be able to send Thank You emails to new or Top 100 customers, Customers with overdue inventory, Customers that have not visited you for awhile, Route customers & e-mail coupons to all your customers.

Call us about our new version of Uniform Tracker.

Ask us about our DCPe RENTAL

more controllable, and with the exception of the investment in a vehicle, need be funded only as the route business grows.

For example, the single largest expense in the drycleaning business is labor. Whereas a store must be staffed continuously or must be fitted with a 24/7 kiosk, a new route can be staffed by a part-time driver whose hours devoted to the route can grow with the sales volume. The vehicle expense can be reduced by using the shuttle van initially until the sales warrant another van.

Another benefit of routes is there is no old inventory— orders are continually delivered upon completion.

Unlike a store, if the research on the location is incorrect and the sales do not materialize as planned, a route can be easily moved to a new neighborhood. The geography can be tested and tweaked with minimal expense and no physical-store-lease obligation. As the route gains momentum, adjacent area can be added and the promotional efforts can snowball with the van and service gaining visibility driving to and from the targeted district.

Route service (either to residential developments or to businesses) eliminates the necessity to match customerpreferred hours. The more flexible the route alternatives, the broader the customer appeal, but a cleaner must acknowledge that flexibility also adds expense. For example, “on-call” customers are more expensive to service than clients on a standard, pre-set route schedule.

The most difficult and the most profitable aspects of the route business are the same: The key is sales. Many owners who “couldn’t find the right salesman” have rejected or abandoned the pickup and delivery concept.

The best sales solution is probably not full-time and probably not a single individual. Some of the most successful route salespeople are part-time and/or work in teams.

Part-timers are more likely to work on a pay-per-performance basis as well because they have other sources

of primary income. This is critical to minimizing the risk of a new route service venture.

Also, part-time teams are more likely to be willing to match their sales effort timing to the most appropriate access to prospects, which is often evenings and weekends for residences.

The easiest route sale is the conversion of existing “counter customers.” It is essential to recognize that, historically, “taking customers off the counter”:

1. has not reduced the sales in the given store; 2. has often dramatically increased the sales to that same customer;

3. has been resisted by the counter staff, so those employees may need a commission to convert “their” customers.

Although there may be disagreement on this point, experience has shown that the best sales people are needed to sell the route and the best route servicers are needed to maintain the business and retain happy customers. Psychological research will show that these two personality types differ greatly. The almost diametrically opposed traits of these two groups, and the consistency of observation of their success, suggests that the two functions should be separated.

That is not to say that one unique person is incapable of both skills, but the separation has been more consistently successful in drycleaning operations studied.

A dry cleaner, using standard psychological testing, may wish to test its top sales people and its top service people and compare the results. Using this information, the business can then try to “clone” the best when hiring for either position.

Another commonly held belief is that the route person must be male. But there are certainly successful routes being sold and/or serviced by women. One reason may be that people are less reluctant to allow them into their homes to make a sales presentation or to service the account.

If a dry cleaner is just beginning with

routes, the business is more likely to reach critical mass sooner with a sales blitz that reaches many prospects in a short period of time. If the cleaner is expanding an existing route base, organic growth may be the more profitable path to pursue.

A sales blitz, particularly in residential areas, can be highly effective and provide support and competition within the sales team. It also allows for more flexibility in blanketing a neighborhood more thoroughly during the few hours that prospects are home. Individuals are better suited to business-to-business sales.

Some companies have instituted route programs that require a minimum per month to subscribe to the service to ensure that the customer will be profitable. Most use the pay-per-service approach. Almost all require a credit card on file for new customers and have also converted their “legacy” house accounts to credit card on file.

Since route customers are rarely at home or have time to chat to route personnel, cross-selling efforts must be handled remotely using hang tags and electronic communication, including e-mails, texts and newsletters.

The traditional approach to routes of two days per week per route has historically resulted in substantial swings in production during the week, so scheduling must be done accordingly to maintain productivity and profitability goals.

The plant must also accommodate storage for the finished work awaiting delivery. This is not difficult for most plants. For operations where space is tight, vertical storage/distribution towers can be an alternative.

The route concept still has limitations or requirements that are hurdles for some customers. Fear of leaving their orders accessible and/or in public view is a key obstacle for some prospects, although this may be overcome by implementing a disciplined day-and-time schedule.

A more challenging obstacle is the inability of the prospect to meet the prescribed route schedule due to their other obligations or irregular travel. It will be important to listen to the objections and determine if they can be overcome. If the hurdles are too daunting to clear, moving on to the next prospect may be prudent.

Both residential routes and business routes can be highly profitable.

Businesses require a more sophisticated professional sales approach. Because they have higher turnover, the management and retention of these accounts are critical.

Residential routes tend to be more stable once they are established, evidence has shown.

Likewise, single-family residences and multi-unit residential developments can both be profitable. Again, the multi-units tend to have more turnover, even if they are condos vs. apartments. Concierge buildings historically have had less turnover than other multi-units.

To keep the staff and customers informed, and to minimize customer complaints, utilizing an efficient point-ofsale (POS) system with both piece- and order-tracking capabilities is essential.

Route customers are usually extremely busy and are quite happy to have the cleaner of choice handle their wardrobe care chores. They also need reliable communication if they have special requests or issues. Ensure that they are able to reach an informed staff member when necessary, and that they need not be transferred to someone other than the person who answered the phone. If the communication is electronic, ensure that it is monitored continually so there will be a prompt response.

Although routes have a unique set of challenges distinct from other distribution channels in a drycleaning business, they can be a flexible way to grow both sales and profit simultaneously. ADC

Diana Vollmer is managing director of Methods for Man agement (MfM), a consulting firm that has served the dry cleaning and laundry industry with affordable management expertise and improved profitability since 1953. She can be reached at dvollmer@mfmi.com, 415-577-6544.

“Route customers are usually extremely busy and are quite happy to have the cleaner of choice handle their wardrobe care chores.”

Irecently saw an online Coca-Cola® ad that caught my attention. It pitches that buying a can of Coca-Cola is good as a motivator. The video shows a montage of people taking their turn on a giant stationary bicycle happily trying to earn a can. The presumption is that ordinarily one wouldn’t be motivated to exercise unless there was an offer of Coca-Cola as a reward. The voiceover says that a can of Coke® contains 140 calories that is consumed by 23 minutes of cycling. Cycle for 23 minutes and treat yourself to a Coke.

The ad may be engaging, but the logic is faulty. Or, at best, reaching. Clearly, it is better to not have a Coke, and reduce calorie intake than to treat yourself to a drink after exercising and nullify the caloric benefit of the workout.

Worse is that the soft drinks are bad calories, in that there is a large sugar content. Says Michele Simon, a public health lawyer and author of Appetite for Profit: How the Food Industry Undermines our Health and How to Fight Back: “It’s so clever on so many levels, but it’s twisted, too.”

Twisted, but effective. Coca-Cola marketing executives are happy with results. Ad viewers are making the emotional connection that they would exercise more if they treated themselves to a soft drink afterward. They take the logic to heart. The result: higher Coke sales.

So possibly we can learn from Coke. If the maker can say drinking Coke is good because it encourages you to exercise, dry cleaners can say drycleaned garments make a customer feel better: Because the drycleaning process adds body and form to outfits so that they fit better, you look better. As a result, you are more comfortable, confident and secure. In other words, regular dry cleaning makes you feel good about yourself.

Clearly, this benefit is reaching a bit, but no more than

To find past columns from Howard Scott or share this month’s with your colleagues, visit www.AmericanDrycleaner.com.

the Coca-Cola boast. So why not try a new approach to your marketing? Focus on the “feel-goodness” and egoboosting of dry cleaning.

Consider this ad message: Feel great in drycleaned clothes. There is something about drycleaned outfits that makes you feel like a million bucks. Just ask customer Mel: “When I put on my drycleaned business suit, I feel I can close any deal I set my mind on. I radiate confidence.”

Here are some other examples:

• Sarah is a customer who regularly dry-cleans all her clothes with us. “There’s something about a freshly drycleaned outfit that gives me confidence and comfort. I love to be out and about. It does wonders for my self-esteem.”

• Is he or is he not wearing drycleaned clothes? Yes, he is. I can tell by the crisp crease lines, the fullbodied look, the bright colors, and the well-formed

collar. He looks good, and it shows. He’s willing to spend a few extra bucks on his clothes, and it reflects in his confident manner.

• Women who care enough to look their very best make sure their clothes are drycleaned. Their dresses contour the body. The ruffles sway in perfect symmetry. The buttons are smartly set. The blouse material is so crisp. Ooh la la—today’s women of the world are so…so…je ne sais quoi

• He looks like he was a military man. So straight, so tall, so authoritative. That suit fits him perfectly. The pale blue shirt is so soft, the tornado red tie so compel ling. What an ensemble! No wonder his 7-year-old suit still looks perfect—He regularly drycleans it. Do you treat your clothes to such care?

“Make the connection that drycleaning your clothes is an ego boost.”

• If you spend good money on your clothes, you should be willing to keep them fresh and groomed through regular dry cleaning. Nothing keeps clothes looking new like dry cleaning. Plus, they last longer because you care more about them. So even on a dollars-and-cents basis, dry cleaning pays.

Each ad would be headed by an appropriate headline, such as “Feel great in drycleaned outfits,” “Feel like a million bucks,” or “You look better drycleaned.” Underneath the ad goes a photograph of an attractive person who is dressed to kill. In the body of the ad, provide copy to accompany the photo, possibly something like the suggestions I’ve shared.

Make the connection that drycleaning your clothes is an ego boost. If there is space, provide three reasons for choosing your shop, such as:

• Convenient hours

• Open seven days a week

• Been in business 50 years

• Five convenient locations

• Pickup and delivery service

• The most advanced, sophisticated stain-removal service in the region

• Same-day service

Such an ad focus can be used on brochures, e-mail promotions, mailings, or online videos, whatever marketing approaches you are involved in. The main point is that dry cleaning not only cleans your clothes, it restores them so that they look new, look better and, in effect, make you look better. This in turn boosts your confidence and makes you happier.

Who would have thought that dry cleaning makes you happy? Well, now it does. Every time the customer takes garments to the dry cleaner, she will be spending money. But it will be worth it because it will make her feel better. So, dry cleaning is a feel-good proposition.

Consider a billboard with an advertisement for your business. It could feature an attractive man and woman, smiling confidently, with the headline: Dry Cleaning Makes You Feel Great About Yourself. It’s a bold statement, and possibly a leap, but no bigger than the Coke ad.

Consider other ways to promote your new message. When your counterperson hands out orders, she might say, “Your clothes will look so perfect on you, you’ll feel like a million bucks,” or “Nothing like freshly cleaned clothes to make you feel great.” Such an enigmatic comment might be a little puzzling at first, but over time the customer will pick up on the idea that drycleaned clothes make one feel good.

I wrote this column to get you thinking expansively about promotional efforts. The Coke campaign shows

Drycleaner,

that you can make extravagant boasts. To be sure, there’s some level of truth to the claim that wearing drycleaned clothes makes one feel better about them selves and is ego-boosting. So, be bold in your market ing approach.

Promote the intangible benefits. Consider an emotional appeal that will entice your customer. Anything else— price; pickup and delivery; high quality; convenient hours and locations—are time-worn offers. A visceral response is what you’re after.

If Coca-Cola can do it, so can you. ADC

Howard Scott is a longtime industry writer and drycleaning consultant, and an H&R Block tax preparer specializing in small businesses. He welcomes questions and comments, and can be reached by writing Howard Scott, Dancing Hill, Pembroke, MA 02359, by calling 781-293-9027 or via e-mail at dancinghill@gmail.com.

It had been 28 years since the Clean Show last convened in Atlanta.

Riddle & Associates, the Atlanta-based show management firm that has overseen Clean since 1993 yet never organized one in its home city, embraced a promotional effort based on the theme of “One Industry. One Stage.”

The Clean Executive Committee, comprised of execs from five sponsoring associations, had worked hard to promote the show to its member launderers, dry cleaners and business owners, as well as the industry at large.

When the dozen hotels offering discounted rates to Clean attendees filled, overflow properties were added.

And with the number of exhibitors reaching 437 by showtime, it was clear that the industry’s vendors were banking on the Atlanta show to generate leads and help them make sales.

On April 16, Brian Wallace, president and CEO of the Coin Laundry Association (CLA), and chair of Clean 2015, clipped the ceremonial ribbon inside the Georgia World Congress Center. The show was open to the public.

The exhibition was busy from the start—and largely stayed that way throughout the first two days of the fourday event. Exhibitors swapped tales of not having time to eat lunch or take a bathroom break because there was always someone else they needed to speak with.

Clean execs called a press conference on the afternoon of the second day and announced that, because the show had already met “certain performance targets” related to attendance and exhibit sales (the latter was announced after the show as 195,400 net square feet), Clean will be returning to Atlanta in 2021 (Las Vegas in 2017 and New Orleans in 2019 are the stops beforehand).

On the morning of the show’s final day, John Riddle, president of Riddle & Associates, told a group of exhibitors that unofficial attendance had topped 11,000 and that the opening day’s attendance exceeded the total attendance of 2013’s three-day show in New Orleans.

“It’s nice to throw a party and have people attend,” says Wallace.

Official attendance figures weren’t available by press time, but Riddle & Associates announced an unaudited total of 11,264 a week after the show ended.

Besides visiting the exhibits, attendees had the opportunity to attend any of more than 30 educational sessions covering a variety of topics. Those sponsored by the Drycleaning & Laundry Institute (DLI) dealt with customer service, selling to the Millennial Generation, boiler operations, fluff-and-fold services, and more. Most presentations were conducted in rooms away from the exhibit

hall, but a handful took place on the show floor itself.

Rain dampened outdoor activities throughout the four days but didn’t stop several companies and trade associations from hosting after-hours parties at venues around Atlanta to thank their customers, distributors and/or members, as well as have some fun.

Sponsors for the Clean Show are the Association for Linen Management (ALM), the CLA, the DLI, the Textile Care Allied Trades Association (TCATA) and the Textile Rental Services Association of America (TRSA).

American Drycleaner will publish a more comprehensive Clean Show Report in its June issue.

By Lauren Dixon

By Lauren Dixon

The Columbia (University) Aging Center recently launched the Age Smart Industry Guides, one of which prominently features Bridge Cleaners & Tailors. The Brooklyn business, owned by the Aviles family, has a workforce that ranges widely in age, and the comfort of staff is important to management.

In a press conference promoting the Industry Guides’ launch, Richard Aviles, co-owner of Bridge Cleaners & Tailors, spoke about his company’s position on employing older workers and how important they are to Bridge’s success.

Aviles’ parents started their business about 45 years ago, and he began working there about a decade

ago. They own three locations, all in New York City: Bridge Cleaners & Tailors, King Garment Care, and a production facility in the Brooklyn Navy Yard.

“We’ve had our ups and downs,” he says in a phone interview with American Drycleaner. “We’ve had some wonderful years. We’ve had some interesting years.”

He mentioned those “interesting years” during the press conference, describing the major damage inflicted on the production facility by Hurricane Sandy. The business had a couple weeks after the storm to rebuild, so Aviles sat down with the production team to discuss ideas for creating a better work environment.

Of all the ideas for rebuilding, 90% of the “best” ideas came from team members, not upper management, he explained.

“If they’re going to be working there eight, nine hours a day, it’s important that they work where they love,” he says. “We wanted anyone, when they got to their workstation, it has everything that they need to produce the best quality that they could and then also feel as comfortable working in that space as they could.”

Aviles credits his mother, Victoria, for leading Bridge Cleaners & Tailors to create a culture of caring

for employees.

“It’s like the age-old tale: the customer is always right,” he says. “Always take care of the customer no matter what. Well, my mother’s philosophy has always been to do everything you can to take care of the people who you work with.”

By listening to employees and getting to know them on a personal level, he says, “then you create a culture where people are passionate about going to work and passionate about training other people and only wanting to see the businesses progress.”

Another practice put into place by Victoria Aviles has been the hiring of individuals from a variety of age groups.

Richard Aviles believes that younger workers lack decorum and relationship-building skills that older generations innately have. The older generation believes it’s important to reach people on a personal level, he says, which enables them

to teach the younger workers how to provide good customer service and build a more loyal customer base. But younger staff can teach the older about the computers and processes that are also important in conducting business.

Gabriella Lawson, a Senior Service Representative for Bridge Cleaners & Tailors, spoke on this topic during the press conference. She was trained in system processes by a younger worker less than half her age, she says.

“Something complementary about our work relationship is that I’ve led by example on how to properly take care of a customer,” Lawson says. “I feel she showed me the technical aspect of the job, but I’ve reignited the fire in her belly for providing excellent, outstanding customer service, which is always appreciated and needed.”

Age Smart Employer program and associate director of Robert N. Butler Columbia Aging Center, spoke to American Drycleaner and explained how Richard Aviles was selected to speak in support of the Age Smart Industry Guides

Bridge Cleaners & Tailors is an industry leader in New York City, Finkelstein says.

“They do very high-end work. … When we interviewed them, we were … really incredibly impressed by the number of sort of thoughtful things that they had done that were very specific and very possible for others to do.”

She notes different considerations the business took for its workers:

• Moved the clothing racks closer to people’s workstations, and positions clothes on the same floor as where employees work.

• Put a lot of thought into worker comfort, with equipment and furnishings such as high-quality chairs, good lighting, and antifatigue mats.

• Organized family lunches for which different people take turns cooking for the group. Finkelstein says this is a point of pride, and everyone gets a great lunch. “Which, obviously, feeds people but also is one of those things that leads to a sense of camaraderie and commitment.”

“We were really impressed by the way that they spoke about the value added of their experienced workers,” she says. “It’s the older workers that look at the piece of clothing overall and understand not just what their little role is, but also what that thing needs to look like when it’s done. … And that’s that value of knowledge and experience as well as your sort of orientation to turning out the best possible product.”

Richard Aviles stated during the

press conference that there is a “tailor shortage” in New York City. This shortage plus declining expertise in other industries are among reasons to hire older workers, as emphasized in the Age Smart Industry Guides. Dorian Block, who researched for the guides, interviewed 100 businesses, asking them about staffing challenges and age in the workplace.

“What businesses told us is that in order to succeed, they must also focus on retaining the expertise that they have in their current experienced workers,” she says. “They also need to develop systems to pass on the knowledge of the current workers to the new workers coming in.”

The average age of manufacturing workers in the United States is 56, the Columbia Aging Center says, citing an NYCEDC report. Additionally, the U.S. Bureau of Labor Statistics states that if workers continue to retire as expected, there will be a shortfall of 10 million skilled manufacturing workers by the year 2020.

Aside from the need to have skilled workers, Finkelstein says there are other benefits to hiring older workers.

“Many of the older adults that we speak with want and need to work,” she remarked during the press conference. “Furthermore, there’s growing evidence that it’s helpful to their healthy aging and their well-being to continue working.”

Finkelstein says the Industry Guides provide “a distillation of our research to bring good experiences to light from small businesses in New York City in order to influence the behavior of other small businesses, because they may recognize that some small adjustments to practice will yield great benefits to their bottom line and their pursuit of mission.”

Richard Aviles advises drycleaning business owners to observe their shop’s numbers as well as the working environment of employees.

“There’s an intangible of taking care of the people you work with that’s so difficult to quantify that always pays back in dividends,” he says.

The Age Smart Industry Guides are available for free download at www.agesmartemployer.org ADC

The Clean Show is behind us, and we should all be focused on refining our cleaning operations going forward.

Those of you who attended the show in Atlanta should be filled to overflowing with ideas and information. For those of you who chose to sit this one out (shame on you), this is the time to take advantage of that association membership and network with fellow members. If you do not take advantage of your membership, well, the information you finally receive will certainly be old enough that someone else has already acted on it.

The show floor inside the Georgia World Congress Center was filled with cleaners looking for an edge in the marketplace.

When new stores “bookend” your best location within a block, it will get your attention.

When the gross sales at a location decline by 27% compared to last year, it will get your attention.

When you stop seeing that $100-a-week customer, it will get your attention.

The stories go on and on. Have I got your attention?

weight to the quality of stain removal as well as production.

I have long held the opinion that knowledge is power, and that includes access to information resources. However, one must first know the character of the fabric—namely the fiber content and anticipated dye stability—before researching guidance in supplemental stain removal.

The greater the amount of knowledge already possessed, the greater the probability of success in the cleaning of the garment. Getting the most effective results requires asking and answering the most detailed questions possible. Secondly, the more you already know, the fewer questions you will have to research. The more you already know, the less time you will need to spend searching for procedures and protocols to use in supplemental stain removal.

Martin YoungOur industry is in transition. About 20 years ago, the combination of improved equipment and environmental pressure led to owners being able to achieve mediocrity with reduced knowledge and reduced effort. This attitude soon became the “new norm.” Gradually, the idea of supplemental stain removal fell into disfavor as being too time-consuming and risky.

But times are changing, as evidenced by the webbased stain removal app for iPhone or iPad for mem bers of the Drycleaning & Laundry Institute (DLI). Soon, stain removal advice will be as close as your tablet or cell phone.

You will still have to apply the information using “touch and technique,” but with time and repetition, you will soon be back to a business model that gives

To find past Spotting Tips columns or share this month’s with your colleagues, visit AmericanDrycleaner.com.

If the floor of the Clean Show is any indication, consolida tion of companies will result in a reduc tion in the number of chemical tools avail able to treat individ ual stains. This may result in one of your long-time, favorite chemical tools leav ing the marketplace. If this happens, rest assured that there are other stain-removal agents that are just as good ready to take its place.

Talk to your distributor representative about the char acteristics you are looking for in a particular chemical tool. Some cleaner/spotters prefer a mild formulation that may require more than one application to get the job done, slowly. Other cleaner/spotters prefer a chemi cal tool with “teeth” that is expected to be “one and done.”

This column is intended to make you and your employees more effective when doing supplemental stain

“ When the customer finds out that the wine stain you left in a blouse will indeed come out, well, you lost a customer.”

removal. Much of that process is based on time, knowledge and effort. However, there is one important variable that is seldom addressed: attitude.

If you are committed to removing stains, “Sorry” tags will become a thing of the past. You will take the time to use an enzyme digester or a bleach bath. You will learn the characteristics of fibers, construction, dyes and garment trim. Your confidence in your ability to remove stains will increase dramatically. If you are committed to removing stains, your time and knowledge will come together and be reflected in your effort to remove the stains in your customers’ garments.

Taken together, these variables form your attitude about supplemental stain removal. At this point, stain removal becomes a part of, not an addition to, your garment care service.

Cleaning customers are moving away from the “me, too” operation. Their discretionary income is shrinking, reflected in the attitude that if money is to be spent on garment care, the customer is looking for quality, even if it means a slightly higher cost. When the customer finds out that the wine stain you left in a blouse will indeed come out, well, you lost a customer.

In this economic climate, customers must be pampered. Make your high-quality stain removal the standard

for the market you service. Don’t allow your plant to become “low hanging fruit” for any competitor in your area. Make it hard on the competition by forcing them to meet your standard of quality and service, not just match your price. ADC

Martin L. Young Jr. has been an industry consultant and trainer for 20 years, and a member of various stakeholder groups on environmental issues. He grew up in his parents’ plant in Concord, N.C., Young Cleaners, which he operates to this day. Contact him by phone at 704-786-3011, e-mail mayoung@vnet.net.

Proper automotive insurance protection can go a long way in seeing that your business smoothly navigates its route to success. Don’t let inadequate insurance cause your ride to be a bumpy one.

Vehicles used for business purposes should be insured on a “Business Auto Policy.” The owner of a drycleaning business should never use their personal vehicle for busi ness pursuits, as most personal automobile insurers exclude coverage for accidents arising out of such pursuits.

Placing your company’s advertising on a personally insured vehicle would be a major mistake, as doing so dem onstrates its use as a business vehicle (contrary to what was intended on a personal insurance policy). Plus, it heightens awareness in the event of an accident that the business could be brought into suit, even if the accident was not during a period when the vehicle was being used for business.

Make cer tain that your business auto (including any corporately owned vans, trucks or private passenger vehicles) insurance policy recognizes that your company vehicles are making deliv eries or are being used between your business locations (between drop stores and your drycleaning plant, for example).

Typically, the vehicle must be reg istered in the corporate name to be in sured on a “Commercial or Business Auto Policy,” unless the business is owned in an individual’s name. If a dry cleaner’s employees are making deliveries in their personal vehicles, then the business needs “Non-Owned Auto Liability” coverage. This pro vides the business with liability cov erage in the event an employee is in

an accident while working and using their personal vehicle.

It is equally important to be certain the employee has reasonable liability limits of their own and not just the staterequired minimums. As a rule of thumb, employees using their vehicles while performing work duties should have limits equal to at least the dry cleaner’s minimum required umbrella liability limits. However, the employee may also be in violation of their personal insurer’s expected use pro visions if they use their personal vehicle for business rea sons, whether they own the business or just work there.

“Hired Auto Liability” coverage provides a business with liability coverage for autos leased, hired, rented or borrowed from other than an employee, an officer of the company, or a member of their household.

For a reasonable premium, “Umbrella Liability” coverage

extends the business’ liability limits above all other quali fied underlying policies such as the general liability and automobile coverages.

In layman’s terms, if a claim exceeds the limits of your current insurance, the umbrella policy will kick in to provide needed coverage. This creates another level of protection of the business’ assets in the event of a claim. This coverage should be considered, especially when the business’ liability exposure extends to drivers and vehicles that go beyond the controls of the four walls of the business. Umbrella coverage, available in various limits depending on needs, may also provide broader coverage for exposures not included in the underlying liability limits.

Finally, when considering the transportation of custom ers’ goods, be sure that “Bailee” coverage is extended to a customer’s garments while they are off the business prem ises in the delivery vehicle or en route to another processor (“In Transit”). Without this most important coverage, if the garments are stolen from the vehicle, or damaged during a delivery, the dry cleaner could be on the hook without hav ing proper coverage and adequate limits.

“Delivery Errors and Omissions” coverage will pay sums for which you become legally obligated to pay as damages to customers’ property you failed to deliver or delivered to the wrong party.

It is vitally important to have periodic reviews of insurance programs with a qualified insurance profes sional to ensure the coverage that is included and/or excluded is adequate to protect you and your business in the unfortunate event of a loss or claim.

The efforts you make to properly insure your business— most likely your most valuable asset—will pay off when coverage is needed. A comprehensive insurance program will provide you with peace of mind and enable you to focus on growing your business. ADC

Adam Weber is president of Irving Weber Associates, a Ronkonkoma, N.Y.-based insurance company that offers specialized coverage for dry cleaners and other textile care providers. He can be reached at 631-619-9201, aweber@ iwains.com.

By Mark E. Battersby

By Mark E. Battersby

Putting money into a drycleaning business, or taking money from the business, is not something to be tackled by amateurs. Admittedly, a surprising number of cleaners depend on themselves when it comes to financing their businesses. Thanks to our complex tax rules, however, getting money invested out of the business can be expensive.

Quite simply, money invested in the business can be withdrawn with a tax bill on any profits from the sale of that capital investment. A loan made by an operator to his or her business can, on the other hand, be repaid taxfree, but only if the ever-vigilant Internal Revenue Service accepts it as a bona fide arm’s length transaction.

On a similar note, it can also be expensive for any owner, partner or officer who attempts to take money from their drycleaning business. Once again, there is the risk the IRS might view the movement of funds from the business to the owner, partner, officer or shareholder as a taxable event.

It should be increasingly obvious that something as apparently simple as taking money from a business or

even putting funds into the business can be painfully expensive under our tax rules. Those tax rules are quite clear: Only bona fide loans and contributed/invested funds qualify for any sort of tax break. When either lending to, or borrowing from, the business, every operator should keep in mind that in order to count in the eyes of the IRS, any transaction must be a legitimate, interestbearing loan. Under our tax rules, an owner, partner or shareholder borrowing from his or her business can face a hefty tax bill should the IRS view the transaction as a dividend payout rather than a loan.

All too often, it is below-market interest rates or the lack of evidence of an arm’s length transaction that draws the attention of an IRS examiner. The IRS is particularly interested in gift loans; corporation-shareholder loans; compensation loans, between employer and employee or loans between independent contractor and client; and any below-market interest loan in which the interest arrangement has significant effect on either the lender’s or borrower’s tax liability.

Should the IRS re-characterize or re-label a transaction, the result is an interest expense deduction when none was previously claimed by the borrower and the addition of unexpected taxable interest income for the lender. The lender’s higher tax bills, which can date back

several years, are usually accompanied by penalties and interest on the underpaid amounts.

For many garment care businesses, borrowing means a loan from the owner or shareholder. In some cases, it is the owner or shareholder who borrows funds from the drycleaning operation. Loans and advances between these so-called “related parties” are quite common in closely held businesses. Corporate loans to shareholders are probably the most commonly seen by IRS auditors, with advances from shareholders to the incorporated business running a close second, particularly in the early years of closely held but thinly capitalized corporations.

The IRS’ interest in these transactions stems from the tremendous potential for tax avoidance, inadvertent or intentional. When an incorporated drycleaning business makes an interest-free (or low-interest) loan to its shareholder, in the eyes of the IRS, the shareholder is deemed to have received a non-deductible dividend equal to the amount of the foregone interest. The incorporated business is, at the same time, deemed to have received a like amount of interest income.

Fortunately, there is a $10,000 de minimis exception for compensation-related and corporate/shareholder

loans, at least those transactions that do not have tax avoidance as one of the principal purposes.

Although this transfer of taxable income between entities may appear to be offsetting, there can be a significant tax impact on the reallocation, depending on the relative tax benefits to the borrower and to the lender and the deductibility of the expense deemed paid.

When IRS examiners review loans from shareholders and the common stock accounts of a drycleaning business, they often encounter what can only be called “thin capitalization.” This occurs when there is little or no common stock and there is a large loan from the shareholder. A special section of the tax law, Section 385, Treatment of certain interests in corporations as stock or indebtedness, governs whether a loan is one made to an incorporated business or treated as debt.

The IRS’ objective when it encounters thin capitalization is to convert a portion, if not all, of the loans made by the shareholders into capital stock in the business. Naturally, this conversion requires an adjustment to the interest expense account, because, at this point, the loans are considered nonexistent. The interest paid by (continued)

the incorporated business on these disallowed loans becomes a dividend paid to the shareholder in an amount equal to the operation’s earnings and profits.

Under our tax laws, a business-bad-debt deduction is not available to shareholders who have advanced money to a corporation where those advances were labeled as contributions to capital. However, a business owner or shareholder who incurs a loss arising from his guaranty of a loan is entitled to deduct that loss—but only where the guaranty arose out of his trade or business or in a transaction entered into for profit. If the guaranty relates to a trade or business, the resulting loss is an ordinary loss for a business bad debt.

receive periodic lease payments. With one transaction, the operation has found a way to get money from the business, without the double-tax bite imposed on dividends, and a tax write-off as the owner of the property or equipment. Even more importantly, the business receives an infusion of much-needed cash.

Unfortunately, under our tax laws, specifically Section 469, which deals with passive activities and losses, income from rental real estate is generally considered “passive activity” income, regardless of the owner or operator’s level of management involvement. The tax rules clearly state that a taxpayer can use losses from a passive activity only to offset passive activity income. In other words, passive losses cannot shelter other income, including profits, salaries, wages or portfolio income such as interest, dividend or annuity income.

A loophole built into the rules states that rental realty income is not passive activity income if the property is rented for use in a trade or business in which the taxpayer materially participates. This rule prevents taxpayers with passive activity losses from artificially creating passive activity income to absorb the losses.

When attempting to take funds from the business, one option involves taking tax benefits instead, especially where the business might profit from an infusion of badly needed cash. If the business is in need of an infusion of cash and the owner is reluctant to invest additional money, an answer may lie with the tax benefits. Are the operation’s tax benefits being wasted because of low or nonexistent profits?

A one-transaction-cures-all, all-purpose solution involves the sale-leaseback of the drycleaning business’ assets. Generally, the business sells its assets, the building that houses the operation, the machinery and equipment used in the business, and its furniture, fixtures, or other property it owns. The buyer of those assets, usually using borrowed funds, is often the operation’s owner, partner or shareholder.

When the owner or shareholders in a drycleaning business own the operation’s assets, the business makes fully tax-deductible lease payments for the right to use those assets in its operation. The business is exchanging depreciable equipment or its building for badly needed capital and immediate deductions for the lease payments it is now required to make.

The new owner of that building or equipment, whether the business’ owner, shareholder or, perhaps, a trust established for the benefit of the owner’s children, will

American Drycleaner, May 2015

With conventional financing still hard to obtain, it is little wonder that “self-financing” remains popular with small-business owners. It’s quick, doesn’t require a lot of paperwork, and is often less expensive than conventional financing.

Unfortunately, when investing in their businesses, many operators overlook the cost of self-financing. The cost everyone using his or her funds should consider is the so-called “lost opportunity” cost—the amount that could have, or might have, been earned had those funds remained in savings or invested elsewhere.

However, in the current topsy-turvy economic climate, doing it yourself or keeping financing within the family frequently produces the fastest and best results. Unfortunately, our tax laws create obstacles that must be overcome to avoid penalties and corresponding higher tax bills.

Navigating complex tax rules obviously requires professional guidance, especially for any dry cleaner wishing to avoid paybacks and those dreaded “accuracyrelated” penalties down the road.

ADC

Information in this article is provided for educational and ref erence purposes only. It is not intended to provide specific advice or individual recommendations. Consult an attorney or tax adviser for advice regarding your particular situation.

Mark E. Battersby is a freelance writer specializing in finance and tax topics. He is based in Ardmore, Pa.

“With conventional financing still hard to obtain, it is little wonder that ‘self-financing’ remains popular with small-business owners.”

John L. Corley Inc. is expanding its NIE Insurance pro gram to serve dry cleaners and coin laundries in 14 addi tional states, bringing the total number of states served to 48, the company says.

Corley can now offer this insurance coverage through a new appointment with The Hartford, which reports that it insures more than 1 million small businesses.

“This is good news for dry cleaners and coin laundries across the country,” says Greg Mouldon, Corley’s presi dent. “We are proud to work with The Hartford. They are a leader in small-business insurance.”

Corley can now place insurance for small businesses across the country, except in Alaska and Hawaii.

John L. Corley Inc. is the attorney-in-fact for National Fire Indemnity Exchange and operates under the trade name “NIE Insurance.”

National Fire Indemnity Exchange is a reciprocal in surance exchange founded in 1915 to serve dry cleaners. It is owned entirely by its policyholder dry cleaners and coin laundries, and governed by an elected committee of seven of those policyholders.

Zengeler Cleaners has begun a build-out for the com pany’s new store in the Chicago suburb of Northbrook, Ill. Located at 770 Skokie Blvd., the project is planned to be completed by early June and open shortly thereafter.

“Zengeler Cleaners conducted a worldwide search to identify best-in-class equipment and machinery for the new store,” says President Tom Zengeler. “The new location will provide several added conveniences for customers, including technology that automates order processing, allowing customers to drop off and pick up their orders 24 hours a day, 365 days of the year.

“We also took great care to assure our architecture fits seamlessly into the fabric of the Northbrook community

while providing a modern, energy-efficient operation de signed to protect the environment.”

Zengeler says a Metalprogetti conveyor system will be utilized to provide a fully automated workflow and “is the engine that drives the 24-hour self-serve kiosk.”

“Our new store is another step forward for our com pany,” he says. Besides the Northbrook store, Zengeler Cleaners has seven other locations in the Chicago area.

Lapels Dry Cleaning recently signed a consulting agreement with World Franchise Associates (WFA) of London and is eyeing an international expansion, the franchisor reports.

WFA is an international franchise organization that expertly assists franchisors entering new international markets and assists international franchise buyers in ac quiring the best franchised business brands.

As part of the one-year agreement, WFA will work to connect the Massachusetts-based Lapels to operating companies in the Middle East and southeast Asia.

“Expanding internationally has been something that’s been on our radar for the past few years but coming up with the right strategy has been a challenge,” says Kevin Dubois, CEO of Lapels Dry Cleaning. “Working with a firm with a track record like WFA’s will greatly expedite our plans for international growth.”

WFA is registered in London, with offices in the United Kingdom, Middle East, Asia, and east and central Europe.

“The types of franchises that succeed in the interna tional market typically have a unique offering,” says Martin Hancock, WFA chief operating officer for North America. “What Lapels has done in creating an environ mentally friendly method to dry-clean clothes certainly fits that description.”

Lapels has pioneered its eco-friendly drycleaning ex perience over the past dozen years, the franchisor says. Most recently, it signed a partnership agreement with GreenEarth® for its newer locations.

Eastern Funding LLC reports it has promoted Stephen Gramaglia from executive vice president to chief operat ing officer.

“Stephen’s experience in the specialty finance indus try extends back to when he was a 20-year-old junior in college. Ever since he joined Eastern 16 years ago, he’s been a key member of our management team, and he’s played a vital role in our growth and com mercial financing success,” says Michael Fanger, Eastern Funding founder and president.

Gramaglia has a bachelor’s degree in business administration from Pace University. He joined Eastern Funding in 1999, previously working for Medallion Financial Corp., TLC Funding Corporation and CPS Services, Inc.

In his new role, Gramaglia will oversee credit op erations along with a number of the company’s business

units, including credit, documentation, loan servicing, customer service, sales and marketing, human resources, compliance and information technology.

Faced with the possibility that decades-old drycleaning fluid may have polluted ground under its original plant in Jeffersonville, Ind., Nu Yale Cleaners has enlisted the aid of EnviroForensics Inc. to investigate and remove the perchloroethylene (perc) contamination.

The Indiana-based environmental consulting firm is working with Nu Yale to remediate any possible contam ination at the plant site at 2940 Holmans Lane. A clean ing operation has been housed there since the 1970s.

“EnviroForensics started right away to collect and test soil samples from the ground under [the] plant,” says Gary Maloney, president of the drycleaning business that now uses an environmentally friendly process developed by Solvair.

He credited EnviroForensics with helping him find in surance and developing a “sound strategy”

for the perc cleanup.

Maloney and his brothers, Michael and Bill, have been involved with Nu Yale since the 1970s, when they pur chased the company from their uncle, Wilbur Horlander, who started the family business in 1956.

During the summer of 2013, EnviroForensics excavated contaminated soil inside the Nu Yale building. It then in stalled groundwater monitoring wells to evaluate the soil removal’s effect on groundwater quality.

The removal “continues to show a positive effect on groundwater contaminant concentrations,” says Brad Lewis, EnviroForensics’ senior scientist for the Nu Yale project. The remediation is expected to be completed over the next few years.

“In the meantime, Nu Yale’s customers and neighbors can rest assured that the environment in that area of Jef fersonville is already safer,” Lewis says.

The Indiana Department of Environmental Man agement has inspected the site and approved EnviroForensics’ cleanup and ongoing water monitoring, the company says.

Nu Yale operates 11 locations: five in Indiana and six in Kentucky.

The Small Business Assistance Program (SBAP) at the Colorado Department of Public Health and Environ ment (CDPHE) is partnering with the Rocky Mountain Fabricare Association to present a free Dry Cleaning Alternatives Industry Trade Fair in Denver next month.

The one-day event on Sunday, June 14, at the Den ver Marriott Tech Center will feature presentations and panel discussions on drycleaning alternatives. Also, there will be an exhibitor trade fair offering a multitude of resources in drycleaning, laundry and wetcleaning equipment supplies.

New this year will be the availability of “resource experts” for round-table discussions on topics such as business growth, funding options for switching to an al ternative drycleaning machine, insurance impacts, mar keting, regulations, and energy efficiency.

Lunch and refreshments will be served. Those interest ed in attending can register online at http://fs8.formsite. com/cohealth/DCtradeshow/. Space is limited, and the registration deadline is May 15.

To learn more, contact Kaitlin Stabrava, SBAP special ist, 303-692-3175, kaitlin.stabrava@state.co.us. ADC

American Drycleaner, May 2015

Total Training for CSRs. Series of NCA webinars, to be held May 6 and 20, and June 3 and 17. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Basic Pressing & Finishing (Korean). NCA course, to be held May 10 in Floral Park, N.Y. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Avoiding Claims: What You Need to Know

About Fabrics & Stain Removal. NCA course, to be held May 31 in Delray Beach, Fla. Call 212-967-3002 or e-mail ncaiclean@aol.com.

NY State DEC Certification (Korean).

Two-day NCA course, to be held June 7 and June 14 in Bronx, N.Y. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Extreme Stain Removal. NCA course, to be held June 14 in Boston. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Spotting with Alternative Solvents. NCA course, to be held July 12 in Bronx, N.Y. Call 212-967-3002 or e-mail ncaiclean@aol.com.

Introduction to Drycleaning. Five-day DLI course, to be held July 13-17 in Laurel, Md. Call 800-638-2627 or visit www.dlionline.org.

Extreme Stain Removal. NCA course, to be held July 19 in Palm Beach, Fla. Call 212-9673002 or e-mail ncaiclean@aol.com.

Advanced Drycleaning. Ten-day DLI course, to be held July 20-31 in Laurel, Md. Call 800638-2627 or visit www.dlionline.org.

NY State DEC Certification. Two-day NCA course, to be held Aug. 2 and Aug. 9 in Nanuet, N.Y. Call 212-967-3002 or e-mail ncaiclean@aol. com.

Features: Clean Show Report An expanded look at the announcements, introductions and ideas presented at Clean ’15. Press & Pad: What’s One Without the Other? Understanding their relationship and how they work together in producing quality finished garments.

Editorial Submission Deadline — April 15

Feature: Garment Preservation Wedding gowns, christening gowns and the like carry special significance and require a high level of attention and care. Getting to Know Your Distributor The skills and experience a dry cleaner should seek when looking for an optimum partner. Showcase: Wetcleaning Equipment

Feature: Distributors Directory Our easy-to-use annual directory issue lists distributors of equipment and supplies nationwide. Editorial Submission Deadline —June 15

Editorial Submission Deadline — May 15 Want

Features: Upgrading Your Drycleaning Equipment Given what today’s high-tech machines are capable of, it may be time for dry cleaners to make a new investment. Tools to Promote Loyalty Programs Spreading the word online and offline so drycleaning customers and prospects are drawn to the lures.

Editorial Submission Deadline — July 15

three- and 12-time rates. If box number is used,

add cost of 5 words. Display classified rates are available on request. All major credit cards are accepted.

DEADLINE: Ads must be received by the 1st of the preceding month.

For example, for a June ad, the closing date is May 1st.

PAYMENT FOR CLASSIFIED ADS: Must accompany order.

10 YEARS AGO. Gearing up for the June Clean Show starts with getting excited about the location. Orlando, Fla., once farmland, is now a mecca to theme parks. Starting with Walt Disney World in 1971, Orlando was never the same. Tourism to the cartoon-themed fantasy world attracted others, such as SeaWorld and Universal Studios. Besides staying hydrated and safe, American Drycleaner advises Clean Show visitors to take advantage of the location and mix some business with some pleasure. … ServiceMaster and the Certified Restoration Drycleaning Network (CRDN) have formed an alliance for the national mitigation and restoration drycleaning program. The two, owned by Service Brands International (SBI), bring this service to the insurance industry for the first time in the United States, SBI says.

25 YEARS AGO. In an effort to get honest feedback from customers, R. Neil Ablitt, owner of Ablitt’s Cleaners & Launderers, sent out a card to his billed customers. Rather than his usual listing of services, the Santa Barbara, Calif., cleaner wrote, “PLEASE COMPLAIN!!!”

By filling out a comment card, customers would receive $5 credited to their accounts. In doing this, Ablitt has learned missteps and gained suggestions, such as separating men’s and women’s clothes. His favorite customer note read, “There you go, outdistancing yourself from the competition again.” … Safety-Kleen Corp.’s storage drum has been selected as a “Design of the Decade,” given by the Industrial Designer’s Society of America. Its features that led to the honor include its stacking capability, long life, ability to be melted down, and anti-rusting properties.

50 YEARS AGO. An Oklahoma mother kept a sense of humor despite her daughters’ cleaning snafu. The mother called up a dry cleaner, asking, “Can you restore my mink-trimmed suede coat that my daughters used to mop the kitchen floor with?” The next morning, the cleaner saw the coat in his dropbox. Attached was a note saying, “If you are unable to do anything with it, please attach a

To read more of American Drycleaner’s chronicling of the industry over the years, visit www. americandrycleaner.com.

handle to it.” … The National Institute of Drycleaning (NID) has selected four young people to receive scholarship grants for their General Course. Recipients are James Randolph Jones, 21; Karen Flynn, 19; Carmine DiGregorio, 24; and Merle D. Toon, 25. The four were chosen based on their essays on Why I Want to Make Dry Cleaning My Profession, and a letter of recommendation. … Archie C. Swan is a man of many bold business moves. His Scotch Cleaners in Topeka, Kan., first offered an outstanding deal: four shirts cleaned for $1. Then, he pushed it to five shirts for $1.19. After, he announced that hanging shirts will be the same price as boxed. Many customers prefer shirts on hangers due to the lack of creases. However, some housewives still think their traveling husbands need neatly folded shirts to fit in suitcases. Either way, Swan gained business by catering to these different needs.

75 YEARS AGO. After rigorous courses and lectures for 12 weeks, the 47th class at the National Association of Dyers and Cleaners (NADC) has graduated. Each week of the graduates’ schooling included two periods in applied science, two in dry cleaning, three in spotting and one in finishing, specials, dyeing and furs. Additionally, each day included three lectures. The 39 students now have skills and knowledge to bring with them into their practices. … When a cash-and-carry laundry system was in danger of going belly-up, owner William Jacobs changed his business plan. Kansas City’s Criterion Cleaners was previously a drive-in laundry, but it quickly changed to a retail cleaning service—and a successful one at that. With hard work and some good newspaper ads, customers flocked in. In a single week in late March of 1940, Criterion laundered and pressed 6,968 shirts, with an average of 27 shirts per operator hour. At one point, the demand was so high that Jacobs even had to add a night shift. ADC

— Compiled by Lauren Dixon

Compact Systems have always been a popular style and now with new larger capacity and availability in two foot prints, there is no need to squeeze a large foot print machine into a limited spaced shop.

Loaded with standard features, three working tanks and dual filter system operating in accordance to your needs has never been easier.

Limited space? High volume? No Problem – the Performance Series is available in Tandem configuration. Tandem systems can be configured in any capacity you require.

“ there is always ingenuity, passion and determination behind every great machine”