4 minute read

Hobart

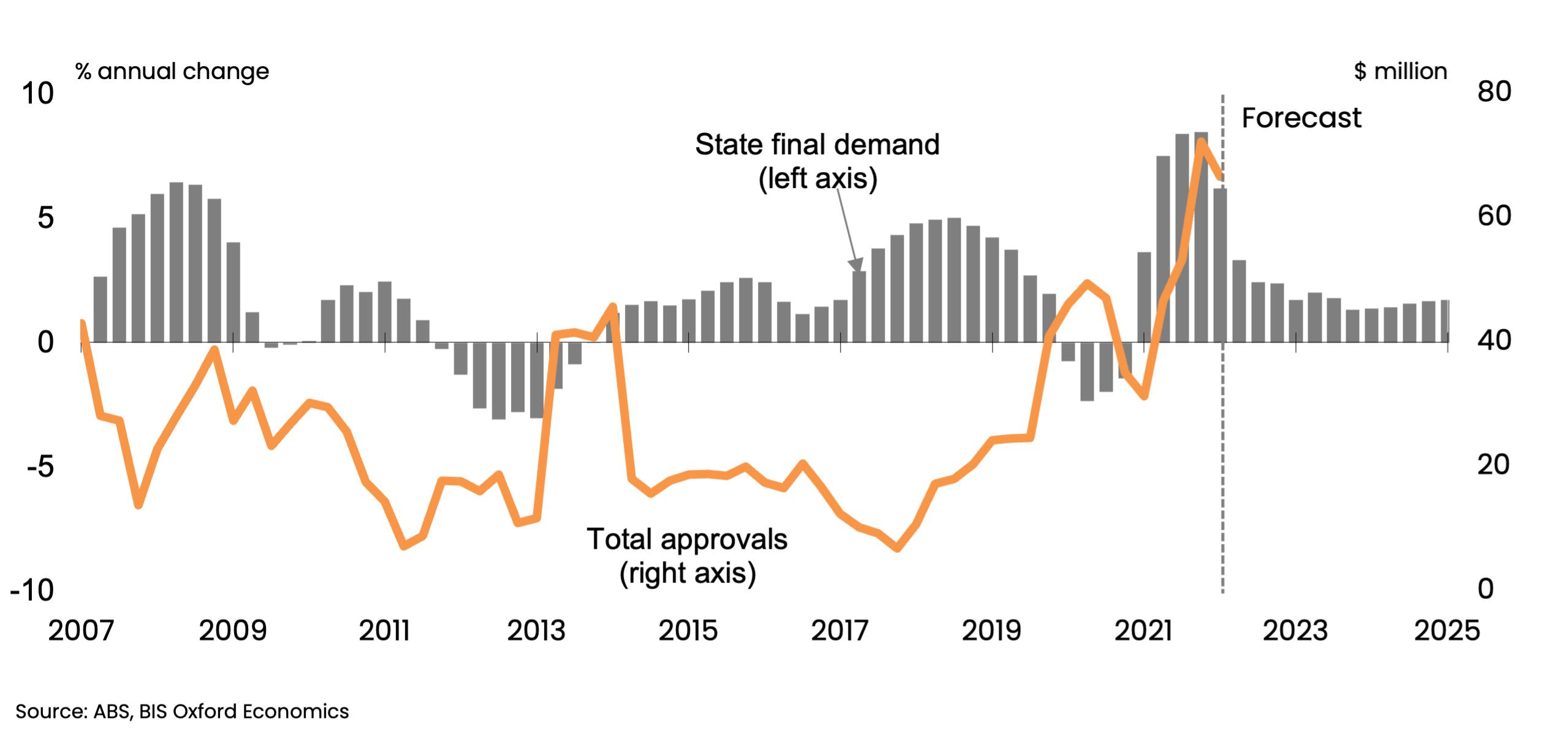

Tasmania’s economy has struggled somewhat through the first half of 2022 after strong gains in the second half of 2021. Supply chain disruptions, high transport costs, falling dwelling and business investment as well as delays in the normalisation of tourism flow have all combined this year to dent growth. Even so, conditions in the labour market remain solid.

Net face rent ($ sqm) Incentive (%) Yield (%) Capital value ($ sqm) Hobart prime industrial market indicators Hobart $200 2.5 5.8 $3,448

Leasing market

Patterns in the economy have played out in industrial property activity, with a lag. Enquiry levels were very strong across most of the precincts (including Derwent Park, Kingston, Cambridge and Mornington) at the start of 2022, up until the federal election in May. Since then, business caution has increased and decisions are taking longer in the face of rising inflation, increasing interest rates and slowing economic growth.

Indeed, the rising cost of debt has seen a change in the mix of occupiers looking for space, from one dominated by owner occupiers, to now tilting back towards tenants. Amongst those looking for space, the greater demand is for properties less than 500 square metres in size, with trades and builders serving the local population the most active. Low vacancies pushed average rents higher over the six months to June 2022, for both prime and secondary space. Higher quality space is leasing at an average $200 per square metre, up from $150 per square metre a year earlier. Secondary space is leasing within a band of $160 to $180 per square metre, reflecting an average $170 per square metre (significantly higher than 6 to 12 months ago). Leasing incentives do not play a significant role in Hobart’s industrial property market due to the high proportion of private owners. Some owners are securing leases incorporating no incentives, with 5 per cent reported as the ceiling.

Hobart’s industrial property investment market was characterised by strong investor interest in 2021, which continued into 2022, but rising interest rates have taken the heat out of the market with no major investment sale reported during the first half of 2022. Sentiment suggests industrial property yields will soften, but there is no transactional evidence as yet to support this. As such, it is difficult to be confident about where yields sit in Hobart. We surmise prime industrial yields remained unchanged during the first half of 2022 at an average 5.8 per cent.

Supply

In response to the tightness in the occupier market, some new industrial property supply is underway. Over the year to June 2022, total approvals across Hobart reached an elevated level of $6 million. This represents a near doubling from the 2021 financial year. Activity was split roughly evenly between warehouses and factories, with warehouses taking up a slightly larger slice. However, not all projects are pushing ahead as rising construction costs cause many developers to pause. Based on projects currently underway, we are only aware of a distribution centre pre-leased to Sigma Healthcare on Greenbanks Road, Bridgewater and around 5,000 square metres of industrial space currently under construction across three projects in Cambridge.

Leasing and investment market outlook

Our view is that the recent upswing in Tasmania’s economy has started to run out of steam and will lose momentum over the over the next two to three years. Tasmania’s post-COVID recovery has relied heavily on government support; the eventual withdrawal of very easy fiscal settings will be a significant headwind to growth. In addition, disruptions to tourism flows will continue to hinder economic growth. Further, demand for the island’s high value produce is being challenged by trade tensions with China (a major export market), although the majority of exporters have managed to find alternative markets.

On the positive side, funding from the Hobart City Deal will go some way to placing a floor under the pull back in government spending. Meanwhile, public investment in road and bridge upgrades is set to be relatively strong in the near-to-medium term. Several major projects are expected or currently underway, including the New Bridgewater bridge and the Hobart to Sorrell Corridor upgrade. In addition, the Macquarie Wharf redevelopment will be a positive for the economy by improving access for freight and cruise ships. However, overall Tasmania’s economy is likely to only grow at a modest pace for some time, which will flow through to weaker demand for industrial property. Approvals data points to higher levels of new industrial property construction activity in the near term. Sigma Healthcare’s distribution centre, mentioned above is due for completion in Q3 2022. Many projects face near term delays due to nationwide material shortages and high construction costs. However, a moderate pick-up in activity is likely over time as capacity constraints ease, based on planned (but not yet approved land releases and associated developments) in Cambridge.

Over the medium term, we expect the current undersupply of industrial property will ease as rising supply meets weakening demand as the economy slows. Overall, there is sufficient industrial zoned land in the pipeline (particularly around the Brighton Transport Hub and on future releases planned at Cambridge) to meet any likely level of demand. This will help moderate rental growth and property prices in Hobart’s key industrial precincts over the medium term. As in other markets, we expect yields to soften in the short to medium term as the rising cost of debt flows through to a repricing of assets. That means the likelihood of a moderate setback to capital values unless rental growth offsets higher yields.

Hobart demand and industrial building approvals