10 minute read

Melbourne

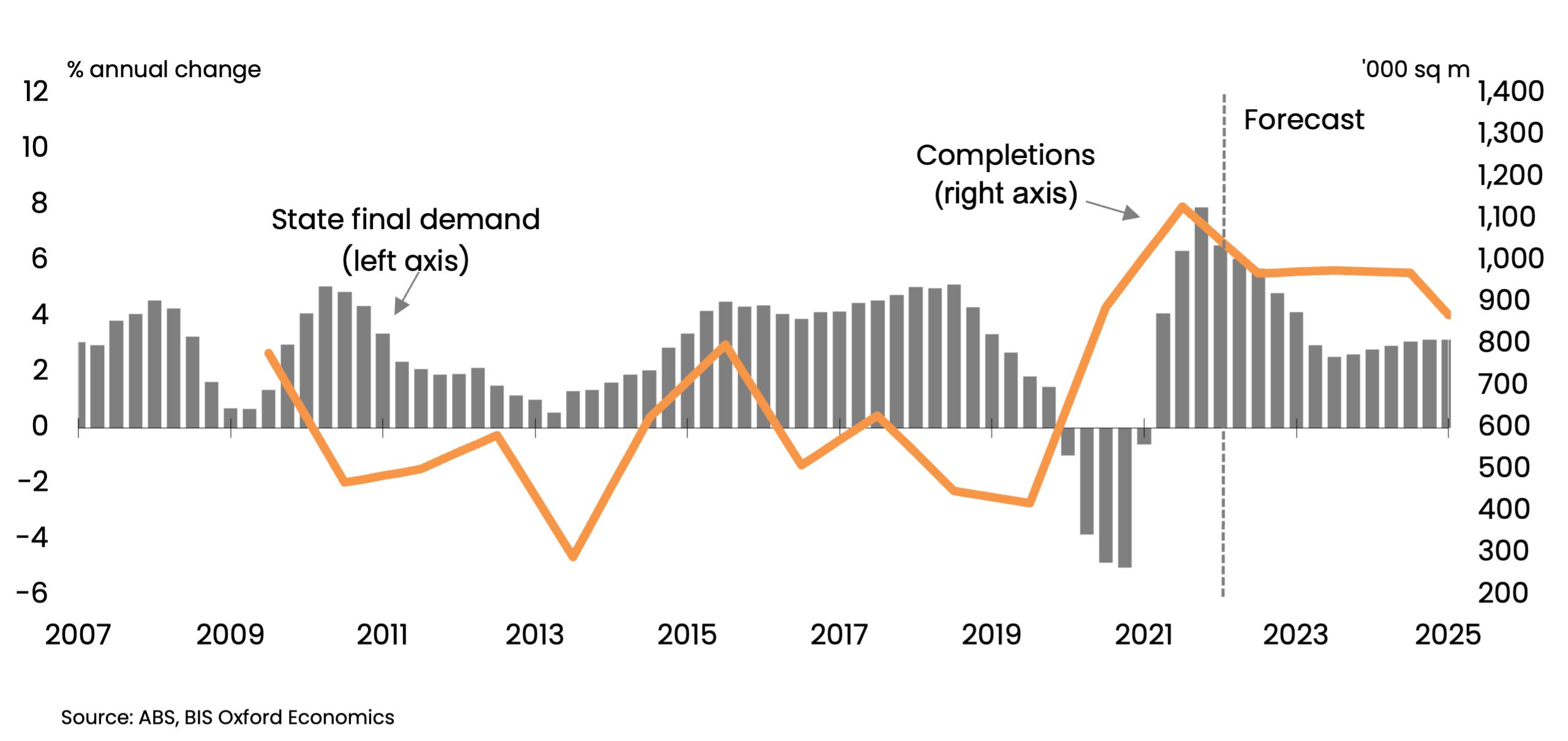

Victoria’s economy was hit especially hard by the pandemic, however, momentum picked up as the state moved beyond the use of lockdown restrictions. This impetus has held into 2022 as catch-up growth persists to help drive the state’s economy.

In the long run, we still expect the state to outperform the national average, but by less than was expected pre-COVID. Leading into the pandemic, Victoria’s strong performance was partially driven by rapid expansions in higher education and tourism, and there will be permanent losses in these areas.

Net face rent ($ sqm) Incentive (%) Yield (%) Capital value ($ sqm) Melbourne prime industrial market indicators South-East North $110 14.0 $96 20.0 West City Fringe $96 $180 20.0 8.0

3.9 $2,826 3.9

3.9 3.8 $2,460 $2,460 $4,764

Demand for industrial property has been extremely strong in Melbourne over the last 12 to 18 months, fuelled by a strong economic rebound from COVID triggered lockdowns and drivers heightened by the pandemic.

We are seeing very high enquiry and demand from a range of tenants and owner occupiers in the West, North and City Fringe and healthy demand in the South-East. Indeed, the lack of available options is pushing would be owner occupiers into the pool of tenants, with gross absorption exceeded 2m square metres during 2021. The strength of demand is underpinned by retailers (both pure play and omnichannel), transport & logistics operators and manufacturers

In net absorption terms, we estimate around 1.4 million square metres was taken up across metro Melbourne (in buildings greater than 5,000 square metres), and 1.2 million square metres for the 2022 financial year. Low vacancies amongst existing buildings are starting to impair business’ ability to take more space. Even so, net absorption is running at close to three times the long run average.

The vacancy rate tightened at a surprising pace in 2021, with record net absorption outpacing record completions. At December 2021, the total vacancy rate had halved from the beginning of the year to a very low 1.4 per cent. Given the strength of demand, we estimate the vacancy rate tightened even further over the second half of the 2022 financial year to around 1.0 per cent. We are seeing very low vacancy rates across the regions, indicating all regions have a shortage of vacant buildings.

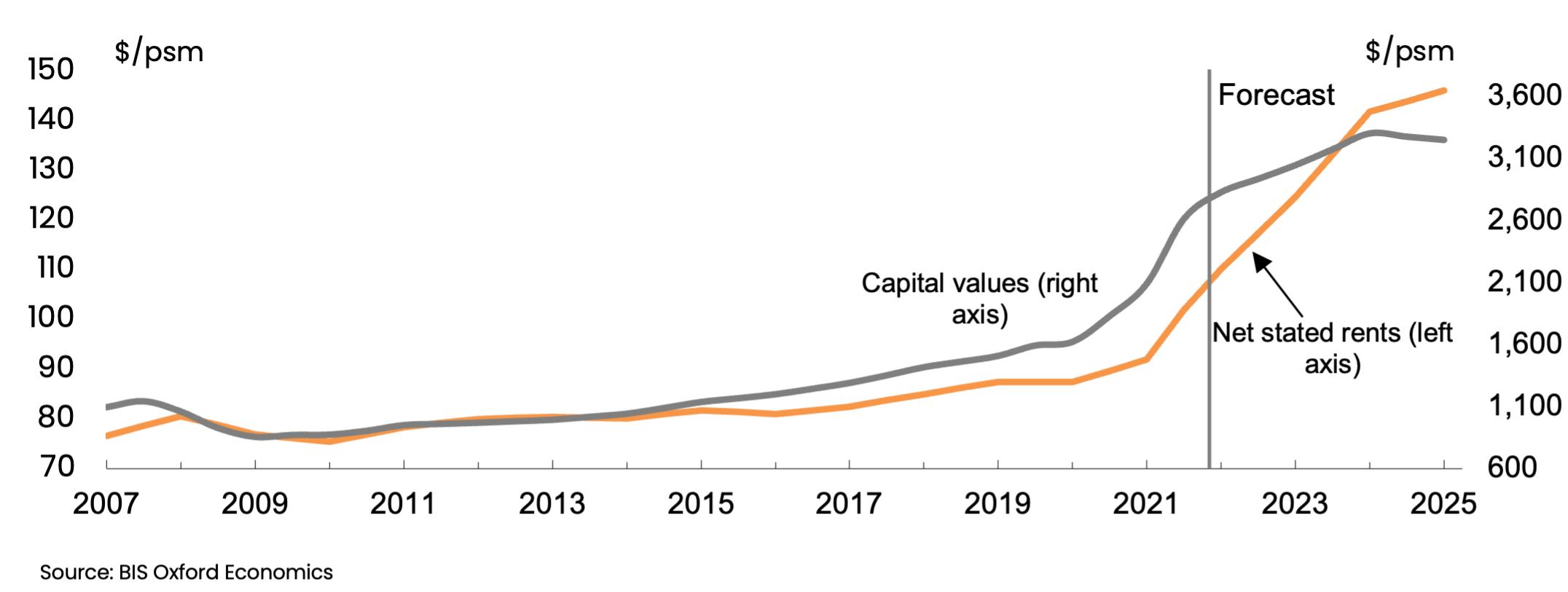

We estimate net stated prime rents rose 20 per cent to $110 per square metre in the 2022 financial year in the South-East, 16 per cent to $96 per square metre in the West and 20 per cent in the City Fringe to $180 per square metre. Rents in the North are comparable to those in the West. The growth pattern in secondary rents in the South-East reflected low vacancies in the region, increasing by around 21 per cent over the 2022 financial year to $85 per square metre.

Despite strong competition to secure tenants for new projects, rising costs means there is still little difference between pre-lease rentals and rents on existing buildings or spec-built warehouses, which are all climbing higher. The main difference between the three is that incentives offered on pre-lease options are typically higher and the tenant must wait for the pre-lease building to be completed.

Recent movements in leasing incentives reflect the rapid market tightening. In the South-East, we estimate prime incentives fell modestly in the second half of 2021 to an average of 19 per cent, but have fallen more steeply since, to 14 per cent by June 2022. In the West, incentives finished last year at an average 22 per cent but were closer to 20 per cent at June. In the City Fringe, average incentives are lower, moving from about 10 per cent at the end of 2021 to 8 per cent in the second quarter of 2022. Secondary incentives in the South-East have also reacted to low vacancies falling over the 2022 financial year an average 10 per cent.

Medium-to-long term, we expect the connection between growth in the economy (as measured by SFD) and demand for industrial property to re-establish itself. Over the next 12 to 18 months however, a handful of key drivers (that were significantly shaped by the pandemic) will remain dominant drivers of industrial property demand in Melbourne.

First is growth in online retail spending. After growing at over 35 per cent in the 2021 financial year, we estimate national domestic online retail sales growth increased by 15 per cent in the 2022 financial year and then should normalise at closer to 10 per cent in the 2023 financial year. Victoria will capture a share of this growth, encouraging ongoing investment from industrial property occupants in more efficient warehousing and delivery services to satisfy their customers. The easing back in online spending will be shaped by consumers rebalancing their pandemic influenced spending back from goods to services.

Second is investment decisions triggered by the surge in food retailing in 2020 (driving demand for cold and room temperature storage). We estimate food retailing in Victoria rose by over 5 per cent in 2020 but eased back to circa 3 per cent in the 2022 financial year. Looking forward, we expect growth to normalise as population growth resumes.

Thirdly, we forecast a strong rebound in economic growth in Victoria this year and next as the state reopens, flowing through to stronger than normal demand for industrial property space. Finally, we do not expect the build-up of domestic inventory will be enduring once supply chains normalise, because of the higher cost to businesses. It is hard to say with confidence when higher stock-to-sales ratios will unwind, but our forecasts allow for supply chain pressure to ease by next year. Even so, we do not expect a return to pre-pandemic ‘just in time’ inventory practices.

Combining the drivers of demand, indicatively, we forecast net absorption to remain above 1 million square metres this year, before easing back to 830,000 square metres for the 2023 financial year and then an average of 600,000 square metres pa in the 2024 financial year.

Given a strong profile for demand, low vacancy rates and rising pre-lease rents, we expect that prime rents will grow circa 13 to 14 per cent pa across the regions in the 2023 financial year and the 2024 financial year. Recent sharp rises in long term bond rates means that we no longer believe yields will continue to firm, removing a key suppresser of pre-lease rents (and in turn market rents). As a result, rising land values, construction costs and a forecast phase of yield softening all point to much higher rents needed to make new builds feasible. Leasing incentives are also forecast to fall at a steady pace to mid-2023, reflecting very tight market conditions, and driving exceptionally strong growth in effective rents.

Melbourne South East Industrial rents and capital values

The investment market for industrial property in Melbourne has been running hot in the last few years. Last year around $7 billion in sales occurred, spurred along by a number of major portfolio sales, notably Blackstone acquiring a large stake in the Dexus Australian Logistics Trust (focused on Melbourne and Sydney) for over $2 billion. During the first half of 2022, more than $2.3 billion of sales have transacted, indicating a normalisation of investor activity.

The value of deals has been fuelled by a strong flow of funds into industrial property at a national level, with widespread reports of considerable capital assessing opportunities in industrial property in Melbourne and across the east coast. However, like Sydney, investors have become more cautious and less urgent when assessing opportunities.

Notable sales of greater than $25 million in recent months include:

• Monash University purchased a 3.6-hectare site at 611-625 Blackburn Road, Notting Hill for $66 million from Toyota; and

• Frasers Logistics & Commercial Trust purchased a portfolio of three warehouses in Melbourne’s

West for $6 million on a yield of 3.7 per cent.

Rising bond rates suggests the phase of yield firming in Melbourne industrial property is drawing to a close. On our forecasts, (notwithstanding short-term volatility) 10-year bond rates will remain around current rates between now and 2024 before tapering back to a longer-term trend rate around 2.9 per cent, taking its lead from the United States.

As a result, yield spreads to prime Melbourne industrial property have fallen to a sharp 20 to 30 basis points, well below the long-term average 400 basis points. We expect this will unsettle many investors, sparking a slow phase of yield softening from the end of this year. By 2025, we forecast prime yields to soften by 60 basis points, taking them back to 4.4 per cent to 4.5 per cent across the regions. Driven by the weight of funds chasing assets, average prime yields firmed considerably during 2021 to a low of 3.8 per cent in the City Fringe and 3.9 per cent in the South-East and West. During the first half of 2022, yields stabilised as investors assessed the impact of rising bond rates. Secondary yields in the South-East are assessed at 5.0 per cent, representing a firming of 110 basis points in 2021, before stabilising in the first half of 2022.

The strength of yield firming underpinned strong growth in capital values in 2021, ranging from 36 per cent to 43 per cent across the regions, representing near record breaking growth. The 2022 financial year growth rates were almost as impressive at an estimated 30 per cent to 36 per cent. Average prime prices at the second quarter of 2022 reached $2,460 per square metre in the West, $2,830 per square metre in the South-East and $4,760 per square metre in the City Fringe. Secondary South-East capital value growth mirrored the above rates to reach prices close to $1,700 per square metre.

The speed of the yield softening will be slowed by strong rental growth for at least part of this period. Yields on secondary properties are forecast to take their lead from prime grade assets but with a greater softening (80 basis points) to 2025.

The combination of rent and yield forecasts will see a slowdown in the extraordinary rate of capital value growth. We expect strong rental growth will drive solid price gains until the 2024 financial year, before a prolonged phase of more modest growth. Average prime values are forecast to rise by 17 per cent to 18 per cent over the two years to June 2024, with slightly lower growth forecast for South-East secondary.

Investment outlook

Melbourne is currently in the midst of a major phase of industrial property supply. Completions (greater than 5,000 square metres) reached a record 1.1 million square metres last year are on track to reach 970,000 square metres across 46 projects for 2022.

Around two thirds of completions due this year are in the West (across 29 projects), one quarter in the South-East (11 projects) and 10 per cent in the North (6 projects).

The majority of completions due this year have been underpinned by pre-commitments or have secured tenants during construction. The largest examples include vidaXL, Myer, Early Settler and PF Logistics.

Based on projects under way and a sustained period of low vacancies driving rents higher, we expect completions to remain historically high at around 970,000 square metres per annum until the end of calendar 2024. We already know of 54 committed projects for 1.15 million square metres and are confident that more will emerge.

Material shortages and construction cost pressures are likely to continue for the next 12 to 18 months, challenging, but not derailing project delivery. Major developers continue to compete hard for pre-leases, keeping pre-lease rents competitive with existing building prime rents, although both are rising notably. It is common to see speculative projects built in tandem with a pre-commitment being secured. Around 25 per cent of the projects due this year started on a speculative basis, although much of this space has already been leased.

In time, these pressures should ease as supply chain disruptions eventually normalise.

We expect the recent mix of pre-lease and spec building to continue as developers look to capture both longer and shorter turnaround needs.

Speculative development also allows developers to pass through cost increases whilst the market stays tight.

Supply outlook

Melbourne industrial demand and new supply