10 minute read

Sydney

36-48 Ashford Avenue, Milperra NSW 2214

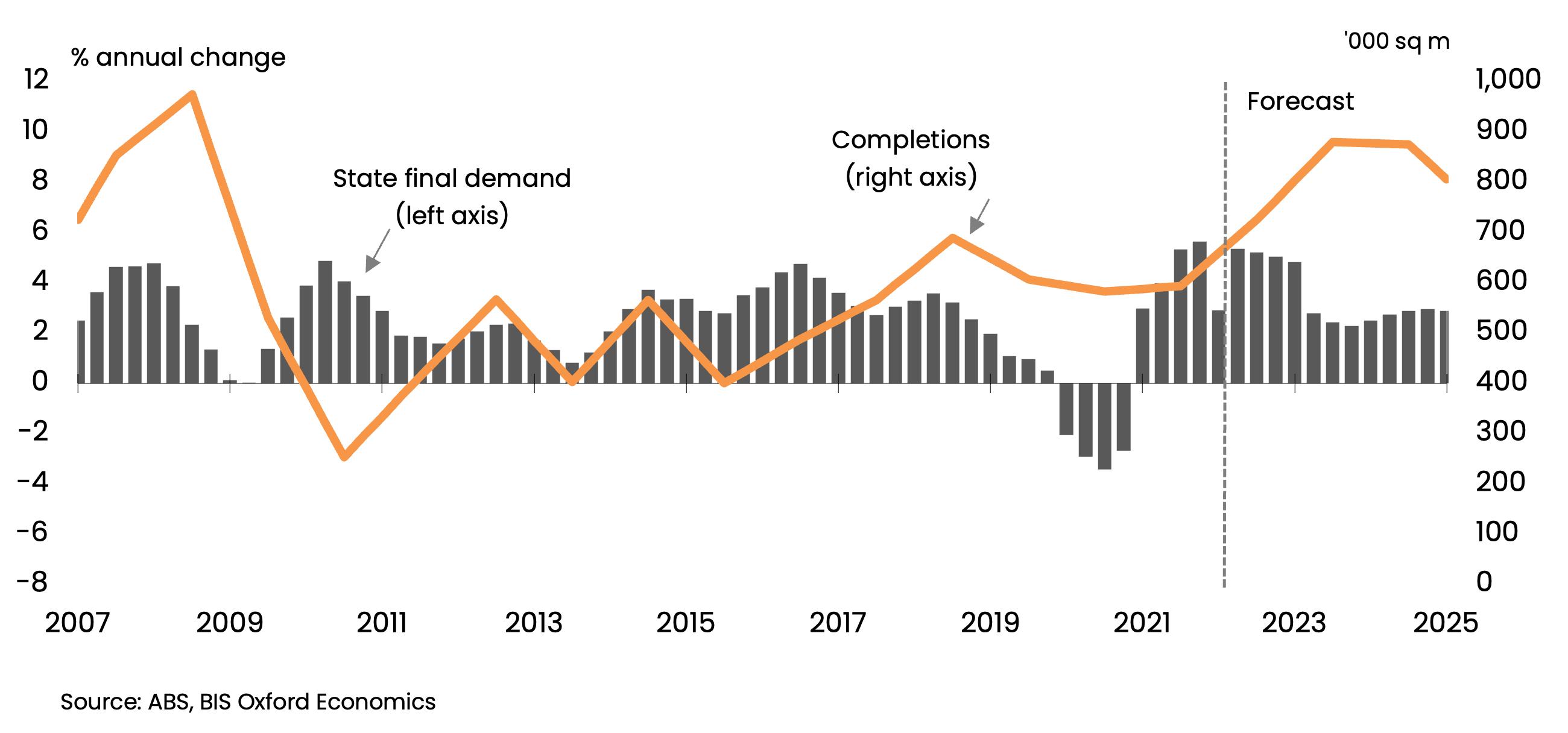

The NSW economy managed to weather the challenges posed by the Omicron variant in the first quarter of 2022, with the recovery from 2021’s lockdowns continuing.

We anticipate a continuation of robust rebound in economic growth over the remainder of 2022 and into 2023 as the state’s strategy of living with COVID becomes further entrenched. This will flow through to stronger than typical demand for industrial property space.

Net face rent ($ sqm) Incentive (%) Yield (%) Capital value ($ sqm) Sydney prime industrial market indicators

South $260 7.0 3.5 $7,453 North $235 11.0 Central West Outer $170 8.0 $140 8.0

3.9

3.7 $6,040 $4,597 3.6 $3,908

Demand for industrial property in Sydney has been extremely strong over the last 18 months, driven by a robust economic rebound across NSW from last year’s lockdowns as well as factors heightened by the pandemic.

Overall, gross take-up of industrial space exceeded 1.1 million square metres last year, reaching as high as 1.8 million square metres. Momentum slowed during the first half of 2022, with take-up only constrained by very tight vacancy amongst existing buildings. Most of the take-up in recent times has focused on the Outer West, followed by the South West and Central West.

The strength in occupier demand is being driven by transport & logistics users, retailers (pure play, e-commerce, food and cold storage), manufactures, and pharmaceuticals. The trend of occupiers taking more space for higher domestic inventories to counter supply chain disruptions is still evident. Supply chain disruptions and delays in securing stock has driven a shift by occupiers from storing sufficient inventories to satisfy immediate customer requirements (known as ‘just in time’) to higher stock levels and storage requirements (referred to as ‘just in case’ or ‘onshoring’).

We estimate metro net absorption reached a record high 1.2 million square metres (in buildings greater than 5,000 square metres) in 2021 and around 900,000 square metres for the 2022 financial year, close to double the long run average. There are many examples of larger footprints being negotiated in pre-lease deals, including a doubling of size by Cameron Group (6,200 square metres in Marsden Park), Kumho Tyres (11,300 square metres also at Marsden Park) and Allied Express (20,000 square metres at Bankstown Airport). Business confidence surveys around the middle of this year show the ongoing pandemic is expected to have minimal impact on industrial property occupiers in NSW and that confidence is positive in the state. Indeed, the strong take-up of above average completions levels and speculatively commenced projects (reflected in very low vacancy rates) shows businesses are broadly confident about their prospects.

Based on our assessment, the vacancy rate for buildings greater than 5,000 square metres tightened at a rapid pace through 2021, as record net absorption outpaced above-average completions. At December, the total vacancy rate fell to an estimated 0.5 per cent (the lowest rate in over 15 years) from 3.0 per cent at the start of 2021. Since then, the vacancy rate has remained very low, ticking down to around 0.4 per cent at June 2022. Available evidence suggests vacancy rates are very low across all the regions, although there does appear to be more options available in the North, particularly for smaller occupiers.

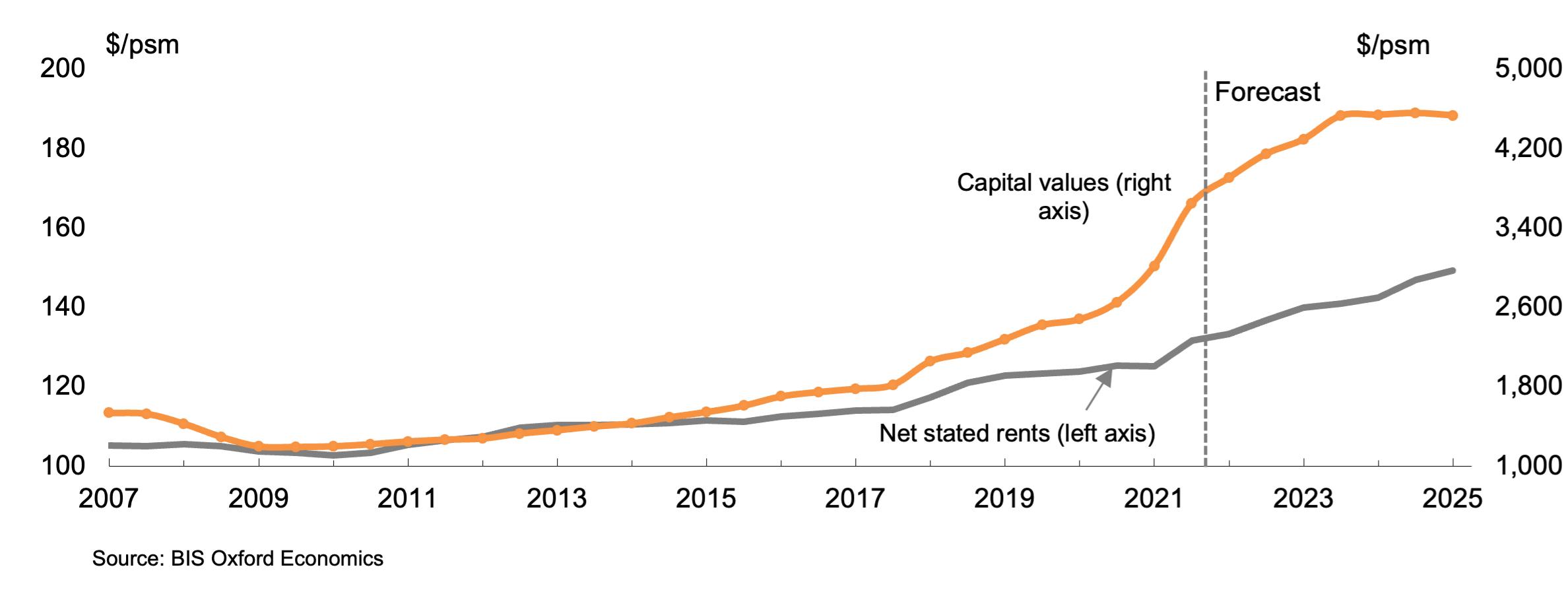

The combination of strong demand and very low vacancies underpinned a sharp increase in prime net stated rents. Overall leasing incentives amongst existing buildings have fallen this year. We estimate average prime leasing incentives ended the 2022 financial year at 7 per cent in the South, 8 per cent in the Central West and Outer West, and 11 per cent in the North.

20 Investigator Drive, Unanderra NSW 2526

Over the next 12 to 18 months, a handful of key drivers (that were significantly shaped by the pandemic) will remain dominant drivers of industrial property demand in Sydney.

Growth in online retail spending will continue to have a strong influence on industrial property demand in Sydney and will continue to encourage ongoing investment from industrial occupiers in more efficient warehousing and delivery services to satisfy their customers.

We do not anticipate that the build-up of domestic inventory seen during the pandemic will be enduring once supply chains normalise, as this inventory management strategy carries a higher cost to businesses. It is hard to say with confidence when higher stock-to-sales ratios will unwind, but our forecasts allow for supply chain pressure to ease by next year. Even so, we do not expect a return to pre-pandemic ‘just in time’ inventory practices.

Combining the drivers of demand, indicatively, we forecast net absorption to remain above 700,000 square metres this calendar and next financial year, sustained by the release of pent-up demand as completions ramp up. Thereafter, as pandemic related drivers ease, we forecast net absorption to moderate to a still healthy 500,000 square metres in the 2024 financial year. Strong demand, lower vacancy and rising pre-lease rents are set to drive elevated rental growth in the near term. We forecast annual growth rates of 12 per cent to 17 per cent across the Central West and Outer West in the 2023 and 2024 financial years, whilst the Northern and Southern regions are anticipated to experience moderately higher rental growth.

Contained vacancies in the South and Central West are also supportive of 10 per cent to 18 per cent annual growth rates in the secondary market. Recent rises in long bond rates means that we no longer believe yields will continue to firm, removing a key suppresser of pre-lease rents (and in turn market rents). Hence, rising land values, construction costs and a forecast phase of yield softening all point to higher rents needed to make new builds feasible. Leasing incentives are also forecast to fall a little further by the end of this year, reflecting very tight market conditions, and driving exceptionally strong growth in effective rents.

Sydney outer western industrial rents and capital values

The Sydney industrial property investment market was very strong, with a record $5 billion in sales transacted in 2021 and $3.5 billion in the first half of 2022, underpinned by a number of major portfolio sales. The market started this year with notable momentum, but the volume of sales dropped during the second quarter 2022 as rising interest (long bond) rates caused investors to pause.

Recent sales include:

• Logos acquired a circa 27-hectare parcel of land on Archbold Road, Eastern Creek for $180 million with plans to develop an industrial property estate;

• Centuria sold a 6,000 square metres warehouse at 30 Clay Place Eastern Creek property to an undisclosed foreign investor for around $35 million; and

• A local developer bought an 8,000 square metres site at 101-103 Fairford Road, Padstow from Chess Engineering for almost $19 million.

In Australia, and across the globe, 10-year bond rates have risen sharply this year, reaching 3.6 per cent at June 2022. On our forecasts, bond rates will remain around current rates between now and 2024 before tapering back to a longer-term trend rate around 2.9 per cent, taking its lead from the United States.

Combined with rising short rates both in Australia and in the United States, this suggests the phase of yield firming in Sydney industrial property is drawing to a close. We are starting to see an increasing stand-off between potential buyers, who are pricing in offers on higher yields, and sellers unwilling to accept lower values. As such, little market evidence has emerged of softening yields.

The combination of forecast rental growth and softer yields will see a slowdown in the extraordinary rate of capital value growth. There still appears to be a notable volume of funds assessing an entry into the industrial property market across Australia’s eastern seaboard, with large mandates from GPT, Logos and Gateway Capital just to name a few. However, investors have become more cautious and less urgent when assessing opportunities.

Driven by the weight of funds chasing assets prime yields firmed 50 to 60 basis points during the 2022 financial year to a low of 3.5 per cent in the South, 3.6 per cent in the Outer West, 3.7 per cent in the Central West and 3.9 per cent in the North.

Secondary yields in the South are assessed at 4.5per cent and 4.8 per cent in the Central West, representing a firming of 50 basis points for the 2022 financial year. The strength of yield firming underpinned strong growth in capital values in 2021, ranging from 37 per cent to 51 per cent across the regions, representing record breaking growth. In the 2022 financial year, growth rates were almost as impressive at an estimated 29 per cent to 42 per cent. Secondary capital value growth in the South and Central West was also exceptionally strong.

We expect strong rental growth to drive solid price gains until the 2024 financial year, before a prolonged phase of more modest growth.

Prime values in the Southern, Northern, Central Western and Outer Western regions are forecast to rise by 16 per cent to 23 per cent over the three years to the 2025 financial year. Secondary prices in the Southern and Central Western regions are forecast to rise 16 per cent to 17 per cent over the same period.

Investment outlook

Sydney is currently in the midst of a significant supply cycle, with completions well above the long run average. Completions (greater than 5,000 square metres) reached around 590,000 square metres in 2021, tracking towards 725,000 square metres for this year across 35 projects.

Project delays caused by material and labour shortages as well as weather disruptions are having a notable impact on delivery timetables, with several developments due for completion last year, pushed into this year as well as others due in 2022 delayed to 2023. The ultimate impact will see a smoothing out and prolonging of the current supply cycle. The Outer region dominates activity, accounting for 80 per cent of metropolitan completions this year – 587,000 square metres across 28 projects. This is followed by the Central West with 107,000 square metres (6 projects and a 15 per cent share). The majority of completions due this year and next have been underpinned by pre-leases or have secured tenants during construction. Major developers continue to compete hard for large pre-commitments, keeping pre-lease rents competitive with (or below) existing prime rents, although both are rising notably. Pre-lease deals also typically include higher leasing incentives. However, our understanding is that there is also a significant proportion of speculative development occurring, with developers looking to benefit from low vacancies and strong demand from occupiers who can’t wait for a pre-lease.

Cost escalations coming from labour and material disruptions have not yet reached a point of derailing the current phase of completions yet. Our assessment is that construction costs alone increased 30 per cent to 35 per cent on average in Sydney in the 2022 financial year. As a result, rents required for new builds are notably rising.

14 Mildon Road, Tuggerah NSW 2259

Based on projects under way and a sustained period of low vacancies driving rents higher, we expect completions to ramp up in 2023 and remain historically high in 2024 at around 880,000 square metres per annum. We already know of around 30 projects, for a collective 970,000 square metres and are confident more will emerge.

Material shortages and construction cost pressures are likely to continue for the next 12 to 18 months, challenging, but not derailing project delivery. We expect the recent mixture of pre-leases and spec construction to continue as the major developers look to capture user requirements with both longer and shorter turnaround times. Beyond the 2024 financial year, we forecast industrial property completions will gradually fall back closer to the long run average, crimped by moderating demand and moderately higher vacancies.

There are sufficient stocks of serviced vacant land to accommodate our near-term supply forecasts. More serviced land will be needed to allow for the bulk of post-2023 completions. The Mamre Road precinct will allow more projects as land is serviced. Further out, some of the precinct plans for the Aerotropolis have just been released, but contributions are yet to be finalised. It is likely that industrial development here will coincide with the 2026 Airport opening.

Sydney industrial demand and new supply