Editor: Denise Maguire

Creative Director: Jane Matthews

Designer: Alan McArthur

Production Executive: Claire Kiernan

Managing Director: Gerry Tynan

Chairman: Diarmaid Lennon

Email: info@ashville.com or write to: Better Business, Ashville Media, Unit 55, Park West Road, Park West Industrial Estate, Dublin 12, D12 X9F9. Tel: (01) 432 2200

All rights reserved. Every care has been taken to ensure that the information contained in this magazine is accurate. The publishers cannot, however, accept responsibility for errors or omissions. Reproduction by any means in whole or in part without the permission of the publisher is prohibited. © Ashville Media Group 2025. All discounts, promotions and competitions contained in this magazine are run independently of Better Business. The promoter/advertiser is responsible for honouring the prize. ISSN 2009-9118 SFA is a trading name of Ibec.

the small business community.

Springtime can be associated with new opportunities. However, the spectre of tari s and protectionist policies emanating beyond our shores presents a looming threat to prosperity. ere remains hope, however, due to the tenacity of the small business community in Ireland and with some of the measures included in the new Programme for Government, announced a couple of months ago. For the past 12 months, the SFA has been calling for a range of policies designed to tackle spiralling business costs. In the short term, the SFA has called for a temporary PRSI rebate for small businesses to assist the transition towards living wage rates. e Programme for Government has committed to bringing forward measures to support SMEs which entail changes to VAT, PRSI and other measures.

e SFA’s General Election Manifesto also called for a roadmap for developing small business communities with the same policy focus that brought the world’s largest companies to our shores. e SFA is pleased to see that there is a commitment to publish ‘Enterprise 2035’, a long-term ambition for enterprise growth and job creation over the coming decade.

e SFA is already engaging with the new administration and other political stakeholders on the implementation of these policies and looks forward to fruitful engagement in the months and years to come.

e spring issue of Better Business is packed with inspiring stories, advice and information from Ireland’s top entrepreneurs. I hope that readers will nd it useful during these uncertain economic times. e sector spotlight features some of Ireland’s most innovative manufacturers and the entrepreneurs section of Better Business focuses on young people in the tech sector. ere are also special reports on the National Minimum Wage and R&D tax credits. e ‘Top Tips’ section provides practical advice on sales in the current economic environment. Our health section outlines the bene ts of exercise in the workplace while the travel section takes a look at Canada, a nation with strong cultural and economic ties to Ireland.

In February, the SFA held its annual ‘Business Connect’ networking event at the Killashee Hotel in Naas, Co Kildare. Over 400 delegates attended, which showcased the nalists of the SFA National Small Business Awards 2025 in the exhibit centre along with awards supporters and indigenous agencies. e theme of the event was ‘Survival, Resilience and Success’. In addition to some informative presentations and panel discussions, the keynote address was delivered by entrepreneur Aimee Connolly who founded award-winning cosmetics range, Sculpted by Aimee. In March, the SFA held its annual Small Business Awards gala event in the RDS, details of which can be found in this issue.

Better Business is the magazine of the small business community. We welcome your feedback, suggestions and ideas to info@sfa.ie on X (Twitter) @SFA_Irl

David Broderick Director, Small Firms Association

Big News for Small Business News, views and profiles from SFA members and small businesses in Ireland

18

Sector Spotlight Irish manufacturers are making waves at home and abroad

28 Cover Story

Joe McGinley at Iconic Offices on why 1980’s style offices are a thing of the past

48 Arts and Culture

Lisa McCormack is making her mark on Ireland’s contemporary jewellery scene

10

National Minimum Wage Small businesses are struggling to stay afloat in an increasingly difficult trading environment

22 Supports InterTradeIreland’s Alison Currie talks about supporting SMEs and fostering female entrepreneurship

32 Entrepreneurs Four dynamic young entrepreneurs chat about building businesses with purpose

52 Travel Canada offers a host of opportunities for Irish businesses

16

SFA Small Business Awards VOYA has been named the overall winner at the annual event

24 R&D

KPMG’s Ken Hardy chats to Better Business about why take-up of the R&D tax credit is low

40 HR

Zaynab Lawal on the steps small businesses should take when managing redundancies

55 And Another Thing

Marina Bleahen on how to increase profit, improve performance and reclaim your time

FROM TOP LEFT: VOYA took home the top award at the 2025 SFA National Small Business Awards, page 16 // Paula McGovern, Founder of Wizard & Grace essential oil candles range, on why innovation in manufacturing is so important, page 18 // Joe McGinley of Iconic Offices explains why flexible workspaces are key when it comes to encouraging employees back to the office, page 28 // Tech entrepreneur Sadhbh Wood is aiming to be a leader in coffee repurposing in Ireland, page 32

CalQRisk has acquired GreenFeet, a provider of carbon accounting software.

By integrating GreenFeet into CalQRisk’s suite, the company is combining its GRC solutions with GreenFeet’s carbon reporting expertise to offer businesses a seamless way to measure, manage and report their emissions. As stakeholder expectations for transparency and accountability rise, the demand for simplified ESG and carbon reporting has never been greater. Sustainability has evolved rapidly since GreenFeet’s inception, with new frameworks emerging and regulations like CSRD taking centre stage. Businesses are embracing carbon measurement at an unprecedented pace. CalQRisk says it’s excited to be at the forefront of this transformation.

IF YOUR BUSINESS HAS SOME NEWS TO SHARE THAT YOU WOULD LIKE FEATURED IN THE NEXT EDITION OF BETTER BUSINESS, CONTACT DAVID BRODERICK AT DAVID.BRODERICK@SFA.IE

Lisa O’Connell, CEO, Forus Training

A surge in enrolments for Special Needs Assistants (SNA), healthcare, homecare and childcare training has been reported by education provider Forus Training, reflecting a broader trend of women returning to the workforce and reskilling into care-related roles. The start of 2025 has seen a marked increase in interest from adult learners seeking flexible, purpose-driven qualifications, according to Forus Training CEO Lisa O’Connell. “The demand for qualified SNAs and homecare professionals is growing every year,” said O’Connell. “These are meaningful jobs that work around people’s lives and the need has never been greater.” This spike follows the Budget 2025 commitment to fund 1,600 additional SNAs in Irish schools, as part of the Government’s continued support for inclusive education. “In 2025, Ireland isn’t short of care jobs – we’re short of people ready to fill them,” O’Connell added. “With demand continuing to rise, there’s a real opportunity to step into work that matters.”

Allenkey Fittings has announced it is the only Safety at Height Contractor in the Republic of Ireland to be added to the SFS Installer Network, a platform dedicated to the advancement of competency in the fall protection industry. No stranger to fall protection services and a former Kee Safety Distributor, Allenkey Fittings has been providing safe access and safety at height services in Ireland since 1981. In an effort to move away from costly imports, Allenkey Fittings first launched its own patented counterbalance weight to the Irish market in 2013, manufactured in Ireland from 100% recycled tyres. Over the past 10 years, the Allenkey team has worked with SFS as an approved installer, increasing its knowledge and expertise in this safety critical area, culminating in SFS expanding the SFS Installer Network Platform into the Republic of Ireland for the first time.

The latest Eurobarometer poll, published in January 2025, shows that Irish consumers have a good awareness of the positive benefits of organic production, such as environmental performance and higher animal welfare standards. Over the last two years, recognition of the EU organic logo (the EU leaf), a key identifier of organic produce in EU retail settings, has also increased. However, this recognition is developing from a lower base than in other European countries. Irish organic production has grown significantly in recent years. This has seen a 2-fold increase in the number of organic farms since 2020, reaching approximately 5,000 farms by 2024, covering 5% of Ireland’s farmland. There has been strong interest amongst beef and sheep farmers as well as growth in horticulture, tillage and dairy. This is helping to increase the availability of Irish organic produce over time as farmers must undertake a two-year conversion before produce can be marketed as “organic”. Promotion campaigns such as the “This Irish Organic” social media campaign created by the Irish Organic Association has sought to increase awareness of organic production amongst Irish consumers. The campaign, originally funded by the Department of Agriculture, Food and the Marine, debuted in April 2024 and has been well-received, scooping an award for “Best Brand” and a nomination for “Best Creative” at the Irish Digital Media Awards. To learn more about the campaign, visit www.thisisirishorganic.ie or contact the Irish Organic Association to find out about potential business opportunities in Ireland’s growing organic sector.

International engineering consulting group, COWI, has opened a new office in Dublin. The expansion will provide critical engineering expertise to support Project Ireland 2040, the Government’s long-term strategy to unlock investment in infrastructure development and sustainable growth. COWI aims to get to 50 staff in the new office within three years and establish a Centre of Excellence that fosters innovation and attracts the next generation of engineers. The team of engineering experts will support both national and international projects, with a key focus on driving Ireland’s green transition.

David Feighery, COWI’s Head of Ireland, said: “Project Ireland 2040 represents a transformative opportunity for sustainable infrastructure development across the country. As Ireland commits to enhancing regional connectivity, transitioning to renewable energy and creating climate resilient communities, COWI brings proven expertise from similar successful transitions in Denmark and wider Scandinavia. We are already contributing to Ireland’s green transition through our work on the Dublin District Heating Project, which aims to provide sustainable heating to homes and businesses. Our engineering solutions will help Ireland achieve its goals of compact urban growth, enhanced regional accessibility and the transition to a low-carbon economy.”

@GeraldineLavin

Minister James Lawless (@lawlessj)

thanking small biz 4 keeping the wheels of State turning @SFA_Irl

#BusinessConnect in @killasheehotel You’re welcome

Minister Great crowd of SME owners & business support orgs. Looking forward to seeing the #SFAAwards2025 exhibitors soon!

@Alan_Dillon

Glad to take the time to meet with representatives of the @SFA_Irl this afternoon in the Department of Enterprise I am determined to engage closely with our small businesses to fulfil our key Programme for Government commitments of supporting our SMEs

@GerardBrady100

Employment by the end of 2025 will be almost 500,000 up on 2019. We’ve come through an exceptional period of growth but that is showing signs of moderating. This is to be expected. We expect domestic demand to grow by 3% in 2025 and 2.7% in 2026. Still pretty strong.

Engineering consultant Total Power Solutions has launched a new website, outlining the services it provides and also highlighting the many accreditations and partnerships secured by the business, including ISO’s, certifications with Schneider Electric and a partnership with Gutor. “It’s great to have a website that showcases the very latest technologies and one that we can easily update ourselves,” said Managing Director Paul Kavanagh. Director Dominick Byrne said: “We are lucky enough to work with the very best equipment and brands in the business and our depth of expertise in relation to UPS and cooling systems is probably second-to-none, so it’s useful to have a website that reflects this.” As part of the new website project, Total Power Solutions took the opportunity to add new case studies and integrate the many 5 star reviews secured by the business.

“This Business Connect sold out in just a few weeks, which once again cements it as Ireland’s leading small business networking event. The theme of survival, resilience and success reflect the reality that many small businesses are facing due to spiralling costs.”

David Broderick speaking ahead of the Business Connect event in Naas, Co Kildare

“Amid the challenges of rising business costs and geopolitical uncertainly, it is an exciting time for the small business community with the advent of this new Government.”

Geraldine Magnier, SFA Chair and CEO of Idiro Analytics, addressing the annual Business Connect event

“Fundamental to the delivery of the investment we need is a strong, resilient and knowledge-based economy, as committed to in the programme for Government. Support for our SMEs is crucial, as well as ensuring that lreland is a competitive and attractive place to do business for international companies.”

Dublin Mid-West TD Shane Moynihan (FF) giving a statement in the Dáil about the Programme for Government

A survey from IT.ie shows a lack of confidence among office workers in their ability to thwart cyberthreats. The survey found that 51% of office workers feel more vulnerable to cyberattacks than they did a year ago, leading to 43% believing that they are at risk of causing a cybersecurity incident in the next 12 months. The research of 1,000 office workers based in Ireland was carried out by Censuswide on behalf of IT.ie and SonicWall, a global leader in cybersecurity innovation. It uncovers a need for more cybersecurity training for office workers, along with a greater sense of shared responsibility for upholding cybersecurity standards. The survey found that of the 43% who feel at risk of causing a breach, 60% attribute it to incomplete or non-existent cybersecurity training and nearly a third (31%) blame poor communication from management regarding cyber risks. These feelings of being ill-prepared are reflected among the general office worker population too, with 21% saying they do not feel adequately trained to deal with increased cybersecurity threats on a day-to-day basis. This is despite the fact that the EU’s incoming cybersecurity legislation, the NIS2 Directive, outlines cybersecurity training as one of the minimum measures required for compliance.

A survey by Auxilion has found that 61% of senior managers working in financial services in Ireland are planning to change jobs within the next two years. The study revealed that a similar proportion (59%) have changed jobs in the past year, with some 80% having interviewed for another job during the past six months. Two thirds (66%) of these senior managers admitted they would retrain in a new career/profession if there were no barriers (e.g. financial or family commitments). Speaking about the findings, Niamh Cray, Chief People Officer, Auxilion, said: “Our research reveals a real risk to financial services firms in terms of talent. Not only are a significant proportion of senior managers contemplating leaving, but many are already actively seeking out new opportunities – indicating that it’s only a matter of time before the impact is felt.” She added: “Companies in this sector in Ireland need to address this, otherwise they could be facing a mass exodus and a resource crisis. Those without a blended talent strategy, consisting of in-house expertise and external resourcing services, could seriously struggle to replace and fill roles with the expertise they need.”

The upgrade of heating, ventilation and air conditioning (HVAC) systems will reduce costs, increase control, boost satisfaction and help reach sustainability targets (lower emissions). Thermodial says that with more than half of the energy use in a typical office down to HVAC and hot water systems, having efficient systems can assist in reaching cost, control, satisfaction or emissions targets. A range of financial supports are available from the Sustainable Energy Authority of Ireland (SEAI) to upgrade heating, cooling, BEMS, solar thermal and solar PV, building fabric and provide technical design assistance. Moreover, from 2026, a medium sized commercial premises (systems of 290kW or greater), must have a building energy management system (BEMS) in place. This EU regulation will help businesses to monitor and control HVAC energy use. Harvard Business Review (HBR) office air research studies have shown that improved ventilation rates can increase workplace productivity and reduce absenteeism. Electing to upgrade systems can not only take advantage of lower running costs, reduced carbon and increased control, but can also take advantage of the latest technology innovations, such as heat pumps and air conditioning units to charge electric vehicles. Read more about Thermodial’s approach to HVAC upgrades at:

www.thermodial.ie/hvac-upgrades/

boost skills - boost business

Future-proof your skills with Skills to Advance Micro-Qualifications - short, targeted courses, at little or no cost, in key areas like sustainability, digital business skills, market development, and more.

Stay ahead by contacting your local Education and Training Board or visit skillstoadvance.ie.

Supported

and

InJanuary 2024, Ireland’s National Minimum Wage increased by 80 cent to €13.50 per hour. at increase is being felt by businesses of all sizes but for small and medium enterprises, it’s having a profound impact. Higher labour costs a ect operational costs, hiring practices and overall sustainability and have added to the increased cost burden facing small rms.

A survey conducted by the SFA in 2024 found that over 80% of small businesses had experienced rising costs in the past year, with an average increase of 16.6% in overall business expenses. Labour costs, insurance and raw materials were cited as other key contributors. ese increases are contributing to a tough trading environment where making a pro t is almost impossible. “Our basic rate of pay is above the national minimum wage, but we’re in a position where we’ve had to increase everyone’s wages. Increases to the national minimum wage over the past four years means we have increased wages by about 32%. In any industry, if costs went up by that amount, there would be uproar. It’s not that I don’t want to pay

my team; they’re excellent and they absolutely deserve it. I just don’t have that money,” said Becci Harrison, owner of Fishers of Newtownmountkennedy. It’s about margin, she says, which is down irrespective of labour costs. “We have both retail and hospitality and they work slightly di erently in terms of setting prices. We can't really adjust what we charge for retail products; if a consumer can nd that item cheaper somewhere else, they’ll go there. On the hospitality side, we have a little bit more exibility but again, there is a limit. Evening trade is very di cult but even with our lunch trade, you’re restricted with what consumers are willing to pay.”

About 18 months ago, Becci sat down with the team to try and identify where cost savings could be made. It quickly became clear that the model the business had operated on for the past 45 years was no longer viable. “We were in a position where we had to nd €60,000 to cover costs, so we had to rethink the way we do business. Unfortunately, we had to make some redundancies but that allowed the rest of the salaries to stay the same. It was a relief but of course, we were devastated for the people that we had to let go.” Although there was more money in the pot for existing sta , the redundancies nevertheless had a negative impact on the business. “We retained our vital sta but the roles we had to let go complemented the business. For example, we had to let go of our merchandiser and our social media expert. We’re now managing those roles in-house, but without any real expertise in those areas. at’s having an impact on sales.”

OF SMALL BUSINESSES HAVE EXPERIENCED RISING COSTS IN THE PAST YEAR SMALL BUSINESSES SAW AN AVERAGE INCREASE OF 16.6% IN OVERALL BUSINESS EXPENSES

is year, Becci is looking at an 8% increase in labour costs. “ at’s still a signi cant increase, particularly when you consider that the sales environment hasn't changed. It means there’s no contingency there, no safety net.” Rising costs mean small businesses will be forced to close their doors, impacting rural areas around the country. “We employ over 40 people and we also rent out space to other businesses. We have a café here where local groups regularly meet. If we were forced to close, the impact would be huge.”

Targeted Government support would, says Becci, allow small rms restructure and evolve. Her husband also runs a small business. “We’re both utterly exhausted because it's just been nonstop. In terms of exibility, there are bene ts to being a small business but the mental load is relentless. Rising costs are a huge part of that worry and strain. If it wasn't for my sta , I may have said to hell with this 18 months ago. is year, we just need to dig in and work incredibly hard. Although I’ve been saying that for the last ve years.”

2025 could, says Barry Prost, be a tough year for small businesses. e Rent a Recruiter CoFounder, who also chairs the Dublin Regional Skills Forum and sits on the Dublin Chamber Labour Task Force, says employers are unfairly carrying the burden of the cost of living crisis.

“In terms of costs, small businesses are facing a triple whammy. We’re looking at statutory sick pay, minimum wage and auto-enrolment which is due to kick in later this year. With the latter, businesses aren’t just looking at pension contribution, they must also meet the cost of administering that contribution too.”

Additional costs such as minimum wage act as a barrier to expansion. “Employers are less likely to take on new sta when they’re grappling with these costs. ey’re also less likely to take on graduates. at’s going to impact on a rm’s ability to thrive and grow.”

e SFA has long called for the introduction of a PRSI rebate to assist small businesses with the transition towards the Living Wage rates. It says the rebate could be based on each worker earning below an agreed threshold. e SFA proposes that the system be operated through Revenue’s PAYE Modernisation in much the same way as the employment wage subsidy scheme. “I think that’s a tool the Government has at its disposal and one that could make a real di erence. Also, why doesn’t the Government reduce the USC? A reduction in the Capital Gains tax rate from 33% to 20% would also be a positive move. Supports are de nitely needed; as a recruiter, I see the challenges facing businesses every day. Closures will continue until those supports are put in place.”

In January, The Small Firms Association hosted the ‘Level-up 2025: Connecting for Growth Cork’, in partnership with Visa and sponsored by Azets Ireland

Almost 100 people attended the event in the Silver Springs Hotel in Cork. The highlight of the morning was definitively the fireside chat with Bernard Jackman, who entertained the crowd with stories from his career and incredible takeaways on leadership and managing teams. Those present were able to get invaluable nuggets from our Digital Payments session with Conor Langford, Country Manager for Visa and Finance for Growth, Jack Swinburne, Partner in the Corporate Finance Department at Azets Ireland and Mark Richardson, Head of the Fund Management Department at Azets Ireland.

If you did not get the chance to attend Business Connect this year, we have plenty of upcoming virtual and in-person events that you can register for now at sfa.ie/ events. If there are any events that you would be interested in either attending or hosting alongside the SFA, please contact info@sfa.ie

Held at Killashee Hotel in Naas, this was the second year in a row that the event has taken place in County Kildare. The event is a unique opportunity for the small business community to network, learn and get inspired. Business Connect was opened by local TD, James Lawless, Minister for Higher Education and Science. The theme of the event was Survival, Resilience and Success and the keynote address was delivered by entrepreneur Aimee Connolly who founded an award-winning cosmetics range, Sculpted by Aimee. Business Connect was hosted by journalist Richard Curran and also featured presentations and panel discussions form Ireland’s leading business experts.

Commenting on the policy priorities for small businesses in her address to delegates, Geraldine Magnier, SFA Chair and CEO of Idiro Analytics said: “Amid the challenges of rising business costs

and geopolitical uncertainly, it is an exciting time for the small business community with the advent of this new Government.

“I am happy to see that the recently published Programme for Government has committed to developing a strategic roadmap for SMEs and proposed changes to VAT and PRSI rates. I am also encouraged by the forthcoming establishment of a cost of business forum in the Department of Enterprise, Tourism and Employment.”

Commenting on the attendance at Business Connect, SFA Director David Broderick said: “This Business Connect sold out in just a few weeks, which once again cements it as Ireland’s leading small business networking event. The theme of survival, resilience and success reflects the reality that many small businesses are facing due to spiralling costs. It is the intention of Business Connect to both inspire and provide practical advice to small business entrepreneurs.”

“THE THEME OF SURVIVAL, RESILIENCE AND SUCCESS REFLECTS THE REALITY THAT MANY SMALL BUSINESSES ARE FACING DUE TO SPIRALLING COSTS. IT IS THE INTENTION OF BUSINESS CONNECT TO INSPIRE AND PROVIDE PRACTICAL ADVICE TO SMALL BUSINESS ENTREPRENEURS.”

VOYA IS NAMED OVERALL WINNER OF THE SMALL FIRMS ASSOCIATION NATIONAL SMALL BUSINESS AWARDS 2025

The winners of the Small Firms Association (SFA) National Small Business Awards 2025 have been announced. The Awards celebrate the achievements of small businesses in Ireland and recognise the important and vital contributions of this sector to the Irish economy. Forty-four finalists and five Emerging New Businesses were selected from hundreds of applications received for the 2025 programme. VOYA was named the Overall National SFA Small Business Winner for 2025.

Established by Mark and Kira Walton in 2006, VOYA has redefined luxury skincare on a global level, combining ethical sourcing with a commitment to sustainability. VOYA products can be found in over 42 countries around the globe, in the most luxurious spas, hotels and retail outlets in the world.

Presenting the awards, Peter Burke T.D., Minister for Enterprise, Tourism and Employment, stated: “These companies represent the pinnacle of small business excellence in Ireland. Our overall winner, along with all finalist and category winners, deserve recognition for their outstanding innovation, creativity and invaluable contribution to the Irish economy.”

SFA Director David Broderick added: “I am delighted that we are continuing to grow a programme that positions the small business brand as the backbone of the Irish economy. Congratulations to all the finalists, each of whom represent the very best in small business and all are winners. Small businesses are present in every village, town and city and contribute enormously to economic activity and community engagement.”

This is the 21st year of the SFA National Small Business Awards, an initiative of the Small Firms Association. The Awards prize package for ALL finalists included a strategic management masterclass, participation in the SFA Business Connect event in February last and media exposure in a special supplement published with the Irish Independent The total prize for finalists is valued at €50,000 each. The category winners were also presented with a trophy and free membership of the Small Firms Association for one year. Skillnet Ireland is management training sponsor of the awards, while our media partner is the Irish Independent

> MANUFACTURING

(Sponsored by PTSB) Lawrence Engineering, Collooney, Co Sligo

> FOOD AND DRINK

(Sponsored by Bord Bia) Carlingford Oyster Company, Carlingford, Co Louth

> SERVICES (Sponsored by Sage) SolarSmart Energy, Dublin

> OUTSTANDING SMALL BUSINESS (Sponsored by Elavon) GP Practice Ally, Arklow, Co Wicklow

> RETAIL

(Sponsored by One4all Rewards) The Smooth Company, Lucan, Co Dublin

> INNOVATION

(Sponsored by National Standards Authority of Ireland (NSAI))

Oriel Marine Extracts, Drogheda, Co Louth

> EXPORTER OF THE YEAR (Sponsored by Enterprise Ireland) VOYA, Sligo

> SUSTAINABILITY

(Sponsored by Strategic Banking Corporation of Ireland (SBCI))

Active Tribe, Courtown, Co Wexford

> WORKPLACE WELLBEING (Sponsored by DeCare) ContractingPLUS, Cork

From biopharmaceuticals, engineering and medical technology to building materials and food production, it’s one of the highest performing sectors in the country. In 2023, manufacturing employed over 220,841 people, generated €197.25 billion in exports, produced €13.7 billion in wages, €3.03 billion in income tax and over €10 billion in corporation tax. That’s according to the Manufacturing in Ireland report by Ibec – Facing Forward: Manufacturing Confidence Amidst Evolving Challenges – which also outlined nine actions that Government should undertake for continued growth and success in the sector. Those actions range from helping the sector to develop strong talent pipelines, reduce energy costs, embrace digitalisation and AI and create a taxation environment which rewards innovation and excellence.

The report, which includes results from a 2024 survey, showed that confidence in Ireland’s manufacturing sector is up, with about seven in 10 expressing positivity at both national and enterprise level. Although operation-related costs are expected to continue to increase, there is an expectation that productivity, profitability and domestic sales will also increase. Challenges exist, however, and like most sectors, recruitment and retention are the most onerous. The cost of labour has also more than doubled from 8% in 2023 to 19% in 2024. That figure likely encompasses existing costs such as statutory sick pay and wage increases, along with prospective costs such as auto-enrolment and pay transparency.

According to the Ibec report labour costs have soared, a sentiment shared by Caroline Horgan, CEO at furnishings business Scatter Box in Navan. Higher expectations around salary increases are contributing to a tougher environment, both in retail and in manufacturing. “The changes to minimum wage have fuelled those expectations. Business is very difficult at the moment and 2024 in particular was a challenging year. From talking to other businesses around Navan, everyone seems to be in the same boat. Our window cleaner, who deals with a lot of businesses around the town, told me recently the only people doing well are the dentist and the doctor! There are businesses in the area that are closing down after 30 years; when I see that happening, I think at least we’re holding our own here.”

2024 was a year of belt-tightening – periods of three-day weeks and staff reviews. “When it comes to cutting back, we’ve gone as far as we can and yet we’re still faced with rising costs.” Striving to be more innovative and offering higher value products to cover costs are strategies that Caroline is employing. Ramping up on manufacturing is also fuelling growth but with that, inevitably, comes higher costs. A couple of years ago, the business invested in a machine to produce feather pads in-house. Previously, the material was being bought in from Europe and the Far East. Sourcing staff to manage the manufacturing side can, however, be tricky. “It’s hard to consistently find the right people. General operative labour is quite hard to come by. There’s full employment in that sector and people generally don’t switch jobs too often. To expand on the manufacturing side and into international markets, we would need to take on more staff and that’s difficult.”

Automation is also coming to the fore, says Caroline. “We have to be as efficient so we’re automating as many of our processes as possible. To expand, we also need to give our customers what they want and what they want are deliveries on a just-in-time basis. Accessing those customers is another challenge, so we’re looking at employing digitalisation a lot more and using 360 degree photos. Maybe that means that instead of attending so many trade shows, we can sell our products through digitalised photography.” It’s a costly endeavour but one that will, ultimately, help grow the business. The cost of exhibiting at trade shows has also shot up in price, says Caroline. “In 2023, we attended a trade show that we had also attended the year before. In just that short period, the cost for a stand had risen by €30,000. You can imagine what you need to make from those trade shows to make a profit.” Despite the challenges, Caroline is

“WE’RE AT A STAGE WHERE WE DON’T WANT TO OVERGROW; WE NEED TO BE CAUTIOUS GIVEN THE GLOBAL MARKET WE’RE IN, BUT I THINK THAT IF WE CAN JUST HOLD ON, WE’LL COME OUT THE OTHER SIDE.”

excited about the changes taking place at Scatter Box, a diversification of Abbeylands Furniture which was founded by Caroline’s father in 1959. “Our product development is innovative and we’ve pushed hard on our Guaranteed Irish and ‘Made with Love in Ireland’ branding. We’re at a stage where we don’t want to overgrow; we need to be cautious given the global market we’re in, but I think that if we can just hold on, we’ll come out the other side.”

Innovation in manufacturing is key, as is finding a gap in the market. With Wizard & Grace, a premium essential oil candles range, Paula McGovern found her niche. When she had her daughter, Paula’s sense of smell completely changed. “All of a sudden, I could sniff out a synthetic fragrance a mile away. I couldn’t

“ULTIMATELY, SETTING UP THE BUSINESS WAS ABOUT CREATING SOMETHING BEAUTIFUL THAT PEOPLE WOULD WANT BUT ALSO ALLOWING ME FREEDOM TO MANAGE MY OWN TIME. THOSE PROGRAMMES AND COURSES WERE IMPORTANT IN MAKING THAT HAPPEN.”

tolerate any artificial smells anymore and ended up going down this rabbit hole on scent. I discovered there’s so much green washing out there when it comes to candles; many of them claim to be natural but are actually made from synthetic perfume. I began making my own completely natural candles, initially for my own use, but soon found there was a more general interest in products like these.”

Paula’s first stop was LEO and the ‘Start your own Business’ course. At this stage, she was making candles at home at her kitchen table on a very small scale. “I also took part in the mentorship programme, which I found invaluable. Then, I did the ‘New Frontiers’ programme with Enterprise Ireland which really helped me in the initial stages of the business. Ultimately, setting up the business was about creating something beautiful that people would want but also allowing me freedom to manage my own time. Those programmes and courses were important in helping to make that happen.”

Making the candles at the kitchen table quickly became unsustainable, so Paula built a studio in her garden. After about 18 months, she began working with a small scale outsource manufacturer who shared her vision for the brand. “I still create all the blends myself, which is really the secret sauce. The manufacturer is fantastic; everything is still as natural and sustainable as possible. Outsourcing the manufacturing meant I could focus on product development and attend showcases and events.”

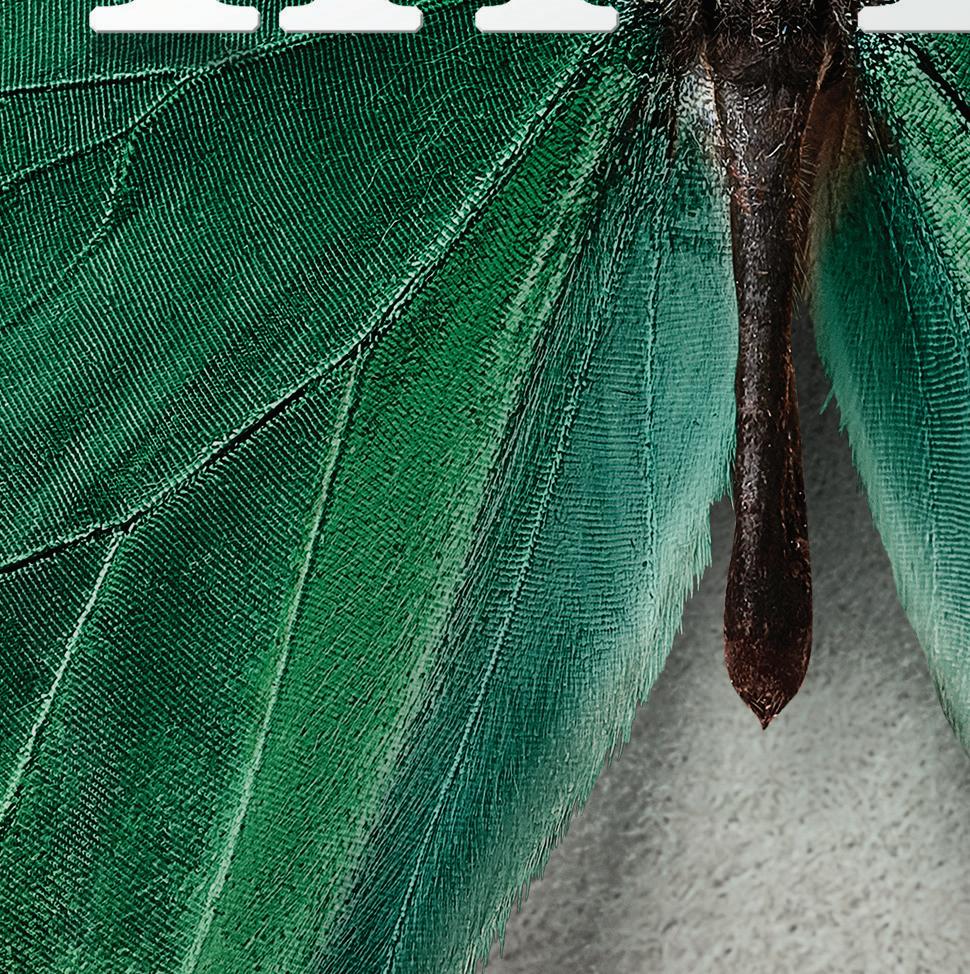

The Wizard & Grace range consists of nine candles, all 100% natural and sustainable. Each blend is designed to support a specific intention such as courage, gratitude or peace. Paula makes them using rapeseed and coconut wax, the most renewable and sustainable wax available on the market. Each one comes in a compostable, beautifully illustrated box, printed with vegan ink. Dublin-based illustrator, Conor Merriman, created the look for the range. “I wanted something that would really stand out from other brands and create a visual statement in the customer’s home.”

Predominantly an e-commerce business, the range is also available in about 30 shops in Ireland and three in the USA. This year, Paula is expanding the brand with a new range of aromatherapy roll-ons. “They’re intended for people who may not have the time to light a candle, but can carry a transportable product around with them that will cater to a specific wellbeing need. Ultimately, the ambition is to launch a suite of self-care products that will allow people to step back and take some time out for themselves. A candle isn’t going to change your life, but it’s a little reminder to slow down and take a breath.”

Lean manufacturing – a process that eliminates waste generated through various supply chain processes – helps businesses be more efficient and responsive to market needs. Dublin chicken firm Rosie & Jim has fully embraced the principles of Lean manufacturing and in so doing, transformed its operational efficiencies. “We have completed several Enterprise Irelandfunded Lean programmes which have been really helpful. When you’re scaling a business, it’s really difficult to implement changes, especially when you’ve been operating a certain way for a long time. Lean has completely changed up the business. We wouldn’t be able to take on the kind of business that we’re taking on now if we still had a small business structure. It has allowed us to grow and expand into international markets,” says Jim McLoughlin who established the business in 1997 with his partner, Rosie. Over the years, the business has built a solid network of foodservice and retail clients in Ireland, helped by a decision in 2015 to move to gluten free products. That decision was a wise one; in 2024, the brand scooped the ‘2024 FreeFrom Champion’ award at the FreeFrom Food Awards, along with three Gold Medals and one Silver Medal.

The company recently broke ground on a new multi-million expansion project at its factory in Dublin 12. The expansion will, says Jim, increase the factory’s footprint by 70%, triple production capacity and allow the business to meet growing demand in both its domestic and export markets. Rosie & Jim buys all its chicken from Europe. Supply has tightened, says Jim. “It’s become challenging but thankfully we have longstanding relationships with a really reputable supplier. That’s helping us work around the issue.” Rising energy and labour costs are another ongoing challenge. “It’s certainly difficult to meet those costs, but we’ve been operating for over 27 years so we’re well used to navigating all kinds of challenges.” Although Ireland remains an important market, the brand has expanded into the UK and also supplies the third largest retailer in Germany. “We’re currently working with a logistics partner who is really helping to open doors into food service in Germany. We’ve been supplying the UK for about 10 years now and in recent times, we’ve really dialled that engagement up. We recently launched into Morrisons and foodservice is also a growing area for us there. We hadn’t really cracked the foodservice industry at home until last year, but now we’ve got listings with all the big food service operators.”

“ONCE IT’S COMPLETE, WE’LL HAVE THREE TIMES THE CAPACITY THAT WE HAVE NOW, SO IT WILL REALLY SET US UP FOR THE FUTURE. WE’RE ALSO FOCUSED ON GROWING SALES IN A SUSTAINABLE MANNER. WE WANT TO BUILD THE BRAND AND EXPAND INTO NEW MARKETS. RIGHT NOW, WE’RE JUST ENJOYING THE JOURNEY.”

This year, the focus is on advancing the new factory extension. It will, says Jim, be quite a protracted project. “It will take two to three years before it’s finished and there’s a huge amount involved in it. Once it’s complete, we’ll have three times the capacity that we have now, so it will really set us up for the future. We’re also focused on growing sales in a sustainable manner. We want to build the brand and expand into new markets. Right now, we’re just enjoying the journey.”

their businesses. My role is about adding value, whether that’s through our own support programmes or by connecting businesses to the right resources elsewhere.

Tell us about your role at InterTradeIreland

I’m the Director of Innovation and Entrepreneurship at InterTradeIreland, the all-island economic development agency. Our mission is to support economic growth and business development across Ireland and we do that by providing SMEs with information, advice and funding.

A big part of my role is working with businesses directly – engaging with them, listening to their challenges and ensuring our supports are relevant. No two days are the same! I could be speaking with businesses, sharing details of our programmes, or sitting on an assessment panel for our Innovation Boost programme, which provides €68,000 in funding to help companies develop new products or services. We also recently launched the Business Explorer Programme, offering €5,000 in funding to help businesses explore solutions to their challenges, with a further €20,000 available for strategic innovation planning. So, at the heart of it all, my job is about making connections and helping businesses grow.

With over 20 years in strategic management, what makes innovation a key focus in your work?

My background is in economic development and I’ve led teams across Scotland, Northern Ireland and Ireland, delivering key business supports. I’m passionate about connecting businesses to opportunities that increase efficiency and boost profits, particularly through innovation. I love working with SMEs and ensuring they have the right support to accelerate their growth. I find it incredibly rewarding to encourage entrepreneurs to take that first step in starting or scaling

And of course, innovation is a core focus at InterTradeIreland. What does that mean in practice?

Innovation means different things to different businesses. For some, it’s a small operational change; for others, it’s developing cutting-edge technology. We work across that full spectrum. We’ve supported SMEs for over 25 years, working with over 60,000 businesses. A key programme is Innovation Boost, where we provide funding to help SMEs collaborate with academics and hire a graduate to drive new product or service development. For example, we’re working with a company that is integrating AI into its technology to repair satellites in space. At the same time, we’re supporting businesses looking at simple but effective ways to improve efficiency. Our ability to respond quickly to emerging challenges keeps us relevant – whether that’s through funding, expert advice or facilitating important connections.

And to innovate, you need support. InterTradeIreland offers substantial funding opportunities. What kinds of businesses are eligible to apply?

All our programmes are tailored for SMEs, primarily within the manufacturing and tradable services sectors. While there are set criteria, we strive to be as supportive as possible. We provide lots of free information and advice if a company does not qualify for direct funding. Our focus on cross-border and all-island business opportunities complements the support offered by Enterprise Ireland and Invest Northern Ireland. That’s where we truly deliver value.

Seedcorn is also a big opportunity for startups, for example. Can you tell us more about how it works and its impact?

Seedcorn is the only all-island investor readiness competition for entrepreneurs and high-potential start-ups. We’ve run it for over 21 years and we know

Alison Currie, Director of Innovation and Entrepreneurship, InterTradeIreland

it works – our winners have secured more than €350 million in investment. A great example is ByoWave, who won Seedcorn in 2022 and then raised €1.6 million. They’ve since signed a contract with Microsoft to develop a gaming module for disabled players. Another previous winner, CroiValve, secured over €12 million and is now progressing to clinical trials for heart valves. The competition isn’t just about the €100,000 prize for the all-island category winners, but the experience. Participants receive expert feedback, business planning workshops and pitching opportunities in front of real investors. This year, we’ve introduced three new categories – B2B, B2C and Deep Tech – to ensure more entrepreneurs can apply and that companies get sectorspecific feedback and connections.

We know the business landscape is constantly evolving, particularly for women in leadership roles. How have you seen things change? It’s hugely positive to see more women in leadership

Like any organisation, we face similar challenges to the businesses we support –talent retention, digital transformation and adapting to economic shifts. The pace of change is relentless for SMEs. Businesses must consider digitalisation, sustainability and competitiveness while dealing with rising costs. That’s why we focus on delivering practical, accessible supports that help businesses survive and thrive.

and entrepreneurship roles. There’s still work to do to remove barriers, but having women in these positions brings diversity of thought, skills and experience, which benefits businesses and the economy. InterTradeIreland, in partnership with Enterprise Ireland and Invest Northern Ireland, recently launched pilot programmes for women in business. We supported over 200 women across different stages – whether they were pre-revenue, growing an existing business or looking to scale internationally. One initiative, She Scales, took a cohort of women from across the island to Boston and New York to meet with potential investors and partners. One participant discussed a strategic partnership weeks after returning and another explored early-stage investment. So we’re creating real opportunities, but there’s still more to do.

Going back to that much-needed support, securing investment can be tougher for womenled businesses – what is InterTradeIreland doing to help change that?

The statistics are clear – women-founded businesses receive far less investment than male-founded or co-founded businesses. That’s why we’re supporting Awaken Angels, an initiative that educates women on becoming angel investors to increase funding for femaleled businesses. Investment is still male-dominated, but we already see deals through Awaken Angels. We’re approaching the challenge from both sides, helping more women start and grow businesses while also working to create a stronger investment ecosystem to support them.

Another huge challenge is the rising cost of doing business. How are you ensuring that SMEs find ways to innovate and stay competitive?

It’s a huge challenge. For example, businesses can’t control energy costs, but they can look at ways to improve efficiency. That could be through automation, digitalisation or reducing their carbon output. Our Innovation Boost programme helps companies take that step by providing funding and expertise to implement real change. One recent participant launched a new service within six months, generating additional local and international sales. We also conduct a quarterly all-island business monitor survey every quarter to stay informed about what businesses need. This allows us to respond in real time with relevant support.

I love working in economic development, particularly at the intersection of business support and policy. Engaging with businesses while also shaping SMEfocused Government policies is incredibly rewarding. I’m ambitious for myself and I’m always looking for ways to do more. But at the heart of it, my passion is helping businesses grow – and that’s exactly what I intend to keep doing.

THE R&D TAX CREDIT IS A VALUABLE INCENTIVE THAT THOUSANDS OF IRISH COMPANIES ARE MISSING OUT ON. KPMG’S KEN HARDY CHATS TO BETTER BUSINESS ABOUT THE CREDIT AND EXPLAINS WHY TAKE-UP IS LOW

First introduced in 2004, the Research and Development (R&D) tax credit is a nancial incentive that was developed to encourage companies to invest in their R&D activities. It works by giving qualifying companies up to 30% of their R&D expenditure in a tax credit or in cash. Put simply – for every €100 a company spends on eligible activities, Revenue will give them a 30% bene t. at bene t will be saved either through a tax reduction or through a cash refund. It’s also available in addition to the normal 12.5% trading corporation tax deduction.

It is, says Ken Hardy, Partner at KPMG Ireland, an excellent incentive and one that’s not being availed of as much as it could be. “ e credit relates to a company’s operating expenditure so can include things like salaries and materials, some limited overheads as well as capital expenditure. For example, if a company built an R&D building or an extension to a building, or they bought a piece of plant that will be partly used for R&D, then potentially there’s a tax credit available for that capital expenditure.”

Determining what’s eligible and what isn’t can be tricky sometimes, says Ken. “ e legislation governing the R&D tax credit is quite complex, with many additions made to it over the last 21 years. Despite its complexity, extensive guidance from Revenue is available, explaining what eligible expenditure is and laying out the ve tests that eligible activities need to meet in order to qualify as R&D activities. KPMG also authored a textbook for the Irish Tax Institute recently, featuring case studies and work examples.”

Take-up of the R&D tax credit has plateaued in recent years. In 2012, there were 1,543 claims and in 2022, there were 1,631. In the intervening years, numbers have followed similar trends. Given the number of companies in Ireland, those gures are surprisingly low. “In my experience, companies prefer dealing with the IDA or Enterprise Ireland with respect to R&D-related grants rather than claiming R&D tax credits. I think some taxpayers might prefer not to engage with Revenue. When you’re engaging with the IDA or Enterprise Ireland, you’re working collaboratively to achieve a common goal, ie a grant. ere are very limited circumstances where a grant that has been paid out could be taken back. Revenue has a di erent operating model; like all tax returns, the R&D tax credit is subject to audit from the period in which the claim was led.” ere is a concern among some companies that a er a length of time, Revenue may look to audit the claim. “I would think there are a number of corporates in Ireland that could avail of the credit, but it takes e ort to apply for it and it can be audited by Revenue well a er the credit has been refunded and that may be o -putting to some.”

Revenue has actively encouraged companies to claim the R&D tax credit, but many companies who may be entitled to claim do not. However, that’s not just an R&D tax credit issue, says Ken. “You see that many tax credits go unclaimed through ignorance or through a fear factor. When it comes to the R&D tax credit, we have proposed that for smaller micro companies and perhaps SMEs, a simpli ed credit could be introduced. at proposal has not been taken up yet as some would argue against having a two-tier regime. If Government wants to see an increase in the number of corporates claiming the credit, a clearer, perhaps less complex approach would encourage take-up.”

Overall, Ken would encourage companies to take the time and investigate if they are eligible for the tax credit. “In 2022, there was €1.1 billion of credits given out to those 1,631 companies. at clearly shows that there’s a signi cant level of credit available. In my experience, corporates that avail of the credit reinvest it in their business. ey hire more engineers or scientists or they buy more equipment to develop new products and processes. Essentially, they increase the e ciencies of their production so it’s a win-win. ose who don’t claim it are losing out on all of that.” e Department of Finance is undertaking a review of the tax credit this year, says Ken. “I would strongly encourage all businesses to feed into that review process and to make their views known. e only way the Department or indeed the Government are going to change policy is if people participate and advise them of issues and opportunities to improve the credit.”

Do you qualify for the R&D tax credit?

To qualify, a company’s R&D activities must:

• Involve systematic, investigative or experimental activities

• Be in the field of science or technology

• Involve one, or more, of these categories of R&D:

- Basic research

- Applied research - Experimental development

• Seek to make scientific or technological advancement

• Involve the resolution of scientific or technological uncertainty.

How to claim

• A company must use Revenue Online Service (ROS) to claim either credit on their Corporation Tax Return

• The company must ensure that the R&D claim meets all the requirements before applying

• Claims must be made within 12 months from the end of the accounting period in which the expenditure is incurred.

For more information, go to www.revenue.ie

Caroline

Reidy

1 2

Managing Director and Founder, The HR Suite

My top tips for entrepreneurs – focus on key priorities –people, operations, customers and business performance. Ensure clear goals, autonomy and support for your team. Continuously improve systems, listen to clients and maintain high service standards. Know your numbers, have relevant performance indicators and enjoy the journey –minding yourself is key to being able to mind your business.

Dr Kevin McCarthy CEO and Co-Founder, Advise

Entrepreneurship is a test of resilience – setbacks will happen but your ability to push through defines your success. But resilience isn’t about being stubborn. True success comes from balancing determination with market and user feedback. Knowing when to pivot toward a better product-market fit as the feedback demands is what sets great entrepreneurs apart.

3

Aisha Farooqui Ambassador, Islamic Republic of Pakistan to Ireland

Explore the plentiful opportunities in an emerging market of 250 million people. Pakistan is situated on the cross roads of central and south Asia, offering significant opportunities for Irish IT, agri food and dairy companies to relocate their back operations. Pakistan presents an exciting environment for joint ventures for Irish dairy and food companies.

Whatever you choose to do, leave tracks. That means don’t do it just for yourself. You will want to leave the world a little bit better for your having lived.

Dave Quinn Managing Director, Investwise Financial Planning

Kim Mackenzie-Doyle Founder, The B!G Idea

Financial Advisor 4 5 6

Having a plan is my one piece of advice to small businesses. Take some time out from your busy schedule to think about where you want the business to be in the future. Be ambitious and set lofty goals. Once there is a plan in place you can then allocate cash flow between owner salary, business reserves and a longerterm retirement fund.

Embracing discomfort pushes boundaries and sparks growth. Though challenging, stepping out of your comfort zone is transformative. That extra step might lead to exciting discoveries, inspiring encounters or invaluable lessons. Stay uncomfortable – it’s where the magic happens!

Nick Charalambous Managing Director, Alpha Wealth

Build a culture of innovation within your business. In today’s world of digital transformation businesses, whether in financial services or any other industry, must stay agile and adapt. Even if you fail, it’s important to try. Embrace change, learn from mistakes and remain competitive in this evolving landscape.

FLEXIBLE, CUSTOM-DESIGNED WORKSPACES ARE ENCOURAGING EMPLOYEES BACK TO THE OFFICE AND ICONIC OFFICES IS LEADING THE TREND. JOE MCGINLEY TALKS TO BETTER BUSINESS ABOUT THE FUTURE OF WORKING AND WHY 1980’S STYLE OFFICES ARE

A THING OF THE PAST

Theworking from home phenomenon has divided many. You’re either a proponent of the trend or perhaps, like Elon Musk, you believe employees that choose to work from the comfort of their kitchen table are simply “phoning it in”. Whatever your opinion, an increasing number of large companies are bringing their staff back to the office full-time. So how do you convince employees to swap the convenience of home working for early morning commuting? You offer them a modern, custom-designed, flexible office space with a set of amenities built around their lifestyle. Since 2013, Iconic Offices has been providing companies with workspaces that inspire. In today’s employee-driven market, where the focus is on work-life balance, flexibility and collaborative environments, Iconic Offices is helping companies to not just bring staff back into the workplace, but attract and retain new talent.

Paul McCarthy

Established by Joe McGinley over a decade ago, Iconic Offices is the market leader in sourcing, designing and managing design led flexible workspaces in Dublin. The ‘flexible’ part is key; Iconic Offices can provide spaces ranging from 1 to 500 desks, with prices to suit start-ups right through to multinational companies. Gone are the dingy, overheated offices of old; workspaces are modern, featuring high-tech meeting rooms and collaborative areas that foster creativity and productivity.

Employees can also avail of amenities such as on-site gyms, coffee shops and social spaces, giving employers leverage when it comes to attracting and retaining staff.

Business is good, says Joe, particularly in the premium flexible workspace market.

“We currently operate 14 locations in Dublin city centre. We’re seeing a surge in demand for premium accommodation in premium locations. I think that’s being driven by employees wanting an engaging, high quality workspace and employers realising they’re more likely to attract staff back to the office if they’re providing a really great environment to work in.”

Companies of all sizes are availing of services from Iconic Offices, from a one person start-up right the way up to international FDI companies. For smaller enterprises, the co-working option is ideal. “People can choose a desk in a shared space, there’s unlimited coffee and tea, continental breakfast and obviously, there’s Wi-Fi. We find that small indigenous companies often go for this option until they scale up to a point where an office makes sense.”

The company’s largest offering is its private offices, where businesses lease an office space on an all-inclusive licensee basis. Joe and the team focus on every detail, from ergonomic furniture and natural lighting to temperature control, acoustics and open plan collaboration. Every element of the space is designed to help a business thrive. Offices are also centrally located, with easy access to public transport. Locations include Viscount House on Fitzwilliam Square, The Lennox Building on South Richmond Street, The Masonry on Thomas Street and two new locations – No 81 Merrion Square and Hume Street House. Iconic Offices also provides for day services, so people can rent a meeting room for a day or take an office for a day.

“WE HAVE A LOT OF INDUSTRY-SPECIFIC EXPERIENCE WITHIN THE BUSINESS. I THINK THAT, COMBINED WITH OUR UNIQUELY IRISH APPROACH, IS SINGLING US OUT IN AN INCREASINGLY COMPETITIVE MARKET.”

Joe got the idea for Iconic Offices when he was running his own estate agent business. There was, he says, a demand for flexible workspaces that wasn’t being met by the market. “People were coming in saying, I’m looking for an office but I don’t want the traditional, uninspiring, old-fashioned space with blue carpets and beige walls. Before opening the estate agent, I had previously worked in interiors and to be honest, I felt like I could provide the type of offices that people were looking for.” Joe’s first building was at 127 Lower Baggot Street. Every three months for the next three years, he took on a new Georgian building. “Real estate is all about timing. You can buy bad properties at the right time and still do well. But if you buy properties at the wrong time, that’s where you really run into trouble. Luckily, that wasn’t my experience. At the time, the market was depressed but was about to start opening up. I had a good idea which I executed at the right time.” How daunting was the new venture? “It wasn’t daunting at all. Having nothing to lose is a great motivator!”

What differentiates Iconic Offices from other providers on the market is its commitment to providing exceptional service. “We have a lot of industry-specific experience within the business. I think that, combined with our uniquely Irish approach, is singling us out in an increasingly competitive market.” Asking staff to return to the office of old is a “stone dead” concept, says Joe. “If you’re trying to create highperformance teams and if you want to be at the pinnacle of your sector and grow, there’s just no choice but to provide equally dynamic workspaces. In a competitive industry, you’re not going to get employees to work in a 1980’s office space. High-performing people want to be around other high-performing people and typically, they’re found in highperforming environments.”

Client requirements are changing all the time. “We’ve installed a number of phone booths recently and they’re proving very popular. We’ve also escalated our design

in some of them to include treadmills; people like to walk and talk. Our gyms are also very popular across a number of the offices. We try to bring as many amenities that people want to use every day into the space. We even have an office with a full cinema for movie nights and town halls.”

Joe believes employees want to return to the workplace, but not for the reasons you may think. “For them, it’s about the social piece. They’ll go in on a Monday because they know John or Mary are in that day and they can catch up with them or go for lunch. Employees are now looking for their work to provide social elements that previously weren’t there. That’s why our offices include great communal spaces for people to meet. We also provide events – probably the best in the business – centred around business topics or wellbeing activities like yoga or pilates. Employers are using those events to attract staff back to the office; we’re seeing a strong uptake in these events, even for the out of hours ones.”

As of yet, Joe has no new locations signed for 2025. “We’ve literally just opened our second largest location at Hume Street House and we’re still in the process of filling every office there. It’s going well and we’re giving it our full attention.” For the moment, the focus is on enhancing the current offering and improving internal processes and procedures. With an increasing number of competitors entering the market with a diluted product, Joe’s aim is to continue to offer an elevated offering. “My aim is to reposition Iconic Offices for further growth by slowing down to speed up. I’ve realised that in order to grow, everything must be at 100%. For the past 12 months or so, we’ve been focused on getting everything absolutely perfect in-house. This is a business that has great potential, I believe in it completely. It’s also a business that’s been very good to me personally and given staff an opportunity to progress their career. I’m proud of what I’ve managed to achieve, but there’s more to come.”

Paul McCarthy

“We have a lot of industryspecific experience within the business. I think that, combined with our uniquely Irish approach, is singling us out in an increasingly competitive market.”

“In a competitive industry, you’re not going to get employees to work in a 1980’s office space. High-performing people want to be around other high-performing people and typically, they’re found in highperforming environments.”

“It’s all about timing. You can buy bad properties at the right time and still do well. But if you buy properties at the wrong time, that’s where you really run into trouble.”

“Some of our phone booths include treadmills; people like to walk and talk. Gyms are also very popular. We try to bring as many amenities that people want to use every day into the space. We even have an office with a full cinema for movie nights and town halls.”

DYNAMICJENNIFERMCSHANECHATSTOFOUR

YOUNGENTREPRENEURSABOUT ANDBREAKINGBARRIERS,TACKLINGCHALLENGES

BUILDINGBUSINESSESWITHPURPOSE

óin Tuohy is the founder and CEO of Sports Impact Technologies, a company pioneering safety solutions for athletes. His innovative wearable device, which ts behind the ear, tracks head impacts in real time during contact sports like rugby, Gaelic football and soccer. e device alerts coaches and medical teams about head impacts, enabling a quicker response to prevent injuries.

Eóin’s journey into the tech industry began with a personal connection to the issue of sports safety. “I was working for the European Space Agency when my dad sent me an article about the risk of head impacts in soccer,” he recalls. “Being a GAA player and massive rugby fan, I understood the big impacts, but didn’t know about the cumulative e ects of smaller impacts.” is sparked the idea that led Eóin to create the wearable device, combining his passion for sport with his technical skills.

Building the product wasn’t an easy feat. “Many people say hardware is hard, which I don’t necessarily agree with, but it’s not easy,” Eóin says. “I had a few variations of the prototypes and had to overcome some electronics challenges that I hadn’t faced before. is took me from an idea to a proof of concept, right through to a minimum viable product,” he explains. “It took some time, but ultimately helped us prove we had a viable solution.”

Despite the hurdles, he says his biggest achievement so far has been the successful pilot test of the product. “ is was with an early version of the prototype. We were testing the connectivity of the devices in a real-world environment,” Eóin recalls. “So we had a team of 15 do a training session while wearing the sensors. e solution was nowhere near where it is now, but it worked. Seeing one of the players get a big hit and data appear on the screen in real-time was something – we knew it would work. We want to make sports safer for all athletes.”

While technology and business development are essential to the company’s success, he explains he believes the real secret to his success lies in mentorship. “My biggest piece of advice is to nd a mentor or advisor to help you and guide you. You don’t know what you don’t know.

Having someone who has done something similar before is such a bene t. It really has made a huge di erence.”

“YOU DON’T KNOW WHAT YOU DON’T KNOW. HAVING SOMEONE WHO HAS DONE SOMETHING SIMILAR BEFORE IS SUCH A BENEFIT. IT REALLY HAS MADE A HUGE DIFFERENCE.”

o ee and skincare. at’s how Sadhbh Wood and her sister Aisling developed their idea for Bean Around, a sustainable skincare start-up that repurposes used co ee grounds to create exfoliating soap bars. e company works with local co ee shops to collect their used grounds and turn them into a high-quality, eco-friendly and e ective product.

e idea was born during the pandemic when their father started using co ee grounds to treat his psoriasis. “We came up with it during the pandemic when my dad’s psoriasis began to are,” Sadhbh explains. “He read an online article outlining the bene ts of using co ee grounds to help soothe the itching and dry skin. So he started using co ee grounds from our kitchen in the shower and it really helped. One night, I decided to try it to remove my fake tan and it worked well. e only problem was it was messy and smelled like co ee!”

is led the sisters to create their own sustainable product to solve these issues. And so, Bean Around was born.

With the product idea in mind, Sadhbh and Aisling began researching the market and quickly realised there was a gap. “We conducted lots of market research on both a customer and industry level to nd out whether there was a need for a product made from repurposed co ee grounds and whether companies were looking for an alternative use for their co ee grounds other than throwing them away,” she explains.

is led the sisters to partner with local co ee shops to collect their used grounds, which they repurposed into exfoliating bars and then sold back to the co ee shops. “ at way, any customer buying a

“IT WAS A SURREAL EXPERIENCE TO SEE MY NAME BESIDE SOME OF THE MOST INFLUENTIAL COMPANIES AND BUSINESS PEOPLE IN IRELAND. IT’S A GREAT FEELING TO BE RECOGNISED FOR YOUR HARD WORK.”

co ee in that co ee shop could see the circular cycle of their co ee grounds.”

is commitment to sustainability has helped fuel their success. “We are constantly looking to innovate and develop new ways to repurpose as much co ee grounds as possible.” eir dream is to be a leader in co ee repurposing, with plans to expand beyond Ireland. “In ve years, I see Bean Around at the forefront of co ee repurposing in Ireland. We plan to expand our business, opening branches in the UK and across Europe,” she says con dently. Her proudest moment so far came when she was nominated for an Irish Times Business Award. “I was nominated in the ‘Future Leaders’ category by an independent panel of judges. It was a surreal experience to see my name beside some of the most in uential companies and business people in Ireland. It’s a great feeling to be recognised for your hard work.”

“THE CONSTANT STREAM OF POSITIVE FEEDBACK VALIDATES ALL THE HARD WORK THAT HAS GONE INTO MAKING THE APP AS USER-FRIENDLY AND EFFICIENT AS POSSIBLE.”

Skippio is an innovative web application designed to enhance the eventgoing experience.

e app allows fans to order drinks, food and merchandise from anywhere at large-scale events and receive real-time alerts when their order is ready, eliminating the need to stand in long queues.

“Skippio was born out of a frustration that many fans experience at large-scale events – wasting time in long queues for food, drinks and merchandise instead of enjoying the event,” CEO Daniel Coen explains. “We knew we wanted to create a seamless fan experience where attendees could order what they need and be noti ed when it’s ready, allowing them to stay engaged in the action without missing a moment.”

Turning Skippio from an idea into a fully functioning solution was a long and challenging process. “It required extensive research, development and collaboration with venues and vendors,” Daniel says. “Without Enterprise Ireland, New Frontiers, Furthr and many more Irish startup supports, we wouldn’t have been able to progress Skippio to where

it is now.” Initially, convincing others to invest in an idea with little to no credibility was daunting, but with persistence, Daniel eventually found people who believed in the concept.

e application has quickly gained traction, with major venues like the Aviva Stadium already using the app. “Seeing Skippio in major venues like the Aviva Stadium, rapidly expanding across Ireland and soon launching into the UK and beyond, is a real pinch-me moment – especially considering how tough it was at the start when nobody would give us a chance,” Daniel re ects.

However, it’s not just the company’s growth that he’s proud of. “Hearing the sheer delight from fans and vendors really brings me pure joy,” he says. “ e constant stream of positive feedback validates all the hard work that has gone into making the app as userfriendly and e cient as possible.”

According to Daniel, the real reward is the transformation of the event experience. “By streamlining the ordering process, Skippio enhances the event experience, making it an essential tool for both attendees and event organisers,” he says. Looking to the future, Daniel is excited about the product’s potential. “Over the next three years, we aim to have all the best stadiums, concert venues and festivals on Skippio, making it the go-to platform for fans.”

StepAhead is an AI-powered platform that connects users with mentors who provide valuable, personalised guidance. Inspiration for StepAhead came from both founders’ frustrations. “My co-founder and I both came home from work one evening, pulling our hair out, unsure of what we actually wanted to do a er graduation,” Oisín recalls. “We realised that career guidance o en depends on who you know rather than clear, structured advice from someone who’s been in your shoes.” is insight drove them to create a platform to connect young professionals with mentors who could provide real-world advice based on experience.

Building StepAhead wasn’t without its challenges, given both founders weren’t in the tech space prior to starting the build. “ e biggest challenge has been building the product itself as we’re non-technical founders, so we’ve had to learn quickly about leveraging AI in development and how to bring on the right people to execute our vision”. e platform quickly gained traction and their rst major success came when they won the national nal of the Red Bull Basement competition, representing Ireland globally in Tokyo.

Oisín is particularly proud of their real-world impact. “Winning the Red Bull Basement national nal and representing Ireland on a global stage in Tokyo was a huge moment for us,” he says. “It validated our idea and gave us the momentum to push forward and build StepAhead. Beyond that, securing our rst pilot school to test the platform was a major milestone.”

He hopes the platform will be the go-to resource for young professionals. “In three years, we want this to be the go-to platform for career guidance, helping thousands of students and young professionals make con dent career decisions,” Oisín says. “We aim to expand into universities and schools across Ireland initially and beyond, using AI to personalise mentorship connections and scale our impact globally.”

“WE AIM TO EXPAND INTO UNIVERSITIES AND SCHOOLS ACROSS IRELAND INITIALLY AND BEYOND, USING AI TO PERSONALISE MENTORSHIP CONNECTIONS AND SCALE OUR IMPACT GLOBALLY.”

Most businesses struggle to get a client’s attention because they focus too much on what they sell instead of what the client actually needs. e most e ective way to stand out is to be relevant. Understanding their challenges, goals and motivations before you sell.

Paul Murphy wanted to move his business from being seen as a supplier by potential customers to being a trusted partner. After having undergone a rebrand and repositioning in the marketplace, he needed to ensure his team was skilled to close higher value deals.

What needed to change?

• They led with their product features instead of understanding the client’s bigger challenges

• They were seen as suppliers, not strategic partners

• They weren’t engaging clients in a way that built long-term trust.

The solution?

A shift in mindset – slowing down, listening more and focusing on value-driven conversations. The result? Six-figure corporate deals closed within six weeks.

Tip: Instead of pitching immediately, earn the clients time to have a strategic conversation with them. Show them you understand their world before o ering a solution.

For many small business owners, sales can feel like a constant chase. But what if you could ip the script and create a buying experience that makes clients eager to work with you? Instead of a transactional sales approach, the key is to position yourself as a trusted advisor, someone clients turn to for guidance, not just another vendor.

Winning more business isn’t just about getting meetings. It’s about leading conversations e ectively. Many business owners are naturally chatty, but being chatty doesn’t close deals. e real skill is knowing how to guide the conversation so the client feels heard and valued.

• Ask better questions – help clients articulate their real challenges and desired outcomes

• Slow down conversations – don’t rush into selling mode

• Listen to understand, not just to respond – this builds trust and positions you as an expert.

Tip: The best salespeople guide clients to discover their own needs, rather than telling them what they should buy.

A common frustration for business owners is spending hours cra ing proposals, only to be ghosted by the client. If this happens, it’s time to rethink your approach.

Winning proposals should:

• Be personalised – don’t send a copypaste template

• Focus on the client’s outcomes –make it about their goals, not just your service list

• Make it easy to say YES – clear next steps prevent delays.

Tip: Before sending a proposal, ask yourself: Does this address their needs and pain points while matching with our solutions? If not, refine it.

Sales shouldn’t feel like chasing clients – it should feel like attracting the right ones and guiding them through a structured journey.

• Make it the norm to have consistent proactive sales activities happening daily

• Ask your best clients for referrals

• Balance inbound and outbound strategies – networking, referrals, content and targeted outreach

• Track key sales metrics – identify where leads drop o and adjust your process.

Tip: A strong sales funnel doesn’t feel like sales – it feels like a seamless journey where the client naturally sees you as the right fit.

For SME's in the EU

out of 18 legislative initiatives aimed at simplifying regulations for businesses

The ASMCR found that SME value added in real terms declined by

1.6% in 2023