LEGAL DISPLAY ADS

LEGAL DISPLAY ADS

LEGAL DISPLAY ADS

LEGAL DISPLAY ADS

LEGAL DISPLAY ADS

LEGAL DISPLAY ADS

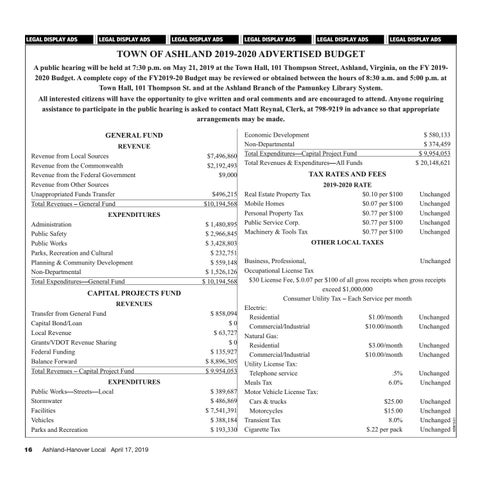

TOWN OF ASHLAND 2019-2020 ADVERTISED BUDGET A public hearing will be held at 7:30 p.m. on May 21, 2019 at the Town Hall, 101 Thompson Street, Ashland, Virginia, on the FY 20192020 Budget. A complete copy of the FY2019-20 Budget may be reviewed or obtained between the hours of 8:30 a.m. and 5:00 p.m. at Town Hall, 101 Thompson St. and at the Ashland Branch of the Pamunkey Library System. All interested citizens will have the opportunity to give written and oral comments and are encouraged to attend. Anyone requiring assistance to participate in the public hearing is asked to contact Matt Reynal, Clerk, at 798-9219 in advance so that appropriate arrangements may be made.

REVENUE Revenue from Local Sources Revenue from the Commonwealth Revenue from the Federal Government Revenue from Other Sources Unappropriated Funds Transfer Total Revenues – General Fund

$7,496,860 $2,192,493 $9,000 $496,215 $10,194,568

EXPENDITURES Administration Public Safety Public Works Parks, Recreation and Cultural Planning & Community Development Non-Departmental Total Expenditures—General Fund

$ 1,480,895 $ 2,966,845 $ 3,428,803 $ 232,751 $ 559,148 $ 1,526,126 $ 10,194,568

CAPITAL PROJECTS FUND REVENUES Transfer from General Fund Capital Bond/Loan Local Revenue Grants/VDOT Revenue Sharing Federal Funding Balance Forward Total Revenues – Capital Project Fund

$ 858,094 $0 $ 63,727 $0 $ 135,927 $ 8,896,305 $ 9,954,053

EXPENDITURES Public Works—Streets—Local Stormwater Facilities Vehicles Parks and Recreation

$ 389,687 $ 486,869 $ 7,541,391 $ 388,184 $ 193,330

16

Ashland-Hanover Local April 17, 2019

Economic Development Non-Departmental Total Expenditures—Capital Project Fund Total Revenues & Expenditures—All Funds

$ 580,133 $ 374,459 $ 9,954,053 $ 20,148,621

TAX RATES AND FEES Real Estate Property Tax Mobile Homes Personal Property Tax Public Service Corp. Machinery & Tools Tax

2019-2020 RATE $0.10 per $100 $0.07 per $100 $0.77 per $100 $0.77 per $100 $0.77 per $100

Unchanged Unchanged Unchanged Unchanged Unchanged

OTHER LOCAL TAXES Business, Professional, Unchanged Occupational License Tax $30 License Fee, $.0.07 per $100 of all gross receipts when gross receipts exceed $1,000,000 Consumer Utility Tax – Each Service per month Electric: Residential $1.00/month Unchanged Commercial/Industrial $10.00/month Unchanged Natural Gas: Residential $3.00/month Unchanged Commercial/Industrial $10.00/month Unchanged Utility License Tax: Telephone service .5% Unchanged Meals Tax 6.0% Unchanged Motor Vehicle License Tax: Cars & trucks $25.00 Unchanged Motorcycles $15.00 Unchanged Transient Tax 8.0% Unchanged Cigarette Tax $.22 per pack Unchanged

925613-01

GENERAL FUND