Shaping the Future: The ASCPA Announces Its 2024 Life & Honorary Members AZ CPA March/April 2024 The Arizona Society of Certified Public Accountants y www.ascpa.com

AZ Individual Tax Credits AZ Low Income Corporate Tax Credit AZ Disabled Displaced Corporate Tax Credit Changing Lives Non-Tax Credit Donations 602-218-6542 | WWW.CEAZ.ORG Four Ways You Can Change a Child’s Life through Scholarships! Catholic Education Arizona is an IRS 501(c)(3) nonprofit charitable organization and has never accepted gifts designated for individuals. Per state law, a school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. TURN YOUR AZ TAX LIABILITY INTO CHANGE FOR GOOD! Offer affordable rents & mortgages Nourish families with healthy meals Promote improved quality of life Uplift family caregivers Invest your Arizona taxes with FSL to: 602-285-1800 | WWW.FSL.ORG “Thank you for your support!”

AZ CPA

The Arizona Society of Certified Public Accountants

President & CEO

Editor

Advertising

Board of Directors

Chair

Chair-Elect

Secretary/Treasurer

Directors

Oliver Yandle

Haley MacDonell

Heidi Frei

Andrea Levy

Lauren Murro

Eugene Park

Austin Billingslea

Ben Cilek

Dave Collins

Tithi Debnath

Marissa Graves

Joe Heidleburg

Ignatius Jackson

Gabby Luoma

Dennis Osuch

Lisa Parke

Jesse Porras

Stella Shanovich

Immediate Past Chair

AICPA Council Members

Rachael Crump

Mike Allen

Jared Van Arsdale

AZ CPA is published by the Arizona Society of Certified Public Accountants (ASCPA) to provide information, news and trends to the accounting profession. It is distributed six times a year as a benefit to ASCPA members. The ASCPA, its members, board of directors and administrative staff assume no responsibility for advertisements herein. The ASCPA and the above people also assume no liability for business decisions made by readers in reference to statements and/or claims in articles or advertisements within this publication. Opinions expressed by contributors are not necessarily those of the ASCPA.

Arizona Society of CPAs

410 N. 44th St. Ste 205 Phoenix, AZ 85008

Telephone (602) 252-4144

AZ Toll-Free (888) 237-0700

www.ascpa.com

Have

Notice (A.R.S 43-1603): A school tuition organization cannot award, restrict, or reserve scholarships based solely on a donor’s recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. 25 YEARS Largest Educational Tax Credit Ask About S-Corp 162 Deduction C & S Corps | Insurance Companies LLC's with S Election Low Income families need help more than ever! Solicit STO Funds While on ESA* Largest Individual Tax Credit Kids | Schools | General Fund Online Application AZ Corporate Tax Credit AZ Individual Tax Credit 520.512.5438 ibescholarships.org IBE is Here to Help Phone | Chat | Email Support | Pay With Credit Card | Simple 5 Minute Process *if eligible

Difference to Arizona Kids

Make a

Are You on Instagram?

you met a cowboy CPA? A CPA that helps veterinarians? A CPA that hikes volcanoes? Follow @ArizonaCPAs to see more incredible stories. 4 AZ CPA MARCH/APRIL 2024

9 The Advocate: Meet 2024 Life Member Michael Lemme By Haley MacDonell 13 A Legacy in Education: Two NAU Professors Share Their Career of Impact By Haley MacDonell 18 Thank You to Our Volunteers 21 Conflicts of Interest Still Cause Trouble for CPAs By Duncan B. Will, CPA (licensed in CA), ABV, CFF, CFE 24 What’s Happening at the ASCPA? Columns & Departments Chair’s Message by Andrea Beth Levy, CPA 6 Member News 7 Quick Quiz 27 13 A Legacy in Education: Two NAU Professors Share Their Career of Impact AZ CPA Features Volume 40 Number 2 March/April 2024 410 N. 44th St. Ste 205 Phoenix, AZ 85008 www.ascpa.com MARCH/APRIL 2024 AZ CPA 5

ASCPA Chair’s Message

Andrea Beth Levy, CPA Chair, Arizona Society of CPAs Vice President of Finance and Operations Greater Phoenix Chamber

Andrea Beth Levy, CPA Chair, Arizona Society of CPAs Vice President of Finance and Operations Greater Phoenix Chamber

More Than Enough

As we head into tax season and toward spring, it’s a good time to remember that the National Alliance for Mental Illness (NAMI) raises awareness about mental health every May.

According to the AICPA & CIMA, “Mental health influences one’s ability to work productively and cope with the stresses of daily living. A healthy psychological state, the less observable inner world of your employees, is central to performance for a knowledge worker. Healthy employees are vital to the success of your firm, and their mental health cannot be ignored in the pursuit of goals. It’s imperative that we learn how to tend to our state of mind. As we do, we will see an increasingly positive effect on job performance and firm success.” Breaking down the stigma of mental health awareness is an urgent matter.

A 2017 National Institute of Mental Health (NIMH) study states, nearly 20% of adults lived with a mental illness and 7.1% of adults have had at least one major depressive episode. According to a recent Gusto article, mental health has not historically been prioritized with importance in the professional realm, especially in accounting and finance industries. As a taboo topic, it can be largely ignored, resulting in a lack of mental health awareness. This means that many people hold myths and misconceptions about mental health and are unable to truly tend to their well-being.

Our professional career can be seen as a series of sprints. Our goal is to set a fast pace and produce accurate and insightful deliverables. We are financial leaders, trusted advisors and resourceful big thinkers; and it can be a lot to hold.

According to Nick Wignall, founder of the Friendly Mind, “We often forget how much our environment still plays a role in our lives. And this is especially true when it comes to the impact our environment, or context, plays on our psychology.”

As leaders in our profession, how can we help?

• Talk to colleagues or others who appear to be struggling. For guidance, visit ascpa.com/maywellness for resources.

• Promote a culture of openness. Foster a culture where it’s acceptable to ask for help.

• Learn about employer-assisted programs for counseling. Many employers offer employee assistance programs (EAPs) which provide free and confidential counseling. Broadcast this information openly at staff meetings and in employee newsletters.

According to the Journal of Accountancy, “Embedded in a culture where mental health issues are not discussed, CPAs might assess the inherent risk of a stigma and not seek professional help – even though they can do so confidentially.”

In closing, together we can break down barriers around mental health awareness and improve mental health care accessibility for all team members. Let’s remember the inherent value we each hold. l

Best,

Andrea Beth Levy

6 AZ CPA MARCH/APRIL 2024

George E. Henderson, CPA, has been appointed to president at BeachFleischman.

Hannah J. Oglesby, CPA, was promoted to partner at Wallace, Plese + Dreher.

Mirza Z. Baig, CPA, was promoted to senior tax manager at Wallace, Plese + Dreher.

Derek M. Unguran, CPA, was promoted to partner at Ludwig Klewer & Rudner PLLC.

Tanner Yeates, CPA, was promoted to partner at HCVT.

Hunter Shelton, CPA, started a new role as controller at Ikon Transportation Services.

David Matthew Walters, CPA, MAcc was promoted to tax senior manager at BeachFleischman.

Sarah Jacobs, CPA, and Cameron D. Kolb, CPA, were promoted to senior associates at Heinfeld, Meech & Co, P.C.

Travis T. Jones, CPA, was recognized in BizTucson Magazine’s 20 Next Gen Leaders to Watch in 2024.

Kaylan Brushwood, CPA, was promoted to principal at BeachFleischman.

Myvan Truong, Tre Flores and Hannah Engen were promoted to tax senior at BeachFleischman.

Anita Asbury was promoted to outsourced accounting & advisory services senior manager at BeachFleischman.

Directs 100% of tuition aid to students with verified need Supports 2343 students attending 39 schools with tuition aid across Arizona Accepts BOTH individuals' and companies' Arizona tax liability Provides a cost-free way to make an impact in our community Join us in our mission by redirecting your tax liability to the Brophy Community Foundation S-corps and C-corps with an Arizona income tax liability and insurance companies that pay Arizona premium tax can redirect their tax liability to Brophy Community Foundation and receive a 100% dollar-for-dollar Arizona income or premium tax credit. The money is awarded to k-12 students, with verified financial need, for tuition assistance at Brophy, Loyola Academy, and 38 other schools across Arizona. Get a tax credit, make a difference

Share Your Member News Visit ascpa.com/member-news to see more exciting career moves from ASCPA members, and share your own updates. Member News MARCH/APRIL 2024 AZ CPA 7

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

– Cantor Forensic Accounting, PLLC

Trusted by accounting and tax professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

22% increase in cash flow with online payments

65% of consumers prefer to pay electronically

62% of bills sent online are paid in 24 hours

AL:

cpacharge.com/ascpa

Get started with CPACharge today

*** PAY CPA

$3,000.00

CPACharge is a registered agent of Wells Fargo Bank N.A., Concord, CA, Synovus Bank, Columbus, GA., and Fifth Third AffiniPay customers experienced 22% increase on average in revenue per firm using online billing solutions

+

The Advocate: Meet 2024 Life Member

Michael Lemme

By Haley MacDonell

Michael Lemme, CPA, has advocated on behalf of hundreds of businesses and individuals during his tenure at Hunter Hagan in Old Town Scottsdale. His commitment to advocating for Arizona residents and CPAs has continued for over 30 years through dedicated volunteer work on the Arizona Society of CPAs’ Tax Legislation Review Committee (TLRC).

MARCH/APRIL 2024 AZ CPA 9

In 2024, Lemme has been selected as the ASCPA’s most recent Life Member. Without Lemme’s leadership and expertise, tax policy, and the role the ASCPA plays in it, would not be the same.

Core Values

Michael Lemme is a shareholder at Hunter Hagan, where he has worked for 29 years almost exclusively in the tax arena. The busy times, like the major tax deadlines, are busy. The leisure time is also busy, but well spent adventuring outdoors and traveling in the United States and throughout the world.

Similarly, Lemme knew he was going to be an accountant shortly after starting college. As an undergraduate student at Arizona State University, he decided that tax was the best fit for him. Different areas of the profession have different relationships with their clients. In auditing roles, for instance, the CPA takes on a questioning role, looking for changes and areas of improvement.

“I wanted to be an advocate, to be in a position that I could help someone,” Lemme explained. “Your job is to help them fully file to avoid any non-reporting issues and to structure them in a way that is most advantageous to them.”

He is proud of developing a reputation of being trusted counsel. In one example, clients had been approached about utilizing the employee retention tax credit (ERC). Lemme and his team looked at their clients, reviewed IRS regulations, ran alternative tests, and ultimately concluded that most didn’t truly qualify.

In moments like this, Lemme digs into the details, always looking for the best outcome for his clients. He’s been wary of life insurance arrangements or other aggressive risks that seem too good to be true. In many cases, they are.

“Our clients trust us,” Lemme explained. “I don’t take that for granted.”

Early in his career, he got involved with the Arizona Society of CPAs as

a member in 1992. As he developed his expertise, he realized that some laws were written only as a basis of theory and clashed with the implementation in his business.

“A lot of people complain about taxes,” Lemme says. “They say, This is stupid the way they wrote it. I was thinking the same thing maybe 30 years ago. If you’re going to think something could have been done better, well, maybe you should get involved with it. I wasn’t going to complain unless I was willing to help.”

So, he did. In 1993, Lemme joined the burgeoning Tax Legislation Committee, a committee within the ASCPA that had been formed three years prior. Interest in advocating on behalf of the profession was growing, so they met with the ASCPA’s lobbyist, Kevin DeMenna. The committee began forming important connections, including with the legislative liaison for the Arizona Department of Revenue, a partnership that continues to be valuable to this day.

The committee began commenting on policy changes to positively impact the feasibility of them for CPAs, like flat tax legislation or income tax conformity, which also remains a priority to this day. Since 2020, the ASCPA and dedicated member volunteers have helped conformity pass before the tax deadline every year.

“At first, the committee had little support from the board,” Lemme remembers. At the time, the executive committee was still setting the committee’s priorities. “The initial thought was that we shouldn’t be involved in legislative matters. That changed when Cindie became the executive director [2000] and she threw her weight behind the committee and gave us support.”

Cindie Hubiak became the ASCPA’s President & CEO in 2000. She had seen Lemme’s critical role on the TLRC during her time on the board, and they continued to work together as the ASCPA’s advocacy work increased.

“We received many more requests for the TLRC’s assistance, and Mike’s leadership was taken to a new level,” she says.

Often, the TLRC interacted over email, allowing each member, including Lemme, to fit in volunteer time when they could in between full-time jobs and personal responsibilities. The committee tried to meet monthly during the legislative session, which often overlapped with tax season.

“He worked countless hours in the evenings and on weekends during busy season to create better legislation,” Hubiak says. Even after the legislative session, work continued: preparing for early

10 AZ CPA MARCH/APRIL 2024

passage of income tax conformity, reviewing draft legislation and assisting the Arizona Department of Revenue.

On some occasions, TLRC members meet with policymakers face to face, like at the annual CPA Day at the Capitol event.

Hubiak recalled a meeting with Senator J.D. Mesnard, where the conversation between the senator and several CPAs became heated on a technical matter. Lemme stayed calm. He flipped through a copy of the Internal Revenue Code that he had brought to find the specific reference of debate. He turned the large book around to face Sen. Mesnard to read the exact language while the code was upside down, assisting him to understand a very complex area of tax law and building a strong relationship with Mesnard in the process.

As an important distinction, the Tax Legislation Review Committee does not introduce new items, does not comment on tax rates and does not advocate for or against specific legislation. Lemme believes that role belongs to the policymakers.

“We’ve tried to let legislation give as much flexibility to the business and individuals,” Lemme explains. “Our role is more administrative, the mechanics.”

The TLRC benefits all CPAs, Arizona residents and legislators by providing practical guidance on implementing ideas. If a policymaker proposes a bill, the TLRC advises on how it would be practically put into action.

“Once legislators decide policy, then we talk about the mechanics of how to make it work. If you wrote it this way, there’s going to be a few hiccups, but if you change the language a bit, you can accomplish the same thing. We’re hands on. For a CPA, it’s not theoretical, and for legislators, this is all theoretical. What is going to work and in the simplest method possible?” Lemme says.

In one example, there are certain contribution credits an employer can withhold from someone’s pay

and direct the money to a school or charity credit. When the TLRC first saw the proposed bill, there was one key word they knew needed to be changed.

“It said the company shall do that,” Lemme remembers. The employer has no option, regardless of the size of the business, which was not the original intention. “We proposed changing shall to may. It doesn’t seem like a big deal, but to those companies it can be.”

“We’ve all benefited from his sage input on the TLRC,” says David Walser, who has volunteered on the TLRC for over 10 years. “By ‘all,’ I mean every resident of the state of Arizona. He, along with the rest of the TLRC, has provided insights that have helped the Legislature craft better tax laws that work as intended.”

During his 30 years on the TLRC, there have been plenty of highlights. Lemme fondly remembers meeting Governor Napolitano around 2007. The committee was invited to witness the governor sign a bill on the ninth

floor of the Capitol building. Lemme was also selected to attend the AICPA Council in Washington, D.C., on behalf of the ASCPA three times. One of the highlights was sitting down with former Sen. Jeff Flake.

On top of his contributions to the TLRC, he presented at and served on the Phoenix Tax Workshop board for over 10 years. “I learned more about tax from sitting down with a roomful of CPAs than I ever did at a presentation,” Lemme recalls.

“Michael has generously shared his time and talents to support the ASCPA profession for decades, and we are all better because of it,” says Oliver Yandle, president and CEO of the ASCPA. “His decades long service on the Tax Legislation Review Committee has helped secure the ASCPA’s reputation as a trusted advisor to the Arizona Legislature. His thoughtful analysis and feedback have been critical in shaping policy, protecting the profession and protecting the public.” l

Help your clients maximize their tax credits! The Jewish Tuition Organization (JTO) is a certified school tuition organization (STO). 480.634.4926 | JTOphoenix.org | info@JTOphoenix.org NOTICE: A school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. Consult your tax advisor for specific tax advice. YEAR 2023 $1,307 / individuals $2,609 / married couples Provide scholarships by supporting the JTO through Arizona’s dollar-for-dollar private school tuition tax credit Deadline April 15, 2024 or when you file your taxes, whichever comes first TAKE THE CREDIT FOR EDUCATION Call for corporate tax credit information

MARCH/APRIL 2024 AZ CPA 11

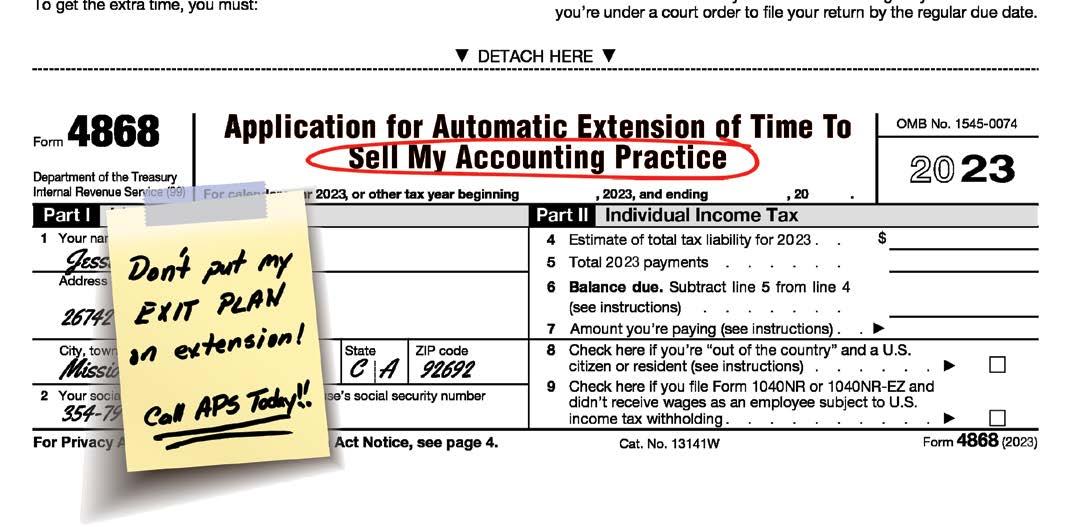

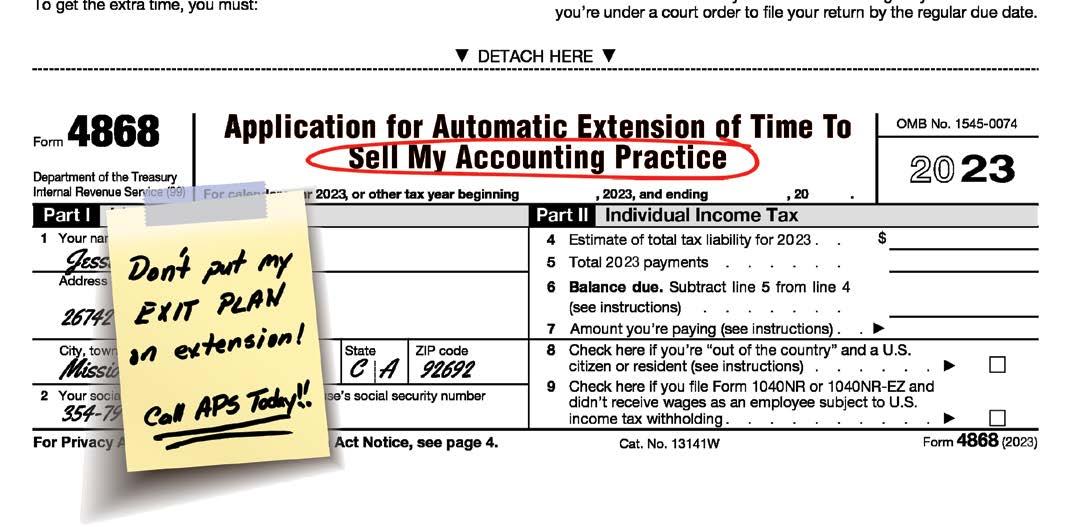

Delivering Results - One Practice At a time GREATEST # of Listings GREATEST # of Buyers UNMATCHED RESULTS! $ 1.5 billion+ in Deals Closed! Our Best-in-class Brokers will help you achieve YOUR goal! Sherif@APS.net 888-783-7822 Scan Here www.APS.net

A Legacy in Education

By Haley MacDonell

Bob Kilpatrick and Nancy Wilburn are Certified Public Accountants turned educators who have touched the lives of thousands of accounting students. Today, their students are leaders, firm partners, recruiters, advisory council members and more. In the ASCPA’s 90-year history, Kilpatrick and Wilburn are recognized in 2024 as the 10th and 11th Honorary Members, selected for their impact on Arizona’s accounting profession.

Professor Wilburn is well-regarded for her early use of collaboration as a teaching method in the classroom to help students connect with the material and their peers. She is the 1994 recipient of the Arizona CPA Foundation for Education & Innovation’s Excellence in Teaching Award and two-time winner of the Foundation’s Education Innovation Award.

Continued on next page...

MARCH/APRIL 2024 AZ CPA 13

Photographer: Rhianna Kahley

Professor Kilpatrik also helped shape the accounting education that helped students to be successful with the CPA examination by modernizing curriculum and incorporating feedback from professionals active in the business. He is the 2009 recipient of the Arizona CPA Foundation for Education & Innovation’s Excellence in Teaching Award and served on the Foundation’s board and scholarship selection committee for nine years.

was going to be out for a few days to watch his son play in the Little League World Series. In his place, the professor asked Kilpatrick to fill in as substitute.

“I gave them a pop quiz as soon as class began,” Kilpatrick remembers. “That’s what he would have done too.”

His reputation spread and soon other educators were asking him to substitute while they were away. He went on to teach four courses a semester at Bellhaven College, a small school with 600 students. Over the next few years, he completed his Ph.D. and became an assistant professor at Texas A&M University.

Bob Kilpatrick

Bob Kilpatrick is in high school working on a big project for his bookkeeping class. It’s late, nearing 2 a.m., but with some Led Zeppelin playing in the background, the time is flying by. He’s writing checks, preparing sales invoices and bookkeeping for a fake client for a grade. For Kilpatrick, this is the first moment where everything is clicking into place, and even though this moment was 52 years ago, it’s a defining moment for someone who would go on to teach thousands of accountants during his career.

Years later, he is working toward his master’s degree in accounting at the University of Southern Mississippi. One of his professors

This was the most prestigious university and title Kilpatrick had had to date. The head of the tax program took him out to lunch to review the student offerings.

“Every class he mentioned was being taught by more senior faculty,” Kilpatrick recalls. “What am I going to get?” The program leader explained that a new course would be offered on compensation, and that would be Kilpatrick’s responsibility. “I had never had any courses in compensation. I did a bunch of trainings with some of the then-Big Eight CPA firms, but there was no book.”

So, Kilpatrick wrote the book, based on his detailed notes on the tax code and other regulations. He went on to publish the CCH U.S. Master Compensation Tax Guide with the educator who later took the course over once Kilpatrick got it off the ground.

A lot of changes occurred between the first class Kilpatrick taught and his last, when he retired from Northern Arizona University in 2022.

One example is the implementation of the 150-hour rule. It shook up the accounting landscape and often required students to complete an extra year of school. Still, the CPA exam continued to remain a priority for many students.

“The students that went through my courses were very successful at passing the CPA exam,” he says. At one point, he joked about a CPAguarantee. “If you do everything that I tell you to do, and you perform well, you will pass the CPA exam. If you don’t, I’ll give you your money back.”

Kilpatrick taught as a professor at Northern Arizona University for 34 years. For many years, he served as accounting coordinator. He helped place the program’s graduates in entry-level accounting jobs and founded the Accounting Area Advisory Council, a group of active practitioners who provided input on the program. With the Council’s input, the curriculum was modernized, and students excelled on the CPA examination.

“This was crucial to the success of our program and enabled us to be highly competitive with our peer institutions in Arizona,” explains Ken Lorek, Northern Arizona University’s first endowed chair. “Bob valued all faculty members’ contributions, rewarded them accordingly and motivated them to contribute to the accounting area’s goals. This is no small task given faculty egos.”

Kilpatrick began his involvement with the ASCPA in 1999. He served in many functions of the Arizona CPA Foundation board and the ASCPA’s scholarship selection committee. He was proud to have never missed a meeting, even though that meant making the drive from Flagstaff down to the ASCPA’s Phoenix office.

That is, until Kilpatrick does miss a meeting due to presenting a paper at a conference. That day, he received a call from Allen Nahrwold, then the Foundation’s president, congratulating Kilpatrick on being voted as his successor.

He laughed it off. The joke must have been a repercussion of his first truancy.

14 AZ CPA MARCH/APRIL 2024

“I’m waiting for the punchline,” Kilpatrick remembers. But it never came. Sure enough, he was voted board president, for which he would serve two years, the penultimate appointment after seven years of serving in various board roles. “Note to self: don’t miss the meeting when they’re voting on officers.”

Kilpatrick was the only faculty member at NAU to be awarded all the major college awards: Outstanding Teacher of the Year, Researcher of the Year and the Outstanding Service Award.

explaining that there were no positions open to begin with. Days later, someone quit and suddenly there were two classes without a teacher, days before instruction was set to begin.

The administrative assistant had heard Wilburn’s request too and brought it up to the desperate director. Because of that, Wilburn was granted one of the two courses to teach that semester.

“I was terrified. Believe it or not, I was not a comfortable public speaker,” Wilburn says. The first day of classes, she mumbled through a short introduction without saying her name and quickly left as soon as it was over. Decades later, that scared first-time teacher is now an esteemed educator who has been recognized with several awards and who has touched the lives of thousands of students.

After earning her degree, Wilburn became an auditor at Deloitte while she studied for and passed her CPA exam. She knew teaching was the road she wanted to follow and began developing a teaching style that fit her.

As a master’s student at Oklahoma State University, Nancy Wilburn wanted to teach. And not, as a graduate assistant, as many graduate students are.

She shared this with the program director, who waved her away,

The earliest advice from her husband, Bob Kilpatrick, was to start the class with a joke, something that he had done for years.

“I’m a terrible joke teller,” Wilburn admits. She remembers reading her evaluations from students on the course. One answer from an anonymous student: Don’t tell jokes. “So, I never told jokes after that. I would make my own way on learning how to teach, which I did.”

In 1994, 10 years into Nancy’s teaching career, she was called into the dean’s office at Northern Arizona University, where he announced she had been awarded the Arizona Society of CPAs’ second annual Excellence in Teaching Award. Excited, she raced home to tell Kilpatrick the good news.

“We live out in the country, so I drove on the I-40 to my exit,” she explained. “I was so excited to tell him that I rolled through a stop sign — and I never roll through stop signs. Do you know what else was there, that was never there? A police officer who pulls me over.

She didn’t get a ticket, but she hasn’t rolled through any stop signs in the 30 years since. It was her very first teaching award, emboldening her to experiment with new methods in her classroom, such as incorporating teamwork.

“Bob was very well respected across all the faculty in the college,” explains Nancy Wilburn, a fellow NAU faculty member and Kilpatrick’s wife. “He was the inaugural recipient of the service award in 2022 for going above and beyond to chair a megasearch committee to successfully hire five new tenure or tenure-track faculty members to maintain AACSB accreditation for the college.” Continued on next

“Teamwork was not often used back then,” Wilburn remembers. “Students were resistant to it. But that award gave me enough courage to try a big change in my teaching style that I fell in love with and used the rest of my career.”

According to Cornell University’s Center for Teaching Innovation, collaborative learning has several proven benefits for students, including improving communication abilities, leadership skills and overall retention.

She assigned students to teams and gave them the annual report of a Fortune 500 company. In preparation, Wilburn had requested 100 annual reports by mail and reviewed each one, looking for the ones that would best fit the project. The students reviewed financial statements and disclosures, answered questions and brought everything they had learned so far together. The project enthused the students and when Nancy went on to present this special project at a national teaching forum, over 60 schools requested copies of the lecture to replicate it.

“Accounting can be a challenging discipline to learn. Professor Wilburn would often go the extra distance to help students. In addition to her regular class instruction and office hours, she would host extra study sessions on Friday afternoons to assist students,” says Lawrence Mohrweis, a professor emeritus at Northern Arizona University.

page...

Nancy Wilburn

MARCH/APRIL 2024 AZ CPA 15

Collaboration has been an essential piece of Wilburn’s teaching philosophy for decades, but it was even more critical during her final years of teaching when smart phones fragmented her students’ attention during class.

In her financial accounting classes, Wilburn knew these senior-level students already knew plenty about technical topics — like leases and income taxes – but collaboration was how she helped them bring the concepts into reality. Students worked examples. She shared lecture notes with fill-in-the-blank spaces. She paired students up for quizzes and assignments so they could reteach each other.

“It’s hard to sit there staring at your phone if you have three other people working in your group,” she explains. “I’ve always felt that if you can teach it to someone else, you’re really learning it yourself. I think it helped students connect, too. I didn’t ever want them to feel isolated, that they could disappear and not engage.”

In addition to awards for her teaching and research, Wilburn is also a two-time recipient of the ASCPA’s innovation award and served on the Foundation Board and Scholarship Selection Committee for several years.

“The number of teaching awards that she received just blows my mind,” Kilpatrick says. “She teaches very rigorous courses, and yet the students love her. That inspired many of us, and certainly me as well. I learned a lot from her.”

While Wilburn was working on her master’s, Kilpatrick was deep in the third year of a Ph.D. program at Oklahoma State University. The two didn’t know each other well at first, but they had mutual friends.

“Larry Watkins set us up on a blind date,” Kilpatrick said, before adding, “Blind for her. I knew all about it. It has led to almost 40 years of marriage.”

When he got his first job as a professor at Texas A&M, Wilburn followed to earn a Ph.D. of her own.

“I had actually accepted a position at Texas A&M to stay there, which is unheard of for students,” she remembers. “You don’t stay where you get your Ph.D., but it was difficult trying to find two positions at any university.”

Until the impossible happened. Two teaching positions opened up at Northern Arizona University in Flagstaff, a city where Kilpatrick and Wilburn had vacationed often. In the spring of 1987, they received a call from Watkins, the same friend who had set them up years before who now was a professor of accounting at NAU. It was true. Two teaching positions were available, and they were Kilpatrick’s and Wilburn’s if they wanted them. They moved to Flagstaff and taught for over 30 years at the university.

“Students loved Bob, which is even more unexpected, as he taught taxation. He was an exceptional leader as the department head and developed and maintained strong relationships with accounting professionals,” Watkins says. “Nancy was a much-loved teacher. She was the only faculty member that could ‘nerd out’ on financial accounting topics with me at lunch, which benefited both me and our students.”

After teaching at NAU for 34 and 33 years, respectively, Dr. Bob and Dr. Nancy, as their students knew them, are now retired emeritus professors. Bob fixes up things around the house and updates a book he co-authored on LexusNexus. Nancy has walked a thousand miles with their dog outdoors and has written questions for the CPA exam.

The Arizona Society of CPAs, and the entire Arizona accounting community, is grateful for their contributions to our profession. l

16 AZ CPA MARCH/APRIL 2024

Join the Arizona accounting community to celebrate service & achievement! Westin Kierland May 9, 2024 11:30 a.m. - 1:30 p.m. ascpa.com/annual PREFERRED PROVIDERS AWARDEES & INNOVATORS

David Lemme, CPA 2024 Life Member

Beth Levy, CPA Outgoing Chair

Kilpatrick

Wilburn 2024 Honorary Members To Be Announced Excellence in Teaching Award

Michael

Andrea

Bob

Nancy

Volunteers

Our volunteers and engaged members are at the heart of the Arizona Society of CPAs. As we begin our 2024-2025 year, the ASCPA is grateful for the committment, wisdom and creativity of our members, especially those who have served on committees, helped others and driven the profession forward.

18 AZ CPA MARCH/APRIL 2024

Committees & Recognitions

MARCH/APRIL 2024 AZ CPA 19

Are

to speed on the most pressing issues of the industry.

CLA

you a CPA or professional working with nonprofit organizations

specific, practical coverage

Desert Willow Conference Center and via webcast · June 21, 2024 24 Platinum Sponsor

Sponsors

Tax Credit Funds

& MHM

? NPC provides

of critical nonprofit accounting, tax and legal issues. In one day, our knowledgeable experts and speakers will get you up

Gold

AZ

CBIZ

(CliftonLarsonAllen)

& Chapman, PLLC

Meech & Co.,

Your Part-Time Controller Register: ascpa.com/npc NOT-FOR-PROFIT CONFERENCE P GRANTS AUDITING POLITICAL ACTIVITY & LOBBYING RISK MANAGEMENT KEY TOPICS

full agenda at ascpa.com/NPC N

JUNE 21, 2024 24 NOT-FOR-PROFITCONFERENCE NP

Fester

Heinfeld,

P.C.

See

FRIDAY,

Conflicts of Interest Still Cause Trouble for CPAs

By Duncan B. Will, CPA (licensed in CA), ABV, CFF, CFE

Conflicts of interest have long been a major factor in professional liability claims against CPAs. Part of the problem is that potential conflicts of interest are hard to recognize or identify until something goes wrong. When clients are satisfied, they tend to perceive the CPA as a competent advisor who has their best interests at heart. It’s not until clients become disappointed that their perception of the CPA begins to change.

Continued on next page...

MARCH/APRIL 2024 AZ CPA 21

One common claim scenario is that of the CPA advising both parties to a transaction, or helping the parties resolve a dispute. For example, the CPA will sometimes agree to represent both the husband and the wife in a divorce when they are still friendly and cooperative. Many times, the relationship in a divorce will deteriorate rapidly, and the CPA is then caught in the middle.

The same is true for dissolutions or disputes between business partners. Disputes between partners or owners often result in the CPA’s advice becoming perceived by one of them as favoring the other.

Participating in business deals or investments with clients is another common scenario where everyone is happy while the investment performs well. But as soon as it takes a downturn or falls apart, the client’s perception of the CPA erodes.

Case Study

Consider the following case study (the names have been changed):

For decades, Paul Noble, the founder and managing partner of his CPA firm, had served as a trusted financial advisor to his clients. Like many CPAs, he also had his own personal financial advisor –stockbroker Rich Arrington. Noble frequently shared advice he received from Arrington with his firm’s clients and partners.

Chad Pennyworth, a junior broker at Arrington’s brokerage house, worked with some of Noble’s clients and took on many of Arrington’s accounts when Arrington retired. Noble trusted Arrington’s judgment in Pennyworth’s training and development. Though Noble did not refer any of his clients or acquaintances to Pennyworth, he did inform several of them that he had elected to work with him. Because of Noble’s reputation, many of his clients chose to engage Pennyworth as their own broker when they learned of Noble’s faith in Pennyworth.

Almost immediately after Arrington left, Pennyworth sold Noble some bonds, based on incorrect information that misidentified the bonds’ guarantor as the state, when the bonds were instead guaranteed by a financially challenged local school district.

Pennyworth acknowledged the mistake to Noble, and the brokerage firm agreed to repurchase the bonds from Noble’s portfolio, subject to a nondisclosure agreement, which Noble signed. Noble was pleased when a safer alternative was substituted for the bond investment a couple weeks later.

Two years later, Noble was troubled when he read of the financial disaster that was all over the news: the local school district’s failure and worthlessness of the bonds the district had guaranteed. Pension funds and investors, including some of his clients, were hurt badly by the losses. Noble felt sorry for the investors but was relieved he had avoided a similar fate.

His relief turned to dismay, as some of his clients called to discuss the impact of the losses they sustained and their intentions to sue Pennyworth and the brokerage house.

Noble’s hands had been tied because of the nondisclosure agreement. He had not warned his clients of the elevated risk of the bond investment, and his clients were now surprised to learn that he was not “in the soup” with them.

During the class action lawsuit against Pennyworth and the brokerage house which followed, Noble’s initial investment, the reversal of that transaction, and the nondisclosure agreement became public knowledge. Noble’s reputation was ruined. He was now seen as a greedy, self-interested collaborator. Ultimately, Noble and his firm were added to the list of defendants in the class action lawsuit. His former clients alleged that Noble and his firm had a duty to disclose the concerns regarding their investment, had ignored the apparent conflict of interest, and had prioritized their own interests over those of their clients.

22 AZ CPA MARCH/APRIL 2024

Loss Prevention Tips

Recognize and communicate potential conflicts of interests. Project the scenario forward to anticipate what would happen if things were to go wrong. Juries tend to sympathize with clients – especially with the benefit of hindsight and the evidence laid out by a skilled attorney.

Embrace “active ethics.” The CPA should recognize that his or her own personal interests can be averse to client interests and should not agree to sign nondisclosure agreements without first protecting vulnerable clients. Moreover, disclosing a conflict of interest, while helpful, does not resolve the problem, even if clients acknowledge and sign the CPA’s disclosure regarding the potential conflict of interest. Clients could later argue that their consent was not “informed” by a third party (such as an attorney). Do not get too comfortable with disclosure as a form of protection. In the end, the issue will be whether there is a perception that the CPA’s loyalty to his or her clients waned.

Recognize that there are risks associated with providing referrals. Clients often link the CPA who gives a referral to the professional who ultimately performs the services. In instances where it may be perceived that a CPA is offering a referral, the CPA should be careful to name three or more qualified candidates to perform the service and encourage the client to perform their own due diligence in assessing the suitability of the professionals’ qualifications. l

Duncan Will is a Loss Prevention Manager and Accounting and Auditing Specialist with CAMICO. He advises policyholders through the CAMICO Loss Prevention hotline and speaks to CPA groups on a wide range of topics. Reprinted with permission from CAMICO.

ASCPA Preferred Providers Unlock Savings for ASCPA Members Like You

ascpa.com/paychex

cpacharge.com/ascpa

As a benefit of the ASCPA’s professional accounting relationship, you have complimentary access to specialized resources and tools developed to keep you informed and enhance your advisory service. Visit and bookmark the website to access an overview video, tools and tax forms, an accountant-specific dashboard for managing mutual clients, educational resources, program offers, retirement benefits and more.

CPACharge gives you a professional way to accept credit, debit and eCheck payments in your office or online, with no equipment or swipe required. Give your clients the convenience of paying with the click of a button, while you get full daily client payment deposits, transaction details and robust reporting for easier reconciliation. Payment data stays safe and private, and a team of in-house experts is here to ensure your success. Sign up to waive your monthly program fee for the first three months.

camico.com

As the nation’s largest CPA-owned and directed program of insurance and risk management for CPAs, CAMICO features benefits such as deductible reductions for early reporting of potential claims, "continuity of coverage for potential claims" and cyber coverages with breach response services. Policyholders have unlimited access to in-house experts, subpoena and consultation services, assistance with potential claims and reported claims, 100+ letter templates, loss prevention advice and more.

collaborates with these providers to bring you high quality products & services.

The ASCPA

Have You Fulfilled Your Ethics Requirement? Visit ascpa.com/ethics to see in-person and online course options for Arizona CPAs. MARCH/APRIL 2024 AZ CPA 23

What’s Happening at the ASCPA?

The ASCPA Attend Young Leaders Event

January 5, 2024

As part of our efforts to engage the accounting professionals of tomorrow, the ASCPA spoke to students at Education Forward AZ’s Annual Leadership Symposium in Phoenix.

Board of Directors Meeting

January 24, 2024

At this meeting, the board received updates on the ASCPA’s student initiatives and advocacy efforts. Chair Andrea Levy led a discussion on inclusive workplaces and communicating with clients. Lauren Murro, chair of the nominating committee, shared the names of the incoming board of directors. To see the full list taking office on May 1, visit ascpa.com/board24.

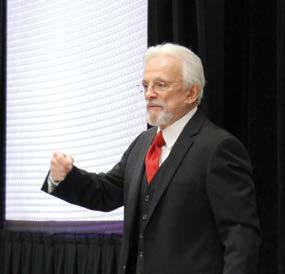

Don Farmer’s Tax Update

January 19, 2024

Don Farmer taught his popular tax class during his final visit to Phoenix. Don is beginning his transition to retirement, though he will still be leading curriculum development. He has appointed Bill Harden as his successor for the Tax Update.

24 AZ CPA MARCH/APRIL 2024

The ASCPA’s Governmental Accounting Conference

February 2, 2024

GAC is one of the ASCPA’s longest running conferences. CPAs and accounting professionals from local, federal and tribal governments came together for a day of learning in Phoenix and live via webcast online.

Special thank you to the Governmental Accounting Community of Practice leadership for making this conference a reality.

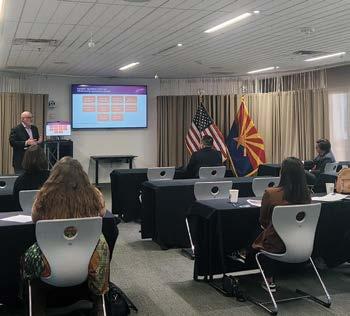

Professional Issues Update Comes to Yuma

January 26, 2024

ASCPA President & CEO Oliver Yandle met with members to share changes that impact the profession, such as legislative efforts, student initiatives and more. Arizona State Senator Brian Fernandez and other local government officials also spoke.

CPA Day at the Capitol

February 5, 2024

Building on the successes from 2023, this year’s event continued to reinforce with state legislators the resource the ASCPA and its members can be for Arizona policy.

Get Involved

March 23

Volunteer with CPAs & Students

ascpa.com/service

Join the ASCPA and accounting students to build meal kits at Feed My Starving Children in Mesa for this volunteering and networking experience.

May 9

Annual Meeting & Awards Luncheon

ascpa.com/annual

Celebrate a year of service, leadership and achievement with other ASCPA members at the Westin Kierland in Scottsdale.

Speak at Converge

ascpa.com/ speakatconverge

Want to share your knowledge with other CPAs? Get involved by presenting at the ASCPA’s annual conference, Converge. Check online for submission details.

MARCH/APRIL 2024 AZ CPA 25

7 Steps for a Successful Tax Season

By Lyle Solomon, Esq.

Tax season is the busiest time for many CPAs and accounting professionals in the U.S. With so much going on, things can get out of hand quite rapidly, but there are steps you can take to set yourself up for success.

1. Begin Early

Provide time for clients to gather any necessary documentation and required proof. This will help prevent you from worrying about numbers and receipts – well-organized records help things flow much more smoothly.

2. Focus on Capacity Management

Do as much as you can before the season truly gets going and use what you learned from last year as a guide. As you plan your schedule for this year, review how you handled more complicated client returns last year to determine when the returns were completed and evaluated. Before any significant tax law changes, research them and incorporate the results into relevant client tasks in your workflow software. It’s also helpful to plan your schedule and client responsibilities, which relates to setting expectations and developing an accountability strategy. To enforce your plan, utilize available technological resources for your client data and share finished organizers in early January.

3. Communicate Effectively

While communication won’t eliminate all the unexpected bumps in your plan for a busy season, effective communication can definitely help cut down on them. During peak periods, your business should have a concrete strategy for

how to communicate with clients, staff and any outside resources you plan to use. Make it clear when, how and where tax information should be sent, along with deadlines and any disclosure or permission forms. Use this as a chance to set realistic expectations, not only with clients, but as an organization as well.

4. Stay Up to Date to Prevent Fines, Penalties & Investigations

Knowing where to begin preparing for tax revisions can be a challenge, with so many subjects to learn about. Fortunately, there are many resources available. The IRS has been steadily increasing the number of audits of Forms 1099 and 1042-S reporting, and domestic organizations are once again the focus of attention when it comes to compliance. Regulators are improving procedures for locating financial firms and taxpayers with inaccurate or incomplete tax reporting. To avoid penalties connected to due diligence and other procedural measures, you must strictly adhere to the requirements and expectations provided in the Internal Revenue Code (IRC 6695).

5. Learn and Use Technology

Utilizing technology to boost productivity is crucial, as the efficiency of a single person can be multiplied with the right tax software. However, technology is only as valuable as the information input, so for a smoother tax season, it’s critical to become informed about software updates and employ the best accounting software available.

6. Outsource Tax Preparation Work

You can increase productivity and profitability by outsourcing certain tax preparation work, such as compiling customer information, arranging data, doing computations, reviewing completed returns and tracking the status of returns. This enables CPAs to focus on client relationships and questions, thereby boosting profitability during peak demand.

7. Be Ready for Challenges

Even if you plan for tax season, unforeseen circumstances will inevitably arise. Set aside time to prepare for anticipated workload and bottleneck problems, and utilize real-time scheduling and task management systems to observe who is buried in preparation or review, who is overloaded and who is under booked, so you can make crucial onthe-fly capacity planning decisions.

Final Note

You should start your tax return as soon as possible and decide when to file based on how hard it is to do. As accounting professionals, it’s important to know how any new laws or regulations could impact your clients. Accounting outsourcing can help the most important people in accounting firms, like small businesses and CPAs, spend more time on vital tasks that add value to the company. l

Lyle Solomon, Esq., is principal attorney at Oak View Law Group. Contact him at lyles.esq@ovlg.com. Reprinted with permission from the Massachusetts Society of CPAs.

Direct:

Casa

Jeril Benedict Commercial Agent

520-251-1034

Grande: 520-836-9301

cattle.benedict@gmail.com www.dansellsland.com 475 E. Cottonwood Lane Casa Grande, AZ 85122 “A Learning Based Company” Each Office Independently Owned and Operated

Email:

26 AZ CPA MARCH/APRIL 2024

AZ CPA Quick Quiz

You’ve Read It, Now Get Credit

Earn one hour of CPE credit in specialized knowledge by completing the AZ CPA Quick Quiz, available online. Receive a score of 70 percent or more about this issue’s articles for credit. It’s that easy!

Fees: Members: $25 Nonmembers: $40

Online Access

Go to www.ascpa.com/quickquiz to access links to all active quizzes. Once a quiz is purchased, a link and password will be emailed to you. Your results will be sent immediately after completion, and certificates are emailed within five business days.

MARCH/APRIL 2024 AZ CPA 27

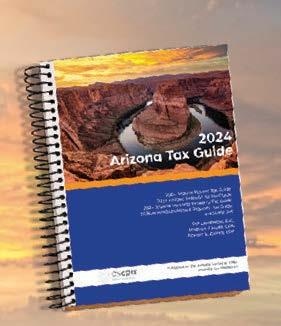

Or der Now

2024 Arizona Tax Guide

Fr om Pat Der denger, Steve Rodis and Ed Zollars

For more than 30 years, the Arizona Tax Guide has been an essential reference for tax professionals It includes:

• The Arizona Income Tax Guide : Better understand income tax law with easy reference to tax tables and individual, corporate, par tnership and trust tax di fferences.

• The Arizona Sales and Use Tax Guide : Simpli f y Arizona and city sales and use tax returns with details on sales tax classifications, exemptions, deductions, rates, compliance, audits and more.

• The Arizona Personal Proper ty Tax Guide : Overview Arizona’s personal proper ty tax system, including exemptions, the classification structure and assessment rates, repor ting, valuation and appeals.

• The Arizona Unclaimed Proper ty Guide : Understand unclaimed proper ty, repor ting requirements and more

Order Now ascpa.com/taxguide PRSRT STD U.S. Postage PAID Tucson, Arizona Permit No. 271 410 N. 44th St. Ste 205 Phoenix, AZ 85008

Andrea Beth Levy, CPA Chair, Arizona Society of CPAs Vice President of Finance and Operations Greater Phoenix Chamber

Andrea Beth Levy, CPA Chair, Arizona Society of CPAs Vice President of Finance and Operations Greater Phoenix Chamber