EDITOR’S NOTE

Welcome to the September 2024 edition of Arizona Ascent! This month, we will explore timely and crucial topics reshaping the Grand Canyon State to keep you informed and inspired.

In this issue, we proudly highlight Buckeye’s remarkable achievement as the No. 1 city in the U.S. for homeownership, a clear testament to the region’s robust housing market. This is a significant milestone that fills us with optimism about the future. Moreover, two other Valley cities have also made it into the Top 20, further enhancing the region’s appeal.

We also explore Phoenix’s remarkable position as the No. 2 city for real estate development over the past 50 years, a testament to the city’s sustained growth and enduring attractiveness for investment. Furthermore, Phoenix’s industrial sector is making waves, ranking No. 6 in the U.S. for large industrial leases in 2024—a strong indicator of the region’s economic vitality.

Arizona’s economic success continues beyond there. In 2024, the state will set records for jobs, capital investment, and wage growth, underscoring its thriving economy and promising future.

As we journey through these stories that shape Arizona’s narrative, we invite you to actively participate. Your thoughts, questions, and topic suggestions are not just welcome; they are integral to shaping the content of Arizona Ascent. Your contribution is what makes this community thrive. Let’s co-create this newsletter together.

Onward and upward,

Jaki Underwood Editor-in-Chief

What You Need to Know About Trends in 17 Key Cities in Arizona

As we navigate the complexities of the real estate market, recent data from the Cromford® Market Index (CMI) offers promising signs, especially for sellers. For the first time since May 9, we’re witnessing a slight majority of cities experiencing an upward trend in their CMI, with nine cities increasing over the past month. Although this change is gradual, it signals a reversal in the market dynamics that could be significant for those looking to sell.

A Subtle Shift in the Momentum

The overall market has been challenging for sellers recently, but the latest figures reveal a glimmer of hope. The average change in the CMI over the past month is +0.7%, marking the first positive shift since May 23. While this improvement may seem modest, it contrasts with the -0.1% change observed just last week, indicating a slow but steady upward trajectory.

City-by-City Analysis

Let’s look at the cities making the most significant moves. Cave Creek, Paradise Valley, Buckeye, and Fountain Hills have seen the most critical percentage gains in their CMI. This is good news for sellers in these areas, as increased demand relative to supply can lead to more favorable selling conditions. Other cities such as Scottsdale, Gilbert, Maricopa, Goodyear, and Peoria have also experienced upticks in their CMI over the last month.

On the flip side, the Southeast Valley— specifically Tempe, Chandler, and Mesa— continues to show declines, with Avondale also weakening substantially. These areas are currently more challenging for sellers, with a higher supply than demand.

Fountain Hills vs. Chandler: A Tale of Two Markets

For potential buyers weighing their options

between cities like Fountain Hills and Chandler, it’s essential to understand the “tradeoffs” each area presents.

Fountain Hills tops the CMI ranking and remains a strong seller’s market with a higher average price per square foot. The trend line shows an increase in prices year-to-date, making it a premium choice for those seeking a more exclusive lifestyle.

Chandler, while still in a strong seller’s market, offers more affordability and stability in pricing. The average price per square foot in Chandler is lower,

making it an attractive option for buyers looking for value without compromising quality.

The Bottom Line

As the market slowly shifts in favor of sellers, those who took advantage of the softer conditions over the past few months may have secured better deals. However, with the recent changes in the CMI, sellers in many areas might now find themselves in a stronger negotiating position.

Understanding these market nuances is critical to making

informed decisions for buyers and sellers alike. Whether you’re eyeing the premium appeal of Fountain Hills or the affordability of Chandler, the real estate market offers opportunities—if you know where to look. just beginning to rise.

Real Estate Briefs

By Jaki Underwood, Editor-in-Chief

Ghost Tree Homes

Set Record Prices in Pine Canyon Symmetry Companies, a Scottsdale-based developer known for luxury residential neighborhoods, has announced the release of Ghost Tree, the final new home in Flagstaff’s prestigious Pine Canyon. These ultra-luxe homes have set a new market record with prices exceeding $1,000 per square foot. The neighborhood, named after a distinctive Ponderosa Pine with an Osprey nest, features multi-level homes ranging from 3,000 to over 4,000 square feet, starting at $3 million. Ghost Tree’s debut follows a $6.4 million renovation of the Pine Canyon golf course, which has been upgraded to

enhance playability and sustainability. The renovation includes an improved course layout, visuals, a 100-yard extension, and a new, water-efficient irrigation system. Pine Canyon, renowned as northern Arizona’s top private luxury golf community, spans over 600 acres and offers a range of amenities, including a clubhouse, dining, a spa, and fitness facilities.

Casas Adobes Plaza Sells for $51 Million, Anchored by Whole Food JLL Capital Markets has facilitated the $51 million sale and acquisition financing of Casas Adobes Plaza, a prominent Whole Foods-anchored shopping center in Tucson, Arizona. Located at 7001-7139 N Oracle Rd., the center

“ “

Built-in 1953 and remodeled in 2014, Casas Adobes Plaza is noted for its architectural elegance and consumer appeal

serves the affluent Catalina Foothills and Oro Valley areas, boasting an average household income of over $122,240 within a one-mile radius. The center, covering 92,330 square feet on 9.51 cres, is 97% occupied and includes high-profile tenants such as Whole Foods, Starbucks, Pure Barre, Orange Theory, and Chico’s. Built-in 1953 and remodeled in 2014, Casas Adobes Plaza is noted for its architectural elegance and consumer appeal, contributing to its high retention rate. The transaction involved JLL’s Patrick Dempsey, Geoff Tranchina, Greg Brown, Jason Carlos, and Quin Madden.

Evergreen Devco Expands Industrial Portfolio with $13 Million Acquisition in Tempe

Evergreen Devco, Inc., a prominent developer specializing in retail, multifamily, and industrial projects, has expanded its industrial portfolio by acquiring

12.68 acres at the southeast corner of 48th Street and Alameda Drive in Tempe, Arizona, for $13 million. This new development, named 48th @ Alameda, will feature two primary sites: 2727 South 48th Street, which will be redeveloped into two speculative industrial buildings totaling 171,025 square feet with an adjacent outdoor storage area, and 2530 West Campus Drive, which will be converted into 65,578 square feet of industrial outdoor storage space. Located in the Airport submarket, which has a low vacancy rate of 3.9% compared to the valley-wide average of 10.1%, the site benefits from its infill location and high entry barriers. Essential amenities in the vicinity include the Los Angeles Angels spring training facility, a class A

office park, the four-star Marriott Phoenix Resort Tempe at the Buttes, and proximity to the I-10 freeway and Sky Harbor International Airport.

Brian Dietz, Vice President of Industrial Development at Evergreen Devco, highlighted the project’s strategic location and innovative approach.

Green Bay Packaging Expands to Casa Grande with Major Land Acquisition

Green Bay Packaging (GBP) has completed the acquisition of an approximately 80-acre parcel of land in Casa Grande, Arizona, located at the NEC/SEC of Bianco and Kortsen Roads. The transaction was facilitated by Kirk McCarville, CCIM, and Trey Davis from Land Advisors Organization’s Casa Grande office,

representing the seller, Auza Ranches LLC. Si Pitstick and Rob Stephens from Newmark represented GBP. Casa Grande Mayor Craig McFarland expressed enthusiasm about the new investment, highlighting it as a sign of the city’s strategic growth and commitment to a vibrant business environment. GBP Executive Vice President Bryan Hollenbach also expressed excitement about the move, noting the area’s growing business community and the anticipated success of GBP’s future corrugated box operation. GBP, which already operates a sales and distribution office in Tempe, AZ, is known for its positive company culture and commitment to high safety standards, quality, and service.

FEATURED ARTICLE

Arizona’s Economic Boom: A Golden Opportunity for Relocation

By Jaki Underwood, Editor-in-Chief

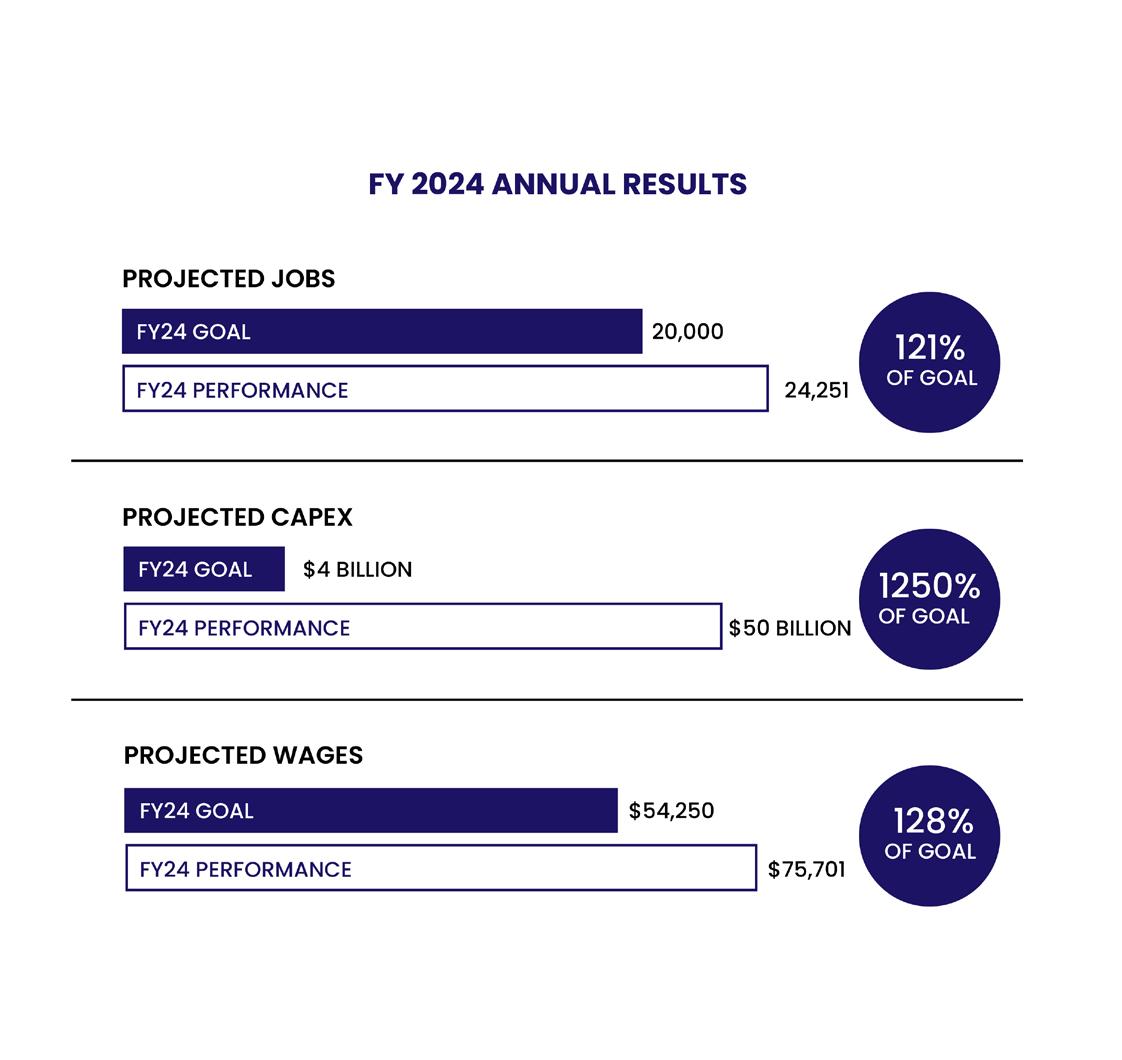

Arizona is currently undergoing a transformative economic success, particularly in Fiscal Year 2024 (FY24). The state has set new records, making it an urgent and potential prime destination for relocation and real estate investment. According to the Arizona Commerce Authority and local economic agencies, Arizona has welcomed an impressive 24,251 new jobs over the past year, with an average annual wage

of $75,701. This job growth is complemented by a staggering $50 billion in capital investment flowing into communities across the state, underscoring Arizona’s burgeoning appeal as a hub of opportunity.

The surge in highpaying jobs is a significant driver of demand in the housing market, creating momentum and growth that is obvious. Arizona’s communities are attracting skilled

professionals seeking new career opportunities and a higher quality of life. This influx of wellcompensated workers creates a ripple effect in the real estate sector, with increased demand for rental and homeownership options. Major urban centers like Phoenix, Scottsdale, and Mesa are experiencing a boom in housing activity as these new residents seek to establish their roots in vibrant, growing communities.

Capital investments are not limited to one sector; they span various industries, from advanced manufacturing to technology. For example, TSMC’s plan to build a third state-ofthe-art semiconductor fab in Phoenix alone represents a $65 billion investment and is expected to create over 6,000 jobs. Similarly, Amkor’s $2 billion investment in Peoria for an advanced packaging and test facility will

generate 2,000 new jobs. These projects, along with others such as Google’s $600 million data center in Mesa and the $20 million health center in Lake Havasu City, are reshaping the economic landscape and driving up demand for local housing.

Economic growth is being felt in nearly 30 cities across the state, including smaller towns like Casa Grande, Yuma, and Prescott. As these areas experience expansion and infrastructure improvements, they present appealing opportunities for real estate investors. The increased economic activity and enhanced community amenities

“ “

With high-paying jobs driving housing demand and substantial captial investments boosting community development, Arizona is emerging as a top choice for individuals and investors alike.

will likely spur housing demand in these burgeoning locales.

Arizona’s recordbreaking economic performance is more than just impressive statistics—it represents a golden opportunity for those looking to relocate or invest in real estate.

With high-paying jobs

driving housing demand and substantial capital investments boosting community development, Arizona is emerging as a top choice for individuals and investors alike. Now is the ideal time to explore the diverse and dynamic real estate opportunities this thriving state offers, filled with excitement and potential for growth.

Buckeye Takes the Lead: No. 1 in the U.S. for Homeownership

By Jaki Underwood, Editor-in-Chief

In today’s housing market, Americans are increasingly facing a crucial decision: should they buy or rent? For many, renting has become a longer-term solution due to various financial or personal circumstances. However, Buckeye, Arizona, is defying this trend by leading the nation in homeownership, establishing itself as the city with the highest percentage of homeowners in the United States.

Buckeye’s Rise to the Top

A recent real estate report, drawing on U.S. Census Bureau data from over 300 cities, revealed

that Buckeye tops the list with a remarkable 85.8% of residents owning their homes. This figure places Buckeye at the forefront of homeownership nationwide, underscoring the city’s appeal as a prime destination for those looking to invest in property and settle down.

Buckeye’s success is no surprise to those familiar with the area. The West Valley city has seen significant growth in recent years, driven by its affordable housing options, strong community spirit, and strategic location. As a result, it has become a magnet for homebuyers seeking a balance between

A recent real estate report, drawing on U.S. Census Bureau data from over 300 cities, revealed that Buckeye tops the list with a remarkable 85.8% of residents owning their homes

urban amenities and suburban tranquility.

The Broader Regional Impact

Buckeye’s dominance in homeownership is part of a more significant trend that sees Western and Southern cities leading the way in this area. Alongside Buckeye, Port St. Lucie, Florida, remains the second-ranking city for homeownership, reflecting the strong appeal of these regions for those looking to purchase homes.

Other cities making the top 10 for homeownership include Rio Rancho, New Mexico; Menifee, California; Sugar Land, Texas; Palm Coast, Florida; Surprise, Arizona; Centennial, Colorado; and Naperville, Illinois. Surprise, AZ, highlights the West Valley’s prominence in the national real estate landscape.

A Contrast in the Northeast

While the West and South shine in homeownership, the Northeast presents a different picture. Hartford, Connecticut, for example, leads the nation in rental rates, with 76.5% of its residents renting their homes. This contrast highlights the varied housing dynamics across the country, with cities like New York also standing out for their high numbers of long-term renters.

What This Means for Prospective Homebuyers

Buckeye’s top-ranking status offers a compelling case for those considering purchasing a home. The

city’s high homeownership rate is a testament to its attractive housing market, which combines affordability with quality of life. As Buckeye continues to grow, its position as a leader in homeownership will likely attract even more interest from prospective buyers.

The success of Buckeye and other Valley cities in the homeownership rankings also reflects the region’s broader appeal. With its strong economy, desirable climate, and thriving communities, the Valley is solidifying its reputation as one of the best places in the nation to buy a home.

As the real estate market continues to evolve, Buckeye’s ascent to the Top of the homeownership rankings serves as a reminder of the ongoing shifts in where Americans choose to invest and build their futures. The city’s success is not just a local achievement but part of a larger narrative about the changing face of homeownership in the United States.

Phoenix’s Real Estate Evolution: A 50-Year Journey to the Top

By Jennifer Conrad, Managing Editor

Phoenix has firmly established itself as a leading force in the real estate sector over the past 50 years. From sprawling single-family homes to bustling multifamily units, expansive industrial complexes, vibrant retail spaces, and innovative self-storage facilities, the city has experienced a remarkable evolution. Today, Phoenix is the second most active real estate development market in the United States, a testament to its dynamic growth and adaptability.

The latest StorageCafe development report, which tracks the construction market from 1980 to 2023, reveals the depth and breadth of Phoenix’s real estate boom. This extensive analysis highlights key trends and shifts in the city’s development landscape over the last five decades.

Single-Family Homes: A Strong Foundation

Phoenix has long been a leader in single-family home construction. Over the past 43 years, the city has issued more than 215,000 building permits for single-family homes, the highest number among major U.S. cities. Although the pace of construction slowed following the Great Recession, the city saw a peak of about 7,068 permits annually in the 2000s. In recent years, from 2020 to 2023, the average has moderated to 4,443 permits per year.

Multifamily Units: A Rising Trend

Phoenix’s multifamily development has surged in recent years. Between 1980 and 2023, the city issued approximately 188,000 multifamily permits. The current decade is the most prolific, with an impressive average of 8,609 permits issued annually from 2020 to 2023. This surge indicates a strong demand for multifamily living options and reflects the city’s ongoing expansion.

Industrial Growth: Building for the Future

Since 1980, the city has added over 127 million square feet of industrial space, ranking third in the nation. The 2000s were particularly notable, with an average of 3.7 million square feet of industrial space constructed each year. This growth underscores Phoenix’s role as a critical hub for industrial development.

Self-Storage: Meeting Demand

The strong migration trends into Phoenix have spurred a rapid increase in self-storage development. Since 1980,

the city has added approximately 11 million square feet of rentable self-storage space. The pace of growth has accelerated significantly in recent years, with the 2020s seeing an annual average of 600,000 square feet added a 78% increase over the previous decade.

Retail and Office Space: A Period of Adjustment

The Great Recession impacted both retail and office space development in Phoenix. Over the past 20 years, the city has seen a slowdown compared to the rapid growth of the previous decades. The

1980s were a high point for office construction, with an average of over 3 million square feet added annually. In comparison, the 2000s saw significant retail development, with nearly 1.9 million square feet built annually.

Phoenix’s real estate development story is one of resilience and transformation. As the city adapts to new demands and opportunities, its real estate market remains vital to its success and growth.

Phoenix’s Industrial Growth: A Catalyst for Residential Real Estate

By Jaki Underwood, Editor-in-Chief

Phoenix ranked sixth nationally for large industrial leases in 2024, a testament to its expanding economic footprint. This significant achievement has far-reaching implications for the city’s residential real estate market.

According to a recent CBRE report, Phoenix is a critical player in industrial leasing, claiming five spots among the top 100 largest industrial leases in the first half of 2024. These leases span a

substantial 4.6 million square feet, underscoring the city’s massive industrial activity. Notably, three of these leases are attributed to e-commerce businesses, with manufacturing companies and third-party logistics (3PL) operators each securing one lease.

The Valley’s industrial leasing activity is comparable to Atlanta’s, highlighting Phoenix’s competitive position.

“Phoenix continues to be a significant player in the

industrial sector,” says Cooper Fratt, Senior Vice President at CBRE.

“In addition to the three major e-commerce leases this year, manufacturing and 3PLs reflect our city’s growing economic dynamism.”

National Trends and Their Local Impact

Nationally, industrial leasing is experiencing a surge, with occupiers signing leases for 31 mega warehouses— facilities exceeding 1 million square feet—in

“The average size of leases among the top 100 largest industrial leases has increased to 814,000 square feet from 791,000 square feet in the previous year

the first half of 202, representing a 35% increase from the previous year. Despite the growth in new supply, first-year rents for these large spaces have seen a slight decline of 2.2%. However, lease rates across all warehouse sizes have risen by 7.7%, highlighting a dynamic market.

The CBRE report reveals that the average size of leases among the

“

top 100 largest industrial leases has increased to 814,000 square feet from 791,000 square feet in the previous year. Retailers, wholesalers, and 3PLs have secured most of these leases, followed by e-commerce operators and food & beverage companies.

Implications for Residential Real Estate

The surge in industrial leases and the influx of e-commerce and logistics

companies in Phoenix are poised to impact the residential real estate market significantly. As industrial growth drives job creation and economic expansion, demand for residential properties will likely increase.

New industrial developments often attract workers who look for housing near their workplaces. This increased demand can raise property values and stimulate the construction of new homes in areas close to these industrial hubs. Moreover, expanding logistics and manufacturing industries can boost consumer spending and overall economic activity, providing additional support to the residential real estate market.

Phoenix’s growing industrial sector and expanding economy will have a noticeable impact on the residential real estate market.

Prospective homebuyers and investors should pay close attention to this sector’s development.

Adela’s Italian Restaurant: A Heartfelt Journey of Family, Food,

and Community

By Jennifer Conrad, Managing Editor

Image Source for Article

By: Samantha Clemens, Intern at the Conrad Group LLC

In the heart of Phoenix’s Arcadia neighborhood, Adela’s Italian Restaurant is a testament to the power of passion, perseverance, and family. As the restaurant approaches its tenth anniversary this October, it continues to delight patrons with its authentic Italian cuisine, warm atmosphere, and deeprooted connection to the community.

A Legacy of Love for Italian Cuisine

Adela’s Italian Restaurant was founded by Pedro Delgado in 2014, bringing over 44 years of culinary expertise to his first chef-owned restaurant. Inspired by his lifelong love for Italian cuisine, Pedro envisioned a place where every dish would be crafted with the finest ingredients and a genuine passion for food. “My father has always loved Italian food,” shares Jaime Delgado, Pedro’s

son and current General Manager. “He started cooking at local restaurants as a teenager, and his passion grew stronger. When we opened Adela’s, it was like watching his dream come to life.”

Family First: The Heart of Adela’s

The Delgado family has built Adela’s into more than just a restaurant—it’s a home. “Being a family business, we try to put

Walking into Adela’s feels like coming home. The staff is amiable, and they genuinely care about their customers. It’s not just about the food; it’s about the experience

the family first,” Jaime explains. “It’s a very calm and loving environment... we even see growth in employees who aren’t family. We treat everyone who walks through our doors as part of our extended family.” This commitment to a familyoriented atmosphere has created a space where employees and customers feel welcomed and cherished.

Customers frequently mention the warm and inviting atmosphere in their reviews. One Google reviewer wrote, “Walking into Adela’s feels like coming home. The staff is amiable, and they genuinely care about their customers. It’s not just about the food; it’s about the experience.” Another review highlights the

restaurant’s personal touch: “The Delgados make you feel like you’re part of their family. You don’t just come here to eat—to be cared for.”

Surviving Through Community Support

Like many small businesses, Adela’s faced immense challenges during the pandemic. Jaime reflects on this difficult period: “We didn’t even think we could make it to next month... But our customers, our clients— they are the backbone of this business. Their support kept us going, and we are forever grateful.” The Arcadia community rallied around the restaurant, with many patrons ordering takeout and spreading the word to ensure Adela’s could weather the storm.

This strong bond with the community is evident in the restaurant’s glowing reviews. “Adela’s is a gem in the Arcadia area,” one customer shared. “Even during the toughest times, they never compromised on quality or service. Their dedication to their craft and their customers is truly remarkable.”

A Taste of Italy in Every Bite

Adela’s menu features a selection of beloved dishes that have become fan favorites. The homemade gnocchi, described by Jaime as “melt-in-your-mouth goodness,” and the signature Polo al Limone, a creamy lemon chicken dish, are just a few highlights. Another crowdpleaser is the Fettuccine Della Casa, a hearty dish with cream sauce, bacon, peas, mushrooms, and onions. “Our gnocchi is something special,” Jaime says with pride. “It’s one of those dishes that just brings a smile to people’s faces. And the Polo al Limone—people all over to try it.”

These dishes, crafted with love and tradition, keep customers returning for more. One reviewer raved, “This is an excellent

Italian Restaurant. My first course was the Insalata di Spinaci (Spinach Salad). The salad was delicious and perfectly dressed. The complimentary bread that came with the meal was outstanding. For the main course, I ordered Fettuccine Della Casa and Penne all’ Arrabbiata; both dishes were incredible.”

Another loyal customer couldn’t help but share their excitement: “The lunch menu has various options at reasonable prices. Portions are perfect for lunch, and the quality is amazing. The bread, the pasta, and the calamari! It’s all so good, and I am working through the menu. I have never had a meal there that disappointed.”

Looking Ahead: Expansion on the Horizon

As Adela’s Italian Restaurant prepares to celebrate its ten-year milestone, the Delgado family is also contemplating the future. Jaime hints at the possibility of expanding to other parts of the Valley, though he acknowledges the growth challenges. “My dad always says if this place doesn’t feel like home to you, then try to find a place that does,” Jaime shares. “We want to expand, but we also want to make sure that wherever we go, it feels like an extension of home. Maintaining the same family-oriented atmosphere and high quality that has made Adela’s so successful

“Maintaining the same familyoriented atmosphere and high quality that has made Adela’s so successful will be out top priority as we consider this next chapter

will be our top priority as we consider this next chapter.”

Jaime is excited about reaching more customers but remains grounded in the restaurant’s core values. “We’ve been blessed with incredible support from our community, and we

“never want to lose that connection. Whether we stay here or expand, we always focus on family, quality, and making our customers feel at home.”