Sheng Long, your professional and trusted aquaculture partner. We are committed to supporting our valuable customers’ success by providing innovation programs with high-performance feeds, healthy shrimp larvae, aquatic probiotics & healthy products and new farming models & technology.

Add: Block A5, Duc Hoa 1 Industrial Park,Duc Hoa District, Long An Province

Tel: (84-272) 3761358 - 3779741 Fax: (84-272) 3761359

Email: thanglong@shenglongbt.com Website: www.shenglongbt.com

Add: Plot No. A-11/1, Part-A, SIPCOT Industrial Park, Thervoykandigai Village, Gummidipoondi Taluk, Thiruvallur District, Tamil Nadu 601202, India.

Tel: 91-44-6790 1001 Fax: 91-44-6790 1017

Email: info@shenglongindia.com Website: www.shenglongindia.com

Aquafeeds in 2023: Market Slowdown

From the editor

2 The Challenging Feed Business

Industry News

4 Vietnam’s shrimp industry players meet in Ca Mau

Shrimp Aquaculture

Review on aquafeeds in Asia, p39 Cover photo credit: Aqua Biz Magazine, Thailand.

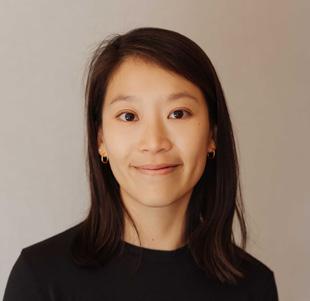

Editor/Publisher

Zuridah Merican, PhD

Tel: +6012 205 3130

Email: zuridah@aquaasiapac.com

Editorial Coordination

Corporate Media Services P L

Tel: +65 6327 8825/6327 8824

Fax: +65 6223 7314

Email: irene@corpmediapl.com

Web: www.corpmediapl.com

Design and Layout

Words Worth Media Management Pte Ltd

Email: sales@wordsworth.com.sg Web: www.wordsworth.com.sg

AQUA Culture Asia Pacific is published bimonthly by

Aqua Research Pte Ltd

3 Pickering Street, #02-36 Nankin Row, Singapore 048660

Web: www.aquaasiapac.com

Tel: +65 9151 2420

Printed in Singapore by Times Printers Private Limited 18 Tuas Avenue 5 Singapore 639342

Subscriptions

Subscribe via the website at www.aquaasiapac.com

Subscriptions can begin at any time.

Subscriptions rate/year (6 issues): SGD 70, Email: subscribe@aquaasiapac.com

Tel: +65 9151 2420

Fax: +65 6223 7314

Copyright © 2024 Aqua Research Pte Ltd.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the copyright owners.

Aqua Culture Asia Pacific is a print and digital magazine. View E-magazine & Download PDF of past issues for free www.aquaasiapac.com

8 From Madagascar to India: Toward to a successful hatchery business with SPF monodon shrimp.

The Unibio hatchery is setting industry standards, by Zuridah Merican

14 Enhancing quality evaluation and disease management across hatcheries. Tanachaporn Utairungsee and Natthinee Mungkongwongsiri discuss the integration of smart devices and real-time PCR technologies in revolutionising operations.

18 Smart shrimp model for higher productivity

Vannamei shrimp culture with assurance that the farmer has minimal problems in each cycle.

22 A comparison of production costs

This is for shrimp fed low protein feeds and when there is an EHP infection, says B. Ravikumar, Victor Suresh, Gnanasri, Uma Maheswararao and Chandhira Sekar

Interview

24 Innovating for sustainability

Nick Piggot of Nutrition Technologies describes its beginnings and growth trajectories.

Feed Technology

26 No such thing as the “Perfect Ingredient”…

A sobering assessment of where we are in the search for new protein sources following a workshop at ISFNF 2022 by Brett D. Glencross

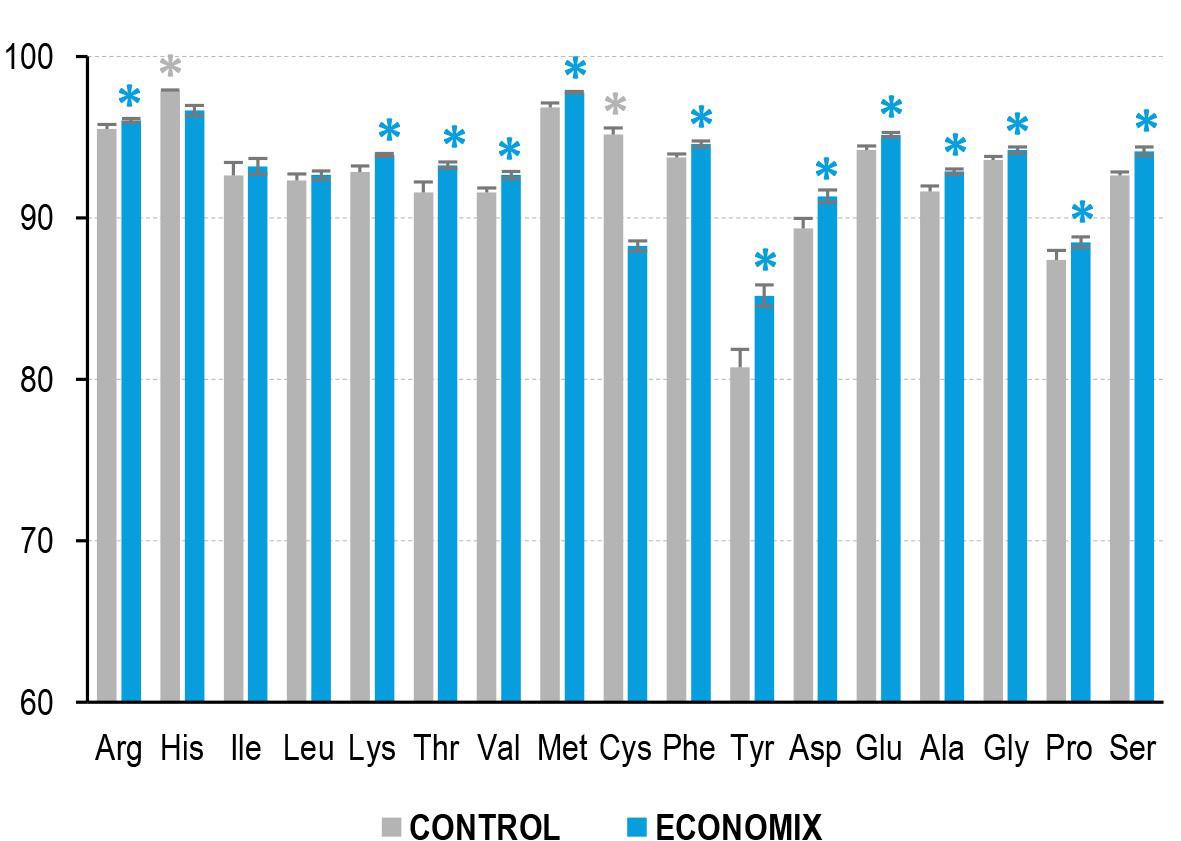

31 Enhancing aquafeed efficiency for sustainable aquaculture growth

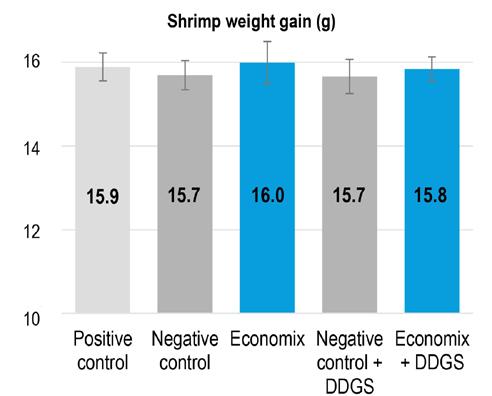

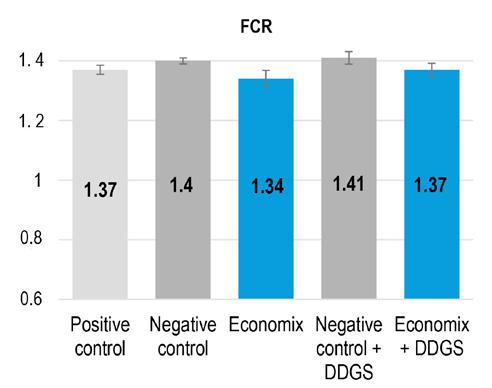

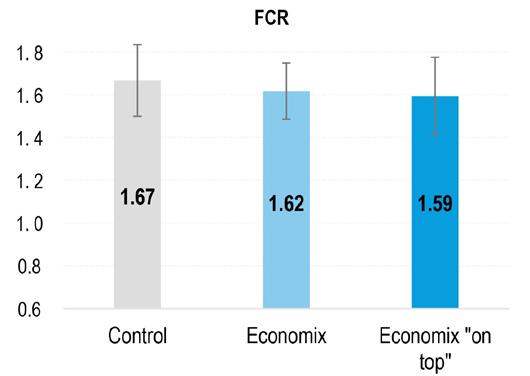

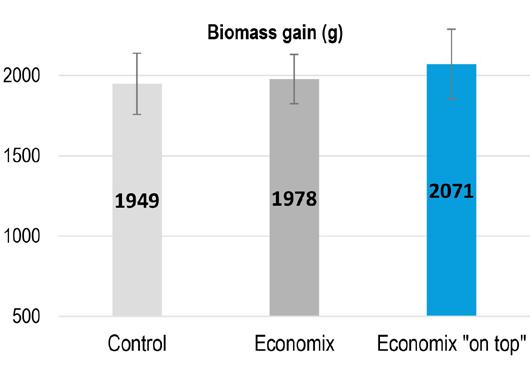

Unlocking protein potential with the use of specific plant extract-based additives. By Pierre Fortin, Nicolas Tanrattana and Sophie Reys

Industry Review- Aquafeeds

35 Unveiling the global feed landscape

Henry Wong on insights from Alltech’s 2023 Global Agrifood survey

39 Aquafeeds in 2023: A market slowdown

Low feed demand as farmers react to low fish/shrimp farmgate prices

41 Aquafeed R&D in Soc Trang

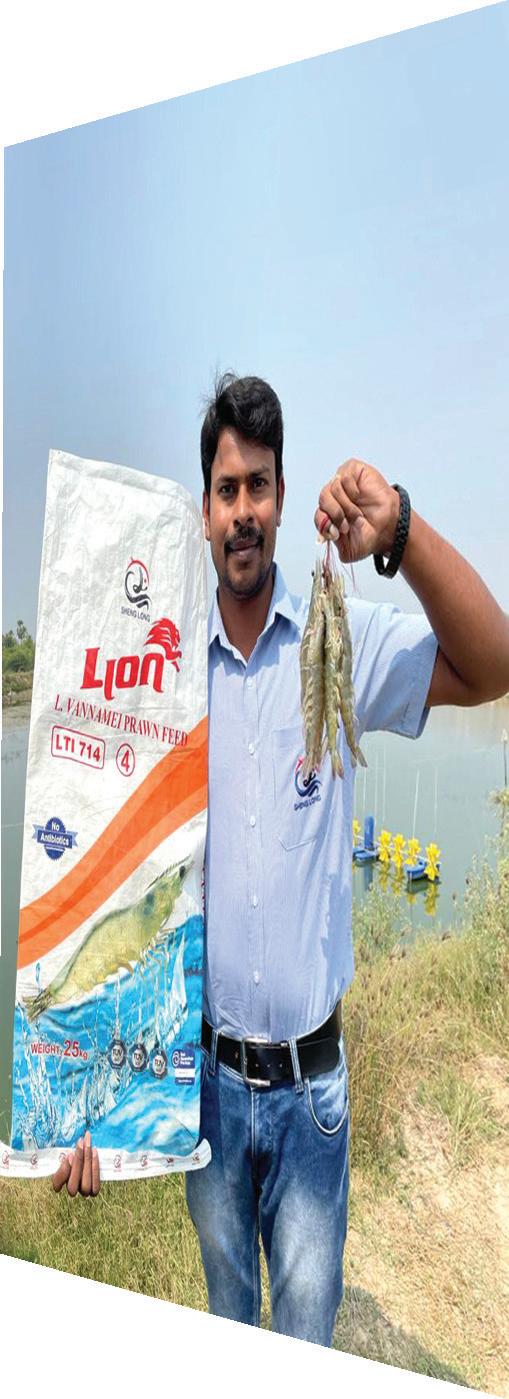

Sheng Long Bio-Tech runs this 18ha facility for marine shrimp and freshwater fish.

42 Ten years in India’s aquafeed market

An interview with Seshu Akkina at Deepak Nexgen Feeds

44 Maximising shrimp farm performance: Managing shrimp feeds and feeding

A discussion at Aqua India 2024.

Sustainable Aquaculture

46 What it takes for sustainability in feed and feeding management

Some takeaways from the Feed and Feed Ingredients panel at Global Shrimp Forum 2023

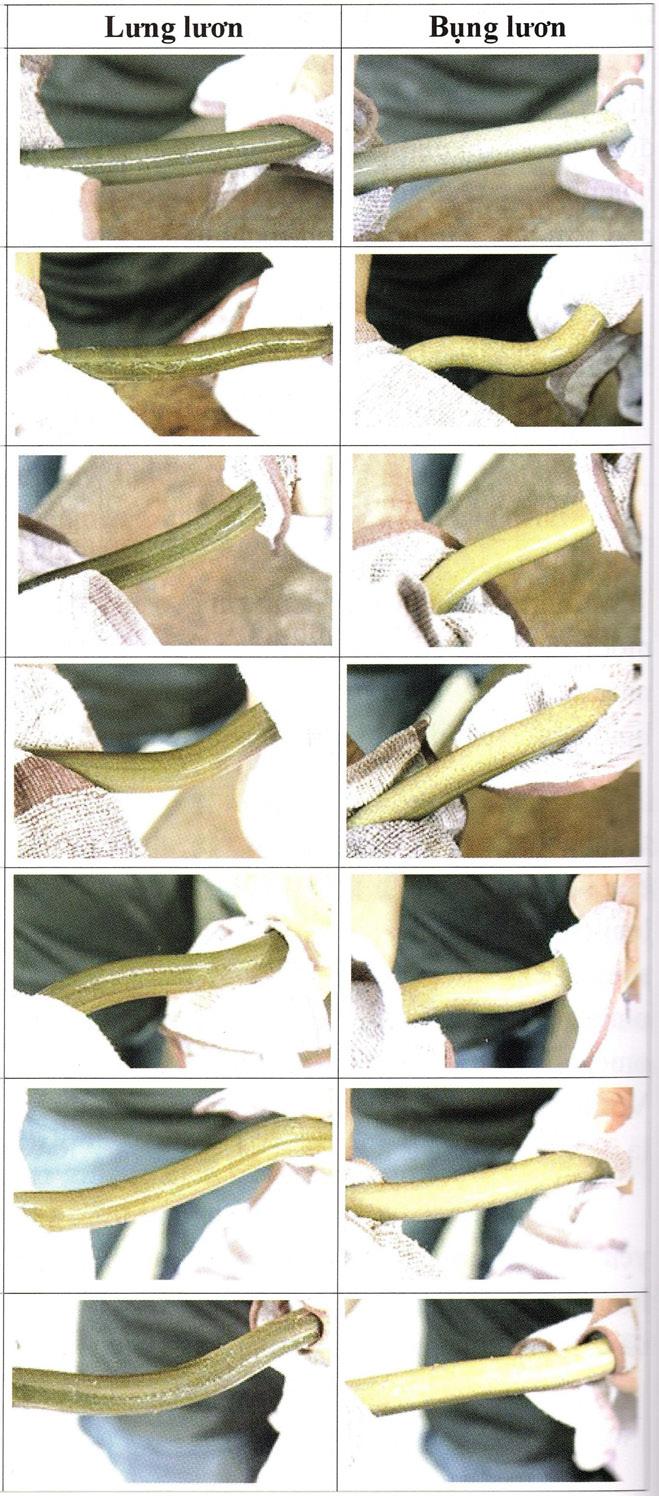

49 Asian swamp eel in Vietnam

The goal is to transform for local and export markets.

Show Review

54 Victam Asia/Health & Nutrition Asia 2024

Company & Event News

Zuridah Merican

Zuridah Merican

The feed segment has always been a promoter and supporter of the aquaculture industry from providing quality feed, technical service to credit to farmers. The past 4 years have seen a very startle change in the challenges and can be divided into two phases. The recent Alltech Feed survey for 2023 showed a 4% drop in aquafeed consumption compared to the previous year. Market prices of shrimp and fish have overtaken feed cost as the major concern for the industry. Today, not only is the feed segment suffering, but there is also little interest in their plight. How do we make sense of this?

Let us review the two phases. The years 2021-2022 saw feed ingredient prices escalate due to the Ukraine war, Covid lockdown and consequential supply chain woes. Companies were forced to increase feed prices but were always behind the curve leading to losses. In certain countries, feed companies were not allowed to increase prices without government approval. This resulted in raw material prices exceeding 90% of the net unit selling prices of feed. However, 2023 saw a significant easing in many feed ingredient prices

We strive to be the beacon for the regional aquaculture industry.

We will be the window to the world for Asia-Pacific aquaculture producers and a door to the market for international suppliers.

We strive to be the forum for the development of self-regulation in the Industry.

and feed prices dropped accordingly, but feed demand has also dropped affecting mill capacity utilisation and hence economies of scale in production cost. Asia has been particularly affected as the prices of its major export species i.e. shrimp, tilapia and pangasius have dropped as supply exceeds demand. Many shrimp farmers have either skipped cycles or reduced stocking densities resulting in lower feed demand. The challenge has now changed from negative margins to a loss of volume.

There are new challenges and innovations coming onstream so how do we navigate this business?

The new challenge comes in the form of sustainability which costs money and seems to sit squarely on the shoulders of the feed segment today. But the major question is what is the definition of sustainability and how does one measure this? This has been continuously asked from the Global Shrimp Forum 2023 and The Aquaculture Round Table Series (TARS) 2023. Many have proposed Life Cycle Assessments in terms of CO2 emitted per kg of commodity but the assumptions for this measure require fine tuning. Then how do we spread the cost increase along the supply chain? The consumer wants it but may not be willing to pay for it.

The feed segment is not standing still – there are innovations.

1. Smart feeding with autofeeders is a key process to improving efficiency, reducing sludge buildup in ponds, and reducing pollution in cage farming. However, the uptake has been slow in Asia. One argument is that Asian aquaculture is fragmented and comprises many smaller farmers who are reluctant to pay for such services.

2. Low crude protein shrimp feeds based on precision nutrition can reduce feed cost. Within Asia, Indonesia has been leading with this concept which has helped reduce feed cost, cost of production and pond pollution.

3. R&D for marine fish species. If Asia wants to develop the barramundi as its major marine species, then more precise nutrition must go into feeds specific for various stages of the life cycle.

4. Alternative feed ingredients. The growth in aquaculture feeds will require more feed ingredients. Fishmeal and marine sourced ingredients will become strategic and must be supplemented by high protein meal from plant sources, co-products from renewable energy, insect meals and single cell proteins.

5. The argument for and against GMO feed ingredients must be fact based, balanced, and viewed holistically. Without GMO Soy and Corn today, there will be insufficient feed ingredients to feed our livestock and aquaculture industries. Imagine the rise in feed cost for producers and the price for the consumers?

6. Functional feed is a competitive business. Uptake has been slower than anticipated in Asia due to two major reasons. Poor understanding in its use as a preventive measure and consequential lack of trust on the part of farmers. It is viewed by farmers as insurance, and many are willing to take the risk when margins become negative. The hope is for the new generation of farmers who are willing to focus on improving productivity and not cost saving.

There is no doubt that the business is more challenging than usual but this pullback in aquafeed demand is only temporary, and the industry must be prepared for the next phase of growth.

If you have any comments, please email: zuridah@aquaasiapac.com

Ca Mau, Vietnam’s southernmost province is home to the largest shrimp farming area. In 2023, it produced 231,000 tonnes, from 278,000ha of farming area. This was 22% of the total shrimp production in 2023 and 40% of total area for shrimp farming. Some 20,000ha are dedicated to extensive farming to produce certified organic black tiger shrimp. The farming of vannamei shrimp is in highly intensive systems, such as the three-stage super intensive vannamei model in 0.45ha producing 60-70 tonnes/crop. In 2023, shrimp exports totalled USD1 billion accounting for 30% of the country’s shrimp export value.

In March, organisers of Vietshrimp Aquaculture International Fair 2024, Vietnam Aquaculture Magazine Thuy San, chose Ca Mau City for its 2024 edition. The event- “in company with shrimp farmers” -, co-hosted by the Vietnam Directorate of Fisheries, the Vietnam Fisheries Society (VINAFIS) and Ca Mau province’s Department of Agriculture and Rural Development, had 215 booths comprising 150 domestic and international exhibitors. The three-day fair also included four seminars on technology transfer in the shrimp value chain and towards a sustainable shrimp industry. The target was value enhancement of Vietnam’s shrimp industry and how can its shrimp farming industry strive for higher efficiency.

Speaking at the opening ceremony, Deputy Minister of Agriculture and Rural Development Phung Duc Tien said that Vietshrimp not only contributes to promoting and introducing the potential, strengths, image and brand of Vietnamese shrimp but is also an opportunity for authorities from central to the local level, experts, scientists, businesses, cooperatives and farmers to exchange and update the situation on new scientific and technical advances. This event also connects businesses to expand and develop markets; connects production and consumption along the value chain and at the same time, discuss measures to overcome industry limitations and shortcomings.

“We believe that Vietshrimp 2024 is a bridge between the business community, partners and customers; it is a forum for the state, scientists, businesses and farmers to join hands to find solutions to develop the shrimp industry effectively and sustainably; maintain Vietnam’s position in the world market, connect all sectors with the world; at the same time, provide learning experiences, and techniques of advanced countries to upgrade the Vietnamese shrimp industry for the future,”

The country’s shrimp farming area reached 737,000ha last year. Although farming areas have not increased, total shrimp production increased by 5.5% compared to 2022. Entering 2024, the shrimp industry players present at the event expect to face many difficulties and challenges. The seminar portion of Vietshrimp demonstrated the wish of all industry players to address challenges, particularly relating to water quality and high costs of production.

During the opening ceremony, officials discussed the challenges facing aquaculture in the Mekong Delta. Vietnam is among the five countries which will be badly affected by climate change, with aquaculture and rice planting as the sectors most affected. In February 2024, the Australia-Vietnam Blueprint for Climate-Smart Agriculture: “Advancing Climate-Smart Shrimp and Rice Industries in Vietnam, was launched. This will serve as a guide for Vietnamese and Australian counterparts on climate-smart agriculture. It explores the challenges and opportunities in Vietnam’s rice and shrimp sectors and highlights how collaboration can accelerate this transformation. In his presentation, Dr Tung Hoang, CSIRO Agriculture & Food said that Vietnam is one of the most vulnerable countries to climate changes which may result in 24% reduction of arable land. Saline intrusion may benefit shrimp farming, but climate change also increases stress to the animal and induces disease outbreaks leading to higher costs of inputs.

As Vietnam’s shrimp farming continues to advance and adopt technology, Vietshrimp provides an opportunity for suppliers along the value chain as well as startups to showcase their products. Cargill Vietnam took this opportunity to officially launch its range of extruded shrimp feeds produced in Vietnam (see pages 5859). Michel Leger, Skretting Vietnam, presented on a new product focussed on parasite management. This is to counter Enterocytozoon hepatopenaei (EHP) and gregarines by reducing the ability of the parasites to replicate and attach to the host.

A year ago, Sheng Long Bio-Tech introduced its hatchery feeds with 45% crude protein. “The price is very competitive against well-known international brands” said Jeff Chuang Jie Cheng, Managing Director. “Attractability is high, water stability is good and we recommend for PL 9-10 over 10-15 days. This is called Beikesu, which in Chinese means grow faster.”

“It is common to find in the market lower protein grower feeds such as 35% in India and 30% in Indonesia. However, in Vietnam, producers are still bent on using high protein grower feed with 38% protein. Reducing protein in feeds is interesting in terms of reducing feed costs,” said Leger. Reducing protein by 2% (from 38% to 36% ) with different levels of fishmeal did not impact FCR and growth. There is good potential of using lower protein feed and Skretting will launch a lower cost feed based on this finding.

Similar to displays of innovative farming models at the booths of leading feed companies in 2023, there were upgraded versions at this year’s event. Most include multiple steps for water treatment, a nursery and multiple grow-out phases. Le Van Khoa, National Technical Director, Grobest presented a multi-stage shrimp farming model which is an open model - suitable for soil conditions and weather and climate of each region and allows farmers to build a completely new farm or upgrade an old one based on existing foundations. He said that the cost of production in Vietnam for size 50/kg is USD4/ kg, which is the highest in Asia, and feed accounted for 64% of the cost of production at USD2.56. The model developed was to optimise farm performance while using efficiently electricity and water and reduce cost per 1 kg of shrimp. According to Grobest, as it moved from Grofarm to GrofarmPro failure rates have dropped from 16% in 2021 to 7% in 2023. Concurrently, profitability has increased.

Nguyen Khac Hai, Sheng Long Biotech discussed the developments with the Thang Long Smart System (see pages 18-21) which has now advanced to version 2. Hai gave examples of farmers successfully applying this model in many provinces in the Mekong Delta. There is also a version developed for earthen ponds. Skretting has integrated its range of products to include water quality management into its ‘success’ program. This promises a survival rate increase of 15~20%; higher growth rate of ~10%; antibiotic-free shrimp which fetch higher prices; lower disease outbreaks; and production cost improved ~15%.

Uni President Vietnam displayed their new range of ready-to-eat shrimp products.

Vietnam has an active startup ecosystem and is also the place for startups to work with farmers and industry players. The rapidly expanding Forte Biotech works closely with shrimp farmers in Vietnam to apply its easy to use, on site diagnostic kit (RAPID). The aim is to help farmers detect infections early, allowing them to take mitigative actions. A new app gives the convenience of centralised, accurate information. At their booth, Kit Yong and Michael Nguyen, co-founders and team members demonstrated to farmers the diagnostics capability of their innovation which can quickly spot diseases like white spot syndrome virus (WSSV), EHP, and acute hepatopancreatic necrosis disease (AHPND) in just 50 minutes. Founded in Vietnam and Singapore, Forte Biotech is now expanding its reach across Southeast Asia.

Tomota has a farm management system with enterprise resource planning and AI features, which it has already deployed in some large corporate farms. It also has operational and maintenance support for corporate farms

such as at Minh Phu’s farms. In a presentation, it listed its success in the digital transformation at these farms resulting in 30% increase in productivity, large reduction of staff on night shifts, detection equipment failures and reduction of less than 7% daily water exchange. It also has Tomota S3, for counting post-larvae and sizing shrimp.

Tepbac is changing Vietnam’s aquaculture via the power of information and technology. It has a website supplying industry information. Farmext is a farm management platform which allows farms to monitor production at all times, via mobile and computer and automatic water monitoring to measure pH, oxygen, temperature, salinity etc, 24/7 easily and automatically.

Dr Nguyen Tan Sy from the Institute of Aquaculture, Nha Trang University discussed work using a microbial protein to control bacterial diseases in shrimp. These diseases include AHPND and translucent post-larvae disease (TPD). Recently, scientists at the Institute conducted experiments supplementing microbial protein into feed. The results showed that shrimp immunity was enhanced, manifested through increased total haemocyte count, increased phenoloxidase (PO) and lysozyme levels.

David Kawahigashi, Vannamei 101 compared farming practices in Ecuador and Vietnam. He said Ecuador’s exponential increase in production is attributed to the multi-phase system with 5 cycles/year, genetics with faster growth strains and recirculation aquaculture system (RAS) of the entire farm. Another contribution to lower cost of production is the use of acoustic feeding systems. Some 36% of farms are using systems which improve FCR by 0.2-0.3. There was improved nutrition with extruded feed. The cost of production is USD2.00/ kg. for 20g shrimp and feed costs USD1 –1.3/kg. Many farms are using synbiotics to reduce feeding rates.

SPECIFIC FOR YOUR SUCCESS

Animals robustness and resilience comes from within. We believe that’s never been more true than today.

Our passion is harnessing the natural power of yeast and bacteria to support health, well-being and performance of all farmed aquatic species.

We help our industry partners and farmers sustainably feeding and farming shrimp with a complete range of microbial solutions for: gut health, immune support, antioxidant balance and micro-nutrition pond water and soil quality.

Setting an industry standard comes with particular attention to quality, strict codes on practices and a proprietary hatching technology

By Zuridah Merican

Uniform and clean PL16 for a customer.

Post larvae from specific pathogen free (SPF) Penaeus monodon broodstock, available since 2021, have been a new lifeline for many shrimp farmers in India. It has fuelled the current resurgence in monodon shrimp farming. The 2023 production estimate announced at Aqua India 2024 in February, was 39,000 tonnes of monodon shrimp., alongside 811,000 tonnes of Penaeus vannamei (Reddy, 2024). It is important to note that the return of the monodon shrimp is helping some farmers overcome some production woes with vannamei shrimp farming, from crop failures particularly over the hot summer months when temperatures are very high, disease problems, supply glut and low farmgate prices.

At the packing sta.on, uniform and clean PL16 for a customer.

pull factor for the shift between monodon and vannamei shrimp farming in India. In 2023, Duraisamy said that in Gujarat, the ratio of monodon: vannamei was 1:1, from a predominant vannamei farming in 2022.

Monodon shrimp hatcheries have a small window of demand since there is only one crop/year. In general, stocking occurs from February to April in all major shrimp farming areas in India such as Andhra Pradesh and Gujarat. The post larvae stocking density is around 5-10PL/m2 , up to 15PL/m2 in Tamil Nadu and Andhra Pradesh, and 20-30PL/ m2 in Gujarat. According to Duraisamy (2024), monodon shrimp farms in Gujarat, Andhra Pradesh and Tamil Nadu use post larvae from SPF broodstocks, and only those in Kerala and West Bengal continue farming using post larvae from wild broodstocks. Currently, there are three sources of SPF monodon broodstocks: Aqualma, Moana and the Rajiv Gandhi Centre for Aquaculture (RGCA). The demand is 1.5 billion PL/year and this is expected to grow in the coming years.

The average harvest size is 50g achieved in 4-5 months but as prices are much better for large sizes, many farmers opt to harvest up to 100g shrimp which require a culture period of 8 months at survival rates of 80%. However, low farmgate prices for both species have become a

India’s Coastal Aquaculture Authority (CAA) has determined that hatcheries can only produce one shrimp species i.e. either monodon or vannamei. Therefore, for hatcheries producing monodon post larvae, this small window of demand is a major business constraint. On the contrary, hatcheries producing vannamei post larvae have a larger market since farmers have at least two cycles or more when they harvest small sized shrimp. Vannamei post larvae sell at USD4/1,000 PL and farmers veer towards cheaper post larvae when farmgate shrimp prices are low, despite the general trend to reduce stocking density to 2025PL/m2 from 40-50PL/m2

The post larvae market is extremely reliant on farmgate prices. Industry reported that since August 2022, post larvae demand began to drop, as farmgate prices declined. This trend continued into 2023 as farmers were uncertain on the direction of prices and some stopped stocking. In comparison, 2021 and 2022 (until August) were good years for the post larvae market. Farmers also had cash flow problems with delayed payments by processors which affected post larvae purchases. In India, there are few farms producing vannamei alongside monodon shrimp. These are mainly large conglomerate farms with larger areas.

“The biggest challenge for us and other hatcheries is the one crop cycle, and we only have three months to produce and market post larvae. We bring broodstocks at the end of November and acclimatise them for 30-35 days before ablation. The other challenge is that this period is the rainy season, and we need to maintain salinity. Our animals must

be stress-free to perform well and luckily, we have the advantage of our experience working in Madagascar. We have only 4% mortality,” said Easwara Prasad P., consultant to the Unibio hatchery, during a visit in February.

India’s Unibio group, part of the joint venture with Unibio Holding, an associate company of Aqualma (Unima Group) in Madagascar began full operations in 2022 at its hatchery in Mugaiyur, Tamil Nadu, around 2 hours drive from Chennai. In India, the group has three associated hatcheries: MAS Aqua Techniks in Nellore, Golden Marine Harvest in Marakanam, Tamil Nadu and UniBay Aquabreeding in Visakhapatnam, Andhra Pradesh.

Previously, a vannamei shrimp hatchery, this facility in Mugaiyur, covering an area of 2ha, underwent considerable modifications and additions to meet the needs for monodon post larvae production. These include the complete renovation and construction of maturation sheds and a new PLRT (post larvae rearing tanks) section. The hatchery launched its first batch of post larvae on March 23, 2021.

“Unibio’s broodstock from Madagascar is the 20th generation and we know that post larvae from such broodstocks are more resilient than from those produced using wild broodstocks. It is possible to get 4-5 spawns/ female during 3 months of use for nauplii production. Fecundity can be as high as 500,000 to 700,000 nauplii for the larger 130-140g broodstock,” said Prasad.

Unibio sells post larvae at USD12/1,000 PL while hatcheries using wild broodstocks sell them at USD4/1,000 PL. “Although not a usual practice, we can grow post larvae to larger sizes over 10 days in a nursery system and offer to farmers at USD15/1,000 PL. However, today, farmers are not ready to purchase and stock larger post larvae.” In the future the post larvae prices may come down to USD7.0-8.0/1,000 PL if the demand goes up when harvesting sizes at 25-35g becomes viable.

In 2023, despite difficult times with low farmgate prices, Unibio managed to sell about 500 million post larvae (PL12-15). “More than 90% of our farmers reported good growth and good survival rates. Since they are happy, we are happy too. This set the base for this year’s projection of 750 million post larvae production.”

The quick transition to successful production in India is attributed to 40 years of experience of the management team, replicating their knowledge in operating the hatchery and farm operations at Aqualma in Madagascar to this facility in India.

luckily, we have the advantage of our experience working in Madagascar. mortality,” said Easwara Prasad P., consultant to the Unibio hatchery

At the packing station, preparing PL16 for delivery. Right

To meet planned post larvae production targets, the SPF broodstock requirement is met by weekly consignments of 400 animals imported from Aqualma at the beginning of the production season.

However, when Unibio started in 2020, it was in the midst of the Covid-19 pandemic and the company encountered logistics problems. Prasad commented, “Before the pandemic, flights from Madagascar to Chennai were through Mauritius but these were not operating in 2021.

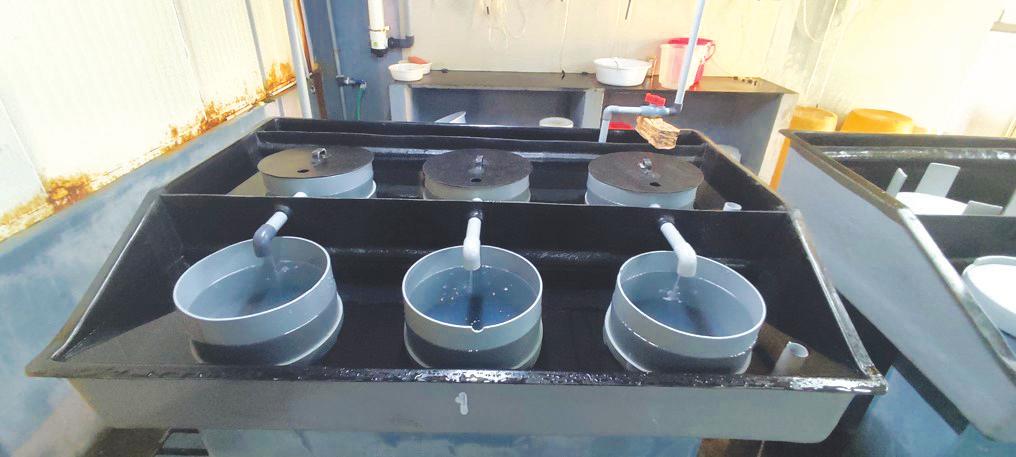

Larval tanks

Unibio Holding, began full opera.ons in 2022 at In India, the group has three in Marakanam, Tamil

hatchery, this facility in Mugaiyur, considerable modifica.ons and addi.ons to meet the needs for These include the complete renova.on and construc.on of matura.on larvae rearing Ttnks) sec.on. The hatchery launched its first batch

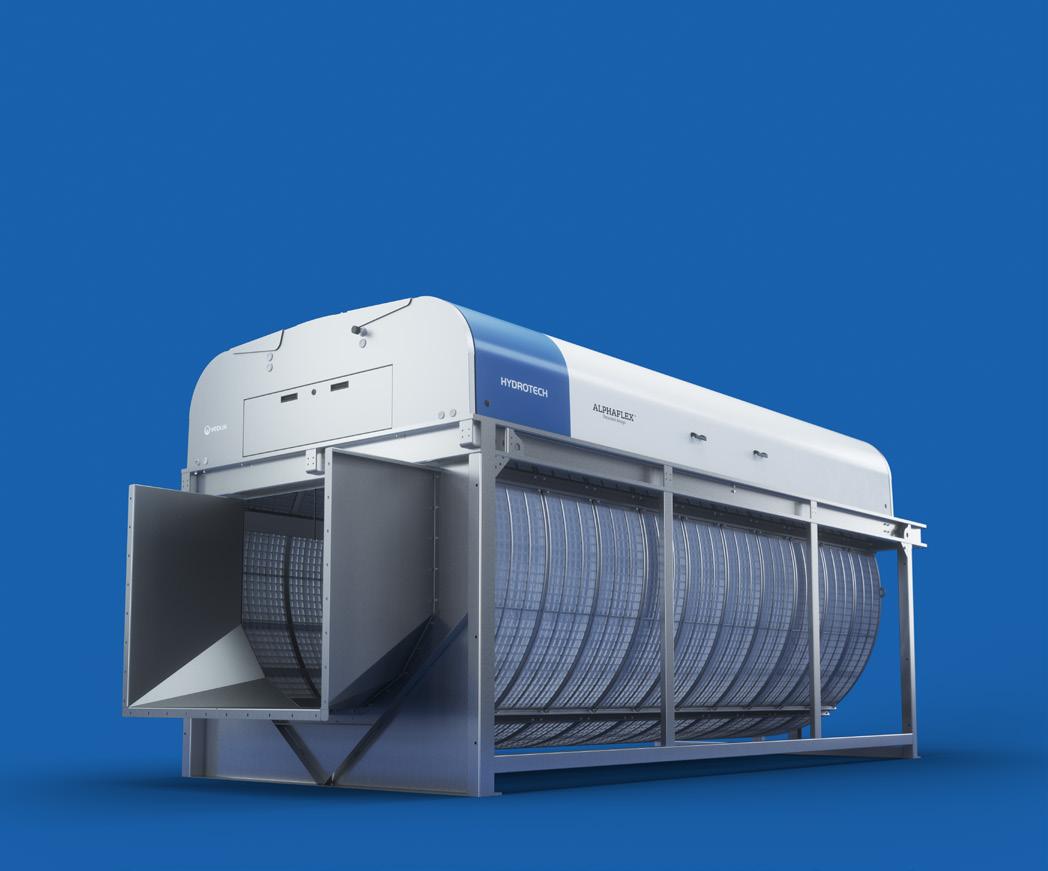

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

“Unibio’s broodstock from Madagascar is the 20th genera.on and such broodstocks are more resilient than from those produced

Let us help you!

Call +46 (0)40 42 95 30, or visit www.hydrotech.se

We resorted to charter flights which were not tenable in the long term. Full operations began in 2022 but logistics continued to be a burden with no flights via Mauritius. A recent strategy is flying broodstock via Addis Ababa with 3-4 consignments per month.”

George Chamberlain, President TCRS (The Center for Responsible Seafood) with from left, the Unibio team of Panchu Duraisamy, Director, Unibio (India) and Manavendra Rao, Business Manager Aqualma with Ramraj D, Hi Breeds Aquatics; Victor Suresh United Research, and Jegan Michael, Growel Feeds. Photo credit. Unibio.

Quality post larvae production and strict protocols

The protocols in post larvae production at Unibio are very specific. It uses only females of 95-100g and 65-75g males to start with. These cost the company USD200/

broodstock, including import duties, quarantine and repacking charges. The minimum size for females is 95g as smaller broodstock shows sub-optimal performances at a fecundity of 200,000 to 300,000 nauplii.

Broodstocks are fed frozen squids from California, polychaetes from the Netherlands and moist pelleted feeds from the US. These broodstocks give an output of 15-20 million nauplii/day. Females moult at a frequency of 2 weeks which allows the male broodstocks to mate naturally. Post ablation, ready to spawn females are held individually overnight in 150L spawning tanks. There are specially designed hatching containers, a proprietary technology developed at Unima in Madagascar. The average hatching rate is 70%. Nauplii are washed following standard protocols. The average survival rate is 40-45% from nauplii to PL12.

Each cycle takes 21 days for a production of 22 million/ cycle of PL12-16. The Unibio hatchery in Mugaiyur operates for 10-12 cycles in a production season. The standard operation procedures are very strict – there are calculations on the target growth of post larvae, on the carrying capacity of each tank and that PL12 should attain 4.5mg. When these do not match, the cycle is extended but this is not encouraged to avoid possible sanitary issues. “Fortunately, monodon has less issues with zoea syndrome compared to vannamei. The hatchery‘s top concern is contamination with Vibrio . Therefore, it has opted for 100% culture of live feeds, Chaetoceros and Thalassiosira in indoor mass culture in transparent cylinders under controlled conditions. Transfers of PL5 to grow to PL 12 are done manually,” added Prasad.

The critical role of water quality is evident with massive volumes of water in large 150 tonnes and 200 tonnes capacity tanks being treated to accommodate the large flow-through system for the maturation facility. The seawater intake source is 50m from the hatchery. Water treatment starts with settlement, ozonation of incoming water, followed by cartridge filters and ultraviolet sterilisation. Water is cooled to maintain at 27-27.5°C for the flow-through system in the maturation facility.

According to Prasad, “The management is very particular on quality. If the batch does not reach the standard, the post larvae are discarded.” Unibio is the only SPF monodon hatchery in India with Best Aquaculture Practice (BAP) certification for the full scope of BAP hatchery standard, from maturation, nauplii and post larvae production. Therefore, the target is to set industry standards.

The cost of post larvae production is increasing rapidly. Labour costs have risen by 20% with recent changes in minimum wages. There is a dependence on the electrical grid but concurrently, the generator is running for several hours. Transport costs have increased for broodstocks while fortunately post larvae delivery costs are the responsibility of the buyers.

Extra costs come with the promise to adjust post larvae transport conditions to align with conditions of stocking water, prior to delivery such as for farming in low saline water ponds. “The minimum salinity at which we pack the post larvae is 10ppt. Alongside these are the preproduction costs of broodstock transport and cubicle, and testing costs at the Aquatic Quarantine Facility, ranging from INR200,000 to 300,000 (USD2,352-3,529) per cubicle which holds 200-250 broodstock.” explained Prasad.

A side discussion was on eyestalk ablation in monodon shrimp. There is considerable debate on shrimp welfare and how to phase out this practice from the point of view of certification. Prasad admitted that eliminating eyestalk ablation is difficult in the close thelycum monodon shrimp. “It is difficult to get them to mature and mate naturally under normal conditions. Aqualma is working with experts and trials are being carried out in Madagascar to eliminate eyestalk ablation.

“The major difference with non-ablated shrimp is the unpredictability in shrimp spawning. This translates to the inability to predict production and the hatchery cannot commit to having nauplii at a set date. Ablation gives a predictable cycle. All businesses need predictability. Fecundity is also predictable with ablated females, moving upwards from 200,000 to 700,000 nauplii. But with nonablation, there is no guarantee on fecundity,” said Prasad.

On the other hand, Prasad said that shrimp health can be affected by ablation but here at Unibio, with the expertise that they have developed to avoid stress at ablation, they have not seen mortality associated with ablation, other than the usual level. “The predictability which comes with ablated females is unmatched,” emphasised Prasad.

An integration of smart devices and real-time PCR technologies is revolutionising operations

By Tanatchaporn Utairungsee and Natthinee MunkongwongsiriShrimp aquaculture is crucial for meeting global seafood demand, but it encounters challenges related to shrimp health, diseases, and quality assurance. There are innovative solutions to address these issues in shrimp hatcheries by revolutionising operations across all of SyAqua’s sites (including those in Thailand, Malaysia and Indonesia), through the integration of smart devices for counting and quality control, along with real-time PCR technologies.

Since its implementation, SyAqua, a global leader in shrimp breeding and nutrition has seen improvement in its efficiency through its efforts to utilise cutting edge technologies to deliver best-in-class hatchery feed, genomic selection, quantitative genetics, and breeding science. The company maintains operations in Thailand, Malaysia, Indonesia, US, India and China.

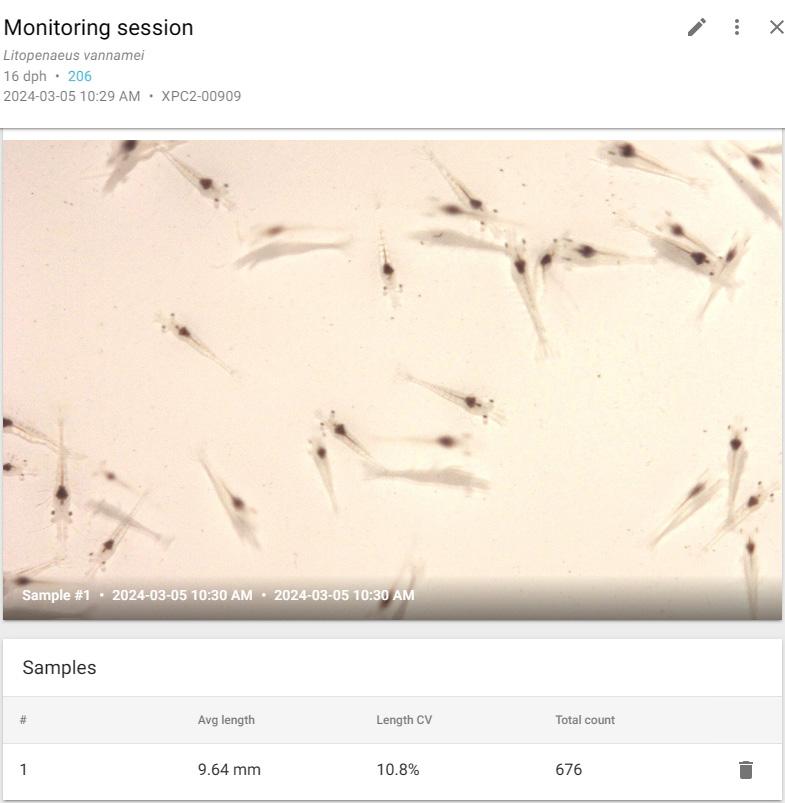

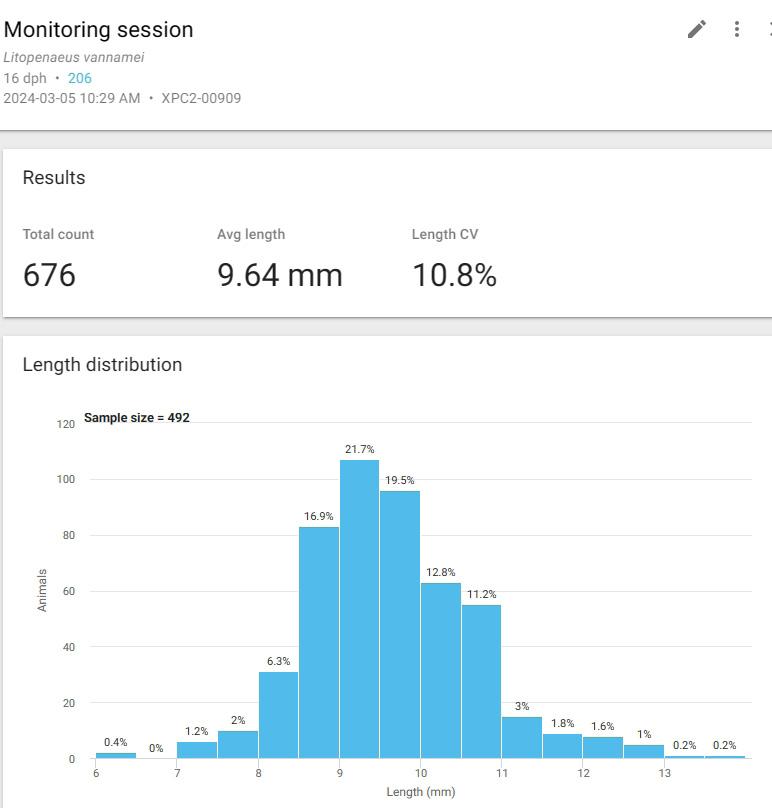

At our hatcheries, we have integrated the application of smart devices for counting and quality control in shrimp post larvae (PL) production. This advanced technology provides key benefits to our operations.

Automatic PL counting was introduced to shrimp hatcheries several years ago. Evolving over time, the application of AI technology for measuring and counting

shrimp is expanding globally. Within the hatchery, the capability to swiftly and precisely count PL effectively manages the steadily growing volume of PL orders from shrimp farmers.

By reducing processing time, we can now access real-time PL size coefficient of variation (CV) using the provided mobile phone or tablet application. This AI-powered technology utilises imaging technology to effectively control PL quality during the harvest and packing processes, and ensuring timely delivery to customers. The analysis is capable of reporting real-time data on mobile phones, allowing access from anywhere.

Using smart devices allows hatcheries to increase sample checks without the time-consuming and strenuous manual counting and sizing. It thus enhances efficiency and provides more reliable determinations about shrimp stock quality. Additionally, these devices eliminate human error and variability, ensuring consistent and automated data acquisition for accurate measurements in quality control.

Furthermore, the device simplifies reporting by automatically generating time series and quality analysis; it also streamlines data interpretation and decision-making for hatchery operators. Our hatcheries can effortlessly maintain comprehensive records and share insights with stakeholders, thus enhancing

operational efficiency and empowering operators to make informed decisions for optimised shrimp production and high-quality standards.

Know the biomass in the pond

Farm management relies on farmers receiving accurate stocking numbers. The implementation of smart counting technology enables our hatcheries to furnish farmers with precise PL counts for every box in every shipment.

There are limitations on relying solely on the spread plate technique for disease detection. These are evident in shrimp hatcheries when we consider its potential drawbacks. For instance, despite providing a visual representation of bacterial colonies on agar plates, this method lacks specificity and reliability in distinguishing between different bacterial strains. In a practical scenario, an abundance of colonies observed on thiosulfate-citratebile- salts- sucrose (TCBS) agar does not guarantee the presence of pathogenic strains, as not all colonies may be virulent.

To address shortcomings of the spread plate technique, real-time PCR has emerged as a valuable complementary tool. It offers enhanced specificity and sensitivity by targeting specific DNA sequences associated with the pathogenic bacterial strains and viruses of interest. This molecular genetic technique enables rapid and precise detection of pathogens, even at low concentrations, providing a more accurate assessment of disease risk in shrimp PL samples.

Our operation sites are equipped with automatic nucleic acid extractors, enabling us to accomplish DNA/RNA extraction within a mere 30 minutes. Leveraging the magnetic bead advantage, this ensures consistent quality and purity of extracted specimens.The extractor can accommodate a maximum of 32 samples per time.

Additionally, we utilise the magnetic induction cycler (MIC) with four channels (green/yellow/orange/red). The MIC qPCR cycler machine employs patented magnetic induction technology for rapid heating and forced airflow cooling. Its robust optical system reads all four channels simultaneously, making multichannel assays quicker than ever.

Remarkably, this compact cycler, roughly the size of an A4 paper, operates at ambient temperature, making it fieldfriendly without the need for air conditioning.

Maximising detection: Quadruple format and new disease detection

Our system can detect four pathogens in a single test. The combinations are:

• Early mortality syndrome (EMS), Enterocytozoon hepatopenaei (EHP), Vibrio parahaemolyticus (Vp) and Vibrio harveyii (VH) i.e EMS/EHP/Vpa/VH, and

• EMS, EHP, white spot syndrome virus (WSSV) and infectious hypodermal and hematopoietic necrosis virus (IHHNV) i.e EMS/ EHP/ WSSV/ IHHNV.

This not only saves time and costs but also serves shrimp health surveillance and monitoring. Today, we receive results within the same day or even within three hours of sampling.

Sustainable Shrimp Technologies GENETICS NUTRITION HEALTH

Achieve Aquaculture Excellence with Our Sustainable Shrimp Technologies. Benefit from Advanced Genetics and Early Nutrition Solutions for Optimal Growth, boasting a 15-point FCR advantage.

ROBUST . RESILIENT . BALANCED

ASIAN-PACIFIC AQUACULTURE 2024

2 - 5 JULY 2024

Grand City Hall Convention & Exhibition Centre in Surabaya, Indonesia

MEET US AT BOOTH 204 /205

Figure 1. Highlights the real-time PCR test results, seamlessly generated by our integrated qPCR machine software upon test completion. This automated process effortlessly transmits the report directly to our designated email via WiFi connectivity.

Given the emergence of highly lethal vibrio disease (HLVD) in China (Yang et al., 2023), caused by virulent strains of Vibrio parahaemolyticus (VpHLVD), our recent introduction of a qPCR test kit for toxin complex A (TcA) and toxin complex B (TcB) is crucial.

Despite no reported cases in Thailand thus far, this proactive measure allows us to effectively surveil and manage the disease. By maintaining specific pathogenfree (SPF) shrimp breeder stocks and their offspring, we ensure the consistent production of high-quality shrimp for our esteemed clients.

The integration of two technologies, the smart device for counting and quality control alongside real-time PCR for disease detection, offers numerous benefits for supporting our hatchery operations.

By integrating both technologies, SyAqua hatcheries can gather a wide range of data, including shrimp population counts, size distributions, and disease prevalence. This comprehensive data collection enables hatchery operators to gain a holistic understanding of their production environment and make informed decisions to optimise operations.

The combination of the smart device and real-time PCR technology strengthens the company’s disease management strategies. While the smart device provides real-time monitoring of shrimp populations for early signs of disease, real-time PCR offers precise and rapid detection of specific pathogens. This integrated approach allows hatcheries to proactively identify and mitigate disease risks, minimising the impact of outbreaks on shrimp health and productivity.

Integrating the two technologies streamlines the quality control process in the hatcheries. The smart device facilitates rapid and accurate counting and sizing of shrimp PL, while real-time PCR ensures the reliability of disease screening results. This efficiency in quality control not only saves time and manpower but also enhances the overall quality assurance measures in shrimp production.

The integrated approach to hatchery management promotes sustainability within our operations. By reducing the reliance on manual labour and chemical treatments for disease control, while simultaneously improving quality control measures, the integrated

Figure 2A. shows the outcomes of shrimp post larvae counting, size measurement, and %CV calculation achieved via cuttingedge smart counting technology.

technologies support environmentally friendly and socially responsible aquaculture practices. Let us delve into how this smart device technology contributes to SyAqua’s sustainability efforts:

Resource efficiency and waste reduction

Smart devices streamline the counting process, reducing the time and labour required, conserving human resources, and minimising fatigue. Real-time monitoring of PL size variation (CV) ensures that only high-quality PL are selected for further production, minimising waste by avoiding the use of suboptimal PL.

The move toward sustainable shrimp farming systems aligns with the commitment to environmental responsibility. By optimising PL quality, the company contributes to sustainable practices in the industry. The MIC qPCR machine’s compact design and ambient temperature operation reduce energy consumption and environmental impact compared to larger, energyintensive equipment.

Detecting multiple pathogens in a single test enhances biosecurity. By identifying diseases early, we can take preventive measures, reducing the need for antibiotics or other interventions. Rapid results from the MIC system enable timely responses, thus preventing disease outbreaks and minimising losses.

By consistently delivering high-quality PL, the company ensures the long-term viability of shrimp farming. Healthy PL lead to robust shrimp populations, which support sustainable aquaculture practices.

2B. This innovation enables prompt reporting, as illustrated in the bar graph, on smartphones or tablets using a dedicated application.

In summary, the adoption of smart device technology not only improves operational efficiency but also contributes to sustainable shrimp production, environmental stewardship, and long-term success. The integration of the smart device for counting and quality control with realtime PCR for disease detection equips SyAqua hatcheries with comprehensive data collection, enhanced disease management, efficient quality control, optimised resource allocation, and support for sustainable practices.

The long-term sustainability of shrimp aquaculture begins with high-quality, robust, fast-growing PL. By combining the genetic base of 27 generations of consistent, balanced selection with the safety, quality, and accuracy of hatchery production systems, our customers are producing more consistent crops. Consistent and efficient production is essential to improve both environmental responsibility and sustainable profitability of the shrimp industry.

Dr Tanatchaporn Utairungsee is Laboratory Manager. Email: tanatchaporn.u@syaqua.com

Dr Natthinee Munkongwongsiri is Field Research Manager. Email: natthinee.m@syaqua.com Both authors are with SyAqua Siam Co. Ltd.

A vannamei shrimp culture with the assurance that the farmer has minimal problems in each cycle, gets a crop of stronger and healthier shrimp with a high success rate

By Zuridah Merican

It has often been reported that vannamei shrimp farmers in Vietnam are enduring a relatively high cost of production (COP). With COP at a low of USD3.50 to as high as USD4/kg to produce size 50/kg vannamei, this may be the highest in Southeast Asia. But it is also relevant to include the fact that most farms in Vietnam comprise very small holdings, such as 2-3 ponds of 1,000m2 each, forcing farmers to apply high stocking densities such as 250 PL/m2, for a profitable farming business. For most farms in the Mekong Delta, expenses are high for water treatment because of the poor quality of shared water resources. Moreover, input costs are high for disease treatments. These are some critical points for industry when designing shrimp farming models.

Over the past 6-7 years, feed companies have been developing the ideal shrimp farming model mainly for their feed clients. Since the third Vietshrimp International event, several feed millers and shrimp farming technology companies have displayed their latest versions of a shrimp farming model. The basic features are multiphase farming and at least a three-step water treatment process.

This is the acronym for the Thang Long Smart System which Sheng Long Bio-Tech, a leading aquafeed producer, developed at its R&D and demonstration facility in Soc Trang, in the Mekong Delta. According to Chew Uik Sen, Technical Manager, it took 6 years to develop the first version of the TLSS. “The idea behind

the best model is one where we can ensure that the farmer has minimal problems in each cycle and there is a crop of stronger and healthier shrimp with a high survival rate,” said Kevin Chew Uik Seng, Assistant Technical Manager, as he explained the features of this smart system. “This model moves away from the traditional single phase where it is 2-3 crops per year to a multi-phase smart version, i.e. a model divided into many stages to control the farming situation, minimise risks, raise shrimp to large sizes, increase output and bring economic efficiency. Our sales and technical service teams are on hand to help the farmers improve and get better results.”

“Farming shrimp in Vietnam has been rather difficult with polluted water resources and diseases such as Enterocytozoon hepatopenaei or EHP and translucent post larvae disease or TPD appearing too often,” said Nguyen Khac Hai, Technical Director, in a presentation at Vietshrimp, held from March 20-22 in Ca Mau. Sheng Long’s objective is to develop an efficient model suitable for the technical capabilities of the farmer. “Climate change and the environment are becoming increasingly complex - difficult to predict and out of control. Managing external environmental factors is critical and requires a deep focus on the shared water resources, and attention on water treatment to clean up incoming water for the ponds. The model is also associated with the right feeds for each phase: there are newly developed feeds: extruded nursery feed, pelleted grow-out and booster feeds as well as a functional feed.”

A unique blend of oleochemicals and an active matrix to helps reduce the impact of parasitic challenges in shrimp like EHP.

To support our customers to combine sustainability and economical performance is a sustainable solution specially developped for Aqua challenges leading to better economical results thanks to a wide spectrum modes of actions essentially linked to the gut balance modulation.

Saves energy for growth during stressful periods thanks to 3 modes of action: stimulation of the immune system, antioxidant effects and effects on inflammation. is a blend of Bacillus spp. strains specially selected and developed for various applications in all aquaculture systems.

First it is to ensure a disease-free process, and this starts with post larvae free of pathogens. At the hatchery, there are 14 tests to ensure that post larvae are free from diseases, especially for EMS (early mortality syndrome) and EHP.

Water quality

Indicators Reference for shrimp farming

Salinity > 10ppt

pH

7.5 -8.3

Alkalinity > 80ppm

DO > 4ppm

NH3

NO2

Ca2+

Mg2+

K+

Remarks

Optimum10-25ppt

Optimum>120 ppm

< 0.1ppm

< 0.2ppm

> 250ppm

> 450ppm

> 200ppm

Residual chlorine N/A

Salinity<10ppt; Ca:Mg=1:1

Salinity>10ppt;-

Ca:Mg=2:1

Table 1. The water quality parameters are used as a reference standard and must be adhered to before and during the farming cycle.

There is a multiphase water treatment process for incoming water - sedimentation and filtration of suspended solids in the reservoir pond of 3,800m2 and subsequently, over 2 days of water treatment with

potassium permanganate (KMnO4) and bleach in three smaller ponds of 2,000m2 and 1,500m2. There are regular checks to ensure that the water quality meets the required standards (Table 1). Water treatment products are used to reduce Vibrio counts, and mineral supplementation are utilised for hard shell formation and to degrade harmful organic matter.

Kevin described in detail a critical infrastructure. This is the central toilet system which is unique in design. It discharges wastes from the ponds and changes water simultaneously. “The waste flows into a biogas pond to decompose and undergo sterilisation. The treated affluent wastes meet safety and pollution-free standards before being discharged back to the water source. The standard operating protocol (SOP) is to clean once every 2 days.”

The objective is to have much better control over production. Each nursery cycle is 25 days in the nursery pond which is fully lined with 1 mm HDPE geomembranes. The stocking density of PL12 is at more than 2,000 PL/m2 and the harvest is post larvae of 1,500-2,000 PL/kg or 1.5-2g/PL. There are precise SOPs on how to manage water quality and shrimp health, such as to clean out the blackish top layer and maintain equipment regularly once every 2 days to reduce risks of disease. The nursery is constructed on higher ground to allow the direct transfer via gravity flow through PVC pipes to the first grow-out pond (phase II). Feeding is with Beikesu, a new hatchery feed in the Vietnamese market, developed in 2023.

In general, grow-out is over 2-months. All in all, the farmer can harvest eight times in a year; in between there is pond

managing external environmental factors is critical, requires a deep focus on the shared water resources, and attention on water treatment to clean up incoming water for the ponds.

From left, clockwise, the Chew brothers at the TLSS area; grow-outAt the entrance to Sheng Long’s R&D centre in Soc Trang. From left to right, Wei Yu Gui, Assistant Manager of R&D Base; Chew Uik Sen, Technical Manager; Chau Bac Anh, GM Assistant; Kevin Chew Uik Seng, Assistant Technical Manager; Dr Liao MeiFu, Senior R&D Engineer and Pham Huu Van, Senior Technican.

preparation for 15 days. Working with farmers in Bac Lieu, Pham Huu Van, Senior Technican said, “The size of the harvest is 30-60/kg depending on the farmer. The smallest harvest size is 100/kg. We focus on the carrying capacity of the ponds and the farmer will work around this. The standard is 7-8 tonnes/1,000m2 of size 60/kg. When the demand is for larger sizes such as 30/kg, the farmer will do a partial harvest to reduce density. In the first grow-out pond, the stocking density is 300 to 500 PL/m2.”

Overall, a farm with an area of 3,000m2 typically has two grow-out ponds, each with an average area of 1,000m2 in addition to a nursery pond and water treatment ponds. The average culture period is 140 days, and each pond can yield 7-8 tonnes of shrimp, with sizes ranging from 20-30/ kg. The total harvest is 12-14 tonnes and the survival rate is ≥80%.

The success rate of the model has continuously improved over the years, and 2023 marked the first year to achieve a positive effect with an 83% success rate. Regarding investment costs, Hai mentioned that infrastructure costs amount to around VND1.527 billion (USD60,169), with profits reaching VND1.815 billion (USD71,306) over two crops. Hai gave an example of a farmer in Bac Lieu who achieved a profit of VND3.46 billion (USD136,588). In terms of tonnage, Hai noted that a farmer in Soc Trang has achieved 150 tonnes in 18 ponds, harvesting shrimp at sizes 18-30/kg.

Kevin summarised that for Sheng Long, its goal is to continuously build up its TLSS system customised for each farmer to have a better control over each cycle. “The post larvae from the hatchery will grow faster with the feed types depending on the needs of each farmer. We want to reduce internal and external risks of diseases and bring up success rates.”

BOOST YOUR BUSINESS BY OPTIMIZING YOUR HEALTH ADDITIVE STRATEGY

RESTRICT inappropriate use of antibiotics and chemicals

REDUCE losses from subclinical disease and outbreaks

INCREASE economical and ecological sustainability

BOOST feed perfomance and farm productivity

Direct production cost was lower by 10-12% with low protein feeds and increased by 20-30% during an EHP infection

By B. Ravikumar, Victor Suresh, Gnanasri, Uma Maheswararao and Chandhira SekarIn the Feeds and Feeding panel at Aqua India 2024, held from 15-17 February, the impact of two challenges related to feeds and farm economy were discussed (see pages 44-45). A recent trend in the shrimp industry in India and in other countries is the use of low protein feeds to manage costs. This practice is most evident and successful in Indonesian farms while there is a long history of using low protein feeds in Latin America. The second challenge is the impact of the microsporidian Enterocytozoon hepatopenaei (EHP) on crop cycles. Growel Feeds’ technical team presented data from some field trials in Andhra Pradesh to show how farm profitability is impacted by these two challenges.

Shrimp prices have been very low during the past two years. Therefore, finding ways to minimise the cost of production in vannamei shrimp is critical. We have conducted trials using feeds with 32% crude protein ( CP) and compared them with 36% CP feeds. In the districts of Krishna and West Godavari, Andhra Pradesh, the average stocking densities have declined year by year. At present, the average stocking density is 25 post larvae (PL)/m2. When the shrimp are reared in fertile ponds, a lower protein feed is likely to perform as well as the higher protein feeds as long as the quality, nutrient balance and digestible protein are maintained in the low protein feeds.

We have conducted trials in more than 125 ponds, where shrimp in 65 ponds were fed the 32% CP feed and shrimp

in another 60 ponds were fed with a 36% CP feed. The post larvae for all 125 ponds were from the same genetics. We showed that in the 32% CP feed group, feed accounted for 50 to 60% of the total cost of production which is 1012% lower than that of the 36% CP group. Water salinity in these ponds ranged from 5 to 12ppt. Other parameters were optimal. We noticed that ponds where shrimp were fed 32% CP feeds had less pond bottom pollution as compared to ponds where shrimp were given feeds with 36% CP. Most of the shrimp farming areas in India have limited water exchange or no water exchange.

These results with lower COP indicated that when selling shrimp at size 100/kg, the farmer gained INR 20-31/kg (USD 0.24-0.37) of shrimp when using the lower protein feed. This is a good profit margin for shrimp farmers in India.

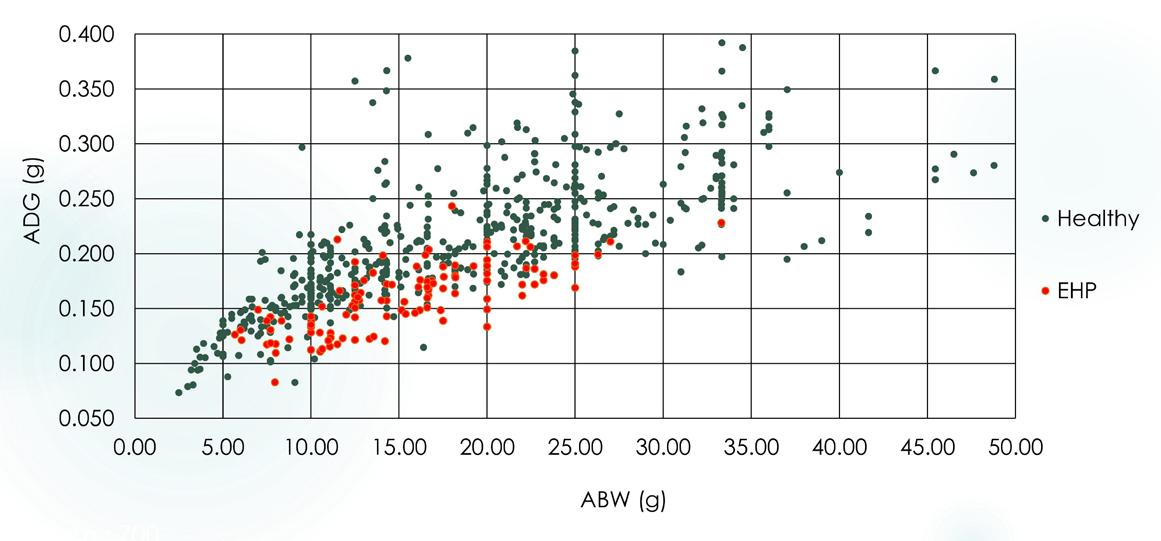

In India, around 70% of the ponds are affected with white fecal disease (WFD). In these ponds, we also find pathogens associated with white spot disease (WSSV), Enterocytozoon hepatopenaei (EHP) and Vibrios. We collected information on average daily growth (ADG) from around 700 ponds. Data showed that the ADG of shrimp in the EHP affected ponds was around 30% lower than the ADG of healthy shrimp in the non-affected ponds (Table 2). For example, the ADG of healthy shrimp of 15g was 0.21g and in the EHP-affected ponds, comparable ADG was lower at 0.15g. When shrimp reached 20g, the ADG was 0.24g for shrimp in the healthy ponds but was only 0.17g for affected shrimp.

1. Average daily growth (ADG) in healthy and EHP ponds from a survey of 700 ponds in

Krishna & West Godavari (Dt.), Andhra Pradesh, India

Ultimately, we see an increase in the cost to produce shrimp in EHP affected ponds due to slow growth and low survival rate. The increase in COP was around 20 to 30% in the affected ponds.

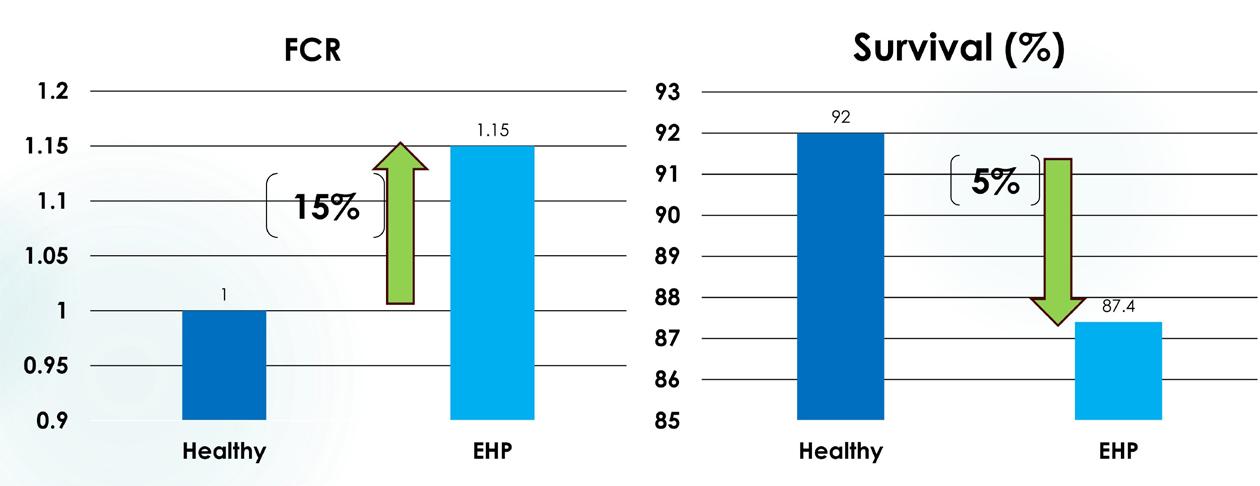

In 10g shrimp, we can see the effects of infection. The FCR of 10g shrimp rose by 15% and survival rate was down by 5% (Figure 2). In 15g shrimp, FCR went up by 25% and survival rate dropped 10% (Figure 3).

Table 1. Production cost of shrimp/kg between higher (36%) and lower protein (32%) feed from trials in Andhra Pradesh (Total ponds = 125; 65 ponds with 32% CP; 60 ponds with 36% CP; Stocking density =25PL/m2; SR=survival rate (%); salinity range= 5-12 ppt; Pond size -1ha; DOC- days of culture; COP=cost of production. Source: Growel Feeds Pvt Ltd, India.

Stocking Density: 30 PL/m2

in healthy vs EHP ponds at

Table 2. Average daily growth (ADG) in healthy vs EHP ponds at various average body weights (ABW).

Figure 2. Feed conversion ratio (FCR) and survival (%) for 10g size shrimp from noninfected (healthy) and EHP infected ponds. Note: 33.8% of EHP affected ponds were harvested between 9 and 11g body weight. Source: Growel Feeds Pvt Ltd.

Figure 3. Feed conversion ratio (FCR) and survival (%) for 15g shrimp from non-infected (healthy) and EHP infected ponds. Note: 33.1% of EHP affected ponds were harvested between 14 and 16g body weight.

In summary, use of low protein feeds shows a difference in the cost of production as long as they are of high quality. It is recommended to use high quality protein for shrimp up to 3g size and subsequently, switch to a low protein feed at the grow-out stage. Ponds fed with low protein feeds show less pond bottom problems.

With regards to shrimp infected by EHP, we showed that FCR was higher by 1525% while survival rate decreased by 5-10%, for size 10-15g. The increase in COP was around 20 to 30% in the affected ponds.

A one-of-a-kind feed for one-of-a-kind results.

Highly digestible proteins 100% from marine origin GMO-free

Includes organic acids and advanced probiotics

Invest in MegaSphe today and watch outstanding production results.

B. Ravikumar is Assistant Vice President - Sales & Technical Email: ravikumar.b@growelfeeds.com

Dr Victor Suresh is Technical Director.

Gnana Sri is Technical Coordinator. Email: tse@growelfeeds.com

Uma Maheswararao is Manager –Technical. Email: umamaheswararao.r@growelfeeds.com

Dr Chandhira Sekar is Assistant Manager – Technical

The above authors are with Growel Feeds Pvt Ltd, Andhra Pradesh, India.

Nurturing from the start. Let’s aquaculture together ®

www.megasupply.com orders@megasupply.net

EXCLUSIVE DISTRIBUTOR FOR INDIA salesorangeenterprise@gmail.com +91-9962525791

Nick Piggott, Co-CEO and Co-founder of insect meal producer Nutrition Technologies describes its beginnings and growth trajectories

Nutrition Technologies, a pioneer of sustainable agriculture in Malaysia, manufactures protein, oil, and organic fertiliser from black soldier fly (Hermetia illucens) larvae. Its zero-waste production model delivers insect-based products beneficial to pet food, livestock, and aquafeed industries. Through a blend of beneficial microbes and larvae, cultivated on traceable agroindustrial by-products, they have created an eco-friendly production system with minimal energy usage and zero waste.

Since its establishment in 2015, the company has grown exponentially, with a primary production plant in Johor Bahru and facilities in multiple locations. Research collaborations with regional institutions and a research partnership with Evonik drive product innovation, supported by investors like Sumitomo Corporation and Bunge Ventures.

Recent milestones include partnerships with Sumitomo Corporation for distribution in Japan and the launch of organic biofertilisers.

Nick Piggott and Tom Berry are Co-CEOs and founders of Nutrition Technologies. Nick brings entrepreneurial expertise from founding Coffee Couriers and program management experience from his work with the United Nations Population Fund (UNFPA) in Sierra Leone. Before co-founding Nutrition Technologies, Tom specialised in risk management at Salamanca Group and served in the British Army and the United Nations in Sierra Leone. Together, Tom and Nick leveraged their diverse backgrounds to propel Nutrition Technologies’ mission of sustainable agriculture and environmental stewardship.

In this email interview, Nick Piggott explores the genesis of insect meal production in Malaysia, the sustainability initiatives and how Nutrition Technologies sets itself apart.

AAP: What are the key drivers behind starting insect meal production in Malaysia? Since starting the company in 2015 in Vietnam, Nutrition Technologies has expanded and grown. It now has the main production plant, laboratory and office at multiple sites in Johor Bahru, Malaysia, with supporting laboratories and offices in Vietnam and Singapore.

NP: We are strategically located in Malaysia, not only because it has the optimal natural conditions for breeding our tropical fly, but also because we have a great opportunity to make significant positive impacts and address several UN SDGs (United Nations Sustainable Development Goals) targets. This is possible through our zero-energy breeding and rearing models, reducing energy costs and associated emissions.

Malaysia also has a supportive regulatory environment, with strong oversight from the Department of Veterinary Services who supported us in being the first Asian producer to export insect meal to the European Union and a growing number of government policies, strategies

On how technology determines pricing strategies, Nick Piggott, Co-CEO and Co-Founder of Nutrition Technologies says, “We use zero energy and our overheads are lower compared to European manufacturers.”

and roadmaps that align to promote Malaysian AgTech businesses and develop the local biotech ecosystem.

What is your feedstock? Are there limitations regarding volume and scalability?

Our black soldier fly live in open-air cages outside our factory, happily breeding, and inside our warehouse, feeding on vegetables and grain by-products, including beer and coffee. Black soldier fly love coffee! Johor Bahru is the heart of food processing for Singapore, so we have extensive raw material options. We also use a lot of lowgrade palm by-products that cannot otherwise be used for animal feed, so we are genuinely reclaiming nutrients that would otherwise be lost. Malaysia generates around 4 million tonnes of palm waste annually, so there’s plenty of supply!

We do have plans to expand in the next year or so to a second factory (also in Malaysia) to keep up with the growing demand and to support Malaysia’s ongoing quest for food security. The Prime Minister has been publicly pushing the AgTech agenda recently, so the timing is great for us.

What are the specifications of your insect meal, and what markets do you primarily target?

Our insect meal is made from 100% black soldier fly larvae, and we offer a range of specifications depending on the customer’s application. For example, we sell a lot to the swine sector, which prefer a full-fat meal (based on the attractive fatty acid profile), but the aquafeed customers

generally prefer a defatted meal. The fatty acid profile is heavily weighted towards saturated fats (approx. 60%), with a high proportion of lauric acid and other MCFAs (medium chain fatty acids).

We are 2 years into a research partnership with Evonik, working on identifying the limiting amino acids in black soldier fly production and optimising the larvae’s amino acid profile. So far, results are great. We also did a salmon feed trial with AB Agri in the UK in 2023 as part of a Horizon 2020 project and saw digestibility scores of 90.1% for crude protein, and 90% plus for almost all of the individual amino acids.

We sell mostly to livestock and aquafeed mills in ASEAN markets, as our company focuses on supporting food security, although we also sell to pet food manufacturers. In 2023, we released two new bio-fertiliser and diseaseprevention products (Diptia and Vitalis) for the Malaysian agricultural sector, so we’re also doing a lot of work in that area.

Where does Nutrition Technologies stand today, and what have been key milestones along the way?

As with any young, ambitious company, every time we meet a target, we set a new one, so we’re always chasing something! We have met our factory utilisation and output targets, and we’re now working on developing and launching new portfolio of products. We expect to have a new range of animal feed products in 2024, as well as expanding our range of plant health products and the markets that we can export them to, including Thailand, Indonesia, and the Philippines.

What distinguishes Nutrition Technologies from other players in the industry?

We use zero energy, and our overheads are lower compared to European manufacturers. Our broader portfolio of products means we benefit from economies of scope, meaning we can control the selling price of all of our products, as we have a wider revenue base than any other producer. On the production side, our fermentation technology enables us to use lower-grade raw materials that otherwise wouldn’t provide sufficient nutrition to the larvae.

However, by growing bacterial biomass in the fermenter, we’re effectively farming microbes to feed the larvae, to feed the fish, to feed the people!

How do you plan to scale up operations, and what factors influence your pricing strategy?

We are developing plans for a second site in Malaysia already, which we expect to be operational in 2026. Using the same blueprint as we have today minimises risk, and we have very forward-leaning investors and regulators here in Malaysia. We have always shied away from charging a ‘sustainability supplement’, where we sit in the value chain, any additional costs that we charge need to be absorbed by someone or passed right the way through to consumers, which is currently challenging.

We price based on the nutritional + functional value of the products only and trial data. Insect meal and oil should get into a formula on merit rather than by forcing it in for sustainability objectives. Because we work on that basis, we’re incredibly competitively priced in both aquafeed and livestock sectors.

How do logistics costs impact your production, and what are your transport logistics within ASEAN countries?

All our materials are locally sourced, so we have limited logistics costs. We have a range of suppliers for each material we use so we can move between suppliers when they adjust their pricing to keep our input costs stable.

We manufacture in Malaysia, but we are located about 20km from Singapore port. Our outbound logistics costs are extremely low, and shipping is frequent to every corner of the world. We get 40 containers to Bangkok in a few days for under USD1,000 and to Rotterdam in 4 weeks.

Tell us about your sustainability initiatives and how you see your contribution to a circular economy. Our business model is based on nature’s own decomposition ecology to create a virtuous cycle, reusing today’s waste to make tomorrow’s raw materials. As we look to close the loop and build a circular economy, we recognise that we are one part of a wave of change helping to create a more sustainable and inclusive tomorrow.

The UN SDGs help chart a course towards that future. We demonstrate our commitment by aligning with and measuring ourselves against the relevant UN SDGs. We are active members of the UNGCMYB (UN Global Compact Malaysia & Brunei), and we have won awards in the last two years running at the UN Global Compact as Sustainability Icons, and for Gender Equality. We also have an internal ESG Committee, a Board Level ESG sub-committee and produce an annual sustainability report.

Lastly, what are the expansion plans, particularly for the aquafeed sector?

We continue to look for opportunities to work with feed producers in the region on refining product applications, as well as developing and testing new products. We have a product coming out for ornamental fish later this year, as well as some species-specific ‘enriched’ products in the pipeline, which we are keen to get into customers’ hands.

We see many uses for our core Hi.Protein® product range, both full-fat and defatted, in companion animals, livestock and aquafeeds. These products offer nutritional or functional benefits, and I can only see their uptake growing over the coming years.

A sobering assessment of where we are in the search for new protein sources following a workshop at ISFNF 2022

By Brett D. GlencrossAfew years back in 2022, ahead of the International Symposium on Fish Nutrition and Feeding (ISFNF) held in Sorrento, Italy, IFFO facilitated a workshop to discuss the current and future landscape in protein resources being used to feed aquaculture. It was a lively workshop with a nice mix of academic and industry participants, with some excellent presentations and discussion emanating from the day. As an outcome, it was decided that we should write up the proceedings as a review.

So, after a long gestation period, recently, the leading scientific journal in fisheries science, Reviews in Fisheries Science and Aquaculture published a review led by me and a cohort of some of the best fish nutritionists in the world, who contributed on the day. With a variety of new feed ingredients emerging in the aquaculture feed sector, the recent publication of a major review encompassing a strength-weakness-opportunities-threats (SWOT) analysis, provides some sobering assessments of where we are in the search for new protein sources.

This article is based on that review published as: Glencross, B., Ling, X., Gatlin, D., Kaushik, S., Øverland, M., Newton, R., & Valente, L. M. (2024). A SWOT Analysis of the Use of Marine, Grain, Terrestrial-Animal and Novel Protein Ingredients in Aquaculture Feeds. Reviews in Fisheries Science & Aquaculture, 1-39. https://doi.org/10.1080/233 08249.2024.2315049

Dealing with the constraints of reality

To place the role of ingredients in context, it really helps to consider the process of feed formulation first. Indeed, when you start to analyse that process of formulation in some detail, you quickly realise that it is a system driven by demands for nutrients, not ingredients. However, the catch here is that you must rely on ingredients to supply those nutrients, but that reliance also brings in various unintended consequences and risks.

To manage those risks, we place what are called “constraints” on the formulation in terms of minimum and/or maximum inclusion levels of those ingredients

under consideration. What constitutes minimum and/or maximum levels depends on a wide array of factors, and they are not necessarily fixed either in that they can be flexible and subject to what other ingredients might be in consideration.

In addition, some of the key issues in dealing with emerging ingredients (and even the more established ones), can be dealing with the technology-readiness level (TRL) of the material;

• Is it still a laboratory experiment, or is it something available at scale?

• What about the cost, as fundamentally the feed manufacturing process is driven to generate profit?

Notably, the TRL can play into this aspect quite significantly. In recent times though it was noted in the review that more than “least-cost” considerations, including issues such as least-risk (feed/food safety) and societal issues (sustainability, environmental footprints, labour) have become major drivers.

The process of defining constraints is increasingly moving towards an environmental, social and governance (ESG) framework as well. Once you have a better overview of what the various constraints you need manage, and what different limits are, then it is the kind of situation where mathematical multi-variate modelling comes into play, and hence the evolution of linear formulating programs. However, a critical part of the ingredient story remains in working out what are our best options.

How to tell the good from the bad…

The key role of ingredients, as discussed earlier, is to be the vehicles for delivering nutrients. However, like all biological entities, their capacity to do this can vary widely based on a suite of background features including:

• Material origin (species/geography);

• How it was processed;

• Level of contaminants, and

• Non-nutritive content.

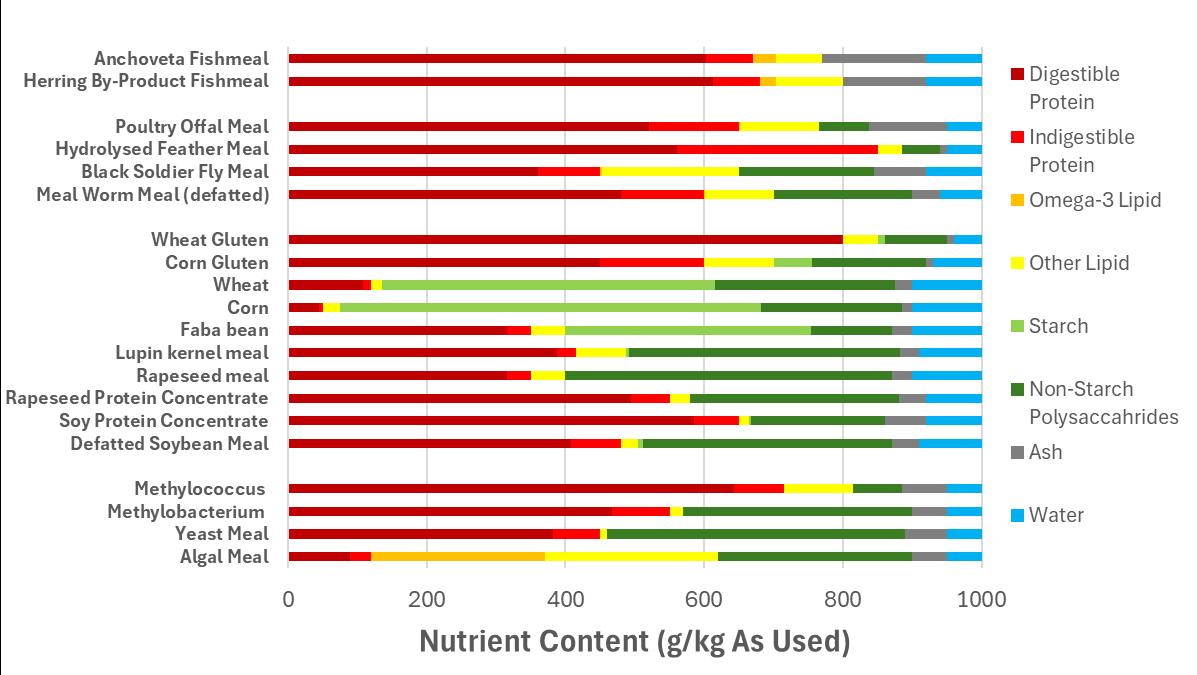

Figure 1. There can be substantial variability in compositional characteristics even among similarly perceived ingredients. Even subtle differences can sometimes be important.

Figure 1. There can be substan^al variability in composi^onal characteris^cs even among similarly perceived ingredients. Even subtle differences can some^mes be important.

If we consider the variation in composition of the key macronutrients of a range of feed ingredients as in Figure 1, we can quickly appreciate the variability situation. Indeed, to consider the use of any ingredient for use in a feed it is critical that we understand what it is that is being assessed.

This assessment of the “what” is referred to as the characterisation process. This characterisation process can involve an assessment of various data sets, but fundamentally, the feed industry requires this information from ingredient suppliers in the form of a technical data sheet (TDS), an information dossier that provides a range of characterisation data so that a desktop assessment of the suitability can be carried out.

In the review being discussed in this ar=cle, those various ingredients cons=tuted marine ingredients These are produced from either forage (reduc=on) fishery or by-products from both fishery and aquaculture resources. We also considered processed animal proteins (PAPs), which in the context of the review included those resources made from terrestrial animals produced for human consump=on from which by-products are generated. Also considered are insect and annelid meals, which like the other terrestrial animals are also cul=vated and come under similar biosecurity legisla=on.

However, the main feed ingredient class considered, which makes up the largest volume of all global aquafeeds was the large variety of grain (cereals, oilseeds, pulses) protein sources. This included plant resources used either unmodified, or with varying degrees of processing from origins such as soybean, pea, faba (horse) bean, guar bean, lupin, wheat, corn, rapeseed, sunflower, among others.

However, assessment of ingredients requires more than just the characterisation – that’s just a screening process and step-1. After that stage we need to understand how those ingredients can be applied to a formulation, and for this we need to understand the ingredients digestibility and its influence on feed intake (palatability). It is only once we have those two additional bits of knowledge, that we are in a position to formulate a diet properly so that we can isolate ingredient effects from nutrient effects. So, as you may see, there is a clear logic process as to how we can tell a good ingredient from a bad one.

The final class of ingredients included in the review were the single-cell protein resources which included ingredients such as those produced from bacterial, yeast, fungal, or microalgal origins.

So, it was quite a collec=on of some VERY different ingredients, each with their own SWOTS.

In the review being discussed in this article, those various ingredients constituted marine ingredients. These are produced from either forage (reduction) fishery or by-products from both fishery and aquaculture resources. We also considered processed animal proteins (PAPs), which in the context of the review included those resources made from terrestrial animals produced for human consumption from which byproducts are generated. Also considered are insect and annelid meals, which like the other terrestrial animals are also cultivated and come under similar biosecurity legislation.

However, the main feed ingredient class considered, which makes up the largest volume of all global aquafeeds was the large variety of grain (cereals,

oilseeds, pulses) protein sources. This included plant resources used either unmodified, or with varying degrees of processing from origins such as soybean, pea, faba (horse) bean, guar bean, lupin, wheat, corn, rapeseed, and sunflower, among others. The final class of ingredients included in the review were the singlecell protein resources which included ingredients such as those produced from bacterial, yeast, fungal, or microalgal origins.

So, it was quite a collection of some VERY different ingredients, each with their own SWOTS.

“.. that in many cases the weaknesses of one ingredient could be matched with the strengths of other ingredients to identify opportunities for complementarity.”

Figure 2. Characterising WHAT it is that you are assessing is the founda^on to the assessment process. Without it, no one can gauge the relevance of any subsequent assessment on what ingredients they might have access to.

One ingredient’s strength…. The analysis of the SWOTs of the four ingredient classes cons=tuted the bulk of the review. In lieu of a detailed descrip=on, Figure 3 is a simple pictorial summary of some of the highlights.

.. that in many cases the weaknesses of one ingredient could be matched with the strengths of other ingredients to iden3fy opportuni3es for complementarity.

ingredient had strengths and