MoneyMonth | Savingsspotlight | Timetoreshapeyourmortgage? | KiwiSaver Investingforbeginners | Doessustainabilitypayoff? | Discoveryourdebtreductionstrategy

Subscribenow

Retirementisn’ttheendofyour financialjourney;it’sthestartof anewphase.ToomanyKiwis arecruisingtowardsretirement withoutastrategyformaking theirmoneylast.

OnemillionKiwiswillhit65inthenext decade.It’sastrangein-between: theendofwork,thestartof…what exactly?

ResearchhasshownthatNewZealandfaces somepersistentchallengeswhenitcomesto retirementreadiness,saysJeffRuscoe,AMP ManagingDirector.Thesehurdlesoftenleadto feelingsofbeingunprepared,particularlyfor thoseintheir50s.

Whenretirementarrives,itbringsarestart. Thatoffersfreedomforsome.Itcanalsobring identityshifts,and/orfinancialuncertainty, withlittleassistanceavailabletohandlethe “whatnow?”

Yourmoneyneedstokeepup

It’swellknownthatwe’resimplynotsaving enoughinNewZealand.That,coupledwith therisingcostofliving,meansthatbuilding asubstantialnesteggrequiresmorefocused effortandplanning.

Alesswellknown,butsignificant,concernis thewidespreadlackofaclearplanforfunding lifestyleinretirement.It’sonethingtohave somesavings.It’sanothertoknowexactlyhow

thosesavingswilltranslate intoasustainable income.“ManyKiwis havenoideawhere tostartwiththat. They’reunsure whetherthey’ve gotenough savingsorhow tomakeitlast.” saysRuscoe.

Thequestion ofhowyou manageyour moneycome retirementisn’t wellservedby financialandother advisersinthiscountry. Howdoyoumakeyour $40,000,or$400,000,orother figurelastthedistance?

JeffRuscoe, AMPManagingDirector

Sortedhasrecently launcheditsonlineRetirementNavigatortool. It’sagreatstart,saysRuscoe.“Acalculatorwill oftengiveyouascenariobasedonaverages. Whereweaddvalueisbytailoringtheadvice toourcustomer’sindividualscenarioand creatingsomethingthatworkspreciselyfor them.Thisgivesourcustomersclaritysothey canturnwhatthey’vesavedintoanincome theycanrelyon.”

WithMoneyMonthkickingofftoday,AMP seesthisasagreattimetomoveawayfrom thecurrent‘headinthesand’avoidant approach,toanticipatingtheirretirement yearsassomethingaspirational,something thathasbeenearned,andsomethingthatis deserved.

Analternativetoleaving yourmoneyonidle Retirementisn’t thefinishline;it’s thebeginningof keepingyour moneyactive andgrowing. Yourmoney needsto keepupwith inflationand generatean incomethat canserveyour lifestylegoals. Withoutadvice, Kiwiscanmake mistakes,despitehaving saveddiligentlyfordecades. Certaincommonmissteps inthelead-uptoandduring retirementcaninadvertently underminetheirefforts.

Thesemistakesoftenstemfromadesireto ‘playitsafe’oralackofunderstandingabout howmoneyshouldbehaveoncetheysay goodbyetoaregularincome.

Toooften,forexample,peoplecashout long-termgrowthinvestmentssuchas KiwiSaverandparkthatmoneyinterm deposits,whichrarelykeeppacewith inflation.“There’saperceptionthatweshould becomeimmenselyconservativeduring retirement,butthetimeframeforwhenthey’ll needtospendtheirsavingsisoften20yearsor more,givingKiwisplentyoftimetogrowtheir wealthfurther,”saysRuscoe.

Whiletermdepositsoffersecurity,they

oftenprovideverymodestreturns,especially wheninterestratesarelow.“Forthosewho maybeinretirementfor20yearsormore, theirmoneydeservestobeworkingharder thanjustsittinginalow-interestaccount,” Ruscoeadds.

Whataboutfinancialadvice

ManyKiwiswhoshouldgetfinancialadvice, don’t.Sometimestheythinkfinancialadvice issomethingreservedforthewealthyorthose rightonthecuspofretirement.

Thinkofitlikethis:youwouldn’twaitfor yourhousetobefallingapartbeforecallinga builder,wouldyou?Similarly,small,consistent adjustmentstoyourfinancialplanovertime canyieldfargreaterresultsthanlast-minute scrambling.

“Whetheryou’rejuststartingyourcareer, planningforamajorlifeevent,ornearing retirement,it’salwaysagoodtimetoseek financialadvice,”saysRuscoe.“Thereareno wronganswerstothe‘when’question.”

Forthoseintheir50sandearly60s,the urgencybecomesmoreapparent.Thisstagein lifeisoftenacriticalwindowwheredecisions cansignificantlyimpactthequalityofyour retirement.

Butevenifyou’renotwithinthisage bracket,understandingyourfinancial trajectoryandmakinginformedchoicestoday canlayasolidfoundationfordecadesto come.

Don’tfallintothetrapofthinkingyouneed tohaveasignificantamountofwealthalready accumulatedtowarrantadvice.Adviceis preciselywhathelpsyoubuildthatwealth.

Navigatingretirementchallenges:why manyKiwisfeelunprepared

Oneofthebigretirementchallenges inNewZealandisthatwesimplyaren’t savingenough.Whilerecentadjustments toKiwiSaversettings,suchasincreased contributionrates,areapositivestepin therightdirection,theywon’tsolvethe problementirely.

Formany,historicalunder-saving, coupledwiththerisingcostofliving, meansthatbuildingasubstantialnestegg requiresmorefocusedeffortandstrategic planning,especiallywithNewZealanders’ relianceonproperty,andthatworksbest whencoupledwithfinancialadvice,says Ruscoe.

OnceKiwishitretirement,theyface anotherissue,readyornot.That’sthe widespreadlackofaclearplanforfunding lifestyleinretirement.It’sonethingtohave somesavings;it’sanothertoknowexactly howthosesavingswilltranslateintoan ongoingincomeoncetheystopworking.

In2022,TeAraAhungaOra,the RetirementCommission,found65%of peopleagedover55hadnoplanoronlya “vagueplan”ofhowtheywouldfundtheir retirement.

Thisvaguenesscanleadtoseveral problems:

● Uncertaintyandanxiety:not knowinghowlongyourmoneywilllastcan beamajorsourceofstress,impactingyour enjoymentofthepre-retirementyearsand theearlystagesofretirementitself.

● Inefficientuseoffunds:withouta plan,peopleoftendon’tusetheiravailable fundsandassetsinthemostefficientway. Theymightdrawdowntooquickly,or conversely,beoverlycautiousandmissout ongrowthopportunities.

● Missedopportunities:alackofclarity canmeanoverlookingvaluablestrategies likeoptimisingKiwiSaverwithdrawals, understandinginvestmentincome,orusing otherassetseffectively.

It’sclearthatthere’sasignificantgap betweentheaspirationforacomfortable retirementandthepracticalplanning requiredtoachieveit.

Thepowerofprofessionalfinancial advice:itpaystobeprepared

The2020MoneyandYouSurveyfound thatNewZealanderswhoreceived professionalfinancialadvicehadabout 52%moreintheirKiwiSaverthanthose whodidn’t.Thatadviceledto:

● Higherinvestmentreturns:Beyond simplyhavingmoresaved,thosewho soughtadvicealsoreportedenjoying higherinvestmentreturnsontheirsavings.

● Greatersatisfactionandwellbeing: It’snotjustaboutthenumbers.Thesurvey alsofoundthatadvisedKiwisexperienced highersatisfactionwiththeirKiwiSaver andbetteroverallwellbeing.Havingaclear planandunderstandingofyourfinancial situation,guidedbyanexpert,can significantlyalleviatethisfinancialstress, leadingtogreaterconfidenceandpeaceof mind.

“[Thisresearch]underscoresthe immensevaluethataconversationwitha qualifiedfinancialadvisercanbringtoyour financialfuture”saysRuscoe.

Thisneedhasneverbeenmorepressing, yetmanystillputitfirmlyinthe“niceto havebutcan’tafford”category.

Somepeoplemaynotevenknowhow togetrelevantadvice,letaloneknowing whetherhowmuchthey’vesavedis enough-orcrucially,howtomakeitlast.

Financialadviceisoftenreadily availableforemployees,and KiwiSavermembersstillgrowing theirsavings,whetherthrough EmployeeAssistanceProgrammes (EAPs)orcomplimentaryadvice fromKiwiSaverproviders.

Numerousonlinecalculatorsalso supportthosestillgrowingtheirmoney.

Whenitcomestoretirementand spendingdownyoursavings,there arefarfeweropportunitiestoaccess financialadvice.That’swhyAMPhas launcheditsnewretirementadvice service.

TheserviceisdesignedtohelpKiwis buildacomprehensiveplanthatfits theirlife.“It’snotagenerictemplate,it’s apersonalisedplanbuiltaroundyour specificcircumstances,yourdesired retirementlifestyleandyourfinancial goals,”saysRuscoe.“[The]serviceis designedtodemystifytheprocessand offertailoredsupport,keepingyour moneyworking,growing,andpaying youforyearstocome.”

“Ourresearchhasuncoveredthat knowingwhereyoustandwithregards tobeingabletomeetyourfinancial obligationsandfundyourlifestylegoals, isvaluedhighlyamongKiwiswhoare approachingretirement,”saysJeff Ruscoe,AMPManagingDirector.

“We’llworkwithyoutobuilda clearplanforretirement,making sureyourfundsareintherightplaces

andcontinuingtoworkforyou,even afteryoustopworking.WehelpKiwis movefromuncertaintytoconfidence bymakingsenseofwhatthey’vegot andturningitintoareliableincome, sotheycantakecontrolandenjoy retirementwithoutsecond-guessing theirspending.”

So,what’sinvolvedinaconsultation?

●YourAMPadviserwillaskyouto thinkaboutcertainthingsaheadofyour appointment.Thisensuresthatthe conversationyou’rehavingistailored toyourpersonalcircumstances.It helpsyouradviserunderstandyour aspirationsandgetasenseofhow youwanttospendyourtimeduring retirement.

●TogetherwithyourAMPadviser you’llthendrilldownintothefiner detailstocreateaclearplanforwhat yourretirementcouldlooklike.

●YouandyourAMPadviserwillgo overyourretirementlifestylegoals, currentfinancialposition,in-comings andout-goings,legacyplanning, inheritance,ifany,projectedretirement incomeandpersonalriskprofile.These aresomeofthebuildingblocksforyour uniqueplan.

ThegoalistoempowerKiwisusing AMP’sservicetostopsecond-guessing theirspendingandfeelconfidentusing thenesteggthey’vebuilt,sotheycan enjoytheirafter-workyearswithpeace ofmindandspendwithconfidence.

Readytotakethefirststeptowardsaconfident retirement?ContactAMPtodaytolearnmoreabout thisfree,personalisedservice.Yourfutureselfwill thankyou.Call0800267263orvisitamp.co.nz/retire.

ByDianaClement

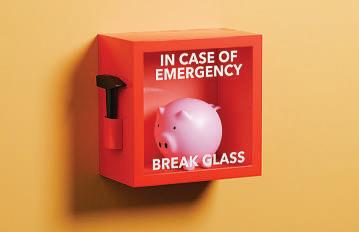

Unexpectedexpensescanhit anyone,atanytime.Yetmany NewZealandershavelittleorno emergencysavings.Couldyou replaceyourwashingmachine orevenatooth,ifdisaster hit?Whataboutsurvivingthe immediateaftermathofan earthquakeorflood?

ThisAugust,aspartofSortedMoney Month,Kiwisarebeingencouragedto takestepstobuildanemergencyfund thatcushionsthemfromlife’sunexpected shocks.ResearchreleasedtodaybyTeAra AhungaOraRetirementCommissionfrom itsFinancialSentimentTrackerrunbyTRA showsthatwhile54%ofKiwiswhohave morethan$1,000worthofsavingsfeel optimisticabouttheirfuturerightnow,only 28%withlessthan$1,000ofsavingsfeelthe sameway.

AccordingtotheFinancialServices Council2025report,Money&You:Consumer ResilienceandtheRoadtoProsperity,about

39percentofNewZealanderscannotaccess $5,000withinaweekwithoutgoinginto debt,highlightingwidespreadvulnerability tofinancialshocks.

Themagicnumberofhowmuchtosavein anemergencyfundisthreetosixmonthsof livingexpenses,whichoftenmeans$10,000 to$20,000.Thatmightseemlikeapipe dreamforsome,butstartsmall.

Sorted.org.nzsuggestsstartingbyaiming tobuilda$1,000emergencyfund.That $1,000couldcoverminoremergenciesand buildupovertime.Waystogetthereinclude sellingunuseditemsordoingextrawork.

There’sacommonmyth:“Ican’tafford tosave.”Intruth,it’stheopposite;wecan’t affordnotto.Anyemergencysavingsare betterthannone.

Startbysavingjustenoughtocoverone weekofexpenses.Thatalonegivesyou breathingroomtopayasingleunexpected billortohelpoutwhānauinatrue emergency.

Don’tkeepyouremergencyfundinyour everydayaccount.Useaseparate,easily accessiblesavingsaccount.Remember,the fundisfortrueemergencies,noteveryday spendingorplannedexpenseslikeholidays. Youcangetstartedwithafewpowerful personalfinancetricks.

●Thefirstistotrackspendingtofreeup

moneyforsavings.Setupsmall,achievable goals,suchasthefirst$40bytheend ofthismonth.Settingupanautomatic payment,evenjust$5or$10aweek,can helpyoubuildyourfundwithouthavingto thinkaboutit.Windfallsliketaxrefundsor bonusesaregreatopportunitiestogiveyour emergencyfundaboost.

●Automatesavingsatthebeginning ofthemonth.Wherepossible,lookfor additionalincomesuchasasmallside hustle.

●Getquickwinsontheboard.Ifyou replaceeggsontoastorleftoversinsteadof, say,$25ontakeaways,chuckthe$15-plus intoyouremergencyfund.DeletingUberEats canfreeupconsiderablecash.

●Haveano-spendweekormonthwhere youonlybuytheabsoluteessentials.Be honestwithyourselfwhatisaneedandwhat isawant.

●Usebudgetingtoolsorappssuch asWestpac’sCashNav,PocketSmith,or BudgetBuddietomanageyourmoneybetter. ToolslikeSorted’sGoalPlannerandBudget Plannercanhelpwiththebiggerfinancial picture.

Learntofindextrasavings.Agreatplace tostartisthesupermarket,wherelateral thinkingcanreducethepainatthecheckout considerably.Noteverythingonsupermarket

shelvesisnecessary.Askhonestly:isitaneed orawant,whenyoupickupanyproductoff theshelf?

Thinkoutoftheboxabouthowtosave money.LoveFoodHateWasterecommends makingmealsfromyourpantrybefore buyingmorefood.

Savingmoneyintoanemergencyfund helpsbuildgoodfinancialskills.Itshouldbe partofabiggerfinancialplan.

Revisityouremergencyfundtargeteach yearasyourneedschange,especiallyafter biglifeeventslikemoving,havingababy,or changingjobs.

Beawarethatsomepersonalitieslurch fromonecrisistothenext.Ifthatsounds familiar,thenconsidergettingthirdparty help.Agoodplacetostartisabudgeting centreorCitizensAdviceBureau,whichcan referyoutomorespecialisedassistanceif youneedit.

Thinkofyouremergencyfundasanactof self-careandempowerment.Startingsmall isstillstarting.Youremergencyfundmay notbuyahousetomorrow,butitcanstopa flattyreorvetbillfromderailingyourwhole month.

Finallystayconsistent.Yourfutureselfwill thankyou.

ByAnnaMorgan

Asinterestratesbegintostabilise afteraturbulentfewyears,many Kiwihomeownersarerevisiting theirmortgageswithfresheyes.

Whetheryourfixedrateiscomingto anendoryou’resimplywondering ifyoucouldbegettingabetterdeal, nowmaybetheperfecttimetorefinanceor restructureyourmortgage.

InNewZealand,theaveragehousehold debttiedupinmortgagesremains significant.Butwiththerightapproach, yourmortgagedoesn’thavetobeafinancial burden,itcanbecomeastrategictool supportingyourlong-termgoals,whether that’spayingdowndebtfaster,freeingup cashflow,orsimplygainingmorepeaceof mind.

WhentoConsiderRefinancing Refinancingyourmortgagemeans switchingtoanewhomeloan,eitherwith yourcurrentlenderoradifferentone,to accessbetterterms.FormanyKiwis,the motivationissimple:securealowerinterest rateandsavemoney.

TheOfficialCashRate(OCR)inNew Zealandhasremainedunchangedat 3.25%thismonth,followingaperiodofsix consecutivecuts.Inresponse,bankshave

loweredtheirinterestrates,particularlyon floating(variable)mortgages,whichtendto trackOCRchangesclosely.

AsmanyKiwiswereforcedtolockinto fixed-termmortgagesatrelativelyhighrates, nowisagreattimetolookatsecuringbetter terms.

“Alotofpeopledon’trealisethatswitching bankscouldmeanalowerrateandacash contribution,”saysBrockShute,Mortgage AdviseratTheMortgageAdviceCompany. “Thatmoneycangotowardlawyerfees, youroffsetaccount,orevenasavingsboost. It’sworthexploring,especiallyifyouhaven’t reviewedthingsinawhile.”

Restructuring:ASmarterWaytoBorrow Refinancingisn’ttheonlypathtooptimise yourhomeloan.Restructuring-revisinghow yourloanisstructured-canhelpalignyour mortgagewithyourlifeplans.

Considerstrategieslike:

•Splittingyourloanintofixedandfloating componentstobalancecertaintyand flexibility

•Extendingorshorteningyourloanterm toadjustrepaymentsbasedonyour currentcashflow

•Makinglump-sumrepaymentsor increasinginstalmentstoreduceinterest costsovertime

•Usinganoffsetaccounttoeffectively reducetheinterestyoupay

•Addingarevolvingcreditfacilitytosuit irregularorlumpyincomestreams

Restructuringisparticularlyhelpfulifyour

incomeorfamilysituationhaschanged,orif you’relookingtoinvestinpropertyandwant amoretax-efficientstructure.

TheValueofExpertMortgageAdvice Navigatinginterestrates,loanterms,bank policies,andpossiblebreakfeescanbe overwhelming.Askilledmortgageadviser canuntanglethecomplexityandhelpyou makeinformedchoices.

TheMortgageAdviceCompanyspecialises inhelpinghomeownersandinvestorsfind tailoredmortgagesolutions.

“Notwoclientsarethesame,sowetake thetimetofigureoutwhatworksforyounotjustwhatthebanksareoffering,”says BrockShute.“Therightstructurecansave youstress,interest,andevenopenupnew opportunitiesdownthetrack.”

Withdeeplocalmarketunderstanding andongoingsupport,anexpertbrokercan ensureyourmortgageevolvesasyourlife does.

WhattoWatchFor Whilerefinancingorrestructuringcanbe rewarding,it’sessentialtobeawareofthe pitfalls:

•Breakfees:Exitingafixed-rateloanearly caninvolveexpensivepenalties-geta clearestimatebeforedeciding

•Hiddencosts:Bemindfuloflegalfees, propertyvaluations,andprocessing charges

•Ratefluctuations:Alowfloatingrate maybetemptingnow,butconsiderthe impactifinterestratesrise

Makesureanychangessupportyourwider financialgoals-notjustashort-termsaving. LetYourMortgageAdaptwithYou Yourhomeloanisyourbiggestfinancial commitment,soitdeservesregular attention.Thinkofitasalivingfinancialtool, notastaticproduct.

Withinterestratesshiftingandbanks competingforclients,nowcouldbea primeopportunitytoexploreyouroptions. Whetheryourefinance,restructure,or simplystayinformed,thekeyisstaying proactiveandmakingsureyourmortgage continuestoworkforyou.

TheMortgageAdviceCompany

BasedinWellngton,andservicing customersalloverNZ,TheMortgageAdvice Companyoffersexpertmarketknowledge andacommitmenttolong-termclient care.Forpersonalisedmortgagestrategies, considerreachingoutforano-obligation chat.

ByDianaClement

Thinkpoor,staypoor.Yourmind playsapowerfulroleinshaping yourfinancialreality.Whether you’relivingpaydaytopayday orearningacomfortablesalary, thewayyouthinkaboutmoney influenceshowyourespond tosetbacks,whetheryouplan aheadorliveforthemoment, andhowconfidentyoufeel makingdecisions.

It’sonereasonwhytwopeoplewith thesameincomecanendupwithvery differentfinancialoutcomes.Mindset affectshowyoubudget,handledebt,and evenhowyoutalkaboutmoneywithfriends andwhānau.

Peoplewhofocusonopportunity,notjust obstacles,oftengetaheadfaster,evenwith fewerresources.Thosestuckinanegative mentalcycleremainonthattreadmill.

NowondertheRetirementCommission’s FinancialResilienceIndexfoundthataround halfofNewZealandersfeltfinancially uncomfortable,usingphrasessuchas “treadingwater”,“sinkingabit”and“sinking

badly”.Fewerwere“swimming happilythantheyears immediatelyprior.

Scarcityshrinksyour financialworld

Awell-known Princeton University studyfound thatpoverty reduces yourmental bandwidth. Whenyour brainisstuck in“survival mode,”long-term planningbecomes harder.You’remore likelytomakedecisions basedonshort-termrelief thanfuturebenefit.As Sorted’sTomHartmannsays, evenasmallemergencyfund givesyoumorementalbandwidth.It’sabout creatingbreathingroom.

InAotearoa,ourNo.8wirecultureofselfreliancecanslipintoscarcitythinking,the ideathatthere’sneverenough.Constantly focusingonwhatwedon’thavecanturn “wants”into“needs,”leadingtospendingon creditcards,buy-now-pay-later,ormortgage top-upsthatdisplacerealpriorities.

Negativeheadlinesandpessimistic companydon’thelp.Butitispossibleto shiftyourfocus.Research,includinginsights fromthebookScarcity,TheTrueCostof

NotHavingEnough,showsthata scarcitymindsetcanlimit decision-making,while anabundancemindset improveswellbeing, choices,and relationships, includingyour relationship withmoney. When perception andreality don’tlineup

Another trapishavinga distortedviewof yourownfinancial reality,oftencalled “moneydysmorphia.” Thishappenswhenhow youfeelaboutyourfinances doesn’tmatchthefacts. Youmightspendwithouta budget,convincingyourselfthatnextpayday willfixtoday’ssplurge,andrelyondebttools likebuy-now-pay-latertogetby.Others swingtheoppositeway,feelinganxiousor guiltyaboutspendingevenwhenthey’reina strongfinancialposition. Socialmediaexaggeratesthesedistortions. Behindsomeone’scuratedlifestylemightbe amountainofcreditcardorpersonalloan debt.

Thefix?Startsmall,butstartnow Sohowdoyourewireyourthinking?Try these:

●Reframelimitingbeliefs.“Ican’tafford it”becomes“Isthisapriorityright now?”

●Practisegratitude.Focusonwhatyou have,notwhatsomeoneelseflaunts. ●Edityourfeeds.Unfollowcontentthat leavesyoufeeling“lessthan.”

●Celebrateothers’wins.Iffriendsbuya house,learnfromthem.

●Joinconversationsthatliftyouup suchasonlinecommunities,personal financegroups,orlocalnetworksthat focusongrowthandsupport. Youdon’thavetooverhauleverything. Justbegin.Likeanyshiftinmindset,ittakes timeandself-awareness,butit’sworthit. Aboveall,startpayingdownyourdebtand beginsaving,onedollaratatime.Sorted isencouragingKiwisthisAugusttosetaside even$5or$10aweekintoanemergency fund.Havingasmallbufferchangesyour thinkingfromhelplesstohopeful.It’snot abouttheamount;it’saboutcreating positivebehaviours.Thatsimplehabitcan buildconfidenceandcontrol,especially whenlifethrowsafinancialcurveball. Youdon’tneedtogoitalone Afinancialadviserormentorcanhelp yougetperspective.Ifyou’renotreadyfor that,juststartwithoneaction.Setupthat emergencyfund.Orhaveabuy-now-paylaterfreemonth.Youmightbesurprisedhow powerfulsmallmovesfeelandtheoutcome onyourfinances.Yourfutureselfwillthank you.

ByDianaClement

We’returningtoDrChatGPTfor quickadviceonminorhealth issues.Sowhynotletithelp usmanageourmoney,too? AIofferseasywaystoanalyse budgetsandinvestments.And thebestpart?Youdon’thaveto beatechexperttobenefit.

Ifyouhaven’ttried,logintothelikesof ChatGPT.com,Perplexity.com,Copilot. microsoft.com,orGemini.google.com. Typeinaquestionsuchas“Whatare somegoodquestionstoaskAItoimprove mypersonalfinancesinNewZealand?” Perplexitygaveexamples:

●What’sthebestwaytoplanforbig expenseslikebuyingahomeoracar?

●Whataresometipsforreducingmy powerorinternetbills?

●HowdoIcheckmycreditscoreand whatdoesitmean?

●HowdoIcomparedifferentKiwiSaver fundsbasedonfeesandperformance?

●Canyouhelpmecreateashoppinglist tosavemoneyatNewWorldorPak’n Save?

●What’sarealisticsavingsgoalfor someoneearning$XinNewZealand? Iftheanswerisn’ttailoredenough,ask follow-upquestions,justasyoumightaska friendoradviser:

●DoesthatrelatetoNewZealand?

●Howwouldyoutailorthattomy incomeof$xx,xxx?

●ButIwanttotravelbeforeIpayoffmy studentloan?

It’simportanttorealisethatAIisn’t ahumanadviser.Treatanswerswith caution.LargeLanguageModelssometimes “hallucinate.”Bigfinancialdecisionssuchas howtoinvestaninheritancewarranthuman advice.ThinkofAIasalearningandideagenerationtool,notasubstituteforexpert guidance.

HerearesomemorewaystouseAItoyour financialadvantage: Emergencysavings:

Sorted’sfocusthisAugustishelpingKiwis buildanemergencyfund,sotryasking: “What’sarealisticemergencysavingsgoal forsomeoneearning$XinNZ?”or“HowdoI startanemergencyfundifIlivepay-to-pay?” ChatGPTsuggestedshiftingthegoalpost

andstartingwitha$100emergencyfund, automatingtinycontributions,andtreating savingslikeabill.

Supermarket:

Ask:“Ihave[$xxx]aweektospend ongroceriesforahouseholdsizeof[xx], includingcleaningandnon-fooditems. Pleaseprovideashoppinglistandmeal plan.”Or:“WhataresomewaysIcanspend lessatthesupermarket?”Theanswersare almostalwayssensible.

Productcomparisons: UseAItodothedetectiveworkwhen comparingprices.Sayyou’rechoosinga laundrysoaker.YoucanasAItocompare thepriceandpercentageofthekeyactive ingredient,sodiumpercarbonate,in productslikeNapisan,Vanish,Frend,Sard, andEarthwise.Withinseconds,itcantellyou whichbrand/sizeoffersthebestvalue.

Expenseanalysis: AIcananalyseallsortsofspendingfrom mobilephoneplans,topublictransport versusdriving,petcostsandmuchmore. Forexample,youcanworkoutwhatitcosts tobuyversusmakeacoffee.Ifacafécoffee costs$6,homemadewithbeansat$27/kg, oatmilkat$4/L,electricity,anddepreciation onan$800machine,costs$1.68.Hint:It’s

probablyfreeatwork.

KiwiSaver:

Whileit’salwaysbesttogetprofessional financialadvice,quickquestionstoAIcan producesensibleanswers.Forexample, AIsaysmaking$10weeklyvoluntary contributionstoKiwiSaverinagrowthfund for20years,thenfiveyearsinabalanced fund,couldgiveyouanextra$38,000in retirement.

Scams:

Weallgetemailsthatscreamscam. Ifyou’renotsure,askAI.Whengivena standardNZPostscamemail,Gemini responded:“Thisisascam.Legitimate organisationslikeNZPostwillneverask foraredeliveryfeeorpersonaldetailsviaa suspiciouslink.”

Budgeting:

AIcansetupabudgetforyouorgive adviceonyourspending.Bybreakingdown yourcurrentspendingitcancreateabudget andmakesuggestionsaboutwhereyoucan savemoney.Don’tuploadsensitivedataand notethatAIisn’tperfectwithnumbers. Justlikehumanadvice,AIworksbest whenyou’reopentolistening.“Mysituation isdifferent”isoneofthebiggestcop-outsin personalfinance.

ByDianaClement

Thinkinvestingis justforricholdguys insuits?Thinkagain. Anyonecaninvest andtheyoungeryou startthebetter.

Thegoodnewsisthataccordingtodata fromTeAraAhungaOraRetirement Commission’sFinancialSentiment TrackerrunbyTRA,15%of18to24-yearoldshave$1,000aswellasinvestments. Thatnumbergrowsforthe25to34-year-old groupto24%,sosomeyoungpeopleare gettingintoinvesting.

Firstinvestmentsaren’taboutstrikingit big.They’reaboutdevelopingtheskillsand mindsettohandlerisk,makedecisions,and buildlong-termwealth.

Startwiththebasics,notthebuzz Whilesavinginbankaccountsissafe, investinginKiwiSaver,shares,fundsand evencryptogivesyourmoneyachanceto grow,andgrow.

Itmightnotbeexcitingbutstartwith KiwiSaverbeforeyoulookattakingonhigh risk,highreturninvestments.YourKiwiSaver contributionsaresmall,butaddupover time,thankstoyouremployer’scontribution andthegovernment’scontribution.As Simplicity’sSamStubbsputsit:“You’restill inthehabit-formingstageoflifeandthe habityoulearn[fromKiwiSaver]isregular savings.”

What’snext:timeforsomethingmore exciting

Onceyou’vegotyourregularKiwiSaver contributionssetup,it’stimetohavesome fun.Youcouldstartbyinvesting$5or$10a week.Thepointofthatistolearnnow,gain later.Westpac’sWarrenNganWoosuggests investingintocompaniesyoualready engagewith,brandsyouuse,shopsyoubuy from,asagoodstartingpoint. Themoreyoucanlearnthebetter.Readthe businessnewstofindouthowcompanies work.JoinforumssuchasSharesies’ ShareClubtolearnfromrealinvestor experiences.You’llsoonstarttorecognise trends,understandwhatdrivescompany performanceandshareprices,andbuild confidenceovertime.Themorefamiliaryou getwithhowbusinessesoperateandgrow, thesmarteryourinvestmentdecisionswill become.

Lookpastthehype

FOMO,fearofmissingout,isn’tjustasocial mediathing.Ithitshardininvestingcircles, especiallywhenheadlinesorRedditforums promisequickwins.Alwaystakethetimeto readuponwhatyou’rebuying.

Investwhatyoucanaffordtolose It’scommontofeelyou’resuperhuman whenyoustartinvesting,butthatoften leadstobiglosses,soonerorlater.The goldenrulewhenyoustartoutinvesting: onlyinvestmoneyyou’repreparedtolose. Eventhebestinvestorsintheworldcan’t predictthenextbigcrash.“Usecoffee moneyorbeermoney,”saysKatrinaShanks ofANZIF.

Nothingwrongwithcrypto:butdon’tbet therent

Manyyounginvestorsstartdropping$10 hereorthereonSharesies,it’sagreatway tolearnandthestartofgettingrichslowly, avaluablestrategy.There’snothingwrong withdabblingincrypto,memestocksorthe nextbuzzystart-up.Justdon’tbettherent onanyofthese.

Don’tputitallononehorse Diversification,AKAabalanceof investments,isaverygoodidea,evenwhen you’reonlyinvestingpocketmoney.A handfulofsharesacrossdifferentcompanies orfundscanteachthesamelessonsasa singlespeculativepick,withoutthesame riskoftotalloss.SamewithCrypto,don’t

sinkallyourmoneyintoasinglecoin. Beawarethatthatinvestingin10meme coins,or10AIcompanies’sharesisn’t spreadingyourbetsfarenough.The entiremarketcancollapse,especiallyin speculativeareas.Inshort:don’tconfuse investingwithgambling.Oneisastrategy; theotherisluck.

Usetech,butdon’tgetplayed PlatformslikeSharesies,Hatchand EasyCryptomakeinvestingaccessible andengaging.Appsgamifyinvesting,says Shanks.Buttheyalsomakeiteasyto overreacttomarketmovesorbuyintohype. Makeyourmistakesearly,andsmall Losingasmallinvestmentisoftenacheap education.“Even$100canbemeaningful,” saysfinancialadviserMarkPattonofStuart Carlyon.“Ifyoulosethatonacrypto [investment]orastocklikeGameStop,your futureselfwillsaythatwasaprettycheap lesson.”That’swhyyoudon’tinvestmore thanyoucanaffordtolose.

WithSortedMoneyMonthrunninginAugust, nowisagreattimeforyoungpeopletostart learningmoreaboutinvesting.

ByAnnaMorgan

Intoday’scashless,fast-paced world,manyparentsworrytheir kidsaregrowingupwithouta basicunderstandingofmoney.

Withtap-and-gopayments,online shopping,andbuy-now-pay-later schemeseverywhere,teaching childrenaboutmoneyhasneverbeenmore important.

“Kidsareexposedtofinancialdecisions fromaveryyoungage,”saysRuthHarper fromConsumerNZ.“Whetherit’sseeingtheir parentspayforgroceriesorscrollingthrough onlineads,theyaresoakinginmoneyhabits allthetime—forbetterorworse.”

Thegoodnewsis,it’snevertooearlyto startbuildingpositivemoneyskills.Infact, researchshowschildrenformmoneyhabits asyoungassevenyearsold.That’swhy financialexpertsrecommendintroducing basicmoneyconceptsinage-appropriate waysasearlyaspossible.

Startsimple.Acommonstartingpointfor manyKiwifamiliesisregularpocketmoney. “Pocketmoneyisagreatwaytohelpkids understandthebasicsofearning,saving,and spending,”saysSorted’sTomHartmann.

Hartmannsaysit’snotabouthowmuch yougivebutaboutusingitasateaching tool.“Even$2aweekcanhelpchildrenlearn valuablelessons.Thekeyistotalkabout whattheycandowithit—whetherthat’s

saving,spending,orgiving.”

Settingupsimplesavinggoalsisauseful nextstep.“Helpyourchildpicksomething they’dreallyliketobuy,likeatoyoratrip tothemovies,”saysHarper.“Thenwork withthemtosavetowardsit.Thisteaches patienceandplanning,twokeymoney skills.”

Forschool-agechildren,havingtheir ownbankaccountisausefulwaytoteach themaboutsavingandmanagingmoney independently.“MostNewZealandbanks offerfee-freekids’accountswithsimple onlineaccess,”saysHartmann.“It’saneasy waytoshowkidshowmoneygrowsover timeandintroducebasicbankingconcepts.”

Someparentschoosetogoastepfurther byintroducingtheirchildrentodigital toolssuchaschild-friendlybankingapps. Thesecanshowbalancesinreal-time,set savingsgoals,andmakemoneylessons interactive.“Justbesuretotalkabout what’shappening,”advisesHarper.“Seeing numbersonascreencanfeelquiteabstract, somakesuretheyunderstandwhatitmeans inreallife.”

Aschildrengetolder,encouragingthemto earntheirownmoneycanbuildconfidence andresponsibility.“ManyKiwikidsstart doingextrachores,mowinglawns,or evenbabysittingintheirteenageyears,” saysHarper.“Thishelpsthemlearnthe connectionbetweeneffortandreward.”

Parentscanalsosetupmini“jobs”around thehousethatareseparatefromregular responsibilities,offeringsmallamountsof paymentforextraeffort.“Thisisagoodway

Don’tletsuddenexpensestake abiteoutofyoursanity.Build youremergencysavingsthis MoneyMonth,soyoucancover costsnostress.

Imaginelife’slittlesurprisesforamoment –carrepairs,unscheduleddentalwork,a suddenvetvisit.Youcanprobablythinkof manyotherunexpectedexpensesthathave croppedupforyou.

Theyrarelyarriveaconvenienttime,but theydon’thavetoderailyourfinances oryourpeaceofmind.Whenitcomesto feelingstressedorsortedwhenunforeseen circumstanceshit,thedifferenceisan emergencyfund:yourveryownfinancial safetynet,readytocatchyouwhenlife dropsyouinit.

HereinAotearoa,AugustisMoneyMonth. Thisyear,financialexpertsareadvisingNew Zealanderseverywheretotakeadvantageof itandmakeitagreatreasontolearnhowto startbuildingorbringaboosttoyourfinancial buffer.You’llbedoingyourselfafavour–one thathelpsyousleepbetteratnight. It’snotjustaboutprotectingagainstmajor disasters(that’swhatinsuranceisfor)–it’s alsoaboutcushioningthosesmallersetbacks thatpopupwhenyouleastexpectthem. Startyoursafetynetsmall Startingyouremergencyfundmightseem daunting,especiallyiftheideaofsaving $1000ormorefeelsoutofreach.Buthere’s thegoodnews:evenasmallstash–$50, $100,whateveryoucanmanage–isabig stepintherightdirection.Everydollarsaved strengthensyourresilience,sowhenthe unexpectedhappens,youwon’thaveto

tostartteachingabouttheworkingworldin asafe,supportiveenvironment,”Hartmann explains.

Teachingkidshowtospendwiselyisjust asimportantassaving.“Childrenneedto understandthedifferencebetweenneeds andwants,”saysHarper.“Atriptothe dairycanbeagreatopportunitytohavea conversationaboutmakingchoices.”

Hartmannsuggestsaskingchildrento manageasmallbudgetforcertainpurchases, liketheirownschoolstationeryorsnacks. “Theylearnquicklywhenthey’reinchargeof themoney.Itteachesreal-lifeconsequences inacontrolledway.”

Astheygrowolder,introduceconcepts likecomparisonshoppingandbudgeting forlargerexpenses.“It’saboutgivingthem increasingresponsibilityastheyprovethey canhandleit,”saysHartmann.

EncourageGenerosityandCommunity Thinking.Financialliteracyisn’tonly aboutspendingandsaving—it’salso aboutfosteringhealthyattitudestowards generosityandcommunity.“Involving childrenincharitablegivingteachesempathy andsocialresponsibility,”saysHarper.“Even settingasideasmallportionoftheirpocket moneytodonatecanhavealastingimpact.”

Somefamiliesinvolvechildrenindecisions aboutwheretogive,whetherit’sdonatingto ananimalshelterorcontributingtoaschool fundraiser.“Theseconversationshelpkids seethebroaderimpactmoneycanhave,” Harperadds.

Hartmannsaysthebestfinanciallessons comefromregularconversations.“Moneyis

partofdailylife,somakeitpartofeveryday conversations,”hesuggests.“Whetherit’s explaininghowEFTPOSworksortalking aboutwhyyou’recomparingpricesatthe supermarket,theselittlemomentsbuildup understandingovertime.”

“Childrenmimicwhattheysee,”adds Harper.“Iftheyseetheirparentsbudgeting, planning,andsaving,they’remorelikelyto adoptthosebehavioursthemselves.”

NewZealandalsooffersformalfinancial educationresources.ProgrammeslikeSorted inSchoolsprovidefreefinancialcapability learningforintermediateandsecondary schoolstudents,coveringtopicslike budgeting,debt,KiwiSaver,andinvesting. “It’safantasticresource,”saysHartmann. “Butitworksbestwhenreinforcedathome.”

Withthecostoflivingrisingandfinancial productsbecomingmorecomplex, equippingchildrenwithfinancialskillsis moreimportantthanever.“You’renotjust teachingthemhowtohandlepocketmoney,” saysHarper.“You’resettingthemupwith skillsthey’llusetheirwholelife.”

Hartmannagrees.“Teachingyour kidsaboutmoneydoesn’tneedtobe complicatedorintimidating.It’sabout regularconversations,smalllessons,and givingthempracticalexperience.Thepayoff isafinanciallyconfidentadultwhocanmake gooddecisions.”

Intheend,raisingfinanciallysavvykids isoneofthegreatestinvestmentsKiwi parentscanmake.“It’salifeskillthatwillpay dividendsforyearstocome,”Harpersays.

relyonloansorrackuphigh-interestdebt togetby.

Buildingyourbufferisn’tjustpractical–it’s empowering.Ithelpsyoustayontrackwith yourotherfinancialgoals,likesavingfora holidayoranewcar,becauseyouwon’t needtousethosefundsinanemergency andwatchyourprogressevaporatewhen lifedoesn’tgoaccordingtoplan.

Temptedtouseyourcashcushionfor non-emergencies?Jointheclub.It’seasy tofindareasontodipintoyoursavingsfor somethingfunoronawhim.That’swhy Sorted’sfreeguidesarepackedwithtipsto helpyounotonlygrowyouremergency fund,butprotectittoo,soyouonlyuseit whenyoutrulyneedto.

MoneyMonthcomesjustonceayear DrivenbySorted(thefree,independent financialcapabilityservicerunby government-fundedagencyTeAraAhunga OraRetirementCommission),theannual campaignMoneyMonthsupportsNew Zealanderstobuildresilienceagainstlife’s curveballsandmakethemostoftheirmoney. Concernedyou’renotcoveredincaseofan emergency?Hackstobuild(andkeep!)your fundaboundatsorted.org.nz.

MoneyMonthisforeveryone ThroughoutMoneyMonth,allofSorted’s freetips,toolsandguidesareavailable alongsidein-personandonlineevents hostedbyNationalStrategyforFinancial Capabilitypartnersnationwide.Sorted’salso runningtwointeractivelunchtimewebinars thatvirtuallyconnectyouwithexperts. ThisMoneyMonth,makesavingyoursanity andprotectingyourfinancialprogressyour priority.Yourfutureselfwillthankyou.

Swapstressedforsortedthis MoneyMonthatsorted.org.nz.

ByAnnaMorgan

Retirementisn’twhatitused tobe—andformanyNew Zealanders,that’sagood thing.Increasingly,olderKiwis arerejectingtheideaofa suddenstoptoworkinglifeand embracingtheconceptofsemiretirement.

Frompart-timeconsultinggigsto runningsmallbusinessesorpickingup casual“lifestylejobs,”semi-retirement isbecomingapopularwaytostayactive, social,andfinanciallycomfortablewell beyondthetraditionalretirementage.

“Ineverwantedtojustclockoutand potterinthegardenallday,”laughs68-yearoldSusanMartinfromTauranga,whoworks threedaysaweekatalocalartgalleryafter a40-yearteachingcareer.“NowIgettostay busydoingsomethingIlove,meetnew people,andstillhavetimeforgrandkids andtravel.Plus,theextraincomemakeslife moreflexible.”

Susanispartofagrowingmovement inAotearoa.FiguresfromStatsNZshow increasingnumbersofpeopleover65 arestayingintheworkforce—eitherby necessityorchoice.In2023,nearly25% ofNewZealandersaged65–69werestill working,afigurethathasnearlydoubled overthepasttwodecades.

TheBenefitsofEasingIntoRetirement Formany,semi-retirementoffersthe bestofbothworlds:freedomwithoutthe financialsqueeze.FinancialadviserLizKoh saysshe’sseeingmoreclientsembrace part-timeworkafter“retirement”tobalance

lifestylegoalswithfinancialsecurity.

“Noteveryonewantstoorcanafford tostopworkingcompletelyat65,”says Koh.“Semi-retirementgivesyoua chancetotopupyourincome, delaydrawingdownon yoursavings,andstay mentallyactive.”

Oneofthe financialbenefits istheabilityto delaydipping intoKiwiSaver.

“Ifyoucan continue earning,even modestly,you cankeepyour KiwiSaverintact andpotentially growitfurther,” Kohexplains.“Every extrayearcanhaveabig impactonyourretirement balance.”

travelfundtickingover.”

Therearealsosocialand healthadvantages.Research fromtheRetirementCommissionhighlights thatworking—insomecapacity—often leadstobetterhealthoutcomes,reduced loneliness,andastrongersenseofpurpose forolderadults.

TheRiseof“LifestyleJobs”

Manysemi-retiredKiwisareoptingfor whatareaffectionatelycalled“lifestyle jobs”—part-timerolesthatarelow-stress, enjoyable,oralignwithpersonalinterests.

For70-year-oldChristchurchlocalPeter Dawson,thatmeantleavingbehindhis seniormanagementroletobecomeaparttimegolfcoach.“Golf’sbeenmypassionfor years,”Petersays.“NowIspendmornings coachingatthelocalcourse,haveafternoons free,andthelittlebitofextracashkeepsmy

Othersareturninghobbiesintosmall businesses.WellingtoncoupleRaewynand DougLewis,bothintheirearly60s, startedaweekendfarmers’ marketstallselling homemadechutneys andpreservesafter finishingfulltimecorporate careers.“It’s fun,social, andgivesus somethingto dotogether,” saysRaewyn. “Plusitpays forourannual SouthIsland campervan trip.” Evencasualroles inretail,hospitality, orcustomerservice arepopularamongthe semi-retired.According toSEEKNZ,rolessuchas tourguiding,retailassistant,seasonalfruit picking,andreceptionistworkoftensee highinterestfromolderapplicantsseeking flexiblehours.

TheFinancialConsiderations

Whilesemi-retirementoffersobvious lifestyleperks,financialexpertsrecommend thinkingthroughthenumbersbeforecutting backonfull-timework.

“Everyindividual’sfinancialsituationis different,”saysTomHartmannfromSorted. “It’simportanttorunthenumbersonwhat youneedtolivecomfortablyandwhatparttimeworkcanrealisticallyprovide.”

Hartmannsuggestsconsidering:

• NZSuperannuationeligibilityand impact:Youcanstillreceiveyoursuper

whileworking,butyou’llpaytaxonallyour income.

• KiwiSaverwithdrawals:Youcanaccess KiwiSaverfromage65butmaychooseto deferwithdrawalstomaximisereturns.

• Taxbrackets:Addingevenpart-time incomecanshiftyouintoahighertax bracket,soplanaccordingly.

Flexibilityofexpenses:Areyou carryingmortgagedebt,orareyour expensesrelativelyfixedandpredictable?

“Doneright,semi-retirementcanbe afantasticwaytotransitionintofull retirementwhilemaintainingfinancial flexibility,”Hartmannsays. PlanningforaFulfillingSemi-Retirement Thekey,saysKoh,isplanningahead. “Thinkaboutwhattypeofworkyou’d actuallyenjoydoing.Maybeit’ssomething relatedtoyourcareer,orsomethingtotally new,”shesays.“Testitoutbeforeretiring fullyifyoucan—doacourse,volunteer,or takeonacasualgig.”

Alsoconsideryourtime.“ManyKiwis underestimatehowmuchfreedomthey wantinretirement,”saysKoh.“Ajobthat’s toodemandingorinflexiblemightendup feelinglikeaburden.”

Finally,sherecommendsbuildingasemiretirementbudget.“Whatwillyouressential expensesbe?Whatextrasdoyouwant— travel,hobbies,diningout?Workouthow muchpart-timeincomecouldcomfortably coverwithoutsacrificingyourlifestylegoals.” ANewRetirementMindset Semi-retirementreflectsashiftinhow Kiwisviewlifeafter65—it’snolongerabout windingdownbutreshapinglifeonyour ownterms.

AsSusanMartinputsit,“Thischapterof lifeisaboutchoices.Ichoosetostayactive, earnalittle,andenjoyabetterqualityoflife. Andthatfeelslikerealfreedom.”

ByAnnaMorgan

Inrecentyears,Kiwishave embracedsustainableliving withopenarms.Fromelectric carsquietlycruisingourstreets tosolarpanelssoakingupthe abundantsunshineandheat pumpswarmingchillyhomes, thepushtowardsgreener lifestylesisclear.

Butbeyondtheenvironmentalbenefits, manyNewZealandersareasking thehardquestion:Dothesepopular sustainableinvestmentsreallypayoff financially?

Let’sbreakdownthenumbersand realitiesbehindelectricvehicles,solar panels,andheatpumpstohelpyoudecideif they’reworththeupfrontcost.

ElectricCars:MoreThan JustaTrend?

Electricvehicles(EVs)havegonefrom nichetomainstreaminNewZealand. AccordingtotheMinistryofTransport,as of2024,EVsmakeupnearly10%ofnew vehiclesales—adramaticincreasedrivenby governmentincentives,expandingcharging infrastructure,andgrowingenvironmental awareness.

Butwhataboutthefinancialbottomline? UpfrontCostsvsRunningSavings EVsgenerallyhaveahigherpurchaseprice comparedtoequivalentpetrolordieselcars. Forexample,anewNissanLeafmaycost around$55,000,whileacomparablepetrol carcouldbecloserto$35,000.However,the gapisclosingasmoreaffordableEVmodels enterthemarket.

Thefinancialadvantagecomesfrom runningcosts.EVsarecheapertofuel— electricitycostsareroughlyhalfthatof

petrolperkilometre.Maintenanceisalso simplerandlessexpensive,sinceEVshave fewermovingpartsanddon’tneedoil changes.

CrunchingtheNumbers

Ifyoudrive15,000kmannually,you mightspendabout$1,200onpetrolbut onlyaround$600onelectricitycharging. Overfiveyears,that’sa$3,000savingon fuelalone.Maintenancesavingscouldadd another$1,000ormore.

WhatAboutResaleValue?

EVsarestillrelativelynewinNewZealand, soresalevaluescanbeuncertain.But withgrowingdemandandbetterbattery longevity,manyexpertspredictstableor improvingvaluesovertime.

TheVerdict:Forthosewhocanaffordthe initialinvestment,anEVcansavemoney overthelongtermanddeliveracleaner drivingexperience.Plus,manyownersfind theinstanttorqueandquietrideanadded bonus.

NewZealand’sgeographymakesit anidealplaceforsolarenergy.With governmentschemeslikethe“Healthy HomesGuarantee”andvariousenergy grants,solarpanelinstallationshavesurged inpopularity.

InitialInvestment

Atypicalresidentialsolarsetupcosts between$8,000and$15,000,depending onsystemsizeandinstallationcomplexity. Thiscanseemsteepupfrontbutneedstobe weighedagainstlong-termsavings.

SavingsonPowerBills

Solarpanelsgeneratefreeelectricity duringdaylighthours,reducingyourreliance ongridpower.Onaverage,awell-sized systemcancutpowerbillsby30%to50%, dependingonhouseholdusageandsunlight availability.

Forexample,ifyourpowerbillis$2,000 ayear,solarcouldsave$600to$1,000 annually.

PaybackPeriod

Generally,solarpanelspayforthemselves within7to10yearsinNewZealand.Given thatpanelsoftencomewith25-year warranties,thesavingsafterpaybackcan addupsignificantly.

SellingExcessPower

Somehomeswithsolarsystemscan exportsurplusenergybacktothegrid, earningcreditsorpayments—though thisdependsonyourelectricityretailer’s policies.

Maintenance

Solarpanelsrequireminimalupkeep—a periodiccleanandinspectionusuallysuffice.

TheVerdict:Solarpanelsofferreliable long-termsavingsandcontributetoalower carbonfootprint.FormanyKiwisplanning tostayintheirhomeslongterm,they’rea soundinvestment.

HeatingisamajorpartofKiwihousehold energyuse,especiallyincoolerregions.Heat pumpshavebecomeafavouredoptionfor efficient,cost-effectiveheatingandcooling.

UpfrontCosts

Installingaheatpumpcancostbetween $3,000and$5,500,includingunitand installation.

EfficiencyandSavings

Heatpumpsareuptofourtimesmore efficientthanelectricheaters.Thatmeans foreveryunitofelectricityused,yougetup tofourunitsofheatoutput.

Onaverage,aheatpumpcanreduce heatingcostsby30%to50%,dependingon yourcurrentsystem.

Forexample,ifyouspend$1,200annually onheating,aheatpumpcouldcutthatto $600–$800.

Year-RoundComfort

Manyheatpumpsalsoprovidecooling, makingthemusefulinsummer—abenefit especiallyappreciatedinwarmerpartsof NewZealand.

HealthandEnvironmentalBenefits

Heatpumpsimproveindoorairqualityby filteringairandreducingdampness,which

canlessenrespiratoryissues. Theyalsoreducedependenceonfirewood orelectricheaters,cuttinghousehold emissions.

TheVerdict:ForKiwisseekingyear-round comfortandlowerenergybills,heatpumps areanefficientandcost-effectiveoption.

Whileeachinvestmentrequiresupfront spending,thelong-termfinancial,health, andenvironmentalbenefitscanbe compelling.Herearesometipstomaximise yourreturn:

• ResearchIncentives:Government subsidiesandrebatescansignificantly reducecosts.

• ChoosetheRightSize:Properlysized solarorheatingsystemsoptimise savings.

• CompareProviders:Getmultiple quotesandcheckreviews.

• PlanforYourHomeandLifestyle: Consideryourenergyusagepatterns, drivinghabits,andfutureplans.

• ThinkLongTerm:Theseinvestments areaboutlong-termsavingsandlifestyle improvements,notquickpayback. Kiwisincreasinglywanttheirmoneyto workharder—notjustfinancially,butfor theirhealthandtheplanet.Electriccars, solarpanels,andheatpumpseachhave upfrontcosts,butwhenchosenwisely,they canpaydividendsinsavings,comfort,and peaceofmind.

Ifyou’reconsideringoneormoreofthese greenupgrades,it’sworthcrunchingyour ownnumbersandseekingexpertadvice. Withcarefulplanning,youcandrivecleaner, poweryourhomesmarter,andlivemore comfortably—whileputtingyourmoneyto workinawaythattrulypaysoff.

ByAnnaMorgan

Formanypeople,managing creditcardbalances,personal loans,andotherdebtscanfeel overwhelming.Choosingthe rightdebtrepaymentstrategy canmakethedifference betweenyearsoffinancial stressandafaster,more confidentpathtofreedom.

Twopopularmethodsdominatethe conversation:theDebtSnowballand theDebtAvalanche.Bothhavetheir champions,andbothhavehelpedKiwis regaincontrolovertheirmoney.Butwhich worksbestdependsonyourpersonality, finances,andgoals.

UnderstandingtheSnowballand AvalancheMethods

DebtSnowballfocusesonpayingoffyour smallestdebtsfirst—regardlessofinterest rate—tobuildmomentumandmotivation. Oncethesmallestdebtiscleared,youroll thatpaymentintothenextsmallest,likea snowballgrowingbiggerasitrolls.

DebtAvalanchetargetsdebtswiththe

highestinterestratesfirst.Bytacklingthe mostexpensivedebt,youminimisethe totalinterestpaidandgetoutofdebtfaster financially.

CaseStudy1:Sarah’sSnowballSuccess

SarahThompson,a32-year-oldgraphic designerfromWellington,wasjugglingthree debts:a$1,200creditcardbalance(18% interest),a$4,500personalloan(9%),anda $2,000storecard(22%).

“IchosetheSnowballmethodbecause Ineededquickwins,”Sarahexplains. “Knockingoutthatsmallcreditcardfirst gavemetheconfidencetokeepgoing.”

Herstrategywastopayminimumsonthe largerdebtswhilefocusingextrapayments onthesmallest.Aftersixmonths,hercredit cardwaspaidoff.Shethenrolledthe paymentsintoclearingthestorecardand finallytackledherpersonalloan.

“Thosesmallwinskeptmemotivated—it wasthedifferencebetweenfeelingstuckand makingrealprogress,”shesays.

CaseStudy2:Mike’sAvalancheAdvantage MikeAnderson,a45-year-oldtradesman fromChristchurch,owed$10,000split betweena$6,000creditcard(24%interest) anda$4,000carloan(7%).

“I’mverynumbers-drivenandthe Avalanchemethodmadesense—tackling thehighestinterestdebtfirstsavesmoney,” Mikesays.“Itfeltefficient,evenifittook

longertogetthatfirstdebtgone.”

Mikepaidminimumsonthecarloanand focusedallextrafundsonthecreditcard. Hecleareditin14months,thenthrew everythingatthecarloan.

“Thisapproachsavedmenearly$1,200 ininterestandshavedmonthsoffmy repaymentplan,”headds. WhichStrategyIsRightforYou?

FinancialcoachArohaNgataisaysboth strategiescanwork—it’saboutmatching yourmindsetandhabits.

“Snowballisgreatifyouneed psychologicalboostsearlyon,”shesays. “Avalanchesuitsthosecomfortablefocusing onthemathsandlong-termsavings.”

“Commitmentisthekey,”Ngataistresses. “Youhavetopickaplanyou’llsticktoover time.”

FinancialplannerJamesMcLeodadds, “Thebestapproachistheonethatkeeps youmotivated.Forsome,smallwinsmean everything.Forothers,knowingthey’re savinginterestismoreimportant.”

TipsforKiwisTacklingDebt

1.ListYourDebtsClearly:Knowhow muchyouowe,interestrates,andminimum payments.

2.CreateaRealisticBudget:Identify whereyoucancutbacktofreeupextra repayments.

3.ConsiderConsolidation:Refinancingor

consolidatinghigh-interestdebtscanhelp.

4.AutomatePayments:Avoidmissed paymentsandlatefees.

5.SeekHelpWhenNeeded:Organisations liketheNewZealandDebtHelplineprovide free,confidentialsupport.

TheEmotionalFactorMatters Researchshowsquickwinscan boostmotivationandreducefeelingsof overwhelm,saysNgatai.

“Payingoffevenasmalldebtcanchange yourmindsetandbuildmomentum,”she says.“Ithelpsyoubelieveyoucanconquer biggerdebtstoo.”

Mikeagrees,“WhileAvalanchesavedme money,Icouldseewhysomepreferthe motivationofSnowball.It’saboutwhat worksforyou.”

TheBestDebtStrategyIstheOneYou StickTo McLeodsumsitup:“Themostimportant thingisstartingandkeepinggoing.Any progressisprogress.”

Whetheryouchoosetosnowballyour debtsorattackthehighestinterestfirst, disciplineandperseverancearekey. Ifyou’refeelingoverwhelmedbydebt, consideryourpersonality,crunchyour numbers,andpickthemethodthatfeels sustainable.Thepathtofinancialfreedomis withinreach—onepaymentatatime.