APA Florida Annual Conference September 18, 2025

APA Florida Annual Conference September 18, 2025

105-Day Legislative Session

Extended until June 16, 2025

Final Budget: $117.4 billion

Governor Vetoed $1.3 billion

1,959 Total Bills Filed

237 Bills Tracked for APA FL

269 Bills Passed (14%)

248 Bills Signed into Law by the Governor

3 Bills Became Law Without Signature

11 Bills Vetoed by the Governor

2024: 325 Bills Passed

2023: 356 Bills Passed

Adaptive Reuse of Land (SB 1572, HB 409)

Adoption of Comprehensive Plan Amendments (HB 1561)

Areas of Critical State Concern (SB 1326, HB 995)

Building and Plumbing Permits for the Use of Onsite Sewage Treatment and Disposal Systems (SB 1120)

Building Permits for a Singlefamily Dwellings (SB 1128, HB 1035)

Community Associations (SB 368)

Conversion of Hotels into Residential Housing (SB 1036, HB 685)

Education (SB 140, HB 123)

Florida Building Code (SB 838)

Historic Cemeteries Program (SB 310)

Housing (SB 184, HB 247)

Impact Fees (SB 482, HB 665)

Land Use and Development Regulations (SB 1118, HB 1209)

Land Use and Zoning (SB 634, HB 401)

Local Business Taxes (SB 1196, HB 503)

Local Governing Authorities (SB 1188, HB 569)

Local Government Code Enforcement (SB 1104, HB 281)

Local Option Taxes (SB 1664, SB 1114, HB 6031, HB 1221)

Nature-based Methods for Improving Coastal Resilience (SB 50, HB 371)

Powers of County Commissioners to Levy Special Assessments (SB 432)

Property Owner Liability (SB 724, HB 599)

Rapid Rail Compact (SB 966, HB 833)

Regional Planning and Economic Development (SB 1264, HB 1125)

Resilience Districts (SB 1316)

Resilient Buildings (SB 62, HB 143)

Restrictions on Redevelopment (SB 452)

Solar Facilities (SB 1304, HB 1595)

Special Districts (SB 986, HB 973)

State Preemption of the Regulation of Hoisting Equipment (SB 346, HB 6009)

Transportation Concurrency (SB 1074, SB 1738, HB 203)

Water Management Districts (SB 7002, HB 1169)

Governor DeSantis signed FY 2025-2026 budget on June 30, 2025.

Budget Total: $117.4 billion ($117.9 billion passed by the Legislature).

Line-item Vetoes: $567 million in projects

Also vetoed $750 million for the budget reserve account and a plan to divert $200 million away from the Florida Wildlife Corridor.

$15.7 billion in reserves.

$830 million to fund FL’s accelerated debt repayment.

Signed $1.29 billion tax relief package.

Environment and Agriculture

Everglades

September

We are a statewide nonprofit organization providing training and technical assistance to local governments and nonprofits on all things affordable housing.

Our work covers:

• Compliance with local, state, and federal affordable housing programs

• Affordable housing program design

• Capacity building for nonprofit housing providers

• Land use policy and regulations for affordable housing

• Research & data analysis

We provide free training and technical assistance under the Catalyst program.

• State funding for affordable housing

• Amendments to the Live Local Act’s land use mandate

• Yes-in-God’s-Backyard (YIGBY) Legislation

• ADU bill (SB 184) did not pass, but local ADU policies can lead the way

FY 25 -26 FinalBudgetFY24-25

*Innovative SAIL no longer recurring

**Eligible occupations for Hometown Heroes are more limited for FY 25/26

***MSFH now only for households ≤ 120% AMI

but no longer recurring

• Live Local Act (2023) created the Innovative SAIL program and dedicated $150m/year in recurring revenue for the program until 2033.

• House Bill 7031 made the funding for this program no longer recurring

• This means this program will be subject to the annual appropriations process - housing advocates will need to continue to advocate for funding this program each year

So far from FY 2023/24 + FY 2024/25: 5,968 total units have been awarded funding.

Roughly 79% of units for developments awarded LLA Innovative SAIL funds will serve households at or below 80% AMI (4,743 units):

• 1,159 units at or below 80% AMI

• 1,915 units at or below 60% AMI

• 584 units at or below 50% AMI

• 326 units at or below 40% AMI

• 565 units at or below 33% AMI RFA 2025-216 alone: 988 rental units all for households at or below 80% AMI

• Senate Bill 110 was the Senate President’s main priority this session and did not pass.

• Would have increased the county minimum for the SHIP program from $350,000 to $1 million.

• Proposed appropriating $30 million from General Revenue to FHFC to preserve affordable multifamily rental housing in rural communities funded through USDA loans.

• Senate spokeswoman says that the Senate President intends to revive the proposal next year.

How have LLA property tax exemptions been working so far?

Middle Market (MMM) Property Tax Exemption:

Affordable housing in commercial, industrial, and mixed-use areas

Mandate contains certain use, density, height, floor area ratio, administrative approval, parking, and other standards for affordable housing developments if a proposed development meets the following criteria:

• Multifamily or mixed-use residential in any area zoned for commercial, industrial, or mixed use

• At least 40% of units are affordable rentals for households up to 120% AMI for at least 30 years

• If mixed-use, at least 65% of the total square footage must be residential

Local government cannot require a development authorized under this preemption to obtain a zoning/land use change, special exception, conditional use approval, variance, or comp plan amendment for use, density, floor area ratio, or height.

Senate Bill 1730 (2025): amended the Live Local Act’s land use mandate for affordable housing in commercial, industrial, and mixed-use areas.

New Definitions

• Newly defines “commercial use,” “industrial use,” “mixed use” and “planned unit development”

• Expands definition of “floor area ratio” to include lot coverage

Eligibility

Additional restrictions on required land use

approvals

Non-residential square

footage for mixed-use LLA projects

Zoning entitlements

• Addresses the PUD issue. Clarifies that the LLA land use mandate applies to “any flexibly zoned area such as a planned unit development permitted for commercial, industrial, or mixed use.”

• Authorizes local governments to allow an adjacent parcel of land to be included within a proposed multifamily LLA project.

• Clearly exempts recreational uses (golf courses, tennis courts, swimming pools, etc.)

Local governments now cannot require a proposed project to obtain a transfer of density or development units or amendment to a development of regional impact for the entitlements authorized under the statute.

Prohibits local governments from requiring more than 10 percent of the total square footage to be used for non -residential purposes.

• Clarifies that density, height, and FAR allowances cannot be lower that the highest currently allowed entitlement or the high est allowed as of July 1, 2023, whichever is least restrictive.

• For LLA proposals adjacent to, on two or more sides, a single-family community with at least 25 contiguous single-family homes, provides that LLA projects cannot exceed 10 stories (in addition to current option for localities to regulate height).

• Newly provides that if an LLA proposal is on a parcel with a structure or building listed in the National Register of Historic Places, the local government can limit the height to the highest currently allowed height, or allowed on July 1, 2023, for a commercial or residential structure within ¾ mile or 3 stories, whichever is higher.

Policy

Senate Bill 1730

Parking Reductions Requires local governments to reduce parking by 15% if requested by the applicant and the project is: 1) within ¼ mile of a transit stop and the stop is accessible from the development; 2) is located within ½ mile of a major transportation hub; or 3) has available parking within 600 feet of the proposed development.

Exemptions Newly exempts the Wekiva Study Area and Everglades Protection Area

Administrative approvals

Prohibits quasi-judicial or administrative board or reviewing body decisions if a LLA proposal otherwise satisfies the local comp plan and LDRs.

Civil Action Requires courts to expedite proceedings alleging that a local government has violated the LLA land use mandate statute. Places caps on attorneys fees and costs.

Building Moratoria Prevents local building moratoria that delay the permitting or construction of an LLA land use project unless:

• The moratorium lasts no more than 90 days in any 3-year period after a local assessment of the jurisdiction’s need for affordable housing.

• The moratorium is imposed or enforced to address stormwater or flood water management, to address the supply of potable water, or due to the necessary repair of sanitary sewer systems, if such moratoria apply equally to all types of multifamily or mixed-use residential development.

New Reporting

Requirement

Requires every local government beginning November 1, 2026, to provide an annual report to the state land planning agency that includes:

• A summary of litigation relating to the LLA land use mandate that was initiated, remains pending, or was resolved during the previous fiscal year; and

• A list of all LLA land use projects proposed or approved during the previous fiscal year including, at minimum, the project’s size, density, intensity, and total number of units (including the number of affordable units and associated targeted housing incomes).

Polices added in SB 1730 in green

Use

• Multifamily or mixed-use areas zoned for commercial, industrial, or mixed-use (which includes portions of property in a PUD zoned for such use) without zoning or land use change

Density

Height

• Highest currently allowed, or allowed on July 1, 2023, density on any land in City or County where residential development is allowed (least restrictive at time of development)

• Highest currently allowed, or allowed on July 1, 2023, height for a commercial or residential development within 1 mile of the proposed development or 3 stories, whichever is higher

• Exception – if proposal is on two or more sides adjacent to SF zoned property within SF home development w/ at least 25 contiguous SF homes, local gov’t. may limit height to the highest of the following:

• 150% of tallest building adjacent to development

• Highest currently allowed height for the property based on LDRs

• 3 stories, not to exceed 10 stories

• Exception – if proposal is on a parcel w/a structure of building listed in the National Register of Historic Places, the local government can limit the height to the highest currently allowed height, or allowed on July 1, 2023, for a commercial or residential structure within ¾ mile or 3 stories, whichever is higher

Polices added in SB 1730 in green

Floor Area

Ratio

Parking

• 150% of the highest currently allowed, or allowed on July 1, 2023, floor area ratio in the jurisdiction where development is allowed under the jurisdiction’s LDRs

Admin.

Approval

• Reduction of at 15% if proposal is 1) within ¼ mile of a transit stop and the stop is accessible from the development; 2) is located within ½ mile of a major transportation hub; or 3) has available parking within 600 feet of the proposed development.

• Elimination of parking requirements if proposal within an area recognized by the jurisdiction as a transit-oriented development or area

• Proposal must be administratively approved with no further action by the city/county commission or any quasi-judicial, administrative board, or reviewing body if proposal satisfies the LDRs and is otherwise consistent with the comp plan excepting density, floor area ratio, height, and use.

• Local govt must post expectations for admin approval on its website.

• If proposal also qualifies for a local entitlement bonus, bonus must be provided administratively.

Polices added in SB 1730 in green

Exceptions

• Parcels within a certain proximity to an airport runway.

• Property defined as recreational and commercial working waterfront in any area zoned industrial

• Admin approval not allowed for parcels within ¼ mile of a military installation as defined in in s. 163.3175(2).

• Wekiva Study Area

• Everglades Protection Area

Civil Actions

• Requires courts to expedite proceedings alleging that a local government has violated the LLA land use mandate statute. Places caps on attorneys fees and costs.

Tracking the Live Local Land Use Mandate for Affordable Housing in Commercial, Industrial, & Mixed-Use Areas – link here to our interactive dashboard

1 For amenities where it is desirable for housing to be nearby, this standard is used in this table to show projects within distances listed. For disamenities where it is desirable to have a buffer from housing, this standard is used in this table to show projects outside of distances listed.

Empowering faith-based groups to build affordable homes

• Passed and signed into law via Senate Bill 1730 (2025)

• Allows local governments to approve housing on certain parcels owned by religious institutions as long as at least 10% of the homes are “affordable” per s. 420.0004

• Parcel eligibility: land owned by a religious institution which

• 1) contains a house of public worship; or

• 2) is contiguous to a parcel with a house of public worship.

• This is a new optional tool for local governments to unlock faith-based land for affordable housing; SB 1730 extends the HB 1339 land use tool (2020) to faith-based land.

• The Florida Housing Coalition estimates this tool can unlock over 30,000 parcels for affordable housing statewide.

Empowering faith-based groups to build affordable homes

125.01055 Affordable housing.— (same language for municipalities)

(6) Notwithstanding any other law or local ordinance or regulation to the contrary, the board of county commissioners may approve the development of housing that is affordable, as defined in s. 420.0004, including, but not limited to, a mixed use residential development, on any parcel zoned for commercial or industrial use, or on any parcel, including any contiguous parcel connected thereto, which is owned by a religious institution as defined in s. 170.201(2) which contains a house of public worship, regardless of underlying zoning, so long as at least 10 percent of the units included in the project are for housing that is affordable.

The provisions of this subsection are self-executing and do not require the board of county commissioners to adopt an ordinance or a regulation before using the approval process in this subsection.

“so long as at least 10 percent of the units included in the project are for housing that is affordable”

• The 10% minimum is a floor – not a ceiling

• Local governments have the discretion to require a higher percentage of affordable units in a YIGBY development

• Local government also have the discretion to target lower income levels (max 120% AMI)

• Example – a City can adopt a local policy limiting use of YIGBY to projects that reserve at least 30% of the units as affordable housing to households at or below 80% AMI

YIGBY! Yes-in-God’s-Backyard

Activating YIGBY:

• Education & outreach to faith-based organizations with land that can be used for affordable housing

• Local advocacy to ensure local governments use the new optional tool

• Partnerships with faith-based organizations to build homes

Check out our Substack article on YIGBY: https://flhousingactionlab.subst ack.com/p/empowering-faithbased-organizations

• Implementing ordinance/policy? Or case-by-case approval?

Ordinance/Policy

• More predictable

• Can lay out important policy decisions such as where the tool will be used, entitlements offered, application criteria, process, etc.

• Longer to implement

• Can approve affordable homes more quickly

• Could invite claims of arbitrary decisionmaking and discrimination

• May discourage builder involvement

• Affordable housing considerations:

• Percentage of affordable homes required (at least 10% is required; LGs have discretion to go higher)

• Length of affordability (statute is silent on affordability period)

• Incomes served (max is 120% AMI); LGs have discretion to go lower

• Planning and zoning considerations:

• Applicability: where will the tool be used?

• Size or type of housing allowed

• Density, height, parking, setbacks, and all other development standards

• Application requirements

• Anti-discrimination provisions

on last day of session

• Would have required local governments to adopt an ordinance allowing accessory dwelling units (ADUs) in all single-family zones

• Expect this bill to come back next year we estimate that legalizing ADUs in all single-family areas could create between 32,000 and 58,000 new ADUs over the next 10 years.

• FHC supports ADU legislation that also addresses local “poison pills” such as restrictive size allowances, discretionary approvals, parking, and rental bans.

• This summer, we have been compiling data to address the ADU and Short-Term Rental debate.

Let’s think through a scenario!

My city provided an approval to a religious entity on the basis of A, B and C. Another religious entity has met A, B, and C. However, there’s no rule set defining what qualifies in my city for YIGBY cases.

Under YIGBY, it’s says that the City “May” – does the City have the ability to deny this new application?

RILUIPA - Religious Land Use and Institutionalized Persons Act

General rule: No government shall impose or implement a land use regulation in a manner that imposes a substantial burden on the religious exercise of a person, including a religious assembly or institution, unless the government can demonstrate that imposition of the burden on that person, assembly or institution is in furtherance of a compelling governmental interest; and is the least restrictive means of furthering that compelling governmental interest.

Past that, it’s about equal protection. May vs. Shall

How do we avoid “arbitrary” and “capricious”?

Beware how items are approved in staff reports and what’s on the record.

Aileen Bouclé, AICP Executive Director

Eliminated the distribution of documentary stamp tax revenues that previously funded the New Starts Transit Program and Florida Rail Enterprise

(a) Dedicated funding stream removed Implications:

(a) Increased funding challenges in expanding commuter rail infrastructure

(b) Less dedicated funding for transit development

(c) Less matching funds

(d) Local governments will have to look for alternative funding sources

New reporting requirements for counties that receive transit-related surtax revenues

(a) Counties must report annually to the state on total revenues received, amounts allocated to road and bridge projects, list of projects and their scope, amounts allocated to all other permissible uses, etc.

(b) Must report total expenditures and unexpended balances

Implications:

(a) Increased reporting of spending of surtax dollars and project delivery

Allows local governments to adopt an ordinance mandating photo identification and age requirements for operation of:

• an electric bicycle

• a motorized scooter

Gives local governments the latitude to provide safety training for operation of micromobility devices

Implications:

(a) Local control over regulation of micromobility devices

Mandates FDOT implement a “Next-Generation Traffic Signal Modernization Program” with the goal of improving traffic flows

(a) Provides for retrofitting of existing traffic signals and controllers

(b) Prioritizes signal upgrades based on average annual daily traffic

(c) Incorporates use of at least one advanced traffic management platform

Applies to signals on State Highway System and nonstate highway system

Implications:

(a) Improved flow and reduced congestion

Requires FDOT collaborate with MPOs to establish quality performance metrics

As a part of their LRTP, MPOs must develop targets for safety, infrastructure condition, congestion relief, and mobility within their boundaries

MPOs must report their progress to FDOT on meeting these targets

Implications:

(a) Increased collaboration between FDOT and MPO’s with respect to meeting performance measures

Mandates that project concept and PD&E studies for capacity improvement projects on limited access facilities include evaluation of using elevated roadways over existing lanes

Allows for the use of eminent domain to preserve a corridor for future proposed improvements

Implications:

(a) Expanded scope of analysis

(b) Strategic infrastructure planning

(c) Cost-efficient future construction

Prohibits the expenditure of state funds for projects or programs if those programs promote energy policy goals that are inconsistent with the State’s defined energy policy

(a) Includes public transit providers, transportation authorities, public-use airports, and seaports

Eliminated the legal framework for high-occupancy vehicle lanes across the state

Implications:

(a) Re-evaluation of programs for consistency with State defined energy policies

Expands the types of public airport and the aviation discretionary capacity improvement projects that FDOT shall provide priority funding in support thereof

Authorizes FDOT to fund infrastructure projects and projects associated with critical infrastructure facilities, within or outside of a space port territory, if the project supports aerospace or launch support facilities within an adjacent spaceport territory boundary

Requires FDOT to address the need for vertiports, advanced air mobility, and other advances in aviation technology in the statewide aviation plan and, as appropriate, in its work program

Implications:

(a) Allows for the advancement of air mobility through partnerships and infrastructure planning

(b) Promotes planning to accommodate growth, including future air mobility applications

Requires FDOT to develop standards for landscaping materials native to specific regions of the state which are reflective of the state’s heritage and natural landscapes

Provides that parking authorities may operate, manage, and control parking facilities in contiguous counties, municipalities, or other local governmental entities upon entering into interlocal agreements with the governing bodies of the appropriate contiguous counties, municipalities, or local governmental entities

Implication:

(a) Allows for collaboration amongst different governmental agencies

Expanded the scope of "hazardous walking conditions" as it relates to students walking to and from school

A walkway is now considered hazardous if the walkway is along a limited access facility defined in F.S. 334.03(12)

This can include a street or highway designed for through traffic and over, from, or to which owners or occupants of abutting land have no right or easement of access, light, air, or view

May include facilities from which trucks, buses, or other commercial vehicles are excluded; or facilities open to use by all customary forms of street and highway traffic

Implications:

(a) Allows local governments to add these considerations to their respective master plans

(b) Augments Safe Routes to Schools/Safe Routes to Parks efforts

Jim Lipsey, AICP-C Chair

Kathie Ebaugh, FAICP Planning Director

School Policy Subcommittee

Charter Schools are considered public facilities

Charter school capacity must be considered in evaluating public school concurrency OUTCOME

Signed into Law 2025 (Chp. 2025-106)

Zoning, site requirements, & transportation at charter school sites = public school sites

Local jurisdiction cannot have different standards for each OUTCOME

Signed into Law 2025 (Chp. 2025-110)

Signed into Law 2023 (Chp. 2023-16) • Public funding for all school types • Expanded public charter and private choices • No income restrictions

OUTCOME

• Cannot acquire new land

• Must surplus vacant land / facilities

• Must give 1 ROR to charters schools & affordable housing OUTCOME

Died in Committee 2024 & 2025 2026…?

• Private schools on community or public lands • No required zoning/land use changes

Signed into Law 2024 (Chp. 2024-101)

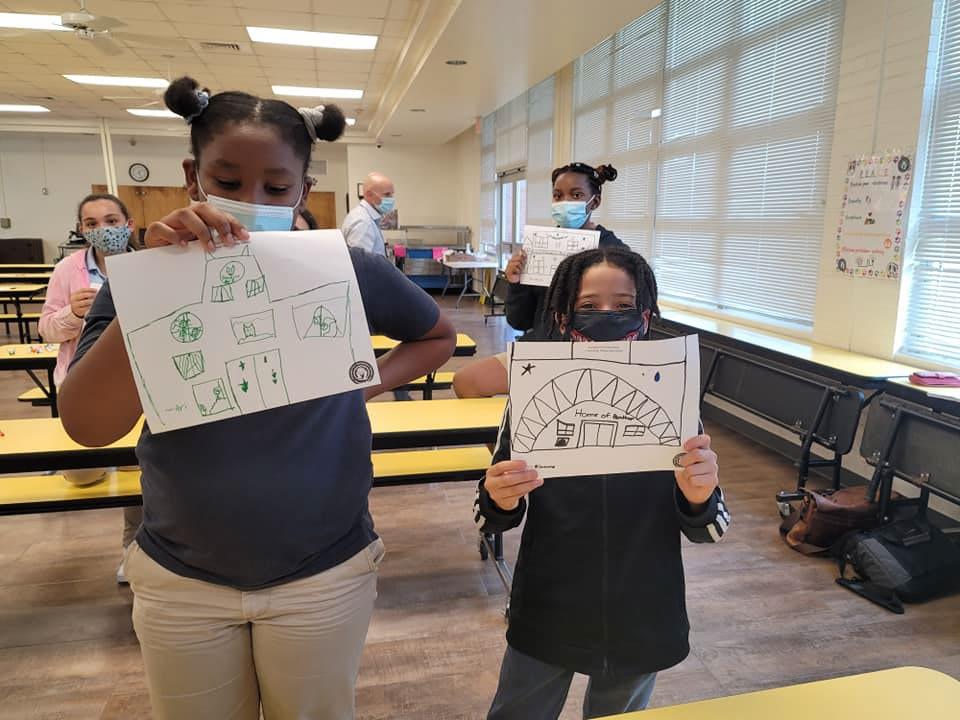

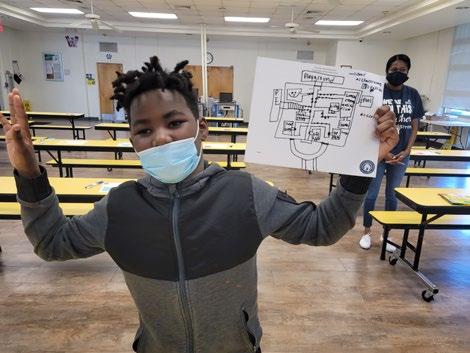

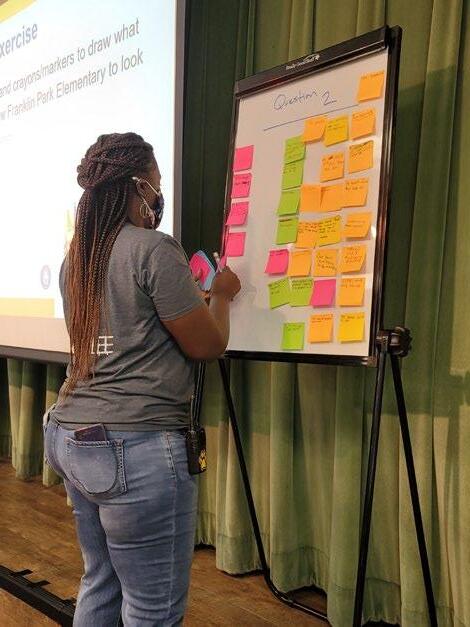

Low Enrollment School Closures Declining Neighborhoods

1. Plan for schools within Comprehensive Plans & Master Plans

2. Ensure schools are a cornerstone of neighborhoods & communities

3. Engage students throughout the planning process

Jim Lipsey, AICP-C Chair

Kathie Ebaugh, FAICP Planning Director

Local governments must now ensure that their emergency declarations and orders do not conflict with state emergency management actions or directives. If a local order is found to be inconsistent with a state emergency declaration, it is subject to being nullified by the state. Local emergency declarations must meet stricter procedural and documentation requirements, including justification standards and notification timelines. Local governments must provide the state with additional information and justification related to emergency measures, including impacts on development. SB 180 also requires contracts and expenditures made under emergency declarations to be posted online and reported to the Legislature. SB 180 further establishes timelines and requirements for reports on emergency-related spending, assets, and reimbursements.

SB 180 revises hurricane shelter funding priorities to target non-school public buildings in shelter-deficit regions. The legislation further requires special needs registration information to be shared by state agencies and housing providers and allows caregivers and dependents to stay together in special needs shelters.

continued:

SB 180 prohibits counties and municipalities impacted by a hurricane (within 100 miles of storm track) from enacting moratoria on construction, redevelopment, or more restrictive land use amendments for 1 year postlandfall. Counties and municipalities affected by Hurricanes Debby (DR-4806), Helene (DR-4828), or Milton (DR4834) are prohibited from imposing moratoria for properties damaged by these storms or adopting more restrictive land use regulations or permitting procedures until October 1, 2027. Any such actions are retroactively void as of August 1, 2024. Legal challenges can be filed to block such actions, with expedited court review and attorney’s fees for prevailing parties.

Local governments participating in the National Flood Insurance Program cannot enforce rules that count cumulative repairs or improvements over time toward substantial improvement thresholds.

Local governments and districts cannot impose impact fees on replacement structures unless the new structure significantly increases demand on public facilities.

continued:

Local governments may no longer rely on emergency powers to justify temporary land use restrictions, such as development moratoria, without facing state oversight or override.

Development moratoria tied to emergency declarations (e.g., infrastructure strain, storm recovery) may be invalidated if they conflict with statewide emergency directives.

Further, local governments imposing moratoria or halting development may face legal challenges from developers or property owners asserting preemption under SB 180.

Limits local regulatory power post-disaster, even for safety or planning concerns.

May force acceptance of redevelopment plans inconsistent with local recovery or resiliency goals.

Reduces ability to pause development while infrastructure or environmental impacts are assessed.

Could create conflict with local zoning or hazard mitigation plans.

General:

Develop protocols for expedited permitting and fee waiver systems based on current and projected needs.

Planners should work with the City Manager's Office and Public Information Officers on the posting of Emergency information, including recovery guides.

Coordinate on flood information.

Section 18 and Section 28:

“More restrictive or burdensome” is the key here

Is a rule defining something already in place or a clarification, and not really a brand new rule?

Review prior legislation for “higher order”/“higher level” functions and rules.

Review the record of Variances and determine if rule changes would have “cured” their issues.

Put aside a file folder with all Development Orders and Amendments since August 1, 2024, and review as needed.

Use distinctions between different approval processes; e.g., Building approvals rooted in the Florida Building Code are separate from Zoning and planning-level approvals in the land development regulations.

In cases where the LDR/LDC is the only amended portion, consider consistency and “root” bases in Comprehensive Plan, and when the Comprehensive Plan rule was passed:

Does a repeal of the LDR/LDC regulation render the code less or completely inconsistent with certain Comprehensive Plan rules?

Were those rules passed before August 1, 2024?

Remember that the Comprehensive Plan takes precedence.

Section 18 and Section 28 continued:

May propose new ordinances – SB 180 does not prevent this.

Consider carrots vs. sticks. Incentive and bonus programs, along with TDRs for conservation, are opt-in systems and are not more burdensome processes.

Consider words like “define” and “clarify” in your thought process for the development of new ordinances.

Consider if it makes sense to clarify something if it is originally open-ended. If you have already changed the rules, consider the reverse of the argument – clarifying an open-ended rule may seem restrictive, but may actually be less restrictive if you are narrowing the scope.

Remember that zoning in progress and moratoriums are different processes. ZIPs may cause some folks to wait and see if the rules are better for them.

Consider case-by-case relief mechanisms

Consider laying out the appeals process. Is the situation "ripe"?

Structure your staff report reasoning accordingly on higher level rules whenever possible.

Consider the timeframe for repeal (14 days) vs. Public Noticing requirements for Commission/Council. Challenges must be internally considered and decided upon quickly on whether you will repeal or hold your ground. Consider decisions within 1-2 day timeframes.

In future events, expedite before landfall.

It’s just a matter of explaining to the aggrieved, or finding another way to get to “yes.”

- Impacts - Examples

The Governor, cabinet members and state legislators “generally” can only serve for 8 consecutive years in an elected office.

House and Senate leadership, committee chairs, and committee membership change every two years.

Term limits mean consistent turnover; 75 members of the 160-member legislature have served less than four years.

There are 26 new Representatives and 12 new Senators after the last election.

2 Representatives flipped from Democrat to Republican, increasing majority to 87. Many legislators leave office early to pursue other opportunities . This also creates an open seat.

5 Representatives and 3 Senators have resigned to run for a different office this year.

January – February

Must be released by December 14, 2025

(30 days prior to start of Session) Last year:

$115.6 Billion

($3 billion less than total FY2324)

Legislative leadership decides how much money for each subject area.

Budget Conference

Mid-February – Early March

April – June

Appropriation committees create their chamber’s version of the budget with project requests.

The appropriation bills are filed, open to amendment by all members, and passed by each chamber.

Joint Budget Conference Committees negotiate over differences between the House and Senate budget bills. The Approps Chairs make all final adjustments and eliminate any outstanding differences between the two.

Final Conference Committee Report has a 72-hour window for public viewing.

Each chamber adopts the report, and votes on the final version of the budget to end Session.

The only requirement for the Legislature to accomplish during Session.

Governor signs final the budget.

Governor has line-item veto power, which allows the state’s chief executive to cancel specific appropriations. A two-thirds majority vote is needed to overturn any veto.

Senate President Ben Albritton

House Speaker Daniel Perez

Federal Funding Cut Impacts

Immigration

Tax Reductions

Property Insurance

Property Tax Reform

FL DOGE

Rural Renaissance

Congressional Redistricting

Accessory Dwelling Units Ag Enclaves Community Redevelopment Agencies

Live Local Pt. 4 Regional Planning Councils Regional Transit Authorities (HART)

Local Government Accountability Report Card Emergencies SB 180 Revision

Co-Chair Rep. Vicki Lopez (R-Miami)

• Met twice before session ended.

Co-Chair Rep. Toby Oberdorf (R-Stuart)

• Meeting September 22-23 in Tallahassee.

• Goal of the committee is to pass the house property tax plan the first week of the 2026 Legislative Session.

• The Senate does not have a committee but supports pursuing a plan to eliminate property taxes in the upcoming session.

• Governor vetoed property tax study passed by the Legislature in 2025 session.

August 18

November 21

January 7

• Members can begin filing bills and appropriation projects

• House bill submission deadline to drafting

• House appropriation project form submission deadline

• House bill submission final draft form deadline

January 9

January 13

January 16

• House bill filing deadline – 5:00pm

• House appropriation project form publication deadline – 5:00pm

• Senate bill filing deadline – 12:00pm (Opening Day of Session)

• House attestation form submission deadline – 5:00pm

• House Ceremonial Resolution submission deadline –5:00pm February 12

February 26

• Ceremonial Resolution Filing Deadline (46th Day of Session)

Agency Legislative Budget Requests

House Property Tax Comm. Meetings

Interim Committee Week 1

• Due by September 15, 2025

• September 22 and September 23, 2025

• October 6, 2025 – October 10, 2025

Interim Committee Week 2

• October 13, 2025 – October 17, 2025

Interim Committee Week 3

• November 3, 2025 – November 7, 2025

Interim Committee Week 4

• November 17, 2025 – November 21, 2025

Interim Committee Week 5

• December 1, 2025 – December 5, 2025

Interim Committee Week 6

Governor’s Budget Recommendations

2026 Legislative Session

• December 8, 2025 – December 12, 2025

• Due to Legislature by December 14, 2025

• January 13, 2026 – March 13, 2026

Deep Dive

1 – July 29, 2025 - Link: https://www.youtube.com/watch?v=eA0TdflrP3Q

Download presentation slides here: https://bit.ly/3U3IZXi

Download relevant bill text here: https://bit.ly/45c0V79

Moving Forward Together - Deep Dive at FPC 25 – 2 Law CM - (Today! slides will be posted)

Deep Dive and Next Steps – 1 Law CM

October 28, 2025 | 1 – 2:30 pm

Rural Lands and Agricultural

More on Housing, including HB 700

Annexations, like HB 384

Environmental, including SB 492 - Mitigation Banks, HB 1622 Beaches

and more!

Oct. 28 webinar registration link: https://bit.ly/legrev10-28 or