ANY SPACE. ANYTIME.

Have you unlocked your Nicotine Pouch category?

TRULS HAUG TALKS

DRS 2.0

It’s time to engage

Have you unlocked your Nicotine Pouch category?

DRS 2.0

It’s time to engage

Checkout festival raises £30k+ for GroceryAid Scotland

SLUSH SCARE

Toddler hospitalised ABUSE INCREASES

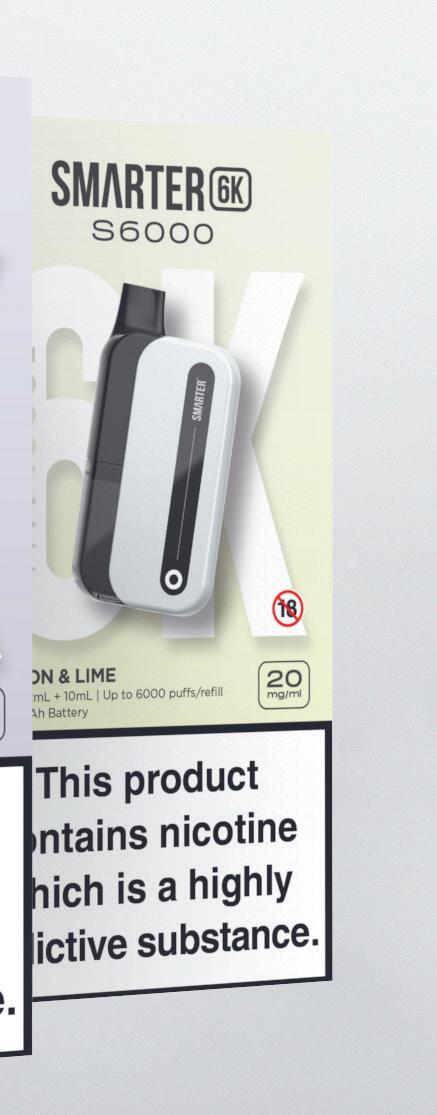

Vape ban fuels spike

06 Trade Organisations Chief Executive James Lowman to leave the Association of Convenience Stores in early 2026.

07 Own Label Co-op Wholesale restricts access to its ownbrand products as it secures a new Costcutter deal.

08 Crime A firebomb attack outside a Glasgow convenience store sparks safety concerns.

09 Politics The Scottish Retail Consortium publishes the first of three mini manifestos ahead of next year’s Scottish Parliamentary Election.

10 Safety Irvine mum slams retailer after slush leaves a threeyear-old child in A&E.

11 Vapes Nearly one-in-five Scots shop workers report a rise in verbal abuse following the disposable vape ban.

12 News Extra Shoplifting Pressure mounts on ScotGov to extend Retail Crime Taskforce financial support.

20 Product News Edinburgh’s Broadway Convenience Store features in a new campaign for Extra gum.

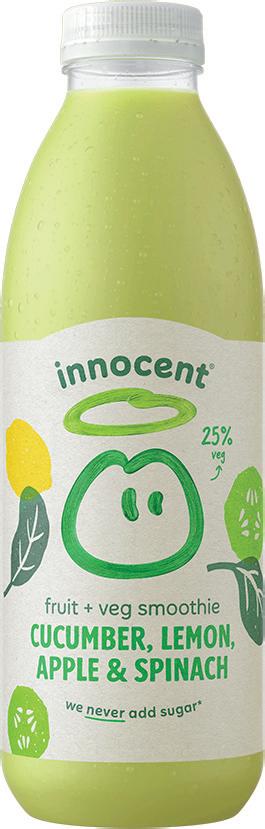

22 Off-Trade News Thatcher’s Vintage launches in cans as Smirnoff Crush makes its UK convenience debut.

25 Above & Beyond Awards 2026 It’s easier than ever to nominate colleagues who deserve some recognition.

30 Advertising Feature SPAR Scotland Discover why SPAR Scotland is perfectly placed to help grow your business at an Open Day later this month.

32 The Big Interview Truls Haug DRS 2.0 should deliver a sustainable, workable solution that benefits consumers and retailers, says Truls Haug of TOMRA Collection.

37 SLR Awards Winner’s Profile Balfron Filling Station Not only a top-notch modern forecourt store, Balfron Filling Station has also revitalised the small village it serves.

40 New Stores Greens Retail launches a new 24/7 ‘foodvenience’ format called Greens on the Go.

42 Hotlines The latest new products and media campaigns.

70 Under The Counter The Auld Boy is dismayed to discover local retailers aren’t on a list of the UK’s unsung heroes.

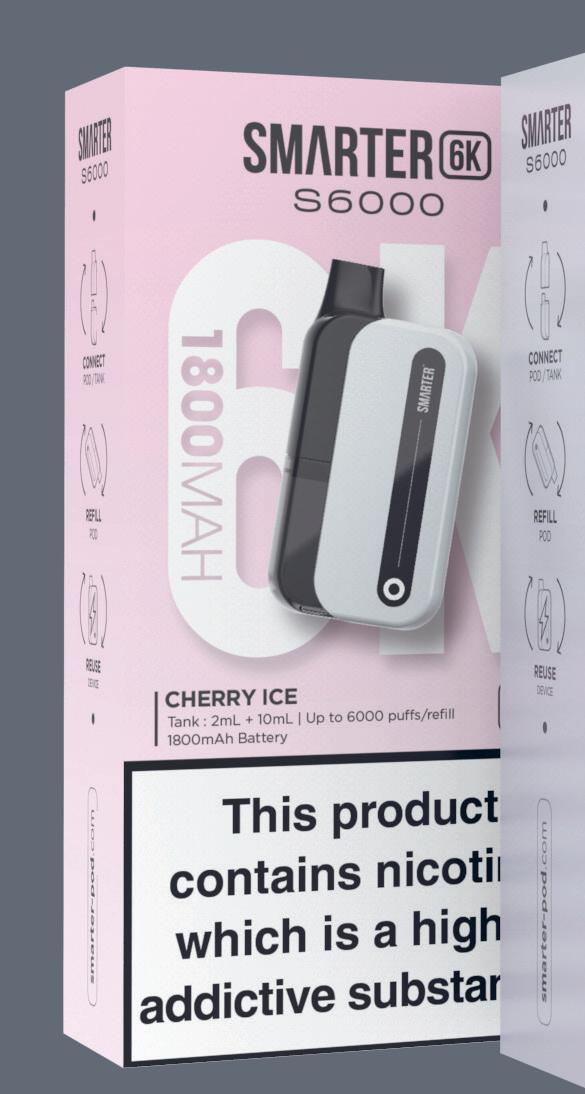

44 Smoking Alternatives The single-use vape ban has disrupted the market, but retailers are riding the storm and identifying areas of growth.

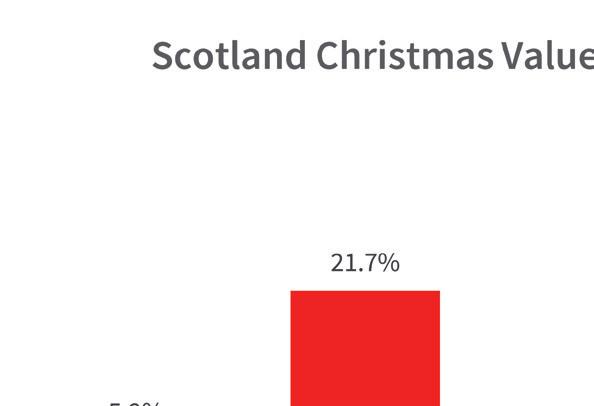

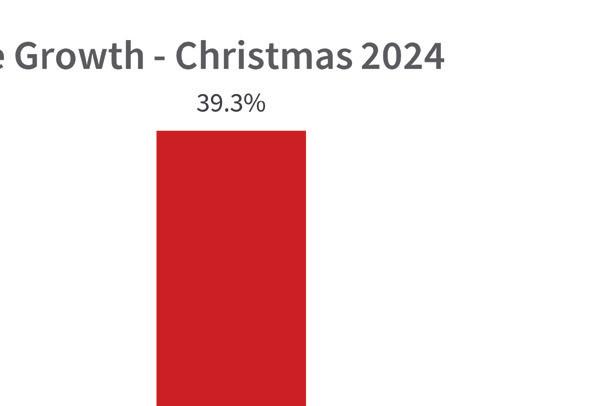

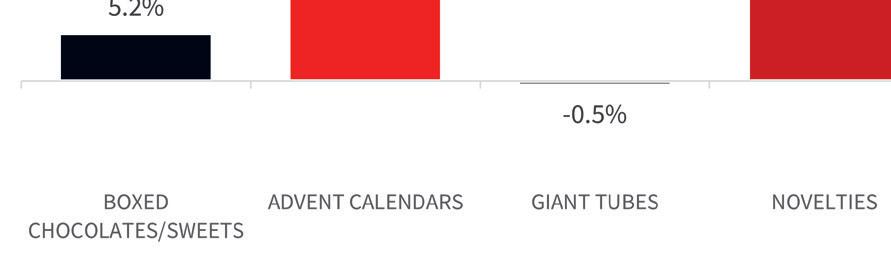

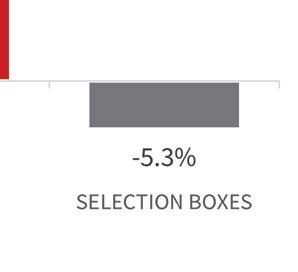

52 Christmas Confectionery We unwrap all the festive confectionery bestsellers in Scottish convenience with CD:UK data from Talysis.

60 Forecourts SLR speaks to Ascona Group about creating a winning food-to-go offer for forecourt customers.

66 Alcoholic RTDs Alcoholic RTDs hold great potential for retailers who can keep up with this fast-moving category.

The UK Deposit Management Organisation (UKDMO) has appointed John Bason as Chair, marking a key milestone in the rollout of the deposit return scheme across England, Scotland and Northern Ireland. The DMO, a business-led not-for-profit organisation, was confirmed by all three governments in May 2026 and is tasked with designing, delivering and operating the scheme, which is due to go live in October 2027.

Forecourt retailer Ascona Group has signed a new five-year contract with Co-op Wholesale. The agreement will see Co-op Wholesale continue to supply all 62 Ascona forecourts, including two Scottish sites in Grangemouth and Aberdeen, with groceries, including Co-op’s own-label range.

England

Local retailers in England could find it easier to expand after the UK Government published its business rates interim report, which states that the Chancellor will explore fixing sudden jumps in business rates – known as “cliff edges”. The report confirms that the government will review how Small Business Rates Relief can support business growth, potentially lifting growth and living standards in the future for those who work in these small businesses.

Retailers have the chance to win one of two £15,000 top prizes as part of Allwyn’s Local Retail Champions 2025 campaign. The National Lottery operator is seeking to crown the two most community-minded retailers in the UK and will award a further 16 £5,000 cash prizes for regional winners. In order to be in with a chance of winning, retailers must receive a customer nomination before 19 October.

James Lowman will leave ACS (the Association of Convenience Stores) in early 2026 a er nearly three decades with the trade organisation.

Lowman joined ACS in March 1997 and became Chief Executive in November 2006. During his tenure, he led lobbying campaigns on product regulation, trading hours, employment rules and planning policy, and appeared before parliamentary select and bill committees. He also represented the sector in print and broadcast media, and sat on boards including Community Alcohol Partnerships, the Proof of Age Standards Scheme and the London Food Board.

He chaired and spoke at industry events in the UK and overseas, and under his leadership ACS expanded

its membership to include major retail groups and more than 100 suppliers.

ACS Chair Ramesh Shingadia praised Lowman’s leadership and long-standing contribution to the organisation, saying he had transformed ACS since becoming Chief Executive in 2006.

He said: “James leaves behind not only a remarkable legacy of achievement, but also a solid foundation for ACS’s future growth and success. His in uence will be felt for many years to come, and he departs with the respect and admiration of colleagues, members, and industry partners alike.

“James’s leadership has le ACS in a position of real strength, with the structures, talent and momentum to continue building on

Midcounties Co-op CEO Phil Ponsonby has been named as the new Chair of e Association of Convenience Stores, following on from Ramesh Shingadia, who completes his two-year term in November. Spar retailer Susan Connolly will take on the position of Vice Chair, alongside Booker Retail MD Colm Johnson.

Ponsonby took up the role of CEO for one of the UK’s largest independent Co-operative Societies, e Midcounties Co-operative, in August 2018 having originally joined to run its food retail business in 2015. Prior to that, he was at the Southern Co-operative, where he was Chief Operating O cer for seven years.

Phil Ponsonby commented: “It has been my privilege to have partnered with the ACS for over 15 years, serving on the Board for nine of those. I am immensely proud to have been elected by the Board as its new Chair.”

Ramesh said: “Phil’s chairmanship will be instrumental in ensuring a smooth transition following James Lowman’s departure as Chief Executive early next year.”

Ramesh said Ponsonby would, with the support of the Board, play a key role in securing a strong successor to Lowman and continue the trade body’s mission to champion and support convenience retailers.

his achievements. We are con dent that his work has positioned the organisation for an even brighter future.”

Lowman commented: “ is is the best sector anyone could hope to represent. Every day I’ve been inspired by the people around me and by what local shop operators do.

“I’m rooting for the organisation and all of its members… It is a wrench to leave this behind, but the right decision for me now.” e ACS board has begun the process of recruiting a successor.

LOCAL SOURCING

ScotGov celebrates ‘Go Local’ with Scotmid butchery tour

Scottish Government has marked the success of the Scottish Grocers’ Federation’s (SGF’s) Go Local programme with a visit to the new butchery at Scotmid’s South Queensferry store.

Cabinet Secretary for Rural Affairs, Land Reform and Islands, Mairi Gougeon MSP, representatives from Scotland Food & Drink and the SGF joined Scotmid staff for a tour of the new in-store butchery department, operated by Edinburgh-based Charles Wilson Butchers.

Research has shown that taking part in the Go Local programme results in an average growth in sales of goods sourced from local producers of 44%.

Co-op Wholesale and Costcutter Supermarkets Group (CSG) have joined together in a new supply agreement, whilst Co-op has cut own-label supplies to several other symbol outlets.

e group ended a chilled supply deal with United Wholesale (Scotland) earlier this year and has also contacted a number of non-Nisa and Costcutter symbol retailers to end their supply of Coop branded goods.

South Ayrshire Costcutter retailer Ross Macpherson was pleased to hear that the contract had been extended with Co-op Wholesale and was also glad of its decision to stop supplying other symbols. “You’re either Nisa or Costcutter or you won’t get Co-op,” he said. “ at’s good from our point of view,” he stated, noting that some retailers tended to locate

Dawood Pervez, Managing Director at Bestway Wholesale and Katie Secretan, Managing Director of Co-op Wholesale.

Co-op branded lines against more budget own-label lines from other symbols, which “doesn’t make sense. It doesn’t help the loyalty or the brand itself”.

Bourtreehill Supermarket le the Day-Today symbol group when store owner Imran Ali could no longer access Co-op products. “ e Nisa model doesn’t suit us because the everyday prices are a wee bit higher and it’s harder to hit rebates

with them,” he told SLR. “As much as I wanted Co-op stu , I decided to change [to Booker].”

However, this has been “a blessing in disguise,” said the retailer. “Since we have changed to Jack’s by Tesco products, we are selling three plus items minimum for every Co-op item we sold and have reduced wastage by over 50% as we tightened up our range, so it’s a win-win for us.”

e store gave customers 50% o all remaining Co-op items to “save them from gathering further dust”.

A spokesperson for Co-op Wholesale said: “Co-op own brand is a unique di erentiator in the market, and together with our service and proposition, it is available exclusively to our partners. We welcome discussions with retailers who are interested in growing alongside us.”

Booker has rolled out a new last-mile delivery partnership between Scoot and Just Eat, enabling its symbol retailers to offer rapid grocery delivery without managing their own fleet.

The service is available to retailers trading under the Premier, Budgens, Londis and Family Shopper fascias, with integration into Just Eat’s courier network and technology. Orders will continue to be placed via the Scoot app and fulfilled by Just Eat couriers.

HOME DELIVERY Nationwide roll out follows success of Glasgow store

Premier Linktown Local in Kirkcaldy and Premier Forfar Road Services in Dundee went live with the service last month, and additional locations across Great Britain are being added weekly. Scoot has developed an API integration with Just Eat to simplify delivery operations for retailers. The service aims to meet growing demand for same-day and on-demand delivery, which now accounts for 80% of customer expectations.

Snappy Shopper has made its 24-hour delivery capability – spearheaded by Glasgow’s Girish Jeeva – available to stores nationwide, and has also launched a tool that helps retailers manage multiple delivery platforms at once.

Premier Girish’s @ Barmulloch became the rst store in Scotland to o er 24-hour delivery using Snappy Shopper’s new technology. Since launching the service in February, the store – which recently won the SLR Awards’ # inkSmart Innovation Award – has seen a surge in overnight orders and surpassed £100,000 in GMV over a 30-day period.

In addition, the technology rm has launched an order aggregation tool that allows retailers to manage up to six major delivery platforms, including Snappy Shopper, Just Eat, Deliveroo, Food Hub, Uber Eats and Snappy Shopper’s white-label solutions, from a single device.

Scotmid and Aldi to open adjacent stores in Uddingston

Scotmid has announced plans to lease its current retail site in Uddingston at 317-319 Old Edinburgh Road to Aldi in early 2026, while simultaneously opening a new food store in its adjacent retail units. Scotmid’s new smaller-format food store will feature an enhanced Kitchen food-to-go offer as well as a tailored retail offer that is designed to meet the convenience needs of the local community.

UWS opens London branch Glasgow-based United Wholesale (Scotland) launched its first England-based cash and carry depot in Rainham, London, on 18 September. The opening follows the group’s acquisition of Time Wholesale Services in May.

Consumer confidence drops as food inflation outpaces wages Consumer confidence has dipped as the latest Consumer Prices Index (CPI) figures show that food inflation rose above 5% in the 12 months to August 2025. While the CPI in the 12 months to August 2025 remained unchanged from July at 3.8%, the rate for food and non-alcoholic beverages was 5.1%, up from 4.9% in July, the Office for National Statistics has revealed.

to test Environmental charity Keep Scotland Beautiful teamed up with New College Lanarkshire and Coca-Cola Europacific Partners last month to trial a financial incentive to encourage recycling through the use of reverse vending machines (RVMs). Students at New College Lanarkshire received a 20p reward – redeemable at the University’s canteens – for every can and plastic bottle recycled through RVMs on campuses during September.

consults on U-16s energy drinks

The UK government has launched a consultation on banning the sale of highcaffeine energy drinks to under-16s in England due to negative impacts on children’s physical and mental health. The consultation will run for 12 weeks, gathering evidence from health experts, education leaders, retailers, manufacturers, local enforcement authorities and the public.

Scotmid raises £288,000 for Maggie’s

Scotmid’s charity partnership with Maggie’s has raised an incredible £288,000 to support people with cancer and their family and friends. Over the past 12 months, Scotmid colleagues, members and customers have taken part in a wide range of fundraising activities, from a daring Jailbreak Challenge, to a sponsored abseil down The Kelpies.

Aldi has announced plans to open new stores in Bishopbriggs in East Dunbartonshire and Dumbarton in West Dunbartonshire as part of its £1.6bn expansion plan over the next two years. In its annual trading update, the discounter said it planned to open 80 stores across 2026 and 2027. The investment will also go towards upgrading existing outlets, as well as the development of Aldi’s distribution network.

Stop marks 50 years

To celebrate its 50th birthday, One Stop launched a month-long activation plan of in-store and online special deals, customer giveaways and £25,000 worth of community grants. The in-store campaign kicked off with goldthemed point-of-sale including hanging signs and bunting. The activity also included promotions on leading brands including Cadbury, Coca-Cola, McVitie’s and Pot Noodle.

Girish Jeeva has spoken out a er a suspected rebomb attack outside his Glasgow store le a luxury car destroyed.

e retailer was working late at Girish’s @ Barmulloch when CCTV captured someone pouring fuel over his ancée’s Porsche, parked in a sta -only bay yards from the shop entrance. e vehicle was then set alight in what Girish believes may have been a targeted act linked to recent disputes over parking.

Girish risked his own safety to remove a fuel canister from the burning vehicle, fearing it could explode with sta still inside the shop. Emergency services arrived shortly a er 11pm, less than an hour a er the store had closed.

Footage of the attack shows the suspect arriving in what appeared to be a red Ford Fiesta, watching from a distance before approaching the vehicle, pouring ammable liquid over it, and setting it alight.

“I think it’s to do with the car park because we’ve had threats about it on Facebook,” Girish said. “I think someone who doesn’t like us in the area is trying to send a message.”

e incident follows Girish’s decision to introduce designated bays in the store’s car park speci cally for sta and delivery drivers, a er repeated issues with overnight parking and the from supplier vehicles. “Suppliers have said unless we give them a parking space they can’t deliver,” he said. e attack came a week a er the store clari ed the parking situation on its Facebook page, saying that, while the store owned the car park and that four of the eight bays were reserved, shoppers were “more than welcome” to use any of them if they were unoccupied.

Natalie Lightfoot of Londis Solo Convenience in Baillieston, Glasgow, has been crowned winner of the 2025 Raj Aggarwal Trophy, which celebrates exceptional community retailing.

Natalie, who also picked up the Community Retailer accolade at the SLR Awards back in June, was given the Raj Aggarwal Trophy at a parliamentary reception following the Association of Convenience Stores’ Heart of the Community Conference in Westminster.

Natalie, who runs her shop with husband Martin, is devoted to her community and is a co-founder of peer-to-peer mental health support group, Retail Family – Online Safe Space.

ACS Chief Executive James Lowman said: “Natalie is an incredible example of what it means to be an outstanding community retailer.”

He was also full of praise for award finalists, Nathalie Fullerton of One Stop Dumbarton Road and Chloe Taylor-Green of Spar Western Downs in Stafford, who have both shown “unwavering commitment to their local communities”.

Natalie said: “Becoming a community-focused store is not only a moral choice but it is a commercial strategy. We all can sell the same stock but what sets us apart is the feelings we create in our community – a sense of togetherness that builds strength and pays back in loyalty.”

e Government has ned three c-stores in the Central Belt £40,000 each for employing illegal workers.

A store on Duns Road in Gi ord, East Lothian, run by Prasath Baskaran; Lochend Store in Edinburgh; and VSR Stores Lifestyle Express and Post O ce in Alexandria, West Dunbartonshire, have each been hit with nes of £40,000 for hiring illegal workers.

e stores were named by the Home O ce in its quarterly Illegal Working Penalties report.

Employers can be sent to jail for ve years and have to pay an unlimited ne if they’re found guilty of employing someone who they knew or had ‘reasonable cause to believe’ did not have the right to work in the United Kingdom.

e Scottish Retail Consortium (SRC) has published the rst of three mini manifestos ahead of next year’s Scottish Parliamentary Election. is rst paper, ‘Scotland’s Future High Streets’, focuses on the challenges facing towns and city centres across the country and a ve-point plan highlighting the policy solutions the retail industry believes are necessary. SRC’s ve-point plan:

Q A renewed push to make Scottish High Streets competitive to invest in through a meaningfully more competitive business rate than England.

Q A drive to make new and re tted stores simpler through an improved planning and building warrants system.

Q A clear focus on combatting retail crime through increased investment in Police Scotland and introducing a directly elected Scottish Police & Crime Commissioner to replace the current Scottish Police Authority.

Q A commitment to improve local authority support for the industry, including compensating Local Authorities who use existing powers under the Community Empowerment Act to o er non-domestic rates relief for high street businesses and to explore creating a Greater Glasgow Local Authority with a directly elected Provost to drive growth in Scotland’s largest city.

Q A renewed push to improve transport infrastructure for private and public transport to make town and city centres more accessible.

Pessimistic consumers and increased costs for retailers are putting the UK’s 50,000 local shops under pressure, resulting in a fall in jobs, investment and sales, The Association of Convenience Stores (ACS) has warned.

The 2025 Local Shop Report revealed that – despite a slight rise in the number of UK c-stores to 50,486 – the number of jobs that they provide has fallen from 445,000 to 443,000; the amount invested by retailers has fallen from £1bn to £900m; and total projected sales this year have fallen to £48.8bn from £49.4bn last year.

Local retailers have faced spiralling employment costs caused by National Living Wage increases and changes to Employer National Insurance rates and thresholds, in addition to major challenges with limited consumer spending.

Retailers have also had to deal with the additional cost of vape recycling in their business, and most recently the impact on their sales from the introduction of a ban on disposable vapes.

ACS Chief Executive James Lowman said: “These figures should serve as a warning to Government that we cannot continue taking the brunt of additional costs and other burdens without the impact being felt by the communities that these essential stores serve.”

Co-op could lose Skye monopoly

Tesco has unveiled plans to open a superstore on the Isle of Skye, meaning that Co-op could lose its position as the main food retailer on the island. Concerns were previously raised over Co-op’s dominance of the island, when the retailer, which has two stores in Portree and one in Broadford, fell victim to a cyber attack earlier this year, causing supply issues.

Ethical debt resolution specialist DCBL has extended its partnership with forecourt protection expert VARS Technology for a further three years in order to tackle fuel theft. The partnership combines VARS’ advanced prevention systems with DCBL’s recovery services to help retailers combat fuel crime, which has surged in recent years. The British Oil Security Syndicate revealed that drive-offs rose from 7.6% of crimes per site in 2020 to 28.4% in 2024.

Over 100 fake Labubu toys seized from Elgin

Moray Council’s Trading Standards team has uncovered over 100 fake Labubu monster dolls at shops in Elgin town centre. The toys were poorquality copies of the collectibles made by Pop Mart, which have gone viral on social media.

Mark Aylwin has been appointed non-executive Chairman of The Wholesale Group. Aylwin, who previously chaired Unitas Wholesale, brings more than 35 years of senior experience in the UK food and drink industry. The Group has also restructured its Executive Board. Jess Douglas is now Managing Director for People and Operations, Tom Gittins is Managing Director for Retail, and Coral Rose is Managing Director for Foodservice.

An Irvine woman, whose daughter was rushed to hospital a er su ering slush-induced glycerol intoxication, has criticised the store that sold her the drink for failing to make her aware of the dangers.

Laura Allan’s three-year-old daughter, Holly, spent ve hours in A&E a er she fell to the oor an hour a er drinking the slush and projectile vomited for 45 minutes before her eyes rolled back into her head and she went oppy.

ankfully, the little girl has since recovered, but her mother vented on Facebook about JH News, which sold her the drink. “ e person that sold it in that shop knew it was for her [my daughter] and said nothing, there was no signs anywhere near those slushie machines at the front of the store. Pro t over health clearly!!”

However, JH News, which is based inside Rivergate Shopping Centre in Irvine, has disputed that the shop was at fault, posting pictures of multiple warning signs located by the slush machine and till area. “We have heard that there is some unfortunate news circulating on Facebook about a terrible reaction that a little girl has had a er having some slushie from our shop,” said the retailer. “We are so sorry to hear this, and we hope that the wee girl is doing better and our heart goes out to her.

“We cannot take responsibility for something which is the parent’s duty. We have clear signs displayed on our slushie machines informing all customers and responsible parents of the unhealthy ingredients included in the slushies and advisories on age restriction.

It is the parent’s job to judge what is suitable for their children and make a decision accordingly. We cannot police all of our customers at the till about who the slushie is for – that is their own responsibility as a parent. Again, we are sorry to hear of what’s happened to the wee girl and hope she’s all better now.”

In June Food Standards Scotland (FSS) updated its voluntary guidance, advising that slush ice drinks containing glycerol should not be sold to children aged under seven.

A 28-year-old man has been sentenced to 13 years in prison for the attempted murder of an elderly shop worker in Inverness.

Richard Wilson was convicted of attempted murder, assault and robbery after pleading guilty at The High Court in Inverness on 5 August 2025 and was sentenced at The High Court in Glasgow on 1 September.

The horrific attack took place on 12 March 2024 at a store on Torvean Avenue. The

84-year-old victim was punched multiple times and had his head stamped on after he refused to hand over £50. The attacker took several vodka bottles and made to leave the store, but then returned for a second attack on the victim and stole vapes.

After leaving the store, Wilson attempted to return for a third attack, but a brave shopper intervened and protected the victim.

Detective Inspector Caroline Mackay said: “This was an extremely vicious and despicable display of violence against an elderly shop worker.

“The man suffered serious injuries and the long-term recovery time, as well as the emotional trauma caused by this attack, cannot be underestimated.

Police Scotland Lanarkshire are appealing for information a er a shopkeeper was seriously injured in an attack in Coalburn on 7 September 2025.

At around 8.50am, the 53-year-old retailer was putting rubbish in bins beside the convenience store on Coalburn Road when he was approached by a man with a bladed weapon and slashed. e attacker then ran o towards Dunns Crescent.

e injured man was taken to Wishaw General Hospital for treatment.

e suspect is described as male, 6 , of a slim build, and was wearing black jogging bottoms, a black North Face hooded top with white writing, a black snood, white trainers and orange gloves.

Since the single-use vape ban came into force on 1 June, nearly one-inve Scottish shop sta surveyed by e Scottish Grocers’ Federation (SGF) have seen an increase in verbal abuse.

e survey, which covered 16 member stores around the country, also found 75% of shop sta think the ban has encouraged illicit trade, while almost 90% are concerned about the impact of future restrictions on illicit trade. A cost increase and avour restrictions are seen as the steps most likely to encourage illicit trade, while there is also concern that restricting avours will prevent smoking cessation among those who wish to quit.

SGF Head of Policy and Public A airs, Luke McGarty, said: “Scotland has been a trailblazer

Stores breaking rules

on smoking harm reduction. But to take the next step towards the Scottish Government’s goal of a smoke-free generation, we need to make sure that the restrictions we put in place do not have unintended consequences.

“ e members we have spoken to are deeply concerned about what they see as a growth in illicit

Scottish Trading Standards has found that up to one-in- ve retailers are selling vapes to kids.

One in seven premises visited by Scottish Trading Standards o cers sold cigarettes to an under-18 volunteer, while one in ve sold vapes to the underage tester, revealed a report from e Society of Chief O cers of Trading Standards in Scotland (SCOTSS).

“ ese are signi cantly worse results than expected and may in

large part be caused by the childappealing nature of vapes, and their wide availability in shops and service premises,” said SCOTTS.

Last year, o cers with young volunteers attempted 662 test purchases of vapes and 251 test purchases of tobacco at premises across Scotland with 131 failures for vapes, and 36 failures for tobacco, where sales were made to under-18s. In total, 263 xed penalties were issued by Trading Standards o cers.

Alexandra Connell, Chair of SCOTSS commented: “ e health of young people is a key priority for Trading Standards and smoking is the greatest threat to their health and development, especially for younger children.

“ ese results are very concerning and we will be stepping up e orts this year to support sellers with advice and continue to take enforcement action where sellers break the law.”

trade. We need to listen to them, and ensure that future restrictions – particularly those around vape avours and store placement – do not make the situation worse.

“Vaping should be for adults who wish to quit smoking, and it is right that the government take strong action to stop non-smokers – particularly children – from accessing vapes.

“But this is about striking a balance that achieves both those aims, and as usual we stand ready to help the Scottish Government to strike it.”

SGF will continue to work with the Scottish Government to ensure that future restrictions on vaping products do not result in negative unintended impacts, including fuelling illicit trade and verbal or physical abuse of sta .

Over 30,000 suspected illegal cigarettes, 15kg of rolling tobacco and £8,000 in cash were seized from a premises on Dumfries High Street on 5 September after community officers carried out a search.

Four men, aged 24, 28, 28 and 31, were arrested and charged and are due to appear at Dumfries Sheriff Court at a later date.

This follows the previous recovery of illegal cigarettes and hand-rolling tobacco worth approximately £3.5m in Dumfries on 23 July 2025.

12th round of Heart of the Community fund launches Co-op Wholesale charity, Making a Difference Locally, has launched the latest round of its Heart of the Community initiative, with £100,000 available to support local projects across the UK. Retailers supplied by Co-op Wholesale, including Nisa partners, are invited to nominate local causes to receive up to £2,000 in funding.

The Welsh Government has launched a consultation on its proposals for a deposit return scheme, which includes plans to add glass from day one and introduce a system for collecting more reusable drinks containers for refilling. The rest of the UK is set to introduce a deposit return scheme for plastic, aluminium and steel drinks containers in October 2027.

David Cooke joins Unitas Unitas Wholesale has appointed David Cooke to the newly created role of Chief Operating Officer as part of a wider reshuffle of its executive team. Cooke joins Unitas from AF Blakemore, where he served as Group Commercial Director. His arrival will see Managing Director John Kinney move to Chief Executive Officer, while recently appointed Trading Director Gurms Athwal will report directly to Cooke and join the Unitas Board with immediate effect.

In just three weeks since its launch, over £1m has been deposited with Paypal’s BankLocal service run in conjunction with Lloyds. The service sees Lloyds become the first major UK bank to launch a mobile app feature which allows up to £300 per day in cash to be paid in at over 30,000 PayPoint locations nationwide, using a simple barcode.

Scottish Grocers’ Federation

SGF is incredibly proud of our sector. We know that our members are a critical part of the communities they serve. Not just essential local businesses, many retailers know their customers as neighbours and friends.

That is why our watchwords are ‘responsible community retailing’, and that is the message SGF consistently shares.

At a time when both Westminster and Edinburgh are bringing in tighter controls, restrictions and bans across a wide range of product areas, it’s more important than ever that we show our members are doing the right thing – before the rules are made even stricter.

News that counterfeit and dangerously high-strength nicotine pouches are being sold to children in Scotland risks every retailer being tarred with the same brush.

While counterfeit branding will always be illegal, there are currently no laws on selling compliant nicotine pouches to children. Nonetheless, the Tobacco & Vape Bill will soon change that, making it illegal to sell all nicotine products to under-16s.

We have already seen that Trading Standards don’t have the resources they need, giving rogue sellers an unfair commercial advantage over compliant retailers.

If you know of anyone selling vapes or tobacco to under-18s, or supplying counterfeit and potentially dangerous products, please report them immediately. Or, if you are unsure of your responsibilities, please check our website for guidance (sgfscot.co.uk/advice-all).

That is the only way we can protect the safety of our customers and our valued sector from an ever-growing regulatory burden.

New Scottish shopli ing gures, revealing an increase of 17% yearon-year, have prompted renewed calls from e Scottish Grocer’s Federation (SGF) for sustained funding for Police Scotland to tackle retail crime.

e number of shopli ing incidents rose from 40,554 to 47,381 crimes in the year ending June 2025, according to newly released government gures. is marks a shocking 124% surge since 2021, and SGF highlights that the true numbers are likely far higher as many crimes go unreported.

SGF’s annual Crime Report 2024/2025 shows the average cost of shop the and vandalism has risen to £19,673 per store – up 38% from the previous year – with a total annual cost of approximately £102.7m.

e Scottish Government allocated an additional £3m to Police Scotland for retail crime in the 2025/26 budget, but that funding has not been extended beyond the current nancial year.

Luke McGarty, Head of Policy & Public A airs at SGF, claimed that retail crime was rising across every metric, including organised crime, and warned that the impact on sta , businesses and communities was becoming overwhelming.

“Shop sta who provide an essential local service are facing abuse and violence every day,” he

Pressure is mounting on ScotGov to extend Retail Crime Taskforce financial support.

said. “Businesses are forking out thousands of pounds for extra security and in lost goods. at is completely unacceptable.”

He said SGF welcomed the extra funding allocated last year and had been working closely with Police Scotland to support the new Retail Crime Taskforce. While progress was being made, McGarty stressed that the funding must be renewed in the autumn budget, “before the situation gets even worse”.

In the meantime, the Retail Crime Taskforce continues to work on multiple projects.

In August, local o cers acting on intelligence gathered by the Retail Crime Taskforce arrested a 45-yearold and 37-year-old in connection with 21 shopli ing incidents from supermarkets and convenience stores in Causewayside and Marchmont in Edinburgh.

While over in the west end of Dundee, a 35-year-old man has been arrested and charged in connection with 25 shopli ing o ences.

On Tuesday 9 September, the Taskforce supported o cers in Aberdeen City, Aberdeenshire and Moray as they held their rst Day of Action. Organised by Retailers Against Crime in partnership with Police Scotland, the event saw 35 crimes detected.

In total, 13 people were arrested for shopli ing, the s from tills,

assaults and robberies committed against retail workers, possession of bladed weapons and warrant o ences.

Other crimes recorded included drugs, breaches of bail, and antisocial behaviour.

Detective Chief Inspector Jackie Knight from the Retail Crime Task Force said: “ is positive collaborative working with a number of retail partners and Retailers Against Crime is vital as we detect and deter these types of o ences.”

Detective Inspector Andy Machray, North East Division’s operational lead on acquisitive crime, said: “Tackling shopli ing and other forms of retail crime is a priority and local o cers continue to work alongside the Retail Crime Taskforce colleagues to identify o enders and bring them to justice.”

Intelligence Co-ordinator at RAC CIC, Natasa Wilson, said: “ e feedback we received from the retailers was incredibly positive, with many sharing that the event was encouraging, reassuring and a reminder that they are not alone in tackling these challenges.

“ is is exactly why Days of Action are so valuable. ey bring us all together, build con dence within the retailer sector and create a stronger united front against retail crime.”

If you were lucky enough to be at the recent Checkout Scotland music festival in Glasgow, I hope you agree with me when I say that helping raise money for charity shouldn’t be this much fun.

As a general rule, raising money for charity involves something deeply unpleasant like running a marathon or jumping off a bridge with a length of rubber attached to your leg the only thing between you and certain death.

So to rock up to a music festival, enjoy a few beers with around 550 industry colleagues and then listen to Peter Andre and Callum Beattie knocking out some banging tunes seems like one of the more pleasant ways to raise money.

I must declare a personal interest here as Checkout Scotland 2025 was the fourth running of the event, but it was the first year that I had the privilege of chairing the Checkout event committee. Thanks must also go to GroceryAid Scotland chair Matthew Howie who committed endless hours to helping deliver what was a massively successful event.

So I’m doubly chuffed that the event went so well and feedback from sponsors and attendees was uniformly and unequivocally positive. With your support, we raised more than £30,000 for GroceryAid Scotland and every penny will be spent supporting industry colleagues in Scotland.

Even more important than the cash, however, is the role that Checkout has played in transforming awareness of the charity and the free and confidential emotional, practical and financial support it can provide to colleagues in Scotland. The more people up here know that GroceryAid is there and can help, the better.

The number of people in Scotland requesting support has more than doubled in the last couple of years and that’s partly down to the sustained challenges we all face in this industry but it’s also down to the fact that colleagues needing help now know there is somewhere they can go.

And we achieved all of that by putting on a party, coming together and having a laugh. Doing good really shouldn’t be this much fun – but at Checkout, it is. So make sure you get involved next year, either by sponsoring or by buying a ticket. It’ll be the best £95 you ever spend.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor

Antony Begley abegley@55north.com

Deputy Editor Sarah Britton sbritton@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

More than 550 people from the retailing and wholesaling sectors attended last month’s spectacular Checkout Scotland music festival as the charity event continues to go from strength to strength.

BY ANTONY BEGLEY

550+ attendees

£30K+ raised

As industry events go, it’s probably no exaggeration to say that last month’s Checkout Scotland at BAaD in Glasgow is right up there with the best in the calendar. A record audience of more than 550 people attended the fourth running of GroceryAid Scotland’s agship annual event and feedback makes it clear that a jolly good time was had by all.

Australian pop star and TV sensation Peter Andre drove the audience ‘Insania’ with a blend of pop, reggae and R&B from the main stage and was clearly a highlight of the evening for many, closing a high-energy set with his biggest hit, Mysterious Girl.

Headline act Callum Beattie then took to the stage to blast out a mix of his chart-topping hits and crowd-pleasing cover versions. ese included the James classic Sit Down (everyone did) and an emotional rendition of Dougie MacLean’s iconic Caledonia to round o his set.

In between times, George Bowie hit the decks and had the room bouncing o the walls while DJ Naeem closed the evening with his unique mashup of beats and Bhangra, complete with live drummers.

And even before all of that, attendees had the chance to chill out in the outdoor courtyard, listen to DJs, sample products from sponsors, get themselves decked out in Buckfast hats and Four Loko Hawaiian shirts, and catch up with old friends while making some new ones too.

Created principally to help raise awareness of the GroceryAid charity in Scotland, Checkout Scotland is now in its fourth year and provides the perfect platform to make more people than ever aware of the nancial, emotional and practical support that GroceryAid can provide to industry colleagues in need of a little help.

ere’s no question that Checkout Scotland has been pivotal in increasing awareness of GroceryAid up here and that can only be a good

thing with the retail environment tougher than ever in so many ways. Demand for GroceryAid’s services has risen dramatically in the last couple of years which re ects the fact that more colleagues then ever need some support, but it also shows that more colleagues than ever now know there is somewhere they can go to get that help.

Checkout Scotland has been key in driving that transformation, but the event also plays a major role in generating vital funds for GroceryAid to allow the charity to continue ramping up the services it provides north of the border and the money it spends on grants and other nancial support.

“We are absolutely delighted that Checkout Scotland raised in excess of £30,000 for GroceryAid last month,” says Matthew Howie, Chair of GroceryAid Scotland.

“Every penny of that money will be spent helping our industry colleagues in Scotland and everyone who attended Checkout or who donated in any way to GroceryAid Scotland should be proud of what they have helped achieve.

“Just as important however is the fact that awareness levels of GroceryAid are higher than they’ve ever been in Scotland and that’s in no small part down to the success of Checkout Scotland. Our plan from day one has always been to create a truly enjoyable, relaxed event with a great atmosphere that most de nitely has a Scottish avour to it.

“ e feedback from retailers, wholesalers, suppliers and everyone else from last month’s event has been truly overwhelming and it’s clear that Checkout Scotland has a bright future.

ere’s no other event like it in Scotland and I would urge everyone in our sector to get involved next year whether that’s as a sponsor or just in buying some tickets. ere’s no better way of doing your bit while also having an unforgettable night out with colleagues from the industry.”

If you are interested in getting involved in Checkout Scotland 2026, get in touch with the Event Chairs:

Antony Begley –abegley@55north. com

Matthew Howie –matthew.howie@ groceryaid.org.uk

Weetabix

Caramelised Biscuit is now available in a new £3.89 pricemarked pack from BestwayBatleys, Booker and Unitas. The flavour, which debuted earlier this year, is the fastest-growing new variant of the last year within the cereal category and is worth over £1m already. The product has also been named a finalist in the Store Cupboards category of The Grocer’s 2025 New Product Awards.

Gulf UK has partnered with Sony Pictures to launch a nationwide giveaway tied to new movie, A Big, Bold, Beautiful Journey, which stars Colin Farrell and Margot Robbie. The promotion offers Gulf UK customers the chance to win a road trip along Italy’s Amalfi Coast, including car hire, flights and four-star accommodation. Instant win prizes such as cinema tickets and movie merchandise are also up for grabs.

Bespoke Foods unveils first Easter range

Empire Bespoke Foods has launched its first Easter range, featuring biscuits, chocolates and luxury seasonal treats from leading European bakeries and confectioners. The range has been curated to help retailers offer something different to their usual Easter lines, with a focus on premium products from family-owned German and Italian producers. All products are suitable for vegetarian diets.

New York Bakery has launched into 192 Booker depots with two of its bestselling lines – New York Bakery Original Bagel and New York Bakery Sesame Bagel. With a 29-day shelf life, the Original and Sesame bagels help to minimise wastage while maintaining freshness. Bagels continue to grow in popularity, with recent Kantar data showing they score highest for enjoyment versus other morning goods.

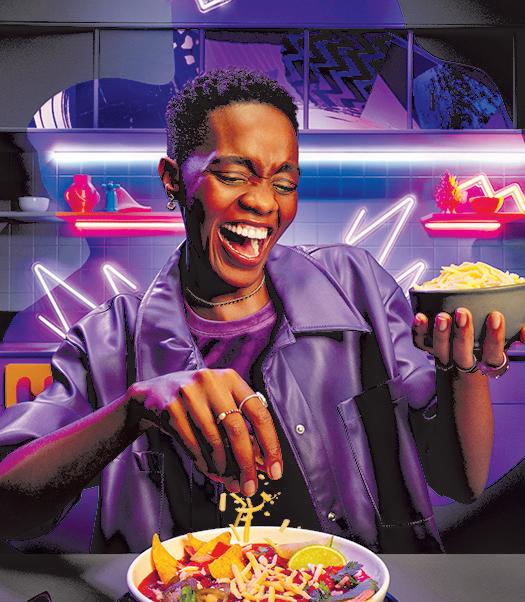

Mars Wrigley’s gum brand Extra brought its new ‘Boss Breaks’ campaign to Edinburgh last month, transforming Broadway Convenience Store into a moodboosting reset space for young professionals.

From 19–25 September, Dennis and Linda Williams’ store hosted a ‘Boss Breaks’ takeover, o ering friendly chats, a listening ear, and free packs of Extra gum. e initiative is part of a campaign positioning independent retailers

Cadbury is relaunching its Secret Santa Postal Service, giving consumers the chance to send a free bar of Cadbury chocolate anonymously in the lead-up to Christmas.

The campaign will run throughout November and December, with entry via QR codes on digital and static posters nationwide.

The campaign will be supported by TV, video on demand, cinema, out-of-home advertising, social, print, radio and digital activities.

as community connectors, helping workers reset during their day. e campaign is rooted in new Extra research showing that 94% of Gen Z frequently face work-related micro-stresses, with 69% saying that chatting with a shopkeeper could help li their mood.

Retailers involved were trained by a life coach to help shoppers pause and de-stress. Each store also bene tted from national PR and social media support to drive awareness and footfall.

Doritos has launched a limitededition Black Garlic Dip and Stranger Things-themed partysized bags to coincide with the final series of the Netflix show.

The spooky black-coloured dip is designed to complement Doritos crisps and is available in the run-up to Halloween.

Stranger Things-themed pack designs also roll out across Monster Munch, Wotsits, Quavers and Squares.

Coca-Cola Europaci c Partners (CCEP) is giving Premier League fans the chance to win thousands of football-themed prizes with its new Fantasy Premier League Challenge on-pack promotion.

e promo is backed by a marketing campaign that includes a Sky Sports tie-in, social media and in uencer activity, and online, TV, digital and out-of-home advertising. POS and digital assets are available from My.CCEP.com.

Fanta has partnered with Universal Pictures and Blumhouse to launch a global Halloween campaign featuring four horror characters: Chucky, Freddy Fazbear, e Grabber and M3gan.

e collaboration coincides with the release of Black Phone 2 (in cinemas 17 October) and Five Nights at Freddy’s 2 (5 December), both from Blumhouse.

e characters appear on limitededition Fanta cans, including a new avour: Fanta Forest Berries Zero Sugar, created for Chucky. Other

pairings include e Grabber on Fruit Twist, Freddy Fazbear on Orange Zero Sugar and M3gan on Lemon. Fans can scan QR codes on cans to access exclusive content.

to the end of October, with the

e campaign will run through to the end of October, with the horror icons appearing on packaging, in stores, vending machines and popping up in real-life experiences.

e full Fanta Halloween Collection is now available nationwide.

A host of classic cars took over forecourts across the UK last month – including this Morris Minor from the Glasgow Moggies club seen at Gulf Lowmoss in Bishopbriggs – as part of Gulf’s Big Journey campaign. The event, organised by Certas Energy in collaboration with Gulf forecourts and car clubs nationwide, was held to celebrate the UK’s rich motoring heritage.

Besides checking out the vintage motors, Gulf customers also had the chance to enter prize draws for special Gulf UK merchandise, cinema tickets and a road trip around the Amalfi Coast.

Purdey’s has launched a new identity across its natural energy drink range, including refreshed packaging and new avours.

e updated line-up includes Berry & Dragon Fruit, Orange & Mango, and a reformulated Apple & Grape. Each variant contains 34–35% fruit juice, natural ca eine, B vitamins, botanicals and guarana. e drinks deliver at least 60mg of natural ca eine per can.

e reformulated Apple & Grape blends crisp apple and grape juices. Berry & Dragon Fruit combines blackberry and dragon fruit, while Orange & Mango o ers a citrus and tropical mix.

e brand refresh aims to capitalise on the growth of natural energy drinks, which are expected to reach £156m by 2027.

e new packaging features a sleek design with clearer avour callouts to aid shopper navigation.

Purdey’s is available in 330ml sleek cans (RSP £1.95), 4 x 250ml slim can multipacks (RSP £4.75), and 12 x 330ml sleek can online packs (RSP £18.49 via Amazon, Ocado and TikTok Shop).

Cadbury Brunch has unveiled new packaging featuring bolder graphics and a stronger use of the brand’s signature purple, designed to highlight taste credentials and ingredients. The revamped range also now includes a 10-bar value pack for Chunky Choc Chip which is available now in shelf-ready cases of six with an RSP of £2.49 per 280g pack.

£24m in first year

Cheez-It Snap’d has reached £24m in value sales just one year after launching in the UK.

Kellanova’s newcomer has shifted 16.3 million units to date – equivalent to one pack sold every two seconds. The milestone coincides with the brand receiving a star at the Great Taste Awards 2025 for its Double Cheese snack.

Chocolate drink brand Chocomel has ditched its 250ml can in favour of a 300ml bottle, following a sell through period. The new packs offer easy sleeve removal, with a tethered cap to reduce littering. The move to a bottle format removes the risk of dented cans, which will reduce wastage. The change will be supported with significant marketing support over the next year across all channels, including a mainstream media campaign in 2026.

Storck’s festive makeover

£18.49 via Amazon, Ocado and TikTok Shop). e launch is supported by in-store activations, point of sale materials, sampling,

e launch is supported by in-store activations, point of sale materials, sampling, PR and in uencer partnerships.

Storck has launched limitededition Christmas-themed packs for its Werther’s Original, Toffifee and merci brands. The new packs are supported by festivethemed POS for retailers to increase visibility and shopper engagement. Last year, the seasonal confectionery market reached £2.7bn in value in the run-up to Christmas – year-onyear growth of +8.3%.

Advertising watchdog bites

Jägermeister and Strongbow have withdrawn social media ads following rulings by the Advertising Standards Authority (ASA). The ASA said two offending Jägermeister adverts implied alcohol was “a key component of social success”. A sponsored post on comedian Al Nash’s Instagram account was also panned, for suggesting that Strongbow was more important than personal relationships and significant life events.

backs Scotch Whisky duty freeze call UKHospitality has joined the Scotch Whisky Association in urging the UK Government to freeze alcohol duty in next month’s Autumn Budget. The call comes amid rising concern over job losses in hospitality and whisky production, and cost burdens in both the on- and offtrades. Whisky and other spirits face the highest tax burden of all alcohol categories, and the highest rate in the G7.

co-founder Dickie calls time

Martin Dickie, co-founder of BrewDog, has left the business after 18 years. In an internal email to staff, Dickie cited personal reasons for stepping down. He founded BrewDog in 2007 alongside James Watt, who stepped down as CEO last year to take up the new role of “captain and co-founder”. It is understood that Dickie has invested £20m in a new medicinal cannabis venture.

Hoppy hour

Belgian beer brand Chouffe has launched its 9% ABV IPA in the UK (RSP £3.25/330ml). It is initially exclusive to Waitrose, with a wider distribution planned for the coming months. The IPA offers a vibrant hoppy character with Chouffe’s signature fruity and spicy notes. The UK debut coincides with a global rebrand, featuring a refreshed gnome mascot, Marcel, on new packaging.

CIDER Launch comes in response to growing consumer demand for more sustainable formats

atchers Cider has launched its award-winning atchers Vintage in 440ml cans.

e move re ects what the brand says is growing consumer demand for premium cider in a more versatile, portable and sustainable format.

atchers Vintage is a medium dry 8.3% ABV cider produced at Myrtle Farm in Somerset using a mixture of bittersweet and modern apple varieties. It is pressed, blended, matured and canned on site.

e cider is the fastest-growing established premium cider, up 104.4% over two years, while the premium cider category is up 23.7% year on year.

Jon Nixon, Commercial Director at atchers Cider said: “Cans continue to grow in popularity –they’re lighter, easier to recycle, and as consumers increasingly look for sustainable options, even in premium products, they o er a great alternative.”

atchers Vintage 4 x 440ml can packs are available now, RSP £6.49.

Hard Rock Cocktails has launched in the UK, bringing six pre-mixed drinks inspired by classic Hard Rock Cafe recipes to shelves in ready-to-drink cans.

Each flavour is designed to deliver bar-quality taste with no mixing required. The range includes Mojito, Peach Punch, Mango Mojito, Pink Coconut Breeze, Piña Colada and Passion Fruit Martini. It is available in Scotland from Booker in 250ml cans (ABV 5%).

CIDER Heineken brand makes major inclusivity move

Strongbow has started rolling out NaviLens QR codes across all of its SKUs. e high-contrast markers are readable by smartphones and link to the NaviLens app, which provides blind and partially sighted shoppers with key product information including ingredients and ABV, as well as brand content and store navigation.

Japanese shochu brand iichiko has signed an exclusive partnership with spirits distributor Speciality Brands.

This sees the launch of three expressions in the UK: Saiten (70cl, 43% ABV, RSP £42.50), Shinwa (70cl, 43% ABV, RSP £42.50) and Silhouette (72cl, 25% ABV, RSP £25).

Shochu is a traditional Japanese distilled spirit typically made from barley, sweet potato or rice. Unlike sake, which is brewed, Shochu is distilled – giving it a cleaner, drier profile.

Smirno has launched a new ready-to-drink range in the UK called Smirno Crush, featuring two fruit-forward avours: Mango & Peach and Lemon & Lime.

e 6% ABV drinks come in 440ml cans and are available exclusively from Booker depots and One Stop stores. A national rollout is planned for early 2026.

Smirno Crush was previously launched in Australia, where it became

LIQUEURS Quincentenary celebrated with five new designs

Disaronno is marking its 500th anniversary with the launch of ve limited-edition bottles, available from October across grocery, convenience and specialist retailers.

e designs – titled Passione, Bellezza, Dolcevita, Stile and Eleganza – aim to drive shopper interest in the run-up to the festive season.

e launch will be supported by a multimillion-pound campaign spanning in-store; in-bar; traditional, retail and social media; and PR.

It follows a strong year for Disaronno Originale, which grew +2.7% in value and +0.4% in volume, outperforming the Non-Cream Liqueurs market. Parent company Disaronno International UK was the only top 20 spirits brand in growth MAT, up +0.2% against a total spirits decline of -8.9%.

Disaronno’s origins date back to 1525, with the current recipe rediscovered in 1600 by Giovanni Reina. e brand is now sold in over 160 countries.

the most successful premix category launch since 2022. According to Smirno , 72% of Australian consumers who tried the product went on to repurchase.

e launch is timed to coincide with the back-touniversity period and the lead-up to the festive season. It will be supported by a marketing campaign focused on impulse and convenience channels, alongside in uencer activity on social media.

Jura has replaced its 10 Year Old Single Malt with a 12 Year Old expression as the new entry point to its aged range and has unveiled new pack designs aimed at making whisky easier to shop.

The move follows consumer tests which found Jura 12 Year Old was preferred by a wider audience, including younger and more frequent whisky drinkers.

To support the change, Jura has redesigned packs across its single malt range, featuring a simplified flavour scale that highlights the three most prominent notes in each whisky. New packs also feature a larger age statement and an enhanced bottle silhouette, alongside a QR code linking to further information.

Win a big weekend with VK RTD brand VK has launched a new on-pack promotion that gives shoppers the chance to win 48 hours of non-stop partying for themselves and three friends on a Butlin’s Big Weekender. There are five weekend breaks up for grabs and the prize also includes a hamper full of VK goodies worth more than £200 to help get the party started. The promotion runs until the middle of December.

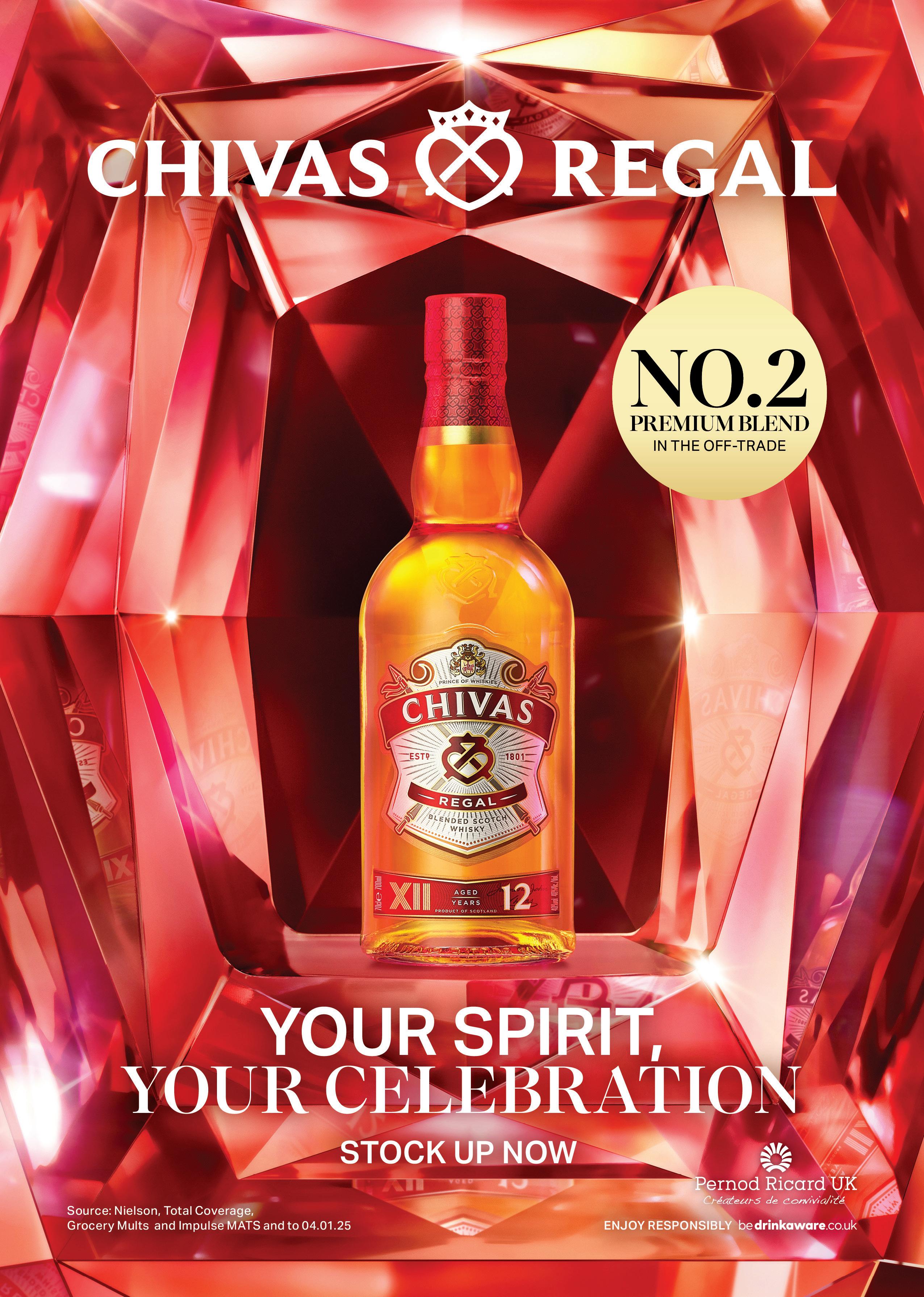

Pernod’s UK brands hold firm in global slowdown

Pernod Ricard has reported a dip in global sales for the year to June, but its key brands in the UK convenience channel remain steady. In the UK, Pernod Ricard maintained market share, with strong performances from Jameson and Chivas Regal helping offset wider European declines. RTDs grew 7% across the group’s portfolio, reflecting the continuing popularity of the category with drinkers.

Glen Moray’s tequila foray Glen Moray has launched two limited-edition single malts: Glen Moray Tequila Cask Finish (RSP £85) and Glen Moray Peated Tequila Cask Finish (RSP £95). The 10th release in the Elginbased distillery’s experimental Warehouse 1 Collection, the new sweet and herbal whiskies mark Glen Moray’s first foray into tequila cask maturation. Only 474 bottles of each have been produced.

Low-calorie canned cocktail range, This Is Skinny, is now available to convenience retailers. The 250ml, 4% ABV range includes Long Island with Earl Grey, Mojito with Rhubarb, and Passion Martini with Strawberry. Each contains fewer than 66 calories and no added sugar. They are also gluten free, keto friendly and suitable for vegans. Email jan@thisisskinny. co.uk or call 0203 773 5743 for stock enquiries.

SLR’s unique and hugely successful Above & Beyond Awards are back for 2026 – and it’s easier than ever to nominate colleagues who deserve some recognition.

The SLR Above & Beyond Awards are now in their third year and have been hugely popular thanks to their unique goal of recognising and rewarding the shop oor heroes that help demonstrate why the local retailing sector is so very special to communities across Scotland.

e Awards were created as a platform to highlight the o en incredible actions of store sta that more o en than not go entirely un-noticed. From literally saving customers’ lives to totally reworking stores and training sta to accommodate the needs of patients at a nearby dementia hospital, the Awards have already unearthed some truly heroic actions where store sta have clearly gone above and beyond the call of duty.

is is what separates local retailing from all other channels, and this is what makes the SLR Above & Beyond Awards so vital and necessary.

e entry process is nomination-based and allows anyone in a store to nominate a colleague for the Above & Beyond Awards. is year we are making the entry process even simpler than before. All you have to do is complete the very brief entry form online ( nd it at slrmag.co.uk/ aboveandbeyond) and then provide us with some basic information

like the nominee’s name, job title and phone number along with one or two bullet points on why you believe your nominee should be considered for an award.

We will then call every nominee to nd out a little more and gather the information we need to share your nominee’s story with the world. It’s that simple.

When all of the calls are complete, we will create an extensive list of nalists, and all nalists will be invited free of charge to a celebratory lunch at the exclusive Corinthian Club in Glasgow on the 18 March 2026.

Working with our generous sponsors, we will ensure that everyone joining us is treated to a magical day, a great meal, a few drinks and the chance to catch up with fellow shop oor superheroes and learn more about why local retailing is the heartbeat of every Scottish community.

So please don’t hang around: it takes less than a minute to get a nomination in and that little bit of e ort could end up making all the di erence to your nominee. It’s never been more important to give our hard-working store colleagues the recognition they so thoroughly deserve.

It couldn’t be quicker or easier:

Q Find the simple nomination form online: www.slrmag.co.uk/aboveandbeyond

Q All we need from you is some very basic information like: the nominee’s name, job title and contact telephone number.

Q one or two bullet points on why you believe your nominee should be considered for an award.

Q Complete and return to events@55north.com

Q Contact Cara with any questions: cbegley@55north.com

Q Our judging panel will then personally call every nominee to find out a little more from them. It’s a very informal and relaxed call and allows us to gather the information we need to share your nominee’s story with the world.

Sponsored by Mondelez International

Open to all colleagues working in independently owned local retailing stores in Scotland that are unaffiliated or members of any symbol group, fascia or franchise.

Sponsored by CJ Lang / Spar Scotland

Open to all colleagues working in CJ Lang companyowned stores in Scotland.

Open to all colleagues who have materially improved their store’s performance by suggesting or introducing a new concept, product, service, communication method or a change in operational process.

Open to all in-store teams which have pulled together to make a positive difference to their store’s performance and/or to their community.

Sponsored by Coca-Cola Europacific Partners

Open to all colleagues aged 25 or under working in any of the store formats detailed above who have shown themselves to be outstanding colleagues with a bright future in the sector ahead of them.

Sponsored by Mondelez International

Open to all colleagues working in any of the store formats detailed above who have worked in the sector, or a single store or chain, for an extended period of time.

Open to all colleagues working in any of the store formats detailed above who truly went Above & Beyond to perform an astonishing act that had a massive positive impact on a customer, colleague or the community.

We are delighted to confirm that The Scottish Sun, Scotland’s best-selling newspaper, is once again our official Media Partner for the SLR Above & Beyond Awards 2026.

The Scottish Sun will run national editorial encouraging readers to nominate local store staff who have been particularly helpful and deserve recognition at the Awards.

In addition, the editorial on past winners plays a vital role in highlighting to readers the important role that local stores play in communities across Scotland.

Scottish Sun Editor-in-Chief Gill Smith said: “The Scottish Sun is once again delighted to be Media Partner for the SLR Above and Beyond Awards.

“We rely on convenience stores to sell our papers day in and day out, and these awards honour the often unseen work of the people who run them. From life-changing community schemes to going beyond the call of duty to help individuals, local retailers are a vital lifeline for many Scots and it’s fantastic to be able to celebrate them.”

Alison helped save the life of an elderly customer who didn’t arrive for his daily morning paper as usual. Alison went to his house where she discovered that he had had a serious accident and had been unable to call for help. Alison quickly raised the alarm, calling the emergency services, and the customer’s life was saved.

“The Above and Beyond Awards were such a fantastic experience,” Alison says. “I’d never really considered that I was doing anything that special or ‘astonishing’ until I was nominated, so it was really lovely to be told that and to meet so many other inspiring people.”

“As the provider of iconic brands such as Cadbury, Bournville, OREO, Maynards Bassetts, belVita and Dairylea, Mondelez International recognises the vital role independent retailers play in connecting our snacks with consumers nationwide. We’re proud to celebrate and reward those who consistently go the extra mile for their shoppers, their teams and their communities.

“Mondelez International is delighted to sponsor the Independent Store Colleague and Long Service categories at the SLR Above & Beyond Awards, honouring some of the most exceptional individuals in independent retail. Best of luck to all entrants!”

“Our team members are undoubtedly our greatest asset, a fact that is clearly recognized and appreciated by our customers. We understand that convenience store staff often work tirelessly behind the scenes, truly serving as the unsung heroes of the community. It’s a privilege for us to participate in industry awards that celebrate and honour their dedication and hard work, highlighting their invaluable contributions.”

Kate Abbotson - Senior External Communications Manager CCEP

Coca-Cola Europacific Partners is proud to celebrate the exceptional contributions of independent retailers through our sponsorship of the Independent Store Colleague & Long Service categories at the SLR Above & Beyond Awards. As the distributor of some of the world’s most loved brands—including Coca-Cola, Fanta, Sprite, Schweppes, and Monster—we recognise the vital role independent retailers play in bringing our drinks to communities across the UK. Their dedication ensures that consumers can enjoy our products wherever and whenever they choose. We’re delighted to support and honour those who consistently go above and beyond for their shoppers, their teams, and their local areas. These awards shine a light on the passion and commitment that drive independent retail forward. Best of luck to all the nominees.

If you are interested in learning more about why SPAR Scotland is perfectly placed to help you grow your business, why not join us at our Open Day this month?

SPAR Scotland is uniquely placed to help you grow your business in the months and years ahead thanks to our unmatched proposition – and we are o ering every local retailer in Scotland the opportunity to come along to our Open Day this month and nd out precisely why.

To help retailers nd out more about the unique capabilities of SPAR Scotland we are hosting an Open Day on Wednesday 15 October at our Depot in Dundee.

Why not come along and bring a retailer or two who would like to Discover SPAR Scotland and nd out for themselves why we are the number one team in the country when it comes to growing independent retailers’ businesses?

The Open Day includes an introduction to SPAR from CEO Colin McLean and Independent Sales Director Brian Straiton, followed by a depot tour. This takes retailers from the point of order capture all the way through to the stock being loaded onto the vehicle.

Retailers will also be given a demonstration of our telematic software which tracks our vehicles and ensures they are on time.

Following this, retailers return to the conference room for lunch, and some interactive sessions with our Executive Team who will present the key functions of their department.

Retailers are encouraged to ask questions and will be given the opportunity to have one-toone chats with Executive Team.

Email discover@sparscotland.co.uk to book your place or nd out more.

Day: 15 October

DISCOVER WHAT YOU CAN ONLY ACCESS WITH SPAR SCOTLAND

Award-winning SPAR own-label range – a unique point of di erence

Exclusive partnership with Barista Bar hot drinks

First-to-market access to NPD – like Prime, Feastables and MAS+

The only Scottish wholesaler to regularly advertise on STV

Not just a wholesale partner, we’re a retailer with stores across Scotland

SWA Symbol Group of the Year – for three consecutive years

DISCOVER THE BEST SUPPORT NETWORK IN SCOTLAND

A one stop shop from the moment you onboard to the SPAR family of retailers

A local brand with a national and global support network

Market-leading business development team

Regular multi-temp deliveries – ensuring stock when you need it most

Championing Scottish produce, with over 50% of our lines sourced in Scotland

Retailer-speci c website

DISCOVER FANTASTIC PROMOTIONS, PROFITS AND EVERYDAY

Up to 6% rebate

Three-weekly promotions

Bene t from our continuous adverts on TV with our STV campaigns

Seasonal event activity driving additional footfall

Digital and gami cation activities

Strong value package on everyday staples – bread, milk, eggs, bacon and more

Depot Open Day Depot Open Day Wednesday 15th October Wednesday 15th October

Join us at our Open Day in Dundee

Discover why SPAR Scotland is the number one team in the country when it comes to growing your independent business.

• Experience a full tour of our award winning distribution centre

• Meet the CJ Lang & Son Ltd team

• Learn more about our local brand that has national and global support services And lots more...

Want to know more?

Speak to the SPAR Scotland team today

Places are limited and on a first come first served basis. To find out more and book your place today email discover@sparscotland.co.uk

2.0 is on course to deliver a

The Scottish Government’s attempt at introducing a Deposit Return Scheme (DRS) will go down in history as a masterclass for the ages in how not to do something that most people wanted to do, including retailers. DRS became one of the most contentious issues in the history of local retailing in Scotland, so the less said about that sorry episode the better. Not erstwhile Circular Economy Minister Lorna Slater’s nest hour.

ere’s little value in rehashing that divisive debate, however, but the one thing that stuck with me throughout is the comment I heard from so many retailers at the time: “We want a DRS, we just don’t want this DRS.”

So if retailers didn’t want that DRS, how will they feel about DRS 2.0? Well, there’s certainly a lot more to like about the new scheme that’s scheduled to come into force in October 2027. Or, to put it slightly di erently, there’s a lot less to dislike about it.

First and foremost, the scheme is now UKwide, more or less – Wales is still debating glass – but the likelihood is that the scheme will be UK-wide, massively reducing cross-border complexity.

Secondly, and no less importantly, the UK scheme is being driven and managed not by the government but by a standalone businessled not-for-pro t organisation, the UK Deposit Management Organisation (DMO). One of the biggest criticisms of Slater & Co was that they didn’t meaningfully engage with the trade and therefore didn’t actually understand what it was they were trying to legislate on. e DMO has learned from that mistake and is sta ed by people that know the trade inside out, people like former AG Barr Commercial Director Jonathan Kemp and Bestway Director of Trading Richard Booth.

ere’s also people like Raymond Gianotten involved, a former Director of the Netherlands DRS Scheme, and Seamus Clancy, former interim CEO of Re-Turn, the scheme administrator in Ireland.

All good, positive stu – so are we actually going to get it done this time around? “It’s been a long, long journey but something positive is happening,” laughs Truls Haug, Vice President, New Markets EMEA for TOMRA Collection, the global leader in reverse vending machines (RVMs).

“We have a well-designed scheme and having the DMO in place from day one has been critical. ey have built up a lot of momentum in a relatively short space of time and they have achieved a lot in that time. It’s a truly businessled organisation and they have recruited well so the people involved in creating the new DRS understand the many complexities and challenges.

“ ey have clearly learned a lot from the last attempt at introducing a DRS in Scotland and they have used those learnings to make a better system, a system that will work for consumers, for retailers and for producers.”

From his interactions with the DMO, Haug says the operator has been very open-minded, pragmatic and committed to making progress.

“ ey understand the needs of the various stakeholders such as retailers and producers, and they’re working towards the best possible solution,” he explains. “Importantly, they’re communicating well and are being very open about their work and are inviting everyone with an interest in DRS to engage.”

As Haug says, the DMO has done a pretty decent job of communicating its progress and being transparent about its plans, unlike the Scottish Government.

Or to put it another way, the DMO is doing the job properly, unlike Ms Slater.

Introducing a scheme like this however, even a very well-designed one, is not going to be entirely pain free. ere are many challenges to

Along with a new, fit-for-purpose DRS, retailers are also set to benefit from enhanced tech from major reverse vending machine (RVM) manufacturers that simplifies and elevates the customer experience.

A great example is TOMRA’s new R2 machine, unveiled for the first time just last month. The innovative multi-feed RVM allows users to pour a whole bag of containers in at once. The R2 features a wall-mounted front unit which minimises the amount of valuable store space required. The machine has no batch limit, meaning customers can pour all their plastic bottles and cans in at once and carry on with their shopping.

The R2 is only 0.8 sqm and can simply be plugged in and is ready to use.

overcome and a lot of water to go under a lot of bridges before October 2027.

“All big changes come with consequences,” says Haug. “We are talking about a major step forward for Scotland, for Scottish people and for the Scottish environment, so there will be consequences for everyone involved.

ose consequences will be di erent for each individual and for each store, but retailers can minimise those consequences by preparing early.”

ere is, of course, another incentive to get DRS delivered on time: the new Extended Producer Responsibility (EPR) regulations which come into force in 2028. EPR basically requires producers to pay the full costs of dealing with the waste generated from when a product is placed onto the market through to the end of its life.

“ e EPR regulations provide a huge nancial incentive to producers to have a DRS in place in 2027,” explains Haug. “If we don’t have DRS in place by March 2028, producers will need to pay the EPR fee, which will be higher than the DRS fee. And it’s worth noting that the biggest

producers in the UK are actually the major retailers like Tesco and Asda.”

e point being, it’s in the nancial interests of the major multiples to get DRS done in time and we know only too well how much in uence the supermarkets have behind the scenes.

So the big question is: what should local retailers in Scotland be doing about all this? Haug’s response is a single word: “engage”.

Last time around, very few local retailers actually had their plans in place and that was probably down to the fact that they had little con dence that the scheme would actually happen. Turns out they were right. But this time around its di erent.

When asked, on a scale of one to 10, how con dent is he that DRS 2.0 will be in force in 2027, Haug looks up to the skies, grimaces a little and says “eight or nine”.

“It may be delayed by a month or two but my feeling is that it will happen this time,” he says. He quickly quali es that statement with a chuckle and an addendum: “Having said that, I was pretty con dent it was going to happen last time!”

Even at this stage, however, it does feel di erent this time. e political will is there, the DMO is in place, and the consumer sentiment seems to be there.