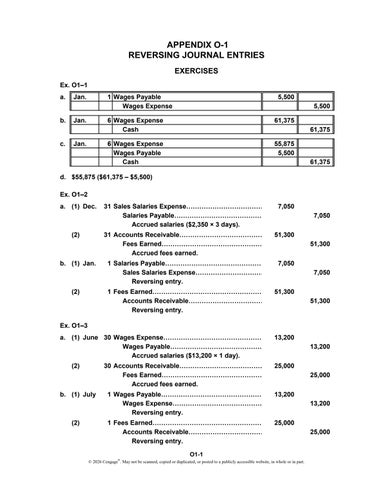

APPENDIX O-1 REVERSING JOURNAL ENTRIES EXERCISES Ex. O1–1 a. b. c.

Jan. Jan. Jan.

1 Wages Payable Wages Expense

5,500

6 Wages Expense Cash

61,375

6 Wages Expense Wages Payable Cash

55,875 5,500

5,500 61,375

61,375

d. $55,875 ($61,375 – $5,500) Ex. O1–2 a. (1) Dec.

(2)

b. (1) Jan.

(2)

31 Sales Salaries Expense……………………………… Salaries Payable…………………………………… Accrued salaries ($2,350 × 3 days).

7,050

31 Accounts Receivable………………………………… Fees Earned………………………………………… Accrued fees earned.

51,300

1 Salaries Payable……………………………………… Sales Salaries Expense…………………………… Reversing entry.

7,050

1 Fees Earned…………………………………………… Accounts Receivable……………………………… Reversing entry.

51,300

7,050

51,300

7,050

51,300

Ex. O1–3 a. (1) June 30 Wages Expense……………………………………… Wages Payable…………………………………… Accrued salaries ($13,200 × 1 day). (2)

b. (1) July

(2)

13,200 13,200

30 Accounts Receivable………………………………… Fees Earned………………………………………… Accrued fees earned.

25,000

1 Wages Payable………………………………………… Wages Expense…………………………………… Reversing entry.

13,200

1 Fees Earned…………………………………………… Accounts Receivable……………………………… Reversing entry.

25,000

25,000

13,200

O1-1 © 2026 Cengage®. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

25,000