Last year, we experienced great success and set a high standard. We now must actively manage customer relationships and monitor industry trends to achieve new heights of innovation, excellence, and growth.

Let's elevate our standards, empower others, and reach a new level of performance in the Year of Elevation.

Elevating

Ansay & Associates is a best-in-class insurance advisor committed to helping our clients secure, protect and grow their version of the American Dream.

Ansay & Associates is committed to superior growth through our strategic initiatives and entrepreneurial spirit. We strive to inspire our employees to provide a first-rate customer experience for our clients by offering reliable solutions through innovative technologies.

“

Serve

customers with integrity, respect and a sincere desire to build lasting relationships that work.”

The Ansay Approach is relationship-driven and solutions-oriented and is driven by the individual needs and risk management for each customer, personal and/or business. The Ansay Approach is a proven, four-step, strategic process. The Ansay Way.

Identify and understand your exposures and needs. Develop strategies to address the needs and exposures identified. Implement tailored programs specifically to meet your needs. Monitor the programs and make proactive changes as needed.

Each year, Business Insurance ranks the 100 largest U.S insurance brokerage firms. Ansay & Associates is ranked 73rd, up 11 places since 2018

The Best and Brightest Companies to Work for competition identifies and honors organization that display a commitment to excellence in their human resource practices and employee enrichment

Ranked one of the top 15 Medium Size Businesses in Southeastern Wisconsin

Ansay & Associates is one of only 53 companies in the United States to receive this distinction

The Best and Brightest in Wellness celebrates those companies that are making their businesses flourish, the lives of their employees better and the community a healthier place to live.

The Best and Brightest Companies to Work for program is presented throughout the United States by the National Association.

Anay & Associates is a recipient of the Acuity Insurance 2020 Top Gun Agent award.

Each year, Business Insurance ranks the 100 largest brokerage firms. Ansay & Associates is ranked 73rd, up 11 places from 2018

Ansay & Associates is a 2019 Premier Agency for Secura Insurance.

Ansay & Associates is a member of the Hastings Mutual 1885 Club.

Ansay & Associates is a member of the Hanover Insurance Group Presidents Club

Ansay & Associates is a member of the Integrity Insurance Leadership Circle.

Ansay & Associates is a leading Partner with EMC Insurance.

Ansay & Associates is a member of the Cincinnati Insurance Companies 2020 President's Club.

Ansay & Associates is a Silver Circle Agency with West Bend Mutual Insurance.

The Western National Circle of Excellence recognition is announced annually to spotlight an elite group of partners who have excelled based on performance and growth over the past six years.

Jerry Thompson Agency A.G.I.S. Insurance Center, Inc.

Doucette, Donegan & Russell (DDR) Insurance S ervices, Inc.

Bautch Insurance Agency Insurance Specialists LLC Schultz & Schultz Insurance Agency

Buxton O’Neil Insurance Agency

13% Employee Benefits Group & Individual

33% Personal Lines

54% Commercial Lines

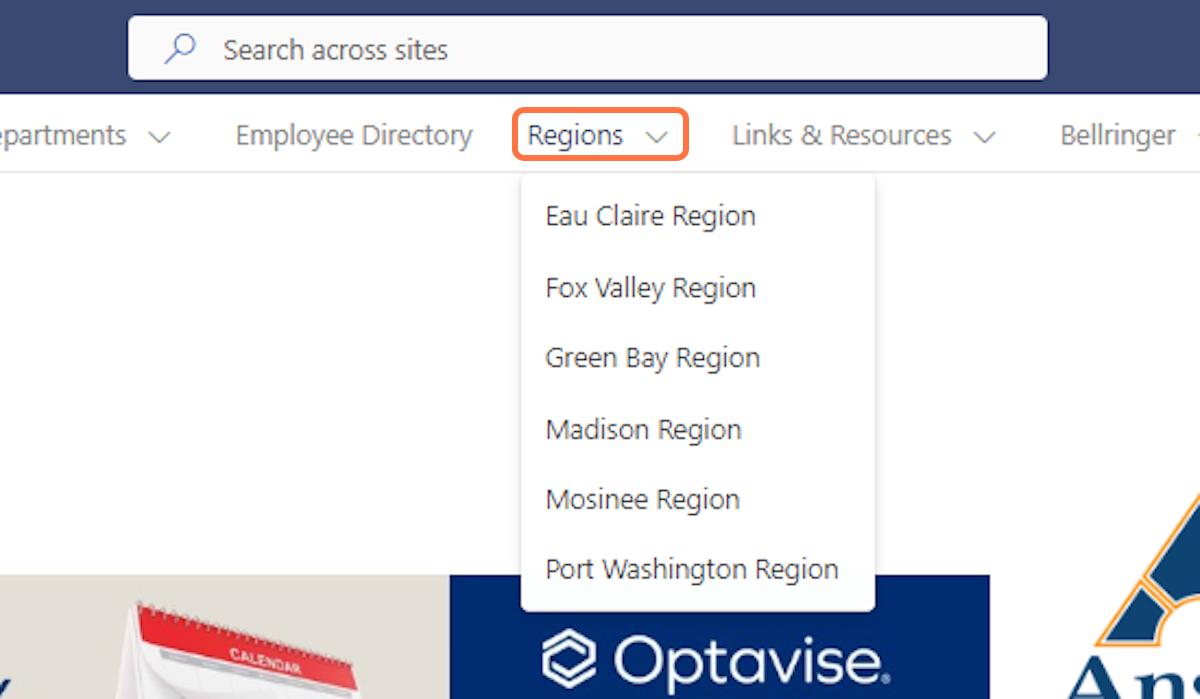

Eau Claire

• Augusta

• Alma

• Bloomer

• Chetek

• Chippewa Falls

• Durand

• Eau Claire

• Menomonie

• New Richmond

• Hudson

Port Washington

•Burlington

•Cedarburg

•Port Washington (HQ)

•Sheboygan

•Wind Lake

Green Bay

•Green Bay

•Manitowoc

Wausau

•Stevens Point Appleton

•Appleton

•Oshkosh

Madison

•Brookfield

•Jefferson

•Madison Michigan

•Ironwood Minnesota

•Edina

•Rochester

We bring you leading knowledge and integrated personal lines solutions as a coordinated single source, ensuring you access to the products and resources that serve your needs best.

Commercial Lines

Employee Benefits

Personal Lines

Angela Sikowski Chief Financial Officer

Rachel Ansay Vice President of Operations

Mike Ansay Chief Executive Officer & Strategic Sales Advisor

Erik Mikkelson Chief Development Officer

Tim Rusch Sr. Executive Vice President Mergers & Acquisitions

Nikki Kiss Chief of Staff & Talent

Heidi Nienow Executive Vice President Personal Lines

Alan Neva Executive Vice President Commercial Lines & Employee Benefits

Greg Kirsch Director of IT

Michael Eickhoff Network & Security Administrator in IT

Heather Jensen HRBP & Benefits Specialist Engagement

Hannah Scherer Meetings & Events

Robyn Tiedt Regional HR Manager

Melissa Dettmering Director of Payroll

Issac Engelkes IT Helpdesk Specialist

Stacy Carter-Davis HR Assistant

Planner Accounting

Abbie Gums Financial Analyst

Alan Neva

Executive Vice President

Commercial Lines & Employee Benefits

Adam Peck Director of Sales

Commercial Lines

Kash Motlani Director of Sales

Select Commercial Lines

Josh Pantel Associate Director of Sales

Commercial Lines

Heidi Nienow

Executive Vice President

Personal Lines

Eau Claire Region

Kash Motlani Director of Sales

Personal Lines

Travis Kaeding Associate Director of Sales

Commercial Lines

Dawn DeGeorge Associate Director of Sales

Personal Lines

Rachel Ansay Vice President of Operations

Kelsie Hoehne Director of Operations

Personal Lines

Sandy Bowman Operations Manager Commercial Lines

Kari Hagenow Operations Manager

Personal Lines Central

Michael Disher II Operations Manager Commercial Lines

Jodi Tousey Operations Manager Commercial Lines

Stacey Robertson Director of Operations Employee Benefits

Kristie Leiviska Operations Manager Personal Lines South

Annie Hooper

Operations Manager

Personal Lines North

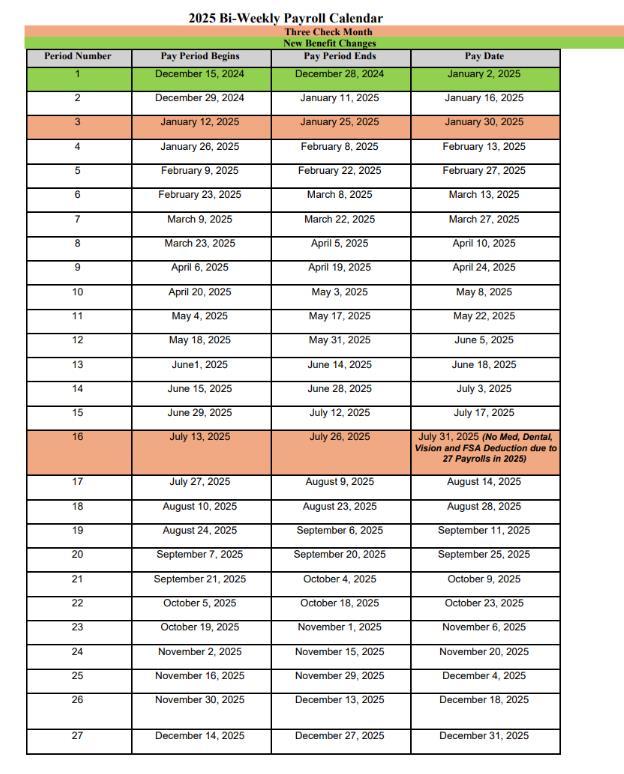

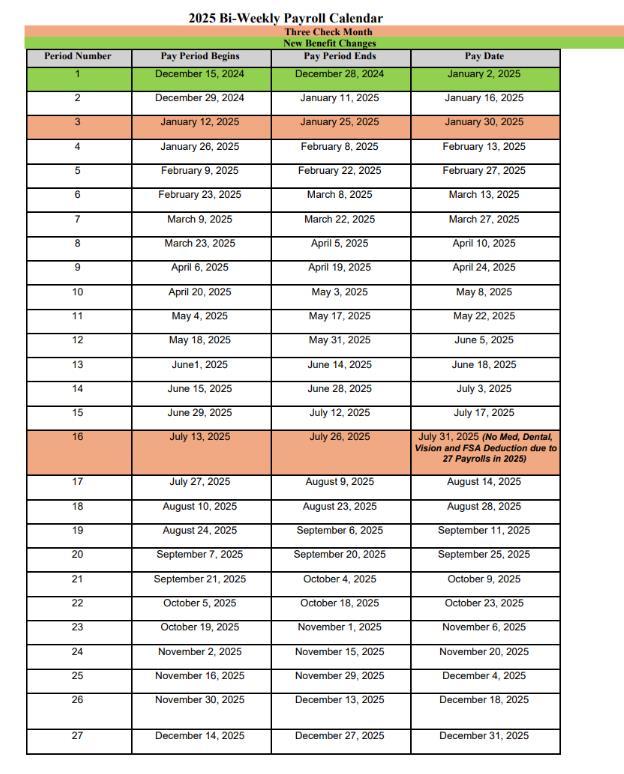

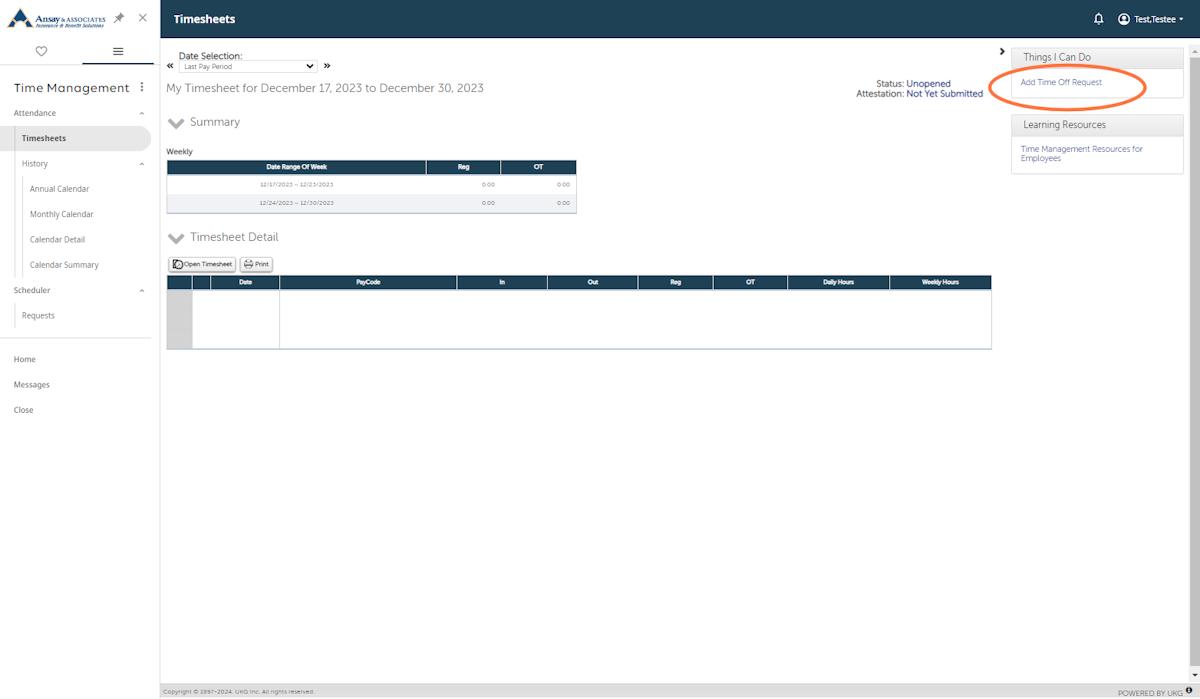

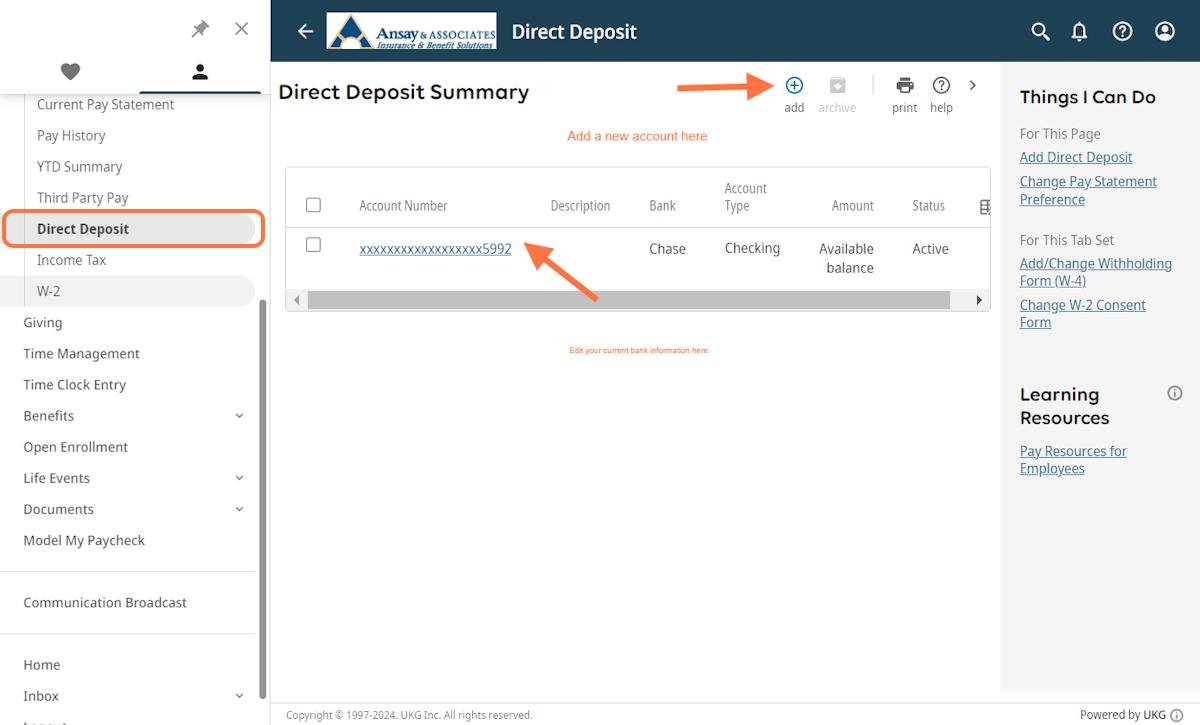

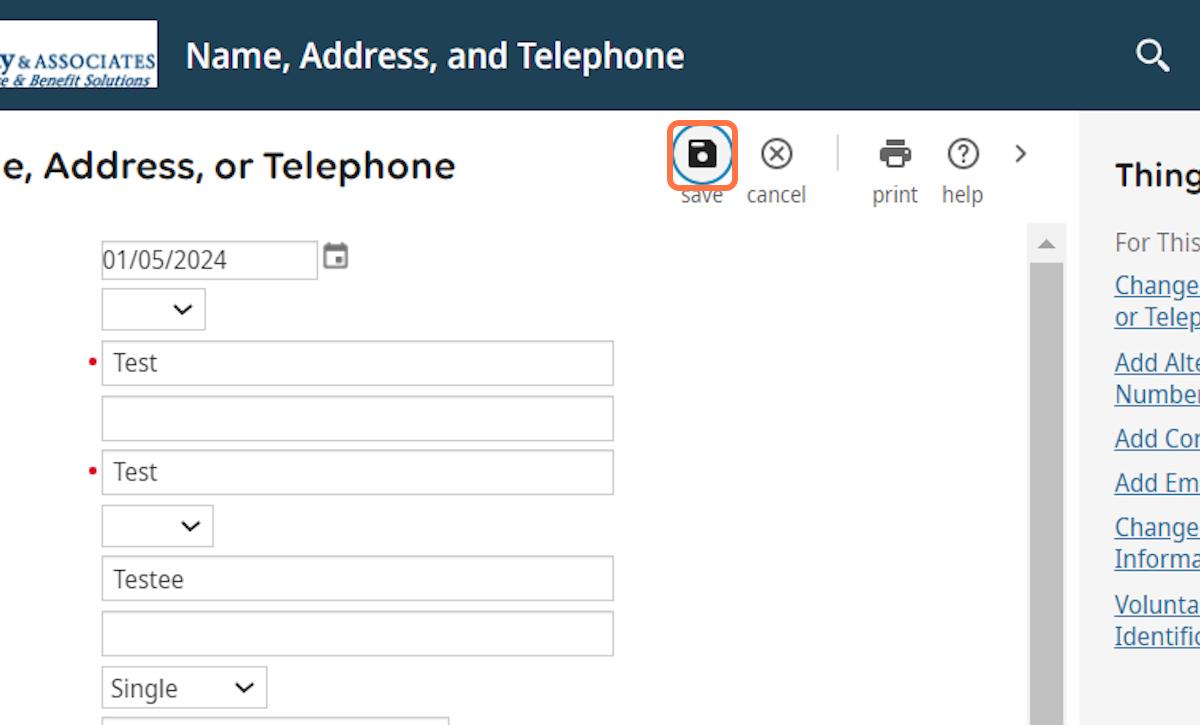

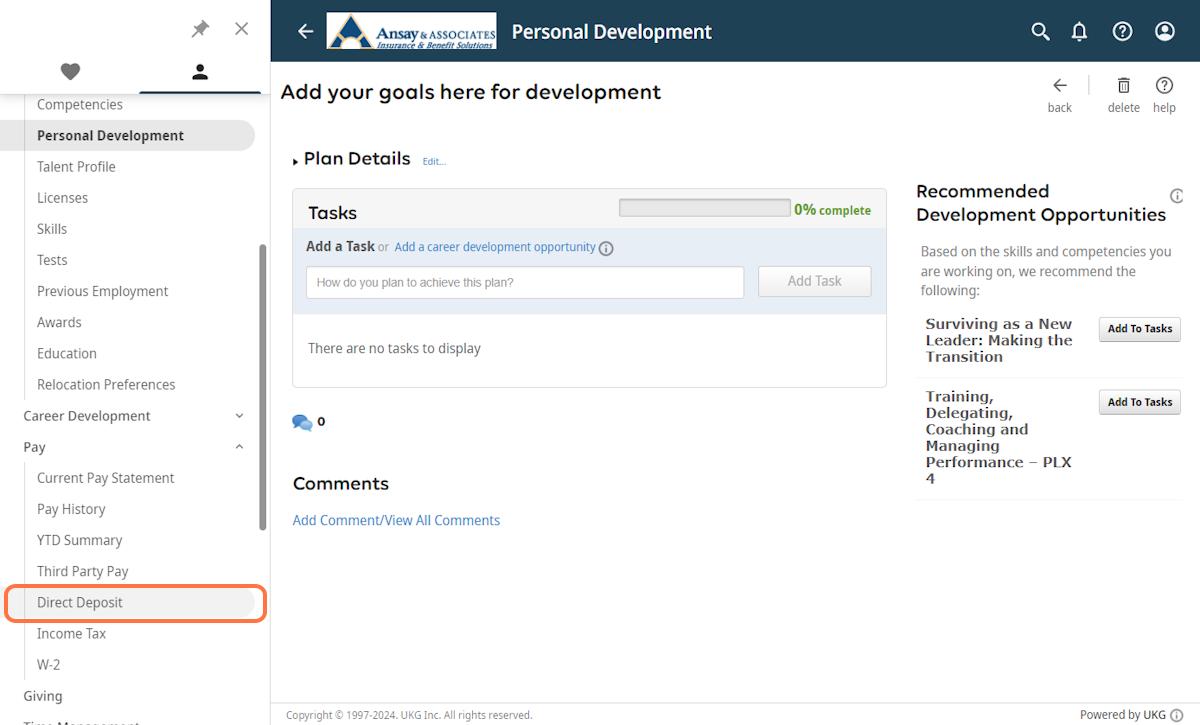

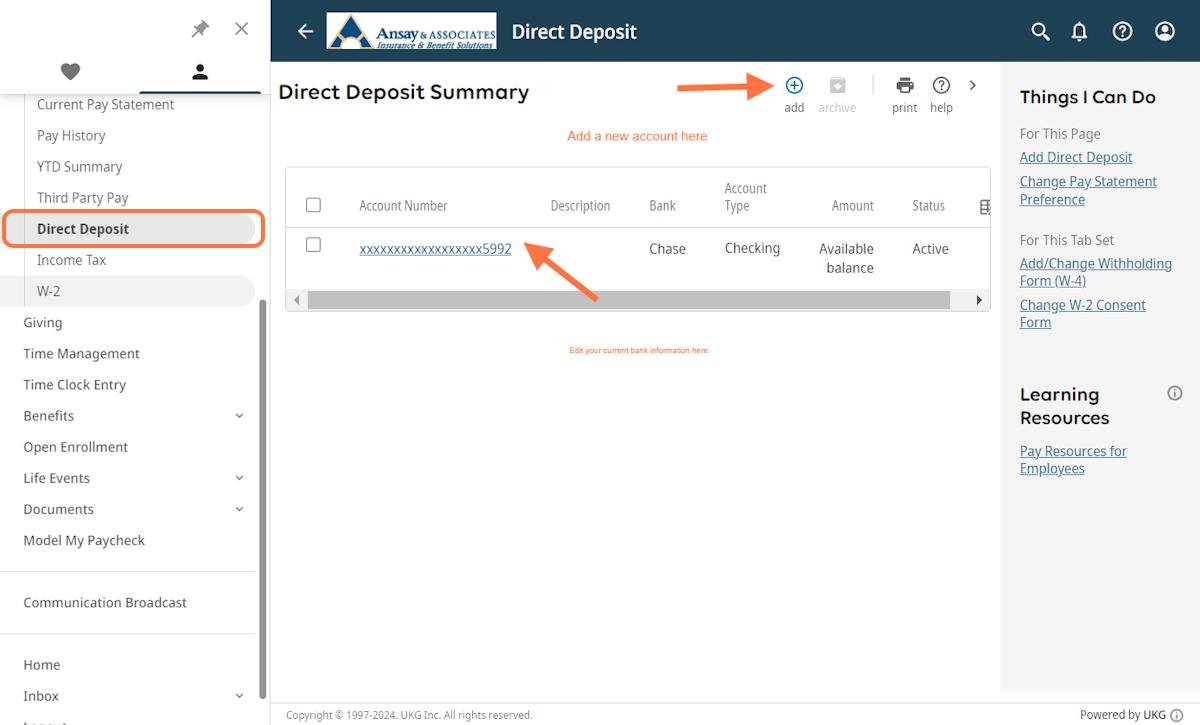

Employees are paid every two weeks on Thursdays. Direct Deposit updates are requested electronically by the employees in UKG. This is an example of our Pay Date Schedule, updated yearly schedule can be found on the Company Intranet

1. To obtain your insurance license, we will reimburse 100% of the course cost and licensing fee (2-time). Your supervisor must approve your attendance to the insurance licensing course and exam.

2. To obtain the renewal of your insurance license, we will reimburse 100% of the license cost.

3. It is expected that you will take at least one course per year from the designated list of approved courses (for your respective department below) in order to obtain a relevant designation, maintain your designation or obtain continuing education credits:

• Personal Lines CISR, CIC

• Employee Benefits GBA, CEBS, Self-Funded (Securities License designation excluded)

• Commercial Lines CISR, CIC, CRM, ARM, CPCU or Ruble Seminars

Note: other courses/classes may be eligible but must be approved (in advance of taking the course) by your supervisor. For example, courses/classes taken for higher education but not required for your position (associates/bachelor’s coursework), may also be approved for reimbursement (within the $750) by your supervisor but will be added to your W-2 as taxable income.

We will reimburse 100% of course fees (excluding travel costs) for supervisor approved courses/classes up to $750 upon passing the examination (if required) and providing proof of attendance (if no examination is required). We will not approve courses/class fees if:

• The course/class has not been approved in advance by your supervisor

• A passing grade was not obtained (if examination required) and a proof of attendance certificate was not obtained (if no examination was required)

Note, any deviation from this policy must be approved by your supervisor. Also, this education benefit is non-cumulative. Accordingly, this education benefit must be used by December 31st of each year, or it is lost.

Program Highlights

• Eligibility – full-time, 30 days, 1st of the month following

• Position/development relevant course

• Accredited university

• Earn a “B” or better grade

• Receive EVP and Corporate HR approval

• Annual maximum per employee - $5,250

• Reimbursement after passing grade submitted

The insurance business requires utmost confidentiality. In our most casual transactions, we are dealing with the private and personal matters of our customers' lives.

• Information must be used in the most discrete manner.

• Absolutely nothing heard or seen that pertains to our business, customers' and employees' accounts, or transactions with the Agency may be divulged except within the Agency, and then only for business purposes.

• Release of information about our customers and/or their transactions are wrong and may involve legal action

• Employees must not review any information regarding a customer or other employee accounts unless it is directly related to their job.

• Employees indiscriminately reviewing or releasing customer or confidential business information will be dismissed from employment.

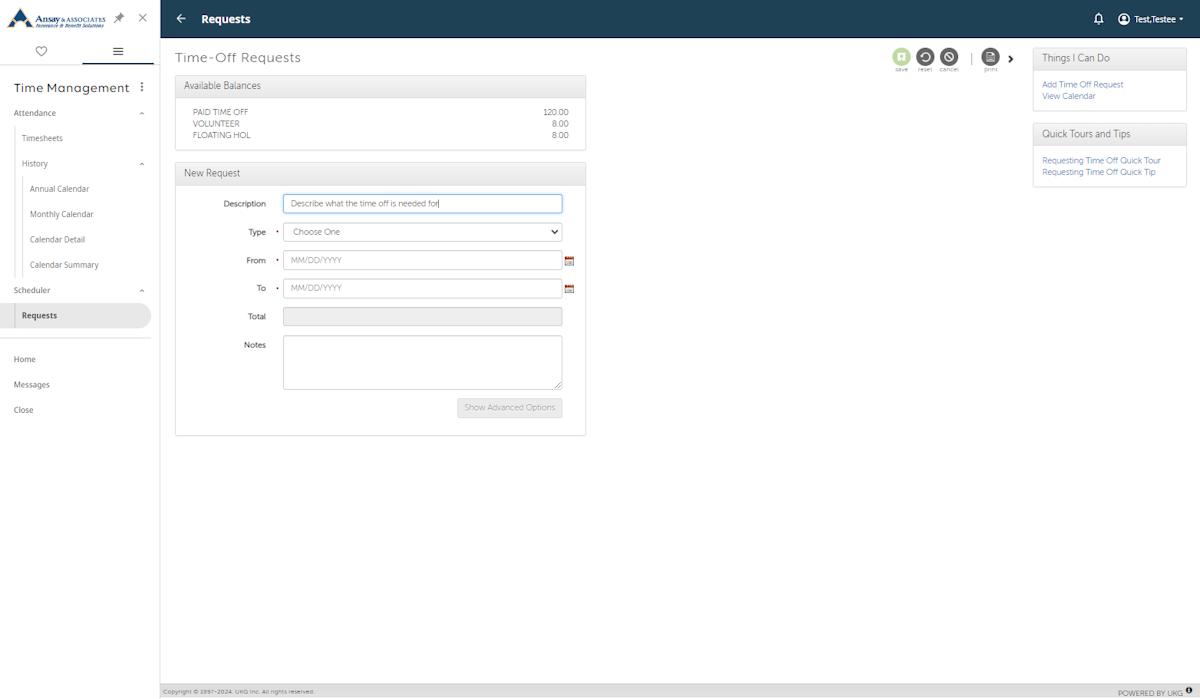

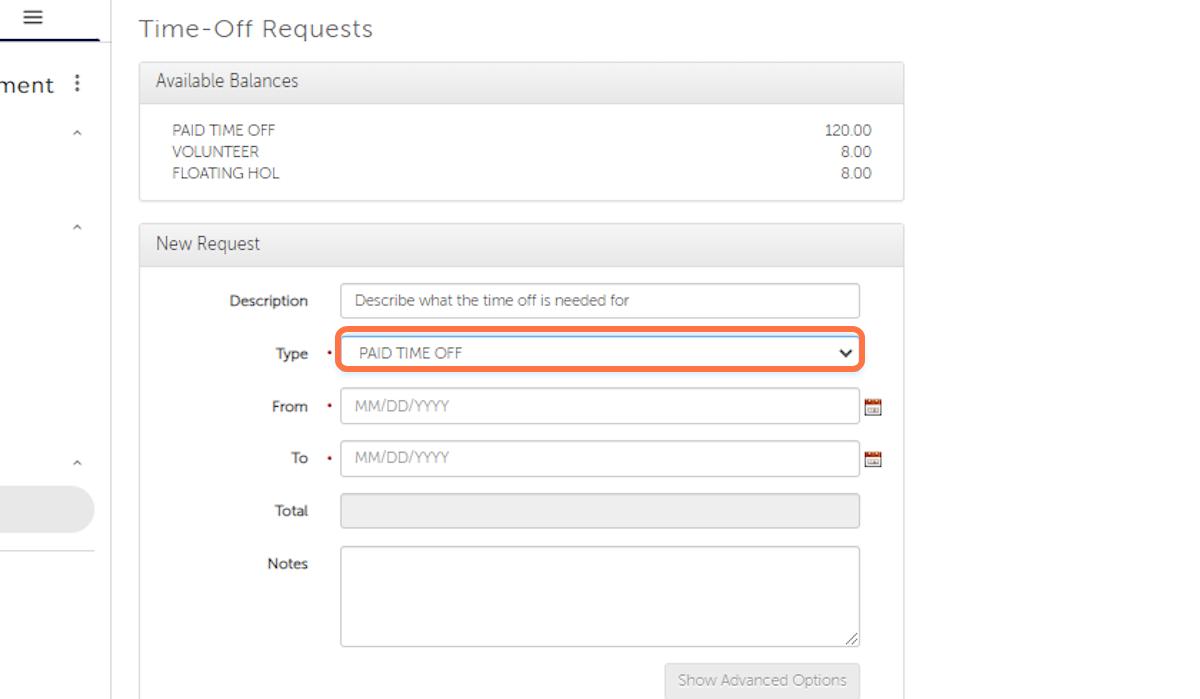

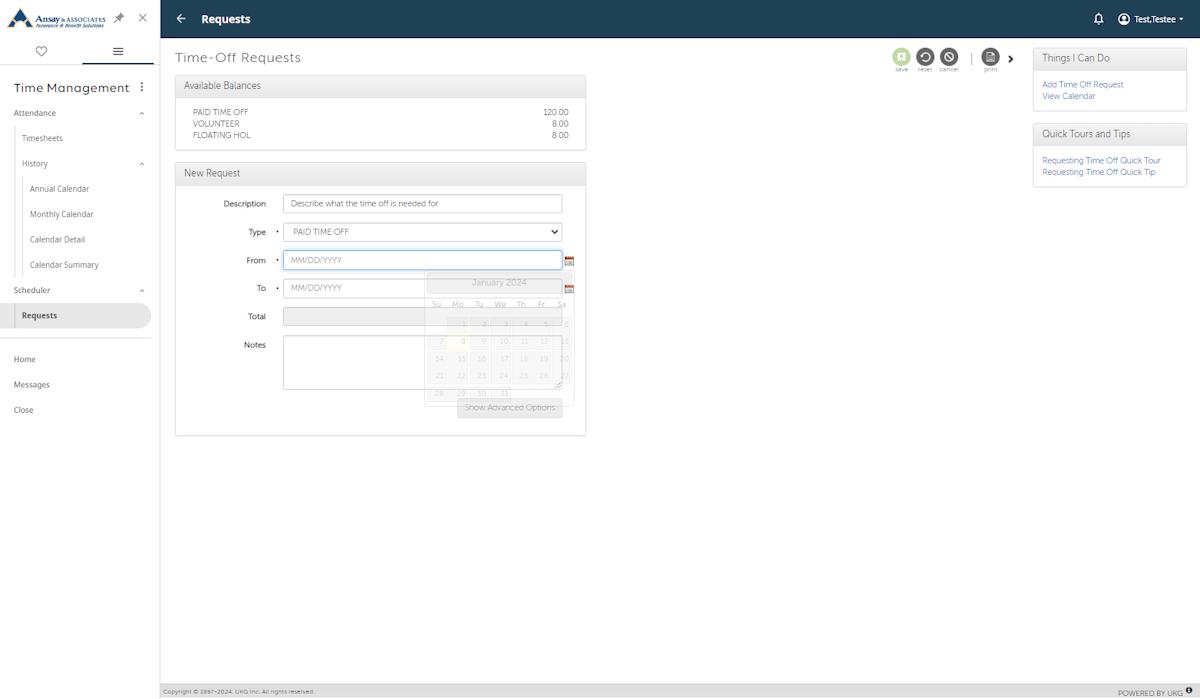

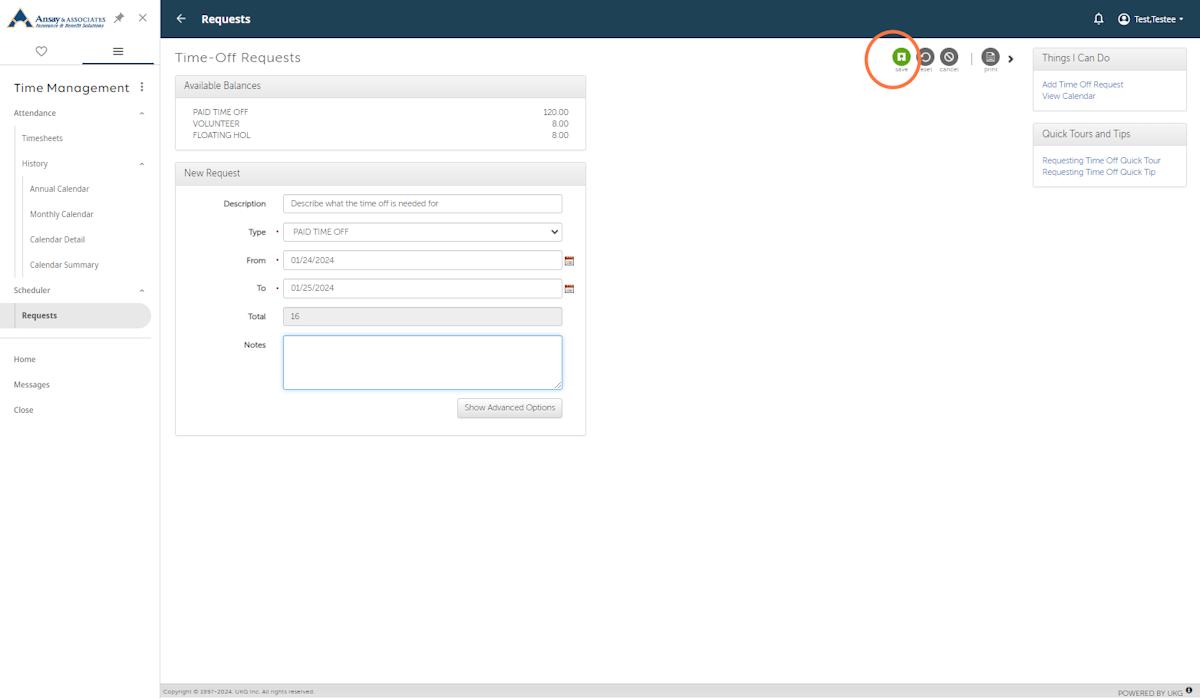

All Ansay employees receive 8 hours each quarter to volunteer at a charity of their choice. To request time off to volunteer:

• Request time off in our time keeping system, UKG, and use the Volunteer code. In the comments area, please leave a detailed description of the volunteer request. Supervisors will ensure the request complies with the handbook details and approve.

• Humane Society

• School Programs or Field Trips

• Food Pantry

• Earth Day Cleanup

• Fundraisers for non-profits

• Mentor for a school program

Monthly Meetings by Region

Summer Picnic by Region

Christmas Party by Region

Wellness Events

Annual Culture Tour: The Leadership Team will travel to several locations in December in each region

Corporate Annual Sales Training Event

Corporate Annual Customer Service Event

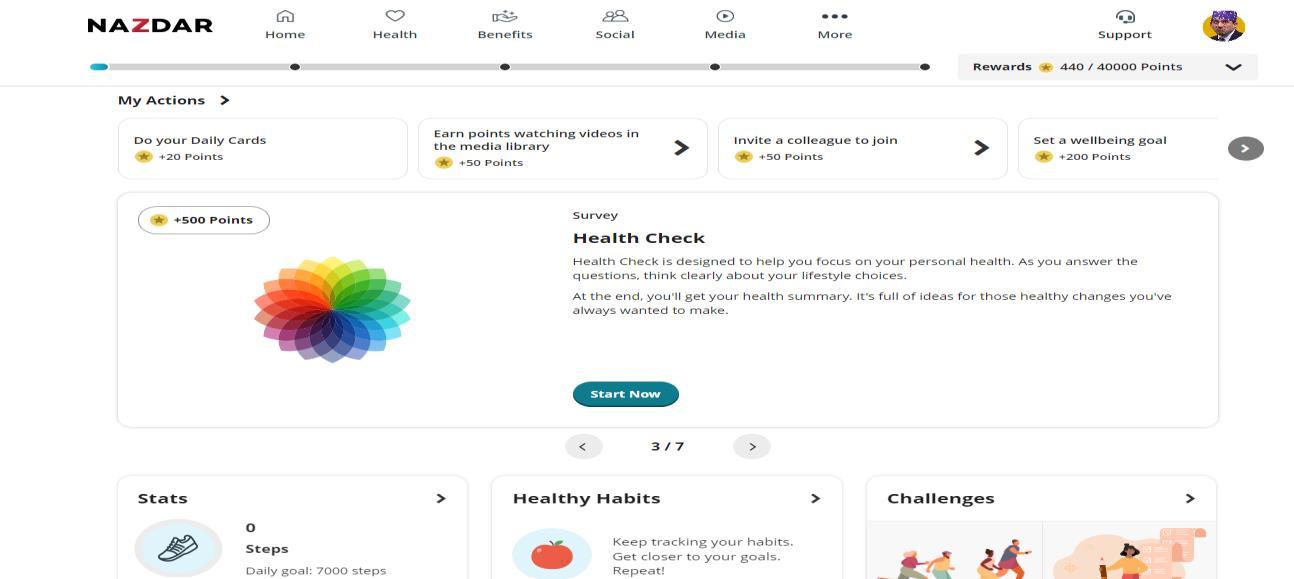

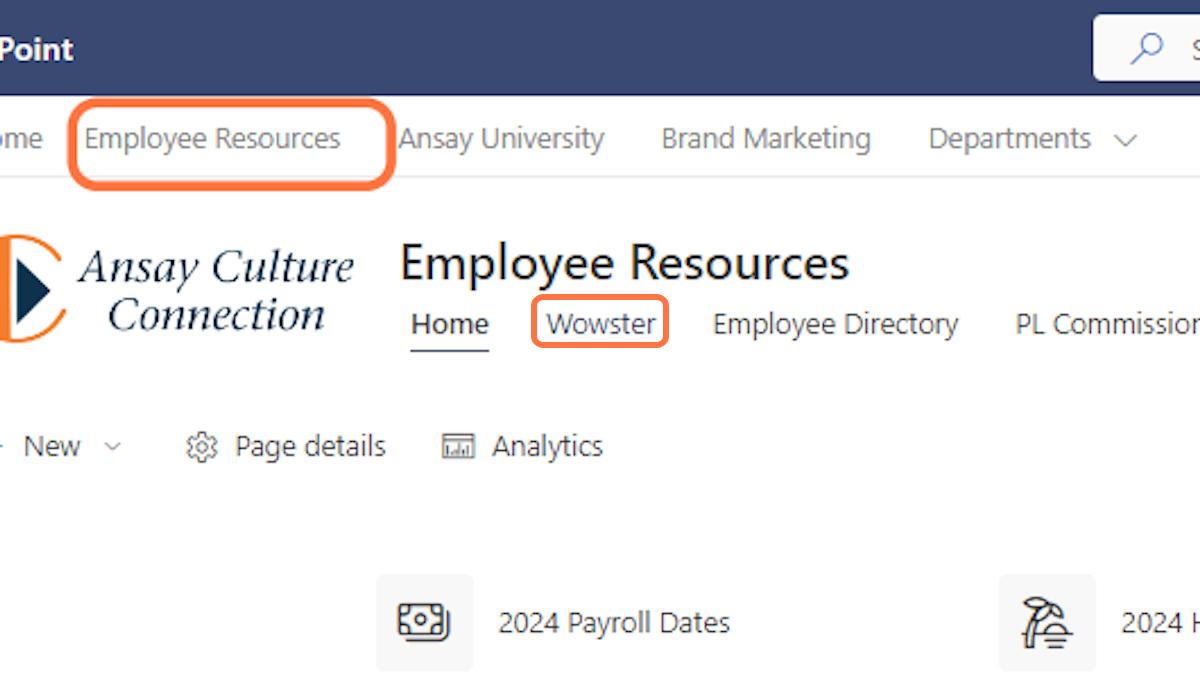

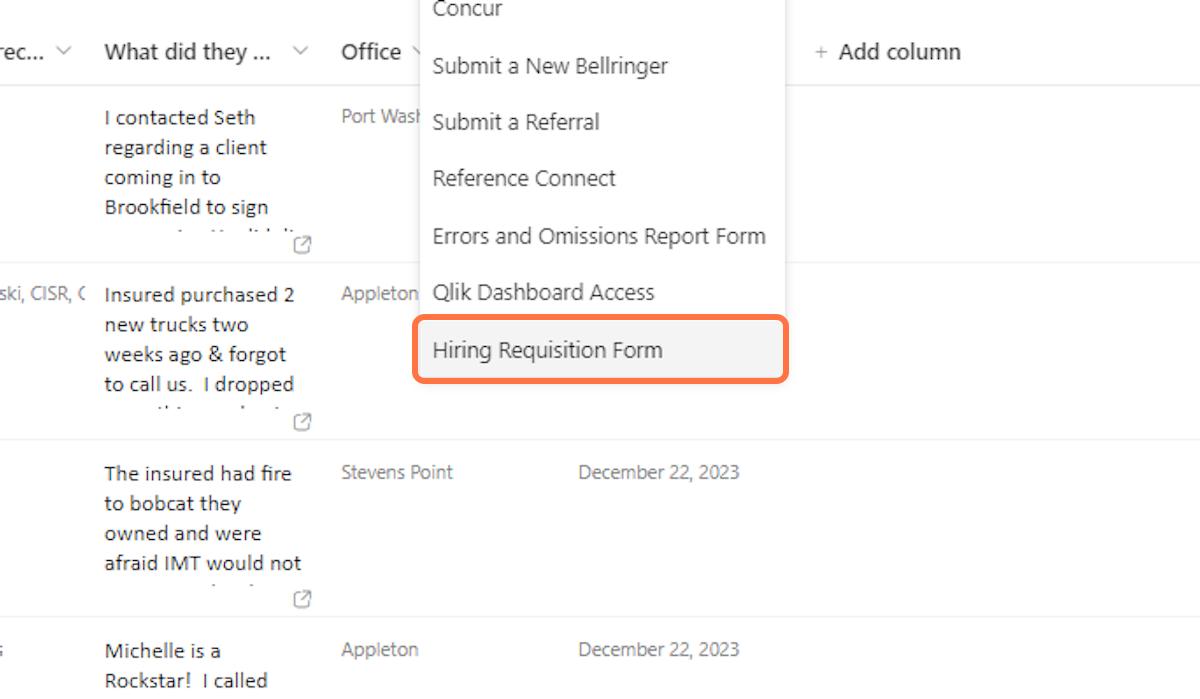

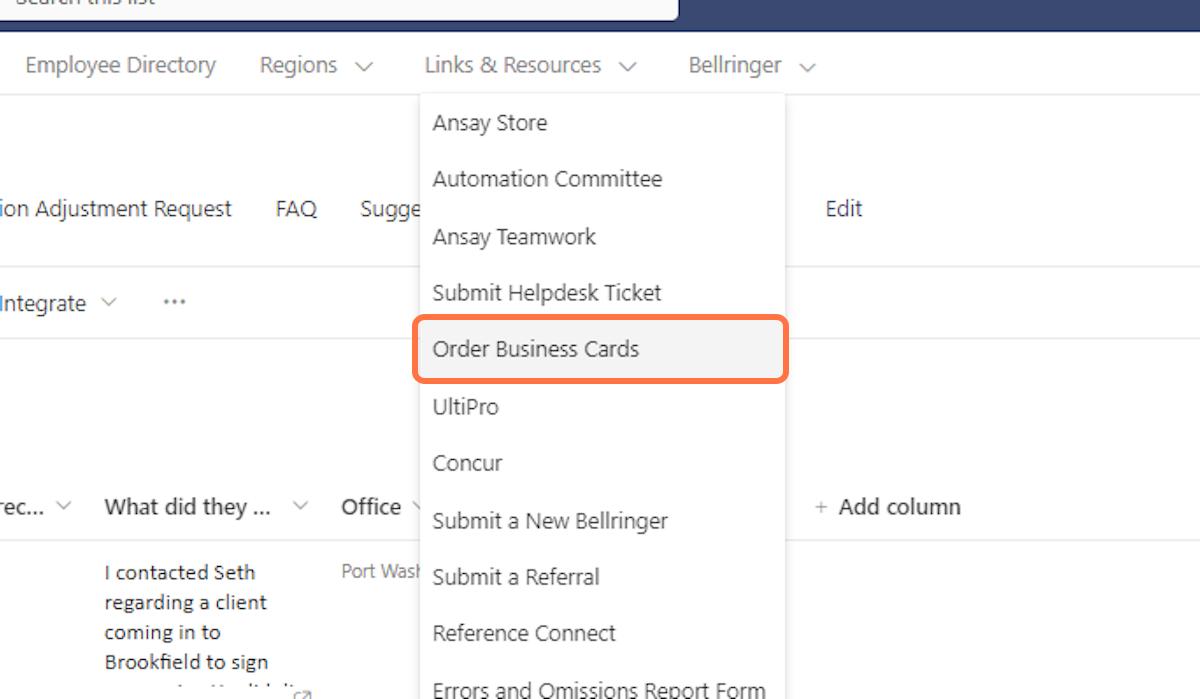

New employees can log in using their Ansay email and Ansay2025 as the password.

There is a $50 credit on the site to purchase Ansay gear!

Each month, Ansay Culture Connection will provide various topics and insights regarding initiatives, programs, and developments

Look for subject matter experts to share their area(s) of focus and provide status updates

Employees can take advantage of Ansay’s robust Wellness Resources

• Enroll in our Wellness portal to start earning points

• Become active in your region’s group that promotes wellness

• Use fitness equipment available at certain locations

• Personify Health Enrollment

✓ $2,000 to any employee who refers a full-time candidate

✓ $1,000 to any employee who refers a part-time candidate

✓ Excludes Interns (unless hired into a regular position)

✓ Candidate must remain employed by the Agency for longer than six months

✓ Bonus will be added to the employee’s paycheck after the last day of the referral’s six month

✓ Bonus is treated as taxable income on their W-2.

✓ Ask the employee to list you as their referral on their online application to receive the referral!

Heather Jensen

Human Resources BP and Benefits Specialist

• More than 6 years of experience in Personal Lines and now Human Resources & Benefits

• With Ansay since 2018

• More than 20 years of experience in Accounting

• With Ansay since 2017

Our Roles:

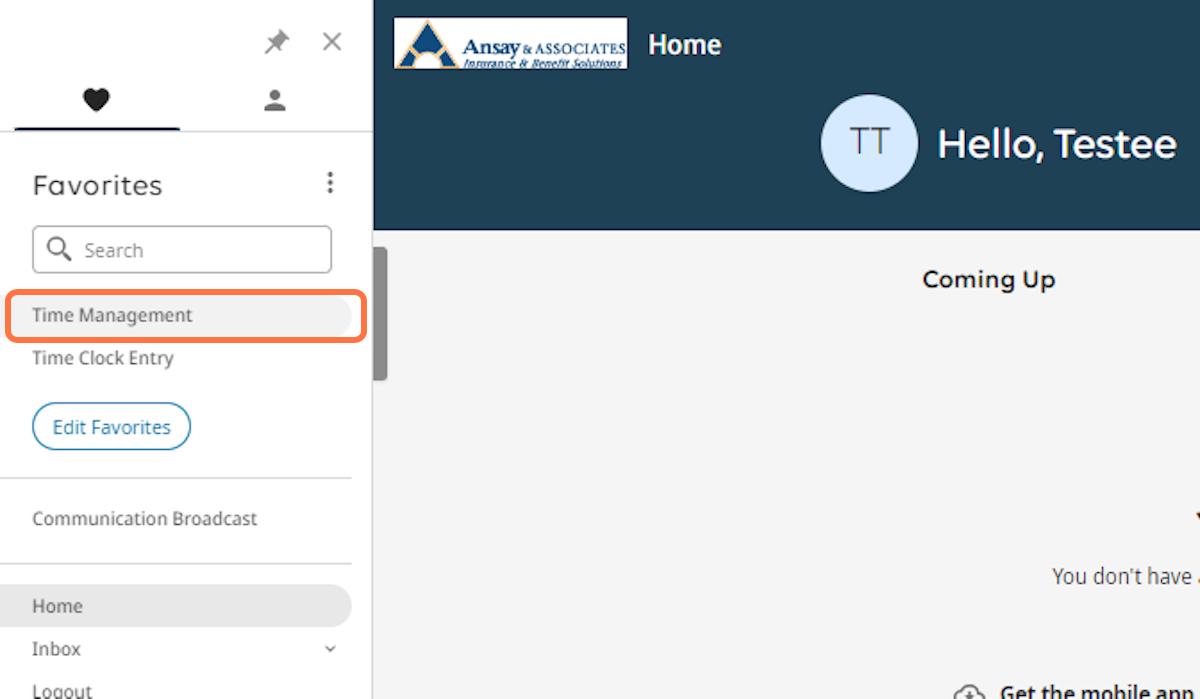

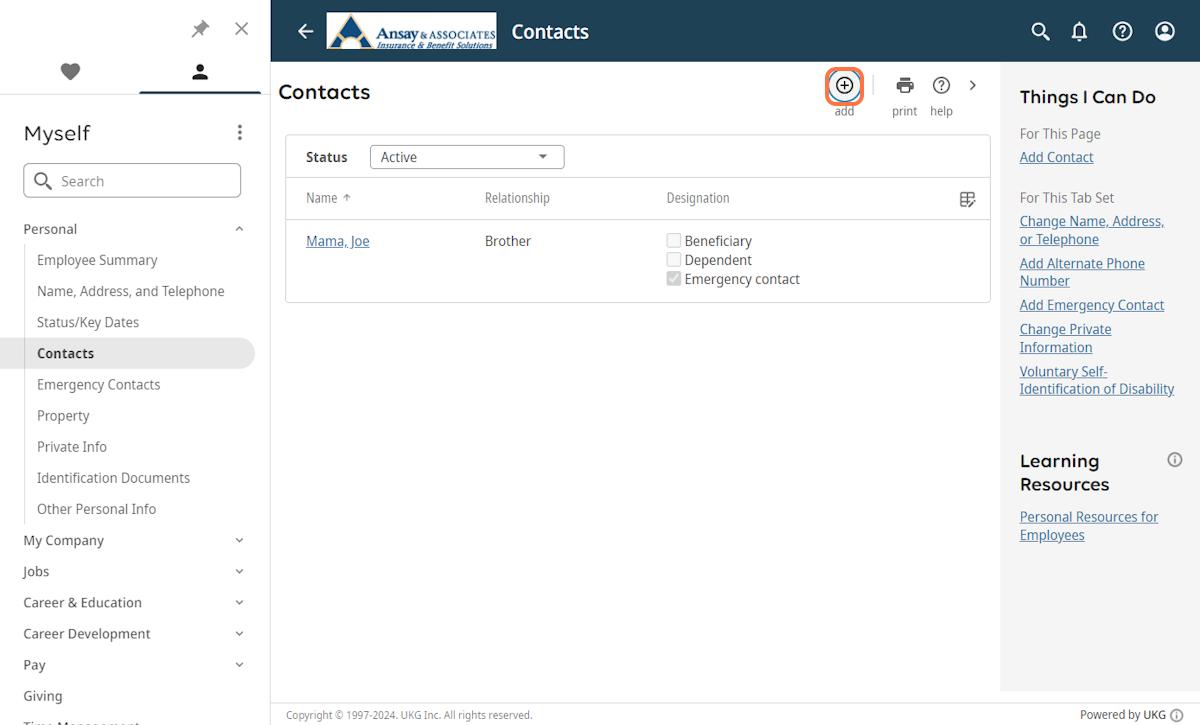

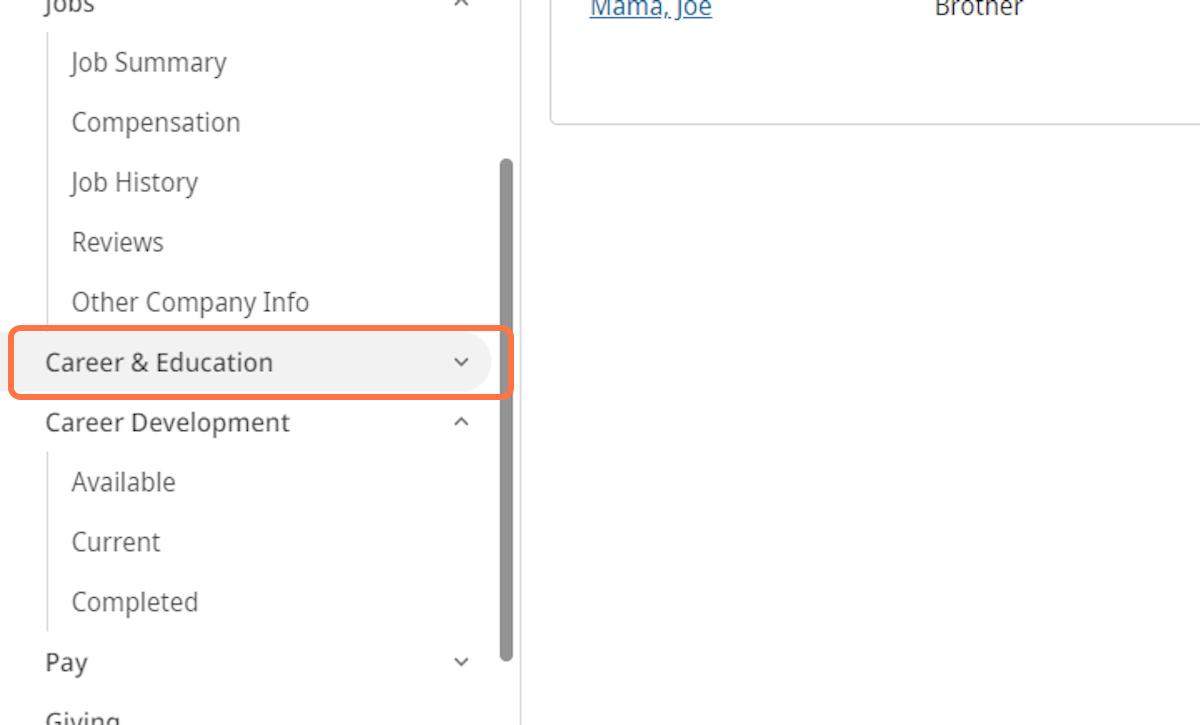

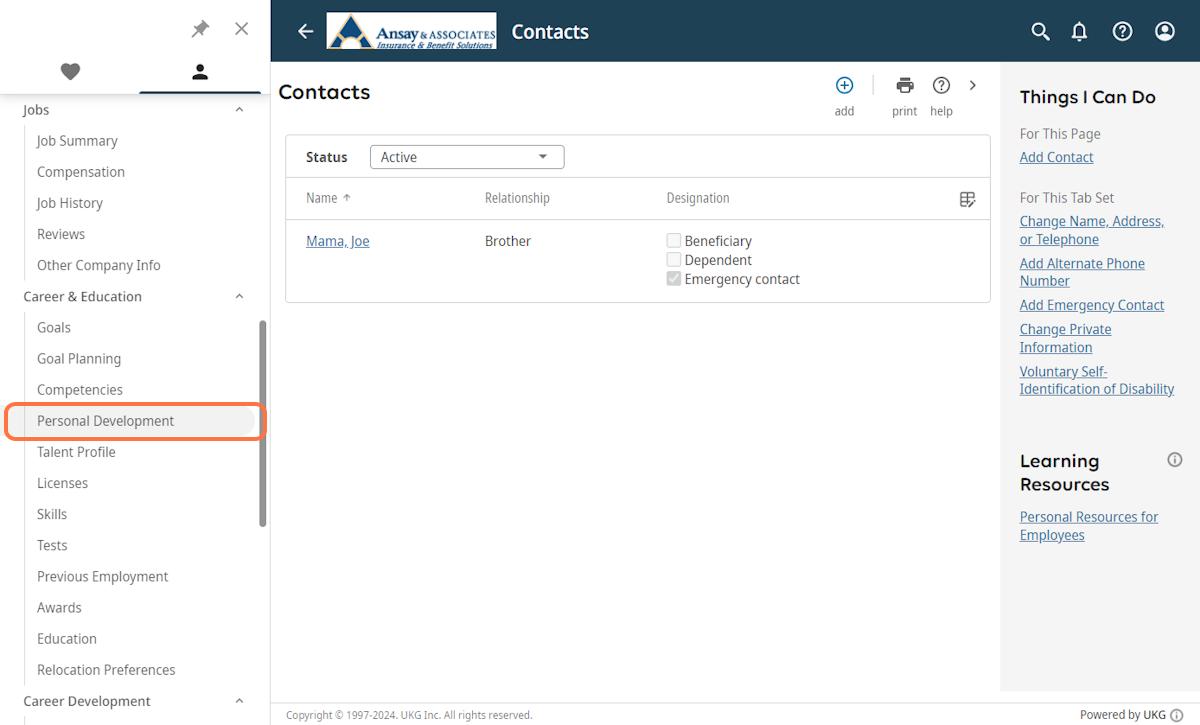

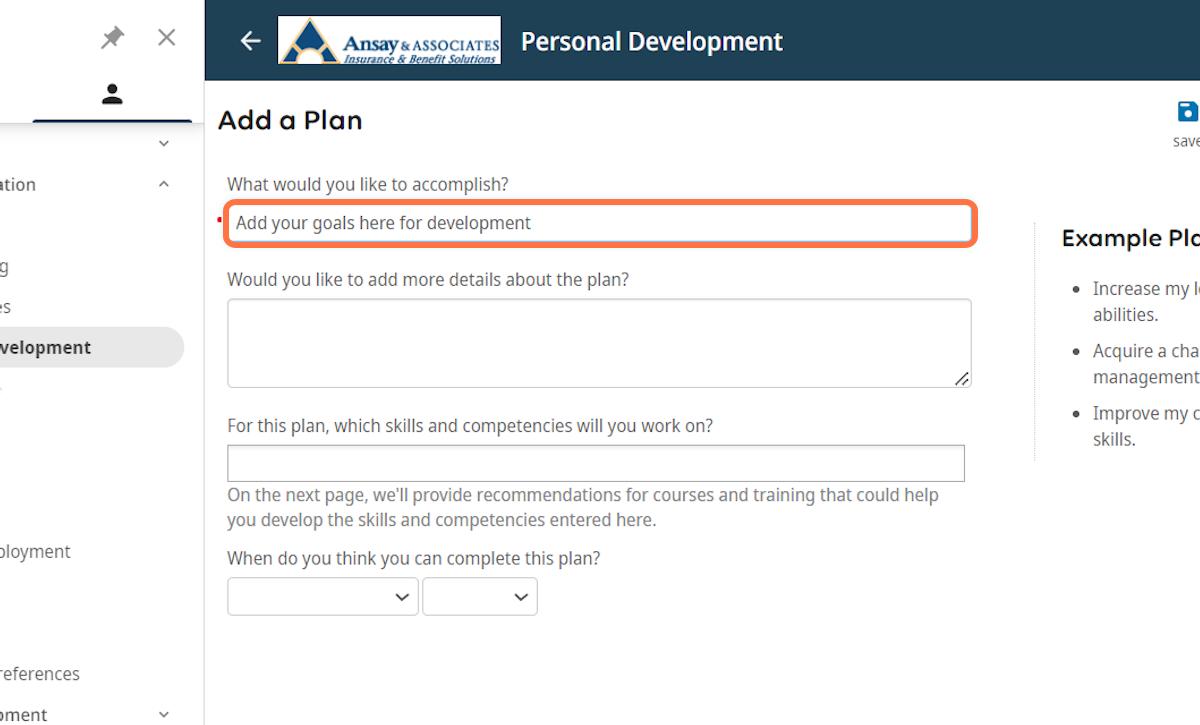

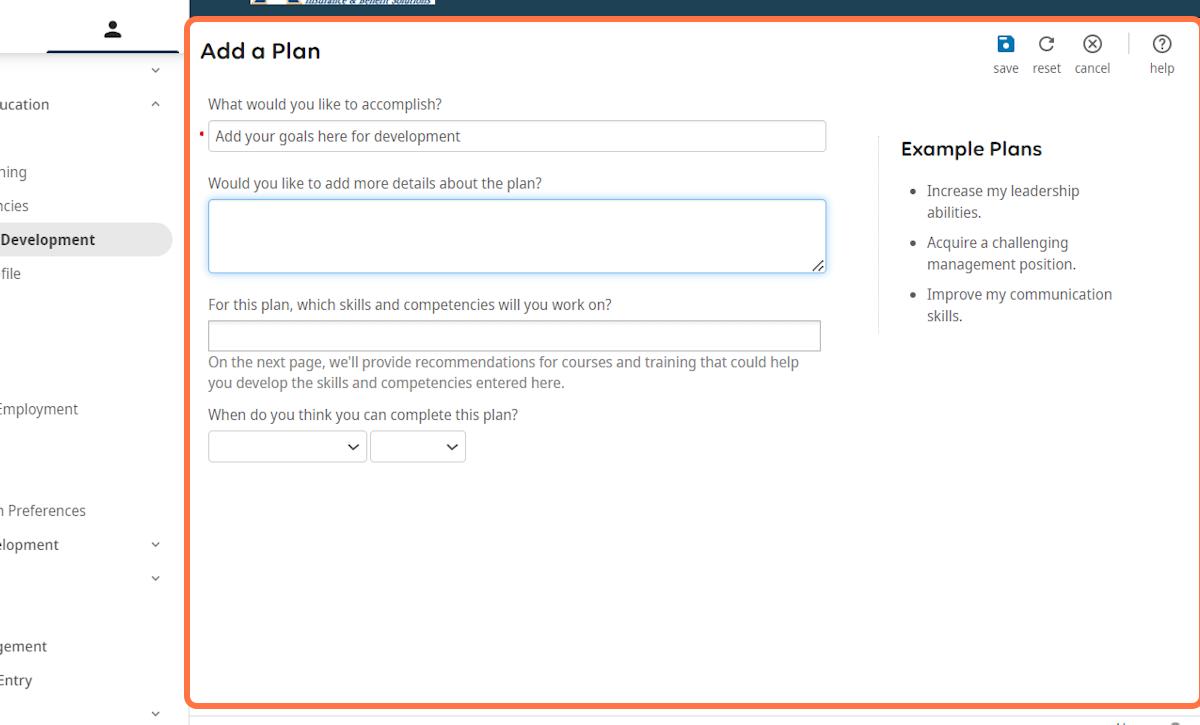

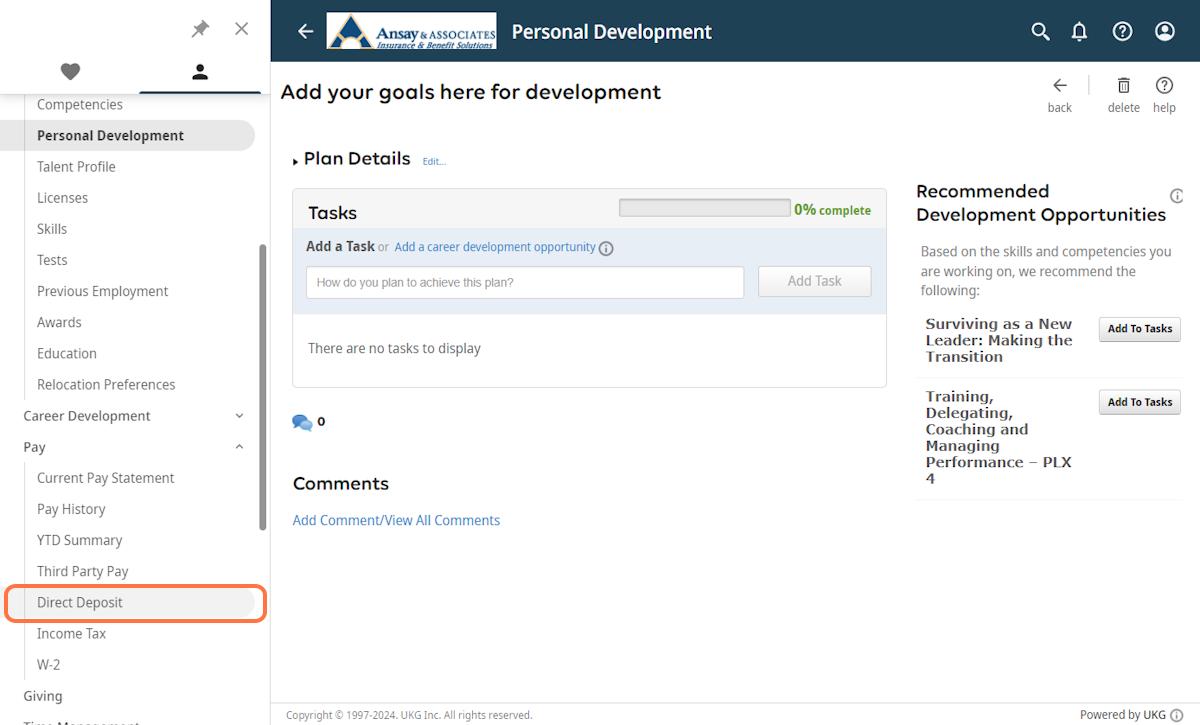

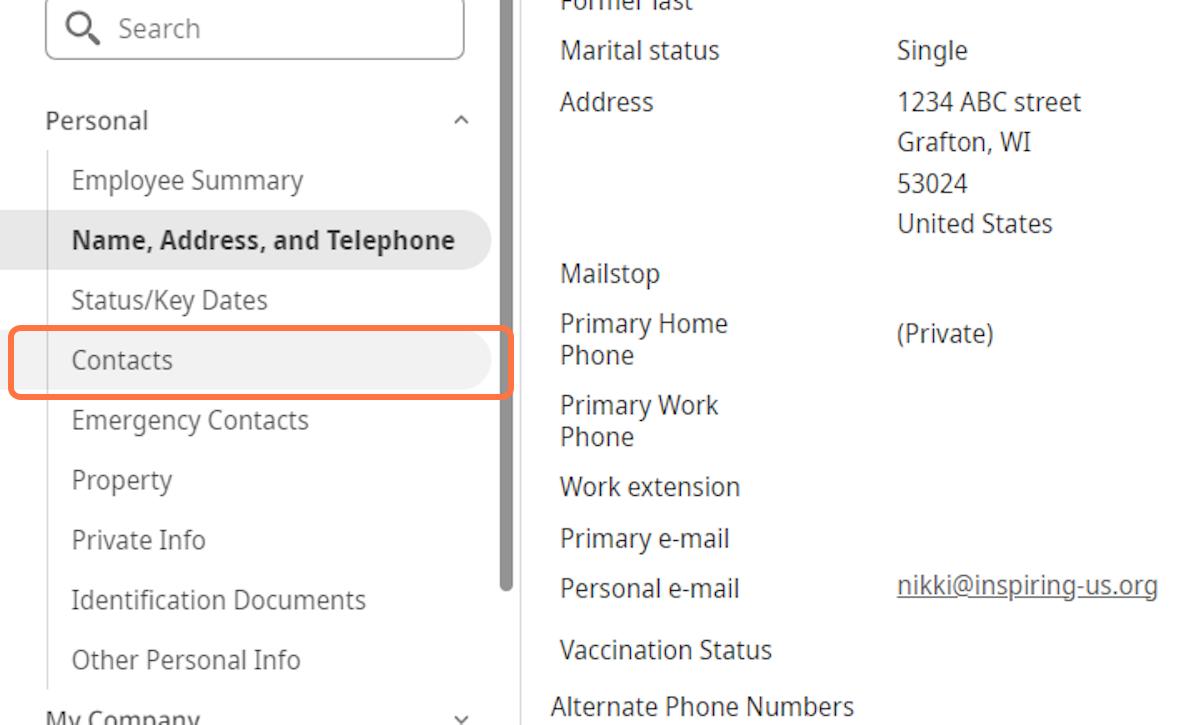

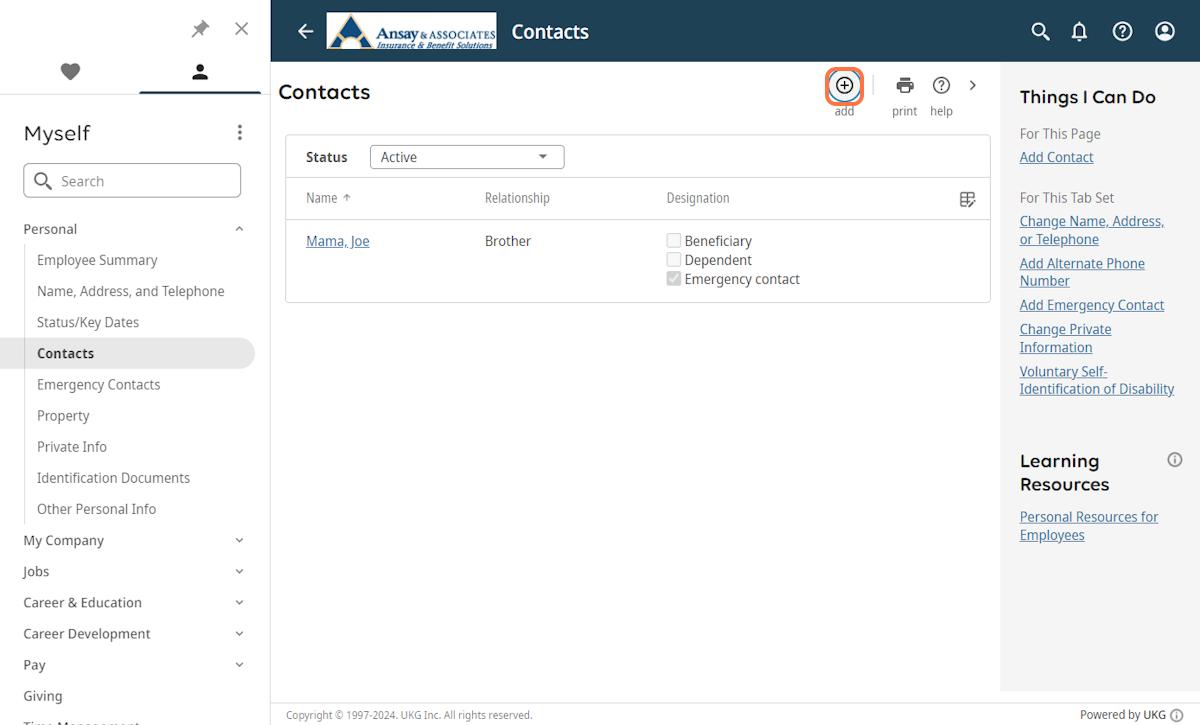

• UKG assistance, training, questions

• Overview of all Benefits, 401(k) & Enrollment guidance

• Communication through Ansay Culture Connection

• Local and Agency support

• Development opportunities through Ansay University

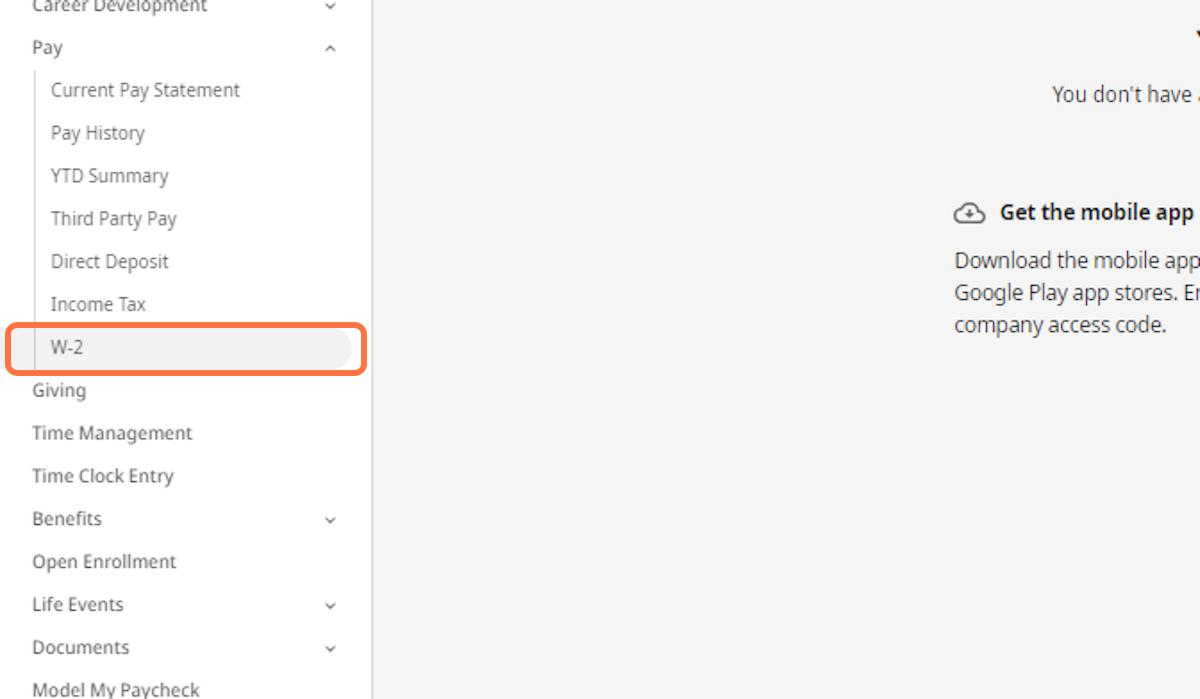

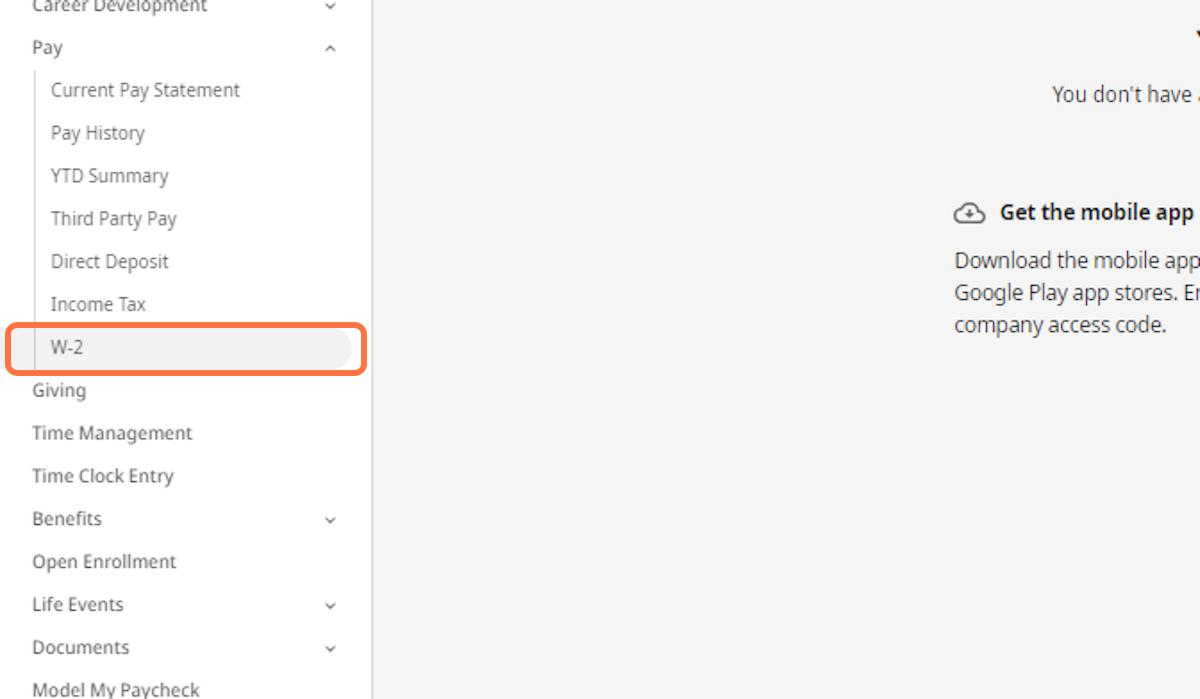

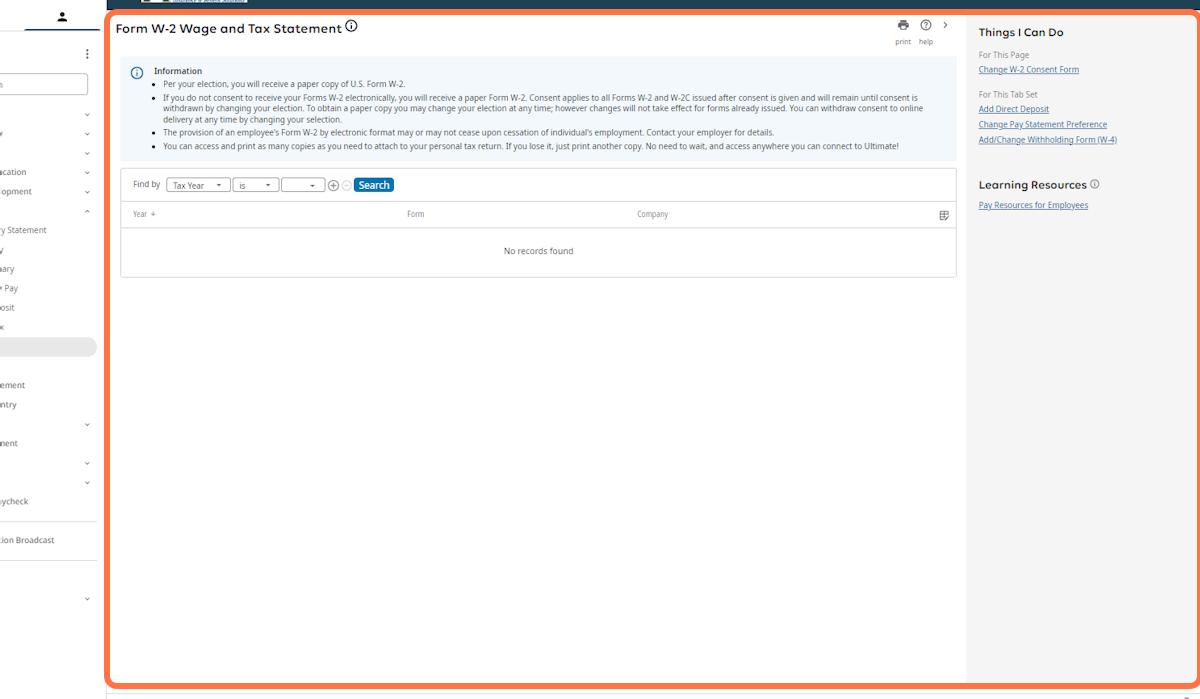

• Payroll, W-4, Banking support through UKG

A LOT of Information Has Flowed Your Way Today – Let’s Manage Together Through Next Steps!

• Review Ansay Information

• Return Signed Ansay Offer Letter & Employment Agreement (R-Sign)

• Watch Work E-Mail For UKG Onboarding Link to Complete New Hire Documents

• Watch Work E-Mail For In Check Link to Complete Your Background Screen

• Connect with the Ansay Team during your orientation online meeting

• Reach Out to Heather Jensen/Nikki Kiss with Any Questions

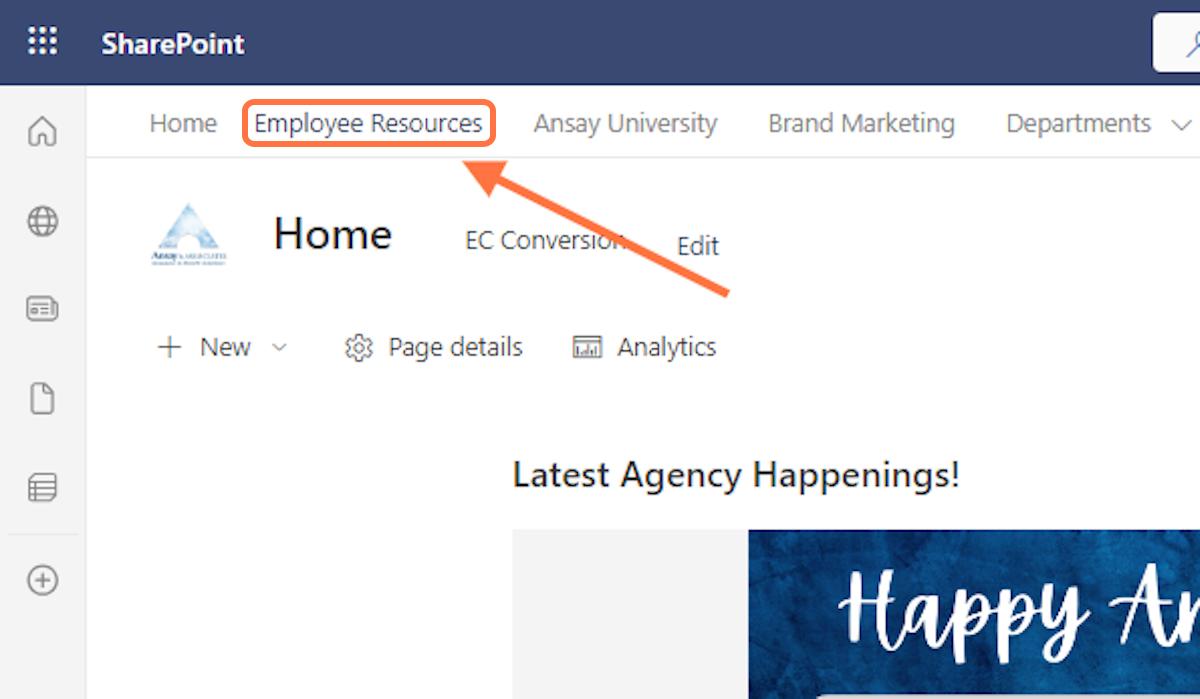

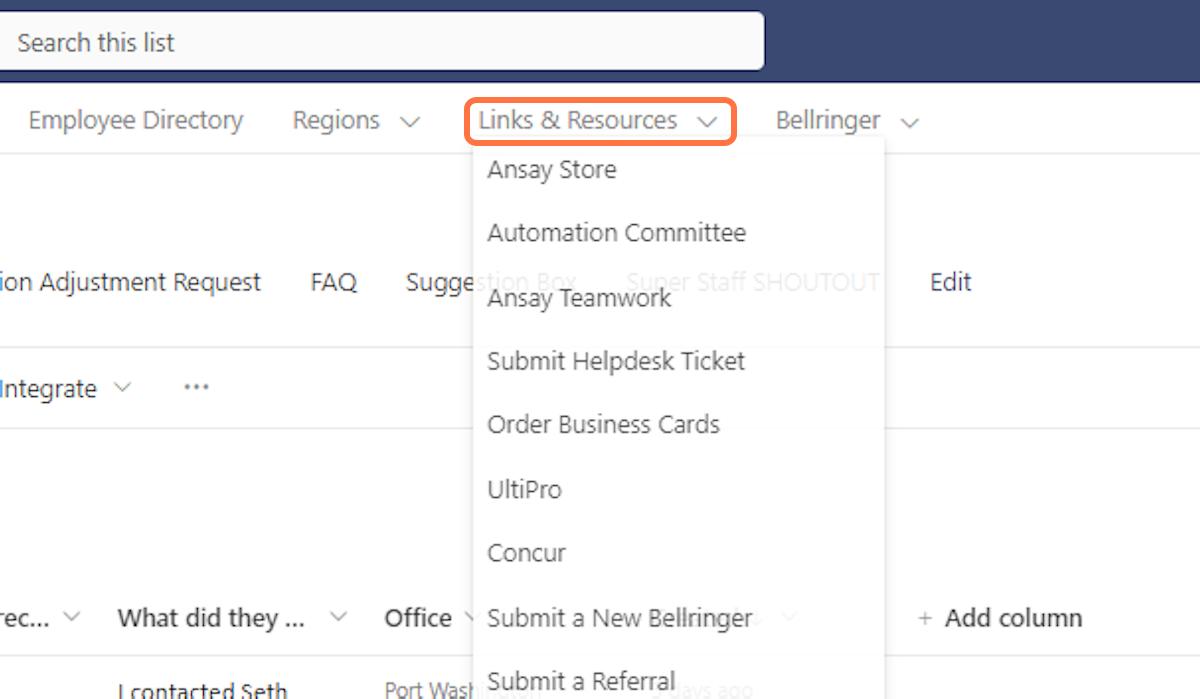

Ansay Important Employee Web Locations

• Direct Supervisor for Position Related – Current Structure – See Org Chart

o HR Related – Heather Jensen

• Ansay Intranet - https://ansayassociates.sharepoint.com/sites/Home

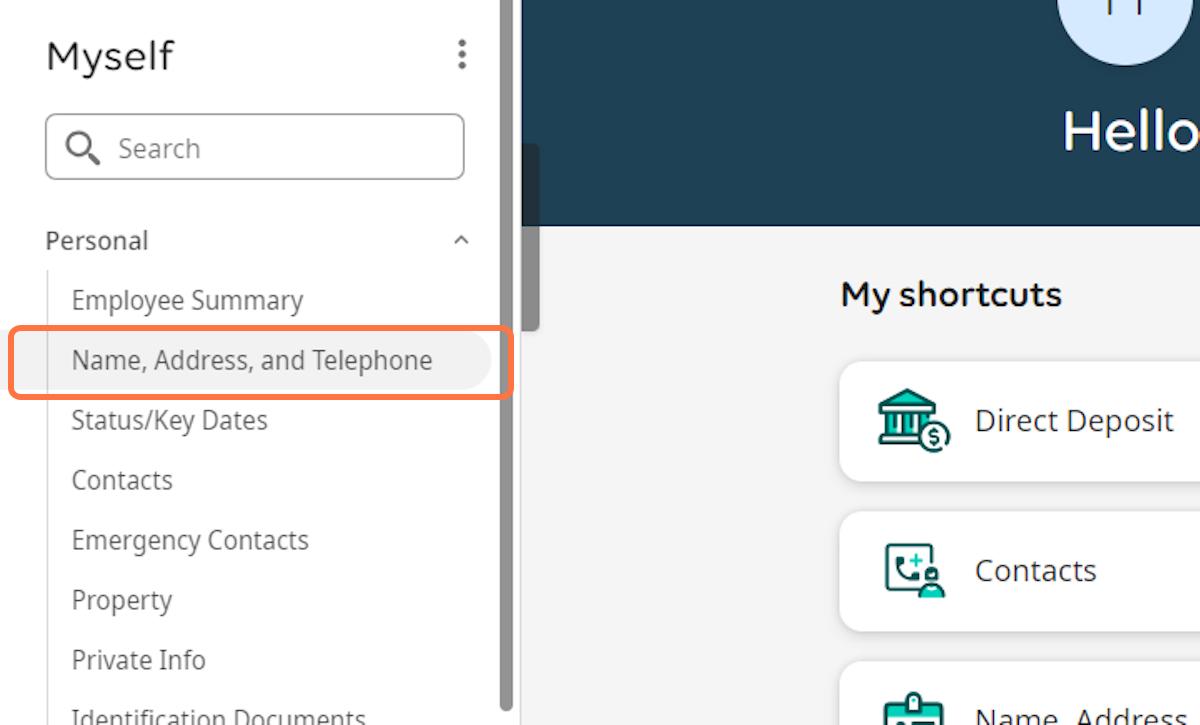

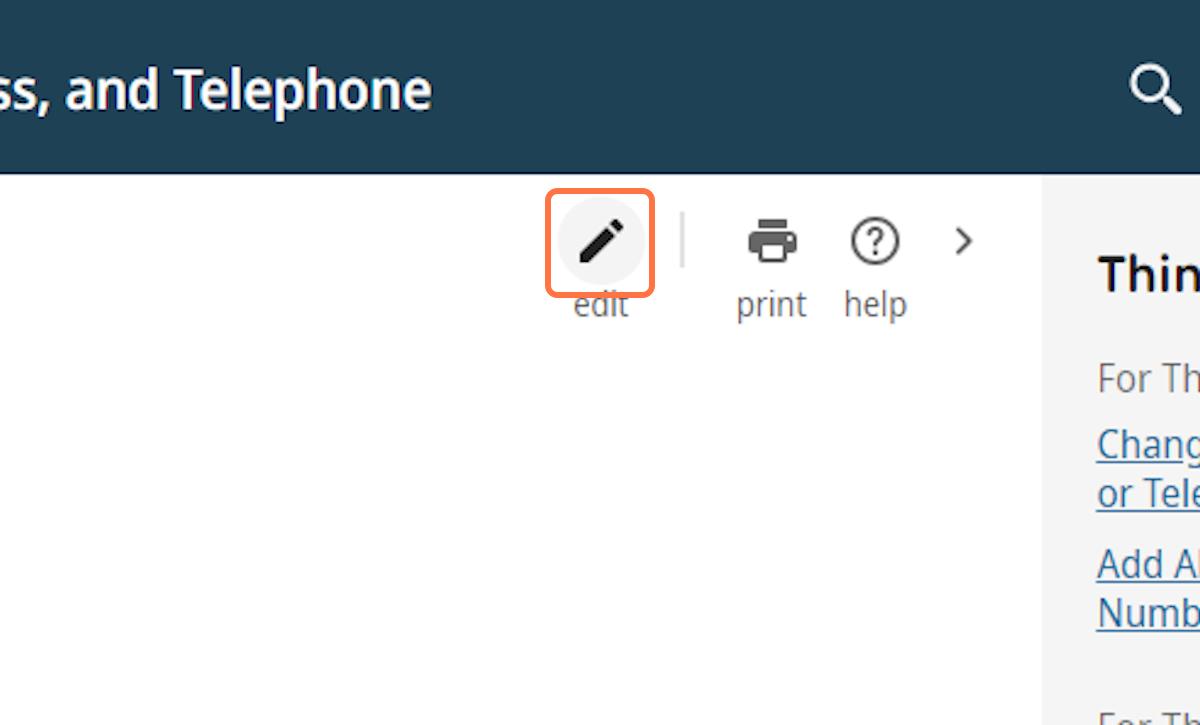

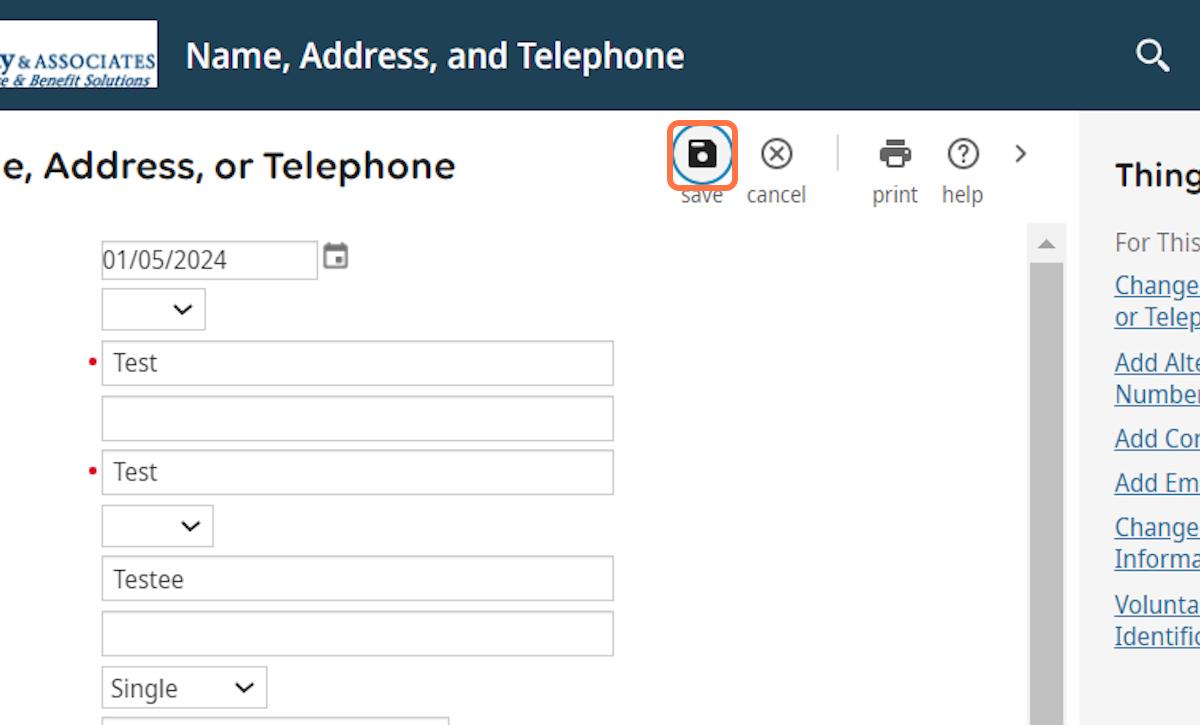

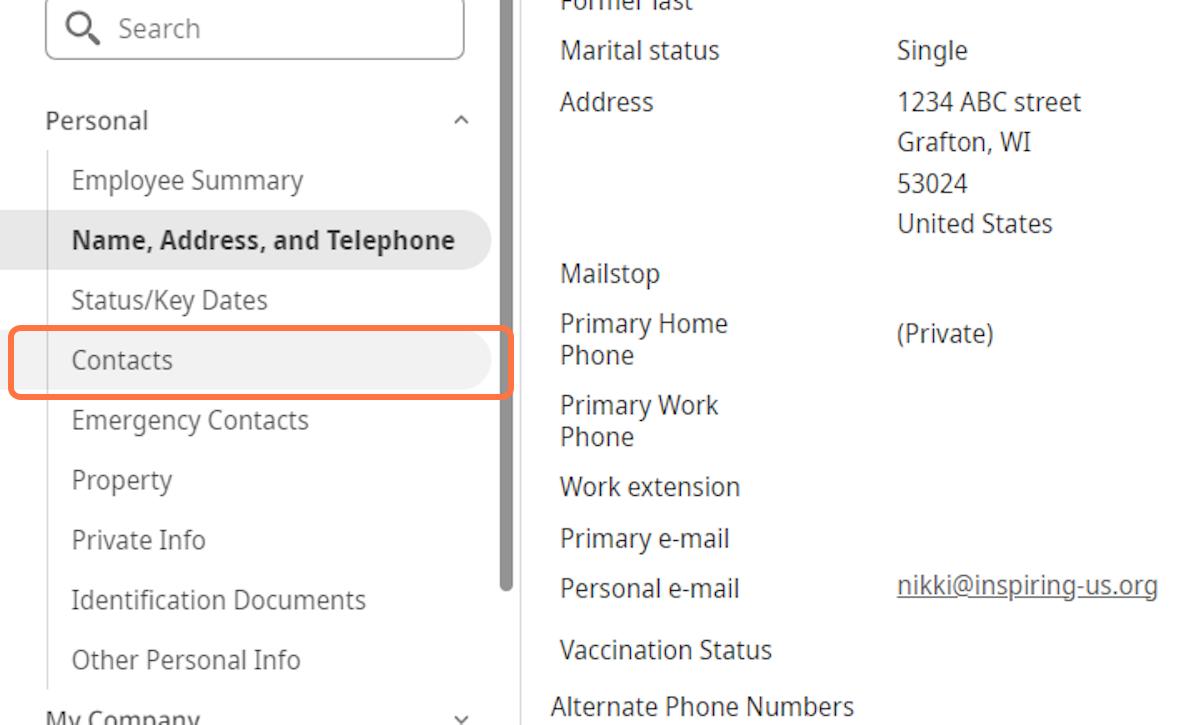

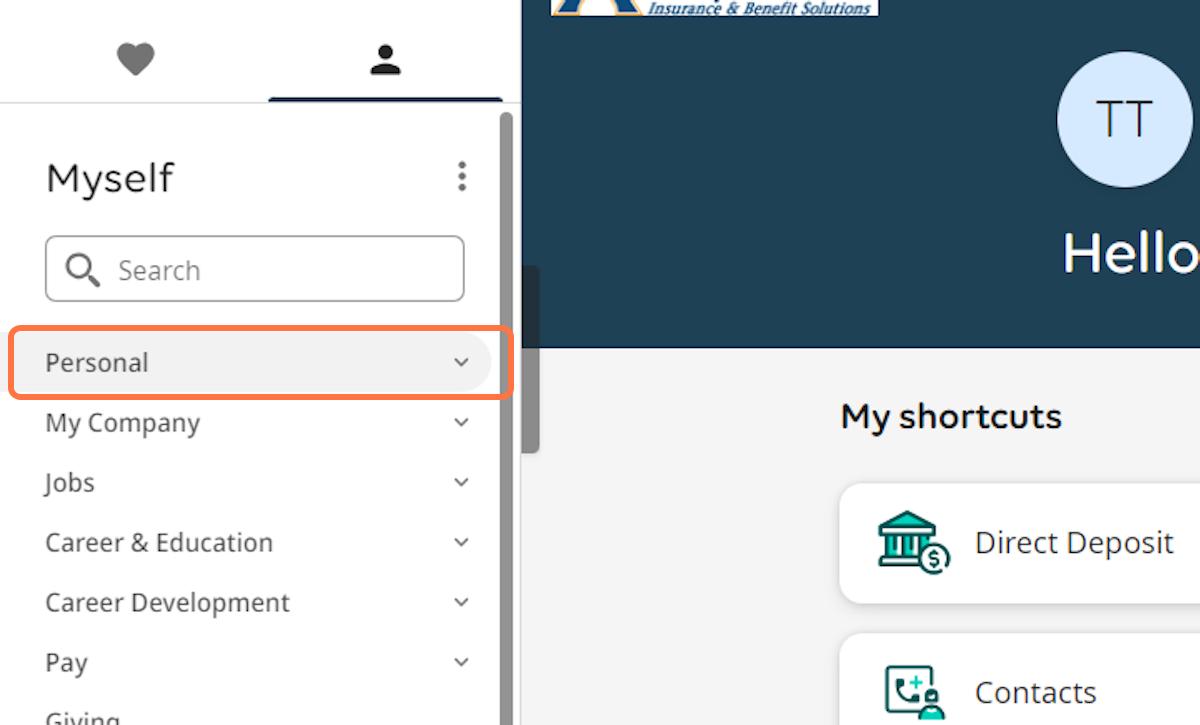

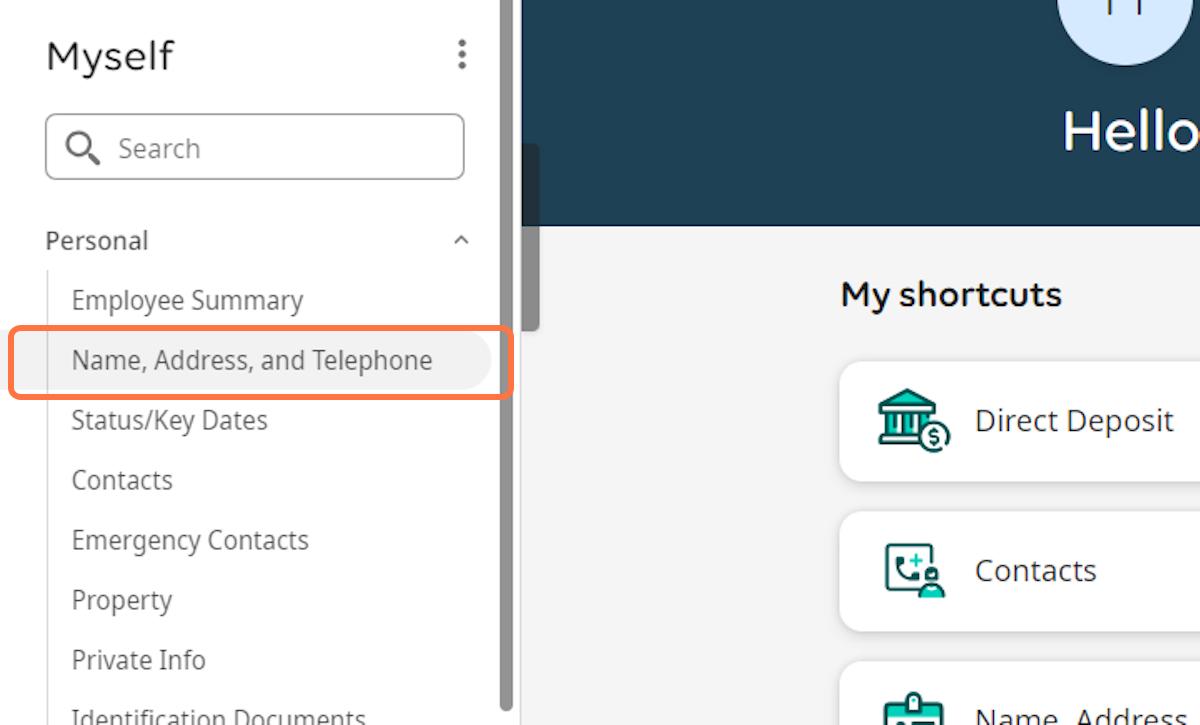

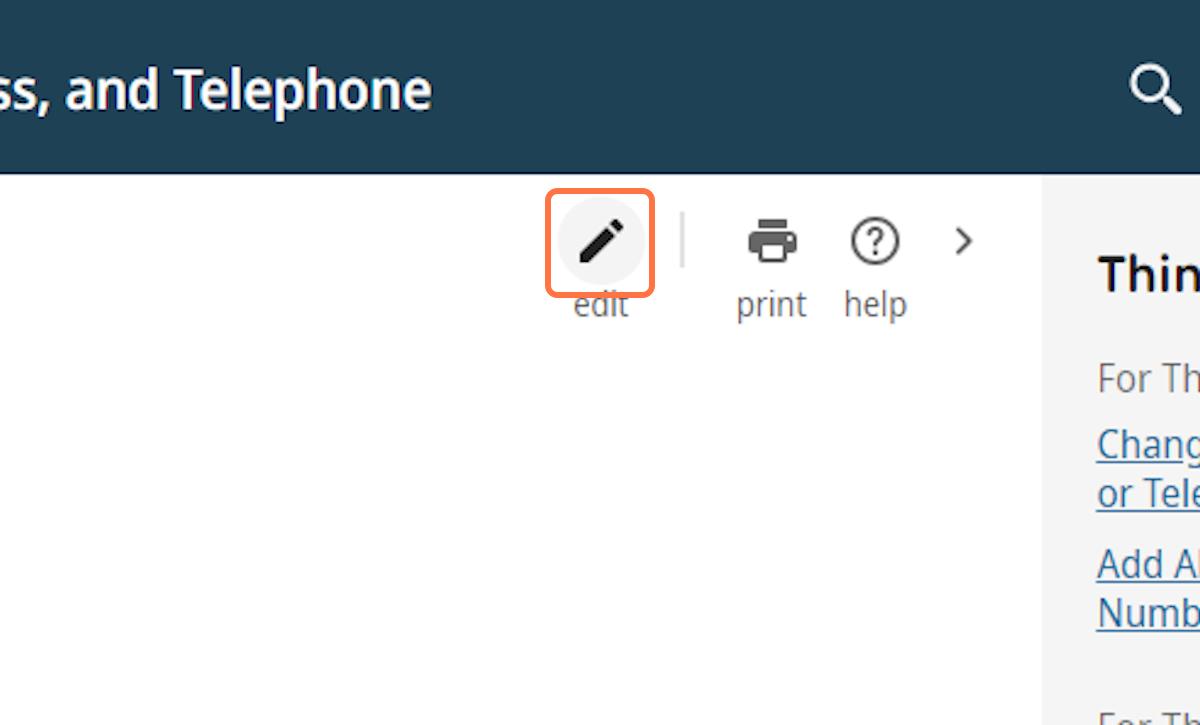

• Ultimate Software or UKG - https://ew24.ultipro.com/login.aspx

o First Time Log In = Username - Work E-mail & Password - Date of Birth (MMDDYYYY)

Employee System

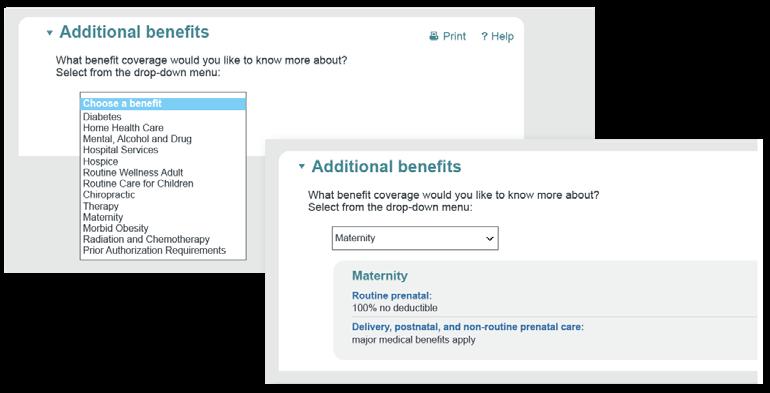

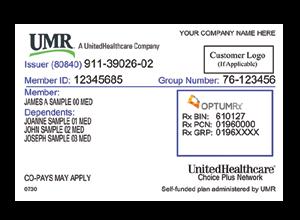

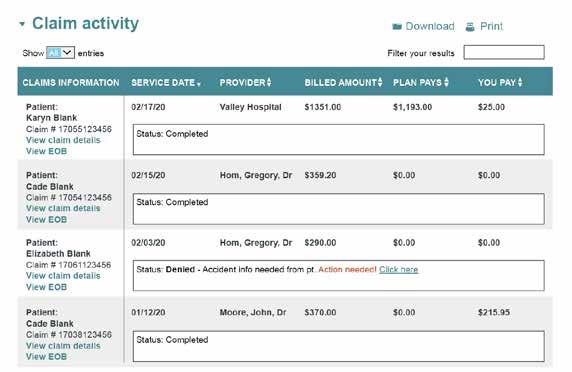

▪ Review Benefits Overview – Make Elections In UKG – Effective July 31, 2025– Will Receive Benefit Cards Electronically 2 Days After Enrolled

▪ 401(k) Enrollment – Log Into Principal Website for Deferral Options & Enter Beneficiary Information

▪ Reach out to Heather Jensen/Nikki Kiss with Questions

Due –End of Day Today, July 31, 2025

▪ Officially An Ansay Employee! August 1, 2025

▪ August 1, 2025– Hourly Employees Log Into UKG to Punch In/Out

▪ First Payroll for Dates: (7/27/2025-8/9/2025)

▪ First Ansay Paycheck: 8/14/2025

▪ Bi-Weekly Payroll (See Payroll Schedule In Binder)

▪ All Benefits In Place – Friday, August 1, 2025

Day 1: Contracts & Onboarding

Financial contracts

HR onboarding

Our values and mission

Integration overview

First 30 days: Announcemen ts & Discovery

Announcement of partnership

Discovery for operations, sales, culture, systems, carriers, accounts

MidStage: Resources & Culture

Co-branding and communication

Support for operations and sales

Resources & culture

Management of contracts, licenses and bookkeeping

IT integrations

Conversion: Integration of Systems & Processes

Our agency management system

Training in workflow, carriers, value adds, sales processes

Roles, reporting & career development

Earnout

Steady State: Integratio n is complete

Full brand transition

Integration with Ansay is complete

CL Sr. Account Manager

Melissa Hobart

Chief Development Officer

Erik Mikkelson

Branch Manager and Director of Sales

Jeff Giles

Deborah Pratt CL Sales Account Executive

Darienne Wesselman Personal Lines Team Leader-

Sherry Freeman

Account Manager

Brenda Schueler

Employees are paid every two weeks on Thursdays. Direct Deposit updates are requested electronically by the employees in UKG. This is an example of our Pay Date Schedule, updated yearly schedule can be found on the Company Intranet

Updated 7/31/2025

This page is intentionally left blank

Welcome, Thank you for joining Ansay & Associates, LLC! We hope you agree you have a great contribution to make to the insurance industry by way of Ansay & Associates LLC, and find your employment here a rewarding experience

We look forward to the opportunity of working together to create a more successful Agency We also want you to feel your employment with Ansay & Associates, LLC, will be mutually beneficial and gratifying In this Employee Handbook, Ansay & Associates, LLC will also be referred to as the “Agency. ”

You have joined an organization that has established an outstanding reputation for quality. Credit for this goes to everyone in the organization. We hope you too, will find satisfaction and take pride in your work here. As a member of the Ansay & Associates, LLC team, you will be expected to contribute your talents and energies to further improve the environment and quality of the Agency.

A.N. Ansay Agency Inc was founded in 1946 by Adolph N. Ansay. The Agency enjoyed early success due to Mr. Ansay's one central goal: Serve customers with integrity, respect and a sincere desire to build lasting relationships.

Together, we can continue down the path of our vision to double every seven years, develop a phenomenal high-performance team and become best-in-class through our well- packaged and differentiated Agency As we continue to grow, we rely everyday on our most valuable resource, our people As we continue to raise the bar on our standards and better utilize our unique abilities, we can continue to make the industry’s weaknesses our strengths and secure our existence now and in the future

We hope you will find this handbook helpful and retain it for reference purposes You have our best wishes for success If you have any questions, or something is not clear, please ask your Supervisor or Human Resources

Ansay & Associates is a best-in-class insurance advisor committed to helping our clients secure, protect and grow their version of the American Dream.

Ansay & Associates is committed to superior growth through our strategic initiatives and entrepreneurial spirit. We strive to inspire our employees to provide a first-rate customer experience for our clients by offering reliable solutions through innovative technologies.

Ansay & Associates, LLC believes in creating a harmonious working relationship between all employees. Everyone shares a common commitment to the tradition of building lasting relationships and bringing every customer a level of service that exceeds expectations - It’s the Ansay Way!

In pursuit of this goal, Ansay & Associates, LLC employees are asked to adhere to the Agency’s core values:

We appreciate that all people have value by treating each other with high regard and consideration. We are loyal and compassionate in our dealings with others.

We conduct ourselves in a professional and ethical manner at all times. Honesty and sincerity are the hallmarks of the way we manage our business.

The customer is our first priority. We listen to our clients and commit ourselves to consistently meeting or exceeding their expectations with forethought, flexibility and a solution-focused “can do” attitude.

We have an energetic and tireless commitment to pursue what is best for our clients, our Agency and our carriers. We provide a fun and supportive environment for our staff. One that provides inspired meaningful and challenging work.

An attitude of constant and never-ending improvement, discipline and oomph.

We seek excellence in all we do through constant improvement of our operations, educational achievement and by pursuing opportunities to further our capabilities. This allows us to build confidence with our carriers and clients.

Ansay & Associates, LLC is an equal employment opportunity employer. Employment decisions are based on merit and business needs, and not on race, color, citizenship status, national origin, ancestry, genetic information, gender identification, sexual orientation, age, religion, creed, physical or mental disability, marital status, veteran status, political affiliation, or any other factor protected by law. Ansay & Associates, LLC. complies with the law regarding reasonable accommodation for handicapped and disabled employees. Ansay & Associates, LLC’s CEO has issued the following policy stating the Agency’s views on this matter.

It is the policy of Ansay & Associates, LLC to comply with all the relevant and applicable provisions of the Americans with Disabilities Act (ADA) as amended. Ansay & Associates, LLC. will not discriminate against any qualified employee or job applicant with respect to any terms, privileges, or conditions of employment because of a person’s physical or mental disability. Ansay & Associates, LLC. will also make reasonable accommodations whenever necessary for all employees or applicants with disabilities, provided the individual is otherwise qualified to safely perform the duties and assignments connected with the job and provided any accommodations made do not impose an undue hardship on the Agency.

Equal employment opportunity notices are posted near employee gathering places as required by law. These notices summarize the rights of employees to equal opportunity in employment and list the names and addresses of the various government agencies that may be contacted in the event any person believes he or she has been subject to unlawful treatment in violation of any of the various federal or state employment laws.

Management is primarily responsible for seeing that Ansay & Associates, LLC’s equal employment opportunity policies are implemented, but all members of the staff share in the responsibility for assuring by their personal actions the policies are effective and apply uniformly to everyone.

Any employee, including managers, involved in discriminatory practices will be subject to discipline, up to and including termination.

The policies and management expectations outlined in this Employee Handbook are not a substitute for the good judgment and honesty that mature, conscientious people have as a part of their basic make-up.

As an employee of Ansay & Associates LLC, your primary responsibility to the Agency is honesty and integrity in all of your dealings. You are the Agency as you represent it every day!

Employees must always conduct themselves in a manner which reflects the best interest of the Agency, based upon accepted business practices, common sense, and good citizenship.

As residents of the US, we have the right to free speech and as employees of Ansay & Associates, LLC., we have a responsibility that comes with that right. Our responsibility includes active awareness of where we are speaking, how our speech may affect others, and a commitment to speak in a way that is respectful of ourselves and others.

Potentially contentious topics (such as politics, race, gender, parenting, etc.) are absolutely okay to be discussed with the condition that those involved in the conversation are always being mindful of our responsibility and with the goal to learn and understand, not convince or argue. BUSINESS ETHICS

This Employee Handbook does not establish a contract (express of implied) between Ansay & Associates, LLC and any employee regarding terms and conditions of employment.

This Employee Handbook does not in any way alter the employment at-will relationship between Ansay & Associates, LLC and its employees. Ansay & Associates, LLC and each employee have the right to terminate the employment relationship at any time, with or without cause or notice.

You should be aware that no supervisor, manager, or representative of Ansay & Associates, LLC, other than the Agency’s CEO, has the authority to enter into any agreement with any individual for employment for any specified period of time or to make any promises or commitments contrary to any policy or guideline established in this employee handbook.

The insurance business by its very nature requires the utmost of confidentiality. In our most casual transactions, we are dealing with the private and personal matters of our customers' lives. All of this information must be used in the conduct of Agency business and then only in the most discrete manner. Absolutely nothing heard or seen in the Agency that pertains to our business, customers' and employees' accounts or transactions with the Agency may be divulged except within the Agency, and then only for business purposes.

Thoughtless or careless actions leading to the release of information about our customers and/or their transactions are not only wrong ethically, but may involve the employee and the Agency legally. Employees must not review any information regarding customer or other employee accounts unless it is directly related to their job. Employees indiscriminately reviewing or releasing customer or confidential business information will be dismissed from employment.

The purpose of this policy is to provide guidance on the appropriate and acceptable use of Ansay & Associates, LLC’s electronic and communication systems.

You may be called upon to handle all kinds of valuable information in the course of each business day. You must be on the alert to assure the safety of everything entrusted to your care.

Ansay & Associates, LLC expends considerable time, effort and expense to establish, maintain and operate e-mail, computer, and Internet systems ("these systems" or collectively the "System"). These systems are all considered the Agency’s property. It is Ansay & Associates, LLC’s policy that the System be used principally and solely for the benefit of the Agency and to advance its business interests and not for personal or other uses.

General information about the Inter/Intranet and E-mail system:

A. Difficulty in Deleting Messages.

Messages are easy to proliferate through the E-mail system and over the Internet, but extremely difficult to track down and delete. The deletion of one stored copy of an e-mail message will generally not be effective in deleting other stored copies of that same message. You should always bear in mind that the possibility that several copies of messages may be stored in electronic or hardcopy format at various physical locations, and it is difficult, if not impossible for any one individual to find or delete all outstanding copies.

In addition, this reality is compounded when messages are sent over the Internet to third parties who are not under the control of the Agency, or through insecure channels where the messages may be intercepted by hackers. Also, be aware that when you visit another Web site, your identity and that of the Agency's Web site can be automatically tracked by the host Web site.

Because of the case of distributing information through the System, utmost caution should be used in determining whether to send messages containing confidential information. Generally, you should only send confidential information to specific individuals having a "need to know" such information. Do not send any confidential information to outside parties who are not authorized to receive the information, and do not send any confidential information to outside parties without first confirming that they are bound by written confidentiality restrictions. You should generally avoid sending confidential messages to distribution lists and, when such lists are used, be careful to identify each recipient on the list individually before sending the message. Messages containing confidential information generally should not be sent through the Internet without first encrypting the message, since the Internet is not a secure channel of communication.

Inbound communications received by you via the Internet, and from third party systems, impose certain risks. Due to the danger of computer virus transmission, downloading shareware programs from the Internet or third party systems is generally prohibited. Even for general business correspondence, it is important to check inbound messages for viruses or other harmful code. The Information Technology Department can supply you with anti-virus software for such purposes. In addition, third parties sending you messages should be notified of this policy, as well as notified that such messages may be accessed and disclosed to outsiders under certain circumstances. Messages sent to or received from third parties will be treated in the same manner as any other messages on the System.

Employee use of the System is strictly limited for the Agency’s business purposes only. However, Ansay & Associates, LLC recognizes that on the rare occasion, an employee may need to use the System for a personal reason. Such personal use is an exception and not the rule. Employees who abuse this exception may be subject to discipline, up to and including termination.

Employees should note, however, that personal messages will be treated like any other messages on the System. This means that messages of a highly personal nature, or those that would cause embarrassment or harm if they were accessed by the Agency or disclosed to other employees or outsiders should not be transmitted or received. In addition, permission for rare and limited incidental personal use does not authorize any use of the System for prohibited uses (see below) or any use which interferes with the normal conduct of the Agency's business and/or the operation of the System.

▪ Individuals using Ansay & Associates, LLC's electronic resources are responsible to maintain security of information stored on each system.

▪ Staff may use only electronic resources for which access is approved.

▪ Confidentiality of systems' accounts, passwords, and personal identification numbers (PINs) and other types of authorization assigned to individual users must be maintained, protected, and not inappropriately shared.

▪ Individuals need to be aware of computer viruses and other destructive programs, and take steps to prevent damage to Ansay & Associates, LLC equipment and systems.

▪ Ansay & Associates, LLC's systems should only be used for Agency business. However, incidental personal use may be appropriate when prior supervisor approval has been obtained or in accordance with departmental guidelines.

▪ Downloading of Internet software is prohibited when resulting in copyright abuse or excessive use of bandwidth.

▪ Each individual is responsible for knowing his/her department's expectations for use of the Agency's System.

▪ Staff may not conduct non-Ansay & Associates, LLC related business or other activities via Ansay & Associates, LLC’s System and equipment.

▪ Supervisors are responsible for insuring that individuals are assigned the appropriate level of security access to systems.

▪ Upon transfer or termination of employment, supervisors should immediately initiate request and follow-up to insure security access has been deleted.

▪ Supervisors must define and communicate departmental expectations on personal use of equipment and systems.

Inappropriate use includes, but is not limited to;

▪ deliberate propagation of any virus, etc., or

▪ intentional disabling or overloading any system or network, or

▪ circumventing any system intended to protect privacy or security of another user, or

▪ accessing or displaying inappropriate images or documents such as those that may be disruptive to the workplace, graphics depicting violence, sexual images, intolerance of differences, etc., or

▪ unauthorized communication as a representative of Ansay & Associates, LLC to or within a public forum.

Generally, messages should not violate or infringe upon the rights of any other person, or be of a nature which a reasonable person would consider abusive, profane, offensive, defamatory, personally embarrassing or harassing, or which violate or encourage others to violate the Agency's e-mail, Internet System Policy or any applicable law.

Messages containing jokes or discriminatory comments regarding sex (including without limitation pregnancy or maternity), sexual orientation, race, color, national origin, ethnicity, disability, or age are strictly prohibited. You must not transmit or knowingly receive messages containing so-called "chain letters," pornographic, obscene, lewd, lascivious or patently offensive material, nor should you use the System to impersonate others, hack into another person's in-box, log or archival files, or disrupt the orderly operation of the System or the Agency's business.

You should be especially careful not to use the System to send or receive containing copyrighted material without first obtaining the owner's permission; as such transmittal may constitute making an unlawful copy of the original work. This includes not only using or transmitting copyrighted information without permission, but also any use that exceeds the scope of the applicable license. Special care should be taken not to transmit confidential or proprietary information belonging to the Agency, or relating to its affairs, without specific permission and compliance with applicable security procedures. You should not use the System for "surfing" of the Internet, except when authorized for purposes directly related to performing your job responsibilities. Any postings to the Agency's Web site should be made only with the authorization of the Agency. With respect to any Web site posting, you grant the Agency the nonexclusive, perpetual, irrevocable right to copy, publish, distribute, transmit and prepare derivative works of the posting as needed to operate its System in the normal course of business.

You should not send messages through the System to solicit money, sell goods or services, organize memberships in any organization or support or oppose any cause, activity or event of a charitable, religious, political or outside business nature, or any other organizing activity not directly related to the advancement of the Agency’s business, as determined by Ansay & Associates, LLC in its sole judgment. It is the Agency’s intention to enforce this policy against all such solicitations in a content-neutral manner.

Messages may be encrypted, locked or password protected using technology or procedures to be approved by the Agency's Information Technology and Systems Security Departments. Before using any other encryption or similar technology, you must provide the Information Technology Department the keys or passwords in your possession or under your control that are needed to unlock such messages.

All messages transmitted through or stored on the System are business documents, and will be considered property of the Agency regardless of origin. Ansay & Associates, LLC has legitimate business or legal reasons to monitor, intercept, access, and review any such messages. Messages may be accessed without providing advance notice to the employee or other individuals involved in the communication. You should not consider any messages to be private, as all messages are subject to access and review by the Agency. Ansay & Associates, LLC reserves the right in its sole discretion and without notice to use any accessed messages internally, or to disclose messages to such third parties, as deemed necessary.

Your communications and use of the Ansay & Associates, LLC's e-mail, computer, and Internet systems will be held to the same standard as all other business communications. Management should be notified of unsolicited, offensive, or otherwise inappropriate materials received by any employee on any of these systems.

Your consent and compliance with the Agency's e-mail, computer, and Internet policies is a term and condition of your employment. Failure to abide by these rules or to consent to any interception, monitoring, copying, reviewing, and downloading of any communications or files is grounds for discipline, up to and including termination.

All employees shall use software only in accordance with its license agreement. Any duplication of copyrighted software, except for backup and archival purposes, is a violation of the law. Unauthorized duplication of copyrighted computer software violates the law and is contrary to the Ansay & Associates, LLC’s standards of conduct.

All employees shall comply with the following:

1. All software shall be used in accordance with its license agreements.

2. Ansay & Associates, LLC will not tolerate the use of any unauthorized copies of software in the Agency. Any persons illegally reproducing software can be subject to civil and criminal penalties. Further, Ansay & Associates, LLC prohibits illegal copying of software under any circumstances and any employee who makes uses or otherwise acquires unauthorized software shall be subject to disciplinary action up to and including discharge.

3. No employee shall give any Agency owned software to any third party or outsider including clients, customers and others.

4. Any employee who determines that there may be misuse of software shall notify their department manager or Human Resources.

5. All software used on any of the Agency’s computers must be properly purchased and registered through the appropriate procedures.

If you have questions regarding this policy, talk to your Supervisor, or the Information Technology Department.

Information that pertains to Ansay & Associates, LLC business, including all nonpublic information concerning the Agency, its vendors and suppliers, is strictly confidential and must not be given to people who are not employed by Ansay & Associates, LLC.

Please help protect confidential information which may include, for example, trade secrets, customer lists and Agency financial information by taking the following precautionary measures:

Effective 5/1/2024

This policy aims to establish unified guidelines for the responsible, secure, and ethical use of generative artificial intelligence (AI) technologies and AI chatbots within our organization. With the increasing popularity of generative AI chatbots such as OpenAI’s ChatGPT and Google’s Bard, it has become necessary to outline the proper use of such tools while working at Ansay and Associates. While we remain committed to adopting new technologies to aid our mission when possible, we also understand the risks and limitations of generative AI chatbots and want to ensure responsible use. Our goal is to protect employees, clients, suppliers, customers and the company from harm.

These technologies include any systems capable of generating human-like text, images, or other media content, as well as AI chatbots like OpenAI's ChatGPT and Google's Bard.

While AI chatbots can be used to perform a variety of functions, this policy addresses only the use of a web-based interface to ask or “prompt” the chatbot in a conversational manner to find answers to questions or to create or edit written content.

Some examples of what could be created using an AI chatbot include:

•Emails and letters.

•Blog posts, reports and other publications.

•Sales and advertising copy.

•Policies and job descriptions.

•Spreadsheet calculations.

•Foreign language translations.

•Coding development or debugging.

•Document or information sorting.

•Outlines or summaries of internal or external information.

There are, however, risks in using this technology, including uncertainty about who owns the AIcreated content and security/privacy concerns with inputting proprietary company information or sensitive information about an employee, client, customer, etc., when interacting with the chatbot. Additionally, the accuracy of the content created by these technologies cannot be relied upon, as the information may be outdated, misleading or in some cases fabricated.

This policy applies to all employees of Ansay and Associates and to all work associated with Ansay and Associates that those employees perform, whether on or off company premises.

This policy applies to all employees, contractors, and third-party individuals involved in using generative AI tools or AI chatbots on behalf of the organization.

3.1 Authorized Use

Generative AI tools and AI chatbots may only be utilized for approved business purposes, including but not limited to content generation, marketing, sales scripting, product development, and customer service enhancements.

3.2 Compliance with Laws and Regulations

All users must adhere to applicable laws, regulations, and ethical standards, particularly concerning intellectual property, privacy, and data protection.

3.3 Intellectual Property Rights

The use of AI-generated content must respect intellectual property rights, ensuring no infringement occurs.

3.4 Responsible AI and Chatbot

Generated content or responses from AI chatbots must align with the organization's values and ethics, avoiding misleading, harmful, or discriminatory content.

4.0

4.1 Access Control

Access to AI and chatbot tools should be limited to authorized personnel, with strict controls to prevent unauthorized use.

4.2 Secure Configuration and Authentication

Ensure secure configuration of AI tools and chatbots, implement strong authentication mechanisms, and maintain user credential confidentiality.

4.3 Data Protection

Special care must be taken to protect personal, sensitive, or confidential data, adhering to our data protection policies and avoiding the use of such data in AI inputs without proper encryption and safeguards.

Monitoring,

5.1 Monitoring and Auditing

Regular monitoring and auditing should be in place to track the use of AI and chatbot technologies, identifying and mitigating unauthorized or inappropriate usage.

5.2 Incident Response

Any security incidents or misuse should be promptly reported and addressed, following our established incident response protocols.

5.3 Training and Awareness

Employees must receive training on responsible and secure AI and chatbot usage, covering potential risks, ethical considerations, and policy compliance.

6.0 Policy Violation Consequences

Violations of this policy may lead to disciplinary action, including termination of employment or legal repercussions, depending on the severity and nature of the non-compliance.

7.0 Policy Review and Update

This policy will be reviewed and updated regularly to reflect technological, legal, and organizational changes, ensuring ongoing relevance and effectiveness.

▪ Discuss work matters only with other Ansay & Associates, LLC employees who have a specific business reason to know or have access to such information.

▪ Do not discuss work matters in public places.

▪ Monitor and supervise visitors to Ansay & Associates, LLC to ensure they do not have access to confidential information or work areas containing confidential or proprietary information.

▪ Destroy hard copies of documents containing confidential information not filed or archived.

▪ 5S your desk or work area of confidential or proprietary information at the end of each business day and, if possible, secure such information in locked desk drawers and cabinets.

Your cooperation is particularly important because of our obligation to protect the security of our clients' and our own confidential and proprietary information. Use your own sound judgment and good common sense, but if at any time you are uncertain as to whether you can properly divulge information or answer questions, please consult Human Resources.

Proprietary information should be recognized as such and treated accordingly. Disclosure of proprietary information to unauthorized individuals by an employee is prohibited and will be grounds for discipline up to and including termination. Should an employee leave the Agency for any reason, he/she will be required to return any written and electronically stored information containing proprietary or confidential information and the obligation not to disclose such information will continue beyond the employee’s last day of employment.

It is Ansay & Associates, LLC. company’s policy to ensure employees who use social media to discuss the company or company-related matters do so in a responsible manner. Before you post something online, consider the consequences. Online conduct that negatively affects your job performance, a co-worker’s performance, or otherwise adversely affect the legitimate business interests of Ansay & Associates, LLC. or its customers and suppliers, may lead to disciplinary action up to and including termination.

Online communication includes all means of communicating online including, but not limited to, posting information or content to websites, blogs, social networking sites, and all other Internetconnected applications.

Nothing in this policy is designed to interfere, restrain, or prevent employee communications regarding wages, hours, or other terms and conditions of employment.

When communicating online, please observe the following guidelines:

1. Post content with which you want to be associated. Online content lasts a long time. Just because you clicked delete doesn’t mean that picture, post, or email is gone. More likely than not, it’s on a server somewhere, and someone can likely access it.

2. If you make a mistake, correct it. Sometimes you might get your facts wrong. When that happens, acknowledge the mistake and correct it. Don’t just delete the post and pretend it didn’t happen. In addition, never post information that you know to be false about Ansay & Associates, LLC., its employees, customers, or suppliers.

3. Understand there is no expectation of privacy with unsecured online communications. Few things that are posted online are private. The Internet has made it easy to share information. Sometimes information that was not intended to be shared beyond a limited group gets shared further than initially intended.

4. Identify yourself. If you share opinions about Ansay & Associates, LLC. , products, or related matters, don’t do so anonymously. Posting anonymously can violate SEC financial disclosure regulations and FTC endorsement regulations. Further, do not represent yourself as an official Ansay & Associates, LLC. spokesperson. Employees do not have authorization to speak on behalf of Ansay & Associates, LLC., unless permission is specifically granted by the President of Ansay & Associates, LLC.. It’s best to use a disclaimer on communications involving Ansay & Associates, LLC. that states “The postings on this site are my own and do not necessarily reflect the views of Ansay & Associates, LLC.”

5. Be Respectful. When talking about other people or other companies, be decent. Don’t trash a competitor’s brand or products. If you have a problem regarding a fellow Ansay & Associates, LLC. employee, we hope you try to resolve the issue directly with your co-worker. Nevertheless, if you decide to post complaints or criticism, avoid using statements, photographs, video or audio that could be viewed as malicious, obscene, threatening or intimidating, or that might constitute harassment based on an individual’s race, color, religion, sex, national origin, age, disability, genetic information, military service or any other characteristic protected by law.

6. Follow all company policies. Abide by all Ansay & Associates, LLC. policies, including confidentiality requirements, non-disclosure agreements, and harassment and bullying policies. Do not give out confidential and/or proprietary information including, but not limited to, customer lists, trade secrets, business plans, or other Ansay & Associates, LLC. documents.

7. Personal Online Communications While at Ansay & Associates, LLC. Ansay & Associates, LLC. asks that you limit your personal online activity during work hours to non-working time, such as breaks and lunch periods.

Employees who report a violation of this policy or who assist in the investigation of a complaint will not be subject to retaliation or reprisals of any kind. Any employee who engages in retaliation against another employee because of a complaint under this policy will be subject to disciplinary action, up to and including termination.

Because of the nature of Agency business, the phone lines are always busy. We receive calls from insureds, insurance carriers and others who are seeking help. Remember the Agency’s mission is to serve others. For this reason, you must keep your personal phone calls to an absolute minimum. Cellular phones are permitted in the workplace, but should have the ringer turned down low or silenced, so as not to disrupt other employees. In addition, cellular phones for personal use should be on your own time. No personal calls are to be made or accepted on the 1800 lines. In addition, employees are prohibited from accepting collect calls.

Technology is everywhere and understand the need to be connected to outside/daily happenings. While in the workplace, and for professional courtesy while performing your daily job duties, below is the Agency’s policy;

▪ While at work, remember to set your phone to silent or vibrate. Ringtones are a distraction to co-workers.

▪ Your cell phone is your personal device, but at work you should not be taking personal calls or texts. Emergencies are understood, and can be taken away from your desk.

▪ Let all calls go to voice mail. It’s easier and faster to check a voice mail to gauge if a call is an emergency or not.

▪ If you need to make a personal call make sure you do it during a break and in a private location away from your desk.

▪ Do not take your phone to the restroom with you. This practice is an invasion of your coworkers privacy.

▪ Cell phones are becoming a popular replacement for a watch. While it is important to keep track of your time in meetings, your cell phone can be a temptation/distraction. To avoid this distraction, leave your cell phone at your desk.

Under current Wisconsin law, inattentive driving of a motor vehicle is prohibited. This includes:

1) Being engaged or occupied with an activity, other than driving the vehicle, which interferes with the person's ability to drive the vehicle safely.

2) Driving a motor vehicle while composing or sending an electronic text message or an email message, subject to various exceptions.

3) A probationary license or instructional permit holder driving a motor vehicle while using a cellular or other wireless telephone.

4) Operating or being in a position to directly view an electronic device that provides visual entertainment, subject to various exceptions.

According to a new law, Wisconsin Act 308, effective on October 1, 2016, a person is also prohibited from driving a motor vehicle while using a cellular or other wireless telephone in a highway maintenance or construction zone, except to report an emergency.

The prohibition does not apply to the use of a voice-operated or hands-free device if the driver does not use his or her hands to operate the device, except to activate or deactivate a feature or function of the device. The prohibition includes using the telephone for a purpose other than communication.

For safety purposes, please take special care to ensure you are not distracted if using a cell phone while driving on Agency business. You must find a safe/legal place to pull off the road and out of traffic to make a call. Team members are expected to comply with applicable state laws regarding the use of cellular telephones.

Associates who are Insurance Advisors, Consultants, or Account Executives (Sales team) whose job responsibilities require the operation of a motor vehicle to visit clients must maintain a valid driver's license and driving record acceptable according to the standards of our insurance carrier.

Associates who are Insurance Advisors, Consultants, or Account Executives (Sales team) whose job responsibilities require the operation of a motor vehicle to visit clients must maintain a valid driver's license and driving record acceptable according to the standards of our insurance carrier.

Newly hired sales staff, will have records and coverage reviewed during the due diligence review conducted by a third-party vendor (InCheck), and then monitored annually thereafter. Current sales staff will be audited by a third-party vendor (InCheck) the first quarter of each year. Failure to maintain a valid driver's license and acceptable driving record may result in suspension of driving privileges and may result in termination.

1. A valid driver's license.

2. Auto insurance with minimum liability limits of: $250,000/500,000/100,000 split-limit/bodily injury/property damage $500,000 combined single limit/bodily injury/property damage.

3. Proof of continuing auto insurance coverage.

4. All changes in driver's license status must be reported to your direct supervisor.

The safety and well-being of employees is essential to the success of Ansay & Associates, LLC. In an effort to prevent or detect theft, substance abuse, violation of Agency policies, and outside competitive activities, investigation and monitoring of employees may take place. Monitoring may occur through computer or telephone communications, as well as searches of lockers, desks, files, personal belongings (including purses and briefcases) and cars. Investigations may be conducted if there is or may be a direct impact on workplace performance, or if reasonable cause/suspicion exists that any Agency policy is being violated or workplace safety is threatened.

An employee's consent to a search is required as a condition of employment and the employee's refusal to consent to any search under this policy may result in disciplinary action, including termination.

The following policy is based on The Drug-Free Workplace Act of 1988.

Possession, manufacture, distribution, dispensation or other use of illegal drugs in the workplace at any of Ansay & Associates, LLC locations is prohibited. Employees must notify the Agency management of any criminal drug statute conviction for a violation occurring in the workplace no later than five days after such a conviction. Drug use, on and off-duty, is prohibited. The Agency reserves the right to terminate employment or suggest counseling for any violation of this policy.

The philosophy of Ansay & Associates, LLC is to provide employees with a work environment that offers the opportunity and resources to optimize their personal health and well-being. Ansay & Associates, LLC and its properties will maintain a Smoke Free Environment. This means smoking (regular or e-cigarettes/vaping), as well as any use of mouth or smokeless tobacco (to include dipping, chewing, etc.) is also prohibited under this policy and is subject to the same restrictions. Tobacco usage will not be allowed anywhere on Agency property and will only be allowed outside Agency property. Each employee is expected to abide by the terms of the Smoke Free Policy.

To ensure a workplace safe and free of violence for all employees, Ansay & Associates, LLC prohibits the possession or use of any type of weapon anywhere on Agency property. Employees are prohibited from bringing or otherwise carrying weapons, including firearms, inside Agency buildings, structures, or other areas or structures and possession of a valid concealed weapons permit or license is not an exception to this policy. Any employee in possession of a firearm or other weapon while on Agency property, except as provided below, will be subject to disciplinary action, including termination.

“Agency property” is defined as all agency-owned or leased buildings and surrounding areas such as sidewalks, walkways, driveways, and parking lots under the Agency’s ownership or control. This policy applies to all Agency-owned or leased vehicles. However, in accordance with Wisconsin law, this policy shall not be interpreted to prohibit any employee who is lawfully licensed to carry a concealed weapon from carrying a concealed weapon, a particular type of concealed weapon, or ammunition in such employee’s own motor vehicle regardless of whether the motor vehicle is used in the course of employment or whether the motor vehicle is driven or parked on property used by the Agency. Nonetheless, such employees shall keep all weapons stored in their vehicles out-of-sight and in a secure location (such as in the trunk or locked glove box). Employees who are not lawfully licensed to carry a concealed weapon are prohibited from possessing any weapons in any vehicle parked or located on Agency property.

To enforce this policy and protect our employees’ safety, we reserve the right to search all Agencyowned or leased vehicles and all vehicles, packages, containers, purses, briefcases, backpacks, lockers, desks or persons entering or located on Agency property. Any violation of this policy, including refusal to promptly permit a search under this policy, will result in prompt disciplinary action, up to and including termination.

Ansay & Associates, LLC intends to provide a work environment that is pleasant, professional, and free from intimidation, hostility or other offenses which might interfere with work performance. Harassment of any sort - verbal, physical, visual - will not be tolerated, particularly against employees in protected classes. These classes include, but are not necessarily limited to race, color, religion, sex, age, sexual orientation, national origin or ancestry, disability, medical condition, marital status, veteran status, or any other protected status defined by law.

Workplace harassment can take many forms. It may be, but is not limited to, words, signs, offensive jokes, cartoons, pictures, posters, e-mail jokes or statements, pranks, intimidation, physical assaults or contact, or violence. Harassment is not necessarily sexual in nature. It may also take the form of other vocal activity including derogatory statements not directed to the targeted individual but taking place within their presence. Other prohibited conduct includes written material such as notes, photographs, cartoons, articles of a harassing or offensive nature, and taking retaliatory action against an employee for discussing or making any complaint of harassment.

All Ansay & Associates, LLC employees, and particularly managers, have a responsibility for keeping our work environment free of harassment. Any employee, who becomes aware of an incident of harassment, whether by witnessing the incident or being told of it, must report it to their immediate supervisor or the designated management representative with whom they feel comfortable. When management becomes aware of the existence of harassment, it is obligated by law to take prompt and appropriate action, whether or not the victim requests the Agency to do so.

Sexual harassment may include unwelcome sexual advances, requests for sexual favors, or other verbal or physical conduct of a sexual nature when such conduct creates an offensive, hostile and intimidating working environment and prevents an individual from effectively performing the duties of their position. It also encompasses such conduct when it is made a term or condition of employment or compensation, either implicitly or explicitly and when an employment decision is based on an individual’s acceptance or rejection of such conduct.

It is important to note that sexual harassment crosses age and gender boundaries and cannot be stereotyped. Among other perceived unconventional situations, sexual harassment may even involve two women or two men.

Sexual harassment may exist on a continuum of behavior. For instance, one example of sexual harassment may be that of an employee showing offensive pictures to another employee.

Generally, two categories of sexual harassment exist. The first, “quid pro quo,” may be defined as an exchange of sexual favors for improvement in your working conditions and/or compensation. The second category, “hostile, intimidating, offensive working environment,” can be described as a situation in which unwelcome sexual advances, requests for sexual favors, or other verbal or physical conduct of a sexual nature when such conduct creates an intimidating or offensive environment.

Examples of a hostile, intimidating, and offensive working environment includes, but is not limited to, pictures, cartoons, symbols, or apparatus found to be offensive and which exist in the workspace of an employee. This behavior does not necessarily link improved working conditions in exchange for sexual favors. It is also against Ansay & Associates, LLC’s policy to download inappropriate pictures or materials from computer systems.

Employees who have complaints of harassment, whether based on sex, race, disability or any other protected category, including, but not limited to, any of the conducts listed by a supervisor, management official, other employee, customer, vendor or any other person in connection with your employment at the Agency, should immediately bring the matter either to their immediate Supervisor, Human Resources, or any other member of management with whom the individual employee feels comfortable.

All information regarding any specific incident will be kept confidential within the necessary boundaries of the fact-finding process. We take allegations of harassment very seriously and will actively investigate all harassment complaints. If it is determined that harassment has occurred, management will take appropriate disciplinary action up to and including discharge of the offending party.

Ansay & Associates, LLC will not retaliate against any employee who makes a report of discrimination, harassment, or inappropriate conduct or assists in or cooperates in an ensuing investigation, nor will the Agency permit any employee to retaliate against another employee for these reasons. If an employee believes that he or she has been retaliated against in any way, he or she should report such retaliation in the same manner as described above.

Ansay & Associates, LLC is committed to high standards of ethical, moral and legal business conduct. In line with this commitment, and the Agency’s commitment to open communication, this policy aims to provide an avenue for employees to raise concerns and reassurance that they will be protected from reprisals or retaliation for whistleblowing.

This policy is intended to cover protections for you if you raise concerns regarding the Agency, such as concerns regarding: (i) incorrect financial reporting; (ii) unlawful activity; (iii) activities that are not in line with the Agency’s policies regarding good and ethical business practices; and (iv) any other activities that would constitute improper business conduct. Employees who make a report in good faith under this policy shall not be subject to any form of retaliation or reprisal for such reports. Any employee who engages in any form of retaliation or reprisals against a whistleblower will be subject to discipline, up to and including termination.

If an employee has knowledge of or a concern related to dishonest, improper or illegal activity, the employee is to contact his/her immediate Supervisor or Human Resources. This procedure for reporting such activity or conduct is intended to be used for serious and sensitive issues. Although an employee is not expected to prove the truth of an allegation, the employee should be able to demonstrate to the person contacted that the report is being made in good faith. This good faith requirement mandates that the employee must exercise sound judgment to avoid baseless allegations. An employee who intentionally files a false report or makes a report in bad faith under this policy will be subject to discipline up to and including termination.

All reports made pursuant to this policy will be promptly investigated and further reported to higher management officials for appropriate action.

It is our hope that because of each employee’s dedication to their job and their professionalism towards our customers that a customer complaint is the rare exception. Too often, however, customers either become frustrated or angered when their needs are not being properly addressed or serviced and many times find it a futile exercise to complain or ask a question. Many times, these frustrated or angered customers are lost forever, allowing us no further opportunity to service their needs to make things right.

Therefore, all employees should inform customers at the very beginning of the customer relationship, and periodically throughout, that if the customer has any questions, concerns or complaints they should bring those questions, concerns or complaints to your attention. Remember your primary job responsibilities and the Agency’s mission is to serve the needs of its customers with high quality service and professionalism. Therefore, we welcome the customer’s questions, concerns, and even complaints as an opportunity for improvement to provide the level of professional service we initially promised to the customer. If you are unable to address or resolve a customer question, concern or complaint, you should then refer the matter over to the department Supervisor for resolution.

A conflict of interest may be defined as any situation in which any employee is exposed to two or more duties which to some extent are mutually incompatible.

Any potential or actual conflicts of interest should be brought to the attention of the President and employees exposed to a potential conflict of interest should disqualify themselves from any decisions concerning such conflicts.

It is our Agency’s policy that neither officer nor employee shall seek and/or receive from any person or entity a gratuity or favor in consideration for any transaction or business in connection with this Agency or its parent company. Seeking and/or acceptance of such gratuity or favor could result in loss of job and/or referral for criminal prosecution.

Unsolicited gratuities or favors should be discouraged by all Agency employees. There may, however be circumstances where the receipt of an unsolicited gratuity or favor is unavoidable. If such a situation should arise, and if the value of the gratuity or favor exceeds one hundred dollars ($100.00), notify your local Human Resource representative as soon as practical.

We recognize that, on occasion, employees may seek a second job outside their employment with the Agency. While we do not want to regulate an employee’s personal affairs, you are reminded that outside interests or employment that limit your job efficiency, working hours, or result in competition with the Agency will not be permitted. In these circumstances, the employee will be asked to resign from or to discontinue his or her outside employment.

Most of the Agency’s equipment and computers are on service contracts, however, all employees are responsible for taking care of the Agency equipment and computers by keeping such equipment and computers free of dust. In addition, all employees should treat the Agency’s equipment and property with proper care as you would treat your own equipment and computers.

Work areas should reflect our professionalism and enhance the beauty of our building. If you are not working with items, they should be put away and properly stored. This refers to computer copies, supplies, files, etc. – 5S your area on a regular basis. General cleaning is done by a cleaning service. However, each employee is personally responsible for the neatness and cleanliness of their work area.

Sanitizer, masks, cleaning products are available in each office, conference rooms, and all employees should take the upmost respect and awareness of hygiene and staying home if sick. Cleanliness is extremely important, and adhering to the office safety precautions.

A break/lunchroom area is provided for the comfort and convenience of all employees. Each person using it will leave it in the same condition of cleanliness and neatness as he/she found it. This includes washing and drying of the utensils, wiping messy table tops, refrigerator, microwaves, and replacing the chairs when leaving. This area should depict the high level of respect we show to each other and to our customers.

In an effort to maintain social distance and food safety. No opened food items are to be placed in the lunch or break rooms. All items should be individually wrapped and covered. All utensils should be disposable and every effort should be taken to maintain an extremely clean and sanitized area – especially when eating and consuming food.

In the case of fire or fire alarm, employees should exit immediately and calmly to the exit closest to them. Exception would be e-mail notification of testing by fire officials. Customers within one's service area should also be escorted to the exit that is closest to them.

In order to clarify the Agency's position concerning our closing and pay policies when there is a winter storm or other office closure, the following should be used as a guideline.

In the event of severe weather conditions or other emergencies, your location may decide to close Ansay & Associates, LLC. All employees will be notified of such closures through emails and/or the Communication portal in UKG. Please ensure your current mobile number is updated in UKG for these important messages.

Employees (Exempt/Non-Exempt) who have the capabilities (laptop) can now continue working should the office close due to the above circumstances. Non-exempt employees will clock in through the UKG system when working.

In the event an employee does not have a laptop or the ability to work remote, no loss of pay will occur as a result of early dismissal for any of these reasons. Likewise, if you report to work and find that Ansay & Associates, LLC. is unexpectedly closed due to an emergency, no loss of pay will occur. Any employee, who was on a previously approved PTO day during a declared emergency, shall not be charged PTO for the emergency period.

Part-time and temporary employees will not be paid for time lost due to inclement weather or other emergency closings.

As part of our family-friendly policies and benefits, Ansay & Associates, LLC. accommodates mothers who wish to express breast milk during the workday when separated from their newborn children.

For up to one year after the child’s birth, nursing employees will be provided with reasonable break time to express breast milk during the workday. Nursing mothers who are returning from maternity leave should speak with their managers or supervisors regarding their needs. Supervisors will work with employees to develop a break schedule that is reasonable, accounts for needs that may vary from day to day and creates the least amount of disruption to the Company’s operations.

Agency will provide a private area, other than a bathroom, for nursing employees to express breast milk. Breaks to express milk will be paid. In addition to these breaks to express milk, employees may use normal break and lunch periods to accommodate additional nursing needs.

It is your civic duty as a citizen to report for jury duty whenever called. If you are called for jury duty, you must notify your supervisor within forty-eight (48) hours of receipt of the jury summons.

Ansay & Associates, LLC will permit you to take the necessary time off and we wish to help you avoid any financial loss because of such service. Ansay & Associates, LLC will reimburse you for the difference between your jury pay and your regular pay, not to exceed eight (8) hours per day, for a maximum of ten (10) business days.

On any day or half-day you are not required to serve, you will be expected to return to work. In order to receive jury duty pay, you must present a statement of jury service and pay to your supervisor. This document is issued by the court.

The primary objective is to have employees project a professional image while taking advantage of more casual and relaxed clothing. The terminology used is “dress for your day” – meaning if client or other meetings, the dress code should be business dress or casual, depending on the client. If in office days or working remote, dress can be casual.

Listed below is a listing of some of the more common items not appropriate for the office. Neither group is intended to be all-inclusive. Rather, these items should help set the general parameters for proper casual business wear and allow you to make intelligent judgments about items not specifically addressed. A good rule of thumb is if you are not sure if something is acceptable, choose something else or inquire first.

▪ Slacks Inappropriate items include sweatpants, short shorts/skirts, Bermuda shorts, bib overalls. Spandex or other form-fitting pants are allowed with longer than waist-length top.

▪ Shirts—Inappropriate items include tank tops, hooded sweatshirts, shirts with offensive logos or slogans, halter-tops, tops with bare shoulders, unless worn under another blouse, shirt, jacket, or sweater.

▪ Footwear Stockings are not required, flip-flops and slippers are not acceptable.

Appropriate summer attire:

▪ Polo shirts

▪ Walking shorts (knee length only), Capris

▪ Open toe sandals with appropriate size heal

▪ Jeans and a nice shirt, dresses or skirts

Inappropriate summer dress attire:

▪ Shirts with offensive logos or slogans

▪ Flip-flops/beach sandals

▪ Slip-on slippers or shoes (i.e. Crocs)

▪ Halter tops, tank tops, or any top with bare shoulders

▪ Sweatpants, wind suits, athletic spandex pants or other workout clothes

If an item of clothing is deemed to be inappropriate for the office by the employee’s supervisor and Human Resources, the employee may be sent home to change clothes and will be given a verbal warning for the first offense, and progressive disciplinary action will be taken for subsequent violations.

It is Ansay & Associates, LLC’s aim to reward individual performance based upon objective criteria such as quality and quantity of work, general behavior and cooperation, attendance, and fulfillment of your job responsibilities. Our goal is to see you are kept advised of how well you are fulfilling these requirements. This communication begins on your first day and is continuous throughout your career with the Agency.

Discussions between you and your supervisor occur continuously during monthly touch base meetings for you to know what is expected and how you are performing. When employees are doing an exceptional job, they deserve recognition for it. When they are not doing part of their job, they generally cannot be expected to do better unless they are told about it.

Monthly performance meetings occur for each employee, with a year in review and accomplishments overview in January of each year.

Furthermore, employees may be eligible for an annual bonus (payable by March) up to 3% of base pay, based on agency, department and individual results based on performance relative to goal.

Opportunities for job advancement or transfers within an office between departments or transfers to other agency offices, are determined on the availability of positions within the Agency.

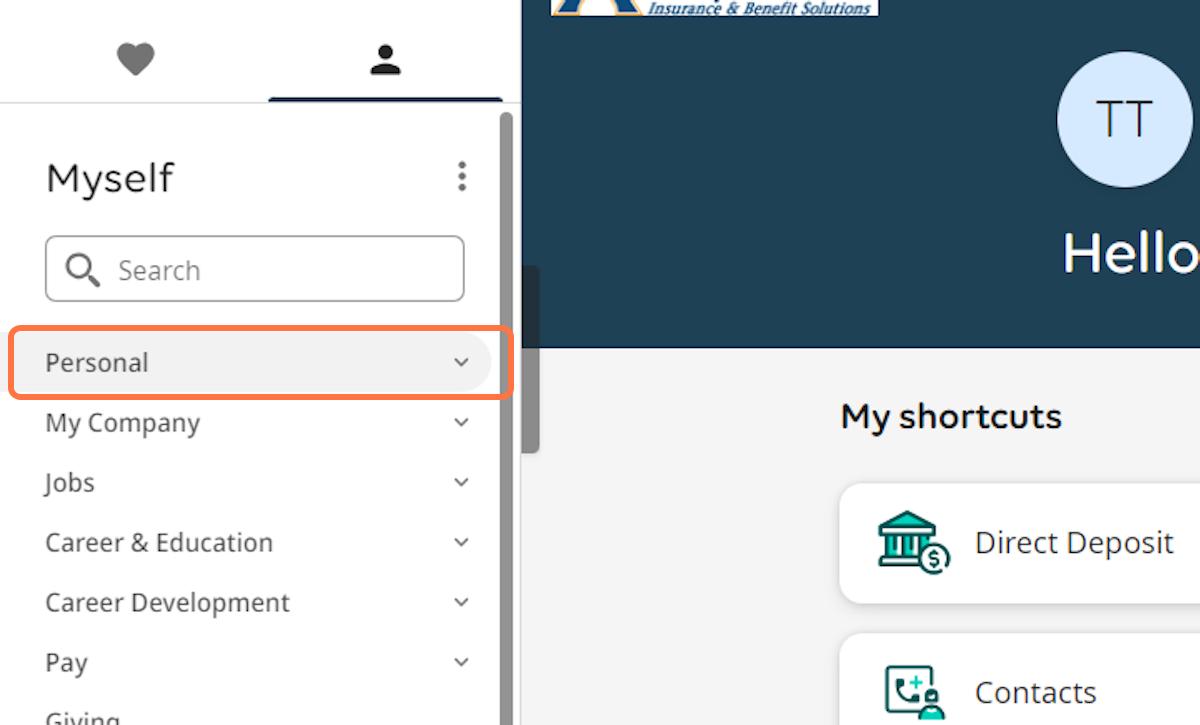

Openings within the Agency are posted under Myself, Company, View Opportunities in UKG and through Ansay Culture Connection email. When applying for a position with another department or office you must first inform your current Supervisor before engaging in discussions or scheduling an interview.

Human Resources will contact your Team Leader/Supervisor to confirm notification has taken place and that you are employed in good standing and eligible for transfer/posting.

It is the policy of Ansay & Associates, LLC to hire the best qualified job candidate regardless of whether the candidate comes from inside or outside of the Agency.

Unacceptable behavior which does not lead to immediate dismissal may be dealt with, subject to management’s discretion, in the following manner:

• Verbal Warning

• Written Warning/Performance Improvement Plan

• Decision-Making Paid Leave / Counseling Session

• Termination

To insure that Ansay & Associates, LLC’s business is conducted properly and efficiently, you must conform to certain standards of attendance, conduct, work performance and other work rules and regulations. When a problem in these areas does arise that does not require immediate termination, your supervisor will coach and counsel you in mutually developing an effective solution. If, however, you fail to respond to coaching or counseling, or an incident occurs requiring formal discipline, the following steps may be taken relative to your employment.

Your supervisor will meet with you to discuss the problem or violation, making sure that you understand the nature of the problem or violation and the expected remedy. The purpose of this conversation is to remind you of exactly what the rule or performance expectation is and also to remind you that it is your responsibility to meet Ansay & Associates, LLC’s expectations. Your supervisor will fully document the Oral Reminder, which will remain in effect for three (3) months. Documentation of the incident will be placed in your personnel record.

If your performance does not improve within the timeframe identified by HR and your supervisor period, or if you are, again, in violation of Ansay & Associates, LLC’s practices, rules or standards of conduct, your supervisor will discuss the problem with you, emphasizing the seriousness of the issue and the need for you to immediately remedy the problem. Your supervisor will advise you that you are now at the second formal level of disciplinary action and what significant improvements are needed to continue employment. Documentation of the incident will be placed in your personnel record.

If your performance does not improve within the identified timeframe following the “Written Warning/Performance Improvement Plan,” or if you are, again, in violation of Ansay & Associates, LLC’s practices, rules or standards of conduct, you will be placed on Decision-Making Leave.

For full-time employees, the Decision-Making Leave is a one (1) day disciplinary suspension, which will serve as the forfeiture of a PTO day. Employees on Decision-Making Leave will spend the following day away from work deciding whether to commit to correcting the immediate problem and to conform to all of the Agency’s practices, rules and standards of conduct, or, instead, resign their employment with Ansay & Associates, LLC.

If your decision following the Decision-Making Leave is to return to work and abide by Ansay & Associates, LLC’s practices, rules and standards of conduct, your supervisor will write a letter to you explaining your commitment and the consequences of failing to meet this commitment. You will be required to sign the letter to acknowledge receipt as a condition of continued employment and this letter may place certain conditions upon you in order for you to remain employed with the Agency. A copy of this letter will be placed in your personnel file.