GLOBAL WOOD PELLET MARKETS OUTLOOK

This

18 How to navigate Trump’s potential tariffs: Focus on what you can control

The recent buzz around Trump’s proposed tariffs has many Canadian businesses — and their American counterparts — feeling uneasy.

20 Finland shares success stories

A recap from the Scaling Up Bio 2024 Conference.

22 Rising from the ashes

CCR is rehabilitating forests while building a business case for biomass harvesting in the B.C. Interior.

26 Wood and biomass moisture: Four ways to increase plant efficiency

Minimize cost and increase efficiency. Both manufacturers and producers have this at the forefront of their agenda.

28 Wood pellets: A renewable heating revolution in the Northwest Territories

The Northwest Territories is making significant strides in transitioning from fossil fuels to sustainable energy sources, and wood pellets are playing a pivotal role in this transformation.

Building up biogas

New Brunswick preparing to grow this sector of the bioeconomy

By Andrew Snook

Back when I initially joined the team at Canadian Biomass in 2015, one of my first trips was to attend the Atlantic Biorefinery Conference in Edmundston, N.B., where I was given the opportunity to tour a variety of players in the province’s bioeconomy. One of the tours was LaForge Bioenvironmental’s commercial biogas production plant in Saint-André, N.B. The facility was operating a 1.6 MWh anaerobic digester. Fuelled by a combination of cow manure and organic waste from regional food processors, the anaerobic digester was converting the waste to electricity, heat and liquid organic fertilizer. I had never witnessed this type of system before, and was amazed to see how it was creating heat, energy and fertilizer from what amounted to waste products.

looking at here and ResearchNB.”

Fast-forward ten years, and the province is still working hard on building up the biogas sector.

Since 2023, research related to building up the province’s bioeconomy has been under the purview of ResearchNB, which signed a 10-year funding agreement with the Province of New Brunswick in 2024 and has an annual budget of about $11 million that flows out to five priority sectors: health, energy, agriculture, forestry and oceans. As ResearchNB’s acting CEO Chris Dickie explained to me, “Bio is implicit across basically everything that we’re

The team at ResearchNB (and previously at BioNB) has been working hard on research for the past three years to find ways for biogas to be profitable for farmers in the province, and looking at the different ways biogas production will benefit New Brunswick. One of the key steps in this process has been researching how much biomass tonnage is available in the province. Danielle Connell, business development manager for biogas at ResearchNB, told me that they are speaking to over 250 farmers and other active players, being very careful in how they measure available biomass to ensure there is no disruption to material currently going to feed livestock or active biogas projects. As Connell mentioned, “There’s enough biomass for everybody to win.”

Our chat also discussed all of the potential opportunities that could come from scaled up production of renewable natural gas, such as new jobs, energy production, and selling the RNG to interested parties.

Farmers throughout the province are interested in becoming biogas producers, and ResearchNB is doing the necessary research to find ways to make this a reality.

I, for one, am excited to see economic opportunities in the bioeconomy coming to the people of New Brunswick. •

Volume 25 No. 1

Reader Service Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Service Ph: (416) 510-5113 Fax: (416) 510-6875 Email: apotal@annexbusinessmedia.com Mail: 111 Gordon Baker Rd., Suite 400 Toronto, ON M2H 3R1

Editor - Andrew Snook Ph: (416) 510-6801 asnook@annexbusinessmedia.com

Contributors - Gordon Murray, J.P. Antonacci, Joel E. Dulin and Ian Thomson

Group Publisher - Anne Beswick Ph: (416) 510-5248 Mobile: 416-277-8428 abeswick@annexbusinessmedia.com

Account Coordinator - Shannon Drumm Ph: (416) 510-6762 sdrumm@annexbusinessmedia.com

National Sales Manager - Rebecca Lewis Ph: (519) 429-5196 rlewis@annexbusinessmedia.com

Quebec Sales - Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexbusinessmedia.com

Western Sales Manager - Tim Shaddick twshaddick@gmail.com Ph: (604) 264-1158 Fax: (604) 264-1367

Audience Development Manager - Layla Samel Ph: 416-510-5187 lsamel@annexbusinessmedia.com

Media Designer - Lisa Zambri

CEO - Scott Jamieson

Canadian Biomass is published four times a year: Winter, Spring, Summer and Fall. Published by Annex Business Media.

Publication Mail Agreement # 40065710

Printed in Canada ISSN 2290-3097

Subscription Rates: Canada - 1 Yr $58.14; 2 Yr $104.04 Single Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $123.93 CDN; Foreign – 1 Yr $140.76 CDN

Annex Privacy Officer Privacy@annexbusinessmedia.com Tel: 800-668-2374

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above. No part of the editorial content of this publication may be reprinted without the publisher’s written permission. ©2025 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

www.canadianbiomassmagazine.ca

CPM ACQUIRES JACOBS GLOBAL

Process equipment and engineered technologies provider CPM has announced that it has acquired Jacobs Global, a supplier of aftermarket parts for hammermills and pellet mills.

CPM stated that the purchase will enhance its product offerings, expand its market reach and add capacity to better serve CPM’s growing global customer base.

“Bringing Jacobs Global into the CPM family is a significant milestone for us,” said David Webster, CEO of CPM.

“Their strong team members and their expertise in manufacturing high-quality aftermarket parts together with their commitment to customer service perfectly complements our business model. We are excited to add Jacobs Global’s capabilities and work together with their team to continue our joint legacy of innovation and customer satisfaction.”

Jacobs Global is well-known in the milling industry. The company was founded in 1934 and has supplied customized solutions to more than 4,000 mills across over 80 countries. The company offers an extensive range of products that includes hammermill hammers and screens; pellet mill dies; and roller shells.

CHAR TECHNOLOGIES ANNOUNCES $2.5M INVESTMENT FROM QUÉBEC FOR BIOCARBON AND GREEN HYDROGEN PROJECT

The Government of Québec, through the Programme Innovation Bois, has announced the approval of $2.5M to CHAR Technologies to support the advancement of the previously announced build, own, operate project to convert wood wastes and residuals into both biocarbon for metallurgical coal replacement, as well as green hydrogen, which the project intends to upgrade further into renewable natural gas. The non-repayable grant funding will be disbursed on predetermined project milestones.

Also announced was a $1-million contribution from the Programme Innovation Bois to la Société de cogénération de Saint-Félicien (SCSF) towards the centre de valorisation de la biomasse (CVB), which is co-located with the CHAR Tech project, and includes a waste heat recovery dryer to pre-process biomass, which will be used by the CHAR Tech project.

SCSF (owned by Green Leaf Power) operates a 25-MW cogeneration facility, converting approximately 260,000 green metric tonnes per year of wood waste biomass into renewable energy, with the electricity sold to Hydro-Québec, and steam for additional industrial uses locally.

“We are deeply grateful for the Government of Québec’s support through the Programme Innovation Bois. This $2.5M contribution will accelerate our efforts towards the collaboration of our technology with the CVB at the SCSF facility in Saint-Félicien. Together, we are driving innovation that contributes to a cleaner, greener future,” stated Andrew White, CEO of CHAR Tech.

ARBIOS BIOTECH COMPLETES BIOMASS TO BIO-OIL FACILITY

Arbios Biotech recently announced that it has completed the construction of its Chuntoh Ghuna facility in Prince George, B.C. The facility uses Licella’s Cat-HTR hydrothermal liquefaction (HTL) technology to transform forest residues and other woody residuals into a renewable bio-oil that can be refined into transportation fuels with a low carbon footprint.

“This facility embodies our vision of creating a circular bioeconomy where low-value residues become a valuable renewable resource,” said Rune Gjessing, CEO of Arbios Biotech.

The facility was developed in close partnership with the Lheidli T’enneh First Nation, which named the facility Chuntoh Ghuna, which means “the forest lives” in the Dakelh language. Chief Logan of the Lheidli T’enneh Nation stated, “As a Nation, we are focused on working with proponents and projects that focus on long-term environment sustainability. We are proud to see the completion of Chuntoh Ghuna, a facility that reflects our shared values of a sustainable bioeconomy.”

Photo: CPM.

DRAX SUPPORTS B.C. AND ALBERTA FOOD BANKS DURING

HOLIDAY SEASON

Global renewable energy company Drax donated $65,000 to 12 food banks across B.C. and Alberta through this past holiday season through the company’s dedicated Community Fund.

“It’s donations and support from community members and businesses such as yours that make it possible for the food bank to run throughout the year working hard to support our community members who need us,” stated Jennifer Palmer-Ciccone, manager of the Armstrong Food Bank.

Drax’s Community Fund awarded more than $821,000 in donations in 2024, including more than $100,000 to food banks across the globe.

“Drax continues to be committed to supporting the communities we live, and operate in. We believe it’s important to show our appreciation to our communities, especially during the holiday season,” said Sandy Sung, Drax’s Canadian community manager. “We hope these donations help local food banks in British Columbia and Alberta support the higher than ever demand they are currently experiencing due to the increased cost of living.”

Canadian food banks that received funding this past holiday season included the Armstrong Food Bank (Boys and Girls

Club Okanagan); Lake District Family Enhancement Society; WEE Community Food Bank; High Level Native Friendship Centre; Salvation Army Bulkley Valley, Lumby Food Bank, Nourish Food Bank (Quesnel); Salvation Army Prince George; Princeton Food Bank; Greater Vancouver Food Bank; Salvation Army Prince Rupert; and the Salvation Army Williams Lake.

Photo: Drax.

IWPAC’s Safety Committee:

Helping make the industry safer for over a decade

By Gordon Murray, Executive Director, Wood Pellet Association of Canada

can’t believe it has been over a decade since the Wood Pellet Association of Canada’s (WPAC’s) Safety Committee was established. Our initial focus was combustible dust in response to tragic sawmill explosions in British Columbia. Over the years, activities have expanded to all health and safety matters.

The committee’s mission is “to improve the wood pellet industry’s collective safety performance, earn a reputation with regulatory authorities and the public as an industry that is highly effective at managing safety, and learn and share best practices regarding safety.” As we enter 2025, I want to reflect on a few past successes and share our Work Plan for the year.

PAST INITIATIVES

I am very proud of the WPAC Safety Committee’s work over the past 10 years. We have developed an ongoing, open, collaborative relationship with WorkSafeBC and the BC Forest Safety Council—one that is built on trust. We have even taken our learnings here in Canada and shared them with customers in Japan, holding two safety sessions focused on safe biomass material handling and storage in 2023. Other successful initiatives included:

Critical Control Management was our first sustained Process Safety Management

(PSM) initiative. It helped improve understanding of operational hazards and ensure the effectiveness of safeguards. It was also the first initiative where Bowtie analyses

“WPAC’s Safety Committee continues to listen to the Canadian wood pellet sector and focus on activities that reflect their needs.”

were used in the industry. They are now developed for most plant processes.

The Inherently Safer Design project focused on the elimination of hazards and treatment of hazards at the source rather than relying on only add-on equipment and procedures.

Deflagration Isolation was designed to improve pellet industry practices regarding equipment isolation, with an eye on minimizing the impact of the potential of combustible dust fires, explosions and deflagrations within wood pellet plants.

The Combustible Gas report summa-

The annual Wood Pellet and Biomass Safety Summit is a place to learn more about key safety issues and to network with others in the industry. Photo: BCFSC.

Caption: PSM is a three-phased process. In 2025, WPAC’s Safety Committee will focus on implementing Phase 1 elements.

rizes the key actions plan operators can take to manage the risk of combustible gas in drum dryers.

Our website wpaclearning.com is a free online operator training program developed by operations for operations to provide training and improve safety competency. I encourage everyone in wood pellet operations to use the program.

ONGOING AND FUTURE INITIATIVES

WPAC’s Safety Committee continues to listen to the Canadian wood pellet sector and focus on activities that reflect their needs. We have several ongoing initiatives planned for 2025 and a few new ones.

Process Safety Management (PSM) is a core focus for the WPAC Safety Committee over the next five to seven years. Around the world, PSM is becoming key to worker safety and managing risk. It protects personnel, equipment and production uptime and is associated with lower maintenance costs, insurance and capital.

The PSM initiative has been broken into three phases so it is more accessible and achievable. In 2025, the Committee will determine key performance indicators for the entire PSM implementation process to establish what success looks like. Focusing on Phase 1 implementation, we will roll out gap analysis worksheets to all operations.

Every workplace has unique hazards that can impact the safe operation of mobile equipment. These hazards must be identified, assessed and controlled to minimize the risk of damage or injury. In 2025, the Committee will hold bow-tie analysis sessions and a symposium on Mobile Equipment Safety to understand the risks associated with mobile equipment in wood pellet plants.

Drum dryers present the risk of fires and explosions due to combustible dust and conditions that can lead to the generation and accumulation of combustible gas. A symposium held in 2024 initiated the Rotary Drum Dryer Safety project, which led to a dedicated Working Group reviewing past incidents and developing enhanced, safer operating procedures. The Group will publish a report and share its findings in 2025.

WorkSafeBC has proposed amendments to part 6, Substance Specific Requirements of the Combustible Dusts section of the Occupational Health and Safety Regulation. To help wood pellet companies understand these proposed changes, the Safety Committee will summarize and share them and prompt operations to assess their readiness to implement them.

We will continue to profile Safety Heroes every two months to acknowledge employees who support safety. You can submit nominations at pellet.org.

The Safety Committee also plans to hold our annual Wood Pellet and Biomass Safety Summit, where we will dive deeper into many critical safety issues affecting the industry today. Stay tuned for an announcement of a location and dates.

New to 2025: Along with the continuing safety initiatives listed above, we will review the impacts of previous safety initiatives, take a closer look at mental health and musculoskeletal injuries (MSI) and update winter fibre truck loading/unloading standard operating procedures.

We warmly welcome new members to the WPAC Safety Committee. We meet on the second Wednesday of every month at 11 a.m. (PST). Members include the BC Forest Safety Council, the wood pellet and biofuel industry and academic institutions. To read the Work Plan and sign up, please visit pellet.org. •

To ensure optimal operation of industrial boilers, it is crucial to determine the moisture content of the feedstock, enabling quick adjustments in feed rate. The implementation of an automatic control device minimizes operator intervention, leading to reduced labor costs. Consistent moisture levels help prevent product wastage, the need for recycling, and the associated expenses related to labor and utilities for resetting the drying system.

Supporting Japan’s climate goals with Canadian wood pellets

By Gordon Murray, Executive Director, Wood Pellet Association of Canada

In November 2024, I was part of an Alberta forest industry trade mission to Japan led by the Honourable Todd Loewen, Minister of Forestry and Parks. Participants included Alberta ministry officials and wood products manufacturers, as well as Canada Wood and the Alberta Forest Products Association. The mission’s focus was to strengthen partnerships and showcase Alberta as a trusted supplier of wood products.

It was a busy 10 days that included the annual Wood Pellet Association of Canada (WPAC) customer appreciation dinner, Canada Wood’s Wood Forum, the BC Council of Forest Industries 50th Anniversary Reception, a press conference and media interviews, and meetings with Japanese government officials.

Japan is the fastest-growing import market in the world for wood pellets, driven by the government’s policy initiatives to mitigate pollution from coal and sup-

ported by a long-term feed-in-tariff (FIT) for biomass energy. The country aims to reduce greenhouse gas emissions to zero to make Japan a carbon-neutral, decarbonized society by 2050 and aims to reduce its greenhouse gas emissions by 46 per cent by 2030. Canadian wood pellets are

“Over the past decade, Canadian pellet exports to Japan grew 27-fold from 2014 (62,000 tonnes) to 2023 (1.70 million tonnes).”

part of the solution for Japan. Canada is well-positioned to support Japan’s climate goals. WPAC recently conducted a Canada-Japan greenhouse gas (GHG) study, which examined GHG emissions for BC wood pellets versus coal use in Japan. The study found that wood pellets fired in Japan produced only 8.37 per cent of the GHG emissions produced by coal (more than a 91-percent reduction).

CANADIAN WOOD PELLET GROWTH IN JAPAN

Over the past decade, Canadian pellet exports to Japan grew 27-fold from 2014 (62,000 tonnes) to 2023 (1.70 million tonnes). Thirty percent of Canadian wood pellet exports to Japan come from Alberta (the other 70 percent from British Co-

Photos: WPAC.

lumbia). In 2023, approximately 550,000 tonnes of wood pellets worth $107 million to Japan were exported to Japan, accounting for a third of the value of Alberta’s forest products exports to Japan.

In 2023, more than five per cent of Japan’s electricity was generated from renewable biomass (in approximately 240 biomass power plants). Biomass’ share of the electricity mix is now approaching that of nuclear, which is barely ahead at seven per cent.

Japan is presently consuming 6.1 million tonnes of wood pellets annually. For the 12 months ending October 31, 2024, Vietnam had the largest market share at 50 per cent, providing three million tonnes. Canada and the United States were tied for second, each with a 20-percent marketshare. Both countries provided 2.3 million tonnes to Japan. Japanese wood pellet consumption is projected to grow by another 30 per cent by 2030, presenting even more opportunities for Canadian wood pellet exports.

COORDINATED CANADIAN APPROACH TO ADDRESS CONCERNS

With the growth of Canadian wood pellets as a low-carbon energy alternative in Japan, customers and regulatory bodies want to learn more about Canada’s reputation in the forest and wood pellets; they want to be satisfied biomass is responsibly produced and sourced. The Canadian delegation had a coordinated approach where people heard from Canadian government officials and trade associations about Canada’s sustainable forest management reputation.

Minister Loewen spoke about the importance of the forest products trade with Japan, including wood pellets, to our long-standing trade relationship. He also spoke to Alberta’s forest management laws and regulations.

Bruce St. John, President of Canada Wood, discussed how Canadian companies responsible for harvesting forests carefully manage, protect and monitor our diverse forests.

I spoke about how the Canadian pellet sector exists to make better use of forests already harvested and that pellets are mainly from sawdust and low-quality logs unsuitable for sawmills and pulp mills.

MORE WORK TO DO

In 2023, Japan replaced the U.K. as Canada’s top wood pellet export destination. Japanese wood pellet consumption is projected to grow by another 30 per cent by 2030, reinforcing Japan’s importance to Canadian pellet producers. During the mission, together with Minister Loewen and his government colleagues and with our allies from Canada Wood Group and Alberta Forest Products Association, we reinforced Canadian forest and wood pellet sustainability to Japanese government and industry stakeholders. I will return soon and often to continue developing relationships to ensure Canadian wood pellets continue to be a vital part of Japan’s electricity mix. •

TSI BUILDS MACHINERY FOR THE BIOMASS INDUSTRY

Complete Dryer and Torrefaction systems including Heat Energy and Pollution Control equipment in one integrated solution for plants from 50,000 tons/year to 500,000 + tons/year.

Global wood pellet markets

2024 in review and thoughts on the next decades

By William Strauss, president, FutureMetrics

It has become traditional for FutureMetrics’ presentations at conferences to begin with a reminder of the urgency of the climate crisis. This article follows that tradition.

This article then proceeds to review current trends in the “industrial” pellet market. The article concludes with a brief discussion of the emerging use of biogenic carbon for refining iron ore in blast furnaces.

ECOLOGICAL DISEQUILIBRIUM FROM THE COMBUSTION OF FOSSIL FUELS IS OVERWHELMING THE EARTH’S SYSTEMS

Since industrialization the coal, petroleum, and methane (natural gas) that contains millions of years of sequestered carbon is being cycled out of the ground and into the air over a period of just a few hundred years.

There are consequences to the unmitigated use of fossil fuels. The energy trapping effects of increasing CO2 concentrations in the atmosphere means that both the atmosphere and the oceans are warming rapidly.

As Figure 2 shows, the oceans are getting warmer. But most troubling is the

Photo: © Irina / Adobe Stock

large changes seen in 2023 and continuing in 2024. Figure 2 shows not only rapid warming but it signals that we may have crossed a tipping point that results in even more rapid change combined with increasing variability (more extreme highs and lows).

One of the many consequences of warming oceans and air is the increasingly rapid decline in sea ice in the Arctic Ocean and in the oceans surrounding Antarctica. As white ice disappears and open water takes its place, the radiative reflection rate declines, and more energy is absorbed by the water. This positive feedback loop accelerates the rate of ocean warming; and thus accelerates the rate of sea level rise and atmospheric warming.

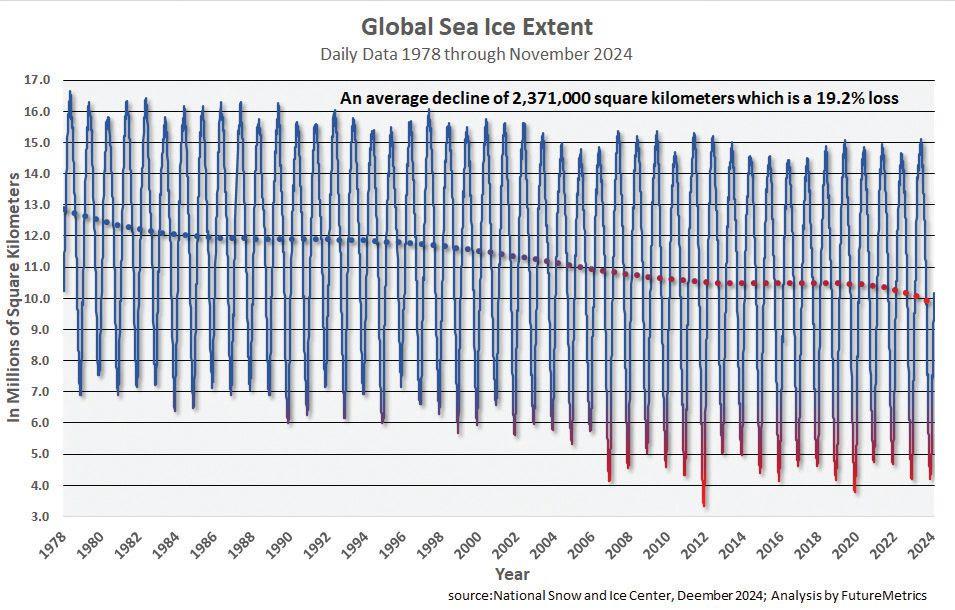

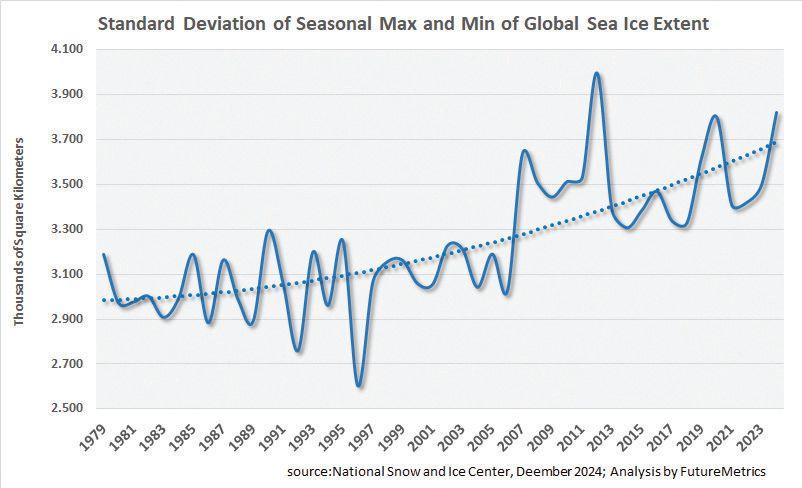

Figure 3 and Figure 4 show the steady loss of sea ice globally and the increasing variability between the seasonal maximums and minimums. From 1978 to November 2024, the average square kilometers of sea ice have fallen by 19 per cent. The seasonal minimum has fallen 39 per cent. The loss of sea ice is just one of many symptoms of the consequences of unabated greenhouse gas emissions. The imbalance in the carbon cycle can no longer be disconnected from global warming and induced climate change.

PELLET FUEL FOR POWER GENERATION IS A CRITICAL PART OF THE NEEDED ACTION

There is a strong and understandable reliance on the use of oil, gas, and coal. That reliance must be overcome.

When renewable energy is discussed, wind and solar generation are assumed to be the solution. They are, and they will be, an essential part of the future of power generation.

However, power generated from wind and solar sources has a serious shortcoming: no matter how many megawatts of solar and wind generation are deployed, sometimes they will generate less than the grid needs.

Over the next few decades, it is likely that energy storage solutions will be developed and deployed at a scale that will sufficiently buffer intermittent and variable supply and keep the power grids stable most (not all) of the time.

Figure 1 - Atmospheric CO2 levels.

Figure 2 - Sea surface temperatures, 1979 to present.

Figure 3 - Global sea ice decline.

But to make the transition to a decarbonized future as seamless as possible, for at least the next few decades the power grids will need a significant quantity of CO2 beneficial generation that is on-demand and load-following.

The use of pellet fuel produced from perpetually renewing (nondepleting) bioresources solves part of that problem. Existing coal-fueled utility power stations can, with relatively low cost and little downtime, make modifications and replace coal with upgraded densified biomass-derived solid fuel (called “pellet” fuels) produced from perpetually renewing (not depleting) sources.

The result is renewable electricity that can be generated on demand.

PELLET FUELS REPLACING COAL IN 2024 AND BEYOND

The industrial pellet fuel sector had, until 2023, seen steady growth. Figure 5 shows that even with the estimated dip in exports in 2023, over the last 13 years the export market has grown at a compounded annual growth rate of 12.9 per cent per year.

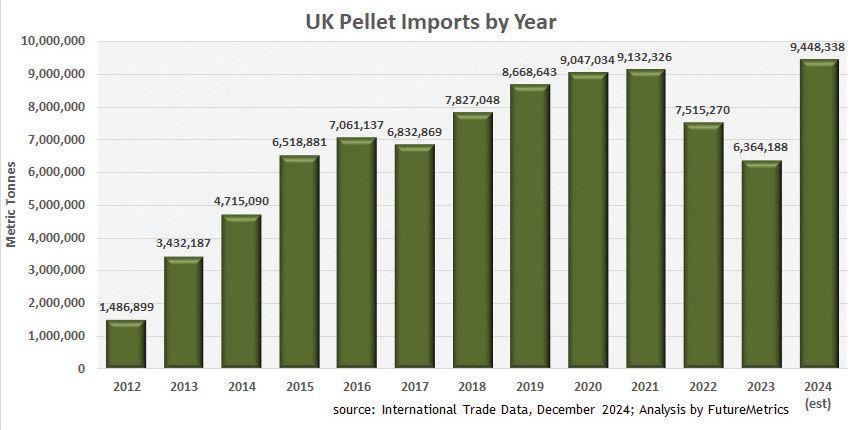

The dip in 2023 was due to a combination of reasons. The primary reason is due to a significant drop in demand in the U.K. (see Figure 6 - U.K. pellet fuel imports by year.) due to the reduction in pellet fuelled generation at the Drax and Lynemouth power stations. High power prices, high pellet spot prices, and characteristics of the U.K. policy called the “contract for difference” (CfD) temporarily made it uneconomical to use pellet fuel to produce electricity in CfD supported units. Power market conditions in the U.K. corrected in the first half of 2024 and generation rates are again at nominal capacity levels.

In fact, FutureMetrics estimates that the U.K. will have its highest year in history for pellet imports in 2024 (see Figure 6U.K. pellet fuel imports by year.).

The U.K. will soon announce a socalled “bridge” policy that, along with defining support for pellet fueled power generation into the 2030’s, will improve how the CfD prices are determined. It is expected that U.K. pellet fuel demand will remain strong in 2025 and into the 2030’s. The expectation is that both major power

Figure 5 - Pellet exports.

Figure 6 - U.K. pellet fuel imports by year.

Figure 4 – Standard deviation of global sea ice extent.

stations will have bioenergy carbon capture and storage (BECCS) deployed and operating in the first half of the 2030’s. The expected revenue from negative carbon emissions will be sufficient to allow the U.K. to phase out the CfD for power sales.

Global trade of pellet fuel between all countries is expected to exceed 25 million tonnes in 2025. Figure 7 - Wood pellet exports by region., shows the major exporting regions’ exports since 2012.

North America is by far the largest producer and exporter of industrial pellet fuel. North American exports remain on a steady growth trajectory (see Figure 8 - Quarterly exports from the U.S. and Canada.).

The recent financial collapse of the world’s largest pellet fuel producer, U.S.based producer Enviva, is not expected to impact the production of pellets at most of Enviva’s existing plants. Enviva announced that it emerged from Chapter 11 bankruptcy on December 6, 2024, as per approval by the court. Until the Epes factory is operating, it is possible that Enviva’s aggregate existing production capacity in the U.S. may decline slightly if a few of Enviva’s least profitable plants are closed.

Canadian exports have pivoted from the U.K. to Japan (see Figure 9 - Canadian exports to the U.K. and Japan.). This is a long-expected change that optimizes western Canadian export logistics and the evolution of long-term supply agreements. It is expected that notwithstanding the reversal in trend in 2024, that the majority of western Canadian production will move into the Asian markets.

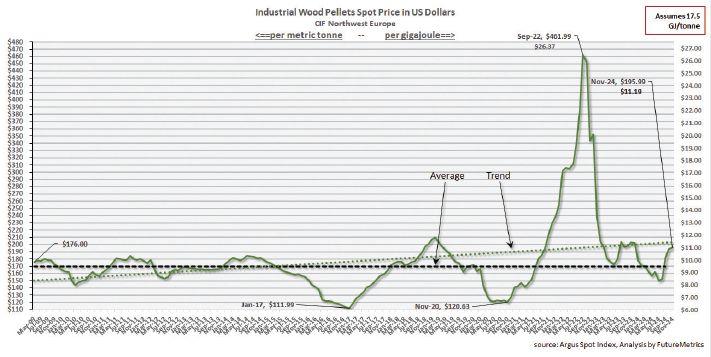

The industrial pellet spot prices reported by Argus provide valuable information regarding supply and demand relationships and expectations. The Argus spot price index is based on northwest Europe (sometimes called ARA for Amsterdam, Rotterdam, and Antwerp). But spot prices do not reflect the actual prices being paid for most of the pellets being imported. The generally accepted assumption is that about 80 per cent, or so, of pellets are traded under long-term agreements at set prices that are independent of the spot price.

Figure 7 - Wood pellet exports by region.

Figure 9 - Canadian exports to the U.K. and Japan.

Figure 8 - Quarterly exports from the U.S. and Canada.

FutureMetrics uses monthly trade data to estimate the average price per tonne for pellets crossing the border into the major importing countries. Figure 10 - Price paid for pellets imported into the U.K.. shows the estimated price per tonne paid for pellets crossing into the U.K.

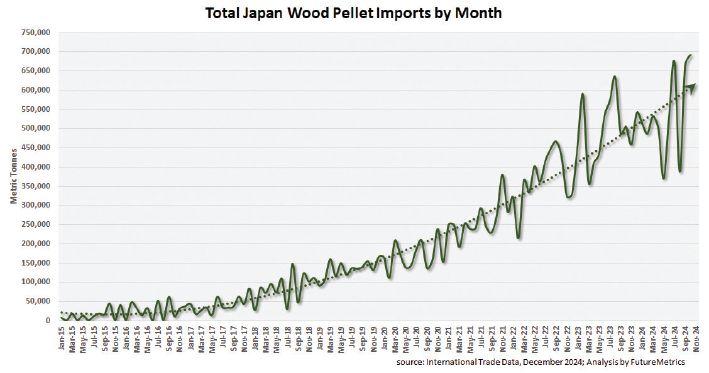

FutureMetrics expects imports into Japan to increase substantially in the next 5 years. Past steady growth in demand (see Figure 11 - Monthly imports into Japan.) is expected to continue.

FutureMetrics expects continued growth in the Japanese markets. In general, Japan’s goals for decarbonization of the power sector and their need for reliable steady power will result in a steady increase in power generated from sustainable pellet fuels.

Japan’s requirements for sustainability certification that will become required in 2025 may influence how pellets fuels are sourced. Currently, Vietnam has the majority of the Japanese market share for imported pellet fuel (see Figure 12 - Origins of pellets imported into Japan.).

The estimated average price paid for pellets in Japan is unlikely to fall to the lows seen from 2016 to 2021 (see Figure 13 - Price paid for pellets imported into Japan.). Suppliers’ costs of production have increased and sustainability requirements will exclude some producers.

The independent power producers in Japan that are supported by the feed-intariff (FiT) have a price ceiling set by the FiT. The FiT rate is high enough to afford to pay for higher priced pellets in the short and possibly medium terms. But given that the FiT price is fixed for 20 years (no annual change), and depending on cost and price inflation expectations, the lengths of Japanese agreements going forward will be shorter and the basis starting price per tonne will be higher.

FutureMetrics expects that future demand growth for pellet fuel could be significant. While Europe and the U.K. are expected to plateau, there is potential for new demand in Germany, Poland, Canada, the U.S., and Taiwan. There is potential for total pellet fuel demand to grow at an annualized rate of about 3.4 million tonnes between 2025 and 2030 (see Figure 14 - Industrial pellet demand forecast to

Figure 11 - Monthly imports into Japan.

Figure 12 - Origins of pellets imported into Japan.

Figure 10 - Price paid for pellets imported into the U.K.

2030.). However, if those expectations are to come true, policy will have to evolve and that will require continued education and advocacy at the policy making levels.

FINAL THOUGHTS: BIOGENIC CARBON REPLACING GEOLOGIC CARBON

Within the limits defined by the renewal rate for global working forests and other crops dedicated to sustainably converting solar energy and CO2 into carbohydrates, uses for the bioresources other than as fuel for making heat and power are emerging.

For example, the supply chains and infrastructure that converts bioresources into homogenized densified pellets and delivers them to users around the globe is well-suited for a major CO2 emitting sector: steelmaking. Demand for highly carbonized biomass as a reductant in steelmaking is expected to ramp up significantly. For a detailed discussion on this topic, see the recent FutureMetrics whitepaper at: www.futuremetrics.info/FutureMetrics/ WhitePapers/SteelMaking/FutureMetrics%20-%20Using%20Highly%20Carbonized%20Bioresources%20for%20 Steelmaking%20-%20Oct%2015%20 2024.pdf.

Over the next few decades, the need for on-demand thermal generation will plateau and eventually decline. But the demand for higher value biogenic carbon will increase. The future for the industrial pellet sector is bright. •

“FutureMetrics expects that future demand growth for pellet fuel could be significant. While Europe and the U.K. are expected to plateau, there is potential for new demand in Germany, Poland, Canada, the U.S., and Taiwan. There is potential for total pellet fuel demand to grow at an annualized rate of about 3.4 million tonnes between 2025 and 2030.”

Figure 13 - Price paid for pellets imported into Japan.

Figure 14 - Industrial pellet demand forecast to 2030.

How to navigate Trump’s potenital tariffs: Focus on what you can control

By Richard Kunst

The recent buzz around Trump’s proposed tariffs has many Canadian businesses—and their American counterparts—feeling uneasy. For exporters and domestic manufacturers alike, the concerns are real:

• Higher costs

• Tighter margins

• Shifting trade dynamics

But while these challenges are significant, they are far from insurmountable. In fact, businesses that take a proactive approach have an opportunity to emerge

leaner, stronger, and more competitive— regardless of the tariff environment.

So, how do you prepare for this potential shake-up? The answer lies not in panic but in process. By optimizing efficiency, businesses can offset rising costs and navigate an uncertain trade landscape with confidence.

FIND AND FIX HIDDEN INEFFICIENCIES

Many businesses don’t realize how much money they lose due to inefficiencies lurking within their operations. From redundant workflows to production bottlenecks, wasted time and resources quietly erode

profitability.

Now is the time to take a close look at your processes. Conduct a deep dive to identify where things slow down or break down:

• Are there delays in production?

• Is there unnecessary waste in materials or time?

• Where are the most significant cost sinks in your operation?

For many businesses, these inefficiencies can be corrected without major capital investments. Simple adjustments often de-

PHOTO: © ruskpp / Adobe Stock

liver significant savings that make all the difference when costs rise.

SHORTEN LEAD TIMES TO STAY COMPETITIVE

Lead time reduction is one of the most effective ways to improve margins and gain an edge. Why? Faster production and delivery mean less inventory, fewer delays, reduced waste, and quicker cash flow.

Optimizing workflows — whether through better resource allocation, automation, or streamlined processes — can help you turn orders around more efficiently. In a tariff-driven environment where costs are climbing, speed and agility become critical competitive advantages.

For example, one of our client’s productions was bogged down by inefficiencies that seemed minor at first glance. However, by implementing Lean methodologies, we cut their lead times by 80 per cent and significantly reduced costs. Not only did they regain their competitive position, but they also strengthened their ability to weather tariff-related pressures.

ENGAGE YOUR TEAM IN THE PROCESS

Your employees are your front-line problem solvers. They see the daily struggles in your operations and often have keen insights into where resources are wasted or workflows could be improved.

Empowering your team to contribute to the process improvement journey can drive significant, sustainable change. It also boosts morale—showing employees that their input matters and that they play a critical role in navigating these challenges.

The key here is collaboration. Engage your teams in identifying issues, brainstorming solutions, and implementing changes. This not only optimizes processes but builds a culture of continuous improvement.

DEMONSTRATED VS. THEORETICAL OUTPUT: WHERE’S YOUR OPPORTUNITY?

When we begin working with a client, we often measure what we call demonstrated output — the actual performance of their processes, including all the inefficiencies and “noise” that have crept in over time. Then, we compare that figure to the theo-

“Conduct a deep dive to identify where things slow down or break down.”

retical output — what the operation could achieve under ideal conditions.

The result? Demonstrated output is typically only 50 per cent of theoretical output. This means there’s often massive untapped potential, and much of it can be unlocked with simple process improvements — not expensive overhauls or new equipment.

This is an important reminder for businesses facing tariffs or rising costs: You may already have the resources you need to stay competitive. The real challenge is ensuring they’re optimized.

CONTROL WHAT YOU CAN: EFFICIENCY WINS THE DAY

Tariffs and shifting trade policies are largely out of your control. But your internal operations? That’s where you hold the power. Businesses that thrive in a high-tariff environment are the ones that focus on what they can influence: efficiency, agility, and smarter processes.

Instead of reacting to higher costs with panic, use this as an opportunity to reassess and improve. The path forward isn’t about cutting corners — it’s about maximizing what you already have.

If you’re ready to uncover opportunities within your operations, start by asking: Where is our potential going unrealized? Whether it’s lead times, inefficiencies, or team engagement, the room for improvement is often much greater than expected.

By taking control of your processes, you can transform challenges into competitive advantages — no matter what trade policies come your way. •

Richard Kunst is the president and CEO of Kunst Solutions.

Finland shares success stories

A recap from the Scaling Up Bio 2024 Conference

By Andrew Snook

Government decision makers, biomass and bioenergy industry experts, investors, scientists and researchers, flocked to Ottawa by the hundreds to take part in the Scaling Up Bio 2024 Conference, which took place this past November at the Fairmont Château Laurier.

The keynote speaker for the event was the Government of Finland’s Minister of Agriculture and Forestry, Sari Essayah, who shared her country’s successes and ambitions for growing the bioeconomy in Finland.

“It’s really a great pleasure to be here in Canada today and talking to you about scale-up of sustainable bioeconomy. This is this is also one of the priorities for the Finnish government and in the EU,” Essayah told the crowd.

She said the bioeconomy is an economic concept that holds very promising potential in addressing major global challenges and in supporting local economies and livelihoods.

“We should remind ourselves that it is also a concept that holds a strong intergen-

erational element. The young must be able to believe in sustainable development, that bioeconomy will always be part of. That should be one of our priorities,” Essayah said.

In Finland, the forestry sector is the leader of its bioeconomy, representing onethird of the total value added to the Finnish bioeconomy. Some of the other significant contributing sectors to the country’s bioeconomy include construction, food and beverage, and energy.

“In Finland, forest policy is relatively high on the national political agenda, and from the culture, you can understand why,” Essayah said. “Finland is the most forested country in the European Union, and roughly 75 per cent of Finland’s land area is covered in forests. Of those forests, over 60 per cent are owned by private families and around one-third by the state. Over 10 per cent of our citizens are forest owners.”

The minster stated that the forest-based bioeconomy has great potential in creating well-being and products for consumers, but that we also need to work continuously to

maintain forest regenerative capacity and sustainability.

“That is a pre-condition for the sustainable scale-up of this industry,” Essayah said.

Finland has had a national bioeconomic strategy since 2014. The country’s current strategy moves away from a focus on increasing the use of biomass to creating more value from the bioeconomy.

“In other words, creating more from less, which I believe is also very relevant to viewpoint for today’s discussions. Finland’s vision is to double the value of the bioeconomy by 2035,” Essayah said.

The minister discussed five areas of focus for growing the bioeconomy policy. The first one was attracting more skilled labour to the industry.

“This is one challenge and concern, at least in Europe. It applies to both primary production and industry,” Essayah said.

While stating that some labour shortages in production operations will likely be solved via automation, the minister added that “we need to pay more attention to make this sector attractive today.”

The second area of focus is the successful scale-up of businesses based on high-quality research and decision making.

“Bioeconomy is at different stages in different countries. What we all share is the need to continue investing in research and development. The bioeconomy still has a lot of untapped innovation potential for products and services, and we still don’t know all products that we can make in the future,” Essayah said.

The ability to measure and monitor the bioeconomy to steer it in the right direction was the third area of focus. The minister stated that being able to measure and mon-

Government of Finland Minister of Agriculture and Forestry Sari Essayah shares her country’s successes at the Scaling Up Bio 2024 Conference in Ottawa. | Photo: Andrew Snook.

FPAC president Derek Nighbor. | Photo: Andrew Snook.

Rising from the ashes

CCR is rehabilitating forests while building a business case for biomass harvesting in the B.C. Interior

By Andrew Snook

Anyone living in a remote, heavily forested community in British Columbia is well acquainted with the mountain pine beetle, and the destruction it has brought to the province’s vast forests. Couple that with the past decade’s record numbers of forest fires, and the rehabilitation efforts necessary to transform these burnt stands of dead trees to productive forests becomes a massive undertaking.

Despite how daunting this task appears, there are companies and communities working diligently on returning their forests back to their natural splendor. One of those companies is Central Chilcotin Rehabilitation Ltd. (CCR), which was formed in the spring of 2017 to address more than 100,000 hectares of dead pine in the Chilcotin region and to rehabilitate those stands into productive forests. CCR was started up by two First Na-

tions communities, Tŝideldel First Nation and Tl’etinqox Government, with the help of a $3.4-million grant from the Forest Enhancement Society of BC (FESBC) to help rehabilitate mountain pine beetledamaged forests near Alexis Creek, a little over 100 kilometres west of Wiliams Lake in the heart of the B.C. Interior.

“We were able to get funding to start some projects focused on the rehabilitation among mountain pine beetle because

CCR’s focus on how it rehabilitated forests changed dramatically in the summer of 2017 when the B.C. Interior experienced the massive Plateau Fire. | Photo: CCR.

there are thousands of hectares out there that are not being rehabilitated that are low value, beetle-infested, and have other diseases, so no logging company would go in and harvest those areas,” explains Percy Guichon, executive director of CCR. “We were able to get some funding to go in with equipment to remove the dead trees and utilize the fibre that was left. But more importantly, it was about trying to get the area back up and productive as soon as possible because it wasn’t doing anything. It was a wildfire hazard, and wildlife were not really using it.”

CCR’s focus on how it rehabilitated forests changed dramatically in the summer of 2017 when the B.C. Interior experienced the massive Plateau Fire.

“It really changed the scope of what we were doing. While we remain dedicated to rehabilitation, our focus has shifted to addressing the urgent situation of rehabilitating the burned stands,” Guichon says. “The Plateau Fire was around 800,000 hectares. So, we felt that we needed to adjust and pivot there and try to focus on utilizing the fibre.”

Some of the stands destroyed were comprised of Douglas fir trees, which did not have a long life after the fires (three to four years) for the sawmills to utilize the fibre before they became worthless.

“It was about utilizing that burnt wood and replanting those areas, trying to get it back up and growing as soon as possible,” Guichon says. “We were heavily dependent on FESBC funding to carry out a lot of our projects.”

CCR successfully applied for additional funding through the FESBC and was awarded approximately $34 million in additional grant funding, which was instrumental in the company’s rehabilitation efforts. The company also has a long-term agreement in place with Natural Resources Canada through the 2 Billion Trees Program. Additionally, at the end of 2024, the Yunesit’in Government joined the First Nation partnership and added its massive traditional territory to the collective.

“That’s really been helpful to help us continue our work and plant as many trees in Chilcotin as we can,” Guichon says.

CCR is now evolving into the primary

forest management entity for its three First Nation owners, taking the lead in all landuse planning initiatives with the Province of British Columbia. This development signifies CCR’s growing role and responsibility in managing forest resources and ensuring sustainable practices.

The company’s forestry operations are supported by several local partners, including Tsi Del Del Biomass Ltd, Dechen Ventures, Consus Management Ltd., and Eniyud Community Forest. These collaborations help CCR implement effective forest management strategies and contrib-

ute to the overall health and sustainability of the region’s forests.

Daniel Persson, forestry superintendent of CCR, says the secret to their success is that they think outside the box and are willing to take on the hardest jobs.

“We do projects that nobody else will,” he says. “CCR is a company that takes risks to do what we need to do.”

Persson says taking on these economic risks to utilize the wood in heavily damaged stands with low economic value while returning the forests to productive stands is a big challenge.

CCR’s forestry operations are supported by local partners, including Tsi Del Del Biomass Ltd, Dechen Ventures, Consus Management Ltd., and Eniyud Community Forest. | Photo: CCR.

“The runway to get this to work is so short that nobody’s done it before. We’re taking on projects that are pretty hard to pull off and taking a lot of risk doing it. We’re working with equipment. We’re working with fibre sales, and we’re going through hundreds of thousands of dollars from one month to the next,” he says.

EXPANDING INTO BIOMASS

Rehabilitating damaged forests can be costly and presents the dilemma of managing the dead fibre removed from the stands. Traditionally, this dead fibre would be piled and burned to reduce fuel loading in the new forest. However, CCR has challenged this approach by seeking alternative uses for the fibre.

“We felt we might as well branch off a little bit and experiment with the biomass, reduce emissions into the atmosphere, uti-

lize slash piles and create jobs,” Guichon says. “Williams Lake is well positioned to have options for where we can send our biomass.”

The main biomass buyers are the Drax Williams Lake Pellet Plant, Atlantic Power, which buys hog fuel to generate power, and pulp mills in Kamloops and Quesnel.

The most challenging aspect of the biomass business has been building capacity.

“We’re doing something new that’s definitely made an impact in our communities in terms of training and creating long-term employment, and so, that definitely helps reduce social issues in our communities,” Guichon says.

Joe Webster, manager of Tsi Del Del Biomass, says the expansion of CCR into the biomass sector was a natural progression for the company.

“As Tsi Del Del Biomass proved to be

competent and were able to fulfill contracts on time and deliver, it was easy to do because, as I always say, ‘If you build it, they will come.’ That’s what happens in this industry, especially with secondary manufacturers. If you’ve got fibre and can deliver it, they want it,” Webster says.

While the amount of biomass being harvested varies from year to year, Tsi Del Del Biomass typically processes in the range of 300,000 cubic metres annually. The company regularly operates three grinders – two Peterson 4710 horizontal grinders, a CBI 6800CT horizontal grinder, a Peterson 5000G mobile chipper, and 20 trucks hauling biomass.

The biomass division currently employs eight or nine people in the bush and around 20 truck drivers and contractors.

“It’s usually pared down a little bit smaller than that. I like to run a small crew and be able to spend the time with the guys as much as possible, just to make sure they’ve got what they need to do their jobs,” Webster says. “The senior guys have been around for a while. There’s not much management of them needed. You just keep giving them work, and they do the work. It’s pretty seamless that way.”

Finding skilled drivers for hauling biomass can be challenging.

“There are two types of drivers out there: a highway chip truck driver, and then there’s a log truck driver,” Webster says. “If you get a log truck driver, he refuses to shovel or do anything like that, but his skill off-highway far surpasses the highway driver. The highway driver will roll his tarps and shovel if the load is stuck, but their skill level in the bush or off-highway is lower.”

While challenges remain for growing the biomass side of the business, Webster says there’s plenty of opportunity to grow with the help of the Ministry of Forests to adjust permitting to assist with harvesting.

“In B.C., we’re running out of saw logs, but there’s no shortage of fibre for biomass. We have a glut,” he says. “If we can get the Ministry on board, and they’re definitely coming around, and maybe we adjust the permitting process… they’ll get it adjusted so that it works well for biomass.”

While the amount of biomass being harvested varies from year to year, Tsi Del Del Biomass typically processes in the range of 300,000 cubic metres annually. | Photo: CCR.

Wood and biomass moisture: Four ways to increase plant efficiency

By Sarah Hammond

Minimize cost and increase efficiency. Both manufacturers and producers have this at the forefront of their agenda, especially in today’s economy. Knowing where improvements can be made and implementing increasingly lean operating procedures creates immediate process line results.

Moisture and wood fuel biomass are vital to each other for minimizing cost, proper operation of biomass boilers, and genuine fuel load assessment. Near-infrared (NIR) technology is a great non-contact way to measure moisture content, immediately improving the product and overall efficiency of the plant.

Moisture control becomes crucial in wood and biomass products as excess moisture has impacts that not only affect the product but also the equipment, energy usage, production efficiency, downtime, and more. Wood fuel boilers are optimally designed to operate with fuel of a limited moisture range content. Fuel outside of the tolerated moisture range of the boiler can lead to multiple inefficiencies, increased emissions, and even error the control system. Knowing and maintaining the moisture content is essential to production efficiency and provides multiple immediate benefits.

Minimizing costs is a top priority for producers and thoroughly evaluating methods of reducing waste can reduce wasted efforts, wasted product, and wasted energy.

PROACTIVE AVOIDANCE

Continuous monitoring of moisture content provides proactive avoidance of potential

issues caused by out-of-tolerance moisture levels. Delivering the highest quality product by utilizing the diamond standard in NIR moisture detection systems ensures the highest quality of accuracy and repeatability. The sensors are insensitive to material variations such as particle size and material height/colour, providing continuous reliable readings with zero maintenance, one-time calibration, non-contact, and a non-drift optical design. Adjustments are made on the fly, producing instant measurements, improving performance, reliability, and consistency.

Dry products create avoidable risk, as do products that are too wet. The pelletizer requires a tolerated moisture range to ensure the proper efficiency of the machine. Excess moisture can cause the pelletizer to malfunction, resulting in significant product loss and downtime on the production line.

Moisture control provides immediate results in reduced transportation costs stemming from excess water, less wear and tear on equipment from ash and dust buildup and prevents blockages on the conveyor which results in shutting down the boiler.

Moisture control provides immediate results. | Photo: MoistTech.

When it comes to challenges faced by plant operators, moisture detection and control is one of the most crucial steps. If there is no current method of moisture measurement in the production process, a large opportunity for increased efficiencies is being missed.

ULTIMATE EFFICIENCY

Do you currently have the ability to consistently measure 100 per cent of the product being produced? Installing NIR moisture sensors throughout the process makes this easily achievable. Proactive, immediate adjustments are easily made to ensure optimal manufacturing by line personnel while monitoring the process anywhere in the facility.

Maximizing automation and increasing reliability through reducing costs is a major significance for operating personnel and easily achieved through moisture monitoring. Moisture ranges outside of tolerance can unravel important facets of the production process. Each phase of the manufacturing process runs more efficiently with accurate moisture content and provides increasing profits.

Identifying and using the best methods can lessen common problems: warping, claims, checks, and excessive transportation costs.

WHY NEAR-INFRARED?

Multiple moisture detection methods exist for industrial processing but not all technology is created the same. Radio-Frequency (RF), weight loss, and probe methods have various factors that need to be considered as they can sometimes provide more of an educated guess than a reliable measurement that can be repeated.

NIR technology is different than others as it does not require being in contact with the product at all. In fact, it is measured approximately 4 to 12 inches away from the product. Non-destructive and precise accuracy also make NIR the number one choice for moisture detection. Very simply, NIR spectroscopy and imaging provide fast, nondestructive analysis of the chemical and physical information in the product. When light hits a product, it interacts in various ways; transmitted light will pass through while backscattered light will reflect from the product back to the sensor. Absorption is key to the NIR analysis.

By implementing an NIR moisture sensor, wood and wood fuel product manufacturers can adjust moisture levels on real-time information lowering raw material and fuel costs, higher yields, and more uniform products. NIR offers clear advantages over the traditional methods, most important being ease of use, elimination of hazardous chemicals, and increased efficiency of product testing. •

Sarah Hammond is the marketing manager for MoistTech

Corp.

Combustible Dust Specialists

Allied brings 49 years experience to help you meet current NFPA Standards with: system design/documentation, spark detection, isolation, grounding, PLC, venting, blast path management, clean-up systems and duct audits — CWB certified and member SMACNA.

Sawmill – Biomass – Boardplants – Pulp & Paper – Power Generation – Mining 50 years of Industrial Air Systems www.alliedblower.com ◆ Phone: 800-576-3611

Wood pellets: A renewable heating revolution in the Northwest Territories

The Northwest Territories (NWT) is making significant strides in transitioning from fossil fuels to sustainable energy sources, and wood pellets are playing a pivotal role in this transformation. With extreme winters and a dispersed population, heating represents one of the territory’s largest energy demands, consuming a considerable share of the budget in households and public infrastructure. As highlighted in the 2022-2023 Northwest Territories Energy Initiatives Report, the use of wood pellets has emerged as a practical, sustainable, and cost-effective solution to meet these challenges.

WHY WOOD PELLETS?

Wood pellets, made from compacted sawdust and wood waste, are a low carbon fuel source. When used in efficient pellet boilers, they release carbon dioxide that was previously absorbed by the trees, maintaining a balanced carbon cycle. This makes them a viable alternative to diesel and heating oil, which dominate the energy landscape in the North.

In the NWT, heating oil still accounts for the majority of energy use in buildings, particularly in remote communities where harsh winters make reliable heating essential. However, the government has recognized the environmental and economic benefits of biomass heating systems. By transitioning to wood pellets, communities can reduce greenhouse gas (GHG) emissions while leveraging locally sourced, renewable materials where feasible.

By David Dubois

IMPLEMENTATION IN THE NWT

The adoption of wood pellets aligns with the NWT’s 2030 Energy Strategy, which aims to reduce GHG emissions by 30 per cent from 2005 levels by 2030. Programs like the Arctic Energy Alliance (AEA) have been instrumental in encouraging this shift. The AEA provides rebates and grants for energy-efficient systems, including those powered by biomass, helping both residential and commercial entities make the switch.

Key regions like South Slave and North Slave are leading this transition, with pellet boilers increasingly used in municipal buildings, schools, and private homes.

lic facilities such as the Legislative Assembly building and correctional centers have installed large-scale wood pellet systems, demonstrating the cost-effectiveness of this technology. These projects not only cut operational costs but also displace thousands of liters of diesel annually.

ENVIRONMENTAL AND ECONOMIC BENEFITS

Switching to wood pellets offers multiple benefits:

Environmental impact: Pellet systems drastically cut GHG emissions compared to fossil fuels. For instance, by substituting heating oil with wood pellets, facilities can

Wood Pellets

Pub-

The adoption of wood pellets aligns with the NWT’s 2030 Energy Strategy.

NWT’s 2030 Energy Strategy aims to reduce GHG emissions by 30 per cent from 2005 levels by 2030.

significantly reduce their carbon footprint, contributing to Canada’s broader climate goals.

Cost savings: While initial installation costs for pellet boilers may be high, oper-

ational costs are significantly lower. Pellets are generally cheaper than heating oil, and their price stability helps communities avoid the volatility of global oil markets.

Energy independence: Pellet heating reduces reliance on imported diesel and heating oil, enhancing local energy resilience. This is particularly critical for remote communities where transporting fuel over long distances can be costly and logistically challenging.

OVERCOMING CHALLENGES

Despite its potential, the widespread adoption of wood pellets in the NWT faces challenges. One significant barrier is the high upfront cost of transitioning to biomass heating systems, which can deter individual homeowners and small businesses. Additionally, ensuring a consistent supply of wood pellets in remote areas remains a logistical hurdle. The government is addressing these issues through grants, subsidies, and infrastructure development.

Another consideration is that not all communities in the NWT have easy access

to wood biomass. For areas above the tree line, alternative renewable energy solutions, such as wind and solar, complement biomass initiatives.

LOOKING AHEAD

The NWT government is committed to expanding the use of wood pellets as part of a broader energy diversification strategy. Future plans include scaling up public infrastructure conversions to biomass and fostering private-sector adoption. Education campaigns are also underway to inform residents and businesses about the benefits of switching to wood pellets and the resources available to support this transition.

By incorporating wood pellets into its energy mix, the NWT is not only addressing immediate heating needs but also contributing to a sustainable energy future. This shift demonstrates how innovative approaches tailored to regional conditions can achieve climate targets while benefiting local economies.

The efforts outlined in the Energy Initiatives Report highlight the importance of collaboration between governments, communities, and private stakeholders. As the Northwest Territories continue to embrace wood pellets and other renewable energy solutions, they serve as a model for other remote and northern regions facing similar challenges.

For more details on the NWT’s energy initiatives and strategies, you can access the full report at: www.inf.gov.nt.ca/sites/ inf/files/resources/121-ei_report_2023_ web.pdf. •

David Dubois is the manager of business development at Fink Machine Inc.

“The NWT government is committed to expanding the use of wood pellets.”

Wood Pellets