Now available on Bandit Whole Tree Chippers, Bandit’s exclusive micro chip drum and card breaker system can be easily configured to produce consistent chips of virtually any size, including micro chips ideally suited for wood pellet production.

All this, without sacrificing Bandit’s legendary throwing power and production, without the need for a chip accelerator.

From wood chippers to stump grinders, horizontal grinders, forestry mowers, and specialty wood processing equipment, there’s no reason why you shouldn’t own a Bandit.

1/4” MICRO CHIPS CARD

MICRO CHIP DRUM

12 Greener fuel for greenhouses

A new control system for biomass furnaces leaves greenhouses with a smaller carbon footprint.

16 United vision

The industry comes together in Quebec to support the move to woody biomass.

19 WPAC show guide

Canadian Biomass has your exclusive guide to the 2014 Wood Pellet Association of Canada’s AGM and Conference.

24 Succinic success

BioAmber is building a global bio-succinic industry.

Exciting times and challenges ahead

Factors that will help or hinder development in the years to come.

Wood pellets are designed to burn - they’re made from highly combustible dust that is pressed into pellet form. SEPTEMBER/OCTOBER

hile looking through my notes from the International Bioenergy Conference in Prince George, I found a quote from Ken Shields, CEO of CanBio: “Who’s responsibility is it to hold the government’s feet to the fire?” I also noted that it will be policy that moves the bioeconomy forward.

One of the biggest challenges facing the bioeconomy is access to feedstock. Shields and WPAC’s executive director, Gord Murray, started a heated exchange on fibre access during that same session, moderated by our own Scott Jamieson. The same can be said for some of Canada’s biofuel producers, who bid on feedstocks from hundreds or thousands of miles away when local resources just aren’t available.

But I am not so sure that fibre availability is still the bioeconomy’s biggest hurdle. The focus of our industrial partners from coast to coast has been on meeting the demands of markets in the U.S., Europe and Asia. At the same time, the industry hopes that domestic policy will change to finally open the doors to sales of notable volumes on home soil. Perhaps it is time for us to shift our focus.

Our national bioeconomy stakeholders need to work on a united push to change government policies in Canada to establish a domestic market. There is currently no greater area for the industry to grow than here at home, even when considering the likely continued growth of international markets.

That isn’t to say that associations across Canada haven’t tried to engage municipal, provincial and federal government officials. Groups like WPAC and the

CRFA, to name just two, have consistently updated their membership on work being done in consultation with government officials or in meetings with government stakeholders. But it is clear that the work done to this point simply hasn’t been enough to launch a domestic bioenergy market.

So how do we progress?

I spoke to CanBio VP Brent Boyko from OPG Atikokan on this very issue. We discussed how easy it is to fall in the trap of just inviting sitting politicians, rather than reaching out to politicians from all parties when an important conference or meeting takes place. Sure, no one wants to have the bioeconomy bounced around like a political football, but inviting politicians from all political stripes creates the potential for discussion in the hallways among the provincial and federal governments.

But there is a need to make sure that there are clear objectives, strong facts, statistics and benefits for pushing the bioeconomy forward. We have seen how easily the industry can come into question; we need to be clear and accurate in presenting arguments to politicians to ensure that they don’t fall on deaf ears.

It is time for industry leaders to present a united front, with legitimate action items signed off by multiple stakeholders to provide the necessary clout. Without a consistent, unified voice in Ottawa and our provincial capitals, we will continue to be overlooked.

Volume 14 No. 5

Editor - Amie Silverwood (289) 221-8946 asilverwood@annexweb.com

Associate Editor - Andrew Macklin (905) 713-4358 amacklin@annexweb.com

Contributors - Staffan Melin, Treena Hein, Gordon Murray, Guillaume Roy, Annie Webb, Gabrielle Bauer, Christopher Rees, Christina Coutu.

Editorial Director/Group Publisher - Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexweb.com

Market Production Manager Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

National Sales Manager Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@annexweb.com

Western Sales Manager Tim Shaddick - tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Media Designer - Brooke Shaw

Canadian Biomass is published six times a year: February, April, June, August, October, and December.

Published and printed by Annex Business Media.

Printed in Canada ISSN 2290-3097

Circulation

Carol Nixon email: cnixon@annexweb.com P.O. Box 51058 Pincourt, QC J7V 9T3

Subscription Rates: Canada - 1 Yr $49.50;

Occasionally, Canadian Biomass magazine will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2014 Annex Business Media, All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

November 17-19, 2014

Vancouver Marriot Pinnacle Hotel · Vancouver, BC

· The Canadian Pellet Industry from Coast to Coast

· Sustainability in a Canadian Context

· Fibre Sourcing

· Transportation and Logistics

· Power Markets

· Heat Markets

· Wood Pellet Workshop

· Sustainability Certificate Workshop and much more!

Methes Energies International Ltd. announced that it has entered into a feedstock credit facility with a major provider of credit to the renewable fuels industry (the Lender), which will provide Methes all the feedstock that is required to run at full current capacity (1 million gallons per month or approximately 40 railcars per month).

The agreement will also allow Methes to fulfill future orders for biodiesel that it

receives from its customers that have been approved by the credit department of the Lender.

Methes has also established a feedstock hedging account with the Lender to protect its margins against market price fluctuations. The Lender is a subsidiary of a Fortune 500 company, which trades in a number of commodities and the group has important connections in the biodiesel

Viridis Energy Inc. announced that Tim Knoop has joined the company as Senior Vice President of Operations. Knoop will oversee Viridis’ Canadian West Coast and East Coast manufacturing operations with the goal of heightening cost efficiencies and fortifying the company’s operational framework in preparation for its expansion strategy.

Knoop brings over 20 years of experience in the forestry industry. He joins Viridis from Pacific Bioenergy, where he served as general manager of operations, as well as director of Nazbec. He also served in senior management positions at CanFor, where he managed continuous improvement strategies and oversaw quality control and optimization of its sawmill operations. In addition, Knoop spent several years at Skeena Cellulose Inc. where he supervised lumber operations and new product development.

“Knoop’s broad background in the timber and wood pellet industries is an important addition to Viridis management team, as we expand our production capabilities in order to satisfy the rapid increase in wood pellet demand. Knoop’s operations management expertise, long, successful track record, and industry relationships will reinforce our management team’s efforts to expand our product offering capabilities and achieve profitability,” commented Christopher Robertson, CEO of Viridis.

industry. The new credit facility replaces Methes’ preexisting $1.5 million credit facility.

Nicholas Ng, President of Methes, said, “Our new feedstock facility is a significant step forward for Methes. The amounts available to us will be driven solely by sales of biodiesel and will allow us to move to full production with confidence that the feedstock will be available.”

The provincial government’s forestry plan has stimulated a $400,000 private investment from Northern Energy Solutions to examine the potential of constructing a pellet plant in the Miramichi region.

The company has received a letter of intent from the Department of Natural Resources stating that if the project is feasible, the company will receive 378,000 cubic metres of softwood from forestry Region 3 (Nepisiguit-Miramichi).

If the results from Northern Energy Solutions feasibility study are positive – resulting in the construction of a pellet plant in Miramichi – the province will provide 200,000 cubic metres of pulp wood. The plant would also need additional wood allocations requiring approximately 100,000 cubic metres of pulp wood annually from private woodlots.

It is estimated that a plant would produce 200,000 tonnes of pellets annually. It would employ 25 technicians and engineers as well as support 75 jobs in the woods.

Northern Energy Solutions estimates it will invest $300,000 to $400,000 on the study, which will take about eight months to complete. It is anticipated the plant would cost $45 million to $50 million.

A Request for Expressions of Interest (RFEOI) for a biomass facility in Revelstoke, B.C. has been met with a huge response from the industry, with over 50 responses received by the community.

The City of Revelstoke has approved $15,000 for consultant John Christie to review and score each of the

requests. Christie was originally hired by the City to prepare the RFEOI.

The community is looking for an industry partner to build a biomass facility in the community to convert locally-sourced wood waste into biofuels.

By Gordon Murray

he United Kingdom (UK) has emerged as Canada’s largest market for wood pellets, accounting for one million tonnes in 2013 (63 per cent of Canadian exports) and up from 794 thousand tonnes in 2012. And since the UK market is dominated by large power utilities replacing coal with wood pellets to reduce CO2 emissions, its climate change policy is of vital interest to pellet producers.

The Climate Change Act of 2008 (the Act) provides that the UK must reduce its CO2 emissions by at least 80 per cent from 1990 levels by 2050 in an effort to limit the global temperature increase to 2°C. To ensure that regular progress is made towards this target, the Act established a system of five-year carbon budgets to serve as achievable steps along the way with the first four set in law. The UK met its first target and is now in its second carbon budget period aiming for a 29 per cent reduction by 2017.

A committee of experts in the fields of climate change, science and economics was established (CCC) and is supported by a secretariat. It acts as an independent body to advise parliament on progress and recommend action where targets are not met by focusing on nine sectors: industry, buildings, transport, aviation, shipping, waste, power, land use and agriculture.

According to the CCC’s July report, deep de-carbonization of the power sector by 2030 is central to emissions reduction and the most economical means of meeting its legislated commitments (since power accounts for around one quarter of total UK emissions).

The CCC makes a number of recommendations that are of interest to pellet producers, which include:

• Completing implementation of Electricity Market Reform (EMR) by setting appropriate strike prices and by signing contracts for low-carbon capacity, while ensuring a suitable mix of low-carbon technologies is supported.

• Requiring all biomass to be sustainably sourced.

• Adding a requirement that all biomass is sourced from forests that can demonstrate constant or increasing carbon stocks, and pushing for this to be reflected in standards at the EU level.

• By no later than 2016, committing funding for low-carbon generation in the period beyond 2020.

Plans are on track for the UK to meet the following scenario:

Around 2 GW of large-scale dedicated biomass or biomass conversion is already on the system, with a further 1.4 GW of co-firing and other biomass capacity under construction.

The Department of Energy and Climate Change has awarded contracts for biomass conversions at Drax (pellets), Lynemouth (pellets), and Teesside (chips) with a total

According to the CCC’s July report, deep de-carbonization of the power sector by 2030 is central to emissions reduction.

• Setting ambitious emissions targets for 2020 and 2030 that will put the UK on a cost-effective path to meeting at least an 80 per cent target for 2050.

The committee reported that biomass power generation rose from 8.7 TWh in 2008 (around three per cent of electricity supply) to 16.5 TWh (five per cent of electricity supply) in 2013. The composition of biomass feedstock used in electricity generation has shifted from a reliance on waste-derived fuels in 2008 (around 85 per cent, the remainder a mix of plant and animal biomass) towards a greater proportion of woody biomass (27 per cent of feedstock in 2013).

The CCC also recommends that the use of biomass in the power sector should focus on conversion of existing coal plants rather than new, dedicated biomass plants.

capacity of 1.4 GW.

There are further plans to convert another unit at Drax (0.65 GW) and potentially at Eggborough (1.4 GW).

1.7 GW of existing biomass conversion capacity is set to come offline by 2016.

The UK is legally committed to aggressive carbon reduction targets well into the future; biomass, especially in the form of wood pellets, will continue to play a prominent role. This is good news for Canadian wood pellet producers. •

Gordon Murray is executive director of the Wood Pellet Association of Canada. He encourages all those who want to support and benefit from the growth of the Canadian wood pellet industry to join. Gordon welcomes all comments and can be contacted by telephone at 250-837-8821 or by email at gord@pellet.org.

CThe executive summary of the 2013 CanBio and NRCan bioenergy industry survey was released in Thunder Bay.

By Christopher Rees

anada’s bioenergy industry is growing and contributing to the replacement of many jobs lost in small communities in traditional industry sectors. The industry is also diversifying from strictly energy products to higher-value bio-materials and bio-chemicals.

In 2013 CanBio and Natural Resources Canada (NRCan) undertook a nationwide survey of Canadian bioenergy plants and operations to understand the growth and structure of the emerging industry.

Policy: The federal and provincial governments have implemented an array of policies to support the bioenergy industry. Federal programs have played a large role in the development of bio-fuels.

Pellets: Installed production capaci -

ty grew by 61 per cent in 2010-12 but uncertain markets led to a small capacity decline in 2013 with the closure of three plants.

Community heat: Until 2000, only five biomass heat projects existed in Canada. By 2013 the number of systems had grown to 109, led by B.C. and the N.W.T. Nationwide, 33 additional bio-heat installations are under construction.

Cogeneration: In 2013, 39 operating biomass cogen plants at pulp and paper mills in Canada were identified with combined electrical capacity of over 1,500 MW. Independent power producers provide an additional 540 MW of electrical capacity and 150 of thermal capacity.

Ethanol: Capacity in ethanol from corn and grain has increased from 411

million litres in 2005 to 1,826 million litres from 14 plants, nearly all of which are producing at full capacity. Four pilots and four commercial demonstration plants for ethanol from lignocellulosic feedstocks are expected to come on stream by 2016.

Biogas: By 2013, Ontario has become the definite leader in Canada for onfarm anaerobic digestion installations with 37 of Canada’s 77 operating facilities. Quebec is in second place with 14 plants but with twice as much capacity as Ontario based on five facilities.

The full survey was released by CanBio following the CanBio Annual Conference in Thunder Bay in September. The full results of the survey will be available on the CanBio website www.canbio.ca in October.•

A new control system for biomass furnaces leaves greenhouses with a smaller carbon footprint.

By Annie Webb and Gabrielle Bauer

greenhouse crops can be grown throughout the year, they are becoming increasingly important for the food supply of countries like Canada, which have colder climates and shorter growing seasons. However, greenhouse heating can be one of the highest operating costs for a producer. Heat is typically supplied by non-renewable fossil fuels, such as oil and natural gas. These fuels are also frequently used to enrich the greenhouse with carbon dioxide (CO2) to enhance plant growth. The high cost and environmental impact of fossil fuels has led some greenhouse operators to look for alternative heat sources, such as biomass.

Enter the Biomass Furnace Flue Gas Emission Control System (GECS), a process designed to recapture energy and CO2 from the furnace and redirect it to the greenhouse.

The brainchild of researchers and several graduate students at McGill University’s Department of Bioresource Engineering, GECS is “a greener way to use wood pellets for heating greenhouses,” says Dr. Mark Lefsrud, the engineering professor spearheading the project. The system not only recovers heat and purifies noxious gases and particulates from the furnace’s exhaust, it also recycles CO2 back into the greenhouse, which enhances plant growth and yields.

The GECS unit consists of a rigid box air filter coupled with two sets of heating elements, two catalytic converters and two forced air fans. The unit is attached to the

chimney of a pellet stove installed in a greenhouse. “Pellet stoves generally produce less harmful emissions than other stove types because the shape of the biomass allows for a better distribution of oxygen, which produces a uniform and complete combustion. This makes the flue gas easier to purify and more suitable for CO2 enrichment,” explains Dr. Lefsrud.

“The air filter removes the particulate matter in the flue gas, while the other elements transform the exhaust gases into less harmful gases,” says Yves Roy, a Master’s candidate who played a pivotal role in designing the system. He explains that there are three steps in the purification process: the first is the mechanical collection of large-scale particulates using a combination of an electrostatic precipitator, cyclone and a bag filter. Finally, two sets of catalytic converters and heating elements transform all noxious gasses to less hazardous gases.

Once the GECS prototype was completed, the team tested it on the chimney of a wood pellet biomass furnace. The device passed with flying colours. “We confirmed that it considerably improves the thermal efficiency of the wood pellet heating system since no heat is lost through the flue gas,” says Dr. Lefsrud. The team’s measurements also affirmed the system’s safety: when the exhaust from the furnace chimney was pumped directly into the greenhouse, the air remained well within Health Canada’s air quality guidelines for acceptable levels of indoor gases and contaminants.

The GECS unit is also very cost-effective: “The capital investment required for the GECS is far lower than for alternative

heating systems currently on the market,” says Lefsrud. His experiments show that direct combustion exhaust gas recuperation through the purification system reduces greenhouse heating costs by 18.8 per cent. Translated into bottom-line terms, this means both a lower heating bill and a lower carbon footprint, even for small operations. “End-users may even be able to claim a carbon credit,” he adds.

BioFuelNet gave legs to the initiative, supporting graduate students to travel to conferences where they showcased the technology and networked with other scientists in the field.

Two things need to be obtained before the GECS goes to market: a patent and a unit suitable for commercial use. The McGill team has already applied for a patent and intends to enhance the product to make it commercially viable. “We plan to build a control system into the unit to allow growers to adjust CO2 levels,” says Dr. Lefsrud, adding that “the BioFuelNet community is helping us with the commercialization process by connecting us to the right people and information.”

Lefsrud has high hopes for the new technology. “Our piece of equipment has the potential to spur economic development in the agriculture and greenhouse sector and strengthen Canadian food security,” he says. Roy shares Lefsrud’s enthusiasm. As weather patterns become increasingly fickle, greenhouses are set to become more popular than ever. “I’m confident our system will make it economically feasible for greenhouse operations of all sizes to use wood-pellet biomass furnaces.” •

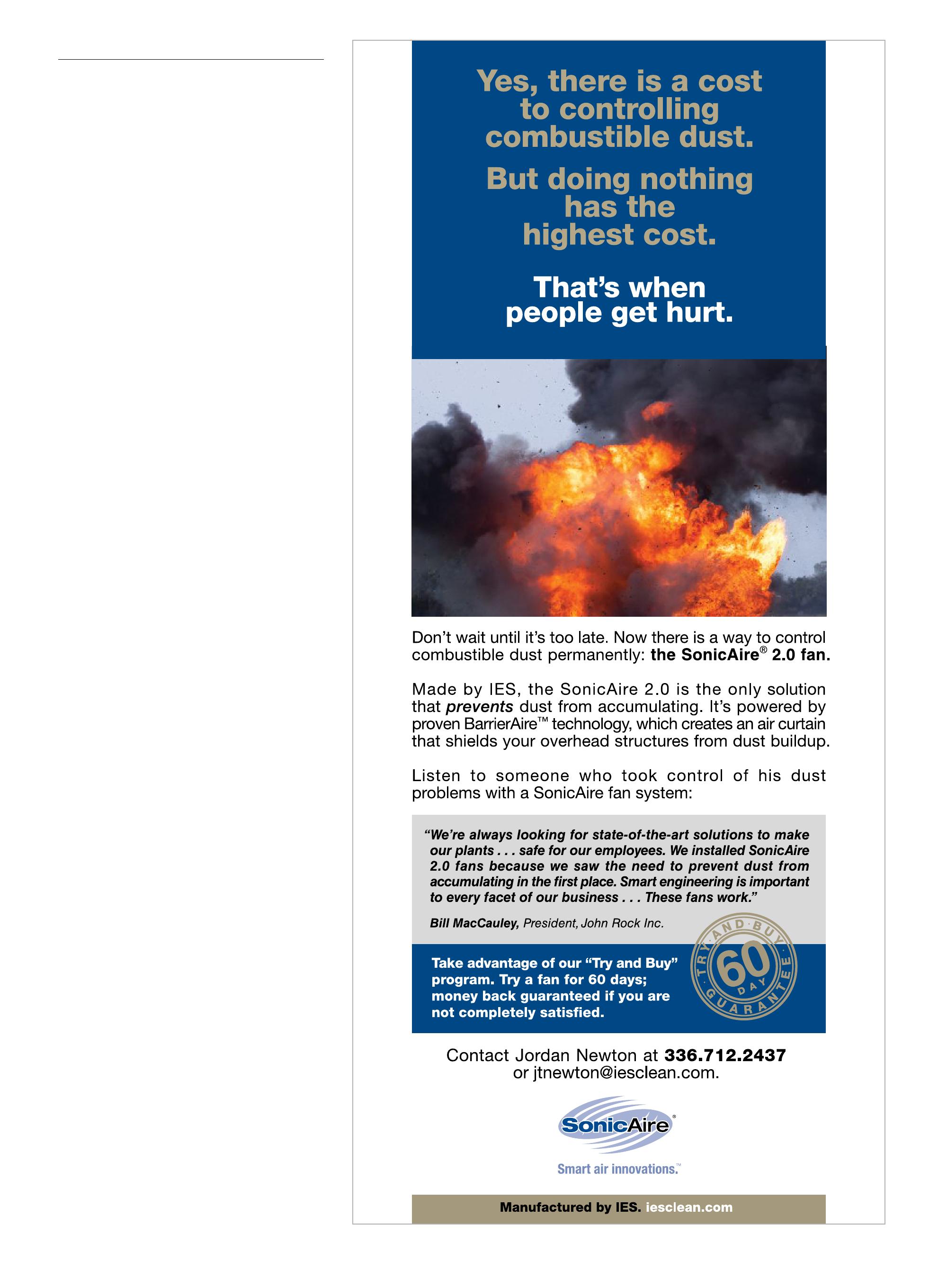

But it’s our menace too.

By Staffan Melin

Woodpellets are designed to burn – they’re made from highly combustible dust that is pressed into pellet form and must be treated with care to prevent this fuel from lighting before it has been added to the boiler.

The business of making dust is challenging due to the risk of dust explosions. The dust is present in all stages of production and is also generated during transportation and storage due to attrition. The finished product is dropped dozens of times before reaching the destination and the drop height can be quite considerable, for example up to 25 metres during the initial stage of loading an ocean vessel.

Dust collection, dust suppression, explosion containment and explosion suppression are employed in facilities for manufacturing, handling and storage to minimize the risk of injuries and damage to equipment and facilities. The risk factors for initiating a fire or explosion includes hot particles or sparks landing on a dust layer setting the dust on fire, often with explosive force, which in turn may trigger a secondary massive explosion when dust in the rest of the facility becomes lofted. A rule of thumb to be used as a guideline for housekeeping is that a maximum thickness of 3.2 mm (1/8”) of dust should not be covering more than five per cent of the floor area. Also, dust on surfaces with temperatures higher than 250ºC will catch fire. If the burning dust is dispersed at high speed in what is referred to as deflagration, it will light everything in its path and continue to burn until the fuel is exhausted.

Surprisingly, dust lofted in the air catches fire if heated to +450ºC or higher. Small particles of dust may stay lofted in the air for a long period of time, particularly in turbulent air. In still air a dust particle with an equivalent diameter of 70 micron may stay in the air for several minutes and a one mi-

cron particle or smaller will stay constantly lofted in still air. If the concentration of lofted particles exceeds 70 gram/m3, a deflagration may be initiated by, for example, an electro-static discharge.

Generation of tribo-electric charges due to fast moving equipment is a major concern. Wood dust has an extremely high electrical resistivity, which means that electrons are accumulated in the surface of dust particles and if materials in contact with the dust also have high resistivity, an electrostatic potential will build up and eventually discharge as a spark.

All materials in contact with wood dust have to be electrically conducting to bleed off the charge from the dust. All equipment has to be properly earthed, grounded and bonded to deflect any electrostatic voltage build-up. There is static paint available to minimize the dust sticking to walls and floors and there are also static dissipative hard toe shoes (CSA – SD certified) available to minimize discharge from workers using synthetic clothing.

Strict engineering design rules apply for mitigating the risk of fires and explosions in manufacturing, handling and storage

Wood pellets and briquettes are produced from a variety of feedstock materials such as sawdust, planers shavings, cut blocks from lumber production, bush grind (harvest residue), bark and even higher quality hogfuel materials. The feedstock preparation involves separation of contaminants, grinding, drying, hammer milling to size before compression to a commercial products, which in turn are screened and cooled before storage and transportation to the end user.

The large majority of the pellets made in Canada are sold and transported in large bulk volumes and used for electrical power production or heat. Smaller volumes are packaged in bags and sold for residential space heaters or boilers. Briquettes are also produced in small volumes.

The quality of pellets and briquettes are specified by ISO Standards, currently being rolled out in Canada as a voluntary CSA Standard. These standards specify the mechanical and chemical composition as well as the acceptable feedstock materials. There are six different qualities for wood pellets and an additional five qualities for non-woody (agricultural) pellets. Woody briquettes are specified in three different qualities and non-woody briquettes are specified in five different qualities.

The common denominator for all these biofuel products is that the feedstock has to be reduced to particles before compression to a commercial product. For some of the products, such as industrial quality pellets, the maximum allowable particle size is stipulated in the ISO Standards. The pellets are crushed to a powder during the fuel preparation in the power plants before sprayed into the furnaces for combustion, much like coal powder or fuel oil.

facilities. In North America guidelines are published by NFPA (National Fire Protection Association), FM (Factory Mutual Insurance Company), OHS (Occupational Health and Safety), local fire codes, etc., some of which are voluntary and others are mandatory. In Europe, ATEX (Atmospheres Explosibles) is universally accepted as the guideline mitigation of risk of explosions. Equipment installed in a facility has to be rated in accordance with a risk zone classification.

In North America, feedstock is dried at high temperatures up to 450ºC, which is a critical ignition temperature for lofted material (as mentioned above). To prevent ignition, the oxygen in the dryer is kept below 10 per cent: the limiting oxygen concentration for wood dust. The thermal balance in the dryer is critical and needs special control strategies, particularly during shutdown or loss of electrical power to the drive system.

Hot particle detectors are installed along the material’s path as it makes its way to become the final product. Some brands of detectors have a temperature set-point capability as low as 250ºC to monitor hot particles destined to land on dust layers. A set-point

temperature of 400ºC is used to monitor lofted particles in areas of high dust concentrations. Besides the risk of fires and explosions caused by dust, there is also the risk of self-heating followed by fire when the feedstock and the final product is in storage.

After the severe and fatal accidents in the Babine and the Lakeland sawmills in British Columbia in 2012, WorkSafeBC and BC Forest Safety Council implemented a strict inspection regime in British Columbia for all woodworking facilities, including pellet plants. Safety audits are conducted based on a very strict protocol on a regular basis. Citations and even fines are issued for more serious or repeated non-compliance. Some surprise audits and work-stop orders can be issued. An inspection of a typical plant usually takes two days.

Employers are mandated to provide training regarding the risks and procedures for mitigating risk. Hot work guide-

lines, ignition source identification and housekeeping are at the heart of the training program. Workers have the right to initiate work-stop if conditions are considered risky. Special guidelines are stipulated for contractors temporarily doing work in a plant. Each plant needs to have a written procedure for managing change involving manpower, equipment and procedures to make sure safety is always paramount.

The safety inspection scheme in British Columbia is likely to expand to other manufacturing facilities over time. A worksafe certification is likely to become a selling tool for the manufacturers since it

minimizes the risk of non-performance by the suppliers and may in fact over time become a contractual obligation by key pellet consumers.

ISO Technical Committee 238 for Solid Biofuels is coming out with guidelines for safe handling and storage of pellets in residential as well as in large-scale industrial applications within the next two years. Also, fire prevention and firefighting guidelines for pellet silos are under development. In addition, protocols for laboratory testing of off-gassing and self-heating characteristics for pellets will be published by ISO. Safety is gradually becoming the overriding management tool for our industry – and dust will gradually become less of a menace. •

The industry comes together to support the move to woody biomass.

By Guillaume Roy | Translated by Amie Silverwood

Theprovince of Quebec has the potential to develop a first rate system for developing woody biomass. Until 2025, 4000GWh of renewable energy could replace fossil fuel usage to prevent up to a thousand tonnes of CO2 from being emitted.

After a shocking Greenpeace campaign last year denounced the “biomascarade,” a group of industry, co-operatives, municipalities, environmental and social organizations and researchers united to promote a vision of a greener future they have termed Quebec’s Biomass Vision.

Not only did Nature Quebec, an environmental organization, take part in the partnership, but it is also one of the leaders and spokespeople for the group.

“Biomass is part of a renewable energy portfolio in Quebec. To replace petroleum products, in district energy, it’s an excellent solution to replace pollutant energy sources and it creates new regional employment opportunities,” says Christian Simard, the general director of

Nature Quebec.

Another one of the groups’ spokespersons, Eugene Simard, deputy director of development for the Quebec Federation of Forestry Cooperatives (QFFC), said, “Greenpeace has denounced extreme methods of harvesting and using biomass. That’s not what we’re talking about.” Using biomass to make heat in local projects is the optimal method of biomass usage even according to Greenpeace.

According to Nature Quebec, the large-scale exportation of biomass and use of biomass to produce electricity is not an environmentally viable option. It’s better to concentrate on replacing polluting and non-competitive energy sources domestically.

“To achieve a breakthrough in public acceptance, any biomass system must be held to the highest environmental standards in harvesting and usage,” explains Christian Simard. To build the best projects and to assure social acceptance, Quebec’s Biomass Vision is focused on projects that have an interesting environmental scope. When it comes to harvesting, fixed limits are set (according to the soil type and stands). Also, emphasis is put on using logging and sawmill residuals – forget about harvesting full trees to make biomass.

According to Nature Quebec, the large-scale exportation of biomass and use of biomass to produce electricity is not an environmentally viable option. It’s better to concentrate on replacing polluting and non-competitive energy sources domestically. (Biomass wouldn’t initially replace natural gas in projections.)

The potential to use biomass is enormous even if the industry concentrates on replacing oil and propane energy sources. In Quebec, the total potential for substitution in commercial, institutional and industrial buildings totals 11,848 GWh, while the supply of residual woody biomass amounts to 21,456 GWh (4.29 BDMT, million) according to the research done by Ecoressources for the QFFC. Concentrating on substituting the two sources of nonrenewable energy, Quebec has the potential to produce 4000 GWh of renewable energy by 2025.

Within the industrial sector, the goal is to increase the use of biomass from 9750 GWh to 12,750 GWh, which is an increase from 19.5 per cent to 25.5 per cent of total energy consumed, excluding electricity. Even more significant gains could be realized in the institutional and commercial sector where consumption could be increased tenfold from 150 GWh to 1150 GWh by 2025. If these stats are achieved, biomass would occupy 9.9 per cent of the energy used in the institutional and commercial sector (excluding electricity).

There are numerous reasons to make the substitution. On one hand, fossil fuel energy sources like light fuel oils ($30.52/ GJ), heavy fuel oil ($17.63/GJ) and propane ($31.01/GJ) are much more expensive than briquettes ($8.76$/GJ) or

wood pellets ($12.83/GJ) (prices are from 2010). And forecasts suggest these price differences will increase over time.

Rather than import nonrenewable resources and generate a commercial balance deficit, Quebec could produce renewable energy and create a local industry producing heat from forestry residuals. One 4000 GWh conversion would allow the province to improve the import balance by $225 million and prevent one million tonnes of CO2. On top of that, these investments in the biomass industry could create 12,500 jobs during the construction phase and 3,600 longterm employment positions.

In terms of long-term development, the use of forestry biomass for energy production has an added edge because this renewable energy creates a lot more jobs than any other form of energy production. “The use of biomass brings social, economic and environmental benefits. For a small forestry community, the system could create many jobs and generate

important economic benefits,” explains Simard.

But it’s in the rural regions of Quebec that developing a biomass system generates the most interest. And it’s for this reason that many municipal partners have signed onto Quebec’s Biomass Vision. “It’s a nice way to support municipalities because it allows them to make the best use of their resources,” Dany Rousseau from the Quebec Municipality Federation points out.

Coop fédérée, a co-operation representing more than 100,000 members, has been interested in biomass since 2008. “We had studied different energy systems and we came to the conclusion that the use of residual woody biomass to make heat is a solution worth promoting. In the context of long-term development, it’s the source of renewable energy that has created the most value,” says Cyril Neron, the director of growth and innovation for Coop fédérée. The Coop fédérée energy branch, Sonic, hopes to profit from the opportunities linked with the development of a biomass industry cluster.

Even if there isn’t much biomass production in private forests at the moment, Quebec’s federation of private forest landowners supports Quebec’s Biomass Vision. “The forest landowners are always partners in the development and utilization of wood products. The biomass cluster has started to take off and can become an interesting revenue source for private forest landowners,” says Marc-André Rhéaume, the federation’s forest engineer.

Quebec’s Biomass Vision rallies several important actors from the industrial, forestry and environmental sectors. Support from Nature Quebec adds credibility to the environmental value of the network. “We want to work at the forefront to ensure heat production from woody biomass becomes the leading model,” explains Amelie St-Laurent Samuel, the head of the biomass project.

“We have managed to rally several organizations around our vision. This

demonstrates the strong social acceptance that has evolved around this initiative,” Eugene Gagne adds.

While the cost of using biomass is very competitive compared to the cost of using oil or propane, the initial investment required for installing biomass heaters is prohibitive to development. It’s for this reason that the government must send a clear message of support for the industry, says Eugene Gagne. “The government is a large institutional energy consumer. It needs to take a leading role in the development of the system to lend credibility and help it attain enough critical mass to take off,” he says.

In some rural regions of Quebec, the volume is too small to adequately prepare the necessary fuel. “A large-scale project, like the conversion of the Amqui hospital required at least 1500 tonnes and allowed critical mass for the region to participate. Following its conversion, several small projects were added since the expertise had already been developed in the region,” explains Gagne.

In order to obtain maximum performance and the economic and environmental advantages, the biomass must be adequately prepared as fuel for the boiler. Attaining enough demand enables the development of qualified expertise in the region.

The province relaunched a biomass program based on the use of forestry residuals in 2013 that helps companies and individuals convert their systems and is an excellent tool to develop more opportunities for the industry. “The actual context is very positive,” Eugene Gagne guesses. “In the last budget, the government announced a $20 million investment in turnkey projects.” These investments will be used for heating systems and to sell electricity to clients rather than simply biomass. “By controlling the whole chain of development, these successful projects will lend credibility to the industry,” he adds.

However, the use of biomass for heat production wasn’t part of the climate change action plan for 2013 to 2020. With a budget of $2 million attached to this plan, it would provide an important source of funding for the development of the biomass industry in Quebec. •

On behalf of the organizing committee, I would like to welcome you to the second Annual General Meeting and Conference of the Wood Pellet Association of Canada (WPAC), again in the beautiful city of Vancouver.

The jam-packed program over the next two days will provide informative sessions with international and local experts, along with plenty of opportunities to network with colleagues covering the full spectrum of the industry.

Highlighted in this year’s conference is a focus on workplace safety. As the industry grows, the size and complexity of the facilities has also grown. This has put a significantly greater emphasis on the need for collaboration amongst industry, engineering/design organizations, equipment suppliers and regulatory bodies to provide a fundamentally safe workplace. As the industry provides a cost-effective and renewable-energy source to world markets, it is imperative to do so in a workplace that is safe through the entire supply chain. This has been a key collaborative focus of WPAC member companies over the past year and this year’s conference is intended to provide some detailed insight into this important area.

No wood pellet conference would be complete without broad-ranging discussion on raw material from the fundamental policies of government on crown lands to the evolution of international sustainability certification. This year’s conference provides delegates with the opportunity to participate in a “hands-on” workshop on the “Sustainability Biomass Partnership” which is designed to provide a common

internationally recognized sustainability certification scheme unifying a number of the current customer-specific sustainability audit processes. This again is a key part of the international growth and unification of the market allowing the product to be openly traded and branded internationally while providing the end users with the key assurance that the product meets strict and internationally recognized sustainability requirements.

Conferences of this nature would not be complete without the participation of our sponsors and trade show participants. I would strongly encourage the delegates to take the time to learn about the newest in equipment evolution and share your experiences with others.

Finally, on behalf of the WPAC members, I would like to thank our Executive Director Gordon Murray for his tireless efforts in putting this event together and more importantly supporting the growth of the sector in Canada and the products’ presence in the market. Canada continues to be one of the recognized leaders in supplying the world and domestic markets with quality, sustainable wood pellets.

Thank you for the support of all the delegates and for making this conference another success and most importantly, enjoy the show!

BRAD BENNETT Chairman and President –Wood Pellet Association

of Canada

Altentech Power

The Altentech Biovertidryer offers a new solution to remove moisture from biomass. It has been engineered to address the serious drying challenges facing the pellet industry, including operating costs, emissions and safety.

Andritz

Andritz is the leading supplier of technologies, systems, and services relating to the equipment for the biomass pelleting industry. Andritz has the ability to manufacturer and supply each and every key processing machine in the pellet production line. Visit us at www.Andritz.com/fb

Biomass Energy Lab

Biomass Energy Lab (BEL) specializes in solid biofuels testing. ISO 17025 Accredited for CEN/EN methods, BEL provides Analytical Certifications for export shipments of wood pellets and other solid biofuels to help meet contractual needs. Along with testing services, BEL also offers EN Plus Auditing & Consulting, and can assist with internal lab design/setup and the development of quality management systems.

Port of Belledune is a modern, year-round marine transport facility and deep-water point of access that is innovative in developing its services and facilities to the fullest. The Port has proven itself capable of handling any and all goods, offering flexible services, creative solutions and excellent rates. Additionally, the Port specializes in the handling of bulk and break-bulk cargoes and is the only existing point of export for wood pellets on the east coast of Canada.

Bruks Rockwood

Bruks is a global leader in mechanical engineering and equipment supply for the bulk materials handling industries. Customer service and product performance are at the heart of its corporate culture; it provides specialized customer solutions, including the development of custom machines and systems. Its services include project engineering, technical support, start-up training and remote-monitoring/ servicing of machine functions.

Specializing in wood processing machinery and material handling systems for the

Biomass and Forestry industries: BioSizer, vibrating conveyors, Grizzly Mill, chippers for pulp-chips or micro-chips, electric log sweeps, log decks, log singulators, rotary debarkers. Custom engineered solutions to take control of your fibre supply and get more from your mill.

Bulldog Bag

Bulldog Bag is celebrating its 50th year of providing various flexible packaging items to a large and ever expanding marketing place both domestic and foreign. From printed polyethylene films, laminated films, paper, paper-poly laminates, poly woven sacks, paper multi wall sacks, lumber covers and many combinations in between, Bulldog Bag can manufacture to meet your needs from our plant in Richmond, B.C.

Canfornav

Founded in 1976 with its headquarters in Montreal, the company’s beginnings were in the lumber trade, which gradually extended to steel and bulk commodities. Today, Canfornav operates over 40 vessels, owned and on long-term time charter, ranging in size from 27,000 to 57,000 dwt vessels, with further new orders pending from Chinese yards for one more 36,000

dwt and two 64,000 dwt vessels. Five 36,000 dwt vessels have already been delivered for use in special bulk trades. In 2013 the company carried over 7 million tonnes of cargo including grain, fertilizer, sugar, minerals, wood pellets and steel.

Cogent Industrial Technologies offers a proven track record in the design and integration of electrical, controls, industrial IT and operational information management systems. Our focus is on embedding safety, efficiency, operability and reliability into the systems and empowering your personnel to manage and improve operational effectiveness. Cogent is the 2014 System Integrator of the Year.

CPM has been a leader in Biomass pelleting for over 20 years. With the formation of the Global Biomass Pelleting Group, we can now call on all of our resources worldwide to ensure that you receive the highest quality equipment along with the highest quality support worldwide.

CPM Wolverine Proctor has over 100 years of experience in conveyor drying: offering customized solutions in a modern and efficient facility devoted exclusively to the manufacturing of thermal processing equipment.

Dieffenbacher is a leading supplier of equipment to the wood products industry. Our product range includes wood fired boilers, furnaces, and thermal oil heaters, as well as rotary dryers, chippers, hammer mills, and pelletizing equipment. We also are a major supplier of MDF, OSB, and chipboard manufacturing equipment worldwide.

Dansons Inc. is the leader in the field of supplying specialty lubricants to the biofuel industry. Not only have we developed and supplied specialized lubricants to the pellet mill industry, we also provide technical support and expert advice on how to get maximum life out of wear components.

Fike Canada Inc

Fike has over 65 years of field experience and a team of engineers, application specialists and combustion researchers delivering a complete line of products and innovative technologies to the explosion protection market.

Firefly AB

Firefly AB is a leading supplier of fire prevention systems to the process industry. With over 40 years of experience, Firefly

offers tailor-made fire protection solutions to avoid costly fires and dust explosions.

Laidig Systems Inc.

Laidig Systems Inc. is a manufacturer of radial screw type reclaimers that are coupled with vertical silos, domes or underthe-pile applications. The Laidig design systems eliminate bridging within vertical silos, create first-in, first-out flow patterns that are ideal for pellet mill process silos that require the handling of sawdust, wood shavings, wood chips and wood bark. The Laidig design pellet storage systems allow for the removal of pellets from storage vessels up to 61 meters (200 feet) in diameter, which allows for an automated ship loading system. Please visit our website at www.laidig.com.

M-E-C designs, engineers, manufactures and services single pass dryers, triple pass dryers, flash tube dryers, fuel storage systems, material handling, fuel preparation and wet and dry wood combustion systems. M-E-C delivers total turn-key system responsibility for the processing of wood fuel pellets since 1983. That’s our difference.

Pinnacle Renewable Energy Inc.

Pinnacle is Canada’s largest manufacturer of wood pellets and winner of both the 2013 BC Export Award and the 2013 Premiers Award for Job Creation. Pinnacle has the lowest Wood Pellet Fuel Supply Risk in the world, due to their multiple operations from six plants, their diversified vessel loading options through two interlinked ports, their secure and abundant fibre supplies and their impeccable delivery track record. Pinnacle is PEFC Chain of Custody certified.

Player Design Inc.

The philosophy behind PDI is simple –design and supply state-of-the-art, reliable equipment to enable our customers to succeed in today’s manufacturing markets. By combining innovative engineering and practical experience, we have created a line of machinery that delivers substantial economic benefits, superior finished product quality, and some of the lowest emissions in the industry.

Prodesa

Prodesa is a well-known supplier of wood pellet facilities and biomass fuelled CHP plants based on ORC (Organic Rankin Cycle). We are manufacturers of drum dryers, low temperature belt dryers, hammermills, pellet mills, etc. We have over 20 years’ experience and dozens of references all over the world.

SARJ Equipment plans, designs and builds full turnkey production plants for the pelleting industry. SARJ incorporates the Amandus Kahl flat die pellet machine into all of pelleting facilities to pellet all species of wood, achieving the highest throughput capacities while maintaining the lowest operating costs.

Seeger Green Energy provides large biomass heating and power plants; small decentralized biomass heating plants; and pellet and briquette production plants, which offer such critical services as project development, planning, financing and project supervision after plant commissioning.

The Sustainable Forestry Initiative (SFI) program is an independent, nonprofit organization with a sciencebased, internationally recognized forest management standard for North America. A third-party forest certification program, SFI promotes responsible forest management and addresses the growing demand for bioenergy feedstocks while supporting forest values such as water quality, soil productivity and biodiversity. Learn more at sfiprogram.org.

Viridis Energy is a publicly traded manufacturer and distributor of biomass fuel that operates two wood pellet manufacturing facilities: Okanagan Pellet Company in B.C. and Scotia Atlantic Biomass in Nova Scotia, with total production of approximately 200,000 tons. It is the only pellet company in North America on both coasts.

The Wellons Group is a leading supplier of biomass- and gas-fired energy systems, including direct-fired hot gas generation systems (HGG’s) for rotary dryers. Wellons has recently supplied HGG’s for pellet plant project at Groupe Savoie (New Brunswick), New England Pellet (New York State) and Resolute Forest Products (Thunder Bay).

West Salem Machinery is a leading manufacturer of screening, grinding and milling machinery. WSM’s Super Shredder is ideal for high-capacity green milling and is available as a component or part of complete green milling island. WSM manufactures 4400 Series Hammermills for dry milling, vibrating screens, metering feeders and bark processing machinery.

Workshop 1

Workshop 2

17:

9:00 AM to 05:00 PM

9:00 AM to 05:00 PM

Tour 9:00 AM to 12:00 PM

PeterWllson and Simon Armstrong,SBP

FahimehYazdanpanah,UBC

KerryLige,Fibreco

Lunch 12:00 PM to 01:30 PM lunch will be provided

AGM 01:30 PM to 05:00 PM

Cocktail 05:00 PM to 07:00 PM

BradBennett,JohnArsenault andGordonMurray

• Hands on Sustainable Biomass Partnership training session for auditors and plant personnel.

• UBC pellet workshop

• Fibreco tour

• WPAC AGM

Sponsored by Viridis Energy

NOVEMBER 18: CONFERENCE DAY 1

7:30 AM to 8:00 AM

Continental Breakfast

MARKET OUTLOOK | MODERATOR: MICHELE REBIERE, VIRIDIS ENERGY

1 8:30 AM to 8:50 AM

2 8:50 AM to 9:10 AM

3 9:10 AM to 9:30 AM

4 9:30 AM to 9:50 AM

Coffee Break 9:50 AM to 10:30 AM

SethWalker,RISI

WilliamStrauss,Future Metrics

ArnoldDale,Ekman

LudgerSpohr,VisNova/EIPS

CERTIFICATION AND SUSTAINABILITY | MODERATOR: GORDON MURRAY, WPAC

1 10:30 AM to 10:50 AM PeterWilson,SBP

2 10:50 to 11:10 AM RichardPeberdy,Drax

3 11:10 AM to 11:30 AM BradBennett,Pacific BioEnergy

• Global review of production, consumption, and forecast

• Pellet potential for North American power generation

• The European pellet market

• European biomass policy update and potential trade impacts

• Sustainable Biomass Partnership sustainability certification

• Drax’s plans for SBP certification and UK policy update

• Canadian Implementation of SBP certification 4 11:30 AM to 11:50 AM ElizabethWoodworth,Enviva

Lunch 11:50 AM to 01:30 PM

FIBRE SUPPLY | MODERATOR: DOMINIK ROSER, FPINNOVATIONS

1 01:30 PM to 01:40 PM

RobMcCurdy,Pinnacle

2 01:40 PM to 01:50 PM KenShields,Conifex

• Enviva: sustainable fibre procurement by a US producer

• BC pellet producer perspective on fibre access and security

• Primary tenure holder perspective on supplying fibre to the biomass industry

01:50 PM to 02:00 PM DavePeterson,BCMNFLR • BC government perspective on bioenergy fibre supply

02:00 PM to 02:10 PM

JonathanLevesque,Groupe Savoie

• Fibre procurement in New Brunswick 5 02:10 PM to 03:00 PM ALLABOVE

• Fibre supply debate Coffee Break 03:00 PM to 03:30 PM RESEARCH AND DEVELOPMENT | MODERATOR: STAFFAN MELIN,

NOVEMBER 19, 2014: CONFERENCE DAY 2

Continental Breakfast 7:30 AM to 8:00 AM

CANADIAN PELLET PRODUCER PANEL | MODERATOR: CAM MCALPINE, PR MEDIA

1 8:30 AM to 9:15 AM

BradBennett,Vaughan Bassett,MicheleRebiere, Pierre-OlivierMorency

ITALIAN PELLET MARKET | MODERATOR: JOHN ARSENAULT, WPAC

1 9:15 AM to 9:35 AM AnalisaPaniz,AIEL

2 9:35 AM to 9:55 AM KerryEllem, Global Renewables

Coffee Break 9:55 AM to 10:30 AM

ASIAN MARKETS | MODERATOR: JOHN ARSENAULT, WPAC

1 10:30 AM to 10:50 AM JJ(Jung)Moon,SMGAsset/ MissionWood Pellet

2 10:50 AM to 11:10 AM WoochunChoi,SamsungC&T America

3 11:10 AM to 11:30 AM KerryLige,Fibreco

4 11:30 AM to 11:50 AM JapaneseTradingHouse

• Discussion of Canadian producer perspectives on markets, sustainability requirements, fibre supply, and safety

• Italian pellet market overview

• Italian wood pellet distribution

• An investor’s perspective of the the Korean pellet market

• A trader’s perpective of the Korean pellet market

• Logistics considerations in shipping to Asia

• Japanese pellet market

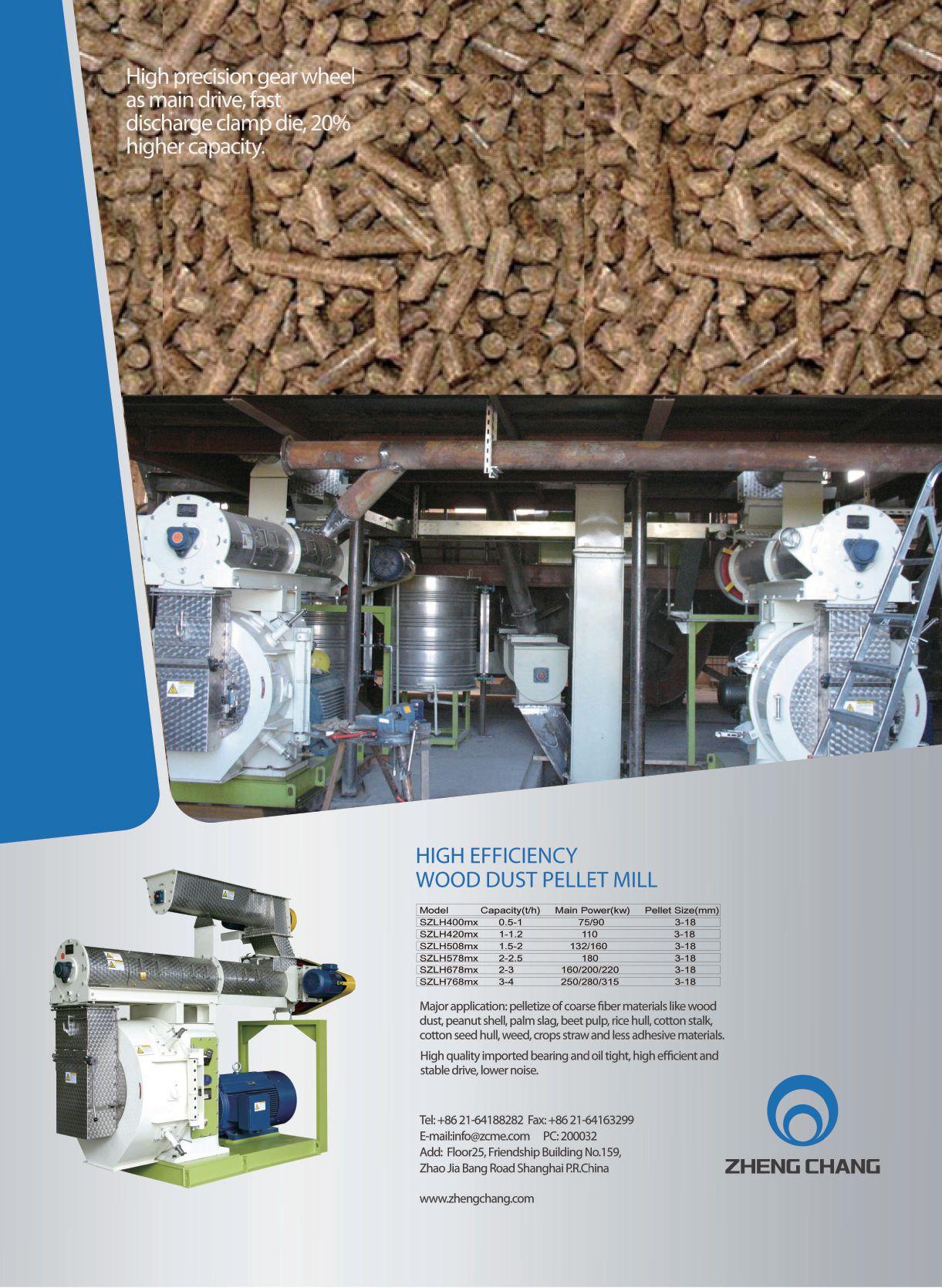

ANDRITZ Feed & Biofuel A/S Europe, Asia, and South America: andritz-fb@andritz.com USA and Canada: andritz-fb.us@andritz.com

ANDRITZ is one of the world’s leading suppliers of technologies, systems, and services relating to advanced industrial equipment for the biomass pelleting industry. We offer single machines for the production of solid and liquid biofuel and waste pellets. We have the ability to manufacture and supply each and every key processing machine in the pellet production line.

www.andritz.com

BioAmber is building a global bio-succinic industry.

By Andrew Macklin

acid is a valuable commodity.

Used in the food and beverage industry as an acidity regulator, and as a component in alkyd resins, petrochemical-based succinic acid is produced at both a high financial and a high environmental cost.

Enter BioAmber, one of a handful of global companies now manufacturing a bio-based version of the chemical. BioAmber has been working on the development of bio-succinic acid for the past 15 years. It began working on the technology in the late90s with support from the U.S. Department of Energy. Nearly six years later, the succinic acid portion of the original company was spun out of the operation, which was followed by a capital fundraising campaign to scale up the acids business.

“After we spun it out, our bio-succinic acid facility in France came online, which was a large-scale demonstration plant,” explains Mike Hartmann, Executive Vice-President of BioAmber.

The plant in France has now been running for over four years, at a similar scale to that of current commercial production plants, producing 3,000 MT per year. De-

spite being a demonstration-scale plant, the company has been able to sell commercially to companies like Dow Chemical, helping BioAmber generate revenue and sign up customers to both supply agreements and take or pay agreements.

The industry credibility that has resulted from the success of the French plant has given the company the needed confidence to push forward with a second industry venture: establishing a commercial-scale facility in North America.

During the original planning stages, company officials established a preliminary list of 100 cities to consider for the new plant.

“We looked throughout North America at different provinces, different states,” said Hartmann. “We then narrowed it down to 10-12 sites and then conducted due diligence for each of those locations. At that point, Sarnia was the only Canadian left in the running.”

Sarnia, located on the eastern shores of the St. Clair River in southwestern Ontario, has traditionally been a hub for the petrochemical industry. However, the community is now transforming some of those

resources towards the biochemical industry, with research and development and education components added to compliment the emerging industries.

The assessment of the remaining locations involved looking at a series of factors that would be important for the new plant, including cost, government support, feedstock availability, service tie-ins, resource availability and logistics. After careful consideration, BioAmber announced in August of 2011 that it had chosen Sarnia as the site of its new bio-succinic acid plant, in a joint venture with Mitsui and Co.

Hartmann noted that, while all of these important factors were met by Sarnia, there was one specific aspect that made the community stand out.

“Sarnia’s location is ideal to ship product to the United States, to Europe and to Asia. It is centrally located for that, and that is important to us because we do have customers in all three of these areas.”

Since making the decision to build in Sarnia, additional factors have become ap-

At capacity, the plant will produce 30,000MT of bio-succinic acid per year, making it the largest plant of its kind in the world.

parent that did not gain appreciable consideration during the decision-making process, but now have become keys to the success of the project.

“The personnel in Sarnia, the history of building large chemical facilities and the abundance of qualified workers were also factors that we didn’t appreciate as much as we should have,” noted Hartmann.

The commercial-scale bio-succinic production plant in Sarnia is a US $125-million project. The plant is located in a bioindustrial park purchased from Lanxess, which produces synthetic rubber for Butyl Rubber. The site is located in the chemical core of Sarnia, surrounded by massive petrochemical producers such as DuPont, Suncor, Imperial Oil, Shell Canada and Praxair. At capacity, the plant will produce 30,000MT of bio-succinic acid per year, making it the largest plant of its kind in the world.

Succinic acid would have traditionally been made in a chemical valley similar to Sarnia. But the discovery of the bio-based version of the acid has changed the production focus away from petroleum.

Both the petroleum and bio versions of succinic acid have the same chemical formula - C4H6O4. The variation between the two acids is just a few parts per million at production scale.

The cost of producing bio-based succinic acid is significantly cheaper than that of the petroleum-based product. Hartmann estimates that bio-succinic acid uses twothirds less energy to produce than petroleum succinic acid. That cost difference makes bio-succinic acid, essentially, “the best molecule for the biotech/bioindustrial route.”

The reason for the savings is that the biorefining process has a strong ability to

convert sugars into succinic acid.

“From a pound of sugar, the theoretical yield is actually more than a pound of product,” explains Hartmann. “That’s because we sequester the CO2 and part of the carbon for the bio-succinic comes from the CO2.”

But what makes the increased commercialization of bio-succinic acid more important is the environmental impact of its production. Bio-succinic acid produces zero carbon emissions. Petroleum-based production emits seven pounds of CO2 gas for every pound of succinic acid produced.

This is a potential game-changer for the biochemical industry, producing a chemical superior to its petroleum equivalent while producing no greenhouse gas emissions. Hartmann expects that this will result in the end of global production of succinic acid from petroleum in a few years very similar to what has happened for citric acid

Construction of the Sarnia facility continues to move forward on schedule. AMEC was hired on as the primary engineer for the plant, and they have been successful with the design, engineering and procurement of the needed materials for the site. As a result, BioAmber is still targeting early 2015 for completion of construction.

BioAmber has implemented a scale of attainable production targets for the bio-succinic plant. The plan includes 50 per cent production by the end of 2015, 85 per cent production by the end of 2016 and 100 per cent production by the end of 2017.

“It has been a multi-year process to get to where we are today,” says Hartmann. “We are very excited to continue construction and get the facility ready. As of right now, we are very optimistic and really looking forward to having the plant start up.” •

2014 has been a year full of important benchmarks for BioAmber and its Sarnia bio-succinic facility. Here is a look at the significant announcements the company has made so far this year.

Awarded a $10-million, interest-free loan from Agriculture Canada for the construction of the Sarnia plant.

MAY 1ST

Announced its first take-orpay contract for the plant, signing a three-year contract for 14,000MT per year with PTTMCC Biochem Company Limited.

Secured a $20-million loan from a financial consortium led by Export Development Canada.

JULY 2ND

Received a $7-million loan from Sustainable Development and Technology Canada.

JULY 8TH

Signs a 15-year take-or-pay contract with Vinmar International for 10,000MT per year from Sarnia and 80 per cent offtake from two additional plants yet to be built

JULY 15TH

Announced a successful secondary public offering of 2.8 million shares of common stock.

By Treena Hein

intheir recent report, “Renewable Energy Scenario to 2040,” the European Renewable Energy Council (EREC) is clear. The Council believes that in the long term, “renewable energies will dominate the world’s energy supply system. The reason is at the same time very simple and imperative: there is no alternative. Humankind cannot indefinitely continue to base its activities on the consumption of finite energy resources.”

EREC projects biomass to remain the most-used renewable energy source on the planet going forward. But, if the longterm future for biomass use is bright, that doesn’t mean the road will be smooth.

Canadian Biomass takes a close look at the factors that will help spur the industry forward, and those that will provide the greatest challenges.

The range of products that can come from biomass is a huge factor in the growth of its use, now and in the future. Biomass can provide heating, electricity, fuel, biochemicals and more. “Biomass is a prolific and globally-distributed renewable carbon-based resource,” notes Doug Bull, a researcher in the Biorefinery & Energy Group at industry research firm FPInnovations. “Other renewable energy

resources (wind, solar, hydro and so on) are not, and hence cannot, be used to directly make carbon-based products such as fuels and to get organic chemicals from.”

Many commercial biofuel plants are expected to be built worldwide over the next few years, some of which can accept feedstocks such as construction debris and textiles. The flexibility of these facilities is very attractive. The conversion of coal power plants to accept biomass is also well underway in several countries, and some are using waste heat in combined heat and power plants (CHP) as well.

Another important feature of biomass is that it can produce energy on demand, notes Gordon Murray, executive director of the Wood Pellet Association of Canada. “In electricity, this is known as dispatchable energy. Some other energy forms are dependent on the sun shining or the wind blowing, etc.”

Canadian natural gas prices are not likely to rise in the next few years, which is as far as anyone can reasonably predict. This reality is going to pose a challenge over that time period in the quest to get more biomass energy projects off the ground.

Keith Schaefer, editor and publisher of Vancouver-based Oil & Gas Investments Bulletin, says continued supply increases of natural gas are the major factor that will keep Canadian gas prices low. He points to brokerage firm Raymond James’ outline of how the fast-growing and low-cost gas production from the stacked Marcellus and Utica shales in the northeastern U.S. could displace the use of all Western Canadian natural gas in Eastern North America in the short- to medium-term.

“There are currently four major projects underway that are going to make the inevitable export of United States natural gas to Canada happen,” Schaefer notes. “Those projects combined should allow for enough U.S. natural gas to get into Eastern Canada so that no Western Canadian natural gas will be needed. This will mean that the Northeast United States will have gone in just a few years from being almost fully dependent on Canada for natural gas, to having the ability to export natural gas to Canada – and fill all of eastern Canada’s needs. Meanwhile, a portion of Western Canadian natural gas production will need a new home, with Canadian natural gas prices therefore facing some stiff headwinds.”

The recent political situation involving Ukraine and Russia is stirring up calls for Europe to start looking hard for energy alternatives to Russian fossil fuels. U.S. President Obama told the European Union in April 2014, that while it can look to the United States to help it reduce dependency on Russian energy (the U.S. has already agreed to relax restrictions on gas exports to Europe, for example), it must also look beyond. The EU currently relies on Russia for about a third of its oil and gas needs. The 28-member association is indeed stepping up efforts to diversify its energy sources, and some of those include biomass. Several European countries, including Germany and England, already have bio-energy plans in place, which is great news.

“Pellets to Europe are presently 9 million tonnes for power plus 10 million tonnes for commercial, residential, and institutional heating annually,” says Murray. “Both sectors continue to grow rapidly. Most experts predict that Europe’s market will be 50 million tonnes by 2020, with South Korea and Japan each at about 5 million tonnes.” He notes that the Northeastern U.S. biomass heating market is also growing rapidly as a result of high oil prices, the introduction of European heating appliances and the cost savings of using bulk pellet deliveries over bags.

We can all count on the fact that fossil fuel prices will continue to rise. This is tough on biomass companies, which need to gather forestry residues and other feedstocks, transport and process them – and in some cases, ship finished products such as pellets as well. At the same time, however, high electricity and fossil fuel prices are prompting more Canadians and beyond to look at biomass.

Murray notes that only 45 per cent of Canadian homes are served by natural gas, which represents a huge opportunity for pellets to be used for heat and hot water production – but that getting there will require significant marketing effort. “In most provinces, pellets are cheaper than oil, electricity, propane. We need to educate Canadians about the modern automated pellet appliances that are commonplace in Europe.”

Dust Collector/Filtration Units-Fans-Ducting Systems-Shredders-Hogs

Experts in Dust Collection & Material Handling systems since 1957

MacDonald Steel Environmental Systems Designs, manufacturers, installs and services

• Dust Collectors/Filters

• Cyclones

• Hogs and Shredders

• Abort Gates

• Material and Air Handling Fans

• Spark Detection and Extinguishing Systems

Cambridge, Ontario Canada | PHONE 519-620-0500 www.macdonald-esi.com | sales@macdonaldsteel.com DIVISION OF TIGERCAT INTERNATIONAL

The European Union has an Emissions Trading System where large emitters must buy emissions allowances, and various countries in that region also have carbon taxes. However, Canada has no national meaningful carbon reduction policy, which hinders the growth of biomass use for energy. In Murray’s view, the Canadian government’s focus on continued development of the oil sands means there will not be any federal carbon-controlling mechanisms introduced anytime soon.

On a provincial level, Dan Fraleigh notes that B.C. has a carbon tax and Alberta has a voluntary cap-and-trade system for large carbon emitters, as does Quebec (which trades with California companies). He expects something in Ontario in the next five to 10 years, but nothing is certain, and like Murray, Fraleigh expects nothing nationally in the foreseeable future. “The voluntary carbon offset market is what’s most active in North America – buying credits for marketing purposes,” says the Chief Operating Officer of Carbonzero, a firm which aids organizations in assessing, reporting, and reducing their emissions.

In its new vision and action plan released in April, “Evolution and Growth: From Biofuels To Bioeconomy,” the Canadian Renewable Fuels Association states that “Globally, more than 40 countries have or are in the process of putting a price on carbon. In so doing, they are effectively monetizing carbon benefits that accrue through the use of sustainable products, like biofuels.” However, while Fraleigh acknowledges that biomass projects are now eligible for credits, he expects that to end within the next decade or so. Offsets are a mechanism to encourage change, he notes, so when an offset-eligible activity such as biomass use becomes prevalent, offsets become unavailable for it (but then become available for other carbon-reducing activities that need support due to growth).

The biomass industry has long called for stable government policy that supports the nation to use more biomass for energy. Kevin Kerschen, a senior project manager for Black & Veatch’s global energy business, echoes the sentiment. Black & Veatch has had a significant role in planning, evaluating and providing engineering services for many of the recent biopower projects under development in the U.S., including standalone biopower, co-firing biomass in coal plants and repowering coal plants with biomass fuel.

In a recent Black & Veatch article, “Four Key Developments Needed to Boost Global Biomass Industry,” Kerschen notes that of all renewable energy sources, biomass is challenged by the widest and most complex set of factors that impact project development. These include everything from forestry sector regulations to carbon emissions, and Kerschen says these issues have been among the reasons the biomass sector has seen slower growth compared to other renewable energy sources.

“For more utilities to be willing to pay a premium for renewable energy, there needs to be more consistent and well-defined government policies, and better clarity on environmental regulations as they pertain to biomass that urge utilities to embrace renewable energy within the context of an overall national energy plan,” Kerschen says. “If governments put into place certain regulations that foster a stable environment, where developers and

buyers meet mutually beneficial objectives, then I can see there being a strong increase in the development of biomass facilities.”

Many countries are putting more of an emphasis on renewable energy production and reducing greenhouse gas emissions than Canada, which is good news for biomass exporters. Murray points out that the United Kingdom is moving away from coal mostly in order to reduce its carbon emissions.

Drax, the U.K.’s largest electricity-generating company, began converting the majority of its facilities from coal to biomass generation in 2003. All of their facilities are now co-gen or predominantly biomass, with the first biomass-only unit was operational in 2013. The company plans to complete the second unit this year and a third by 2016 – a fourth is under consideration.

Murray reports that Drax calculates that having three units firing pellets instead of coal will reduce carbon emissions by about 80 per cent, reducing CO2 production by 10 million tonnes a year compared to levels today. When all three units are done, Drax will use seven to eight million tonnes of pellets annually, and will likely be the world’s largest biomass generating company.

“The current biggest challenge for commercializing biomass to energy systems, is the true cost of biomass-derived energy (par-

ticularly for liquid transport fuels), versus their fossil fuel equivalents,” says FPInnovations’ Doug Bull. “Economies of scale limitations exist with biomass-based energy systems to a greater extent than occurs with most fossil fuel energy facilities. Furthermore, depending on the conversion process and final form of the energy being generated, some major technical challenges exist with biomass energy conversion routes.”

A prime example is deoxygenating biomass-based energy carriers such as pyrolysis oil and biocrude for conversion into hydrocarbon transportation fuels. However, Bull says that upgrading techniques and solutions to technical challenges are being actively developed around the world. “Hence, the economic viability of such processes are difficult to predict while technical development is still occurring.”

Green energy, as FPInnovations’ Forest Feedstocks Research Leader, Dr. Dominik Roser, notes, is already a reality in Canada. “Whenever we are in areas or communities that are not connected to the natural gas grid, forest biomass can be a good alternative to heating oil or propane,” he says.

“Communities across Canada are making the switch to a renewable, sustainable and local source of energy that creates energy independence and ensures that money stays in the communities. Using forest biomass for heating in communities is something that can be done now, and helps to bridge the gap until higher value uses for forest biomass can be found.” •

LAdvancing biochemical opportunities in the Sault.

by Christina Coutu

ike many Northern Ontario communities, when Sault Ste. Marie’s 100-yearold paper mill went into receivership due to the changes in market demand for paper-based products, the city’s leadership was uncertain about the future landscape of biomass and the role it would play. The community had a long-standing history of forestry expertise, yet lacked clear direction on the use of the abundant wood resources accessible throughout the region. More recently, the Sault has seen significant growth in numerous smart energy projects includ-

“The community had a longstanding history of forestry expertise, yet lacked clear direction on the use of the abundant wood resources.”

ing wind and solar farms, and the development of a cogeneration and waste-to-energy plant. These projects are in all stages of development – conception, research and development, pilot projects, commercialization and full-scale operations. The Sault Ste. Marie Innovation Centre (SSMIC) along with various community partners, commissioned the Smart Energy Strategy, a report which identified attracting a biotechnology project using bio fibre as one of the pillars to the plan, and addresses the issue of how to best utilize the ample and sustainable wood supply from Northern Ontario forests and the renewable supply of biofibre feedstock in the area.

Continuing with this momentum, SSMIC released a Request for Proposal earli-

er this year with the purpose of attracting a wood-based biotechnology project to the Sault, and aggressively reached out to technology developers. The intent of the RFP was to study the supply base and implement a project which would lead to the construction of a commercial or demonstration plant in the city, in turn stimulating local economic growth and creating jobs. SSMIC received strong proposals from companies worldwide. The proposals were reviewed by a committee composed of forestry, biotechnology, business and economic development experts. Among the proposals, pyrolysis-based technology from Battelle was determined to be the closest to shovel-ready and best initiative to meet the community’s desire to implement a bioenergy project.

Battelle is now engaged in a detailed study for the implementation of a fast biopolyol unit in the Sault with the aim to produce biopolyol, which will be sold to produce foams, insulation, coatings, and other high-margin commercial products. Battelle, the world’s largest nonprofit research and development organization, managing more than 22,000 professional, technical and management experts worldwide, has created a plan for a profitable micro-refinery business with multiple markets, and a scale-up approach to biofuels, which reduces investor risk by generating early revenues from biopolyol production. There is significant market potential for polyol globally with demand for over 15 billion pounds to be used in applications such as building and construction, furniture, appliances, packag-

ing and textiles.