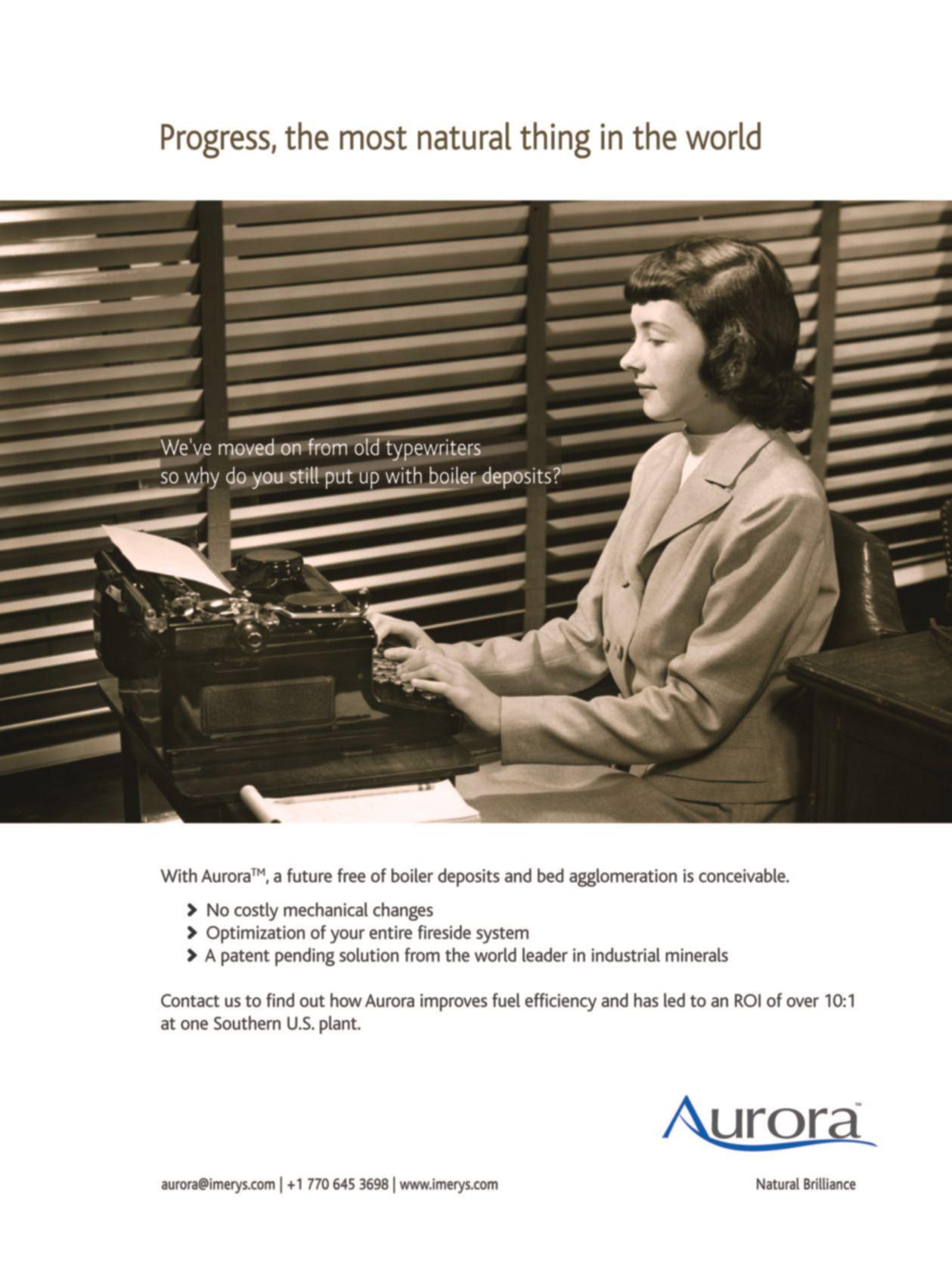

A biomass power plant north of Edmonton is one of Alberta’s sources of renewable electricity.

The CHPP concept hasn’t caught on in Canada yet, but there are a few facilities in Sweden and Finland.

The Fibreco port terminal expands to meet a surging demand for wood pellet exports.

A number of communities are trying out biomass district heating: Prince George and Quesnel, British Columbia, and Strathcona, Alberta.

Pellets are set to explode, but only literally, as the PFI annual conference addressed fire safety as well as expanding markets.

North American pellet producers will have to keep up with market developments to retain access to industrial pellet end-users.

Here’s a look at some of the biomass-related projects that will go ahead with fibre awarded in Ontario’s wood supply competition.

As pellet markets expand and pellet producers crop up, what steps are needed to remain competitive?

anadian pellet manufacturers have been the main source of pellets to Europe almost since the beginning of co-firing, but that might change. Our producers could soon be pushed out by bigger, newer plants in the southeastern United States, which are closer to the market and can grow trees quickly on intensively managed plantations. If John Keppler has his way, that’s exactly what would happen.

Keppler is CEO of Enviva, a southeastern U.S. pellet producer. Speaking at the recent North American Biomass Pellet Export Conference in New Orleans, Louisiana (covered on page 30), he indicated that the U.S. south is poised to become the supplier of pellets to Europe and Scandinavia. He suggested that western producers should return to supplying pulp and/or pulp chips to Asian markets and should send their pellets to new markets developing there. “We’ve seen a bunch of that trade going through the [Panama] Canal. That shouldn’t happen,” he stated. The Maritimes he viewed as potential competitors with the U.S. south to supply Europe.

Enviva is planning to supply Europe 1 million tonnes/year, and Florida-based Green Circle Bio Energy 500,000 tonnes/ year, their respective CEOs stated at the conference. Plus, there’s additional export pellet production capacity in the U.S. southwest, and more planned. Then there’s Suzano in Brazil, which is planning to produce 3 million tonnes/year of pellets starting in 2014.

Predicted increases in European demand

for pellets of up to triple the current consumption certainly provides room for production growth. Canada is still the top supplier of pellets to Europe, with about double the U.S. exports, but the United States is catching up. Canadian producers need to keep a close eye on these developments and take steps to remain competitive. Two major factors are transport and fibre costs. Northeastern producers should be in an excellent position to supply Europe, with a shorter shipping distance than from more southerly regions, but they are hobbled by poor port infrastructure. Serious investment is needed in eastern deepwater port storage and handling terminals designed specifically for efficient pellet transfer. The expected commoditization of pellets, with an exchange to begin in late 2011, plus the move to introduce standardized pellet properties and specifications (through ISO/CEN certification) will present the opportunity for aggregating pellets, similar to grain handling. This would allow multiple small producers to combine standardized product, maximizing economies of scale for shipping. Such producers might consider joint investments in port infrastructure.

To minimize production costs, pellet producers must continue to source the lowest cost fibre from sawmill and logging residues. Supporting market development for those sectors will ensure a continuous and stable supply of low-cost residue. •

Heather Hager, Editor hhager@annexweb.com

Volume 4 No.5

Editor - Heather Hager (519) 429-3966 ext 261 hhager@annexweb.com

Group Publisher/Editorial Director- Scott Jamieson (519) 429-3966 ext 244 sjamieson@annexweb.com

Contributors - Gordon Murray, Colleen Cross, Catherine Cobden

Market Production Manager

Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@forestcommunications.com

National Sales Manager

Ross Anderson Ph: (519) 429-5188 Fax: (519) 429-3094 randerson@annexweb.com

Quebec Sales

Josée Crevier Ph: (514) 425-0025 Fax: (514) 425-0068 jcrevier@forestcommunications.com

Western Sales Manager

Tim Shaddick - tootall1@shaw.ca Ph: (604) 264-1158 Fax: (604) 264-1367

Production Artist - Emily Sun

Canadian Biomass is published six times a year: February, April, June, August, October, and December.

Published and printed by Annex Publishing & Printing Inc.

Printed in Canada ISSN 0318-4277

Circulation

Carol Nixon e-mail: cnixon@annexweb.com P.O. Box 51058 Pincourt, QC J7V 9T3

Subscription Rates:

Copy - $9.00 (Canadian prices do not include applicable taxes) USA – 1 Yr $60 US; Foreign – 1 Yr $77 US

Occasionally, Canadian Biomass magazine will mail information on behalf of industryrelated groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above..

No part of the editorial content of this publication may be reprinted without the publisher’s written permission ©2011 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication. www.canadianbiomassmagazine.com

An elementary school scheduled to be built on Fredericton’s north side will be the first in New Brunswick to be heated by wood pellets. The wood pellet-fired hot water heating boiler was included in the new school’s tender package that was issued in the spring. The hot water boiler plant will use wood pellets as the base fuel, supplemented by a natural gas boiler for extreme weather. The 500-kW biomass boiler will use about 300 tonnes of pellets annually. Most construction is expected to be completed by October 2012.

“We are committed to implementing provincial policies that encourage the use of wood pellets and other biofuels to heat provincial buildings,” says

Transportation and Infrastructure Minister Claude Williams.

“The Department of Supply and Services is reviewing provincially owned buildings to identify viable opportunities for conversion to biomass energy.

We are also encouraging the installation of biomass boilers to cover base heating requirements on new construction projects, particularly in areas of the province where natural gas is not available.”

Sustainable Development Technology Canada (SDTC) has issued its annual call for applications under the federal NextGen Biofuels Fund. The fund was created to support the establishment of first-ofkind large demonstration-scale facilities (biorefineries) for the production of next-generation renewable fuels and co-products. The NextGen Biofuels Fund supports up to 40% of eligible project costs, with the contribution repayable based on free cash flow over a period of 10 years after project completion. See the SDTC website (www.sdtc.ca).

British Columbia’s Innovative Clean Energy (ICE) Fund recently awarded a total of $8 million to twelve new projects that support the development of new clean energy technologies. The ICE Fund helps project developers demonstrate the viability of their precommercial clean technologies. Three of the twelve proponents were awarded $1 million

each towards woody biomass projects. Nations Energy is planning a commercial-scale torrefaction plant. Pytrade Canada will build a fast-pyrolysis plant to produce pyrolysis oil, which could be used to generate electricity for the grid. The Tsay Keh Dene First Nation will produce heat and electricity from wood waste to reduce its reliance on diesel energy.

A hammer blow to your operating costs. The hammer mill Granulex™ is the new dynamic grinding machine from Buhler. Designed for ultimate power, Granulex™ delivers high capacity grinding up to 15 t/h for wood and 75 t/h for biomass. Heavy design and supreme ease of maintenance minimize downtime, so you can make maximum use of this productivity. It’s an investment in quality that is sure to show a rapid return – and deliver a hammer blow to your operating costs.

Buhler Inc., 13105 12th Ave N., Plymouth, MN 55441, 763-847-9900, buhler.minneapolis@buhlergroup.com, www.buhlergroup.com

Innovations for a better world.

and

In the article Grow your own feedstock, July/August 2011, the willow plantation is estimated to produce on average 200 dry tons of wood chips annually beginning three years after planting, and not 1500 tons of chips over a three-year period, as was indicated.

The Quebec Ministry of Natural Resources and Wildlife has issued a request for proposals to allocate available forest biomass in the AbitibiTémiscamingue region. Documents are available at www.mrnf.gouv.qc.ca/ forests/business/companies-transformation-biomasse.jsp.

The Canadian Food Inspection Agency (CFIA) has confirmed the presence of the brown spruce longhorn beetle (BSLB) near a campground within the Kouchibouguac National Park in New Brunswick. This is the first find of BSLB outside Nova Scotia. CFIA suspects that the pest was transported on firewood. This new find is nearly 165 km away from the closest BSLB site, located in Westchester Station, Nova Scotia. Since its discovery in Nova Scotia in 1999, the beetle has killed thousands of spruce trees there, and it has the potential to spread through the spruce forests of North America. The most important way to limit its spread is to avoid transporting spruce materials such as spruce firewood.

Vancouver, British Columbia-based Nations Energy Corporation has entered into a 15year lease agreement with Biosource Power Ltd. concomitant to its purchase of land, buildings, and a pellet manufacturing facility currently located in Kamloops, British Columbia. Under the agreement, its subsidiary, Cedarhurst Forestry Products, will lease a portion of the property as the permanent site for its planned biomass power project pursuant to Nations Energy’s selection by

BC Hydro under its community-based biomass power program for Kamloops. Both Biosource and Cedarhurst plan to cooperate with respect to the use of the facilities, including potential arrangements on fibre supply for pellet production, and distribution via shared use of rail transport facilities.

The company was also recently awarded $1 million from British Columbia’s Innovative Clean Energy fund to develop a commercial-scale torrefied pellet plant.

Several southeastern U.S. wood pellet manufacturers who export to European utilities are undertaking expansion plans. Fram Renewable Fuels has entered into an agreement to build a new 125,000-tonnes/ year pellet plant in south-central Georgia. Green Circle Bio Energy is looking at possible expansion locations in the U.S. southeast to add to its production capacity. It currently makes 560,000 tons/year

of pellets from its plant in Florida.

Enviva plans to build a second wood pellet manufacturing facility in northeastern North Carolina, which could be operational as early as October 2012. The plant, designed to produce 400,000 tonnes/year of pellets, would be Enviva’s fourth pellet plant in the southeastern United States, and would ship out of Enviva’s Chesapeake, Virginia, deep water port facilities.

Canada is moving forward with regulations for the coal-fired electricity sector. The proposed regulations will apply a stringent performance standard to new coal-fired electricity generation units and those coalfired units that have reached the end of their economic life.

“We are taking action in the electricity sector because we recognize the potential for significant emissions reductions,” stated Environment Minister Peter Kent in a recent Environment Canada release.

Since the Canadian government first announced its intention to reduce greenhouse gas emissions in the electricity sector in June 2010, consultations have been ongoing with key stakeholders. The regulations were published in the Canada Gazette Part I on August 27, 2011, for a 60-day public consultation period. Final regulations should be published in 2012 and should come into effect on July 1, 2015. For more information, visit www.ec.gc.ca.

By Heather Hager

TheDapp Power plant is visible across the prairie from a long distance. Located halfway between Edmonton and Slave Lake, Alberta, the plant turns woody biomass into electricity for the consuming public. It’s winter when I visit, and it’s a far cry from the plant’s original home in balmy California.

This power plant has an interesting history, having had various owners and several upgrades. It was first built in California, where it produced power from forestry waste for about eight years. It was purchased and moved to its current location, a region with extensive peat resources, in 1997, with a plan of producing power from peat. The moisture content of the peat created difficulties in the boiler, so a gasfired rotary dryer was later installed to dry the fuel prior to burning. However, the energy inefficiency of having to dry the fuel made the plant uneconomical to run, and it was shut down in early 2000.

After changing hands a couple of times but remaining idle for several years, Calgary-based Verdant Energy purchased half ownership of the plant. It converted the boiler to a bubbling fluidized bed style, and the plant was restarted with woody biomass as the fuel of choice. Verdant gained full ownership in 2007. Finally, in 2008, the current owner, New York-based Fortistar, purchased the 17-MW biomass plant, bringing its renewable portfolio to a total of 310 MW of power from six biomass plants and 50 landfill gas plants in the U.S. and Canada.

“We probably go through approximately 180,000 green tonnes/year of woody biomass,” says plant manager Fred Stock. That quantity of biomass comes from several sources. “We get forestry waste from a sawmill and from a pulp mill, both owned by West Fraser, in Slave Lake. We also bring in landfill-diverted wood from our Biofuels Division at Northlands Landfill in Edmonton. And we also have several other sources of landfill-diverted wood from the Edmonton area,” he says.

One of these other sources is a wood exchange with a composting operation at another Edmonton landfill. For every tonne of clean wood biomass that’s sent to the composter, Dapp receives 1.5 tonnes

LEFT MAIN: Twenty-three full-time employees operate and maintain the Dapp Power plant 24/7, not counting the biomass transport crew and other trucking contractors. INSETS (FROM LEFT): A shaker screen separates clinkers and rocks from sand released from the bubbling fluidized bed boiler. The sand is reinjected into the boiler while the impurities are discharged outside. Plant manager Fred Stock, a power engineer, has worked at biomass power and cogeneration plants for more than 30 years, mostly in British Columbia.

of wood that’s unsuitable for composting but fine for burning. The plant also receives biomass from the Enoch First Nations from “an old pile of wood that they’ve had on their site for a number of years,” says Stock. And additional biomass is coming from the deconstruction of old buildings, camps, and pallets from a large energy corporation in the Fort McMurray, Alberta, area.

The goal is to have biomass coming in from many sources, says Stock, but the main challenge is transportation. “Trucking and fuel are probably the two highest costs,” he notes. The biomass is trucked in, in 53-foot walking floor trailers, as it is generated, so deliveries vary in frequency depending on the season and type of material.

When trucks arrive, they are weighed, and the biomass is dumped onto a shaker table with disc screens that remove oversize material. “Any oversize material over three inches is hogged,” says Stock. “Material that’s under three inches normally falls though our disc screen and it’s just accepted without being hogged.” Magnets remove much of the nails and other metal from the landfill-diverted wood, although the Doppstadt shredder used by the Biofuels Division removes a lot of the metal from that material source, says Stock. “Once it’s been ground and we remove probably about 90% of the metal, we store it on site.”

Following Dapp’s fuel storage management plan, Stock keeps about a twomonths supply of fuel at the power plant, stored in piles outdoors. The oldest fuel is always burned first. “There’s enough moisture that, if you turn it over within two months, normally you don’t have a fire issue [from self-heating],” he explains.

Two reclaimers start the process that feeds biomass to the furnace. “They’re good for approximately six hours of run time on each, so we alternate them: while we’re running on one, we’re filling the other one,” explains Stock. A Deere loader fills each reclaimer, which feeds the fuel through another disc screen, more magnets, and into a fuel metering bin at the boiler house. The disc screen at this point removes frozen lumps of fuel and anything oversize that slipped through the first screens; those are re-hogged. From the metering bin, three feed systems send biomass to the Babcox & Wilcox furnace. The plant operator controls the reclaimer

and infeed speeds from a central control room, regulating the fuel flow.

Originally a circulating fluidized bed boiler, the furnace was converted to a bubbling bed to reduce erosion from sand circulation and improve biomass combustion, says Stock. “They both have a sand bed in the furnace, which is basically your mass of heat. In the circulating style, the sand is actually blown up to the top of the boiler, collected in hoppers, and reinjected into the furnace,” he explains. In the bubbling bed, the sand stays in the furnace, and air is bubbled upwards through it. “It’s a lot more efficient and there’s a lot less maintenance cost to it,” adds Stock. The sand bed operates at 1750°F (954°C), essentially gasifying the biomass.

Rocks, impurities, and slag, which are heavier than sand, fall below the air nozzles at the bottom of the bubbling bed. Periodically, one of three outlets at the bottom of the furnace opens, dropping these items and some of the sand onto a vibrating screen. The sand falls through and is returned to the boiler, whereas the impurities pass to a chute that takes them to a disposal pile outside the boiler room. Wood ash is mixed with a small amount

of water to prevent it from becoming airborne and then drops onto an ash pile.

The furnace heats a boiler, generating steam, which turns a Turbodyne turbine, creating the power, explains Stock. The system is virtually closed, with the steam condensed and returned to the boiler as water. The power is sold to TransAlta, a power generator and wholesale electricity marketer headquartered in Calgary, and then to Alberta customers.

“All the ash that we generate basically goes to local farmers,” says Stock. They usually apply it in the fall or early spring to increase soil pH. Dapp may or may not charge a loading fee, and providing it to local growers keeps it out of the landfill, notes Stock.

Emissions are controlled by a Clyde Bergemann electrostatic precipitator that Stock says was totally rebuilt in fall 2009. “We have an online emissions monitoring control system, which is reportable to Alberta Environment monthly. It’s a regulation in Alberta that you have an online monitoring control system, and everything is recorded as either one-hour averages or six-minute averages, depending on

With the patented ERCS process (Energy Recovery & Cleaning Systems) for treating flue gases from biomassfired combustion plants, results like these are possible:

• 50% of the boiler thermal output can be recovered

• 30% fuel savings can be realized

• 20% reduction in investment costs for the heating plant can be achieved.

The costs for the integration of new ERCS systems or for retrofitting ERCS systems to existing plants are amortized within two years.

Scheuch Inc. 2351 Huron Street, Unit 1 London, Ontario, N5V 0A8, Canada Phone: 519 951-7700 I Fax: 519 951-7711

office@scheuch.ca www.scheuch.ca

which particular parameter they require,” he explains. If emissions exceed the limits for any reason, the plant must take corrective action and report to Alberta Environment within 24 hours, notes Stock.

A side benefit to burning landfill-diverted wood is that the Alberta provincial government has a carbon credit system in place that rewards this re-use. It involves keeping track of how much wood is diverted from landfill, as well as third-party verification and auditing of the records. Stock says the goal is to burn mainly landfill-diverted wood, both for the carbon credits and because it is dryer than the hog fuel that comes from forestry residue. “This past year [2010], we burned approximately 40% landfill-diverted wood,” he notes. •

To read about the Biofuels Division that supplies construction and demolition biomass to Dapp Power, see Landfill Diversion in the March/April 2011 issue of Canadian Biomass (http://www. canadianbiomassmagazine.ca/index. php?option=com_content&task=view &id=2395&Itemid=132).

The CHPP concept hasn’t caught on in Canada yet, but there are a few facilities in Sweden and Finland. Economies of scale can be a challenge.

By Treena

Hein

heat, power, and pellet production all in one facility is a highly efficient use of biomass. Europe boasts several combined heat, power, and pellets (CHPP) facilities, and they could make sense in Canada, but only if a few factors such as higher electricity rates are in play.

“Combining a CHP system with a pellet mill can be an excellent fit,” says Christiane Egger, manager at the OekoenergieCluster, a network of green energy businesses in Upper Austria. “It can use the waste heat from the CHP to dry the material and for other processing heat demands, and for the electricity demand of the production process,” she observes. “Also, depending on the biomass resource available, the CHP plant can be supplied

with less-valuable fractions of the biomass material.” The economics are workable, Egger says, with a suitable feed-in tariff rate in place, but the size of the pellet mill and CHP unit also matter, as does “the possibility of selling additional heat to another heat user nearby.”

The Canadian District Energy Association (CDEA) has been invited to visit district heating systems in Finland and Denmark and is assessing interest among its members in touring these countries in spring 2012. One of the stops may be the Vapo Oy Ilomantsi CHPP plant in Finland, which runs on a combination of peat and wood residues. It has a 20-MW fluidized bed boiler, producing 3.5 MW of electricity, 8 MW of heat to municipal district heating in Ilomantsi, and 8 MW of process heat for its 70,000 tonne/year pellet plant. CDEA president Mary Ellen Richardson notes that

the association understands the benefits of visiting plants abroad, given that two of the most recently built Canadian district energy systems had their “inspirational roots” in international study tours.

GreenExergy in Sweden seems to have originated the CHPP concept, having designed and commissioned plants in Hedensbyn in 1996 and Storuman in 2008. These facilities use peat as well as wood residues from forestry operations and sawmills. GreenExergy says that adding pellet production to CHP results in greater efficiencies of energy use, even with wet biomass. Estimated efficiencies for using biomass are 35% for electricity production alone, 88% for CHP, and up to 98% for CHPP.

Gordon Murray, executive director of the Wood Pellet Association of Canada, agrees that CHPP systems do result in high fuel efficiency, “sometimes as high as 95%.”

However, he says, “the downside is that at a small scale it has not yet proven economic.”

The CHP plant at the CHPP in Hedensbyn was built for wet biofuels and has two fluidized bed boilers. Its pellet plant has an additional steam turbine that recycles and uses the energy that goes through the drying process, providing an additional 25–30 GWh/year of power. In fact, both of GreenExergy’s CHPP plants boast a pressurized steam circuit with feedstock drying and a steam turbine. The company says the process is based on innovative technology for drying raw materials, technology which considerably improves the energy efficiency of the production compared to alternatives.

“At the heart of the process is the socalled SSD dryer (superheated steam dryer),” says Rolf Lindgren, GreenExergy vice-president. “This dryer operates in an enclosed environment at 170°C and 4 bar pressure. The wet fuel, let’s say wood with 50% moisture, is injected into the closed

loop of the dryer. It will dry in about 20 to 30 seconds and is then taken out of the loop through cyclones. The water that came in with the wet wood creates, at the same time, a ‘dirty steam’ at the operating pressure.” This steam is taken out of the dryer and to a heat exchanger to produce clean steam by condensing out the impurities. The clean steam is then used in a turbine to produce electricity.

“All in all, we only need 140 kWh/ton of evaporated water for drying compared to conventional drying systems (rotary and belt dryers) that take 10 times more energy,” notes Lindgren. “In a so-called bioenergy combine, we have three outgoing products: electricity, district heating, and wood pellets.” He says the proportions of end product among these three can change depending on the profitability of each, with the entire system being most profitable when fuel prices are high.

Murray agrees. “Fossil fuel prices are much higher in Europe than here, and there is also much stronger policy support there to cut greenhouse gases and use renewable fuels,” he says. “This means

that CHP systems, let alone CHPP systems, have to compete with fossil fuels here in Canada on price alone.” Murray observes that CHP has really only so far been financially feasible at pulp and paper mills, which are intensive power users. “Sawmills have added biomass heat for kiln drying, but adding power generation takes more investment,” he says. “Current rates the utilities are willing to pay will not allow sawmills to generate sufficient return on capital to justify the investment. Alternatively, CHP would be good to add at a pellet plant if there could be sufficient return for capital.” Murray notes that presently, pellet producers use biomass boilers to create heat for the drying process, but not electricity.

“At [current rates], there is insufficient profitability to incent pellet producers to add electrical generating capacity,” Murray says. “Until there is more pressure and a stronger political will to support renewable energy systems in Canada, we will not see CHPP move forward here. But they are a great example of what could be achieved with full use of Canadian biomass.” •

rThe new forest products industry is an emerging player in the bioeconomy, extracting more from each tree.

By Catherine Cobden

ecent media reports have suggested that one of Canada’s oldest economic sectors, the forest products industry, is becoming a bit tarnished. As one prominent newspaper put it, the industry is in great need of some razzmatazz. After all, the market for paper products has been shrinking and the malaise in the American housing market continues to depress demand for lumber. Might the mighty forest products sector of the past be on its way to fading into the sunset?

Well, fear not. Traditional lumber and pulp and paper mills are now looking at producing innovative new products, all

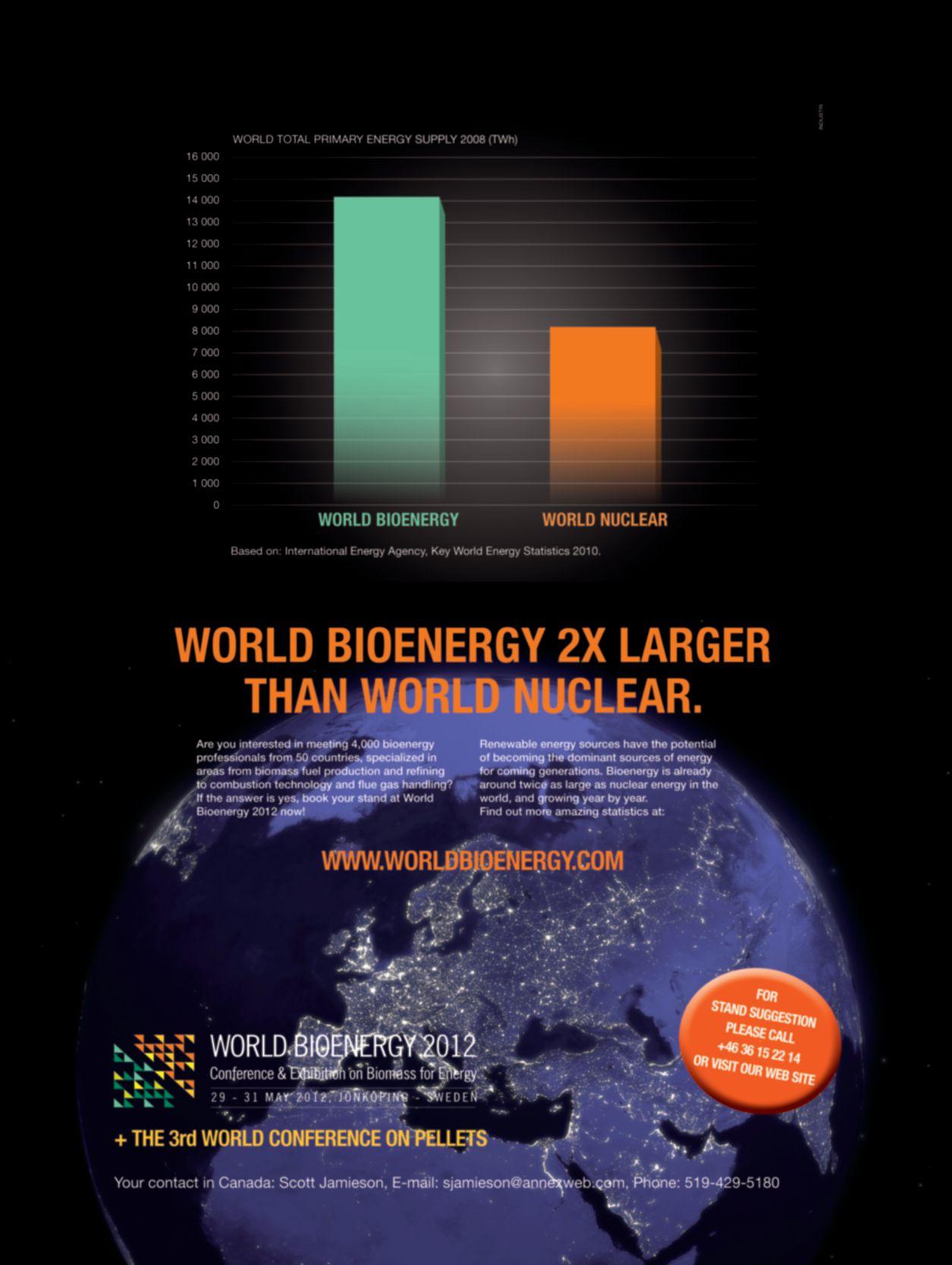

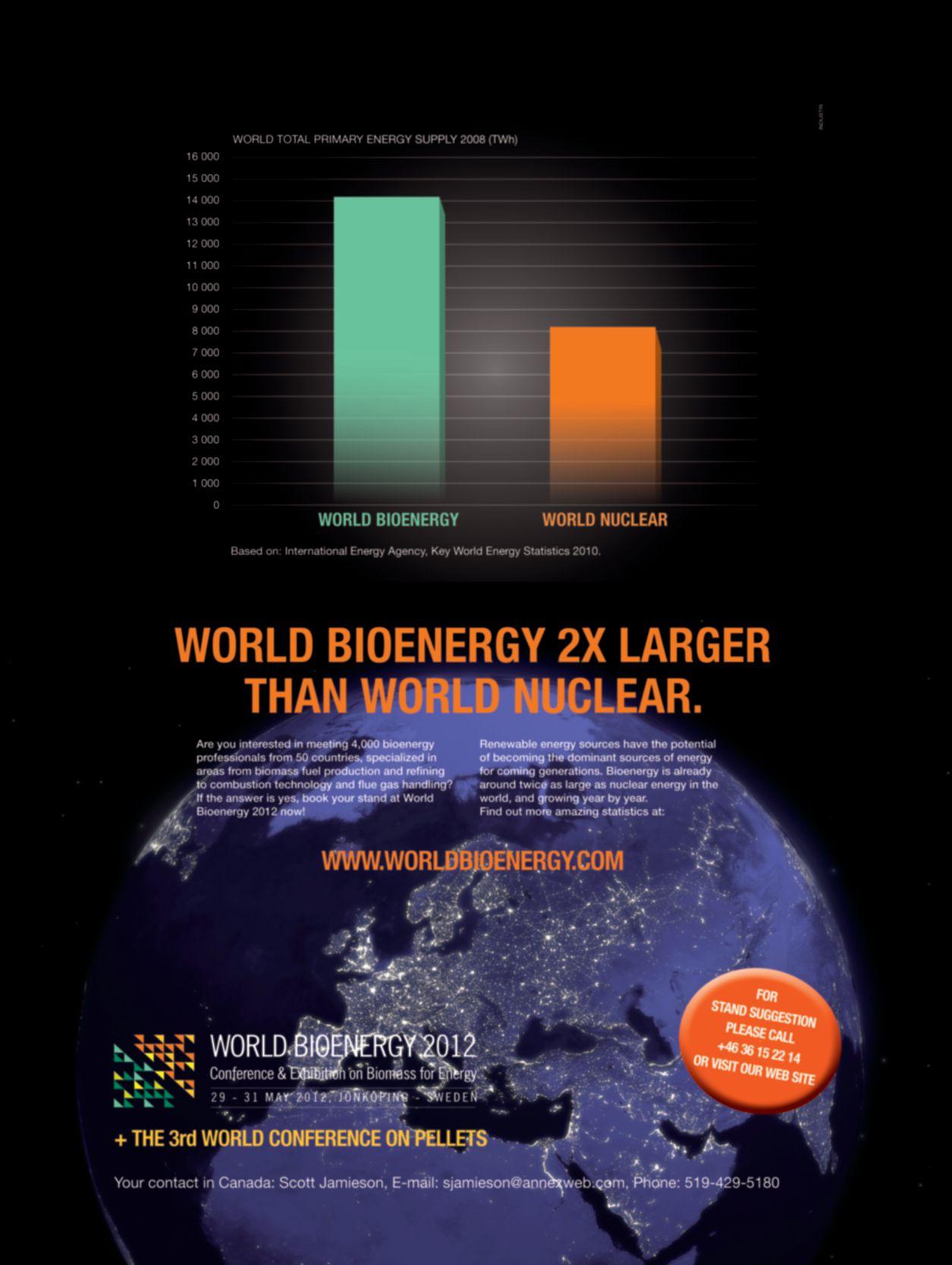

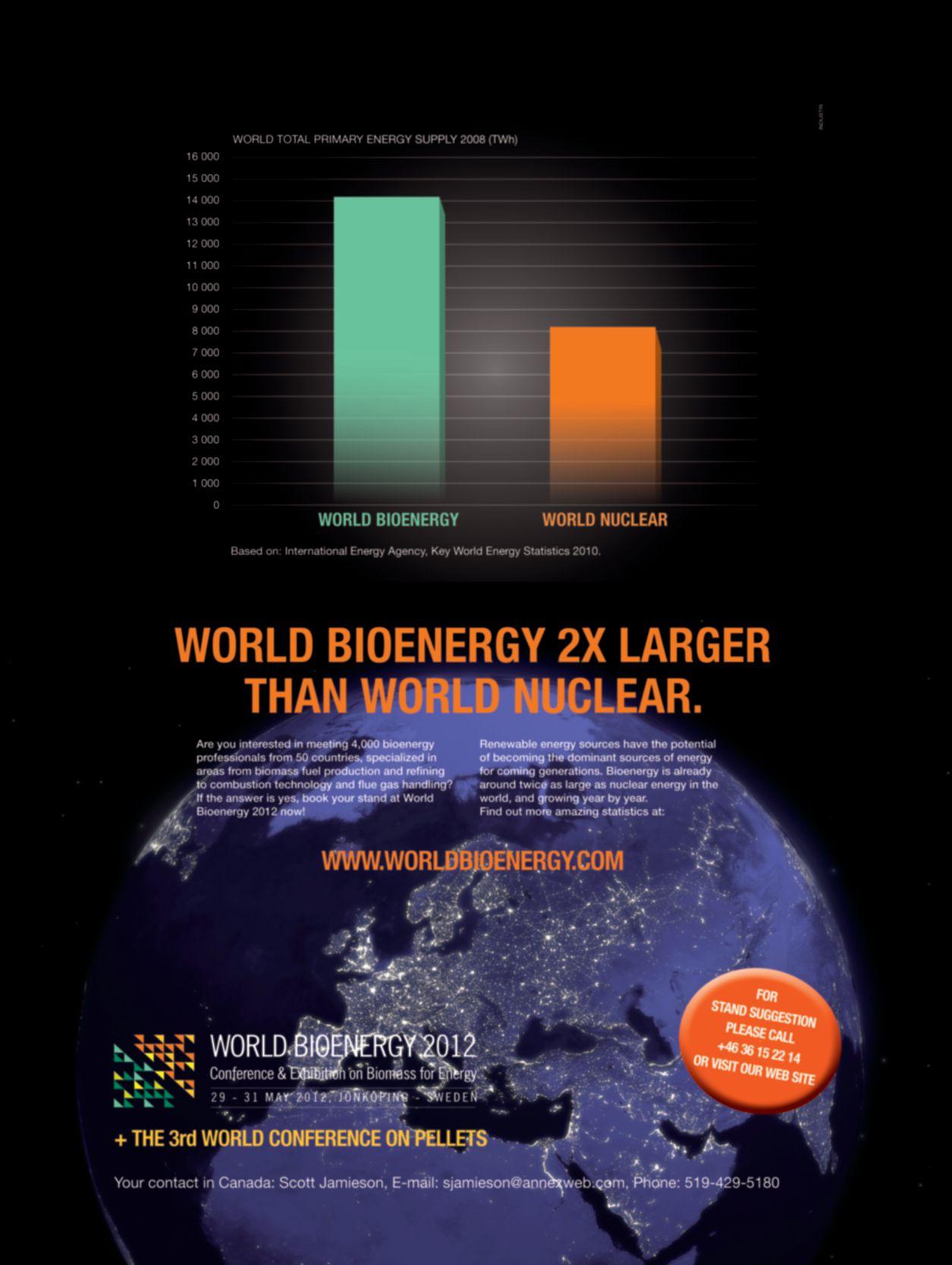

sector produces renewable energy from biomass at a level equivalent to three nuclear reactors—enough to power both Edmonton and Calgary or all of the Maritime provinces.

But the bio-revolution in Canada’s forest products industry is about more than just helping produce the kind of clean energy that is increasingly attractive in a world concerned about the environment and escalating oil prices.

“Yesterday’s waste stream is rapidly becoming tomorrow’s revenue stream.”

based on wood from our facilities’ waste streams. Some exciting examples include jet fuel, bio-plastics, and futuristic ultralight-weight materials. In essence, the sector is embracing a snazzy new vision that is helping to transform it and turn yesterday’s traditional lumber-jacks-inplaid sector into a dynamic sunrise business producing innovative, renewable bio-products. The forest products sector of old is helping lead the way in establishing Canada as a global player in the new bio-age.

Biomass from trees already fuels more than two-thirds of the energy requirements of the member companies of the Forest Products Association of Canada (FPAC), and surplus generation is being sent to the electricity grid to power homes. The Canadian pulp and paper

Our operations are morphing into bio-refineries that extract more valuable products from every tree harvested. By adding these novel technologies into our existing operations, wood from our waste streams can produce light bio-plastics for car parts, non-toxic green chemicals suitable for food processing, and rayon used in clothes. And there are many other exciting possibilities on the near horizon. Imagine producing rubber tires containing wood derivatives that enhance their properties or producing smart bio-active paper and packaging that could indicate food freshness, provide allergen alerts, or remove pathogens from water.

The most exciting development may lie in the possibilities inherent in producing an ultra- sophisticated new material called nanocrystalline cellulose. This novel product has incredible properties. For example, it is as much as eight times stronger than stainless steel and has unique colour features. These properties suggest that it could be used in airplanes, lipstick, and even bulletproof vests. The forest industry innovation leader, FPInnovations, is

now working with industry partners on a demonstration plant in Quebec that could soon produce nanocrystalline cellulose at commercial levels.

Yesterday’s waste stream is rapidly becoming tomorrow’s revenue stream. The traditional lumber and pulp and paper sectors are continuing to incorporate the production of these new bio-products as side businesses that can reap tremendous value and capture niche markets around the globe. Recent reports predict the market for bio-products is growing rapidly, with estimates that it will reach $200 billion/year by 2015.

So when we in the forest industry look at trees, we must remember to think beyond wood and newsprint. We must also think of their potential for renewable fuels, innovative new medicines, renewable fabrics, and more.

Now that’s razzmatazz. •

Catherine Cobden is vice-president of economics for the Forest Products Association of Canada (FPAC). She supports FPAC member companies on issues such as forest sector transformation, taxation, competition, energy, and rail policy, and is also responsible for the bio-pathways project, an innovative look at the opportunities available for the forest products industry in the emerging bio-economy. Visit FPAC’s website at www.fpac.ca.

iN our suBsequeNt columNs...

FPAC will be focusing in on what other countries are doing to rejuvenate their forest products industries. We’ll also explore how the forest industry is building partnerships with other sectors to benefit from the huge biopotential of this fibre resource.

The Fibreco port terminal expands to meet a surging demand for wood pellet exports.

By Jean Sorensen

Columbia’s port terminals stand ready

to accommodate a jump in wood pellet production that is expected to happen over the next five years to meet increased world demand. But it is Fibreco Export Inc. that has been leading the charge. “We have more than doubled our volume of annual exports (since Fibreco began handling pellet exports, with the first full year 2006),” says Fibreco president and CEO Grant Watkins. The company continues to expand its storage capacity at its North Vancouver facilities to meet British Columbia’s surge in pellet production.

The 30-year-old international woodfibre marketing and export terminal company was originally launched by independent mills and is now a private enterprise. So far in 2011, it has handled l00% of British Columbia’s pellet exports, although its next-door neighbour, Kinder Morgan, handled some of Pinnacle Pellet’s shipments up until 2010. Pinnacle also has unused storage capacity at Port of Prince Rupert, where it has loaded ships through Ridley Terminals.

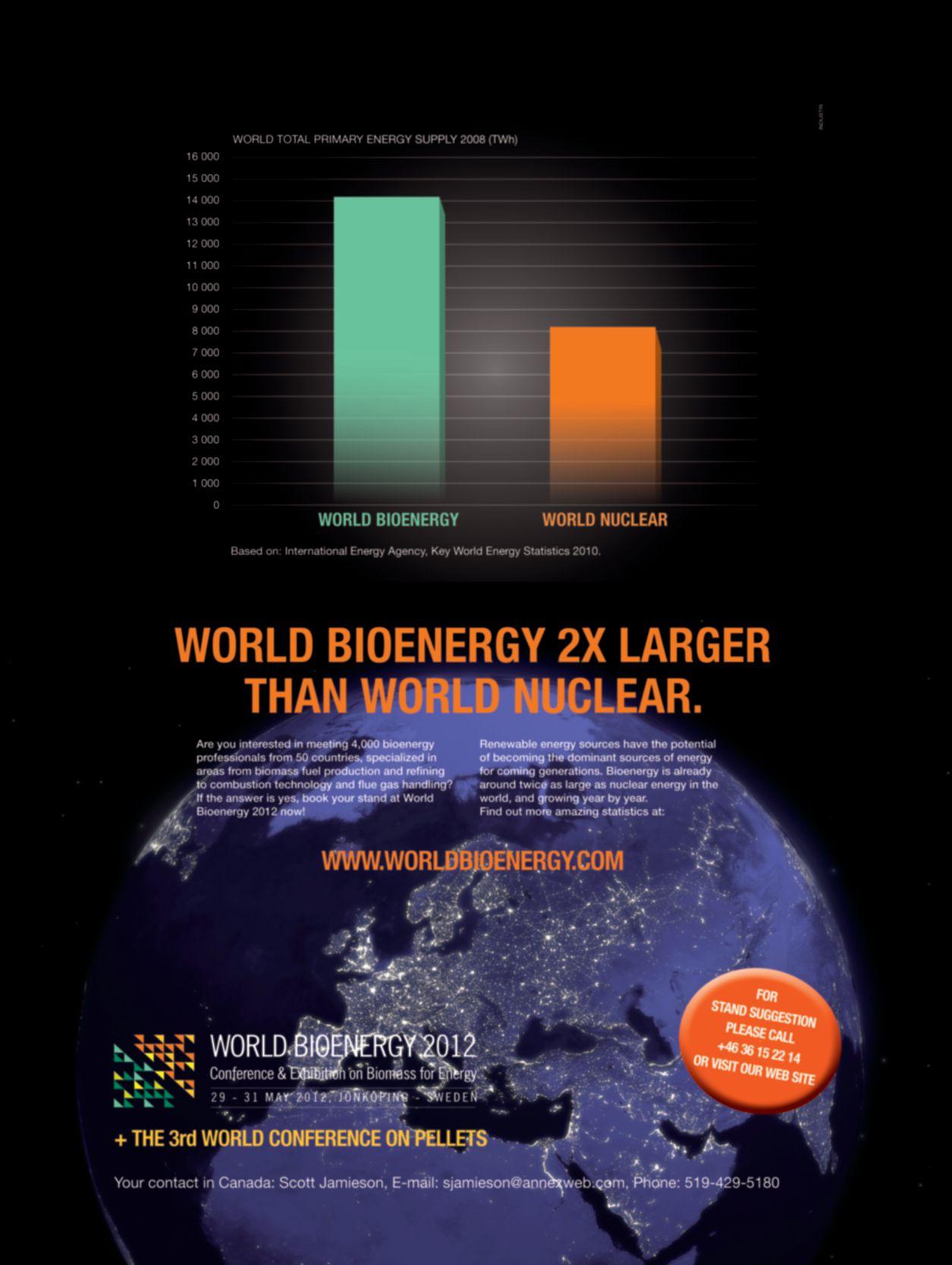

“There is tremendous expansion in demand going on worldwide and part of that expansion is being handled in British Columbia,” says Staffan Melin, a member of the University of British Columbia faculty of chemical and biological engineering and research director for the Canadian Wood Pellet Association. Strong demand in Europe, South Korea, and Japan is expected to grow, with worldwide consumption soaring to as high as 120 million tonnes/year in 2020 from today’s 12 million tonnes, much of which can be attributed to renewable energy policies.

“According to the projections, which are for enormous expansion worldwide, we will need more terminal capacity and much more production capacity,” Melin says. He adds that it’s not only terminals that will be affected; associated transportation systems will also be influenced.

“Pellets, in the future, will be traded as a commodity,” he predicts, adding that only 20% of an average tree now goes to lumber, with the rest going into products such as pulp, particle board, wood pellets, or biomass. Scandinavian forests are privately owned and much more efficiently

run, says Melin. Forest companies, in addition to producing forest products, also operate their own energy companies using waste and at the same time generating revenues from selling heat and power. In Europe, Melin says, power companies are also acquiring forestry companies so they can lock down a fibre base. “There is a lot of vertical integration going on, and this integration is increasingly international, involving also British Columbia,” he says.

The increased feed stream of pellets and bioenergy chips arriving at Fibreco’s North Vancouver waterfront and deep-sea loading terminal is a reflection of the growing world demand for biomass fuels. When Fibreco first started handling wood pellets at the end of 2005, it began with six silos capable of holding 4,500 tonnes each, yielding a combined storage capability of 27,000 tonnes. It was considered the largest international terminal in Canada

ABOVE: Fibreco is building a new covered storage unit to keep wood pellets out of the elements until they can be loaded onto ships.

for shipping wood pellets. “We are now building an 18,000 tonne fibre shed so we will be able to store 45,000 tonnes of pellets on site in total,” Watkins says.

“It’s not really a shed,” says Watkins of the new facility, which was completed in summer 2011. “It’s a very large 50,000-squarefoot building.” The structure is a tension fabric facility constructed by ClearSpan Fabric Structures out of the United States, which provides fabric structures for multiple purposes, including riding arenas and salt storage sheds. The new facility will allow Fibreco to store up to a full vessel load on site between ship loadings.

Continued global demand for fossil fuel alternatives and cleaner fuels is expected to drive demand for wood pellets even higher and affect Fibreco’s storage requirements in the next five years. Fibreco is currently only using 50% of its handling capacity of 3.5 million tonnes of combined fibre products (pellets, bioenergy wood chips, and pulp chips). “After that, we will have to look at redevelopment to go higher,” Watkins says.

Watkins is anticipating that Fibreco will

require another expansion in 2012, with a possible doubling of the current shed, hiking storage capacity to 60,000 tonnes. That’s because the next wave of pellet production in British Columbia, with new mills coming on-stream or new lines ramping up, is expected to hit in 2012. This could affect Fibreco next year with as much as 1.5 million tonnes (up from 1 million tonnes) of product arriving at its doorstep to go to markets, explains Watkins. He adds that as the industry becomes more established, an additional 1 million tonnes of pellets “could” come to the terminal facility again in the next three to five years.

Fibreco has aggressively gone after the burgeoning pellet market, says Watkins, who came to Fibreco from MGI International, where he served as president, and also spent 14 years with British Columbia timber major International Forest Products as general manager. The pellet business neatly dovetails with Fibreco’s traditional chip export market and provides a buffer to the cyclical pulp market. Watkins estimates that of the total volume of fibre that arrives at the North Vancouver terminal this year, approximately 75% will be pellets

(with 5% of that being wood chips destined for the bioenergy sector in Japan to replace coal), while only 25% will be wood chips directed towards traditional pulp markets. That’s not to say that the pulp side has dropped, but it has remained flat while the bioenergy sector has soared.

“In most cases,” notes Watkins, speaking of European market buyers, “the product is going to replace coal.” There is a growing worldwide awareness of the benefits of using wood pellets, which have almost a zero net value in carbon release when burned.

Fibreco’s modified ship loader gives it the ability to either store the pellets brought in by rail car or “hot load” directly onto a vessel. Pellets arrive via grain rail cars, which are enclosed to protect the pellets. Fibreco has a rotary dumper on site for wood chip rail cars but uses a bottom feeding conveying system to unload pellets.

As part of the learning curve in pellet handling over the past five years, the company has been an active participant in a number of studies. In 2010, the University of British Columbia’s Biomass and

Silvana specializes in providing turn-key, small-scale pellet press solutions from SPC Sweden to fit your specific needs. Talk to us and start making more profit now!

Bioenergy Research Group published a report titled Quality of Wood Pellets Produced in B.C. for Export,which was a result of pellet sampling over an 18-month window performed in 2007–2008 on pellets between storage and loading at the Fibreco facility. The report concluded that British Columbia’s pellets for export meet European grades and the grades set out by the Pellet Fuels Institute for the United States.

Fibreco’s facility is located in Vancouver’s scenic inner harbour and close to large population bases. As a result, it is susceptible to complaints such as dust, plus it must adhere to stringent work safety, fire, and carbon monoxide requirements. “We have done extensive amounts of work for both fire and dust abatement,” says Watkins.

Fires from explosions, dust, and overheating in silos are ongoing concerns, both at pellet plants and at terminal loading sites such as Fibreco, as well as at discharging sites overseas. Pacific BioEnergy’s pellet plant in Prince George suffered a fire in December 2010, and Armstrong Pellets (part of Pinnacle Pellets) also suffered a fire in April 2011. “There are other more dangerous materials than pellets handled in the Port of Vancouver every day through various export terminals that have the required equipment and procedures in place to operate safely and efficiently,” says Watkins. He says that the silos on the Fibreco site have thermal probes by OPI Systems Inc. that monitor constantly. The sensors and monitors are on site, and off-site data logging serves as a backup supervisory

system for alarm and failure detection. If the temperature rises, automatic fans located below the silos blow cool air through to reduce the temperature. Fibreco’s safety policy also restricts smoking on site.

Cool air infused into the silos also reduces the incidence of carbon monoxide buildup in silos, which can occur with off-gassing. Fibreco’s safety regulations re-

quire that all employees who work on the conveying system at the top or in the tunnel beneath the silos carry a carbon monoxide monitor. Incidents caused by carbon monoxide buildup from off-gassing have not been a problem at the Fibreco storage facility, says Watkins.

Located next door to Fibreco is one of the world’s largest terminal operators, Kinder Morgan. Kinder Morgan assistant general manager Dave Klitch says that once the contract concluded with Pinnacle in 2010, the berth that was converted to handle wood pellets is now being used to handle canola meal pellets and peas, which are higher-value commodities. “But who knows,” he says, adding that Kinder Morgan may gain business back in the future as demand for wood pellets increases. The facility has the capacity to handle up to 1 million tonnes, but Kinder Morgan tends to pursue mainly volume business. When it first revamped a berth to handle wood pellets, it installed temperature monitors, a GreCon spark detection and extinguishing system, and spark detection equipment on the conveying belts, says Klitch. •

British Columbia port terminals and pellet plants are moving through a learning curve and gaining greater wood pellet handling expertise to prevent fires, off-gassing, dust, and pellet quality degradation.

“There are really three problems,” says Staffan Melin, who researches many of the associated problems with wood pellet storage, handling, and shipping. They are off-gassing, self-heating, and dust control.

“I think we now have got a good handle on off-gassing here after a string of serious accidents overseas. We have good WorkSafe BC training programs in place for contained space entry,” says Melin. “We have also addressed the intricate problem of off-gassing onboard large ocean vessels by introducing a safety code now in place through the International Maritime Organization (IMO), with regulations for transportation of pellets in large bulk.”

Self-heating occurs from chemical oxidation of fatty acids in the pellets, thermal condensation and evaporation, and biological decomposition of the material. Temperature sensors are critical to monitor heat buildup, which can cause a fire.

Dust control is still the major challenge facing all pellet mills and handling facilities. “We have a better wood pellet today that is more mechanically stable,” says Melin. Currently, handling facilities are attempting to use systems for anti-static conveyance, dust collection, and dust sup-

pression. Airborne dust is also accumulated in covered conveyance belts, hoppers, and anti-static surfaces, eliminating layering or buildup of electrostatic charges. This reduces the likelihood of fines or dust igniting on a hot surface, from a spark, or from an electrostatic discharge.

“Dust control is related to not just the handling of the pellet, but also the durability of the pellet. That in turn is related to the lignin content and the length of the wood pellet as well as the machinery used for compression of the wood to produce pellets and the temperature and moisture of the material going into the extrusion channel of the pelletizer machine,” says Melin. “Lignin content also varies from species to species.”

Research and applied findings have helped facilities reduce pellet degradation. “It has been a combination of fundamental research at the University of British Columbia’s Biomass and Bioenergy Research Group and learning from experience in collaboration with Fibreco and Kinder Morgan installations,” he explains.

The next phase is now focused on adding natural products to the pellet, which may strengthen it. “This is especially important for torrified pellets, as the material is very brittle,” he notes. Additives such as oils, starches, and lignins are all being considered. “Binding characteristics are very sensitive, and only 0.5% moisture may change the durability of the pellets and make them even more durable,” he says.

Technical evolution at pellet plants is also ongoing. A new development, known as an electric nose, has been developed in Europe and is being experimented with in the United States and Europe, but has not yet been introduced into British Columbia, says Melin. The Swedish manufacturer Firefly is known for producing sensing devices for fire detection but has recently developed the nose, which can sniff out trace gases in the very early stages of a fire’s development.

Hundreds of millions of dollars are invested annually in the pellet industry around the globe, and safety has become a major concern, prompting increased preventive design and operating practices.

From start to finish, CPM specializes in total solutions for superior production levels of high-quality pellets. The latest technology. The highest-quality pellet mills and dies. Efficient and economical. Built to run 24/7 in the toughest conditions.

For high-capacity wood and biomass pellet production, low energy consumption and superior pellet quality, look to Your Partner in Productivity. Look to CPM.

By Colleen Cross & Heather Hager

Pellet producers Enviva, Fram Renewable Fuels, Green Circle Bio Energy, and the Westervelt Company have formed the U.S. Industrial Pellet Association (USIPA) to represent and assist U.S. industrial pellet producers who are exporting to Europe. The association, established in February 2011, is concentrating on a number of issues related to the pellet industry, including Europe policy that will affect the developing U.S. industry. USIPA is the first group to focus exclusively on U.S. industrial pellets and the issues surrounding international export, particularly to Europe.

“There was no voice for U.S. industrial pellet producers who are exporting to Europe. It’s obviously a very, very focused organization. Because of that void, these founding members got together,” says executive director Seth Ginther. Ginther handles the day-to-day running of the organization, recruiting, and European lobbying. He is an

independent contractor and a lawyer with Hirschler Fleischer in Richmond, Virginia.

To date, 26 members have joined, among them Andritz Group, Astec Industries, ICAP Logistics & Shipping, Platou Shipping, Oldendorff Shipping, Bruks, Bühler, Büttner, Dieffenbacher, Forest2Market, Energy Title Services, T. Parker Host, and Evolution Markets.

Speaking at the September 2011 North American Biomass Pellet Export Conference in New Orleans, Louisiana, Ginther said, “We will begin participating in meetings with the international Wood Pellet Buyers Group, offering our opinions from a USIPA perspective on three very key issues that the buyers are looking at: pellet specification standards, sustainability, and forming a uniform trading contract.”

He added that the group also has its eye on a key domestic issue: best practices in safety in both shipping and manufacturing. “It’s only going to take one incident to really

sideline this industry for some time. So we’ve got to be very diligent about our safety.”

USIPA has a strong relationship with Gordon Murray and the Wood Pellet Association of Canada (WPAC). “We are interested in working with, and have a very strong relationship with the WPAC, and have many of the same interests, and so there are lots of opportunities to work together there,” explains Ginther. “The work that Gordon is doing is very similar to the work that we’re doing. In fact, Canadians have made great strides from a safety standpoint.”

On U.S. domestic issues and foreign policy as they relate to industrial wood pellet buying, the association has been working with the Pellet Fuels Institute, which concentrates on the retail side of the wood pellet industry.

USIPA plans to make the Pellet Export Conference an annual event going forward. Keep an eye out to the Canadian Biomass events page. •

A number of communities are trying out biomass district heating: Prince George and Quesnel, British Columbia, and Strathcona, Alberta.

By Treena Hein

heating is suddenly hot in western Canada. “Similar, yet different” is a good way to sum up the new projects in Prince George and Quesnel, British Columbia, and Strathcona, Alberta. While the end goal and system basics are the same—a connected group of buildings heated using biomass-based energy—the details, journey, and challenges are more diverse.

Construction of Prince George’s downtown district energy system (DES) got

underway at the start of August 2011 and is going almost completely according to plan, says communications manager Mike Davis. Like other district heating systems, the DES involves the installation of pipes leading from the heat source to interconnected buildings. This work has been sandwiched in time between the removal and eventual reconstruction of existing road structures, curbs, gutters, and more. The DES will capture heat from a biomassbased boiler system already in place at the Sinclair Group Forest Products’ Lakeland Mills sawmill to generate heat and hot water. The equipment for the DES that’s being installed at Lakeland will be owned by the City and operated by the mill.

Wellons Canada is supplying the heat recovery system. Waste heat will be captured from the mill’s exhaust stack and will also be netted from the excess capacity of the mill’s heating system. The hot gas will pass through a heat exchanger to heat fluid in the DES pipeline. A metered exchange point at the mill will measure the energy that the City will purchase from Lakeland Mills. The heat will then pass through a hot water heating loop under the CN rail yards to the peaking/backup plant downtown. “This will house the

ABOVE: Hot water distribution pipes for Prince George, British Columbia’s district energy project are laid down outside City Hall.

circulation pumps, natural gas back-up peaking boilers, and other equipment like a standby generator,” says Marco Fornari, manager of utilities for Prince George. “From that plant, we will be connecting approximately 10 buildings.” These include the library, Civic Centre, Four Seasons, Art Gallery, Coast Inn, Coliseum, the

emissions was a very important factor in public acceptance and support of the project,” says Fornari.

strathcoNa’s diverse fuels

Ground has also been broken for a district heating system in Strathcona County, Alberta, at Sherwood Park’s Centre in the Park. It will keep nine buildings cosy when complete: three municipal office buildings, a community theatre, ice arena, swim-

lets) from the commercial sector, agricultural residues such as straw from farmers, and oat hulls from Alberta Oats.”

In addition, the system will accept wood pellets made by a local company using a Doppstadt wood grinder and a pelletizer from New Brunswick-based Pellet Systems International. The use of different fuels will be computer-controlled. “Each fuel…is programmed into the system, and when the fuel switches, the module will automatically adjust,” Swonek explains. About 250 kilograms/hour of fuel and 1400 tonnes for the entire heating season (October to April) is expected to be required.

peaking plant, and City Hall. All of these structures were previously heated by hot water heat from natural gas-fired boilers.

An electrostatic precipitator supplied by Wellons will improve the mill’s particulate emissions. Additional air quality improvements will be gained from reduced truck traffic leaving the mill to transport residue to pellet plants because more biomass will be consumed onsite for heat generation. “This reduction in particulate

ming pool, and three condos. The madeto-order heating module is being built by Lambion Energy of Germany and will arrive in mid-September 2011. Two additional fuel containers will allow for three-plus days of fuel storage.

“The equipment is being custom designed to accommodate local feedstocks,” says Norm Swonek, project manager of community energy systems for Strathcona County. “These include waste wood (pal-

A $1.5 million grant for the system from the Western Economic Diversification Program went to both the Resource Industry Suppliers Association and Strathcona County. They each are also contributing $675,000 to the project. When cost-return will be achieved is a matter of how current energy prices play out. “[Because] the system uses local fuels to offset natural gas, at the present cost of natural gas, the cost-return will have a much longer payback period than if the cost of natural gas were higher,” Swonek says.

The City of Quesnel in British Columbia and Terasen Gas are moving forward on a final feasibility study of a proposed unique combined heat and power (CHP)/ district heating system, in cooperation with West Fraser Timber Co. Ltd. and BC Hydro. “The Quesnel Community Energy System (QCES) is currently in a negotiation stage, and we are awaiting a number of final details before moving into a new round of assessment on costs,” says Quesnel economic development officer April Cheng. “With the successful conclusion of. . .agreements and the engineering work, approval from the BC Utilities Commission will be required to proceed with the project. We are unsure, at this time, if the project will be operational in 2012.”

The plan is for both waste heat and residues from West Fraser’s Quesnel sawmill to be used to generate heat and electricity, a first in North America. The QCES is expected to provide 5.5 MW of heat to 22 industrial, municipal, commercial, and multi-dwelling residential

with an overall planned energy efficiency of 90%. An estimated 9,000 tonnes/year of wood waste from milling operations will be burned.

Cheng says the partners are continuing to press forward in finding funds for the project, which had an initial estimated capital cost of $14 million. Quesnel’s Economic Development Corporation secured a grant of $4.13 million through B.C.’s Innovative Clean Energy Fund, with Terasen Gas providing funds as well. Western Economic Diversification Canada, the Green Municipal Fund, BC Hydro, and BC Bioenergy Network are also involved.

Who better to ask for advice and insights into how to handle challenges in navigating a district heating project than those on the front line? Swonek says the list of challenges in Strathcona included funding, selection of the best available technology, securing local sustainable feedstocks, and transportation and processing logistics. “District heating systems require large initial capital investments, which requires funding by either grants or borrowed funds,” he notes, adding, “Securing customers to deliver the energy to is key.”

Two challenges stood out in Prince

plants are in fact similar to emissions from natural gas boiler systems,” Davis explains. The city got this message out in the proposal stage through holding public engagement sessions; notes from these meetings were included in the mandatory Federal Environmental Assessment. This was part of an overall communications plan to share information that will continue throughout construction. The City highlighted positive aspects such as the fact that the system will be paid for in 10 years and has a positive net present value of $2.8 million over 25 years. However, at the same time, Davis says the other major challenge was how to maintain the financial viability of a biomass-based energy supply utility in the face of historically low natural gas prices. “We are effectively competing against natural gas in the market place for heat customers,” says Davis. Although the Quesnel project is still at the stage of working out funding and other details, Cheng shares some advice, “Patience. These projects take time, and some of [our] early mistakes were on the suggested amount of time.” She also advises, “Take the figures lightly. Cost estimates and revenues can change based on any one single factor, and partners need to be prepared for change on projects of this scale and complexity.” •

Pellets are set to explode, but only literally, as the PFI annual conference addressed fire safety as well as expanding markets.

By Scott Jamieson

over250 delegates gathered near Jacksonville, Florida, in late July 2011 for the Pellet Fuels Institute (PFI) annual conference and expo. They were treated to stifling humidity, market updates, some technical tips, and fire safety updates.

Setting the tone on market forecasts was Fram Renewable Fuels’ president Harold Arnold. The bioenergy pioneer warned delegates to hold onto their hats in the coming decade, as fantastic growth coupled with swings in biomass flow will be the norm.

“The industry will see wild growth in the next 10 years,” Arnold concluded. “We’ll see a tripling of global demand, new capacity to try to keep pace, changes in the way business is done that we can’t even imagine today, and dramatic changes in the flow of fibre around the globe. Bioenergy is the wild west.”

He sees growth in global demand from today’s 15 million tonnes to 27.5 million tonnes in 2015 and 45 million tonnes by 2020. While current production is only at 50% of capacity, much of that unused capacity is at smaller plants serving localized markets. As a result, larger, strategically located pellet plants will need to be built to meet that rising bulk demand from European and Asian power generators.

Asia, specifically Korea and Japan, will require massive imports to meet aggressive co-firing requirements. “Korea in particular shows the kind of sharp growth that can happen when a government decides to support renewable energy.” He added that 5 to 6 million tonnes will need to be imported into Korea alone.

Future global markets will belong to large-scale plants, according to Fram president Harold Arnold.

Still on markets, RISI bioenergy economist Seth Walker switched the spotlight to the UK. He noted that biomass investment has surged in both eastern and western Canada during the past quarter, while growth in the United States stalled during that same period.

The economist also noted that consumption of biomass in Europe continues to grow at a healthy pace, being led by the UK. “I was surprised to find that some 75% of the new demand for biomass coming out of Europe was based in the UK. They have some aggressive renewable energy targets, and we can expect to see significant growth in co-firing there in the coming five years.”

News was less positive concerning the

stalled U.S. housing and lumber markets. With lumber production currently at just 50% of the 2005 peak, Walker believes that the sector has levelled off. However, the continuing grind in the U.S. housing market has led RISI to change its recovery timeline. Walker now expects that sector to hit the magical one million starts level in 2014, rather than RISI’s original prediction of 2012.

“The good news is that we expect a significant and strong recovery from that point, with 2005 levels being hit around 2015. For pellet producers who have managed to cope with the current greatly reduced supply of sawmill residuals, that means things only get better from here as far as supply goes.”

turNiNg techNical

The program also included a healthy dose of technical content. Pellet expert Clyde Stearns, a wood products efficiency veteran who is currently helping pellet start-up Zilkha Biomass Energy build greenfield mills in the United States and Canada, treated delegates to a shopping list of design and operating tips to get the most production and best quality from their plants. In particular, he extolled the virtues of microchips, created by stationary chippers or the new generation of mobile horizontal grinders, which give the consistent size distribution typically seen in pulp chips, with 100% sizing less than 3/8 inch. Benefits include the relative ease of adjusting and measuring moisture content (MC), more consistent MC within and between chips, increased grinding capacity and drying efficiency, and an overall boost in plant production using the same equipment.

Stearns also discussed the benefits of adding more surge capacity at two key points in the production process: after the dryer and between the grinder and pelletizers. “If you have eight hours’ surge capacity after the dryer, the moisture content in the chips will completely equalize, which will really enhance the downstream process. That’s not practical, but even an hour will make a significant difference,” he said. About 30 to 60 minutes of storage time after the fine grinders will have a similar effect, he added. “The result of focusing on raw material - size distribution, variability, moisture - is a more stable operation. Overall, your pelleting process should become routine if you can supply a more consistent raw material. Often when there is an issue at the pelletizer, you’ll see a lot of people standing around it trying to solve

Canadian Biomass’ Scott Jamieson was on site at Trebio’s 130,000 tonne/year pellet plant in Portage-du-Fort, QC, in late September to report on the facility’s commissioning and production ramp up. The plant is jointly owned by GF Energy and Trebio’s management team, and features North America’s first Promill-Stolz pellet mills (four of the five shown above). See the complete story in our next issue, or look for highlights today at www.canadianbiomassmagazine.ca.

the problem. They would likely be better off going back to the raw material and trying to improve that.”

Several speakers, including Stearns, discussed fire safety. Gord Murray, executive director of the Wood Pellet Association of Canada (WPAC), and Stephen Chaplin, director of training and program development for the BC Forest Safety Council, gave attendees a sneak peek at a new system being developed to promote and improve pellet mill safety.

“We have members who have been denied insurance,” Murray explained. “We have insurance providers simply getting out of the pellet insurance market. We’ve seen WCB [Worker’s Compensation Board] rates increase by 54% in just three years. It’s not sustainable.”

To combat this disturbing trend, WPAC has joined forces with the BC Forest Safety Council, a non-profit, industry-funded organization that started tackling timber harvesting safety after the disastrous fatality numbers in 2005. The pellet program is in the fact-finding and consultation phase, with the goal of rolling out a SAFE Certification system similar to that developed for harvesting operations. That system has been credited with a 45% drop in incident rates and a 25% drop in WCB rates in the harvesting sector. Look for pilot audits this fall. “Our desire is to improve safety for pellet manufacturers across the industry,” Murray said in response to a question from a U.S.-based pellet manufacturer. “The system is in its early days, and we’re basing it on the BC Forest Safety Council model used for logging. We think it will transfer well to the pellet process, and when we’re done, we’ll have an audit system that fits any pellet mill. Once we do, we’d be delighted to help roll it out in other areas.” •

North American pellet producers will have to keep up with market developments to retain access to industrial pellet end-users.

By Heather Hager

consultants expect the global wood pellet industry to triple over the next ten years as renewable energy gains in importance. That potential is already attracting new players to pellet manufacturing, both within and outside North America. To discuss strategies and challenges for moving their wood pellets in the growing global industrial market, North American pellet exporters met in New Orleans in September 2011 at the North American Biomass Pellet Export Conference.

The increasing demand for pellets will intensify producer competition, particularly with new entrants from low-cost regions outside North America, such as Brazil and Russia, said Jonathan Rager of Pöyry Management Consulting. With the European Union predicted to remain the most important market (and smaller growth in Asia and North America), regions of the world that have a sustainable, low-cost fibre supply and short-distance shipping access to Europe should benefit most. Something for North American pellet exporters to keep an eye on, said Rager, is “where that new supply will go, and how it will affect the existing markets.”

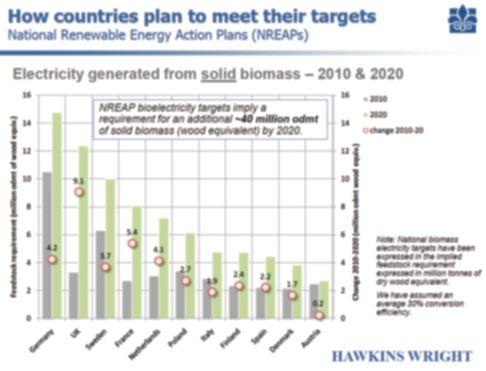

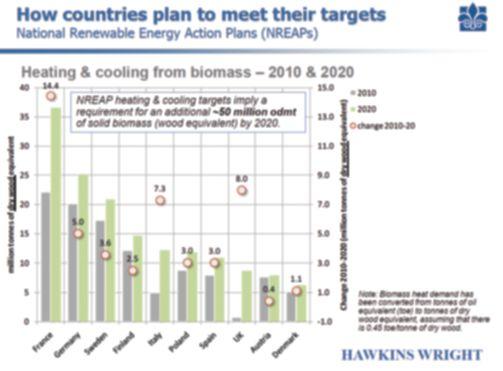

“The European Union is still where the game is, from an industrial pellet perspective,” said John Bingham of UK-based Hawkins Wright, a forest markets consultancy. About 90% of EU biomass import demand currently goes to the UK, Netherlands, Sweden, Denmark, Belgium, and Italy. Based on EU member countries’ renewable energy plans, Bingham expects to see growth of 40 million and 50 million oven-

dried tonnes of biomass for the power and heating markets, respectively, by 2020. Major growth markets will be Germany, UK, Italy, Sweden, Netherlands, and Poland for power generation, and France, Germany, Italy, UK, and Sweden for heating and cooling. However, Germany, France, and Poland should be able to meet their supply from domestic sources, said Bingham. These markets will continue to be highly dependent on policy direction, he added.

Sustainability was a key buzzword throughout the conference. “Sustainability to biomass is like safety to nuclear,” said Ben Goh of Eon, a Germany-based power and gas company. “Utilities must be seen to be acting in a manner consistent with sustainability.” With the EU establishing criteria

for sustainably harvested biofuels, North American pellet producers are eager to see some final policy direction so they can ensure their pellets will meet the standards.

Currently, a major challenge for pellet producers is that each utility sets its own pellet specifications. Simon Rodian Christensen of Copenhagen Merchants, which ships and handles pellets and owns several port terminals, gave numerous examples. Some power plants require low fines/dust if located near residential areas or if the pellets need to be handled multiple times. Utilities can also differ in requirements for nitrogen level, ash content, and pellet diameter, contract term, shipment size, etc. This means that producers need to understand as many specs as possible and be able to meet them, said Christensen, illustrating the need to commoditize pellet

trading with standardized specs and contracts.

“It’s not a question of if, but when it will be a commodity,” stated Henry Pease of RWE Supply & Trading, a European energy trading house. Establishing standardized contracts, sustainability criteria, and credible certification will go hand in hand in gaining commodity status for wood pellets. All of these are currently in development.

Logistics and transportation speaker panels emphasized that the future of North American pellet production and transport will be all about economies of scale. Only the most efficient producers will remain competitive, with smaller plants being edged out of the market, and larger plants gaining from efficiencies of scale, said Nicolas Denis of McKinsey Consulting. However, optimal plant size will vary, as production will be constrained by the carrying capacity of a particular region. At some point, a plant will become its own wood fibre competitor, noted Steven Meyers, Fram Renewable Fuels’ wood procurement manager. The trick will be in finding the right production capacity for each fibre basket.

Economies of scale in shipping also currently benefit larger producers. Henrick Christiansen of Oldendorff Shipping, a dry bulk shipping company out of Germany that handles wood pellets, estimated that the best volumes are about 25,000 tonnes if shipping pellets from the east coast of North America and 40,000 to 45,000 tonnes if shipping from the west coast. “The smaller you go, the more expensive it gets,” he said.

In fact, larger volumes could be shipped if the ports were capable of handling them, said David Elsy of ICAP Shipping. However, he noted that few U.S. ports have a draft greater than 50 feet (15 metres) to accommodate larger ships, and loading those volumes within the short time allotted at port can be difficult. Port storage capacity also limits the cargo volume, added Christiansen.

Maximizing shipping volumes is problematic for smaller plants that might only have a 50,000-tonne/year production capacity. Pellet commoditization would alleviate some shipping costs by allowing the blending of pellets from multiple producers. However, certification will likely be more costly per unit production for smaller producers. •

A demonstration facility in Colorado that deploys Rentech’s synthetic fuels technology has produced more than 150,000 litres of certified synthetic fuels.

Here’s

a look at some of the biomass-related projects that will go ahead with fibre awarded in Ontario’s wood supply competition.

By Colleen Cross

Formany Ontario mills and forestry companies, the wait for fibre is over. The province has announced 41 successful proponents in its recent wood competition and has allocated more than 5 million cubic-metres/ year of merchantable and unmerchantable fibre. Some key objectives were to free up fibre from shuttered mills and put it to use, as well as to secure more aboriginal involvement in the forest industry.

“In November 2009, we had a situation where the previous harvest was around 24 or 25 million cubic-metres/year in Ontario,” says David Hayhurst, acting director of industry relations for the forestry division of the Ontario Ministry of Northern

Development, Mining, and Forestry. “But because of the economic downturn… we were harvesting less than half of what had historically been harvested.” This led to “an awful lot of unused wood.”

The competition was undertaken in 2009 to see if this wood, much of which was committed or licensed to existing facilities but unused, could be put to other purposes. Of the 8.5 million cubic-metres/ year of wood supply available in the competition, about 5.6 million cubic metres/ year of wood was offered to successful proponents. Forty-one offers have now been accepted, one is still under consideration, and four were turned down for various reasons.

Wood not offered in the competition is estimated at about 2.9 million cubic-metres/year, Hayhurst says. Because factors such as markets, forest companies, and wood use and availability have changed, the leftover wood supply that wasn’t offered via the competition is being reviewed. Offers that were declined are not being re-allocated, he adds, but rather “de-allocated” in a process known as unencumbering, or reverting back to the previous licence holder.

Among other purposes, the wood is being used to produce lumber, dimension lumber, laminated strand lumber, pulp and paper, utility poles, synthetic jet fuel, naphtha, heat, electricity, mulch, fire-

wood, pellets, and briquettes. Following is just a sampling of many of the biomassrelated projects that received allocations.

AbitibiBowater is using 317,500 cubic-metres/year of merchantable and unmerchantable spruce, pine, fir, white birch, and poplar to increase pulp and paper production to pre-economic-downturn levels and to generate power at its Fort Frances mill. Another allocation of 291,800 cubic-metres of similar fibre will generate electricity at its Thunder Bay pulp and paper mill.

“The company saw the competition as an opportunity to improve the fibre supply to its highly competitive northwestern Ontario assets, diversify its production into pellets, and create fibre supply synergies in the region,” says Pierre Choquette, AbiBow’s director of Canadian public affairs.

A condensing turbine that will produce power for the Thunder Bay mill is currently under construction. Existing equipment consists of two biomass boilers that burn hog fuel supplemented by sludge produced at the paper mill, and one spent liquor recovery boiler. These produce highpressure steam, running a General Electric turbine and Brown Boveri generator. A purchase order for a new transformer has been issued, mill water tie-ins and piping modifications have been completed, and refurbishment of a power boiler superheater contract has been awarded. The new turbine will produce approximately 40 MW of electricity.

Capital Power’s award of 173,000 cubic-metres of unmerchantable conifer and hardwood will augment the fuel supply to its biomass power plant in Calstock, Ontario, near Hearst, says Mike Long, the company’s manager of external communications. The Calstock plant, which has operated for 10 years, is a steam turbinedriven power generating plant that uses wood waste from the Hearst region as well as waste heat from TransCanada’s nearby Station 88 compressor station. The plant is designed to burn 320,000 green tonnes/ year of wood waste, producing up to 35 MW of electricity.

Power is generated using a 41-MW Alstom steam turbine-driven generator. In addition to burning wood waste to produce steam in the biomass boiler, steam produced from the compressor turbine drives waste heat in two Innovative Steam Tech-

nologies “once through” steam generators.

Long says the Calstock plant has a 20year power purchase agreement with the province that expires in January 2020.

One allocation has attracted Californiabased cleantech company Rentech to White River, Ontario. The company is proposing to establish what it calls the Olympiad Renewable Energy Centre to turn its 1,146,000 cubic-metres/year fibre allocation into 85 million litres/year of low-carbon, biodegradable synthetic jet fuel, approximately 43 million litres/year of renewable naphtha, which can be used to make biodegradable products, and 40 MW of electricity.

Rentech is completing the commercial

aspects of the project, including site control and potential offtake agreements, says Julie Dawoodjee, vice-president of Investor Relations at Rentech. It has completed the scoping work and is in the pre-feasibility engineering phase, which includes assessment of potential sites to ensure adequate infrastructure. If all goes according to plan, the company expects to complete the plant in 2015.

“Top priority for us is working through the SDTC [Sustainable Development Technology Canada] application process,” says Dawoodjee. “We need to demonstrate the integrated technology chain that would be used at the Olympiad project.” This requires completion of the demonstration of the Rentech ClearFuels gasifier at the company’s existing synthetic fuel facility

in Commerce City, Colorado, which is in many ways, says Dawoodjee, a “mini Olympiad project.” The process involves gasifying biomass and upgrading it to drop-in transportation fuel. Rentech is on track for producing renewable fuels from that technology chain by the end of 2011.

The SDTC, through its NextGen Biofuels Fund, offers potential funding of up to 40%

to a maximum of $200 million of eligible project development and construction costs, which would be repaid from a percentage of the completed project’s cash flows.

Dawoodjee notes that the fuel, which is already certified, will be in high demand by commercial airlines facing the potential carbon tax brought about by the EU emissions trading scheme, with changes for

airlines coming into effect in 2012. A successful commercial test flight was made in April 2010 using a blend of synthetic jet fuel and conventional Jet-A.

Olav Haavaldsrud Timber Company is using its 220,000 cubic-metres/year allocation of merchantable wood to expand production its lumber mill. The residuals will supply an adjacent cogeneration facility that’s now under construction. The Becker plant will use a bubbling fluidized bed boiler to burn the residual biomass, producing highpressure steam that will run an extraction/ condensing steam turbine generator.

Construction of the partially built cogen plant was briefly suspended while power connection issues were resolved, says Carlo Bin, the company’s president. The company has since reached an agreement with Hydro One on the connection issues, which required some re-engineering. The generating capacity will be 10 MW, down from the original 15 MW. Agreements with equipment providers were in place, but in some cases those contracts may have to be redone. The commercial start-up date is now August 2013.

Under a 2009 request for proposals, the company was granted a contract to sell the electricity to the grid under a CHP-3 agreement. Residual steam will be used for drying and heating purposes at the mill.

For Haavaldsrud, the chance to acquire wood to augment the supply already earmarked for the project was too good to pass up. “We’ve never had such an opportunity in the history of the company to expand our operations, and to the extent that the wood competition allowed,” says Bin.

Whitesand First Nation, located north of Thunder Bay near Armstrong, is planning to produce 60,000 tonnes/year of pellets, as well as to supply heat and power to three local communities. The cogen facility will initially produce 1 MW, but will have the capacity to increase to 3 MW, supplying Whitesand, Armstrong, and Collins.

“I can’t get tired of telling this story,” says Clifford Tibishkogijig, economic development officer for Whitesand. “In 1992, Whitesand First Nation and the community of Armstrong had approached the Ministry of Northern Development, Mining, and Forestry, and the Ministry of

Natural Resources, to look at ways of harvesting the Armstrong forest in a more economical and sustainable manner.” Tibishkogijig says they proposed a cogen facility, but the project was turned down. They updated that proposal to meet competition requirements and based some of their argument for gaining a wood supply on the fact it was a revamped proposal.

Plans for the projects are moving quickly. Whitesand has initiated a tendering process for the environmental assessment. Site selection for the cogen facility is in progress, but they must demonstrate that the projects are environmentally and financially sound. The cogen facility will run 24/7 all year, with the existing diesel generating site in Armstrong as a backup power source.