COLUMNS

22

ARELLANO

22

ARELLANO

By Jean Ko Din

Everyone in the industry wants to know what’s next in the world of recirculating aquaculture systems (RAS). But even if it were that simple, I wonder if that would cause you to change course.

All the market reports tell us that there are strong headwinds on the horizon for land-based aquaculture. There is a lot of money circulating and therefore, there is a lot of money to be made in the industry.

However, I can’t also ignore the stories that I’ve heard from projects that have stalled or delayed because potential investors have gone radio-silent. Projects with a green light are few and far between, which means that competition for contracts is also more fierce. One can’t help but think that one wrong move or one wrong headline could mean your RAS vision goes up in smoke. This is the mood that I’m seeing right now and it’s not one that I personally enjoy, especially as we look to the end of this year.

This time of year causes all of us to take stock of what we’ve accomplished so far and look ahead to what we want to accomplish in the future. If we have any say about it, it’s meant to be a time of encouragement and hope, so it’s not easy to hear that we’re all starting to clam-up under the pressure. I’ve always been an advocate for collective coorperation. I firmly believe that open collaboration must win out in order to drive progress in the industry, so it doesn’t feel good that people are now moving through their projects with their purse close to their chest.

Reciting a litany of good signs might not assure you the way it once did, either. RAS raised up US$1 billion in capital in the first four months of this year and is poised to raise another billion by year’s end. At this pace, another report estimates that the global RAS market could reach $13 billion in less than 10 years. They say hybrid flowthrough is finally reaching its stride

with its production volumes. Maybe smaller, more low-impact investments can mitigate the risk of production startup. Maybe larger post-smolt is the key to net pen farming. Maybe artificial intelligence and automation can be the answer to seeing flaws in the system before a disaster strikes. Maybe the key to RAS is growing anything but Atlantic salmon.

I’m curious to know what you’re seeing in your own farms and in your own networks. But, I pose the question to you again: If you could predict where the market will go next year, would you change course?

Now, this doesn’t mean that you ignore everything completely. By all means, adjust your strategies, correct your budget estimates, change your stocking densities. But at the core of your project, if your own models move according to the market’s volatility, I would argue that you don’t have a good model at all. It may seem narrow-minded and unecessarily dismissive (and maybe it is), but I’d like to believe that a solid project succeeds not just because it found the right windstream. Eventually, that windstream dies down and so, what will you do then?

It’s like that old economic adage: it’s not about timing the market, it’s about time in the market. Perhaps, what this industry needs is time. The good projects will persist simply because they work.

Anyway, I’m sure I can use all the nautical and aquaculture metaphors I want, but at the end of the day, I’m just trying to say that no one has a clear picture of the future. We can draw all the projections we want with the limited information that we have, but perhaps the only thing that can allow industry leaders to emerge on the other side of downturns is by staying the course. Keep doing good work and the fish will respond in-kind. Maybe farmers know this more than I would. I hope to continue more of these conversations in the new year at jkodin@annexbusinessmedia.com.

www.rastechmagazine.com

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Audience Development Manager Tel: 416-510-5113

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Editor Jean Ko Din 437-990-1107 jkodin@annexbusinessmedia.com

Associate Editor

Sherene Chen-See 647-203-7031

schen-see@annexbusinessmedia.com

Associate Publisher Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.com

Sales Manager Patrick Villanueva 416-606-6964 pvillanueva@annexbusinessmedia.com

Account Coordinator Barb Vowles 416-844-7106 bvowles@annexbusinessmedia.com

Group Publisher Anne Beswick 416-410-5248 abeswick@annexbusinessmedia.com

Audience Manager Urszula Grzyb 416- 510-5180 ugrzyb@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

Printed in Canada

Subscription Rates

Canada $37.00, United States – $48.00 CAD, Foreign - $62.00 CAD

All prices are for 1yr subscription and in Cdn funds.

ISSN 2817-7266 - Print

ISSN 2817-7274 - Online

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com

Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Made possible with the support of

Thor Salmon CEO, Halldor Ragnar Gislason stepped down on Sept. 30, handing over the role to Steinþór Pálsson.

“Thor is fortunate to have Steinthor joining the team, bringing with him extensive experience in building and leading successful organizations,” Gislason said on LinkedIn.

As the new CEO, Pálsson will oversee ongoing development of the company’s salmon farming facility in Þorlákshöfn, Iceland, the company said in a statement on LinkedIn.

Pálsson is an experienced executive with a broad background in Icelandic and international business.

“We see a turning point ahead for Thor Salmon,” said Pálsson. “Behind us is thorough preparatory work that enables the company to move forward with great momentum in the coming months. I’m excited to take part in this development alongside the strong team that has brought the company to this stage.”

A new hatchery was commissioned at Thor Salmon in May when the first eggs were placed in incubators and the fry are now well-established. Construction of the smolt facility, which began in July, is near completion and is designed to hold up to four million smolts annually.

Thor Salmon’s first smolts are expected to enter the growout phase in summer 2026. The long-term aim is to produce up to 20,000 tonnes of salmon annually, the company stated.

Andfjord Salmon Group reported a successful second release of smolt in its hybrid flowthrough system.

The company released 350,000 smolt in September and plans to release 750,000 smolt in October for a total of 1.1 million. The October release was not confirmed at the time of publication.

“Our planned release of 1.1 million smolt represents a significant scale up of commercial operations for Andfjord Salmon,” said CEO Martin Rasmussen. “This is what we have worked tirelessly towards for the past two years, with strong support from our shareholders.”

Andfjord Salmon is developing its land-based aquaculture facility at Kvalnes, Andøya in Norway. The total production output is expected to be about 23,700 tonnes (head-on gutted,

plus post-smolt). In addition, area infrastructure has been developed to support future production there of 48,000 tonnes of salmon, said the company.

The company also announced their Q2 results. During that quarter, Andfjord Salmon shared a revised budget designed to maximize progress and efficiency for current and future build-out at Kvalnes.

Funds of approximately NOK 1.55 billion (US$156.8 million) were raised in the second quarter, the company explained. Due to ongoing construction at the Kvalnes facility, Andfjord Salmon did not produce salmon in Q2, leading to almost zero revenue during that period (about NOK 100,00o or US$10,111). The company reported a net loss of NOK 26.8 million (US$2.7 million) for Q2.

InsightAce Analytic Pvt. Ltd. has released a market assessment report indicating the global recirculating aquaculture system (RAS) market could reach US$13 billion by the year 2034.

This market research and consulting firm valued the 2024 RAS market at $5.2 billion and forecasted a compound annual growth rate (CAGR) of 9.6 per cent for 2025-2034.

“The sector is witnessing heightened investment, driven by funding from governmental bodies, private enterprises, and research institutions aimed at the development and expansion of integrated RAS solutions,” the report said.

“These investments underscore the growing recognition of RAS as a

sustainable approach to meeting global seafood demand while complying with stringent environmental regulations.”

The report said environmental sustainability is a key driver as the technology is designed to reduce water consumption through continuous treatment and recirculation. RAS facilities can also be operated in non-coastal or urban areas which allows producers to be closer to end consumers, said InsightAce Analytic.

The report also cites enhanced biosecurity as an advantage. RAS offers precision control over water quality, which helps prevent disease and promotes healthier fish.

Despite these benefits, there are several challenges to broader market penetration. RAS requires high initial

capital expenditure to establish technologically sophisticated facilities. Integrating advanced water treatment, automation, and environmental control systems increases upfront costs. Additionally, ongoing energy consumption and maintenance expenses can affect long-term profitability, the company explained.

Overall though, RAS is well-suited to the North American market, which offers a technologically advanced landscape. Companies are actively incorporating innovative solutions to enhance scalability and efficiency.

Europe also represents a significant market for integrated RAS. The region emphasizes sustainability, regulatory adherence, and technological advancement.

First Water, Laxey, Samherji Fiskeldi, and Thor Salmon are formally collaborating on responsible treatment of land-based aquaculture waste streams for its Iceland facilities.

The collaboration is part of work that began within the Terraforming LIFE project, in which First Water and the Icelandic Farmers Association are beneficiaries. They are looking to pioneer ways to convert fish sludge from land-based aquaculture farms

into organic fertilizer and biogas.

“This initiative aims to turn waste streams into valuable products and strengthen Iceland’s circular economy,” said Margrét Ágústa Sigurðardóttir, managing director of the Icelandic Farmers Association.

“This is a pivotal achievement in aquaculture and an example for others to follow.”

A business plan and financing needs assessment for the next 24 months will be conducted.

Australian salmon farming company, Huon Aquaculture, has chosen Norway’s Pure Salmon Technology AS for the design, supply, and installation of its new landbased smolt facility.

Construction is planned in Tasmania at the end of 2025, subject to regulatory approvals. Full commissioning is expected for 2027.

“Huon has led the way in Tasmania in investments in RAS and the proposed project will more than double our land-

The Icelandic Farmers Association and other stakeholders will play a key role in the process, Terraforming LIFE indicated.

“This commitment represents a major step ... to enable innovative and scalable environmental solutions across Europe,” said Terraforming LIFE.

Terraforming LIFE designs and develops new technologies and methods to create an integrated agriculture aquaculture system where aquaculture, agriculture farmers, and agriculturists are at the heart of a circular economy, according to the company’s website.

based farming capacity,” said Depha Miedecke, Huon’s general manager of aquaculture. “Growing larger fish on land reduces the amount of time our salmon spend in the marine environment and supports stable year-round production.”

“Pending regulatory approvals, we’re looking forward to working with the excellent team at Pure Salmon and local contractors, including electricians and builders, to bring this project to life,” Miedecke added.

The company said the new facility is designed for flexibility of operations, aiming for high-intensity recirculation and minimal environmental impact.

“This project not only marks our expansion into the Australian market but also showcases the delivery of a facility built around fixed bed bioreactor technology — a tailored solution for Huon that complements our traditional moving bed bioreactor offering,” said Luke Kellgren Parker, managing director of Pure Salmon.

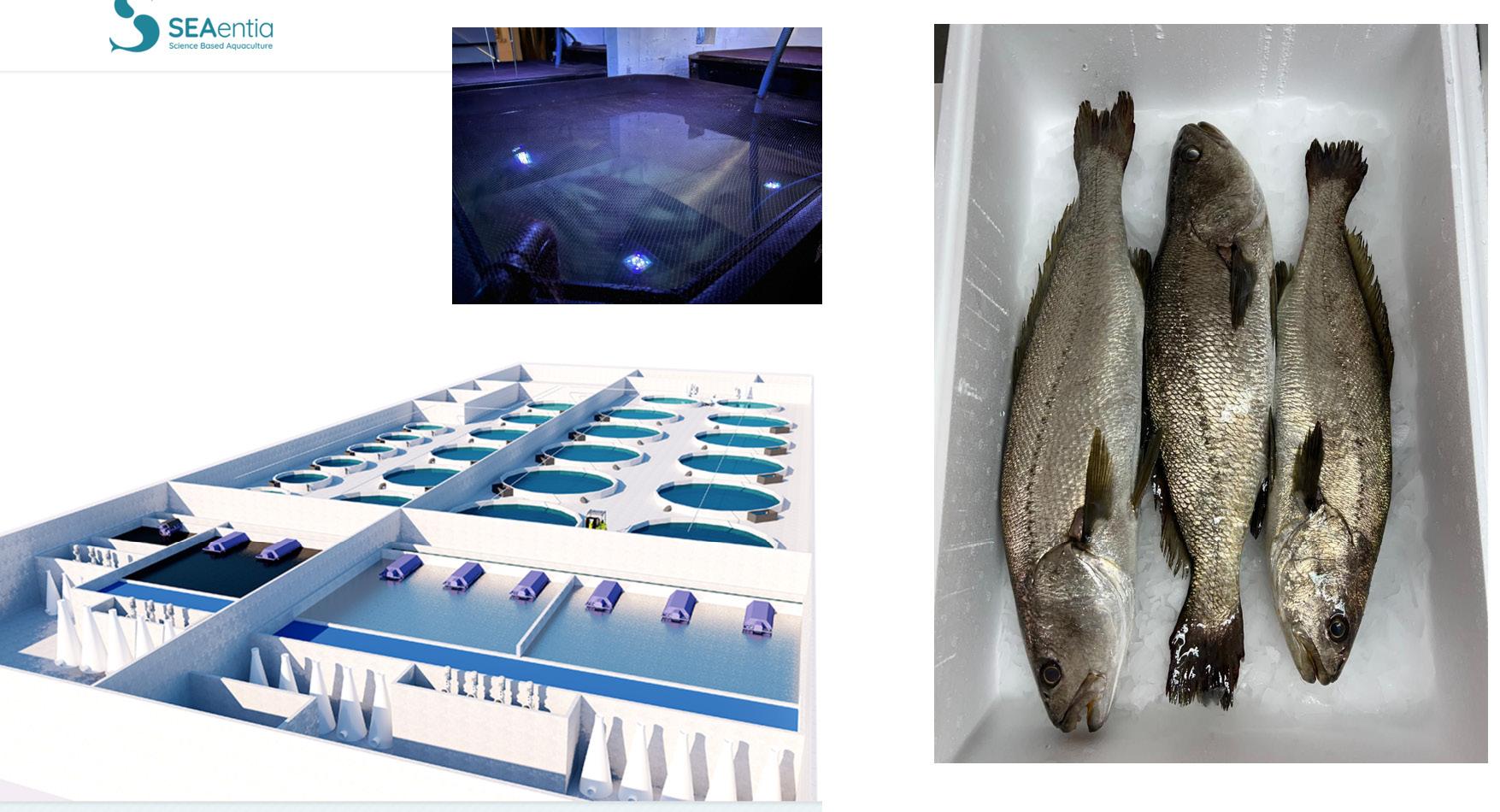

Sole (solea solea) producer, Sea Eight, opened its first growout plant with recirculating aquaculture systems (RAS) in the Port of Gijón, Asturias, Spain.

The inauguration ceremony was held Sept. 25 at the company’s facilities in the port of Gijón.

This milestone is part of the company’s strategic plan that will reach €55 million (US$64.3 million) in investments and create 100 new jobs, Sea Eight said in a public statement.

“With this investment, we want to consolidate our leadership in the high-quality sole market,” said CEO Jaime León. “We are convinced of the need to produce food sustainably and locally to feed the population. Asturias will become a benchmark in sustainable aquaculture production on land.”

With this project, Sea Eight will integrate the entire production cycle, from hatchery to growout, processing, and packaging.

Sea Eight currently produces 700 tonnes of sole per year and has a workforce of 70 people. The strategic plan has a goal of reaching 1,500 tonnes in 2026, with 170 direct jobs and a turnover of €30 million (US$35 million), said Sea Eight.

The company has an exclusive agreement with Mercadona to supply farmed sole. This enables Sea Eight to distribute the product throughout Spain. Sea Eight also exports to various European countries and the United States, the company indicated.

Sea Eight is committed to developing improvements in reproduction and nutrition processes. It has launched a project to apply artificial intelligence to optimize production. The company aims to provide a premium product with the highest quality and food safety, which responds to the growing global demand for sole, Sea Eight added.

With this opening, Sea Eight adds its fourth production plant along with the three it operates in Portugal and Spain.

By Matt Craze

Matt Craze worked for many years as a commodities analyst, helping establish Bloomberg’s agri-commodities pricing coverage, and as a strategy consultant working for Big Four firms. He set up Spheric Research in 2017 as an independent research firm dedicated to the global aquaculture industry. The company’s yearly “Land-based Aquaculture Report” is published each year via Undercurrent News, and has been featured in The Economist. (matt@sphericresearch.com)

Adozen Komatsu trucks were revving up to build Pure Salmon’s Japan growout facility in a September heatwave.

With the hatchery ready for operations and a post-smolt facility that is semi-built, the growout tanks will become part of the world’s largest salmon RAS farm with an annual capacity of 10,000 metric tons.

There are huge advantages to building a mega-farm in one site, according to Erol Emed, CEO of Pure Salmon Japan. The laying of underground pipes and infrastructure work can be done at the same time, boosting efficiency and reducing project costs, he said.

“This project is going to be a revolution” in the salmon industry, he said during a Spheric Research site visit.

His comments come at a time when the land-based aquaculture industry is trending towards smaller initial designs, as a safer bet to master the science of RAS farming before scaling up. A five-hour drive away towards Tokyo, Tez Sogo at the FRD trout project in Futtsu, Japan is glad his company ran a 50-ton pilot at the farm with financing from Mitsui Corp. before embarking on the construction of a US$150 million farm with capacity of 3,500 tons a year.

“It was really nice to experience all the RAS challenges in Phase 1,” Sogo said during a visit to the advanced works in Futtsu, Japan. “3,500 tons a year is not the optimum size, but it is a good balance between what you need to fundraise and reach profitability.”

In our recent study of new and already operating salmon RAS projects, the average size of under-construction projects dropped to 2,500 tons annually in 2025, compared with a peak of almost 6,700 tons in 2023.

For sure, the trend towards smaller initial designs stems from major startup issues at Atlantic Sapphire, which started operations in 2020. The Miami-based facility is only just beginning to improve key performance metrics at the site in 2025, after several years of failed harvests that burned a lot of invest-

ors. Mitsubishi Corp., which owns Cermaq and Maruha Nichiro, ranked the world’s largest seafood company, decided on a smaller 2,500-ton design in Japan to test salmon RAS.

Hayashi Trout Farms, one of the oldest operators of traditional trout farms in Japan, is espousing a more compact RAS system at one of its farms using Nofitech technology from Norway. Hayashi, which has a license to sell Nofitech technology in Japan, is also in the business of building systems for other operators.

The trend towards smaller designs might be less about testing operations at a smaller size and more about the lack of investor appetite to back a mega-farm in the wake of Atlantic Sapphire, according to one investor.

While Pure Salmon is building a growout facility for the first time, the company has 25 similar hatcheries supplying smolt and postsmolt through its technology arm. 8F Asset Management, the Abu Dhabi-based private equity fund that owns Pure Salmon, acquired the leading Norwegian RAS technology

company in Kruger Kaldnes in 2021. The vast internal experience that Pure Salmon has building the earlier stages of a RAS salmon farm arguably put it in a better position to skip the experimental phase of production. However, 8F Asset Management has also decided to start with a bigger size because it has raised the funds to start with a bigger design.

When comparing technologies, a different trend is emerging among projects using hybrid flowthrough (HFT) technology. The average size of projects being developed mainly in Iceland and Norway has stayed constant at about 5,000 tons per year. In this space, there has been enthusiasm for the initial success enjoyed by Salmon Evolution in Norway that uses this technology. Projects in Iceland, such as FirstWater and Laxey, have managed to fundraise and build plants on the back of Salmon Evolution’s successful start.

Laxey, a company built with capital from the sale of a capture fishing business, will harvest fish this year from a facility with a starting capacity of 4,500 tons a year. Salmon

Evolution is more than doubling capacity at its farm to 18,000 tons a year, while Andfjord Salmon seeded smolt this year at a novel flowthrough (FT) design that will begin to produce 8,000 tons a year in 2026.

The startup of operations, such as Salmon Evolution and Gigante Salmon, in the HFT/FT space is raising the average capacity of operational farms. This reached 3,000 tons a year in 2025, from 2,050 tons a year before. Due to the existence of several salmon RAS farms still in operation, average capacity is still at 640 tons this year, compared with 600 tons a year in 2024.

In the HFT business, there is little evidence of a shift to compact farms, hinting that the reduction to smaller RAS is more to do with the difficulty of fundraising full RAS. That’s why we predict salmon supply from FT/HFT systems will outpace volumes from full RAS systems through 2030. In the longer run, the competitiveness of these systems will come down to multiple factors. From within the landbased industry, technological breakthroughs will help encourage investment.

The traditional salmon industry appears to be entering a breakthrough phase with cage technology, particularly by way of submerged pens, that combined with post-smolt strategies, could unlock some growth. Norway is also starting to award offshore licenses, which heralds a new era in salmon farming by unlocking new sea concessions. There is also the development of vessels such as those built recently in China that roam the high oceans while growing salmon.

Within RAS and FT/HFT, it is hard to predict whether smaller scale or bigger scale is the best route to market, and the answer is nuanced. FRD in its pilot phase tested denitrification technology, a novel treatment system that is needed in Japan to reduce the need for freshwater inputs. Less water discharge in Japan is necessary because the cost of cooling large volumes of fresh input water is prohibitively high, FRD’s Sogo said.

It also makes sense why a company like Pure Salmon with vast

construction experience through the 2020 Kruger Kaldnes would sidestep a pilot phase and build a large-scale facility in one step. One thing is certain, if Pure Salmon is successful, it is likely to capture investment for more large-scale facilities, if salmon supply remains constrained.

Amid choppy economic waters and unpredictable political currents in the United States, a nascent partnership of five Norwegian aquaculture technology companies has set a course for the North American land-based aquaculture market.

Founding members of Norwegian Aquaculture in America (NACA) believe there’s steady demand for their products and services beneath the turbulent surface.

“You have several thousands of seafood farmers in the United States and Canada. The continent is moving towards self-sufficiency in seafood. They also have a growing potential in becoming global leaders in aquaculture production,” according to Bjørn Dorum, chairman and owner of Mat-Kuling. “We want to engage and support that market.”

NACA made their formal North American debut at the RASTECH 2025 conference (June 9-10) in San Diego, Calif. Mat-Kuling Vannbehandling AS is a water treatment specialist based in Stavanger, Norway. It is one of the five aquaculture tech firms that make up NACA.

The other members of the organization are Simona Stadpipe AS, a piping system company; Helland Silosystem AS, a maker of silos feeders and conveyors; Silikal Nordvest AS, a company that develops specialized coating for land-based aquaculture tanks; and Dynamic FishEye which produces advanced control systems for land-based aquaculture.

The FishEye platform features real-time data collection and analysis for optimized feeding and improved fish health.

The NACA business network is backed by Innovation Norway, a state-funded body that helps Norwegian companies expand their business.

The goal of NACA’s three-year project is to strengthen Norway’s stance in the area of land-based aquaculture technology.

“Mat-Kuling are experts in water treatment with over 30 years of experience in the field,” says Dorum.

Mat-Kuling designs, manufactures, and supplies equipment for land-based farming for various saltwater and freshwater species, such as salmon, trout, sea urchin, and eel. It has clients in Canada, the United States, Australia, and New Zealand.

In May 2025, the Norwegian company partnered with National Aquaculture Group (NAQUA) to develop a “next generation” hatchery for barramundi in the Middle East.

Where some businesses see uncertainty, Dorum says he sees opportunity in the U.S. market.

Take, for example, the tariffs imposed on other nations by U.S. President Donald Trump. In the import-dominated U.S. seafood market, the extra cost will likely be passed onto consumers.

Dorum believes this situation could spur North American seafood farmers to improve production and make their goods more competitive. Mat-Kuling and NACA will be there to help them out.

NACA also stands to benefit from Trump’s April 2025 executive order on “Restoring American Seafood Competitiveness.” Executive Order 14276 is meant to reduce regulatory burdens, combat unfair foreign trade practices, and modernize and boost domestic seafood production and exports to address the U.S. seafood

“In

trade deficit. It also aims to improve the competitiveness of the American seafood industry.

“We are a one-stop shop of high-quality equipment and services for RAS and aquaculture,” says Dorum. “We offer the equipment and the know-how that will help American aquaculture producers achieve their goals.”

This is a sentiment shared by Nils-Per Sjåstad, chief executive officer of Simona Stadpipe AS. He says the North American land-based aquaculture space is experiencing growth in investments. For example, strategy research firm, Spheric Research, reported that in the first four months of 2025, land-based aquaculture farms received no less than US$1 billion in investments. Investment in the sector for the whole of 2024 only amounted to $738 million.

“There are a lot of new and growing U.S. aquaculture companies that want to compete in the global market,” Sjåstad explains. “We have the experience and knowledge to help them build a cost-effective and productive operation.”

Simona Stadpipe has more than 30 years of experience. It is a specialist in custom-made, high-resistance piping systems for RAS, hybrid, and flow-through systems. The company’s work covers the entire value chain, from planning, design, manu-

facturing, delivery, installation and testing.

Simona Stadpipe was selected as a contractor for underground piping at Salmon Evolution’s plant in Indre Harøy, Norway, which involved the construction and installation of pipes. Simona Stadpipe is also installing underground pipes at Grieg Seafood’s facility in Adamselv, Norway.

Simona Stadpipe also signed a contract in January 2025 to provide a piping system for the entire water distribution at the Arctic Seafarm facility in Nesna, Norway.

“In the future, we plan to establish a workshop to build products in the U.S.,” says Sjåstad.

Simona Stadpipe’s parent company, Simona AG, already has a presence in the U.S. market through SIMONA Industries. They also own Boltaron Thermoplastics and PMC in Ohio.

Inge Stian Helland, CEO of the familyowned Helland Silosystem AS, is hopeful that the current environment will improve.

Established in 1965, Helland Silosystem has provided feed-handling equipment to fish farmers for more than 40 years. In the last 10 years, the company developed new feed-handling equipment that were adapted to land-based aquaculture.

Helland Silosystem’s automatic feeders can be used for different types of feeds and can be adapted for use in tanks from six feet to 75 feet in diameter.

“I believe that this uncertainty we are now seeing in the U.S. will stabilize and the signals indicate that the U.S. will invest

more in land-based fish farming,” according to Helland. “At the same time, the U.S. needs more self-produced food, and they want to become more self-sufficient.”

There is also a growing number of aquaculture companies that want to enter the U.S. market, he adds.

“Several of our international customers are now planning for developments in the U.S. and this further supports our commitment,” he says. “We are also looking for partners in the U.S. to handle the market.”

NACA members are confident that their deep-rooted RAS expertise can help North American seafood producers navigate complexity, optimize operations, and chart a course for long-term growth in sustainable seafood production. .

Despite the headwinds, market leaders say RAS is still viable in Europe.

By Vladislav Vorotnikov

In spite of the initial promise of finally driving European aquaculture out of protracted stagnation, the RAS segment has shown only mixed development dynamics in the last several years. Quite a few projects were shut down, failing to overcome the existing economic and regulatory challenges, but the general sentiment in the industry remains optimistic.

The RAS industry in Europe has recently been performing exactly like any young industry should, says Andrew Whiston, CEO of RAS Technology, a Scottish company providing feasibility, design, consultancy, and troubleshooting services for RAS farms.

He explains that in some failed projects, investors have fallen victim to inflated expectations. As under many forecasts, RAS technologies were expected to revolutionize European aquaculture.

“To attract investment, there is always a temptation to offer an investor exactly what they are looking for, a low capital expenditures (CapEx) project offering global domination by next week with a profitable exit in a year or two,” says Whiston.

“Sadly, reality doesn’t look like that and attempting a progression from crawling to flying without the steps in between has predictable results. Likewise, shaving down CapEx to the point that it impacts redundancy, biosecurity or applies pressure for unrealistic RAS performance is dangerous.”

Insufficient economic planning is one of the key factors that has been plaguing the RAS industry in Europe.

“In several cases, the reason for closing down RAS farms was simply lack of liquidity despite their business model working,” says Andreas Mäck, CEO of Infinite Sea, the world’s first large-scale urban marine fish farm located in Völklingen in the middle of Germany.

However, the economic landscape for the RAS projects in Europe also remains challenging, with energy prices remaining high and the price of fish and seafood often not high enough.

“If the investment climate improves, more companies can overcome the difficult phase until they reach break-even,” Mäck says, adding that the investors should avoid making survivor’s mistakes and pay more attention to the failed projects to understand what went wrong rather than be guided only by

success stories.

“Examples of failing RAS companies led to an increased risk-avoidance strategy of investors, and therefore, it is currently very difficult for new and emerging projects to receive funding,” Mäck admits. “All new projects must learn the lessons of other projects and farms to avoid repeating mistakes.”

On top of that, building a RAS farm in Europe is still associated with substantial regulatory hurdles, which have largely constrained the industry development.

“I’ve seen more projects get stranded due to regulations and not being able to obtain the necessary permits for land development and water use than anything else,” says Rob van de Ven, managing director of Landing Aquaculture BV, an engineering and consultancy company based in Boxtel, the Netherlands.

According to van de Ven, access to capital is no longer an issue, and projects that lack a sound business model or technical design in the EU are usually weeded out in the early stages before large-scale development.

Despite setbacks and the visible frustration of some investors, the RAS industry in Europe is in a favourable strategic position, market players believe.

“The entire economic situation also has an effect on fish consumption. Inflation makes people more aware of how much what they eat costs. Therefore, the market is currently more price sensitive,” Mäck says. “But it is still a huge market with hundreds of millions of consumers, which is currently dominantly served by imports. And this is the great opportunity of RAS farming in Europe.”

The industry needs time and patience to play its cards right and unravel its growth potential.

“I think the benefits of RAS are clear and

proven to us insiders, but there is a lot more marketing to do to convince decision-makers to support the development of these kinds of projects before RAS can really be a driver for the European aquaculture industry,” van de Ven says.

The example of Norway and the Faroe Islands, where the salmon industry is at a high level of development, using increasingly RAS

to grow smolts larger, shows that the industry has huge potential.

“For countries like Germany, Austria, Switzerland, Italy, or France, RAS presents a great opportunity to produce inland. Several examples show that it’s possible; also smaller conventional farms use more and more technology to reuse water, turning therefore increasingly into RAS farms,” says Mäck, ad-

mitting that the key constraints which hamper the development of the RAS sector in these countries are limited investments accompanied with long administrative permission cycles and no political will to increase aquaculture production.

Over the years, investors also faced numerous challenges on the technological side, as it is not enough to build a farm.

“Water treatment, biology, chemistry, light, discharge – everything that will have an impact on the welfare and the growth rate – will challenge you. You solve one issue, and two new pop up,” says Björn Dörum, founder and chairman of Mat-Kuling.

However, there is progress in how and to what size fish is grown at RAS farms.

“When we first started looking deeper into onshore seafood farming, a typical fish ready for the net cage was 150 grams. Today, we talk about a normal size of 750-1,000 grams,” he adds.

The growth of the RAS segment will pick up pace as more knowledge, data, and experienced personnel will contribute to its growth, says Siri Tømmerås, commercial director for land-based farms at Akva Group, a smolt manufacturer based in Norway.

“Smolt and post-smolt RAS will continue to grow in the salmon-producing countries since we see the benefits of shorter time in the open sea with fewer lice infections, treatments, and lower mortality,” she says.

Observers predict that the RAS segment will continue to grow in Europe, albeit unevenly, with some countries leading the way and others lagging behind.

“I see that, currently, projects in Norway and Iceland are about to start massively with huge reported volumes. In Central Europe, however, I unfortunately assume there will be a consolidation until the entire investment climate improves and several RAS projects prove their economies,” Mäck adds.

However, even slow development should be welcomed, as the industry, in general, is moving in the right direction, says Whiston.

“Sluggish and boring progress is to be celebrated; it might indicate a maturing of the industry from the goldrush of ‘fear of missing out’ to a more grown-up approach. In my experience, nothing good happens quickly in RAS, and a boring stepwise approach is also called the scientific method,” he says.

In short, the industry needs time and patient capital. Investor-driven RAS project development needs to slow down in order to stop tripping over its own feet.

“There are some profitable and successful RAS farms in Europe, but these tend to be the ones nobody hears about. Instead, we hear lots about the ones raising huge sums of money and the ones having huge disasters. We don’t hear enough about the ‘boring ones’ who just get on with it like Danish Salmon, Skagen Salmon, CreveTec, or the Kingfish Company,” says Whiston.

Tightening environmental agendas is actually good for real RAS as a sector that can

operate very cleanly. For instance, Whiston said that his King Prawn farm is built on a brownfield site, runs on solar power, and returns water to the environment cleaner than when it was borrowed.

“Our farming wastes are captured and valorized rather than being dumped. Traditional open pen or flow-through aquaculture can’t do that,” he adds.

Looking ahead, market players anticipate that the RAS industry will experience positive developments already in the foreseeable future.

“I look forward to seeing the projects that are currently being prepared and designed come to completion. Some of these will be projects in locations that have not seen a lot of RAS farms, and hopefully, those projects will open up possibilities by acting as a showcase for policymakers and other entrepreneurs,” van de Ven said.

“I also hope, from a geopolitical point of view, that Europe commits to building a healthy food production industry of which I

believe aquaculture needs to be a part,” van de Ven added.

“Given tighter environmental regulations, higher consumer awareness of where their food comes from, a changing and less benign weather environment, and the ever-increasing need for good quality nutritious food, I

believe that the RAS sector has a very bright future in Europe. Capture fisheries and traditional aquaculture simply can’t provide enough food in an acceptable manner,” Whiston adds.

“Personally, I’ve bet everything I have on that outcome, so I’m a little biased.”

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

Let us help you! Call +46 (0)40 42 95 30, or visit www.hydrotech.se

By Bendik Fyhn Terjesen

Bendik Fyhn Terjesen, PhD is head of Land-based Innovation in Cermaq Group, where he works with the regions to build new infrastructures and improve operations to give the fish a safe start in life. He has an extensive research background in fish physiology, nutrition, and RAS, and is adjunct professor at Nord University in Norway, where he teaches aquaculture technology. (bendik.fyhn. terjesen@cermaq.com)

Whether for full cycle to harvest weight or a post-smolt facility, the leader of a large landbased aquaculture project faces tough challenges to succeed. Many land-based aquaculture projects fail to reach the target Production Volume and serious fish mortality events occur.

It takes a long time (sometimes 10 years) from when the idea is formed, through planning, construction, commissioning, until biomass build-up is complete. The facility can cost billions (NOK), and the investors require construction to be completed on time without surprises, on budget, and production shall be at the target volume right away.

To achieve success in land-based projects, a new project management methodology must be developed for these very specialized infrastructures. And here, in my new column, I will venture to outline my argument that a missing focus on Fish Welfare is the main reason behind the failures.

The project leader can use various methods to control Cost, Time, and Scope to achieve the target quality (Figure 1a). Aptly named the Iron Triangle, the project leader cannot modify one of these constraints without changing the others, or quality will suffer.

And herein lies the problem, in my opinion. There is no established project management method which is suitable for building advanced biological process factories like land-based RAS for salmon.

In particular, the terms, Scope and Quality, in the traditional project triangle are inadequate to highlight how critical the biological requirements of the fish are to success

or fiasco. Without fulfilling the biological requirements, the project will be a failure. This means that the project must invest in designs and dimensions that are based on the scientific forefront and documented operational experience.

Furthermore, in land-based projects, the terms Scope and Quality are more intertwined than in other more common constructions. For example, you can choose not to include water treatment components such as protein skimmers (Scope), but removing the skimmers can increase fine particles in the water (Quality) and adversely affect Fish Welfare. To ensure acceptable animal welfare, and to reach the targeted production, a new project management philosophy is therefore needed to make land-based aquaculture a success.

Animal welfare is the responsibility of all animal farmers and aquaculture is no exception. The World Organization for Animal Health defines welfare as the physical and mental state of an animal in relation to the conditions in which it lives and dies. The concept of the Five Freedoms is useful as guidance; the animals shall be free of threats such as hunger, discomfort, fear, pain, injury, and disease, and be able to express their normal behaviour.

Welfare issues can have many causes, but failure to maintain water quality requirements, allowing excessive biomass, or inadequate biosecurity or failsafes to prevent catastrophe are common. In several landbased projects that I have seen, animal welfare does not figure at all or only briefly.

I don’t believe this happens due to malicious intent. Salmon are very robust by nature, but they are living animals with physiological limits and cannot be handled like bricks or machines, as just another industrial

product. Nevertheless, when cost overruns happen, the project leader can choose several ways to rectify the situation.

Sadly, investments in Fish Welfare are often cut in this process through an unfortunate sequence of events. First the project leader can try to save Costs by slowing down completion of the facility (i.e., by increasing the Time). However, such a tactic is usually not acceptable to owners in land-based projects since their funds are already frozen for a long time until production starts, and further delays will worsen their return on investments.

Next, the project management can then attempt to reduce Scope to save Costs, such as removing a growout department. The diligent project leader would then warn about lower production capacity; however, reducing tons of fish per year is usually not accepted by investors since they are concerned about economies of scale (e.g., NOK investment per kilogram produced) and worsening return on investments.

The result is often that Scope is reduced by removing departments, but Production Volume target remains unchanged. This decision will adversely affect Fish Welfare once the facility is in operation, because the smaller system will be overtaxed to handle the same load.

If the Scope cost-cut is not enough, the project leader may next be forced to reduce Quality. In land-based projects, water treatment is costly. Consequently, management often cuts the water treatment dimensions, such as by accepting higher toxic CO2 levels in the fish tanks and jeopardizingFish Welfare.

Unfortunately, what is often not understood is that worsening water quality automatically reduces production output because of the negative impacts of CO2 on growth rate. In their quest for cutting Costs, this

project management will inadvertently worsen the Production Volume, and reduce investors’ return on investments as well.

The entire issue is, in my opinion, deeply rooted in traditional project management and because the terms, Quality and Scope, do not embody the concept of animal welfare. “Quality” does not describe well that choosing poor Quality will result in unacceptable animal welfare and perhaps even large fish mortality events.

What should the project management have done? Early in the project, the team, with biologists or veterinarians onboard, should develop a new management method defining key non-negotiable criteria for good Fish Welfare, based on the scientific forefront and documented operational experience (the solid red triangle in Figure 1b).

These criteria must be consulted during all decisions about designs, dimensions, and during cost-cut processes. A thorough collaboration phase with a competent RAS supplier can also help ensure Fish Welfare stays intact. Finally, a Fish Welfare Control Board should be established in the company, with veto power over any changes in the project that risk breaching welfare criteria

But how shall the project management meet the budget if Fish Welfare cannot be compromised, other savings have been fully explored, and Costs still increase? The Production Volume target must first be lowered before the facility dimensions are reduced to cut Costs.

To make this clear, the project management should replace the term Scope with Production Volume, as the second change to the traditional triangle (Figure 1b). In land-based projects, costs often scale non-linearly with Production Volume.

Still, when Production Volume is given, Fish Welfare criteria are fixed, and a responsible production plan developed, then deliverables and cost of the facility can be calculated. Hence, Production Volume includes the term Scope and extends it to be better suited for landbased projects.

In this way, projects can avoid situations where reductions in dimensions without reducing Production Volume end up seriously degrading Fish Welfare (e.g., when tank volume and/or hydraulic exchange rate are reduced to save investments), but the owners decide to keep the same growth rate and biomass targets. Using unreal-

istic assumptions to grow fish in Excel leads to underperformance and Fish Welfare challenges.

How does replacing a couple of words really change anything? The words in the triangle matter because the constraints are on everyone’s mind during project decisions every day. An experienced manager will remind everybody what the project value drivers are. Lifting Fish Welfare up as a central constraint and replacing the vague “Quality” emphasizes that the project has a non-negotiable set of designs and dimensions that cannot be changed.

I often compare land-based aquaculture facilities to hospitals. Not because the fish are patients that are ill (though that may be the case as well), but because the facility must always provide life support for the fish, as also hospitals must do for their human patients. In both cases, downtime is completely unacceptable, which necessitates well-designed redundancies. Again, such requirements for Fish Welfare are not well-represented in the term Quality.

Rigorously protecting the biological requirements of the fish means increased costs for the same Production Volume. However, this is, in my opinion, a necessary price to pay for improving Fish Welfare to the level where it must be. And in the end, I believe it will pay off.

HealthTech Bio Actives (HTBA) recently launched its new fishfeed intake enhancer called Sugarex AQUA at the 2025 European Aquaculture Society Congress in Valencia, Spain.

The product, based on neohesperidin dihydrochalcone (NHDC), has enhanced sensory and solubility properties. It is designed to stimulate intake, improve feed palatability, and enhance growth performance in farmed fish, HTBA said in a press release.

“The feedback from researchers, feed producers, and farmers [at the conference] confirms that our solution addresses needs in the sector — improving fish performance while supporting sustainability and ani-

mal welfare,” said Mar Serra, Animal Nutrition Solutions division manager.

At the conference, HTBA

presented a study on Sugarex AQUA, in collaboration with AquaBioTech Group. The study found that the product boosts

feed intake under medicated diet and low-palatability conditions. It improved growth performance, with up to 34 per cent higher specific growth rates compared to unsupplemented diets, said the company.

Sugarex AQUA enhanced feed efficiency, with feed conversion ratios reduced by up to 11.7 per cent. It also maintained feeding behaviour and survival rates, even under dietary stress, HTBA added.

“These findings highlight Sugarex AQUA’s role as a practical, science-driven solution for sustainable aquaculture, particularly valuable when feed formulations change or when medicated diets are required,” the company said.

Cefetra and BioMar Group are combining their expertise from agriculture and aquaculture to reduce emissions from key vegetable-based ingredients in aquaculture diets.

Cefetra Ecosystem Services is a leader in agricultural supply chains, and BioMar is a global producer of aquaculture feed.

“This collaboration is an important step towards meeting our science-based climate targets and delivering low-carbon feed solutions to our customers,” said Ivana Russo, formulations manager and sustainability lead at BioMar UK.

Starting in the United Kingdom, the initiative targets the carbon footprint of vegetable-based feed ingredients such as wheat. Cefetra supports farmers in adopting practices that improve soil health and deliver verified carbon removals. When farmers make these improvements, they are financially rewarded.

“Cefetra’s unique position allows us to aggregate demand from hundreds of buyers across industries,” said James Neilson, supply chain director at Cefetra Ecosystem Services. “With our deep knowledge of the supply chain, we can ensure improvements on the farm translate into real climate benefits for downstream sectors like aquaculture.”

Innovasea has announced the hiring of Andreas Mintsios, new managing director for the Mediterranean.

Mintsios will play a key role in the strategic development and execution of Innovasea’s aquaculture operations across the Mediterranean, the company said in a press release.

Innovasea’s new managing director, Andreas Mintsios

“Mintsios’s vast background and wealth of leadership experience made him the ideal candidate for this role,” said Innovasea VP Marc Turano. “His problem-solving and relationship-building uniquely position him to effectively support our current efforts and introduce new solutions that meet the needs of this strategically important area.”

Mintsios comes to Innovasea from Thraki SA, where he was managing director. He also brings nearly two decades of aquaculture experience, having previously worked at HELPA SA, first overseeing their partial RAS (PRAS) eel farming operations before helping the company transition to sturgeon.

With the launch of their sturgeon farm, Mintsios played a key role in creating Greece’s first successful farmed caviar operation in the modern era.

By Curtis Crouse

Things are going to go wrong at your RAS facility. When they do, it may be your job to figure out the problem and fix it. Practicing your troubleshooting skills on items that improve operational efficiency and reduce waste and downtime will better prepare you for when the alarm calls hit your phone. Following a structured troubleshooting process is a path to developing this invaluable skill.

When defining a problem, begin by simply identifying the need that is no longer being met. Follow that up by stating what the conditions should be. Establishing this target helps define the goal that needs to be met. It is important not to name possible causes in the problem statement because they may not be true and can lead to incorrect hypothesis formation.

With the problem statement to guide them, operators can now begin gathering facts related to the issue. Start with an inspection of the area and associated equipment. Use your senses to see damaged materials, hear grinding gears, notice unusual odours, or feel especially warm motors. Remember to collect data from monitoring equipment like gauges or meters, review recent service logs, read diagnostic and error messages, and review recent changes to the environment or operation of the equipment. Finally, review the operator’s manual for any suspect equipment that could provide insight into next steps.

It is finally time to speculate on causes, but try not to begin with the assumption that

something is wrong with the equipment. The reason that something does not meet your needs may be a mismatch in needs and output.

For example, an unseasonably warm day may outpace the capacity of a chiller or motors may heat up when a pump is manipulated to provide a flow rate outside of its performance curve. Confirm that the equipment has all of the prerequisites for operation (fuel, power, on/off switches in the correct position).

Once these are ruled out, propose possible causes of the problem and ways it can be addressed. Consider if the issue is a major priority that needs immediate attention, or something that can be patched with a temporary or permanent workaround.

Limitations like tools, time, skill, and safety will also influence your options and the decision to do the work in-house or hire it out.

A final decision at this stage may be whether to repair or replace a piece of equipment. First, determine whether the equipment matches your current needs and future considerations like obsolescence, efficiency, and continued manufacturer support.

Once this is determined, the repair or replace decision becomes economic, weighing the repair costs related to diagnosis, parts, and labour, etc., versus the new purchase cost, installation, scrap value/ disposal fee, etc.

Eliminate possibilities until the best hypothesis can be proposed.

A good hypothesis will fit logically with the information so far gathered and favour the most likely cause of the problem. The hypothesis will provide direction for testing. Before putting the hypothesis to the

test, the risks of action should be measured.

For example, think of possible issues that could arise while implementing a fix, and what strategies can mitigate them. If the work cannot be quickly reversed, have contingency plans ready to deploy. It is also important to communicate and schedule the job with other affected staff members. While testing, be sure to take notes of what has been done and take pictures for future reference or to remember how the pieces fit back together. Notes can also prove valuable if the action taken does not yield desired results and another hypothesis is needed.

Once you think you have corrected the problem, be sure to confirm the fix.

Depending on the issue, this can mean different things, but always monitor the situation long enough to observe trends toward normal operation or required environmental conditions in the RAS.

If someone else initially reported the issue, be sure to have them test out the equipment and make sure it is up to their expectations. Buy-in for improvement is never higher than it is in the aftermath of a close call. Use this time to gather key personnel and discuss the problem.

During this discussion, apply the “five whys” tool to pinpoint a root cause and determine what solutions can be implemented to prevent recurrence in the future. By sharing what you learned during the troubleshooting process, you improve staff knowledge.

Formalize this institutional knowledge by updating standard operating procedures to reflect root cause solutions and troubleshooting trees with new paths of investigation that may save time and headaches in the future.

GENERATE YOUR OWN LOx

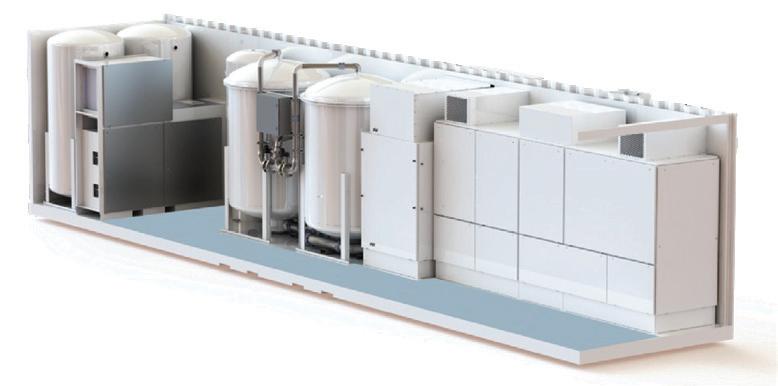

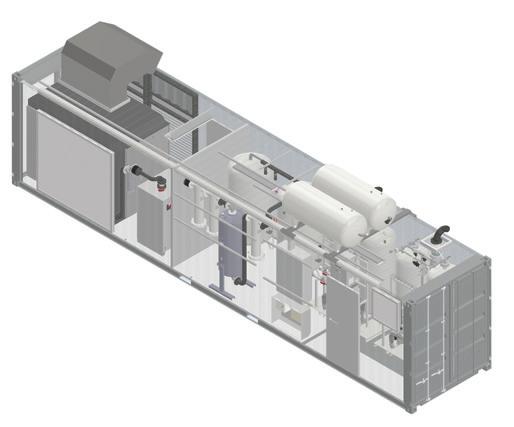

Ensure your security of supply with OxyMax - an integrated solution by Benchmark International Inc.

Independence Generate your own LOx onsite, eliminating risk of supply disruptions.

No LOx Losses Recompress vapours to prevent venting and waste.

Reduce Carbon Footprint Reduce emissions with onsite generation by eliminating trucking and leveraging green energy.

Reduced Cost Avoid costly supply contracts, transportation fees, tank rentals, and minimum purchase requirements.

LEARN MORE ABOUT OUR SOLUTIONS AT osioxygen.com